Form DEF 14A GP STRATEGIES CORP For: Jun 22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant þ

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ | Preliminary Proxy Statement | |

¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

þ | Definitive Proxy Statement | |

¨ | Definitive Additional Materials | |

¨ | Soliciting Material Pursuant to Rule 14a-11c or Rule 14a-12 | |

GP Strategies Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement)

Payment of Filing Fee (Check the appropriate box):

þ | No fee required. | |

¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

(1) | Title of each class of securities to which transaction applies: |

(2) | Aggregate number of securities to which transaction applies: |

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

(4) | Proposed maximum aggregate value of transaction: |

(5) | Total fee paid: |

o | Fee paid previously with preliminary materials. | |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

(1) | Amount Previously Paid: |

(2) | Form, Schedule or Registration Statement No.: |

(3) | Filing Party: |

(4) | Date Filed: |

GP STRATEGIES CORPORATION

70 Corporate Center

11000 Broken Land Parkway, Suite 200

Columbia, Maryland 21044

_____________________

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To be held June 22, 2016

_____________________

To our Stockholders:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders (the “Annual Meeting”) of GP Strategies Corporation (the “Company”) will be held at the Company’s offices at 70 Corporate Center, 11000 Broken Land Parkway, Suite 200, Columbia, Maryland, on the 22nd day of June 2016, at 10:30 a.m., local time, for the following purposes:

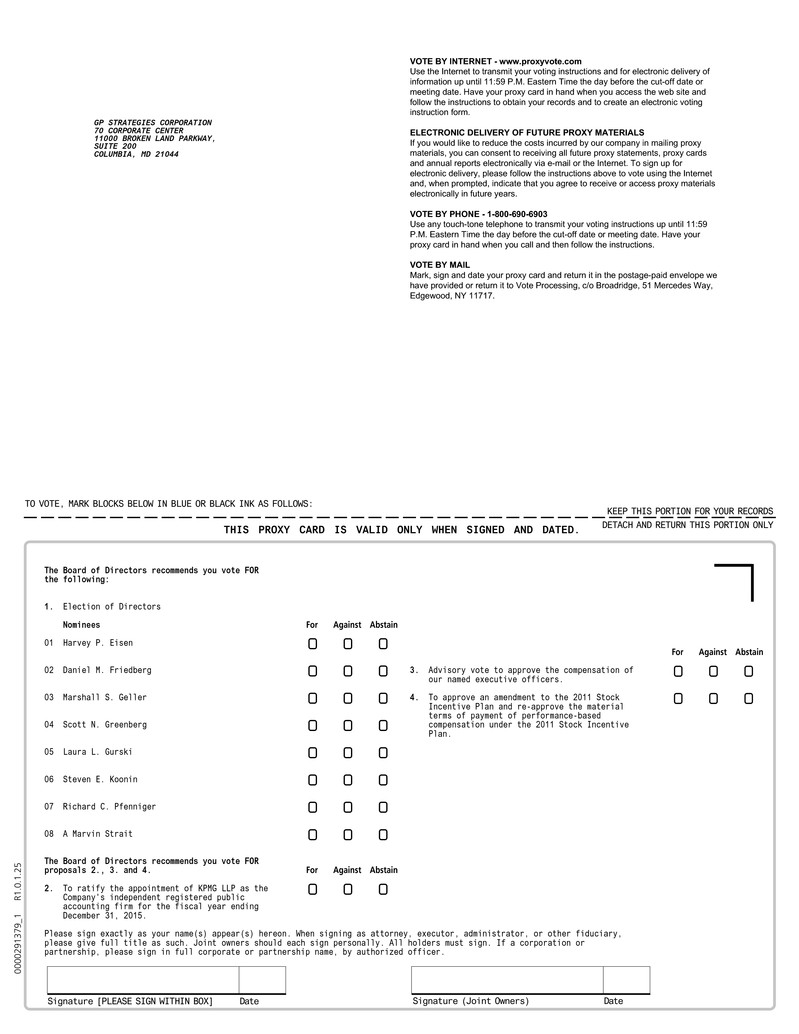

1. | To elect eight persons to the Board of Directors of the Company to serve until their respective successors are elected and qualified. |

2. | To ratify the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2016. |

3. | To vote on an advisory basis on the compensation of our named executive officers as disclosed in the attached Proxy Statement. |

4. | To approve an amendment to the 2011 Stock Incentive Plan and re-approve the material terms of payment of performance-based compensation under the 2011 Stock Incentive Plan |

These items are described more fully in our Proxy Statement. Our Board of Directors has no knowledge of any other business which may come before the meeting.

Only stockholders of record as of the close of business on April 25, 2016 are entitled to receive notice of and to vote at the Annual Meeting. A list of such stockholders shall be open to the examination of any stockholder, for any purpose germane to the Annual Meeting, during ordinary business hours, for a period of ten days prior to the meeting, at the offices of the Company at 70 Corporate Center, 11000 Broken Land Parkway, Suite 200, Columbia, Maryland.

Whether or not you plan to attend the Annual Meeting, please vote as soon as possible. As an alternative to voting in person at the Annual Meeting, you may vote via the Internet, by telephone or, if you receive a paper proxy card in the mail, by mailing a completed proxy card. For detailed information regarding voting instructions, please refer to the section entitled “Voting via the Internet, by Telephone or by Mail” on page 2 of the Proxy Statement. You may revoke a previously delivered proxy at any time prior to the Annual Meeting. If you decide to attend the Annual Meeting and wish to change your proxy vote, you may do so automatically by voting in person at the Annual Meeting.

By Order of the Board of Directors

Kenneth L. Crawford, Secretary

Columbia, Maryland

April 29, 2016

INTERNET AVAILABILITY OF PROXY MATERIALS In accordance with U.S. Securities and Exchange Commission rules, we are using the Internet as our primary means of furnishing proxy materials to stockholders. Consequently, most stockholders will not receive paper copies of our proxy materials. We will instead send these stockholders a Notice of Internet Availability of Proxy Materials with instructions for accessing the proxy materials, including our proxy statement and annual report, and voting via the Internet. The Notice of Internet Availability of Proxy Materials also provides information on how stockholders may obtain paper copies of our proxy materials if they so choose. We believe this will make the proxy distribution process more efficient, less costly and help in conserving natural resources. If you previously elected to receive our proxy materials electronically, these materials will continue to be sent via email unless you change your election. | ||||

GP STRATEGIES CORPORATION

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 22, 2016

TABLE OF CONTENTS

GP STRATEGIES CORPORATION

70 Corporate Center

11000 Broken Land Parkway

Columbia, Maryland 21044

_____________________

PROXY STATEMENT

_____________________

INFORMATION CONCERNING SOLICITATION AND VOTING

The accompanying Proxy is solicited by and on behalf of the Board of Directors of the Company, for use only at the Annual Meeting to be held at the Company’s offices at 70 Corporate Center, 11000 Broken Land Parkway, Suite 200, Columbia, Maryland on the 22nd day of June 2016, at 10:30 a.m., local time, and at any adjournments or postponement thereof. The approximate date on which this Proxy Statement and the accompanying Proxy were first given or sent to security holders was April 29, 2016.

Properly delivered Proxies will be voted in accordance with the specifications made and where no specifications are given, such Proxies will be voted FOR the proposal to elect eight persons to the Board of Directors of the Company to serve until their respective successors are elected and qualified, FOR the proposal to ratify the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2016, FOR the compensation of our named executive officers and FOR the approval of the amendment to the 2011 Stock Incentive Plan and re-approval of the material terms of the payment of performance-based compensation under the 2011 Stock Incentive Plan. In the discretion of the proxy holders, the Proxies will also be voted FOR or AGAINST such other matters as may properly come before the Annual Meeting. The management of the Company is not aware of any other matters that are to be presented for action at the Annual Meeting. If any other matters are properly brought before the Annual Meeting, the persons named in your proxies will vote in accordance with their best judgment. Although it is intended that the Proxies will be voted for the nominees named herein, the holders of the Proxies reserve discretion to cast votes for individuals other than such nominees in the event of the unavailability of any such nominee. The Company has no reason to believe that any of the nominees will become unavailable for election. The Proxies may not be voted for a greater number of persons than the number of nominees named.

Quorum; Required Votes

In order to conduct business at the Annual Meeting a quorum must be present. A quorum is the presence, in person or by proxy, of holders of record of shares of GP Strategies Common Stock (the "Common Stock") representing a majority of the number of votes entitled to be cast at the Annual Meeting. Proxies marked as abstaining on any matter to be acted upon by stockholders and “broker non-votes”, described below, will be treated as present for purposes of determining if a quorum is present.

The election of directors (Proposal 1) requires that each nominee receive more votes cast “for” than "against" the nominee at the Annual Meeting in order for the nominee to be elected. Shares not present and shares present but not voted (whether as an abstention, broker non-vote or otherwise) will have no effect on the election of directors.

The ratification of the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2016 (Proposal 2) requires the affirmative vote of a majority of the votes cast on the matter. Abstentions and broker non-votes have no effect on this proposal.

The advisory vote on compensation of our named executive officers (Proposal 3) requires the affirmative vote of a majority of the votes cast on the matter. Abstentions and broker non-votes have no effect on this proposal. Although the advisory vote on the compensation of our named executive officers is non-binding, the Board of Directors will review the results of the vote and will take them into account when making decisions concerning executive compensation of our named executive officers.

The approval of amendment to the 2011 Stock Incentive Plan and re-approval of the material terms of payment of performance-based compensation under the 2011 Stock Incentive Plan (Proposal 4) requires the affirmative vote of a majority of the votes cast on the matter, assuming a quorum is present and the total votes cast on the proposal represents over 50% in interest of the outstanding shares of Common Stock. Abstentions and broker non-votes will be counted as having been present for purposes of determining the presence of a quorum and will have the effect of negative votes on this proposal, unless holders of more than 50% in interest of the outstanding shares of stock cast votes on the proposal, in which case they will have no effect on this proposal.

1

If you hold your shares in “street name” (that is through a broker or other nominee), your broker may be able to vote your shares for certain “routine” matters even if you do not provide the broker with voting instructions. If you do not give your broker instructions on how to vote your shares the broker will return the proxy card without voting on proposals not considered “routine.” This is a broker non-vote. Proposals 1, 3 and 4 are considered “non-routine” matters. The broker may not vote on these matters without instructions from you.

Record Date

The Board of Directors has fixed the close of business on April 25, 2016 as the record date for the determination of stockholders entitled to receive notice of and to vote at the Annual Meeting. The issued and outstanding capital stock of the Company on April 25, 2016 consisted of 16,748,900 shares of Common Stock, each entitled to one vote per share.

Voting via the Internet, by Telephone or by Mail; Revoking Earlier Vote

Stockholders whose shares are registered in their own names may vote in person at the Annual Meeting, via the Internet, by telephone or, if they receive a paper proxy card in the mail, by mailing a completed proxy card. The Notice of Internet Availability of Proxy Materials provides instructions on how to access your proxy card, which contains instructions on how to vote via the Internet or by telephone. If you receive a paper proxy card, instructions for voting via the Internet or by telephone are set forth on the proxy card. If you receive a paper proxy card and voting instructions by mail and elect to vote by mail, you should sign and return the mailed proxy card in the prepaid and addressed envelope that was enclosed with the proxy materials, and your shares will be voted at the Annual Meeting in the manner you direct.

If your shares are registered in the name of a bank or brokerage firm (your record holder), you will receive instructions from your record holder that you must follow to specify how your record holder will vote your shares. If you hold shares through a bank or brokerage firm and wish to be able to vote in person at the Annual Meeting, you must obtain a legal proxy from your brokerage firm, bank or other holder of record and present it to the inspector of elections with your ballot.

You may revoke or change a previously delivered proxy at any time before the Annual Meeting by delivering another proxy with a later date, by voting again via the Internet or by telephone, by delivering written notice of revocation of your proxy to the Company’s Secretary at its principal executive offices before the beginning of the Annual Meeting, or by attending the Annual Meeting and voting in person. Attendance at the Annual Meeting will not, in and of itself, revoke a valid proxy that was previously delivered. If you hold shares through a bank or brokerage firm, you must contact that bank or brokerage firm to revoke any prior voting instructions. You may also vote in person at the Annual Meeting if you obtain a legal proxy as described in the preceding paragraph.

2

PRINCIPAL STOCKHOLDERS

The following table sets forth the number of shares of Common Stock beneficially owned as of April 25, 2016 by each person who is known by the Company based on such person’s filings with the Securities and Exchange Commission (“SEC”) to own beneficially more than 5% of the outstanding Common Stock.

Name and Address of Beneficial Owner | Amount and Nature of Beneficial Owner | Percent of Class | ||||

Sagard Capital Partners, L.P. 325 Greenwich Avenue Greenwich, CT 06830 | 3,516,774 shares | (1) | 21.0% | |||

Pembroke Management, LTD 1002 Sherbrooke Street West Suite 1700 Montreal, Quebec H3A 354 | 1,036,898 shares | (2) | 6.2% | |||

Dimensional Fund Advisors LP Palisades West, Building One 6300 Bee Cave Road Austin, TX 78746 | 936,618 shares | (3) | 5.6% | |||

RBC Global Asset Management (U.S.) Inc. 50 South Sixth Street, Suite 2350 Minneapolis, MN 55402 | 927,084 shares | (4) | 5.5% | |||

Wellington Management Company LLP 280 Congress Street Boston, MA 02210 | 836,835 shares | (5) | 5.0% | |||

__________________________

(1) | Based on a Form 4 filed by Sagard Capital Partners, L.P. with the SEC on April 1, 2016. |

(2) | Based on a Schedule 13G/A filed by Pembroke Management, LTD with the SEC on February 8, 2016. |

(3) | Based on a Schedule 13G/A filed by Dimensional Fund Advisors LP ("Dimensional") with the SEC on February 9, 2016. Dimensional has informed the Company that the shares are owned by advisory clients of Dimensional and that Dimensional disclaims beneficial ownership of such shares. |

(4) | Based on a Schedule 13G filed by RBC Global Asset Management (U.S.) Inc. with the SEC on February 10, 2016. |

(5) | Based on a Schedule 13G/A filed by Wellington Management Co. LLP with the SEC on February 11, 2016. |

3

SECURITY OWNERSHIP OF DIRECTORS AND NAMED EXECUTIVE OFFICERS

The following table sets forth the beneficial ownership of Common Stock, by each director, each of our Chief Executive Officer, Chief Financial Officer, and three other most highly compensated officers (collectively, the Named Executive Officers), and all directors and executive officers as a group as of April 25, 2016.

Name of Beneficial Owner | Amount and Nature of Beneficial Owner | Percent of Class(1) | ||||||

Jennifer E. Brown | — | * | ||||||

Harvey P. Eisen | 23,728 | * | ||||||

Daniel M. Friedberg | 3,516,774 | (2) | 21.0 | % | ||||

Marshall S. Geller | 145,645 | * | ||||||

Scott N. Greenberg | 166,734 | (3) | 1.0 | % | ||||

Laura L. Gurski | 2,000 | * | ||||||

Steven E. Koonin | — | * | ||||||

Richard C. Pfenniger, Jr. | 37,377 | * | ||||||

A. Marvin Strait | 27,933 | * | ||||||

Douglas E. Sharp | 63,081 | (3) | * | |||||

Sharon Esposito-Mayer | 50,924 | (3) | * | |||||

Karl Baer | 25,888 | (3) | * | |||||

Donald R. Duquette | 41,493 | (3) | * | |||||

Directors and Executive Officers as a Group (14 persons) | 4,168,106 | (4) | 24.9 | % | ||||

__________________________

* | Less than one percent. | |

(1) | Assumes for each beneficial owner and directors and executive officers as a group that all currently exercisable options are exercised in full only by the named beneficial owner or members of the group and no other options are exercised. |

(2) | The amount reported by Daniel M. Friedberg represents the beneficial ownership of the Company’s securities by Sagard Capital Partners, L.P., a Delaware limited partnership ("Sagard Capital"). Mr. Friedberg is the President and Chief Executive Officer of Sagard Capital Partners Management Corporation ("Sagard Management"), the investment manager of Sagard Capital, and is the President and Chief Executive Officer of Sagard Capital Partners GP, Inc., the general partner of Sagard Capital. Mr. Friedberg disclaims beneficial ownership of such securities, by virtue of his position as the President and Chief Executive Officer of Sagard Management. |

(3) | Includes 14,688 shares for Mr. Greenberg, 9,866 shares for Mr. Sharp, 10,272 shares for Ms. Esposito-Mayer, 4,493 shares for Mr. Baer and 7,813 shares for Mr. Duquette allocated pursuant to the provisions of our Retirement Savings Plan. |

(4) | Includes 4,000 shares of Common Stock issuable upon exercise of currently exercisable stock options and 51,320 shares of Common Stock allocated to accounts pursuant to the provisions of our Retirement Savings Plan. |

4

PROPOSAL 1. ELECTION OF DIRECTORS

Eight directors will be elected at the Annual Meeting to hold office until the next Annual Meeting of Stockholders and until their respective successors are elected and qualify. Each nominee has consented to being named in this proxy statement and has agreed to serve if elected. If instructed to do so, Proxies will be voted for the following nominees, but the holders of these Proxies reserve discretion to cast votes for individuals other than the nominees for Director named below in the event of the unavailability of any such nominee.

We seek persons to serve as directors who possess qualifications and expertise that will enhance the composition of the Board, applying considerations set forth in our Corporate Governance Guidelines (described below).

Set forth below are the names of the nominees, the year in which first elected a Director of the Company, the principal occupation of each nominee, and a brief biography of each nominee, including information regarding the specific experience, qualifications, attributes or skills that led the Board of Directors to determine that the applicable director should be re-nominated and elected to serve as a member of our Board of Directors.

Name and Year First Elected as Director | Age | Principal Occupation and Business Experience During the Past Five Years | ||

Scott N. Greenberg (1987) | 59 | Mr. Greenberg has been Chief Executive Officer of the Company since April 2005. He was President of the Company from 2001 until 2006, Chief Financial Officer from 1989 until 2005, Executive Vice President from 1998 to 2001, Vice President from 1985 to 1998, and held various other positions since joining the Company in 1981. From 1999 to 2008, he was a Director of GSE Systems, Inc. (“GSE”), a global provider of real-time simulation and training solutions which is a former majority-owned subsidiary of the Company that was spun off in 2005. Mr. Greenberg was also a Director of Wright Investors’ Service Holdings Inc., formerly National Patent Development Corporation (“NPDC”), from 2004 to 2015. Mr. Greenberg was also Chief Financial Officer of NPDC from 2004 until 2007. Mr. Greenberg brings to the Board significant experience and expertise in management, acquisitions and strategic planning, as well as many years of finance and related transaction experience. As our Chief Executive Officer, he brings to the Board extensive knowledge of the Company’s structure, history, major stockholders and culture. | ||

Harvey P. Eisen (2002) | 73 | Mr. Eisen is Chairman, Chief Executive Officer and Director of Wright Investors' Service Holdings, Inc., formerly NPDC. He has also served as Chairman of Bedford Oak Advisors, LLC, an investment partnership, since 1998. He was previously Senior Vice President of Travelers, Inc. and held various executive positions with Primerica, SunAmerica Corp., and Integrated Resources Asset Management. Mr. Eisen has served on the Strategic Development Board for the Trulaske College of Business, University of Missouri since 1995 where he established the first accredited course on the Warren Buffet Principles of Investing. He also served on the Zanvyl Krieger School of Arts and Sciences Advisory Board for Johns Hopkins University as well as the Carey Business School Board of Overseers and the Hopkins Parents Council. Mr. Eisen has been Chairman of our Board of Directors since 2005. Mr. Eisen has over three decades of investment experience. His long, distinguished career in the investment and finance industry, combined with his wealth of experience with companies in many sectors, make him a skilled advisor who provides critical insight into strategic planning and financial matters. | ||

5

Name and Year First Elected as Director | Age | Principal Occupation and Business Experience During the Past Five Years | ||

Marshall S. Geller (2002) | 77 | Mr. Geller is a Founder and Senior Managing Partner of St. Cloud Capital, a Los Angeles based private equity fund formed in December 2001. He has spent more than 40 years in corporate finance and investment banking, including 21 years as a Senior Managing Partner of Bear, Stearns & Co., with oversight of all operations in Los Angeles, San Francisco, Chicago, Hong Kong and the Far East. Mr. Geller is currently on the Board of Directors of COR Capital LLC, Wright Investors' Service Holdings, Inc. and UCLA Health System and is on the Board of Governors of Cedars Sinai Medical Center, Los Angeles. Mr. Geller also serves on the Dean's Advisory Council for the College of Business & Economics at California State University, Los Angeles. During the past five years, Mr. Geller has also been a director of Guidance Software, Inc., National Holdings Corporation and California Pizza Kitchen. As the managing partner of a private equity fund and a director of other public companies, Mr. Geller brings to the Board many years of experience and expertise as an investor in and advisor to companies in various sectors. | ||

Richard C. Pfenniger, Jr. (2005) | 60 | Mr. Pfenniger served as Interim Chief Executive Officer of Vein Clinics of America, Inc. from May 2014 to February 2015 and as Interim Chief Executive Officer of Integramed America, Inc., a manager of highly specialized outpatient medical centers, from January to June 2013. From 2003 until 2011, Mr. Pfenniger served as the Chairman of the Board, President and Chief Executive Officer of Continucare Corporation, a provider of primary care physician services. Mr. Pfenniger was the Chief Executive Officer and Vice Chairman of Whitman Education Group, Inc., a provider of career-oriented higher education, from 1997 until 2003. From 1994 to 1997, Mr. Pfenniger served as the Chief Operating Officer of IVAX Corporation, and from 1989 to 1994 he served as the Senior Vice President-Legal Affairs and General Counsel of IVAX Corporation, a multi-national pharmaceutical company. Mr. Pfenniger currently serves as a Director of TransEnterix, Inc. (a medical device company), Opko Health, Inc. (a multi-national pharmaceutical and diagnostics company), and Wright Investors' Service Holdings, Inc. Mr. Pfenniger’s prior experience as a Chief Executive Officer of a public company and prior experience in the education industry brings relevant experience managing a growth-oriented business and balancing the demands of clients, employees and investors. | ||

A. Marvin Strait (2007) | 82 | Mr. Strait presently practices as a Certified Public Accountant under the name A. Marvin Strait, CPA. He has practiced in the field of public accountancy in Colorado for over 40 years. He presently serves as a member of the Board of Trustees of the Colorado Springs Fine Arts Center Foundation, the Sam S. Bloom Foundation and Pikes Peak Educational Foundation. He also presently serves as a member of the Board of Directors and Chairman of the Audit Committee of Sturm Financial Group, Inc. Mr. Strait previously served as the Chairman of the Board of Directors of the American Institute of Certified Public Accountants (AICPA), as President of the Colorado Society of Certified Public Accountants and the Colorado State Board of Accountancy, and serves as a permanent member of the AICPA Governing Council. Mr. Strait served as a Director and Chairman of the Audit Committee of Continucare Corporation from 2004 to 2011, and as a Director and Chairman of the Audit Committee of RAE Systems, Inc. from 2006 to 2009. Mr. Strait brings to the Board significant expertise in accounting and financial matters and in analyzing and evaluating financial statements. He has served on the audit committees of several companies, and is Chair of our Audit Committee. | ||

6

Name and Year First Elected as Director | Age | Principal Occupation and Business Experience During the Past Five Years | ||

Daniel M. Friedberg (2009) | 54 | Mr. Friedberg has been President and Chief Executive Officer of Sagard Capital Partners Management Corporation, the investment manager of Sagard Capital Partners, L.P., since its founding in 2005. Since 2005, he has also been a Vice President of Power Corporation of Canada, a diversified international management holding company. Prior to that, he was a Partner at Bain & Company. Mr. Friedberg joined Bain & Company in 1987 in the London office, and was a founder of the Toronto office in 1989 and the New York office in 2000. Mr. Friedberg has served as a director of Performance Sports Group Ltd. since March 2016 and also served as a director of X-Rite, Incorporated from 2008 to 2012. Mr. Friedberg was elected a director in 2009 pursuant to the terms of the Securities Purchase Agreement under which Sagard Capital Partners, L.P. made an equity investment in the Company. Mr. Friedberg brings to the Board experience in investment management, which provides valuable perspective into our organizational and operational management as well as strategic planning matters. | ||

Laura L. Gurski (2015) | 50 | Ms. Gurski is currently a partner at A.T. Kearney, a global management consulting firm. She also serves as Global Head of Practices, Chairwoman of the Portfolio & Governance Committee and Member of the Senior Leadership Team at A.T. Kearney. Prior to joining A.T. Kearney in 1995, Ms. Gurski’s experience included senior marketing positions in brand management, merchant and product marketing for Sear’s Discover card, and sales promotion and advertising for a regional food retailer. She earned a masters of management from the J.L. Kellogg School of Management at Northwestern University, with emphasis in strategy, finance and international business, and a bachelor of science in marketing and French from Northern Illinois University. Ms. Gurski brings extensive consulting experience with large global clients across multiple industries, which is relevant and valuable in connection with the Company's growth strategy, especially with respect to international expansion. | ||

Steven E. Koonin (2016) | 64 | Dr. Steven E. Koonin has been the director of the Center for Urban Science and Progress since its creation in April 2012 by New York University, where he is also a Professor of Information, Operations, and Management Sciences in the Stern School of Business and of Civil and Urban Engineering in the Tandon School of Engineering. Prior to his current roles, Dr. Koonin served as Undersecretary for Science at the U.S. Department of Energy from May 2009, following his confirmation by the U.S. Senate, until November 2011. Prior to joining the government, Dr. Koonin spent five years, from March 2004 to May 2009, as Chief Scientist for BP, p.l.c. From September 1975 to July 2006, Dr. Koonin was a professor of theoretical physics at Caltech and was the institute’s Provost from February 1995 to January 2004. Dr. Koonin was a director of CERES, Inc., a publicly traded company pursuing genetically enhanced bioenergy crops, from 2012 to 2015. His memberships include the U.S. National Academy of Sciences, the American Academy of Arts and Sciences, the Council on Foreign Relations, and the Trilateral Commission. He has been a member of the JASON advisory group from July 1988 to May 2009, and from November 2011 to present, and served as the group’s chair from 1998 to 2004. He also has served as an independent governor of the Los Alamos and Lawrence Livermore National Security LLCs since July 2012 and of the Sandia Corporation since 2016 and has been a member of the Secretary of Energy’s Advisory Board since 2013. Dr. Koonin holds a B.S. in Physics from Caltech and a Ph.D. in Theoretical Physics from MIT and has been a Trustee of the Institute for Defense Analyses since 2014. Dr. Koonin brings extensive experience in science, education, energy and government to our Board of Directors. | ||

Required Vote and Board Recommendation

The election of directors requires that each nominee receives more votes cast “for” than "against" the nominee in order for the nominee to be elected. Shares not present and shares present but not voted (whether as an abstention, broker non-vote or otherwise) will have no effect on the election of directors.

The Board of Directors recommends that you vote FOR the election of each of the eight nominees.

7

Corporate Governance

The Board of Directors has the responsibility for establishing broad corporate policies and for the overall performance of the Company, although it is not involved in day-to-day operating details. Members of the Board of Directors are kept informed of the Company’s business by various reports and documents sent to them as well as by operating and financial reports made at Board and Committee meetings. The Board of Directors held nine meetings in 2015. All of the Directors attended at least 75% of the total number of meetings of the Board of Directors and of Committees of the Board on which they served. We do not have an official policy with regard to Board members’ attendance at annual meetings of stockholders. However, we encourage all Directors to attend and typically schedule a meeting of the Board of Directors on the same day as our meeting of stockholders.

Corporate Governance Guidelines

Our Board of Directors, on the recommendation of the Nominating/Corporate Governance Committee, adopted a set of corporate governance guidelines, a copy of which is available on our website at www.gpstrategies.com under the “Corporate Governance” page of the “Investors” section (http://investors.gpstrategies.com/common/pdf/investors/guidelines.pdf). We will provide a copy of such guidelines to any stockholder who requests one by contacting our Secretary, 70 Corporate Center, 11000 Broken Land Parkway, Suite 200, Columbia, MD 21044. We continue to monitor our corporate governance guidelines to comply with rules adopted by the SEC, the NYSE and industry practice.

Code of Business Conduct and Ethics

We have adopted a Code of Business Conduct and Ethics for our directors, officers and employees, including, but not limited to, the Chief Executive Officer and the Chief Financial Officer and other senior managers in our accounting and finance departments. A copy of this Code of Business Conduct and Ethics can be found on our website at www.gpstrategies.com under the “Corporate Governance” page of the “Investors” section (http://investors.gpstrategies.com/common/pdf/investors/gpxCodeOfEthics.pdf). We will provide a copy of such code to any stockholder who requests one by contacting our Secretary, 70 Corporate Center, 11000 Broken Land Parkway, Suite 200, Columbia, MD 21044. If we make any substantive amendments to the Code of Ethics for our executive officers or directors or grant any waiver from a provision of the Code of Ethics for our executive officers or directors, we will within four (4) business days disclose the nature of such amendment or waiver in a Report on Form 8-K or on our website at www.gpstrategies.com.

Director Independence

The Board of Directors reviews the independence of its members on an annual basis. No Director will be deemed to be independent unless the Board affirmatively determines that the Director in question has no material relationship with the Company, directly or as an officer, stockholder, member or partner of an organization that has a material relationship with the Company. The Board has not adopted any categorical standards of Director independence, however, the Board of Directors employs the standards of independence of the New York Stock Exchange (“NYSE”) rules currently in effect in making its determination that a Director qualifies as independent. In its annual review of Director independence, the Board considers all commercial, banking, consulting, legal, accounting, charitable or other business relationships any Director may have with the Company. As a result of its annual review, the Board of Directors has determined that Jennifer E. Brown, Harvey P. Eisen, Daniel M. Friedberg, Marshall S. Geller, Laura L. Gurski, Steven E. Koonin, Richard C. Pfenniger, Jr. and A. Marvin Strait are independent and that Scott N. Greenberg is not independent. The Company has Nominating/Corporate Governance, Compensation and Audit Committees and based on these standards, all current members of such Committees are independent. The Company also has an Executive Committee, of which Mr. Greenberg is a member.

Stock Ownership Guidelines

On March 30, 2015, the Company revised its stock ownership guidelines for its directors and adopted stock ownership guidelines for certain of its officers, including the Chief Executive Officer and the Named Executive Officers.

All directors (other than the Chief Executive Officer) are expected to accumulate and hold shares of Common Stock with a value of at least five times their annual cash base fees. Previously, directors were expected to accumulate and hold at least 15,000 shares of Common Stock. As of April 25, 2016 and throughout 2015 each director held shares of the Company’s common stock sufficient to satisfy the guideline other than Ms. Gurski who became a director in April 2015.

8

The Chief Executive Officer is expected to accumulate and hold shares of Common Stock with a value of at least six times his annual cash base salary and the other Named Executive Officers are expected to accumulate and hold shares of Common Stock with a value of at least three times their respective annual cash base salaries. Until the ownership guideline is satisfied, the Chief Executive Officer and Named Executive Officers are required to retain at least 50% of net profit shares delivered through the GP Strategies 2011 Stock Incentive Plan. Net profit shares refer to those that remain after payment of any exercise price and taxes owed at the exercise of stock options, vesting of restricted stock, restricted stock units, or earn out of performance shares.

Board Leadership Structure

We have separated the roles of the Chairman of the Board of Directors and Chief Executive Officer (the “CEO”) in recognition of the differences between the two roles. The CEO is responsible for setting the strategic direction for the Company and the day to day leadership and performance of the Company, while the Chairman of the Board of Directors provides guidance to the CEO, consults with the CEO about the agenda for Board of Directors meetings, and presides over meetings of the full Board of Directors. At present, our Board believes that this structure is appropriate and that it facilitates independent oversight of management.

Executive Sessions of Non-Management Directors

The non-management Directors meet periodically in executive session. The executive sessions of non-management Directors are presided over by the Director who is the Chairman of the Committee responsible for the issue being discussed. Executive sessions are also routinely held as a part of meetings of the Audit Committee. The Board intends to schedule at least two executive sessions of non-management Directors each year. However, any Director may request additional executive sessions of non-management Directors to discuss any matter of concern.

Risk Oversight

Our Board of Directors oversees an enterprise-wide approach to risk management, designed to support the achievement of organizational objectives, including strategic objectives, to improve long-term organizational performance and enhance stockholder value. A fundamental part of risk management is not only understanding the risks the Company faces and what steps management is taking to manage those risks, but also understanding what level of risk is appropriate for the Company. Management is responsible for establishing our business strategy, identifying and assessing the related risks and establishing appropriate risk management practices. Our Board receives reports on various areas of risk, reviews our business strategy and management’s assessment of the related risk, and discusses with management the appropriate level of risk for the Company.

Our Board administers its risk oversight function with respect to our operating risk as a whole, and meets with management at least quarterly to receive updates with respect to our operations, business strategies and the monitoring of related risks. The Board also delegates oversight of certain risks to the Audit, Compensation and Nominating/Corporate Governance Committees.

Our Audit Committee oversees financial risk exposures, including monitoring the integrity of the financial statements, internal controls over financial reporting, and the independence of the independent auditor of the Company. The Audit Committee also monitors our whistleblower hot lines with respect to financial reporting matters, alleged violations of our codes of conduct and business ethics, and cybersecurity and information technology risks. Individuals who supervise day-to-day risk in these areas have direct access to the Board of Directors through the Audit Committee.

Our Nominating/Corporate Governance Committee oversees governance related risks by working with management to establish corporate governance guidelines applicable to the Company, including recommendations regarding director nominees, the determination of director independence, Board leadership structure and membership on Board Committees. The Company’s Nominating/Corporate Governance Committee also oversees risk by working with management to adopt corporate governance policies and procedures designed to support the highest standards of business ethics.

Our Compensation Committee oversees risk management by participating in the creation of compensation structures that create incentives that support an appropriate level of risk-taking behavior consistent with the Company’s business strategy.

9

Committee Charters

Each of our Nominating/Corporate Governance, Audit, and Compensation Committees acts under a written charter, which may be viewed on the Company’s website at www.gpstrategies.com under the “Corporate Governance” page of the “Investors” section at the locations indicated in the table below.

Committee | Online location of Charter | |

Nominating/Corporate Governance | http://investors.gpstrategies.com/common/pdf/investors/nomCharter.pdf | |

Audit | http://investors.gpstrategies.com/common/pdf/investors/auditCharter.pdf | |

Compensation | http://investors.gpstrategies.com/common/pdf/investors/compCharter.pdf | |

We will provide a copy of each committee charter to any stockholder who requests one by contacting our Secretary, 70 Corporate Center, 11000 Broken Land Parkway, Suite 200, Columbia, MD 21044.

Nominating/Corporate Governance Committee

The members of the Nominating/Corporate Governance Committee are Daniel M. Friedberg, Marshall S. Geller and Richard C. Pfenniger, who is the Chairman of the Nominating/Corporate Governance Committee. All members of such committee satisfy the independence requirements of the NYSE rules currently in effect. The Nominating/Corporate Governance Committee met twice in 2015. The principal functions of the Nominating/Corporate Governance Committee are to:

(i) | develop policies on the size and composition of the Board of Directors; |

(ii) | identify individuals qualified to become members of the Board of Directors; |

(iii) | recommend a slate of nominees to the Board of Directors annually; |

(iv) | ensure that the Audit, Compensation and Nominating/Corporate Governance Committees of the Board of Directors have the benefit of qualified and experienced independent Directors; |

(v) | review and reassess the adequacy of the Board of Directors’ corporate governance principles (which principles may be viewed online on the Company’s website at www.gpstrategies.com under the “Corporate Governance” page of the “Investors” section); and |

(vi) | advise the full Board of Directors on corporate governance matters. |

Our Nominating/Corporate Governance Committee identifies individuals qualified to be Board members, evaluates any stockholder recommendations for Board membership, and develops and recommends corporate governance policies and procedures. We did not implement any changes to our process for stockholder recommendations of director nominees during 2015.

Criteria and Diversity

When the Board of Directors decides to recruit a new member, it seeks strong candidates who possess qualifications and expertise that will enhance the composition of the Board of Directors. The criteria for selecting new Directors can be viewed online on the Company’s website at www.gpstrategies.com under the “Corporate Governance” page of the “Investors” section. The Board of Directors will consider any such strong candidate provided he or she possesses integrity and ethical character. The Company may engage an executive search firm to assist it in finding qualified candidates. If the Board of Directors does not believe that a candidate possesses the above personal characteristics, that candidate will not be considered.

In evaluating potential board members, the Nominating/Corporate Governance Committee will apply the criteria set forth in our Corporate Governance Guidelines including:

• | A candidate’s background, achievements, and experience; |

• | Demonstrated leadership ability; |

• | The intelligence and ability to make independent analytical inquiries; |

• | The ability to exercise sound business judgment; and |

• | Due consideration to the Board’s overall balance of diversity of perspectives, backgrounds and experiences, as well as age, gender and ethnicity. |

Accordingly, in consideration with many other factors, the Nominating/Corporate Governance Committee selects nominees with a broad diversity of abilities, experience, professions, skills and backgrounds. The Nominating/Corporate

10

Governance Committee does not assign specific weights to particular criteria and no particular criterion is necessarily applicable to all prospective nominees. We believe that the backgrounds and qualifications of members of our Board of Directors, considered as a group, should provide a significant composite mix of experience, knowledge and abilities that will allow the Board to fulfill its responsibilities. Nominees are not discriminated against on the basis of race, religion, national origin, sexual orientation, disability or any other basis proscribed by law.

The Nominating/Corporate Governance Committee uses the same criteria to evaluate all candidates regardless of whether the person was recommended by directors, officers, employees, stockholders or others. Upon selection of a qualified candidate, the Nominating/Corporate Governance Committee would recommend the candidate for consideration by the full Board of Directors.

Stockholder Recommendations for Board Nominees

To recommend a prospective nominee for the Nominating/Corporate Governance Committee’s consideration, stockholders should submit the candidate’s name and qualification to our Secretary in writing at 70 Corporate Center, 11000 Broken Land Parkway, Suite 200, Columbia, MD 21044. When submitting candidates for nomination to be elected at our annual meeting of stockholders, stockholders must also follow the notice procedures and provide the information required by our By-laws. Our By-laws provide that any stockholder wishing to nominate a candidate for Director or to propose other business at an annual meeting of stockholders must give written notice that is received by our Secretary not less than 90 days prior to the anniversary date of the proxy statement relating to the immediately preceding annual meeting of stockholders (no later than January 30, 2017 with respect to the 2017 Annual Meeting of Stockholders); provided that in the event that the annual meeting is called for a date that is not within 30 days before or after such anniversary date, such notice must be received not less than 90 days prior to the date of the meeting or, if the first public announcement of the meeting date is less than 100 days before such meeting date, not later than the close of business on the tenth day following the day on which public disclosure of the date of the annual meeting was first made. Such notice must provide certain information specified in our By-laws. Copies of our By-laws are available to stockholders without charge upon request to our Secretary at the address set forth above.

Compensation Committee

The members of the Compensation Committee are Daniel M. Friedberg, Marshall S. Geller and A. Marvin Strait. Marshall S. Geller is the Chairman of the Compensation Committee. All members of such committee satisfy the independence requirements of the NYSE rules currently in effect. The principal function of the Compensation Committee is to assist the Board of Directors in discharging its responsibilities in respect of compensation of the Company’s executive officers by:

(i) | evaluating the Chief Executive Officer’s performance and setting the Chief Executive Officer’s compensation based on such evaluation; and |

(ii) | developing guidelines and reviewing the compensation and performance of officers of the Company. |

The Compensation Committee administers the Company’s Stock Incentive Plan. Additional information concerning the Compensation Committee is provided in the "Executive Compensation" section of this Proxy Statement.

The Compensation Committee met twice in 2015.

Executive Committee

The Executive Committee meets on call and has authority to act on most matters during the intervals between Board meetings and acts as an advisory body to the Board of Directors by reviewing various matters prior to submission to the Board. The members of the Executive Committee are Scott N. Greenberg, Harvey P. Eisen, Daniel M. Friedberg, Marshall S. Geller and Douglas E. Sharp, who is a non-voting member.

Audit Committee

The members of the Audit Committee are A. Marvin Strait, Chairman, Daniel M. Friedberg, Laura L. Gurski and Richard C. Pfenniger, Jr. All members satisfy the independence and experience requirements of the SEC and the NYSE rules currently in effect. The Board of Directors has determined that A. Marvin Strait and Richard C. Pfenniger, Jr. are Audit Committee financial experts. The Audit Committee met five times in 2015.

The Audit Committee's charter sets forth its responsibilities which include:

11

(i) | reviewing the independence, qualifications, services, fees and performance of the independent auditors; |

(ii) | appointing, replacing and discharging the independent auditors; |

(iii) | approving the professional services provided by the independent auditors; |

(iv) | reviewing the scope of the annual audit and quarterly reports and recommendations submitted by the independent auditors; and |

(v) | reviewing the Company’s financial reporting, the system of internal financial controls, and accounting policies, including any significant changes, with management and the independent auditors. |

Communications with the Board of Directors

The Board of Directors has provided a process by which stockholders and other interested parties may send communications to the Board, the non-management/independent directors as a group, or to individual members of the Board. Such communications should be directed to the Secretary of the Company, 70 Corporate Center, 11000 Broken Land Parkway, Suite 200, Columbia, MD 21044, or by email at [email protected], who will forward them to the intended recipients. Relevant communications are distributed to the Board, or to any individual director or directors as appropriate, depending on the facts and circumstances outlined in the communication. In that regard, the Board has requested that certain items that are unrelated to the duties and responsibilities of the Board should be excluded, such as: business solicitations or advertisements; junk mail and mass mailings; new product or service suggestions; product or service complaints; product or service inquiries; resumes and other forms of job inquiries; spam; and surveys. In addition, material that is unduly hostile, threatening, illegal or similarly unsuitable will be excluded. Any communication that is filtered out must be made available to any outside director upon request.

12

Identification of Executive Officers

Set forth below is certain information regarding the positions and business experience of each executive officer who is not also a director.

Executive Officer | Age | Positions | ||

Douglas E. Sharp | 57 | Mr. Sharp has been President of the Company since February 2006. He was President of the Company's former principal operating subsidiary, General Physics Corporation (“General Physics”), from 2002 to 2011, when it was merged with the Company. Mr. Sharp had served as Chief Operating Officer of General Physics prior to becoming President and has held various other positions since joining General Physics in 1981. He currently serves on the Managing Board of Aerospace Testing Alliance, a joint venture partnership of the Company, and National Aerospace Solutions, LLC and serves as a Director of the Company's principal foreign subsidiaries. Mr. Sharp holds a Bachelor of Science in Mechanical Engineering from University of Maryland. | ||

Sharon Esposito-Mayer | 49 | Ms. Esposito-Mayer has been Executive Vice President and Chief Financial Officer of the Company since December 2005. She has been Executive Vice President since 2004, was Vice President of Finance of General Physics from 2001 until 2004 and held various financial positions prior to joining General Physics in 1995. Ms. Esposito-Mayer holds a Bachelor of Science in Accounting from Pennsylvania State University and a MBA from Loyola College. | ||

Karl Baer | 56 | Mr. Baer has been Executive Vice President, Professional & Technical Services, of the Company since March 2006. He has been an Executive Vice President since 2004 and was a Vice President of General Physics from 1998 until 2004. Mr. Baer has held various other positions since joining General Physics in 1987. Prior to joining General Physics, Mr. Baer served in the U.S. Navy’s nuclear submarine force for over nine years. | ||

Donald R. Duquette | 62 | Mr. Duquette has been Executive Vice President, Learning Solutions, of the Company since September 2008. He was a Senior Vice President of General Physics from 2004 to 2008. He was a Vice President of General Physics from 1989 to 2004 and held various other positions since joining General Physics in 1979. Mr. Duquette holds a Bachelor of Science degree in Mechanical Engineering from Johns Hopkins University and an Executive MBA from Loyola College. | ||

Kenneth L. Crawford | 57 | Mr. Crawford has been Senior Vice President, General Counsel and Secretary of the Company since April 2007. He became a Senior Vice President of General Physics in March 2006, was a Vice President of General Physics from 1991 to March 2006, and became General Counsel of General Physics in 1991 and Secretary of General Physics in 1990. Mr. Crawford joined General Physics in 1987. Prior to that he was engaged in the private practice of law. Mr. Crawford is a graduate of the University of Michigan Law School. | ||

David A. Gugala | 67 | Mr. Gugala was appointed Senior Vice President of the Company in June 2012. He has been Vice President Operations, Sandy Corporation – a division of GP Strategies (“Sandy”) since January 2007, when the Company acquired Sandy from ADP, Inc. He has served in various operations leadership roles since joining Sandy in 1976. Mr. Gugala holds a Bachelor of Arts degree from Wayne State University. | ||

Deborah T. Ung | 53 | Ms. Ung has been Senior Vice President of the Company since December 2011 and was Vice President, RWD, since April 2011, when the Company acquired the consulting business of RWD. Prior to joining the Company, Ms. Ung was a Vice President of RWD from 2006 to 2011 and from 1997 to 2001, and held various operational and leadership roles after joining RWD in 1989. From 2002 to 2005, she was President of Accelera Corporation, an education services provider for the life sciences industry. Ms. Ung received a Bachelor of Science degree in Environmental Health/Health Physics from Purdue University. | ||

13

PROPOSAL 2. RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has selected KPMG LLP as the independent registered public accounting firm for the Company and its subsidiaries for the fiscal year ending December 31, 2016. KPMG LLP has informed the Company that it does not have any financial interest in the Company and that neither it nor any members or employees have any connection with the Company in the capacity of promoter, underwriter, voting trustee, director, officer or employee. The stockholders’ ratification of the appointment of KPMG LLP will not impact the Audit Committee’s responsibility pursuant to its charter, to appoint, replace and discharge the Company’s independent registered public accounting firm. In the event the stockholders fail to ratify this selection, it is expected that the matter of the selection of the Company’s independent registered public accounting firm will be reconsidered by the Audit Committee.

A representative of KPMG LLP is expected to be present at the Annual Meeting, will have the opportunity to make a statement if he or she so desires and is expected to be available to respond to appropriate questions from stockholders.

Independent Registered Public Accounting Firms’ Fees

The following table sets forth the fees billed to the Company for the years ended December 31, 2015 and 2014 for professional services rendered by KPMG LLP:

2015 | 2014 | |||||||

Audit Fees (1) | $ | 1,198,000 | $ | 1,050,000 | ||||

Audit-Related Fees (2) | 25,000 | 24,000 | ||||||

Tax Fees (3) | 258,000 | 294,000 | ||||||

All Other Fees | — | — | ||||||

Total | $ | 1,481,000 | $ | 1,368,000 | ||||

__________________________

(1) | Audit fees for 2015 and 2014 consisted of $1,090,000 and $937,000, respectively, for the audit of our consolidated financial statements, including quarterly review services, fees with respect to the audit of internal control over financial reporting and SEC reporting matters, and $108,000 and $113,000, respectively, for statutory audit services for foreign subsidiaries. |

(2) | Audited-related fees for 2015 and 2014 consisted of the audit of the financial statements of employee benefit plans. |

(3) | Tax fees for 2015 and 2014 consisted of fees for tax compliance services, including the preparation of tax returns, and tax consulting services including technical research. |

Policy on Pre-Approval of Services Provided by Independent Auditor

Pursuant to the requirements of the Sarbanes-Oxley Act of 2002, the terms of the engagement of KPMG LLP are subject to specific pre-approval policies of the Audit Committee. All audit and permitted non-audit services to be performed by KPMG LLP require pre-approval by the Audit Committee in accordance with pre-approval policies established by the Audit Committee. The procedures require all proposed engagements of KPMG LLP for services of any kind be directed to the Company’s Chief Financial Officer and then submitted for approval to the Audit Committee prior to the beginning of any service.

Audit Committee Report

During the year ended December 31, 2015, the Audit Committee reviewed and discussed the Company’s annual report on Form 10-K, quarterly reports on Form 10-Q, the Company’s earnings releases and the Company’s audited financial statements with management and with KPMG LLP, prior to their release. In addition, in accordance with Section 404 of the Sarbanes-Oxley Act of 2002, the Audit Committee reviewed and discussed with management, the company’s internal auditors and KPMG LLP, management’s report on the operating effectiveness of internal control over financial reporting in accordance with Section 404 of the Sarbanes-Oxley Act of 2002, including KPMG LLP’s related report and attestation. The Audit Committee also discussed with KPMG LLP the matters required to be discussed by Public Company Accounting Oversight Board (“PCAOB”) Auditing Standard No. 16, Communications with Audit Committees, relating to the conduct of the audit. The Audit Committee has received the written disclosures and the letter from KPMG LLP required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountant’s communications with the Audit Committee concerning independence and has discussed with KPMG LLP their independence and satisfied itself as to KPMG LLP’s independence.

14

Based on the Audit Committee’s review of the audited financial statements and the review and discussions described in the foregoing paragraph, the Audit Committee recommended to the Board of Directors that the audited financial statements for the fiscal year ended December 31, 2015 be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2015 for filing with the SEC. In addition, the Audit Committee approved KPMG LLP as the independent registered public accounting firm for the Company and its subsidiaries for the fiscal year ending December 31, 2016.

Notwithstanding anything to the contrary set forth in any of the Company’s previous filings under the Securities Act of 1933, as amended (the “Securities Act”) or the Securities Exchange Act of 1934, as amended, (the “Exchange Act”) that might incorporate future filings made by the Company under either the Securities Act or the Exchange Act, in whole or in part, this report shall not be deemed to be incorporated by reference into any such filings, nor will this report be incorporated by reference into any future filings made by the Company under either the Securities Act or the Exchange Act.

Audit Committee

A. Marvin Strait, Chairman

Daniel M. Friedberg

Laura L. Gurski

Richard C. Pfenniger, Jr.

Required Vote and Board Recommendation

Approval of this proposal requires the affirmative vote of a majority of the votes cast on the matter.

The Board of Directors recommends a vote FOR the proposal to ratify the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2016.

15

EXECUTIVE COMPENSATION

Compensation Committee

The Compensation Committee is responsible for establishing and administering our policies governing the compensation of our executive officers and directors. The responsibilities of the Compensation Committee include the following:

• | Develop guidelines and review and approve corporate goals relevant to the compensation of the Chief Executive Officer, evaluate the Chief Executive Officer’s performance in light of these goals and objectives, and set the Chief Executive Officer’s compensation based on this evaluation; |

• | Produce an annual report on executive compensation for inclusion in our proxy statement, in accordance with applicable rules and regulations; |

• | Make recommendations to the Board with respect to the compensation of our executive officers and incentive-compensation plans and equity-based plans, and establish criteria for the granting of stock-based compensation to our officers and other employees, and review and approve the granting of stock-based compensation in accordance with such criteria; |

• | Review director compensation levels and practices, and recommend from time to time changes in such compensation levels and practices to the Board, with equity ownership in the Company encouraged; |

• | Annually review and reassess the adequacy of the charter of the Compensation Committee and recommend any proposed changes to the Board for approval; and |

• | Make recommendations to the Board with respect to (a) committee member qualifications, (b) committee member appointments and removals, (c) committee structure and operations, and (d) committee reporting to the Board. |

The Compensation Committee is responsible for making compensation decisions regarding the Chief Executive Officer, the President, the Chief Financial Officer and our other executive officers. The Compensation Committee is also involved in making compensation decisions regarding certain key non-executive officer employees.

None of the members of the Compensation Committee is a current or former officer or employee of ours.

Compensation Discussion & Analysis

Overview

This Compensation Discussion and Analysis explains our compensation philosophy, policies and practices with respect to our Chief Executive Officer, Chief Financial Officer, and the other three Named Executive Officers. This discussion focuses on the information contained in the following tables and related footnotes and narrative discussions for primarily the last completed fiscal year, but we also describe compensation actions taken before or after the last completed fiscal year to the extent they enhance the understanding of our executive compensation disclosure.

Results of 2015 Stockholder Say on Pay Vote

At our 2015 annual meeting of stockholders our stockholders overwhelmingly approved the compensation of our Named Executive Officers, with 14,386,080 shares voting in favor (representing over 90% of shares voted and approximately 84% of shares outstanding), 183,153 shares voting against, 10,323 shares abstaining and 984,925 shares held by brokers not voting. These results are similar to the stockholder votes on executive compensation at our 2014 annual meeting of stockholders, so we believe that our stockholders are generally supportive of the amounts and the manner in which Named Executive Officers have been compensated. The past results of the stockholder advisory vote on executive compensation, particularly the strong support expressed by the stockholders, were among the many factors considered by the Compensation Committee in making its decisions regarding executive compensation in 2015.

2015 Executive Compensation Actions

In 2015, the Compensation Committee engaged Frederic W. Cook & Co., Inc. (the “Compensation Consultant”), who the Compensation Committee determined to be independent, to assess the competitiveness of compensation levels for certain of our officers, including our Named Executive Officers, relative to survey market data. In March 2015, the Compensation Committee made certain decisions discussed below regarding Named Executive Officer salaries, determining target long-term equity incentive amounts for the Named Executive Officers, and the mix between time-based and performance-based long-term incentives after considering the input of the Compensation Consultant, survey market data, our 2014 performance, and other relevant factors.

16

Compensation Philosophy and Objectives

The Compensation Committee seeks to provide compensation programs designed to:

• | Attract and retain talented and dedicated executives; |

• | Motivate and reward executives whose knowledge, skills, potential and performance are critical to our success; and |

• | Align the interests of our executive officers and stockholders by motivating executive officers to increase stockholder value and rewarding executive officers when stockholder value increases. |

The Compensation Committee believes that the most effective compensation program is one that provides competitive base pay, rewards the achievement of goals and objectives, and provides an incentive for retention. The principal elements of our executive compensation program are base salary, annual cash incentives, long-term equity incentives (the vesting of which may accelerate upon termination of employment and/or a change in control), other benefits and perquisites and post-termination severance compensation. Base salary, benefits, and limited perquisites are designed to attract and retain highly qualified individuals. Also, in order to avoid excessive risk taking, it is important that not all cash compensation be variable. Annual cash incentive compensation awards are designed to focus the entire senior executive team, including the Named Executive Officers, toward achieving our goals while recognizing their individual contributions. Long-term equity incentives are designed to align the interests of our Named Executive Officers with our stockholders, reward overall enterprise performance, and encourage the retention of the Named Executive Officers by providing additional opportunities for them to participate in the ownership of the Company and its future growth.

Setting Executive Compensation

We typically evaluate annually whether the elements of our executive compensation program are aligned with our compensation philosophy and objectives, while also promoting the interests of our stockholders. As part of this evaluation, we subscribe annually to a number of compensation data resources to evaluate the compensation of our executive officers compared to similar positions in the marketplace, including resources published by Kenexa, Mercer and Western Management Group which provide base salary and bonus compensation data. In general, our objective is to compensate our executive officers at levels between the 50th and 75th percentiles for executives in similar positions at similarly sized companies, which we believe usually allows us to satisfy the objectives described above. The Compensation Committee has sometimes deemed it appropriate to compensate certain executives at levels outside the 50th to 75th percentile for executives in similar positions due to the executives’ experience and the market for executives with similar experience, scope of responsibility, accountability and impact on our operations, and the impact their departure could potentially have on our performance.

In addition, to assist management and the Compensation Committee in assessing and determining competitive compensation packages, at times we have engaged an independent compensation consultant to evaluate the compensation of certain executive officers and other key employees. In 2015, the Compensation Consultant analyzed the long-term incentive compensation of our Named Executive Officers compared to corresponding data in the 25th percentile, 50th percentile and 75th percentile for executives in similar positions from the survey market data. Based on the Compensation Committee’s evaluation of the information provided by the Compensation Consultant and the performance of the Company and the Named Executive Officers, on March 30, 2015 the Compensation Committee approved an incentive program under which a target level of equity compensation and the mix between time and performance-based equity compensation was set for each officer and is described in more detail below under Long-Term Equity Incentive Compensation.

Elements of Compensation

Base Salary

General

The Compensation Committee, with input from the Chief Executive Officer, considers competitive, individual and company performance data in order to make or recommend compensation decisions that will incentivize, retain and maintain a competitive standing for each executive officer. The Compensation Committee considers several factors when adjusting an executive’s salary, including individual and Company performance, the executive’s market value and prospective value to us, the knowledge, experience and accomplishments of the executive, the executive’s level of responsibility, the recommendation of the Chief Executive Officer as to officers other than the Chief Executive Officer, and the compensation levels for individuals with similar credentials. On March 30, 2015, the Compensation Committee approved salary increases for the Named Executive Officers which became effective on April 1, 2015. The salary increases were based on survey market data and resulted in the executives' salaries being at levels between the 50th and 75th percentiles for executives in similar positions at similarly sized

17

companies. The Board of Directors approved the following increases in the annual base salaries for the following Named Executive Officers, which had been last increased October 1, 2012:

Name | Prior Salary | New Salary | ||

Scott N. Greenberg | $472,000 | $560,000 | ||

Sharon Esposito-Mayer | $310,000 | $360,000 | ||

Douglas E. Sharp | $425,000 | $520,000 | ||

Donald R. Duquette | $300,000 | $350,000 | ||

Karl Baer | $300,000 | $325,000 | ||

Cash-Based Incentive Compensation (Bonus)

Bonuses to our Chief Executive Officer and President

The employment agreements with our Chief Executive Officer and our President contain formulas for determining their annual cash bonuses. The formula ties the bonus payable to them to increases in our earnings before income taxes, depreciation and amortization (“EBITDA”) compared to the prior year, as adjusted for acquisitions and dispositions and other extraordinary or unusual nonrecurring items as defined in their employment agreements. EBITDA is a widely used non-GAAP financial measure of operating performance. EBITDA is calculated from our audited financial statements by adding back interest expense, income tax expense, depreciation and amortization to net income, and adjusting for certain non-recurring items such as gains or losses on the change in fair value of contingent consideration. Under their employment agreements, the Chief Executive Officer’s and President’s bonuses are (a) 1% of base salary for each 1% increase in EBITDA, up to a 10% increase; (b) then 2% of base salary for each 1% increase in EBITDA, up to a 15% increase; (c) then 3% of base salary for each 1% increase in EBITDA, up to a 25% increase; subject to a maximum bonus for any calendar year of 50% of his base salary for that year. In calculating the bonus for Mr. Greenberg and Mr. Sharp, for any year in which we acquire any business, the formula set forth in their employment agreements requires that EBITDA for the prior year be adjusted to reflect the budgeted EBITDA of the acquired business (as set forth in the budget numbers on which the acquisition was based) for the period from the date of the acquisition to the end of the calendar year in which the acquisition takes place.

For 2015, our EBITDA, as adjusted for acquisitions and other unusual nonrecurring items in 2015 and 2014, decreased 20%. As a result, no bonuses were paid to Mr. Greenberg or Mr. Sharp with respect to the year ended December 31, 2015 pursuant to their employment agreements or otherwise.

Bonuses to our other Named Executive Officers

Our Cash Bonus Plan (the “Bonus Plan”) that was in effect during 2015 provides for the payment of cash bonuses to eligible employees and executive officers, including the Named Executive Officers except for Mr. Greenberg and Mr. Sharp whose bonuses fall under their individual employment agreements, as described above.

The Bonus Plan contains separate formulas and incentives for the executive team, business unit leaders and all other employees. Each part of the plan sets forth, among other things, (1) which levels of executives or employees are eligible to participate in that part of the plan, (2) the method of determining the amount of bonuses available for distribution under that part of the plan, and (3) performance criteria to be used in determining the amount, if any, of each participant’s bonus. For purposes of the Bonus Plan, our executive team includes the aforementioned Named Executive Officers and certain other executive and senior vice presidents. The total bonus pool that may be allocated among the executive team will not exceed 50% of the executive team’s total base salaries and is determined by using a formula based on our revenue growth and pre-tax income growth over the prior year’s results. Once the bonus pool is established, the amount of each executive team member’s potential cash bonus, if any, is determined using a score (up to 100 points) given to each executive team member based upon the attainment of the performance objectives recommended by the Chief Executive Officer and approved by the Compensation Committee of the Board of Directors. Performance objectives include specific corporate level, group level (or for executive team members who are not group leaders, additional corporate level) and individual objectives. Corporate level and group level objectives are based on revenue and pre-tax income growth of the Company and the operating group within the Company for which the executive is responsible, compared to the prior fiscal year results, adjusted for acquisitions during the year and other non-recurring items when deemed appropriate.

18

Except for the Chief Financial Officer and any executive who does not manage an operating group, executive team members could achieve maximum scores of 15 points under the Bonus Plan for corporate revenue growth of 10% or more and 15 additional points for corporate pre-tax income growth of 20% or more, and maximum scores of 25 points under the Bonus Plan for group revenue growth of 15% or more and 25 additional points for group gross profit growth of 30% or more. Achievement of individual goals may add up to 20 more points to each executive team member’s score.

For the year ended December 31, 2015, the total bonus pool for the executive team was zero due to the decline in our consolidated revenue and pre-tax income. Therefore, no bonuses were awarded to any of the executives for the year ended December 31, 2015. In contrast, the total bonus pool for the executive team for the year ended December 31, 2014, was $325,500.

New Bonus Plan in 2016

On March 29, 2016, our Board of Directors approved a Short-Term Incentive Program (the “STIP”) based on the recommendation of the Compensation Committee of the Board of Directors. The STIP provides for the payment of cash bonuses to eligible employees of the Company and its subsidiaries, including Named Executive Officers Sharon Esposito-Mayer, Karl Baer, and Donald Duquette. Scott Greenberg and Douglas Sharp, the Company’s Chief Executive Officer and President, respectively, are not eligible to participate in the STIP as their cash bonuses will continue to be determined under their individual employment agreements as described above. The STIP replaces our previous cash bonus plan and participating employees’ cash bonuses for fiscal year 2016 will be determined under the STIP.

We believe that the STIP provides greater incentives than the previous cash bonus plan for group and business unit leaders to drive achievement of Company level objectives (for example, cross-selling between business units) over those efforts that may more directly affect group and business unit objectives by linking a larger percentage of each employee’s bonus opportunity to the achievement of Company level objectives. Adoption of the STIP is also part of the Company’s plan to move to a compensation structure that places more emphasis on performance-based incentives than salary in rewarding performance.

The STIP divides eligible employees into categories based on their levels of responsibility and also establishes a general pool for paying cash bonuses to all other eligible employees of the Company. For each category of participants (other than those in the general pool), the STIP establishes the amount of cash bonus opportunity, types of performance objectives, and allocation of bonus among those types of performance objectives. The specific performance objectives to be used and the thresholds for earning part or all of the bonus opportunity allocated to each of those objectives are established each year in accordance with the terms of the plan applicable for the category. The STIP also provides for bonus payments to be made to participants in addition to the bonus opportunity applicable for each category if the Company’s performance exceeds an aggressive goal established annually, but the total amount paid to any employee under the STIP may not exceed 100% of the employee’s annual base salary. In addition to giving more weight to company performance objectives than the previous cash bonus plan, the STIP provides for the establishment of minimum thresholds for group or business unit performance that must be achieved for an employee in a group or business unit to earn the part of the bonus attributable to Company performance objectives in order to assure an acceptable minimum level of group and business unit performance.