Form SD MICROSOFT CORP

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM SD

Specialized Disclosure Report

Microsoft Corporation

(Exact Name of Registrant as Specified in Its Charter)

| Washington | 0-14278 | 91-1144442 | ||

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| One Microsoft Way, Redmond, Washington | 98052-6399 | |

| (Address of Principal Executive Offices) | (Zip Code) |

Bradford L. Smith

President, Chief Legal Officer

(425) 706-3024

(Name and telephone number of the person to contact in connection with this report.)

Check the appropriate box to indicate the rule pursuant to which this form is being filed and provide the period to which the information in this form applies:

| x | Rule 13p-1 under the Securities Exchange Act (17 CFR 240.13p-1) for the reporting period from January 1 to December 31, 2015. |

Section 1 - Conflict Minerals Disclosure

Item 1.01 Conflict Minerals Disclosure and Report

A copy of The Company’s Conflict Minerals Report is provided as Exhibit 1.01 hereto and is publicly available at https://www.microsoft.com/about/csr/responsible-sourcing/.

Item 1.02 Exhibit

The Conflict Minerals Report required by Item 1.01 is filed as Exhibit 1.01 to this Form SD.

Section 2 - Exhibits

Item 2.01 – Exhibits

Exhibit 1.01 - Conflict Minerals Report for the reporting period January 1, 2015 - December 31, 2015 is attached per Section 1.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the duly authorized undersigned.

MICROSOFT CORPORATION

(Registrant)

| /s/ Bradford L. Smith | May 31, 2016 | |||

| Bradford L. Smith | ||||

| President, Chief Legal Officer |

INDEX TO EXHIBITS

| Exhibit No. |

Description | |

| 1.01 | Conflict Minerals Report for the reporting period January 1, 2015 - December 31, 2015 | |

Exhibit 1.01

MICROSOFT CORPORATION

CONFLICT MINERALS REPORT

FOR THE REPORTING PERIOD FROM

JANUARY 1 TO DECEMBER 31, 2015

| I. | INTRODUCTION |

This Conflict Minerals Report (“CMR”) for MICROSOFT CORPORATION is presented to comply with Rule 13p-1 under the Securities Exchange Act of 1934 (the “Rule”) for the reporting period from January 1 to December 31, 2015 (“2015 reporting year”). The report covers activities of all Microsoft majority-owned subsidiaries and variable interest entities that are subject to the Rule (“Microsoft”). The Rule imposes certain due diligence and reporting obligations on US Securities and Exchange Commission (“SEC”) registrants whose manufactured products (including products contracted to be made for each registrant) contain “conflict minerals” necessary to the functionality or production of those products. The Rule defines “conflict minerals” to include cassiterite, columbite-tantalite, gold, wolframite and their derivatives limited to tin, tantalum, tungsten, and gold (collectively referred to as “3TGs”).

Microsoft develops and markets software, services, and hardware devices that deliver new opportunities, greater convenience, and enhanced value to people’s lives. Microsoft is committed to the responsible sourcing of raw materials globally in support of human rights, labor, health and safety, environmental protection, and business ethics. Our commitment and strategy are outlined in the Microsoft Responsible Sourcing of Raw Materials policy. Under our policy, Microsoft takes a holistic approach to responsible sourcing while working toward the use of conflict-free minerals in our hardware devices (“devices”). One of our objectives is to ensure that we do not harm communities through an inadvertent de facto embargo of minerals from the Democratic Republic of the Congo (“DRC”) or an adjoining country (defined as a country that shares an internationally recognized border with the DRC) - both considered a “Covered Country” for purposes of the Rule.

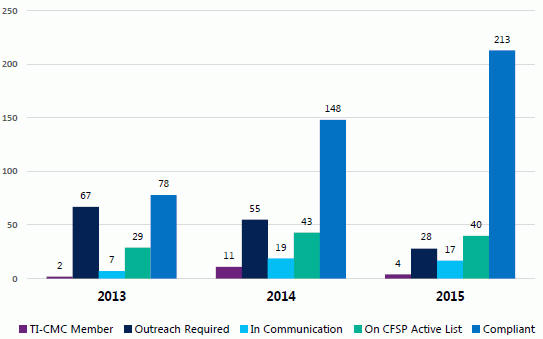

This year’s report documents our efforts for the 2015 reporting year, which demonstrate meaningful progress. The number of Conflict-Free Smelter Program1 (“CFSP”)-compliant smelters or refiners (the “SORs”) in our supply chain increased from 148 to 213 due to targeted supplier outreach and maturation of the CFSP - of which Microsoft is a founding partner and strong supporter. Based on Microsoft’s data analysis, we also concluded that 100 percent of tantalum smelters identified in Microsoft’s supply chain were CFSP compliant.

Since the 2014 reporting year (January 1 to December 31, 2014), we have also taken several notable actions to improve our conflict minerals due diligence, including the following:

| • | Completed implementation of recommendations from third party audit firm covering 2014 reporting year external assessment; |

1 Please note: this CMR contains references and hyper-text links to non-Microsoft, external websites. These links are provided for informational purposes only. Their inclusion in this CMR does not establish Microsoft’s endorsement of or assumption of liability for content posted on these external websites.

1

| • | Implemented process improvements to increase supplier response rate, including extensive sourcing manager involvement, supplier resource support, and tailored outreach to both new suppliers and 2014 unresponsive suppliers; |

| • | Developed and refined internal controls and procedures to improve in-scope supplier determination, data collection and validation, and supply chain due diligence, including early engagement with suppliers upon initial on-boarding through Microsoft’s Social and Environmental Accountability (“SEA”) online Audit Management System; and |

| • | Enhanced our supplier data collection process such as addition of automated “red flags” to identify quality control issues and Covered Country sourcing risk early in the surveying process. |

Microsoft devices contain one or more 3TGs and are within the Rule’s scope. Devices manufactured during the 2015 reporting year included:

| • | Surface line of tablet and laptop computers and accessories; |

| • | Xbox gaming/entertainment consoles and accessories; |

| • | Personal computing accessories, including mice and keyboards; |

| • | Mobile devices, including Nokia and Lumia branded mobile phones and devices; |

| • | Surface Hub computing displays; and |

| • | Microsoft Band wellness devices. |

On the basis of our performance of the required “Reasonable Country of Origin Inquiry” (“RCOI”) (see Section II), we cannot exclude the possibility that some of the 3TGs contained in our devices may have originated in a Covered Country. Therefore, we are submitting this CMR, which describes the conflict minerals due diligence we performed, as an exhibit to our Form SD.

We are submitting this CMR to the SEC under the reporting requirements of the Rule and have published the CMR externally on our corporate website: see Responsible Sourcing. The manufacture of devices during any specified time period may include raw materials sourced before, as well as during, that time period. In particular, some 3TGs used during the 2015 reporting year may have been smelted and refined prior to January 31, 2013 and are exempt under the Rule because they were outside the supply chain prior to the Rule’s initial reporting period. While such 3TGs are excluded from the Rule’s scope, our RCOI and supply chain due diligence conducted for the 2015 reporting year may have included such minerals.

2

| II. | REASONABLE COUNTRY OF ORIGIN INQUIRY |

Our RCOI corresponds to the first and second steps of the five-step OECD Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas (“OECD Guidance”), as that Guidance (including its Supplements) applies to each of the 3TGs and to Microsoft as a “downstream company.” The OECD Guidance provides a framework for detailed due diligence to support responsible global supply chain management of minerals, including 3TGs, and is currently the only nationally or internationally recognized framework for conflict minerals due diligence.

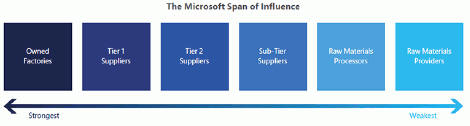

Microsoft does not contract with raw material providers in preparation for manufacturing our devices and does not source 3TGs directly. We source products from suppliers, which, in turn, source materials, components, and products from their suppliers (“sub-tier suppliers”). Our supply chain is extensive and complex with many layers of suppliers positioned between ourselves and 3TG SORs. Our contracts require all Microsoft supplier partners to identify, by weight, each and every substance contained in the materials, components, and products supplied to us, including 3TGs. We refer collectively in this CMR to our own manufacturing facilities, contracted manufacturing partners, and our strategic component suppliers as “in-scope suppliers.” Due to our extended supply chain, we leverage our in-scope suppliers, which provide us with information concerning the sources and chains of custody of 3TGs necessary to the functionality or production of our devices. We provide more detail on our supply chain due diligence process in Section III. The graphic below demonstrates Microsoft’s span of influence with its suppliers.

| A. | Establish Strong Company Management Systems |

| 1. | Company Policies |

Microsoft’s Responsible Sourcing of Raw Materials policy describes our commitment and strategy to responsibly source raw materials used in our devices. Microsoft is committed to the sourcing of raw materials in a way that supports human rights, labor, health and safety, environment, and ethics. Consistent with this mission, we address the issues associated with the harvesting, extraction, and transportation of raw materials as a global responsibility applicable to all substances used in our devices - unbounded by specific materials or locations. This policy also states that we implement programs that are region-specific, such as working toward the use of conflict-free minerals in our devices. We expect our suppliers to support our commitment to the responsible sourcing of raw materials.

3

Microsoft’s policies also include Microsoft’s Global Human Rights Statement; our Supplier Code of Conduct, which defines our expectations concerning ethical business, employment, environmental, and worker safety practices; and our internal Standards of Business Conduct, which outlines expected behaviors for all Microsoft employees. Microsoft uses supplier specifications and internal procedures to establish supplier commitments for the responsible sourcing of raw materials, including 3TGs. We incorporate these requirements into our hardware and packaging contracts.

| 2. | Internal Management Team |

A cross-functional team (“team”) supports Microsoft’s responsible sourcing activities, including compliance activities associated with the Rule. The Corporate Vice President of Microsoft’s Manufacturing and Supply Chain organization is the executive sponsor of the team. Representatives from various Microsoft corporate groups are involved in the development, review and filing of the CMR. Corporate groups represented on the team include Sourcing, Social and Environmental Accountability, Manufacturing, Accounting/Finance, Internal Audit, Windows and Devices Group, Corporate, External and Legal Affairs, Business and Corporate Responsibility, Information Services, and Product Environmental Compliance.

This team meets according to Microsoft’s internal Responsible Sourcing Program Manual and, at a minimum, quarterly to assess the progress of our program and identify steps that are necessary to meet our compliance obligations. The team also trains other internal stakeholders on their roles and responsibilities for implementing and supporting Microsoft’s responsible sourcing program.

| 3. | System of Supply Chain Controls and Transparency |

We require our in-scope suppliers to fully disclose all substances and materials that are present in the devices or components they supply to us by component and weight. These material disclosure requirements explicitly cover 3TGs. Our in-scope suppliers are responsible for communicating these 3TG sourcing requirements and specifications to their sub-tier suppliers. Data obtained from our in-scope suppliers, therefore, includes 3TG information obtained from their sub-tier suppliers.

In addition, we require all in-scope suppliers to submit a Conflict Minerals Reporting Template (“CMRT”) annually. These CMRTs are evaluated for completeness, data integrity, due diligence thoroughness, and sourcing risk. Potential risks may include, but are not limited to, failure to fully complete the CMRT, inconsistencies in the CMRT, and possible sourcing from a Covered Country. If data gaps or risks are identified, Microsoft investigates each issue and engages with those suppliers to address all concerns in conformance to Microsoft policies, procedures and specifications..

In cases where the supplier still poses risk, Microsoft initiates supplier corrective action calibrated to the severity of the identified risk. H02050 - Microsoft Supplier Social and Environmental Accountability Manual and Microsoft internal operating procedures establish controls for documenting supplier engagement, supplier response, and corrective action for any non-conformance findings.

If we confirm that a supplier’s upstream SOR is using raw materials that do not comply with Microsoft’s Responsible Sourcing of Raw Materials policy or the specifications referenced in this CMR, Microsoft initiates actions to address the non-conformance. These actions may include supplier engagement, training, and/or additional audits. Microsoft works with impacted suppliers to find alternate sources for non-compliant minerals. If a supplier does not commit to an alternate source within a reasonable time period, Microsoft places the supplier on restricted status with no new Microsoft business awarded until any non-conformance is resolved. Termination of Microsoft’s business relationship with the supplier may also occur.

4

Microsoft is a longstanding member of the Global e-Sustainability Initiative (“GeSI”) and the Electronics Industry Citizenship Coalition (“EICC”) - two organizations that initiated the Conflict-Free Sourcing Initiative (“CFSI”). Founded in 2008 by GeSI and EICC members, the CFSI is one of the most utilized and respected resources for addressing supply chain conflict minerals issues. The CFSI, through its CFSP, uses an independent third-party audit to verify SORs that demonstrate that the 3TGs, which they process, do not originate from sources that may be directly or indirectly financing or benefitting armed groups in a Covered Country. Microsoft funded an early adopters program that provided initial audit funds, enabling more SORs to be CFSP audited. Microsoft also provides financial support to the Industrial Technology Research Institute’s Tin Supply Chain Initiative (“iTSCi”) that has established a system of traceability and due diligence in Covered Countries and we support the efforts of organizations, including the Public-Private Alliance for Minerals Trade (“PPA”), that promote responsible mining and raw material sourcing. Microsoft is a sponsor of the Multi-Stakeholder Group, hosted by the Responsible Sourcing Network, which coordinates efforts to promote security and stability in the DRC region by engaging governments to bring an end to the conflict in the DRC.

Microsoft works to positively impact end-to-end mining sustainability, from artisanal mines to larger mining enterprises. Through this work, we aspire to improve conditions directly at the source across a broad scope of issues in partnership with the electronics industry, the mining industry, and other not-for-profit partners. In particular, Microsoft believes that it can improve practices associated with the mining of metal ores at their source through participation in collaborative initiatives related to the upstream mining industry. Microsoft supports and participates in numerous additional partnerships that work to establish responsible mining standards and the responsible sourcing of minerals, including the following:

| • | Initiative for Responsible Mining Assurance (“IRMA”): established a multi-stakeholder and independently verifiable responsible mining assurance system that improves social and environmental performance; |

| • | Pact: empowers small and medium sized miners to achieve legal, safe and secure livelihoods; and |

| • | Alliance for Responsible Mining (“ARM”): sets standards for responsible artisanal and small scale mining and supports and creates opportunities for gold miners and provides them incentives to become responsible economic, technological and environmental enterprises. |

| 4. | Supplier Engagement |

In light of our corporate size, the complexity of our devices, and the depth, breadth, and constant evolution of our supply chain; we rely on our in-scope suppliers to provide us with information concerning the source and chain of custody of 3TGs contained in the products and components they supply to us. Many of our in-scope suppliers are also subject to the Rule, and they rely on information provided by their upstream suppliers to meet their compliance obligations.

5

We drive responsible sourcing through our extended supply chain by surveying our in-scope suppliers’ sourcing of raw materials in their upstream supply chains. We also use tools that include supplier and smelter capability building and support broader industry efforts to promote responsible mining and sourcing. Finally, we conduct audits of our contracted suppliers to verify conformance to Microsoft requirements. More information is set forth below.

| • | Supplier Requirements: We require our in-scope suppliers to meet our material disclosure requirements and related responsible sourcing policies through contractual provisions and product specifications that we communicate, monitor, and track electronically to ensure conformance. These policies and procedures are outlined in Section III. We also train our directly contracted suppliers to meet our requirements through training sessions, educational forums, and direct communications. |

| • | Capability Building and Partnerships: We work closely with our supply chain partners to build the raw material supplier capabilities for achieving our responsible sourcing goals. We invest in industry programs, such as the CFSP, to increase suppliers’ capabilities and provide them with platforms to share best practices with each other. |

| • | Supplier Audits: Microsoft conducts audits of its contracted suppliers to assess their conformance to Microsoft requirements, including supply chain transparency. All new contracted hardware and packaging suppliers undergo an initial capability assessment to verify conformance to Microsoft requirements. Microsoft requires that suppliers have a policy and effective procedures to establish and monitor their responsible sourcing of raw materials. Microsoft selects and retains only those business partners that commit to meeting these requirements. A failure by a supplier or any sub-tier supplier to conform to these requirements may constitute a breach of the supplier’s contractual agreement with Microsoft. During the 2015 reporting year, Microsoft-engaged auditors conducted onsite audits of 129 contracted hardware and packaging suppliers to assess areas of SEA conformance, including whether the suppliers had an established conflict minerals policy, systems in place to implement that policy, and documentation to verify conformance to Microsoft responsible sourcing requirements. |

CFSI’s “Practical Guidance for Downstream Companies” document states that “all of the [OECD Guidance’s] red flag triggers are contained in the upstream portion of the supply chain.” Because these conflict mineral supply chain “triggers” are directed to upstream companies, rather than downstream manufacturers, such as Microsoft, we mitigate risks associated with the sourcing of 3TGs by working with our in-scope suppliers to identify 3TG SORs and encourage those facilities to become CFSP compliant or, failing to do so, use an alternate facility that is CFSP compliant. We also participate in industry-wide initiatives, such as the CFSP, that assess SOR compliance with the OECD Guidance as recommended by CFSI guidance documents. We require our in-scope suppliers to actively work with their upstream suppliers to mitigate risks associated with their sourcing of 3TGs.

6

| 5. | Grievance Mechanism |

Microsoft’s Global Human Rights Statement expresses our commitment to provide an anonymous grievance reporting mechanism for our employees and other stakeholders who may be impacted by our operations. Microsoft’s Business Conduct Hotline provides that mechanism, which allows employees and others to ask compliance questions or report concerns regarding Microsoft’s business operations, including its mineral sourcing policies or those of its suppliers. We investigate and, where appropriate, take remedial action to address reported incidents. We also participate in industry efforts to develop specific grievance mechanisms for conflict minerals-related issues, including PPA’s efforts to establish an in-region hotline.

| B. | Identify and Assess Risk in the Supply Chain |

We took the following steps to identify and assess supplier conflict mineral sourcing risk in connection with 2015 reporting year data2:

| • | Using the Rule and SEC guidance, we generated a list of potential in-scope suppliers to receive Microsoft’s annual CMRT survey. |

| • | We surveyed all potential in-scope suppliers to determine the status of any 3TGs contained in devices manufactured during the 2015 reporting year by utilizing the CFSI-standard CMRT and the services of a third party solution provider. The survey included questions regarding a supplier’s responsible sourcing policies, its practices for engaging with its upstream suppliers, a request to list all SORs from which its 3TGs were sourced, and other detailed questions concerning the origins of 3TGs contained in the supplier’s products as well as its 3TG due diligence policies and procedures. |

| • | The survey followed the OECD Guidance as tailored for Microsoft’s role as a downstream company. We reviewed all supplier CMRT submissions to validate that they were complete and to identify any contradictions or inconsistencies. We worked with our third-party solution provider to secure updated responses from suppliers, as needed. |

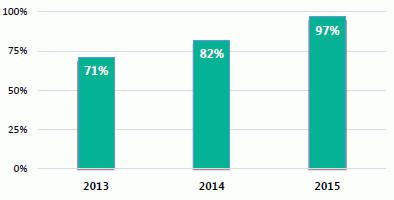

| • | We identified 276 active and in-scope suppliers for reporting year 2015. Of the 276 active and in-scope suppliers surveyed, we received responses from 267. This resulted in a 97% response rate - an improvement from the 2014 reporting year rate of 82% and the 2013 reporting year rate of 71% as shown in Figure 1. |

2 Microsoft completed its supplier conflict mineral sourcing data analysis for the 2015 reporting year on March 31, 2016.

7

Figure 1. Response Rate for Active and In-scope Suppliers (2013-2015 Reporting Years)

III. DUE DILIGENCE DESIGN AND PERFORMANCE

On the basis of our RCOI, we determined that 3TGs contained in our devices may have originated in one or more Covered Country. Accordingly, we designed and performed due diligence on the source and chain-of-custody of those 3TGs.

| A. | Due Diligence Design |

Our 3TG due diligence process conforms to the third and fourth steps of the five-step OECD Guidance. The first and second steps of the five-step OECD Guidance were addressed in Section II.

| B. | Due Diligence Performed |

| 1. | Design and Implement a Strategy to Respond to Risks |

Microsoft requires its suppliers to take affirmative actions to minimize the possible sourcing of 3TGs from conflict-affected and high-risk areas. This is required through contracts with our suppliers and supplier specifications.

| a. | Microsoft Supplier Specifications - H00594 and HO0642 |

Microsoft’s supplier specification H00594, Restricted Substances for Hardware Products (“H00594”), requires 100 percent identification of all materials, including 3TG, used in all packaging and hardware products and parts supplied to Microsoft on a component-by-component level. Specifically, H00594 requires contracted suppliers to do the following:

| • | Post a responsible sourcing policy, conforming to the OECD Guidance, on their website; |

8

| • | Exercise due diligence on the source and chain of custody of any 3TG contained in materials, components, or products they supply to Microsoft; |

| • | Identify, by name, each SOR that has processed or otherwise handled 3TGs contained in those materials, components, or products; |

| • | Encourage those SORs to participate in the CFSP or an equivalent third-party conflict-free audit scheme, when available; |

| • | Confirm that 3TGs in their supply chain are sourced from SORs that are compliant with the CFSP or an equivalent independent private sector audit firm, when available; and |

| • | Notify Microsoft immediately if they obtain information or knowledge that the minerals used in the materials, components, or products that they supply to Microsoft may contain 3TGs sourced from a Covered Country. |

H00594 requires Microsoft suppliers to impose these same requirements on their sub-tier suppliers and to provide appropriate training and support to help their sub-tier suppliers meet Microsoft responsible sourcing requirements. To facilitate this process, H00642, Restricted Substances Control System for Hardware Products. requires Microsoft suppliers to utilize the common CMRT provided by the CFSI and found at www.conflictfreesourcing.org. Suppliers are responsible for submitting the annual CMRT as well as updating the CMRT upon request or when changes occur.

| b. | Responsible Sourcing Program Manual Processes to Implement OECD Guidance |

To respond to possible conflict mineral risks that were identified during our due diligence process, Microsoft implemented responsible sourcing practices, to communicate with suppliers that may be sourcing 3TGs under conditions that may be directly or indirectly financing or benefitting armed groups in a Covered Country. Under our Responsible Sourcing of Raw Materials Program, we use the OECD Guidance to review supplier CMRT data and identify potential red flags for the sourcing of 3TGs, including the following:

| • | The minerals originated from or were transported via a conflict-affected or high-risk area; |

| • | The minerals were claimed to originate from a country that has limited known reserves for the mineral in question; |

| • | The minerals were claimed to originate from a country in which minerals from conflict-affected and high-risk areas are known to transit; |

| • | The company’s suppliers or other known upstream companies have shareholder or other interests in companies that supply minerals or operate in one of the red flag locations of mineral origin and transit; and |

| • | The company’s suppliers’ or other known upstream companies were known to have sourced minerals from a red flag location of mineral origin and transit in the last 12 months. |

9

Microsoft’s program includes an escalation process that may require an in-scope supplier to find an alternative to a non-CFSP compliant source of 3TGs for use in materials, components, or products supplied to Microsoft or risk termination as a Microsoft supplier. To date, we have not encountered a responsible sourcing issue with a supplier that has warranted contract termination.

Also, as required by Microsoft’s internal Responsible Sourcing Program Manual, our team assessed the progress of our conflict minerals program and identified steps necessary to meet our compliance obligations. The team also provided monthly program status updates, including metrics and audit results, to Microsoft’s Corporate Vice President of Manufacturing and Supply Chain organization. We utilized supplier survey updates, supplier communications, supplier social and environmental accountability audits, and new supplier briefings to prevent the introduction of any new 3TG sourcing risk to our supply chain. We also leveraged meetings with executives to report findings and receive program guidance.

| c. | Industry and NGO Partner Engagement |

Microsoft participated in, or has been a member of, several industry-wide responsible mining and smelting initiatives, including CFSI, PPA, ITRI’s iTSCi program, IRMA, Pact, and ARM. As part of our due diligence, we also conducted smelter outreach on behalf of the CFSI Smelter Engagement Team.

| 2. | Carried Out Independent Third-Party Audit of Supply Chain Due Diligence |

As contemplated by the OECD Guidance, our due diligence program leveraged independent SOR audits, which were undertaken in accordance with the CFSP and other similar programs. Microsoft obtained SOR data from the CFSP Compliant Smelter List through our membership in the CFSI using the Reasonable Country of Origin Inquiry Data for member MSFT. This data was used to support certain statements contained in this CMR. The CFSP Compliant Smelter List is a published list of SORs that have undergone assessment through the CFSP or industry equivalent program (such as Responsible Jewellery Council or London Bullion Market Association (“LBMA”)). Microsoft also participated in CFSI’s Smelter Engagement Team during the 2015 reporting year and we engaged a third party to assist smelters prepare for CFSP audits.

| 3. | Reported on Supply Chain Due Diligence |

Microsoft’s Responsible Sourcing of Raw Materials policy and other responsible sourcing documents are available on our external website. We have filed our CMR, required by the Rule, with the SEC and we have posted it on our external Responsible Sourcing website. These disclosures meet the fifth step of the five-step OECD Guidance.

10

| IV. | SOR INFORMATION |

| A. | 3TG Processing Facilities |

Microsoft has made a reasonable good faith effort to collect and evaluate information concerning 3TG SORs based on data provided by our in-scope suppliers. The vast majority of our in-scope suppliers provided data at a company or divisional level or otherwise were unable to identify specific entities that had processed 3TGs contained in the materials, components, or products supplied to us. This was expected given the multiple tiers of supply chain actors that are positioned between our in-scope suppliers and 3TG SORs.

Our supplier survey data revealed 19,568 potential 3TG SORs in the Microsoft supply chain. We validated the data by removing duplicate SORs, reconciling multiple SOR names for a single entity, and eliminating otherwise invalid SOR names. This process reduced the list to 688 entities. Of this list, 226 SORs were unknown to CFSI (but are being investigated by CFSI members) and another 160 SORs were confirmed as misidentified and/or were not actual SORs. After removing those entities, 302 SORs remained.

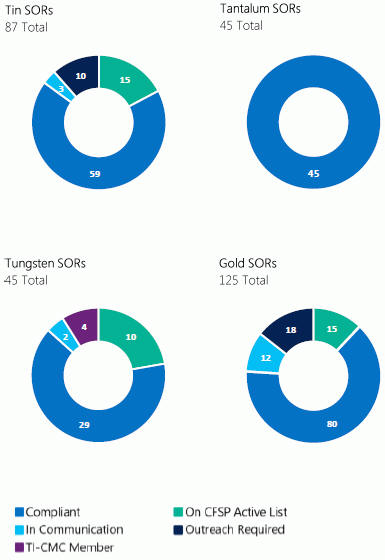

The Figures below provide a visual depiction of the SORs identified in Microsoft’s supply chain by CFSP audit status. Figure 2 categorizes the SORs by audit status and reporting year. Figure 3 categorizes the SORs by 3TG mineral and audit status.

Appendix A to this CMR lists the 302 SORs which, to the extent known, processed 3TGs in Microsoft devices during the 2015 reporting year. Appendix A provides each SOR’s country location, 3TG processed, and CFSP audit status. Appendix A includes several gold SORs which have received the LBMA Responsible Gold Certificate - these are marked with an asterisk.

Table 1 (below) summarizes the conflict mineral status of the 302 SORs that were identified in the Microsoft supply chain.

CFSI defines each audit stage in the following manner:

| • | Compliant: SOR has been audited and found to be compliant with the relevant audit protocols; |

| • | Active: SOR has been engaged but is not yet compliant; |

| • | In Communication: SOR is not yet active but is in communication with CFSP and/or member company; |

| • | Outreach Required: SOR is not yet active and outreach is needed by CFSI member companies to encourage SOR participation in CFSP; and |

| • | TI-CMC Member Company: SOR is a member of the Tungsten Industry – Conflict Mineral Council (“TI-CMC”) and has agreed to undergo an audit within 2 years of joining TI-CMC. |

11

Figure 2. Identified SORs by CFSP Audit Status (2013-2015 Reporting Years)

12

Figure 3: Identified SORs by 3TG and CFSP Audit Status

13

Table 1: Summary of CFSP Audit Status of Identified SORs

|

Number of SORs Identified in Microsoft Supply Chain |

Audit Status | |

| 213 |

Compliant | |

|

40 |

Active | |

| 17 |

In Communication | |

|

28 |

Outreach Required | |

| 4 |

TI-CMC | |

|

673 |

LBMA |

Figures 4-7 show the geographic distribution of the 302 SORs identified in the Microsoft supply chain by 3TG mineral. The circle size corresponds to the relative number of times our in-scope suppliers identified each 3TG SOR in their completed CMRT form.

Figure 4: Location and Relative Number of Identified SORs by 3TG Mineral (Tin)

3 These 67 LBMA Gold SORs are included in the 302 SORs listed in Appendix A and identified by asterisk.

14

Figure 5: Location and Relative Number of Identified SORs by 3TG Mineral (Tantalum)

Figure 6: Location and Relative Number of Identified SORs by 3TG Mineral (Tungsten)

15

Figure 7: Location and Relative Number of Identified SORs by 3TG Mineral (Gold)

| B. | 3TG Countries of Origin |

Countries of origin for the 3TGs that were identified by our CFSP-compliant SORs include: Argentina, Angola, Australia, Austria, Belgium, Brazil, Burundi, Cambodia, Canada, Central African Republic, Chile, China, Colombia, Côte D’Ivoire, Czech Republic, Djibouti, Ecuador, Egypt, Estonia, Ethiopia, France, Germany, Guyana, Hungary, India, Indonesia, Ireland, Israel, Japan, Kazakhstan, Kenya, Laos, Luxembourg, Madagascar, Malaysia, Mongolia, Mozambique, Myanmar, Namibia, Netherlands, Nigeria, Peru, Portugal, Republic of Congo, Russia, Rwanda, Sierra Leone, Singapore, Slovakia, South Africa, South Korea, South Sudan, Spain, Suriname, Switzerland, Taiwan, Tanzania, Thailand, Uganda, United Kingdom, United States of America, Vietnam, Zambia, and Zimbabwe. Other countries of origin identified through additional due diligence included: Armenia, Belarus, Ghana, Guinea, Hong Kong, Italy, Jersey, Kyrgyzstan, Mali, Mexico, Morocco, Niger, Papua New Guinea, Philippines, Poland, Saudi Arabia, Sweden, Tajikistan, Turkey, United Arab Emirates, and Uzbekistan.

Figure 8 provides a graphical presentation of the countries of origin for 3TGs that were identified as being used in the Microsoft supply chain during the 2015 reporting year. Although Covered Countries are listed in Microsoft’s countries of origin list, the SORs located in those countries are CFSP-compliant, verifying that they have been determined by CFSP to source 3TGs in a manner that does not directly or indirectly finance or benefit armed groups in a Covered Country. At this time, we have country-of-origin information for CFSP-compliant SORs and countries identified through additional due diligence.

16

Figure 8: Country-of-Origin Information for SORs Identified in Microsoft’s Supply Chain

For the identified conflict-free SORs for which minerals sourcing information is available from CFSI4:

| • | 55% process recycled or scrap material. |

| • | 75% are not sourcing from Covered Countries. |

| • | 38 SORs are sourcing from Covered Countries but are CFSP compliant. |

| C. | 3TG Mines or Locations of Origin |

Microsoft obtained Reasonable Country of Origin data through our membership in the CFSI using the Reasonable Country of Origin Inquiry Data for member MSFT. We used this data to determine the 3TG country of origin of SORs identified in Microsoft’s supply chain. Microsoft supports the continued refinement and expansion of the list of participating SORs in the CFSP audit program through our membership in CFSI, which oversees the CFSP. We encourage SORs to participate in the CFSP by contacting all non-compliant SORs identified in our supply chain each reporting year. We also require all of our suppliers that reported non-compliant SORs to conduct outreach to those SORs and encourage them to join the CFSP. In addition, we have encouraged other SORs to participate in the CFSP by contacting SORs directly and by engaging in outreach events to encourage greater CFSP participation. We funded a third party to help educate SORs and prepare the SORs for the audit process. We have also offered to visit SORs to facilitate their participation in the CFSP.

4 These numbers include metrics on indirect sourcing that were not included in the 2014 reporting year report as they were made available for the first time this year by CFSI.

17

| V. | IMPROVEMENTS |

Microsoft’s key 2015 reporting year accomplishments and improvements are detailed below. Although comparisons to the 2014 reporting year data are of limited utility due to supply chain year-to-year variances in the data pool, this year’s report, which documents our efforts to expand the number of verified conflict-free SORs in our supply chain, demonstrates meaningful progress, including the following improvements:

| • | Increased the number of CFSP-compliant SORs identified through our due diligence from 148 to 213 due to enhanced supplier outreach, and maturation of CFSI’s CFSP; |

| • | Increased supplier response rate from 71% in 2013 and 82% in 2014 to 97% in the 2015 reporting year; |

| • | Developed early risk identification mechanisms with third party solution provider; |

| • | Strengthened supplier corrective action process to drive and improve supplier due diligence; |

| • | Developed new internal operational controls to standardize responsible sourcing, scoping determination, data collection, data validation and reporting; |

| • | Initiated external review of Microsoft’s conflict minerals program by a third-party audit firm to assess alignment with OECD Guidance and implemented audit recommendations; and |

| • | Enhanced engagement with external organizations, such as Pact, ARM and IRMA that are committed to advancing responsible sourcing on a global basis by developing mining standards and addressing issues such as child labor in the mining industry. |

| VI. | FUTURE ACTIONS |

Microsoft is committed to the sourcing of raw materials in ways that fundamentally support human rights, labor, health and safety, environmental protection, and business ethics in our supply chain. We will continue to improve our ability to identify, assess, and mitigate risks associated with our raw materials sourcing. We will continue to implement our Responsible Sourcing of Raw Materials policy that includes a combination of building cross-industry sector capability, supporting electronics industry efforts, implementing region-specific programs such as working toward the use of conflict-free minerals in our devices and working with in-region expert NGOs that are able to implement community programs that are linguistically and culturally effective. Encouraging SORs to participate in the CFSP will improve our knowledge about the 3TGs in our raw material supply chain and we will continue to encourage CFSP participation.

Microsoft is aware of concerns that have been raised regarding the Rule’s possible unintended negative consequences for local communities. Microsoft is committed to complying with the OECD Guidance and the Rule in such a way that mitigates such concerns through implementation of our Responsible Sourcing of Raw Materials program, which is a holistic program that extends beyond the geographic limitations and the scope of the Rule. Consistent with our commitments, we intend to take the following steps to continuously improve our responsible sourcing of raw materials due diligence efforts:

| • | Continue to refine and improve internal procedures and processes to enhance alignment with the OECD Guidance, including Microsoft’s supplier escalation process and supplier audit procedures; |

18

| • | Increase Microsoft’s level of engagement with suppliers by holding supplier forums, webinars, and providing resources; |

| • | Continue to refine supplier data by conducting outreach where reported data is incomplete or uncertain; |

| • | Enhance our usage of software tools and technology for improved tracking, evaluating and storing of supplier 3TG due diligence data; |

| • | Strengthen engagement with relevant industry groups and external stakeholders to define and improve best practices and build supplier and SOR capabilities (including encouraging SORs to become CSFP compliant); |

| • | Continue active participation in the CFSI Smelter Engagement Team, which seeks to bring non-compliant SORs into the CFSP; and |

| • | Continue our engagement with organizations like IRMA, ARM, and Pact to establish global responsible sourcing standards and programs in the mineral supply chain |

19

APPENDIX A

Conflict Mineral Status of Identified SORs1

This Appendix lists the 302 SORs which, to the extent known, processed 3TGs that were used to manufacture Microsoft devices during the 2015 reporting year. The SORs are listed by their audit status, 3TG processed, and country location. Appendix A includes several gold SORs which have received the LBMA Responsible Gold Certificate - these are marked with an asterisk.

| # | SOR Name |

Conflict Free Audit Status |

Metal | Country | ||||

| 1 | Aida Chemical Industries Co., Ltd. | Compliant | Gold | JAPAN | ||||

| 2 | Allgemeine Gold-und Silberscheideanstalt A.G.* | Compliant | Gold | GERMANY | ||||

| 3 | AngloGold Ashanti Córrego do Sĺtio Mineração* | Compliant | Gold | BRAZIL | ||||

| 4 | Argor-Heraeus S.A.* | Compliant | Gold | SWITZERLAND | ||||

| 5 | Asahi Pretec Corp.* | Compliant | Gold | JAPAN | ||||

| 6 | Asahi Refining Canada Ltd.* | Compliant | Gold | CANADA | ||||

| 7 | Asahi Refining USA Inc.* | Compliant | Gold | UNITED STATES | ||||

| 8 | Asaka Riken Co., Ltd. | Compliant | Gold | JAPAN | ||||

| 9 | Aurubis AG* | Compliant | Gold | GERMANY | ||||

| 10 | Bangko Sentral ng Pilipinas (Central Bank of the Philippines)* | Compliant | Gold | PHILIPPINES | ||||

| 11 | Boliden AB* | Compliant | Gold | SWEDEN | ||||

| 12 | C. Hafner GmbH + Co. KG* | Compliant | Gold | GERMANY | ||||

| 13 | CCR Refinery - Glencore Canada Corporation* | Compliant | Gold | CANADA | ||||

| 14 | Chimet S.p.A.* | Compliant | Gold | ITALY | ||||

| 15 | DODUCO GmbH | Compliant | Gold | GERMANY | ||||

| 16 | Dowa | Compliant | Gold | JAPAN | ||||

| 17 | Eco-System Recycling Co., Ltd. | Compliant | Gold | JAPAN | ||||

| 18 | Elemetal Refining, LLC | Compliant | Gold | UNITED STATES | ||||

| 19 | Emirates Gold DMCC* | Compliant | Gold | UNITED ARAB EMIRATES | ||||

| 20 | Heimerle + Meule GmbH | Compliant | Gold | GERMANY | ||||

| 21 | Heraeus Ltd. Hong Kong* | Compliant | Gold | CHINA | ||||

| 22 | Heraeus Precious Metals GmbH & Co. KG* | Compliant | Gold | GERMANY | ||||

| 23 | Inner Mongolia Qiankun Gold and Silver Refinery Share Co., Ltd.* | Compliant | Gold | CHINA | ||||

| 24 | Ishifuku Metal Industry Co., Ltd.* | Compliant | Gold | JAPAN | ||||

| 25 | Istanbul Gold Refinery* | Compliant | Gold | TURKEY | ||||

| 26 | Japan Mint* | Compliant | Gold | JAPAN | ||||

| 27 | Jiangxi Copper Co., Ltd.* | Compliant | Gold | CHINA |

1 Data as of April 15, 2016.

A-1

| # | SOR Name |

Conflict Free Audit Status |

Metal | Country | ||||

| 28 | JSC Ekaterinburg Non-Ferrous Metal Processing Plant* | Compliant | Gold | RUSSIAN FEDERATION | ||||

| 29 | JSC Uralelectromed* | Compliant | Gold | RUSSIAN FEDERATION | ||||

| 30 | JX Nippon Mining & Metals Co., Ltd.* | Compliant | Gold | JAPAN | ||||

| 31 | Kazzinc* | Compliant | Gold | KAZAKHSTAN | ||||

| 32 | Kennecott Utah Copper LLC* | Compliant | Gold | UNITED STATES | ||||

| 33 | Kojima Chemicals Co., Ltd. | Compliant | Gold | JAPAN | ||||

| 34 | LS-NIKKO Copper Inc.* | Compliant | Gold | KOREA, REPUBLIC OF | ||||

| 35 | Materion | Compliant | Gold | UNITED STATES | ||||

| 36 | Matsuda Sangyo Co., Ltd.* | Compliant | Gold | JAPAN | ||||

| 37 | Metalor Technologies (Hong Kong) Ltd.* | Compliant | Gold | CHINA | ||||

| 38 | Metalor Technologies (Singapore) Pte., Ltd.* | Compliant | Gold | SINGAPORE | ||||

| 39 | Metalor Technologies S.A.* | Compliant | Gold | SWITZERLAND | ||||

| 40 | Metalor USA Refining Corporation* | Compliant | Gold | UNITED STATES | ||||

| 41 | Metalúrgica Met-Mex Peñoles S.A. De C.V.* | Compliant | Gold | MEXICO | ||||

| 42 | Mitsubishi Materials Corporation* | Compliant | Gold | JAPAN | ||||

| 43 | Mitsui Mining and Smelting Co., Ltd.* | Compliant | Gold | JAPAN | ||||

| 44 | MMTC-PAMP India Pvt., Ltd.* | Compliant | Gold | INDIA | ||||

| 45 | Moscow Special Alloys Processing Plant* | Compliant | Gold | RUSSIAN FEDERATION | ||||

| 46 | Nadir Metal Rafineri San. Ve Tic. A.Ş.* | Compliant | Gold | TURKEY | ||||

| 47 | Nihon Material Co., Ltd.* | Compliant | Gold | JAPAN | ||||

| 48 | Ögussa Österreichische Gold- und Silber-Scheideanstalt GmbH | Compliant | Gold | AUSTRIA | ||||

| 49 | Ohura Precious Metal Industry Co., Ltd. | Compliant | Gold | JAPAN | ||||

| 50 | OJSC “The Gulidov Krasnoyarsk Non-Ferrous Metals Plant” (OJSC Krastsvetmet)* | Compliant | Gold | RUSSIAN FEDERATION | ||||

| 51 | OJSC Novosibirsk Refinery* | Compliant | Gold | RUSSIAN FEDERATION | ||||

| 52 | PAMP S.A.* | Compliant | Gold | SWITZERLAND | ||||

| 53 | Prioksky Plant of Non-Ferrous Metals* | Compliant | Gold | RUSSIAN FEDERATION | ||||

| 54 | PT Aneka Tambang (Persero) Tbk* | Compliant | Gold | INDONESIA | ||||

| 55 | PX Précinox S.A.* | Compliant | Gold | SWITZERLAND | ||||

| 56 | Rand Refinery (Pty) Ltd.* | Compliant | Gold | SOUTH AFRICA | ||||

| 57 | Republic Metals Corporation | Compliant | Gold | UNITED STATES | ||||

| 58 | Royal Canadian Mint* | Compliant | Gold | CANADA | ||||

| 59 | Schone Edelmetaal B.V.* | Compliant | Gold | NETHERLANDS | ||||

| 60 | SEMPSA Joyerĺa Platerĺa S.A.* | Compliant | Gold | SPAIN | ||||

| 61 | Shandong Zhaojin Gold & Silver Refinery Co., Ltd.* | Compliant | Gold | CHINA | ||||

| 62 | Sichuan Tianze Precious Metals Co., Ltd.* | Compliant | Gold | CHINA |

A-2

| # | SOR Name |

Conflict Free Audit Status |

Metal | Country | ||||

| 63 | Singway Technology Co., Ltd. | Compliant | Gold | TAIWAN | ||||

| 64 | SOE Shyolkovsky Factory of Secondary Precious Metals* | Compliant | Gold | RUSSIAN FEDERATION | ||||

| 65 | Solar Applied Materials Technology Corp.* | Compliant | Gold | TAIWAN | ||||

| 66 | Sumitomo Metal Mining Co., Ltd.* | Compliant | Gold | JAPAN | ||||

| 67 | T.C.A S.p.A* | Compliant | Gold | ITALY | ||||

| 68 | Tanaka Kikinzoku Kogyo K.K.* | Compliant | Gold | JAPAN | ||||

| 69 | The Refinery of Shandong Gold Mining Co., Ltd.* | Compliant | Gold | CHINA | ||||

| 70 | Tokuriki Honten Co., Ltd.* | Compliant | Gold | JAPAN | ||||

| 71 | Umicore Brasil Ltda.* | Compliant | Gold | BRAZIL | ||||

| 72 | Umicore Precious Metals Thailand | Compliant | Gold | THAILAND | ||||

| 73 | Umicore S.A. Business Unit Precious Metals Refining* | Compliant | Gold | BELGIUM | ||||

| 74 | United Precious Metal Refining, Inc. | Compliant | Gold | UNITED STATES | ||||

| 75 | Valcambi S.A.* | Compliant | Gold | SWITZERLAND | ||||

| 76 | Western Australian Mint trading as The Perth Mint* | Compliant | Gold | AUSTRALIA | ||||

| 77 | Yamamoto Precious Metal Co., Ltd. | Compliant | Gold | JAPAN | ||||

| 78 | Yokohama Metal Co., Ltd. | Compliant | Gold | JAPAN | ||||

| 79 | Zhongyuan Gold Smelter of Zhongjin Gold Corporation* | Compliant | Gold | CHINA | ||||

| 80 | Zijin Mining Group Co., Ltd. Gold Refinery* | Compliant | Gold | CHINA | ||||

| 81 | Advanced Chemical Company | Active | Gold | UNITED STATES | ||||

| 82 | Almalyk Mining and Metallurgical Complex (AMMC)* | Active | Gold | UZBEKISTAN | ||||

| 83 | Cendres + Métaux S.A. | Active | Gold | SWITZERLAND | ||||

| 84 | Daejin Indus Co., Ltd. | Active | Gold | KOREA, REPUBLIC OF | ||||

| 85 | DSC (Do Sung Corporation) | Active | Gold | KOREA, REPUBLIC OF | ||||

| 86 | Faggi Enrico S.p.A. | Active | Gold | ITALY | ||||

| 87 | Geib Refining Corporation | Active | Gold | UNITED STATES | ||||

| 88 | KGHM Polska Miedź Spółka Akcyjna | Active | Gold | POLAND | ||||

| 89 | Korea Zinc Co., Ltd. | Active | Gold | KOREA, REPUBLIC OF | ||||

| 90 | Metalor Technologies (Suzhou) Ltd. | Active | Gold | CHINA | ||||

| 91 | Navoi Mining and Metallurgical Combinat* | Active | Gold | UZBEKISTAN | ||||

| 92 | Samduck Precious Metals | Active | Gold | KOREA, REPUBLIC OF | ||||

| 93 | SAXONIA Edelmetalle GmbH | Active | Gold | GERMANY | ||||

| 94 | Torecom | Active | Gold | KOREA, REPUBLIC OF | ||||

| 95 | WIELAND Edelmetalle GmbH | Active | Gold | GERMANY | ||||

| 96 | Caridad | In Communication | Gold | MEXICO |

A-3

| # | SOR Name |

Conflict Free Audit Status |

Metal | Country | ||||

| 97 | Chugai Mining | In Communication | Gold | JAPAN | ||||

| 98 | Daye Non-Ferrous Metals Mining Ltd. | In Communication | Gold | CHINA | ||||

| 99 | Guoda Safina High-Tech Environmental Refinery Co., Ltd. | In Communication | Gold | CHINA | ||||

| 100 | Hunan Chenzhou Mining Co., Ltd. | In Communication | Gold | CHINA | ||||

| 101 | Hwasung CJ Co., Ltd. | In Communication | Gold | KOREA, REPUBLIC OF | ||||

| 102 | Kazakhmys Smelting LLC | In Communication | Gold | KAZAKHSTAN | ||||

| 103 | Korea Metal Co., Ltd. | In Communication | Gold | KOREA, REPUBLIC OF | ||||

| 104 | Morris and Watson | In Communication | Gold | NEW ZEALAND | ||||

| 105 | Remondis Argentia B.V. | In Communication | Gold | NETHERLANDS | ||||

| 106 | SAMWON Metals Corp. | In Communication | Gold | KOREA, REPUBLIC OF | ||||

| 107 | Shandong Tiancheng Biological Gold Industrial Co., Ltd. | In Communication | Gold | CHINA | ||||

| 108 | Al Etihad Gold Refinery DMCC | Outreach Required |

Gold | UNITED ARAB EMIRATES | ||||

| 109 | Atasay Kuyumculuk Sanayi Ve Ticaret A.S. | Outreach Required |

Gold | TURKEY | ||||

| 110 | AURA-II | Outreach Required |

Gold | UNITED STATES | ||||

| 111 | Gansu Seemine Material Hi-Tech Co., Ltd. | Outreach Required |

Gold | CHINA | ||||

| 112 | Great Wall Precious Metals Co., Ltd. of CBPM* | Outreach Required |

Gold | CHINA | ||||

| 113 | Guangdong Jinding Gold Limited | Outreach Required |

Gold | CHINA | ||||

| 114 | Hangzhou Fuchunjiang Smelting Co., Ltd. | Outreach Required |

Gold | CHINA | ||||

| 115 | Kaloti Precious Metals | Outreach Required |

Gold | UNITED ARAB EMIRATES | ||||

| 116 | Kyrgyzaltyn JSC* | Outreach Required |

Gold | KYRGYZSTAN | ||||

| 117 | L’azurde Company For Jewelry | Outreach Required |

Gold | SAUDI ARABIA | ||||

| 118 | Lingbao Gold Co., Ltd. | Outreach Required |

Gold | CHINA | ||||

| 119 | Lingbao Jinyuan Tonghui Refinery Co., Ltd. | Outreach Required |

Gold | CHINA | ||||

| 120 | Luoyang Zijin Yinhui Gold Refinery Co., Ltd. | Outreach Required |

Gold | CHINA | ||||

| 121 | Penglai Penggang Gold Industry Co., Ltd. | Outreach Required |

Gold | CHINA | ||||

| 122 | Sabin Metal Corp. | Outreach Required |

Gold | UNITED STATES |

A-4

| # | SOR Name |

Conflict Free Audit Status |

Metal | Country | ||||

| 123 | So Accurate Group, Inc. | Outreach Required |

Gold | UNITED STATES | ||||

| 124 | Tongling Nonferrous Metals Group Co., Ltd. | Outreach Required |

Gold | CHINA | ||||

| 125 | Yunnan Copper Industry Co., Ltd. | Outreach Required |

Gold | CHINA | ||||

| 126 | Changsha South Tantalum Niobium Co., Ltd. | Compliant | Tantalum | CHINA | ||||

| 127 | Conghua Tantalum and Niobium Smeltry | Compliant | Tantalum | CHINA | ||||

| 128 | D Block Metals, LLC | Compliant | Tantalum | UNITED STATES | ||||

| 129 | Duoluoshan | Compliant | Tantalum | CHINA | ||||

| 130 | Exotech Inc. | Compliant | Tantalum | UNITED STATES | ||||

| 131 | F&X Electro-Materials Ltd. | Compliant | Tantalum | CHINA | ||||

| 132 | FIR Metals & Resource Ltd. | Compliant | Tantalum | CHINA | ||||

| 133 | Global Advanced Metals Aizu | Compliant | Tantalum | JAPAN | ||||

| 134 | Global Advanced Metals Boyertown | Compliant | Tantalum | UNITED STATES | ||||

| 135 | Guangdong Zhiyuan New Material Co., Ltd. | Compliant | Tantalum | CHINA | ||||

| 136 | H.C. Starck Co., Ltd. | Compliant | Tantalum | THAILAND | ||||

| 137 | H.C. Starck GmbH Goslar | Compliant | Tantalum | GERMANY | ||||

| 138 | H.C. Starck GmbH Laufenburg | Compliant | Tantalum | GERMANY | ||||

| 139 | H.C. Starck Hermsdorf GmbH | Compliant | Tantalum | GERMANY | ||||

| 140 | H.C. Starck Inc. | Compliant | Tantalum | UNITED STATES | ||||

| 141 | H.C. Starck Ltd. | Compliant | Tantalum | JAPAN | ||||

| 142 | H.C. Starck Smelting GmbH & Co. KG | Compliant | Tantalum | GERMANY | ||||

| 143 | Hengyang King Xing Lifeng New Materials Co., Ltd. | Compliant | Tantalum | CHINA | ||||

| 144 | Hi-Temp Specialty Metals, Inc. | Compliant | Tantalum | UNITED STATES | ||||

| 145 | Jiangxi Dinghai Tantalum & Niobium Co., Ltd. | Compliant | Tantalum | CHINA | ||||

| 146 | JiuJiang JinXin Nonferrous Metals Co., Ltd. | Compliant | Tantalum | CHINA | ||||

| 147 | Jiujiang Tanbre Co., Ltd. | Compliant | Tantalum | CHINA | ||||

| 148 | Jiujiang Zhongao Tantalum & Niobium Co., Ltd. | Compliant | Tantalum | CHINA | ||||

| 149 | KEMET Blue Metals | Compliant | Tantalum | MEXICO | ||||

| 150 | KEMET Blue Powder | Compliant | Tantalum | UNITED STATES | ||||

| 151 | King-Tan Tantalum Industry Ltd. | Compliant | Tantalum | CHINA | ||||

| 152 | LSM Brasil S.A. | Compliant | Tantalum | BRAZIL | ||||

| 153 | Metallurgical Products India Pvt., Ltd. | Compliant | Tantalum | INDIA | ||||

| 154 | Mineração Taboca S.A. | Compliant | Tantalum | BRAZIL | ||||

| 155 | Mitsui Mining & Smelting | Compliant | Tantalum | JAPAN | ||||

| 156 | Molycorp Silmet A.S. | Compliant | Tantalum | ESTONIA | ||||

| 157 | Ningxia Orient Tantalum Industry Co., Ltd. | Compliant | Tantalum | CHINA | ||||

| 158 | Plansee SE Liezen | Compliant | Tantalum | AUSTRIA | ||||

| 159 | Plansee SE Reutte | Compliant | Tantalum | AUSTRIA | ||||

| 160 | QuantumClean | Compliant | Tantalum | UNITED STATES | ||||

| 161 | Resind Indústria e Comércio Ltda. | Compliant | Tantalum | BRAZIL | ||||

| 162 | RFH Tantalum Smeltry Co., Ltd. | Compliant | Tantalum | CHINA |

A-5

| # | SOR Name |

Conflict Free Audit Status |

Metal | Country | ||||

| 163 | Solikamsk Magnesium Works OAO | Compliant | Tantalum | RUSSIAN FEDERATION | ||||

| 164 | Taki Chemicals | Compliant | Tantalum | JAPAN | ||||

| 165 | Telex Metals | Compliant | Tantalum | UNITED STATES | ||||

| 166 | Tranzact, Inc. | Compliant | Tantalum | UNITED STATES | ||||

| 167 | Ulba Metallurgical Plant JSC | Compliant | Tantalum | KAZAKHSTAN | ||||

| 168 | XinXing HaoRong Electronic Material Co., Ltd. | Compliant | Tantalum | CHINA | ||||

| 169 | Yichun Jin Yang Rare Metal Co., Ltd. | Compliant | Tantalum | CHINA | ||||

| 170 | Zhuzhou Cemented Carbide | Compliant | Tantalum | CHINA | ||||

| 171 | Alpha | Compliant | Tin | UNITED STATES | ||||

| 172 | China Tin Group Co., Ltd. | Compliant | Tin | CHINA | ||||

| 173 | Cooperativa Metalurgica de Rondônia Ltda. | Compliant | Tin | BRAZIL | ||||

| 174 | CV Ayi Jaya | Compliant | Tin | INDONESIA | ||||

| 175 | CV Gita Pesona | Compliant | Tin | INDONESIA | ||||

| 176 | CV Serumpun Sebalai | Compliant | Tin | INDONESIA | ||||

| 177 | CV United Smelting | Compliant | Tin | INDONESIA | ||||

| 178 | CV Venus Inti Perkasa | Compliant | Tin | INDONESIA | ||||

| 179 | Dowa | Compliant | Tin | JAPAN | ||||

| 180 | Elmet S.L.U. | Compliant | Tin | SPAIN | ||||

| 181 | EM Vinto | Compliant | Tin | BOLIVIA | ||||

| 182 | Fenix Metals | Compliant | Tin | POLAND | ||||

| 183 | Gejiu Non-Ferrous Metal Processing Co., Ltd. | Compliant | Tin | CHINA | ||||

| 184 | Jiangxi Ketai Advanced Material Co., Ltd. | Compliant | Tin | CHINA | ||||

| 185 | Magnu’s Minerais Metais e Ligas Ltda. | Compliant | Tin | BRAZIL | ||||

| 186 | Malaysia Smelting Corporation (MSC) | Compliant | Tin | MALAYSIA | ||||

| 187 | Melt Metais e Ligas S.A. | Compliant | Tin | BRAZIL | ||||

| 188 | Metallic Resources, Inc. | Compliant | Tin | UNITED STATES | ||||

| 189 | Metallo-Chimique N.V. | Compliant | Tin | BELGIUM | ||||

| 190 | Mineração Taboca S.A. | Compliant | Tin | BRAZIL | ||||

| 191 | Minsur | Compliant | Tin | PERU | ||||

| 192 | Mitsubishi Materials Corporation | Compliant | Tin | JAPAN | ||||

| 193 | O.M. Manufacturing (Thailand) Co., Ltd. | Compliant | Tin | THAILAND | ||||

| 194 | O.M. Manufacturing Philippines, Inc. | Compliant | Tin | PHILIPPINES | ||||

| 195 | Operaciones Metalurgical S.A. | Compliant | Tin | BOLIVIA | ||||

| 196 | PT Aries Kencana Sejahtera | Compliant | Tin | INDONESIA | ||||

| 197 | PT Artha Cipta Langgeng | Compliant | Tin | INDONESIA | ||||

| 198 | PT ATD Makmur Mandiri Jaya | Compliant | Tin | INDONESIA | ||||

| 199 | PT Babel Inti Perkasa | Compliant | Tin | INDONESIA | ||||

| 200 | PT Bangka Prima Tin | Compliant | Tin | INDONESIA | ||||

| 201 | PT Bangka Tin Industry | Compliant | Tin | INDONESIA | ||||

| 202 | PT Belitung Industri Sejahtera | Compliant | Tin | INDONESIA | ||||

| 203 | PT BilliTin Makmur Lestari | Compliant | Tin | INDONESIA |

A-6

| # | SOR Name |

Conflict Free Audit Status |

Metal | Country | ||||

| 204 | PT Bukit Timah | Compliant | Tin | INDONESIA | ||||

| 205 | PT Cipta Persada Mulia | Compliant | Tin | INDONESIA | ||||

| 206 | PT DS Jaya Abadi | Compliant | Tin | INDONESIA | ||||

| 207 | PT Eunindo Usaha Mandiri | Compliant | Tin | INDONESIA | ||||

| 208 | PT Inti Stania Prima | Compliant | Tin | INDONESIA | ||||

| 209 | PT Justindo | Compliant | Tin | INDONESIA | ||||

| 210 | PT Mitra Stania Prima | Compliant | Tin | INDONESIA | ||||

| 211 | PT Panca Mega Persada | Compliant | Tin | INDONESIA | ||||

| 212 | PT Prima Timah Utama | Compliant | Tin | INDONESIA | ||||

| 213 | PT Refined Bangka Tin | Compliant | Tin | INDONESIA | ||||

| 214 | PT Sariwiguna Binasentosa | Compliant | Tin | INDONESIA | ||||

| 215 | PT Stanindo Inti Perkasa | Compliant | Tin | INDONESIA | ||||

| 216 | PT Sukses Inti Makmur | Compliant | Tin | INDONESIA | ||||

| 217 | PT Sumber Jaya Indah | Compliant | Tin | INDONESIA | ||||

| 218 | PT Timah (Persero) Tbk Kundur | Compliant | Tin | INDONESIA | ||||

| 219 | PT Timah (Persero) Tbk Mentok | Compliant | Tin | INDONESIA | ||||

| 220 | PT Tinindo Inter Nusa | Compliant | Tin | INDONESIA | ||||

| 221 | PT Tommy Utama | Compliant | Tin | INDONESIA | ||||

| 222 | PT Wahana Perkit Jaya | Compliant | Tin | INDONESIA | ||||

| 223 | Resind Indústria e Comércio Ltda. | Compliant | Tin | BRAZIL | ||||

| 224 | Rui Da Hung | Compliant | Tin | TAIWAN | ||||

| 225 | Soft Metais Ltda. | Compliant | Tin | BRAZIL | ||||

| 226 | Thaisarco | Compliant | Tin | THAILAND | ||||

| 227 | VQB Mineral and Trading Group JSC | Compliant | Tin | VIETNAM | ||||

| 228 | White Solder Metalurgia e Mineração Ltda. | Compliant | Tin | BRAZIL | ||||

| 229 | Yunnan Tin Company Limited | Compliant | Tin | CHINA | ||||

| 230 | An Thai Minerals Co., Ltd. | Active | Tin | VIETNAM | ||||

| 231 | An Vinh Joint Stock Mineral Processing Company | Active | Tin | VIETNAM | ||||

| 232 | Chenzhou Yunxiang Mining and Metallurgy Co., Ltd. | Active | Tin | CHINA | ||||

| 233 | CV Dua Sekawan | Active | Tin | INDONESIA | ||||

| 234 | Electro-Mechanical Facility of the Cao Bang Minerals & Metallurgy Joint Stock Company | Active | Tin | VIETNAM | ||||

| 235 | Feinhütte Halsbrücke GmbH | Active | Tin | GERMANY | ||||

| 236 | Gejiu Fengming Metallurgy Chemical Plant | Active | Tin | CHINA | ||||

| 237 | Gejiu Jinye Mineral Company | Active | Tin | CHINA | ||||

| 238 | Gejiu Kai Meng Industry and Trade LLC | Active | Tin | CHINA | ||||

| 239 | Gejiu Yunxin Nonferrous Electrolysis Co., Ltd. | Active | Tin | CHINA | ||||

| 240 | Nghe Tinh Non-Ferrous Metals Joint Stock Company | Active | Tin | VIETNAM | ||||

| 241 | Phoenix Metal Ltd. | Active | Tin | RWANDA | ||||

| 242 | PT Karimun Mining | Active | Tin | INDONESIA |

A-7

| # | SOR Name |

Conflict Free Audit Status |

Metal | Country | ||||

| 243 | Tuyen Quang Non-Ferrous Metals Joint Stock Company | Active | Tin | VIETNAM | ||||

| 244 | Yunnan Chengfeng Non-ferrous Metals Co., Ltd. | Active | Tin | CHINA | ||||

| 245 | Estanho de Rondônia S.A. | In Communication | Tin | BRAZIL | ||||

| 246 | Gejiu Zili Mining And Metallurgy Co., Ltd. | In Communication | Tin | CHINA | ||||

| 247 | Linwu Xianggui Ore Smelting Co., Ltd. | In Communication | Tin | CHINA | ||||

| 248 | CNMC (Guangxi) PGMA Co., Ltd. | Outreach Required |

Tin | CHINA | ||||

| 249 | Huichang Jinshunda Tin Co., Ltd. | Outreach Required |

Tin | CHINA | ||||

| 250 | Nankang Nanshan Tin Manufactory Co., Ltd. | Outreach Required |

Tin | CHINA | ||||

| 251 | PT Alam Lestari Kencana | Outreach Required |

Tin | INDONESIA | ||||

| 252 | PT Bangka Kudai Tin | Outreach Required |

Tin | INDONESIA | ||||

| 253 | PT Bangka Timah Utama Sejahtera | Outreach Required |

Tin | INDONESIA | ||||

| 254 | PT Fang Di MulTindo | Outreach Required |

Tin | INDONESIA | ||||

| 255 | PT Pelat Timah Nusantara Tbk | Outreach Required |

Tin | INDONESIA | ||||

| 256 | PT Seirama Tin Investment | Outreach Required |

Tin | INDONESIA | ||||

| 257 | PT Tirus Putra Mandiri | Outreach Required |

Tin | INDONESIA | ||||

| 258 | A.L.M.T. TUNGSTEN Corp. | Compliant | Tungsten | JAPAN | ||||

| 259 | Asia Tungsten Products Vietnam Ltd. | Compliant | Tungsten | VIETNAM | ||||

| 260 | Chenzhou Diamond Tungsten Products Co., Ltd. | Compliant | Tungsten | CHINA | ||||

| 261 | Chongyi Zhangyuan Tungsten Co., Ltd. | Compliant | Tungsten | CHINA | ||||

| 262 | Fujian Jinxin Tungsten Co., Ltd. | Compliant | Tungsten | CHINA | ||||

| 263 | Ganzhou Huaxing Tungsten Products Co., Ltd. | Compliant | Tungsten | CHINA | ||||

| 264 | Ganzhou Jiangwu Ferrotungsten Co., Ltd. | Compliant | Tungsten | CHINA | ||||

| 265 | Ganzhou Seadragon W & Mo Co., Ltd. | Compliant | Tungsten | CHINA | ||||

| 266 | Ganzhou Yatai Tungsten Co., Ltd. | Compliant | Tungsten | CHINA | ||||

| 267 | Global Tungsten & Powders Corp. | Compliant | Tungsten | UNITED STATES | ||||

| 268 | Guangdong Xianglu Tungsten Co., Ltd. | Compliant | Tungsten | CHINA | ||||

| 269 | H.C. Starck GmbH | Compliant | Tungsten | GERMANY | ||||

| 270 | H.C. Starck Smelting GmbH & Co.KG | Compliant | Tungsten | GERMANY | ||||

| 271 | Hunan Chenzhou Mining Co., Ltd. | Compliant | Tungsten | CHINA | ||||

| 272 | Hunan Chunchang Nonferrous Metals Co., Ltd. | Compliant | Tungsten | CHINA | ||||

| 273 | Hydrometallurg, JSC | Compliant | Tungsten | RUSSIAN FEDERATION | ||||

| 274 | Japan New Metals Co., Ltd. | Compliant | Tungsten | JAPAN | ||||

| 275 | Jiangxi Gan Bei Tungsten Co., Ltd. | Compliant | Tungsten | CHINA |

A-8

| # | SOR Name |

Conflict Free Audit Status |

Metal | Country | ||||

| 276 | Jiangxi Xiushui Xianggan Nonferrous Metals Co., Ltd. | Compliant | Tungsten | CHINA | ||||

| 277 | Kennametal Huntsville | Compliant | Tungsten | UNITED STATES | ||||

| 278 | Malipo Haiyu Tungsten Co., Ltd. | Compliant | Tungsten | CHINA | ||||

| 279 | Niagara Refining LLC | Compliant | Tungsten | UNITED STATES | ||||

| 280 | Nui Phao H.C. Starck Tungsten Chemicals Manufacturing LLC | Compliant | Tungsten | VIETNAM | ||||

| 281 | Tejing (Vietnam) Tungsten Co., Ltd. | Compliant | Tungsten | VIETNAM | ||||

| 282 | Vietnam Youngsun Tungsten Industry Co., Ltd. | Compliant | Tungsten | VIETNAM | ||||

| 283 | Wolfram Bergbau und Hütten AG | Compliant | Tungsten | AUSTRIA | ||||

| 284 | Xiamen Tungsten (H.C.) Co., Ltd. | Compliant | Tungsten | CHINA | ||||

| 285 | Xiamen Tungsten Co., Ltd. | Compliant | Tungsten | CHINA | ||||

| 286 | Xinhai Rendan Shaoguan Tungsten Co., Ltd. | Compliant | Tungsten | CHINA | ||||

| 287 | ACL Metais Eireli | Active | Tungsten | BRAZIL | ||||

| 288 | Hunan Chuangda Vanadium Tungsten Co., Ltd. Wuji | Active | Tungsten | CHINA | ||||

| 289 | Hunan Chuangda Vanadium Tungsten Co., Ltd. Yanglin | Active | Tungsten | CHINA | ||||

| 290 | Jiangwu H.C. Starck Tungsten Products Co., Ltd. | Active | Tungsten | CHINA | ||||

| 291 | Jiangxi Tonggu Non-ferrous Metallurgical & Chemical Co., Ltd. | Active | Tungsten | CHINA | ||||

| 292 | Jiangxi Xinsheng Tungsten Industry Co., Ltd. | Active | Tungsten | CHINA | ||||

| 293 | Jiangxi Yaosheng Tungsten Co., Ltd. | Active | Tungsten | CHINA | ||||

| 294 | Kennametal Fallon | Active | Tungsten | UNITED STATES | ||||

| 295 | Sanher Tungsten Vietnam Co., Ltd. | Active | Tungsten | VIETNAM | ||||

| 296 | Xinfeng Huarui Tungsten & Molybdenum New Material Co., Ltd. | Active | Tungsten | CHINA | ||||

| 297 | Ganxian Shirui New Material Co., Ltd. | In Communication | Tungsten | CHINA | ||||

| 298 | Jiangxi Minmetals Gao’an Non-ferrous Metals Co., Ltd. | In Communication | Tungsten | CHINA | ||||

| 299 | Dayu Jincheng Tungsten Industry Co., Ltd. | TI-CMC Member Company |

Tungsten | CHINA | ||||

| 300 | Dayu Weiliang Tungsten Co., Ltd. | TI-CMC Member Company |

Tungsten | CHINA | ||||

| 301 | Ganzhou Non-ferrous Metals Smelting Co., Ltd. | TI-CMC Member Company |

Tungsten | CHINA | ||||

| 302 | Pobedit, JSC | TI-CMC Member Company |

Tungsten | RUSSIAN FEDERATION |

A-9

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Microsoft earnings press release available on Investor Relations website

- Martinrea International Inc. to Announce First Quarter Results on May 2, 2024

- ROSEN, NATIONAL TRIAL LAWYERS, Encourages Northern Genesis Acquisition Corp. n/k/a The Lion Electric Company Investors to Secure Counsel Before Important Deadline in Securities Class Action – NGA

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share