Form 8-K VECTOR GROUP LTD For: Nov 12

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date earliest event reported): | November 10, 2015 | |

VECTOR GROUP LTD.

(Exact Name of Registrant as Specified in Its Charter)

DELAWARE | ||

(State or Other Jurisdiction of Incorporation) | ||

1-5759 | 65-0949535 | |

(Commission File Number) | (IRS Employer Identification Number) | |

4400 Biscayne Boulevard, Miami, Florida | ||

(Address of Principal Executive Offices) | ||

33137 | ||

(Zip Code) | ||

Registrant’s Telephone Number, Including Area Code: (305) 579-8000 | ||

Not Applicable | ||

(Former Name or Former Address, if Changed Since Last Report) | ||

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions: | ||

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | ||

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | ||

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | ||

Item 5.02 Departure of Directors or Principal Officers; Election of Directors; Appointment of Principal Officers; Compensatory Arrangements of Certain Officers

(e) Compensatory Arrangements of Certain Officers

On November 10, 2015, the Performance-Based Subcommittee of the Compensation Committee of the Board of Directors of Vector Group Ltd. (the "Company”) granted Howard M. Lorber, the Company’s President and Chief Executive Officer, an award of 1,200,000 shares of Common Stock subject to performance-based vesting (the “Award Shares”) pursuant to the Company’s 2014 Management Incentive Plan (the “2014 Plan”), which was approved by the Company’s stockholders in May 2014. The award is intended as a meaningful incentive for Mr. Lorber to continue to serve as CEO during the next seven years, even though he is eligible to retire now, and for him to enhance corporate value during that time. The Award Shares will be issued pursuant to the terms of an agreement (the “Award Agreement”) which provides that both a performance requirement and a continued employment requirement must be met during a stated performance period to earn vested rights with respect to the Award Shares. The maximum potential amount of the Award Shares reflects recognition of his contributions as CEO since January 1, 2006 and the value of his management and real estate expertise to the Company. Mr. Lorber paid the Company $120,000, representing the par value of the Award Shares.

The terms of the Award Shares have been structured in a manner that is intended to be treated as “qualified performance-based compensation” under Treasury Regulation 1.162-27(e).

Except to the extent provided in Section 5 of the Award Agreement, Mr. Lorber shall only earn a non-forfeitable right to an Award Share by satisfying both (i) the target for Vector Group Ltd. Adjusted EBITDA (as defined below) on the applicable vesting date as set forth in the following table, and (ii) being continuously employed with the Company through the applicable Vesting Date as set forth in the following table:

Vesting Date Number of Vested Shares (Cumulative)

November 15, 2016 | 171,428 shares if the Vector Group Ltd. Adjusted EBITDA from October 1, 2015 to September 30, 2016 exceeds $175 million; |

July 1, 2017 | 342,857 shares minus shares previously vested if cumulative Vector Group Ltd. Adjusted EBITDA from October 1, 2015 to December 31, 2016 exceeds $218.75 million; |

July 1, 2018 | 514,285 shares minus shares previously vested if cumulative Vector Group Ltd. Adjusted EBITDA from October 1, 2015 to December 31, 2017 exceeds $393.75 million; |

July 1, 2019 | 685,713 shares minus shares previously vested if cumulative Vector Group Ltd. Adjusted EBITDA from October 1, 2015 to December 31, 2018 exceeds $568.75 million; |

July 1, 2020 | 857,141 shares minus shares previously vested if cumulative Vector Group Ltd. Adjusted EBITDA from October 1, 2015 to December 31, 2019 exceeds $743.75 million; |

July 1, 2021 | 1,028,570 shares minus shares previously vested if cumulative Vector Group Ltd. Adjusted EBITDA from October 1, 2015 to December 31, 2020 exceeds $918.75 million; and |

July 1, 2022 | 1,200,000 shares minus shares previously vested if cumulative Vector Group Ltd. Adjusted EBITDA from October 1, 2015 to December 31, 2021 exceeds $1.09375 billion. |

“Vector Group Ltd. Adjusted EBITDA” is defined in the Award Agreement to mean the Company’s Earnings Before Interest, Income Taxes, Depreciation and Amortization excluding litigation or claim judgments or settlements and non-operating items and expenses for restructuring, productivity initiatives and new business initiatives.

Section 5 of the Award Agreement provides for accelerated vesting in the event of death or disability and if Mr. Lorber is employed by the Company at the time of a change on control as defined in the 2014 Plan, as well as limited accelerated vesting in certain other circumstances.

Mr. Lorber is entitled to receive a payment equal to the amount that would otherwise have been paid on or after the date of issuance of the Award Shares as dividends or other distributions (including securities of another issuer) on the Award Shares had such unvested portion been vested in Mr. Lorber as of the record date for such dividend or other distribution, provided such payment shall only be made to the Executive at the time of vesting of the unvested portion of the earned Award Shares on which such dividend or other distribution was paid.

The foregoing description is a summary of key terms only and is qualified in its entirety by reference to the Award Agreement, attached hereto as Exhibit 10.1

Item 7.01. Regulation FD Disclosure.

Vector Group Ltd. has prepared materials for presentations to investors updated for the three and nine months ended September 30, 2015. The materials are furnished (not filed) as Exhibits 99.1, 99.2 and 99.3 to this Current Report on Form 8-K pursuant to Regulation FD.

Non-GAAP Financial Measures

Exhibits 99.1, 99.2 and 99.3 contain the Non-GAAP Financial Measures discussed below.

The Pro-forma non-GAAP financial measures are presented assuming Vector Group Ltd.’s acquisition of its additional 20.59% interest in Douglas Elliman Realty, LLC, and the related purchase accounting adjustments, occurred prior to the beginning of each period presented. Non-GAAP financial results also include, among other things, adjustments for litigation settlement and judgment expenses in the Tobacco segment, settlements of long-standing disputes related to the Master Settlement Agreement in the Tobacco segment, restructuring and pension settlement expenses in the Tobacco segment, non-cash stock compensation expense (for purposes of Pro-forma Adjusted EBITDA only), and non-cash interest items associated with the Company's convertible debt. Reconciliations of non-GAAP financial results to the comparable GAAP financial results for the three and nine months ended September 30, 2015 and 2014 are included in the Company's Current Reports on Form 8-K dated November 2, 2015 and October 2, 2015.

Pro-forma Adjusted Revenues, Pro-forma Adjusted EBITDA, Pro-forma Adjusted Net Income, Pro-forma Adjusted Operating Income, Tobacco Adjusted Operating Income, New Valley LLC Pro-forma Adjusted Revenues, New Valley LLC Pro-forma Adjusted EBITDA, Douglas Elliman Realty, LLC Adjusted Revenues, and Douglas Elliman Realty, LLC Adjusted EBITDA (hereafter referred collectively to as "the Non-GAAP Financial Measures") are financial measures not prepared in accordance with generally accepted accounting principles (“GAAP”). The Company believes that the Non-GAAP Financial Measures are important measures that supplement discussions and analysis of its results of operations and enhances an understanding of its operating performance. The Company believes the Non-GAAP Financial Measures provide investors and analysts with a useful measure of operating results unaffected by differences in capital structures, capital investment cycles and ages of related assets among otherwise comparable companies. Management uses the Non-GAAP Financial Measures as measures to review and assess operating performance of the Company's business, and investors should review both the overall performance (GAAP net income) and the operating performance (the Non-GAAP Financial Measures) of the Company's business. While management considers the Non-GAAP Financial Measures to be important, they should be considered in addition to, but not as substitutes for or superior to, other measures of financial performance prepared in accordance with GAAP, such as operating income, net

income and cash flows from operations. In addition, the Non-GAAP Financial Measures are susceptible to varying calculations and the Company's measurement of the Non-GAAP Financial Measures may not be comparable to those of other companies.

Forward-Looking Statements.

This Current Report on Form 8-K contains forward-looking statements, which involve risk and uncertainties. The words "could", “believe,” “expect,” “estimate,” “may,” “will,” “could,” “plan,” or “continue” and similar expressions are intended to identify forward-looking statements. The Company’s actual results could differ significantly from the results discussed in such forward-looking statements. Factors that could cause or contribute to such differences in results and outcomes include, without limitation, those discussed under the heading “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2014 and the Company's Quarterly Report on Form 10-Q for the quarter ended September 30, 2015. Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this Current Report on Form 8-K. The Company undertakes no obligation to (and expressly disclaims any obligation to) revise or update any forward-looking statement, whether as a result of new information, subsequent events, or otherwise (except as may be required by law), in order to reflect any event or circumstance which may arise after the date of this Current Report on Form 8-K.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

Exhibit No. | Exhibit | |

10.1 | Performance-Based Restricted Share Award Agreement, pursuant to Vector Group Ltd. 2014 Management Incentive Plan, dated as of November 10, 2015 by and between Vector Group Ltd. and Howard M. Lorber. | |

99.1 | Investor presentation of Vector Group Ltd. dated November 2015 (furnished pursuant to Regulation FD). | |

99.2 | Fact Sheet of Vector Group Ltd. dated November 2015 (furnished pursuant to Regulation FD). | |

99.3 | Fact Sheet of New Valley LLC dated November 2015 (furnished pursuant to Regulation FD). | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

VECTOR GROUP LTD. | ||

By: | /s/ J. Bryant Kirkland III | |

J. Bryant Kirkland III | ||

Vice President, Treasurer & Chief Financial Officer | ||

Date: November 12, 2015

EXHIBIT 10.1

PERFORMANCE-BASED RESTRICTED SHARE AWARD AGREEMENT

PURSUANT TO THE VECTOR GROUP LTD.

2014 MANAGEMENT INCENTIVE PLAN

THIS PERFORMANCE-BASED RESTRICTED SHARE AWARD AGREEMENT (the “Agreement”), effective as of November 10, 2015 (the “Grant Date”), by and between Vector Group Ltd., a Delaware corporation (the “Company”), and Howard M. Lorber (the “Executive”)

WITNESSETH:

A. WHEREAS, the Executive serves as President and Chief Executive Officer of the Company, pursuant to an Amended and Restated Employment Agreement dated as of January 27, 2006, as amended to date (the “Employment Agreement”); and

B. WHEREAS, the Company wishes to retain the Executive by awarding him a proprietary interest in the Company through ownership of an equity interest therein, which interest shall be subject to the restrictions on vesting and transferability hereinafter set forth;

NOW, THEREFORE, in consideration of the mutual covenants set forth herein, the Company and the Executive hereby agree as follows:

1. Share Award.

Subject to the terms and conditions of this Agreement, the Company hereby grants to the Executive 1,200,000 shares (collectively, the “Award Shares”) of its Common Stock, $.10 par value per share (the “Common Stock”), pursuant to the Company’s 2014 Management Incentive Plan as in effect and amended from time to time (the “Plan”). This award is intended to be a Performance-Based Award within the meaning of Section 14 of the Plan that is exempt from the $1,000,000 deduction limitation under Section 162(m) of the Code and shall be interpreted consistent with this intention.

Except to the extent provided in Section 5 below, the Executive shall only earn a non-forfeitable right to an Award Share by satisfying both (i) the target for Vector Group Ltd. Adjusted EBITDA (as defined below) on the applicable Vesting Date as set forth in the following table, and (ii) being continuously employed with the Company through the applicable Vesting Date as set forth in the following table:

Vesting Date Number of Vested Shares (Cumulative)

November 15, 2016 | 171,428 shares if the Vector Group Ltd Adjusted EBITDA from October 1, 2015 to September 30, 2016 exceeds $175 million; |

July 1, 2017, | 342,857 shares minus shares previously vested if cumulative Vector Group Ltd. Adjusted EBITDA from October 1, 2015 to December 31, 2016 exceeds $218.75 million; |

July 1, 2018 | 514,285 shares minus shares previously vested if cumulative Vector Group Ltd. Adjusted EBITDA from October 1, 2015 to December 31, 2017 exceeds $393.75 million; |

July 1, 2019 | 685,713 shares minus shares previously vested if cumulative Vector Group Ltd. Adjusted EBITDA from October 1, 2015 to December 31, 2018 exceeds $568.75 million; |

July 1, 2020 | 857,141 shares minus shares previously vested if cumulative Vector Group Ltd. Adjusted EBITDA from October 1, 2015 to December 31, 2019 exceeds $743.75 million; |

July 1, 2021 | 1,028,570 shares minus shares previously vested if cumulative Vector Group Ltd. Adjusted EBITDA from October 1, 2015 to December 31, 2020 exceeds $918.75 million; and |

July 1, 2022 | 1,200,000 shares minus shares previously vested if cumulative Vector Group Ltd. Adjusted EBITDA from October 1, 2015 to December 31, 2021 exceeds $1.09375 billion. |

For purposes of this section, “Vector Group Ltd. Adjusted EBITDA” shall mean the Company’s Earnings Before Interest, Income Taxes, Depreciation and Amortization excluding litigation or claim judgments or settlements and non-operating items and expenses for restructuring, productivity initiatives and new business initiatives. In no event shall the target for Vector Group Ltd Adjusted EBITDA associated with a Vesting Date be considered satisfied unless and until the Committee has provided the certification of financial results required under Section 162(m) of the Code.

2. Issuance; Transfer Restrictions.

Certificates for the Award Shares shall be issued in the name of the Executive as soon as practicable after the Grant Date, provided the Executive has (i) executed appropriate blank stock powers and any other documents which the Company may reasonably require and (ii) delivered to the Company a check for $120,000, representing the par value of the Award Shares, provided further, that if determined by the Company to be required, the Executive shall file a notification form with respect to the issuance of the Award Shares under the Hart-Scott-Rodino Antitrust Improvement Act of 1976, as amended (the “Hart-Scott-Rodino Act”), and in that case the Award Shares shall be issued as soon as practicable after the expiration of the waiting period under the Hart-Scott-Rodino Act. The certificates for the unvested Award Shares shall be deposited, together with the stock powers, or other documents required by the Company, with the Company. Except to the extent provided in Section 7 hereof or as otherwise provided by the terms of this Agreement, upon deposit of such unvested Award Shares with the Company, the Executive shall have all of the rights of a shareholder with respect to such shares, including the right to vote the shares and to receive all dividends or other distributions, if any, paid or made with respect to such shares. Upon vesting of any portion of the Award Shares, the Company shall cause a stock certificate for such shares to be delivered to the Executive. No interest in this Agreement or in any portion of the Award Shares may be sold, transferred, assigned, pledged, encumbered or otherwise alienated or hypothecated, nor shall certificates for any Award Shares be delivered to the Executive, except to the extent of any portion of the Award Shares that has vested in the Executive in accordance with the terms hereof. The Executive acknowledges that the Award shares are subject to the Company’s Equity Retention and Hedging Policy adopted in January 2013.

3. Certificates Legended.

The Executive acknowledges that certificates for the Award Shares shall bear a legend to the following effect:

THE TRANSFER OF THESE SECURITIES HAS NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933 AND MAY NOT BE OFFERED OR SOLD IN THE ABSENCE OF AN EFFECTIVE REGISTRATION STATEMENT COVERING SUCH ACT OR AN OPINION OF COUNSEL SATISFACTORY TO THE CORPORATION THAT SUCH REGISTRATION IS NOT REQUIRED.

The Company shall enter in its records a notation of the foregoing legend and of the restrictions on transfer provided in Section 2 hereof.

4. Forfeiture.

Except to the extent provided in Section 5 hereof, upon the earlier of the Executive’s termination of employment with the Company for any reason or July 1, 2022, any remaining Award Shares not theretofore vested shall be forfeited by the Executive and transferred back to the Company, without payment of any consideration by the Company.

5. Accelerated Vesting.

a. The Executive shall be fully vested in all of the Award Shares in the event of his termination of employment due to death or disability (as determined in good faith by the Committee) or if a Change in Control of the Company as defined in Section 13.3 of the Plan occurs while he is employed by the Company, in each case consistent with the requirements for the award being treated as “performance-based compensation” under Section 162(m) of the Code and Treas. Reg. Sect. 1.162-27(e)(2)(v).

b. In the event of either the termination of the Executive’s employment by the Company without Cause as defined in Section 6(d) of the Employment Agreement, or the voluntary termination by the Executive of his employment (to the extent the provisions of Section 6(a) of the Employment Agreement apply), the requirement to be continuously employed on any future Vesting Date shall be waived, and the Executive shall be vested in any remaining unvested Award Shares under

Section 1 of this Agreement based on the level of cumulative Vector Group Ltd. Adjusted EBITDA as of the end of the immediately preceding calendar quarter.

c. In the event of the occurrence of a Change of Control of the Company, the Committee will provide for settlement of any Award Shares that are subject to accelerated vesting under Section 5 of this Agreement in accordance with the terms of Section 13.2 of the Plan.

6. Adjustment of Award Shares.

In the event of any of the transactions or events described in Section 12 of the Plan, the aggregate number and kind of Award Shares shall be proportionately adjusted by the Company in accordance with the terms of Section 12.

7. Dividend Payments.

The Executive shall be entitled to receive the dividends or other distributions (including securities of another issuer) that are paid by the Company on the Award Shares on or after their date of issuance, but only if such Shares are subsequently earned and vested. Any such dividend or other distribution shall be paid to the Executive as soon as reasonably practicable after the underlying Award Shares have become vested. No interest shall be paid on any dividends or other distributions under this Section 7.

8. Limitations.

Nothing in this Agreement shall be construed to provide the Executive any rights whatsoever with respect to the Award Shares except as specifically provided herein, or constitute evidence of any agreement or understanding, express or implied, that the Company shall employ the Executive other than as provided in the Employment Agreement.

9. Tax Withholding.

The Executive agrees not to file a Section 83(b) election. The Executive shall pay to the Company, at each time any portion of the Award Shares vests in the Executive or any amounts are paid under Section 7 an amount that the Company deems necessary to satisfy its minimum required obligations to withhold federal, state or local income or other taxes incurred by reason thereof. In accordance with Section 15 of the Plan, tax withholding may be satisfied by the surrender of shares having a Fair Market Value on the date the tax is to be determined equal to the minimum statutory total tax that could be imposed on the transaction.

10. Incorporation by Reference; Plan Document Receipt; Coordination with Employment Agreement

This Agreement is subject in all respects to the terms and provisions of the Plan (including, without limitation, any amendments thereto adopted at any time and from time to time unless such amendments are expressly intended not to apply to the award provided hereunder), all of which terms and provisions are made a part of and incorporated in this Agreement as if they were expressly set forth herein. Any capitalized term not defined in this Agreement shall have the same meaning as is ascribed thereto in the Plan. For the avoidance of doubt, references to the “Committee” in this Agreement shall refer to the Subcommittee in accordance with Section 4.1 of the Plan. Notwithstanding anything to the contrary in the Employment Agreement, the terms and conditions applicable to the Award Shares, including but not limited to vesting conditions, shall be governed solely and exclusively by this Agreement. The Executive hereby acknowledges receipt of a true copy of the Plan and that the Executive has read the Plan carefully and fully understands its content. In the event of a conflict between the terms of this Agreement and the terms of the Plan, the terms of the Plan shall control.

11. Miscellaneous.

a. The parties agree to execute such further instruments and to take such further action as may reasonably be necessary to carry out the intent of this Agreement.

b. All notices, requests, demands and other communications hereunder shall be in writing and shall be deemed to have been duly given if delivered by hand or overnight delivery service or mailed within the continental United States by first class, certified mail, return receipt requested, to the applicable party and addressed as follows:

if to the Company:

Vector Group Ltd.

4400 Biscayne Boulevard, 10th Floor

Miami, Florida 33137

Attn: Marc N. Bell, Vice President

and General Counsel

if to the Executive:

Howard M. Lorber

at the most recent home address as indicated on the Company’s records

Addresses may be changed by notice in writing signed by the addressee.

c. This Agreement shall not entitle the Executive to any preemptive rights to subscribe to any securities of any kind hereinafter issued by the Company.

d. This Agreement shall inure to the benefit of the successors and assigns of the Company and, subject to the restrictions on the Executive herein set forth, be binding upon and inure to the benefit of the Executive, his heirs, executors, administrators, successors and assigns.

e. This Agreement contains the entire agreement between the parties hereto with respect to the subject matter contained herein, and supersedes all prior agreements or prior understandings, whether written or oral, between the parties relating to such subject matter. The Board, the Committee or the Subcommittee shall have the right, in its sole discretion, to modify or amend this Agreement from time to time in accordance with and as provided in the Plan; provided, however, that no such modification or amendment shall materially adversely affect the rights of the Executive under this Agreement without the consent of the Executive. The Company shall give notice to the Executive of any such modification or amendment of this Agreement as soon as practicable after the adoption thereof. This Agreement may also be modified or amended by a writing signed by both the Company and the Executive.

IN WITNESS WHEREOF, the parties hereto have executed this Agreement as of the day and year first above written.

VECTOR GROUP LTD. | ||||||

By: | /s/ J. Bryant Kikland III | |||||

J. Bryant Kirkland III | ||||||

Vice President, Treasurer and CFO | ||||||

/s/ Howard M. Lorber | ||||||

Howard M. Lorber | ||||||

November 2015 INVESTOR PRESENTATION

DISCLAIMER This document and any related oral presentation does not constitute an offer or invitation to subscribe for, purchase or otherwise acquire any equity securities or debt securities instruments of Vector Group Ltd. (“Vector”, “Vector Group Ltd.” or “the Company”) and nothing contained herein or its presentation shall form the basis of any contract or commitment whatsoever. The distribution of this document and any related oral presentation in certain jurisdictions may be restricted by law and persons into whose possession this document or any related oral presentation comes should inform themselves about, and observe, any such restriction. Any failure to comply with these restrictions may constitute a violation of the laws of any such other jurisdiction. The information contained herein does not constitute investment, legal, accounting, regulatory, taxation or other advice and the information does not take into account your investment objectives or legal, accounting, regulatory, taxation or financial situation or particular needs. You are solely responsible for forming your own opinions and conclusions on such matters and the market and for making your own independent assessment of the information. You are solely responsible for seeking independent professional advice in relation to the information and any action taken on the basis of the information. The following presentation may contain "forward-looking statements,” including any statements that may be contained in the presentation that reflect Vector’s expectations or beliefs with respect to future events and financial performance, such as the expectation that the tobacco transition payment program could yield substantial incremental free cash flow. These forward- looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those contained in any forward-looking statement made by or on behalf of the Company, including the risk that changes in Vector’s capital expenditures impact its expected free cash flow and the other risk factors described in Vector’s annual report on Form 10-K for the year ended December 31, 2014 and Form 10-Q for the quarterly period ended September 30, 2015, as filed with the SEC. Please also refer to Vector's Current Reports on Forms 8-K, filed on October 2, 2015 and November 2, 2015 (Commission File Number 1-5759) as filed with the SEC for information, including cautionary and explanatory language, relating to Non-GAAP Financial Measures in this Presentation labeled "Pro- forma Adjusted" or "Adjusted". Results actually achieved may differ materially from expected results included in these forward-looking statements as a result of these or other factors. Due to such uncertainties and risks, potential investors are cautioned not to place undue reliance on such forward-looking statements, which speak only as of the date on which such statements are made. The Company disclaims any obligation to, and does not undertake to, update or revise and forward- looking statements in this presentation. 2

INVESTMENT HIGHLIGHTS & PORTFOLIO = Diversified Holding Company with two unrelated, but complementary, businesses with iconic brand names: tobacco (Liggett Group) and real estate (Douglas Elliman). History of strong earnings, and Pro-Forma Adjusted EBITDA has increased from $175.6 million in 2010 (1) to $241.7.0 million for twelve months ended September 30, 2015 (7.0% compounded annually)(2). Tobacco Adjusted EBITDA of $236.5 million for twelve months ended September 30, 2015(3). Douglas Elliman, which is a 70.59%-owned subsidiary, produces Pro-Forma Adjusted Revenues of $620 million and Pro- Forma Adjusted EBITDA of $36.0 million for twelve months ended September 30, 2015(4). Diversified New Valley portfolio of consolidated and non-consolidated domestic and international real estate investments. Maintains substantial liquidity with cash, marketable securities and long-term investments of $593 million as of September 30, 2015(5) and has no significant debt maturities until February 2019. 20 years of uninterrupted quarterly cash dividends and an annual 5% stock dividend since 1999. Management team and directors beneficially own approximately 15% of Vector Group. Perpetual cost advantage over the three largest U.S. tobacco companies – currently worth approximately $160 million annually(6). 3 Overview (1) Vector’s Net income for the year ended December 31, 2010 was $54.1 million. Pro-Forma Adjusted EBITDA is a Non-GAAP Financial Measure. Please refer to Exhibit 99.1 of the Company’s Current Report on Form 8-K, dated October 2, 2015 (Table 1) for a reconciliation of Net income to Pro-Forma Adjusted EBITDA as well as the Disclaimer to this document on Page 2. (2) Vector’s Net income for the twelve months ended September 30, 2015 was $62.6 million. Pro-Forma Adjusted EBITDA is a Non-GAAP Financial Measure. Please refer to Exhibit 99.1 of the Company’s Current Report on Form 8-K, filed on November 2, 2015 Table 3, for a reconciliation of Net income to Pro-Forma Adjusted EBITDA as well as the Disclaimer to this document on Page 2. (3) All “Liggett” and “Tobacco” financial information in this presentation includes the operations of Liggett Group LLC, Vector Tobacco Inc., and Liggett Vector Brands LLC unless otherwise noted. Tobacco Adjusted EBITDA is a Non-GAAP Financial Measure and is defined in Table 3 of Exhibit 99.1 to the Company’s Current Report on Form 8-K, dated November 2, 2015. (4) Douglas Elliman’s revenues were $619 million and its Net income was $24.4 million for the twelve months ended September 30, 2015. Pro-Forma Adjusted Revenues and Pro-Forma Adjusted EBITDA are Non-GAAP Financial Measures. Please refer to Exhibit 99.1 of the Company’s Current Report on Form 8-K, dated November 2, 2015, for a reconciliation to Revenues of Non-GAAP financial measures and Net Income to Pro-Forma Adjusted Revenues and Pro-Forma Adjusted EBITDA (Tables 9 and 10) as well as the Disclaimer to this document on Page 2. (5) Excludes real estate investments. (6) Cost advantage applies only to cigarettes sold below applicable market share exemption.

TOBACCO OPERATIONS 4

LIGGETT GROUP OVERVIEW Fourth-largest U.S. tobacco company; founded in 1873 — Core Discount Brands – Pyramid, Grand Prix, Liggett Select, Eve and Eagle 20’s — Partner Brands – USA, Bronson and Tourney Consistent and strong cash flow —Tobacco Adjusted EBITDA of $236.5 million for the twelve months ended September 30, 2015(1) —Low capital requirements with capital expenditures of $4.7 million related to tobacco operations for the twelve months ended September 30, 2015 —2014 expiration of the TTPP could yield substantial incremental free cash flow Approximately $7.1 million based on Liggett’s TTPP payments for the twelve months ended September 30, 2015 Current cost advantage of 64 cents per pack compared to the three largest U.S. tobacco companies expected to maintain volume and drive profit in core brands — Pursuant to the MSA, Liggett has no payment obligations unless its market share exceeds a market share exemption of approximately 1.65% of total cigarettes sold in the United States, and Vector Tobacco has no payment obligations unless its market share exceeds a market share exemption of approximately 0.28% of total cigarettes sold in the United States — MSA exemption currently worth approximately $160 million annually for Liggett and Vector Tobacco 5 (1) Tobacco Adjusted EBITDA is a Non-GAAP Financial Measure and is defined in Table 3 of Exhibit 99.1 of the Company’s Current Report on Form 8-K, dated November 2, 2015. Please also refer to the Disclaimer to this document on Page 2.

LIGGETT GROUP HISTORY 6 $46 $79 $77 $121 $111 $127 $130 $144 $146 $158 $170 $165 $158 $174 $186 $200 $211 $236 1.3% 1.2% 1.5% 2.2% 2.4% 2.5% 2.3% 2.2% 2.4% 2.5% 2.5% 2.7% 3.5% 3.8% 3.5% 3.3% 3.4% 3.3% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% $0 $50 $100 $150 $200 $250 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 To b ac co A d ju st e d E B IT D A (1 ) ($ M ill io n s) Source: MSA CRA wholesale shipment database. Note: The Liggett and Vector Tobacco businesses have been combined into a single segment for all periods since 2007. (1) Tobacco Adjusted EBITDA is a Non-GAAP Financial Measure and is defined in Table 3 of Exhibit 99.1 of the Company’s Current Reports on Form 8-K, dated November 2, 2015, as well as Table 2 to Exhibit 99.2 of the Company’s Current Report on Form 8- K, dated October 2, 2015. D o m e st ic M arke t Sh are 1998 1999 2005 2009 2013 Today Signed the MSA as a Subsequent Participating Manufacturer, which established perpetual cost advantage over three largest U.S. tobacco companies Introduced deep discount brand Liggett Select ,taking advantage of the Company’s cost advantage resulting from the MSA Launched deep discount brand Grand Prix Repositioned Pyramid as a deep-discount brand in response to a large Federal Excise Tax increase LTM 9/30/15 Introduced deep discount brand Eagle 20’s Liggett focuses on margin enhancement resulting in continued earnings growth with record Tobacco Adjusted EBITDA

TOBACCO LITIGATION AND REGULATORY UPDATES Liggett led the industry in acknowledging the addictive properties of nicotine while seeking a legislated settlement of litigation On October 23, 2013, Liggett reached a settlement with approximately 4,900 Engle plaintiffs, which represented substantially all of Liggett’s pending litigation — Liggett agreed to pay $60 million in a lump sum in 2014 and the balance in installments of $3.4 million in the following 14 years (2015 – 2028) — Approximately 285 Engle progeny plaintiffs remain — There are presently another ten cases under appeal, and the range of loss in these cases is $0 to $26.2 million (plus attorneys’ fees and interest) of which Liggett has secured approximately $12.3 million in outstanding bonds 7 Litigation Regulatory Since 1998, the MSA has restricted the advertising and marketing of tobacco products In 2009, Family Smoking Prevention and Tobacco Control Act granted the FDA power to regulate the manufacture, sale, marketing and packaging of tobacco products — FDA is prohibited from issuing regulations that ban cigarettes Federal Excise Tax is $1.01/pack (since April 1, 2009) and additional state and municipal excise taxes exist. The TTPP, also known as the tobacco quota buyout, was established in 2004 and expired at the end of 2014 — For the twelve months ended September 30, 2015, Liggett paid $7.1 million under the TTPP

REAL ESTATE OPERATIONS 8

REAL ESTATE OVERVIEW New Valley, which owns 70.59% of Douglas Elliman Realty, LLC, is a diversified real estate company that is seeking to acquire additional operating companies and real estate properties New Valley has invested approximately $205 million, as of September 30, 2015, in a broad portfolio of 23 domestic and international real estate investments 9 New Valley Pro-Forma Adjusted EBITDA(1) $20.6M $51.3M $40.2M $29.3M PF2012 PF2013 PF2014 LTM 9/30/2015 New Valley Pro-Forma Adjusted Revenues – LTM September 30, 2015(1) $11M $28M $588M $627M Real Estate Brokerage Commissions Property Management Other (1) New Valley’s revenues were $625.0 million and New Valley’s net income was $16.4 million, $59.4 million, $21.4 million and $14.0 million for the periods presented. Pro-Forma Adjusted EBITDA and Pro-Forma Adjusted Revenues are non- GAAP financial measures. For a reconciliation of Revenues to Pro-Forma Adjusted Revenues and Net income to Pro-Forma Adjusted EBITDA, please see Vector Group Ltd.’s Current Reports on Forms 8-K, filed on October 2, 2015 (Exhibit 99.2) and November 2, 2015 (Exhibit 99.1) and Form 10-Q for the quarterly period ended September 30, 2015 (Commission File Number 1-5759) as well as the Disclaimer to this document on Page 2. New Valley’s Pro-Forma Adjusted EBITDA do not include an allocation of Vector Group Ltd.’s Corporate and Other Expenses (for purposes of computing Pro-Forma Adjusted EBITDA) of $13.1 million, $12.6 million, $10.4 million and $10.2 million, for the periods presented, respectively.

Douglas Elliman Pro-Forma Adjusted EBITDA(1) DOUGLAS ELLIMAN REALTY, LLC 10 Largest residential real estate brokerage firm in the highly competitive New York metropolitan area and fourth- largest residential brokerage firm in the U.S. in 2014 Approximately 6,000 affiliated agents and 80 offices in the U.S. Alliance with Knight Frank provides a network with 400 offices across 55 countries with 22,000 affiliated agents Also offers title and settlement services, relocation services, and residential property management services through various subsidiaries Became a consolidated subsidiary in December 2013 (1) Douglas Elliman’s Revenues were $618.8M for the twelve months ended September 30, 2015 and Douglas Elliman’s net income was $28.9M, $38.1M, $38.4M and $24.4M for the periods presented. Pro-forma Adjusted EBITDA and Pro-forma Adjusted Revenues are non-GAAP financial measures. For a reconciliation of Pro-forma Adjusted EBITDA to net income and Pro-forma Adjusted Revenues to revenues, please see Vector Group Ltd.’s Current Reports on Forms 8-K, filed on October 2, 2015 (Exhibit 99.2) and November 2, 2015 (Exhibit 99.1) and Form 10-Q for the quarterly period ended September 30, 2015 (Commission File Number 1-5759) as well as the Disclaimer to this document on Page 2. Douglas Elliman Closed Sales – LTM September 30, 2015 $30.9M $45.7M $50.7M $36.0M PF2012 PF2013 PF2014 LTM 9/30/2015 Douglas Elliman Closed Sales – LTM September 30, 2015 $11.5B $11.1B $12.4B $14.9B $18.2B $21.1B 2010 2011 2012 2013 2014 LTM 9/30/2015 Douglas Elliman Pro-Forma Adjusted Revenues – LTM September 30, 2015 (1) $4M $28M $588M $620M Real Estate Brokerage Commissions Property Management Other Long Island, Westchester, Connecticut $6.2B New York City $12B South Florida $2.1B Aspen Los Angeles

NEW VALLEY’S REAL ESTATE INVESTMENTS AT SEPTEMBER 30, 2015 11 87 Park (Miami Beach) Monad Terrace (Miami Beach) Sagaponack (East Hampton) Maryland Portfolio (Baltimore County) The Plaza at Harmon Meadow (New Jersey) West Hollywood Edition (West Hollywood) New York City Investments (see slide 12) Escena Master Planned Community (Palm Springs) Commercial Retail/ Office Assets Apartments/ Condominiums/Hotels Land Development/Real Estate Held for Sale, net Milanosesto Holdings Milan, Italy Hotel Taiwana St. Barthélemy Coral Beach and Tennis Club Bermuda International Investments (1) ST Portfolio (Stamford and Houston) (1) For the percentage of each real estate project owned, please refer to the “Summary of Real Estate Investments” section of Item 2 - Management’s Discussion and Analysis of Financial Condition and Results of Operations - located on page 59 of Vector Group Ltd.’s Form 10-Q for the quarterly period ended September 30, 2015 (Commission File Number 1-5759).

NEW VALLEY’S REAL ESTATE INVESTMENTS IN NEW YORK CITY 1. The Marquand Upper East Side 2. 10 Madison Square Park West Flatiron District/NoMad 3. 11 Beach Street TriBeCa 4. 20 Times Square Times Square 5. 111 Murray Street TriBeCa 6. 357 West Street Greenwich Village 7. PUBLIC Chrystie House Lower East Side 8. The Dutch Long Island City 9. Queens Plaza Long Island City 10. Park Lane Hotel Central Park South 11. 125 Greenwich Street Financial District 12. 76 Eleventh Avenue West Chelsea 12 1 10 4 2 12 9 8 6 5 3 11 7 (1) For the percentage of each real estate project owned, please refer to the “Summary of Real Estate Investments” section of Item 2 - Management’s Discussion and Analysis of Financial Condition and Results of Operations - located on page 59 of Vector Group Ltd.’s Form 10-Q for the quarterly period ended September 30, 2015 (Commission File Number 1-5759). (1)

NEW VALLEY’S REAL ESTATE SUMMARY AT SEPTEMBER 30, 2015 13 Net cash invested Cumulative earnings (loss) Carrying value Range of ownership per investment Number of investments Land owned New York City SMSA $ 12,512 $ - $ 12,512 100.0% 1 All other U.S. areas 1,975 8,476 10,451 100.0% 1 $ 14,487 $ 8,476 $ 22,963 2 Condominium and Mixed Use Development New York City SMSA $ 107,278 $ 8,433 $ 115,711 5.0% - 49.5% 11 All other U.S. areas 18,042 (346) 17,696 15.0% - 48.5% 3 $ 125,320 $ 8,087 $ 133,407 14 Apartments All other U.S. areas 17,380 878 18,258 7.5% - 16.4% 2 $ 17,380 $ 878 $ 18,258 2 Hotels New York City SMSA $ 23,104 $ (3,731) $ 19,373 5.0% 1 International 13,097 (2,737) 10,360 17.0% - 49.0% 2 $ 36,201 $ (6,468) $ 29,733 3 Commercial New York City SMSA 5,591 47 5,638 49.0% 1 $ 5,591 $ 47 $ 5,638 1 Land Development International 5,037 - 5,037 7.2% 1 $ 5,037 $ - $ 5,037 1 Total $ 204,016 $ 11,020 $ 215,036 23 SUMMARY New York City SMSA $ 148,485 $ 4,749 $ 153,234 14 All other U.S. areas 37,397 9,008 46,405 6 International 18,134 (2,737) 15,397 3 $ 204,016 $ 11,020 $ 215,036 23 (1) For the percentage of each real estate project owned, please refer to the “Summary of Real Estate Investments” section of Item 2 - Management’s Discussion and Analysis of Financial Condition and Results of Operations - located on page 59 of Vector Group Ltd.’s Form 10-Q for the quarterly period ended September 30, 2015 (Commission File Number 1-5759). (Dollars in thousands) (1)

FINANCIAL DATA

$21 $51 $40 $29 $186 $199 $211 $236 2012 2013 2014 LTM 9/30/15 PRO-FORMA HISTORICAL FINANCIAL DATA $389 $483 $563 $627 $1,085 $1,014 $1,021 $1,019 2012 2013 2014 LTM 9/30/15 15 $9 $1,474 $1,498 $1,646 $1,593 Real Estate E-cigarettes Tobacco Corporate & Other Pro-Forma Adjusted Revenues(1) Pro-Forma Adjusted EBITDA(1) $193 $236 $242 $228 (1) Vector’s revenues for the periods presented were $1.096B, $1.080B, $1.591B and $1.644B, respectively. Vector’s Net income for the periods presented was $30.6M, $38.9M, $37.0M and $62.6M, respectively Pro-Forma Adjusted Revenues and Pro-Forma Adjusted EBITDA are Non-GAAP Financial Measures. Please refer to the Company’s Current Report on Forms 8-K, filed on October 2, 2015 (Exhibit 99.2) and November 2, 2015 (Exhibit 99.1) for a reconciliation of Non-GAAP financial measures to GAAP as well as the Disclaimer to this document on Page 2. ($13) ($14) ($13) ($10) ($10) ($13) Real Estate E-cigarettes Tobacco Corporate & Other (Dollars in millions)

Vector Group Ltd. 100.0 112.1 143.4 112.5 135.4 192.7 227.0 219.3 279.5 411.4 477.3 S&P 500 100.0 115.8 122.2 77.0 97.4 112.0 114.4 132.7 175.6 199.7 193.9 S&P MidCap 100.0 110.3 119.1 76.0 104.3 132.1 129.8 152.9 204.1 224.0 220.7 NYSE ARCA Tobacco 100.0 140.2 154.2 123.0 173.7 207.4 243.9 289.5 319.0 317.0 375.0 Dow Jones Real Estate Total Return 100.0 135.5 110.9 66.5 86.9 110.4 117.1 139.2 141.6 180.2 168.9 HISTORICAL STOCK PERFORMANCE 16 Note: The graph above compares the total annual return of Vector’s Common Stock, the S&P 500 Index, the S&P MidCap 400 Index, the NYSE ARCA Tobacco Index and the Dow Jones Real Estate Total Return for the period from December 31, 2005 through October 31, 2015. The graph assumes that all dividends and distributions were reinvested. Source: Bloomberg LP Value of $100 Invested – December 31, 2005 -100% 0% 100% 200% 300% 400% 500% Dec-05 Dec-06 Dec-07 Dec-08 Dec-09 Dec-10 Dec-11 Dec-12 Dec-13 Dec-14 Dec-15 418.6% 301.4% 125.6% 105.1% 82.4% C u m u la ti ve R e tu rn Vector Group Ltd. S&P 500 S&P MidCap NYSE ARCA Tobacco Dow Jones Real Estate Total Return Nov-15

Vector Group Ltd. owns Liggett Group, Vector Tobacco, Zoom E-Cigs, and New Valley. New Valley owns a 70% interest in Douglas Elliman. Pro-Forma Adjusted Revenues LTM 9/30/151 EXECUTIVE MANAGEMENT Howard M. Lorber President and Chief Executive Officer Richard J. Lampen Executive Vice President J. Bryant Kirkland III Vice President, Chief Financial Officer and Treasurer Marc N. Bell Vice President, General Counsel and Secretary Ronald J. Bernstein President and Chief Executive Officer of Liggett Group LLC and Liggett Vector Brands LLC • New Valley, which owns 70.59% of Douglas Elliman Realty, LLC, is a diversified real estate company that is seeking to acquire additional operating companies and real estate properties. • New Valley has invested approximately $205 million, as of September 30, 2015, in a broad portfolio of 23 domestic and international real estate investments. • Douglas Elliman is the largest residential real estate brokerage firm in the New York metropolitan area and the fourth-largest in the U.S. • Douglas Elliman’s closings totaled $21.1 billion for the twelve months ended September 30, 2015 and it has approximately 6,000 affiliated agents and 80 offices throughout the New York metropolitan area, South Florida, Aspen, Greenwich, and Los Angeles. 10-Year Stockholder Return TOBACCO REAL ESTATE Real Estate Tobacco This summary contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. We have identified these forward-looking statements using words such as “could” and similar expressions. These statements reflect our current beliefs. Accordingly, such forward-looking statements involve known and unknown risks, uncertainties and other factors that could cause our actual results, performance or achievements to differ materially from those expressed in, or implied by, such statements. • Fourth-largest cigarette manufacturer in the U.S. with a strong family of brands — Pyramid, Grand Prix, Liggett Select, Eve and Eagle 20’s — representing 12% share of the discount market. • Focused on brand strength and long-term profit growth, while continuing to evaluate opportunities to pursue incremental volume and margin growth. • Annual cost advantage of approximately $160 million due to favorable treatment under the Master Settlement Agreement. • The only cigarette company to have reached a comprehensive settlement resolving substantially all of the individual Engle progeny product liability cases pending in Florida. The Engle progeny cases have represented the most significant litigation against the U.S. cigarette industry in recent years. • 2014 expiration of the Tobacco Transition Payment Program could yield substantial incremental free cash flow. TTPP payments were approximately $7.1 million for the twelve months ended September 30, 2015. COMPANY HIGHLIGHTS • Headquartered in Miami with an executive office in Manhattan and tobacco operations in North Carolina • Employs approximately 1,400 people • Executive management and directors beneficially own 15% of the Company • Reported cash of $246 million and investments with fair value of $347 million at September 30, 2015 • Recognized as one of America’s Most Trustworthy Companies by Forbes in 2013 • In 2014, entered e-cigarette category with national rollout of Zoom, a superior disposable product featuring Tobacco and Menthol flavors. E-CIGARETTES Real Estate Tobacco Corporate and Other 2012 2013 LTM 9/30/20152014 $186M $200M $236M$211M $21M $51M $29M$40M ($13M) ($14M) ($13M)($10M) $193M $242M$228M$237M $1.019B $627M TOTAL $1.646B Vector is a largely underfollowed company with a highly competent management team and numerous ways to unlock value “ “ Barron’s Online, August 14, 2014 Oppenheimer analyst Ian Zaffino 2 10-Year return from October 31, 2005 to October 30, 2015 and assumes reinvestment of dividends received. The Company’s net income attributable to Vector Group Ltd. for the periods presented was $31M, $39M, $37M and $63M, respectively. The Company’s revenues for the twelve months ended September 30, 2015 were $1.6B . Pro-Forma Adjusted EBITDA and Pro-Forma Adjusted Revenues are non-GAAP financial measures. For a reconciliation of Pro-Forma Adjusted EBITDA to net income and Pro-Forma Adjusted Revenues to revenues, please see Vector Group Ltd.’s Current Reports on Forms 8-K, filed on November 2, 2015, October 2, 2015 and March 2, 2015 and Form 10-Q for the quarterly period ended September 30, 2015 (Commission File Number 1-5759). 1 Pro-Forma Adjusted EBITDA1 Contact: Emily Deissler / Ben Spicehandler / Spencer Waybright of Sard Verbinnen & Co (212) 687-8080 VGR Total Return 382% (17.0% Compounded) 2 2006 2007 2008 2009 2010 2011 2012 2013 2014 20152005 S&P 500 Total Return 113% (7.9% Compounded) 2 500 400 300 200 100 www.vectorgroupltd.com November 2015 E-Cigarettes ($1M) ($10M)($13M)

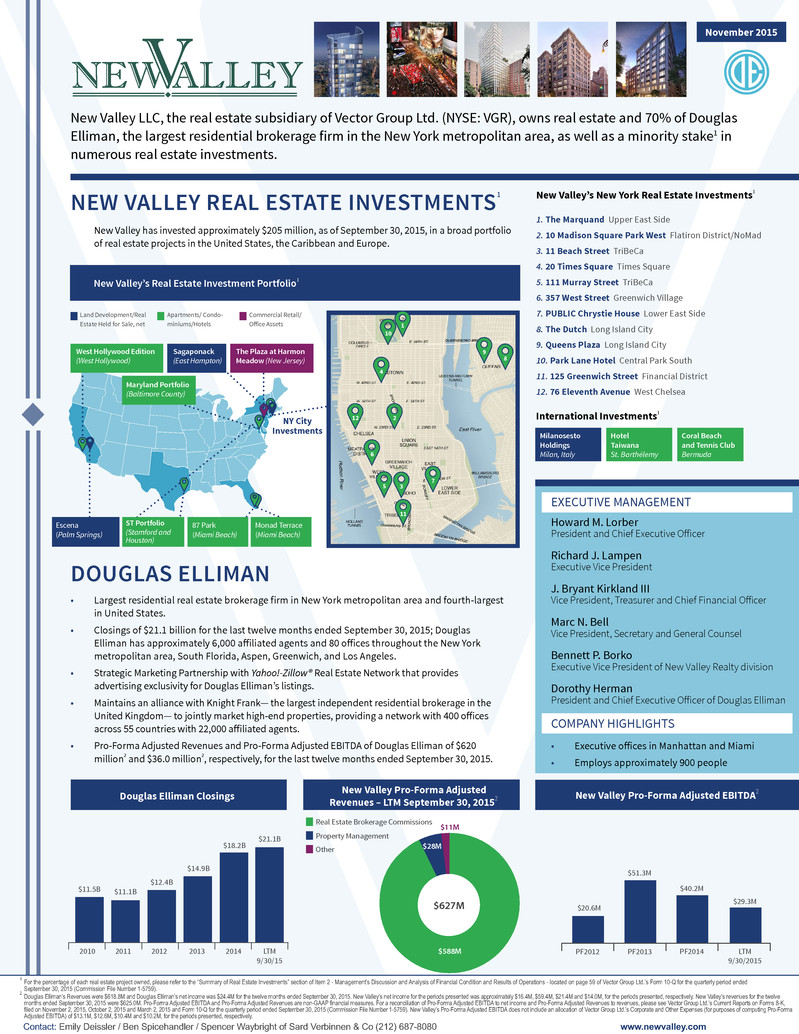

New Valley LLC, the real estate subsidiary of Vector Group Ltd. (NYSE: VGR), owns real estate and 70% of Douglas Elliman, the largest residential brokerage firm in the New York metropolitan area, as well as a minority stake1 in numerous real estate investments. New Valley has invested approximately $205 million, as of September 30, 2015, in a broad portfolio of real estate projects in the United States, the Caribbean and Europe. NEW VALLEY REAL ESTATE INVESTMENTS1 November 2015 DOUGLAS ELLIMAN • Largest residential real estate brokerage firm in New York metropolitan area and fourth-largest in United States. • Closings of $21.1 billion for the last twelve months ended September 30, 2015; Douglas Elliman has approximately 6,000 affiliated agents and 80 offices throughout the New York metropolitan area, South Florida, Aspen, Greenwich, and Los Angeles. • Strategic Marketing Partnership with Yahoo!-Zillow® Real Estate Network that provides advertising exclusivity for Douglas Elliman’s listings. • Maintains an alliance with Knight Frank— the largest independent residential brokerage in the United Kingdom— to jointly market high-end properties, providing a network with 400 offices across 55 countries with 22,000 affiliated agents. • Pro-Forma Adjusted Revenues and Pro-Forma Adjusted EBITDA of Douglas Elliman of $620 million2 and $36.0 million2, respectively, for the last twelve months ended September 30, 2015. COMPANY HIGHLIGHTS • Executive offices in Manhattan and Miami • Employs approximately 900 people Douglas Elliman’s Revenues were $618.8M and Douglas Elliman’s net income was $24.4M for the twelve months ended September 30, 2015. New Valley’s net income for the periods presented was approximately $16.4M, $59.4M, $21.4M and $14.0M, for the periods presented, respectively. New Valley’s revenues for the twelve months ended September 30, 2015 were $625.0M. Pro-Forma Adjusted EBITDA and Pro-Forma Adjusted Revenues are non-GAAP financial measures. For a reconciliation of Pro-Forma Adjusted EBITDA to net income and Pro-Forma Adjusted Revenues to revenues, please see Vector Group Ltd.’s Current Reports on Forms 8-K, filed on November 2, 2015, October 2, 2015 and March 2, 2015 and Form 10-Q for the quarterly period ended September 30, 2015 (Commission File Number 1-5759). New Valley’s Pro-Forma Adjusted EBITDA does not include an allocation of Vector Group Ltd.’s Corporate and Other Expenses (for purposes of computing Pro-Forma Adjusted EBITDA) of $13.1M, $12.6M, $10.4M and $10.2M, for the periods presented, respectively. 2 PF2012 PF2013 PF2014 LTM 9/30/2015 $20.6M $51.3M $40.2M $29.3M New Valley Pro-Forma Adjusted EBITDA2 212 3 10 5 6 7 8 9 1 4 Maryland Portfolio (Baltimore County) New Valley’s Real Estate Investment Portfolio1 New Valley’s New York Real Estate Investments1 1. The Marquand Upper East Side 2. 10 Madison Square Park West Flatiron District/NoMad 3. 11 Beach Street TriBeCa 4. 20 Times Square Times Square 5. 111 Murray Street TriBeCa 6. 357 West Street Greenwich Village 7. PUBLIC Chrystie House Lower East Side 8. The Dutch Long Island City 9. Queens Plaza Long Island City 10. Park Lane Hotel Central Park South 11. 125 Greenwich Street Financial District 12. 76 Eleventh Avenue West Chelsea Hotel Taiwana St. Barthélemy Milanosesto Holdings Milan, Italy Coral Beach and Tennis Club Bermuda International Investments1 Land Development/Real Estate Held for Sale, net Apartments/ Condo- miniums/Hotels Commercial Retail/ Office Assets Monad Terrace (Miami Beach) www.newvalley.comContact: Emily Deissler / Ben Spicehandler / Spencer Waybright of Sard Verbinnen & Co (212) 687-8080 Escena (Palm Springs) Douglas Elliman Closings 2010 2011 2012 2013 LTM 9/30/15 $11.5B $11.1B $12.4B $14.9B $18.2B $21.1B 2014 EXECUTIVE MANAGEMENT Howard M. Lorber President and Chief Executive Officer Richard J. Lampen Executive Vice President J. Bryant Kirkland III Vice President, Treasurer and Chief Financial Officer Marc N. Bell Vice President, Secretary and General Counsel Bennett P. Borko Executive Vice President of New Valley Realty division Dorothy Herman President and Chief Executive Officer of Douglas Elliman NY City Investments For the percentage of each real estate project owned, please refer to the “Summary of Real Estate Investments” section of Item 2 - Management’s Discussion and Analysis of Financial Condition and Results of Operations - located on page 59 of Vector Group Ltd.’s Form 10-Q for the quarterly period ended September 30, 2015 (Commission File Number 1-5759). 1 New Valley Pro-Forma Adjusted Revenues – LTM September 30, 20152 Other Real Estate Brokerage Commissions Property Management 11 West Hollywood Edition (West Hollywood) $627M $588M $28M $11M The Plaza at Harmon Meadow (New Jersey) Sagaponack (East Hampton) 87 Park (Miami Beach) ST Portfolio (Stamford and Houston)

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Transflo Wins 2024 Top Workplaces Culture Excellence Awards for Innovation, Work-Life Flexibility, Leadership

- PBIRx Growth Fueled by Johnson & Johnson ERISA Lawsuit

- Ecora Resources PLC Announces Transaction in Own Shares

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share