Form 8-K REGIONS FINANCIAL CORP For: Apr 14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): April 14, 2016

REGIONS FINANCIAL CORPORATION

(Exact name of registrant as specified in its charter)

DELAWARE | 001-34034 | 63-0589368 | ||

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) | ||

1900 FIFTH AVENUE NORTH

BIRMINGHAM, ALABAMA 35203

(Address, including zip code, of principal executive office)

Registrant’s telephone number, including area code: (205) 581-7890

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ | Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02 Results of Operations and Financial Condition

Item 7.01 Regulation FD Disclosure

On April 15, 2016, Regions Financial Corporation (“Regions”) will issue a press release announcing its preliminary results of operations for the quarter ended March 31, 2016. A copy of the press release is attached hereto as Exhibit 99.1. Supplemental financial information for the quarter ended March 31, 2016 is attached as Exhibit 99.2. Executives from Regions will review the results via teleconference and live audio webcast at 11:00 a.m. Eastern time on April 15, 2016. A copy of a visual presentation that will be a part of that review is attached as Exhibit 99.3. All of the attached exhibits are incorporated herein and may also be found on Regions' website at www.regions.com, and an archived webcast of the teleconference will be available through May 15, 2016.

In accordance with general instruction B.2 of Form 8-K, this information is being furnished and shall not be deemed filed for purposes of Section 18 of the Securities Exchange Act of 1934.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

99.1 | Press Release dated April 15, 2016 | ||

99.2 | Supplemental Financial Information | ||

99.3 | Visual Presentation of April 15, 2016 | ||

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

REGIONS FINANCIAL CORPORATION | |

By: | /s/ Fournier J. Gale, III |

Name: | Fournier J. Gale, III |

Title: | Senior Executive Vice President, General Counsel and Corporate Secretary |

Date: April 14, 2016

Exhibit 99.1

Media Contact: | Investor Relations Contact: | |||

Evelyn Mitchell | Dana Nolan | |||

(205) 264-4551 | (205) 581-7890 | |||

Regions reports earnings of $257 million and earnings per share of $0.20 for the first quarter of 2016

BIRMINGHAM, Ala. - (BUSINESS WIRE) - April 15, 2016 - Regions Financial Corporation (NYSE: RF) today announced earnings for the first quarter ended March 31, 2016. The company reported net income available to common shareholders of $257 million, an increase of 18 percent compared to the first quarter of 2015. Earnings per diluted share was $0.20, an increase of $0.04 from the first quarter of 2015.

“These results illustrate that we are successfully executing our strategic plan, which includes reducing expenses so we can invest in new revenue initiatives,” said Chairman, President and CEO Grayson Hall. “We are demonstrating that we can increase revenue while prudently managing expenses, which puts us on track to reach our long-term performance targets.”

SUMMARY OF FIRST QUARTER 2016 RESULTS:

Quarter Ended | ||||||||||||

($ amounts in millions, except per share data) | 3/31/2016 | 12/31/2015 | 3/31/2015 | |||||||||

Income from continuing operations (A) | $ | 273 | $ | 288 | $ | 236 | ||||||

Income (loss) from discontinued operations, net of tax | — | (3 | ) | (2 | ) | |||||||

Net income | 273 | 285 | 234 | |||||||||

Preferred dividends (B) | 16 | 16 | 16 | |||||||||

Net income available to common shareholders | $ | 257 | $ | 269 | $ | 218 | ||||||

Net income from continuing operations available to common shareholders (A) – (B) | $ | 257 | $ | 272 | $ | 220 | ||||||

Diluted earnings per common share from continuing operations | $ | 0.20 | $ | 0.21 | $ | 0.16 | ||||||

Diluted earnings per common share | $ | 0.20 | $ | 0.21 | $ | 0.16 | ||||||

1

FIRST QUARTER 2016 FINANCIAL RESULTS:

Selected items impacting earnings

Quarter Ended | |||||||||||||

($ amounts in millions, except per share data) | 3/31/2016 | 12/31/2015 | 3/31/2015 | ||||||||||

Pre-tax select items: | |||||||||||||

Branch consolidation, property and equipment charges | $ | (14 | ) | $ | (6 | ) | $ | (22 | ) | ||||

Salaries and benefits related to severance charges | (12 | ) | (6 | ) | |||||||||

Bank-owned life insurance benefits (tax free) | 14 | ||||||||||||

Professional fee recovery | 7 | ||||||||||||

Insurance proceeds | 3 | 1 | |||||||||||

Lease adjustment | (15 | ) | |||||||||||

Loss on early extinguishment of debt | (43 | ) | |||||||||||

State deferred tax adjustment | 10 | ||||||||||||

Diluted EPS impact | — | (0.01 | ) | (0.02 | ) | ||||||||

During the first quarter of 2016, the company incurred $14 million of property-related expenses primarily related to previously announced branch consolidations as well as occupancy optimization initiatives. The company also incurred $12 million of severance expense, primarily related to efficiency efforts as the company executes its plan to eliminate $300 million in core expenses over the next three years.

The company also recorded additional income in bank-owned life insurance of $14 million in the first quarter related to a claim benefit as well as a gain on exchange of policies. In addition, professional and legal fees benefited from a $7 million settlement recovery, and insurance proceeds of $3 million were recognized related to prior legal matters.

First quarter 2016 results compared to fourth quarter 2015:

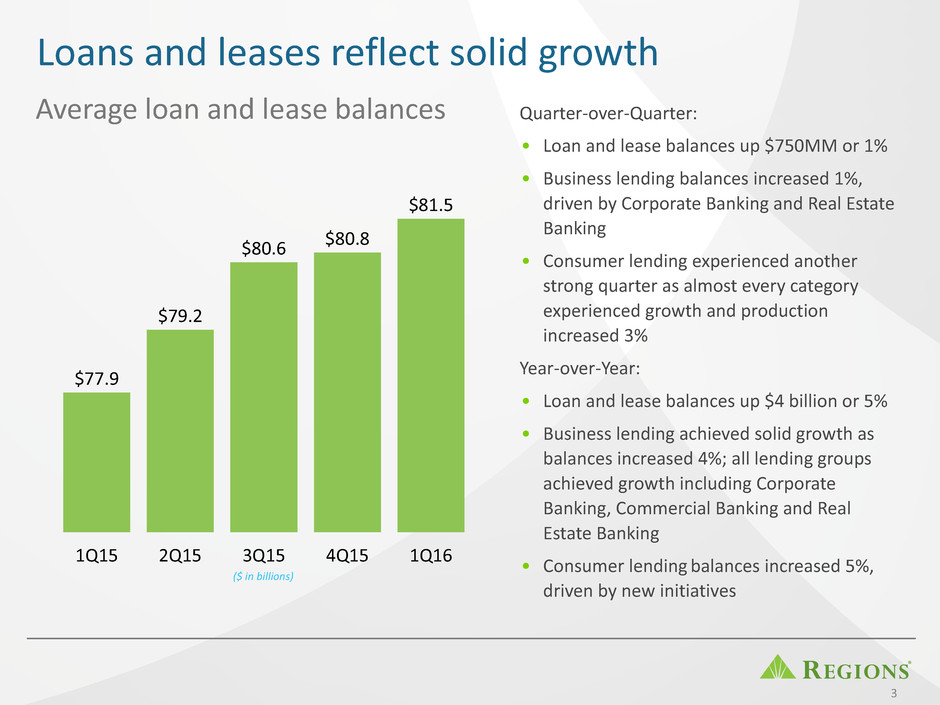

• | Average loans and leases totaled $82 billion, an increase of 1 percent. |

◦ | Business lending balances increased 1 percent on an average basis. |

◦ | Consumer lending balances increased 1 percent on an average basis. |

• | Average deposit balances totaled $98 billion, an increase of $262 million; low-cost deposits increased $712 million or 1 percent. |

• | Net interest income and other financing income on a fully taxable equivalent (FTE) basis was $883 million, an increase of $12 million or 1 percent excluding the lease adjustment(4) from the prior quarter. The resulting net interest margin was 3.19 percent. |

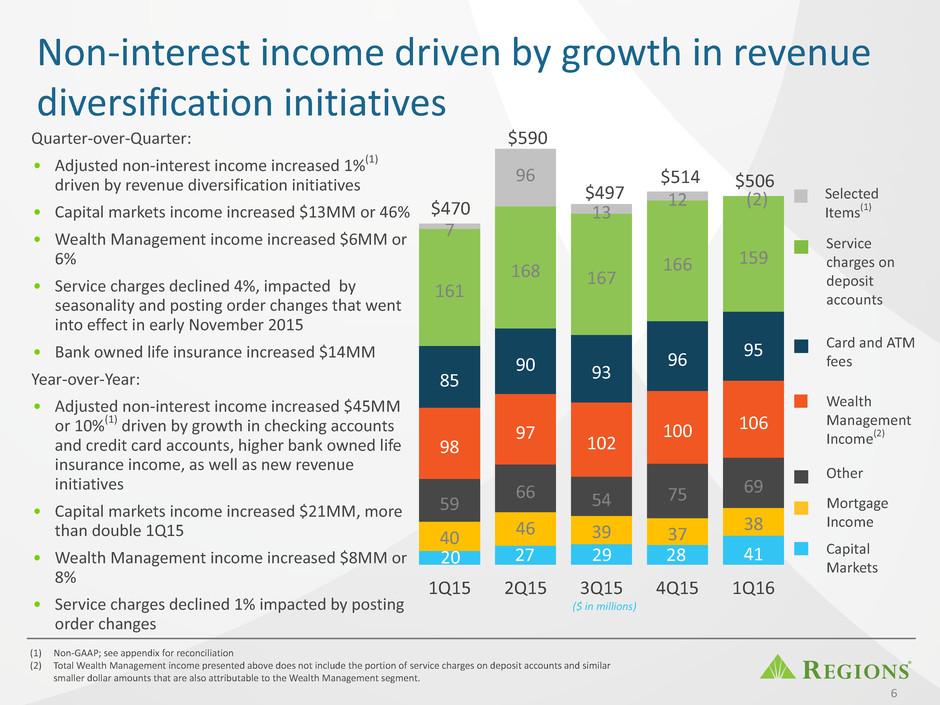

• | Non-interest income increased 1 percent on an adjusted basis(1). |

• | Non-interest expenses decreased 2 percent on an adjusted basis(1). |

• | Net charge-offs decreased 13 percent while non-accrual loans, excluding loans held for sale, increased 27 percent and represented 1.22 percent of loans outstanding. |

2

• | The fully phased-in pro-forma Common Equity Tier 1 ratio(1)(2) was estimated at 10.7 percent and the loan-to-deposit ratio was 83 percent at March 31, 2016. |

First quarter 2016 results compared to first quarter 2015:

• | Average loans and leases increased $4 billion or 5 percent. |

◦ | Business lending balances increased $2 billion or 4 percent on an average basis. |

◦ | Consumer lending balances increased $1 billion or 5 percent on an average basis. |

• | Average deposit balances increased $2 billion or 2 percent; average low-cost deposits increased 4 percent. |

• | Net interest income and other financing income (FTE) increased $51 million or 6 percent. |

• | Non-interest income increased 10 percent on an adjusted basis(1). |

• | Non-interest expenses were relatively flat on an adjusted basis(1). |

• | Net charge-offs increased 26 percent and represented 0.34 percent of average loans while non-accrual loans, excluding loans held for sale, increased 24 percent and represented 1.22 percent of loans outstanding. |

Total revenue

Quarter Ended | ||||||||||||||||||||||||||

($ amounts in millions) | 3/31/2016 | 12/31/2015 | 3/31/2015 | 1Q16 vs. 4Q15 | 1Q16 vs. 1Q15 | |||||||||||||||||||||

Net interest income and other financing income* | $ | 862 | $ | 836 | $ | 815 | $ | 26 | 3.1 | % | $ | 47 | 5.8 | % | ||||||||||||

Net interest income and other financing income (FTE)* | $ | 883 | $ | 856 | $ | 832 | $ | 27 | 3.2 | % | $ | 51 | 6.1 | % | ||||||||||||

Net interest margin (FTE)* | 3.19 | % | 3.08 | % | 3.18 | % | ||||||||||||||||||||

Non-interest income: | ||||||||||||||||||||||||||

Service charges on deposit accounts | 159 | 166 | 161 | (7 | ) | (4.2 | )% | (2 | ) | (1.2 | )% | |||||||||||||||

Wealth Management | 106 | 100 | 98 | 6 | 6.0 | % | 8 | 8.2 | % | |||||||||||||||||

Card and ATM fees | 95 | 96 | 85 | (1 | ) | (1.0 | )% | 10 | 11.8 | % | ||||||||||||||||

Mortgage income | 38 | 37 | 40 | 1 | 2.7 | % | (2 | ) | (5.0 | )% | ||||||||||||||||

Capital markets fee income and other | 41 | 28 | 20 | 13 | 46.4 | % | 21 | 105.0 | % | |||||||||||||||||

Bank-owned life insurance | 33 | 19 | 20 | 14 | 73.7 | % | 13 | 65.0 | % | |||||||||||||||||

Commercial credit fee income | 19 | 19 | 16 | — | — | % | 3 | 18.8 | % | |||||||||||||||||

Net revenue from affordable housing | 11 | 14 | 2 | (3 | ) | (21.4 | )% | 9 | 450 | % | ||||||||||||||||

Securities gains (losses), net | (5 | ) | 11 | 5 | (16 | ) | (145.5 | )% | (10 | ) | (200.0 | )% | ||||||||||||||

Other | 9 | 24 | 23 | (15 | ) | (62.5 | )% | (14 | ) | (60.9 | )% | |||||||||||||||

Non-interest income | 506 | 514 | 470 | (8 | ) | (1.6 | )% | 36 | 7.7 | % | ||||||||||||||||

Total Revenue | $ | 1,368 | $ | 1,350 | $ | 1,285 | $ | 18 | 1.3 | % | $ | 83 | 6.5 | % | ||||||||||||

Adjusted total revenue, taxable-equivalent basis (non-GAAP)(1) | $ | 1,391 | $ | 1,358 | $ | 1,295 | $ | 33 | 2.4 | % | $ | 96 | 7.4 | % | ||||||||||||

3

Comparison of first quarter 2016 to fourth quarter 2015

Total revenue (FTE) was $1.4 billion in the first quarter. On an adjusted basis(1) compared to the prior quarter total revenue (FTE) increased $33 million or 2 percent. Net interest income and other financing income (FTE)was $883 million, an increase of $27 million or 3 percent, and the resulting net interest margin was 3.19 percent. Excluding the $15 million lease adjustment in the prior quarter, net interest income and other financing income (FTE) increased $12 million or 1 percent. Net interest income and other financing income benefited from the increase in short-term rates, higher loan balances and lower premium amortization; however, these increases were partially offset by lower dividends on Federal Reserve stock and one less day in the quarter.

Non-interest income totaled $506 million in the first quarter. On an adjusted basis(1) compared to the prior quarter this represented an increase of 1 percent that was driven primarily by revenue diversification initiatives. In particular, capital markets income increased $13 million or 46 percent from the prior quarter driven by revenue contributions from the recently expanded mergers and acquisition advisory services group, fees generated from the placement of permanent financing for real estate customers, as well as syndicated loan transactions. Wealth Management income increased $6 million or 6 percent from the fourth quarter, driven by seasonal increases in insurance income, revenue from recent insurance related acquisitions and increased investment services fee income. This was partially offset by lower investment management fees driven by challenging market conditions.

Solid growth in checking accounts helped to offset the impact of seasonality and posting order changes that went into effect in early November 2015, as service charges declined 4 percent. Seasonally lower transaction volume impacted card and ATM income which declined 1 percent. Other non-interest income included a reduction to revenue of $12 million reflecting a decline in market value related to assets held for certain employment benefits, which is offset in salaries and benefits.

4

Comparison of first quarter 2016 to first quarter 2015

Total revenue (FTE) increased $96 million or 7 percent on an adjusted basis(1) compared to the first quarter of 2015. Net interest income and other financing income (FTE) increased $51 million or 6 percent. The increase was driven primarily by loan growth, balance sheet hedging and optimization strategies and the impact of higher short term rates.

Non-interest income increased $36 million or 8 percent. The year-over-year improvement was driven primarily by growth in checking accounts and credit card accounts, higher bank owned life insurance income, as well as new revenue initiatives. Capital markets income increased $21 million or more than doubled from the prior year as the company expanded M&A advisory service offerings and increased loan syndication volume and fees generated from the placement of permanent financing for real estate customers.

Card and ATM income increased $10 million or 12 percent, primarily related to an increase in transaction volume as the company grew active debit cards 4 percent and increased commercial card usage 38 percent. Wealth Management income improved $8 million or 8 percent as the company expanded insurance capabilities and increased investment services fee income through additional financial consultants. Service charges declined 1 percent from the first quarter of 2015 and were impacted by posting order changes that went into effect in early November 2015. However, excluding this change, service charges would have increased over the prior year.

5

Non-interest expense

Quarter Ended | ||||||||||||||||||||||||||

($ amounts in millions) | 3/31/2016 | 12/31/2015 | 3/31/2015 | 1Q16 vs. 4Q15 | 1Q16 vs. 1Q15 | |||||||||||||||||||||

Salaries and employee benefits | $ | 475 | $ | 478 | $ | 458 | $ | (3 | ) | (0.6 | )% | $ | 17 | 3.7 | % | |||||||||||

Net occupancy expense | 86 | 91 | 91 | (5 | ) | (5.5 | )% | (5 | ) | (5.5 | )% | |||||||||||||||

Furniture and equipment expense | 78 | 79 | 71 | (1 | ) | (1.3 | )% | 7 | 9.9 | % | ||||||||||||||||

Outside services | 36 | 40 | 31 | (4 | ) | (10.0 | )% | 5 | 16.1 | % | ||||||||||||||||

Marketing | 25 | 23 | 26 | 2 | 8.7 | % | (1 | ) | (3.8 | )% | ||||||||||||||||

Professional, legal and regulatory expenses | 13 | 22 | 19 | (9 | ) | (40.9 | )% | (6 | ) | (31.6 | )% | |||||||||||||||

FDIC insurance assessments | 25 | 22 | 22 | 3 | 13.6 | % | 3 | 13.6 | % | |||||||||||||||||

Credit/checkcard expenses | 13 | 13 | 13 | — | NM | — | NM | |||||||||||||||||||

Branch consolidation, property and equipment charges | 14 | 6 | 22 | 8 | 133.3 | % | (8 | ) | (36.4 | )% | ||||||||||||||||

Loss on early extinguishment of debt | — | — | 43 | — | NM | (43 | ) | (100.0 | )% | |||||||||||||||||

Other | 104 | 99 | 109 | 5 | 5.1 | % | (5 | ) | (4.6 | )% | ||||||||||||||||

Total non-interest expense from continuing operations | $ | 869 | $ | 873 | $ | 905 | $ | (4 | ) | (0.5 | )% | $ | (36 | ) | (4.0 | )% | ||||||||||

Total adjusted non-interest expense(1) | $ | 843 | $ | 861 | $ | 840 | $ | (18 | ) | (2.1 | )% | $ | 3 | 0.4 | % | |||||||||||

Comparison of first quarter 2016 to fourth quarter 2015

Non-interest expense totaled $869 million in the first quarter. On an adjusted basis(1) this represents a decrease of $18 million or 2 percent. Total salaries and benefits decreased $3 million from the previous quarter, which included $12 million in severance expense. Excluding severance charges in both the first quarter of 2016 and the fourth quarter of 2015, salaries and benefits declined $9 million or 2 percent. The decrease for the quarter was primarily due to a 2 percent reduction in staffing and lower expenses related to a decline in market value for assets held for certain employment benefits. This was partially offset by seasonal increases in payroll taxes and increased incentives related to fee based revenue growth.

Legal fees declined $9 million or 41 percent which included a favorable legal settlement of $7 million. Total occupancy expenses decreased as the company benefits from lower total square footage resulting from branch and non-branch reductions.

6

The adjusted efficiency ratio(1) was 60.6 percent. Under the current operating environment with continued low interest rates, the company remains committed to disciplined expense management and is taking steps to continue to improve efficiencies and lower costs.

The effective tax rate for the first quarter was 29.3 percent which includes a benefit related to the conclusion of a state tax examination. Excluding the impact of this benefit, the effective tax rate was 30.3 percent. The effective tax rate is expected to be in the 29 to 31 percent range during 2016.

Comparison of first quarter 2016 to first quarter 2015

Non-interest expense increased $3 million on an adjusted basis(1) from the first quarter of last year. Total salaries and benefits increased $17 million from the previous year, primarily attributable to $12 million in 2016 severance expenses.

The company incurred branch consolidation, property and equipment costs totaling $14 million in the first quarter of 2016 and $22 million in the first quarter of 2015. Legal fees declined $6 million from the prior year, primarily related to favorable legal settlements in the first quarter of 2016.

Loans and Leases

Average Balances | |||||||||||||||||||||||||

($ amounts in millions) | 1Q16 | 4Q15 | 1Q15 | 1Q16 vs. 4Q15 | 1Q16 vs. 1Q15 | ||||||||||||||||||||

Total commercial | $ | 43,974 | $ | 43,601 | $ | 41,983 | $ | 373 | 0.9 | % | $ | 1,991 | 4.7% | ||||||||||||

Total investor real estate | 7,021 | 6,908 | 6,865 | 113 | 1.6 | % | 156 | 2.3% | |||||||||||||||||

Business Loans | 50,995 | 50,509 | 48,848 | 486 | 1.0 | % | 2,147 | 4.4% | |||||||||||||||||

Residential first mortgage | 12,828 | 12,753 | 12,330 | 75 | 0.6 | % | 498 | 4.0% | |||||||||||||||||

Home equity | 10,956 | 10,948 | 10,885 | 8 | 0.1 | % | 71 | 0.7% | |||||||||||||||||

Indirect—vehicles | 4,056 | 3,969 | 3,708 | 87 | 2.2 | % | 348 | 9.4% | |||||||||||||||||

Indirect—other consumer | 599 | 523 | 237 | 76 | 14.5 | % | 362 | 152.7% | |||||||||||||||||

Consumer credit card | 1,050 | 1,031 | 977 | 19 | 1.8 | % | 73 | 7.5% | |||||||||||||||||

Other consumer | 1,026 | 1,027 | 957 | (1 | ) | (0.1 | )% | 69 | 7.2% | ||||||||||||||||

Consumer Lending | 30,515 | 30,251 | 29,094 | 264 | 0.9 | % | 1,421 | 4.9% | |||||||||||||||||

Total Loans | $ | 81,510 | $ | 80,760 | $ | 77,942 | $ | 750 | 0.9 | % | $ | 3,568 | 4.6% | ||||||||||||

7

Comparison of first quarter 2016 to fourth quarter 2015

Average loans and leases were $82 billion for the first quarter, an increase of $750 million or 1

percent. Average balances in the business lending portfolio were $51 billion during the first quarter, an increase of $486 million or 1 percent. This increase was driven by Corporate Banking and Real Estate Banking. New relationships in the Technology & Defense group and an increase in line utilization in Energy & Natural Resources also contributed to loan growth. Commercial loan balances increased $373 million or 1 percent. Investor real estate loans increased $113 million or 2 percent. Commitments remained flat from the previous quarter and commercial line utilization increased 110 basis points to 47.8 percent from the previous quarter.

The consumer lending portfolio experienced growth in almost every product category as average balances increased $264 million or 1 percent from the prior quarter. Indirect-vehicle lending continued to expand as balances increased $87 million or 2 percent from the previous quarter. Indirect-other increased $76 million or 15 percent as the company continues to successfully expand its point-of-sale initiatives. Residential first mortgage balances increased $75 million or 1 percent, and home equity balances increased $8 million as new production continued to out-pace run-off. Additionally, consumer credit card balances increased $19 million or 2 percent as active credit cards increased 2 percent.

Comparison of first quarter 2016 to first quarter 2015

Average loans and leases increased $4 billion or 5 percent over the prior year (3) as both the business and consumer lending portfolios achieved growth.

Average business lending balances increased $2 billion or 4 percent, as all lending groups achieved growth including Corporate Banking, Commercial Banking and Real Estate Banking. Within Corporate Banking, the company's specialized lending groups achieved solid loan growth, driven by new relationships within Restaurant, Technology & Defense, and Energy & Natural Resources primarily in the midstream sector. Average commercial loan balances increased $2 billion or 5 percent and investor real estate loans increased $156 million or 2 percent. Commitments increased 6 percent and commercial line utilization increased 180 basis points from the previous year.

The consumer lending portfolio experienced growth in every product category as average balances increased $1.4 billion or 5 percent from the prior year. Residential first mortgage balances increased $498 million or 4 percent benefiting from an increase in new-home purchases and continued low interest rates. Home equity balances increased $71 million. Indirect-vehicle lending balances increased $348 million or 9 percent as production increased 21 percent. Indirect-other increased $362 million or 153 percent as the company

8

successfully implemented its point-of-sale initiatives. Additionally, consumer credit card balances increased $73 million or 8 percent as active credit cards increased 12 percent, and the company's penetration rate of deposit base customers increased 165 basis points over the year to approximately 17.5 percent.

Deposits

Average Balances | ||||||||||||||||||||||||

($ amounts in millions) | 1Q16 | 4Q15 | 1Q15 | 1Q16 vs. 4Q15 | 1Q16 vs. 1Q15 | |||||||||||||||||||

Low-cost deposits | $ | 90,382 | $ | 89,670 | $ | 87,283 | $ | 712 | 0.8% | $ | 3,099 | 3.6% | ||||||||||||

Time deposits | 7,368 | 7,818 | 8,500 | (450 | ) | (5.8)% | (1,132 | ) | (13.3)% | |||||||||||||||

Total Deposits | $ | 97,750 | $ | 97,488 | $ | 95,783 | $ | 262 | 0.3% | $ | 1,967 | 2.1% | ||||||||||||

Comparison of first quarter 2016 to fourth quarter 2015

Total average deposit balances were $98 billion in the first quarter, an increase of $262 million compared to the prior quarter. In the quarter, average low-cost deposits increased $712 million and represented 92 percent of average deposits, reflecting the company's solid funding base. Deposit costs remained near historical lows at 11 basis points, and total funding costs were 28 basis points for the first quarter.

Comparison of first quarter 2016 to first quarter 2015

Total average deposit balances increased $2 billion or 2 percent from the prior year. Average low-cost deposits increased $3 billion or 4 percent from the prior year.

9

Asset quality

As of and for the Quarter Ended | ||||||

($ amounts in millions) | 3/31/2016 | 12/31/2015 | 3/31/2015 | |||

ALL/Loans, net~ | 1.41% | 1.36% | 1.40% | |||

Net loan charge-offs as a % of average loans, annualized | 0.34% | 0.38% | 0.28% | |||

Non-accrual loans, excluding loans held for sale/Loans, net | 1.22% | 0.96% | 1.02% | |||

NPAs (ex. 90+ past due)/Loans, foreclosed properties and non-performing loans held for sale | 1.36% | 1.13% | 1.24% | |||

NPAs (inc. 90+ past due)/Loans, foreclosed properties and non-performing loans held for sale | 1.61% | 1.39% | 1.51% | |||

Total TDRs | $1,276 | $1,303 | $1,505 | |||

Total Criticized and Classified Loans—Business Services* | $3,625 | $3,371 | $2,824 | |||

* Business services represents the combined total of commercial and investor real estate loans.

~ ALL excludes operating leases

Comparison of first quarter 2016 to fourth quarter 2015

Net charge-offs totaled $68 million for the first quarter, a decrease of $10 million from the previous quarter. Net charge-offs as a percent of average loans were 0.34 percent compared to 0.38 percent in the fourth quarter. The provision for loan losses was $113 million, and the resulting allowance for loan and lease losses was 1.41 percent of total loans outstanding at the end of the quarter. This compares to 1.36 percent of total loans outstanding in the fourth quarter, and the increase was primarily attributable to an increase in energy related loan reserves. Total loan loss allowance for the direct energy loan portfolio was 8 percent at the end of the first quarter compared to 6 percent at the end of the fourth quarter.

Total non-accrual loans, excluding loans held for sale, increased $211 million from the previous quarter and represented 1.22 percent of total loans, while troubled debt restructured loans declined 2 percent. Beginning primarily in the third quarter of 2015, low oil prices began to drive the migration of a number of large energy credits into criticized loans, primarily in the exploration and production as well as oil field services sectors. Continued low oil prices prompted further migration of some of those credits into classified loans. As a result, total business services criticized loans increased 8 percent including a 36 percent increase in classified loans.

Comparison of first quarter 2016 to first quarter 2015

Net charge-offs increased $14 million from the first quarter of 2015. Net charge-offs as a percent of average loans was 0.34 percent compared to 0.28 percent in the first quarter last year. The allowance for loan and lease losses as a percent of total loans increased 1 basis point.

10

Total non-accrual loans, excluding loans held for sale, increased $193 million from the previous year, while troubled debt restructured loans declined 15 percent. Total business services criticized and classified loans increased 28 percent, primarily related to risk rating migration in the energy portfolio.

Capital and liquidity

As of and for Quarter Ended | ||||||

3/31/2016 | 12/31/2015 | 3/31/2015 | ||||

Basel III Common Equity Tier 1 ratio(2) | 10.9% | 10.9% | 11.4% | |||

Basel III Common Equity Tier 1 ratio — Fully Phased-In Pro-Forma (non-GAAP)(1)(2) | 10.7% | 10.7% | 11.2% | |||

Tier 1 capital ratio(2) | 11.6% | 11.7% | 12.2% | |||

Tangible common stockholders’ equity to tangible assets (non-GAAP)(1) | 9.48% | 9.13% | 9.59% | |||

Tangible common book value per share (non-GAAP)(1) | $8.97 | $8.52 | $8.39 | |||

Under the Basel III capital rules, Regions’ estimated ratios remain well above current regulatory requirements. The Tier 1(2) and Common Equity Tier 1(2) ratios were estimated at 11.6 percent and 10.9 percent, respectively, at quarter-end under the phase-in provisions. In addition, the Common Equity Tier 1 ratio(1)(2) was estimated at 10.7 percent on a fully phased-in basis.

During the first quarter, the company repurchased $175 million or 23 million shares of common stock. In addition, the company declared $80 million in dividends to common shareholders.

The company’s loan-to-deposit ratio at the end of the quarter was 83 percent. Additionally, as of period-end, the company was fully compliant with the liquidity coverage ratio rule.

(1) | Non-GAAP, refer to pages 9 and 19 of the financial supplement to this earnings release |

(2) | Current quarter Basel III common equity Tier 1, and Tier 1 capital ratios are estimated. |

(3) | During the fourth quarter of 2015, Regions corrected the accounting for certain leases which had previously been included in commercial loans. These leases had been |

classified as capital leases but were subsequently determined to be operating leases. The adjustment resulted in a reclassification of these leases out of loans into other

earning assets. The average balance of these leases in the first quarter of 2016 was $825 million. Prior periods were not restated to account for this change.

(4) The cumulative effect on pre-tax income related to the lease adjustment lowered net interest income and other financing income $15 million in the fourth quarter of 2015.

Conference Call

A replay of the earnings call will be available from Friday, April 15, 2016, at 2 p.m. ET through Monday, May 15, 2016. To listen by telephone, please dial 1-855-859-2056, and use access code 68982537. An archived webcast will also be available until May 15 on the Investor Relations page of www.regions.com.

About Regions Financial Corporation

Regions Financial Corporation (NYSE: RF), with $126 billion in assets, is a member of the S&P 500 Index and is one of the nation’s largest full-service providers of consumer and commercial banking, wealth management, mortgage, and insurance products and services. Regions serves customers across the South, Midwest and Texas, and through its subsidiary, Regions Bank, operates approximately 1,600 banking offices and 2,000 ATMs.

11

Additional information about Regions and its full line of products and services can be found at www.regions.com.

Forward-Looking Statements

This release may include forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995, which reflect Regions’ current views with respect to future events and financial performance. Forward-looking statements are not based on historical information, but rather are related to future operations, strategies, financial results or other developments. Forward-looking statements are based on management’s expectations as well as certain assumptions and estimates made by, and information available to, management at the time the statements are made. Those statements are based on general assumptions and are subject to various risks, uncertainties and other factors that may cause actual results to differ materially from the views, beliefs and projections expressed in such statements. These risks, uncertainties and other factors include, but are not limited to, those described below:

• | Current and future economic and market conditions in the United States generally or in the communities we serve, including the effects of declines in property values, unemployment rates and potential reductions of economic growth, which may adversely affect our lending and other businesses and our financial results and conditions. |

• | Possible changes in trade, monetary and fiscal policies of, and other activities undertaken by, governments, agencies, central banks and similar organizations, which could have a material adverse effect on our earnings. |

• | The effects of a possible downgrade in the U.S. government’s sovereign credit rating or outlook, which could result in risks to us and general economic conditions that we are not able to predict. |

• | Possible changes in market interest rates or capital markets could adversely affect our revenue and expense, the value of assets and obligations, and the availability and cost of capital and liquidity. |

• | Any impairment of our goodwill or other intangibles, or any adjustment of valuation allowances on our deferred tax assets due to adverse changes in the economic environment, declining operations of the reporting unit, or other factors. |

• | Possible changes in the creditworthiness of customers and the possible impairment of the collectability of loans. |

• | Changes in the speed of loan prepayments, loan origination and sale volumes, charge-offs, loan loss provisions or actual loan losses where our allowance for loan losses may not be adequate to cover our eventual losses. |

• | Possible acceleration of prepayments on mortgage-backed securities due to low interest rates, and the related acceleration of premium amortization on those securities. |

• | Our ability to effectively compete with other financial services companies, some of whom possess greater financial resources than we do and are subject to different regulatory standards than we are. |

• | Loss of customer checking and savings account deposits as customers pursue other, higher-yield investments, which could increase our funding costs. |

• | Our inability to develop and gain acceptance from current and prospective customers for new products and services in a timely manner could have a negative impact on our revenue. |

• | The effects of any developments, changes or actions relating to any litigation or regulatory proceedings brought against us or any of our subsidiaries. |

• | Changes in laws and regulations affecting our businesses, such as the Dodd-Frank Act and other legislation and regulations relating to bank products and services, as well as changes in the enforcement and interpretation of such laws and regulations by applicable governmental and self-regulatory agencies, which could require us to change certain business practices, increase compliance risk, reduce our revenue, impose additional costs on us, or otherwise negatively affect our businesses. |

• | Our ability to obtain a regulatory non-objection (as part of the comprehensive capital analysis and review ("CCAR") process or otherwise) to take certain capital actions, including paying dividends and any plans to increase common stock dividends, repurchase common stock under current or future programs, or redeem preferred stock or other regulatory capital instruments, may impact our ability to return capital to stockholders and market perceptions of us. |

• | Our ability to comply with stress testing and capital planning requirements (as part of the CCAR process or otherwise) may continue to require a significant investment of our managerial resources due to the importance and intensity of such tests and requirements. |

• | Our ability to comply with applicable capital and liquidity requirements (including, among other things, the Basel III capital standards and the liquidity coverage ratio "LCR" rule), including our ability to generate capital internally or raise capital on favorable terms, and if we fail to meet requirements, our financial condition could be negatively impacted. |

• | The Basel III framework calls for additional risk-based capital surcharges for globally systemically important banks. Although we are not subject to such surcharges, it is possible that in the future we may become subject to similar surcharges. |

• | The costs, including possibly incurring fines, penalties, or other negative effects (including reputational harm) of any adverse judicial, administrative, or arbitral rulings or proceedings, regulatory enforcement actions, or other legal actions to which we or any of our subsidiaries are a party, and which may adversely affect our results. |

• | Our ability to manage fluctuations in the value of assets and liabilities and off-balance sheet exposure so as to maintain sufficient capital and liquidity to support our business. |

• | Our ability to execute on our strategic and operational plans, including our ability to fully realize the financial and non-financial benefits relating to our strategic initiatives. |

• | The success of our marketing efforts in attracting and retaining customers. |

• | Possible changes in consumer and business spending and saving habits and the related effect on our ability to increase assets and to attract deposits, which could adversely affect our net income. |

12

• | Our ability to recruit and retain talented and experienced personnel to assist in the development, management and operation of our products and services may be affected by changes in laws and regulations in effect from time to time. |

• | Fraud or misconduct by our customers, employees or business partners. |

• | Any inaccurate or incomplete information provided to us by our customers or counterparties. |

• | The risks and uncertainties related to our acquisition and integration of other companies. |

• | Inability of our framework to manage risks associated with our business such as credit risk and operational risk, including third-party vendors and other service providers, which could, among other things, result in a breach of operating or security systems as a result of a cyber attack or similar act. |

• | The inability of our internal disclosure controls and procedures to prevent, detect or mitigate any material errors or fraudulent acts. |

• | The effects of geopolitical instability, including wars, conflicts and terrorist attacks and the potential impact, directly or indirectly, on our businesses. |

• | The effects of man-made and natural disasters, including fires, floods, droughts, tornadoes, hurricanes, and environmental damage, which may negatively affect our operations and/or our loan portfolios and increase our cost of conducting business. |

• | Changes in commodity market prices and conditions could adversely affect the cash flows of our borrowers operating in industries that are impacted by changes in commodity prices (including businesses indirectly impacted by commodities prices such as businesses that transport commodities or manufacture equipment used in the production of commodities), which could impair their ability to service any loans outstanding to them and/or reduce demand for loans in those industries. |

• | Our inability to keep pace with technological changes could result in losing business to competitors. |

• | Our ability to identify and address cyber-security risks such as data security breaches, “denial of service” attacks, “hacking” and identity theft, a failure of which could disrupt our business and result in the disclosure of and/or misuse or misappropriation of confidential or proprietary information; increased costs; losses; or adverse effects to our reputation. |

• | Significant disruption of, or loss of public confidence in, the Internet and services and devices used to access the Internet could affect the ability of our customers to access their accounts and conduct banking transactions. |

• | Possible downgrades in our credit ratings or outlook could increase the costs of funding from capital markets. |

• | The effects of problems encountered by other financial institutions that adversely affect us or the banking industry generally could require us to change certain business practices, reduce our revenue, impose additional costs on us, or otherwise negatively affect our businesses. |

• | The effects of the failure of any component of our business infrastructure provided by a third party could disrupt our businesses; result in the disclosure of and/or misuse of confidential information or proprietary information; increase our costs; negatively affect our reputation; and cause losses. |

• | Our ability to receive dividends from our subsidiaries could affect our liquidity and ability to pay dividends to stockholders. |

• | Changes in accounting policies or procedures as may be required by the Financial Accounting Standards Board ("FASB") or other regulatory agencies could materially affect how we report our financial results. |

• | Other risks identified from time to time in reports that we file with the Securities and Exchange Commission ("SEC"). |

• | The effects of any damage to our reputation resulting from developments related to any of the items identified above. |

The foregoing list of factors is not exhaustive. For discussion of these and other factors that may cause actual results to differ from expectations, look under the captions “Forward-Looking Statements” and “Risk Factors” of Regions’ Annual Report on Form 10-K for the year ended December 31, 2015, as filed with the Securities and Exchange Commission.

The words “anticipates,” “intends,” “plans,” “seeks,” “believes,” “estimates,” “expects,” “targets,” “projects,” “outlook,” “forecast,” “will,” “may,” “could,” “should,” “can,” and similar expressions often signify forward-looking statements. You should not place undue reliance on any forward-looking statements, which speak only as of the date made. We assume no obligation to update or revise any forward-looking statements that are made from time to time.

Regions’ Investor Relations contact is Dana Nolan at (205) 581-7890; Regions’ Media contact is Evelyn Mitchell at (205) 264-4551.

Use of non-GAAP financial measures

Management uses the adjusted efficiency ratio (non-GAAP) and the adjusted fee income ratio (non-GAAP) to monitor performance and believes these measures provide meaningful information to investors. Non-interest expense (GAAP) is presented excluding certain adjustments to arrive at adjusted non-interest expense (non-GAAP), which is the numerator for the efficiency ratio. Non-interest income (GAAP) is presented excluding certain adjustments to arrive at adjusted non-interest income (non-GAAP), which is the numerator for the fee income ratio. Net interest income and other financing income on a taxable-equivalent basis and non-interest income are added together to arrive at total revenue on a taxable-equivalent basis. Adjustments are made to arrive at adjusted total revenue on a taxable-equivalent basis (non-GAAP), which is the denominator for the fee income and efficiency ratios. Regions believes that the exclusion of these adjustments provides a meaningful base for period-to-period comparisons, which management believes will assist investors in analyzing the operating results of the Company and predicting future performance. These non-GAAP financial measures are also used by management to assess the performance of Regions’ business. It is possible that the activities related to the adjustments may recur; however, management does not consider the activities related to the adjustments to be indications of ongoing operations. Regions believes that presentation of these non-GAAP financial measures will permit investors to assess the performance of the Company on the same basis as that applied by management.

Tangible common stockholders’ equity ratios have become a focus of some investors and management believes they may assist investors in analyzing the capital position of the Company absent the effects of intangible assets and preferred stock. Analysts and banking regulators have assessed Regions’ capital

13

adequacy using the tangible common stockholders’ equity measure. Because tangible common stockholders’ equity is not formally defined by GAAP or prescribed in any amount by federal banking regulations it is currently considered to be a non-GAAP financial measure and other entities may calculate it differently than Regions’ disclosed calculations. Since analysts and banking regulators may assess Regions’ capital adequacy using tangible common stockholders’ equity, management believes that it is useful to provide investors the ability to assess Regions’ capital adequacy on this same basis.

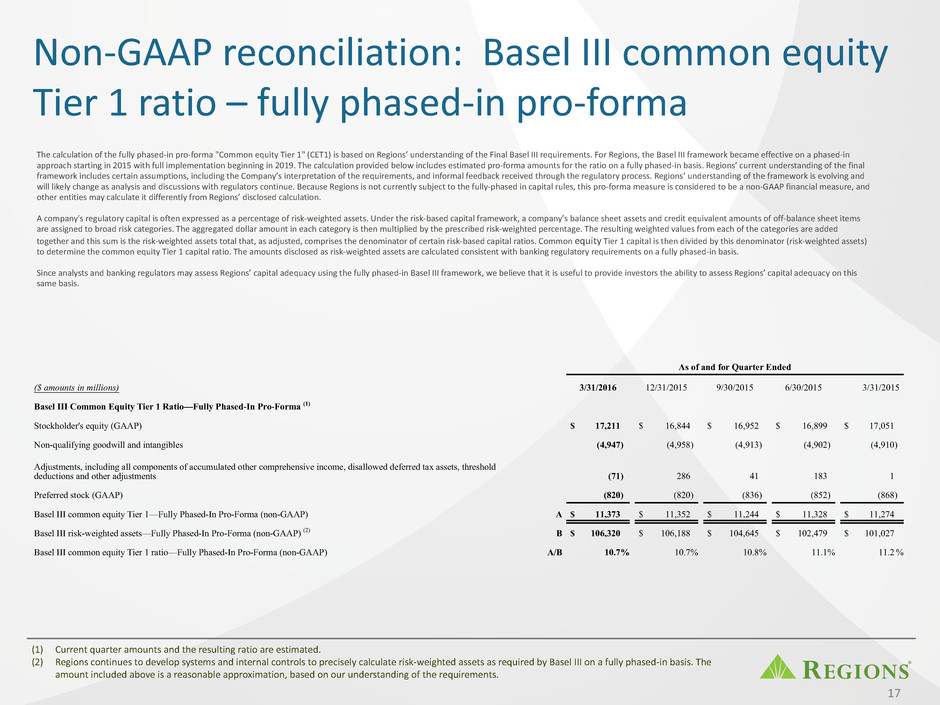

The calculation of the fully phased-in pro-forma "Common equity Tier 1" (CET1) is based on Regions’ understanding of the Final Basel III requirements. For Regions, the Basel III framework became effective on a phased-in approach starting in 2015 with full implementation beginning in 2019. The calculation includes estimated pro-forma amounts for the ratio on a fully phased-in basis. Regions’ current understanding of the final framework includes certain assumptions, including the Company’s interpretation of the requirements, and informal feedback received through the regulatory process. Regions’ understanding of the framework is evolving and will likely change as analysis and discussions with regulators continue. Because Regions is not currently subject to the fully-phased in capital rules, this pro-forma measure is considered to be a non-GAAP financial measure, and other entities may calculate it differently from Regions’ disclosed calculation.

A company's regulatory capital is often expressed as a percentage of risk-weighted assets. Under the risk-based capital framework, a company’s balance sheet assets and credit equivalent amounts of off-balance sheet items are assigned to broad risk categories. The aggregated dollar amount in each category is then multiplied by the prescribed risk-weighted percentage. The resulting weighted values from each of the categories are added together and this sum is the risk-weighted assets total that, as adjusted, comprises the denominator of certain risk-based capital ratios. CET1 capital is then divided by this denominator (risk-weighted assets) to determine the CET1 capital ratio. The amounts disclosed as risk-weighted assets are calculated consistent with banking regulatory requirements on a fully phased-in basis.

During the fourth quarter 2015, Regions corrected the accounting for certain leases which had previously been included in loans. These leases had been classified as capital leases but were subsequently determined to be operating leases. The adjustment resulted in a reclassification of these leases out of loans into other earning assets. Regions believes including the impact of the operating leases, reported as capital leases prior to the fourth quarter of 2015, provides a meaningful calculation of loan and lease growth rates and presents them on the same basis as that applied by management. Total loans (GAAP) is presented including the lease adjustment to arrive at adjusted total loans and leases (non-GAAP).

Non-GAAP financial measures have inherent limitations, are not required to be uniformly applied and are not audited. Although these non-GAAP financial measures are frequently used by stakeholders in the evaluation of a company, they have limitations as analytical tools, and should not be considered in isolation, or as a substitute for analyses of results as reported under GAAP. In particular, a measure of earnings that excludes selected items does not represent the amount that effectively accrues directly to stockholders.

Management and the Board of Directors utilize non-GAAP measures as follows:

•Preparation of Regions' operating budgets

•Monthly financial performance reporting

•Monthly close-out reporting of consolidated results (management only)

•Presentation to investors of company performance

14

Exhibit 99.2

Regions Financial Corporation and Subsidiaries

Financial Supplement

First Quarter 2016

Regions Financial Corporation and Subsidiaries

Financial Supplement to First Quarter 2016 Earnings Release

Table of Contents

Page | ||

Financial Highlights | ||

Selected Ratios and Other Information | ||

Consolidated Statements of Income | ||

Consolidated Average Daily Balances and Yield / Rate Analysis from Continuing Operations | ||

Pre-Tax Pre-Provision Income ("PPI") and Adjusted PPI | ||

Non-Interest Income, Mortgage Income and Wealth Management Income | ||

Non-Interest Expense | ||

Reconciliation to GAAP Financial Measures | ||

Adjusted Efficiency Ratios, Adjusted Fee Income Ratios, Adjusted Non-Interest Income / Expense, and Return Ratios | ||

Statement of Discontinued Operations | ||

Credit Quality | ||

Allowance for Credit Losses, Net Charge-Offs and Related Ratios | ||

Non-Accrual Loans (excludes loans held for sale), Criticized and Classified Loans - Commercial and Investor Real Estate, and Home Equity Lines of Credit - Future Principal Payment Resets | ||

Early and Late Stage Delinquencies | ||

Troubled Debt Restructurings | ||

Consolidated Balance Sheets | ||

Loans and Leases | ||

Deposits | ||

Reconciliation to GAAP Financial Measures | ||

Tangible Common Ratios and Capital | ||

Forward Looking Statements | ||

Regions Financial Corporation and Subsidiaries

Financial Supplement to First Quarter 2016 Earnings Release

Financial Highlights

Quarter Ended | |||||||||||||||||||

($ amounts in millions, except per share data) | 3/31/2016 | 12/31/2015 | 9/30/2015 | 6/30/2015 | 3/31/2015 | ||||||||||||||

Earnings Summary | |||||||||||||||||||

Interest income and other financing income - taxable equivalent | $ | 984 | $ | 953 | $ | 920 | $ | 902 | $ | 903 | |||||||||

Interest expense - taxable equivalent | 74 | 69 | 65 | 63 | 71 | ||||||||||||||

Depreciation expense on operating lease assets | 27 | 28 | — | — | — | ||||||||||||||

Net interest income and other financing income - taxable equivalent | 883 | 856 | 855 | 839 | 832 | ||||||||||||||

Less: Taxable-equivalent adjustment | 21 | 20 | 19 | 19 | 17 | ||||||||||||||

Net interest income and other financing income | 862 | 836 | 836 | 820 | 815 | ||||||||||||||

Provision for loan losses | 113 | 69 | 60 | 63 | 49 | ||||||||||||||

Net interest income and other financing income after provision for loan losses | 749 | 767 | 776 | 757 | 766 | ||||||||||||||

Non-interest income | 506 | 514 | 497 | 590 | 470 | ||||||||||||||

Non-interest expense | 869 | 873 | 895 | 934 | 905 | ||||||||||||||

Income from continuing operations before income taxes | 386 | 408 | 378 | 413 | 331 | ||||||||||||||

Income tax expense | 113 | 120 | 116 | 124 | 95 | ||||||||||||||

Income from continuing operations | 273 | 288 | 262 | 289 | 236 | ||||||||||||||

Income (loss) from discontinued operations before income taxes | — | (6 | ) | (6 | ) | (6 | ) | (4 | ) | ||||||||||

Income tax expense (benefit) | — | (3 | ) | (2 | ) | (2 | ) | (2 | ) | ||||||||||

Income (loss) from discontinued operations, net of tax | — | (3 | ) | (4 | ) | (4 | ) | (2 | ) | ||||||||||

Net income | $ | 273 | $ | 285 | $ | 258 | $ | 285 | $ | 234 | |||||||||

Income from continuing operations available to common shareholders | $ | 257 | $ | 272 | $ | 246 | $ | 273 | $ | 220 | |||||||||

Net income available to common shareholders | $ | 257 | $ | 269 | $ | 242 | $ | 269 | $ | 218 | |||||||||

Earnings per common share from continuing operations - basic | $ | 0.20 | $ | 0.21 | $ | 0.19 | $ | 0.20 | $ | 0.16 | |||||||||

Earnings per common share from continuing operations - diluted | 0.20 | 0.21 | 0.19 | 0.20 | 0.16 | ||||||||||||||

Earnings per common share - basic | 0.20 | 0.21 | 0.18 | 0.20 | 0.16 | ||||||||||||||

Earnings per common share - diluted | 0.20 | 0.21 | 0.18 | 0.20 | 0.16 | ||||||||||||||

Balance Sheet Summary | |||||||||||||||||||

At quarter-end—Consolidated | |||||||||||||||||||

Loans, net of unearned income | $ | 81,606 | $ | 81,162 | $ | 81,063 | $ | 80,149 | $ | 78,243 | |||||||||

Allowance for loan losses | (1,151 | ) | (1,106 | ) | (1,115 | ) | (1,115 | ) | (1,098 | ) | |||||||||

Assets | 125,539 | 126,050 | 124,789 | 121,855 | 122,447 | ||||||||||||||

Deposits | 98,154 | 98,430 | 97,178 | 97,075 | 97,477 | ||||||||||||||

Long-term debt | 7,851 | 8,349 | 7,364 | 3,602 | 3,208 | ||||||||||||||

Stockholders' equity | 17,211 | 16,844 | 16,952 | 16,899 | 17,051 | ||||||||||||||

Average balances—Continuing Operations | |||||||||||||||||||

Loans, net of unearned income | $ | 81,510 | $ | 80,760 | $ | 80,615 | $ | 79,175 | $ | 77,942 | |||||||||

Assets | 125,960 | 124,645 | 122,920 | 120,875 | 120,566 | ||||||||||||||

Deposits | 97,750 | 97,488 | 97,166 | 97,100 | 95,783 | ||||||||||||||

Long-term debt | 8,806 | 7,740 | 6,112 | 2,903 | 3,371 | ||||||||||||||

Stockholders' equity | 17,086 | 16,901 | 16,874 | 16,950 | 16,963 | ||||||||||||||

1

Regions Financial Corporation and Subsidiaries

Financial Supplement to First Quarter 2016 Earnings Release

Selected Ratios and Other Information

As of and for Quarter Ended | |||||||||||||||||||

3/31/2016 | 12/31/2015 | 9/30/2015 | 6/30/2015 | 3/31/2015 | |||||||||||||||

Return on average assets from continuing operations* | 0.82 | % | 0.87 | % | 0.79 | % | 0.90 | % | 0.74 | % | |||||||||

Return on average tangible common stockholders’ equity (non-GAAP)* (1) | 9.16 | % | 9.61 | % | 8.65 | % | 9.66 | % | 7.91 | % | |||||||||

Adjusted efficiency ratio from continuing operations (non-GAAP) (1)(2) | 60.6 | % | 63.4 | % | 66.8 | % | 64.5 | % | 64.9 | % | |||||||||

Common book value per share | $ | 12.86 | $ | 12.35 | $ | 12.36 | $ | 12.06 | $ | 12.05 | |||||||||

Tangible common book value per share (non-GAAP) (1) | $ | 8.97 | $ | 8.52 | $ | 8.58 | $ | 8.37 | $ | 8.39 | |||||||||

Tangible common stockholders’ equity to tangible assets (non-GAAP) (1) | 9.48 | % | 9.13 | % | 9.34 | % | 9.52 | % | 9.59 | % | |||||||||

Basel III common equity (3) | $ | 11,496 | $ | 11,543 | $ | 11,438 | $ | 11,527 | 11,477 | ||||||||||

Basel III common equity Tier 1 ratio (3) | 10.9 | % | 10.9 | % | 11.0 | % | 11.3 | % | 11.4 | % | |||||||||

Basel III common equity Tier 1 ratio—Fully Phased-In Pro-Forma (non-GAAP) (1)(3) | 10.7 | % | 10.7 | % | 10.8 | % | 11.1 | % | 11.2 | % | |||||||||

Tier 1 capital ratio (3) | 11.6 | % | 11.7 | % | 11.7 | % | 12.1 | % | 12.2 | % | |||||||||

Total risk-based capital ratio (3) | 13.8 | % | 13.9 | % | 14.0 | % | 14.4 | % | 14.6 | % | |||||||||

Leverage ratio (3) | 10.1 | % | 10.3 | % | 10.4 | % | 10.6 | % | 10.6 | % | |||||||||

Effective tax rate (4) | 29.3 | % | 29.3 | % | 30.7 | % | 30.1 | % | 28.7 | % | |||||||||

Allowance for loan losses as a percentage of loans, net of unearned income | 1.41 | % | 1.36 | % | 1.38 | % | 1.39 | % | 1.40 | % | |||||||||

Allowance for loan losses to non-performing loans, excluding loans held for sale | 1.16 | x | 1.41x | 1.41x | 1.49x | 1.37x | |||||||||||||

Net interest margin (FTE) from continuing operations*(5) | 3.19 | % | 3.08 | % | 3.13 | % | 3.16 | % | 3.18 | % | |||||||||

Loans, net of unearned income, to total deposits | 83.1 | % | 82.5 | % | 83.4 | % | 82.6 | % | 80.3 | % | |||||||||

Net charge-offs as a percentage of average loans* | 0.34 | % | 0.38 | % | 0.30 | % | 0.23 | % | 0.28 | % | |||||||||

Non-accrual loans, excluding loans held for sale, as a percentage of loans | 1.22 | % | 0.96 | % | 0.97 | % | 0.94 | % | 1.02 | % | |||||||||

Non-performing assets (excluding loans 90 days past due) as a percentage of loans, foreclosed properties and non-performing loans held for sale | 1.36 | % | 1.13 | % | 1.14 | % | 1.13 | % | 1.24 | % | |||||||||

Non-performing assets (including loans 90 days past due) as a percentage of loans, foreclosed properties and non-performing loans held for sale (6) | 1.61 | % | 1.39 | % | 1.40 | % | 1.38 | % | 1.51 | % | |||||||||

Associate headcount—full-time equivalent | 22,855 | 23,393 | 23,423 | 23,155 | 23,062 | ||||||||||||||

ATMs | 1,950 | 1,962 | 1,966 | 1,960 | 1,966 | ||||||||||||||

Branch Statistics | |||||||||||||||||||

Full service | 1,525 | 1,548 | 1,549 | 1,549 | 1,551 | ||||||||||||||

Drive-thru/transaction service only | 80 | 79 | 81 | 82 | 82 | ||||||||||||||

Total branch outlets | 1,605 | 1,627 | 1,630 | 1,631 | 1,633 | ||||||||||||||

*Annualized

(1) | See reconciliation of GAAP to non-GAAP Financial Measures on pages 9 and 19. |

(2) | During the fourth quarter of 2015, Regions corrected the accounting for certain leases, for which Regions is the lessor. These leases had been previously classified as capital leases but were subsequently determined to be operating leases and totaled approximately $834 million at December 31, 2015. The aggregate impact of this adjustment lowered net interest income and other financing income $15 million. Excluding the negative impact of the $15 million, the adjusted efficiency ratio would have been 62.7%. During the third quarter of 2015, approximately $23 million of FDIC insurance assessment adjustments to prior assessments were recorded. Excluding the $23 million, the adjusted efficiency ratio would have been 65.0%. |

(3) | Current quarter Basel III common equity as well as the Basel III common equity Tier 1, Tier 1 capital, Total risk-based capital and Leverage ratios are estimated. |

(4) | The first quarter of 2016 includes an income tax benefit related to the conclusion of a state tax examination. The fourth quarter of 2015 reflects the impact of higher than expected income tax benefits related to affordable housing investments. The second quarter of 2015 includes an income tax benefit related to the conclusion of certain state and federal examinations. The first quarter of 2015 includes an income tax benefit related to state deferred tax asset adjustments. |

(5) | Excluding the negative impact of the $15 million lease adjustment discussed above, net interest margin would have been 3.13% for the fourth quarter of 2015. |

(6) | Excludes guaranteed residential first mortgages that are 90+ days past due and still accruing. Refer to the footnotes on page 13 for amounts related to these loans. |

2

Regions Financial Corporation and Subsidiaries

Financial Supplement to First Quarter 2016 Earnings Release

Consolidated Statements of Income (unaudited)

Quarter Ended | |||||||||||||||||||

($ amounts in millions, except per share data) | 3/31/2016 | 12/31/2015 | 9/30/2015 | 6/30/2015 | 3/31/2015 | ||||||||||||||

Interest income, including other financing income on: | |||||||||||||||||||

Loans, including fees (1) | $ | 768 | $ | 741 | $ | 748 | $ | 728 | $ | 725 | |||||||||

Securities—taxable | 147 | 140 | 137 | 141 | 145 | ||||||||||||||

Loans held for sale | 3 | 4 | 5 | 4 | 3 | ||||||||||||||

Trading account securities | 3 | 1 | — | 1 | 3 | ||||||||||||||

Other earning assets | 10 | 14 | 11 | 9 | 10 | ||||||||||||||

Operating lease assets (1) | 32 | 33 | — | — | — | ||||||||||||||

Total interest income, including other financing income | 963 | 933 | 901 | 883 | 886 | ||||||||||||||

Interest expense on: | |||||||||||||||||||

Deposits | 27 | 27 | 27 | 27 | 28 | ||||||||||||||

Short-term borrowings | — | — | — | 1 | — | ||||||||||||||

Long-term borrowings | 47 | 42 | 38 | 35 | 43 | ||||||||||||||

Total interest expense | 74 | 69 | 65 | 63 | 71 | ||||||||||||||

Depreciation expense on operating lease assets (1) | 27 | 28 | — | — | — | ||||||||||||||

Total interest expense and depreciation expense on operating lease assets | 101 | 97 | 65 | 63 | 71 | ||||||||||||||

Net interest income and other financing income | 862 | 836 | 836 | 820 | 815 | ||||||||||||||

Provision for loan losses | 113 | 69 | 60 | 63 | 49 | ||||||||||||||

Net interest income and other financing income after provision for loan losses | 749 | 767 | 776 | 757 | 766 | ||||||||||||||

Non-interest income: | |||||||||||||||||||

Service charges on deposit accounts | 159 | 166 | 167 | 168 | 161 | ||||||||||||||

Card and ATM fees | 95 | 96 | 93 | 90 | 85 | ||||||||||||||

Mortgage income | 38 | 37 | 39 | 46 | 40 | ||||||||||||||

Securities gains (losses), net | (5 | ) | 11 | 7 | 6 | 5 | |||||||||||||

Other | 219 | 204 | 191 | 280 | 179 | ||||||||||||||

Total non-interest income | 506 | 514 | 497 | 590 | 470 | ||||||||||||||

Non-interest expense: | |||||||||||||||||||

Salaries and employee benefits | 475 | 478 | 470 | 477 | 458 | ||||||||||||||

Net occupancy expense | 86 | 91 | 90 | 89 | 91 | ||||||||||||||

Furniture and equipment expense | 78 | 79 | 77 | 76 | 71 | ||||||||||||||

Other | 230 | 225 | 258 | 292 | 285 | ||||||||||||||

Total non-interest expense | 869 | 873 | 895 | 934 | 905 | ||||||||||||||

Income from continuing operations before income taxes | 386 | 408 | 378 | 413 | 331 | ||||||||||||||

Income tax expense | 113 | 120 | 116 | 124 | 95 | ||||||||||||||

Income from continuing operations | 273 | 288 | 262 | 289 | 236 | ||||||||||||||

Discontinued operations: | |||||||||||||||||||

Income (loss) from discontinued operations before income taxes | — | (6 | ) | (6 | ) | (6 | ) | (4 | ) | ||||||||||

Income tax expense (benefit) | — | (3 | ) | (2 | ) | (2 | ) | (2 | ) | ||||||||||

Income (loss) from discontinued operations, net of tax | — | (3 | ) | (4 | ) | (4 | ) | (2 | ) | ||||||||||

Net income | $ | 273 | $ | 285 | $ | 258 | $ | 285 | $ | 234 | |||||||||

Net income from continuing operations available to common shareholders | $ | 257 | $ | 272 | $ | 246 | $ | 273 | $ | 220 | |||||||||

Net income available to common shareholders | $ | 257 | $ | 269 | $ | 242 | $ | 269 | $ | 218 | |||||||||

Weighted-average shares outstanding—during quarter: | |||||||||||||||||||

Basic | 1,286 | 1,301 | 1,319 | 1,335 | 1,346 | ||||||||||||||

Diluted | 1,291 | 1,308 | 1,326 | 1,346 | 1,358 | ||||||||||||||

Actual shares outstanding—end of quarter | 1,275 | 1,297 | 1,304 | 1,331 | 1,343 | ||||||||||||||

Earnings per common share from continuing operations: | |||||||||||||||||||

Basic | $ | 0.20 | $ | 0.21 | $ | 0.19 | $ | 0.20 | $ | 0.16 | |||||||||

Diluted | $ | 0.20 | $ | 0.21 | $ | 0.19 | $ | 0.20 | $ | 0.16 | |||||||||

Earnings per common share: | |||||||||||||||||||

Basic | $ | 0.20 | $ | 0.21 | $ | 0.18 | $ | 0.20 | $ | 0.16 | |||||||||

Diluted | $ | 0.20 | $ | 0.21 | $ | 0.18 | $ | 0.20 | $ | 0.16 | |||||||||

Cash dividends declared per common share | $ | 0.06 | $ | 0.06 | $ | 0.06 | $ | 0.06 | $ | 0.05 | |||||||||

Taxable-equivalent net interest income and other financing income from continuing operations | $ | 883 | $ | 856 | $ | 855 | $ | 839 | $ | 832 | |||||||||

_________

(1) During the fourth quarter of 2015, Regions corrected the accounting for certain leases, for which Regions is the lessor. These leases had been previously classified as capital leases but were subsequently determined to be operating leases and totaled approximately $834 million at December 31, 2015. The aggregate impact of this adjustment lowered net interest income and other financing income $15 million.

3

Regions Financial Corporation and Subsidiaries

Financial Supplement to First Quarter 2016 Earnings Release

Consolidated Average Daily Balances and Yield/Rate Analysis from Continuing Operations

Quarter Ended | |||||||||||||||||||||

3/31/2016 | 12/31/2015 | ||||||||||||||||||||

($ amounts in millions; yields on taxable-equivalent basis) | Average Balance | Income/ Expense | Yield/ Rate | Average Balance | Income/ Expense | Yield/ Rate | |||||||||||||||

Assets | |||||||||||||||||||||

Earning assets: | |||||||||||||||||||||

Federal funds sold and securities purchased under agreements to resell | $ | 11 | $ | — | — | % | $ | 10 | $ | — | — | % | |||||||||

Trading account securities | 132 | 3 | 10.20 | 138 | 1 | 3.71 | |||||||||||||||

Securities: | |||||||||||||||||||||

Taxable | 24,618 | 147 | 2.39 | 24,325 | 140 | 2.28 | |||||||||||||||

Tax-exempt | 1 | — | — | 1 | — | — | |||||||||||||||

Loans held for sale | 362 | 3 | 3.30 | 404 | 4 | 4.18 | |||||||||||||||

Loans, net of unearned income: | |||||||||||||||||||||

Commercial and industrial (1) | 36,103 | 321 | 3.56 | 35,511 | 290 | 3.24 | |||||||||||||||

Commercial real estate mortgage—owner-occupied | 7,512 | 91 | 4.79 | 7,675 | 97 | 5.04 | |||||||||||||||

Commercial real estate construction—owner-occupied | 359 | 4 | 4.17 | 415 | 5 | 4.48 | |||||||||||||||

Commercial investor real estate mortgage | 4,430 | 34 | 3.07 | 4,332 | 35 | 3.20 | |||||||||||||||

Commercial investor real estate construction | 2,591 | 20 | 3.11 | 2,576 | 19 | 2.97 | |||||||||||||||

Residential first mortgage | 12,828 | 125 | 3.89 | 12,753 | 127 | 3.93 | |||||||||||||||

Home equity | 10,956 | 99 | 3.63 | 10,948 | 96 | 3.48 | |||||||||||||||

Indirect—vehicles | 4,056 | 32 | 3.18 | 3,969 | 32 | 3.22 | |||||||||||||||

Indirect—other consumer | 599 | 10 | 6.41 | 523 | 8 | 5.71 | |||||||||||||||

Consumer credit card | 1,050 | 31 | 12.01 | 1,031 | 30 | 11.52 | |||||||||||||||

Other consumer | 1,026 | 22 | 8.47 | 1,027 | 22 | 8.50 | |||||||||||||||

Total loans, net of unearned income (1) | 81,510 | 789 | 3.87 | 80,760 | 761 | 3.74 | |||||||||||||||

Investment in operating leases, net (1) | 825 | 5 | 2.71 | 852 | 5 | 2.60 | |||||||||||||||

Other earning assets | 4,046 | 10 | 0.98 | 3,709 | 14 | 1.39 | |||||||||||||||

Total earning assets | 111,505 | 957 | 3.43 | 110,199 | 925 | 3.33 | |||||||||||||||

Allowance for loan losses | (1,108 | ) | (1,120 | ) | |||||||||||||||||

Cash and due from banks | 1,710 | 1,642 | |||||||||||||||||||

Other non-earning assets | 13,853 | 13,924 | |||||||||||||||||||

$ | 125,960 | $ | 124,645 | ||||||||||||||||||

Liabilities and Stockholders’ Equity | |||||||||||||||||||||

Interest-bearing liabilities: | |||||||||||||||||||||

Savings | $ | 7,491 | 3 | 0.16 | $ | 7,245 | 2 | 0.12 | |||||||||||||

Interest-bearing checking | 21,244 | 5 | 0.10 | 21,052 | 5 | 0.08 | |||||||||||||||

Money market | 26,821 | 7 | 0.10 | 26,627 | 7 | 0.10 | |||||||||||||||

Time deposits | 7,368 | 12 | 0.67 | 7,818 | 13 | 0.67 | |||||||||||||||

Total interest-bearing deposits (2) | 62,924 | 27 | 0.18 | 62,742 | 27 | 0.17 | |||||||||||||||

Federal funds purchased and securities sold under agreements to repurchase | — | — | — | 10 | — | — | |||||||||||||||

Other short-term borrowings | 8 | — | — | 3 | — | — | |||||||||||||||

Long-term borrowings | 8,806 | 47 | 2.13 | 7,740 | 42 | 2.19 | |||||||||||||||

Total interest-bearing liabilities | 71,738 | 74 | 0.42 | 70,495 | 69 | 0.39 | |||||||||||||||

Non-interest-bearing deposits (2) | 34,826 | — | — | 34,746 | — | — | |||||||||||||||

Total funding sources | 106,564 | 74 | 0.28 | 105,241 | 69 | 0.26 | |||||||||||||||

Net interest spread | 3.01 | 2.94 | |||||||||||||||||||

Other liabilities | 2,310 | 2,503 | |||||||||||||||||||

Stockholders’ equity | 17,086 | 16,901 | |||||||||||||||||||

$ | 125,960 | $ | 124,645 | ||||||||||||||||||

Net interest income and other financing income/margin FTE basis (1) | $ | 883 | 3.19 | % | $ | 856 | 3.08 | % | |||||||||||||

_______

(1) During the fourth quarter of 2015, Regions corrected the accounting for approximately $852 million of average balances of leases, for which Regions is the lessor. These leases had been previously classified as capital leases but were subsequently determined to be operating leases. Net interest margin, excluding the negative impact of the $15 million lease adjustment recorded in the fourth quarter of 2015 would have been 3.13%.

(2) | Total deposit costs from continuing operations may be calculated by dividing total interest expense on deposits by the sum of interest-bearing deposits and non-interest bearing deposits. The rates for total deposit costs from continuing operations equal 0.11% for both quarters ended March 31, 2016 and December 31, 2015. |

4

Regions Financial Corporation and Subsidiaries

Financial Supplement to First Quarter 2016 Earnings Release

Consolidated Average Daily Balances and Yield/Rate Analysis from Continuing Operations (Continued)

Quarter Ended | ||||||||||||||||||||||||||||||||

9/30/2015 | 6/30/2015 | 3/31/2015 | ||||||||||||||||||||||||||||||

($ amounts in millions; yields on taxable-equivalent basis) | Average Balance | Income/ Expense | Yield/ Rate | Average Balance | Income/ Expense | Yield/ Rate | Average Balance | Income/ Expense | Yield/ Rate | |||||||||||||||||||||||

Assets | ||||||||||||||||||||||||||||||||

Earning assets: | ||||||||||||||||||||||||||||||||

Federal funds sold and securities purchased under agreements to resell | $ | 3 | $ | — | — | % | $ | 2 | $ | — | — | % | $ | 21 | $ | — | — | % | ||||||||||||||

Trading account securities | 111 | — | — | 112 | 1 | 1.06 | 104 | 3 | 12.91 | |||||||||||||||||||||||

Securities: | ||||||||||||||||||||||||||||||||

Taxable | 23,912 | 137 | 2.28 | 24,114 | 142 | 2.35 | 24,170 | 145 | 2.43 | |||||||||||||||||||||||

Tax-exempt | 1 | — | — | 2 | — | — | 2 | — | — | |||||||||||||||||||||||

Loans held for sale | 492 | 5 | 3.58 | 463 | 4 | 3.44 | 406 | 3 | 3.46 | |||||||||||||||||||||||

Loans, net of unearned income: | ||||||||||||||||||||||||||||||||

Commercial and industrial | 35,647 | 302 | 3.37 | 34,480 | 291 | 3.38 | 33,418 | 287 | 3.48 | |||||||||||||||||||||||

Commercial real estate mortgage—owner-occupied | 7,768 | 99 | 5.04 | 7,921 | 97 | 4.89 | 8,143 | 98 | 4.90 | |||||||||||||||||||||||

Commercial real estate construction—owner-occupied | 443 | 5 | 4.31 | 430 | 5 | 4.25 | 422 | 4 | 4.22 | |||||||||||||||||||||||

Commercial investor real estate mortgage | 4,441 | 35 | 3.14 | 4,549 | 36 | 3.15 | 4,629 | 36 | 3.15 | |||||||||||||||||||||||

Commercial investor real estate construction | 2,455 | 18 | 2.96 | 2,416 | 18 | 3.00 | 2,236 | 17 | 3.04 | |||||||||||||||||||||||

Residential first mortgage | 12,649 | 123 | 3.86 | 12,471 | 121 | 3.91 | 12,330 | 121 | 3.97 | |||||||||||||||||||||||

Home equity | 10,902 | 96 | 3.51 | 10,867 | 96 | 3.55 | 10,885 | 97 | 3.61 | |||||||||||||||||||||||

Indirect—vehicles | 3,863 | 31 | 3.23 | 3,768 | 31 | 3.29 | 3,708 | 31 | 3.37 | |||||||||||||||||||||||

Indirect—other consumer | 439 | 6 | 5.44 | 328 | 4 | 4.83 | 237 | 2 | 3.96 | |||||||||||||||||||||||

Consumer credit card | 1,004 | 30 | 11.57 | 975 | 27 | 11.23 | 977 | 28 | 11.73 | |||||||||||||||||||||||

Other consumer | 1,004 | 22 | 8.61 | 970 | 21 | 8.63 | 957 | 21 | 8.81 | |||||||||||||||||||||||

Total loans, net of unearned income | 80,615 | 767 | 3.78 | 79,175 | 747 | 3.78 | 77,942 | 742 | 3.86 | |||||||||||||||||||||||

Investment in operating leases, net | — | — | — | — | — | — | — | — | — | |||||||||||||||||||||||

Other earning assets | 3,441 | 11 | 1.21 | 2,659 | 8 | 1.44 | 3,486 | 10 | 1.11 | |||||||||||||||||||||||

Total earning assets | 108,575 | 920 | 3.36 | 106,527 | 902 | 3.40 | 106,131 | 903 | 3.45 | |||||||||||||||||||||||

Allowance for loan losses | (1,111 | ) | (1,097 | ) | (1,098 | ) | ||||||||||||||||||||||||||

Cash and due from banks | 1,687 | 1,706 | 1,773 | |||||||||||||||||||||||||||||

Other non-earning assets | 13,769 | 13,739 | 13,760 | |||||||||||||||||||||||||||||

$ | 122,920 | $ | 120,875 | $ | 120,566 | |||||||||||||||||||||||||||

Liabilities and Stockholders’ Equity | ||||||||||||||||||||||||||||||||

Interest-bearing liabilities: | ||||||||||||||||||||||||||||||||

Savings | $ | 7,182 | 2 | 0.13 | $ | 7,165 | 3 | 0.12 | $ | 6,878 | 2 | 0.14 | ||||||||||||||||||||

Interest-bearing checking | 20,992 | 4 | 0.08 | 21,494 | 4 | 0.08 | 21,769 | 5 | 0.09 | |||||||||||||||||||||||

Money market | 26,793 | 7 | 0.10 | 26,483 | 7 | 0.11 | 26,381 | 7 | 0.11 | |||||||||||||||||||||||

Time deposits | 8,110 | 14 | 0.67 | 8,250 | 13 | 0.67 | 8,500 | 14 | 0.65 | |||||||||||||||||||||||

Total interest-bearing deposits (1) | 63,077 | 27 | 0.17 | 63,392 | 27 | 0.17 | 63,528 | 28 | 0.18 | |||||||||||||||||||||||

Federal funds purchased and securities sold under agreements to repurchase | 46 | — | — | 637 | — | — | 1,685 | — | — | |||||||||||||||||||||||

Other short-term borrowings | 250 | — | — | 942 | 1 | 0.21 | 161 | — | — | |||||||||||||||||||||||

Long-term borrowings | 6,112 | 38 | 2.45 | 2,903 | 35 | 4.83 | 3,371 | 43 | 5.20 | |||||||||||||||||||||||

Total interest-bearing liabilities | 69,485 | 65 | 0.37 | 67,874 | 63 | 0.37 | 68,745 | 71 | 0.42 | |||||||||||||||||||||||

Non-interest-bearing deposits (2) | 34,089 | — | — | 33,708 | — | — | 32,255 | — | — | |||||||||||||||||||||||

Total funding sources | 103,574 | 65 | 0.25 | 101,582 | 63 | 0.25 | 101,000 | 71 | 0.29 | |||||||||||||||||||||||

Net interest spread | 2.99 | 3.03 | 3.03 | |||||||||||||||||||||||||||||

Other liabilities | 2,472 | 2,343 | 2,603 | |||||||||||||||||||||||||||||

Stockholders’ equity | 16,874 | 16,950 | 16,963 | |||||||||||||||||||||||||||||

$ | 122,920 | $ | 120,875 | $ | 120,566 | |||||||||||||||||||||||||||

Net interest income and other financing income/margin FTE basis | $ | 855 | 3.13 | % | $ | 839 | 3.16 | % | $ | 832 | 3.18 | % | ||||||||||||||||||||

(1) | Total deposit costs from continuing operations may be calculated by dividing total interest expense on deposits by the sum of interest-bearing deposits and non-interest bearing deposits. The rates for total deposit costs from continuing operations equal 0.11%, 0.11% and 0.12% for each of the quarters ended September 31, 2015, June 30, 2015, and March 31, 2015, respectively. |

5

Regions Financial Corporation and Subsidiaries

Financial Supplement to First Quarter 2016 Earnings Release

Pre-Tax Pre-Provision Income ("PPI") and Adjusted PPI (non-GAAP)

The Pre-Tax Pre-Provision Income table below presents computations of pre-tax pre-provision income from continuing operations excluding certain adjustments (non-GAAP). Regions believes that the presentation of PPI and the exclusion of certain items from PPI provides a meaningful base for period-to-period comparisons, which management believes will assist investors in analyzing the operating results of the Company and predicting future performance. These non-GAAP financial measures are also used by management to assess the performance of Regions’ business. It is possible that the activities related to the adjustments may recur; however, management does not consider the activities related to the adjustments to be indications of ongoing operations. Regions believes that presentation of these non-GAAP financial measures will permit investors to assess the performance of the Company on the same basis as that applied by management. Non-GAAP financial measures have inherent limitations, are not required to be uniformly applied and are not audited. Although these non-GAAP financial measures are frequently used by stakeholders in the evaluation of a company, they have limitations as analytical tools, and should not be considered in isolation, or as a substitute for analyses of results as reported under GAAP. In particular, a measure of income that excludes certain adjustments does not represent the amount that effectively accrues directly to stockholders.

Quarter Ended | |||||||||||||||||||||||||||||||||

($ amounts in millions) | 3/31/2016 | 12/31/2015 | 9/30/2015 | 6/30/2015 | 3/31/2015 | 1Q16 vs. 4Q15 | 1Q16 vs. 1Q15 | ||||||||||||||||||||||||||

Net income from continuing operations available to common shareholders (GAAP) | $ | 257 | $ | 272 | $ | 246 | $ | 273 | $ | 220 | $ | (15 | ) | (5.5 | )% | $ | 37 | 16.8 | % | ||||||||||||||

Preferred dividends (GAAP) | 16 | 16 | 16 | 16 | 16 | — | — | % | — | — | % | ||||||||||||||||||||||

Income tax expense (GAAP) | 113 | 120 | 116 | 124 | 95 | (7 | ) | (5.8 | )% | 18 | 18.9 | % | |||||||||||||||||||||

Income from continuing operations before income taxes (GAAP) | 386 | 408 | 378 | 413 | 331 | (22 | ) | (5.4 | )% | 55 | 16.6 | % | |||||||||||||||||||||

Provision for loan losses (GAAP) | 113 | 69 | 60 | 63 | 49 | 44 | 63.8 | % | 64 | 130.6 | % | ||||||||||||||||||||||

Pre-tax pre-provision income from continuing operations (non-GAAP) | 499 | 477 | 438 | 476 | 380 | 22 | 4.6 | % | 119 | 31.3 | % | ||||||||||||||||||||||

Other adjustments: | |||||||||||||||||||||||||||||||||

Securities (gains) losses, net | 5 | (11 | ) | (7 | ) | (6 | ) | (5 | ) | 16 | (145.5 | )% | 10 | (200.0 | )% | ||||||||||||||||||

Insurance proceeds (1) | (3 | ) | (1 | ) | — | (90 | ) | — | (2 | ) | 200.0 | % | (3 | ) | NM | ||||||||||||||||||

Leveraged lease termination gains, net | — | — | (6 | ) | — | (2 | ) | — | NM | 2 | (100.0 | )% | |||||||||||||||||||||

Salaries and employee benefits—severance charges | 12 | 6 | — | — | — | 6 | 100.0 | % | 12 | NM | |||||||||||||||||||||||

Professional, legal and regulatory expenses (2) | — | — | — | 48 | — | — | NM | — | NM | ||||||||||||||||||||||||

Branch consolidation, property and equipment charges (3) | 14 | 6 | 1 | 27 | 22 | 8 | 133.3 | % | (8 | ) | (36.4 | )% | |||||||||||||||||||||

Loss on early extinguishment of debt | — | — | — | — | 43 | — | NM | (43 | ) | (100.0 | )% | ||||||||||||||||||||||

Total other adjustments | 28 | — | (12 | ) | (21 | ) | 58 | 28 | NM | (30 | ) | (51.7 | )% | ||||||||||||||||||||

Adjusted pre-tax pre-provision income from continuing operations (non-GAAP) | $ | 527 | $ | 477 | $ | 426 | $ | 455 | $ | 438 | $ | 50 | 10.5 | % | $ | 89 | 20.3 | % | |||||||||||||||

NM - Not Meaningful

(1) | Insurance proceeds recognized in all periods presented are related to the settlement of the previously disclosed 2010 class-action lawsuit. |

(2) | Regions recorded $50 million and $100 million of contingent legal and regulatory accruals during the second quarter of 2015 and the fourth quarter of 2014, respectively, related to previously disclosed matters. The fourth quarter of 2014 accruals were settled in the second quarter of 2015 for $2 million less than originally estimated and a corresponding recovery was recognized. |

(3) | Charges in the second quarter of 2015 resulted from the transfer of land, previously held for future branch expansion, to held for sale based on changes in management's intent. |

6

Regions Financial Corporation and Subsidiaries

Financial Supplement to First Quarter 2016 Earnings Release

Non-Interest Income

Quarter Ended | |||||||||||||||||||||||||||||||||

($ amounts in millions) | 3/31/2016 | 12/31/2015 | 9/30/2015 | 6/30/2015 | 3/31/2015 | 1Q16 vs. 4Q15 | 1Q16 vs. 1Q15 | ||||||||||||||||||||||||||