Form 8-K Apollo Residential Mortg For: May 09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 9, 2016

Apollo Residential Mortgage, Inc.

(Exact name of registrant as specified in its charter)

| Maryland | 001-35246 | 45-0679215 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) | ||

| c/o Apollo Global Management, LLC 9 West 57th Street, 43rd Floor New York, New York |

10019 | |||

| (Address of principal executive offices) | (Zip Code) | |||

Registrant’s telephone number, including area code: (212) 515-3200

n/a

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| ITEM 2.02. | Results of Operations and Financial Condition. |

On May 9, 2016, Apollo Residential Mortgage, Inc. (the “Company”) issued an earnings release announcing its financial results for the quarter ended March 31, 2016. A copy of the earnings release is attached as Exhibit 99.1 hereto and incorporated herein by reference.

On May 9, 2016, the Company posted supplemental financial information on the Investor Relations section of its website (www.apolloresidentialmortgage.com). A copy of the supplemental financial information is furnished as Exhibit 99.2 hereto and incorporated herein by reference.

The information in this Current Report, including Exhibits 99.1 and 99.2, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. The information in this Current Report shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended, unless it is specifically incorporated by reference therein.

| ITEM 9.01. | Financial Statements and Exhibits. |

| (d) | Exhibits. |

| Exhibit |

Description | |

| 99.1 | Earnings Release, dated May 9, 2016 | |

| 99.2 | Supplemental Financial Information Presentation for the quarter ended March 31, 2016 | |

- 2 -

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Apollo Residential Mortgage, Inc. | ||

| By: | /s/ Michael A. Commaroto | |

| Name: | Michael A. Commaroto | |

| Title: | President and Chief Executive Officer | |

Date: May 9, 2016

- 3 -

Exhibit Index

| Exhibit |

Description | |

| 99.1 | Earnings Release, dated May 9, 2016 | |

| 99.2 | Supplemental Financial Information Presentation for the quarter ended March 31, 2016 | |

- 4 -

Exhibit 99.1

| FOR IMMEDIATE RELEASE | ||

| CONTACT: Hilary Ginsberg | NYSE: AMTG | |

| (212) 822-0767 |

APOLLO RESIDENTIAL MORTGAGE, INC. REPORTS

FIRST QUARTER 2016 FINANCIAL RESULTS

New York, NY, May 9, 2016 - Apollo Residential Mortgage, Inc. (the “Company”) (NYSE: AMTG) today reported financial results for the quarter ended March 31, 2016.

First Quarter 2016 Financial Summary

| • | Net loss allocable to common stock of $16.6 million, or $(0.52) per basic and diluted share of common stock; |

| • | Operating earnings(1) of $9.4 million, or $0.29 per share of common stock; excluding $3.6 million of expenses associated with the proposed acquisition of AMTG by Apollo Commercial Real Estate Finance, Inc. (NYSE:ARI), Operating earnings(1) of $13.0 million, or $0.41 per share of common stock; |

| • | Declared a $0.48 dividend per share of common stock for the quarter. |

First Quarter 2016 Portfolio Summary

| • | Book value per share of common stock of $15.39 at March 31, 2016; |

| • | $2.8 billion residential mortgage backed securities (“RMBS”) portfolio consisted of Agency RMBS with an estimated fair value of $1.6 billion and non-Agency RMBS with an estimated fair value of $1.1 billion; |

| • | RMBS, securitized mortgage loans and other credit investment portfolio had a 2.65% effective net interest rate spread for the three months ended March 31, 2016(1); |

| • | Average leverage multiple of 3.9x for the quarter ended March 31, 2016. |

| (1) | Reflects a “non-GAAP” financial measure (i.e., a measure that is not calculated in accordance with U.S. Generally Accepted Accounting Principles). See “Reconciliations of Non-GAAP Financial Measures” in this press release. |

Portfolio Summary (Table 1)

The following table sets forth additional detail regarding the Company’s RMBS, other investment securities and securitized mortgage loans as of March 31, 2016:

| Principal Balance |

Premium/ (Discount), Net(1) |

Amortized Cost (2) |

Estimated Fair Value |

Unrealized Gain/ (Loss), net |

Weighted Average Coupon |

Estimated Weighted Average Yield (3) |

||||||||||||||||||||||

| ($ amounts in thousands) | ||||||||||||||||||||||||||||

| Agency pass-through RMBS 30-Year Mortgages: |

||||||||||||||||||||||||||||

| ARM-RMBS |

$ | 255,340 | $ | 18,055 | $ | 273,395 | $ | 269,240 | $ | (4,155 | ) | 2.56 | % | 1.47 | % | |||||||||||||

| 3.5% coupon |

593,562 | 27,735 | 621,297 | 623,281 | 1,984 | 3.50 | % | 2.73 | % | |||||||||||||||||||

| 4.0% coupon |

636,453 | 40,877 | 677,330 | 683,649 | 6,319 | 4.00 | % | 2.85 | % | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| 1,485,355 | 86,667 | 1,572,022 | 1,576,170 | 4,148 | 3.61 | % | 2.56 | % | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Agency IO (4) |

— | — | 55,522 | 49,975 | (5,547 | ) | 2.25 | % | 5.20 | % | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total Agency securities |

1,485,355 | 86,667 | 1,627,544 | 1,626,145 | (1,399 | ) | 4.53 | % | 2.65 | % | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Non-Agency RMBS |

1,325,231 | (219,022 | ) | 1,106,209 | 1,126,720 | 20,511 | 1.68 | % | 5.87 | % | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total RMBS |

$ | 2,810,586 | $ | (132,355 | ) | $ | 2,733,753 | $ | 2,752,865 | $ | 19,112 | 3.11 | % | 3.95 | % | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Securitized Mortgage Loans |

$ | 205,819 | $ | (49,654 | ) | $ | 156,165 | $ | 159,301 | $ | 3,136 | 5.91 | % | 8.44 | % | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Other Investment Securities |

$ | 176,210 | $ | (9,850 | ) | $ | 166,360 | $ | 159,917 | $ | (6,443 | ) | 2.73 | % | 5.28 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total |

$ | 3,192,615 | $ | (191,859 | ) | $ | 3,056,278 | $ | 3,072,083 | $ | 15,805 | 3.26 | % | 4.24 | % | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| (1) | A portion of the purchase discount on non-Agency RMBS is not expected to be recognized as interest income, and is instead viewed as a credit discount. At March 31, 2016, the Company’s non-Agency RMBS had gross discounts of $219,181, which included credit discounts and other-than-temporary impairments (“OTTI”) of $81,354, and Other Investment Securities had gross discounts of $10,205, which included credit discounts and OTTI of $1,639. |

| (2) | Amortized cost is reduced by allowances for loan losses on securitized mortgage loans and OTTI on investment securities. |

| (3) | The estimated weighted average yield at March 31, 2016 presented incorporates estimates for future prepayment assumptions and forward interest rate assumptions on all RMBS and loss assumptions on non-Agency RMBS; actual future results may differ significantly. |

| (4) | Agency IO are interest only (“IO”) securities that receive interest payments, but no principal payments, made on a related series of assets, based on a notional balance. At March 31, 2016, the Company’s investments in Agency IO had a notional balance of $541,385. |

As of March 31, 2016, the average cost basis of the Company’s Agency RMBS pass-through portfolio was 105.8% of par value and the average cost basis of the Company’s non-Agency RMBS portfolio was 83.5% of par value.

The Agency RMBS pass-through portfolio experienced prepayments at an average one month constant prepayment rate (“CPR”) for the quarter ended March 31, 2016 of 8.0%. Including Agency IOs, the Agency RMBS portfolio experienced prepayments at an average one month CPR of 8.2% for the quarter ended March 31, 2016.

Other Investments (Table 2)

The following table sets forth the Company’s other investments at March 31, 2016:

| ($ amounts in thousands) | Carrying Value | |||

| Warehouse line receivable |

$ | 5,955 | ||

| Real estate subject to BFT Contracts, net of accumulated depreciation(1)(2) |

30,205 | |||

| Mortgage loans purchased through Seller Financing Program |

9,484 | |||

|

|

|

|||

| Total Other Investments |

$ | 45,644 | ||

|

|

|

|||

| (1) | Reflects legal title to real estate subject to BFT Contracts at March 31, 2016, which had an aggregate principal balance of $30,937 with a weighted average contractual interest rate of 8.17%. |

| (2) | Net of $732 of accumulated depreciation. |

Portfolio Financing

At March 31, 2016, the Company had master repurchase agreements with 25 counterparties and had outstanding repurchase borrowings with 17 counterparties totaling approximately $2.5 billion.

(Table 3)

The following table sets forth information about the Company’s borrowings at March 31, 2016:

| ($ amount in thousands) |

Balance | Weighted Average Contractual Borrowing Rate |

Weighted Average Remaining Maturity (days) |

|||||||||

| Securities Financed: |

||||||||||||

| Agency RMBS |

$ | 1,467,721 | 0.69 | % | 21 | |||||||

| Non-Agency RMBS(1) |

961,222 | 2.16 | 85 | |||||||||

| Other investment securities |

120,765 | 2.15 | 115 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total |

$ | 2,549,708 | 1.32 | % | 50 | |||||||

|

|

|

|

|

|

|

|||||||

| (1) | Includes $85,675 of repurchase borrowings collateralized by $119,442 of non-Agency RMBS that were eliminated from the Company’s consolidated balance sheet in consolidation with the variable interest entities associated with the Company’s securitization transactions. These borrowings are indirectly collateralized by the Company’s securitized mortgage loans. |

2

(Table 4)

The Company’s derivative instruments consisted of the following at March 31, 2016:

| ($ amounts in thousands) | Notional Amount |

Estimated Fair Value |

||||||

| Swaptions – assets |

$ | 425,000 | $ | 77 | ||||

| Swaps – (liabilities) |

1,287,000 | (7,767 | ) | |||||

| Swaptions – (liabilities)(1) |

300,000 | (10,813 | ) | |||||

| Long TBA Contracts – assets |

100,000 | 378 | ||||||

|

|

|

|

|

|||||

| Total derivative instruments |

$ | 2,112,000 | $ | (18,125 | ) | |||

|

|

|

|

|

|||||

| (1) | Are comprised of Swaption sale contracts. |

(Table 5)

The following table summarizes the weighted average fixed-pay rate and weighted average maturity for the Company’s Swaps at March 31, 2016:

| Term to Maturity ($ amount in thousands) |

Notional Amount |

Weighted Average Fixed Pay Rate |

Weighted Average Maturity (years) |

|||||||||

| Less than one year |

$ | 160,000 | 1.39 | % | 0.7 | |||||||

| More than one year up to and including three years |

949,000 | 1.00 | 1.4 | |||||||||

| More than three years up to and including five years |

64,000 | 2.28 | 4.3 | |||||||||

| More than five years |

114,000 | 1.82 | 6.5 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total |

$ | 1,287,000 | 1.19 | % | 1.9 | |||||||

|

|

|

|

|

|

|

|||||||

(Table 6)

The following tables present information about the Company’s Swaptions at March 31, 2016:

| ($ amounts in thousands) | Option | Underlying Swap | ||||||||||||||||||||||

| Premium Cost |

Fair Value | Weighted Average Months Until Option Expiration |

Notional Amount |

Weighted Average Swap Term (Years) |

Weighted Average Fixed-Pay Rate |

|||||||||||||||||||

| Purchase Contracts: |

||||||||||||||||||||||||

| Fixed-Pay Rate for Underlying Swap |

||||||||||||||||||||||||

| 2.51 – 2.75% |

$ | 552 | $ | — | 3.9 | $ | 75,000 | 5.0 | 2.72 | % | ||||||||||||||

| 2.76 – 3.00% |

648 | 12 | 5.7 | 50,000 | 10.0 | 2.99 | ||||||||||||||||||

| 3.01 – 3.25% |

4,019 | 65 | 4.4 | 300,000 | 10.0 | 3.15 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total |

$ | 5,219 | $ | 77 | 4.5 | $ | 425,000 | 9.1 | 3.05 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

3

| ($ amounts in thousands) | Option | Underlying Swap | ||||||||||||||||||||||

| Premium (Received) |

Fair Value | Weighted Average Months Until Option Expiration |

Notional Amount |

Weighted Average Swap Term (Years) |

Weighted Average Fixed-Pay Rate |

|||||||||||||||||||

| Sale Contracts: |

||||||||||||||||||||||||

| Fixed-Pay Rate for Underlying Swap |

||||||||||||||||||||||||

| 1.72% |

$ | (500 | ) | $ | (1,835 | ) | 3.9 | $ | 75,000 | 5.0 | 1.72 | % | ||||||||||||

| 1.99% |

(640 | ) | (1,751 | ) | 5.7 | 50,000 | 10.0 | 1.99 | ||||||||||||||||

| 2.03% |

(1,200 | ) | (3,868 | ) | 7.5 | 100,000 | 10.0 | 2.03 | ||||||||||||||||

| 2.14% |

(953 | ) | (3,359 | ) | 3.9 | 75,000 | 10.0 | 2.14 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total |

$ | (3,293 | ) | $ | (10,813 | ) | 5.4 | $ | 300,000 | 8.8 | 1.97 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Estimated Taxable Income

The Company’s taxable income may vary significantly on a quarterly basis. Estimated ordinary taxable income available to common stockholders, net of the preferred stock dividend, for the quarter ended March 31, 2016 was $0.34 per share of common stock. This difference between the Company’s operating earnings and taxable ordinary income primarily reflects estimated tax to GAAP timing differences associated with discount accretion on certain non-Agency RMBS. The difference primarily is attributable to changes in cash flows on the Company’s locked-out non-Agency RMBS, which impacts the timing of market discount accretion by the Company for tax purposes on such securities. Certain locked-out bonds may move from being locked-out to current pay, and vice-versa, depending on the performance of the underlying collateral and the associated triggers specified in the securitization structure.

Book Value

The Company’s book value per share of common stock at March 31, 2016 was $15.39 as compared to book value per share of common stock of $16.40 at December 31, 2015. During the three months ended March 31, 2016, the decrease in unrealized gains in the non-Agency RMBS portfolio reflected items that were re-characterized to either realized gains or interest income. Specifically, with respect to the non-Agency RMBS, the unrealized gains decreased by $9.9 million, however, the Company realized gains of $1.1 million on sales and accreted $10.8 million of purchase discounts into interest income.

Supplemental Information

The Company provides a supplemental information package to offer more transparency into its financial results and make its reporting more informative and easier to follow. The supplemental package is available in the investor relations section of the Company’s website at www.apolloresidentialmortgage.com.

About Apollo Residential Mortgage, Inc.

Apollo Residential Mortgage, Inc. is a real estate investment trust that invests in and manages residential mortgage-backed securities and other residential mortgage assets throughout the United States. The Company is externally managed and advised by ARM Manager, LLC, a Delaware limited liability company and an indirect subsidiary of Apollo Global Management, LLC (NYSE:APO), a leading global alternative investment manager with approximately $172.5 billion of assets under management at March 31, 2016. Additional information can be found on the Company’s website at www.apolloresidentialmortgage.com.

Forward-Looking Statements

Certain statements contained in this press release may constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and the Company claims the protections of the safe harbor for forward-looking statements contained in such sections. Forward-looking statements are subject to substantial risks and uncertainties, many of which are difficult to predict and are generally beyond the Company’s control. These forward-looking statements include information about possible or assumed future results of the Company’s business, financial condition, liquidity, results of operations, plans and objectives. When used in this release, the words “believe”, “expect”, “anticipate”, “estimate”, “plan”, “continue”, “intend”, “should”, “may”, or similar expressions are intended to identify forward-looking statements. Statements

4

regarding the following subjects, among others, may be forward-looking: market trends in the Company’s industry, interest rates, real estate values, the debt securities markets, the U.S. housing market or the general economy or the demand for residential mortgage loans; the Company’s business and investment strategy; the Company’s operating results and potential asset performance; availability of opportunities to acquire Agency RMBS, non-Agency RMBS, residential mortgage loans and other residential mortgage assets or other real estate related assets; changes in the prepayment rates on the mortgage loans securing the Company’s RMBS management’s assumptions regarding default rates on the mortgage loans securing the Company’s non-Agency RMBS; the Company’s ability to borrow to finance its assets and the terms, including the cost, maturity and other terms, of any such borrowing; the Company’s estimates regarding taxable income, the actual amount of which is dependent on a number of factors, including, but not limited to, changes in the amount of interest income and financing costs, the method elected by the Company to accrete the market discount on non-Agency RMBS, realized losses and changes in the composition of the Company’s Agency RMBS and non-Agency RMBS portfolios that may occur during the applicable tax period, including gain or loss on any RMBS disposals; expected leverage; general volatility of the securities markets in which the Company participates; the Company’s expected portfolio and scope of the Company’s target assets; the Company’s expected investment and underwriting process; interest rate mismatches between the Company’s target assets and any borrowings used to fund such assets; changes in interest rates and the market value of the Company’s target assets; rates of default or decreased recovery rates on the Company’s assets; the degree to which the Company’s hedging strategies may or may not protect the Company from interest rate volatility and the effects of hedging instruments on the Company’s assets; the impact of and changes in governmental regulations, tax law and rates, accounting, legal or regulatory issues or guidance and similar matters affecting the Company’s business; the timing and amount of distributions to stockholders, which are declared and paid at the discretion of the Company’s board of directors and will depend on, among other things, the Company’s taxable income, the Company’s financial results and overall financial condition and liquidity; continued maintenance of the Company’s qualification as a real estate investment trust for U.S. Federal income tax purposes and such other factors as the Company’s board of directors deems relevant; the Company’s continued maintenance of its exclusion from registration as an investment company under the Investment Company Act of 1940, as amended; availability of qualified personnel through ARM Manager, LLC; the Company’s present and future competition; risks associated with the ability and timing to consummate the proposed merger transaction with ARI and whether any terms may change; the risk that the anticipated benefits from the mergers and related transactions may not be realized or may take longer to realize than expected; and unexpected costs or unexpected liabilities, including those related to litigation, that may arise from the proposed mergers and related transactions, whether or not consummated. For a further list and description of such risks and uncertainties, see the Company’s Annual Report on Form 10-K for the year ended December 31, 2015 and other reports filed by the Company with the Securities and Exchange Commission. The forward-looking statements, and other risks, uncertainties and factors are based on the Company’s beliefs, assumptions and expectations of its future performance, taking into account all information currently available to the Company. Forward-looking statements are not predictions of future events. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

5

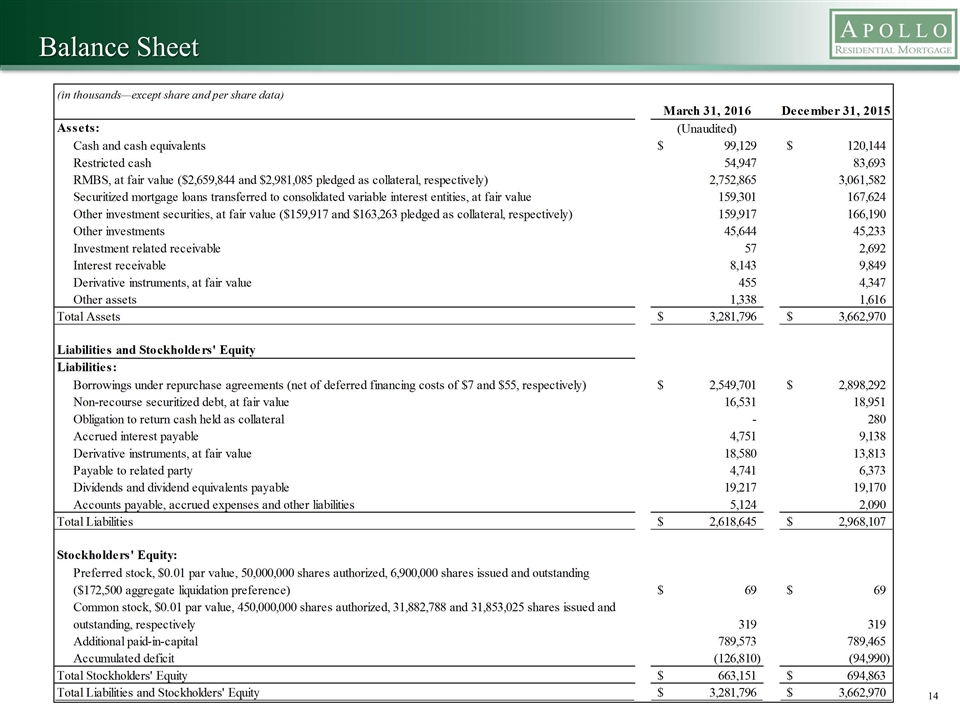

Apollo Residential Mortgage, Inc. and Subsidiaries Consolidated Balance Sheets

(in thousands – except share and per share data)

| March 31, 2016 | December 31, 2015 | |||||||

| (unaudited) | ||||||||

| Assets: |

||||||||

| Cash and cash equivalents |

$ | 99,129 | $ | 120,144 | ||||

| Restricted cash |

54,947 | 83,693 | ||||||

| RMBS, at fair value ($2,659,844 and $2,981,085 pledged as collateral, respectively) |

2,752,865 | 3,061,582 | ||||||

| Securitized mortgage loans transferred to consolidated variable interest entities, at fair value |

159,301 | 167,624 | ||||||

| Other investment securities, at fair value ($159,917 and $163,263 pledged as collateral, respectively) |

159,917 | 166,190 | ||||||

| Other investments |

45,644 | 45,233 | ||||||

| Investment related receivable |

57 | 2,692 | ||||||

| Interest receivable |

8,143 | 9,849 | ||||||

| Derivative instruments, at fair value |

455 | 4,347 | ||||||

| Other assets |

1,338 | 1,616 | ||||||

|

|

|

|

|

|||||

| Total Assets |

$ | 3,281,796 | $ | 3,662,970 | ||||

|

|

|

|

|

|||||

| Liabilities and Stockholders’ Equity |

||||||||

| Liabilities: |

||||||||

| Borrowings under repurchase agreements (net of deferred financing costs of $7 and $55, respectively) |

$ | 2,549,701 | $ | 2,898,292 | ||||

| Non-recourse securitized debt, at fair value |

16,531 | 18,951 | ||||||

| Obligation to return cash held as collateral |

— | 280 | ||||||

| Accrued interest payable |

4,751 | 9,138 | ||||||

| Derivative instruments, at fair value |

18,580 | 13,813 | ||||||

| Payable to related party |

4,741 | 6,373 | ||||||

| Dividends and dividend equivalents payable |

19,217 | 19,170 | ||||||

| Accounts payable, accrued expenses and other liabilities |

5,124 | 2,090 | ||||||

|

|

|

|

|

|||||

| Total Liabilities |

2,618,645 | 2,968,107 | ||||||

|

|

|

|

|

|||||

| Stockholders’ Equity: |

||||||||

| Preferred stock, $0.01 par value, 50,000,000 shares authorized, 6,900,000 shares issued and outstanding ($172,500 aggregate liquidation preference) |

$ | 69 | $ | 69 | ||||

| Common stock, $0.01 par value, 450,000,000 shares authorized, 31,882,788 and 31,853,025 shares issued and outstanding, respectively |

319 | 319 | ||||||

| Additional paid-in-capital |

789,573 | 789,465 | ||||||

| Accumulated deficit |

(126,810 | ) | (94,990 | ) | ||||

|

|

|

|

|

|||||

| Total Stockholders’ Equity |

663,151 | 694,863 | ||||||

|

|

|

|

|

|||||

| Total Liabilities and Stockholders’ Equity |

$ | 3,281,796 | $ | 3,662,970 | ||||

|

|

|

|

|

|||||

6

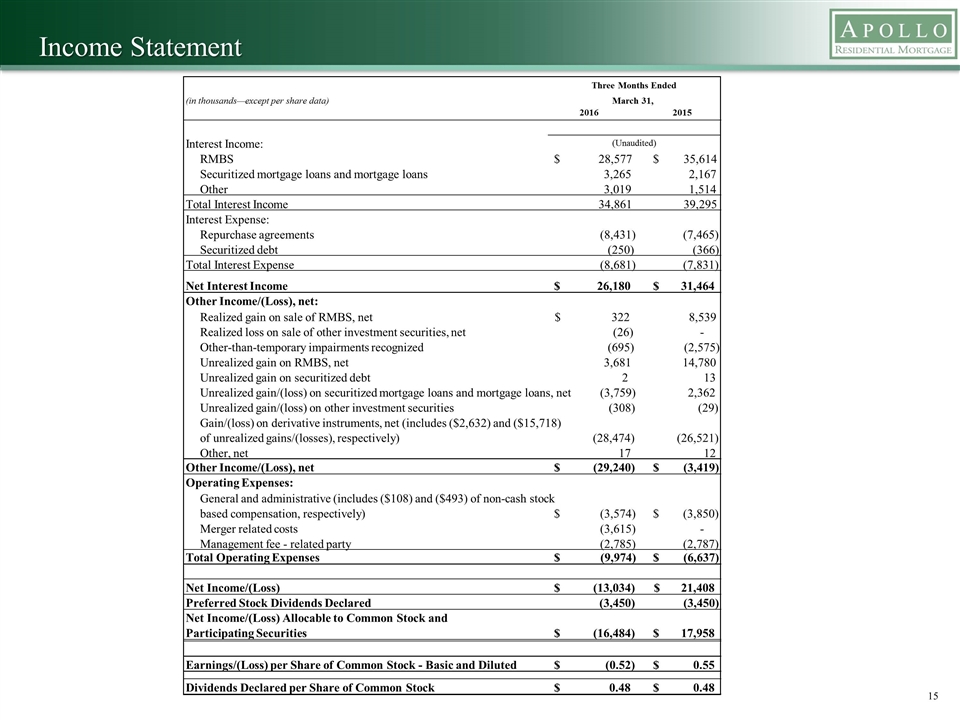

Apollo Residential Mortgage, Inc. and Subsidiaries

Consolidated Statements of Operations (in thousands – except per share data) (Unaudited)

| Three Months Ended March 31, |

||||||||

| 2016 | 2015 | |||||||

| Interest Income: |

||||||||

| RMBS |

$ | 28,577 | $ | 35,614 | ||||

| Securitized mortgage loans |

3,265 | 2,167 | ||||||

| Other |

3,019 | 1,514 | ||||||

|

|

|

|

|

|||||

| Total Interest Income |

34,861 | 39,295 | ||||||

|

|

|

|

|

|||||

| Interest Expense: |

||||||||

| Repurchase agreements |

(8,431 | ) | (7,465 | ) | ||||

| Securitized debt |

(250 | ) | (366 | ) | ||||

|

|

|

|

|

|||||

| Total Interest Expense |

(8,681 | ) | (7,831 | ) | ||||

|

|

|

|

|

|||||

| Net Interest Income |

26,180 | 31,464 | ||||||

|

|

|

|

|

|||||

| Other Income/(Loss): |

||||||||

| Realized gain on sale of RMBS, net |

322 | 8,539 | ||||||

| Other-than-temporary impairments recognized |

(695 | ) | (2,575 | ) | ||||

| Realized loss on sale of other investment securities, net |

(26 | ) | — | |||||

| Unrealized gain on RMBS, net |

3,681 | 14,780 | ||||||

| Unrealized gain on securitized debt |

2 | 13 | ||||||

| Unrealized gain/(loss) on securitized mortgage loans and mortgage loans, net |

(3,759 | ) | 2,362 | |||||

| Unrealized gain/(loss) on other investment securities |

(308 | ) | (29 | ) | ||||

| Gain/(loss) on derivative instruments, net (includes ($2,632) and ($15,718) of unrealized (losses), respectively) |

(28,474 | ) | (26,521 | ) | ||||

| Other, net |

17 | 12 | ||||||

|

|

|

|

|

|||||

| Other Income/(Loss), net |

(29,240 | ) | (3,419 | ) | ||||

|

|

|

|

|

|||||

| Operating Expenses: |

||||||||

| General and administrative (includes ($108) and ($493) of non-cash stock based compensation, respectively) |

(3,574 | ) | (3,850 | ) | ||||

| Merger related costs |

(3,615 | ) | — | |||||

| Management fee – related party |

(2,785 | ) | (2,787 | ) | ||||

|

|

|

|

|

|||||

| Total Operating Expenses |

(9,974 | ) | (6,637 | ) | ||||

|

|

|

|

|

|||||

| Net Income |

$ | (13,034 | ) | $ | 21,408 | |||

|

|

|

|

|

|||||

| Preferred Stock Dividends Declared |

(3,450 | ) | (3,450 | ) | ||||

|

|

|

|

|

|||||

| Net Income/(Loss) Allocable to Common Stock and Participating Securities |

$ | (16,484 | ) | $ | 17,958 | |||

|

|

|

|

|

|||||

| Earnings/(Loss) per Share of Common Stock – Basic and Diluted |

$ | (0.52 | ) | $ | 0.55 | |||

|

|

|

|

|

|||||

| Dividends Declared per Share of Common Stock |

$ | 0.48 | $ | 0.48 | ||||

|

|

|

|

|

|||||

7

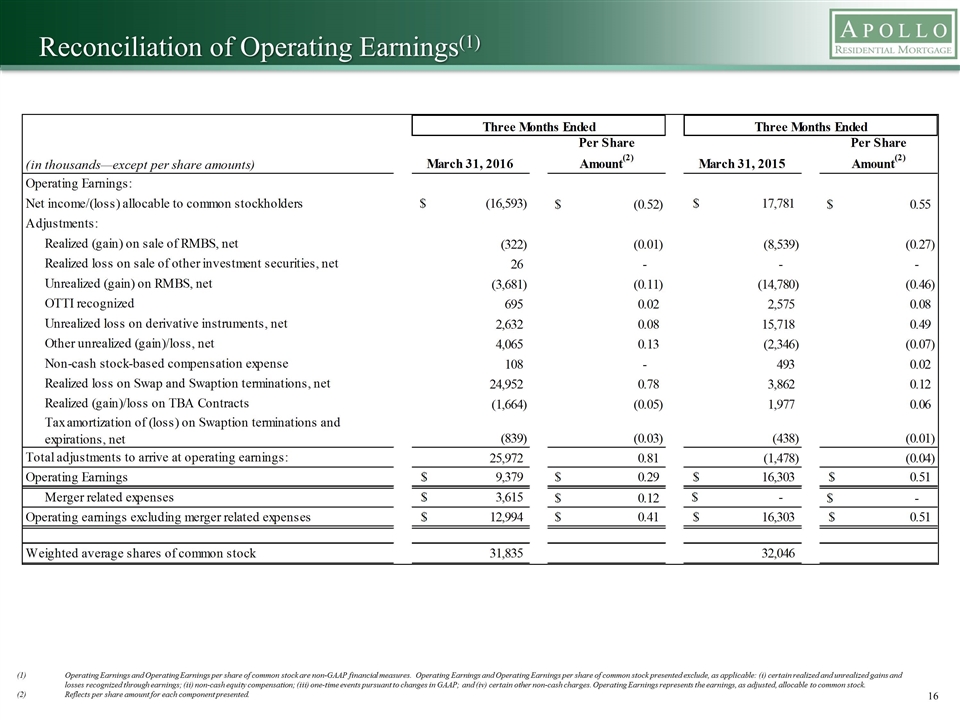

Reconciliations of Non-GAAP Financial Measures

Included in this press release are disclosures about the Company’s “operating earnings,” “operating earnings per share of common stock” and “effective net interest rate spread” which measures constitute non-GAAP financial measures within the meaning of Regulation G promulgated by the Securities and Exchange Commission. The Company believes that the non-GAAP financial measures presented, when considered together with GAAP financial measures, provide information that is useful to investors in understanding the Company’s operating results. An analysis of any non-GAAP financial measures should be made in conjunction with results presented in accordance with GAAP.

Operating earnings and operating earnings per share of common stock presented exclude, as applicable: (i) certain realized and unrealized gains and losses recognized through earnings; (ii) non-cash equity compensation; (iii) one-time events pursuant to changes in GAAP; and (iv) certain other non-cash charges. Operating earnings is a non-GAAP financial measure that is used by the Manager to assess the Company’s business results.

While the Company has not elected hedge accounting under GAAP for its Swaps, such derivative instruments are viewed by the Company as an economic hedge against increases in future market interest rates. To present how the Company views its Swaps, the Company provides the “effective cost of funds” which is comprised of GAAP interest expense plus the interest expense component for Swaps. The interest expense component of the Company’s Swaps reflects the net interest payments made or accrued on its Swaps. The Company believes that the presentation of effective cost of funds is useful for investors as it presents the Company’s borrowing costs as viewed by management.

The Company believes that the non-GAAP measures presented provide investors and other readers of this press release with meaningful information to assess the performance of the Company’s ongoing business and believes it is useful supplemental information for both management and investors in evaluating the Company’s financial results. The primary limitation associated with operating earnings as a measure of the Company’s financial performance over any period is that such measure excludes, except for the net interest component of Swaps, the effects of net realized and unrealized gains and losses from investments and realized and unrealized gains and losses from derivative instruments. In addition, the Company’s presentation of operating earnings may not be comparable to similarly-titled measures of other companies, who may use different definitions or calculations for such term. As a result, operating earnings should not be considered as a substitute for GAAP net income as a measure of the Company’s financial performance or the Company’s liquidity under GAAP.

A reconciliation of the GAAP items discussed above to their non-GAAP measures for the three month periods ended March 31, 2016 and March 31, 2015, are presented in the tables below.

8

(Table 7)

The following tables reconcile net income allocable to common stockholders with operating earnings for the three months ended March 31, 2016 and March 31, 2015, respectively:

| Three Months Ended March 31, 2016 |

Three Months Ended March 31, 2015 |

|||||||||||||||

| ($ amounts in thousands except per share amounts) | Per Share | Per Share | ||||||||||||||

| Net income/(loss) allocable to common stockholders |

$ | (16,593 | ) | $ | (0.52 | ) | $ | 17,781 | $ | 0.55 | ||||||

| Adjustments: |

||||||||||||||||

| Realized (gain) on sale of RMBS, net |

(322 | ) | (0.01 | ) | (8,539 | ) | (0.27 | ) | ||||||||

| Realized loss on sale of other investment securities, net |

26 | — | — | — | ||||||||||||

| Unrealized (gain) on RMBS, net |

(3,681 | ) | (0.11 | ) | (14,780 | ) | (0.46 | ) | ||||||||

| OTTI recognized |

695 | 0.02 | 2,575 | 0.08 | ||||||||||||

| Unrealized loss on derivative instruments, net |

2,632 | 0.08 | 15,718 | 0.49 | ||||||||||||

| Other unrealized (gain)/loss, net |

4,065 | 0.13 | (2,346 | ) | (0.07 | ) | ||||||||||

| Non-cash stock-based compensation expense |

108 | — | 493 | 0.02 | ||||||||||||

| Realized loss on Swap and Swaption terminations, net |

24,952 | 0.78 | 3,862 | 0.12 | ||||||||||||

| Realized (gain)/loss on TBA Contracts |

(1,664 | ) | (0.05 | ) | 1,977 | 0.06 | ||||||||||

| Tax amortization of (loss) on Swaption terminations and expirations, net |

(839 | ) | (0.03 | ) | (438 | ) | (0.01 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total adjustments to arrive at operating earnings |

25,972 | 0.81 | (1,478 | ) | (0.04 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating earnings |

$ | 9,379 | $ | 0.29 | $ | 16,303 | $ | 0.51 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Merger related expenses |

$ | 3,615 | $ | 0.12 | $ | — | $ | — | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating earnings excluding merger related expenses |

$ | 12,994 | $ | 0.41 | $ | 16,303 | $ | 0.51 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Weighted average shares of common stock |

31,835 | 32,046 | ||||||||||||||

|

|

|

|

|

|||||||||||||

(Table 8)

The following table details Effective Net Interest Spread for the three months ended March 31, 2016:

| Agency RMBS | Non-Agency RMBS and Other Credit Investments |

Securitized Mortgage Loans |

Weighted Average |

|||||||||||||

| Asset Yield |

2.87 | % | 5.69 | % | 8.37 | % | 4.33 | % | ||||||||

| Interest Expense |

0.64 | % | 2.07 | % | 3.23 | % | 1.30 | % | ||||||||

| Cost of Swaps |

0.64 | % | — | 0.41 | % | 0.38 | % | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Effective Net Interest Spread |

1.59 | % | 3.62 | % | 4.73 | % | 2.65 | % | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

9

Information is as of March 31, 2016, except as otherwise noted. It should not be assumed that investments made in the future will be profitable or will equal the performance of investments in this document. Supplemental Financial Information Package – Q1 2016 May 9, 2016 Exhibit 99.2

Forward Looking Statements and Other Disclosures Certain statements contained in this presentation may constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and Apollo Residential Mortgage, Inc. (“AMTG” or the “Company”) claims the protections of the safe harbor for forward looking statements contained in such sections. Forward-looking statements are subject to substantial risks and uncertainties, many of which are difficult to predict and are generally beyond management’s control. These forward-looking statements include information about possible or assumed future results of Apollo Residential Mortgage, Inc.’s the Company’s business, financial condition, liquidity, results of operations, plans and objectives. When used in this presentation, the words “believe," "expect," "anticipate," "estimate," "plan," "continue," "intend," "should," "may”, or similar expressions are intended to identify forward-looking statements. Statements regarding the following subjects, among others, may be forward-looking: market trends in the Company’s industry, interest rates, real estate values, the debt securities markets, the U.S. housing market or the general economy or the demand for residential mortgage loans; the Company’s business and investment strategy; the Company’s operating results and potential asset performance; availability of opportunities to acquire Agency RMBS, non-Agency RMBS, residential mortgage loans and other residential mortgage assets or other real estate related assets; changes in the prepayment rates on the mortgage loans securing the Company’s RMBS; management’s assumptions regarding default rates on the mortgage loans securing the Company’s non-Agency RMBS; the Company’s ability to borrow to finance its assets and the terms, including the cost, maturity and other terms, of any such borrowing; the Company’s estimates regarding taxable income, the actual amount of which is dependent on a number of factors, including, but not limited to, changes in the amount of interest income and financing costs, the method elected by the Company to accrete the market discount on non-Agency RMBS, realized losses and changes in the composition of the Company’s Agency RMBS and non-Agency RMBS portfolios that may occur during the applicable tax period, including gain or loss on any RMBS disposals; expected leverage; general volatility of the securities markets in which the Company participates; the Company’s expected portfolio and scope of the Company’s target assets; the Company’s expected investment and underwriting process; interest rate mismatches between the Company’s target assets and any borrowings used to fund such assets; changes in interest rates and the market value of the Company’s target assets; rates of default or decreased recovery rates on the Company’s assets; the degree to which the Company’s hedging strategies may or may not protect the Company from interest rate volatility and the effects of hedging instruments on the Company’s assets; the impact of and changes in governmental regulations, tax law and rates, accounting, legal or regulatory issues or guidance and similar matters affecting the Company’s business; the timing and amount of distributions to stockholders, which are declared and paid at the discretion of the Company’s board of directors and will depend on, among other things, the Company’s taxable income, the Company’s financial results and overall financial condition and liquidity; continued maintenance of the Company’s qualification as a real estate investment trust for U.S. Federal income tax purposes and such other factors as the Company’s board of directors deems relevant; the Company’s continued maintenance of its exclusion from registration as an investment company under the Investment Company Act of 1940, as amended; availability of qualified personnel through ARM Manager, LLC; the Company’s present and future competition; risks associated with the ability and timing to consummate the proposed merger transaction with Apollo Commercial Real Estate Finance, Inc. and whether any terms may change; the risk that the anticipated benefits from the mergers and related transactions may not be realized or may take longer to realize than expected; and unexpected costs or unexpected liabilities, including those related to litigation, that may arise from the proposed mergers and related transactions, whether or not consummated. The forward-looking statements are based on management’s beliefs, assumptions and expectations of AMTG’s future performance, taking into account all information currently available to management. Forward-looking statements are not predictions of future events. These beliefs, assumptions and expectations can change as a result of many possible events or factors, not all of which are known to AMTG. Some of these factors are described in the Company's Annual Report on Form 10-K for the year ended December 31, 2015 and the Company’s other filings with the Securities and Exchange Commission (“SEC”). These and other risks, uncertainties and factors, including those described in the Company’s annual, quarterly and current reports filed with the SEC, could cause the Company’s actual results to differ materially from those included in any forward-looking statements the Company makes. All forward-looking statements speak only as of the date on which they are made. New risks and uncertainties arise over time, and it is not possible for management to predict those events or how they may affect AMTG. Except as required by law, AMTG is not obligated to, and does not intend to, update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. This presentation contains information regarding the Company’s financial results that is calculated and presented on the basis of methodologies other than in accordance with accounting principles generally accepted in the United States (“GAAP”), including Operating Earnings and Operating Earnings per share. Please refer to page 2 for a definition of “Operating Earnings” and the reconciliation of “Operating Earnings” to the applicable GAAP financial measure set forth on page 16. This presentation may contain statistics and other data that in some cases has been obtained from or compiled from information made available by third-party service providers. AMTG makes no representation or warranty, expressed or implied, with respect to the accuracy, reasonableness or completeness of such information. Past performance is not indicative nor a guarantee of future returns. Index performance and yield data are shown for illustrative purposes only and have limitations when used for comparison or for other purposes due to, among other matters, volatility, credit or other factors (such as number and types of securities). Indices are unmanaged, do not charge any fees or expenses, assume reinvestment of income and do not employ special investment techniques such as leveraging or short selling. No such index is indicative of the future results of any investment by AMTG.

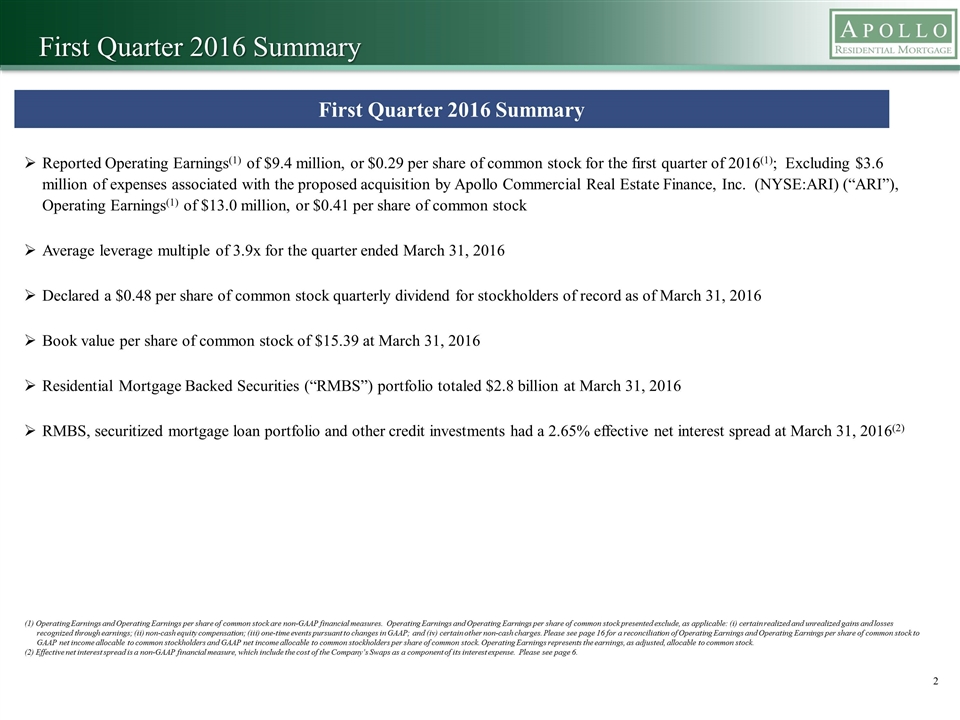

First Quarter 2016 Summary Reported Operating Earnings(1) of $9.4 million, or $0.29 per share of common stock for the first quarter of 2016(1); Excluding $3.6 million of expenses associated with the proposed acquisition by Apollo Commercial Real Estate Finance, Inc. (NYSE:ARI) (“ARI”), Operating Earnings(1) of $13.0 million, or $0.41 per share of common stock Average leverage multiple of 3.9x for the quarter ended March 31, 2016 Declared a $0.48 per share of common stock quarterly dividend for stockholders of record as of March 31, 2016 Book value per share of common stock of $15.39 at March 31, 2016 Residential Mortgage Backed Securities (“RMBS”) portfolio totaled $2.8 billion at March 31, 2016 RMBS, securitized mortgage loan portfolio and other credit investments had a 2.65% effective net interest spread at March 31, 2016(2) First Quarter 2016 Summary (1) Operating Earnings and Operating Earnings per share of common stock are non-GAAP financial measures. Operating Earnings and Operating Earnings per share of common stock presented exclude, as applicable: (i) certain realized and unrealized gains and losses recognized through earnings; (ii) non-cash equity compensation; (iii) one-time events pursuant to changes in GAAP; and (iv) certain other non-cash charges. Please see page 16 for a reconciliation of Operating Earnings and Operating Earnings per share of common stock to GAAP net income allocable to common stockholders and GAAP net income allocable to common stockholders per share of common stock. Operating Earnings represents the earnings, as adjusted, allocable to common stock. (2) Effective net interest spread is a non-GAAP financial measure, which include the cost of the Company’s Swaps as a component of its interest expense. Please see page 6.

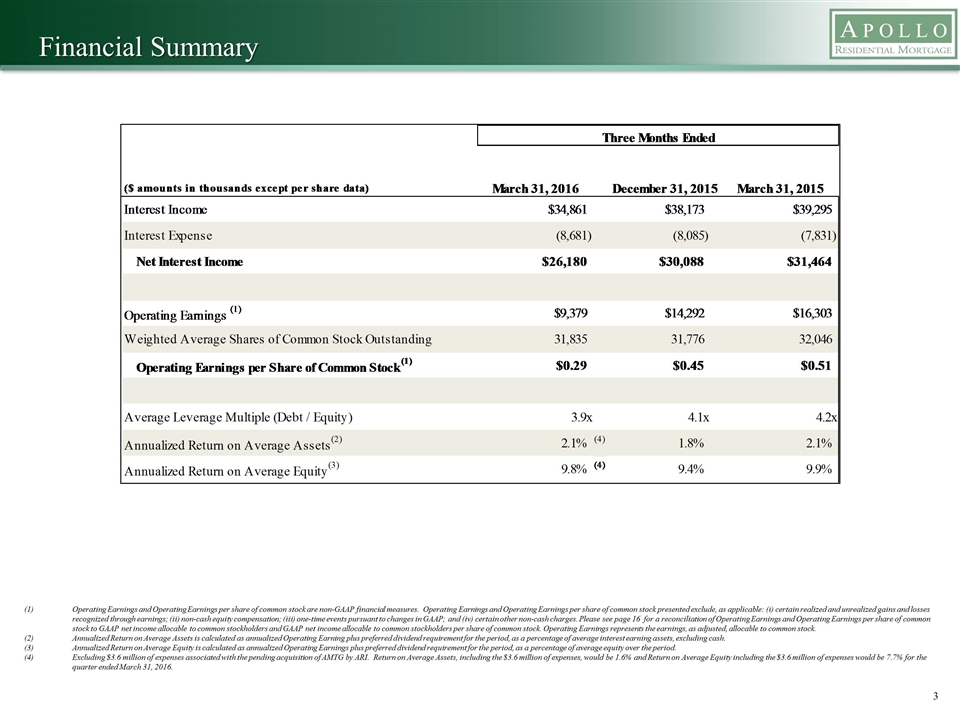

Financial Summary Operating Earnings and Operating Earnings per share of common stock are non-GAAP financial measures. Operating Earnings and Operating Earnings per share of common stock presented exclude, as applicable: (i) certain realized and unrealized gains and losses recognized through earnings; (ii) non-cash equity compensation; (iii) one-time events pursuant to changes in GAAP; and (iv) certain other non-cash charges. Please see page 16 for a reconciliation of Operating Earnings and Operating Earnings per share of common stock to GAAP net income allocable to common stockholders and GAAP net income allocable to common stockholders per share of common stock. Operating Earnings represents the earnings, as adjusted, allocable to common stock. Annualized Return on Average Assets is calculated as annualized Operating Earning plus preferred dividend requirement for the period, as a percentage of average interest earning assets, excluding cash. Annualized Return on Average Equity is calculated as annualized Operating Earnings plus preferred dividend requirement for the period, as a percentage of average equity over the period. Excluding $3.6 million of expenses associated with the pending acquisition of AMTG by ARI. Return on Average Assets, including the $3.6 million of expenses, would be 1.6% and Return on Average Equity including the $3.6 million of expenses would be 7.7% for the quarter ended March 31, 2016.

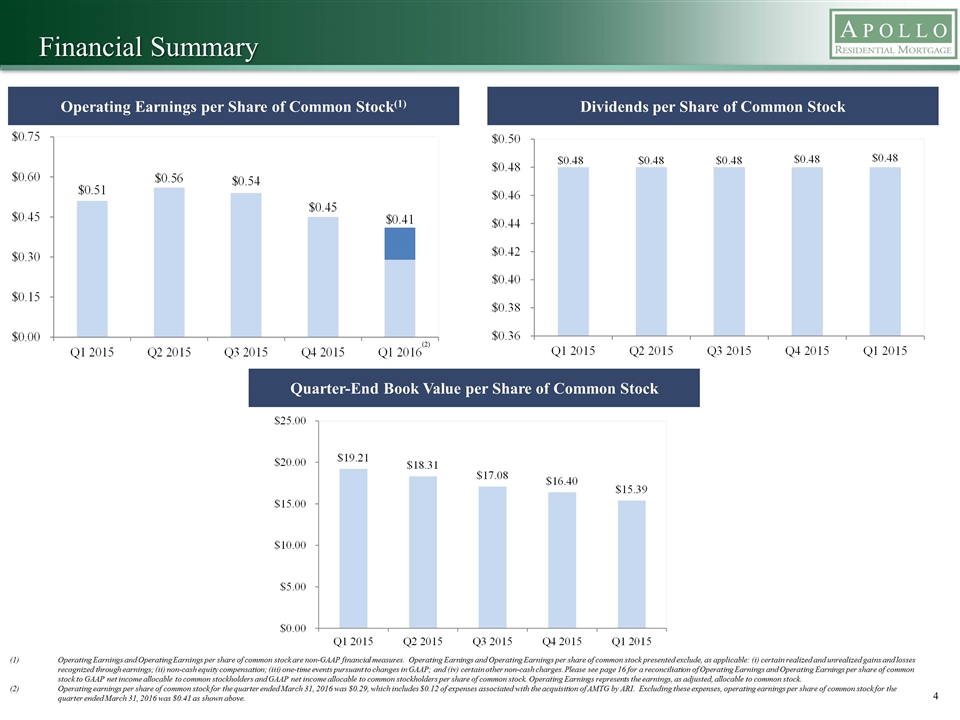

Financial Summary Operating Earnings per Share of Common Stock(1) Dividends per Share of Common Stock Quarter-End Book Value per Share of Common Stock Operating Earnings and Operating Earnings per share of common stock are non-GAAP financial measures. Operating Earnings and Operating Earnings per share of common stock presented exclude, as applicable: (i) certain realized and unrealized gains and losses recognized through earnings; (ii) non-cash equity compensation; (iii) one-time events pursuant to changes in GAAP; and (iv) certain other non-cash charges. Please see page 16 for a reconciliation of Operating Earnings and Operating Earnings per share of common stock to GAAP net income allocable to common stockholders and GAAP net income allocable to common stockholders per share of common stock. Operating Earnings represents the earnings, as adjusted, allocable to common stock. Operating earnings per share of common stock for the quarter ended March 31, 2016 was $0.29, which includes $0.12 of expenses associated with the acquisition of AMTG by ARI. Excluding these expenses, operating earnings per share of common stock for the quarter ended March 31, 2016 was $0.41 as shown above. (2)

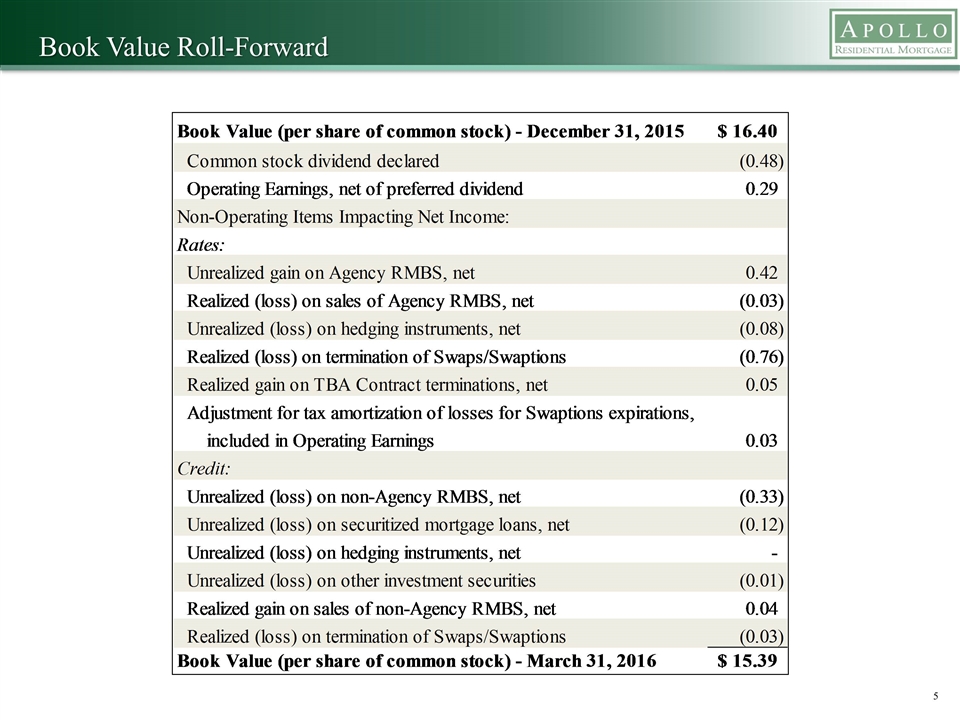

Book Value Roll-Forward

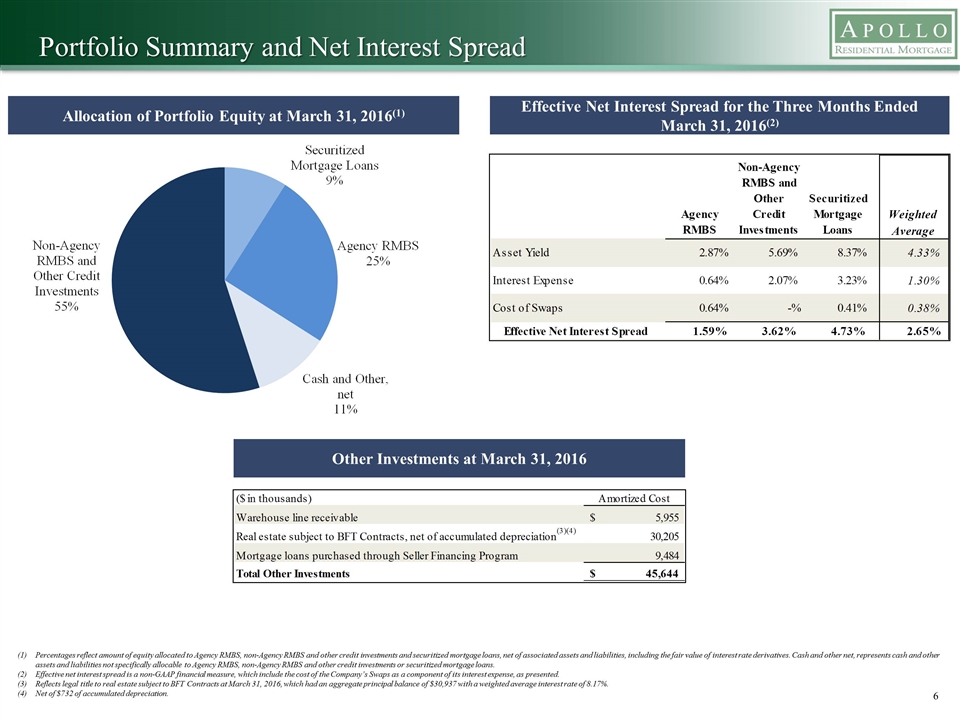

Portfolio Summary and Net Interest Spread Allocation of Portfolio Equity at March 31, 2016(1) Effective Net Interest Spread for the Three Months Ended March 31, 2016(2) Percentages reflect amount of equity allocated to Agency RMBS, non-Agency RMBS and other credit investments and securitized mortgage loans, net of associated assets and liabilities, including the fair value of interest rate derivatives. Cash and other net, represents cash and other assets and liabilities not specifically allocable to Agency RMBS, non-Agency RMBS and other credit investments or securitized mortgage loans. Effective net interest spread is a non-GAAP financial measure, which include the cost of the Company’s Swaps as a component of its interest expense, as presented. Reflects legal title to real estate subject to BFT Contracts at March 31, 2016, which had an aggregate principal balance of $30,937 with a weighted average interest rate of 8.17%. Net of $732 of accumulated depreciation. Other Investments at March 31, 2016

Agency RMBS Portfolio at March 31, 2016 Agency RMBS Portfolio Overview Constant Prepayment Rates (“CPR”) Other includes 30-year pass-throughs backed by relocation mortgages and Agency interest only securities (“Agency IO”). Short Reset ARMs 17% HARP / MHA / High LTV 30 Year Pass - Throughs 4% Loan Balance 30 Year Pass - Throughs 58% New Production 30 - Year Pass - Throughs 2% Geographic 30 - Year Pass - Throughs 14% Other(1) 5% 4.9% 6.7% 8.0% 6.8% 6.0% 8.6% 7.6% 8.6% 8.2% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Total Agency Portfolio average one month CPR

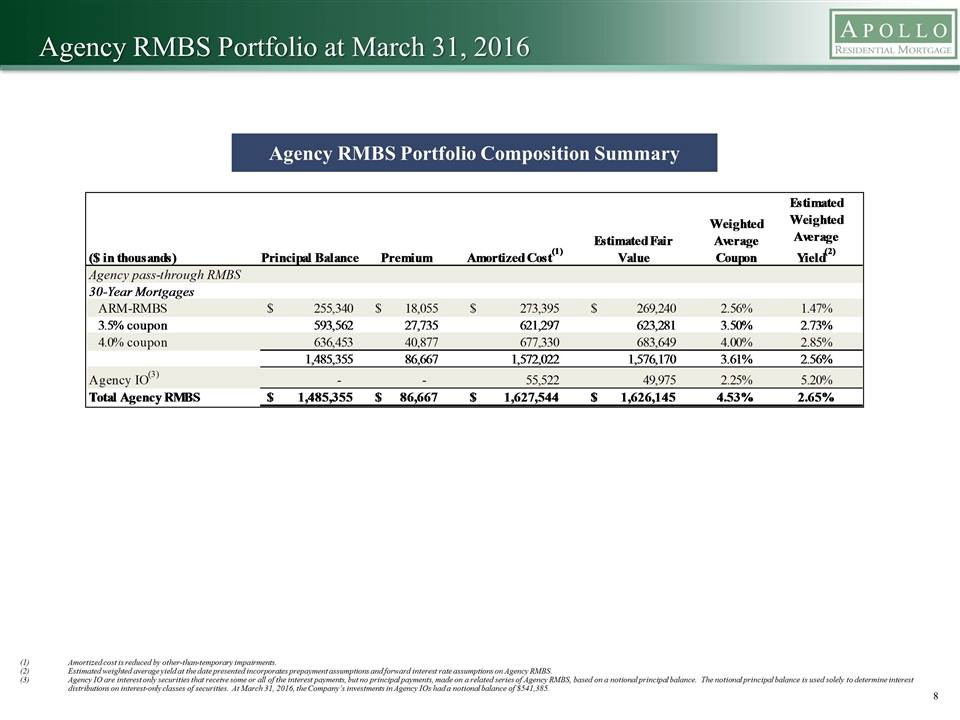

Agency RMBS Portfolio at March 31, 2016 Agency RMBS Portfolio Composition Summary Amortized cost is reduced by other-than-temporary impairments. Estimated weighted average yield at the date presented incorporates prepayment assumptions and forward interest rate assumptions on Agency RMBS. Agency IO are interest only securities that receive some or all of the interest payments, but no principal payments, made on a related series of Agency RMBS, based on a notional principal balance. The notional principal balance is used solely to determine interest distributions on interest-only classes of securities. At March 31, 2016, the Company’s investments in Agency IOs had a notional balance of $541,385.

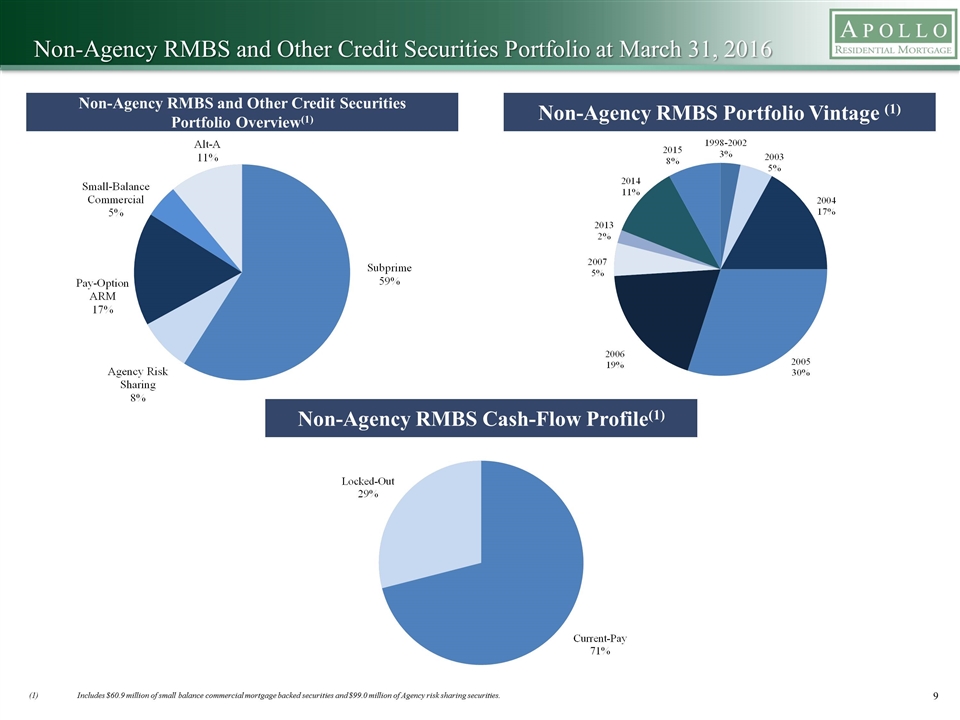

Non-Agency RMBS and Other Credit Securities Portfolio at March 31, 2016 Non-Agency RMBS and Other Credit Securities Portfolio Overview(1) Non-Agency RMBS Portfolio Vintage (1) Non-Agency RMBS Cash-Flow Profile(1) Includes $60.9 million of small balance commercial mortgage backed securities and $99.0 million of Agency risk sharing securities.

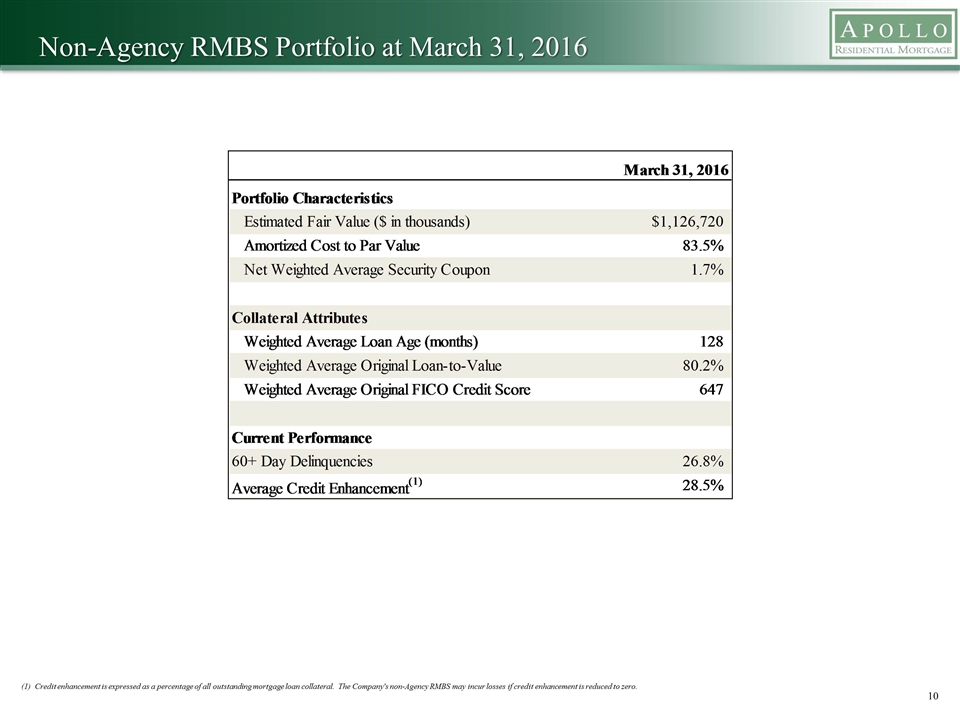

Non-Agency RMBS Portfolio at March 31, 2016 (1) Credit enhancement is expressed as a percentage of all outstanding mortgage loan collateral. The Company's non-Agency RMBS may incur losses if credit enhancement is reduced to zero.

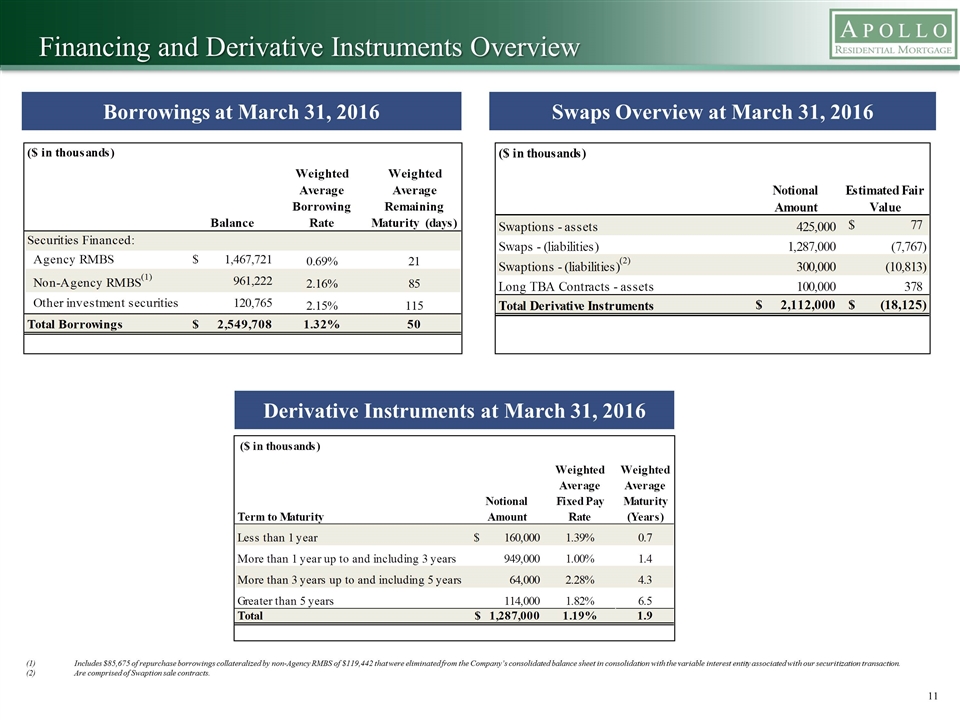

Financing and Derivative Instruments Overview Borrowings at March 31, 2016 Derivative Instruments at March 31, 2016 Swaps Overview at March 31, 2016 Includes $85,675 of repurchase borrowings collateralized by non-Agency RMBS of $119,442 that were eliminated from the Company’s consolidated balance sheet in consolidation with the variable interest entity associated with our securitization transaction. Are comprised of Swaption sale contracts.

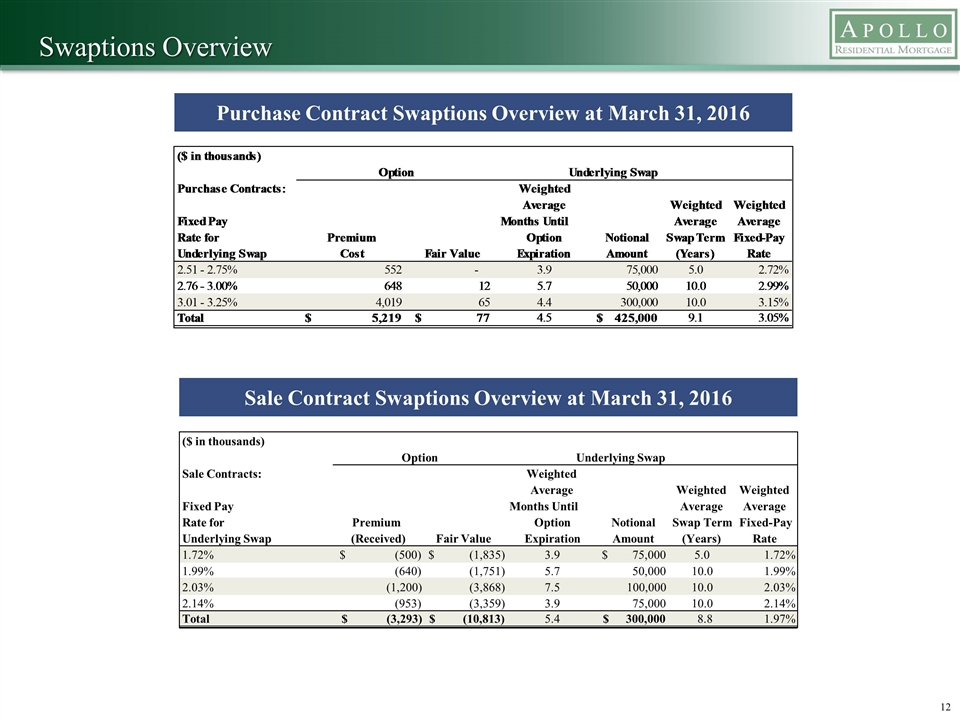

Swaptions Overview Purchase Contract Swaptions Overview at March 31, 2016 Sale Contract Swaptions Overview at March 31, 2016 ($ in thousands) Sale Contracts: Weighted Average Weighted Weighted Fixed Pay Months Until Average Average Rate for Premium Option Notional Swap Term Fixed-Pay Underlying Swap (Received) Fair Value Expiration Amount (Years) Rate 1.72% (500) $ (1,835) $ 3.9 75,000 $ 5.0 1.72% 1.99% (640) (1,751) 5.7 50,000 10.0 1.99% 2.03% (1,200) (3,868) 7.5 100,000 10.0 2.03% 2.14% (953) (3,359) 3.9 75,000 10.0 2.14% Total (3,293) $ (10,813) $ 5.4 300,000 $ 8.8 1.97% Option Underlying Swap

Financials

Balance Sheet

Income Statement (in thousands—except per share data) 2016 2015 Interest Income: RMBS 28,577 $ 35,614 $ Securitized mortgage loans and mortgage loans 3,265 2,167 Other 3,019 1,514 Total Interest Income 34,861 39,295 Interest Expense: Repurchase agreements (8,431) (7,465) Securitized debt (250) (366) Total Interest Expense (8,681) (7,831) Net Interest Income 26,180 $ 31,464 $ Other Income/(Loss), net: Realized gain on sale of RMBS, net 322 $ 8,539 Realized loss on sale of other investment securities, net (26) - Other-than-temporary impairments recognized (695) (2,575) Unrealized gain on RMBS, net 3,681 14,780 Unrealized gain on securitized debt 2 13 Unrealized gain/(loss) on securitized mortgage loans and mortgage loans, net (3,759) 2,362 Unrealized gain/(loss) on other investment securities (308) (29) Gain/(loss) on derivative instruments, net (includes ($2,632) and ($15,718) of unrealized gains/(losses), respectively) (28,474) (26,521) Other, net 17 12 Other Income/(Loss), net (29,240) $ (3,419) $ Operating Expenses: General and administrative (includes ($108) and ($493) of non-cash stock based compensation, respectively) (3,574) $ (3,850) $ Merger related costs (3,615) - Management fee - related party (2,785) (2,787) Total Operating Expenses (9,974) $ (6,637) $ Net Income/(Loss) (13,034) $ 21,408 $ Preferred Stock Dividends Declared (3,450) (3,450) Net Income/(Loss) Allocable to Common Stock and Participating Securities (16,484) $ 17,958 $ Earnings/(Loss) per Share of Common Stock - Basic and Diluted (0.52) $ 0.55 $ Dividends Declared per Share of Common Stock 0.48 $ 0.48 $ (Unaudited) Three Months Ended March 31,

Reconciliation of Operating Earnings(1) Operating Earnings and Operating Earnings per share of common stock are non-GAAP financial measures. Operating Earnings and Operating Earnings per share of common stock presented exclude, as applicable: (i) certain realized and unrealized gains and losses recognized through earnings; (ii) non-cash equity compensation; (iii) one-time events pursuant to changes in GAAP; and (iv) certain other non-cash charges. Operating Earnings represents the earnings, as adjusted, allocable to common stock. Reflects per share amount for each component presented.

Contact Information Hilary Ginsberg Investor Relations Manager 212-822-0767

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Axway Software: Disclosure of Transactions in Own Shares

- ParcelPal Announces Late Filing of Its Annual Financial Disclosure and Application for Management Cease Trade Order

- Buenaventura Cordially Invites You to Its First Quarter 2024 Earnings Conference Call

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share