Form DEF 14A WAL MART STORES INC For: Apr 20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a) of the Securities

Exchange

Act of 1934 (Amendment No. )

|

Filed by the Registrant |  |

Filed by a Party other than the Registrant |

| Check the appropriate box: | |

|

Preliminary Proxy Statement |

|

CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14a-6(e)(2)) |

|

Definitive Proxy Statement |

|

Definitive Additional Materials |

|

Soliciting Material Pursuant to §240.14a-12 |

WAL-MART STORES, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check the appropriate box): | |

|

No fee required. |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) Title of each class of securities to which transaction applies: | |

| (2) Aggregate number of securities to which transaction applies: | |

| (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) Proposed maximum aggregate value of transaction: | |

| (5) Total fee paid: | |

|

Fee paid previously with preliminary materials. |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) Amount Previously Paid: | |

| (2) Form, Schedule or Registration Statement No.: | |

| (3) Filing Party: | |

| (4) Date Filed: | |

2016

Notice

of Annual

Shareholders’ Meeting and

Proxy Statement

Friday, June 3, 2016

8:00 a.m., Central time

Bud Walton

Arena, University of Arkansas,

Fayetteville, Arkansas

NYSE: WMT

April 20, 2016

We are pleased to invite you to attend Walmart’s 2016 Annual Shareholders’ Meeting on June 3, 2016 at 8:00 a.m. Central Time. If you plan to attend, please see page 94 for admission requirements. For those unable to join in-person, the meeting will also be webcast at www.stock.walmart.com.

Walmart is going through a period of transformation as we make strategic investments to better serve customers and drive shareholder value. Over the past year, we have actively engaged with many of our largest institutional shareholders to understand their perspectives on a variety of topics, including corporate strategy, governance, and compensation. We both participated in this engagement effort and we would like to take this opportunity to update you on some of the themes from these discussions, which are also key focus areas for our Board.

Our Board is actively engaged in company strategy

| • | We remain focused on the execution of our enterprise strategy – working to win with stores, deepening digital relationships with customers, and bolstering critical capabilities such as our next generation supply chain, technology and data, our talent, and how we work. The Board believes that this strategy positions the company for sustainable growth in the future. We have challenged management to accelerate the pace of change even further, and we are tracking various metrics such as comp sales and customer satisfaction scores to monitor progress in delivering the strategy. In our conversations with shareholders, they expressed strong support for our investments in our people and technology, as we seek to deliver a seamless shopping experience for our customers. | ||

| Our Board has the right skills and experience to support the company’s strategy | |||

| • | We believe that Board refreshment and succession planning are critical as Walmart continues to change for our customer. We’ve added 5 new independent directors to the Board in the last 4 years, and we’ve made changes to the way the Board operates to maximize our effectiveness as we adapt to evolving customer needs. These changes include reducing the size of the Board while maintaining its independence, changing the composition of Board committees, and ensuring that Board and committee agendas are focused on Walmart’s strategic priorities. We have revised the Corporate Governance section of our proxy statement to provide more information on these topics (see page 12). Your Board is committed to continuous improvement, and in early 2016 we engaged a third party consulting firm to help us think about ways to further improve our effectiveness. The sentiment from shareholders has been consistent – that the value, quality, and diversity of our directors are strategic assets for Walmart. | ||

Our compensation program is aligned with our strategy

| • | The Compensation, Nominating and Governance Committee of our Board regularly reviews the performance metrics used in our incentive plans and has determined that they are appropriately aligned with shareholder interests. We have revised the disclosure in the Compensation Discussion and Analysis section of our proxy statement to address some of the frequently asked questions from shareholders, and to more clearly describe the direct link between executive compensation and corporate strategy (see page 39). In our conversations, shareholders expressed a variety of viewpoints on our executive compensation program, but most felt it was appropriately performance-based and aligned with our strategy. |

The Board greatly values shareholder feedback and thanks those of you who contributed to the constructive dialogue. You have challenged us to continue to improve our proxy statement disclosure, and we hope that you will find this year’s proxy statement even better than the last. Thank you for being a Walmart shareholder and we look forward to seeing many of you at the meeting in June. Regardless of whether or not you attend the meeting in person, your vote is important to us. For instructions on how to vote, please see page 91 of our proxy statement.

|

|

| Gregory B. Penner | Dr. James I. Cash, Jr. |

| Chairman | Lead Independent Director |

| Notice of 2016 Annual Shareholders’ Meeting |

Friday, June 3, 2016

8:00 a.m., Central time

Bud Walton Arena, University of Arkansas Campus, Fayetteville, Arkansas 72701

Please join our Board of Directors, senior leadership, and other shareholders for the Wal-Mart Stores, Inc. 2016 Annual Shareholders’ Meeting.

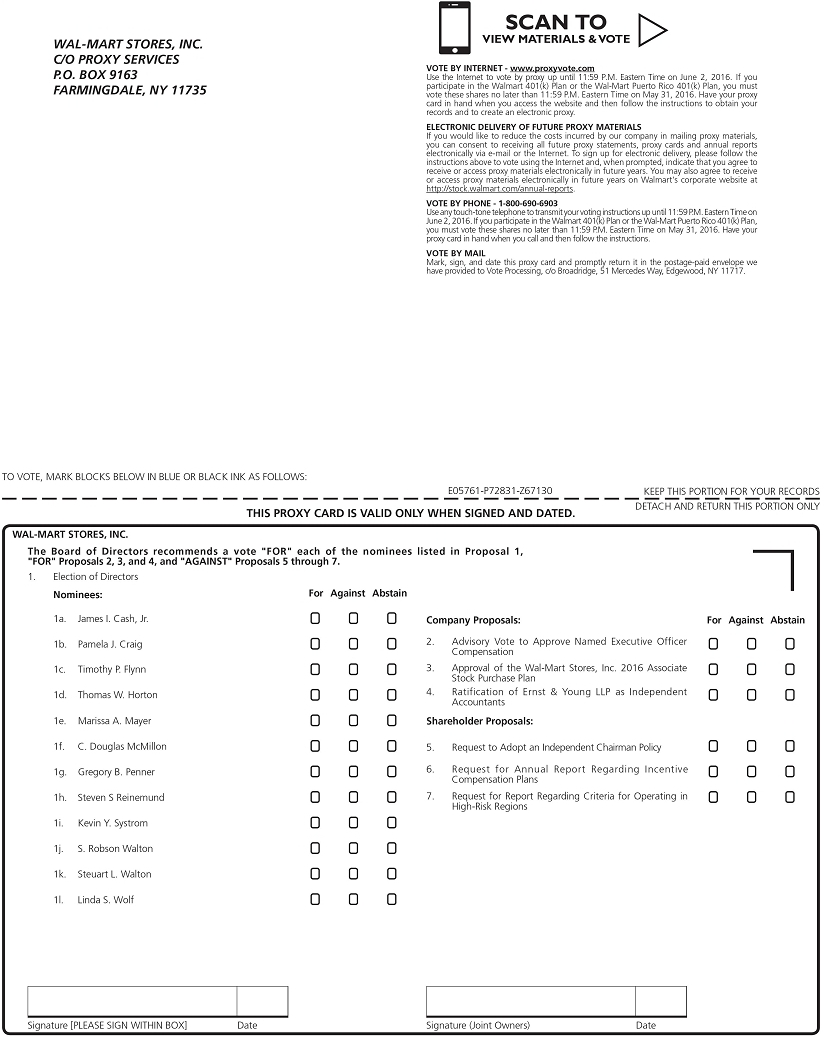

| ITEMS OF BUSINESS |

| 1. | To elect as directors the 12 nominees identified in the accompanying proxy statement; | |

| 2. | To vote on a non-binding, advisory resolution to approve the compensation of the company’s named executive officers; | |

| 3. | To vote on the approval of the Wal-Mart Stores, Inc. 2016 Associate Stock Purchase Plan; | |

| 4. | To ratify the appointment of Ernst & Young LLP as the company’s independent accountants for the fiscal year ending January 31, 2017; | |

| 5. | To vote on the 3 shareholder proposals described in the accompanying proxy statement, if properly presented at the meeting; and | |

| 6. | To transact any other business properly brought before the 2016 Annual Shareholders’ Meeting. |

| RECORD DATE |

The record date for the meeting is April 8, 2016. This means that you are entitled to receive notice of the meeting and vote your shares at the meeting if you were a shareholder of record as of the close of business on April 8, 2016.

| HOW TO CAST YOUR VOTE (PAGE 91) |

You can vote by any of the following methods:

|

on the internet at www.proxyvote.com; |

|

calling toll-free (U.S. and Canada) at 1-800-690-6903; |

|

on your mobile device by scanning the QR code on your proxy card, notice of internet availability of proxy materials, or voting instruction form; |

|

mailing in your signed proxy card or voting instruction form (if you received one); or |

|

in person at the 2016 Annual Shareholders’ Meeting. |

| HOW TO ATTEND THE MEETING |

If you plan to attend the meeting in person, please see page 94 for admission requirements.

The proxy statement and our Annual Report to Shareholders for the fiscal year ended January 31, 2016, are available in the “Investors” section of our corporate website at http://stock.walmart.com/annual-reports.

April 20, 2016

By Order of the Board of Directors

Jeffrey J. Gearhart

Executive Vice President, Global Governance

and Corporate Secretary

2016 Proxy Statement 7

2016 Proxy Statement 7

You have received these proxy materials because the Board is soliciting your proxy to vote your Shares at the 2016 Annual Shareholders’ Meeting. This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider, and you should read the entire proxy statement carefully before voting. Page references (“XX”) are supplied to help you find further information in this proxy statement. Please refer to the Table of Abbreviations on page 96 for the meaning of certain terms used in this summary and the rest of this proxy statement. This proxy statement and the related proxy materials were first released to shareholders and made available on the internet on April 20, 2016.

| ANNUAL SHAREHOLDERS’ MEETING |

Date and Time

Date and Time |

Place

Place |

Record Date

Record Date |

Admission

Admission | |||

| June 3, 2016, 8:00 a.m., Central time | Bud Walton Arena, University of Arkansas Campus, Fayetteville, Arkansas 72701 | You can vote if you were a shareholder of record of the company at the close of business on April 8, 2016 (page 89). | You must have proof of ownership of your Shares as of the record date to attend the 2016 Annual Shareholders’ Meeting (page 94). |

If you are unable to attend in person, you can view a live webcast of the 2016 Annual Shareholders’ Meeting at http://stock.walmart.com.

| SUMMARY OF VOTING MATTERS |

The Board is not aware of any matter that will be presented for a vote at the 2016 Annual Shareholders’ Meeting other than those shown below.

| Board Vote | Page Reference | |||

| Recommendation | (for more detail) | |||

| Item 1: Election of 12 Directors | FOR each | |||

| Director Nominee | 12 | |||

| Item 2: Advisory Vote to Approve Named Executive Officer Compensation | FOR | 74 | ||

| Item 3: Approval of the Wal-Mart Stores, Inc. 2016 Associate Stock Purchase Plan | FOR | 77 | ||

| Item 4: Ratification of Independent Accountants | FOR | 82 | ||

| Items 5-7: Shareholder Proposals | AGAINST each | |||

| shareholder proposal | 84 | |||

2016 Proxy Statement 8

2016 Proxy Statement 8

| BOARD OVERVIEW |

Highly Engaged Board

| • | Actively involved in Walmart’s strategy |

| • | 98% overall attendance rate at Board and committee meetings |

| • | 31 committee meetings during fiscal 2016 |

Thoughtful Board Refreshment

| • | 12-year term limit for Independent Directors |

| • | 5 new Independent Directors in the last 4 years |

| • | Reducing size of Board to promote effectiveness |

| • | Ongoing Board succession planning |

Experience and Expertise

Our 12 director nominees bring a variety of backgrounds, qualifications, skills, and experiences that contribute to a well-rounded Board uniquely positioned to effectively oversee our strategy and operations in a rapidly evolving retail industry.

9 Senior leadership 4 Retail Technology or e-commerce 5 4 Marketing or brand management Regulatory or legal 4 Global or international business 12 5 Finance, accounting, or nancial reporting

Tenure, Age, and Gender Diversity

Our 12 nominees represent an effective mix of deep company knowledge and fresh perspectives.

TENURE MEDIAN: 4 YRS AVERAGE: 7 YRS 10 yrs 2 0-3 yrs 5 7-10 yrs 2 4-6 yrs 3 AGE MEDIAN: 57 AVERAGE: 54 5 50 3 50-59 3 60-69 1 70-75 GENDER Female Male

2016 Proxy Statement 9

2016 Proxy Statement 9

| BOARD NOMINEES (PAGES 15-21) |

8 of our 12 Board nominees are independent, all members of the Audit Committee and CNGC are independent, and our key committee chairs are independent. Despite their significant Share ownership, only three members of the Walton family are Board nominees.

| Other | ||||||||||||||||||

| Public | ||||||||||||||||||

| Director | Key Committee Membership | Company | ||||||||||||||||

| Name | Age | Since | Principal Occupation | Independent | AC | CNGC | SPFC | TeCC | Boards | |||||||||

| Jim Cash*

|

68 | 2006 | James E. Robison Professor of Business Administration Emeritus, Harvard Business School |

|

|

|

1 | |||||||||||

| Pam Craig

|

59 | 2013 | Retired CFO, Accenture plc |  |

|

|

2 | |||||||||||

| Tim Flynn

|

59 | 2012 | Retired Chairman and CEO, KPMG |  |

|

|

1 | |||||||||||

| Tom Horton

|

54 | 2014 | Senior Advisor,

Warburg Pincus LLC, and retired Chairman and CEO, AMR Corporation |

|

|

|

1 | |||||||||||

| Marissa Mayer

|

40 | 2012 | President and CEO, Yahoo! Inc. |  |

|

|

1 | |||||||||||

| Doug McMillon

|

49 | 2013 | President and CEO, Walmart | 0 | ||||||||||||||

| Greg Penner**

|

46 | 2008 | Chairman, Walmart and Partner, Madrone Capital Partners |

1 | ||||||||||||||

| Steve Reinemund

|

68 | 2010 | Retired Dean of Business, Wake Forest University, and retired Chairman and CEO, PepsiCo., Inc. |

|

|

|

2 | |||||||||||

| Kevin Systrom

|

32 | 2014 | CEO and Co-Founder, Instagram |  |

|

|

0 | |||||||||||

| Rob Walton

|

71 | 1978 | Retired Chairman, Walmart |  |

0 | |||||||||||||

| Steuart Walton

|

34 | Nominee | CEO, Game Composites, Ltd. | 0 | ||||||||||||||

| Linda Wolf

|

68 | 2005 | Retired Chairman and CEO, Leo Burnett Worldwide, Inc. |

|

|

|

1 | |||||||||||

| *Lead Independent Director |  Chair Chair |

Member Member | |

| **Board Chairman | |||

| Qualifications and Experience: | Committees: | |||

|

Senior Leadership |  |

Marketing/Brand Management | AC = Audit Committee |

|

Retail |  |

Finance/Accounting | CNGC = Compensation, Nominating and Governance Committee |

|

Global/International |  |

Regulatory/Legal | SPFC = Strategic Planning and Finance Committee |

|

Technology/e-commerce | TeCC = Technology and eCommerce Committee | ||

2016 Proxy Statement 10

2016 Proxy Statement 10

| CORPORATE GOVERNANCE HIGHLIGHTS (PAGES 12-38) |

| • | Majority Independent Board |

| • | Shareholder Right to Call Special Meetings |

| • | Independent Key Committee Chairs |

| • | No Poison Pill |

| • | Separate Chair and CEO |

| • | Lead Independent Director |

| • | No Supermajority Voting Requirements |

| • | CNGC Oversight of Political and Social Engagement |

| • | Annual Election of All Directors |

| • | Robust Board Evaluations |

| • | Majority Voting for Director Elections |

| • | Board-Level Risk Oversight |

| • | Commitment to Board Refreshment |

| • | Extensive Shareholder Engagement |

| • | Focus on Succession Planning |

| • | Board Oversight of Company Strategy |

| • | Robust Stock Ownership Guidelines |

| • | No Hedging and Restrictions on Pledging |

| • | No Employment Agreements with Executives |

| • | No Change-in-Control Provisions |

| COMPENSATION ALIGNED WITH PERFORMANCE (PAGES 39-74) |

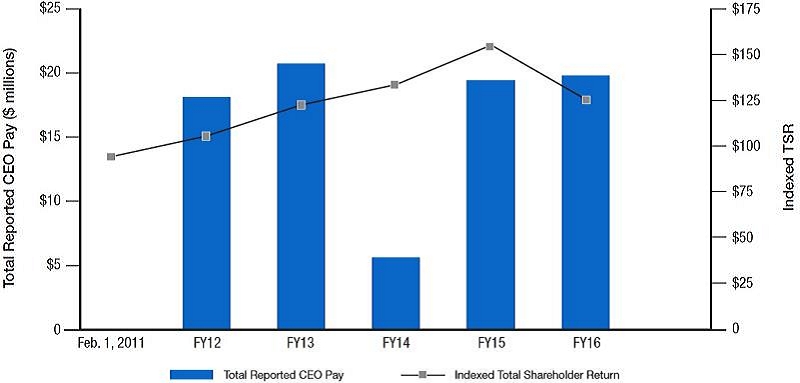

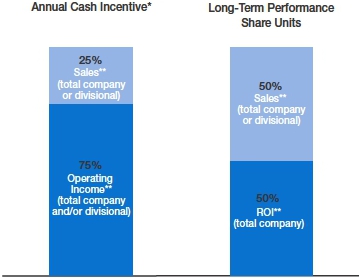

Our executive compensation program is heavily based on performance and aligned with our strategy. More than 75% of our CEO’s fiscal 2016 total direct compensation was based on operating income, sales, and ROI, which are aligned with our strategy and important indicators of retail performance. The chart below illustrates the alignment between our TSR and the reported compensation of our CEO each of the last five fiscal years:

Total Reported CEO Pay ($ millions) $25 $20 $15 $10 $5 0 Feb. 1, 2011 FY12 FY13 FY14 FY15 FY16 Indexed TSR $175 $150 $125 $100 $75 $50 $25 0 Total Reported CEO Pay Indexed Total Shareholder Return

(1) The compensation shown above is the total compensation reported on the Summary Compensation table for our CEO for each fiscal year shown. For fiscal 2015 and fiscal 2016, the amount shown is the total compensation reported for Mr. McMillon. For fiscal 2012 through fiscal 2014, the amount shown is the total compensation reported for our former CEO, Michael T. Duke. Due to his pending retirement, Mr. Duke did not receive any equity awards in fiscal 2014, resulting in relatively low total reported compensation for that year.

(2) Indexed TSR illustrates the total shareholder return on Walmart common stock during the five fiscal years ending January 31, 2016, assuming $100 was invested on the first day of fiscal 2012 and assuming reinvestment of all dividends.

2016 Proxy Statement 11

2016 Proxy Statement 11

| Proposal No. 1 | Election of Directors |

What am I voting on?

You are voting to elect each nominee named below as a director of the company for a one-year term. If you return your proxy, your proxy holder will vote your Shares FOR the election of each Board nominee named below unless you instruct otherwise. If the shareholders elect all of the director nominees named in this proxy statement at the 2016 Annual Shareholders’ Meeting, Walmart will have 12 directors. Each director nominee named in this proxy statement has consented to act as a director of Walmart if elected. If a nominee becomes unwilling or unable to serve as a director, your proxy holder will have the authority to vote your Shares for any substitute candidate nominated by the Board, or the Board may decrease the size of the Board.

What qualifications do the Compensation, Nominating and Governance Committee and the Board consider when selecting candidates for nomination?

An effective Board should be comprised of individuals who collectively provide an appropriate balance of distinguished leadership, diverse perspectives, strategic skill sets, and professional experience relevant to our company’s business and strategic objectives. In fulfilling its responsibility for identifying and evaluating director candidates, in accordance with Walmart’s Corporate Governance Guidelines, the CNGC selects potential candidates on the basis of: outstanding achievement in their professional careers; broad experience and wisdom; personal and professional integrity; ability to make independent, analytical inquiries; experience with and understanding of the business environment; willingness and ability to devote adequate time to Board duties; and such other experience, attributes, and skills that the CNGC determines qualify candidates for service on the Board. The CNGC also considers whether a potential candidate satisfies the independence and other requirements for service on the Board and its committees, as set forth in the NYSE Listed Company Rules and the SEC’s rules. Additional information regarding qualifications for service on the Board and the nomination process for director candidates is set forth in the CNGC’s charter and our Corporate Governance Guidelines, which are available on the Corporate Governance page of our website at http://stock.walmart.com.

2016 Proxy Statement 12

2016 Proxy Statement 12

Walmart is in a period of transformation as we pursue a long-term strategy to deliver a seamless customer experience in our stores, clubs, and through e-commerce. In light of this, and depending on the current composition of the Board and Board committees and expected future turnover on our Board, the CNGC generally seeks director candidates with experience, skills, or background in one or more of the following areas:

| STRATEGY | |||||

| Retail experience: As the world’s largest retailer, we seek directors who possess an understanding of financial, operational, and strategic issues facing large retail companies. | |||||

| Global or international business experience: As a global organization, directors with broad international exposure provide useful business and cultural perspectives, and we seek directors with experience at multinational companies or in international markets. | |||||

| Technology or e-commerce experience: We aim to be the first retailer to deliver a seamless shopping experience at scale, and so we seek directors with experience in e-commerce or related industries such as digital, mobile, and consumer internet industries. | |||||

| Marketing or brand management: Directors with relevant experience in consumer marketing or brand management, especially on a global basis, provide important insights to our Board. | |||||

| LEADERSHIP EXPERIENCE |

||||||||||||

| DIVERSITY | ||||||||||||

| Directors who have served in relevant senior leadership positions bring unique experience and perspective. We seek directors who have demonstrated expertise in governance, strategy, development, and execution. | Diversity and inclusion are values embedded in our culture and fundamental to our business. We believe that a board comprised of directors with diverse backgrounds, experiences, and perspectives improves the dialogue and decisionmaking in the board room and contributes to overall Board effectiveness. The Board assesses the effectiveness of its approach to Board diversity as part of the Board and committee evaluation process. | |||||||||||

| GOVERNANCE | |||||

| Finance, accounting, or financial reporting experience: We value an understanding of finance and financial reporting processes because of the importance our company places on accurate financial reporting and robust financial controls and compliance. We also seek to have multiple directors who qualify as audit committee financial experts. | |||||

| Regulatory or legal experience: Our company’s business requires compliance with a variety of regulatory requirements across a number of countries. Our Board values the insights of directors who have experience advising or working at companies in regulated industries, and it benefits from the perspectives of directors with governmental, public policy, and legal experience and expertise. | |||||

2016 Proxy Statement 13

2016 Proxy Statement 13

Summary of Director Qualifications and Experience

Below we identify the balance of skills and qualifications each director and director nominee brings to the Board. The fact that a particular skill or qualification is not designated does not mean the director nominee does not possess that particular attribute. Rather, the skills and qualifications noted below are those reviewed by the CNGC and the Board in making nomination decisions and as part of the Board succession planning process. We believe the combination of the skills and qualifications shown below demonstrates how our Board is well-positioned to provide effective oversight and strategic advice to our management.

| Strategy | Governance | |||||||||||||||

Senior leadership |

Retail |

Global or international business |

Technology or e-commerce |

Marketing or brand management |

Finance, accounting, or financial reporting |

Regulatory or legal |

||||||||||

| Jim Cash |  |

|

|

|||||||||||||

| Pam Craig |  |

|

|

|||||||||||||

| Tim Flynn |  |

|

|

|

||||||||||||

| Tom Horton |  |

|

|

|

||||||||||||

| Marissa Mayer |  |

|

|

|

||||||||||||

| Doug McMillon |  |

|

|

|||||||||||||

| Greg Penner |  |

|

|

|

|

|||||||||||

| Steve Reinemund |  |

|

|

|||||||||||||

| Kevin Systrom |  |

|

|

|

||||||||||||

| Rob Walton |  |

|

|

|

||||||||||||

| Steuart Walton* |  |

|

|

|||||||||||||

| Linda Wolf |  |

|

|

|||||||||||||

| TOTAL | 9 | 4 | 12 | 5 | 4 | 5 | 4 | |||||||||

| Aida Alvarez(1) |  |

|

|

|

||||||||||||

| Roger Corbett(1) |  |

|

|

|||||||||||||

| Mike Duke(1) |  |

|

|

|||||||||||||

| Jim Walton(1) |  |

|

|

|

||||||||||||

| * | Steuart Walton is standing for election for the first time at the 2016 Annual Shareholders’ Meeting. |

| (1) | Aida Alvarez, Roger Corbett, Mike Duke, and Jim Walton are not being nominated for election as directors and will retire from the Board effective June 3, 2016. |

2016 Proxy Statement 14

2016 Proxy Statement 14

Who are the 2016 director nominees?

Based on the recommendation of the CNGC, the Board has nominated the following candidates for election as directors at the 2016 Annual Shareholders’ Meeting. The information set forth below includes, with respect to each nominee, his or her age, principal occupation and employment during the past five years, the year in which he or she first became a director of Walmart, each Board committee on which he or she currently serves, whether he or she is independent, and directorships of other public companies held by each nominee during the past five years.

The Board recommends that shareholders vote FOR each of the nominees named below for election to the Board.

| James I. Cash, Jr. |    | ||||

Lead Independent

|

Dr. Cash is the James E. Robison Professor of Business Administration Emeritus at Harvard Business School, where he served from July 1976 to October 2003. Dr. Cash served as the Senior Associate Dean and Chairman of HBS Publishing and Chairman of the MBA Program while on the faculty of the Harvard Business School. Dr. Cash holds an advanced degree in accounting and computer science and has been published extensively in accounting and information technology journals. He currently provides executive development and consulting services through The Cash Catalyst, LLC, which he formed in 2009. He has served as a director of Chubb Limited (formerly The Chubb Corporation) since 1996. Dr. Cash has served as a director of a number of other public companies, including General Electric Company from April 1997 to April 2016, Phase Forward Incorporated from October 2003 to May 2009, and Microsoft Corporation from May 2001 to November 2009, and has served on the audit committees of several public companies. He also serves as a director of several private companies. | ||||

Joined the Board: 2006

Age: 68

Board Committees: Audit Committee; Executive

Other Current Public |

Skills and Qualifications: | ||||

|

Dr. Cash brings financial, accounting, and strategic planning expertise from his distinguished career in academia, and from his service at HBS Publishing and on the boards of directors and audit committees of other large, multinational public companies. | ||||

|

Dr. Cash brings a global perspective gained from his service on boards of large, multinational companies in a variety of industries. | ||||

|

The Board benefits from Dr. Cash’s unique knowledge of information technology, as well as his experiences gained from consulting activities and service on the boards of directors of technology companies. | ||||

2016 Proxy Statement 15

2016 Proxy Statement 15

| Pamela J. Craig |    | ||||

Independent Director

|

Ms. Craig was CFO of Accenture plc (“Accenture”), a multinational management consulting, technology and outsourcing company, from October 2006 to June 2013. On July 1, 2013, Ms. Craig stepped down as CFO and retired from Accenture in August 2013. In her 34 years with Accenture and its predecessor companies, she served in a variety of consulting, operational, and finance leadership roles, including as senior vice president, finance, from March 2004 to October 2006, group director, business operations and services, from March 2003 to March 2004, and managing partner, global business operations, from June 2001 to March 2003. She has served on the boards of Akamai Technologies, Inc. since May 2011 and Merck & Co., Inc. since September 2015. She also served on the board of VMWare, Inc. from September 2013 to December 2015. She also serves on the boards of several private and charitable organizations. | ||||

|

Joined the Board: 2013

Age: 59

Board Committee: Audit Committee; TeCC

Other Current Public

|

Skills and Qualifications: | ||||

|

Ms. Craig brings financial reporting, accounting, and risk management expertise gained through her service as the CFO of a prominent, publicly-held management consulting, technology, and outsourcing firm. | ||||

|

The Board benefits from Ms. Craig’s experience in global business leadership and governance. | ||||

|

Ms. Craig also brings experience gained from her service on the boards of directors of various technology companies. | ||||

| Timothy P. Flynn |     | ||||

Independent Director

|

Mr. Flynn was the Chairman of KPMG International (“KPMG”), a global professional services organization that provides audit, tax, and advisory services, from 2007 until his retirement in October 2011. From 2005 until 2010, he served as Chairman and from 2005 to 2008 as Chief Executive Officer of KPMG LLP in the U.S., the largest individual member firm of KPMG. Prior to serving as Chairman and CEO of KPMG LLP, Mr. Flynn was Vice Chairman, Audit and Risk Advisory Services, with operating responsibility for Audit, Risk Advisory and Financial Advisory Services practices. Mr. Flynn has served as a member of the board directors of JPMorgan Chase & Co. since 2012. He served as a member of the board of directors of The Chubb Corporation from September 2013 until its acquisition in January 2016. He has been a director of the International Integrated Reporting Council since September 2015, and he previously served as a trustee of the Financial Accounting Standards Board, a member of the World Economic Forum’s International Business Council, and was a founding member of The Prince of Wales’ International Integrated Reporting Committee. Mr. Flynn graduated from The University of St. Thomas, St. Paul, Minnesota and is a member of the school’s board of trustees. | ||||

|

Joined the Board: 2012

Age: 59

Board Committee:

Other Current Public

|

Skills and Qualifications: | ||||

|

Mr. Flynn has over 32 years of experience in risk management, financial services, financial reporting, and accounting. | ||||

|

Mr. Flynn also brings extensive experience with issues facing complex, global companies, and expertise in accounting, auditing, risk management, and regulatory affairs for such companies. | ||||

|

In addition, Mr. Flynn brings his experiences in executive leadership positions at KPMG and his service on the boards of directors of other large public companies. | ||||

2016

Proxy Statement 16

2016

Proxy Statement 16

| Thomas W. Horton |     | ||||

Independent Director

|

Mr. Horton is a Senior Advisor at Warburg Pincus LLC, a private equity firm focused on growth investing. Mr. Horton was the Chairman of AMR Corporation, parent company of American Airlines Group, Inc. (“AMR”) from December 2013 to June 2014. He also served in other executive leadership positions at AMR, including as President from 2010 until his appointment as Chairman and CEO in 2011, during which time he led AMR through a successful restructuring and turnaround that culminated in the merger of AMR and US Airways, creating the world’s largest airline. From 2006 to 2010, Mr. Horton served as Executive Vice President of Finance and Planning at AMR. Mr. Horton joined AMR from AT&T Corporation, where he served in various roles between 2002 and 2005, including as Vice Chairman and as Chief Financial Officer. While at AT&T, Mr. Horton led the evaluation of strategic alternatives that ultimately led to the combination of AT&T and SBC Communications, Inc. Mr. Horton joined AT&T from AMR, where he had served in various roles from 1985 until 2002, including as Senior Vice President and Chief Financial Officer. Before joining AMR, Mr. Horton worked at Peat Marwick & Company, which is now KPMG. He has served on the board of directors of QUALCOMM Incorporated since 2008, and also serves on the executive board of the Cox School of Business at Southern Methodist University. | ||||

|

Joined the Board: 2014

Age: 54

Board Committee:

Other Current Public

|

Skills and Qualifications: | ||||

|

Mr. Horton brings valuable perspective developed from more than 30 years of experience in finance, accounting, auditing, and risk management. | ||||

|

Our Board benefits from Mr. Horton’s valuable experiences at complex, international business industries. | ||||

|

In addition, Mr. Horton brings unique insights gained from his executive leadership roles at large, highly-regulated, publicly-traded companies. | ||||

| Marissa A. Mayer |     | ||||

Independent Director

|

Ms. Mayer is the President and Chief Executive Officer and a member of the board of directors of Yahoo! Inc. (“Yahoo”), a digital media company. Since joining in July 2012, Ms. Mayer has led Yahoo’s focus as a guide to digital information discovery through search, communications, and digital content products. Ms. Mayer also helmed Yahoo’s digital advertising strategy across mobile, video, native, and social. Under her leadership, Yahoo has grown to serve over 1 billion users worldwide, with over 600 million mobile users. Prior to her role at Yahoo, Ms. Mayer spent 13 years at Google Inc. (“Google”) where she led various initiatives including Google Search for more than a decade, and other early stage products such as Google Maps, Gmail, and Google News. Ms. Mayer holds a bachelor’s degree in symbolic systems and a master’s degree in computer science from Stanford University. Ms. Mayer serves on the board of directors for AliphCom, which operates as Jawbone, and she also serves on the boards of the San Francisco Museum of Modern Art and the San Francisco Ballet. | ||||

|

Joined the Board: 2012

Age: 40

Board Committees:

Other Current Public

|

Skills and Qualifications: | ||||

|

Ms. Mayer brings extensive expertise and insight into the technology and consumer internet industries, and her senior leadership experience is demonstrated by her executive role at a prominent consumer internet company and her positions on the boards of several non-profit organizations. | ||||

|

Ms. Mayer brings distinguished experience in internet product development, engineering, and brand management. | ||||

|

As the CEO of a global company, Ms. Mayer brings insights into global business, strategy, and governance. | ||||

2016 Proxy Statement 17

2016 Proxy Statement 17

| C. Douglas McMillon |    | ||||

President and

|

Mr. McMillon is the President and CEO of Walmart and has served in that position since February 1, 2014. Prior to this appointment, he held numerous other positions with Walmart, including Executive Vice President, President and CEO, Walmart International, from February 1, 2009 through January 31, 2014, and Executive Vice President, President and CEO, Sam’s Club, from August 2005 through January 2009. Mr. McMillon has held a variety of other leadership positions since joining our company 25 years ago. Mr. McMillon also serves as a member of the executive committee of the Business Roundtable, and serves as a member of the boards of directors of a number of organizations, including The Consumer Goods Forum, The US-China Business Council, and Crystal Bridges Museum of American Art. | ||||

|

Joined the Board: 2013

Age: 49

Board Committees:

Other Current Public

|

Skills and Qualifications: | ||||

|

Mr. McMillon brings years of executive leadership experience at our company and extensive expertise in corporate strategy, development, and execution. | ||||

|

In addition, Mr. McMillon brings extensive knowledge and unique experience with the Walmart International segment. | ||||

|

Mr. McMillon has more than 25 years of experience in the retail industry and at our company. | ||||

| Gregory B. Penner+ |      | ||||

Chairman

|

Mr. Penner was appointed as Chairman of the Board in June 2015, after serving as Vice Chairman of the Board from June 2014 to June 2015. He has been a General Partner of Madrone Capital Partners, LLC, an investment management firm, since 2005. From 2002 to 2005, he served as Walmart’s Senior Vice President and CFO – Japan, and before serving in that role, Mr. Penner was the Senior Vice President of Finance and Strategy for Walmart. com from 2001 to 2002. Prior to working for Walmart, Mr. Penner was a General Partner at Peninsula Capital, an early stage venture capital fund, and a financial analyst for Goldman, Sachs & Co. Mr. Penner has been a member of the board of directors of Baidu, Inc. since 2004, and he previously served on the boards of Hyatt Hotels Corporation; eHarmony, Inc.; Castleton Commodities International, LLC; 99Bill Corporation; and Cuil, Inc. | ||||

|

Joined the Board: 2008

Age: 46

Board Committees:

Other Current Public

|

Skills and Qualifications: | ||||

|

Mr. Penner brings expertise in strategic planning, finance, and investment matters, including prior experience as a CFO in our company’s operations in Japan, and his service on the boards of directors of public and private companies in a variety of industries. | ||||

|

The Board benefits from Mr. Penner’s retail experiences with our company’s operations in Japan and at Walmart.com, as well as his service as our Chairman. | ||||

|

In addition, Mr. Penner has broad knowledge of international business, particularly in Japan and China. | ||||

|

Mr. Penner brings unique technology expertise gained through both his service with the company and as a director of various technology companies. | ||||

| + | Greg Penner is the son-in-law of Rob Walton. |

2016 Proxy Statement 18

2016 Proxy Statement 18

| Steven S Reinemund |    | ||||

Independent Director

|

Mr. Reinemund is the retired Dean of Business and Professor of Leadership and Strategy at Wake Forest University, a position he held from July 2008 to June 2014, and where he continues to serve in an advisory role as an Executive-in-Residence. Prior to joining the faculty of Wake Forest University, Mr. Reinemund had a distinguished 23-year career with PepsiCo, Inc. (“PepsiCo”), where he served as Chairman of the Board from October 2006 to May 2007, and Chairman and CEO from May 2001 to October 2006. Prior to becoming Chairman and CEO, Mr. Reinemund was PepsiCo’s President and Chief Operating Officer from 1999 to 2001 and Chairman and CEO of Frito-Lay’s worldwide operations from 1996 to 1999. Mr. Reinemund has served as a director of Exxon Mobil Corporation and Marriott International, Inc. since 2007 and Chick-fil-A, Inc. since June 2015. He previously served as a director of American Express Company from 2007 to 2015 and Johnson & Johnson from 2003 to 2008. Mr. Reinemund is a member of the boards of trustees of The Cooper Institute and the U.S. Naval Academy Foundation. | ||||

|

Joined the Board: 2010

Age: 68

Board Committee:

Other Current Public

|

Skills and Qualifications: | ||||

|

Mr. Reinemund has considerable international business leadership experience gained through his service as Chairman and CEO of a global public company, through his service as dean of a prominent business school, and his service on the boards of several large companies in a variety of industries. | ||||

|

Mr. Reinemund also brings valuable experience with large, international businesses. | ||||

|

In addition, Mr. Reinemund’s experience in executive leadership positions at PepsiCo and Frito-Lay provides valuable insights to our Board regarding brand management, marketing, finance, and strategic planning. | ||||

| Kevin Y. Systrom |     | ||||

Independent Director

|

Mr. Systrom is the CEO and co-founder of Instagram, where he managed the company from its founding in 2010 through a period of extremely rapid growth and through the purchase of Instagram by Facebook, Inc. in April 2012. Under his leadership as CEO, Instagram has continued its entrepreneurial development of a video sharing and direct messaging product, Instagram Direct, and has grown it to hundreds of millions of active users worldwide, making it one of the fastest growing social networks of all time. From 2006 until 2009, he was at Google Inc. and worked on large consumer products such as Gmail and Google Calendar. Before joining Google, Mr. Systrom worked with Odeo, a startup company that eventually became Twitter. He graduated from Stanford University with a bachelor of science in management science and engineering with a concentration in finance and decision analysis. While attending Stanford University, he participated in the Mayfield Fellows Program, a high-tech entrepreneurship program. | ||||

|

Joined the Board: 2014

Age: 32

Board Committees:

Other Current Public

|

Skills and Qualifications: | ||||

|

Mr. Systrom provides unique insights, experiences, and expertise in developing impactful social networking and consumer internet products. | ||||

|

The Board benefits from Mr. Systrom’s successful entrepreneurial leadership in the technology and consumer internet industries. | ||||

|

In addition, Mr. Systrom brings distinguished experience in the design of internationally-recognized consumer internet products. | ||||

|

As the CEO of a fast-growing and complex international company, Mr. Systrom brings valuable insights into global business, strategy, and governance. | ||||

2016 Proxy Statement 19

2016 Proxy Statement 19

| S. Robson Walton+ |     | ||||

|

Mr. Walton was the Chairman of Walmart from 1992 to June 2015 and has been a member of the Board since 1978. Prior to becoming Chairman, he had been an officer at our company since 1969 and held a variety of positions during his service, including Senior Vice President, Corporate Secretary, General Counsel, and Vice Chairman. Before joining Walmart, Mr. Walton was in private law practice as a partner with the law firm of Conner & Winters in Tulsa, Oklahoma. In addition to his duties at Walmart, Mr. Walton is involved with a number of non-profit and educational organizations, including Conservation International, where he serves as Chairman of that organization’s executive committee, and the College of Wooster, where he is an Emeritus Life Trustee for the college. | ||||

|

Joined the Board: 1978

Age: 71

Board Committees: SPFC;

Other Current Public

|

Skills and Qualifications: | ||||

|

Mr. Walton brings decades of leadership experience with Walmart and his expertise in strategic planning gained through his service on the boards and other governing bodies of non-profit organizations. | ||||

|

Mr. Walton has extensive legal and corporate governance expertise gained as Walmart’s Corporate Secretary and General Counsel and as an attorney in private practice. | ||||

|

The Board benefits from Mr. Walton’s in-depth knowledge of our company, its history and the global retail industry, all gained through more than 35 years of service on the Board and more than 20 years of service as our company’s Chairman. | ||||

+ Greg Penner is the son-in-law of Rob Walton; Steuart Walton is the nephew of Rob Walton; and Jim Walton and Rob Walton are brothers.

| Steuart L. Walton+ |    | ||||

|

Since February 2013, Mr. Walton has been the CEO and founder of Game Composites, Ltd., a company that designs and builds small composite aircraft. Before founding Game Composites, from June 2011 to January 2013, Mr. Walton worked in our company’s International division as a Senior Director, International Mergers and Acquisitions. Prior to his service at our company, he was an associate at Allen & Overy, LLP in London from 2007 to 2010, where he advised companies on securities offerings. In 2004, he served in the offices of U.S. Senator Peter Fitzgerald. Mr. Walton is also a member of the boards of directors of Crystal Bridges Museum of American Art, Leadership for Educational Equity, the Smithsonian National Air and Space Museum, and the Walton Family Foundation. He is a graduate of Georgetown University Law Center, and he holds a bachelor’s degree in business administration from the University of Colorado, Boulder. | ||||

|

Joined the Board: Nominee

Age: 34

Board Committees: N/A

Other Current Public

|

Skills and Qualifications: | ||||

|

Mr. Walton brings broad-based and valuable international legal and regulatory experience gained from his work on complex, international financial transactions. | ||||

|

Mr. Walton has a strong history and familiarity with our company and its businesses. He also brings valuable leadership and financial insights gained from his entrepreneurial experiences and investments. | ||||

+ Steuart Walton is the son of Jim Walton and the nephew of Rob Walton.

2016 Proxy Statement 20

2016 Proxy Statement 20

| Linda S. Wolf |    | ||||

Independent Director

|

Ms. Wolf is the retired Chairman and CEO of Leo Burnett Worldwide, Inc. (“Leo Burnett”), a global advertising agency and division of Publicis Groupe S.A. Ms. Wolf served in various positions with Leo Burnett and its predecessors from 1978 to April 2005, including as Chairman and CEO from January 2001 until April 2005. She serves as a trustee for investment funds advised by the Janus Capital Group Inc. and has served on the board of InnerWorkings, Inc., a provider of managed print and promotional procurement solutions, since November 2006, and Wrapports, LLC since 2012. Among other endeavors, Ms. Wolf also serves on the boards of the Rehabilitation Institute of Chicago, Lurie Children’s Hospital of Chicago, The Chicago Council on Global Affairs, and the Chicago Community Trust. | ||||

|

Joined the Board: 2005

Age: 68

Board Committees:

Other Current Public

|

Skills and Qualifications: | ||||

|

Ms. Wolf brings executive leadership and management experience gained as a CEO of a global company and through her service on a variety of public company and non-profit boards. | ||||

|

Ms. Wolf’s qualifications to serve on the Board also include her experience in brand management and advertising gained through her years leading Leo Burnett. | ||||

|

As the former CEO of a global company, Ms. Wolf brings a valuable international perspective to the Board. | ||||

Are there any directors not standing for reelection?

Yes. Aida Alvarez, Roger Corbett, Mike Duke, and Jim Walton, each of whom currently serves on the Board, will rotate off the Board at the conclusion of her or his current term and will not stand for reelection at the 2016 Annual Shareholders’ Meeting.

| Aida M. Alvarez |     | ||||

Independent Director

|

From 1997 to 2001, Ms. Alvarez was a member of President Clinton’s Cabinet as the Administrator of the U.S. Small Business Administration (the “SBA”). She was the founding Director of the Office of Federal Housing Enterprise Oversight from 1993 to 1997. Ms. Alvarez was a vice president in public finance at First Boston Corporation and Bear Stearns & Co., Inc. prior to 1993. She is the Chair of the Latino Community Foundation, and she has served on the boards of directors of Oportun (formerly Progress Financial Corporation) since 2011; Zoosk, Inc. since 2015; and HP Inc. since February 2016. From 2004 to 2014, Ms. Alvarez served on the boards of MUFG Americas Holdings Corporation (formerly UnionBanCal Corporation) and MUFG Union Bank N.A. (formerly Union Bank N.A.). | ||||

|

Joined the Board: 2006

Age: 66

Board Committee:

Other Current Public

|

Skills and Qualifications: | ||||

|

Ms. Alvarez gained executive experience through her years in President Clinton’s Cabinet, her executive roles at government agencies, and her leadership at a prominent philanthropic organization. | ||||

|

Ms. Alvarez brings extensive knowledge of the federal government and insight into public policy. | ||||

|

The Board also benefits from Ms. Alvarez’s knowledge of investment banking and finance. | ||||

|

As the head of the SBA, Ms. Alvarez expanded the international role of the SBA and developed a global agenda for the SBA. | ||||

2016 Proxy Statement 21

2016 Proxy Statement 21

| Roger C. Corbett |    | ||||

Independent Director

|

Mr. Corbett is the retired CEO and Group Managing Director of Woolworths Limited, the largest retail company in Australia, where he served from 1990 to 2006. He also is a director and non-executive Chairman of Mayne Pharma Group Limited, an Australian pharmaceutical company. Mr. Corbett has served as the Chairman of Firefly Health Pty Ltd (a venture capital company dealing with monitoring devices in the area of diabetes) since December 2015 and is the Chairman-elect of Australian Leisure Holdings Group (a hotel and retail liquor company). Until recently, he was a director of The Reserve Bank of Australia, Chairman of Fairfax Media Limited (an Australian newspaper, magazine and internet publisher), and Chairman of PrimeAg Australia (an Australian farming enterprise). Mr. Corbett is a former founding director of Outback Stores and holds leadership positions on boards and advisory councils of various industry, charitable, and non-profit organizations. | ||||

|

Joined the Board: 2006

Age: 73

Board Committee: SPFC

Other Current Public

|

Skills and Qualifications: | ||||

|

Mr. Corbett has more than 50 years of experience in the retail industry, and brings unique financial, operational, and strategic expertise in matters facing large retail companies. | ||||

|

In addition, Mr. Corbett’s leadership positions with multinational companies bring to the Board an international retail perspective and understanding of international markets. | ||||

| Michael T. Duke |    | ||||

|

Mr. Duke was Walmart’s President and CEO from February 1, 2009 to January 31, 2014, and served as Chair of the Executive Committee from February 1, 2011 to January 31, 2015, when he retired from the company. Prior to his appointment as our company’s President and CEO, he held other positions with Walmart since July 1995, including Vice Chairman with responsibility for Walmart International beginning in September 2005 and Executive Vice President, President and CEO of Walmart U.S., beginning in April 2003. Since June 2015, Mr. Duke has served on the board of directors of Chick-fil-A, Inc. and on the board of trustees of the Georgia Tech Foundation, where he is also a Distinguished Executive in Residence. He previously has served on the board of directors of The Consumer Goods Forum and the boards of advisors for the University of Arkansas and the Tsinghua University School of Economics and Management in Beijing, China. He is also a member of the National Academy of Engineering. | ||||

|

Joined the Board: 2008

Age: 66

Board Committees:

Other Current Public

|

Skills and Qualifications: | ||||

|

Mr. Duke brings years of executive leadership experience across multiple operating segments of our company. | ||||

|

The Board benefits from Mr. Duke’s decades of experience and leadership in the retail industry and at our company. | ||||

|

Mr. Duke has extensive knowledge of international markets and international retailing. | ||||

2016 Proxy Statement 22

2016 Proxy Statement 22

| Jim C. Walton+ |     | ||||

|

Mr. Walton has been the Chairman and CEO of Arvest Bank Group, Inc., a group of banks operating in the states of Arkansas, Kansas, Missouri, and Oklahoma since 1990. From 1982 to 2015, Mr. Walton served as Chairman of Community Publishers, Inc., which operated newspapers in Arkansas, Missouri, and Oklahoma. In addition, Mr. Walton serves on the boards of directors of a number of charitable and non-profit organizations. | ||||

|

Joined the Board: 2005

Age: 67

Board Committee: TeCC

Other Current Public

|

Skills and Qualifications: | ||||

|

Mr. Walton brings to the Board his executive leadership, strategic planning, and management experience gained through his leadership positions at the companies described above, including in the banking industry. | ||||

|

Mr. Walton’s qualifications to serve on the Board include his banking and investment expertise. | ||||

|

The Board benefits from Mr. Walton’s long history and familiarity with our company and its operations gained through his service on the Board and prior service on the SPFC. | ||||

+ Jim Walton and Rob Walton are brothers; and Steuart Walton is the son of Jim Walton.

2016 Proxy Statement 23

2016 Proxy Statement 23

As part of its annual evaluation process described below, the Board reviews its leadership structure to ensure that it is designed to provide robust oversight and promote overall Board effectiveness. Our current Board leadership structure consists of:

| Non-Executive Chairman | Lead Independent Director | President and CEO | ||

Greg Penner Greg Penner |

Jim Cash Jim Cash |

Doug McMillon Doug McMillon | ||

|

Primary Responsibilities

• Presides over meetings of the Board and shareholders • Focuses on Board oversight and governance matters • Provides advice and counsel to the CEO |

Primary Responsibilities

• Liaison between Chairman and Independent Directors • Agenda review process • Board and committee development and evaluation • Interactions with major shareholders |

Primary Responsibilities

• Leadership of Walmart’s complex global business • Implements strategic initiatives • Development of robust management team | ||

| Skills and Qualifications | Skills and Qualifications | Skills and Qualifications | ||

|

|

|

We have separated the Chairman and CEO roles since 1988. As required by our Corporate Governance Guidelines, we separate these roles because we believe Walmart benefits from the distinct perspectives and experiences of a separate Chairman and CEO. By separating these roles, our CEO is able to focus on managing Walmart’s complex daily operations and our Chairman, who is an Outside Director, can devote his time and attention to matters of Board oversight and governance. Moreover, we believe this separation of roles allows the Board to more effectively perform its risk oversight role as described on page 31.

We have an active and engaged Lead Independent Director. Pursuant to our Corporate Governance Guidelines, the Independent Directors annually appoint a Lead Independent Director who presides over executive sessions of the Outside Directors and Independent Directors and presides over Board meetings in the Chairman’s absence.

We have had a Lead Independent Director since 2004. Dr. Cash has served in this role since 2013. In addition to the responsibilities noted above, he also:

| • | has authority to call meetings of the directors, including separate meetings of the Outside Directors and Independent Directors; |

| • | in conjunction with the Chair of the CNGC, leads the annual Board and committee evaluation process; |

| • | in conjunction with the Chairman and the Chair of the CNGC, actively participates in work related to overall Board effectiveness, including Board development, succession planning, and refreshment; and |

| • | is available, when appropriate, for consultation with major shareholders. |

Committee Chairs: Each of the Board’s key committees is led by an independent chair. These committees play a critical role in our governance and strategy, and each committee has access to management and the authority to retain independent advisors as it deems appropriate.

| Governance Committees | Strategy Committees | |||

Tim Flynn Tim Flynn |

Linda Wolf Linda Wolf |

Steve Reinemund Steve Reinemund |

Kevin Systrom Kevin Systrom | |

|

• Audit Committee Chair • Independent |

• CNGC Chair • Independent |

• SPFC Chair • Independent |

• TeCC Chair • Independent | |

| Skills and Qualifications | Skills and Qualifications | Skills and Qualifications | Skills and Qualifications | |

|

|

|

| |

Additional information about each of the directors in our Board leadership structure may be found in the section titled “Who are the 2016 director nominees?” on pages 15-21.

2016 Proxy Statement 24

2016 Proxy Statement 24

To enhance the effectiveness of the Board’s risk oversight function, the Board reviews its committee structure and committee responsibilities to ensure that the Board has an appropriate committee structure focused on matters of strategic and governance importance to Walmart. Currently, the Board has six standing committees, which are described below. In addition to the duties described below, our Board committees perform the risk oversight functions described on page 31.

| STRATEGIC PLANNING AND FINANCE COMMITTEE |

Number of meetings during fiscal 2016: 5

Roles and responsibilities

| • | Reviews global financial policies and practices and reviews and analyzes financial matters, acquisition and divestiture transactions |

| • | Oversees long-range strategic planning |

| • | Reviews and recommends a dividend policy to the Board |

| • | Reviews the preliminary annual financial plan and annual capital plan to be approved by the Board, as well as the company’s capital structure and capital expenditures |

|

Members:

Steve Reinemund, Chair |

|

– Steve Reinemund |

Global 6 Sr. Leadership 6 Regulatory 3 Retail 3 Finance 2 Marketing 1 |

* Not standing for reelection at the 2016 Annual Shareholders’ meeting.

| TECHNOLOGY AND ECOMMERCE COMMITTEE |

Number of meetings during fiscal 2016: 3

Roles and responsibilities

| • | Reviews matters relating to information technology, e-commerce, and innovation and oversees the integration of Walmart’s information technology, e-commerce, and innovation efforts with Walmart’s overall strategy |

| • | Reviews and provides guidance regarding trends in technology and e-commerce and monitors overall industry trends |

|

Members:

Kevin Systrom, Chair |

|

– Kevin Systrom |

Global 6 Sr. Leadership 5 Finance 4 Tech 4 Marketing 3 Regulatory 2 Retail 1 |

* Not standing for reelection at the 2016 Annual Shareholders’ meeting.

2016 Proxy Statement 25

2016 Proxy Statement 25

| AUDIT COMMITTEE |

Number of meetings during fiscal 2016: 10

Roles and Responsibilities

| • | Reviews and approves the financial statements and oversees the financial reporting policies, procedures, and internal controls |

| • | Responsible for the appointment, compensation, and oversight of the independent accountants |

| • | Pre-approves audit, audit-related, and non-audit services to be performed by Walmart’s independent accountants |

| • | Reviews and approves any related person transactions and other transactions subject to our Transaction Review Policy |

| • | Reviews risk management policies and procedures, as well as policies, processes, and procedures regarding compliance with applicable laws and regulations, as well as Global Statement of Ethics and Code of Ethics for the CEO and Senior Financial Officers |

| • | Oversees internal investigatory matters, including the internal investigation into alleged violations of the FCPA and other alleged crimes or misconduct# |

| • | Oversees Walmart’s enhanced global compliance program |

| • | Oversees the company’s internal audit function |

|

Members: *

Tim Flynn, Chair |

|

– Tim Flynn |

Global 4 Finance 4 Sr. Leadership 2 Tech 2 Regulatory 2 |

* Independence and financial literacy: The Board has determined that each member of the Audit Committee is independent as defined by the Exchange Act, the SEC’s rules, and the NYSE Listed Company Rules. Each Audit Committee member is financially literate as required by NYSE Listed Company Rules, and is an “audit committee financial expert” as defined in the SEC’s rules.

# For more information about the Audit Committee’s role with respect to the FCPA investigation, see “Director Compensation” on page 36.

| COMPENSATION, NOMINATING AND GOVERNANCE COMMITTEE |

Number of meetings during fiscal 2016: 8

Roles and responsibilities

| • | In consultation with the CEO, approves compensation of Executive Officers other than the CEO, and reviews compensation of other senior officers |

| • | Reviews and approves the compensation of the CEO and recommends to the Board the compensation of the Outside Directors |

| • | Sets performance measures and goals and verifies the attainment of performance goals under our incentive compensation plans |

| • | Reviews compensation and benefits issues |

| • | Oversees corporate governance issues and makes recommendations to the Board |

| • | Identifies, evaluates, and recommends candidates for nomination to the Board |

| • | Reviews and makes recommendations to the Board regarding director independence |

| • | Reviews and advises management on social, community, and sustainability initiatives, as well as legislative affairs and public policy engagement |

| • | Oversees the management development, succession planning, and retention practices for Executive Officers and senior leaders |

|

Members: *

Linda Wolf, Chair |

|

– Linda Wolf |

Global 5 Sr. Leadership 5 Marketing 4 Tech 2 Finance 1 Regulatory 1 |

* Independence: The Board has determined that each member of the CNGC is independent as defined by the Exchange Act, the SEC’s rules, and the NYSE Listed Company Rules, is an outside director as defined in Section 162(m) of the Internal Revenue Code, and is a “non-employee director” as defined in the SEC’s rules.

(1) Not standing for reelection at the 2016 Annual Shareholders’ Meeting

2016 Proxy Statement 26

2016 Proxy Statement 26

The remaining two standing committees of the Board are responsible for various administrative matters.

| GLOBAL COMPENSATION COMMITTEE |

|

Number of meetings during fiscal 2016: 5

Roles and Responsibilities

• Administers Walmart’s equity and cash incentive compensation plans for Associates who are not directors or Executive Officers |

|

Members:

Doug McMillon, Chair |

| EXECUTIVE COMMITTEE |

|

Number of meetings during fiscal 2016: 0*

Roles and responsibilities

• Implements policy decisions of the Board • Acts on the Board’s behalf between Board meetings |

|

Members:

Doug McMillon, Chair |

*The Executive Committee acted by unanimous written consent 11 times during fiscal 2016. The Board reviewed each unanimous written consent of the Executive Committee during fiscal 2016 and ratified each of them.

Governing Documents. Each standing committee of the Board has a written charter, which sets forth the roles and responsibilities of the Board committee. In addition, the Board has adopted Corporate Governance Guidelines, as more specifically described below. The committee charters and the Corporate Governance Guidelines, provide the overall framework for our corporate governance practices. The CNGC and the Board review the Corporate Governance Guidelines, and the CNGC, the Board, and each Board committee review the Board committee charters at least annually to determine whether any updates or revisions to these documents may be necessary or appropriate. Our Corporate Governance Guidelines address, among other topics:

| • | Board size, structure, and composition; |

| • | the Board leadership structure, including the separation of the Chairman and CEO roles and the selection, role, and responsibilities of the Lead Independent Director; |

| • | the committees of the Board; |

| • | stock ownership guidelines; |

| • | the Board’s commitment to diversified membership; |

| • | management development and succession planning, diversity initiatives, and long-term strategic planning; |

| • | the directors’ full and free access to officers, other Associates of the company, and the company’s outside advisors; |

| • | director compensation; |

| • | director orientation and continuing education; |

| • | the annual review of the CEO’s performance by the CNGC and the Board; and |

| • | annual Board and Board committee self-evaluations. |

|

Our Board and Board committee governance documents, including the Board committee charters, the Corporate Governance Guidelines, and other key corporate governance documents are available to our shareholders:

• on our corporate website at http://stock.walmart.com/corporate-governance/governance-documents; or • in print at no charge to any shareholder who requests a copy by writing to our Global Investor Relations Department at: Wal-Mart Stores, Inc., Global Investor Relations Department, 702 Southwest 8th Street, Bentonville, Arkansas 72716-0100.

You may also access and review the following additional corporate governance documents at http://stock.walmart.com/corporate-governance/governance-documents:

• Amended and Restated Bylaws; • Code of Ethics for the CEO and Senior Financial Officers*; • Global Statement of Ethics; • Procedures for Accounting and Audit-Related Complaints; • Investment Community Communications Policy; • Fair Disclosure Procedures; • Global Anti-Corruption Policy; • Government Relations Policy; and • Privacy Policy. |

*Walmart’s Code of Ethics for the CEO and Senior Financial Officers supplements Walmart’s Global Statement of Ethics, which is applicable to all directors, Executive Officers, and Associates and is also available at www.walmartethics.com. A description of any substantive amendment or waiver of Walmart’s Code of Ethics for the CEO and Senior Financial Officers or Walmart’s Global Statement of Ethics granted to Executive Officers or directors will be disclosed on our corporate website (http://stock.walmart.com/corporate-governance/ governance-documents) for a period of 12 months after the date of the amendment or waiver. There were no substantive amendments to or waivers of Walmart’s Code of Ethics for the CEO and Senior Financial Officers or Walmart’s Global Statement of Ethics granted to Executive Officers or directors during fiscal 2016.

2016 Proxy Statement 27

2016 Proxy Statement 27

Board Meetings and Director Attendance

The Board held a total of 6 meetings during fiscal 2016. During fiscal 2016, each director attended 75% or more of the aggregate number of Board meetings and meetings of Board committees on which he or she served. As a whole, during fiscal 2016, our directors attended approximately 98% of the aggregate number of Board meetings and meetings of Board committees on which they served, and 9 of the 11 incumbent director nominees standing for reelection had perfect attendance. The Outside Directors and Independent Directors met regularly in executive sessions, with the Lead Independent Director chairing those sessions.

Board Attendance at Annual Shareholders’ Meetings

The Board has adopted a policy stating that all directors are expected to attend the company’s annual shareholders’ meetings. While the Board understands that there may be situations that prevent a director from attending an annual shareholders’ meeting, the Board encourages all directors to make attendance at all annual shareholders’ meetings a priority. Fourteen Board members attended the 2015 Annual Shareholders’ Meeting, including all director nominees named in this proxy statement who were members of the Board at the time of the 2015 Annual Shareholders’ Meeting.

The Board welcomes feedback from shareholders and other interested parties. There are a number of ways that you can contact the Board or individual members of the Board.

|

Name of Director(s) or Board of Directors c/o Gordon Y. Allison, Vice President and General Counsel, Corporate Division Wal-Mart Stores, Inc. 702 Southwest 8th Street Bentonville, Arkansas 72716-0215 |

|

Via email: |

|

• the entire Board at [email protected]; • the Independent Directors at [email protected]; • the Outside Directors at [email protected]; or • any individual director, at the full name of the director as listed under “Proposal No.1 – Election of Directors” followed by “@wal-mart.com.” For example, our Chairman, Gregory B. Penner, may be reached at [email protected]. |

Our company receives a large volume of correspondence regarding a wide range of subjects each day, including correspondence relating to ordinary store operations and merchandise in our stores. As a result, our individual directors are often not able to respond to all communications directly. Therefore, the Board has established a process for managing communications to the Board and individual directors.

Communications directed to the Board or individual directors are reviewed to determine whether, based on the facts and circumstances of the communication, a response on behalf of the Board or an individual director is appropriate. If a response on behalf of the Board or an individual director is appropriate, Walmart management may assist the Board or individual director in gathering all relevant information and preparing a response. Communications related to day-to-day store operations, merchandise, and similar matters are typically directed to an appropriate member of management for a response. Walmart maintains records of communications directed to the Board and individual directors, and these records are available to our directors at any time upon request.

Shareholders wishing to recommend director candidates for consideration should do so in writing to the address set forth above. The recommendation should include the candidate’s name and address, a resume or curriculum vitae that demonstrates the candidate’s experience, skills, and qualifications, and other relevant information for the Board’s consideration. All director candidates recommended by shareholders will be evaluated by the CNGC on the same basis as any other director candidates.

2016 Proxy Statement 28

2016 Proxy Statement 28

Board Evaluations and Board Effectiveness

Evaluation Process. The Board is committed to continuous improvement, and Board and Board committee evaluations are an important tool for promoting effectiveness. This evaluation process currently includes:

| • | Questionnaires – each director completes a detailed questionnaire. Topics covered include, among others: |

| – | The effectiveness of the Board’s leadership structure and the Board committee structure; | |

| – | Board and committee skills, composition, diversity, and succession planning; | |

| – | Board culture and dynamics, including the effectiveness of discussion and debate at Board and committee meetings; | |

| – | The quality of Board and committee agendas and the appropriateness of Board and committee priorities; and | |

| – | Board/management dynamics, including the quality of management presentations and information provided to the Board and committees. |

| • | Individual director interviews – each director participates in a confidential, open-ended, one-on-one interview to solicit input and perspective on Board and committee effectiveness. |

| • | Senior management questionnaires and interviews – Since fiscal 2014, members of Walmart’s senior executive team have also completed brief, anonymous questionnaires and participated in confidential, one-on-one interviews designed to solicit management’s perspective on the Board’s effectiveness, engagement, and the dynamic between the Board and management. |

| The evaluation process is led by our Lead Independent Director and the Chair of the CNGC. In 2016, the Board engaged a third party consulting firm to assist with the evaluation process. | |

Action Items. These evaluations have consistently found that the Board and Board committees are operating effectively. Over the past few years, this evaluation process has contributed to various refinements in the way the Board and committees operate, including:

| • | reducing the size of the Board to promote engagement and input into our strategic decisionmaking; |

| • | changing committee assignments so that Independent Directors sit on one “strategy” committee and one “governance” committee; |

| • | ensuring that Board and committee agendas are appropriately focused on strategic priorities and provide adequate time for director input; |

| • | additional responsibilities for our Lead Independent Director, including active participation in the agenda-setting process for the Board and committees; and |

| • | increased focus on continuous Board succession planning and Board refreshment. |

Board Refreshment and Succession Planning

The CNGC is responsible for identifying and evaluating potential director candidates, for reviewing the composition of the Board and Board committees, and for making recommendations to the full Board on these matters. Throughout the year, the CNGC actively engages in Board succession planning, taking into account the following considerations:

| • | Input from Board discussions and from the Board and Board committee evaluation process regarding the specific backgrounds, skills, and experiences that would contribute to overall Board and committee effectiveness; and |

| • | The future needs of the Board and Board committees in light of the Board’s tenure policies, Walmart’s strategy, and the skills and qualifications of directors who are expected to retire in the future. |

Director Tenure Policies Board/Committee Evaluations Director Recruitment Director Onboarding Allow Board to anticipate future Board turnover Identify skill sets that would enhance Board effectiveness Identify top director talent with desired background and skill setsDirector Tailored onboarding enables new directors to contribute quickly

2016 Proxy Statement 29

2016 Proxy Statement 29

The Board believes that a mix of longer-tenured directors and newer directors with fresh perspectives contributes to an effective Board. In order to promote thoughtful Board refreshment, the Board has adopted the following retirement policies for Independent Directors, as set forth in Walmart’s Corporate Governance Guidelines:

| Term Limit | Independent Directors are expected to commit to at least six years of service, and may not serve for more than 12 years. |

| Retirement Age | Unless they have not yet completed their initial six-year commitment, Independent Directors may not stand for reelection after age 75. |

The Board may make exceptions to these retirement policies if circumstances warrant. For example, the Board could extend the term limit or retirement age for an individual director with particular skills or qualifications that are valuable to the Board’s effectiveness until a suitable replacement is found. Similarly, an Independent Director may retire before serving 12 years in order to avoid excessive turnover on the Board or a Board committee in a short period of time. The Board believes that these policies have helped to provide discipline to the Board refreshment process, and have resulted in a diverse Board with an effective mix of skills, experiences, and tenures, as shown on page 9.

As a part of the process of identifying potential director candidates, the CNGC may consult with other directors and senior officers and may engage a search firm to assist in the process. If the CNGC decides to proceed with further consideration of a potential candidate, the Chair of the CNGC and other members of the CNGC, as well as other members of the Board, may interview the candidate. The CNGC then may recommend that the full Board appoint or nominate the candidate for election to the Board.

Steuart Walton is standing for election to the Board for the first time at the 2016 Annual Shareholders’ Meeting, and was recommended by members of the Walton family who beneficially own more than 5% of our outstanding Shares, including Rob Walton and Jim Walton, who are Outside Directors. Historically, three members of the Walton family have been members of our Board, which the CNGC and Board believe is appropriate given the Walton family’s significant and long-term Share ownership. With Jim Walton not being nominated for reelection, the Walton family recommended Steuart Walton for nomination in the context of the Board’s succession planning process and in light of Steuart Walton’s skills and qualifications described on page 20.

Director Onboarding and Engagement with the Business