Form 8-K LABORATORY CORP OF AMERI For: Jan 13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

January 13, 2016

(Date of earliest event reported)

LABORATORY CORPORATION OF

AMERICA HOLDINGS

(Exact Name of Registrant as Specified in its Charter)

Delaware | 1-11353 | 13-3757370 | ||

(State or other jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) | ||

358 South Main Street, | ||||

Burlington, North Carolina | 27215 | 336-229-1127 | ||

(Address of principal executive offices) | (Zip Code) | (Registrant’s telephone number including area code) | ||

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[x] | Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | |

[ ] | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | |

[ ] | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | |

[ ] | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | |

Item 7.01 | Regulation FD Disclosure | |

Summary information of the Company dated January 13, 2016.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

LABORATORY CORPORATION OF AMERICA HOLDINGS

Registrant

By: | /s/ F. SAMUEL EBERTS III | ||

F. Samuel Eberts III | |||

Chief Legal Officer and Secretary | |||

January 13, 2016

J.P. MORGAN HEALTHCARE CONFERENCE JANUARY 13, 2016 | SAN FRANCISCO, CA

1 FORWARD LOOKING STATEMENT Cautionary Statement Regarding Forward Looking Statements This presentation contains forward-looking statements including with respect to estimated 2015 and 2016 guidance and the impact of various factors on operating results. Each of the forward-looking statements is subject to change based on various important factors, including without limitation, competitive actions in the marketplace, adverse actions of governmental and other third-party payers and the results from the Company’s acquisition of Covance. Actual results could differ materially from those suggested by these forward-looking statements. Further information on potential factors that could affect LabCorp’s operating and financial results is included in the Company’s Form 10-K for the year ended December 31, 2014, and the Company’s subsequent Forms 10-Q, including in each case under the heading risk factors, and in the Company’s other filings with the SEC, as well as in the risk factors included in Covance’s filings with the SEC. The information in this presentation should be read in conjunction with a review of the Company’s filings with the SEC including the information in the Company’s Form 10-K for the year ended December 31, 2014, and subsequent Forms 10-Q, under the heading MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS. The Company assumes no obligation to update any forward-looking information included in this presentation.

2 Strategic Priorities Financial Strength Company and Strategic Vision AGENDA

3 LABCORP OVERVIEW 1. Based on guidance issued on October 26, 2015 • Provides diagnostic, drug development and technology-enabled solutions for >100 million patient encounters per year • Leading national clinical laboratory – LabCorp Diagnostics • Leading Contract Research Organization (CRO) – Covance Drug Development • Approximately $8.5B revenue expected in 20151 • >50,000 employees worldwide • Experienced management team • Serves large, growing, fragmented global markets Corporate Headquarters: Burlington, NC World’s Leading Healthcare Diagnostics Company

4 LABCORP DIAGNOSTICS OVERVIEW • Approximately $6.2B revenue expected in 20151 • National network of 39 primary clinical laboratories and approximately 1,700 patient service centers • Offers broad range of 4,700+ clinical, anatomic pathology, genetic and genomic tests • Processes approximately 500,000 patient specimens daily • Serves >220,000 physicians, government agencies, managed care organizations, hospitals, clinical labs and pharmaceutical companies 1. Based on guidance issued on October 26, 2015, and presented on a pro forma basis as if the acquisition of Covance closed on January 1, 2015 2. Presented on a pro forma basis as if the acquisition of Covance closed on January 1, 2014. Adjusted operating income and margin exclude unallocated corporate expenses, amortization, restructuring and other special items Leading National Clinical Laboratory Pro Forma Segment Financial Summary2 Constant Nine Months Ended Currency 9/30/2015 9/30/2014 Change Change Revenue 4,659$ 4,435$ 5.0% 5.8% Adj. O.I. 978$ 879$ 11.2% Adj. O.I. % 21.0% 19.8% 120 bps

5 Pro Forma Segment Financial Summary2 Constant Nine Months Ended Currency 9/30/2015 9/30/2014 Change Change Revenue 1,937$ 1,950$ -0.7% 3.4% Adj. O.I. 261$ 251$ 4.2% Adj. O.I. % 13.5% 12.8% 70 bps COVANCE DRUG DEVELOPMENT OVERVIEW • Approximately $2.6B revenue expected in 20151 • Only provider of full spectrum of drug development services • Market leader in early development, central laboratory, and Phase I-IV clinical trial management services • Involved in the development of all of the top 50 drugs on the market3 • Generates more safety and efficacy data than any other drug development company 1. Based on guidance issued on October 26, 2015, and presented on a pro forma basis as if the acquisition of Covance closed on January 1, 2015 2. Presented on a pro forma basis as if the acquisition of Covance closed on January 1, 2014. Adjusted operating income and margin exclude unallocated corporate expenses, amortization, restructuring and other special items 3. Based on 2014 drug sales Leading CRO / Drug Development Services Provider

6 DIVERSIFIED REVENUE BASE1 (2015 REVENUE DISTRIBUTION THROUGH SEPTEMBER 30, 2015) Unique Customer Mix 29% 31% 23% 11% 3% 3% Pharma & Biotech Managed Care (Fee for Service) Other Payers Medicare & Medicaid Patient Managed Care (Capitated) 1. Presented on a pro forma basis as if the acquisition of Covance closed on January 1st, 2015 2. Includes physicians and hospitals, Occupational Testing Services, non-U.S. clinical diagnostic laboratory operations, nutritional chemistry and food safety operations, and Beacon LBS 2

7 EXPANDED GROWTH OPPORTUNITIES WITH INCREASED GLOBAL PRESENCE 1. 2014 revenue excludes Covance. 2015 revenue presented on a pro forma basis (from January 1st through September 30th) as if the acquisition of Covance closed on January 1st, 2015. 2. Based on industry publications and company estimates 3. Over 30 currencies in 2015 and no single currency (other than US dollar) accounts for more than 5% of 2015 revenue 2014 Revenue Distribution1 >$70 billion addressable market2 2015 Revenue Distribution1 0% 25% 50% 75% 100% USA Rest of World 92.7% 81.0% 7.3% 19.0% 0% 25% 50% 75% 100% USA Rest of World 92.7% Markets Served North American Clinical Reference Laboratory Central Laboratory Market Opportunities Global Clinical Reference Laboratory Drug Development Central Laboratory Market Access Food Safety and Chemistry >$200 billion addressable market2 3

8 OUR STRATEGIC VISION: IMPROVE HEALTH AND IMPROVE LIVES Build / Acquire Complementary Capabilities Organic Growth Through New Tests, Customers and Markets Integrate Diagnostic Information and Content Build / Acquire Complementary Capabilities Use Tools and Technology to Improve Success, and Reduce Time and Cost, of Trials Commercialize Technology-Enabled Solutions Develop Scalable Platforms and Applications for Customers Delivering World Class Diagnostics Bringing Innovative Medicines to Patients Faster Changing the Way Care is Provided

9 OUR STRATEGIC VISION: IMPROVE HEALTH AND IMPROVE LIVES Delivering World Class Diagnostics Bringing Innovative Medicines to Patients Faster Changing the Way Care is Provided

10 GROW THE BASE THROUGH CUSTOMER FOCUS AND ENTERPRISE PARTNERSHIPS Drive Organic Growth to Serve Multiple Customers Across Care Settings • Increase breadth and scope of partnerships with managed care • Seek innovative partnerships with government payers • Increase breadth and depth of partnerships with health systems, integrated delivery networks and physician groups • Embrace new partners, solutions, payment structures and care models • Capitalize on new capabilities to increase patient engagement and assist patients in better managing their health

11 EXPAND DIAGNOSTIC OFFERING WITH NEW TESTS Maintain Leadership in Scientific Innovation • Introduced over 75 assays in 2015 • Industry-leading position in companion diagnostics (CDx) with differentiated capabilities and unparalleled experience • Continue expansion of next-generation sequencing capabilities • Complement LabCorp R&D through acquisitions, licensing and collaborations with leading companies and academic institutions Preferred Provider of End-to-End Clinical Development and Commercial Lab Testing Solutions as well as Regulatory Support for Innovative CDx • PD-L1 IHC 22C3 pharmDx (Merck’s Keytruda®) • PD-L1 IHC 28-8 pharmDx (Bristol-Myers Squibb’s OPDIVO®) • cobas® EGFR Mutation Test v2 (AstraZeneca’s TAGRISSO™) Approved and commercialized within past 6 months Keytruda is a registered trademark of Merck Sharp & Dohme Corp., a subsidiary of Merck & Co., Inc. OPDIVO is a registered trademark of Bristol-Myers Squibb Company. cobas is a registered trademark of Roche. TAGRISSO is a trademark of the AstraZeneca group of companies.

12 CREATE SHAREHOLDER VALUE THROUGH ACQUISITION OF COMPLEMENTARY BUSINESSES Target Acquisition Considerations Attractive market opportunity that leverages our core competencies Meets financial criteria Proven technology Attractive customer set Global scope Strong management team Genzyme Genetics

13 OUR STRATEGIC VISION: IMPROVE HEALTH AND IMPROVE LIVES Delivering World Class Diagnostics Bringing Innovative Medicines to Patients Faster Changing the Way Care is Provided

14 DELIVER HIGHEST QUALITY, END-TO-END DRUG DEVELOPMENT SOLUTIONS TO THE MARKET • Create therapeutically-driven solutions that span the drug development and testing continuum • Pursue pull-through opportunities and broaden customer segment coverage globally • Leverage scale, cost efficiencies and integrated capabilities to increase market share, reduce development timelines and drive down costs • Continue global leadership in companion diagnostics from discovery to commercialization • Offer commercial solutions to maximize biopharmaceutical partners’ asset value

15 CREATE DIFFERENTIATED DRUG DEVELOPMENT APPROACHES Help Partners Rethink and Redesign their Global R&D Decisions Early Development Phase Solutions • Innovative offering to connect the customers’ non-clinical and clinical development goals • Consistent and focused project team • Continuity of drug development partnership • Flexibility to meet partners’ needs • Efficient and cost effective Proof Of Concept COMMERCIALIZATION DRUG DRUG DEVELOPMENT CYCLE

16 DEPLOY INNOVATIVE TOOLS AND TECHNOLOGY TO ADDRESS PARTNER NEEDS • Deliver SaaS platform to replace internally- built clinical IT structures while improving value and insight • Create scientific solutions that accelerate discovery and development of innovative medicines • Lower patient burden and improve patient access to clinical trials • Continue to develop real-world evidence capabilities

17 DEVELOP INFORMATICS-DRIVEN SOLUTIONS IN PATIENT RECRUITMENT AND STUDY START UP • Health information from >100 million patient encounters annually • Identify desired patient populations and relevant investigator sites • Inform study design • Facilitate faster clinical trial enrollment Filtered patient population Filtered investigator sites Provide Partners with Unique Perspectives and Actionable Insights ~$100 million of new orders won through the combination of LabCorp patient data and Covance capabilities

18 OUR STRATEGIC VISION: IMPROVE HEALTH AND IMPROVE LIVES Delivering World Class Diagnostics Bringing Innovative Medicines to Patients Faster Changing the Way Care is Provided

19 • Decision support tool to guide lab and test selection • Designed to: • Improve quality of lab services • Support evidence-based guidelines for patient care • Help payers manage laboratory cost and trend • Integrated into provider workflow • Developed and implemented by collaborative team with extensive laboratory medicine experience COMMERCIALIZE INNOVATIVE TECHNOLOGY-ENABLED SOLUTIONS BeaconLBS: Appropriate Test, Appropriate Patient, Appropriate Time

20 PROVIDE BETTER INSIGHTS TO HELP CUSTOMERS MANAGE HEALTH Innovative Decision Support Tools • Programs include: • Chronic Kidney Disease (CKD) • Cardiovascular Disease • Type 2 Diabetes • Kidney Stones • Medical Drug Monitoring • Delivered more than 5 million enhanced reports in 2015 • Reports provide actionable diagnostic information to change decision making Physicians receiving the proprietary clinical decision support reports were 29 percent to 88 percent more likely to order CKD-related testing in accordance with guidelines than those physicians who did not receive the reports

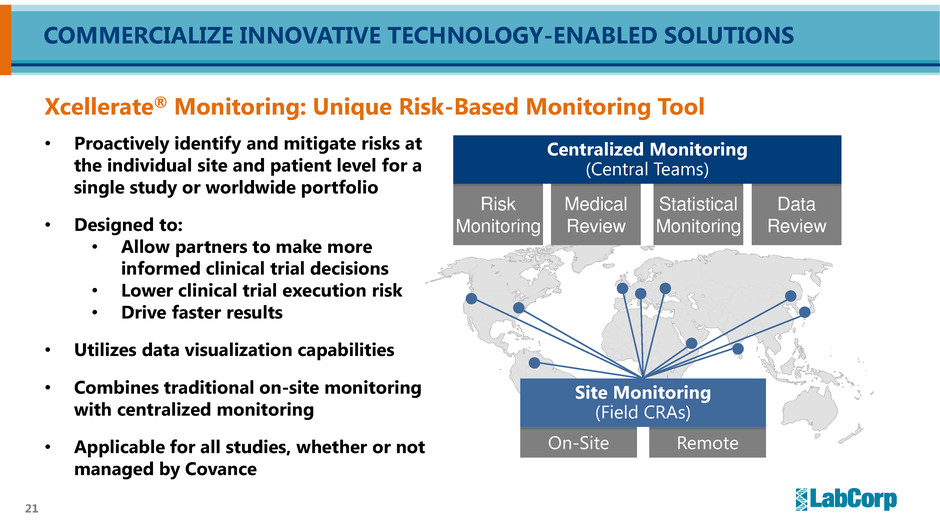

21 • Proactively identify and mitigate risks at the individual site and patient level for a single study or worldwide portfolio • Designed to: • Allow partners to make more informed clinical trial decisions • Lower clinical trial execution risk • Drive faster results • Utilizes data visualization capabilities • Combines traditional on-site monitoring with centralized monitoring • Applicable for all studies, whether or not managed by Covance COMMERCIALIZE INNOVATIVE TECHNOLOGY-ENABLED SOLUTIONS Xcellerate® Monitoring: Unique Risk-Based Monitoring Tool On-Site Remote Risk Monitoring Medical Review Statistical Monitoring Data Review Site Monitoring (Field CRAs) Centralized Monitoring (Central Teams)

22 FOCUSED ON PROFITABLE GROWTH 1. Results presented on a pro forma basis as if the acquisition of Covance closed on January 1, 2014. Adjusted operating income excludes amortization, restructuring and other special items. See Appendix for reconciliation. 2. Reported results include Covance as of February 19, 2015; prior to February 19, 2015, results exclude Covance. Adjusted EPS exclude amortization, restructuring and other special items. See Appendix for reconciliation. $3.0 $3.5 $4.0 $4.5 $5.0 $5.5 $6.0 $6.5 $7.0 Pro Forma Revenue $0.8 $0.9 $1.0 $1.1 $1.2 Pro Forma Adjusted OI $300 $350 $400 $450 Reported Free Cash Flow $4.00 $4.50 $5.00 $5.50 $6.00 $6.50 Reported Adjusted EPS In Billions In Billions In Millions Nine Months Ended 9/30/14 Nine Months Ended 9/30/15 1 1 2 2

23 EFFECTIVE CAPITAL DEPLOYMENT TO BUILD SHAREHOLDER VALUE Capital Expenditures 9% $2.8 billion Share Repurchase 24% Other Acquisitions 17% Approximately $11.8 billion in capital deployment between 2010 and Sep. 30, 20151 $5.6 billion $1.0 billion 1. Includes cash from operations (approximately $4.7 billion) as well as debt (approximately $5.3 billion) and equity (approximately $1.8 billion) issuances Debt Repayment 2% Covance Acquisition 48% $2.1 billion

24 CONCLUSION • Unique business with unique capabilities • Expanded growth opportunities in the US and around the globe • Focus on execution of our strategy to increase shareholder value Key Points

J.P. MORGAN HEALTHCARE CONFERENCE JANUARY 13, 2016 | SAN FRANCISCO, CA

26 Appendix

27 1. Adjusted Operating Income excludes amortization, restructuring and special items 2. See Reconciliation of non-GAAP Financial Measures in Appendix Pro forma results assume that the acquisition of Covance closed on January 1, 2014 Nine Months Nine Months Ended 9/30/15 Ended 9/30/14 % Change Net Revenue LabCorp Diagnostics $4,659.2 $4,435.3 5.0% Covance Drug Development $1,937.3 $1,950.4 (0.7%) Total Net Revenue $6,596.5 $6,385.7 3.3% Adjusted Operating Income1, 2 LabCorp Diagnostics $977.6 $879.4 11.2% Adjusted Operating Margin 21.0% 19.8% 120 bps Covance Drug Development $261.1 $250.5 4.2% Adjusted Operating Margin 13.5% 12.8% 70 bps Unallocated Corporate Expense ($129.6) ($124.3) 4.3% Total Adjusted Operating Income $1,109.1 $1,005.6 10.3% Total Adjusted Operating Margin 16.8% 15.7% 110 bps YEAR-TO-DATE PRO FORMA SEGMENT RESULTS (DOLLARS IN MILLIONS)

28 The following consolidated results include Covance as of February 19, 2015; prior to February 19, 2015, all consolidated results exclude Covance RECONCILIATION OF NON-GAAP FINANCIAL MEASURES Adjusted Operating Income 2015 2014 Operating Income 759.5$ 691.4$ Acquisition-related costs 118.0 - Restructuring and other special charges 59.9 15.4 Consulting fees 15.2 10.2 Amortization of intangibles and other assets 126.2 61.3 Adjusted operating income 1,078.8$ 778.3$ Adjusted EPS Diluted earnings per common share 3.24$ 4.53$ Restructuring and special items 1.83 0.18 Amortization expense 0.87 0.44 Adjusted EPS 5.94$ 5.15$ Nine Months Ended September 30, LABORATORY CORPORATION OF AMERICA HOLDINGS Reconciliation of Non-GAAP Financial Measures (in millions, except per share data)

29 The following consolidated results include Covance as of February 19, 2015; prior to February 19, 2015, all consolidated results exclude Covance RECONCILIATION OF NON-GAAP FINANCIAL MEASURES Free Cash Flow: 2015 2014 Net cash provided by operating activities 597.8$ 525.3$ Less: Capital expenditures (170.7) (157.2) Free cash flow 427.1$ 368.1$ Free Cash Flow, Excluding Acquisition Related Charges: Net cash provided by operating activities 597.8$ 525.3$ Add back: Acquisition related charges 153.5 - Net cash provided by operating activities, excluding acquisition related charges 751.3$ 525.3$ Less: Capital expenditures (170.7) (157.2) Free cash flow, excluding acquisition related charges 580.6$ 368.1$ Nine Months Ended September 30, LABORATORY CORPORATION OF AMERICA HOLDINGS Reconciliation of Non-GAAP Financial Measures (in millions, except per share data)

30 1) During the third quarter of 2015, the Company recorded net restructuring and special items of $26.4 million. The charges included $24.4 million in severance and other personnel costs along with $2.3 million in facility-related costs associated with facility closures and general integration initiatives. The Company reversed previously established reserves of $0.3 million in unused facility-related costs. The Company also recorded $3.7 million in consulting expenses relating to fees incurred as part of its Covance integration costs, along with $1.4 million in short-term equity retention arrangements relating to the acquisition of Covance (all recorded in selling, general and administrative expenses). In addition, the Company recorded a non-cash loss of $2.3 million, upon the dissolution of one of its equity investments (recorded in other, net in the accompanying Consolidated Statements of Operations). The after tax impact of these charges decreased net earnings for the quarter ended September 30, 2015, by $27.7 million and diluted earnings per share by $0.27 ($27.7 million divided by 102.9 million shares). During the first two quarters of 2015, the Company recorded net restructuring and other special charges of $33.5 million. The charges included $9.5 million in severance and other personnel costs along with $9.8 million in costs associated with facility closures and general integration initiatives. The Company reversed previously established reserves of $0.6 million in unused facility-related costs. In addition, the Company recorded asset impairments of $14.8 million relating to lab and customer service applications that will no longer be used. The Company also recorded $11.6 million of consulting expenses relating to fees incurred as part of its Project LaunchPad business process improvement initiative as well as Covance integration costs. In addition, the Company also expensed $2.9 million in short-term equity retention arrangements relating to the acquisition of Covance. During the first quarter of 2015, the Company recorded $166.0 million of one-time costs associated with its acquisition of Covance. The costs included $79.5 million of Covance employee equity awards, change in control payments and short-term retention arrangements that were accelerated or triggered by the acquisition transaction (recorded in selling, general and administrative expenses in the accompanying Consolidated Statements of Operations). The acquisition costs also included advisor and legal fees of $33.9 million (recorded in selling, general and administrative expenses in the accompanying Consolidated Statements of Operations), $15.2 million of deferred financing fees associated with the Company’s bridge loan facility as well as a make-whole payment of $37.4 million paid to call Covance’s private placement debt outstanding at the purchase date (both amounts recorded in interest expense in the accompanying Consolidated Statements of Operations). The after tax impact of these charges decreased net earnings for the nine months ended September 30, 2015, by $182.5 million and diluted earnings per share by $1.83 ($182.5 million divided by 99.7 million shares). RECONCILIATION OF NON-GAAP FINANCIAL MEASURES – FOOTNOTES

31 2) During the third quarter of 2014, the Company recorded net restructuring and special items of $5.8 million. The charges included $4.6 million in severance and other personnel costs along with $1.6 million in facility-related costs associated with facility closures and general integration initiatives. The Company reversed previously established reserves of $0.2 in unused severance and $0.2 million in unused facility-related costs. In addition, the Company recorded $5.5 million in consulting expenses relating to fees incurred as part of its comprehensive enterprise-wide cost structure review as well as legal fees associated with its LipoScience acquisition (all such fees recorded in selling, general and administrative expenses). The after tax impact of these combined charges decreased net earnings for the quarter ended September 30, 2014, by $7.0 million and diluted earnings per share by $0.08 ($7.0 million divided by 86.5 million shares). During the first two quarters of 2014, the Company recorded net restructuring and special items of $14.3 million. The charges included $5.3 million in severance and other personnel costs along with $5.0 million in costs associated with facility closures and general integration initiatives. The Company reversed previously established reserves of $0.2 million in unused severance and $0.5 million in unused facility-related costs. In addition, the Company recorded $4.7 million in consulting expenses (recorded in selling, general and administrative expenses) relating to fees incurred as part of its comprehensive enterprise-wide cost structure review as well as one-time CFO transition costs. The after tax impact of these combined charges decreased net earnings for the nine months ended September 30, 2014, by $15.8 million and diluted earnings per share by $0.18 ($15.8 million divided by 86.5 million shares). 3) The Company continues to grow the business through acquisitions and uses Adjusted EPS Excluding Amortization as a measure of operational performance, growth and shareholder returns. The Company believes adjusting EPS for amortization provides investors with better insight into the operating performance of the business. For the quarters ended September 30, 2015 and 2014, intangible amortization was $47.1 million and $18.3 million, respectively ($32.9 million and $11.3 million net of tax, respectively) and decreased EPS by $0.31 ($32.9 million divided by 102.9 million shares) and $0.13 ($11.3 million divided by 86.5 million shares), respectively. For the nine months ended September 30, 2015 and 2014, intangible amortization was $126.2 million and $61.3 million, respectively ($86.5 million and $37.8 million net of tax, respectively) and decreased EPS by $0.87 ($86.5 million divided by 99.7 million shares) and $0.44 ($37.8 million divided by 86.5 million shares), respectively. 4) During the first quarter of 2015, the Company's operating cash flows were reduced due to payment of $153.5 million in acquisition-related charges. These payments were comprised of $75.5 million in legal and advisor fees, $40.6 million in accelerated Covance employee equity awards, and $37.4 million in make- whole payments triggered by calling Covance private placement notes outstanding at the time of the transaction. RECONCILIATION OF NON-GAAP FINANCIAL MEASURES – FOOTNOTES

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Labcorp Announces First-of-Its-Kind Test for Early Indication of Neurodegenerative Diseases and Brain Injuries Using a Blood Draw

- PSEG Declares Regular Quarterly Dividend for the Second Quarter of 2024

- Labcorp (LH) Receives FDA Emergency Use Authorization for Mpox PCR Test Home Collection Kit

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share