Form 8-K NuStar Energy L.P. For: Nov 11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 11, 2015

NuStar Energy L.P.

(Exact name of registrant as specified in its charter)

Delaware | 001-16417 | 74-2956831 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

19003 IH-10 West San Antonio, Texas 78257 | ||

(Address of principal executive offices) | ||

(210) 918-2000 | ||

(Registrant’s telephone number, including area code) | ||

Not applicable | ||

(Former name or former address, if changed since last report.) | ||

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 7.01 Regulation FD Disclosure.

Senior management of NuStar Energy L.P. (the “Partnership”) is meeting with members of the investment community at the Jefferies 2015 Energy Conference in Houston, Texas on November 11-12, 2015. The slides attached to this report were prepared in connection with, and are being used during, the conference. The slides are included in Exhibit 99.1 to this report and are incorporated herein by reference. The slides became available in the “Investors” section of the Partnership’s website at www.nustarenergy.com at 8:30 a.m. (Central Time) on November 11, 2015.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

Exhibit Number | EXHIBIT | |

Exhibit 99.1 | Slides used on November 11-12, 2015. | |

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

NUSTAR ENERGY L.P. | ||||

By: | Riverwalk Logistics, L.P. | |||

its general partner | ||||

By: | NuStar GP, LLC | |||

its general partner | ||||

Date: November 12, 2015 | By: | /s/ Amy L. Perry | ||

Name: | Amy L. Perry | |||

Title: | Senior Vice President, General Counsel - Corporate & Commercial Law and Corporate Secretary | |||

3

EXHIBIT INDEX

Exhibit Number | EXHIBIT | |

Exhibit 99.1 | Slides used on November 11-12, 2015. | |

4

Jefferies Energy Conference November 11 & 12, 2015 Exhibit 99.1

Forward-Looking Statements Statements contained in this presentation that state management’s expectations or predictions of the future are forward-looking statements. While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested in this presentation. These forward-looking statements can generally be identified by the words "anticipates," "believes," "expects," "plans," "intends," "estimates," "forecasts," "budgets," "projects," "could," "should," "may" and similar expressions. These statements reflect our current views with regard to future events and are subject to various risks, uncertainties and assumptions. We undertake no duty to update any forward-looking statement to conform the statement to actual results or changes in the company’s expectations. For more information concerning factors that could cause actual results to differ from those expressed or forecasted, see NuStar Energy L.P.’s annual report on Form 10-K and quarterly reports on Form 10-Q, filed with the SEC and available on NuStar’s website at www.nustarenergy.com. We use financial measures in this presentation that are not calculated in accordance with generally accepted accounting principles (“non-GAAP”) and our reconciliations of non-GAAP financial measures to GAAP financial measures are located in the appendix to this presentation. These non-GAAP financial measures should not be considered an alternative to GAAP financial measures. 2

NuStar Overview

Two Publicly Traded Companies 4 2% G.P. Interest in NS IPO Date: 4/16/2001 13.0% L.P. Interest in NS Unit Price (11/4/15): $47.22 Incentive Distribution Rights in NS (IDR) Annualized Distribution/Unit: $4.38 ~13.0% NS Distribution Take Yield (11/4/15): 9.3% IPO Date: 7/19/2006 Market Capitalization: $3.7 billion Unit Price (11/4/15): $25.87 Enterprise Value: $6.7 billion Annualized Distribution/Unit: $2.18 Credit Ratings Yield (11/4/15): 8.4% Moody's: Ba1/Stable Market Capitalization: $1.1 billion S&P: BB+/Stable Enterprise Value: $1.1 billion Fitch: BB/Stable NYSE: NSH NYSE: NS William E. Greehey 8.6 million NSH Units 19.9% Membership Interest Public Unitholders 67.5 million NS Units 85.0% L.P. Interest Public Unitholders 34.3 million NSH Units 80.1% Membership Interest

Large and Diverse Geographic Footprint with Assets in Key Locations Assets: 79 terminals ~93 million barrels of storage capacity ~8,700 miles of crude oil and refined product pipelines Corpus Christi, TX – Destination for South Texas Crude Oil Pipeline System St. James, LA – 9.2MM bbls Pt. Tupper, Nova Scotia – 7.7MM bbls Linden, NJ – 4.3MM bbls St. Eustatius – 14.4MM bbls 3.8MM bbls 5

Percentage of 2015 Segment EBITDA (for the nine months ended 9/30/15) Refined Product Pipelines Crude Oil Pipelines Refined Product Terminals Crude Oil Storage Fuels Marketing: 2% Refined Products Marketing, Bunkering and Crude & Fuel Oil Trading Majority of Segment EBITDA Generated by Fee-Based Pipeline and Storage Segments Pipeline and Storage segments account for about 98% of 2015 segment EBITDA Storage: 48% Pipeline: 50% 6 48% 50%

Acquired remaining 50% interest in our 4.3 million barrel Linden terminal in January 2015 Completed expansion of South Texas Crude Oil Pipeline System in February 2015, which increased capacity to 340,000 bpd Finished construction of 400,000 barrels of additional storage at our Corpus Christi North Beach Terminal in the third quarter 2015 Recently completed four of our six projects to increase distillate and propane supply throughout our Central East System and some projects that connect our Oakville to Corpus Christi 16-inch crude oil pipeline to a few major refineries in the Corpus Christi, Texas area Signed letter of intent with PMI to develop project to transport LPGs from the U.S. into northern Mexico, expect to finalize agreements in the fourth quarter 2015 Taking steps to increase capacity and flexibility of our ammonia pipeline and build out additional capacity at our St. James terminal Third Quarter 2015 Highlights 17% increase in storage lease revenues Base business experienced improved throughputs despite challenging market conditions Coverage ratio: 1.05 times, sixth consecutive quarter in excess of 1.0 times We expect fourth quarter 2015 earnings per unit to be in the range of $0.45 to $0.55 Achieving 2015 Goals - Strong 3rd Quarter Results and Strategic Capital Spending Program Position NuStar for Continued Distribution Coverage in 2015 & 2016 7

Building on Our Strengths - Stable, Diversified Business Foundation for Future Growth Contracted fee-based storage and pipeline assets provide stable cash flows, delivering approximately 98% of 2015 segment EBITDA Storage terminals effectively full ~75% of pipeline revenues are based on refinery/fertilizer plant feedstock supply or refinery production delivery ~25% of pipeline revenues are Eagle Ford volumes to area refineries or Corpus Christi, TX docks ~95% of tariffs are FERC-based, which are adjusted annually for inflation Diverse and high-quality customer base composed of large integrated oil companies, national oil companies and refiners 1 – 94% committed through take or pay contracts or through structural exclusivity (uncommitted lines serving refinery customers with no competition) 8

In early January, we purchased the remaining 50% interest in our Linden terminal for $142.5 million Sole ownership of the terminal strengthens our presence in the New York Harbor and the East Coast market and may provide opportunities for expansion Terminal is strategically located in the New York Harbor with: 4.3 million barrels of refined products storage capacity, primarily gasoline, jet fuel and fuel oil A deep-water ship dock and one barge dock that are used for inbound and outbound shipments Inbound pipeline connections to the Colonial and Sun pipelines, and an outbound connection to the Buckeye Pipeline Direct connection to our adjacent, 100%-owned terminal, which has 389,000 barrels of refined product storage capacity and receives shipments via truck and pipeline and delivers product via its eight-bay truck loading rack Executing on Growth – Closed on an Acquisition in First Quarter 2015 9

Pipeline Segment

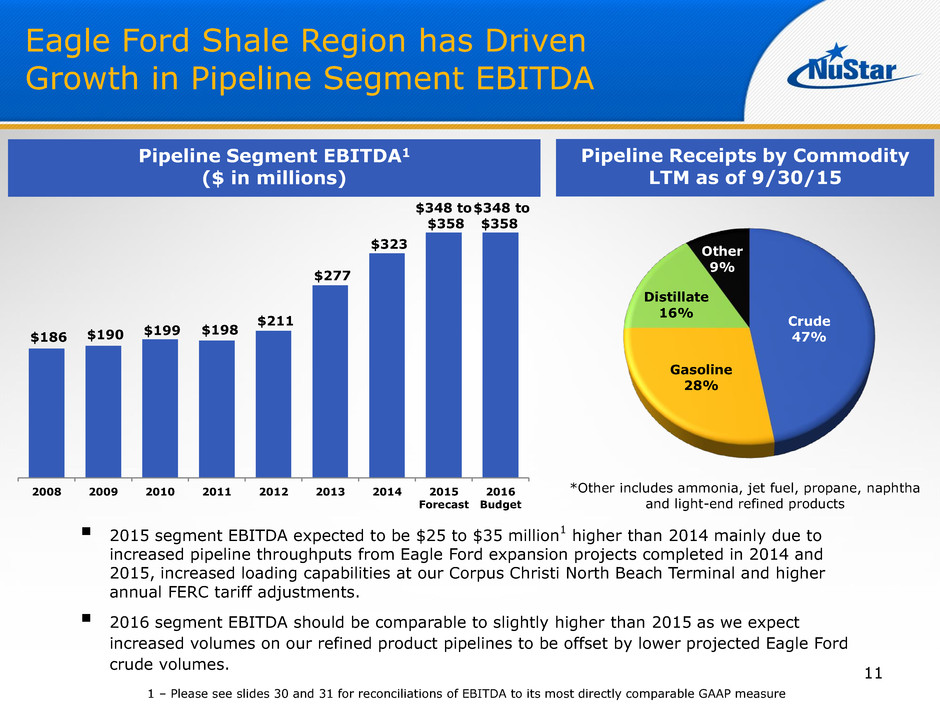

2015 segment EBITDA expected to be $25 to $35 million1 higher than 2014 mainly due to increased pipeline throughputs from Eagle Ford expansion projects completed in 2014 and 2015, increased loading capabilities at our Corpus Christi North Beach Terminal and higher annual FERC tariff adjustments. 2016 segment EBITDA should be comparable to slightly higher than 2015 as we expect increased volumes on our refined product pipelines to be offset by lower projected Eagle Ford crude volumes. Eagle Ford Shale Region has Driven Growth in Pipeline Segment EBITDA Pipeline Segment EBITDA1 ($ in millions) Crude 47% Gasoline 28% Distillate 16% Other 9% Pipeline Receipts by Commodity LTM as of 9/30/15 *Other includes ammonia, jet fuel, propane, naphtha and light-end refined products 11 1 – Please see slides 30 and 31 for reconciliations of EBITDA to its most directly comparable GAAP measure $186 $190 $199 $198 $211 $277 $323 $348 to $358 $348 to $358 2008 2009 2010 2011 2012 2013 2014 2015 Forecast 2016 Budget

South Texas Crude Oil Pipeline Expansion 1 – Please see slide 31 for a reconciliation of EBITDA to its most directly comparable GAAP measure Total Estimated Eagle Ford Spending Pipeline Segment ~$702 million Total (includes Storage Segment) ~$870 million We expect these projects to earn EBITDA multiples in the range of 4x – 8x 12

Throughputs in NuStar’s South Texas Crude Oil Pipeline System Have Remained Strong 13 168 179 218 255 270 290 272 263 254 258 112 120 149 173 179 190 193 175 173 178 100 200 300 4Q 2013 Actual 1Q 2014 Actual (Corpus Dock) 2Q 2014 Actual (Phase 1) 3Q 2014 Actual 4Q 2014 Actual 1Q 2015 Actual (Phase 2) 2Q 2015 Actual 3Q 2015 Actual 4Q 2015 Estimate 2016 Estimate Total Eagle Ford Throughputs - Avg. Daily Throughputs (MBPD), Includes South Texas Crude Oil Pipeline System Throughputs South Texas Crude Oil Pipeline System Throughputs into our Corpus Christi North Beach Terminal - Avg. Daily Throughputs (MBPD)

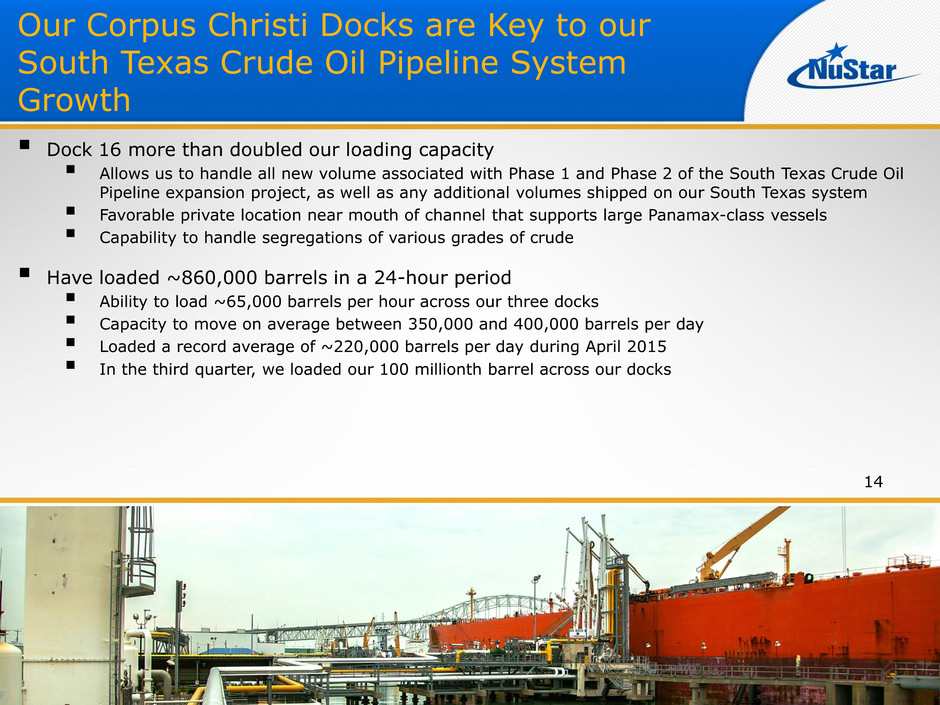

Dock 16 more than doubled our loading capacity Allows us to handle all new volume associated with Phase 1 and Phase 2 of the South Texas Crude Oil Pipeline expansion project, as well as any additional volumes shipped on our South Texas system Favorable private location near mouth of channel that supports large Panamax-class vessels Capability to handle segregations of various grades of crude Have loaded ~860,000 barrels in a 24-hour period Ability to load ~65,000 barrels per hour across our three docks Capacity to move on average between 350,000 and 400,000 barrels per day Loaded a record average of ~220,000 barrels per day during April 2015 In the third quarter, we loaded our 100 millionth barrel across our docks Our Corpus Christi Docks are Key to our South Texas Crude Oil Pipeline System Growth 14

Choke Canyon PL – 12” Laredo PL – 8” Dos Laredo – 8” Valley PL – 6”/8”/10” Pettus South – 10” Houston – 12” Pawnee to Oakville PL – 12” Three Rivers Supply – 12” Corpus-Odem-3R – 8” Oakville to Corpus – 16” Second Phase of Expansion – 12” NuStar’s South Texas Pipeline Presence 15

Signed Letter of Intent with PMI to Develop Project to Transport LPGs from the U.S. Into Northern Mexico Signed non-binding Letter of Intent with PMI Based on development to date, we expect to establish a joint venture with PMI by the end of the year Project expected to be complete in the first half of 2017 Laredo PL – 8” Valley PL – 6”/8”/10” Houston – 12” 16

NuStar Expanding Mid-Continent Pipeline and Terminal Network Completed four of the six projects under development with a key customer to increase distillate and propane supply throughout the Upper Midwest for an investment of approximately $50 million Capital investments to be backed by long- term agreements Propane supply projects complete and in service. Construction on remaining projects should be completed by the first quarter of 2017 17

Storage Segment

1 – Please see slides 30 and 31 for reconciliations of adjusted EBITDA to its most directly comparable GAAP measure Storage Segment EBITDA Benefiting from Linden Terminal Acquisition 2015 segment EBITDA expected to be $40 to $50 million1 higher than 2014, primarily due to incremental EBITDA from the Linden terminal acquisition, a full-year benefit from 8 million barrels of renewed storage in St. Eustatius and Pt. Tupper, Canada, favorable renewals at several terminals, expected insurance proceeds related to our Linden terminal and strong throughputs at our Corpus Christi North Beach facility during the first half of the year. 2016 segment EBITDA expected to decrease $15 to $351 million compared to 2015 mostly due to the negative impact of lower Eagle Ford shale production on expected throughput volumes into our Corpus Christi North Beach terminal, lower expected revenue from some of foreign terminals and the absence of the expected 2015 insurance proceeds next year. Adjusted Storage Segment EBITDA1 ($ in millions) 19 30% 58% 12% < 1 Year 1 to 3 Years 3 to 5 Years > 5 Years Storage Lease Renewals (% as of 10/19/2015) $208 $242 $256 $279 $287 $277 $287 $327 to $337 $292 to $322 2008 2009 2010 2011 2012 2013 2014 2015 Forecast 2016 Budget

Fuels Marketing Segment

Fuels Marketing Segment Benefits Base Business Segment is composed of: Refined Products Marketing Bunkering Crude & Fuel Oil Trading Fuels Marketing Segment currently pays Storage Segment approximately $26 million in annual storage fees Represents around 5% of Storage Segment revenues 2015 EBITDA results for the segment are expected to be $10 to $20 million1 2016 EBITDA results for the segment are expected to be $15 to $35 million1 1 – Please see slide 31 for a reconciliation of EBITDA to its most directly comparable GAAP measure 21

Strategic Growth Update

Pursuing Pipeline and Storage Opportunities – Currently Evaluating: Total Pipeline and Storage Segment strategic growth spending could be in the $1.2 to $1.6 billion1 range 1 – capital spending to take place over the next two to three years. Expansion of our Ammonia pipeline system Export opportunities for our west coast operations Crude oil and refined product pipeline opportunities in various shale plays Additional storage expansion opportunities at our St. James and Linden terminals Project to transport LPGs from the U.S. into northern Mexico 23 Opportunities to expand some Texas pipeline and terminal assets into new markets Further expansion of our South Texas Pipeline System

Financial Overview

Capital Structure (as of September 30, 2015, Dollars in Millions) $1.5 billion Credit Facility $908 NuStar Logistics Notes (4.75%) 250 NuStar Logistics Notes (4.80%) 450 NuStar Logistics Notes (6.75%) 300 NuStar Logistics Notes (7.65%) 350 NuStar Logistics Sub Notes (7.625%) 403 GO Zone Bonds 365 Receivables Financing 57 Net unamortized discount and fair value adjustments 26 Total Long-term Debt $3,109 Total Short-term Debt 42 Total Partners’ Equity 1,654 Total Capitalization $4,805 Availability under $1.5 billion Credit Facility (as of September 30, 2015): ~$561 million $908 million in borrowings and $31 million in Letters of Credit outstanding Debt to EBITDA calculation per Credit Facility of 4.4x (as of September 30, 2015) 25

Long-term Debt Maturity Profile (as of September 30, 2015, Dollars in Millions) Currently, no debt maturities until 2018 Long-term Debt structure 56% fixed rate – 44% variable rate Callable in 2018, but final maturity in 2043 26 $908 $350 $450 $300 $250 $365 $403 $57 $0 $250 $500 $750 $1,000 2015 2016 2017 2018 2019 2020 2021 2022 2038- 2041 Receivables Financing Sub Notes GO Zone Financing Senior Unsecured Notes Revolver $810

Expect ~$435 to $445 Million of Strategic Spending in 2015 and $360 to $380 in 2016 (Dollars in Millions) 2015 Total Capital Spending, which includes Reliability Capital, is expected to be in the range of $465 to $485 million in 2015 2016 Total Capital Spending, which includes Reliability Capital, is expected to be in the range of $395 to $425 million in 2016 27 $219 $294 $374 $302 $328 $292 to $302 $360 to $380 $43 $101 $316 $143 $0 $100 $200 $300 $400 $500 $600 $700 $800 2010 2011 2012 2013 2014 2015 Forecast 2016 Budget Internal Growth Acquisitions $262 $395 $690 $435 to $445

The Fundamentals of our Business Remain Strong Fee-based pipeline and storage operations Supported by contracts from creditworthy customers World-class assets in strategic locations that allow us to take advantage of: Continued shale oil development Potential exports of both crude oil and condensates Changing storage fundamentals Strong balance sheet and improved financial metrics Company-wide commitment to our distributable cash flow growth 28

Appendix

Reconciliation of Non-GAAP Financial Information 2008 2009 2010 2011 2012 2013 2014 Operating income 135,086$ 139,869$ 148,571$ 146,403$ 158,590$ 208,293$ 245,233$ Plus depreciation and amortization expense 50,749 50,528 50,617 51,165 52,878 68,871 77,691 EBITDA 185,835$ 190,397$ 199,188$ 197,568$ 211,468$ 277,164$ 322,924$ 2008 2009 2010 2011 2012 2013 2014 Operating income (loss) 141,079$ 171,245$ 178,947$ 196,508$ 198,842$ (127,484)$ 183,104$ Plus depreciation and amortization expense 66,706 70,888 77,071 82,921 88,217 99,868 103,848 EBITDA 207,785$ 242,133$ 256,018$ 279,429$ 287,059$ (27,616)$ 286,952$ Impact from non-cash charges 304,453 Adjusted EBITDA 276,837$ Pipeline Segment Storage Segment Projected operating income $ 263,000 - 268,000 $ 213,000 - 218,000 Plus projected depreciation and amortization expense 85,000 - 90,000 114,000 - 119,000 Projected EBITDA $ 348,000 - 358,000 $ 327,000 - 337,000 Pipeline Segment Storage Segment Projected operating income $ 263,000 - 268,000 $ 176,000 - 197,000 Plus projected depreciation and amortization expense 85,000 - 90,000 116,000 - 125,000 Projected EBITDA $ 348,000 - 358,000 $ 292,000 - 322,000 NuStar Energy L.P. utilizes financial measures such as earnings before interest, taxes, depreciation and amortization (EBITDA), distributable cash flow (DCF), adjusted net income and adjusted net income per unit (collectively, financial measures), which are not defined in U.S. generally accepted accounting principles (GAAP). Management uses these financial measures because they are widely accepted financial indicators used by investors to compare partnership performance. In addition, management believes that these financial measures provide investors an enhanced perspective of the operating performance of the partnership’s assets and/or the cash that the business is generating. None of these financial measures are presented as an alternative to net income or income from continuing operations. They should not be considered in isolation or as substitutes for a measure of performance prepared in accordance with GAAP. For purposes of segment reporting, we do not allocate general and administrative expenses to our reported operating segments because those expenses relate primarily to the overall management at the entity level. Therefore, EBITDA reflected in the segment reconciliations exclude any allocation of general and administrative expenses consistent with our policy for determining segmental operating income, the most directly comparable GAAP measure. The following is a reconciliation of operating income to EBITDA for the pipeline segment: The following is a reconciliation of projected operating income to projected EBITDA for the year ended December 31, 2016: The following is a reconciliation of operating income (loss) to EBITDA for the storage segment: The following is a reconciliation of projected operating income to projected EBITDA for the year ended December 31, 2015: Year Ended December 31, Year Ended December 31, 30

Reconciliation of Non-GAAP Financial Information The following is a reconciliation of projected incremental operating income to projected incremental EBITDA for the year ended December 31, 2015: Pipeline Segment Storage Segment Projected incremental operating income $ 18,000 - 23,000 $ 30,000 - 35,000 Plus projected incremental depreciation and amortization expense 7,000 - 12,000 10,000 - 15,000 Projected incremental EBITDA $ 25,000 - 35,000 $ 40,000 - 50,000 The following is a reconciliation of projected incremental operating income to projected incremental EBITDA for the year ended December 31, 2016: Storage Segment Projected incremental operating income $ (17,000 - 41,000) Plus projected incremental depreciation and amortization expense 2,000 - 6,000 Projected incremental EBITDA $ (15,000 - 35,000) The following is a reconciliation of projected annual operating income to projected annual EBITDA for a certain project in our pipeline segment: South Texas Crude Phase One Projected annual operating income 19,000$ Plus projected annual depreciation and amortization expense 1,000 Projected annual EBITDA 20,000$ The following is a reconciliation of projected operating income to projected EBITDA for the fuels marketing segment: 2016 2015 Projected operating income $ 15,000 - 35,000 $ 10,000 - 20,000 Plus projected depreciation and amortization expense - - Projected EBITDA $ 15,000 - 35,000 $ 10,000 - 20,000 Year Ended December 31, NuStar Energy L.P. utilizes financial measures such as earnings before interest, taxes, depreciation and amortization (EBITDA), distributable cash flow (DCF), adjusted net income and adjusted net income per unit (collectively, financial measures), which are not defined in U.S. generally accepted accounting principles (GAAP). Management uses these financial measures because they are widely accepted financial indicators used by investors to compare partnership performance. In addition, management believes that these financial measures provide investors an enhanced perspective of the operating performance of the partnership’s assets and/or the cash that the business is generating. None of these financial measures are presented as an alternative to net income or income from continuing operations. They should not be considered in isolation or as substitutes for a measure of performance prepared in accordance with GAAP. For purposes of segment reporting, we do not allocate general and administrative expenses to our reported operating segments because those expenses relate primarily to the overall management at the entity level. Therefore, EBITDA reflected in the segment reconciliations exclude any allocation of general and administrative expenses consistent with our policy for determining segmental operating income, the most directly comparable GAAP measure. 31

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Kuehn Law Encourages NS, NXPL, IP, and RXMD Investors to Contact Law Firm

- Relevate Power Announces Rebranding and Launches Equity Raise to Accelerate M&A Growth

- RAJANT’S REIOS IoT SOLUTIONS TRANSFORM ENERGY EFFICIENCY AND SAFETY

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share