Form 8-K MDC PARTNERS INC For: Feb 29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

Current Report Pursuant to Section 13 or

15(d)

of the Securities Exchange Act of 1934

Date of Report (Date Earliest Event reported) — February 29, 2016 (February 29, 2016)

MDC PARTNERS INC.

(Exact name of registrant as specified in its charter)

| Canada (Jurisdiction of Incorporation) |

001-13718 (Commission File Number)

|

98-0364441 (IRS Employer Identification No.) |

745 Fifth Avenue, 19th Floor,

New York, NY 10151

(Address of principal executive offices and zip code)

(646) 429-1800

(Registrant’s Telephone Number)

Check the appropriate box below if the Form 8−K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a−12 under the Exchange Act (17 CFR 240.14a−12) |

| ¨ | Pre−commencement communications pursuant to Rule 14d−2(b) under the Exchange Act (17 CFR 240.14d−2(b)) |

| ¨ | Pre−commencement communications pursuant to Rule 13e−4(c) under the Exchange Act (17 CFR 240.13e− 4(c)) |

Item 7.01 Regulation FD Disclosure.

On February 29, 2016, MDC Partners Inc. (the “Company”) made a presentation at JPMorgan’s Global High Yield and Leverage Finance Conference in which certain financial results were discussed, including guidance for the Company’s expected financial results for the twelve months ending December 31, 2016. The presentation materials are attached as Exhibit 99.1 hereto.

As discussed on page 2 of Exhibit 99.1, the presentation contains forward-looking statements within the meaning of the federal securities laws. These statements are present expectations, and are subject to the limitations listed therein and in the Company’s other SEC reports, including that actual events or results may differ materially from those in the forward-looking statements.

The foregoing information (including the exhibits hereto) is being furnished under “Item 7.01. Regulation FD Disclosure.” Such information (including the exhibits hereto) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

99.1 Presentation materials, dated February 29, 2016.

2

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed by the undersigned hereunto duly authorized.

| Date: February 29, 2016 | MDC Partners Inc. | |||

| By: |

/s/ Matthew Speiser Matthew Speiser | |||

3

Exhibit 99.1

JP Morgan High Yield & Leveraged Finance Conference February 29, 2016

2 FORWARD LOOKING STATEMENTS & OTHER INFORMATION This presentation, including our “ 2016 Financial Outlook”, contains forward - looking statements . The Company’s representatives may also make forward - looking statements orally from time to time . Statements in this presentation that are not historical facts, including statements about the Company’s beliefs and expectations, earnings guidance, recent business and economic trends, potential acquisitions, and estimates of amounts for redeemable noncontrolling interests and deferred acquisition consideration, constitute forward - looking statements . These statements are based on current plans, estimates and projections, and are subject to change based on a number of factors, including those outlined in this section . Forward - looking statements speak only as of the date they are made, and the Company undertakes no obligation to update publicly any of them in light of new information or future events, if any . Forward - looking statements involve inherent risks and uncertainties . A number of important factors could cause actual results to differ materially from those contained in any forward - looking statements . Such risk factors include, but are not limited to, the following : • risks associated with the SEC’s ongoing investigation and the related class action litigation claims ; • risks associated with severe effects of international, national and regional economic conditions ; • the Company’s ability to attract new clients and retain existing clients; • the spending patterns and financial success of the Company’s clients ; • the Company’s ability to retain and attract key employees; • the Company’s ability to remain in compliance with its debt agreements and the Company’s ability to finance its contingent pa yme nt obligations when due and payable, including but not limited to those relating to redeemable noncontrolling interests and deferred acquisition consideration; • the successful completion and integration of acquisitions which complement and expand the Company’s business capabilities; and • foreign currency fluctuations. The Company’s business strategy includes ongoing efforts to engage in acquisitions of ownership interests in entities in the marketing communications services industry . The Company intends to finance these acquisitions by using available cash from operations, from borrowings under the Credit Agreement and through incurrence of bridge or other debt financing, any of which may increase the Company’s leverage ratios, or by issuing equity, which may have a dilutive impact on existing shareholders proportionate ownership . At any given time the Company may be engaged in a number of discussions that may result in one or more acquisitions . These opportunities require confidentiality and may involve negotiations that require quick responses by the Company . Although there is uncertainty that any of these discussions will result in definitive agreements or the completion of any transactions, the announcement of any such transaction may lead to increased volatility in the trading price of the Company’s securities . Investors should carefully consider these risk factors and the additional risk factors outlined in more detail in the Annual Report on Form 10 - K for the year ended December 31 , 2015 , under the caption “Risk Factors” and in the Company’s other SEC filings .

3 WHO WE ARE MDC is a network of 50+ marketing and communications firms that leverage technology, data analytics, insights and strategic solutions to drive meaningful returns on marketing investment

4 MDC TODAY » One of the fastest - growing and most influential marketing and communications networks in the world, with the most powerful, globally recognized brands in the industry » Operating units in the United States, Canada, Europe, Asia and Latin America, and over 1,700 clients worldwide, and approximately 5,700 full time employees » >$1 billion platform with significant infrastructure built for profitable growth in the core business, in emerging disciplines such as Media and Analytics, and internationally » Progressive offerings in the rapidly transforming marketing toolbox – digital, social, analytics » Industry - leading financial performance, particularly organic revenue growth (~4x peers 1 over last 9 years) 1 Peers include WPP, Omnicom, Publicis, Interpublic Group, Havas.

5 OUR UNIQUE ADVANTAGE The Modern Global Model Built for the Digital World Unencumbered creativity Cutting edge technology MDC CULTURE Talent, Entrepreneurism, Innovation & Invention Unburdened by legacy brick and mortar investments. Silo - free means no competing visions or P&Ls. Digital capabilities embedded into core offerings. Centralized source of strategic and creative leadership. Empowering entrepreneurial talent. Elevates the quality of the work and Maximizes return on investment.

6 POWERFUL AGENCY BRANDS Specialized Expertise: Over 50+ Creatively Driven Agencies Advertising, Branding, and Design Digital, Social, Interactive, E - commerce Customer Engagement and Experiential Marketing Media Planning, Buying and Research Public Relations, Strategic Communications, Investor Relations Digital is a core competency embedded in all of our brands and offerings

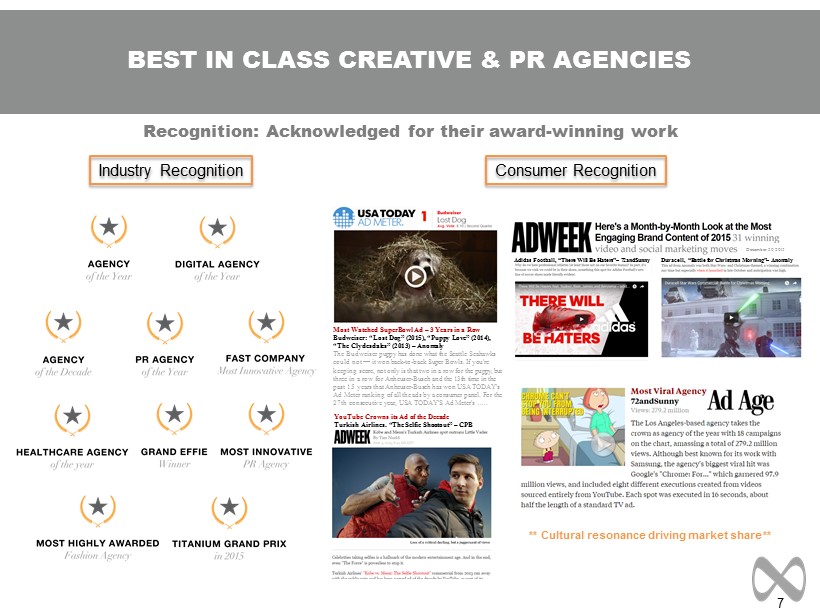

7 BEST IN CLASS CREATIVE & PR AGENCIES Recognition: Acknowledged for their award - winning work Industry Recognition Consumer Recognition YouTube Crowns its Ad of the Decade Turkish Airlines. “The Selfie Shootout” – CPB Most Watched SuperBowl Ad – 3 Years in a Row Budweiser: “Lost Dog” (2015), “Puppy Love” (2014), “The Clydesdales” (2013) – Anomaly The Budweiser puppy has done what the Seattle Seahawks could not — it won back - to - back Super Bowls. If you're keeping score, not only is that two in a row for the puppy, but three in a row for Anheuser - Busch and the 13th time in the past 15 years that Anheuser - Busch has won USA TODAY's Ad Meter ranking of all the ads by a consumer panel . For the 27th consecutive year, USA TODAY'S Ad Meter's ….. ** Cultural resonance driving market share ** Duracell, “Battle for Christmas Morning” – Anomaly Adidas Football, “There Will Be Haters” – 72andSunny December 30, 2015

8 WORLD CLASS CLIENT BASE Significant white space <3 % of US market share and 5% share of clients’ wallet Communications / Media Retail Food & Beverage Consumer Products Technology Automotive Financials Healthcare

9 SUSTAINED MARKET SHARE GAINS Outperformance in good times and bad, and despite more difficult comparisons Organic Revenue Growth: MDC Partners 1 vs. Peers 2 9 Year Average 2007 through 2015 MDC 10.5% Peers 2.8% Fastest growing global holding company… Organic growth ~ 4x more than peers over last 9 years 1 In all periods, MDC excludes Accent Marketing Services, which was sold in May 2015. 2 Peers include WPP, Omnicom, Publicis, Interpublic Group, Havas. Consensus estimates used for WPP for 2015. Note : See appendix for definitions of non - GAAP measures

10 ROBUST NEW BUSINESS TRENDS 1 Includes select wins in the public domain only Recent New Clients 1 Net New Business Trend 2 2 Excludes discontinued operations

11 INTERNATIONAL EXPANSION IS A KEY DRIVER “Brands without Borders”: hub and spoke model to cover global accounts 9% of MDC revenue is outside North America (at Q4 2015) vs. 55 - 60 % of global ad spend 2012 2013 2014 2015 % of MDC revs 4.5% 5.3% 6.5% 8.5% Int’l Organic Growth +53% +31% +28% +32% Key Global or Int’l Wins Note : International defined as all geographies outside of North America

12 MEDIA BUYING REPRESENTS A STRONG GROWTH CATALYST T echnology and data are democratizing Media Media makes up >10% of MDC versus estimated 20 - 25% of other Holdco’s

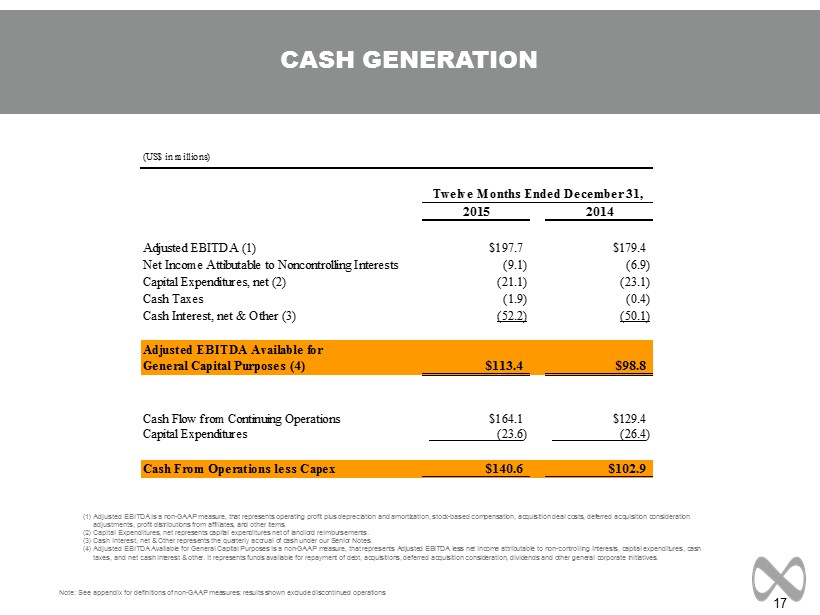

13 2015 FINANCIAL HIGHLIGHTS SUPERIOR FINANCIAL PERFORMANCE ACROSS ALL KEY METRICS – INDUSTRY LEADING ORGANIC REVENUE GROWTH, STRONG EBITDA GROWTH, SOLID CASH GENERATION AND LEVERAGE REDUCTION » Industry - leading organic revenue growth of 7.1% » Revenue increased 8.4% to $1.33 billion from $1.22 billion » Adjusted EBITDA increased 10.2% to $197.7 million from $179.4 million » Adjusted EBITDA margin expanded to 14.9% versus 14.7% a year ago » Net new business wins of $116.7 million » Adjusted EBITDA Available for General Capital Purposes increased 14.8% to $113.4 million from $98.8 million » Cash Flow From Operations 1 less Capex increased 36.6% to $140.6 million from $102.9 million » Net Debt - to - EBITDA leverage of 3.4x, steady within last year 1 Defined as Cash Flow from Continuing Operations Source: Public filings, company management Note: See appendix for definitions of non - GAAP measures

14 MDC HAS COME A LONG WAY D iversification of risk as we have become a larger company 2009 1 2015 » Revenue $546 million $1.07 billion $1.33 billion » Adjusted EBITDA $70 million $118 million $198 million » CFO 2 less Capex $54 million $58 million $141 million » Contracted retainer based revenue 63% 71% 81% » Client concentration - top 10 49% 26% 24% » # of countries / cities / agencies outside the US and Canada 3 / 3 / 3 4 / 4 / 9 11 / 15 / 12 1 As reported with Full Year 2009 and Full Year 2012 results at the time, respectively 2 Defined as Cash Flow From Continuing Operations Note : See appendix for definitions of non - GAAP measures 2012 1

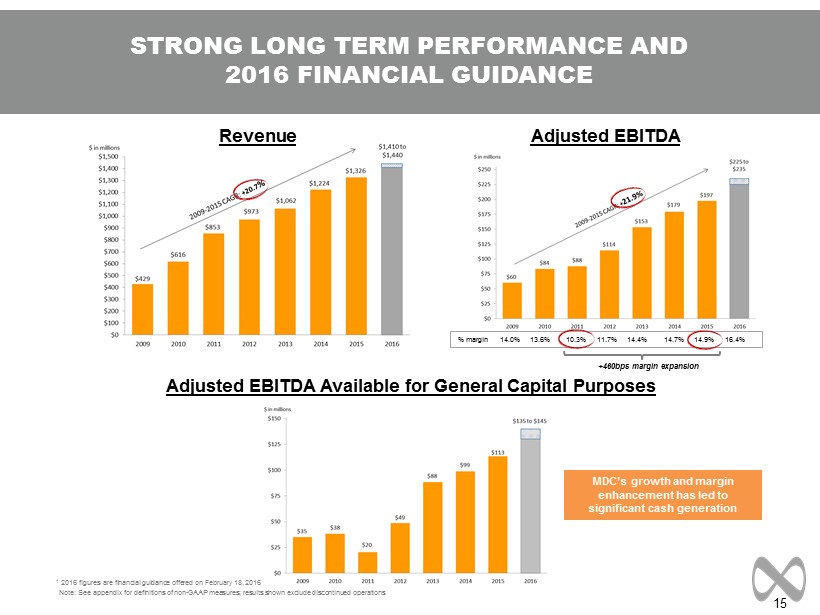

15 STRONG LONG TERM PERFORMANCE AND 2016 FINANCIAL GUIDANCE Revenue Adjusted EBITDA Note: See appendix for definitions of non - GAAP measures; results shown exclude discontinued operations Adjusted EBITDA Available for General Capital Purposes % margin 14.0% 13.6% 10.3% 11.7% 14.4% 14.7% 14.9% 16.4% +460bps margin expansion MDC’s growth and margin enhancement has led to significant cash generation 1 2016 figures are financial guidance offered on February 18, 2016

16 DIVERSIFIED AND STABLE REVENUE MODEL Revenue Mix Ongoing shift to retainer - based contracts % of Revenue by Client Sector, 2015 1 Largest client ~4% of revenue (% of Total Revenue) 2009 2015 Top 10 Customers 49% 24% Top Customer 16% 4% 1 Excludes discontinued operations

17 CASH GENERATION (1) Adjusted EBITDA is a non - GAAP measure, that represents operating profit plus depreciation and amortization, stock - based compensa tion, acquisition deal costs, deferred acquisition consideration adjustments, profit distributions from affiliates, and other items. (2) Capital Expenditures, net represents capital expenditures net of landlord reimbursements. (3) Cash Interest, net & Other represents the quarterly accrual of cash under our Senior Notes. (4) Adjusted EBITDA Available for General Capital Purposes is a non - GAAP measure, that represents Adjusted EBITDA less net income at tributable to non - controlling Interests, capital expenditures, cash taxes, and net cash interest & other. It represents funds available for repayment of debt, acquisitions, deferred acquisition co nsideration, dividends and other general corporate initiatives. Note: See appendix for definitions of non - GAAP measures; results shown exclude discontinued operations (US$ in millions) 2015 2014 Adjusted EBITDA (1) $197.7 $179.4 Net Income Attibutable to Noncontrolling Interests (9.1) (6.9) Capital Expenditures, net (2) (21.1) (23.1) Cash Taxes (1.9) (0.4) Cash Interest, net & Other (3) (52.2) (50.1) Adjusted EBITDA Available for General Capital Purposes (4) $113.4 $98.8 Cash Flow from Continuing Operations $164.1 $129.4 Capital Expenditures (23.6) (26.4) Cash From Operations less Capex $140.6 $102.9 Twelve Months Ended December 31,

18 FINANCIAL POLICY » Maintain solid liquidity position ▪ Access to $325 million revolving credit facility for growing working capital and other general corporate purposes, subject to available borrowings » No significant near term acquisitions currently in the pipeline ▪ Smaller opportunistic tuck ins are likely consistent with historical deal structure » Continued focus on de - leveraging and payment of deferred acquisition consideration and minority interest ▪ Target b alance s heet n et d ebt / EBITDA below 2.5x ▪ Maintain dividend policy in line with balance sheet structure ▪ Committed to maintaining a positive and proactive working relationship with investors , ratings agencies, and the financial community

19 APPENDIX

20 DEFINITION OF NON - GAAP MEASURES Adjusted EBITDA: Adjusted EBITDA is a non - GAAP measure, that represents operating profit plus depreciation and amortization, stock - based compensation, acquisition deal costs, deferred acquisition consideration adjustments, one time incentive compensation, profit distributions from affiliates, and other items. Organic Growth: Organic revenue growth is a non - GAAP measure that refers to growth in revenues from sources other than acquisitions or foreign exchange impacts. Adjusted EBITDA Available for General Capital Purposes: Adjusted EBITDA Available for General Capital Purposes is a non - GAAP measure, that represents Adjusted EBITDA less net income attributable to non - controlling Interests, capital expenditures, cash taxes, and net cash interest & other. It represents funds available for repayment of debt, acquisitions, deferred acquisition consideration, dividends and other general corporate initiatives. Net Bank Debt or Net Debt: Debt due pertaining to the revolving credit facility plus debt pertaining to the Senior Notes less total cash and cash equivalents. Note: A reconciliation of Non - GAAP to US GAAP reported results has been provided by the Company in the tables included in the earnings release issued on February 18, 2016.

21 ADJUSTED EBITDA SCHEDULE For the Twelve Months Ended December 31, 2015 Advertising and Communications Corporate Total Revenue 1,326,256$ -$ 1,326,256$ Net loss attributable to MDC Partners Inc. (37,357)$ Adjustments to reconcile to Operating profit (loss): Net income attributable to the noncontrolling interests 9,054 Loss from discontinued operations attributable to MDC Partners Inc., net of taxes 6,281 Equity in earnings of non-consolidated affiliates (1,058) Income tax expense 5,664 Interest expense and finance charges, net 57,436 Other, net 32,090 Operating profit (loss) 137,282$ (65,172)$ 72,110$ margin 10.4% 5.4% Additional adjustments to reconcile to Adjusted EBITDA: Depreciation and amortization 50,449 1,774 52,223 Stock-based compensation 15,056 2,740 17,796 Acquisition deal costs 704 2,208 2,912 Deferred acquisition consideration adjustments 36,347 - 36,347 Distributions from non-consolidated affiliates *** 679 7,272 7,951 Other items, net ** - 8,327 8,327 Adjusted EBITDA * 240,517$ (42,851)$ 197,666$ margin 18.1% 14.9% * Adjusted EBITDA is a non - GAAP measure, but as shown above it represents operating profit (loss) plus depreciation and amortization, stock - based compensation, acquisition deal costs, deferred acquisition consideration adjustments, distributions from non - consolidated affiliates, and other items. ** Other items includes ( i ) one - time gains related to the former CEO's repayment to the Company for certain perquisites and expenses ($11.3 million), (ii) legal fees and related expenses, net of insurance proceeds, relating to the ongoing SEC investigation ($12.7 million), (iii) one - time charge for the balance of prior cash bonus award amounts paid to the former CEO and CAO that will not be recovered ($5.8 million), and (iv) write - off of certain assets related to the CEO and CAO termination ($1.1 million ). *** Distributions from non - consolidated affiliates includes cash received for profit distributions as well as proceeds from the sale of non - consol idated affiliates.

22 ADJUSTED EBITDA SCHEDULE * Adjusted EBITDA is a non - GAAP measure, but as shown above it represents operating profit (loss) plus depreciation and amortization, stock - based compensation, acquisition deal costs, deferred acquisition consideration adjustments, distributions from non - consolidated affiliates, and other items. ** Distributions from non - consolidated affiliates includes cash received for profit distributions. For the Twelve Months Ended December 31, 2014 Advertising and Communications Corporate Total Revenue 1,223,512$ -$ 1,223,512$ Net loss attributable to MDC Partners Inc. (24,057)$ Adjustments to reconcile to Operating profit (loss): Net income attributable to the noncontrolling interests 6,890 Loss from discontinued operations attributable to MDC Partners Inc., net of taxes 21,260 Equity in earnings of non-consolidated affiliates (1,406) Income tax expense 12,422 Interest expense and finance charges, net 54,847 Other, net 17,793 Operating profit (loss) 155,826$ (68,077)$ 87,749$ margin 12.7% 7.2% Additional adjustments to reconcile to Adjusted EBITDA: Depreciation and amortization 45,387 1,785 47,172 Stock-based compensation 12,033 5,663 17,696 Acquisition deal costs 3,502 2,632 6,134 Deferred acquisition consideration adjustments 16,467 - 16,467 Distributions from non-consolidated affiliates ** 937 3,201 4,138 Adjusted EBITDA * 234,152$ (54,796)$ 179,356$ margin 19.1% 14.7%

MDC Partners Innovation Center 745 Fifth Avenue, Floor 19 New York, NY 10151 www.mdc - partners.com www.twitter.com/mdcpartners Investor Contact : Matt Chesler, CFA Head of Investor Relations (646)412 - 6877 mchesler@mdc - partners.com

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- e360 Named Citrix’s North American Partner of the Year for 2023

- Salesforce Growth Proves Boon to Brazilian Businesses

- Empire Communities Corp. Announces the Expiration and Results of Cash Tender Offer for Any and All 7.000% Senior Notes Due 2025

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share