Form 8-K KERYX BIOPHARMACEUTICALS For: Apr 28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): April 28, 2016

Keryx Biopharmaceuticals, Inc.

(Exact Name of Registrant as Specified in Charter)

| Delaware | 000-30929 | 13-4087132 | ||

| (State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

One Marina Park Drive, 12th Floor

Boston, Massachusetts 02210

(Address of Principal Executive Offices)

(617) 466-3500

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act. |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act. |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. |

| Item 2.02. | Results of Operations and Financial Condition. |

On April 28, 2016, Keryx Biopharmaceuticals, Inc. (“Keryx”) issued a press release announcing its results of operations for the first quarter ended March 31, 2016. Keryx also announced that on April 28, 2016 at 8:00 a.m. ET, it will host an investor conference call to discuss the Company’s first quarter financial results and provide a business update. A copy of such press release is being furnished as Exhibit 99.1 to this report and is incorporated herein by reference.

The information set forth in Exhibit 99.1 shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liability of that section, and shall not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

| Item 9.01. | Financial Statements And Exhibits. |

| (d) | Exhibits. |

The following exhibit is furnished herewith:

| 99.1 | Press release issued by Keryx Biopharmaceuticals, Inc., dated April 28, 2016. | |

| 99.2 | PowerPoint presentation to be presented by Keryx Biopharmaceuticals, Inc. on April 28, 2016. | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Keryx Biopharmaceuticals, Inc. | ||||||

| (Registrant) | ||||||

| Date: April 28, 2016 | ||||||

| By: | /s/ Brian Adams | |||||

| Brian Adams | ||||||

| General Counsel and Corporate Secretary | ||||||

INDEX TO EXHIBITS

| Exhibit Number |

Description | |

| 99.1 | Press release issued by Keryx Biopharmaceuticals, Inc., dated April 28, 2016. | |

| 99.2 | PowerPoint presentation to be presented by Keryx Biopharmaceuticals, Inc. on April 28, 2016. | |

Exhibit 99.1

Keryx Biopharmaceuticals Announces First Quarter 2016 Financial Results

| • | Company reported $6.8 million in first quarter total revenues, including $5.6 million of Auryxia™ (ferric citrate) net U.S. product sales |

| • | 2016 product sales and cash operating expense guidance reiterated |

| • | Company on track to submit supplemental new drug application (sNDA) in the third quarter of 2016 seeking to expand ferric citrate’s indication |

BOSTON, MA, April 28, 2016 – Keryx Biopharmaceuticals, Inc. (Nasdaq: KERX), a biopharmaceutical company focused on bringing innovative medicines to people with renal disease, today announced its financial results for the first quarter ended March 31, 2016.

“In March, our recently expanded and fully trained field team began calling on physicians, dietitians and the entire dialysis care team to enhance awareness of Auryxia and drive increased adoption,” said Greg Madison, chief executive officer of Keryx Biopharmaceuticals. “Through the expansion of our field team, we are able to increase the reach and frequency of contact with the treating community, and I am confident that with their efforts we will continue to increase uptake of Auryxia in people with chronic kidney disease (CKD) on dialysis.”

Mr. Madison continued, “In the first quarter, we announced positive top-line results from our pivotal Phase 3 study evaluating ferric citrate in people with non-dialysis dependent CKD struggling with iron deficiency anemia (IDA). These results bring us one step closer to treating another important complication of CKD. The rapid, durable and significant responses observed with ferric citrate in the study were a major milestone for Keryx and confirmed the unique attributes of ferric citrate’s mechanism of action, which delivers iron orally through the body’s natural absorption process. As we look ahead, our top priorities for this year are to increase adoption of Auryxia in the dialysis setting, submit a regulatory application seeking label expansion, and prepare for potential launch in 2017 in the new indication.”

FIRST QUARTER 2016 BUSINESS HIGHLIGHTS

Auryxia Commercialization

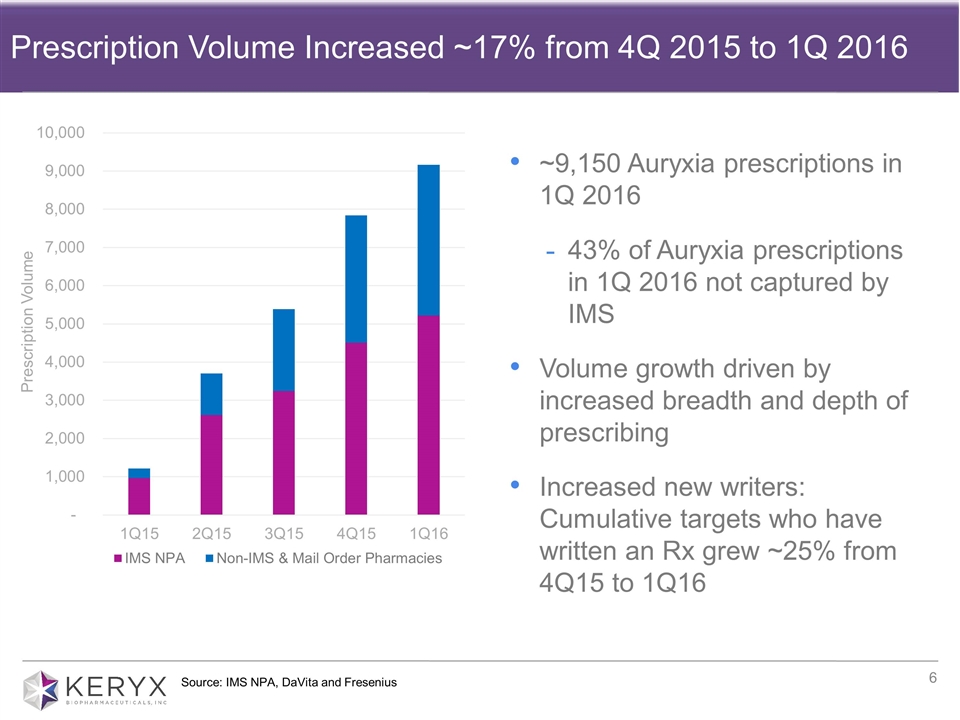

| • | Auryxia net U.S. product sales for the first quarter of 2016 were $5.6 million compared with $0.4 million in the first quarter of 2015. First quarter 2016 Auryxia product sales resulted from approximately 9,150 prescriptions, which represented 17 percent growth in total prescriptions compared to the fourth quarter of 2015. |

| • | In the first quarter of 2016, cumulative target physicians who have written a prescription for Auryxia increased approximately 25 percent from the fourth quarter of 2015. This reflects continued efforts to increase the breadth of physicians prescribing Auryxia. |

Potential Label Expansion

Pivotal Phase 3 Trial Aimed at Increasing the Number of Adults Eligible for Treatment with Ferric Citrate

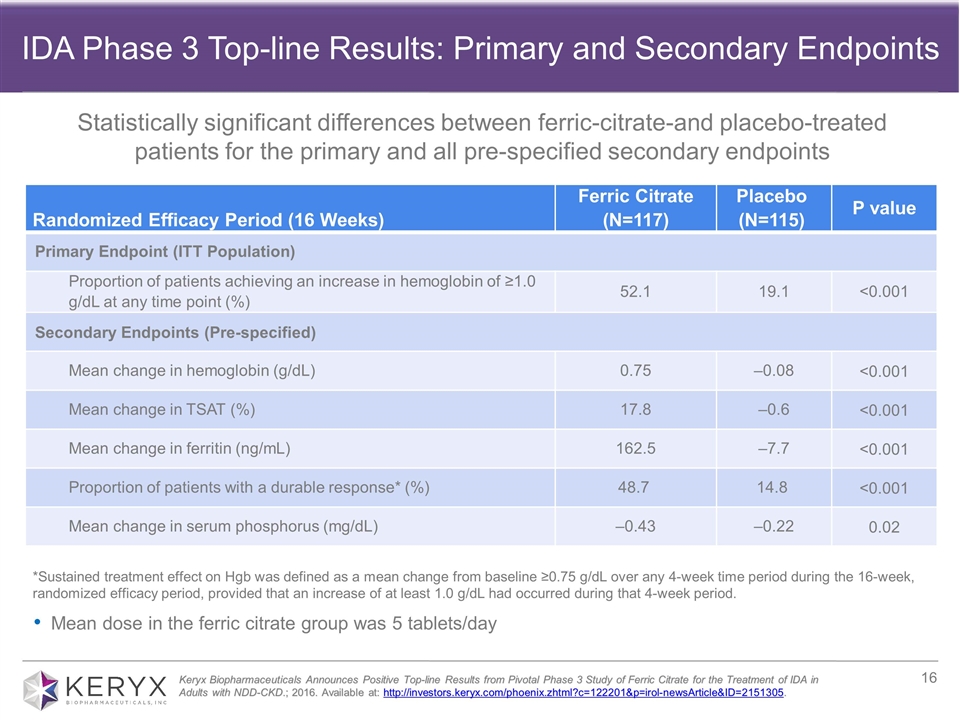

| • | In March, the company announced that its 24-week pivotal Phase 3 trial evaluating ferric citrate for the treatment of iron deficiency anemia in adults with stage 3-5 non-dialysis dependent CKD demonstrated statistically significant differences between ferric citrate- and placebo-treated patients for the primary and all pre-specified secondary endpoints. Specifically, 52 percent (61/117) of patients who received ferric citrate achieved the primary endpoint, which was a 1g/dL or greater rise in hemoglobin at any time point during the 16-week randomized efficacy period, |

| compared with 19 percent (22/115) in the placebo group (p<0.001). Importantly, the vast majority of patients who achieved the primary endpoint (57/61) had a durable response. In terms of safety, during the randomized efficacy period, the majority of adverse events reported were mild to moderate, with the most common being diarrhea. Read the full press release of the top-line Phase 3 results here. |

| • | The company intends to submit an sNDA for approval to the U.S. FDA in the third quarter of 2016. |

| • | Keryx plans to submit detailed Phase 3 results for presentation at the American Society of Nephrology’s 2016 Kidney Week taking place November 15 – 20, 2016, and plans to submit data for possible publication in a peer reviewed medical journal. |

Corporate

| • | In April, Keryx announced new appointments and changes to its board of directors. |

First Quarter Ended March 31, 2016 Financial Results

“As a result of our continued focus on commercial execution and fiscal discipline, we met or exceeded all of our internal financial goals in the first quarter and, therefore, are progressing nicely toward achieving our previously stated 2016 full year financial objectives,” said Scott Holmes, chief financial officer of Keryx. “The passion and commitment that my colleagues at Keryx bring to work each day both in the field and in our home office will drive us to achieve our goals in 2016 and beyond.”

At March 31, 2016, the company had cash and cash equivalents of $170.5 million.

Total revenues for the quarter ended March 31, 2016 were approximately $6.8 million, compared with $1.2 million during the same period in 2015. Total revenues for the quarter consisted of Auryxia net U.S. product sales of $5.6 million, and license revenue of $1.2 million associated with royalties received on ferric citrate net sales from Keryx’s Japanese partner.

Cost of goods sold for the quarter ended March 31, 2016 was $1.1 million or 19 percent of Auryxia net U.S. product sales, as compared with $0.1 million or 18 percent during the same period in 2015.

Research and development expenses for the quarter ended March 31, 2016 were $7.6 million compared with $9.6 million during the same period in 2015. The decrease was primarily due to a decrease in costs associated with the company’s recently completed Phase 3 clinical trial evaluating ferric citrate for the treatment of IDA in adults with stage 3-5 non-dialysis dependent CKD.

Selling, general and administrative expenses for the quarter ended March 31, 2016 were $20.8 million, as compared with $18.9 million during the same period in 2015. The increase was primarily related to incremental costs associated with hiring and onboarding of Keryx’s expanded field team.

Net loss for the first quarter ended March 31, 2016 was $41.0 million, or $0.39 per share, compared to a net loss of $27.7 million, or $0.28 per share, for the comparable quarter in 2015. The company’s net loss for the quarter ended March 31, 2016 includes $15.7 million in non-cash interest expense related to amortization of the debt discount on its convertible senior notes, as well as a $2.0 million non-cash charge related to the increase in fair value of the derivative liability that was recorded in connection with the issuance of the convertible senior notes.

Cash Operating Expenses (a non-GAAP measurement)*

Total operating expenses (excluding cost of goods sold and license expenses) for the first quarter ended March 31, 2016 were $28.4 million, which included $4.5 million in non-cash expenses, thereby making cash operating expenses $23.9 million for the first quarter. During the same period in 2015, total operating expenses were $28.5 million, which included $4.5 million in non-cash expenses, thereby making cash operating expenses $24.0 million.

Non-cash expenses referenced above include stock-based compensation expense, depreciation expense and certain non-cash commercial expenses, such as product samples.

2016 Financial Guidance

This section contains forward-looking guidance about the financial outlook for Keryx Biopharmaceuticals

Keryx today reiterated the following financial guidance provided in February 2016.

Auryxia net U.S. product sales: Keryx expects full year 2016 Auryxia net U.S. product sales to be in the range of $31 to $34 million, and expects sales to ramp throughout the year, as it realizes the full impact of its expanded field team.

Cash operating expenses: Keryx expects its 2016 cash operating expenses will be in the range of $87 to $92 million. Cash operating expense guidance excludes cost of goods sold, license expenses, and other non-cash expenses.*

| * | Please refer to the section below titled “Use of Non-GAAP Financial Measures” for information about Keryx’s use of non-GAAP financial measures. |

Conference Call Information

Keryx will host an investor conference call today, Thursday, April 28, 2016, at 8:00 a.m. ET to discuss financial results for the first quarter of 2016. In order to participate in the conference call, please call 1-(888) 396-2320 (U.S.), 1-(774) 264-7560 (outside the U.S.), call-in ID: 90827914. The call will also be webcast with slides, which will be accessible through the Investors section of the company’s website at www.keryx.com. The audio replay will be available at http://www.keryx.com for a period of 15 days after the call.

About Non-Dialysis Dependent Chronic Kidney Disease and Iron Deficiency Anemia

It is estimated that approximately one in 10 U.S. adults are affected by CKD, which has no cure. Treatment today consists of measures to help control signs and symptoms, reduce the impact of many complications to make a person more comfortable and slow disease progression.

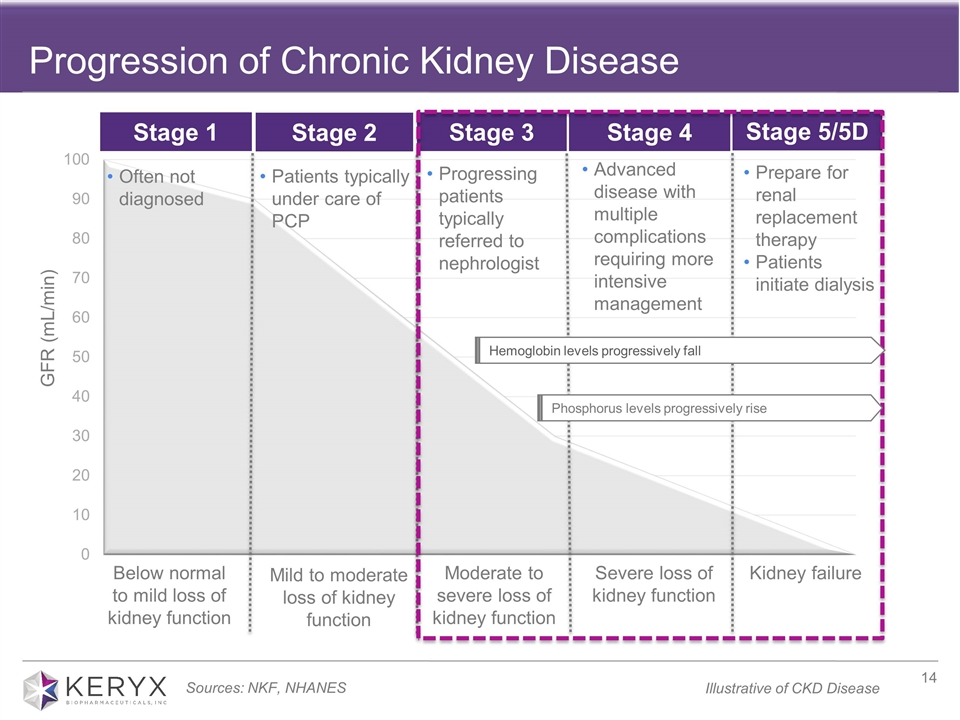

Iron deficiency anemia is one of the most common complications of chronic kidney disease. IDA develops early in the course of CKD and worsens with disease progression, is extremely prevalent in the non-dialysis dependent CKD population and is associated with fatigue, lethargy, decreased quality of life and is also believed to be associated with cardiovascular complications, hospitalizations, and increased mortality. There are five stages of CKD; in stages 1 and 2 people are typically under the care of a primary care physician and have a mild loss of kidney function. Typically, as people progress to stage 3 hemoglobin levels begin to fall, the patient experiences moderate to severe loss of kidney function and is generally referred to a nephrologist. Stage 4 is characterized as advanced disease with multiple complications. Stage 5 is considered kidney failure and the stage in which a patient would often initiate dialysis. It is estimated that approximately 1.6 million adults with stage 3-5 CKD in the U.S. alone are also afflicted with iron deficiency anemia. Currently available oral iron supplements are associated with limited efficacy and dose-limiting tolerability issues. No oral iron medicines are currently FDA approved to treat iron deficiency anemia in non-dialysis dependent CKD patients, and the NDD-CKD patient population remains underserved.

About Auryxia™

Auryxia™ (ferric citrate) was approved by the U.S. Food and Drug Administration on September 5, 2014 and is indicated in the U.S. for the control of serum phosphorus levels in patients with CKD on dialysis. The U.S. approval of Auryxia was based on data from the company’s Phase 3 registration program. In the Phase 3 clinical trials, Auryxia effectively reduced serum phosphorus levels to within the KDOQI guidelines range of 3.5 to 5.5 mg/dL.

Auryxia binds with dietary phosphate in the GI tract and precipitates as ferric phosphate. The unbound portion of Auryxia has been shown to increase serum iron parameters including ferritin and transferrin saturation (TSAT). Iron absorption from Auryxia may lead to excessive elevations in iron stores. Accordingly, physicians should assess and monitor iron parameters before starting and while on Auryxia, and may need to decrease or discontinue IV iron for these patients. The most common adverse events for Auryxia treated patients were gastrointestinal-related, including diarrhea, nausea, vomiting and constipation. For more information about Auryxia and the US full prescribing information, visit www.Auryxia.com.

IMPORTANT U.S. SAFETY INFORMATION FOR AURYXIA™

Contraindication: Patients with iron overload syndrome, e.g. hemochromatosis, should not take Auryxia™.

Iron Overload: Iron absorption from Auryxia may lead to increased iron in storage sites. Iron parameters should be monitored prior to and while on Auryxia. Patients receiving IV iron may require a reduction in dose or discontinuation of IV iron therapy.

Accidental Overdose of Iron: Accidental overdose of iron containing products is a leading cause of fatal poisoning in children under 6 years of age. Keep Auryxia away from children as it contains iron. Call a poison control center or your physician in case of an accidental overdose in a child.

Patients with Gastrointestinal Bleeding or Inflammation: Safety has not been established for these patients.

Adverse Events: The most common adverse events with Auryxia were diarrhea (21%), nausea (11%), constipation (8%), vomiting (7%) and cough (6%). Gastrointestinal adverse reactions were the most common reason for discontinuing Auryxia (14%). Auryxia contains iron and may cause dark stools, which is considered normal with oral medications containing iron.

Drug Interactions: Doxycycline should be taken at least 1 hour before Auryxia. Ciprofloxacin should be taken at least 2 hours before or after Auryxia.

For Full Prescribing Information for Auryxia, please visit http://auryxia.com/important-safety-information/

Keryx Biopharmaceuticals, Inc.

Condensed Consolidated Statement of Operations

(In thousands, except share and per share amounts)

(unaudited)

| Three Months Ended | ||||||||

| March 31 | ||||||||

| 2016 | 2015 | |||||||

| Revenues: |

||||||||

| Net U.S. Auryxia product sales |

$ | 5,616 | $ | 422 | ||||

| License revenue |

1,209 | 753 | ||||||

|

|

|

|

|

|||||

| Total Revenues |

6,825 | 1,175 | ||||||

|

|

|

|

|

|||||

| Operating Expenses: |

||||||||

| Cost of goods sold |

1,071 | 76 | ||||||

| License expenses |

726 | 452 | ||||||

| Research and development |

7,616 | 9,591 | ||||||

| Selling, general and administrative |

20,809 | 18,880 | ||||||

|

|

|

|

|

|||||

| Total Operating Expenses |

30,222 | 28,999 | ||||||

|

|

|

|

|

|||||

| Operating Loss |

(23,397 | ) | (27,824 | ) | ||||

| Other Income (expense): |

||||||||

| Other income (expense), net |

(17,547 | ) | 107 | |||||

|

|

|

|

|

|||||

| Loss Before Income Taxes |

(40,944 | ) | (27,717 | ) | ||||

| Income taxes |

20 | 22 | ||||||

|

|

|

|

|

|||||

| Net Loss |

$ | (40,964 | ) | $ | (27,739 | ) | ||

|

|

|

|

|

|||||

| Net Loss Per Common Share |

||||||||

| Basic and diluted net loss per common share |

$ | (0.39 | ) | $ | (0.28 | ) | ||

|

|

|

|

|

|||||

| Shares Used in Computing Net Loss Per Common Share |

||||||||

| Basic and diluted |

105,649,571 | 100,553,490 | ||||||

|

|

|

|

|

|||||

Selected Consolidated Balance Sheet Data

(In thousands)

(unaudited)

| March 31, 2016 | December 31, 2015 | |||||||

| Assets |

||||||||

| Cash and cash equivalents |

$ | 170,531 | $ | 200,290 | ||||

| Inventory |

$ | 42,198 | $ | 41,881 | ||||

| Total assets |

$ | 229,532 | $ | 258,685 | ||||

| Liabilities and Stockholders’ Equity |

||||||||

| Accounts payable and accrued expenses |

$ | 17,328 | $ | 26,795 | ||||

| Deferred revenue |

$ | 3,718 | $ | 3,526 | ||||

| Derivative liability |

$ | 48,693 | $ | 46,686 | ||||

| Convertible senior notes, net of discount |

$ | 106,521 | $ | 90,773 | ||||

| Total liabilities |

$ | 180,137 | $ | 171,751 | ||||

| Stockholders’ equity |

$ | 49,395 | $ | 86,934 | ||||

Forward Looking Statements

Some of the statements included in this press release, particularly those regarding the commercialization and ongoing clinical development of Auryxia and our expected cash operating expenses, may be forward-looking statements that involve a number of risks and uncertainties. For those statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Among the factors that could cause our actual results to differ materially are the following: whether we can increase adoption of Auryxia in patients with CKD on dialysis; whether we can maintain our operating expenses to projected levels while continuing our current clinical,regulatory and commercial activities; whether we will able to identify and negotiate acceptable terms with a commercialization partner in the E.U.; whether we or a partner can successfully launch Fexeric in the E.U.; whether Riona® will be successfully marketed in Japan by our Japanese partner, Japan Tobacco, Inc. and Torii Pharmaceutical Co., Ltd; the risk that the FDA may not concur with our interpretation of our Phase 3 study results in non-dialysis dependent (NDD) CKD, supportive data, conduct of the studies, or any other part of our regulatory submission and could ultimately deny approval of ferric citrate for the treatment of IDA in adults with stage 3-5 NDD CKD; the risk that if approved for use in NDD-CKD that we may not be able to successfully market Auryxia; and other risk factors identified from time to time in our reports filed with the Securities and Exchange Commission. Any forward looking statements set forth in this press release speak only as of the date of this press release. We do not undertake to update any of these forward-looking statements to reflect events or circumstances that occur after the date hereof. This press release and prior releases are available at http://www.keryx.com. The information found on our website is not incorporated by reference into this press release and is included for reference purposes only.

Use of Non-GAAP Financial Measures

To supplement the financial measures presented in Keryx’ press release and related conference call or webcast in accordance with accounting principles generally accepted in the United States (“GAAP”), Keryx also presents expected cash operating expenses in the 2016 financial guidance discussion above, which is a non-GAAP financial measure. This non-GAAP financial measure’s most comparable GAAP

financial measure is total operating expenses. Keryx believes that the non-GAAP financial measure cash operating expenses provides investors with useful information regarding the company’s financial condition and prospects because this measure helps an investor better understand the company’s expected liquidity needs. Also, this non-GAAP measure is used by Keryx management for internal review of the company’s operating performance.

A “non-GAAP financial measure” refers to a numerical measure of the company’s historical or future financial performance, financial position, or cash flows that excludes (or includes) amounts that are included in (or excluded from) the most directly comparable measure calculated and presented in accordance with GAAP in the company’s financial statements. Keryx provides the non-GAAP measure listed above as additional information relating to Keryx’ expected operating results as a complement to results provided in accordance with GAAP. The non-GAAP financial information presented here should be considered in conjunction with, and not as a substitute for or superior to, the financial information presented in accordance with GAAP. There are significant limitations associated with the use of non-GAAP financial measures. Further, these measures may differ from the non-GAAP information, even where similarly titled, used by other companies and therefore should not be used to compare Keryx’ performance to that of other companies.

About Keryx Biopharmaceuticals, Inc.

Keryx Biopharmaceuticals, with headquarters in Boston, is focused on bringing innovative medicines to market for people with renal disease. In December 2014, the company launched its first FDA-approved medicine, Auryxia™ (ferric citrate) in the United States. In January 2014, ferric citrate was approved for use in Japan, where it is being marketed as Riona® by Keryx’s Japanese partner, Japan Tobacco Inc. and Torii Pharmaceutical Co. Ltd. In September 2015, the European Commission granted European market authorization for Fexeric® (ferric citrate coordination complex). For more information about Keryx, please visit www.keryx.com

KERYX BIOPHARMACEUTICALS CONTACTS:

Amy Sullivan

Vice President, Corporate Development and Public Affairs

T: 617.466.3519

Lora Pike

Senior Director, Investor Relations

T: 617.466.3511

First Quarter 2016 Financial Results April 28, 2016 Keryx Biopharmaceuticals, Inc. Exhibit 99.2

Safe Harbor Statement Various remarks that we make about our future expectations, plans and prospects constitute forward-looking statements for purposes of the safe harbor provisions under the Private Securities Litigation Reform Act of 1995. Important factors may cause our actual results to differ materially, including: whether we can increase adoption of Auryxia in patients with CKD on dialysis; whether we can maintain our operating expenses to projected levels while continuing our current clinical, regulatory and commercial activities; whether we will able to identify and negotiate acceptable terms with a commercialization partner in the E.U.; whether we or a partner can successfully launch Fexeric in the E.U.; whether Riona® will be successfully marketed in Japan by our Japanese partner, Japan Tobacco, Inc. and Torii Pharmaceutical Co., Ltd; the risk that the FDA may not concur with our interpretation of our Phase 3 study results in non-dialysis dependent CKD, supportive data, conduct of the studies, or any other part of our regulatory submission and could ultimately deny approval of ferric citrate for the treatment of IDA in adults with stage 3-5 non-dialysis dependent (NDD) CKD; the risk that if approved for use in NDD-CKD that we may not be able to successfully market Auryxia; and other risk factors identified from time to time in our reports filed with the Securities and Exchange Commission. These and other important factors that may affect our results are discussed under the heading “Risk Factors” in public filings including our 2015 Annual Report on Form 10-K, Form 10-Qs, as well as other filings we periodically make with the SEC. In addition, any forward-looking statements made during this presentation speak only as of the date of this presentation. While we may update these forward-looking statements to reflect events or circumstances that occur after this date, we specifically disclaim any obligation to do so, even if our estimates and expectations change.

Non-GAAP Financial Measures To supplement the financial measures presented in our press release and related conference call, and in accordance with accounting principles generally accepted in the United States (“GAAP”), Keryx also presents expected cash operating expenses in the 2016 financial guidance discussion, which is a non-GAAP financial measure. This non-GAAP financial measure’s most comparable GAAP financial measure is total operating expenses. Keryx believes that the non-GAAP financial measure cash operating expenses provides investors with useful information regarding the company’s financial condition and prospects because this measure helps an investor better understand the company’s expected liquidity needs. Also, this non-GAAP measure is used by Keryx management for internal review of the company’s operating performance. A “non-GAAP financial measure” refers to a numerical measure of the company’s historical or future financial performance, financial position, or cash flows that excludes (or includes) amounts that are included in (or excluded from) the most directly comparable measure calculated and presented in accordance with GAAP in the company’s financial statements. Keryx provides the non-GAAP measure listed above as additional information relating to Keryx’ expected operating results as a complement to results provided in accordance with GAAP. The non-GAAP financial information presented here should be considered in conjunction with, and not as a substitute for or superior to, the financial information presented in accordance with GAAP. There are significant limitations associated with the use of non-GAAP financial measures. Further, these measures may differ from the non-GAAP information, even where similarly titled, used by other companies and therefore should not be used to compare Keryx’ performance to that of other companies.

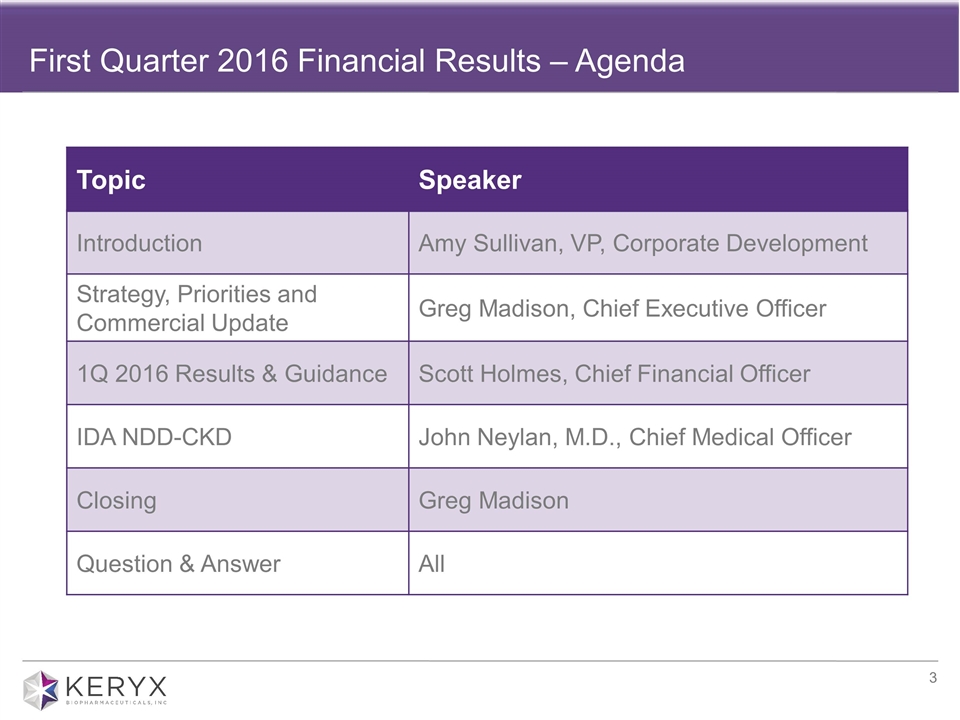

First Quarter 2016 Financial Results – Agenda Topic Speaker Introduction Amy Sullivan, VP, Corporate Development Strategy, Priorities and Commercial Update Greg Madison, Chief Executive Officer 1Q 2016 Results & Guidance Scott Holmes, Chief Financial Officer IDA NDD-CKD John Neylan, M.D., Chief Medical Officer Closing Greg Madison Question & Answer All

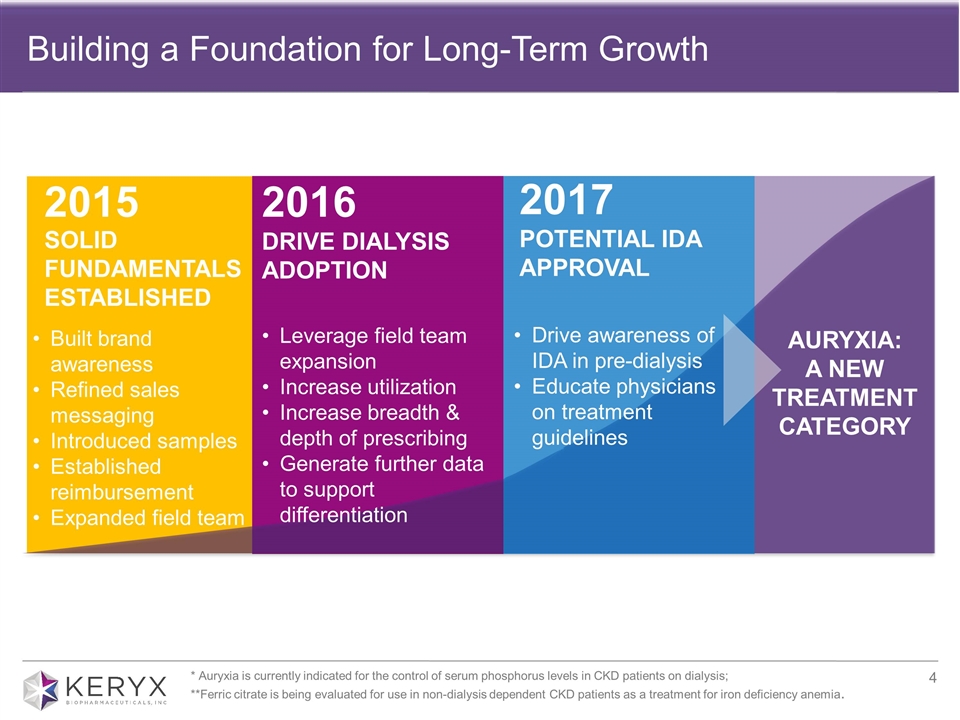

Building a Foundation for Long-Term Growth SOLID FUNDAMENTALS ESTABLISHED 2015 2017 POTENTIAL IDA APPROVAL 2016 DRIVE DIALYSIS ADOPTION AURYXIA: A NEW TREATMENT CATEGORY Leverage field team expansion Increase utilization Increase breadth & depth of prescribing Generate further data to support differentiation Drive awareness of IDA in pre-dialysis Educate physicians on treatment guidelines 2017 POTENTIAL IDA APPROVAL Built brand awareness Refined sales messaging Introduced samples Established reimbursement Expanded field team * Auryxia is currently indicated for the control of serum phosphorus levels in CKD patients on dialysis; **Ferric citrate is being evaluated for use in non-dialysis dependent CKD patients as a treatment for iron deficiency anemia.

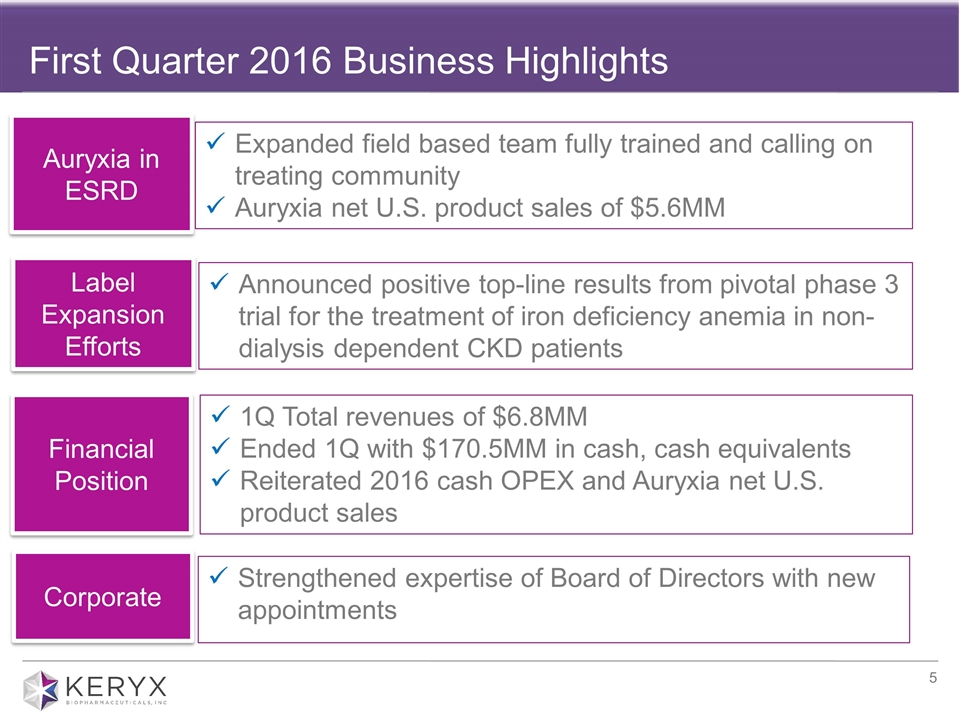

First Quarter 2016 Business Highlights Expanded field based team fully trained and calling on treating community Auryxia net U.S. product sales of $5.6MM Announced positive top-line results from pivotal phase 3 trial for the treatment of iron deficiency anemia in non-dialysis dependent CKD patients 1Q Total revenues of $6.8MM Ended 1Q with $170.5MM in cash, cash equivalents Reiterated 2016 cash OPEX and Auryxia net U.S. product sales Auryxia in ESRD Label Expansion Efforts Strengthened expertise of Board of Directors with new appointments Financial Position Corporate

Source: IMS NPA, DaVita and Fresenius Prescription Volume Increased ~17% from 4Q 2015 to 1Q 2016 ~9,150 Auryxia prescriptions in 1Q 2016 43% of Auryxia prescriptions in 1Q 2016 not captured by IMS Volume growth driven by increased breadth and depth of prescribing Increased new writers: Cumulative targets who have written an Rx grew ~25% from 4Q15 to 1Q16

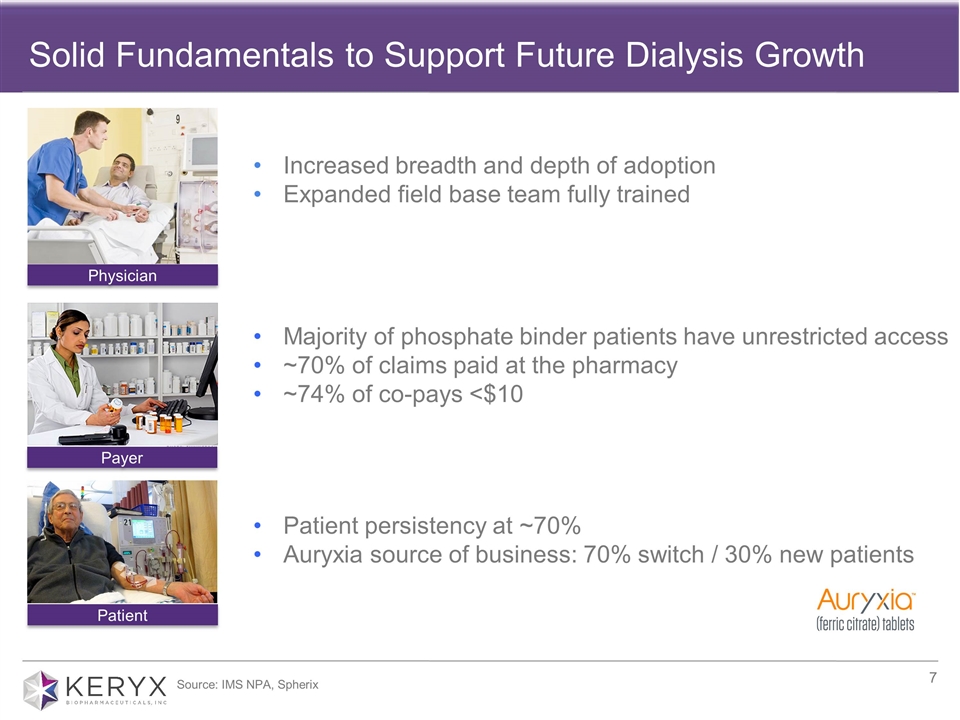

Solid Fundamentals to Support Future Dialysis Growth Physician Payer Patient Increased breadth and depth of adoption Expanded field base team fully trained Majority of phosphate binder patients have unrestricted access ~70% of claims paid at the pharmacy ~74% of co-pays <$10 Patient persistency at ~70% Auryxia source of business: 70% switch / 30% new patients Source: IMS NPA, Spherix

Financial Highlights Scott Holmes Chief Financial Officer

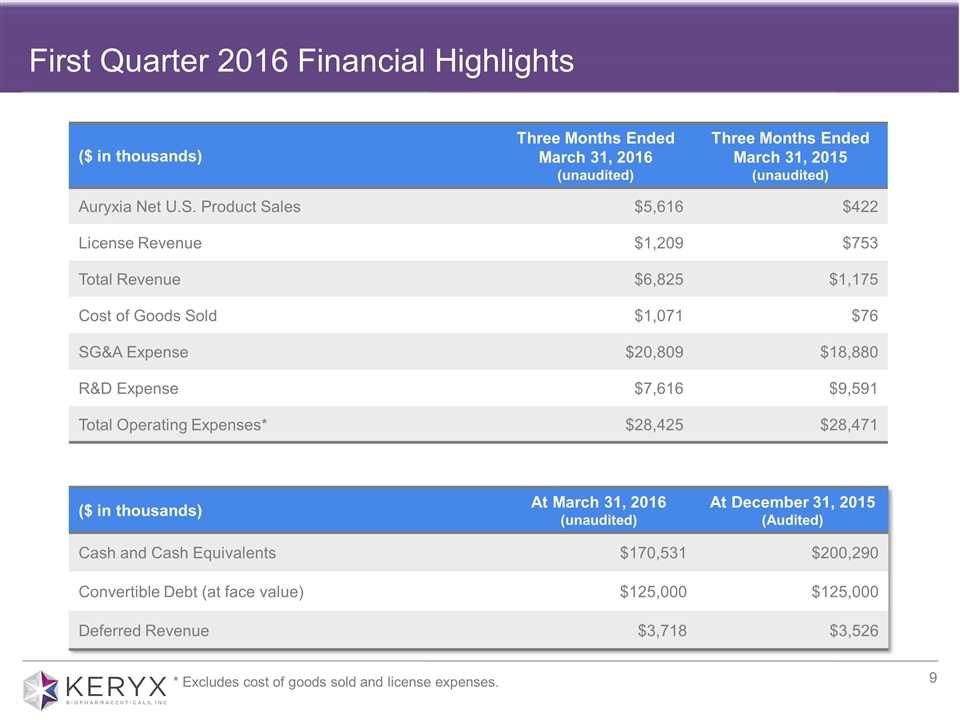

First Quarter 2016 Financial Highlights ($ in thousands) Three Months Ended March 31, 2016 (unaudited) Three Months Ended March 31, 2015 (unaudited) Auryxia Net U.S. Product Sales $5,616 $422 License Revenue $1,209 $753 Total Revenue $6,825 $1,175 Cost of Goods Sold $1,071 $76 SG&A Expense $20,809 $18,880 R&D Expense $7,616 $9,591 Total Operating Expenses* $28,425 $28,471 ($ in thousands) At March 31, 2016 (unaudited) At December 31, 2015 (Audited) Cash and Cash Equivalents $170,531 $200,290 Convertible Debt (at face value) $125,000 $125,000 Deferred Revenue $3,718 $3,526 * Excludes cost of goods sold and license expenses.

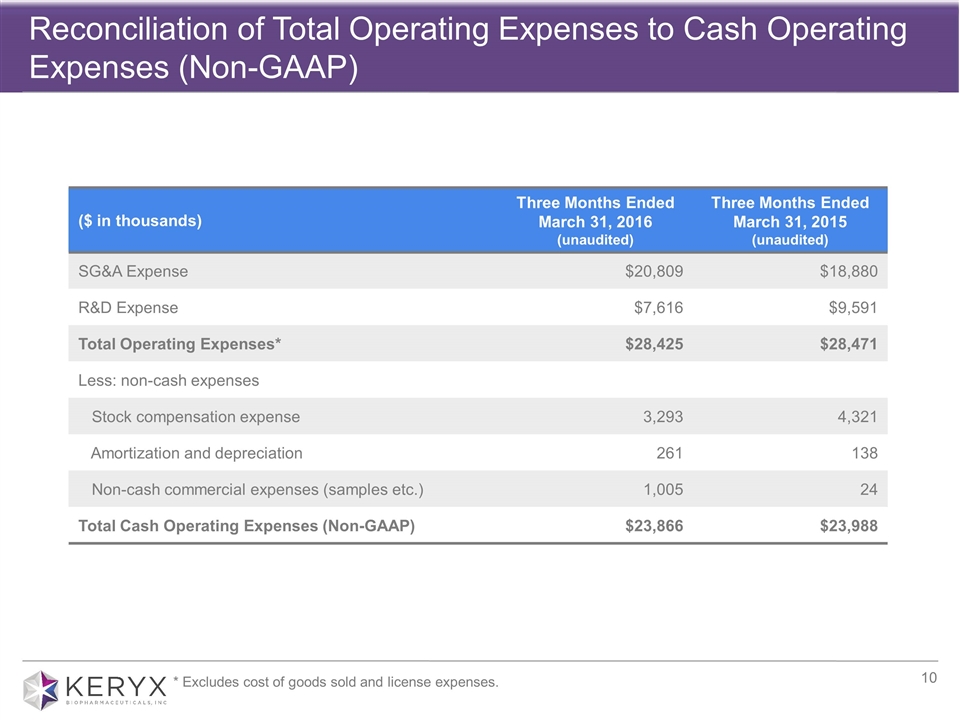

Reconciliation of Total Operating Expenses to Cash Operating Expenses (Non-GAAP) ($ in thousands) Three Months Ended March 31, 2016 (unaudited) Three Months Ended March 31, 2015 (unaudited) SG&A Expense $20,809 $18,880 R&D Expense $7,616 $9,591 Total Operating Expenses* $28,425 $28,471 Less: non-cash expenses Stock compensation expense 3,293 4,321 Amortization and depreciation 261 138 Non-cash commercial expenses (samples etc.) 1,005 24 Total Cash Operating Expenses (Non-GAAP) $23,866 $23,988 * Excludes cost of goods sold and license expenses.

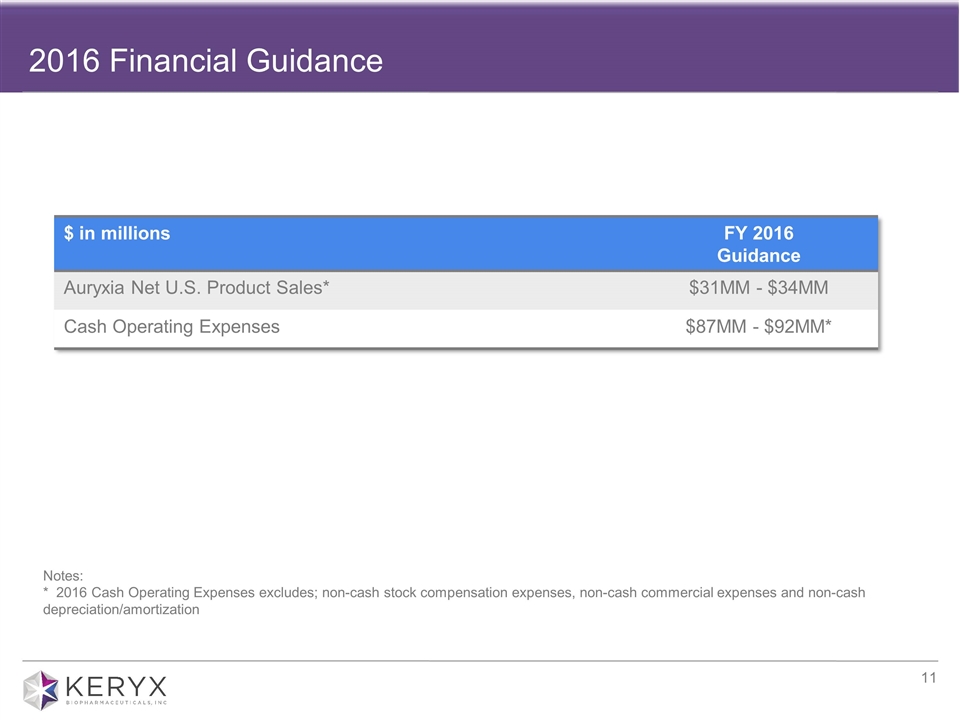

2016 Financial Guidance $ in millions FY 2016 Guidance Auryxia Net U.S. Product Sales* $31MM - $34MM Cash Operating Expenses $87MM - $92MM* Notes: * 2016 Cash Operating Expenses excludes; non-cash stock compensation expenses, non-cash commercial expenses and non-cash depreciation/amortization

NDD CKD - Iron Deficiency Anemia Label Expansion Opportunity John Neylan, M.D. Chief Medical Officer

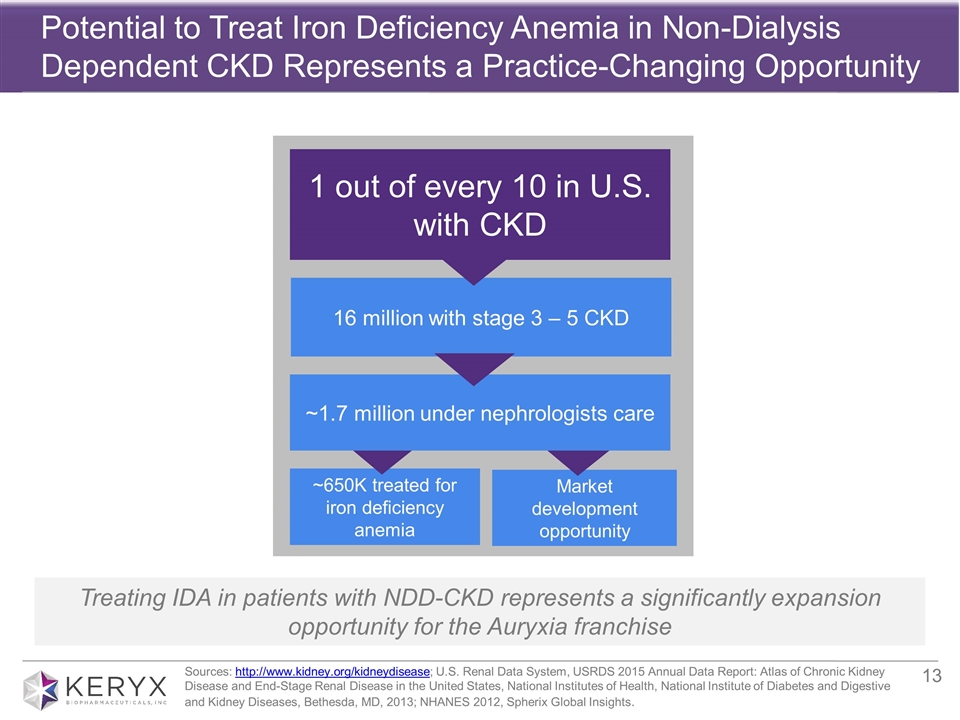

Potential to Treat Iron Deficiency Anemia in Non-Dialysis Dependent CKD Represents a Practice-Changing Opportunity Sources: http://www.kidney.org/kidneydisease; U.S. Renal Data System, USRDS 2015 Annual Data Report: Atlas of Chronic Kidney Disease and End-Stage Renal Disease in the United States, National Institutes of Health, National Institute of Diabetes and Digestive and Kidney Diseases, Bethesda, MD, 2013; NHANES 2012, Spherix Global Insights. 1 out of every 10 in U.S. with CKD 16 million with stage 3 – 5 CKD ~650K treated for iron deficiency anemia Market development opportunity ~1.7 million under nephrologists care Treating IDA in patients with NDD-CKD represents a significantly expansion opportunity for the Auryxia franchise

Progression of Chronic Kidney Disease Progressing patients typically referred to nephrologist Prepare for renal replacement therapy Patients initiate dialysis GFR (mL/min) Often not diagnosed Patients typically under care of PCP Moderate to severe loss of kidney function Severe loss of kidney function Kidney failure Below normal to mild loss of kidney function Mild to moderate loss of kidney function Stage 3 Stage 4 Stage 5/5D Stage 1 Stage 2 Hemoglobin levels progressively fall Sources: NKF, NHANES Advanced disease with multiple complications requiring more intensive management Phosphorus levels progressively rise Illustrative of CKD Disease

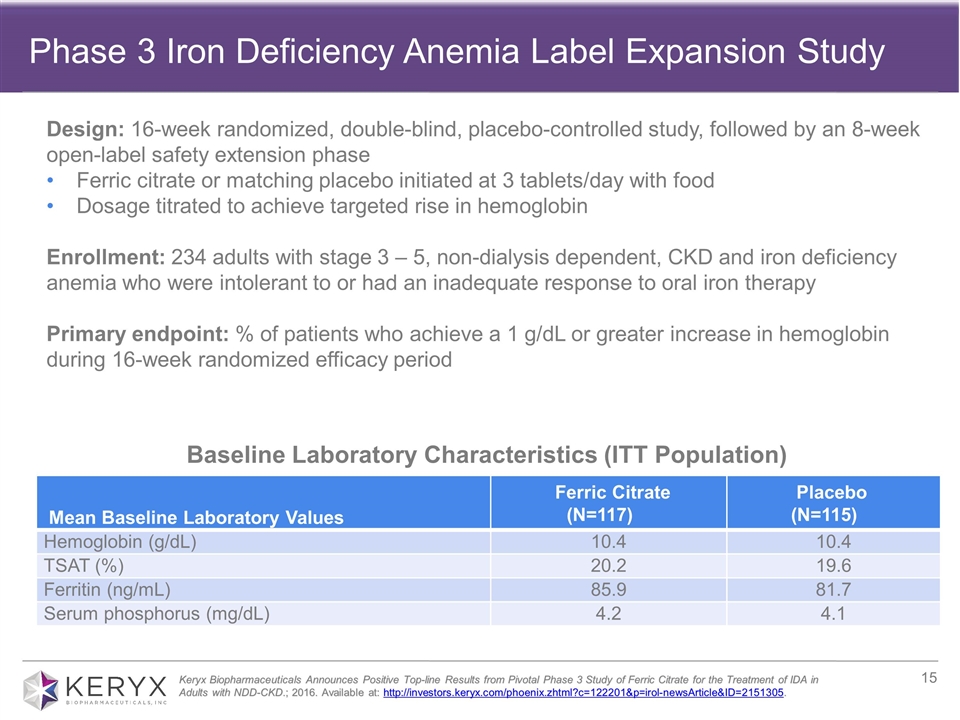

Baseline Laboratory Characteristics (ITT Population) Mean Baseline Laboratory Values Ferric Citrate (N=117) Placebo (N=115) Hemoglobin (g/dL) 10.4 10.4 TSAT (%) 20.2 19.6 Ferritin (ng/mL) 85.9 81.7 Serum phosphorus (mg/dL) 4.2 4.1 Keryx Biopharmaceuticals Announces Positive Top-line Results from Pivotal Phase 3 Study of Ferric Citrate for the Treatment of IDA in Adults with NDD-CKD.; 2016. Available at: http://investors.keryx.com/phoenix.zhtml?c=122201&p=irol-newsArticle&ID=2151305. Design: 16-week randomized, double-blind, placebo-controlled study, followed by an 8-week open-label safety extension phase Ferric citrate or matching placebo initiated at 3 tablets/day with food Dosage titrated to achieve targeted rise in hemoglobin Enrollment: 234 adults with stage 3 – 5, non-dialysis dependent, CKD and iron deficiency anemia who were intolerant to or had an inadequate response to oral iron therapy Primary endpoint: % of patients who achieve a 1 g/dL or greater increase in hemoglobin during 16-week randomized efficacy period Phase 3 Iron Deficiency Anemia Label Expansion Study

*Sustained treatment effect on Hgb was defined as a mean change from baseline ≥0.75 g/dL over any 4-week time period during the 16-week, randomized efficacy period, provided that an increase of at least 1.0 g/dL had occurred during that 4-week period. Randomized Efficacy Period (16 Weeks) Ferric Citrate (N=117) Placebo (N=115) P value Primary Endpoint (ITT Population) Proportion of patients achieving an increase in hemoglobin of ≥1.0 g/dL at any time point (%) 52.1 19.1 <0.001 Secondary Endpoints (Pre-specified) Mean change in hemoglobin (g/dL) 0.75 ‒0.08 <0.001 Mean change in TSAT (%) 17.8 ‒0.6 <0.001 Mean change in ferritin (ng/mL) 162.5 ‒7.7 <0.001 Proportion of patients with a durable response* (%) 48.7 14.8 <0.001 Mean change in serum phosphorus (mg/dL) ‒0.43 ‒0.22 0.02 Mean dose in the ferric citrate group was 5 tablets/day Keryx Biopharmaceuticals Announces Positive Top-line Results from Pivotal Phase 3 Study of Ferric Citrate for the Treatment of IDA in Adults with NDD-CKD.; 2016. Available at: http://investors.keryx.com/phoenix.zhtml?c=122201&p=irol-newsArticle&ID=2151305. IDA Phase 3 Top-line Results: Primary and Secondary Endpoints Statistically significant differences between ferric-citrate-and placebo-treated patients for the primary and all pre-specified secondary endpoints

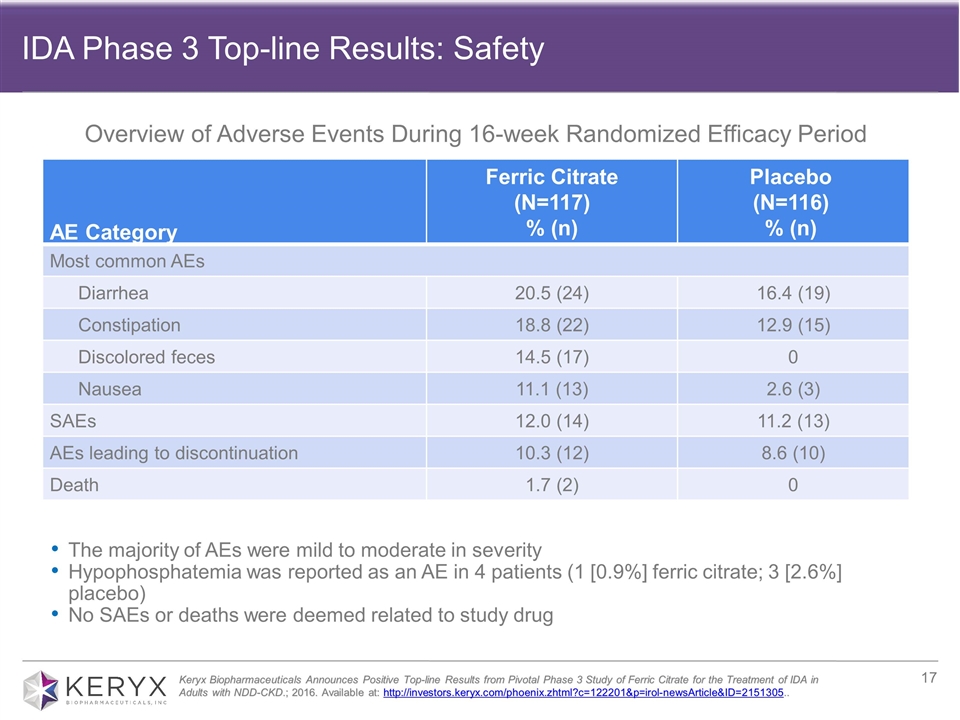

AE Category Ferric Citrate (N=117) % (n) Placebo (N=116) % (n) Most common AEs Diarrhea 20.5 (24) 16.4 (19) Constipation 18.8 (22) 12.9 (15) Discolored feces 14.5 (17) 0 Nausea 11.1 (13) 2.6 (3) SAEs 12.0 (14) 11.2 (13) AEs leading to discontinuation 10.3 (12) 8.6 (10) Death 1.7 (2) 0 The majority of AEs were mild to moderate in severity Hypophosphatemia was reported as an AE in 4 patients (1 [0.9%] ferric citrate; 3 [2.6%] placebo) No SAEs or deaths were deemed related to study drug Keryx Biopharmaceuticals Announces Positive Top-line Results from Pivotal Phase 3 Study of Ferric Citrate for the Treatment of IDA in Adults with NDD-CKD.; 2016. Available at: http://investors.keryx.com/phoenix.zhtml?c=122201&p=irol-newsArticle&ID=2151305.. Overview of Adverse Events During 16-week Randomized Efficacy Period IDA Phase 3 Top-line Results: Safety

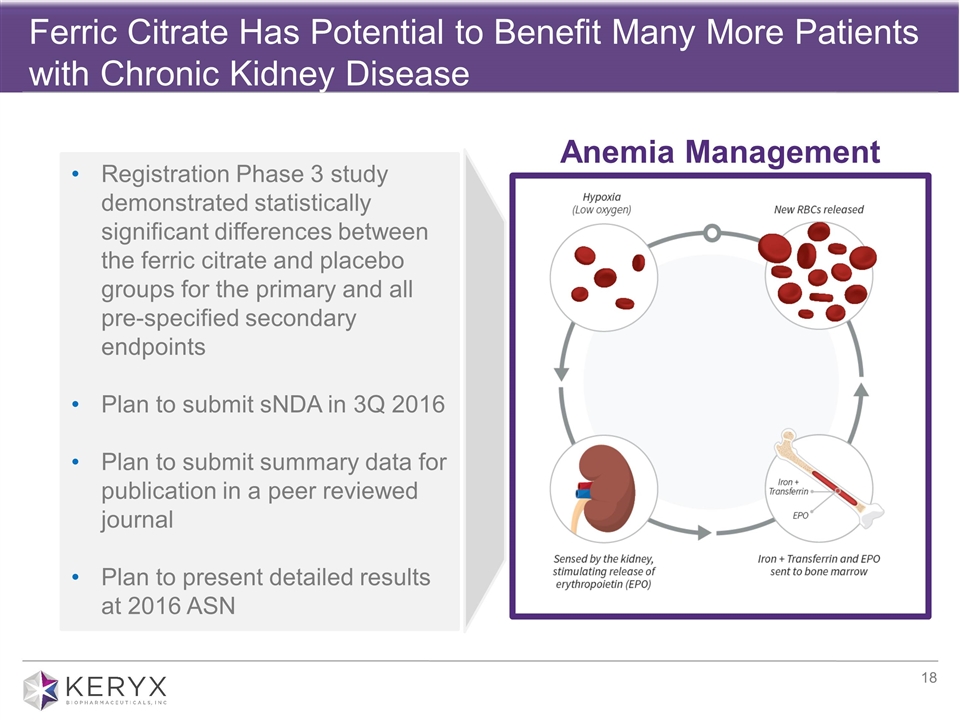

Ferric Citrate Has Potential to Benefit Many More Patients with Chronic Kidney Disease Anemia Management Registration Phase 3 study demonstrated statistically significant differences between the ferric citrate and placebo groups for the primary and all pre-specified secondary endpoints Plan to submit sNDA in 3Q 2016 Plan to submit summary data for publication in a peer reviewed journal Plan to present detailed results at 2016 ASN

Closing Remarks & Q&A Greg Madison

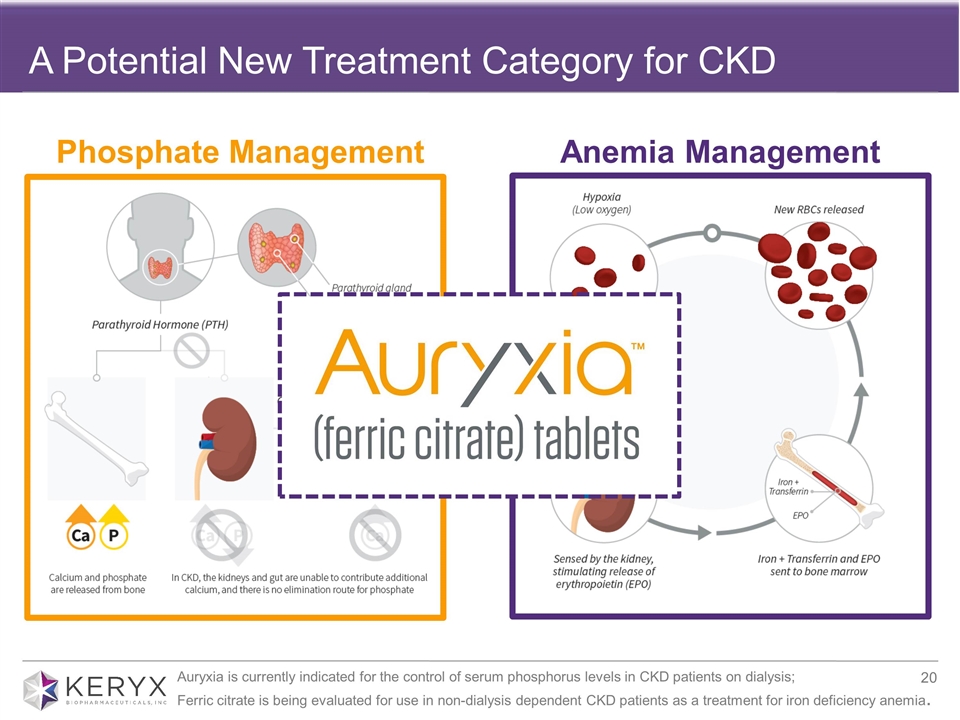

A Potential New Treatment Category for CKD Phosphate Management Anemia Management Auryxia is currently indicated for the control of serum phosphorus levels in CKD patients on dialysis; Ferric citrate is being evaluated for use in non-dialysis dependent CKD patients as a treatment for iron deficiency anemia.

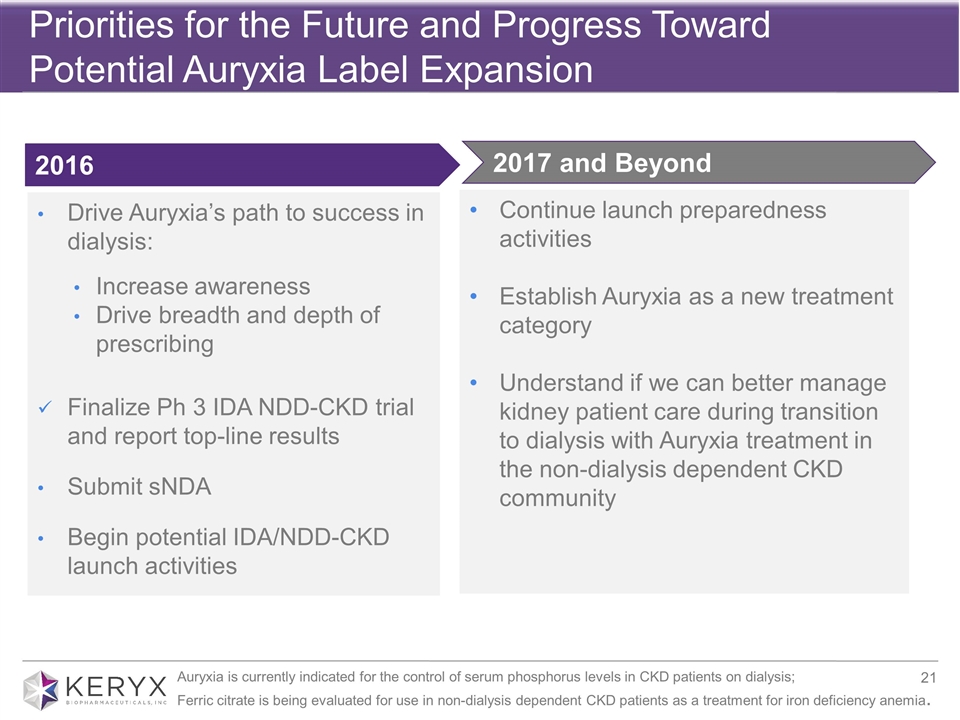

Priorities for the Future and Progress Toward Potential Auryxia Label Expansion Drive Auryxia’s path to success in dialysis: Increase awareness Drive breadth and depth of prescribing Finalize Ph 3 IDA NDD-CKD trial and report top-line results Submit sNDA Begin potential IDA/NDD-CKD launch activities Continue launch preparedness activities Establish Auryxia as a new treatment category Understand if we can better manage kidney patient care during transition to dialysis with Auryxia treatment in the non-dialysis dependent CKD community 2017 and Beyond 2016 Auryxia is currently indicated for the control of serum phosphorus levels in CKD patients on dialysis; Ferric citrate is being evaluated for use in non-dialysis dependent CKD patients as a treatment for iron deficiency anemia.

First Quarter 2016 Financial Results April 28, 2016 Keryx Biopharmaceuticals, Inc.

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Range Announces First Quarter 2024 Results

- Leger Ketchum & Cohoon, PLLC Wins Historic Verdict Against Ford Motor Company

- IDEX Reports First Quarter Results and Confirms Full Year Guidance

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share