Form 6-K UBS Group AG For: Mar 16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

Date: March 16, 2016

UBS Group AG

Commission File Number: 1-36764

UBS AG

Commission File Number: 1-15060

(Registrants’ Names)

Bahnhofstrasse 45, Zurich, Switzerland

(Address of principal executive office)

Indicate by check mark whether the registrants file or will file annual reports under cover of Form 20-F or Form 40-F. Form 20-F x Form 40-F ¨

This Form 6-K consists of materials presented by UBS Group AG at a conference on March 16, 2016, which appear immediately following this page.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Strictly confidential

Morgan Stanley Conference

Presenting at 9:30am – Hyde

Word count (excluding slide titles): 3,000 ~24 mins

Thank you, Huw. Good morning everyone.

SLIDE 1 - Cautionary statement regarding forward-looking statements

Before I get started, please make note of the cautionary statement applicable to this presentation.

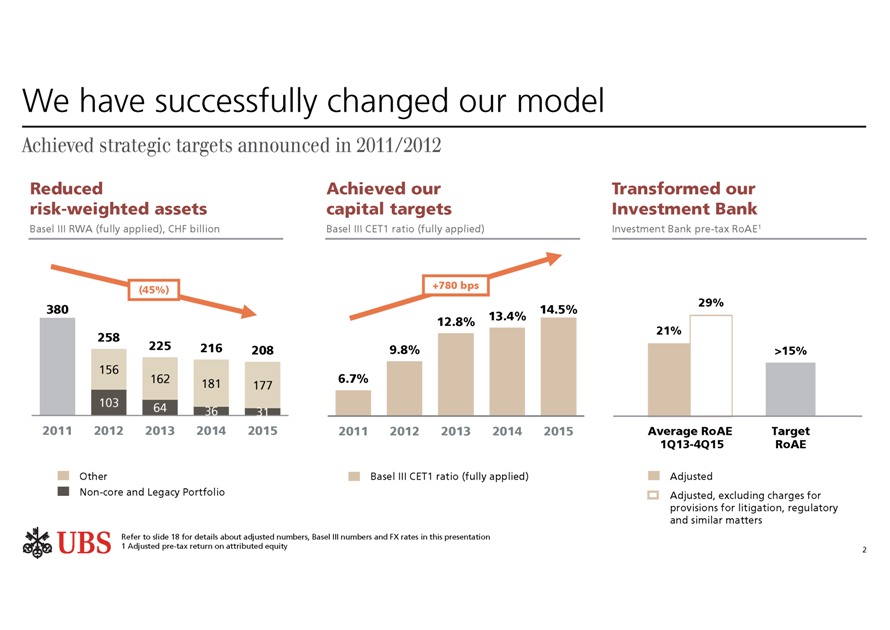

SLIDE 2 - We have successfully changed our model

Today’s theme, confronting negativity, improving earnings power by changing the model and harnessing fintech, is a journey that we embarked on in 2011 with the introduction and subsequent acceleration of our strategy in 2012.

Today, I want to remind you of the challenges we faced on this journey, and why transforming UBS early has given us the ability to fully focus on managing the current challenging environment, and further build on our track record of long-term and sustainable success.

Our strategy centers on our world leading wealth management businesses and the premier universal bank in Switzerland, enhanced by an asset manager and an investment bank that are world class in their chosen areas of focus.

Capital strength is the foundation of our success. Since November 2011, we have reduced our risk-weighted assets by over 170 billion. Today, our capital ratios are the highest among our global competitors, with our fully applied CET1 ratio at 14.5% at the end of 2015. Over three years ago, we correctly anticipated the regulatory changes that would shape the industry, and today we are well prepared to fulfil the proposed requirements under the new Swiss SRB rules.

The transformation of our Investment Bank has been vital to our success. Today, it is the only Investment Bank that consistently generates pre-tax returns far above its cost of equity, averaging an adjusted return on attributed equity of 21%, and 29% also excluding costs associated with litigation, both well above our target of greater than 15%. The business has capitalized on its strengths in advisory, Equites, FX and precious metals, and today it is a magnet for talent, attracting people who understand our model and believe they can succeed within it.

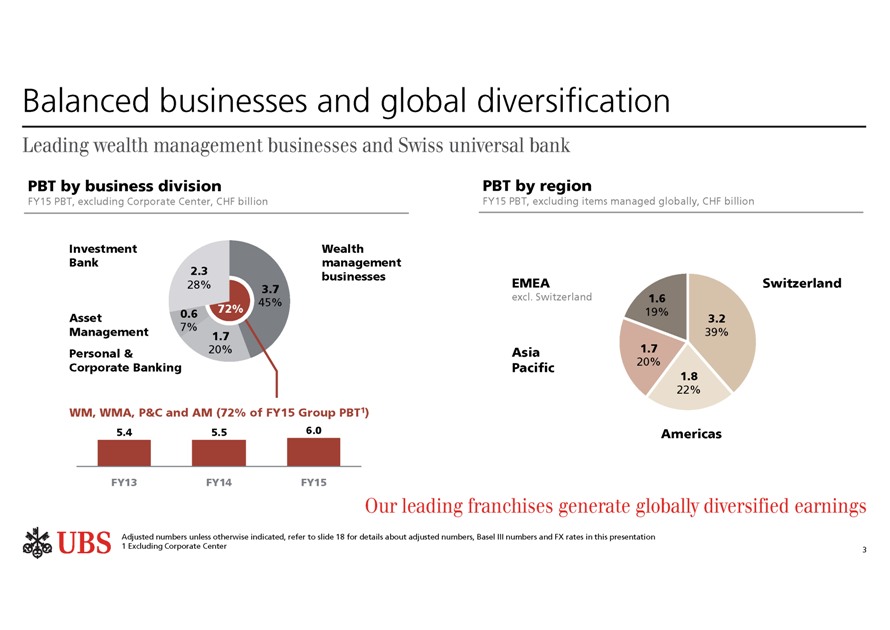

Slide 3 - Balanced business and global diversification

In 2015, over 70% of our business divisions’ profits, or 6 billion francs, were generated from our asset gathering businesses and Personal and Corporate, which generate stable and predictable earnings streams, driven by recurring fee and interest income. Our asset gathering businesses are significantly less capital intensive than most other activities in the sector, and therefore are highly cashflow generative, supporting our commitment to return at least 50% of our earnings to shareholders.

Our Investment Bank operates a client-flow driven model with specific risk-weighted asset and leverage ratio denominator resource targets. In the fourth quarter of 2015, the IB consumed 39% of the bank’s allocated equity, down from 65% in 2012, when we announced the acceleration of our strategy.

Our earnings streams are also geographically diverse. Switzerland, our home market, is the biggest contributor, with a balanced earnings contribution from APAC, EMEA and the Americas. Nearly 100% of our earnings in the US fall to the bottom line, as we utilise our deferred tax assets, making it a very important contributor to net profit. Sustainable growth in the US is therefore a key strategic objective for the Group.

Despite the slowdown in growth in APAC towards the end of 2015, this region remains of critical importance to UBS, as it has been for the past 50 years. Even if growth in China were to fall to for example just 4% for the next 20 years, the economy would double in size, making the Chinese onshore market one of the single most important opportunities for UBS.

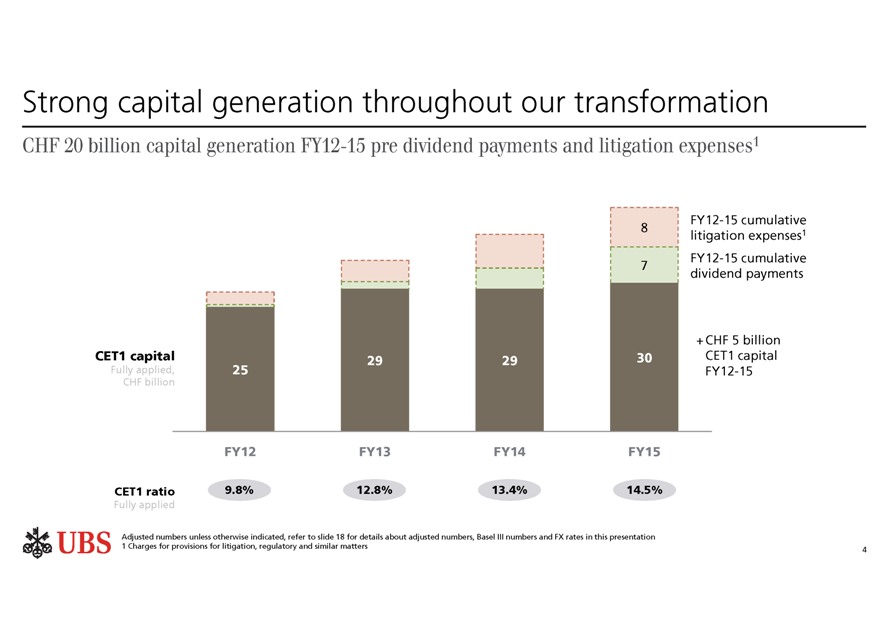

Slide 4 - Strong capital generation throughout our transformation

Our transformation and unique highly cashflow generative model are evident from this slide. In total, we have generated over 20 billion francs in four years if we account, not only for the 5 billion increase in CET1, but also for the cumulative expenses of 8 billion related to the resolution of legacy litigation matters and 7 billion of dividends returned to our shareholders. This is despite headwinds from regulatory costs, which in the past 3 years alone have cost us around 2.4 billion on a cumulative basis.

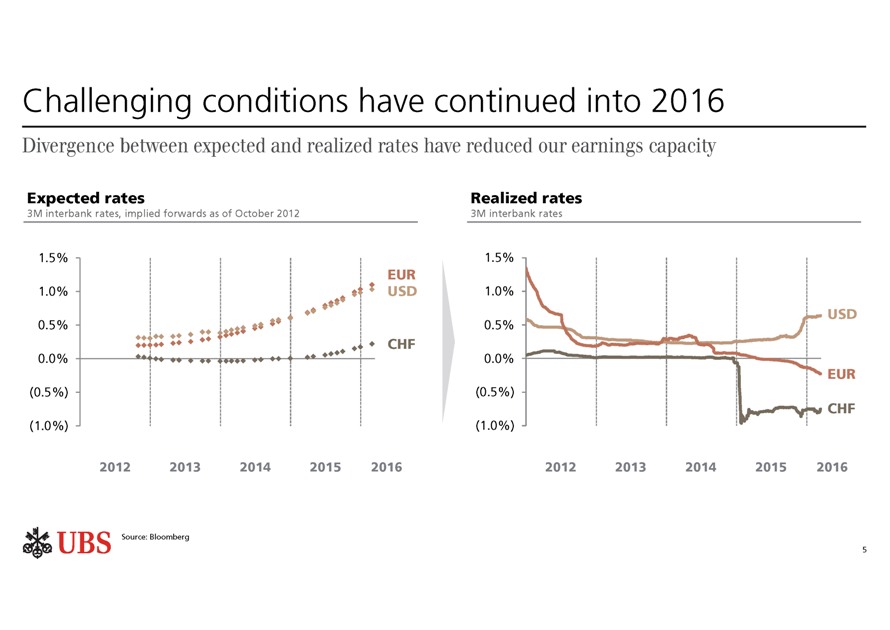

Slide 5 - Challenging conditions have continued into 2016

While we are very pleased with both the strategic and financial progress we have achieved, the macroeconomic environment continues to limit our ability to achieve our full potential. Our targets, and the market’s expectations of what we can achieve, have been scaled back over the past few years.

There is no doubt that the tailwind from strong equity markets has provided momentum to our invested asset base in recent years. But we and the industry are facing unprecedented headwinds, for example from interest rates, which have pressured net interest margins in all of our businesses and from macroeconomic and political uncertainties that have contributed to huge risk aversion among our clients.

The chart on implied forwards shows the radical difference between the market expectations we used when we first set our targets in October of 2012 and actual rates. It also serves to underline that in an environment with more constructive interest and FX rates, stable regulation and more normalized litigation, our ambition to achieve an adjusted return on tangible equity of greater than 15% makes sense.

So, what does that mean for UBS for this quarter and the rest of the year?

The conditions we noted in our most recent outlook statement have persisted throughout the quarter. Industry activity levels in investment banking advisory have slowed markedly year on year, and, while equity volumes in the US are buoyant, flat volumes in Europe and sharp declines in Asia do not favor our geographic mix. We also have a very tough year-on-year comparative from a revenue point of view. Last year we generated significant FX revenues from activity around the Swiss Franc peg removal, and also saw a materially stronger performance in APAC in Equities.

In respect of energy exposures, in the past few weeks we have seen a significant improvement in the oil price and we continue to believe our exposures are modest. Based on our sensitivity analysis on Oil and Gas lending exposures with oil at USD 25 per barrel until the end of 2017, we estimate a credit loss expense of approximately CHF 100m related mostly to exposures in reserve based lending positions in the exploration and production segment, and in oilfield services. Further information is available in the appendix to this presentation.

In challenging market conditions, like those we have seen this quarter, we would consider performance to be satisfactory if the Investment Bank covers its cost of equity. And I am confident we will be able to achieve this comfortably for Q1.

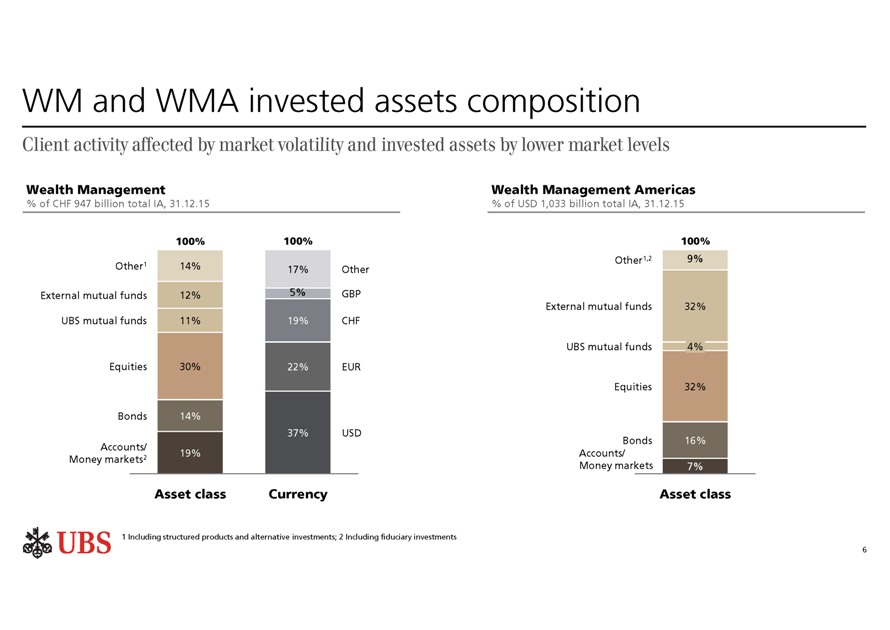

Slide 6 - WM and WMA invested assets composition

Market volatility has also affected our wealth management clients, and while client activity has recovered somewhat from the lows we saw in Q4, transaction-based revenues have not rebounded to levels typically seen in previous first quarters.

Our invested asset base will also be affected by declines in global markets, most notably equity markets, as well as changes in currency. We have provided the year-end balances on the slide, and updating this for the latest market information gives a good guide to the likely impact on our asset based income.

For the Group as a whole, this year we must also keep an even keener eye on costs to protect earnings, but fundamentally, our focus on driving sustainable performance for our clients and shareholders will not change. We will continue to drive our strategic initiatives to improve the quality and sustainability of revenues, while making further investments in technology to improve efficiency, effectiveness and to drive innovation. We will also continue with selective hiring in strategic growth areas, while supporting the development of key talent within the business.

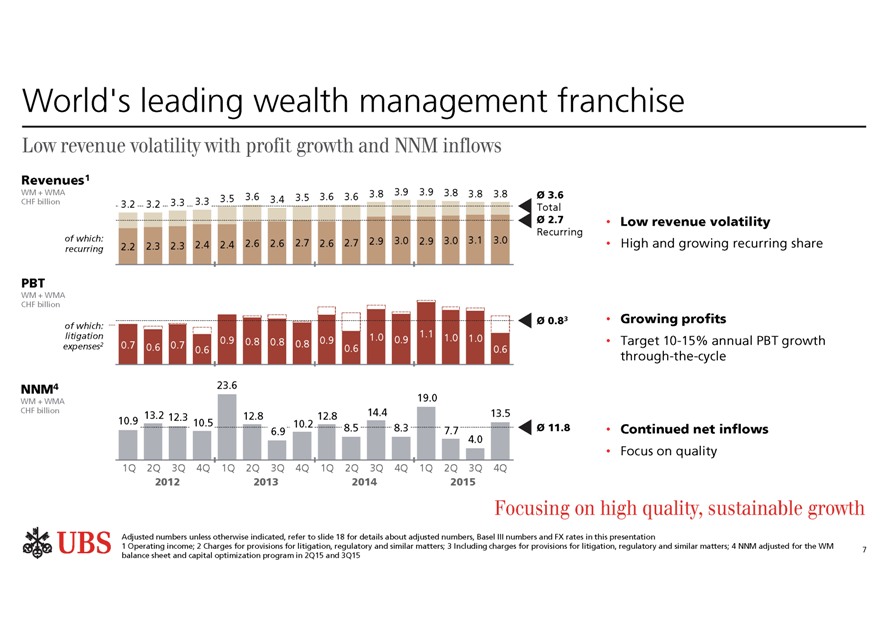

Slide 7 - World’s leading wealth management franchise

Looking back over the achievements of the past four years, the success of our wealth management franchise is clear. We have steadily grown quarterly revenues from 3.2 billion to over 3.8 billion and within the mix, growth in recurring fees from interest and asset-based fees has outstripped declines in transactional revenues. This underlines our successful initiatives to grow mandates and lending, and our fundamental focus on improving the quality and sustainability of our earnings, which average around 800 million per quarter.

Net new money has averaged around 12 billion francs per quarter over the past four years, showing relatively predictable seasonal patterns. While in the midst of the financial crisis, net new money was a critical indicator of the health of the business, it is now one of a number of important metrics we use to run the business. Our focus today is on quality rather than quantity. As I have said before, we could attract tens of billions of inflows in a given quarter, but this would dilute returns, so our objective is to seek high quality inflows that are likely to be invested and therefore accretive to both earnings and our economic profit.

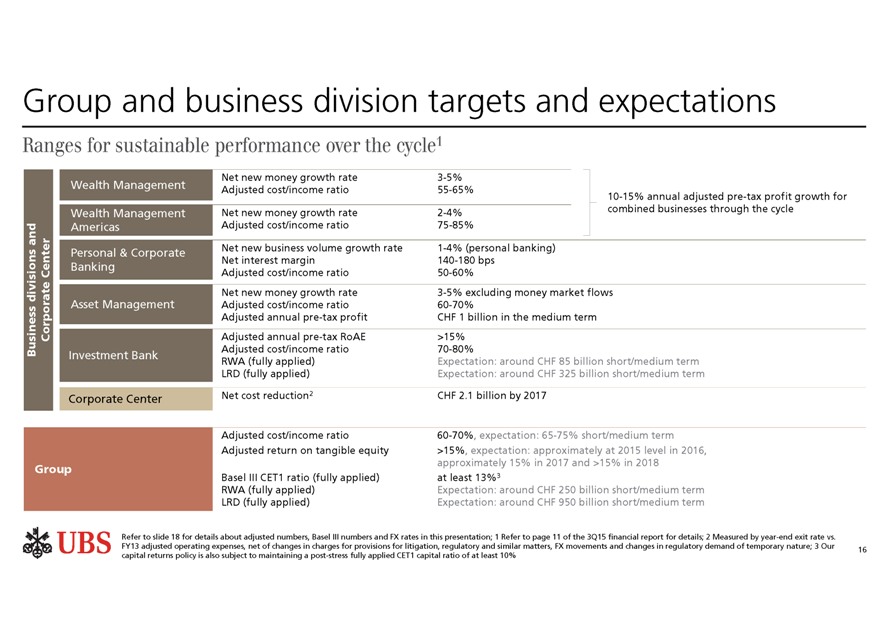

Achieving sustainable adjusted pre-tax profit growth of 10-15% per year over the cycle remains the key objective for this business.

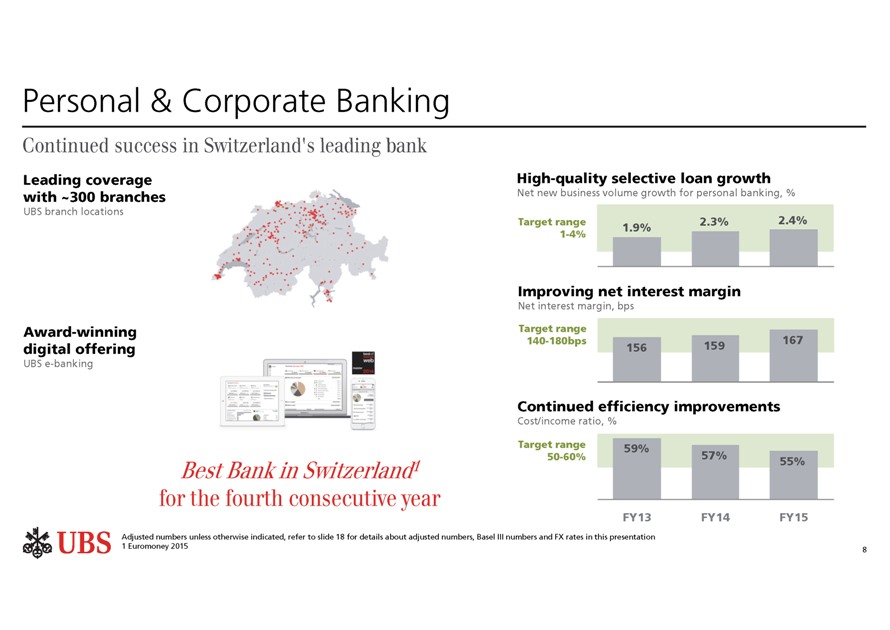

Slide 8 - Personal and Corporate banking

Personal & Corporate Banking is the leading bank for individual and corporate clients in Switzerland.

The business division’s performance continued to be very strong in 2015, with growing profits and improving KPIs. This is an excellent achievement for a deposit-taking and lending-focused franchise operating in an environment with negative interest rates.

Our net interest margins began to improve in mid-2014 as a result of pricing efforts on both the loan and deposit side over the past three years.

We have been prepared to forego growth and reduce our market share in mortgages to sustain and improve the quality of our lending book, which has supported expansion in our net interest margin despite downward pressure from rates. More recently, we have seen others follow our lead on mortgage pricing following the introduction of negative rates. But the resilience of mortgage margins has attracted a number of new entrants who are pressuring pricing and lowering lending standards, which in my view, is a problematic trend overall.

We also remain focused on sustained and profitable growth in the personal segment, where we continue to see above-GDP growth in volumes, and also have seen the highest level of account openings since the crisis.

Overall our success is supported by continued investment in technology, notably in mobile and e-banking services, where we have seen year-over-year increases in client penetration. These investments are helping support margins and, together with progress in our corporate center cost reduction program, are helping to improve our cost / income ratio. What perhaps is even more compelling is that clients who embrace both traditional and digital channels have proven to be very attractive from a profitability and client satisfaction point of view.

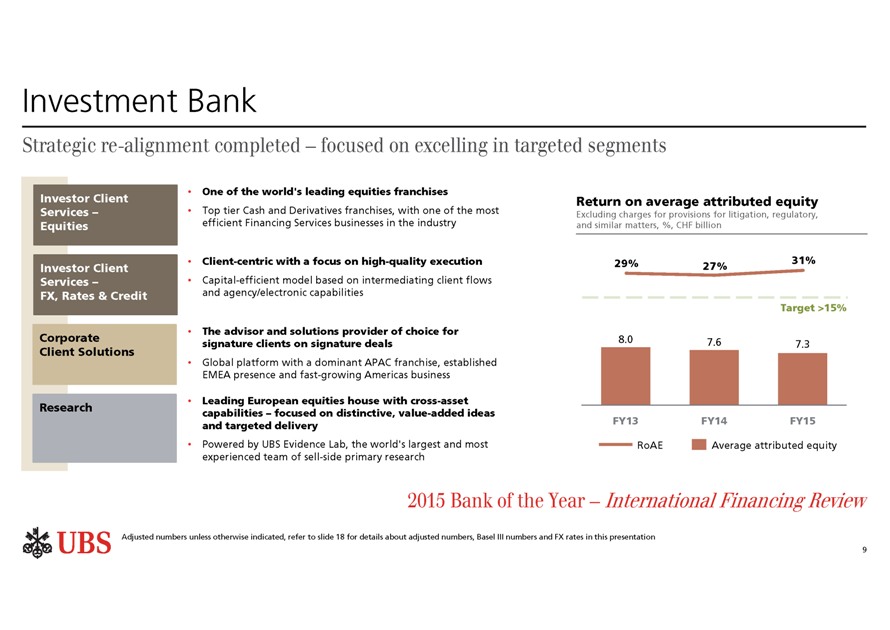

Slide 9 - Investment Bank

The strategic realignment of, and our chosen business mix in the Investment Bank have been a clear success. Today, our IB is more focused, less risky and in a leading or strong position in its targeted segments, and we could not operate the world’s leading wealth management business without it

Our client flow and resource-efficient model aims to deliver an adjusted pre-tax return on attributed equity of greater than 15% per annum. Over the past 3 years, we have proven that we can consistently deliver the highest return on attributed equity, while operating carefully within the limit and target structure for RWA and LRD. I would also note that our equity attribution model is consistent, transparent and generally conservative.

For the first time ever, International Financing Review selected the Investment Bank as “Bank of the Year”, highlighting the recognition of our innovative and sustainable operating model. A few years ago, it would have been inconceivable for UBS to win an award like this, and this is a credit to our employees for their impeccable execution and to our clients for their support.

Looking ahead, we are focussing on our areas of strength, investing in technology and continuing to attract and develop talent to better serve our clients and drive growth, without deviating from our clear commitment to conservative capital and resource allocation.

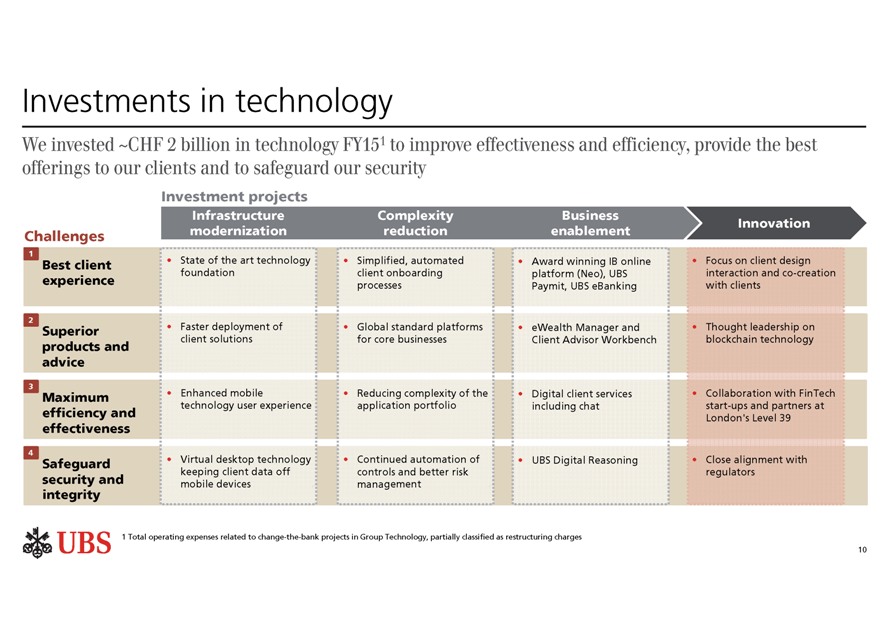

Slide 10 - Investments in technology

Investment in technology in the financial services industry is critical for a number of reasons. Driving new revenue streams and offsetting continued cost pressures are the most obvious. Creating a better client experience, reducing risks in areas like compliance and cyber, and addressing regulatory requirements are also critical.

That’s why we invested around 2 billion francs in technology investment projects in 2015.

Of the four key challenges we are addressing through investments in technology, improving the client experience is the most important.

We are doing this by modernizing our technology infrastructure, reducing systems complexity and developing state-of-the-art business enabling tools. We are also expanding the deployment and utilization of data analytics and machine learning for advisory and investment management, for example for our online platform UBS Neo and UBS Advice. As we reduce complexity, we are also able to onboard clients more efficiently and deploy new client solutions more quickly.

Our investments in technology improve our security, as modern, unified systems are not only less costly to maintain, but also easier to monitor.

We are well integrated in FinTech networks and we are monitoring and spear-heading technologies that have the potential to disrupt the current financial system, like Blockchain and robo-advisory capabilities.

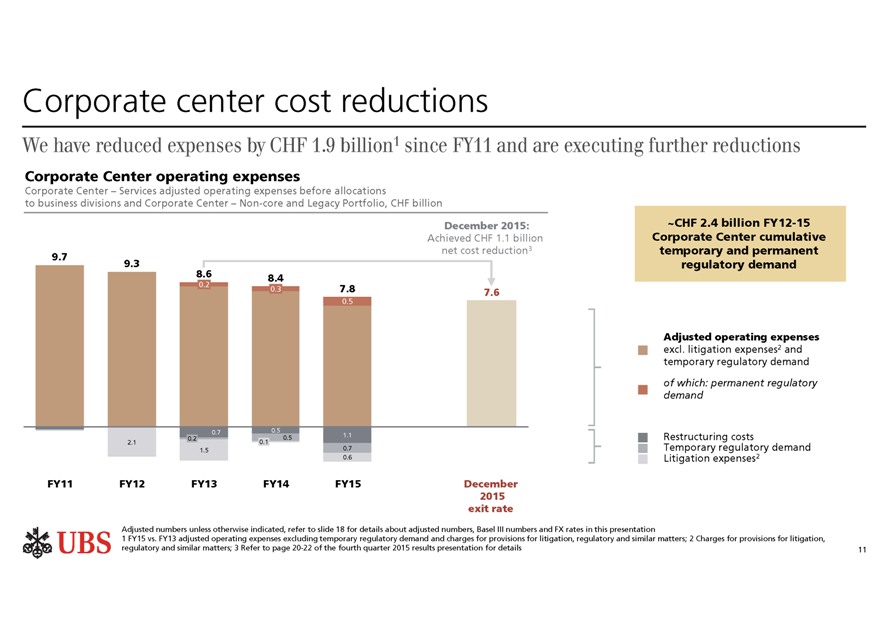

Slide 11 - Cost reductions

As I mentioned before, delivering our cost reduction initiatives continues to be one of our key priorities.

We have reduced Corporate Center costs by around 2 billion francs since 2011. In executing our plans we have faced growing headwinds, not only from increased permanent regulatory demand, but also from higher business demand. Given the lack of clarity in certain aspects of regulation, there is also a risk that some costs that we view as temporary today may not fall away completely. Therefore, the effects and associated costs of legal entity regulation, for example, mean that we are considering further changes in our processes in order to achieve our targets. This means the overall scope of gross savings has increased relative to the net targets we have communicated. Regardless we remain fully committed to delivering CHF 2.1 billion in net savings by the end of next year.

Of course, cost management will continue to be a focus regardless of market conditions, but we need to strike the right balance between protecting earnings and dividends, and doing no harm to our ability to serve clients and the longer term prospects of the business.

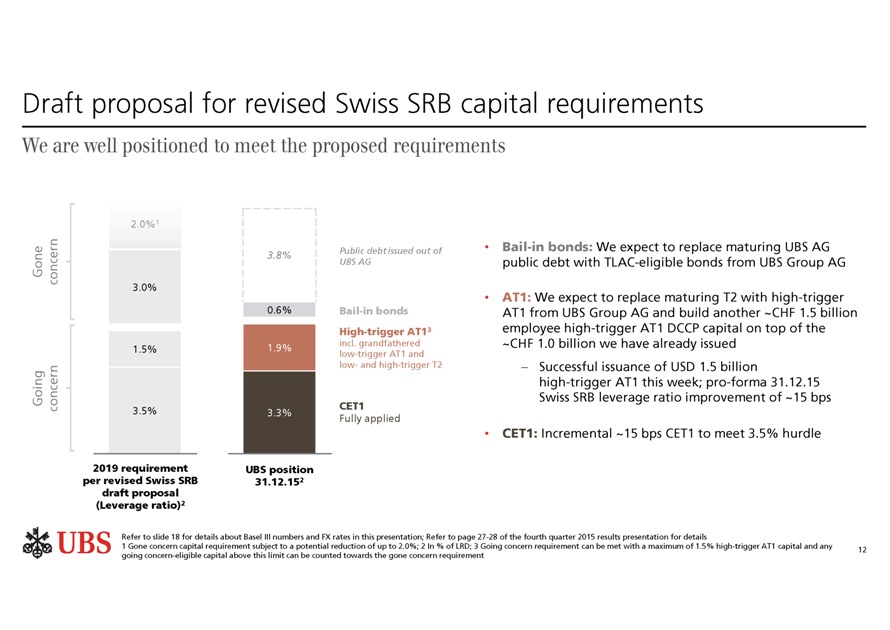

Slide 12 - Draft proposal for revised Swiss SRB capital requirements

Given our already strong CET1 position and grandfathering rules applicable to low trigger AT1 and our T2 instruments, we are in no hurry to get ahead of the new requirements as this would add unnecessary costs with no tangible benefit. To meet the 2019 requirements in full on the CET1 side, we need to build just 15 basis points of equity, or roughly 3 billion francs.

In respect of the high trigger component, we are aiming to make steady progress, rolling over existing Tier 2 instruments into AT1. Our plans also include an intention to build another 1.5 billion francs in high-trigger AT1 from deferred compensation awards to employees, to compliment the 1 billion already in issuance. This award program allows us to continue to pay competitively, while strengthening our capital position during the 5 year cliff vesting period.

Despite challenging market conditions we were very pleased to price a USD 1.5bn AT1 issuance on Monday attracting a significant, high quality order book, and adding 16 basis points to our 2015 year-end proforma Swiss SRB leverage ratio, taking it to 5.45%. Our ability to re-open the markets with such strong demand is the ultimate demonstration of our capital strength and the validity of our strategy.

In respect of the bailinable component, we intend to fulfil the requirement by replacing existing senior debt with TLAC eligible instruments.

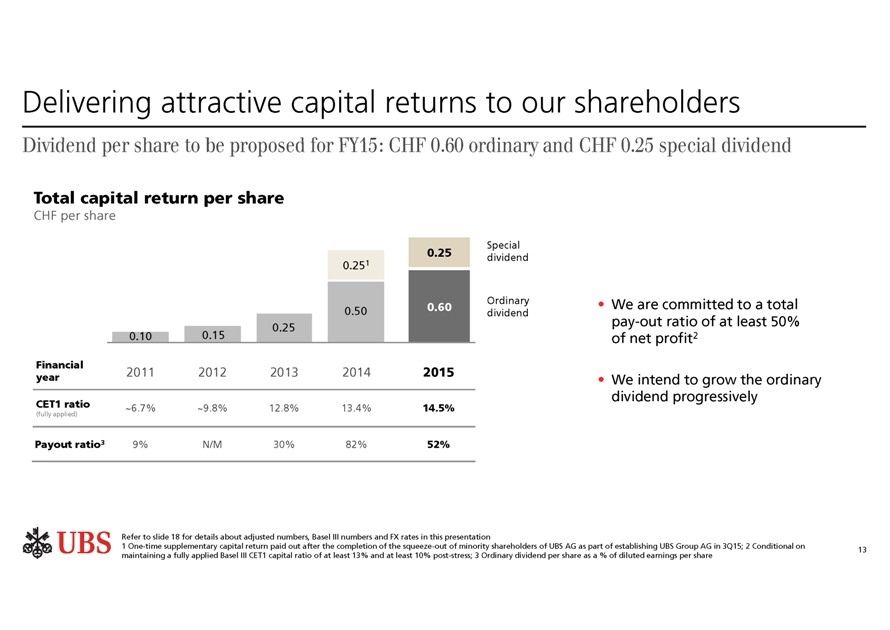

Slide 13 - Delivering attractive capital returns to our shareholders

As you can see, we have gradually increased total returns to shareholders as we transformed the business. For 2015, our Board intends to recommend an ordinary dividend of 60 Rappen per share and a special dividend of 25 Rappen per share, which will be paid in May following shareholder approval at our AGM. The ordinary dividend reflects our strong operating performance, while the special dividend reflects the substantial upward revaluation of our deferred tax assets in 2015. But let me be clear on our thoughts on this topic for this year. We are not expecting material DTA write ups in 2016, having guided to a figure of around 500 million francs, and therefore do not anticipate paying a special dividend. Going forward, we remain committed to our policy of returning at least 50% of net profits to shareholders. Although it’s early in the year, our aim is to continue to grow our ordinary dividend, while building over time the capital needed to address regulatory requirements and to support our growth.

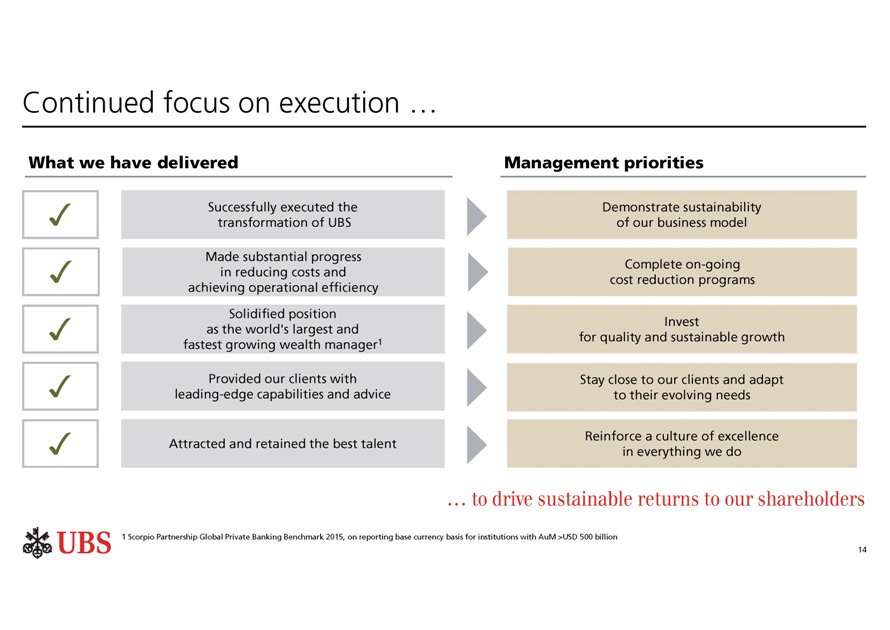

Slide 14 - Continued focus on execution

So in conclusion, UBS has already adapted its model to improve earnings and we are continuing to invest across our businesses, including in technology, to help support our goal of driving long term sustainable performance in the bank. Our unique mix of highly cash flow generative businesses, our leading capital position and capital efficiency result in UBS being highly levered to a more normalized macroeconomic and litigation environment.

We have begun a year that clearly looks very challenging, but by focusing on our strengths, we believe we have the ability to gain share of wallet and market share. We need to maintain our global perspective on the trends driving long term wealth accumulation. That is the reason we are keen to invest in those businesses and geographies that will sustain growth over the long-term. Opportunities exist, particularly in the US and Asia.

We must also keep our focus on execution, including our cost reduction program. Our goal is to deliver sustainable costs savings that improve our long-term effectiveness. As we do that, we will free up resources which enables us to selectively invest for growth.

We will continue to build our talent pool, both internally and with selective external hiring, and at the same time continue to focus on maintaining excellence in everything we do.

Most importantly, in the current environment, staying close to our clients and delivering on our commitments remains paramount.

These factors will underpin our ability to deliver value to shareholders, and I have every confidence in our ability to execute on our plans.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrants have duly caused this report to be signed on their behalf by the undersigned, thereunto duly authorized.

| UBS GROUP AG | ||

| By: | /s/ David Kelly | |

| Name: David Kelly | ||

| Title: Managing Director | ||

| By: | /s/ Sarah M. Starkweather | |

| Name: Sarah Starkweather | ||

| Title: Executive Director | ||

| UBS AG | ||

| By: | /s/ David Kelly | |

| Name: David Kelly | ||

| Title: Managing Director | ||

| By: | /s/ Sarah M. Starkweather | |

| Name: Sarah Starkweather | ||

| Title: Executive Director | ||

Date: March 16, 2016

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- UBS AG (UBSG:SW) (UBS) PT Lowered to CHF28 at RBC Capital

- UBS AG (UBSG:SW) (UBS) PT Lowered to CHF31 at Morgan Stanley

- Citi Downgrades UBS AG (UBSG:SW) (UBS) to Neutral

Create E-mail Alert Related Categories

SEC FilingsRelated Entities

UBSSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share