Form 8-K MASTERCARD INC For: Apr 28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

_______________________________________

FORM 8-K

_______________________________________

_______________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 28, 2016 | ||||

_______________________________________ | ||||

MasterCard Incorporated (Exact name of registrant as specified in its charter) | ||||

_______________________________________ | ||||

Delaware (State or other jurisdiction of incorporation) | 001-32877 (Commission File Number) | 13-4172551 (IRS Employer Identification No.) | ||

2000 Purchase Street Purchase, New York (Address of principal executive offices) | 10577 (Zip Code) | |||

(914) 249-2000 (Registrant's telephone number, including area code) | ||||

NOT APPLICABLE (Former name or former address, if changed since last report) | ||||

_______________________________________ | ||||

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | |

1

Item 2.02 Results of Operations and Financial Condition

On April 28, 2016, MasterCard Incorporated (“MasterCard”) issued a press release announcing financial results for its first quarter 2016.

A copy of the press release is attached hereto as Exhibit 99.1. All information in the press release is furnished but not filed.

Non-GAAP Financial Information

In the attached press release, MasterCard presents growth rates on a currency-neutral basis, which is a non-GAAP financial measure. Currency-neutral growth rates are calculated by remeasuring the prior period’s results using the current period’s exchange rates for both the translational and transactional impacts on our operating results. The impact of foreign currency translation represents the effect of translating operating results where the functional currency is different than our U.S. dollar reporting currency. The impact of the transactional foreign currency represents the effect of converting revenue and expenses occurring in a currency other than the functional currency. MasterCard’s management believes the presentation of certain currency-neutral growth rates provides relevant information. MasterCard’s management uses non-GAAP financial measures to, among other things, evaluate its ongoing operations in relation to historical results, for internal planning and forecasting purposes and in the calculation of performance-based compensation. The presentation of non-GAAP financial measures should not be considered in isolation or as a substitute for MasterCard’s related financial results prepared in accordance with GAAP.

Item 7.01 Regulation FD Disclosure

On April 28, 2016, MasterCard will host a conference call to discuss its first-quarter 2016 financial results. A copy of the presentation to be used during the conference call is attached hereto as Exhibit 99.2. All information in the presentation is furnished but not filed.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

Exhibit Number | Exhibit Description |

99.1 | Press Release issued by MasterCard Incorporated, dated April 28, 2016 |

99.2 | Presentation of MasterCard Incorporated, dated April 28, 2016 |

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

MASTERCARD INCORPORATED | ||||

Date: | April 28, 2016 | By: | /s/ Janet McGinness | |

Janet McGinness | ||||

Corporate Secretary | ||||

3

EXHIBIT INDEX

Exhibit Number | Exhibit Description |

99.1 | Press Release issued by MasterCard Incorporated, dated April 28, 2016 |

99.2 | Presentation of MasterCard Incorporated, dated April 28, 2016 |

4

|  | |

MasterCard Incorporated Reports

First-Quarter 2016 Financial Results

First-Quarter 2016 Financial Results

• | First-quarter net income of $959 million, or $0.86 per diluted share |

• | First-quarter net revenue increase of 10%, to $2.4 billion |

• | First-quarter gross dollar volume up 13% and purchase volume up 12% |

Purchase, NY, April 28, 2016 - MasterCard Incorporated (NYSE: MA) today announced financial results for the first quarter of 2016. The company reported net income of $959 million, a decrease of 6%, or 2% on a currency-neutral basis, and earnings per diluted share of $0.86, down 3%, or up 1% on a currency-neutral basis, versus the year-ago period. As expected, earnings per diluted share were unfavorably impacted by $0.08 due to the non-recurrence of a discrete tax credit and balance sheet remeasurement related to Venezuela in last year’s first quarter.

Net revenue for the first quarter of 2016 was $2.4 billion, a 10% increase versus the same period in 2015. On a currency-neutral basis, net revenue increased 14%. Net revenue growth was driven by the impact of the following:

• | An increase in processed transactions of 14%, to 12.6 billion; |

• | A 13% increase in gross dollar volume, on a local currency basis, to $1.1 trillion; and |

• | An increase in cross-border volumes of 12%. |

These factors were partially offset by an increase in rebates and incentives, primarily due to new and renewed agreements and increased volumes.

Worldwide purchase volume during the quarter was up 12% on a local currency basis versus the first quarter of 2015, to $838 billion. As of March 31, 2016, the company’s customers had issued 2.3 billion MasterCard and Maestro-branded cards.

“The year is off to a good start with solid growth in revenue due to strong volume and transaction levels this quarter,” said Ajay Banga, president and CEO, MasterCard. “We continue to deliver against our strategy, looking to our investments and acquisitions to create a better cardholder experience, supported by a relentless commitment to security. Our encryption and token services are helping to support new ways to pay in an increasingly digital world, while our APT and Pinpoint businesses are helping to drive stronger connections between merchants and their customers.”

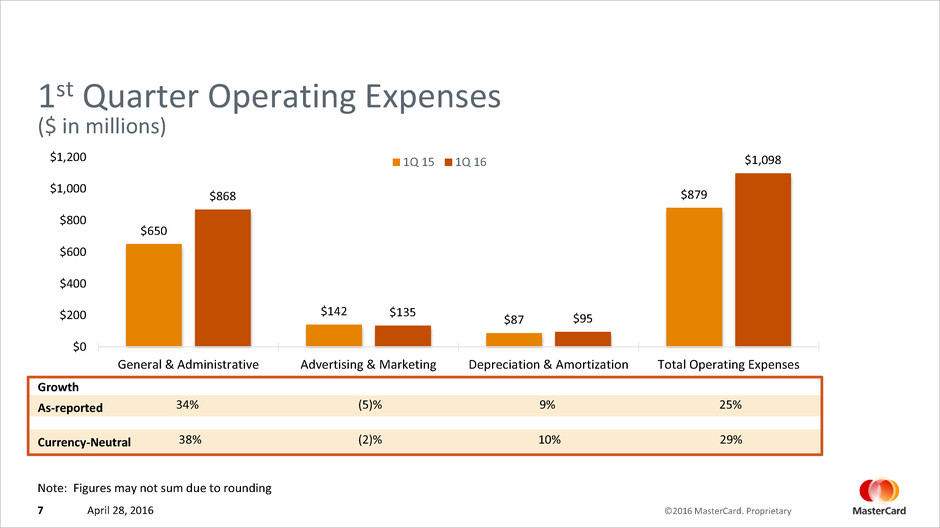

Total operating expenses increased 25%, or 29% on a currency-neutral basis, to $1.1 billion during the first quarter of 2016 compared to the same period in 2015. The increase was primarily due to the difference between foreign exchange gains related to currency hedging and balance sheet remeasurement which occurred in last year’s first quarter versus foreign exchange losses on currency hedging in the first

-more-

MasterCard Incorporated - Page 2

quarter of 2016. Additionally, this year’s period included the impact of higher investments to support our strategic initiatives.

Operating income for the first quarter of 2016 was flat, or up 4% on a currency-neutral basis, versus the year-ago period. The company delivered an operating margin of 55.1%.

MasterCard reported other expense of $11 million in the first quarter of 2016, the same as the first quarter of 2015.

MasterCard’s effective tax rate was 28.3% in the first quarter of 2016, versus a rate of 23.9% in the comparable period in 2015. The increase was primarily due to the non-recurrence of a discrete U.S. foreign tax credit benefit which occurred in the first quarter of 2015.

During the first quarter of 2016, MasterCard repurchased approximately 15 million shares of Class A common stock at a cost of almost $1.4 billion. Quarter-to-date through April 21st, the company repurchased an additional 3.0 million shares at a cost of $288 million, with $2.9 billion remaining under current repurchase program authorizations.

First-Quarter Financial Results Conference Call Details

At 9:00 a.m. ET today, the company will host a conference call to discuss its first-quarter financial results.

The dial-in information for this call is 866-393-4306 (within the U.S.) and 734-385-2616 (outside the U.S.), and the passcode is 81063498. A replay of the call will be available for 30 days and can be accessed by dialing 855-859-2056 (within the U.S.) and 404-537-3406 (outside the U.S.), and using passcode 81063498.

This call can also be accessed through the Investor Relations section of the company’s website at www.mastercard.com/investor.

Non-GAAP Financial Information

The presentation of growth rates on a currency-neutral basis represent a non-GAAP measure and are calculated by remeasuring the prior period’s results using the current period’s exchange rates for both the translational and transactional impacts in our operating results.

About MasterCard Incorporated

MasterCard (NYSE: MA), www.mastercard.com, is a technology company in the global payments industry. We operate the world’s fastest payments processing network, connecting consumers, financial institutions, merchants, governments and businesses in more than 210 countries and territories. MasterCard’s products and solutions make everyday commerce activities - such as shopping, traveling, running a business and managing finances - easier, more secure and more efficient for everyone. Follow

MasterCard Incorporated - Page 3

us on Twitter @MasterCardNews, join the discussion on the Beyond the Transaction Blog and subscribe for the latest news on the Engagement Bureau.

Forward-Looking Statements

This press release contains forward-looking statements pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical facts may be forward-looking statements. When used in this press release, the words “believe”, “expect”, “could”, “may”, “would”, “will”, “trend” and similar words are intended to identify forward-looking statements. Examples of forward-looking statements include, but are not limited to, statements that relate to the MasterCard’s future prospects, developments and business strategies. We caution you to not place undue reliance on these forward-looking statements, as they speak only as of the date they are made. Except for the company’s ongoing obligations under the U.S. federal securities laws, the company does not intend to update or otherwise revise the forward-looking information to reflect actual results of operations, changes in financial condition, changes in estimates, expectations or assumptions, changes in general economic or industry conditions or other circumstances arising and/or existing since the preparation of this press release or to reflect the occurrence of any unanticipated events.

Many factors and uncertainties relating to our operations and business environment, all of which are difficult to predict and many of which are outside of our control, influence whether any forward-looking statements can or will be achieved. Any one of those factors could cause our actual results to differ materially from those expressed or implied in writing in any forward-looking statements made by MasterCard or on its behalf, including, but not limited to, the following factors:

• | payments system-related legal and regulatory challenges (including interchange fees, surcharging and the extension of current regulatory activity to additional jurisdictions or products); |

• | the impact of preferential or protective government actions; |

• | regulation to which we are subject based on our participation in the payments industry; |

• | regulation of privacy, data protection and security; |

• | the impact of competition in the global payments industry (including disintermediation and pricing pressure); |

• | the challenges relating to rapid technological developments and changes; |

• | the impact of information security failures, breaches or service disruptions on our business; |

• | issues related to our relationships with our customers (including loss of substantial business from significant customers, competitor relationships with our customers and banking industry consolidation); |

• | the impact of our relationships with stakeholders, including issuers and acquirers, merchants and governments; |

MasterCard Incorporated - Page 4

• | exposure to loss or illiquidity due to settlement guarantees and other significant third-party obligations; |

• | the impact of global economic and political events and conditions, including global financial market activity, declines in cross-border activity; negative trends in consumer spending and the effect of adverse currency fluctuation; |

• | reputational impact, including impact related to brand perception, account data breaches and fraudulent activity; |

• | issues related to acquisition integration, strategic investments and entry into new businesses; and |

• | potential or incurred liability and limitations on business resulting from litigation. |

For additional information on these and other factors that could cause MasterCard’s actual results to differ materially from expected results, please see the company’s filings with the Securities and Exchange Commission, including the company’s Annual Report on Form 10-K for the year ended December 31, 2015 and any subsequent reports on Forms 10-Q and 8-K.

###

Contacts:

Investor Relations: Barbara Gasper or Matt Lanford, [email protected], 914-249-4565

Media Relations: Seth Eisen, [email protected], 914-249-3153

MasterCard Incorporated - Page 5

MASTERCARD INCORPORATED

CONSOLIDATED STATEMENT OF OPERATIONS

(UNAUDITED)

Three Months Ended March 31, | |||||||

2016 | 2015 | ||||||

(in millions, except per share data) | |||||||

Net Revenue | $ | 2,446 | $ | 2,230 | |||

Operating Expenses | |||||||

General and administrative | 868 | 650 | |||||

Advertising and marketing | 135 | 142 | |||||

Depreciation and amortization | 95 | 87 | |||||

Total operating expenses | 1,098 | 879 | |||||

Operating income | 1,348 | 1,351 | |||||

Other Income (Expense) | |||||||

Investment income | 10 | 9 | |||||

Interest expense | (20 | ) | (17 | ) | |||

Other income (expense), net | (1 | ) | (3 | ) | |||

Total other income (expense) | (11 | ) | (11 | ) | |||

Income before income taxes | 1,337 | 1,340 | |||||

Income tax expense | 378 | 320 | |||||

Net Income | $ | 959 | $ | 1,020 | |||

Basic Earnings per Share | $ | 0.86 | $ | 0.89 | |||

Basic Weighted-Average Shares Outstanding | 1,109 | 1,148 | |||||

Diluted Earnings per Share | $ | 0.86 | $ | 0.89 | |||

Diluted Weighted-Average Shares Outstanding | 1,112 | 1,152 | |||||

MasterCard Incorporated - Page 6

MASTERCARD INCORPORATED

CONSOLIDATED BALANCE SHEET

(UNAUDITED)

March 31, 2016 | December 31, 2015 | ||||||

(in millions, except per share data) | |||||||

ASSETS | |||||||

Cash and cash equivalents | $ | 4,894 | $ | 5,747 | |||

Restricted cash for litigation settlement | 542 | 541 | |||||

Investments | 1,314 | 991 | |||||

Accounts receivable | 1,186 | 1,079 | |||||

Settlement due from customers | 1,020 | 1,068 | |||||

Restricted security deposits held for customers | 937 | 895 | |||||

Prepaid expenses and other current assets | 713 | 663 | |||||

Total Current Assets | 10,606 | 10,984 | |||||

Property, plant and equipment, net of accumulated depreciation of $526 and $491, respectively | 669 | 675 | |||||

Deferred income taxes | 353 | 317 | |||||

Goodwill | 1,886 | 1,891 | |||||

Other intangible assets, net of accumulated amortization of $871 and $816, respectively | 788 | 803 | |||||

Other assets | 1,603 | 1,580 | |||||

Total Assets | $ | 15,905 | $ | 16,250 | |||

LIABILITIES AND EQUITY | |||||||

Accounts payable | $ | 409 | $ | 472 | |||

Settlement due to customers | 849 | 866 | |||||

Restricted security deposits held for customers | 937 | 895 | |||||

Accrued litigation | 710 | 709 | |||||

Accrued expenses | 2,876 | 2,763 | |||||

Other current liabilities | 659 | 564 | |||||

Total Current Liabilities | 6,440 | 6,269 | |||||

Long-term debt | 3,333 | 3,268 | |||||

Deferred income taxes | 76 | 79 | |||||

Other liabilities | 545 | 572 | |||||

Total Liabilities | 10,394 | 10,188 | |||||

Commitments and Contingencies | |||||||

Stockholders’ Equity | |||||||

Class A common stock, $0.0001 par value; authorized 3,000 shares, 1,372 and 1,370 shares issued and 1,082 and 1,095 outstanding, respectively | — | — | |||||

Class B common stock, $0.0001 par value; authorized 1,200 shares, 20 and 21 issued and outstanding, respectively | — | — | |||||

Additional paid-in-capital | 4,009 | 4,004 | |||||

Class A treasury stock, at cost, 291 and 275 shares, respectively | (14,882 | ) | (13,522 | ) | |||

Retained earnings | 16,972 | 16,222 | |||||

Accumulated other comprehensive income (loss) | (620 | ) | (676 | ) | |||

Total Stockholders’ Equity | 5,479 | 6,028 | |||||

Non-controlling interests | 32 | 34 | |||||

Total Equity | 5,511 | 6,062 | |||||

Total Liabilities and Equity | $ | 15,905 | $ | 16,250 | |||

MasterCard Incorporated - Page 7

MASTERCARD INCORPORATED

CONSOLIDATED STATEMENT OF CASH FLOWS

(UNAUDITED)

Three Months Ended March 31, | |||||||

2016 | 2015 | ||||||

(in millions) | |||||||

Operating Activities | |||||||

Net income | $ | 959 | $ | 1,020 | |||

Adjustments to reconcile net income to net cash provided by operating activities: | |||||||

Amortization of customer and merchant incentives | 204 | 184 | |||||

Depreciation and amortization | 95 | 87 | |||||

Share-based payments | (40 | ) | (53 | ) | |||

Deferred income taxes | (20 | ) | 37 | ||||

Other | (15 | ) | (37 | ) | |||

Changes in operating assets and liabilities: | |||||||

Accounts receivable | (87 | ) | (30 | ) | |||

Income taxes receivable | (3 | ) | (63 | ) | |||

Settlement due from customers | 69 | (108 | ) | ||||

Prepaid expenses | (180 | ) | (57 | ) | |||

Accrued litigation and legal settlements | 6 | (40 | ) | ||||

Accounts payable | (75 | ) | 1 | ||||

Settlement due to customers | (41 | ) | 158 | ||||

Accrued expenses | 27 | (214 | ) | ||||

Net change in other assets and liabilities | 109 | 26 | |||||

Net cash provided by operating activities | 1,008 | 911 | |||||

Investing Activities | |||||||

Purchases of investment securities available-for-sale | (446 | ) | (691 | ) | |||

Purchases of other short-term investments held-to-maturity | (60 | ) | — | ||||

Proceeds from sales of investment securities available-for-sale | 69 | 84 | |||||

Proceeds from maturities of investment securities available-for-sale | 55 | 166 | |||||

Proceeds from maturities of investment securities held-to-maturity | 80 | — | |||||

Acquisition of businesses, net of cash acquired | — | (12 | ) | ||||

Purchases of property, plant and equipment | (37 | ) | (31 | ) | |||

Capitalized software | (38 | ) | (26 | ) | |||

Other investing activities | (8 | ) | (9 | ) | |||

Net cash used in investing activities | (385 | ) | (519 | ) | |||

Financing Activities | |||||||

Purchases of treasury stock | (1,357 | ) | (947 | ) | |||

Dividends paid | (212 | ) | (184 | ) | |||

Tax benefit for share-based payments | 22 | 27 | |||||

Cash proceeds from exercise of stock options | 4 | 10 | |||||

Other financing activities | (2 | ) | (6 | ) | |||

Net cash used in financing activities | (1,545 | ) | (1,100 | ) | |||

Effect of exchange rate changes on cash and cash equivalents | 69 | (222 | ) | ||||

Net decrease in cash and cash equivalents | (853 | ) | (930 | ) | |||

Cash and cash equivalents - beginning of period | 5,747 | 5,137 | |||||

Cash and cash equivalents - end of period | $ | 4,894 | $ | 4,207 | |||

Non-Cash Investing and Financing Activities | |||||||

Fair value of assets acquired, net of cash acquired | $ | — | $ | 13 | |||

Fair value of liabilities assumed related to acquisitions | $ | — | $ | — | |||

MasterCard Incorporated - Page 8

MASTERCARD INCORPORATED OPERATING PERFORMANCE

For the 3 Months Ended March 31, 2016 | |||||||||||||||||||||||||||||||||||

GDV (Bil.) | Growth (USD) | Growth (Local) | Purchase Volume (Bil.) | Growth (Local) | Purchase Trans. (Mil.) | Cash Volume (Bil.) | Growth (Local) | Cash Trans (Mil.) | Accounts (Mil.) | Cards (Mil.) | |||||||||||||||||||||||||

All MasterCard Credit, Charge and Debit Programs | |||||||||||||||||||||||||||||||||||

APMEA | $ | 350 | 6.1 | % | 13.2 | % | $ | 234 | 12.5 | % | 3,261 | $ | 117 | 14.9 | % | 1,219 | 535 | 572 | |||||||||||||||||

Canada | 29 | -2.0 | % | 8.6 | % | 27 | 9.5 | % | 446 | 2 | -4.6 | % | 5 | 42 | 49 | ||||||||||||||||||||

Europe | 316 | 10.8 | % | 17.7 | % | 218 | 14.5 | % | 4,857 | 99 | 25.4 | % | 796 | 401 | 416 | ||||||||||||||||||||

Latin America | 73 | -8.7 | % | 14.4 | % | 42 | 15.0 | % | 1,482 | 31 | 13.6 | % | 238 | 152 | 174 | ||||||||||||||||||||

Worldwide less United States | 769 | 6.0 | % | 15.0 | % | 521 | 13.4 | % | 10,046 | 248 | 18.5 | % | 2,259 | 1,131 | 1,210 | ||||||||||||||||||||

United States | 372 | 9.8 | % | 9.8 | % | 316 | 10.3 | % | 5,773 | 56 | 7.0 | % | 337 | 346 | 383 | ||||||||||||||||||||

Worldwide | 1,141 | 7.2 | % | 13.2 | % | 838 | 12.2 | % | 15,819 | 303 | 16.2 | % | 2,596 | 1,477 | 1,593 | ||||||||||||||||||||

MasterCard Credit and Charge Programs | |||||||||||||||||||||||||||||||||||

Worldwide less United States | 423 | 0.6 | % | 9.1 | % | 387 | 9.9 | % | 5,774 | 36 | 2.1 | % | 178 | 526 | 588 | ||||||||||||||||||||

United States | 170 | 11.5 | % | 11.5 | % | 162 | 11.2 | % | 1,843 | 7 | 19.0 | % | 9 | 161 | 195 | ||||||||||||||||||||

Worldwide | 593 | 3.5 | % | 9.8 | % | 549 | 10.2 | % | 7,617 | 44 | 4.5 | % | 187 | 687 | 783 | ||||||||||||||||||||

MasterCard Debit Programs | |||||||||||||||||||||||||||||||||||

Worldwide less United States | 345 | 13.5 | % | 23.0 | % | 134 | 24.7 | % | 4,272 | 211 | 21.9 | % | 2,081 | 605 | 622 | ||||||||||||||||||||

United States | 203 | 8.5 | % | 8.5 | % | 154 | 9.5 | % | 3,930 | 49 | 5.4 | % | 329 | 185 | 188 | ||||||||||||||||||||

Worldwide | 548 | 11.6 | % | 17.2 | % | 289 | 16.1 | % | 8,201 | 260 | 18.4 | % | 2,409 | 790 | 810 | ||||||||||||||||||||

For the 3 months ended March 31, 2015 | |||||||||||||||||||||||||||||||||||

GDV (Bil.) | Growth (USD) | Growth (Local) | Purchase Volume (Bil.) | Growth (Local) | Purchase Trans. (Mil.) | Cash Volume (Bil.) | Growth (Local) | Cash Trans (Mil.) | Accounts (Mil.) | Cards (Mil.) | |||||||||||||||||||||||||

All MasterCard Credit, Charge and Debit Programs | |||||||||||||||||||||||||||||||||||

APMEA | $ | 330 | 8.9 | % | 15.1 | % | $ | 220 | 15.2 | % | 2,681 | $ | 110 | 15.0 | % | 1,025 | 465 | 498 | |||||||||||||||||

Canada | 30 | 2.2 | % | 15.0 | % | 28 | 17.2 | % | 393 | 2 | -9.6 | % | 5 | 38 | 44 | ||||||||||||||||||||

Europe | 285 | -8.5 | % | 15.0 | % | 200 | 13.1 | % | 3,938 | 85 | 19.8 | % | 671 | 365 | 382 | ||||||||||||||||||||

Latin America | 80 | -2.9 | % | 15.0 | % | 48 | 19.2 | % | 1,338 | 32 | 9.3 | % | 214 | 137 | 157 | ||||||||||||||||||||

Worldwide less United States | 725 | -0.1 | % | 15.1 | % | 496 | 14.8 | % | 8,350 | 229 | 15.6 | % | 1,915 | 1,005 | 1,081 | ||||||||||||||||||||

United States | 339 | 6.5 | % | 6.5 | % | 287 | 7.0 | % | 5,117 | 52 | 3.7 | % | 326 | 321 | 356 | ||||||||||||||||||||

Worldwide | 1,064 | 1.9 | % | 12.2 | % | 783 | 11.8 | % | 13,467 | 281 | 13.2 | % | 2,241 | 1,326 | 1,436 | ||||||||||||||||||||

MasterCard Credit and Charge Programs | |||||||||||||||||||||||||||||||||||

Worldwide less United States | 421 | -1.7 | % | 10.9 | % | 382 | 12.3 | % | 5,160 | 39 | -1.2 | % | 179 | 506 | 569 | ||||||||||||||||||||

United States | 152 | 5.3 | % | 5.3 | % | 146 | 6.1 | % | 1,609 | 6 | -10.2 | % | 7 | 151 | 182 | ||||||||||||||||||||

Worldwide | 573 | 0.1 | % | 9.4 | % | 528 | 10.5 | % | 6,770 | 45 | -2.5 | % | 186 | 658 | 752 | ||||||||||||||||||||

MasterCard Debit Programs | |||||||||||||||||||||||||||||||||||

Worldwide less United States | 304 | 2.1 | % | 21.3 | % | 114 | 24.1 | % | 3,190 | 190 | 19.8 | % | 1,736 | 499 | 512 | ||||||||||||||||||||

United States | 187 | 7.5 | % | 7.5 | % | 141 | 8.0 | % | 3,507 | 46 | 5.9 | % | 319 | 170 | 173 | ||||||||||||||||||||

Worldwide | 491 | 4.1 | % | 15.7 | % | 255 | 14.7 | % | 6,697 | 236 | 16.8 | % | 2,055 | 669 | 685 | ||||||||||||||||||||

APMEA = Asia Pacific / Middle East / Africa | |||||||||||||||||||||||||||||||||||

Note that the figures in the preceding tables may not sum due to rounding; growth represents change from the comparable year-ago period | |||||||||||||||||||||||||||||||||||

MasterCard Incorporated - Page 9

Footnote

The tables set forth the gross dollar volume (“GDV”), purchase volume, cash volume and the number of purchase transactions, cash transactions, accounts and cards on a regional and global basis for MasterCard®-branded and MasterCard Electronic™-branded cards. Growth rates over prior periods are provided for volume-based data.

Debit transactions on Maestro® and Cirrus®-branded cards and transactions involving brands other than MasterCard are not included in the preceding tables.

For purposes of the table: GDV represents purchase volume plus cash volume and includes the impact of balance transfers and convenience checks; “purchase volume” means the aggregate dollar amount of purchases made with MasterCard-branded cards for the relevant period; and “cash volume” means the aggregate dollar amount of cash disbursements obtained with MasterCard-branded cards for the relevant period. The number of cards includes virtual cards, which are MasterCard-branded payment accounts that do not generally have physical cards associated with them.

The MasterCard payment product is comprised of credit, charge and debit programs, and data relating to each type of program is included in the tables. Debit programs include MasterCard-branded debit programs where the primary means of cardholder validation at the point of sale is for cardholders either to sign a sales receipt or enter a PIN. The tables include information with respect to transactions involving MasterCard-branded cards that are not processed by MasterCard and transactions for which MasterCard does not earn significant revenues.

Information denominated in U.S. dollars is calculated by applying an established U.S. dollar/local currency exchange rate for each local currency in which MasterCard volumes are reported. These exchange rates are calculated on a quarterly basis using the average exchange rate for each quarter. MasterCard reports period-over-period rates of change in purchase volume and cash volume on the basis of local currency information, in order to eliminate the impact of changes in the value of foreign currencies against the U.S. dollar in calculating such rates of change.

The data set forth in the GDV, purchase volume, purchase transactions, cash volume and cash transactions columns is provided by MasterCard customers and is subject to verification by MasterCard and partial cross-checking against information provided by MasterCard’s transaction processing systems. The data set forth in the accounts and cards columns is provided by MasterCard customers and is subject to certain limited verification by MasterCard. A portion of the data set forth in the accounts and cards columns reflects the impact of routine portfolio changes among customers and other practices that may lead to over counting of the underlying data in certain circumstances. All data is subject to revision and amendment by MasterCard’s customers subsequent to the date of its release.

In 2015 Q3, several customers purged inactive MasterCard cards and accounts. Data for the comparable periods has been revised to be consistent with this approach.

Performance information for prior periods can be found in the “Investor Relations” section of the MasterCard website at www.mastercard.com/investor.

MasterCard Incorporated First-Quarter 2016 Financial Results Conference Call April 28, 2016

©2016 MasterCard. Proprietary Business Update Financial & Operational Overview Economic Update Business Highlights April 28, 20162

©2016 MasterCard. Proprietary 1st Quarter Selected Financial Performance 1Q 16 1Q 15 Net revenue 2,446$ 2,230$ 10% 14% Total operating expenses 1,098 879 25% 29% Operating income 1,348 1,351 (0%) 4% Operating margin 55.1% 60.6% (5.5) ppts (5.2) ppts Net income 959$ 1,020$ (6%) (2%) Diluted EPS 0.86$ 0.89$ (3%) 1% Effective tax rate 28.3% 23.9% Currency Neutral YOY Growth As Reported ($ in millions, except per share data) Note: Figures may not sum due to rounding. April 28, 20163

©2016 MasterCard. Proprietary $573 $593 $152 $170 $421 $423 $491 $548 $187 $203 $304 $345 $0 $400 $800 $1,200 1Q 15 1Q 16 1Q 15 1Q 16 1Q 15 1Q 16 Credit Debit Worldwide 13% Growth ($ in billions) 1st Quarter Gross Dollar Volume (GDV) $1,064 $1,141 $339 $372 $725 $769 United States 10% Growth Rest of World 15% Growth Notes: 1. Growth rates are shown in local currency 2. Figures may not sum due to rounding April 28, 20164

©2016 MasterCard. Proprietary 1st Quarter Processed Transactions and Cards Cards 7% Growth 1,436 1,593 687 685 0 500 1,000 1,500 2,000 2,500 1Q 15 1Q 16 Ca rd s (in m ill io ns ) MasterCard Cards Maestro Cards 2,12311,035 12,601 0 2,500 5,000 7,500 10,000 12,500 15,000 1Q 15 1Q 16 Tr an sa ct io ns (i n m ill io ns ) Processed Transactions 14% Growth 2,278 Note: Figures may not sum due to rounding April 28, 20165

©2016 MasterCard. Proprietary 1st Quarter Revenue ($ in millions) $963 $724 $1,006 $418 ($881) $2,230 $1,027 $796 $1,165 $497 ($1,039) $2,446 Domestic Assessments Cross-Border Volume Fees Transaction Processing Fees Other Revenue Rebates and Incentives Total Net Revenue -$2,000 -$1,000 $0 $1,000 $2,000 $3,000 1Q 15 1Q 16 Note: Figures may not sum due to rounding. 7% 10% 16% 19% 18% 10%As-reported 14%22%22%18%14%Currency-Neutral 13% Growth April 28, 20166

©2016 MasterCard. Proprietary Note: Figures may not sum due to rounding 1st Quarter Operating Expenses ($ in millions) $650 $142 $87 $879$868 $135 $95 $1,098 General & Administrative Advertising & Marketing Depreciation & Amortization Total Operating Expenses $0 $200 $400 $600 $800 $1,000 $1,200 1Q 15 1Q 16 34% (5)% 9% 25%As-reported 29% Growth 38% (2)% 10%Currency-Neutral April 28, 20167

©2016 MasterCard. Proprietary Looking Ahead Business update through April 21st Long-Term Performance Objectives Thoughts for 2016 April 28, 20168

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- MasterCard (MA) PT Raised to $545 at Baird, 'like the stock over the course of 2024'

- Agriculture Robots Market to USD 76.4 Billion by 2031 Owing to Growing Demand for Food and Labor Shortages

- VulnCheck Closes $7.95 Million in Seed Funding to Accelerate Momentum Amid Growing Demand for its Next-Generation Exploit Intelligence Solutions

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share