Form 6-K EZCHIP SEMICONDUCTOR For: Nov 04

|

EZchip Semiconductor Ltd.

|

|

By:

|

/S/ Dror Israel

|

|

Name:

|

Dror Israel

|

|

Title:

|

Chief Financial Officer

|

|

Exhibit 99.1

|

Press Release of the Company, dated November 4, 2015, titled “EZchip Responds to Glass Lewis & Co Report.”

|

|

|

Exhibit 99.2

|

Notice of the Company titled “EZCHIP SETS THE RECORD STRAIGHT.”

|

4

|

|

Ø

|

CERTAINTY OF VALUE IN A CONSOLIDATING INDUSTRY: “From the onset, we recognize that the Company operates as a relatively smaller player in a competitive, dynamic and consolidating industry, relying in large part on a few significant customers. In our view, these factors could reasonably lead the board to conclude that selling the Company, particularly at a certain and immediate all-cash price, may be the best way to maximize shareholder value, compared to the primary alternative of continuing to operate on a standalone basis.”

|

|

|

Ø

|

FAIR VALUE: “The purchase price for EZchip also looks particularly favorable when compared to prior transactions on the basis of trailing multiples.”

|

|

|

Ø

|

RAGING’S INTERESTS ARE DIFFERENT FROM OTHER SHAREHOLDERS: “It should be highlighted that Raging Capital has purchased put options which protect it from a drop in EZchip's share price below $25. We recognize that the vast majority of other EZchip shareholders probably don't have similar protection and likely remain exposed to such a price decline.”

|

|

|

Ø

|

“We do not believe there are substantial issues for shareholder concern as to any of the nominees. Accordingly, we recommend that shareholders vote FOR all incumbent nominees.”

|

|

|

Ø

|

“In our view, Mr. McWilliams’ lack of public company board experience and Mr. Traub’s nomination by Raging Capital in multiple other activism campaigns raises reasonable doubt as to whether these individuals are more qualified or better suited to serve as EZchip directors other than any of the Company’s current directors.”

|

1 Permission to use quotations neither sought nor obtained

|

|

Ø

|

“A vote FOR this proposal is warranted given:

|

|

|

·

|

The reasonable valuation multiples;

|

|

|

·

|

The downside potential in an adverse scenario for sales of NPS-400.”

|

|

|

Ø

|

“…The offer price of USD 25.50 in cash provides reasonable compensation for giving up the potential upside in a successful turnaround.”

|

|

|

Ø

|

“Raging Capital highlights the significant upside for shareholders with good execution, though there might also be significant downside from the offer of USD 25.50 if EZchip does not succeed in replacing lost revenues fast enough.”

|

|

|

Ø

|

“In conclusion, as we examine this transaction, we believe that the alignment of interests of the CEO of the Company, who is also its largest individual shareholder, the fact that the transaction was done at a price higher than the market price at the time of its announcement and the lack of any higher proposal thus far from any competitor, indicate that the price offered by Mellanox is beneficial to all of EZchip's shareholders.”

|

Exhibit 99.2

EZchip Sets the Record Straight

FINANCIAL BENEFITS OF VOTING FOR THE TRANSACTION BOARD SUPPORT

What does Immediate and

Unanimously approved by

Certain Value EZchip’s Board of Directors

$25.50 per share mean?

Full and Fair Culmination of a comprehensive

Valuation for EZchip process and extensive

Shareholders negotiations by the EZchip Board

+31% Eliminates execution risks for EZchip continuing on a premium over 3-month volume-weighted average closing price standalone basis +33% prior to transaction announcement

“As the founder of EZchip over 15 years ago premium over 12-month volume-and its largest individual shareholder, my weighted average closing price +16% interests are aligned with yours. I believe in prior to transaction announcement premium over closing price on the merits of this transaction and the value September 29, 2015 (last trading day that it creates for EZchip shareholders.” prior to transaction announcement)

– Eli Fruchter, CEO, EZchip

IMPORTANT FACTS TO CONSIDER ABOUT YOUR INVESTMENT IN EZCHIP

Although there is potential for our NPS-400 and Tile-MX product lines, THERE ARE CHALLENGES.

Potential revenue streams Mellanox deal recognizes The semiconductor Proposed transaction from unproven products NPS/Tile-MX value, industry is a highly provides meaningful are always fraught with following decline in competitive market where synergies on a combined risk. Potential for future market value for legacy scale will be a deciding basis vs. operating as investor disappointment if NP products after Cisco’s factor between winners stand-alone company expectations are not realized decision to go in-house and losers

The Mellanox transaction provides CERTAIN VALUE and REWARDS SHAREHOLDERS. This transaction is about joining forces to create a true powerhouse for connectivity and processing, which is extremely important in an industry as competitive as ours.

Vote FOR the Merger Proposal With Mellanox Technologies Ltd.

If you have any questions or need assistance in voting your shares, please contact our proxy solicitor:

MacKenzie Partners, Inc. / 1.800.322.2885 (toll-free) / 1.212.929.5500 (call collect) / [email protected]

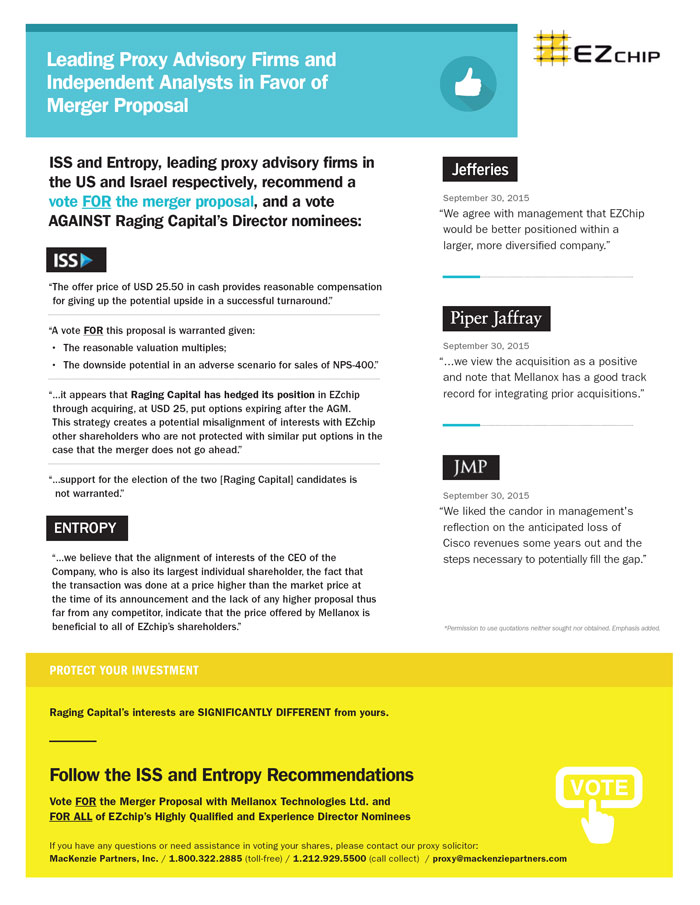

Leading Proxy Advisory Firms and Independent Analysts in Favor of Merger Proposal ISS and Entropy, leading proxy advisory firms in the US and Israel respectively, recommend a vote FOR the merger proposal, and a vote AGAINST Raging Capital’s Director nominees: “The offer price of USD 25.50 in cash provides reasonable compensation for giving up the potential upside in a successful turnaround.”“A vote FOR this proposal is warranted given:• The reasonable valuation multiples;•The downside potential in an adverse scenario for sales of NPS-400.” “...it appears that Raging Capital has hedged its position in EZchip through acquiring, at USD 25, put options expiring after the AGM. This strategy creates a potential misalignment of interests with EZchip other shareholders who are not protected with similar put options in the case that the merger does not go ahead.” “...support for the election of the two [Raging Capital] candidates is not warranted.”ENTROPY “...we believe that the alignment of interests of the CEO of the Company, who is also its largest individual shareholder, the fact that the transaction was done at a price higher than the market price at the time of its announcement and the lack of any higher proposal thus far from any competitor, indicate that the price offered by Mellanox is bene3cial to all of EZchip’s shareholders.” September 30, 2015 “We agree with management that EZChip would be better positioned within a larger, more diversi3ed company.”September 30, 2015 we view the acquisition as a positive and note that Mellanox has a good track record for integrating prior acquisitions.” September 30, 2015 We liked the candor in management's re3ection on the anticipated loss of Cisco revenues some years out and the steps necessary to potentially 3ll the gap.”*Permission to use quotations neither sought nor obtained. Emphasis added. PROTECT YOUR INVESTMENT Raging Capital’s interests are SIGNIFICANTLY DIFFERENT from yours.Follow the ISS and Entropy Recommendations Vote FOR the Merger Proposal with Mellanox Technologies Ltd. and FOR ALL of EZchip’s Highly Qualified and Experience Director Nominees If you have any questions or need assistance in voting your shares, please contact our proxy solicitor:MacKenzie Partners, Inc. / 1.800.322.2885 (toll-free) / 1.212.929.5500 (call collect) / [email protected]

SAFE HARBOR STATEMENT

This communication contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended.3Forward-looking statements are statements that are not historical facts and may include 3nancial projections and estimates and their underlying assumptions, statements regarding plans, objectives and expectations with respect to future operations, products and services, and statements regarding future performance and the consummation of the merger with Mellanox Technologies, Ltd.3These statements are only predictions based on EZchip's current expectations and projections about future events based on its current knowledge.3There are important factors that could cause EZchip's actual results, level of activity, performance or achievements to differ materially from the results, level of activity, performance or achievements expressed or implied by the forward-looking statements.3Those factors include, but are not limited to, the impact of general economic conditions, competitive products (including in-house customer developed products), product demand and market acceptance risks, customer order cancellations, reliance on key strategic alliances, 3uctuations in operating results, delays in development of highly-complex products and other factors indicated in EZchip's 3lings with the Securities and Exchange Commission (SEC).3For more details, refer to EZchip's SEC 3lings and the amendments thereto, including its Annual Report on Form 20-F 3led on March331, 2015 and its Current Reports on Form 6-K (including EZchip’s Proxy Statement, dated October 13, 2015 (as supplemented on October 26, 2015)). EZchip undertakes no obligation to update forward-looking statements to re3ect subsequent occurring events or circumstances, or to changes in our expectations, except as may be required by law.

3IMPORTANT ADDITIONAL INFORMATION

This communication is neither an offer to purchase nor a solicitation of an offer to sell securities. Shareholders are urged to read the Proxy Statement, dated October 13, 2015 (as supplemented on October 26, 2015), together with the Merger Agreement and other exhibits thereto, in their entirety because they contain important information. The Proxy Statement, dated October 13, 2015 (including the Merger Agreement with Mellanox Technologies, Ltd. and the fairness opinion received by the EZchip Board), has been 3led by EZchip with the SEC and mailed to shareholders.3 The Supplement to the Proxy Statement, dated October 26, 2015, has been 3led by EZchip with the SEC and is being mailed to shareholders.3 Shareholders may also obtain a free copy of these statements and other documents 3led by EZchip with the SEC at the website maintained by the SEC at www.sec.gov3by directing such requests to:3

MacKenzie Partners, Inc.

Toll-free: (800) 322-2885 Collect: (212) 929-5500 [email protected]

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Cryogenic Tank Market to Reach USD 10 Billion by 2031 Driven by Surging Demand for Clean Energy Solutions

- HSBC Accelerates Wealth Management Strategy in U.S. with Opening of Flagship Wealth Center at Hudson Yards

- Healthcare IT Market Size Worth USD 1827.12 billion By 2031 | CAGR of 29.61%

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share