Form 8-K AUTOLIV INC For: Apr 29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 29, 2016

Autoliv, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 001-12933 | 51-0378542 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

Vasagatan 11, 7th Floor, SE-111 20

Box 70381,

SE-107 24, Stockholm, Sweden

(Address and Zip Code of principal executive offices)

+46 8 587 20 600

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 2.02 | Results of Operations and Financial Condition |

On April 29, 2016, Autoliv, Inc. (the “Company”) issued a press release announcing its financial results for the first quarter of 2016. A copy of the press release is furnished as Exhibit 99.1 to this report and is incorporated herein by reference. This press release contains certain references to financial measures identified as “organic sales,” “operating margin (excluding certain costs),” “operating working capital,” “adjusted EPS,” “net debt (cash)” and “leverage ratio,” all of which are adjustments from comparable measures calculated and presented in accordance with U.S. generally accepted accounting principles (GAAP). These financial measures, as used herein, differ from financial measures reported under GAAP, and management believes that these financial presentations provide useful supplemental information, which is important to a proper understanding by investors of the Company’s core business results. These presentations should not be viewed as a substitute for results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP financial measures presented by other companies. For an explanation of the reasons why management uses these figures, see the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2015, filed with SEC on February 19, 2016.

| Item 7.01 | Regulation FD Disclosure |

On April 29, 2016, the Company issued a press release announcing its financial results for the first quarter of 2016. A copy of the press release is furnished as Exhibit 99.1 to this report and is incorporated herein by reference. The information in this Form 8-K and the exhibit attached hereto as Exhibit 99.1 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

| Item 9.01 | Financial Statements and Exhibits |

| (d) | EXHIBITS |

| 99.1 | Press Release of Autoliv, Inc. dated April 29, 2016. |

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| AUTOLIV, INC. | ||

| By: | /s/ Lars A. Sjöbring | |

| Name: | Lars A. Sjöbring | |

| Title: | Group Vice President for Legal Affairs, General Counsel and Secretary | |

Date: April 29, 2016

3

EXHIBIT INDEX

| Exhibit No. |

Description | |

| 99.1 | Press Release of Autoliv, Inc. dated April 29, 2016. | |

4

Exhibit 99.1

Financial Report January - March 2016

Strong sales growth and improved operating margin

(Stockholm, April 29, 2016) – – – For the three-month period ended March 31, 2016, Autoliv, Inc. (NYSE: ALV and SSE: ALIV.Sdb) – the worldwide leader in automotive safety systems – reported consolidated sales of $2,430 million. Quarterly organic sales* grew by close to 15%. The adjusted operating margin* was 9.1% (for non-U.S. GAAP measures see enclosed reconciliation tables).

The expectation at the beginning of the quarter was for organic sales growth of “more than 10%” and an adjusted operating margin of “around 8.5%”. The higher than expected sales growth came from stronger than expected sales in most regions.

For the second quarter of 2016, the Company expects organic sales to increase by around 10% and an adjusted operating margin of around 8.5%. The expectation for the full year is now for an organic sales growth of more than 7% and an adjusted operating margin of more than 9%. Both the second quarter and full year expectations now include the recently closed joint venture with Nissin Kogyo – Autoliv-Nissin Brake Systems (ANBS).

Key Figures

| (Dollars in millions, except per share data) | Q1 2016 | Q1 2015 | Change | |||||||||

| Net sales |

$2,430.0 | $2,174.1 | 11.8% | |||||||||

| Operating income |

$205.2 | $80.0 | 156.5% | |||||||||

| Operating margin |

8.4% | 3.7% | 4.7pp | |||||||||

| Adjusted operating margin1) |

9.1% | 8.9% | 0.2pp | |||||||||

| Earnings per share, diluted2) |

$1.51 | $0.40 | 277.5% | |||||||||

| Adjusted earnings per share, diluted1, 2) |

$1.66 | $1.42 | 16.9% | |||||||||

| Operating cash flow |

$200.5 | $84.2 | 138.1% | |||||||||

1) Excluding costs for capacity alignment and antitrust related matters. 2) Assuming dilution and net of treasury shares.

| Comments from Jan Carlson, Chairman, President & CEO

| ||

|

“Autoliv had a solid first quarter. Sales growth and operating margin both exceeded our expectations from the beginning of the quarter, operating cash flow was strong and our adjusted earnings per share grew by 17%. I am pleased with the quarter.

In Passive Safety we had solid growth across most regions and outperformed the light vehicle production. This was due to a generally positive vehicle mix coming from a combination of high Autoliv content on successful platforms and the effects from launches of new models in the second half of 2015.

We continue to experience solid growth in our business related to the current recall situation in the airbag market. This relates both to the sales of replacement inflators which is now higher than previously expected and the sustainable business we are winning. | |

|

It was a quarter with several important events for our Electronics business. In Active Safety the strong growth continued, particularly in North America and Europe. The new Mercedes E-Class, generally seen as the vehicle with the most advanced autonomous driving features in the world, was launched with a full suite of Autoliv active safety products. Additionally, we took the important step of finalizing our joint venture with Nissin Kogyo of Japan. The new joint venture, Autoliv-Nissin Brake Systems, gives us access to the latest technology in brake systems and brake control and we look forward to introducing these new products in our portfolio to our customers around the world.

With quality as our first priority we are executing to deliver on our growth and margin expectations while integrating our new businesses into Autoliv”. | ||

An earnings conference call will be held at 2:00 p.m. (CET) today, April 29. To follow the webcast or to obtain the pin code and phone number, please access www.autoliv.com. The conference slides will be available on our web site as soon as possible following the publication of this earnings report.

|

Q1 Report – 2016

|

1st Quarter |

Outlook

Consolidated Sales

Sales by Product

| Change vs. same quarter last year | ||||||||||||||||||||

| Sales (MUSD) | Reported (U.S. GAAP) |

Acquisitions/ Divestitures |

Currency effects1) |

Organic change* |

||||||||||||||||

| Airbags2) |

$1,324.8 | 12.2% | - | (3.7)% | 15.9% | |||||||||||||||

| Seatbelts2) |

$664.1 | 1.6% | - | (4.7)% | 6.3% | |||||||||||||||

| Passive Safety Electronics |

$250.6 | 17.5% | - | (2.2)% | 19.7% | |||||||||||||||

| Active Safety |

$190.5 | 50.7% | 12.9% | (0.8)% | 38.6% | |||||||||||||||

| Total |

$2,430.0 | 11.8% | 0.7% | (3.6)% | 14.7% | |||||||||||||||

1) Effects from currency translations. 2) Including Corporate and other sales.

2

|

Q1 Report – 2016

|

1st Quarter |

Sales by Region

| Change vs. same quarter last year | ||||||||||||||||||||

| Sales (MUSD) | Reported (U.S. GAAP) |

Acquisitions/ Divestitures |

Currency effects1) |

Organic change* |

||||||||||||||||

| Asia |

$811.9 | 12.5% | - | (3.8)% | 16.3% | |||||||||||||||

| Whereof: |

China | $396.3 | 11.8% | - | (4.6)% | 16.4% | ||||||||||||||

| Japan | $198.3 | 29.9% | - | 3.7% | 26.2% | |||||||||||||||

| Rest of Asia | $217.3 | 1.2% | - | (8.1)% | 9.3% | |||||||||||||||

| Americas |

$826.9 | 10.5% | 2.2% | (4.7)% | 13.0% | |||||||||||||||

| Europe |

$791.2 | 12.4% | - | (2.4)% | 14.8% | |||||||||||||||

| Global |

$2,430.0 | 11.8% | 0.7% | (3.6)% | 14.7% | |||||||||||||||

1) Effects from currency translations.

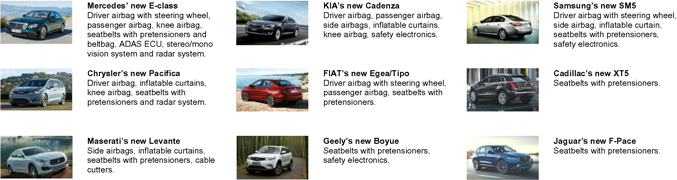

Launches in the 1st Quarter

3

|

Q1 Report – 2016

|

1st Quarter |

Earnings

| (Dollars in millions, except per share data) | Q1 2016 | Q1 2015 | Change | |||

| Net Sales |

$2,430.0 | $2,174.1 | 11.8% | |||

| Gross profit |

$501.0 | $423.3 | 18.4% | |||

| % of sales |

20.6% | 19.5% | 1.1pp | |||

| S,G&A |

$(113.1) | $(100.6) | 12.4% | |||

| % of sales |

(4.7)% | (4.6)% | (0.1)pp | |||

| R,D&E net |

$(158.8) | $(126.5) | 25.5% | |||

| % of sales |

(6.5)% | (5.8)% | (0.7)pp | |||

| Operating income |

$205.2 | $80.0 | 156.5% | |||

| % of sales |

8.4% | 3.7% | 4.7pp | |||

| Adjusted operating income1) |

$222.1 | $192.9 | 15.1% | |||

| % of sales |

9.1% | 8.9% | 0.2pp | |||

| Income before taxes |

$190.3 | $64.5 | 195.0% | |||

| Tax rate |

29.9% | 44.6% | (14.7)pp | |||

| Net income |

$133.5 | $35.7 | 273.9% | |||

| Net income attributable to controlling interest |

$133.2 | $35.7 | 273.1% | |||

| Earnings per share, diluted2) |

$1.51 | $0.40 | 277.5% | |||

| Adjusted earnings per share, diluted1, 2) |

$1.66 | $1.42 | 16.9% | |||

| 1) Excluding costs for capacity alignment and antitrust related matters. 2) Assuming dilution and net of treasury shares. | ||||||

4

|

Q1 Report – 2016

|

1st Quarter |

Light Vehicle Production Development

| Change vs. same quarter last year | ||||||||||||

| China | Japan | RoA | Americas | Europe | Total | |||||||

|

LVP1) |

4.9% | (2.9)% | (1.4)% | (0.4)% | 2.2% | 1.2% | ||||||

| 1) Source: IHS Apr 15, 2016. |

||||||||||||

Headcount

| March 31, 2016 | December 31, 2015 | March 31, 2015 | ||||||||

| Headcount |

66,633 | 64,088 | 61,056 | |||||||

| Whereof: Direct workers in manufacturing |

69% | 72% | 72% | |||||||

|

Best Cost Countries |

74% | 75% | 74% | |||||||

|

Temporary personnel |

11% | 15% | 15% | |||||||

5

|

Q1 Report – 2016

|

Segment information

Passive Safety

| (Dollars in millions) | Q1 2016 | Q1 2015 | Change | Organic change* | ||||

| Segment sales |

$1,988.7 | $1,830.4 | 8.6% | 12.7% | ||||

| Segment operating income |

$191.5 | $63.2 | 203.0% | |||||

| Segment operating margin |

9.6% | 3.5% | 6.1pp | |||||

Electronics

| (Dollars in millions) | Q1 2016 | Q1 2015 | Change | Organic change* | ||||

| Segment sales |

$456.4 | $351.2 | 30.0% | 27.0% | ||||

| Segment operating income |

$11.8 | $9.0 | 31.1% | |||||

| Segment operating margin |

2.6% | 2.5% | 0.1pp | |||||

Headcount

| March 31, 2016 | December 31, 2015 | March 31, 2015 | ||||

| Headcount Passive Safety segment |

60,153 | 59,861 | 57,316 | |||

| Headcount Electronics segment |

6,124 | 4,080 | 3,607 | |||

6

|

Q1 Report – 2016

|

1st Quarter |

7

|

Q1 Report – 2016

|

1st Quarter |

8

|

Q1 Report – 2016

|

1st Quarter |

Key Ratios

| Quarter January - March | Latest 12 | Full year | ||||||||||||||

| 2016 | 2015 | months | 2015 | |||||||||||||

| Earnings per share, basic |

$1.51 | $0.40 | $6.29 | $5.18 | ||||||||||||

| Earnings per share, diluted1) |

$1.51 | $0.40 | $6.28 | $5.17 | ||||||||||||

| Total parent shareholders’ equity per share |

$40.82 | $36.48 | $40.82 | $39.22 | ||||||||||||

| Cash dividend paid per share |

$0.56 | $0.54 | $2.24 | $2.22 | ||||||||||||

| Operating working capital, $ in millions2) |

563 | 572 | 563 | 570 | ||||||||||||

| Capital employed, $ in millions3) |

4,227 | 3,490 | 4,227 | 3,670 | ||||||||||||

| Net debt, $ in millions2) |

362 | 264 | 362 | 202 | ||||||||||||

| Net debt to capitalization,%4) |

9 | 8 | 9 | 6 | ||||||||||||

| Gross margin,%5) |

20.6 | 19.5 | 20.4 | 20.1 | ||||||||||||

| Operating margin,%6) |

8.4 | 3.7 | 9.0 | 7.9 | ||||||||||||

| Return on total equity,%7) |

14.6 | 4.3 | 16.1 | 13.6 | ||||||||||||

| Return on capital employed,%8) |

20.8 | 9.3 | 22.9 | 20.4 | ||||||||||||

| Average no. of shares in millions1) |

88.3 | 88.6 | 88.3 | 88.4 | ||||||||||||

| No. of shares at period-end in millions9) |

88.2 | 88.0 | 88.2 | 88.1 | ||||||||||||

| No. of employees at period-end10) |

59,066 | 51,608 | 59,066 | 54,600 | ||||||||||||

| Headcount at period-end11) |

66,633 | 61,056 | 66,633 | 64,088 | ||||||||||||

| Days receivables outstanding12) |

74 | 76 | 77 | 73 | ||||||||||||

| Days inventory outstanding13) |

32 | 31 | 33 | 33 | ||||||||||||

|

1) Assuming dilution and net of treasury shares. 2) Non-U.S. GAAP measure; for reconciliation see enclosed tables below. 3) Total equity and net debt. 4) Net debt in relation to capital employed. 5) Gross profit relative to sales. 6) Operating income relative to sales. 7) Net income relative to average total equity. 8) Operating income and income from equity method investments, relative to average capital employed. 9) Excluding dilution and net of treasury shares. 10) Employees with a continuous employment agreement, recalculated to full time equivalent heads. 11) Includes temporary hourly personnel. 12) Outstanding receivables relative to average daily sales. 13) Outstanding inventory relative to average daily sales. |

| |||||||||||||||

9

|

Q1 Report – 2016

|

1st Quarter |

Consolidated Statements of Net Income

| Quarter January - March | Latest 12 | Full year | ||||||||||||||

| (Dollars in millions, except per share data) | 2016 | 2015 | months | 2015 | ||||||||||||

| Net sales |

||||||||||||||||

| Airbag products1) |

$1,324.8 | $1,181.1 | $5,179.9 | $5,036.2 | ||||||||||||

| Seatbelt products1) |

664.1 | 653.4 | 2,609.8 | 2,599.1 | ||||||||||||

| Passive safety electronic products |

250.6 | 213.2 | 960.6 | 923.2 | ||||||||||||

| Active safety products |

190.5 | 126.4 | 675.2 | 611.1 | ||||||||||||

| Total net sales |

2,430.0 | 2,174.1 | 9,425.5 | 9,169.6 | ||||||||||||

| Cost of sales |

(1,929.0) | (1,750.8) | (7,503.7) | (7,325.5) | ||||||||||||

| Gross profit |

501.0 | 423.3 | 1,921.8 | 1,844.1 | ||||||||||||

| Selling, general & administrative expenses |

(113.1) | (100.6) | (424.0) | (411.5) | ||||||||||||

| Research, development & engineering expenses, net |

(158.8) | (126.5) | (556.1) | (523.8) | ||||||||||||

| Amortization of intangibles |

(7.9) | (3.7) | (23.8) | (19.6) | ||||||||||||

| Other income (expense), net |

(16.0) | (112.5) | (64.9) | (161.4) | ||||||||||||

| Operating income |

205.2 | 80.0 | 853.0 | 727.8 | ||||||||||||

| Income from equity method investments |

0.6 | 1.3 | 4.0 | 4.7 | ||||||||||||

| Interest income |

1.2 | 0.4 | 3.5 | 2.7 | ||||||||||||

| Interest expense |

(15.5) | (17.1) | (63.5) | (65.1) | ||||||||||||

| Other non-operating items, net |

(1.2) | (0.1) | 4.5 | 5.6 | ||||||||||||

| Income before income taxes |

190.3 | 64.5 | 801.5 | 675.7 | ||||||||||||

| Income taxes |

(56.8) | (28.8) | (246.2) | (218.2) | ||||||||||||

| Net income |

$133.5 | $35.7 | $555.3 | $457.5 | ||||||||||||

| Less; Net income attributable to non-controlling interest |

0.3 | 0.0 | 1.0 | 0.7 | ||||||||||||

| Net income attributable to controlling interest |

$133.2 | $35.7 | $554.3 | $456.8 | ||||||||||||

| Earnings per share2) |

$1.51 | $0.40 | $6.28 | $5.17 | ||||||||||||

| 1) Including Corporate and other sales. 2) Assuming dilution and net of treasury shares. | ||||||||||||||||

10

|

Q1 Report – 2016

|

1st Quarter |

Consolidated Balance Sheets

| March 31 | December 31 | September 30 | June 30 | March 31 | ||||||||||||||||

| (Dollars in millions) | 2016 | 2015 | 2015 | 2015 | 2015 | |||||||||||||||

| Assets |

||||||||||||||||||||

| Cash & cash equivalents |

$1,161.6 | $1,333.5 | $1,181.1 | $1,323.3 | $1,364.1 | |||||||||||||||

| Receivables, net |

2,000.2 | 1,787.6 | 1,688.8 | 1,795.7 | 1,783.3 | |||||||||||||||

| Inventories, net |

766.7 | 711.4 | 692.8 | 684.1 | 652.7 | |||||||||||||||

| Other current assets |

131.6 | 205.8 | 250.5 | 241.0 | 217.3 | |||||||||||||||

| Total current assets |

4,060.1 | 4,038.3 | 3,813.2 | 4,044.1 | 4,017.4 | |||||||||||||||

| Property, plant & equipment, net |

1,638.6 | 1,437.1 | 1,422.3 | 1,434.1 | 1,384.7 | |||||||||||||||

| Investments and other non-current assets |

350.3 | 255.8 | 256.3 | 270.1 | 268.2 | |||||||||||||||

| Goodwill assets |

1,838.7 | 1,666.3 | 1,668.0 | 1,586.7 | 1,583.6 | |||||||||||||||

| Intangible assets, net |

256.6 | 128.0 | 133.6 | 70.4 | 72.6 | |||||||||||||||

| Total assets |

$8,144.3 | $7,525.5 | $7,293.4 | $7,405.4 | $7,326.5 | |||||||||||||||

| Liabilities and equity |

||||||||||||||||||||

| Short-term debt |

$28.8 | $39.6 | $53.5 | $93.2 | $124.3 | |||||||||||||||

| Accounts payable |

1,240.3 | 1,169.6 | 1,032.3 | 1,127.3 | 1,093.1 | |||||||||||||||

| Other current liabilities |

1,147.4 | 1,017.2 | 1,026.2 | 1,004.8 | 1,038.8 | |||||||||||||||

| Total current liabilities |

2,416.5 | 2,226.4 | 2,112.0 | 2,225.3 | 2,256.2 | |||||||||||||||

| Long-term debt |

1,499.4 | 1,499.4 | 1,499.5 | 1,505.6 | 1,511.0 | |||||||||||||||

| Pension liability |

215.2 | 197.0 | 229.0 | 229.4 | 226.7 | |||||||||||||||

| Other non-current liabilities |

148.0 | 134.6 | 133.9 | 104.1 | 107.0 | |||||||||||||||

| Total non-current liabilities |

1,862.6 | 1,831.0 | 1,862.4 | 1,839.1 | 1,844.7 | |||||||||||||||

| Total parent shareholders’ equity |

3,600.2 | 3,455.6 | 3,306.7 | 3,325.9 | 3,210.6 | |||||||||||||||

| Non-controlling interest |

265.0 | 12.5 | 12.3 | 15.1 | 15.0 | |||||||||||||||

| Total equity |

3,865.2 | 3,468.1 | 3,319.0 | 3,341.0 | 3,225.6 | |||||||||||||||

| Total liabilities and equity |

$8,144.3 | $7,525.5 | $7,293.4 | $7,405.4 | $7,326.5 | |||||||||||||||

11

|

Q1 Report – 2016

|

1st Quarter |

Consolidated Statements of Cash Flows

| Quarter January - March | Latest 12 | Full year | ||||||||||||||

| (Dollars in millions) | 2016 | 2015 | months | 2015 | ||||||||||||

| Net income |

$133.5 | $35.7 | $555.3 | $457.5 | ||||||||||||

| Depreciation and amortization |

85.1 | 73.7 | 330.5 | 319.1 | ||||||||||||

| Other, net |

3.3 | (19.0) | 22.3 | (0.0) | ||||||||||||

| Changes in operating assets and liabilities |

(21.4) | (6.2) | (41.3) | (26.1) | ||||||||||||

| Net cash provided by operating activities |

200.5 | 84.2 | 866.8 | 750.5 | ||||||||||||

| Capital expenditures, net |

(91.2) | (128.0) | (412.8) | (449.6) | ||||||||||||

| Acquisitions of businesses and other, net |

(227.4) | (3.2) | (365.7) | (141.5) | ||||||||||||

| Net cash used in investing activities |

(318.6) | (131.2) | (778.5) | (591.1) | ||||||||||||

| Net cash before financing1) |

(118.1) | (47.0) | 88.3 | 159.4 | ||||||||||||

| Net increase (decrease) in short-term debt |

(14.6) | 55.3 | (98.9) | (29.0) | ||||||||||||

| Repayments and other changes in long-term debt |

- | - | (12.2) | (12.2) | ||||||||||||

| Dividends paid |

(49.3) | (47.8) | (197.2) | (195.7) | ||||||||||||

| Shares repurchased |

- | (104.4) | - | (104.4) | ||||||||||||

| Common stock options exercised |

0.7 | 11.0 | 10.0 | 20.3 | ||||||||||||

| Dividend paid to non-controlling interests |

(1.7) | - | (1.7) | - | ||||||||||||

| Capital contribution from non-controlling interests |

- | - | 1.6 | 1.6 | ||||||||||||

| Other, net |

0.2 | 0.0 | 0.7 | 0.5 | ||||||||||||

| Effect of exchange rate changes on cash |

10.9 | (32.0) | 6.9 | (36.0) | ||||||||||||

| Increase (decrease) in cash and cash equivalents |

(171.9) | (164.9) | (202.5) | (195.5) | ||||||||||||

| Cash and cash equivalents at period-start |

1,333.5 | 1,529.0 | 1,364.1 | 1,529.0 | ||||||||||||

| Cash and cash equivalents at period-end |

$1,161.6 | $1,364.1 | $1,161.6 | $1,333.5 | ||||||||||||

| 1) Non-U.S. GAAP measure comprised of “Net cash provided by operating activities” and “Net cash used in investing activities”. | ||||||||||||||||

12

|

Q1 Report – 2016

|

1st Quarter |

RECONCILIATION OF NON-U.S. GAAP MEASURES TO U.S. GAAP

(Dollars in millions)

In this report we sometimes refer to non-U.S. GAAP measures that we and securities analysts use in measuring Autoliv’s performance. We believe that these measures assist investors and management in analyzing trends in the Company’s business for the reasons given below. Investors should not consider these non-U.S. GAAP measures as substitutes, but rather as additions, to financial reporting measures prepared in accordance with U.S. GAAP. It should be noted that these measures, as defined, may not be comparable to similarly titled measures used by other companies.

Components in Sales Increase/Decrease

Since the Company generates approximately 73% of sales in currencies other than in the reporting currency (i.e. U.S. dollars) and currency rates have proven to be rather volatile, and due to the fact that the Company has historically made several acquisitions and divestitures, we analyze the Company’s sales trends and performance as changes in organic sales growth. This presents the increase or decrease in the overall U.S. dollar net sales on a comparable basis, allowing separate discussions of the impact of acquisitions/divestitures and exchange rates. The tables below present changes in organic sales growth as reconciled to the change in the total U.S. GAAP net sales.

Sales by Product

| Quarter January - March 2016 | Airbag Products2) |

Seatbelt Products2) |

Passive Safety Electronics |

Active Safety | Total | |||||||||||||||||||||||||||||||||||

| % | $ | % | $ | % | $ | % | $ | % | $ | |||||||||||||||||||||||||||||||

| Organic change |

15.9 | $187.6 | 6.3 | $41.4 | 19.7 | $42.0 | 38.6 | $48.8 | 14.7 | $319.8 | ||||||||||||||||||||||||||||||

| Currency effects1) |

(3.7) | (43.9) | (4.7) | (30.7) | (2.2) | (4.6) | (0.8) | (1.0) | (3.6) | (80.2) | ||||||||||||||||||||||||||||||

| Acquisitions/divestitures |

- | - | - | - | - | - | 12.9 | 16.3 | 0.7 | 16.3 | ||||||||||||||||||||||||||||||

| Reported change |

12.2 | $143.7 | 1.6 | $10.7 | 17.5 | $37.4 | 50.7 | $64.1 | 11.8 | $255.9 | ||||||||||||||||||||||||||||||

| 1) Effects from currency translations. 2) Including Corporate and other sales. | ||||||||||||||||||||||||||||||||||||||||

Sales by Region

| Quarter January - March 2016 | China | Japan | RoA | Americas | Europe | Total | ||||||||||||||||||||||||||||||||||||||||||

| % | $ | % | $ | % | $ | % | $ | % | $ | % | $ | |||||||||||||||||||||||||||||||||||||

| Organic change |

16.4 | $58.2 | 26.2 | $39.9 | 9.3 | $19.9 | 13.0 | $97.4 | 14.8 | $104.4 | 14.7 | $319.8 | ||||||||||||||||||||||||||||||||||||

| Currency effects1) |

(4.6) | (16.3) | 3.7 | 5.8 | (8.1) | (17.4) | (4.7) | (34.9) | (2.4) | (17.4) | (3.6) | (80.2) | ||||||||||||||||||||||||||||||||||||

| Acquisitions/divestitures |

- | - | - | - | - | - | 2.2 | 16.3 | - | - | 0.7 | 16.3 | ||||||||||||||||||||||||||||||||||||

| Reported change |

11.8 | $41.9 | 29.9 | $ | 45.7 | 1.2 | $2.5 | 10.5 | $78.8 | 12.4 | $87.0 | 11.8 | $255.9 | |||||||||||||||||||||||||||||||||||

| 1) Effects from currency translations. | ||||||||||||||||||||||||||||||||||||||||||||||||

Sales by Segment

| Quarter January - March 2016 | Passive Safety | Electronics | Other and eliminations |

Total | ||||||||||||||||||||||||

| % | $ | % | $ | $ | % | $ | ||||||||||||||||||||||

| Organic change |

12.7 | $232.8 | 27.0 | $94.9 | $(7.9) | 14.7 | $319.8 | |||||||||||||||||||||

| Currency effects1) |

(4.1) | (74.5) | (1.6) | (6.0) | 0.3 | (3.6) | (80.2) | |||||||||||||||||||||

| Acquisitions/divestitures |

- | - | 4.6 | 16.3 | - | 0.7 | 16.3 | |||||||||||||||||||||

| Reported change |

8.6 | $158.3 | 30.0 | $105.2 | $(7.6) | 11.8 | $255.9 | |||||||||||||||||||||

| 1) Effects from currency translations. | ||||||||||||||||||||||||||||

13

|

Q1 Report – 2016

|

1st Quarter |

Operating Working Capital

Due to the need to optimize cash generation to create value for shareholders, management focuses on operationally derived working capital as defined in the table below. The reconciling items used to derive this measure are, by contrast, managed as part of our overall management of cash and debt, but they are not part of the responsibilities of day-to-day operations’ management.

| March 31 2016 |

December 31 2015 |

September 30 2015 |

June 30 2015 |

March 31 2015 |

||||||||||||||||

| Total current assets |

$4,060.1 | $4,038.3 | $3,813.2 | $4,044.1 | $4,017.4 | |||||||||||||||

| Total current liabilities |

(2,416.5) | (2,226.4) | (2,112.0) | (2,225.3) | (2,256.2) | |||||||||||||||

| Working capital |

1,643.6 | 1,811.9 | 1,701.2 | 1,818.8 | 1,761.2 | |||||||||||||||

| Cash and cash equivalents |

(1,161.6) | (1,333.5) | (1,181.1) | (1,323.3) | (1,364.1) | |||||||||||||||

| Short-term debt |

28.8 | 39.6 | 53.5 | 93.2 | 124.3 | |||||||||||||||

| Derivative asset and liability, current |

0.6 | 2.4 | (0.4) | 1.2 | 1.4 | |||||||||||||||

| Dividends payable |

51.1 | 49.3 | 49.3 | 49.3 | 49.5 | |||||||||||||||

| Operating working capital |

$562.5 | $569.7 | $622.5 | $639.2 | $572.3 | |||||||||||||||

Net Debt

As part of efficiently managing the Company’s overall cost of funds, we routinely enter into “debt-related derivatives” (DRD) as part of our debt management. Creditors and credit rating agencies use net debt adjusted for DRD in their analyses of the Company’s debt and therefore we provide this non-U.S. GAAP measure. DRD are fair value adjustments to the carrying value of the underlying debt. Also included in the DRD is an unamortized fair value adjustment related to a discontinued fair value hedge which will be amortized over the remaining life of the debt. By adjusting for DRD, the total financial liability of net debt is disclosed without grossing debt up with currency or interest fair values.

| March 31

|

December 31

|

September 30

|

June 30

|

March 31

|

||||||||||||||||

| Short-term debt |

$28.8 | $39.6 | $53.5 | $93.2 | $124.3 | |||||||||||||||

| Long-term debt |

1,499.4 | 1,499.4 | 1,499.5 | 1,505.6 | 1,511.0 | |||||||||||||||

| Total debt |

1,528.2 | 1,539.0 | 1,553.0 | 1,598.8 | 1,635.3 | |||||||||||||||

| Cash and cash equivalents |

(1,161.6) | (1,333.5) | (1,181.1) | (1,323.3) | (1,364.1) | |||||||||||||||

| Debt-related derivatives |

(4.7) | (3.9) | (7.0) | (7.0) | (7.2) | |||||||||||||||

| Net debt |

$361.9 | $201.6 | $364.9 | $268.5 | $264.0 | |||||||||||||||

Leverage ratio

The non-U.S. GAAP measure net debt is also used in the non-U.S. GAAP measure “Leverage ratio”. Management uses this measure to analyze the amount of debt the Company can incur under its debt policy. Management believes that this policy also provides guidance to credit and equity investors regarding the extent to which the Company would be prepared to leverage its operations. For details on leverage ratio refer to the table.

| March 31 2016 |

December 31 2015 |

March 31 2015 | ||||||||

| Net debt1) |

$361.9 | $201.6 | $264.0 | |||||||

| Pension liabilities |

215.2 | 197.0 | 226.7 | |||||||

| Debt per the Policy |

$577.1 | $398.6 | $490.7 | |||||||

| Income before income taxes2) |

$801.5 | $675.7 | $547.2 | |||||||

| Plus: Interest expense, net2, 3) |

60.0 | 62.4 | 68.5 | |||||||

| Depreciation and amortization of intangibles2, 4) |

330.5 | 319.1 | 305.3 | |||||||

| EBITDA per the Policy |

$1,192.0 | $1,057.2 | $921.0 | |||||||

| Leverage ratio |

0.5 | 0.4 | 0.5 | |||||||

| 1) Net debt is short- and long-term debt less cash and cash equivalents and debt-related derivatives. 2) Latest 12 months. 3) Interest expense, net is interest expense including cost for extinguishment of debt, if any, less interest income. 4) Including impairment write-offs, if any. | ||||||||||

14

|

Q1 Report – 2016

|

1st Quarter |

Items Affecting Comparability

(Dollars in millions, except per share data)

The following items have affected the comparability of reported results from year to year. We believe that, to assist in understanding Autoliv’s operations, it is useful to consider certain U.S. GAAP measures exclusive of these items. Accordingly, the table below reconcile from non-U.S. GAAP to the equivalent U.S. GAAP measure.

| Quarter January - March 2016 | Quarter January - March 2015 | |||||||||||||||||||||

| Non-U.S. GAAP |

Adjustments1) | Reported U.S. GAAP |

Non-U.S. GAAP |

Adjustments1) | Reported U.S. GAAP | |||||||||||||||||

| Operating income |

$222.1 | $(16.9) | $205.2 | $192.9 | $(112.9) | $80.0 | ||||||||||||||||

| Operating margin,% |

9.1 | (0.7) | 8.4 | 8.9 | (5.2) | 3.7 | ||||||||||||||||

| Income before taxes |

$207.2 | $(16.9) | $190.3 | $177.4 | $(112.9) | $64.5 | ||||||||||||||||

| Net income |

$147.0 | $(13.5) | $133.5 | $126.1 | $(90.4) | $35.7 | ||||||||||||||||

| Capital employed |

$4,241 | $(14) | $4,227 | $3,580 | $(90) | $3,490 | ||||||||||||||||

| Return on capital employed,% |

22.5 | (1.7) | 20.8 | 21.9 | (12.6) | 9.3 | ||||||||||||||||

| Return on total equity,% |

16.0 | (1.4) | 14.6 | 14.9 | (10.6) | 4.3 | ||||||||||||||||

| Earnings per share, diluted2) |

$1.66 | $(0.15) | $1.51 | $1.42 | $(1.02) | $0.40 | ||||||||||||||||

| Total parent shareholders’ equity per share |

$40.97 | $(0.15) | $40.82 | $37.51 | $(1.03) | $36.48 | ||||||||||||||||

| 1) Excluding costs for capacity alignment and antitrust related matters (including settlements in Q1 2015). 2) Assuming dilution and net of treasury shares. | ||||||||||||||||||||||

15

|

Q1 Report – 2016

|

1st Quarter |

Segment Disclosure

| Sales, including Intersegment Sales | Quarter January - March | |||||||

| (Dollars in millions) | 2016 | 2015 | ||||||

| Passive Safety |

$1,988.7 | $1,830.4 | ||||||

| Electronics |

456.4 | 351.2 | ||||||

| Total segment sales |

$2,445.1 | $2,181.6 | ||||||

| Corporate and other |

0.3 | 4.2 | ||||||

| Intersegment sales |

(15.4 | ) | (11.7 | ) | ||||

| Total net sales |

$2,430.0 | $2,174.1 | ||||||

| Income before Income Taxes | Quarter January - March | |||||||

| (Dollars in millions) | 2016 | 2015 | ||||||

| Passive Safety |

$191.5 | $63.2 | ||||||

| Electronics |

11.8 | 9.0 | ||||||

| Segment operating income |

$203.3 | $72.2 | ||||||

| Corporate and other |

1.9 | 7.8 | ||||||

| Interest and other non-operating expenses, net |

(15.5 | ) | (16.8 | ) | ||||

| Income from equity method investments |

0.6 | 1.3 | ||||||

| Income before income taxes |

$190.3 | $64.5 | ||||||

| Capital Expenditures | Quarter January - March | |||||||

| (Dollars in millions) | 2016 | 2015 | ||||||

| Passive Safety |

$72.8 | $121.2 | ||||||

| Electronics |

16.3 | 11.6 | ||||||

| Corporate and other |

2.7 | 2.0 | ||||||

| Total capital expenditures |

$91.8 | $134.8 | ||||||

| Depreciation and Amortization | Quarter January - March | |||||||

| (Dollars in millions) | 2016 | 2015 | ||||||

| Passive Safety |

$68.3 | $61.8 | ||||||

| Electronics |

14.7 | 10.7 | ||||||

| Corporate and other |

2.1 | 1.2 | ||||||

| Total depreciation and amortization |

$85.1 | $73.7 | ||||||

| Segment Assets | ||||||||

| (Dollars in millions) | March 31, 2016 | December 31, 2015 | ||||||

| Passive Safety |

$5,827.7 | $5,539.3 | ||||||

| Electronics |

1,589.1 | 966.5 | ||||||

| Segment assets |

$7,416.8 | $6,505.8 | ||||||

| Corporate and other1) |

727.5 | 1,019.7 | ||||||

| Total assets |

$8,144.3 | $7,525.5 | ||||||

|

1) Corporate and other assets mainly consists of cash and cash equivalents, income tax and deferred tax assets and equity method investments. |

| |||||||

16

|

Q1 Report – 2016

|

1st Quarter |

Multi-year Summary

| (Dollars in millions, except per share data) | 20151) | 20141) | 20131, 5) | 20121) | 20111) | |||||||||||||||

| Sales and Income |

||||||||||||||||||||

| Net sales |

$9,170 | $9,240 | $8,803 | $8,267 | $8,232 | |||||||||||||||

| Operating income |

728 | 723 | 761 | 705 | 889 | |||||||||||||||

| Income before income taxes |

676 | 667 | 734 | 669 | 828 | |||||||||||||||

| Net income attributable to controlling interest |

457 | 468 | 486 | 483 | 623 | |||||||||||||||

| Financial Position |

||||||||||||||||||||

| Current assets excluding cash |

2,705 | 2,607 | 2,582 | 2,312 | 2,261 | |||||||||||||||

| Property, plant and equipment, net |

1,437 | 1,390 | 1,336 | 1,233 | 1,121 | |||||||||||||||

| Intangible assets (primarily goodwill) |

1,794 | 1,661 | 1,687 | 1,707 | 1,716 | |||||||||||||||

| Non-interest bearing liabilities |

2,518 | 2,400 | 2,364 | 2,162 | 2,102 | |||||||||||||||

| Capital employed |

3,670 | 3,504 | 3,489 | 3,415 | 3,257 | |||||||||||||||

| Net debt (cash) |

202 | 62 | (511) | (361) | (92) | |||||||||||||||

| Total equity |

3,468 | 3,442 | 4,000 | 3,776 | 3,349 | |||||||||||||||

| Total assets |

7,526 | 7,443 | 6,983 | 6,570 | 6,117 | |||||||||||||||

| Long-term debt |

1,499 | 1,521 | 279 | 563 | 364 | |||||||||||||||

| Share data |

||||||||||||||||||||

| Earnings per share (US$) – basic |

5.18 | 5.08 | 5.09 | 5.17 | 6.99 | |||||||||||||||

| Earnings per share (US$) – assuming dilution |

5.17 | 5.06 | 5.07 | 5.08 | 6.65 | |||||||||||||||

| Total parent shareholders’ equity per share (US$) |

39.22 | 38.64 | 42.17 | 39.36 | 37.33 | |||||||||||||||

| Cash dividends paid per share (US$) |

2.22 | 2.12 | 2.00 | 1.89 | 1.73 | |||||||||||||||

| Cash dividends declared per share (US$) |

2.24 | 2.14 | 2.02 | 1.94 | 1.78 | |||||||||||||||

| Share repurchases |

104 | 616 | 148 | - | - | |||||||||||||||

| Number of shares outstanding (million)2) |

88.1 | 88.7 | 94.4 | 95.5 | 89.3 | |||||||||||||||

| Ratios |

||||||||||||||||||||

| Gross margin (%) |

20.1 | 19.5 | 19.4 | 19.9 | 21.0 | |||||||||||||||

| Operating margin (%) |

7.9 | 7.8 | 8.6 | 8.5 | 10.8 | |||||||||||||||

| Pretax margin (%) |

7.4 | 7.2 | 8.3 | 8.1 | 10.1 | |||||||||||||||

| Return on capital employed (%) |

20 | 21 | 22 | 21 | 28 | |||||||||||||||

| Return on total equity (%) |

14 | 12 | 13 | 14 | 20 | |||||||||||||||

| Total equity ratio (%) |

46 | 46 | 57 | 57 | 55 | |||||||||||||||

| Net debt to capitalization (%) |

6 | 2 | n/a | n/a | n/a | |||||||||||||||

| Days receivables outstanding |

73 | 71 | 70 | 66 | 67 | |||||||||||||||

| Days inventory outstanding |

33 | 32 | 31 | 30 | 32 | |||||||||||||||

| Other data |

||||||||||||||||||||

| Airbag sales3) |

5,036 | 5,019 | 4,822 | 5,392 | 5,393 | |||||||||||||||

| Seatbelt sales4) |

2,599 | 2,800 | 2,773 | 2,657 | 2,679 | |||||||||||||||

| Passive safety electronic sales6) |

923 | 932 | 863 | n/a | n/a | |||||||||||||||

| Active safety sales |

611 | 489 | 345 | 218 | 160 | |||||||||||||||

| Net cash provided by operating activities |

751 | 713 | 838 | 689 | 758 | |||||||||||||||

| Capital expenditures, net |

450 | 453 | 379 | 360 | 357 | |||||||||||||||

| Net cash used in investing activities |

(591) | (453) | (377) | (358) | (373) | |||||||||||||||

| Net cash provided by (used in) financing activities |

(319) | 226 | (318) | (91) | (223) | |||||||||||||||

| Number of employees, December 31 |

54,600 | 50,800 | 46,900 | 41,700 | 38,500 | |||||||||||||||

| 1) Costs in 2015, 2014, 2013, 2012 and 2011 for capacity alignments and antitrust related matters reduced operating income by (millions) $166, $120, $47, $98 and $19 and net income by (millions) $131, $80, $33, $71 and $14. This corresponds to 1.8%, 1.3%, 0.6%, 1.2% and 0.2% on operating margins and 1.4%, 0.9%, 0.4%, 0.9% and 0.2% on net margins. The impact on EPS was $1.48, $0.87, $0.34, $0.74 and $0.15 while return on total equity was reduced by 1.7%, 1.9%, 0.8%, 1.8% and 0.4% for the same five year period. 2) At year end, net of treasury shares. 3) Incl. passive electronics (2011 and 2012), steering wheels, inflators and initiators. 4) Incl. seat components until a June 2012 divestiture. 5) Incl. adjustments for a non-cash, non-recurring valuation allowance for deferred tax assets of $39 million on net income and capital employed, and $0.41 on EPS and total parent shareholder equity per share. 6) In 2012 and 2011, sales for passive safety electronics were in airbag sales. |

| |||||||||||||||||||

17

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- PIMCO California Municipal Income Fund, PIMCO California Municipal Income Fund II, PIMCO California Municipal Income Fund III, PIMCO Municipal Income Fund, PIMCO Municipal Income Fund II, PIMCO Munici

- Elemental Clean Fuels and Cariboo Low Carbon Fuels Partner to Advance Clean Fuels Hubs Across Western Canada

- L3Harris Announces Quarterly Dividend

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share