Form 10-Q CELADON GROUP INC For: Sep 30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

|

[ X ]

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

|

For the quarterly period ended September 30, 2015

or

|

[ ]

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

|

Commission file number: 001-34533

CELADON GROUP, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

13-3361050

|

|

(State or other jurisdiction of

|

(IRS Employer

|

|

incorporation or organization)

|

Identification No.)

|

|

9503 East 33rd Street

|

|

|

One Celadon Drive

|

|

|

Indianapolis, IN

|

46235-4207

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

(317) 972-7000

(Registrant's telephone number, including area code)

|

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes [X] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of "accelerated filer and large accelerated filer" in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer [ ]

|

Accelerated filer [X]

|

Non-accelerated filer [ ]

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12-b2 of the Exchange Act).

Yes [ ] No [X]

As of November 9, 2015 (the latest practicable date), 27,851,827 shares of the registrant's common stock, par value $0.033 per share, were outstanding.

Index to

September 30, 2015 Form 10-Q

|

Part I.

|

Financial Information

|

|||

|

Item 1.

|

Financial Statements

|

|||

|

Condensed Consolidated Statements of Income for the three months ended September 30, 2015 and 2014 (Unaudited)

|

||||

|

Condensed Consolidated Statements of Comprehensive Income for the three months ended September 30, 2015 and 2014 (Unaudited)

|

||||

|

Condensed Consolidated Balance Sheets at September 30, 2015 (Unaudited) and June 30, 2015

|

||||

|

Condensed Consolidated Statements of Cash Flows for the three months ended September 30, 2015 and 2014 (Unaudited)

|

||||

|

Notes to Condensed Consolidated Financial Statements (Unaudited)

|

||||

|

Item 2.

|

Management's Discussion and Analysis of Financial Condition and Results of Operations

|

|||

|

Item 3.

|

Quantitative and Qualitative Disclosures about Market Risk

|

|||

|

Item 4.

|

Controls and Procedures

|

|||

|

Part II.

|

Other Information

|

|||

|

Item 1.

|

Legal Proceedings

|

|||

|

Item 1A.

|

Risk Factors

|

|||

|

Item 2.

|

Unregistered Sales of Equity Securities and Use of Proceeds

|

|||

|

Item 3.

|

Defaults Upon Senior Securities

|

|||

|

Item 4.

|

Mine Safety Disclosures

|

|||

|

Item 5.

|

Other Information

|

|||

|

Item 6.

|

Exhibits

|

|||

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(Dollars and shares in thousands except per share amounts)

(Unaudited)

|

For the three months ended

|

||||||||

|

September 30,

|

||||||||

|

2015

|

2014

|

|||||||

|

OPERATING REVENUE:

|

||||||||

|

Freight revenue

|

$ | 237,812 | $ | 157,704 | ||||

|

Fuel surcharge revenue

|

28,309 | 35,712 | ||||||

|

Total revenue

|

266,121 | 193,416 | ||||||

|

OPERATING EXPENSES:

|

||||||||

|

Salaries, wages, and employee benefits

|

81,478 | 57,222 | ||||||

|

Fuel

|

27,728 | 39,985 | ||||||

|

Purchased transportation

|

89,031 | 43,637 | ||||||

|

Revenue equipment rentals

|

2,222 | 2,590 | ||||||

|

Operations and maintenance

|

17,606 | 11,240 | ||||||

|

Insurance and claims

|

6,928 | 5,676 | ||||||

|

Depreciation and amortization

|

21,601 | 15,556 | ||||||

|

Communications and utilities

|

2,344 | 1,830 | ||||||

|

Operating taxes and licenses

|

4,971 | 3,315 | ||||||

|

General and other operating

|

4,282 | 3,455 | ||||||

|

Gain on disposition of equipment

|

(13,242 | ) | (4,558 | ) | ||||

|

Total operating expenses

|

244,949 | 179,948 | ||||||

|

Operating income

|

21,172 | 13,468 | ||||||

|

Interest expense

|

3,152 | 1,169 | ||||||

|

Other (income) expense

|

100 | (78 | ) | |||||

|

Income before income taxes

|

17,920 | 12,377 | ||||||

|

Income tax expense

|

6,553 | 4,329 | ||||||

|

Net income

|

$ | 11,367 | $ | 8,048 | ||||

|

Income per common share:

|

||||||||

|

Diluted

|

$ | 0.41 | $ | 0.34 | ||||

|

Basic

|

$ | 0.41 | $ | 0.35 | ||||

|

Diluted weighted average shares outstanding

|

27,966 | 23,934 | ||||||

|

Basic weighted average shares outstanding

|

27,453 | 23,240 | ||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(in thousands)

(Unaudited)

|

For the three months ended

|

||||||||

|

September 30,

|

||||||||

|

2015

|

2014

|

|||||||

|

Net income

|

$ | 11,367 | $ | 8,048 | ||||

|

Other comprehensive income (loss):

|

||||||||

|

Unrealized gain (loss) on fuel derivative instruments, net of tax

|

(476 | ) | --- | |||||

|

Unrealized gain (loss) on currency derivative instruments, net of tax

|

--- | (35 | ) | |||||

|

Foreign currency translation adjustments, net of tax

|

(9,431 | ) | (3,852 | ) | ||||

|

Total other comprehensive income (loss)

|

(9,907 | ) | (3,887 | ) | ||||

|

Comprehensive income

|

$ | 1,460 | $ | 4,161 | ||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

CONDENSED CONSOLIDATED BALANCE SHEETS

September 30, 2015 and June 30, 2015

(Dollars and shares in thousands except par value)

|

(unaudited)

|

||||||||

|

September 30,

|

June 30,

|

|||||||

|

ASSETS

|

2015

|

2015

|

||||||

|

Current assets:

|

||||||||

|

Cash and cash equivalents

|

$ | 24,844 | $ | 24,699 | ||||

|

Trade receivables, net of allowance for doubtful accounts of $1,385 and $1,002 at September 30, 2015 and June 30, 2015, respectively

|

134,916 | 130,892 | ||||||

|

Prepaid expenses and other current assets

|

44,664 | 33,267 | ||||||

|

Tires in service

|

2,174 | 1,857 | ||||||

|

Equipment held for resale

|

175,125 | 102,447 | ||||||

|

Income tax receivable

|

10,440 | 17,926 | ||||||

|

Deferred income taxes

|

6,553 | 7,083 | ||||||

|

Total current assets

|

398,716 | 318,171 | ||||||

|

Property and equipment

|

932,867 | 935,976 | ||||||

|

Less accumulated depreciation and amortization

|

142,400 | 147,446 | ||||||

|

Net property and equipment

|

790,467 | 788,530 | ||||||

|

Tires in service

|

2,587 | 2,173 | ||||||

|

Goodwill

|

57,130 | 55,357 | ||||||

|

Investment in unconsolidated companies

|

2,000 | --- | ||||||

|

Other assets

|

11,321 | 11,458 | ||||||

|

Total assets

|

$ | 1,262,221 | $ | 1,175,689 | ||||

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

||||||||

|

Current liabilities:

|

||||||||

|

Accounts payable

|

$ | 17,042 | $ | 13,699 | ||||

|

Accrued salaries and benefits

|

15,147 | 16,329 | ||||||

|

Accrued insurance and claims

|

16,486 | 14,808 | ||||||

|

Accrued fuel expense

|

10,345 | 10,979 | ||||||

|

Accrued purchased transportation

|

20,795 | 16,259 | ||||||

|

Accrued equipment purchases

|

21,307 | 775 | ||||||

|

Deferred leasing revenue

|

40,696 | 31,872 | ||||||

|

Other accrued expenses

|

25,657 | 31,835 | ||||||

|

Current maturities of long term debt

|

781 | 948 | ||||||

|

Current maturities of capital lease obligations

|

65,390 | 62,992 | ||||||

|

Total current liabilities

|

233,646 | 200,496 | ||||||

|

Capital lease obligations, net of current maturities

|

385,998 | 366,452 | ||||||

|

Long term debt

|

162,635 | 133,199 | ||||||

|

Other long term liabilities

|

500 | 953 | ||||||

|

Deferred income taxes

|

111,433 | 108,246 | ||||||

|

Stockholders' equity:

|

||||||||

|

Common stock, $0.033 par value, authorized 40,000 shares; issued and outstanding 28,352 and 28,342 shares at September 30, 2015 and June 30, 2015, respectively

|

936 | 935 | ||||||

|

Treasury stock at cost; 500 shares at September 30, 2015 and June 30, 2015, respectively

|

(3,453 | ) | (3,453 | ) | ||||

|

Additional paid-in capital

|

196,436 | 195,682 | ||||||

|

Retained earnings

|

206,230 | 195,412 | ||||||

|

Accumulated other comprehensive loss

|

(32,140 | ) | (22,233 | ) | ||||

|

Total stockholders' equity

|

368,009 | 366,343 | ||||||

|

Total liabilities and stockholders' equity

|

$ | 1,262,221 | $ | 1,175,689 | ||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(Unaudited)

|

For the three months ended

|

||||||||

|

September 30,

|

||||||||

|

2015

|

2014

|

|||||||

|

Cash flows from operating activities:

|

||||||||

|

Net income

|

$ | 11,367 | $ | 8,048 | ||||

|

Adjustments to reconcile net income to net cash provided by operating activities:

|

||||||||

|

Depreciation and amortization

|

21,730 | 15,625 | ||||||

|

Gain on sale of equipment

|

(13,242 | ) | (4,558 | ) | ||||

|

Stock based compensation

|

747 | 720 | ||||||

|

Deferred income taxes

|

4,005 | 2,775 | ||||||

|

Provision for doubtful accounts

|

144 | 60 | ||||||

|

Changes in assets and liabilities:

|

||||||||

|

Trade receivables

|

(2,095 | ) | 5,370 | |||||

|

Income taxes

|

7,175 | 1,845 | ||||||

|

Tires in service

|

(773 | ) | 555 | |||||

|

Prepaid expenses and other current assets

|

(11,735 | ) | (17,213 | ) | ||||

|

Other assets

|

(2,894 | ) | (170 | ) | ||||

|

Accounts payable and accrued expenses

|

36,270 | (4,208 | ) | |||||

|

Equipment held for resale

|

(73,506 | ) | --- | |||||

|

Net cash (used in) provided by operating activities

|

(22,807 | ) | 8,849 | |||||

|

Cash flows from investing activities:

|

||||||||

|

Purchase of property and equipment

|

(67,442 | ) | (78,828 | ) | ||||

|

Proceeds on sale of property and equipment

|

115,490 | 71,927 | ||||||

|

Purchase of businesses, net of cash acquired

|

(12,604 | ) | (10,048 | ) | ||||

| Investment in unconsolidated entity | (2,000 | ) | --- | |||||

|

Net cash provided by (used in) investing activities

|

33,444 | (16,949 | ) | |||||

|

Cash flows from financing activities:

|

||||||||

|

Proceeds from borrowings on long-term debt

|

303,520 | 162,100 | ||||||

|

Payments on bank borrowing on long-term debt

|

(275,138 | ) | (133,100 | ) | ||||

|

Principal payments under capital lease obligations

|

(38,885 | ) | (26,648 | ) | ||||

|

Dividends paid

|

(549 | ) | (464 | ) | ||||

|

Proceeds from issuance of common stock

|

7 | 852 | ||||||

|

Net cash (used in) provided by financing activities

|

(11,045 | ) | 2,740 | |||||

|

Effect of exchange rates on cash and cash equivalents

|

553 | (51 | ) | |||||

|

Increase (Decrease) in cash and cash equivalents

|

145 | (5,411 | ) | |||||

|

Cash and cash equivalents at beginning of period

|

24,699 | 15,508 | ||||||

|

Cash and cash equivalents at end of period

|

$ | 24,844 | $ | 10,097 | ||||

|

Supplemental disclosure of cash flow information:

|

||||||||

|

Interest paid

|

$ | 3,152 | $ | 1,181 | ||||

|

Income taxes paid

|

$ | 81 | $ | 4,200 | ||||

|

Lease obligation incurred in the purchase of equipment

|

$ | 60,828 | $ | 41,695 | ||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

References in this Report on Form 10-Q to "we," "us," "our," "Celadon," the "Company," or similar terms refer to Celadon Group, Inc. and its consolidated subsidiaries. All inter-company balances and transactions have been eliminated in consolidation.

The accompanying unaudited condensed consolidated financial statements of Celadon Group, Inc. and its subsidiaries have been prepared in accordance with accounting principles generally accepted in the United States of America and Regulation S-X, instructions to Form 10-Q, and other relevant rules and regulations of the Securities and Exchange Commission (the "SEC"), as applicable to the preparation and presentation of interim financial information. Certain information and footnote disclosures have been omitted or condensed pursuant to such rules and regulations. We believe all adjustments (consisting of normal recurring adjustments) considered necessary for a fair presentation have been included. Results of operations in interim periods are not necessarily indicative of results for a full year. These unaudited condensed consolidated financial statements and notes thereto should be read in conjunction with our consolidated financial statements and notes thereto included in our Annual Report on Form 10-K for the year ended June 30, 2015.

The preparation of the financial statements in conformity with United States generally accepted accounting principles ("GAAP") requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Actual results could differ from those estimates.

2. Earnings Per Share (in thousands, except per share data)

A reconciliation of the basic and diluted earnings per share is as follows:

|

For the three months ended

|

||||||||

|

September 30,

|

||||||||

|

2015

|

2014

|

|||||||

|

Weighted average common shares outstanding – basic

|

27,453 | 23,240 | ||||||

|

Dilutive effect of stock options and unvested restricted stock units

|

513 | 694 | ||||||

|

Weighted average common shares outstanding – diluted

|

27,966 | 23,934 | ||||||

|

Net income

|

$ | 11,367 | $ | 8,048 | ||||

|

Earnings per common share:

|

||||||||

|

Basic

|

$ | 0.41 | $ | 0.35 | ||||

|

Diluted

|

$ | 0.41 | $ | 0.34 | ||||

For the three months ended September 30, 2015 and September 30, 2014, there were no shares classified as anti-dilutive.

3. Stock Based Compensation

The following table summarizes the components of our stock based compensation program expense (in thousands):

|

For the three months ended

|

||||||||

|

September 30,

|

||||||||

|

2015

|

2014

|

|||||||

|

Stock compensation expense for options, net of forfeitures

|

$ | 0 | $ | 24 | ||||

|

Stock compensation expense for restricted stock, net of forfeitures

|

747 | 696 | ||||||

|

Total stock compensation expense

|

$ | 747 | $ | 720 | ||||

As of September 30, 2015, we have no unrecognized compensation cost related to unvested options granted under our 2006 Omnibus Incentive Plan, as amended (the "2006 Plan").

A summary of the award activity of our stock option plans as of September 30, 2015, and changes during the three-month period then ended is presented below:

|

Options

|

Options Totals

|

Weighted-Average Exercise Price per Share

|

||||||

|

Outstanding at July 1, 2015

|

295,789 | $ | 9.47 | |||||

|

Granted

|

--- | --- | ||||||

|

Vested and Issued

|

9,950 | $ | 12.61 | |||||

|

Forfeited

|

--- | --- | ||||||

|

Outstanding at September 30, 2015

|

285,839 | $ | 9.36 | |||||

|

Exercisable at September 30, 2015

|

285,839 | $ | 9.36 | |||||

As of September 30, 2015, we also have approximately $6.2 million of unrecognized compensation expense related to restricted stock awards, which is anticipated to be recognized over a weighted-average period of 2.5 years and a total period of 3.4 years. A summary of the restricted stock award activity under the 2006 Plan as of September 30, 2015, and changes during the three-month period then ended is presented below:

|

Number of Restricted Stock Awards

|

Weighted-Average Grant Date Fair Value

|

|||||||

|

Unvested at July 1, 2015

|

396,366 | $ | 21.13 | |||||

|

Granted

|

--- | --- | ||||||

|

Vested and Issued

|

3,000 | $ | 14.36 | |||||

|

Forfeited

|

420 | $ | 22.00 | |||||

|

Outstanding at September 30, 2015

|

392,946 | $ | 21.18 | |||||

The grant date fair value of each restricted stock award is based on the closing market price on the date of grant.

4. Segment Information

We have three reportable segments comprised of an asset-based segment, an asset-light based segment and an equipment leasing and services segment. Our asset-based segment includes our asset-based dry van carrier and rail services, which are geographically diversified but have similar economic and other relevant characteristics, as they all provide truckload carrier services of general commodities to a similar class of customers. Our asset-light based segment consists of our warehousing, brokerage, and less-than-truckload ("LTL") operations. Our equipment leasing and services segment consists of tractor and trailer sales and leasing. This segment also includes revenues from insurance, maintenance, and other ancillary services that we provide for independent contractors. We have determined that these segments qualify as reportable segments under ASC 280-10, Segment Reporting. Information regarding our reportable segments is summarized below (in thousands):

|

Operating Revenue

|

||||||||

|

For the three months ended

|

||||||||

|

September 30,

|

||||||||

|

2015

|

2014

|

|||||||

|

Asset-based

|

$ | 230,775 | $ | 176,869 | ||||

|

Asset-light based

|

30,584 | 16,547 | ||||||

|

Equipment leasing and services

|

4,762 | --- | ||||||

|

Total

|

$ | 266,121 | $ | 193,416 | ||||

|

Operating Income

|

||||||||

|

For the three months ended

|

||||||||

|

September 30,

|

||||||||

|

2015

|

2014

|

|||||||

|

Asset-based

|

$ | 7,383 | $ | 11,249 | ||||

|

Asset-light based

|

3,928 | 2,219 | ||||||

|

Equipment leasing and services

|

9,861 | --- | ||||||

|

Total

|

$ | 21,172 | $ | 13,468 | ||||

Results of the Equipment leasing and services segment prior to the current fiscal year are impracticable to discern due to the way we had costs integrated with our asset-based segment.

Information as to our operating revenue by geographic area is summarized below (in thousands). We allocate operating revenue based on the country of origin of the tractor hauling the freight:

|

Operating Revenue

|

||||||||

|

For the three months ended

|

||||||||

|

September 30,

|

||||||||

|

2015

|

2014

|

|||||||

|

United States

|

$ | 232,710 | $ | 153,186 | ||||

|

Canada

|

21,944 | 29,206 | ||||||

|

Mexico

|

11,467 | 11,024 | ||||||

|

Consolidated

|

$ | 266,121 | $ | 193,416 | ||||

5. Income Taxes

Our effective income tax rate was 36.6% for the three-month period ended September 30, 2015, compared with 35.0% for the three-month period ended September 30, 2014. In determining our quarterly provision for income taxes, we use an estimated annual effective tax rate, which is based on our expected annual income, statutory tax rates, nontaxable and nondeductible items of income and expense, and the ultimate outcome of tax audits. The change in the proportion of income from domestic and foreign sources affects our effective tax rate. Income tax expense also varies from the amount computed by applying the statutory federal tax rate to income before income taxes primarily due to state income taxes, net of federal income tax effect, adjusted for permanent differences, the most significant of which is the effect of the per diem pay structure for drivers. Under this pay structure, drivers who meet the requirements and elect to receive per diem pay are generally required to receive non-taxable per diem pay in lieu of a portion of their taxable wages. This per diem program increases our drivers’ net pay per mile, after taxes, while decreasing gross pay, before taxes. As a result, salaries, wages, and employee benefits are slightly lower, and our effective income tax rate is higher than the statutory rate. Generally, as pre-tax income increases, the impact of the driver per diem program on our effective tax rate decreases because aggregate per diem pay becomes smaller in relation to pre-tax income. Due to the partially nondeductible effect of per diem pay, our tax rate will fluctuate in future periods based on fluctuations in earnings and in the number of drivers who elect to be paid under this pay structure.

We follow ASC Topic 740-10-25 in accounting for uncertainty in income taxes ("Topic 740"). Topic 740 prescribes a recognition threshold and measurement attribute for the financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. We account for any uncertainty in income taxes by determining whether it is more likely than not that a tax position taken or expected to be taken in a tax return will be sustained upon examination by the appropriate taxing authority based on the technical merits of the position. In that regard, we have analyzed filing positions in our federal and applicable state tax returns as well as in all open tax years. The only periods subject to examination for our federal returns are the 2011 through 2013 tax years. We believe that our income tax filing positions and deductions will be sustained on audit and do not anticipate any adjustments that will result in a material change to our consolidated financial position, results of operations, or cash flows. As of September 30, 2015, we recorded a $0.5 million liability for unrecognized tax benefits, a portion of which represents penalties and interest.

6. Commitments and Contingencies

We are party to certain lawsuits in the ordinary course of business. We are not currently party to any proceedings which we believe will have a material adverse effect on our consolidated financial position or operations. Our subsidiary has been named as the defendant in Wilmoth et al. v. Celadon Trucking Services, Inc., a class action proceeding. A summary judgment was recently granted in favor of the plaintiffs. We have appealed this judgment. We believe that we will be successful on appeal, but that it is also reasonably possible the judgment will be upheld. We estimate the possible range of financial exposure associated with this claim to be between $0 and approximately $5 million. We currently do not have a contingency reserved for this claim, but will continue to monitor the progress of this claim to determine if a reserve is necessary in the future.

We have been named as the defendant in Day et al. v. Celadon Trucking Services, Inc., a class action proceeding. A judgment was recently granted in favor of the plaintiffs. We have appealed this judgment. We believe that we will be successful on appeal, but that it is also reasonably possible the judgment will be upheld. We estimate the possible range of financial exposure associated with this claim to be between $0 and approximately $2 million. We currently do not have a contingency reserved for this claim, but will continue to monitor the progress of this claim to determine if a reserve is necessary in the future.

We have outstanding commitments to purchase approximately $23.3 million of revenue equipment at September 30, 2015.

Standby letters of credit, not reflected in the accompanying condensed consolidated financial statements, aggregated approximately $2.2 million at September 30, 2015. In addition, at September 30, 2015, 500,000 treasury shares were held in a trust as collateral for self-insurance reserves.

7. Lease Obligations and Long-Term Debt

Leases

We lease certain revenue and service equipment under long-term lease agreements, payable in monthly installments.

Equipment obtained under a capital lease is reflected on our condensed consolidated balance sheet as owned and the related leases bear interest rates ranging from 1.4% to 3.6% per annum maturing at various dates through 2022.

Assets held under operating leases are not recorded on our condensed consolidated balance sheet. We lease revenue and service equipment under non-cancellable operating leases expiring at various dates through December 2018.

Long-Term Debt

We had debt, excluding capital leases, of $163.4 million at September 30, 2015, of which $162.0 million relates to our credit facility. Debt includes revenue equipment installment notes of $1.4 million with an average interest rate of 4.6 percent at September 30, 2015, due in monthly installments with final maturities at various dates through June 2019.

Future minimum lease payments relating to capital leases and operating leases as of September 30, 2015 (in thousands):

|

Capital

Leases

|

Operating

Leases

|

|||||||

|

2016

|

$ | 74,935 | $ | 4,888 | ||||

|

2017

|

92,959 | 1,548 | ||||||

|

2018

|

187,005 | 5,855 | ||||||

|

2019

|

46,051 | 1,559 | ||||||

|

2020

|

24,853 | --- | ||||||

|

Thereafter

|

54,882 | --- | ||||||

|

Total minimum lease payments

|

$ | 480,685 | $ | 13,850 | ||||

|

Less amounts representing interest

|

29,297 | |||||||

|

Present value of minimum lease payments

|

451,388 | |||||||

|

Less current maturities

|

65,390 | |||||||

|

Non-current portion

|

$ | 385,998 | ||||||

8. Fair Value Measurements

ASC 820-10 Fair Value Measurements defines fair value, establishes a framework for measuring fair value under GAAP, and expands disclosures about fair value measurements. This standard establishes a three-level hierarchy for fair value measurements based upon the significant inputs used to determine fair value. Observable inputs are those which are obtained from market participants external to us, while unobservable inputs are generally developed internally, utilizing management’s estimates assumptions, and specific knowledge of the nature of the assets or liabilities and related markets. The three levels are defined as follows:

Level 1 – Inputs are quoted prices (unadjusted) in active markets for identical assets or liabilities that we have the ability to access at the measurement date. An active market is defined as a market in which transactions for the assets or liabilities occur with sufficient frequency and volume to provide pricing information on an ongoing basis.

Level 2 – Inputs include quoted prices for similar assets and liabilities in active markets, quoted prices for identical or similar assets or liabilities in markets that are not active (markets with few transactions), inputs other than quoted prices that are observable for the asset or liability (i.e., interest rates, yield curves, etc.), and inputs that are derived principally from or corroborated by observable market data correlation or other means (market corroborated inputs).

Level 3 – Unobservable inputs, only used to the extent that observable inputs are not available, reflect our assumptions about the pricing of an asset or liability.

In accordance with the fair value hierarchy described above, the following table shows the fair value of our financial assets and liabilities (in thousands) that are required to be measured at fair value as of September 30, 2015, and June 30, 2015.

|

Level 1

|

Level 2

|

Level 3

|

||||||||||||||||||||||||||||||

|

Balance

|

Balance

|

Balance

|

Balance

|

Balance

|

Balance

|

Balance

|

Balance

|

|||||||||||||||||||||||||

|

at

|

at

|

at

|

at

|

at

|

at

|

at

|

at

|

|||||||||||||||||||||||||

|

September

|

June

|

September

|

June

|

September

|

June

|

September

|

June

|

|||||||||||||||||||||||||

| 30, | 30, | 30, | 30, | 30, | 30, | 30, | 30, | |||||||||||||||||||||||||

| 2015 | 2015 | 2015 | 2015 | 2015 | 2015 | 2015 | 2015 | |||||||||||||||||||||||||

|

Foreign currency derivatives

|

$ | --- | $ | --- | $ | --- | $ | --- | $ | --- | $ | --- | $ | --- | $ | --- | ||||||||||||||||

|

Fuel derivatives

|

(760 | ) | --- | --- | --- | (760 | ) | --- | --- | --- | ||||||||||||||||||||||

We pay a fixed contract rate for foreign currency. The fair value of foreign currency forward contracts is based on the valuation model that discounts cash flows resulting from the differential between the contract price and the market-based forward rate.

Our other financial instruments consist primarily of cash and cash equivalents, accounts receivable, accounts payable, long-term debt, and capital lease obligations. At September 30, 2015 the fair value of these instruments were approximated by their carrying values.

9. Fuel Derivatives

In our day to day business activities we are exposed to certain market risks, including the effects of changes in fuel prices. We review new ways to reduce the potentially adverse effects that the volatility of fuel markets may have on operating results. In an effort to reduce the variability of the ultimate cash flows associated with fluctuations in diesel fuel prices, we may enter into futures contracts. These instruments will be heating oil futures contracts as the related index, New York Mercantile Exchange (“NYMEX”), generally exhibits high correlation with the changes in the dollars of the forecasted purchase of diesel fuel. We do not engage in speculative transactions, nor do we hold or issue financial instruments for trading purposes.

We have entered into futures contracts relating to 5,292,000 total gallons of diesel fuel, or 336,000 gallons per month for October 2015 through February 2017, approximately 10.0% of our monthly projected fuel requirements through February 2017. Under these contracts, we pay a fixed rate per gallon of heating oil and receive the monthly average price of New York heating oil per the NYMEX. We have done retrospective and prospective regression analyses that showed the changes in the prices of diesel fuel and heating oil were deemed to be highly effective based on the relevant authoritative guidance. Accordingly, we have designated the respective hedges as cash flow hedges.

We perform both a prospective and retrospective assessment of the effectiveness of our hedge contracts at inception and quarterly. If our analysis shows that the derivatives are not highly effective as hedges, we will discontinue hedge accounting for the period and prospectively recognize changes in the fair value of the derivative being recognized through earnings. As a result of our effectiveness assessment at inception and at September 30, 2015, we believe our hedge contracts have been and will continue to be highly effective in offsetting changes in cash flows attributable to the hedged risk.

We recognize all derivative instruments at fair value on our condensed consolidated balance sheets in other assets or other accrued expenses. Our derivative instruments are designated as cash flow hedges, thus the effective portion of the gain or loss on the derivative is reported as a component of accumulated other comprehensive income and will be reclassified into earnings in the same period during which the hedged transactions affect earnings. The effective portion of the derivative represents the change in fair value of the hedge that offsets the change in fair value of the hedged item. To the extent the change in the fair value of the hedge does not perfectly offset the change in the fair value of the hedged item, the ineffective portion of the hedge is immediately recognized in other income or expense on our condensed consolidated statements of income. The ineffective portion of the hedge for the quarter ended September 30, 2015 was immaterial and therefore not recognized through earnings.

Based on the amounts in accumulated other comprehensive income as of September 30, 2015, and the expected timing of the purchases of the diesel fuel hedged, we expect to reclassify $0.8 million of loss on derivative instruments from accumulated other comprehensive income to our condensed consolidated statement of income, as an offset to fuel expense, due to the actual diesel fuel purchases. The amounts actually realized will depend on the fair values as of the date of settlement.

Outstanding financial derivative instruments expose us to credit loss in the event of nonperformance by the counterparties with which we have these agreements. Our credit exposure related to these financial instruments is represented by the fair value of contracts reported as liabilities. To evaluate credit risk, we review each counterparty's audited financial statements and credit ratings and obtain references. Any credit valuation adjustments deemed necessary would be reflected in the fair value of the instrument. As of September 30, 2015, we have not made any such adjustments.

10. Dividend

On July 28, 2015, we declared a cash dividend of $0.02 per share of common stock. The dividend was payable to shareholders of record on October 9, 2015, and was paid on October 23, 2015. Future payment of cash dividends, and the amount of any such dividends, will depend on our financial condition, results of operations, cash requirements, tax treatment, and certain corporate law requirements, as well as other factors deemed relevant by our Board of Directors.

11. Acquisitions

Immaterial acquisitions for the quarter ended September 30, 2015

In July 2015, we acquired certain assets of Buckler Transport, Inc. (“Buckler”) in Roulette, PA, for $13.7 million. The assets acquired include tractors and trailers that we intend to operate in the short term. We used borrowings under our existing credit facility to fund the purchase price. The purposes of the acquisition were to offer employment opportunities to Buckler drivers and to diversify into the hot asphalt and fracking industry.

12. Goodwill and Other Intangible Assets

The acquired intangible assets, included in the condensed consolidated balance sheet within other assets, relate to customer relations acquired through acquisition in fiscal 2015. There have been no additions to intangible assets in fiscal 2016. All previously acquired intangibles relate to our asset-based business. The intangible assets are being amortized on a straight-line basis through 2041 (dollar amounts below in thousands).

|

Intangibles

|

||||||||||||

|

June 30, 2015

|

Current Year

Additions

|

September 30, 2015

|

||||||||||

|

Gross carrying amount

|

$ | 8,096 | --- | $ | 8,096 | |||||||

|

Accumulated amortization

|

1,048 | $ | 41 | 1,089 | ||||||||

| $ | 7,048 | $ | 41 | $ | 7,007 | |||||||

The additions to goodwill relate to the Buckler acquisition of $1.8 million. The Buckler related goodwill is tax deductible (dollar amounts below in thousands).

|

Goodwill

|

||||||||||||

|

June 30, 2015

|

Current year

Additions

|

September 30, 2015

|

||||||||||

|

Asset-based

|

$ | 53,989 | $ | 1,773 | $ | 55,762 | ||||||

|

Asset-light based

|

$ | 1,368 | --- | $ | 1,368 | |||||||

|

Total Goodwill

|

$ | 55,357 | $ | 1,773 | $ | 57,130 | ||||||

13. Equipment Leasing and Services Segment

We routinely sell equipment to Element Financial Corp. ("Element") under our agreement with Element for use by independent contractors. Total net sales proceeds of units purchased with the intent to sell during the quarter ended September 30, 2015 were $152.5 million. In accordance with ASC 605-45, we recorded these transactions on a net basis as an agent versus grossing up the sales in revenue and costs of goods sold as a principal. The net gain as a result of these transactions in the quarter ended September 30, 2015 was $12.9 million. The $9.9 million of operating income reported under the equipment leasing and services segment is a result of the $12.9 million in gains recorded on a net basis for the quarter ended September 30, 2015.

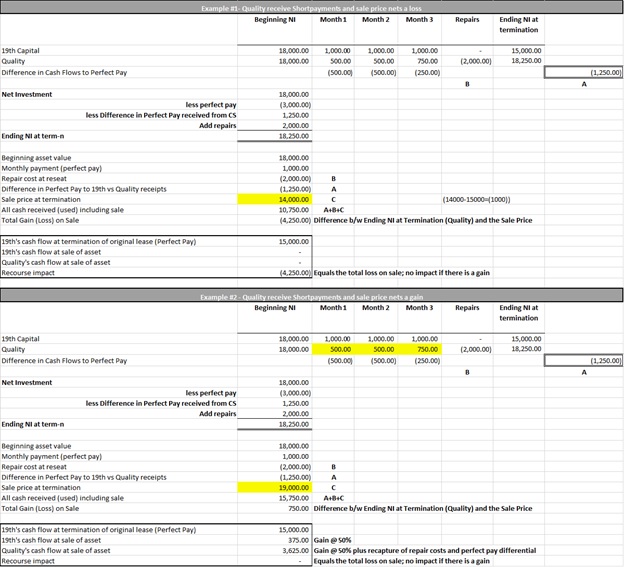

14. Unconsolidated Related-party Investments

In late September 2015, Quality Equipment Leasing, LLC and Quality Companies, LLC (together, “Quality” or “Quality Companies”), our wholly owned subsidiaries, entered into a Portfolio Purchase and Sale Agreement, a Fleet Program Agreement, a Service Agreement and a Program Agreement with 19th Capital Group, LLC (“19th Capital”). Under the Portfolio Purchase and Sale Agreement, 19th Capital purchased a portfolio of Quality's independent contractor leases and associated assets for approximately $13.6 million. The portfolio includes leases for approximately 110 tractors and 130 trailers currently in service with our independent contractors and other partner carriers. The net gain as a result of this transaction in the quarter ended September 30, 2015 was $0.1 million.

Under the Program Agreement, 19th Capital will finance the renewal and expansion of transportation assets operated by independent lessees under contract with us. Under related agreements, Quality will provide administrative and servicing support for 19th Capital’s lease and financing portfolio, certain driver recruiting, lease payment remittance, maintenance, and insurance services, which the Company has deferred $1.3 million which is included in deferred leasing revenue on the condensed consolidated balance sheet as of September 30, 2015. Under the Fleet Program Agreement, 19th Capital will have the opportunity to provide leases and financing to our partner carriers.

These transactions resulted in finalization of the prior formation of 19th Capital, which was established with capital contributions from us (33.33%) and Tiger ELS, LLC (“Tiger”) (67.67%), an entity controlled by Larsen MacColl Partners, an unaffiliated investment firm. As of September 30, 2015, we had invested $2.0 million of the total capital contributions to 19th Capital of $6.0 million. In addition to the Company’s ownership, certain management own a membership interest in 19th Capital.

15. Reclassifications and Adjustments

Certain items in the fiscal 2015 condensed consolidated financial statements have been reclassified to conform to the current presentation. The reclassifications had no impact on earnings.

Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations

Disclosure Regarding Forward Looking Statements

Except for certain historical information contained herein, this report contains certain statements that may be considered "forward-looking statements" within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), and Section 27A of the Securities Act of 1933, as amended, and such statements are subject to the safe harbor created by those sections and the Private Securities Litigation Reform Act of 1995, as amended. All statements, other than statements of historical or current fact, are statements that could be deemed forward-looking statements, including without limitation: any projections of revenues, earnings, cash flows, dividends, capital expenditures, or other financial items; any statement of plans, strategies, and objectives of management for future operations; any statements concerning proposed acquisition plans, new services, or developments; any statements regarding future economic conditions or performance; and any statements of belief and any statement of assumptions underlying any of the foregoing. In this Item 2, statements regarding our ability to reduce future fuel consumption and increase fuel efficiency, future prices of fuel, future freight rates, future industry capacity, future purchased transportation expenses, future costs of maintenance and operations, future driver recruiting and retention costs, future depreciation and gains on sale of equipment, future income tax rates, future insurance and claims expenses, our ability to grow our independent contractor fleet, expected capital expenditures, the likelihood and impact of future acquisitions, our future ability to fund operating expenses, future used equipment values, future dividends, future revenue and growth, and future sources of liquidity, among others, are forward-looking statements. Words such as "believe," "may," "could," "will," "expects," "hopes," "estimates," "projects," "intends," "anticipates," and "likely," and variations of these words, or similar expressions, terms, or phrases, are intended to identify such forward-looking statements. Forward-looking statements are inherently subject to risks, assumptions, and uncertainties, some of which cannot be predicted or quantified, which could cause future events and actual results to differ materially from those set forth in, contemplated by, or underlying the forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in the section entitled "Item 1A. Risk Factors," set forth in our Form 10-K for the year ended June 30, 2015, along with any supplements in Part II below. Readers should review and consider the factors discussed in "Item 1A. Risk Factors," set forth in our Form 10-K for the year ended June 30, 2015, along with any supplements in Part II below, in addition to various disclosures in our press releases, stockholder reports, and other filings with the Securities and Exchange Commission.

All such forward-looking statements speak only as of the date of this Form 10-Q. You are cautioned not to place undue reliance on such forward-looking statements. We expressly disclaim any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in our expectations with regard thereto or any change in the events, conditions, or circumstances on which any such statement is based.

All forward-looking statements attributable to us, or persons acting on our behalf, are expressly qualified in their entirety by this cautionary statement.

References to the "Company," "we," "us," "our," and words of similar import refer to Celadon Group, Inc. and its consolidated subsidiaries.

Business Overview

We are one of North America's largest truckload carriers as measured by revenue. We generated $900.8 million in operating revenue during our fiscal year ended June 30, 2015. We offer a broad range of truckload transportation and logistics services within the United States, including long-haul, regional, dedicated, temperature-controlled, less-than-truckload, intermodal, and logistics. Through a series of acquisitions, we have expanded our operations and service offerings both within the United States and internationally. These acquisitions have contributed significantly to our driver fleet and improved lane density, freight mix, and customer diversity, as well as helping us expand our international operations. Through our asset and asset-light services, we are able to transport or arrange for transportation throughout the United States, Canada, and Mexico.

Approximately 34% of our revenue for fiscal 2015 was derived from international operations, and we believe our international operations offer an attractive business niche. The additional complexity involved with developing cross-border business partners, a strong organization, and an adequate infrastructure in Mexico afford some barriers to competition that are not present in traditional U.S. truckload service. We have also pursued opportunities to expand our operations in Canada through acquisitions and we plan to continue expanding our cross-border operations to take advantage of these opportunities.

Recent Results of Operations

Our results of operations for the quarter ended September 30, 2015, compared to the same period in 2014 are:

|

·

|

Total revenue increased 37.6% to $266.1 million from $193.4 million;

|

|

|

·

|

Net income increased 41.2% to $11.4 million from $8.0 million; and

|

|

|

·

|

Net income per diluted share increased 20.9% to $0.41 from $0.34, on a 16.8% increase in weighted average diluted shares resulting primarily from our public follow-on offering of 3.5 million shares of common stock in May 2015.

|

In the quarter ended September 30, 2015, average revenue per loaded mile increased 14.6% from the quarter ended September 30, 2014. Average revenue per tractor per week decreased 3.0%, which was primarily attributable to the decrease in average miles per seated tractor per week from the quarter ended September 30, 2014, which resulted primarily from a lackluster freight environment, coupled with significant growth in seated tractor count. We continue to increase our customer freight to better align with our increased fleet size.

Our average seated line haul tractors increased to 4,985 tractors in the quarter ended September 30, 2015, compared to 3,255 tractors for the same period a year ago. The net change of 1,730 units is comprised of a 594-unit increase in company tractors and a 1,136-unit increase in independent contractor tractors. The number of tractors operated by independent contractors represented 34.7% of our total fleet as of September 30, 2015.

At September 30, 2015, our total balance sheet debt was $614.8 million and our total stockholders' equity was $368.0 million, for a total debt to capitalization ratio of 62.6%. At September 30, 2015 we had $135.8 million of available borrowing capacity under our revolving credit facility.

Revenue and Expenses

We primarily generate revenue by transporting freight for our customers, by arranging for transportation of their freight, and through equipment sales, leasing, and related ancillary services through our Quality division. Generally, we are paid by the mile or by the load for our freight transportation services. We also derive revenue from fuel surcharges, loading and unloading activities, equipment detention, other trucking related services, and warehousing services. The main factors that affect our revenue are the revenue per mile we receive from our customers, the percentage of miles for which we are compensated, the number of tractors operating, the number of miles we generate with our equipment, and the price of used equipment we sell through our Quality division, which we book on a net basis. These factors relate to, among other things, economic activity and conditions in the United States, Canada, and Mexico, shipper inventory levels, the level of truck capacity in our markets, specific customer demand, the percentage of team-driven tractors in our fleet, driver and independent contractor availability, our average length of haul, and conditions in the used tractor and trailer markets.

We remove fuel surcharges from revenue to obtain what we refer to as "freight revenue" when calculating operating ratios and some of our operating data. We believe that evaluating our operations without considering the impact of fuel surcharges, which are sometimes a volatile source of revenue, affords a more consistent basis for comparing our results of operations from period to period. Freight revenue is a financial measure that is not in accordance with GAAP. This measure is a supplemental non-GAAP financial measure that is used by management and external users of our financial statements, such as industry analysts, investors, and lenders. While we believe such measure is useful for investors, it should not be used as a replacement for financial measures that are in accordance with GAAP.

The main expenses impacting our profitability are attributable to the variable costs of transporting freight for our customers. These costs include fuel expense, driver-related expenses, such as wages, benefits, training, and recruitment, and independent contractor costs, which we record as purchased transportation. Expenses that have both fixed and variable components include maintenance and tire expense and our total cost of insurance and claims. These expenses generally vary with the miles we travel, but also have a controllable component based on safety, fleet age, efficiency, and other factors. Our main fixed cost is the acquisition and financing of long-term assets, primarily revenue equipment. We have other mostly fixed costs, such as our non-driver personnel and facilities expenses. In discussing our expenses as a percentage of revenue, we sometimes discuss changes as a percentage of revenue before fuel surcharges, in addition to absolute dollar changes, because we believe that evaluation of our operating performance can be done more accurately by excluding the highly variable impact of fuel surcharges on our revenue.

The trucking industry has experienced significant increases in expenses over the past several years, in particular those relating to equipment costs, driver compensation, insurance, and, until relatively recently, fuel. As the economy continues to grow and capacity in the trucking industry begins to tighten, we believe that rates will continue to increase. Over the long-term, we expect the limited pool of qualified drivers and intense competition to recruit and retain those drivers will constrain overall industry capacity, although we expect our recent efforts related to our driving school and average fleet age will improve our driver recruiting and retention. Assuming continued economic growth occurs in U.S. manufacturing, retail, and other high volume shipping industries, we expect to be able to raise freight rates in line with or faster than expenses.

Results of Operations

The following table sets forth the percentage relationship of expense items to freight revenue for the periods indicated:

|

For the three months ended

|

||||||||

|

September 30,

|

||||||||

|

2015

|

2014

|

|||||||

|

Operating Revenue

|

100.0 | % | 100.0 | % | ||||

|

Operating expenses:

|

||||||||

|

Salaries, wages, and employee benefits

|

30.6 | % | 29.6 | % | ||||

|

Fuel

|

10.4 | % | 20.7 | % | ||||

|

Purchased transportation

|

33.5 | % | 22.6 | % | ||||

|

Revenue equipment rentals

|

0.8 | % | 1.3 | % | ||||

|

Operations and maintenance

|

6.6 | % | 5.8 | % | ||||

|

Insurance and claims

|

2.6 | % | 2.9 | % | ||||

|

Depreciation and amortization

|

8.1 | % | 8.0 | % | ||||

|

Communications and utilities

|

0.9 | % | 1.0 | % | ||||

|

Operating taxes and licenses

|

1.9 | % | 1.7 | % | ||||

|

General and other operating

|

1.6 | % | 1.8 | % | ||||

|

Gain on disposition of equipment

|

(5.0 | )% | (2.4 | )% | ||||

|

Total operating expenses

|

92.0 | % | 93.0 | % | ||||

|

Operating income

|

8.0 | % | 7.0 | % | ||||

|

Other expense:

|

||||||||

|

Interest expense

|

1.2 | % | 0.6 | % | ||||

|

Other income, net

|

0.0 | % | 0.0 | % | ||||

|

Income before income taxes

|

6.8 | % | 6.4 | % | ||||

|

Provision for income taxes

|

2.5 | % | 2.2 | % | ||||

|

Net income

|

4.3 | % | 4.2 | % | ||||

|

Freight revenue(1)

|

100.0 | % | 100.0 | % | ||||

|

Operating expenses:

|

||||||||

|

Salaries, wages, and employee benefits

|

34.3 | % | 36.3 | % | ||||

|

Fuel(1)

|

(0.3 | )% | 2.7 | % | ||||

|

Purchased transportation

|

37.4 | % | 27.7 | % | ||||

|

Revenue equipment rentals

|

0.9 | % | 1.6 | % | ||||

|

Operations and maintenance

|

7.4 | % | 7.1 | % | ||||

|

Insurance and claims

|

2.9 | % | 3.6 | % | ||||

|

Depreciation and amortization

|

9.1 | % | 9.9 | % | ||||

|

Communications and utilities

|

1.0 | % | 1.2 | % | ||||

|

Operating taxes and licenses

|

2.1 | % | 2.1 | % | ||||

|

General and other operating

|

1.8 | % | 2.2 | % | ||||

|

Gain on disposition of equipment

|

(5.6 | )% | (2.9 | )% | ||||

|

Total operating expenses

|

91.0 | % | 91.5 | % | ||||

|

Operating income

|

9.0 | % | 8.5 | % | ||||

|

Other expense:

|

||||||||

|

Interest expense

|

1.3 | % | 0.7 | % | ||||

|

Other income, net

|

0.0 | % | 0.0 | % | ||||

|

Income before income taxes

|

7.6 | % | 7.8 | % | ||||

|

Provision for income taxes

|

2.8 | % | 2.7 | % | ||||

|

Net income

|

4.8 | % | 5.1 | % |

|

(1)

|

Freight revenue is total revenue less fuel surcharges. In this table, fuel surcharges are eliminated from revenue and subtracted from fuel expense. Fuel surcharges were $28.3 million and $35.7 million for the first quarter of fiscal 2016 and 2015, respectively. Freight revenue is not a recognized measure under GAAP and should not be considered an alternative to or superior to other measures derived in accordance with GAAP. We believe our presentation of freight revenue and our discussion of various expenses as a percentage of freight revenue is a useful way to evaluate our core operating performance.

|

Comparison of Three Months Ended September 30, 2015 to Three Months Ended September 30, 2014

Total revenue increased by $72.7 million, or 37.6%, to $266.1 million for the first quarter of fiscal 2016, from $193.4 million for the first quarter of fiscal 2015. Freight revenue increased by $80.1 million, or 50.8%, to $237.8 million for the first quarter of fiscal 2016, from $157.7 million for the first quarter of fiscal 2015. These increases were attributable to an increase in loaded miles to 100.0 million for the first quarter of fiscal 2016 from 77.1 million in the first quarter of fiscal 2015, in addition to an increase in average revenue per loaded mile to $1.872 for the first quarter of fiscal 2016 from $1.633 for the first quarter of fiscal 2015. The increase in loaded miles was also the result of an increase in average seated line-haul tractors to 4,985 in the first quarter of fiscal 2016, from 3,255 in the first quarter of 2015, due to improved driver recruiting efforts, including our driving school, and the increase in drivers resulting from the integration of acquired fleets. Slightly offsetting these increases was a decrease in miles per seated truck of 13.3% versus the first quarter of fiscal 2015, which resulted primarily from acquired fleets having a shorter existing average length-of-hauls.

Revenue for our asset-light segment increased to $30.6 million in the first quarter of fiscal 2016 from $16.5 million in the first quarter of fiscal 2015, primarily based on increases in our warehousing and LTL revenues. Revenue from our asset-light businesses was aided in part by acquisitions of asset-light businesses and growing demand for brokerage and other specialized services we offer. Through our acquisitions, the services we are able to offer customers through our asset-light business have expanded, and we expect revenue derived from our asset-light operations to increase moderately throughout the remainder of fiscal 2016.

Revenue from our equipment leasing and services segment increased $4.8 million in the first quarter of fiscal 2016 compared to the first quarter of fiscal 2015, primarily based on the growth of service offerings provided by the segment. Our equipment leasing and services segment consists of tractor and trailer sales and leasing. This segment also includes revenues from insurance, maintenance, and other ancillary services that we provide for independent contractors. We anticipate revenue related to these service offerings to see some growth in the future as we continue to expand.

Fuel surcharge revenue decreased to $28.3 million in the first quarter of fiscal 2016 from $35.7 million for the first quarter of fiscal 2015, which was attributable to a decrease in the price of diesel fuel and related decrease in our fuel surcharge rates.

Salaries, wages, and employee benefits were $81.5 million, or 30.6% of total revenue and 34.3% of freight revenue, for the first quarter of fiscal 2016, compared to $57.2 million, or 29.6% of total revenue and 36.3% of freight revenue, for the first quarter of fiscal 2015. These changes are the result of an increase in driver payroll, administrative payroll, and increased recruiting expense attributable to our driving school and other recruitment efforts. Driver payroll increased due to an increase in the number of Company drivers and higher recruiting costs resulting from a competitive driver market. Administrative payroll has increased in connection with the integration of acquired operations. We have continued investing in expanding our driving school, which has produced a significant number of drivers for our fleet. We expect the market for drivers to remain competitive and place ongoing pressure on these expenses.

Fuel expenses, without reduction for fuel surcharge revenue, decreased to $27.7 million, or 10.4% of total revenue, for the first quarter of fiscal 2016, compared to $40.0 million, or 20.7% of total revenue, for the first quarter of fiscal 2015. Fuel surcharge revenue, net of fuel expense, was $0.6 million, or 0.3% of revenue, for the first quarter of fiscal 2016, compared to fuel expense, net of fuel surcharge revenue (or "net fuel expense"), of $4.3 million, or 2.7% of revenue, for the first quarter of fiscal 2015. The decreases in fuel expense and net fuel expense were attributable to a decrease in the average weekly on-highway diesel prices of $1.219 per gallon, from $3.835 to $2.616 in the 2015 and 2016 quarters, respectively, partially offset by an increase in total miles in the fiscal 2016 quarter compared to the 2015 quarter. We expect that our continued efforts to reduce idling and operate more fuel-efficient tractors and aerodynamic trailers will continue to have a positive impact on our miles per gallon. However, we expect this positive impact to be partially offset by increasing fuel costs per gallon and the use of more costly ultra-low sulfur diesel fuel.

Purchased transportation increased to $89.0 million, or 33.5% of total revenues and 37.4% of freight revenue, for the first quarter of fiscal 2016, from $43.6 million, or 22.6% of total revenue and 27.7% of freight revenue, for the first quarter of fiscal 2015. These increases are primarily related to increases in intermodal transportation expense and LTL/brokerage expenses. We believe our increased focus on these areas of our business has led to increased revenue as well as the costs associated with generating that revenue. We expect purchased transportation to increase as we continue our efforts to increase our LTL/brokerage and intermodal transportation businesses. We have seen an increase in the average number of independent contractors when compared to the first quarter of fiscal 2015, and we will continue to actively recruit them. If successful in the recruitment efforts, we would expect purchased transportation to increase accordingly.

Operations and maintenance increased to $17.6 million, or 6.6% of total revenue and 7.4% of freight revenue, for the first quarter of fiscal 2016, from $11.2 million, or 5.8% of total revenue and 7.1% of freight revenue, for the first quarter of fiscal 2015. Operations and maintenance consist of direct operating expense, maintenance, and tire expense. These increases in the first quarter of fiscal 2016 are primarily related to the increase in tractor and trailer counts that were acquired through recent acquisitions. We believe that maintenance costs will decrease as we replace a portion of the older equipment obtained through acquisitions with newer units, for which maintenance costs are lower on a per-unit basis. Additionally, newer equipment repairs are more likely to be covered by warranty, creating further reductions to our maintenance expense.

Insurance and claims expense increased to $6.9 million, or 2.6% of total revenue and 2.9% of freight revenue, for the first quarter of fiscal 2016, from $5.7 million, or 2.9% of total revenue and 3.6% of freight revenue, for the first quarter of fiscal 2015. Insurance consists of premiums for liability, physical damage, cargo damage, and workers' compensation insurance, in addition to claims expense. The increased cost is attributable to an increase in liability claims and workers' compensation claims due to an increase in the number of claims reported, including loss development. Our insurance program involves self-insurance at various risk retention levels. Claims in excess of these risk levels are covered by insurance in amounts we consider to be adequate. We accrue for the uninsured portion of claims based on known claims and historical experience. We periodically review and adjust our insurance program to maintain a balance between premium expense and the risk retention we are willing to assume. We expect our insurance and claims expense to be consistent with historical average amounts going forward. However, this category will vary based upon the frequency and severity of claims, the level of self-insurance, and premium expense.

Depreciation and amortization, consisting primarily of depreciation of revenue equipment, increased to $21.6 million, or 8.1% of total revenue and 9.1% of freight revenue, for the first quarter of fiscal 2016, compared to $15.6 million, or 8.0% of total revenue and 9.9% of freight revenue, for the first quarter of fiscal 2015. The increased cost is primarily related to the increased number of tractors and trailers owned during the fiscal 2016 quarter compared to the same quarter in fiscal 2015. Revenue equipment held under operating leases is not reflected on our condensed consolidated balance sheet and the expenses related to such equipment are reflected on our consolidated statements of operations in revenue equipment rentals, rather than in depreciation and amortization and interest expense, as is the case for revenue equipment that is financed with borrowings or capital leases. As we refresh older units in our fleet, we expect depreciation to increase in connection with increased equipment costs.

Gains on the disposition of equipment increased from $4.6 million in the first quarter of fiscal 2015, to $13.2 million in the first quarter of fiscal 2016. The increase is due primarily to the equipment that we sold to Element. We expect gain on sale to decrease over the next few months related to the holiday season and then continue to grow subsequently, although gain on sale can vary significantly due to a variety of factors, including our ability to grow Quality, availability of replacement equipment and conditions in the new and used equipment markets.

All of our other operating expenses are relatively minor in amount, and there were no significant changes in such expenses. Accordingly, we have not provided a detailed discussion of such expenses.

Our pre-tax margin, which we believe is a useful measure of our operating performance because it is neutral with regard to the method of revenue equipment financing that a company uses, increased to 6.8% of operating revenue and decreased to 7.6% of freight revenue for first quarter of fiscal 2016, from 6.4% of operating revenue and 7.8% of freight revenue for the first quarter of fiscal 2015.

Income taxes increased to $6.6 million, with an effective tax rate of 36.6%, for the first quarter of fiscal 2016, from $4.3 million, with an effective tax rate of 35.0%, for the first quarter of fiscal 2015. Going forward, we expect our effective tax rate will be approximately 35% to 38%. As pre-tax net income increases, our non-deductible expenses, such as per diem expense, have a lesser impact on our effective rate. Furthermore, the effective rate in foreign countries is lower than that in the United States. Therefore, as our percentage of income attributable to foreign income changes, our total income tax effective rate will also change.

Liquidity and Capital Resources

Trucking is a capital-intensive business. We require cash to fund our operating expenses (other than depreciation and amortization), to make capital expenditures and acquisitions, and to repay lease obligations and debt, including principal and interest payments. Other than ordinary operating expenses, we anticipate that capital expenditures for the acquisition of revenue equipment will constitute our primary cash requirement over the next twelve months. We have recently completed several acquisitions, and we frequently consider additional potential acquisitions. If we were to engage in additional acquisitions, our cash requirements would increase and we may have to modify our expected financing sources for the purchase of equipment. Subject to any required lender approval, we may make acquisitions in the future. Our principal sources of liquidity are cash generated from operations, bank borrowings, capital and operating lease financing of revenue equipment, and proceeds from the sale of used revenue equipment. At September 30, 2015, our total balance sheet debt, including capital lease obligations and current maturities, was $614.8 million, compared to $564.5 million at June 30, 2015.

As of September 30, 2015, we had purchase commitments for revenue equipment of $23.3 million for delivery through fiscal 2016. These commitment amounts were calculated before considering the proceeds from the disposition of equipment that is being replaced. In fiscal 2016, we expect to purchase our new tractors and trailers with primarily a combination of cash generated from operations and capital leases. However, given that we recently completed our equipment refresh cycle, we expect capital expenditures on tractors in trailers in fiscal 2016 to be less than fiscal 2015.

At September 30, 2015, we were authorized to borrow up to $300.0 million under our primary credit facility, which expires May 2018. The applicable interest rate under this agreement is based on either a base rate equal to Bank of America, N.A.'s prime rate or LIBOR plus an applicable margin between 0.825% and 1.45% that is adjusted quarterly based on our lease adjusted total debt to EBITDAR ratio. At September 30, 2015, we had $162.0 million in outstanding borrowings related to our credit facility and $2.2 million utilized for letters of credit, leaving availability of $135.8 million. The agreement is collateralized by substantially all of the assets of our U.S. and Canadian subsidiaries, with the notable exception of revenue equipment subject to third party financing or capital leases. We are obligated to comply with certain financial covenants under our credit facility and we were in compliance with these covenants at September 30, 2015.

We believe we will be able to fund our operating expenses, as well as our current commitments for the acquisition of revenue equipment over the next twelve months, with a combination of cash generated from operations, borrowings available under our primary credit facility, and lease financing arrangements. We believe that the current availability under our credit facility will allow us flexibility to evaluate other potential acquisition targets. We will continue to have significant capital requirements over the long term, and the availability of the needed capital will depend upon our financial condition, operating results, and numerous other factors over which we have limited or no control, including prevailing market conditions and the market price of our common stock. However, based on our operating results, anticipated future cash flows, current availability under our credit facility, expected capital expenditures, and sources of equipment lease financing that we expect will be available to us, we do not expect to experience significant liquidity constraints in the foreseeable future.

Cash Flows

Net cash used in operations for the three months ended September 30, 2015 was $22.8 million, compared to net cash provided by operations of $9.0 million for the three months ended September 30, 2014. Cash provided by operations decreased primarily due to a decrease in change in equipment held for resale. This fluctuation was partially offset by an increase in our accounts payable and accrued expenses balance.

Net cash provided by investing activities was $33.4 million for the three months ended September 30, 2015, compared to net cash used in investing activities of $17.1 million for the three months ended September 30, 2014. Cash provided by/used in investing activities includes the net cash effect of acquisitions and dispositions of property and revenue equipment during each period. Capital expenditures for property and equipment totaled $67.4 million for the three months ended September 30, 2015, and $78.8 million for the three months ended September 30, 2014. We generated proceeds from the sale of property and equipment of $115.5 million and $71.3 million for the three months ended September 30, 2015, and September 30, 2014, respectively.

Net cash used in financing activities was $11.0 million for the three months ended September 30, 2015, compared to net cash provided by financing activities of $2.7 million for the three months ended September 30, 2014. The decrease in cash provided by financing activities was due primarily to an increase in principal payment of capital leases offset by an increase in net borrowings on our credit facility.

Cash dividends paid for the three months ended September 30, 2015, were approximately $0.5 million, or $0.02 per share. We currently expect to continue to pay quarterly cash dividends in the future. Future payment of cash dividends, and the amount of any such dividends, will depend upon our financial condition, results of operations, cash requirements, tax treatment, and certain corporate law requirements, as well as other factors deemed relevant by our Board of Directors.

Contractual Obligations

During the three months ended September 30, 2015, there were no material changes in our commitments or contractual liabilities.

Off-Balance Sheet Arrangements

Operating leases have been an important source of financing for our revenue equipment. Our operating leases include some under which we do not guarantee the value of the asset at the end of the lease term ("walk-away leases") and some under which we do guarantee the value of the asset at the end of the lease term ("residual value guarantees"). Therefore, we are subject to the risk that equipment values may decline, in which case we would suffer a loss upon disposition and be required to make cash payments because of the residual value guarantees. At September 30, 2015, we were obligated for residual value guarantees related to operating leases of $6.0 million, compared to $19.0 million at September 30, 2014. We believe that any residual payment obligations will be satisfied by the value of the related equipment at the end of the lease. To the extent the expected value at the lease termination date is lower than the residual value guarantee, we would accrue for the difference over the remaining lease term. We anticipate that going forward we will primarily use a combination of cash generated from operations and capital leases to finance tractor and trailer purchases.

Critical Accounting Policies

The preparation of financial statements in accordance with GAAP requires that management make a number of assumptions and estimates that affect the reported amounts of assets, liabilities, revenue, and expenses in our consolidated financial statements and accompanying notes. Management bases its estimates on historical experience and various other assumptions believed to be reasonable. These estimates are based on management's best knowledge of current events and actions that affect, or could affect, our financial statements materially and involve a significant level of judgment by management. The accounting policies we deem most critical to use include revenue recognition, allowance for doubtful accounts, depreciation, claims accrual, and accounting for income taxes. There have been no significant changes to our critical accounting policies and estimates during the three months ended September 30, 2015, compared to those disclosed in Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operation," included in our 2015 Annual Report on Form 10-K.

Seasonality