Form 8-K PDL BIOPHARMA, INC. For: Nov 04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): November 4, 2015

PDL BioPharma, Inc.

(Exact name of Company as specified in its charter)

000-19756

(Commission File Number)

Delaware | 94-3023969 | |

(State or Other Jurisdiction of Incorporation) | (I.R.S. Employer Identification No.) | |

932 Southwood Boulevard

Incline Village, Nevada 89451

(Address of principal executive offices, with zip code)

(775) 832-8500

(Company’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Company under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition.

On November 4, 2015, PDL BioPharma, Inc. (the Company) issued a press release announcing its financial results for the third quarter ended September 30, 2015. A copy of this earnings release is furnished hereto as Exhibit 99.1. The Company will host an earnings call and webcast on November 4, 2015, during which the Company will discuss its financial results for the third quarter ended September 30, 2015.

Item 7.01 Regulation FD Disclosure.

Presentation Materials

On November 4, 2015, the Company posted to its website a set of presentation materials that it will use during its earnings call and webcast to assist participants with understanding the Company’s financial results. A copy of this presentation is attached hereto as Exhibit 99.2.

Information Sheet

On November 4, 2015, the Company distributed to analysts covering the Company’s securities a summary of certain information regarding the Company’s net income, dividends, recent transactions and licensed product development and sales (the Information Sheet) to assist those analysts in valuing the Company’s securities. The Information Sheet and its associated tables are attached hereto as Exhibit 99.3.

Limitation of Incorporation by Reference

In accordance with General Instruction B.2. of Form 8-K, the information in this report, including the exhibits, is furnished pursuant to Items 2.02 and 7.01 and shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section and shall not be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended or the Exchange Act.

Cautionary Statements

This filing and its exhibits include “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we can give no assurance that such expectations will prove to be correct. Important factors that could impair the Company’s royalty assets or business are disclosed in the “Risk Factors” contained in the Company’s Annual Report on Form 10-K, as updated by subsequent quarterly reports, filed with the Securities and Exchange Commission. All forward-looking statements are expressly qualified in their entirety by such factors. We do not undertake any duty to update any forward-looking statement except as required by law.

Item 9.01 Financial Statements and Exhibits.

The following exhibits are furnished with this report:

Exhibit No. | Description | |

99.1 | Press Release | |

99.2 | Presentation | |

99.3 | Information Sheet | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

PDL BIOPHARMA, INC. | ||

(Company) | ||

By: | /s/ Peter S. Garcia | |

Peter S. Garcia | ||

Vice President and Chief Financial Officer | ||

Dated: November 4, 2015

Exhibit Index

Exhibit No. | Description | |

99.1 | Press Release | |

99.2 | Presentation | |

99.3 | Information Sheet | |

Exhibit 99.1

Contacts: | ||

Peter Garcia | Jennifer Williams | |

PDL BioPharma, Inc. | Cook Williams Communications, Inc. | |

775-832-8500 | 360-668-3701 | |

PDL BioPharma Announces Third Quarter 2015 Financial Results

INCLINE VILLAGE, NV, November 4, 2015 – PDL BioPharma, Inc. (PDL) (NASDAQ: PDLI) today reported financial results for the third quarter and nine months ended September 30, 2015.

Total revenues were $124.6 million for the three months ended September 30, 2015, compared to $164.6 million for the same period of 2014, and $412.4 million for the nine months ended September 30, 2015, compared to $464.2 million for the same period of 2014. During the three and nine months ended September 30, 2015 and 2014, our Queen et al. royalty revenues consisted of royalties and maintenance fees earned on sales of products under license agreements associated with our Queen et al. patents. During the three and nine months ended September 30, 2015 and 2014, royalty rights - change in fair value consisted of revenues associated with the change in estimated fair value of our royalty right assets, primarily Depomed, Inc., The Regents of the University of Michigan, Viscogliosi Brothers, LLC, ARIAD Pharmaceuticals Inc., AcelRx Pharmaceuticals, Inc. and Avinger, Inc. Revenues for the quarter ended September 30, 2015 included $119.2 million in royalty and license payments from PDL's licensees to the Queen et al. patents, negative $4.3 million in the change in estimated fair value of the royalty rights assets, which included approximately a positive $6.9 million in net cash royalty rights payments, $9.1 million in interest revenue from notes receivable debt financings to late-stage healthcare companies, and $0.6 million in realized gains from the sale of AxoGen, Inc. common stock. Revenues for the nine months ended September 30, 2015 included $363.9 million in royalty and license payments from PDL's licensees to the Queen et al. patents, $19.3 million in net royalty payments from acquired royalty rights and a change in estimated fair value of the royalty rights assets, which included approximately $9.0 million in net cash royalty rights payments, $28.6 million in interest revenue from notes receivable debt financings to late-state healthcare companies, and $0.6 million in realized gains from the sale of AxoGen, Inc. common stock.

Total revenues decreased by 24% and 11%, respectively, for the three and nine months ended September 30, 2015, when compared to the same periods in 2014. The decrease is primarily driven by the decrease in the Depomed royalty rights cash proceeds related to Valeant Pharmaceuticals International, Inc. sales of Glumetza, decreased interest revenues due to the early payoff of the AxoGen and Durata notes receivables, and decreased Actemra royalties as a result of the conclusion of the Actemra license agreement. The decrease in the Depomed royalty rights proceeds in the quarter ending September 30, 2015 is a result of no royalty payments being made by Valeant during the quarter. While Valeant reported revenue for Glumetza of $53 million for the period ending September 30, 2015, it had not provided monthly reporting or payments per its contractual obligations during this period. In late October 2015, Valeant issued reports and cash payments for the third quarter of 2015 with net royalties of $16.9 million due to PDL, which are included in PDL's fair value assessment at the end of the third quarter. PDL expects to exercise its royalty audit right for Glumetza in the near future.

Operating expenses in the third quarter of 2015 were $8.5 million, compared with $5.7 million in the third quarter of 2014. The increase in operating expenses for the three months ended September 30, 2015, as compared to the same period in 2014, was a result of an increase in general and administrative expenses of $1.1 million for professional service expenses mostly related to the asset management of Wellstat Diagnostics, $1.0 million for compensation including stock-based compensation and $0.6 million for legal services.

Operating expenses for the nine months ended September 30, 2015 were $23.5 million, compared with $17.2 million in the first nine months of 2014. The increase in operating expenses for the nine months ended September 30, 2015, as compared to the same period in 2014, was a result of an increase in general and administrative expenses of $3.9 million for professional service

expenses mostly related to the asset management of Wellstat Diagnostics, $1.9 million for compensation including stock-based compensation and $0.3 million for legal services.

Net income in the third quarter of 2015 was $69.5 million, or $0.42 per diluted share as compared with net income in the third quarter of 2014 of $102.2 million, or $0.61 per diluted share. Net income in the nine months ended September 30, 2015 was $232.2 million, or $1.42 per diluted share as compared with net income in the first nine months of 2014 of $267.2 million, or $1.62 per diluted share. The decrease in net income for the nine months ended September 30, 2015, compared to the same period in 2014, is primarily driven by the decrease in the Depomed royalty rights cash proceeds.

Net cash provided by operating activities in the first nine months of 2015 was $231.4 million, compared with $223.2 million in the same period in 2014. At September 30, 2015, PDL had cash, cash equivalents and short-term investments of $229.7 million, compared with $293.7 million at December 31, 2014. The change and slight decrease in the cash balance at September 30, 2015 was primarily attributable to retirement of the Series 2012 Notes and May 2015 Notes for $177.4 million, the purchase of royalty right assets for $115.0 million, payment of dividends of $73.6 million, repayment of a portion of the March 2015 Term Loan for $50.0 million, additional notes receivable purchases of $9.0 million, and the payment of $0.6 million for debt issuance costs related to the March 2015 Term Loan, offset in part by net cash provided by the proceeds from the March 2015 Term Loan of $100.0 million, repayment of notes receivables of $20.6 million, proceeds from royalty rights of $9.0 million, and cash generated by operating activities of $231.4 million.

Recent Developments

ARIAD Royalty Agreement

On July 28, 2015, PDL entered into the ARIAD Royalty Agreement, whereby the Company acquired the rights to receive royalties payable from ARIAD's net revenues generated by the sale, distribution or other use of Iclusig® (ponatinib), a cancer medicine for the treatment of adult patients with chronic myeloid leukemia, in exchange for up to $200.0 million in cash payments. The purchase price of $100.0 million is payable in two tranches of $50.0 million each, with the first tranche funded on the closing date and the second tranche to be funded on the 12-month anniversary of the closing date. The ARIAD Royalty Agreement provides ARIAD with an option to draw up to an additional $100.0 million in up to two draws at any time between the six- and 12-month anniversaries of the closing date. ARIAD may repurchase the royalty rights at any time for a specified amount. Upon the occurrence of certain events, PDL has the right to require ARIAD to repurchase the royalty rights for a specified amount. Under the ARIAD Royalty Agreement, the Company has the right to a make-whole payment from ARIAD if the Company does not receive payments equal to or greater than the amounts funded on or prior to the fifth anniversary of each of the respective fundings. In such case, ARIAD will pay to the Company the difference between the amounts paid to such date by ARIAD and the amounts funded by the Company.

Under the terms of the ARIAD Royalty Agreement, the Company will receive royalty payments at a royalty rate ranging from 2.5% to 7.5% of Iclusig revenue until the first to occur of (i) repurchase of the royalty rights by ARIAD or (ii) December 31, 2033. If Iclusig revenue does not meet certain agreed-upon projections on an annual basis, PDL is entitled to royalty payments based on certain percentage of revenues of another ARIAD product, brigatinib, up to the amount of the shortfall from the projections for the applicable year.

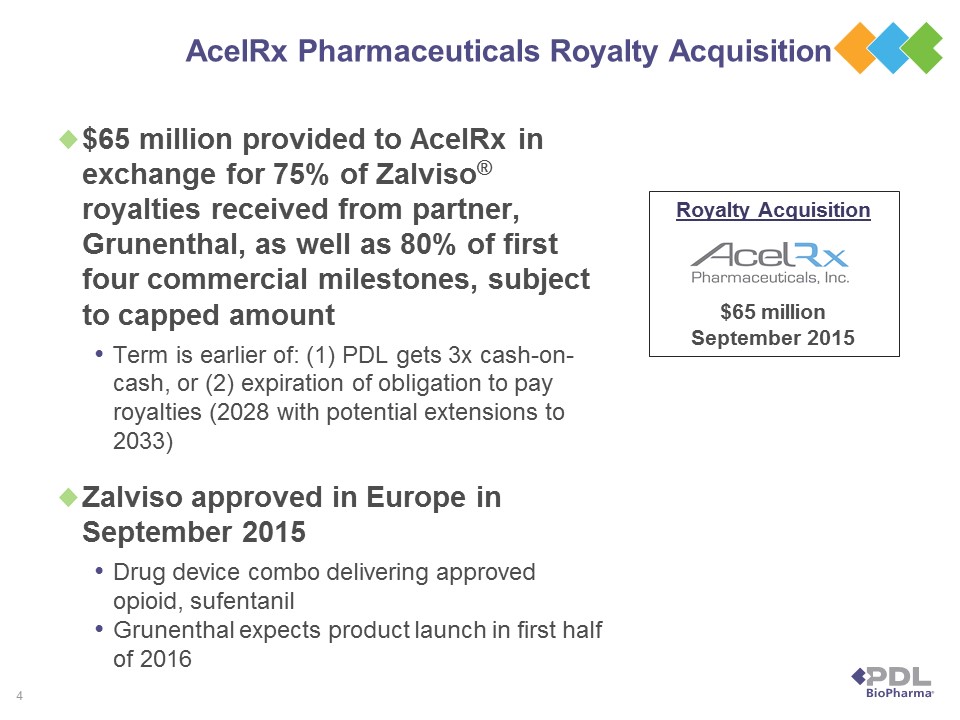

AcelRx Royalty Agreement

On September 18, 2015, PDL entered into the AcelRx Royalty Agreement, whereby the Company acquired the rights to receive a portion of the royalties and certain milestone payments on sales of Zalviso™ (sufentanil sublingual tablet system) in the European Union, Switzerland and Australia by AcelRx's commercial partner, Grünenthal, in exchange for a $65.0 million cash payment. Under the terms of the AcelRx Royalty Agreement, the Company will receive 75% of all royalty payments and 80% of the first four commercial milestone payments due under AcelRx's license agreement with Grünenthal until the earlier to occur of (i) receipt by the Company of payments equal to three times the cash payments made to AcelRx and (ii) the expiration of the licensed patents. PDL expects to begin recognizing royalties shortly after the commercial launch by Grünenthal in the first half of 2016.

Paradigm Spine Credit Agreement

On October 27, 2015, PDL and Paradigm Spine entered into an amendment to the Paradigm Spine Credit Agreement to provide additional term loan commitments for up to $7.0 million payable in two tranches, of which the first tranche of $4.0 million was drawn on the closing date of the amendment, net of fees, and the second tranche of $3.0 million is to be funded at the option of Paradigm Spine prior to June 30, 2016.

Kaléo Note Purchase Agreement

On October 28, 2015, Sanofi US initiated a voluntary nationwide recall of all Auvi-Q® units effectively immediately. Sanofi is the exclusive licensee of kaléo. for the manufacturing and commercialization of Auvi-Q. While Sanofi has not identified the reason for the recall, press reports indicate that a small number of units have failed to activate or delivered inadequate doses of epinephrine. It is not known at this time when Sanofi will reintroduce Auvi-Q in the U.S.

As background, on April 1, 2014, PDL entered into a note purchase agreement (the Note Purchase Agreement) with Accel 300, LLC, a wholly-owned subsidiary of kaléo, pursuant to which the Company acquired $150 million of secured notes due 2029 (the Notes). The Notes are secured by 100 percent of royalties from kaléo’s first approved product, Auvi-Q (epinephrine auto-injection, USP) (known as Allerject in Canada) and 10 percent of the net sales of kaléo’s second product, EVZIO, which is manufactured and commercialized by kaléo (the Revenue Interests). The Notes carry interest at 13 percent per annum, paid quarterly in arrears on principal outstanding. The principal balance of the Notes is repaid to the extent that the Revenue Interests exceed the quarterly interest payment, as limited by a quarterly payment cap. The final maturity of the Notes is March 2029. As part of the transaction, kaléo was required to establish an interest reserve account of $20 million from the $150 million provided by PDL. The purpose of this interest reserve account is to cover any possible shortfalls in interest payments owed to PDL. As of this date, despite the recall of Auvi-Q, it is projected that the interest reserve account alone is sufficient to cover possible interest shortfalls until at least through the first quarter of 2016. PDL will monitor the recall situation and how it may impact the ability of kaléo to meet its obligations under the Notes, but at this point it has been determined that there is no impairment.

2015 Dividends

On January 27, 2015, our board of directors declared that the regular quarterly dividends to be paid to our stockholders in 2015 will be $0.15 per share of common stock, payable on March 12, June 12, September 11 and December 11 of 2015 to stockholders of record on March 5, June 5, September 4 and December 4 of 2015, the record dates for each of the dividend payments, respectively. On September 11, 2015, we paid the regular quarterly dividend to our stockholders totaling $24.5 million using earnings generated in the three months ended September 30, 2015.

Conference Call Details

PDL will hold a conference call to discuss financial results at 4:30 p.m. Eastern Time today, November 4, 2015.

To access the live conference call via phone, please dial (800) 668-4132 from the United States and Canada or (224) 357-2196 internationally. The conference ID is 66826786. Please dial in approximately 10 minutes prior to the start of the call. A telephone replay will be available beginning approximately one hour after the call through November 10, 2015, and may be accessed by dialing (855) 859-2056 from the United States and Canada or (404) 537-3406 internationally. The replay passcode is 66826786.

To access the live and subsequently archived webcast of the conference call, go to the Company’s website at http://www.pdl.com and go to “Events & Presentations.” Please connect to the website at least 15 minutes prior to the call to allow for any software download that may be necessary.

About PDL BioPharma, Inc.

PDL manages a portfolio of patents and royalty assets, consisting of its Queen et al. patents, license agreements with various biotechnology and pharmaceutical companies, and royalty and other assets acquired. To acquire new income generating assets, PDL provides non-dilutive growth capital and financing solutions to late-stage public and private healthcare companies and offers immediate financial monetization of royalty streams to companies, academic institutions, and inventors. PDL has committed over $1 billion and funded approximately $919 million in these investments to date. PDL evaluates its investments based on the quality of the income generating assets and potential returns on investment. PDL is currently focused on acquiring new income generating assets, the management of its intellectual property and income generating assets, and maximizing value for its stockholders.

The Company was formerly known as Protein Design Labs, Inc. and changed its name to PDL BioPharma, Inc. in 2006. PDL was founded in 1986 and is headquartered in Incline Village, Nevada. PDL pioneered the humanization of monoclonal antibodies and, by doing so, enabled the discovery of a new generation of targeted treatments for cancer and immunologic diseases for which it receives significant royalty revenue.

PDL BioPharma and the PDL BioPharma logo are considered trademarks of PDL BioPharma, Inc.

Forward-looking Statements

This press release contains "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Each of these forward-looking statements involves risks and uncertainties. Actual results may differ materially from those, express or implied, in these forward-looking statements. Important factors that could impair the value of the Company's royalty assets, restrict or impede the ability of the Company to invest in new royalty bearing assets and limit the Company's ability to pay dividends are disclosed in the risk factors contained in the Company's Annual Report on Form 10-K, as updated by subsequent quarterly reports, filed with the Securities and Exchange Commission. All forward-looking statements are expressly qualified in their entirety by such factors. We do not undertake any duty to update any forward-looking statement except as required by law.

PDL BIOPHARMA, INC.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME DATA

(Unaudited)

(In thousands, except per share amounts)

Three Months Ended | Nine Months Ended | |||||||||||||||

September 30, | September 30, | |||||||||||||||

2015 | 2014 | 2015 | 2014 | |||||||||||||

Revenues | ||||||||||||||||

Royalties from Queen et al. patents | $ | 119,222 | $ | 123,916 | $ | 363,916 | $ | 355,008 | ||||||||

Royalty rights - change in fair value | (4,280 | ) | 27,602 | 19,298 | 73,807 | |||||||||||

Interest revenue | 9,096 | 13,076 | 28,596 | 34,760 | ||||||||||||

License and other | 580 | — | 580 | 575 | ||||||||||||

Total revenues | 124,618 | 164,594 | 412,390 | 464,150 | ||||||||||||

Operating Expenses | ||||||||||||||||

General and administrative expenses | 8,450 | 5,686 | 23,545 | 17,188 | ||||||||||||

Operating income | 116,168 | 158,908 | 388,845 | 446,962 | ||||||||||||

Non-operating expense, net | ||||||||||||||||

Interest and other income, net | 87 | 75 | 294 | 207 | ||||||||||||

Interest expense | (5,901 | ) | (9,387 | ) | (21,710 | ) | (29,770 | ) | ||||||||

Loss on extinguishment of debt | — | — | — | (6,143 | ) | |||||||||||

Total non-operating expense, net | (5,814 | ) | (9,312 | ) | (21,416 | ) | (35,706 | ) | ||||||||

Income before income taxes | 110,354 | 149,596 | 367,429 | 411,256 | ||||||||||||

Income tax expense | 40,895 | 47,361 | 135,208 | 144,083 | ||||||||||||

Net income | $ | 69,459 | $ | 102,235 | $ | 232,221 | $ | 267,173 | ||||||||

Net income per share | ||||||||||||||||

Basic | $ | 0.42 | $ | 0.64 | $ | 1.42 | $ | 1.70 | ||||||||

Diluted | $ | 0.42 | $ | 0.61 | $ | 1.42 | $ | 1.62 | ||||||||

Shares used to compute income per basic share | 163,560 | 160,268 | 163,314 | 157,274 | ||||||||||||

Shares used to compute income per diluted share | 163,742 | 166,894 | 163,899 | 165,141 | ||||||||||||

Cash dividends declared per common share | $ | — | $ | — | $ | 0.60 | $ | 0.60 | ||||||||

PDL BIOPHARMA, INC.

CONDENSED CONSOLIDATED BALANCE SHEET DATA

(Unaudited)

(In thousands)

September 30, | December 31, | |||||||

2015 | 2014 | |||||||

Cash, cash equivalents and short-term investments | $ | 229,682 | $ | 293,687 | ||||

Total notes receivable | $ | 353,406 | $ | 363,212 | ||||

Total royalty rights - at fair value | $ | 384,572 | $ | 259,244 | ||||

Total assets | $ | 1,020,601 | $ | 962,350 | ||||

Total term loan payable | $ | 49,842 | $ | — | ||||

Total convertible notes payable | $ | 281,581 | $ | 451,724 | ||||

Total stockholders' equity | $ | 595,957 | $ | 460,437 | ||||

PDL BIOPHARMA, INC.

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOW DATA

(Unaudited)

(In thousands)

Nine Months Ended | ||||||||

September 30, | ||||||||

2015 | 2014 | |||||||

Net income | $ | 232,221 | $ | 267,173 | ||||

Adjustments to reconcile net income to net cash used in operating activities | 386 | (58,992 | ) | |||||

Changes in assets and liabilities | (1,221 | ) | 15,058 | |||||

Net cash provided by operating activities | $ | 231,386 | $ | 223,239 | ||||

Exhibit 99.2

Exhibit 99.3

PDL BioPharma, Inc.

Q3 2015

November 4, 2015

Following are some of the key points regarding PDL’s third quarter 2015 financial and business results.

Net Income

Net income in the third quarter of 2015 was $69.5 million, or $0.42 per diluted share as compared with net income in the third quarter of 2014 of $102.2 million, or $0.61 per diluted share.

Updates on Approved Royalty Bearing Products related to Queen et al. patents

Avastin® (bevacizumab):

• | On October 22, 2015, Genentech/Roche reported that YTD 2015 worldwide sales were CHF 4.968 billion and increased by 9%. |

◦ | EU: Growth driven by ovarian and cervical cancer. |

◦ | US: Sales driven by uptake in lung, ovarian and cervical cancer. |

◦ | Japan: Growth driven by all indications. |

◦ | International: Growth by Latin America (+29%) and China. |

Herceptin® (trastuzumab):

• | On October 22, 2015, Genentech/Roche reported that YTD 2015 worldwide sales were CHF 4.879 billion and increased by 10%. |

◦ | US: Strong volume growth in first line metastatic breast cancer due to longer treatment times. |

◦ | EU: Stable sales with continuing conversion to subcutaneous formulation. |

◦ | International: Strong growth in all regions, especially Latin America and China. |

Xolair® (omalizumab):

• | On October 22, 2015, Genentech/Roche reported that YTD 2015 US sales were CHF 932 million and increased by 25%. |

◦ | Growth in allergic asthma and chronic idiopathic urticaria (hives) due to longer treatment duration. |

• | On October 27, 2015, Novartis reported that 3Q15 ex-US sales were $184 million and increased by 4%. |

Tysabri® (natalizumab):

• | On October 21, 2015, Biogen reported that 3Q15 worldwide sales were $480 million, up from $463 million in 2Q15. |

• | Biogen also reported that it did not meet its primary endpoint in a Phase 3 trial in patients with secondary, progressive multiple sclerosis, which could have been an expansion to its label. |

Perjeta® (pertuzumab):

• | On October 22, 2015, Genentech/Roche reported that YTD 2015 worldwide sales were CHF 1.035 billion and increased by 66%. |

◦ | US: Driven by first line metastatic breast cancer and by neoadjuvant. Benefiting from increase in overall survival in first line metastatic breast cancer when combined with Herceptin and docetaxel which data were added to US label in 1Q15. |

◦ | EU: Driven by first line metastatic breast cancer and by neoadjuvant, which was approved in 3Q15. |

◦ | International: Growth in all regions. |

◦ | Japan: Continued uptake in first line metastatic breast cancer. |

Kadcyla® (TDM-1 or ado-trastuzumab emtansine):

• | On October 22, 2015, Genentech/Roche reported that YTD 2015 worldwide sales were CHF 558 million and increased by 57%. |

◦ | US: Slight increase in patient share in second line metastatic breast cancer. |

◦ | EU: Strong uptake in recently launched countries, such as Italy and France. |

◦ | International: Growth driven by Brazil. |

Page 1

PDL BioPharma, Inc.

Q3 2015

November 4, 2015

◦ | Japan: Reimbursement granted in 1H15. |

• | On October 23, 2015, Genentech/Roche reported that Kadcyla failed to show a benefit in second line HER2+ gastric cancer when compared to taxane. |

Updates on Unapproved Royalty Bearing Products Related to Queen et al. patents

Solanezumab

• | On October 22, 2015, Lilly re-affirmed in its 3Q earnings call that data from its Phase 3 trial in patients with mild Alzheimer’s Disease are expected in late 2016, that the Data Safety and Monitoring Board will not take an interim look at efficacy prior to that time, and that it would file for approval in 1H2017 if data were positive. |

Updates on Income Generating Assets

Wellstat Diagnostics, LLC

• | Summary: Private company dedicated to development, manufacture and sale of third generation small point of care diagnostic systems that can perform a wide variety of tests utilizing electrochemical luminescence technology. |

• | Deal: $44 million senior secured transaction whereby Wellstat is required to repay outstanding principal and a specific target internal rate of return at maturity or upon the occurrence of certain key events. Target IRR is 26% if before end of 2016 and 30% if repayment is after 2016. PDL receives 12% royalty on sales of product. Term is up to 2021. |

• | Status: The investment bank of Duff & Phelps is running a sale process. A drug developed by Wellstat Therapeutics for a very rare condition was recently approved which has triggered a payment by Astra Zeneca for the FDA expedited review voucher associated with such approval. PDL has commenced legal proceedings in New York to attach this payment and other Wellstat and Wohlstadter non-Diagnostics’ assets. |

Avinger, Inc.

• | Summary: Public company developing and commercializing catheters utilizing imaging technology for peripheral blockages and occlusions. They have two approved products, one for total blockages in blood vessels in the leg and the other for partial blockages in blood vessels in the leg. |

• | Deal: $20 million hybrid loan and royalty structure at 12.0% interest which was interest only until 2Q16 with full repayment by April 2018. 1.8% royalty on sales. Early repayment dropped the royalty to 0.9% and mandatory minimum, quarterly royalty payments are required. |

• | Status: On September 22, 2015, Avinger repaid the loan (including principal, interest and fees), but the 0.9% royalty remains payable on all of its products (subject to certain minimum payments). On October 14, 2015, Avinger announced 510(k) clearance for its second product for partial occlusions in the leg. |

Depomed, Inc.

• | Summary: Depomed is a publicly traded company focused predominantly on development and commercialization of treatments for pain. They had a sustained release technology that was licensed by a number of companies for use in orally available treatments for type II diabetes. |

• | Deal: $240.5 million to acquire royalties and milestones associated with five type 2 diabetes products, both approved and unapproved. PDL to receive 100% of all associated royalties and milestones up to 2x ($481 million) its initial investment, after which all net payments will be shared evenly (50/50) between PDL and Depomed. |

• | Status: Valeant has increased the price of Glumetza by 500% and then 50% a few weeks later. Early and limited IMS data suggests that the effective price increase will be less than the nominal percents. PDL has not received any royalty payments from Valeant in the third quarter. While Valeant reported revenue for Glumetza of $53M for the period ending September 30, 2015, it had not provided monthly reporting or payments as contractually required. In late October 2015, Valeant issued reports and cash payments for the 3rd quarter 2015 with net royalties of $16.9 million due to PDL, which is included in PDL’s fair value assessment at quarter-end. PDL expects to exercise its royalty audit rights for Glumetza in the near future. |

Page 2

PDL BioPharma, Inc.

Q3 2015

November 4, 2015

Direct Flow Medical, Inc.

• | Summary: Direct Flow is a private company developing and commercializing transcatheter heart valve technologies. It is approved in the EU and being investigated in US with estimated clearance in 2017. |

• | Deal: Senior secured debt with initial provision of $35 million and additional $15 million funded in November 2014. Interest rate on tranche 1 was 15.5% which declined to 13.5% on all amounts after funding of the second tranche. Loans mature on November 5, 2018. |

• | Status: Direct Flow has hired a new CEO and CFO. |

LENSAR, Inc.

• | Summary: Private medical device company commercializing laser technology for cataract treatment. Femtosecond laser approved in the US in March 2013 and in the EU in April 2013. Differentiating feature of LENSAR system is its use of 3-D imaging and liquid interface preventing accidental incision and allowing more accurate corneal incisions with more precise and uniform depth of incision. |

• | Deal: Senior secured debt with initial provision of $40 million. Interest rate on the loans was 15.5% and is now 18.5%. |

• | Status: Forbearance Agreement signed and PDL has advanced additional sums to LENSAR while it conducts a sale process. Current carrying value of the loan as of September 30, is $50.3 million. |

Paradigm Spine, LLC

• | Summary: Paradigm Spine is a private medical device company focused on development and commercialization of treatments for spinal conditions. Their lead product, CoFlex, is approved in US (with Level 1 data under a PMA) and 53 other countries. It is EBITDA positive. |

• | Deal: Senior secured debt with initial provision of $50 million with potential for an additional $12.5 million upon the attainment of certain milestones. Interest rate is 13%. Loans mature on August 14, 2019. |

• | Status: The company recently released 4-year follow up data which confirmed continuing superiority to fusion. On October 27, 2015, PDL and Paradigm Spine amended the credit agreement and PDL provided an additional $4 million to Paradigm Spine for general corporate purposes and promotional activities. In addition, PDL committed to a second tranche of up to $3 million to be funded at the option of Paradigm Spine prior to June 30, 2016. |

kaleo, Inc.

• | Summary: kaleo is a private pharmaceutical company located in Virginia that uses its auto-injector delivery system for drugs. Their first product, Auvi-Q is a new system for delivery of epinephrine to treat severe allergic reactions that can be life-threatening i.e., anaphylaxis. Their second product, EVZIO, which was approved by the FDA on April 3, 2014, uses the same technology to deliver Naloxone for the treatment of patients who overdose on opioids. |

• | Deal: PDL acquired $150 million worth of notes backed by 100% of royalties from sales of Auvi-Q by Sanofi and 10% of net sales of EVZIO by kaleo. The Notes pay interest at 13%. |

• | Status: On October 28, 2015, Sanofi initiated a voluntary nationwide recall of all Auvi-Q units effectively immediately. Sanofi is the exclusive licensee of kaleo for the manufacture and commercialization of Auvi-Q. While Sanofi has not identified the reason for the recall, press reports indicate that a small number of units have failed to deliver the correct amount of drug. It is not known at this time how long commercialization of Auvi-Q will be interrupted. The Notes carry interest at 13 percent per annum, paid quarterly in arrears on principal outstanding. As part of the transaction, kaleo was required to establish an interest reserve account of $20 million from the $150 million provided by PDL. The purpose of this interest reserve account is to cover any possible shortfalls in interest payments owed to PDL. As of this date, despite the recall of Auvi-Q, it is projected that the interest reserve account alone is sufficient to cover possible interest shortfalls until at least the first quarter of 2016. PDL will monitor the recall situation and how it may impact the ability of kaleo to meet its obligations under the Notes, but at this point it has been determined that there is no impairment. |

Viscogliosi Brothers, LLC

• | Summary: Viscogliosi Brothers have substantial stakes in a number of medtech companies, including Paradigm Spine. |

Page 3

PDL BioPharma, Inc.

Q3 2015

November 4, 2015

• | Deal: In return for payment of $15.5 million, PDL acquired right to Viscogliosi Brothers’ royalty on sales of Paradigm Spine’s approved spinal implant until PDL receives 2.3 times the cash advanced after which the royalties revert to the Viscogliosi Brothers. |

• | Status: The company recently released 4-year follow up data which confirmed continuing superiority to fusion. On October 27, 2015, PDL and Paradigm Spine amended the credit agreement and PDL provided an additional $4 million to Paradigm Spine for general corporate purposes and promotional activities. In addition, PDL committed to a second tranche of up to $3 million to be funded at the option of Paradigm Spine prior to June 30, 2016. |

University of Michigan

• | Summary: Cerdelga is an approved oral drug for adult patients with Gaucher Disease type 1, a rare and genetic condition, which was approved in the US on August 19, 2014 and an application for approval is pending in the EU. Genzyme, a Sanofi Company, developed and commercializes Cerdelga. |

• | Deal: On November 6, 2014, PDL acquired 75% of the University of Michigan’s royalty interest in Cerdelga until the expiration of the licensed patents in return for $65.6 million. |

• | Status: Cerdelga is doing well with recent approvals in EU and Japan. Performing according to PDL model in the U.S. |

CareView Communications, Inc.

• | Summary: CareView commercializes a video system and virtual bed rails to monitor passively hospital patients at risk of falling. |

• | Deal: On June 29, 2015, PDL agreed to loan up to $40 million in two tranches of $20 million each, payable upon attainment of a milestone by October 31, 2015 and a second milestone by June 30, 2017. Each of the Notes are for five years and pay interest at 13.5% and 13.0% on the tranches, respectively. |

• | Status: On October 7, 2015, PDL and CareView amended the debt facility and funded $20 million of the first tranche based on an expanded definition of revenue generating activities. The milestones associated with the second tranche of $20 million, which relate to the placement of CareView systems and Consolidated EBITDA, still must be attained by June 30, 2017. |

Ariad Pharmaceuticals, Inc.

• | Summary: Ariad commercializes Iclusig for CML and is developing brigatinib for non-small cell lung cancer. |

• | Deal: On July 29, 2015, PDL agreed to loan up to $200 million with $50 million on execution, $50 million on the 12 month anniversary and up to $100 million in 6 to 12 months after signing. PDL will receive 2.5% of global net revenues from Iclusig for the first year of the agreement (5.0% after the first year through the end of 2018, and 6.5% from 2019 until PDL receives a specified targeted IRR). For the period after 2019, the royalty rate will increase to 7.5% if Ariad has drawn in excess of $150 million. Term is through December 31, 2033 (subject to the put and call options). Financial terms of put and call: Greater of IRR of 10% or 1.15x cash-on-cash (CoC) year 1 1.2x CoC year 2, 1.3x CoC year 3 and thereafter. |

• | Status: Ariad was in play for a period of time but Baxalta was apparently unwilling to pay requested price. On September 15, 2015, Ariad announced completion of enrollment of its pivotal trial of brigatinib in ALK+ non-small cell lung cancers patients and that it expects to report data from this trial at ASCO in mid-2016. |

AcelRx Pharmaceuticals, Inc.

• | Summary: Public company which develops and commercializes treatments for acute pain. Zalviso, its most advanced product, is a drug and device combination of a sublingual formulation of sufentanil and a patient controlled delivery device. In EU, it is approved in EU for treatment of moderate-to-severe post-operative pain and marketed by Grünenthal. |

• | Deal: On September 21, 2015, PDL acquired 75% of royalties and 80% of first four commercial milestones due from Grünenthal. The term is the earlier of PDL gets 3x cash-on-cash or expiration of the obligation to pay royalties (2018 with potential extensions to 2033). |

• | Status: On September 24, 2015, Zalviso was approved in EU. Grünenthal is expected to launch in 1H16 and PDL is expected to receive its share of royalties shortly thereafter. |

Page 4

PDL BioPharma, Inc.

Q3 2015

November 4, 2015

Forward-looking Statements

This document contains "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Each of these forward-looking statements involves risks and uncertainties. Actual results may differ materially from those, express or implied, in these forward-looking statements. Important factors that could impair the value of the Company's royalty assets, restrict or impede the ability of the Company to invest in new income generating assets and limit the Company's ability to pay dividends are disclosed in the risk factors contained in the Company's Annual Report on Form 10-K, as updated by subsequent quarterly reports filed with the Securities and Exchange Commission, as updated by subsequent filings. All forward-looking statements are expressly qualified in their entirety by such factors. We do not undertake any duty to update any forward looking statement except as required by law.

Page 5

PDL BioPharma, Inc.

Q3 2015

November 4, 2015

Queen et al. Royalties | ||||||||||

Royalty Revenue by Product ($ in 000's) * | ||||||||||

Avastin | Q1 | Q2 | Q3 | Q4 | Total | |||||

2015 | 38,809 | 38,447 | 39,284 | — | 116,540 | |||||

2014 | 38,122 | 38,924 | 38,864 | 40,723 | 156,632 | |||||

2013 | 33,234 | 46,720 | 32,224 | 32,287 | 144,464 | |||||

2012 | 23,215 | 41,670 | 25,955 | 30,041 | 120,882 | |||||

2011 | 22,283 | 41,967 | 23,870 | 22,886 | 111,006 | |||||

2010 | 16,870 | 44,765 | 29,989 | 24,922 | 116,547 | |||||

2009 | 13,605 | 35,161 | 21,060 | 15,141 | 84,966 | |||||

2008 | 9,957 | 30,480 | 19,574 | 12,394 | 72,405 | |||||

2007 | 8,990 | 21,842 | 17,478 | 9,549 | 57,859 | |||||

2006 | 10,438 | 15,572 | 15,405 | 12,536 | 53,952 | |||||

Herceptin | Q1 | Q2 | Q3 | Q4 | Total | |||||

2015 | 37,875 | 39,476 | 39,457 | — | 116,808 | |||||

2014 | 36,646 | 38,292 | 39,407 | 40,049 | 154,394 | |||||

2013 | 30,287 | 47,353 | 30,961 | 33,038 | 141,640 | |||||

2012 | 25,702 | 44,628 | 30,433 | 28,307 | 129,070 | |||||

2011 | 25,089 | 42,209 | 31,933 | 21,812 | 121,042 | |||||

2010 | 23,402 | 38,555 | 27,952 | 25,441 | 115,350 | |||||

2009 | 16,003 | 32,331 | 26,830 | 18,615 | 93,779 | |||||

2008 | 14,092 | 34,383 | 28,122 | 20,282 | 96,880 | |||||

2007 | 19,035 | 28,188 | 22,582 | 14,802 | 84,608 | |||||

2006 | 15,142 | 19,716 | 21,557 | 20,354 | 76,769 | |||||

Lucentis | Q1 | Q2 | Q3 | Q4 | Total | |||||

2015 | 15,920 | — | — | — | 15,920 | |||||

2014 | 17,390 | 16,777 | 16,883 | 16,695 | 67,746 | |||||

2013 | 12,032 | 30,066 | 13,536 | 12,127 | 67,760 | |||||

2012 | 10,791 | 27,938 | 12,552 | 11,097 | 62,377 | |||||

2011 | 8,878 | 24,313 | 12,157 | 10,750 | 56,099 | |||||

2010 | 7,220 | 19,091 | 10,841 | 8,047 | 45,198 | |||||

2009 | 4,621 | 12,863 | 8,123 | 6,152 | 31,759 | |||||

2008 | 3,636 | 11,060 | 7,631 | 4,549 | 26,876 | |||||

2007 | 2,931 | 6,543 | 6,579 | 3,517 | 19,570 | |||||

2006 | — | — | 289 | 3,335 | 3,624 | |||||

Xolair | Q1 | Q2 | Q3 | Q4 | Total | |||||

2015 | 10,971 | 11,075 | 12,407 | — | 34,453 | |||||

2014 | 8,886 | 9,099 | 10,442 | 11,237 | 39,663 | |||||

2013 | 5,930 | 10,025 | 7,334 | 7,330 | 30,619 | |||||

2012 | 5,447 | 8,609 | 6,504 | 6,145 | 26,705 | |||||

2011 | 4,590 | 7,621 | 5,916 | 5,823 | 23,949 | |||||

2010 | 3,723 | 6,386 | 4,980 | 4,652 | 19,741 | |||||

2009 | 2,665 | 5,082 | 4,085 | 3,722 | 15,553 | |||||

2008 | 1,488 | 4,866 | 3,569 | 2,927 | 12,850 | |||||

2007 | 1,684 | 3,942 | 3,332 | 2,184 | 11,142 | |||||

2006 | 2,263 | 2,969 | 3,041 | 2,495 | 10,768 | |||||

Perjeta | Q1 | Q2 | Q3 | Q4 | Total | |||||

2015 | 6,596 | 7,419 | 7,898 | — | 21,913 | |||||

2014 | 3,375 | 4,385 | 5,157 | 5,850 | 18,767 | |||||

2013 | 340 | 1,414 | 748 | 879 | 3,381 | |||||

2012 | — | — | 58 | 250 | 308 | |||||

Page 6

PDL BioPharma, Inc.

Q3 2015

November 4, 2015

Queen et al. Royalties | ||||||||||

Royalty Revenue by Product ($ in 000's) * | ||||||||||

Kadcyla | Q1 | Q2 | Q3 | Q4 | Total | |||||

2015 | 3,852 | 4,177 | 4,319 | — | 12,348 | |||||

2014 | 1,934 | 2,491 | 3,048 | 3,464 | 10,937 | |||||

2013 | — | 551 | 830 | 859 | 2,240 | |||||

Tysabri | Q1 | Q2 | Q3 | Q4 | Total | |||||

2015 | 14,385 | 13,614 | 13,557 | — | 41,556 | |||||

2014 | 12,857 | 13,350 | 16,048 | 15,015 | 57,270 | |||||

2013 | 12,965 | 13,616 | 11,622 | 12,100 | 50,304 | |||||

2012 | 11,233 | 12,202 | 11,749 | 12,255 | 47,439 | |||||

2011 | 9,891 | 10,796 | 11,588 | 11,450 | 43,725 | |||||

2010 | 8,791 | 8,788 | 8,735 | 9,440 | 35,754 | |||||

2009 | 6,656 | 7,050 | 7,642 | 8,564 | 29,912 | |||||

2008 | 3,883 | 5,042 | 5,949 | 6,992 | 21,866 | |||||

2007 | 839 | 1,611 | 2,084 | 2,836 | 7,370 | |||||

2006 | — | — | — | 237 | 237 | |||||

Actemra | Q1 | Q2 | Q3 | Q4 | Total | |||||

2015 | 4,990 | — | — | — | 4,990 | |||||

2014 | 3,446 | 3,932 | 4,419 | 5,406 | 17,202 | |||||

2013 | 2,631 | 2,816 | 2,939 | 3,744 | 12,131 | |||||

2012 | 1,705 | 2,074 | 2,145 | 2,462 | 8,385 | |||||

2011 | 913 | 1,136 | 1,401 | 1,460 | 4,910 | |||||

2010 | 1,587 | 237 | 315 | 688 | 2,827 | |||||

2009 | 585 | 537 | 909 | 1,197 | 3,228 | |||||

2008 | 44 | — | 146 | 369 | 559 | |||||

2007 | 32 | — | — | 17 | 49 | |||||

Gazyva | Q1 | Q2 | Q3 | Q4 | Total | |||||

2015 | 313 | — | — | — | 313 | |||||

2014 | 51 | 283 | 325 | 436 | 1,094 | |||||

Entyvio | Q1 | Q2 | Q3 | Q4 | Total | |||||

2015 | 2,223 | — | — | — | 2,223 | |||||

2014 | — | — | 153 | 2,192 | 2,344 | |||||

* As reported to PDL by its licensees. Totals may not sum due to rounding. | ||||||||||

Q1 2014 royalty revenue by product above do not include a $5 million payment received from Genentech in Q1 2014 for a retroactive settlement payment from 2013. | ||||||||||

Page 7

PDL BioPharma, Inc.

Q3 2015

November 4, 2015

Queen et al. Sales Revenue | ||||||||||

Reported Licensee Net Sales Revenue by Product ($ in 000's) * | ||||||||||

Avastin | Q1 | Q2 | Q3 | Q4 | Total | |||||

2015 | 1,826,289 | 1,809,286 | 1,848,655 | — | 5,484,230 | |||||

2014 | 1,786,912 | 1,838,764 | 1,828,900 | 1,916,353 | 7,370,929 | |||||

2013 | 1,653,108 | 1,694,678 | 1,746,135 | 1,819,877 | 6,913,798 | |||||

2012 | 1,502,757 | 1,573,727 | 1,551,327 | 1,662,977 | 6,290,788 | |||||

2011 | 1,597,461 | 1,582,705 | 1,581,095 | 1,469,994 | 6,231,255 | |||||

2010 | 1,506,788 | 1,596,892 | 1,594,707 | 1,646,218 | 6,344,605 | |||||

2009 | 1,345,487 | 1,295,536 | 1,439,730 | 1,514,053 | 5,594,806 | |||||

2008 | 980,715 | 1,084,930 | 1,180,427 | 1,239,382 | 4,485,454 | |||||

2007 | 678,068 | 746,587 | 797,013 | 875,084 | 3,096,752 | |||||

2006 | 439,318 | 516,052 | 570,551 | 592,897 | 2,118,817 | |||||

Herceptin | Q1 | Q2 | Q3 | Q4 | Total | |||||

2015 | 1,789,404 | 1,857,696 | 1,856,803 | — | 5,503,903 | |||||

2014 | 1,731,564 | 1,801,990 | 1,854,452 | 1,877,614 | 7,265,621 | |||||

2013 | 1,681,574 | 1,744,145 | 1,681,860 | 1,726,551 | 6,834,130 | |||||

2012 | 1,515,255 | 1,625,313 | 1,663,695 | 1,650,495 | 6,454,759 | |||||

2011 | 1,391,568 | 1,559,975 | 1,642,898 | 1,432,771 | 6,027,211 | |||||

2010 | 1,270,846 | 1,349,512 | 1,300,934 | 1,409,310 | 5,330,602 | |||||

2009 | 1,210,268 | 1,133,993 | 1,226,435 | 1,278,626 | 4,849,323 | |||||

2008 | 1,105,426 | 1,195,215 | 1,211,982 | 1,186,806 | 4,699,428 | |||||

2007 | 891,761 | 949,556 | 979,602 | 1,015,033 | 3,835,952 | |||||

2006 | 529,585 | 659,719 | 761,099 | 803,576 | 2,753,979 | |||||

Lucentis | Q1 | Q2 | Q3 | Q4 | Total | |||||

2015 | 749,182 | — | — | — | 749,182 | |||||

2014 | 818,376 | 789,483 | 794,505 | 785,669 | 3,188,031 | |||||

2013 | 1,203,179 | 1,171,423 | 1,200,791 | 1,212,651 | 4,788,045 | |||||

2012 | 1,079,092 | 1,086,543 | 1,097,541 | 1,109,695 | 4,372,871 | |||||

2011 | 887,757 | 943,418 | 1,052,809 | 1,075,015 | 3,958,999 | |||||

2010 | 721,967 | 698,890 | 745,376 | 804,684 | 2,970,917 | |||||

2009 | 462,103 | 469,736 | 555,296 | 615,212 | 2,102,347 | |||||

2008 | 363,615 | 393,682 | 460,167 | 454,922 | 1,672,386 | |||||

2007 | 224,820 | 219,579 | 299,995 | 322,300 | 1,066,695 | |||||

2006 | — | — | 10,689 | 157,742 | 168,431 | |||||

Xolair | Q1 | Q2 | Q3 | Q4 | Total | |||||

2015 | 523,340 | 521,192 | 583,856 | — | 1,628,388 | |||||

2014 | 425,243 | 428,171 | 491,372 | 521,726 | 1,866,512 | |||||

2013 | 341,309 | 365,778 | 391,900 | 401,333 | 1,500,321 | |||||

2012 | 310,234 | 314,638 | 347,796 | 340,431 | 1,313,100 | |||||

2011 | 267,754 | 277,642 | 310,874 | 314,911 | 1,171,182 | |||||

2010 | 228,859 | 225,878 | 251,055 | 263,389 | 969,179 | |||||

2009 | 184,669 | 181,086 | 211,006 | 219,693 | 796,454 | |||||

2008 | 137,875 | 169,521 | 177,179 | 183,753 | 668,329 | |||||

2007 | 129,172 | 130,700 | 144,250 | 147,754 | 551,876 | |||||

2006 | 95,241 | 99,354 | 112,608 | 118,002 | 425,204 | |||||

Perjeta | Q1 | Q2 | Q3 | Q4 | Total | |||||

2015 | 310,410 | 349,125 | 371,668 | — | 1,031,203 | |||||

2014 | 158,809 | 206,333 | 242,700 | 275,311 | 883,153 | |||||

2013 | 34,008 | 55,076 | 66,353 | 87,949 | 243,386 | |||||

2012 | — | — | 5,080 | 25,000 | 30,079 | |||||

Page 8

PDL BioPharma, Inc.

Q3 2015

November 4, 2015

Queen et al. Sales Revenue | ||||||||||

Reported Licensee Net Sales Revenue by Product ($ in 000's) * | ||||||||||

Kadcyla | Q1 | Q2 | Q3 | Q4 | Total | |||||

2015 | 181,275 | 196,556 | 203,258 | — | 581,089 | |||||

2014 | 91,031 | 117,212 | 143,414 | 163,028 | 514,685 | |||||

2013 | — | 21,459 | 73,626 | 85,906 | 180,991 | |||||

Tysabri | Q1 | Q2 | Q3 | Q4 | Total | |||||

2015 | 479,526 | 453,786 | 451,898 | — | 1,385,210 | |||||

2014 | 428,561 | 442,492 | 534,946 | 500,511 | 1,906,510 | |||||

2013 | 434,677 | 451,358 | 387,407 | 403,334 | 1,676,776 | |||||

2012 | 374,430 | 401,743 | 391,623 | 408,711 | 1,576,508 | |||||

2011 | 329,696 | 356,876 | 388,758 | 381,618 | 1,456,948 | |||||

2010 | 293,047 | 287,925 | 293,664 | 316,657 | 1,191,292 | |||||

2009 | 221,854 | 229,993 | 257,240 | 285,481 | 994,569 | |||||

2008 | 129,430 | 163,076 | 200,783 | 233,070 | 726,359 | |||||

2007 | 30,468 | 48,715 | 71,972 | 94,521 | 245,675 | |||||

2006 | — | — | — | 7,890 | 7,890 | |||||

Actemra | Q1 | Q2 | Q3 | Q4 | Total | |||||

2015 | 166,338 | — | — | — | 166,338 | |||||

2014 | 114,865 | 124,736 | 147,285 | 180,197 | 567,082 | |||||

2013 | 87,703 | 91,374 | 97,961 | 124,815 | 401,852 | |||||

2012 | 56,662 | 66,624 | 71,505 | 82,053 | 276,843 | |||||

2011 | 30,433 | 35,370 | 46,709 | 48,671 | 161,183 | |||||

2010 | 52,908 | 5,405 | 10,493 | 22,919 | 91,725 | |||||

2009 | 19,504 | 17,920 | 30,313 | 39,888 | 107,625 | |||||

2008 | 1,452 | 1,377 | 5,981 | 12,305 | 21,115 | |||||

2007 | — | — | — | 1,137 | 1,137 | |||||

Gazyva | Q1 | Q2 | Q3 | Q4 | Total | |||||

2015 | 9,627 | — | — | — | 9,627 | |||||

2014 | 3,095 | 8,697 | 11,531 | 13,428 | 36,750 | |||||

Entyvio | Q1 | Q2 | Q3 | Q4 | Total | |||||

2015 | 59,287 | — | — | — | 59,287 | |||||

2014 | — | — | 5,347 | 58,500 | 63,848 | |||||

* As reported to PDL by its licensee. Dates in above charts reflect when PDL receives | ||||||||||

royalties on sales. Sales occurred in the quarter prior to the dates in the above charts. | ||||||||||

Totals may not sum due to rounding. | ||||||||||

Page 9

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- BiomX Inc. (PHGE) Appoints Susan Blum to its Board

- Publication of the 2023 annual report

- Super Star Builder Shane Duffy Shares Helpful Home Improvement Inspiration on TipsOnTV

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share