Form 8-K Forestar Group Inc. For: Nov 04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report: November 4, 2015

(Date of earliest event reported)

FORESTAR GROUP INC.

(Exact name of registrant as specified in its charter)

Delaware | Commission File Number | 26-1336998 | ||

(State or other jurisdiction of incorporation or organization) | 001-33662 | (I.R.S. Employer Identification No.) | ||

6300 Bee Cave Road, Building Two, Suite 500

Austin, Texas 78746

(Address of principal executive offices) (zip code)

(512) 433-5200

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

1

Item 2.02. Results of Operations and Financial Condition.

On November 4, 2015, Forestar Group Inc. (the “Company”) issued a press release announcing the Company’s results for the quarter ended September 30, 2015. A copy of the press release is furnished as Exhibit 99.1 of this report.

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On November 4, 2015, the Company announced that Bruce F. Dickson will retire from his position as its Chief Real Estate Officer, effective as of March 31, 2016. A copy of the press release is furnished as Exhibit 99.1 of this report.

Item 7.01. Regulation FD Disclosure

On November 4, 2015, management of the Company will participate in a conference call discussing the Company’s results for the quarter ended September 30, 2015. Copies of the presentation materials to be used by management are furnished as Exhibit 99.2 of this report.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

Exhibit | Description | ||

99.1 | Press release issued by the Company on November 4, 2015 | ||

99.2 | Presentation materials to be used by management in a conference call on November 4, 2015, discussing the Company’s results for the quarter ended September 30, 2015. | ||

2

SIGNATURE

Pursuant to the requirements of the Securities and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

FORESTAR GROUP INC. | ||||

Date: | November 4, 2015 | By: | /s/ David M. Grimm | |

Name: | David M. Grimm | |||

Title: | Chief Administrative Officer | |||

3

EXHIBIT INDEX

Exhibit | Description | ||

99.1 | Press release issued by the Company on November 4, 2015 | ||

99.2 | Presentation materials to be used by management in a conference call on November 4, 2015, discussing the Company’s results for the quarter ended September 30, 2015. | ||

4

Exhibit 99.1

NEWS

RELEASE

FOR IMMEDIATE RELEASE

CONTACT: Anna E. Torma

(512) 433-5312

FORESTAR GROUP INC. REPORTS THIRD QUARTER 2015 RESULTS

Tremendous changes at Forestar including four key initiatives:

• | Reducing costs across the entire organization |

• | Reviewing entire portfolio of assets |

• | Reviewing capital structure |

• | Reviewing additional disclosures |

AUSTIN, TEXAS, November 4, 2015—Forestar Group Inc. (NYSE: FOR) (“Forestar” or the “Company”)today reported a third quarter 2015 net loss of approximately ($164.2) million, or ($4.79) per share outstanding, compared with third quarter 2014 net income of approximately $5.2 million, or $0.12 per share outstanding. Third quarter 2015 results include charges of approximately ($153.9) million, or ($4.48) per share, related to a deferred tax asset valuation allowance, impairment of proved properties and unproved leasehold interests associated with non-core oil and gas assets, and severance related charges. To the extent the Company generates sufficient future taxable income, the Company may utilize the tax deductions represented by the deferred tax asset in future tax returns notwithstanding the valuation allowance. Excluding special items, third quarter 2015 net loss was approximately ($10.3) million, or ($0.31) per share.

Third Quarter | ||||||||

2015 | 2014 | |||||||

Net income (loss) per share - as reported | ($4.79 | ) | $0.12 | |||||

Special items per share: | ||||||||

Deferred tax asset valuation allowance | 2.88 | — | ||||||

Proved property impairments - oil & gas | 1.24 | — | ||||||

Unproved leasehold interest impairments - oil & gas | 0.30 | — | ||||||

Severance related charges | 0.06 | — | ||||||

Total special items per share (after-tax) | $4.48 | $— | ||||||

Net income (loss) per share - excluding special items | ($0.31 | ) | $0.12 | |||||

Focusing on Residential Housing Development, Significantly Reducing Costs and Reviewing Alternatives

“Forestar has made tremendous changes at the Board and management levels. We are focused on creating shareholder value through our core residential housing development business. In addition, we are focused on four key initiatives: to significantly reduce costs across our entire business, review our entire portfolio of assets, review our capital structure to match our real estate focus going forward, and review additional disclosures,” said Phil Weber, Chief Executive Officer of Forestar. “We have taken actions to eliminate over $13 million in general administrative and segment operating expenses, representing a 2016 cost reduction of approximately 22% compared to 2015 run rate levels. Going forward, we expect additional cost reductions as we focus on our core residential housing development business.”

Residential Housing Demand Stable, Despite Construction and Permitting Delays

“We continue to see stable market demand for our communities, with over 1,440 lots currently under option contracts with builders, with average residential lot prices up 4% compared with third quarter 2014. Multifamily

1

construction activity continued on four existing projects, with two additional multifamily developments, 360° in Denver and Acklen in Nashville, currently nearing completion and experiencing solid leasing activity. In addition, our two stabilized multifamily projects, Eleven in Austin and Midtown near Dallas, are both nearly 95% leased and generating effective rents above our initial underwriting.”

Forestar manages its operations through three business segments: real estate, oil and gas and other natural resources.

REAL ESTATE

Third Quarter 2015 Significant Highlights (Includes Ventures)

• | Sold 301 developed residential lots for over $76,600 per lot and average gross profit of over $30,500 per lot |

• | Sold 220 acres of residential tracts for over $2,800 per acre |

• | Sold 4,616 acres of undeveloped land for $2,190 per acre, principally from a 50% joint venture |

Segment Financial Results:

($ in millions) | Q3 2015 | Q3 2014 | Q2 2015 | |||

Segment Revenues | $28.0 | $32.4 | $39.4 | |||

Segment Earnings | $5.2 | $16.0 | $15.5 | |||

Real estate segment earnings declined in third quarter 2015 compared with the prior year principally due to a $7.6 million gain in third quarter 2014 associated with acquisition of our partner's interest in the Eleven multifamily venture, decreased residential lot sales activity and $1.8 million of interest income in third quarter 2014 related to a loan secured by a mixed-use real estate community in Houston. Third quarter 2015 lot sales reflect the impact of construction and inspection delays associated with abnormally wet weather conditions in second quarter 2015. Real estate segment earnings declined in third quarter 2015 compared with second quarter 2015 principally due to lower residential lot sales activity.

OIL AND GAS

Third Quarter 2015 Significant Highlights (Includes Ventures)

• | Incurred non-cash impairment charges of approximately ($81) million related to proved properties and unproved leasehold interests, principally in North Dakota, Nebraska and Kansas, primarily due to the continued decline in oil and gas prices |

• | Reduced operating expenses by approximately 36% compared with third quarter 2014 |

• | Generated over $11 million in proceeds from the sale of approximately 240 net mineral acres in the Bakken/Three Forks and 9,700 net mineral acres in Oklahoma, and 27 gross / 4 net producing wells |

Segment Financial Results:

($ in millions) | Q3 2015 | Q3 2014 | Q2 2015 | |||

Segment Revenues | $13.5 | $24.1 | $16.2 | |||

Segment Earnings (Loss) | ($86.2) | $6.0 | ($56.9) | |||

“Through the successful execution of our initiatives to significantly reduce costs and capital expenditures, the oil and gas segment generated over $18 million in positive cash flow in third quarter 2015, including $11 million from non-core asset sales, compared with ($4) million in negative cash flow in third quarter 2014. Going forward, our oil and gas segment is positioned to generate positive cash flow at third quarter-end 2015 commodity prices,” concluded Mr. Weber.

2

Oil and gas segment results decreased in third quarter 2015 compared with third quarter 2014 and second quarter 2015 principally due to non-cash asset impairment charges of ($81) million, of which ($65) million is related to proved properties and ($16) million is related to unproved leasehold interests, principally due to the continued decline in oil and gas prices. Total oil and liquids production increased 18% in third quarter 2015 compared with third quarter 2014, driven by new wells commencing production in the Bakken / Three Forks formations in North Dakota. In addition, total oil and gas segment operating expenses were down approximately 36% in third quarter 2015 compared with third quarter 2014, principally due to lower staffing costs and initiatives to reduce oil and gas operating expenses. Second quarter 2015 oil and gas segment results include approximately ($57) million in non-cash charges principally related to impairment of proved properties and unproved leasehold interests and exploratory dry hole costs.

OTHER NATURAL RESOURCES

Third Quarter 2015 Significant Highlights (Includes Ventures)

• | Sold over 60,000 tons of fiber for $12.41 per ton |

• | 97,000 acres under lease for recreational purposes at $8.93 per acre |

Segment Financial Results:

($ in millions) | Q3 2015 | Q3 2014 | Q2 2015 | |||

Segment Revenues | $1.7 | $2.3 | $1.9 | |||

Segment Earnings (Loss) | ($0.1) | $0.7 | ($0.0) | |||

Third quarter 2015 other natural resources segment results decreased compared with prior year principally due to lower fiber sales and almost $0.4 million in earnings in third quarter 2014 associated with a groundwater reservation agreement and gain on sale of water rights related to a real estate project in Colorado. Third quarter 2015 other natural resources segment results decreased compared with second quarter 2015 principally due to lower fiber pricing.

OUTLOOK

Forestar Target Residential Housing Markets Supported by Favorable Fundamentals

“Residential real estate market conditions continue to reflect relatively stable supply and demand fundamentals in our target markets. Despite a slowdown in job growth in Houston, lower housing and finished lot inventories are driving steady demand for our communities which are principally focused on first and second move-up markets, the largest segments of the new home construction market. With stable market demand for our communities and over 1,440 lots currently under option contracts with builders, the company anticipates lot sales in 2015 to be in the range of 1,400 - 1,600 lots.”

“Multifamily market conditions remain solid in our target markets, and our Midtown Cedar Hill multifamily project near Dallas is currently under contract and expected to close by year-end. Going forward, we will continue to strategically invest in multifamily development opportunities, principally located in urban core and other strong sub-markets where the company can achieve attractive risk-adjusted returns.”

Significantly Lower Costs and Focus on Core Residential Housing Development Business

“We are focused on executing our core residential housing development business. In addition, we have restructured our oil and gas business by significantly lowering operating expenses and reducing capital expenditures to generate positive cash flow at third quarter-end 2015 commodity pricing. We are also evaluating our entire portfolio of assets and expect to further reduce corporate and other segment operating expenses as we align the company’s cost structure with our core real estate businesses to maximize long-term shareholder value,” said Mr. Weber.

Chief Real Estate Officer Planning 2016 Retirement

The Company also announced today that Bruce Dickson, Chief Real Estate Officer, plans to retire on March 31, 2016. “We thank Bruce for his outstanding leadership of our real estate segment since 2011, and for his many other contributions to Forestar. We wish Bruce the very best following his retirement next year,” concluded Mr. Weber.

3

The Company will host a conference call on November 4, 2015 at 10:00 am ET to discuss results of third quarter 2015. The meeting may be accessed through webcast or by conference call. The webcast may be accessed through Forestar’s Internet site at www.forestargroup.com. To access the conference call, listeners calling from North America should dial 1-855-546-9555 at least 15 minutes prior to the start of the meeting. Those wishing to access the call from outside North America should dial 1-412-455-6094. The password is Forestar. Replays of the call will be available for two weeks following the completion of the live call and can be accessed at 1-855-859-2056 in North America and at 1-404-537-3406 outside North America. The password for the replay is 56791336.

About Forestar Group

Forestar Group Inc. operates in three business segments: real estate, oil and gas and other natural resources. At third quarter-end 2015, the real estate segment owns directly or through ventures 106,000 acres of real estate located in 12 states and 15 markets in the U.S. The real estate segment has 11 real estate projects representing approximately 24,400 acres currently in the entitlement process, and 80 entitled, developed and under development projects in 11 states and 14 markets encompassing 10,700 acres, comprised of 17,400 planned residential lots and approximately 1,900 commercial acres. The oil and gas segment includes approximately 914,000 net acres of oil and gas mineral interests, with approximately 590,000 acres of fee ownership located principally in Texas, Louisiana, Georgia, and Alabama, and approximately 324,000 net acres of leasehold interests principally located in Nebraska, Kansas, Oklahoma, North Dakota and Texas. These leasehold interests include about 9,000 net mineral acres in the core of the prolific Bakken and Three Forks formations. The other natural resources segment includes sale of wood fiber and management of our recreational leases, and approximately 1.5 million acres of groundwater resources, including a 45% nonparticipating royalty interest in groundwater rights on approximately 1.4 million surface acres in Texas, Louisiana, Georgia and Alabama and groundwater production from leases on about 20,000 surface acres in central Texas. Forestar’s address on the World Wide Web is www.forestargroup.com.

Forward Looking Statements

This release contains “forward-looking statements” within the meaning of the federal securities laws. Forward-looking statements are typically identified by words or phrases such as “will,” “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “target,” “forecast,” and other words and terms of similar meaning. These statements reflect management’s current views with respect to future events and are subject to risk and uncertainties. We note that a variety of factors and uncertainties could cause our actual results to differ significantly from the results discussed in the forward-looking statements, including but not limited to: general economic, market, or business conditions; changes in commodity prices; opportunities (or lack thereof) that may be presented to us and that we may pursue; fluctuations in costs and expenses including development costs; demand for new housing, including impacts from mortgage credit rates or availability; lengthy and uncertain entitlement processes; cyclicality of our businesses; accuracy of accounting assumptions; competitive actions by other companies; changes in laws or regulations; and other factors, many of which are beyond our control. Except as required by law, we expressly disclaim any obligation to publicly revise any forward-looking statements contained in this news release to reflect the occurrence of events after the date of this news release.

4

FORESTAR GROUP INC.

(UNAUDITED)

Business Segments

Third Quarter | First Nine Months | ||||||||||||||

2015 | 2014 | 2015 | 2014 | ||||||||||||

(In thousands) | |||||||||||||||

Revenues: | |||||||||||||||

Real estate | $ | 27,957 | $ | 32,445 | $ | 100,196 | $ | 153,098 | |||||||

Oil and gas | 13,485 | 24,145 | 42,835 | 66,076 | |||||||||||

Other natural resources | 1,726 | 2,250 | 5,372 | 7,284 | |||||||||||

Total revenues | $ | 43,168 | $ | 58,840 | $ | 148,403 | $ | 226,458 | |||||||

Segment earnings (loss): | |||||||||||||||

Real estate | $ | 5,154 | $ | 15,987 | $ | 29,747 | $ | 66,859 | |||||||

Oil and gas | (86,192 | ) | 6,002 | (146,000 | ) | 16,331 | |||||||||

Other natural resources | (77 | ) | 669 | (511 | ) | 2,220 | |||||||||

Total segment earnings (loss) | (81,115 | ) | 22,658 | (116,764 | ) | 85,410 | |||||||||

Items not allocated to segments: | |||||||||||||||

General and administrative expense | (8,343 | ) | (5,190 | ) | (19,540 | ) | (15,924 | ) | |||||||

Share-based and long-term incentive compensation expense | (2,245 | ) | (991 | ) | (5,726 | ) | (4,523 | ) | |||||||

Interest expense | (8,315 | ) | (8,634 | ) | (25,851 | ) | (21,507 | ) | |||||||

Other corporate non-operating income | 38 | 139 | 133 | 391 | |||||||||||

Income (loss) before taxes | (99,980 | ) | 7,982 | (167,748 | ) | 43,847 | |||||||||

Income tax (expense) benefit (a) | (64,236 | ) | (2,755 | ) | (39,133 | ) | (15,464 | ) | |||||||

Net income (loss) attributable to Forestar Group Inc. | $ | (164,216 | ) | $ | 5,227 | $ | (206,881 | ) | $ | 28,383 | |||||

Net income (loss) per common share: | |||||||||||||||

Diluted | $ | (4.79 | ) | $ | 0.12 | $ | (6.04 | ) | $ | 0.65 | |||||

Weighted average common shares outstanding (in millions): | |||||||||||||||

Diluted (b) | 34.3 | 43.9 | 34.2 | 43.8 | |||||||||||

Third Quarter | ||||||||

Supplemental Financial Information: | 2015 | 2014 | ||||||

(In thousands) | ||||||||

Cash and cash equivalents | $ | 92,640 | $ | 170,606 | ||||

Senior secured notes | 250,000 | 250,000 | ||||||

Convertible senior notes, net of discount | 105,672 | 102,368 | ||||||

Tangible equity unit notes, net of discount | 10,899 | 19,192 | ||||||

Other debt (c) | 68,724 | 57,735 | ||||||

Total debt | $ | 435,295 | $ | 429,295 | ||||

Net debt | $ | 342,655 | $ | 258,689 | ||||

_____________________

(a) | Income tax provision for third quarter 2015 was ($64.2) million which includes a ($98.9) million valuation allowance for our deferred tax asset and is net of an income tax benefit of $34.7 million associated with our third quarter 2015 pre-tax losses. |

(b) | Weighted average diluted shares outstanding during third quarter and first nine months 2015 exclude 7.9 million shares associated with tangible equity units issued during fourth quarter 2013. The actual number of shares to be issued in December 2016 will be between 6.5 million - 7.9 million shares based on the market value of our stock. Weighted average diluted shares outstanding during third quarter and first nine months 2014 includes 7.9 million shares associated with tangible equity units issued during fourth quarter 2013. |

(c) | Other debt for third quarter-end 2015 consists principally of $48.1 million in senior secured loans for two multifamily properties, and excludes unconsolidated venture debt and outstanding letters of credit of approximately $144.0 million and $16.2 million, respectively. |

5

FORESTAR GROUP INC.

REAL ESTATE SEGMENT

PERFORMANCE METRICS

Third Quarter | First Nine Months | ||||||||||||||

2015 | 2014 | 2015 | 2014 | ||||||||||||

REAL ESTATE | |||||||||||||||

Owned, Consolidated & Equity Method Ventures: | |||||||||||||||

Residential Lots Sold | 301 | 323 | 1,109 | 1,834 | |||||||||||

Revenue per Lot Sold | $ | 76,623 | $ | 73,653 | $ | 75,019 | $ | 54,354 | |||||||

Commercial Acres Sold | 3 | 4 | 56 | 7 | |||||||||||

Revenue per Commercial Acre Sold | $ | 28,037 | $ | 589,203 | $ | 216,997 | $ | 369,874 | |||||||

Undeveloped Acres Sold | 4,616 | 637 | 6,595 | 13,174 | |||||||||||

Revenue per Acre Sold | $ | 2,190 | $ | 3,179 | $ | 2,411 | $ | 2,249 | |||||||

Owned & Consolidated Ventures: | |||||||||||||||

Residential Lots Sold | 186 | 286 | 699 | 1,603 | |||||||||||

Revenue per Lot Sold | $ | 76,232 | $ | 72,352 | $ | 73,287 | $ | 52,052 | |||||||

Commercial Acres Sold | 3 | — | 27 | 3 | |||||||||||

Revenue per Commercial Acre Sold | $ | 28,037 | $ | — | $ | 109,802 | $ | 96,774 | |||||||

Undeveloped Acres Sold | 744 | 637 | 2,378 | 12,916 | |||||||||||

Revenue per Acre Sold | $ | 2,900 | $ | 3,179 | $ | 2,911 | $ | 2,248 | |||||||

Ventures Accounted For Using the Equity Method: | |||||||||||||||

Residential Lots Sold | 115 | 37 | 410 | 231 | |||||||||||

Revenue per Lot Sold | $ | 77,256 | $ | 83,711 | $ | 77,973 | $ | 70,325 | |||||||

Commercial Acres Sold | — | 4 | 29 | 4 | |||||||||||

Revenue per Commercial Acre Sold | $ | — | $ | 589,203 | $ | 311,995 | $ | 589,203 | |||||||

Undeveloped Acres Sold | 3,872 | — | 4,217 | 258 | |||||||||||

Revenue per Acre Sold | $ | 2,053 | $ | — | $ | 2,129 | $ | 2,306 | |||||||

THIRD QUARTER 2015

REAL ESTATE PIPELINE

Real Estate | Entitled Acres | Developed & Under Development Acres | Total Acres (a) | |||||

Residential | ||||||||

Owned | 6,902 | 653 | ||||||

Ventures | 1,075 | 157 | 8,787 | |||||

Commercial | ||||||||

Owned | 1,065 | 525 | ||||||

Ventures | 210 | 103 | 1,903 | |||||

Total Acres | 9,252 | 1,438 | 10,690 | |||||

Estimated Residential Lots | 14,930 | 2,437 | 17,367 | |||||

_____________________

(a) | Excludes acres associated with commercial and income producing properties, 70,769 undeveloped timberland acres and 24,430 acres in the entitlement process. |

6

FORESTAR GROUP INC.

PROJECTS IN ENTITLEMENT

A summary of our real estate projects in the entitlement process (a) at third quarter-end 2015 follows:

Project | County | Market | Project Acres (b) | |||

California | ||||||

Hidden Creek Estates | Los Angeles | Los Angeles | 700 | |||

Terrace at Hidden Hills | Los Angeles | Los Angeles | 30 | |||

Georgia | ||||||

Ball Ground | Cherokee | Atlanta | 500 | |||

Crossing | Coweta | Atlanta | 230 | |||

Fincher Road | Cherokee | Atlanta | 3,890 | |||

Garland Mountain | Cherokee/Bartow | Atlanta | 350 | |||

Martin’s Bridge | Banks | Atlanta | 970 | |||

Mill Creek | Coweta | Atlanta | 770 | |||

Wolf Creek | Carroll/Douglas | Atlanta | 12,230 | |||

Yellow Creek | Cherokee | Atlanta | 1,060 | |||

Texas | ||||||

Lake Houston | Harris/Liberty | Houston | 3,700 | |||

Total | 24,430 | |||||

_____________________

(a) | A project is deemed to be in the entitlement process when customary steps necessary for the preparation of an application for governmental land-use approvals, like conducting pre-application meetings or similar discussions with governmental officials, have commenced, or an application has been filed. Projects listed may have significant steps remaining, and there is no assurance that entitlements ultimately will be received. |

(b) | Project acres, which are the total for the project regardless of our ownership interest, are approximate. The actual number of acres entitled may vary. |

7

FORESTAR GROUP INC.

REAL ESTATE PROJECTS

A summary of activity within our projects in the development process, which includes entitled (a), developed and under development real estate projects, at third quarter-end 2015 follows:

Residential Lots (c) | Commercial Acres (d) | |||||||||||||||

Project | County | Interest Owned (b) | Lots Sold Since Inception | Lots Remaining | Acres Sold Since Inception | Acres Remaining (e) | ||||||||||

Projects we own | ||||||||||||||||

California | ||||||||||||||||

San Joaquin River | Contra Costa/Sacramento | 100 | % | — | — | — | 288 | |||||||||

Colorado | ||||||||||||||||

Buffalo Highlands | Weld | 100 | % | — | 164 | — | — | |||||||||

Johnstown Farms | Weld | 100 | % | 281 | 313 | 2 | 3 | |||||||||

Pinery West | Douglas | 100 | % | 86 | — | 20 | 106 | |||||||||

Stonebraker | Weld | 100 | % | — | 603 | — | — | |||||||||

Georgia | ||||||||||||||||

Seven Hills | Paulding | 100 | % | 843 | 240 | 26 | 113 | |||||||||

The Villages at Burt Creek | Dawson | 100 | % | — | 1,715 | — | 57 | |||||||||

West Oaks | Cobb | 100 | % | — | 57 | — | — | |||||||||

Other projects (17) | Various | 100 | % | 245 | 2,258 | — | 695 | |||||||||

North & South Carolina | ||||||||||||||||

Habersham | York | 100 | % | 20 | 167 | — | — | |||||||||

Walden | Mecklenburg | 100 | % | — | 387 | — | — | |||||||||

Tennessee | ||||||||||||||||

Beckwith Crossing | Wilson | 100 | % | — | 99 | — | — | |||||||||

Morgan Farms | Williamson | 100 | % | 86 | 87 | — | — | |||||||||

Scales | Williamson | 100 | % | — | 87 | — | — | |||||||||

Weatherford Estates | Williamson | 100 | % | — | 17 | — | — | |||||||||

Texas | ||||||||||||||||

Arrowhead Ranch | Hays | 100 | % | — | 381 | — | 11 | |||||||||

Bar C Ranch | Tarrant | 100 | % | 366 | 739 | — | — | |||||||||

Barrington Kingwood | Harris | 100 | % | 170 | 10 | — | — | |||||||||

Cibolo Canyons | Bexar | 100 | % | 954 | 815 | 130 | 56 | |||||||||

Harbor Lakes | Hood | 100 | % | 231 | — | 21 | — | |||||||||

Hunter’s Crossing | Bastrop | 100 | % | 510 | — | 54 | 49 | |||||||||

Imperial Forest | Harris | 100 | % | — | 428 | — | — | |||||||||

La Conterra | Williamson | 100 | % | 202 | — | 3 | 55 | |||||||||

Lakes of Prosper | Collin | 100 | % | 151 | 136 | 4 | — | |||||||||

Lantana | Denton | 100 | % | 1,220 | 544 | 14 | — | |||||||||

Maxwell Creek | Collin | 100 | % | 941 | 60 | 10 | — | |||||||||

Oak Creek Estates | Comal | 100 | % | 273 | 281 | 13 | — | |||||||||

Parkside | Collin | 100 | % | 8 | 192 | — | — | |||||||||

River's Edge | Denton | 100 | % | — | 202 | — | — | |||||||||

Stoney Creek | Dallas | 100 | % | 231 | 477 | — | — | |||||||||

Summer Creek Ranch | Tarrant | 100 | % | 983 | 268 | 35 | 44 | |||||||||

Summer Lakes | Fort Bend | 100 | % | 675 | 394 | 56 | — | |||||||||

8

Residential Lots (c) | Commercial Acres (d) | |||||||||||||||

Project | County | Interest Owned (b) | Lots Sold Since Inception | Lots Remaining | Acres Sold Since Inception | Acres Remaining (e) | ||||||||||

Summer Park | Fort Bend | 100 | % | 69 | 130 | 28 | 68 | |||||||||

The Colony | Bastrop | 100 | % | 455 | 1,430 | 22 | 31 | |||||||||

The Preserve at Pecan Creek | Denton | 100 | % | 587 | 195 | — | 7 | |||||||||

Village Park | Collin | 100 | % | 567 | — | 3 | 2 | |||||||||

Westside at Buttercup Creek | Williamson | 100 | % | 1,496 | 1 | 66 | — | |||||||||

Other projects (7) | Various | 100 | % | 1,566 | 20 | 135 | 5 | |||||||||

Other | ||||||||||||||||

Other projects (2) | Various | 100 | % | 543 | 320 | — | — | |||||||||

13,759 | 13,217 | 642 | 1,590 | |||||||||||||

Projects in entities we consolidate | ||||||||||||||||

Texas | ||||||||||||||||

City Park | Harris | 75 | % | 1,311 | 504 | 52 | 113 | |||||||||

Timber Creek | Collin | 88 | % | — | 601 | — | — | |||||||||

Willow Creek Farms II | Waller/Fort Bend | 90 | % | 90 | 175 | — | — | |||||||||

Other projects (2) | Various | Various | 10 | 198 | — | 18 | ||||||||||

1,411 | 1,478 | 52 | 131 | |||||||||||||

Total owned and consolidated | 15,170 | 14,695 | 694 | 1,721 | ||||||||||||

Projects in ventures that we account for using the equity method | ||||||||||||||||

Texas | ||||||||||||||||

Entrada | Travis | 50 | % | — | 821 | — | — | |||||||||

Fannin Farms West | Tarrant | 50 | % | 324 | — | — | — | |||||||||

Harper’s Preserve | Montgomery | 50 | % | 513 | 1,215 | 30 | 49 | |||||||||

Lantana - Rayzor Ranch | Denton | 25 | % | 1,163 | — | 50 | — | |||||||||

Long Meadow Farms | Fort Bend | 38 | % | 1,514 | 290 | 187 | 118 | |||||||||

Southern Trails | Brazoria | 80 | % | 870 | 126 | 1 | — | |||||||||

Stonewall Estates | Bexar | 50 | % | 363 | 27 | — | — | |||||||||

Other projects (7) | Various | Various | — | 193 | — | 15 | ||||||||||

Total in ventures | 4,747 | 2,672 | 268 | 182 | ||||||||||||

Combined total | 19,917 | 17,367 | 962 | 1,903 | ||||||||||||

_____________________

(a) | A project is deemed entitled when all major discretionary governmental land-use approvals have been received. Some projects may require additional permits and/or non-governmental authorizations for development. |

(b) | Interest owned reflects our net equity interest in the project, whether owned directly or indirectly. There are some projects that have multiple ownership structures within them. Accordingly, portions of these projects may appear as owned, consolidated or accounted for using the equity method. |

(c) | Lots are for the total project, regardless of our ownership interest. Lots remaining represent vacant developed lots, lots under development and future planned lots and are subject to change based on business plan revisions. |

(d) | Commercial acres are for the total project, regardless of our ownership interest, and are net developable acres, which may be fewer than the gross acres available in the project. |

(e) | Excludes acres associated with commercial and income producing properties. |

9

A summary of our significant commercial and multifamily properties at third quarter-end 2015 follows:

Project | Market | Interest Owned (a) | Type | Acres | Description | |||||||

Radisson Hotel | Austin | 100 | % | Hotel | 2 | 413 guest rooms and suites | ||||||

Dillon (b) | Charlotte | 100 | % | Multifamily | 3 | 379-unit luxury apartment | ||||||

Eleven | Austin | 100 | % | Multifamily | 3 | 257-unit luxury apartment | ||||||

Midtown | Dallas | 100 | % | Multifamily | 13 | 354-unit luxury apartment | ||||||

Music Row (b) | Nashville | 100 | % | Multifamily | 1 | 230-unit luxury apartment | ||||||

Elan 99 (b) | Houston | 90 | % | Multifamily | 17 | 360-unit luxury apartment | ||||||

Acklen (b) | Nashville | 30 | % | Multifamily | 4 | 320-unit luxury apartment | ||||||

HiLine (b) | Denver | 25 | % | Multifamily | 18 | 385-unit luxury apartment | ||||||

360° (b) | Denver | 20 | % | Multifamily | 4 | 304-unit luxury apartment | ||||||

_____________________

(a) | Interest owned reflects our total interest in the project, whether owned directly or indirectly. |

(b) | Construction in progress. |

10

FORESTAR GROUP INC.

OIL AND GAS SEGMENT

PERFORMANCE METRICS

Third Quarter | First Nine Months | ||||||||||||||

2015 | 2014 | 2015 | 2014 | ||||||||||||

Leasing Activity from Owned Mineral Interests | |||||||||||||||

Acres Leased | 1,720 | 744 | 3,343 | 3,865 | |||||||||||

Average Bonus / Acre | $ | 291 | $ | 205 | $ | 298 | $ | 320 | |||||||

Delay Rentals Received | $ | 98,000 | $ | — | $ | 182,000 | $ | 14,000 | |||||||

Oil & Gas Production | |||||||||||||||

Royalty Interests (a) | |||||||||||||||

Gross Wells (at end of the period) | 533 | 547 | 533 | 547 | |||||||||||

Oil Production (Barrels) (b) | 31,800 | 32,900 | 102,600 | 96,000 | |||||||||||

Average Oil Price ($ / Barrel) | $ | 45.92 | $ | 91.08 | $ | 47.81 | $ | 89.34 | |||||||

Natural Gas Production (MMcf) | 258.3 | 273.5 | 775.3 | 792.0 | |||||||||||

Average Natural Gas Price ($ / Mcf) | $ | 2.45 | $ | 4.35 | $ | 2.82 | $ | 4.18 | |||||||

BOE Production (c) | 74,800 | 78,500 | 231,800 | 228,000 | |||||||||||

Average Price ($ / BOE) | $ | 27.94 | $ | 53.30 | $ | 30.60 | $ | 52.15 | |||||||

Working Interests | |||||||||||||||

Gross Wells (at end of the period) | 413 | 447 | 413 | 447 | |||||||||||

Oil Production (Barrels) (b) | 277,500 | 229,100 | 789,500 | 575,300 | |||||||||||

Average Oil Price ($ / Barrel) | $ | 36.87 | $ | 83.17 | $ | 41.23 | $ | 87.74 | |||||||

Natural Gas Production (MMcf) | 293.5 | 226.2 | 855.9 | 654.1 | |||||||||||

Average Natural Gas Price ($ / Mcf) | $ | 2.20 | $ | 4.12 | $ | 2.60 | $ | 4.59 | |||||||

BOE Production (c) | 326,400 | 266,900 | 932,100 | 684,400 | |||||||||||

Average Price ($ / BOE) | $ | 33.32 | $ | 74.91 | $ | 37.31 | $ | 78.15 | |||||||

Total Oil & Gas Interests | |||||||||||||||

Gross Wells (d) (at end of the period) | 914 | 961 | 914 | 961 | |||||||||||

Oil Production (Barrels) (b) | 309,300 | 262,000 | 892,100 | 671,300 | |||||||||||

Average Oil Price ($ / Barrel) | $ | 37.80 | $ | 84.16 | $ | 41.98 | $ | 87.97 | |||||||

Natural Gas Production (MMcf) | 551.8 | 499.7 | 1,631.2 | 1,446.1 | |||||||||||

Average Natural Gas Price ($ / Mcf) | $ | 2.31 | $ | 4.24 | $ | 2.71 | $ | 4.37 | |||||||

BOE Production (c) | 401,200 | 345,400 | 1,163,900 | 912,400 | |||||||||||

Average Price ($ / BOE) | $ | 32.32 | $ | 70.00 | $ | 35.97 | $ | 71.65 | |||||||

Average Daily Production | |||||||||||||||

BOE per Day | |||||||||||||||

Royalty Interests | 813 | 853 | 849 | 835 | |||||||||||

Working Interests | 3,548 | 2,901 | 3,414 | 2,507 | |||||||||||

Total | 4,361 | 3,754 | 4,263 | 3,342 | |||||||||||

Working Interests BOE per Day | |||||||||||||||

North Dakota | 2,589 | 1,664 | 2,318 | 1,347 | |||||||||||

Kansas/Nebraska | 476 | 707 | 563 | 610 | |||||||||||

Texas, Louisiana and Other | 483 | 530 | 533 | 550 | |||||||||||

Total | 3,548 | 2,901 | 3,414 | 2,507 | |||||||||||

_____________________

(a) | Includes our share of venture activity of which we own a 50% interest. Our share of natural gas production was 46.8 MMcf and 129.2 MMcf in the third quarter and first nine months of 2015 and 49.1 MMcf and 152.3 MMcf in the third quarter and first nine months of 2014. |

(b) | Oil production includes natural gas liquids (NGLs). |

(c) | BOE – Barrels of oil equivalent (converting natural gas to oil at 6 Mcfe / Bbl). |

(d) | Represent wells in which we own a royalty or working interest in a producing well. Includes wells operated by third-party lessees/operators. Excludes 31 and 33 working interest wells at third quarter-end 2015 and third quarter-end 2014, as we also own a royalty interest in these wells. |

11

FORESTAR GROUP INC.

OIL AND GAS SEGMENT

Third Quarter | First Nine Months | ||||||||||

2015 | 2014 | 2015 | 2014 | ||||||||

Well Activity | |||||||||||

Mineral Interests Owned (a) | |||||||||||

Net Acres Held By Production | 36,000 | 36,000 | 36,000 | 36,000 | |||||||

Productive Gross Wells | 532 | 547 | 532 | 547 | |||||||

Mineral Interests Leased | |||||||||||

Net Acres Held By Production (b) | 45,000 | 46,000 | 45,000 | 46,000 | |||||||

Gross Wells Drilled | 7 | 31 | 38 | 97 | |||||||

Productive Gross Wells (c) | 382 | 414 | 382 | 414 | |||||||

Total Well Activity | |||||||||||

Net Acres Held By Production | 81,000 | 82,000 | 81,000 | 82,000 | |||||||

Gross Wells Drilled | 7 | 31 | 38 | 97 | |||||||

Productive Gross Wells | 914 | 961 | 914 | 961 | |||||||

_____________________

(a) | Represent wells in which we own a royalty or working interest in a producing well. Includes wells operated by third-party lessees/operators. |

(b) | Excludes approximately 8,000 net acres in which we have an overriding royalty interest. |

(c) | Excludes approximately 1,200 wells in which we have an overriding royalty, and 31 and 33 working interest wells at third quarter-end 2015 and third quarter-end 2014, as we also own a royalty interest in these wells. |

12

FORESTAR GROUP INC.

OTHER NATURAL RESOURCES SEGMENT

PERFORMANCE METRICS

Third Quarter | First Nine Months | ||||||||||||||

2015 | 2014 | 2015 | 2014 | ||||||||||||

Fiber Sales | |||||||||||||||

Pulpwood tons sold | 45,600 | 71,500 | 109,100 | 157,900 | |||||||||||

Average pulpwood price per ton | $ | 9.89 | $ | 11.18 | $ | 9.41 | $ | 11.00 | |||||||

Sawtimber tons sold | 14,400 | 21,500 | 53,800 | 100,000 | |||||||||||

Average sawtimber price per ton | $ | 20.41 | $ | 21.31 | $ | 21.22 | $ | 22.38 | |||||||

Total tons sold | 60,000 | 93,000 | 162,900 | 257,900 | |||||||||||

Average stumpage price per ton (a) | $ | 12.41 | $ | 13.52 | $ | 13.31 | $ | 15.41 | |||||||

Recreational Activity | |||||||||||||||

Average recreational acres leased | 97,000 | 107,800 | 99,900 | 111,400 | |||||||||||

Average price per leased acre | $ | 8.93 | $ | 8.66 | $ | 9.18 | $ | 9.17 | |||||||

_____________________

(a) | Average stumpage price per ton is based on gross revenues less cut and haul costs. |

13

FORESTAR GROUP INC.

CALCULATION OF NON-GAAP FINANCIAL MEASURES

(UNAUDITED)

In our third quarter and first nine months 2015 earnings release and conference call presentation materials furnished to the Securities and Exchange Commission on Form 8-K on November 4, 2015, we used certain non-GAAP financial measures. The non-GAAP financial measures should not be relied upon to the exclusion of GAAP financial measures. These non-GAAP financial measures reflect an additional way of viewing aspects of our operations that, when viewed with our GAAP financial statements and the accompanying reconciliations to corresponding GAAP financial measures, may provide a more complete understanding of our business. We strongly encourage investors to review our consolidated financial statements and publicly filed reports in their entirety.

Reconciliation of Non-GAAP Financial Measures (Unaudited)

The following table shows a reconciliation of net income before special items and earnings per share excluding special items to net income and earnings per share (the most directly comparable measure calculated and presented in accordance with generally accepted accounting principles, or GAAP). Net income excluding special items and earnings per share excluding special items are useful to evaluate the performance of the company because it excludes non-recurring non-cash impairments and other costs, which management believes are not indicative of the ongoing operating results of the business. A reconciliation of net income and earnings per share excluding special items to net income and earnings per share as computed under GAAP is illustrated below:

Third Quarter | First Nine Months | ||||||||||||||

2015 | 2014 | 2015 | 2014 | ||||||||||||

(In millions, except share data) | |||||||||||||||

Net income (loss) - as reported | ($164.2 | ) | $5.2 | ($206.9 | ) | $28.4 | |||||||||

Net income (loss) per share - as reported | ($4.79 | ) | $0.12 | ($6.04 | ) | $0.65 | |||||||||

Special items: | |||||||||||||||

Deferred tax asset valuation allowance | 98.9 | — | 98.9 | — | |||||||||||

Proved property impairments - oil & gas | 42.5 | — | 58.8 | — | |||||||||||

Unproved leasehold interest impairments - oil & gas | 10.3 | — | 23.8 | — | |||||||||||

Exploratory dry hole expense and other charges | — | — | 6.9 | — | |||||||||||

Severance related charges | 2.2 | — | 2.2 | — | |||||||||||

Total special items (after-tax) | $153.9 | $— | $190.6 | $— | |||||||||||

Total special items per share (after-tax) | $4.48 | $— | $5.57 | $— | |||||||||||

Net income (loss) - excluding special items | ($10.3 | ) | $5.2 | ($16.3 | ) | $28.4 | |||||||||

Net Income (loss) per share - excluding special items | ($0.31 | ) | $0.12 | ($0.47 | ) | $0.65 | |||||||||

14

Third Quarter 2015 Financial Results November 4, 2015 Exhibit 99.2

Notice to Investors This presentation contains “forward-looking statements” within the meaning of the federal securities laws. Forward-looking statements are typically identified by words or phrases such as “will,” “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “target,” “forecast,” and other words and terms of similar meaning. These statements reflect management’s current views with respect to future events and are subject to risk and uncertainties. We note that a variety of factors and uncertainties could cause our actual results to differ significantly from the results discussed in the forward-looking statements, including but not limited to: general economic, market, or business conditions; changes in commodity prices; opportunities (or lack thereof) that may be presented to us and that we may pursue; fluctuations in costs and expenses including development costs; demand for new housing, including impacts from mortgage credit rates or availability; lengthy and uncertain entitlement processes; cyclicality of our businesses; accuracy of accounting assumptions; competitive actions by other companies; changes in laws or regulations; and other factors, many of which are beyond our control. Except as required by law, we expressly disclaim any obligation to publicly revise any forward-looking statements contained in this presentation to reflect the occurrence of events after the date of this presentation. This presentation includes Non-GAAP financial measures. The required reconciliation to GAAP financial measures can be found as an exhibit to this presentation and on our website at www.forestargroup.com. 2

Initiatives Reducing Costs Across the Entire Organization • Taking actions to eliminate over $13 million of G&A and segment operating expenses in 2016 vs 2015, an estimated 22% cost reduction • Additional cost reductions to be identified across organization Reviewing Entire Portfolio of Assets • Core residential housing assets• Non-core, non-residential housing assets Reviewing Capital Structure • Evaluating capital structure Reviewing Additional Disclosures • Reviewing additional disclosures Focusing Forestar on Residential Housing Development 3 Tremendous Changes Underway at Forestar

Third Quarter 2015 Results Impacted By Deferred Tax Asset Valuation Allowance and Impairment Charges Principally Related To Non-Core Oil and Gas Assets 4 ($ in Millions, except per share data) Q3 2015 Q3 2014 Net Income (Loss) - As Reported ($164.2) $5.2 Net Income (Loss) Per Share - As Reported ($4.79) $0.12 Special Items: Deferred Tax Asset Valuation Allowance 98.9 -- Proved Property Impairments – Oil & Gas 42.5 -- Unproved Leasehold Interest Impairments – Oil & Gas 10.3 -- Severance Related Charges 2.2 -- Total Special Items (After-Tax) $153.9 -- Net Income (Loss) – Excluding Special Items* ($10.3) $5.2 Net Income (Loss) Per Share – Excluding Special Items* ($0.31) $0.12 • Q3 2015 financial results include non-cash charges of ($52.8) million, or ($1.54) per share, after-tax, primarily associated with impairment of proved properties and unproved leasehold interests associated with non-core oil and gas assets principally in North Dakota, Nebraska and Kansas • Q3 2015 financial results include a deferred tax asset valuation allowance of ($98.9) million, or ($2.88) per share, as a result of cumulative net losses incurred over the three-year period ending September 30, 2015 primarily due to non-cash asset impairment charges related to the oil and gas segment *Reconciliation to GAAP can be found in the appendix to this presentation Note: Weighted average diluted shares outstanding were 34.3 million in Q3 2015 and 43.9 million in Q3 2014 (Q3 2015 diluted shares outstanding exclude 7.9 million shares associated with tangible equity units issued during Q4 2013)

Segment Results Adversely Impacted By Impairment Charges Related to Non-Core Oil & Gas Assets 5 ($ in Millions, except per share data) Q3 2015 As Reported Q3 2015 Excluding Special Items* Q3 2014 As Reported Segment Earnings (Loss) Real Estate $5.2 $5.2 $16.0 Oil and Gas (86.2) (5.0) 6.0 Other Natural Resources (0.1) (0.1) 0.7 Total Segment Earnings (Loss) ($81.1) $0.1 $22.7 • Q3 2014 real estate segment results include a gain of $7.6 million, pre-tax, associated with acquisition of our partner’s interest in the Eleven multifamily venture in Austin • Q3 2015 oil and gas segment results include non-cash charges of ($81.2) million, pre-tax, principally associated with impairment of proved properties and unproved leasehold interests associated with non-core oil and gas assets principally in North Dakota, Nebraska and Kansas * Reconciliation to GAAP can be found in the appendix to this presentation.

Stable Market Demand in Texas with Construction and Inspection Delays Impacting Lot Sales Timing 6 Texas New Home Inventory Below Equilibrium 0.00 0.50 1.00 1.50 2.00 2.50 3.00 3.50 0 5,000 10,000 15,000 20,000 25,000 30,000 1Q01 1Q02 1Q03 1Q04 1Q05 1Q06 1Q07 1Q08 1Q09 1Q10 1Q11 1Q12 1Q13 1Q14 1Q15 Housing Inventory Months of Supply Equilibrium M on th s of S up pl y Ne w Ho m e In ve nt or ie s Note: Includes ventures Source: Metrostudy and Bureau of Labor Statistics September 2015 vs. September 2014 Austin 3.2% Dallas / Fort Worth 3.2% Houston 1.2% San Antonio 3.7% U.S. Average 2.0% Texas Job Growth vs. National Average • 2015 total lot sales expected to be in the range of 1,400 – 1,600 lots, primarily due to construction and inspection delays 0 500 1,000 1,500 2,000 Q 11 2 Q 21 2 Q 31 2 Q 41 2 Q 11 3 Q 21 3 Q 31 3 Q 41 3 Q 11 4 Q 21 4 Q 31 4 Q 41 4 Q 11 5 Q 21 5 Q 31 5 Re sid en tia l L ot s Developed Lots Lots Under Development Forestar: > 1,440 Lots Under Option Contract

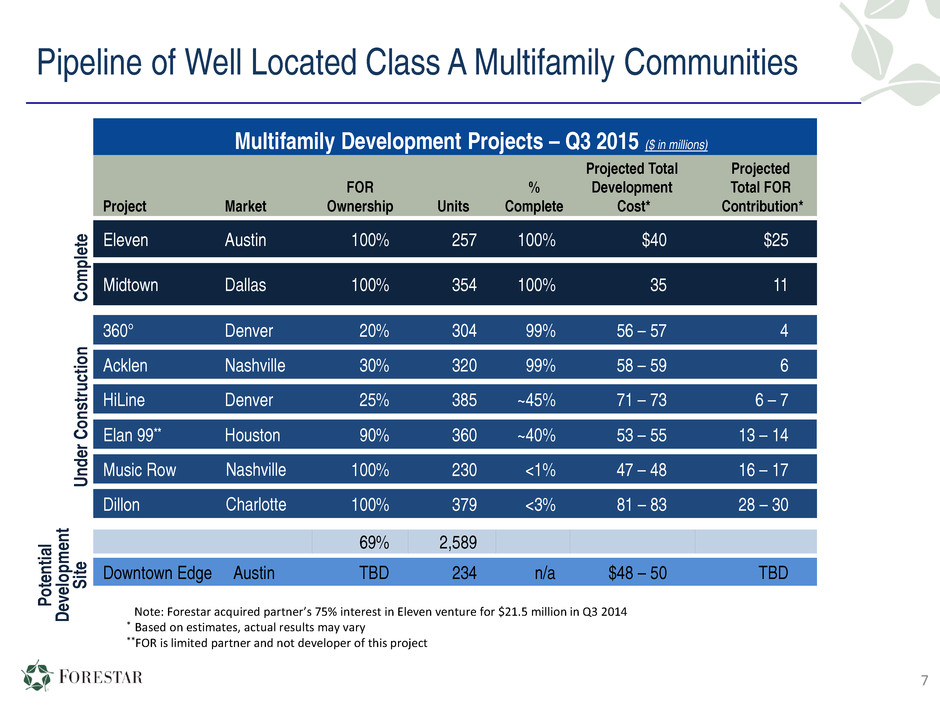

Pipeline of Well Located Class A Multifamily Communities Multifamily Development Projects – Q3 2015 ($ in millions) Project Market FOR Ownership Units % Complete Projected Total Development Cost* Projected Total FOR Contribution* Co m pl et e Eleven Austin 100% 257 100% $40 $25 Midtown Dallas 100% 354 100% 35 11 Un de r C on st ru ct io n 360° Denver 20% 304 99% 56 – 57 4 Acklen Nashville 30% 320 99% 58 – 59 6 HiLine Denver 25% 385 ~45% 71 – 73 6 – 7 Elan 99** Houston 90% 360 ~40% 53 – 55 13 – 14 Music Row Nashville 100% 230 <1% 47 – 48 16 – 17 Dillon Charlotte 100% 379 <3% 81 – 83 28 – 30 69% 2,589 Downtown Edge Austin TBD 234 n/a $48 – 50 TBD Note: Forestar acquired partner’s 75% interest in Eleven venture for $21.5 million in Q3 2014 * Based on estimates, actual results may vary **FOR is limited partner and not developer of this project 7 Po te nt ia l De ve lo pm en t Si te

8

Third Quarter 2014 Non-Cash Gains and Lot Closing Delays Impact Year-Over-Year Real Estate Results ($7.2) ($2.5) $16.0 $1.6 $1.0 $0.2 ($2.2) ($1.7) $5.2 $0 $10 $20 Q3 2014 Multifamily and Income Producing Properties Residential & Commercial Tract Sales Undeveloped Land Sales Gains* Lot Sales Operating Expenses Interest Income Q3 2015 Segment Earnings Reconciliation Q3 2014 vs. Q3 2015 ($ in millions) Q3 2015 Highlights Residential Lots – 301 lots sold • >$76,600 avg. price per lot - up >4% vs Q3 2014 • ~$30,600 gross profit per lot - down >12% vs Q3 2014, due to mix of lots sold Residential Tracts – 220 acres sold • >$2,800 average price per acre Undeveloped Land – 4,616 acres sold, principally from 50% joint-venture • $2,200 average price per acre • ~$3.0 million in segment earnings 10 Note: Includes ventures *Includes $7.6 million gain in Q3 2014 associated with the acquisition of our partner’s 75% interest in the Eleven multifamily venture in Austin for $21.5 million reflecting the fair market value of the project on the date of acquisition. Includes $0.4 million gain in Q3 2015 related to proceeds from Cibolo hotel and occupancy receipts

Real Estate Segment KPI’s Q3 2015 Q3 2014 YTD Q3 2015 YTD Q3 2014 Residential Lot Sales Lots Sold 301 323 1,109 1,834 Average Price / Lot* $76,600 $73,700 $75,000 $54,400 Gross Profit / Lot* $30,600 $34,900 $34,200 $22,800 Commercial Tract Sales Acres Sold 3 4 56 7 Average Price / Acre $28,000 $589,200 $217,000 $369,900 Undeveloped Land Sales Acres Sold 4,616 637 6,595 13,174 Average Price / Acre $2,200 $3,200 $2,400 $2,200 Segment Revenues ($ in Millions) $28.0 $32.4 $100.2 $153.1 Segment Earnings ($ in Millions) $5.2 $16.0 $29.7 $66.9 YTD Q3 2014 average sales price was approximately $64,600 per lot and average gross profit was approximately $28,000 per lot, excluding almost 370 bulk lot sales. Q3 2014 and YTD Q3 2014 real estate segment results include a 7.6 million gain associated with the purchase of our partner’s 75% interest in Eleven, an Austin multifamily project. YTD Q3 2014 results also include a $10.5 million gain associated with a non-monetary exchange of leasehold timber rights for 5,400 acres of undeveloped land with a partner in a consolidated venture. Note: Includes ventures 11 **** ** * * *

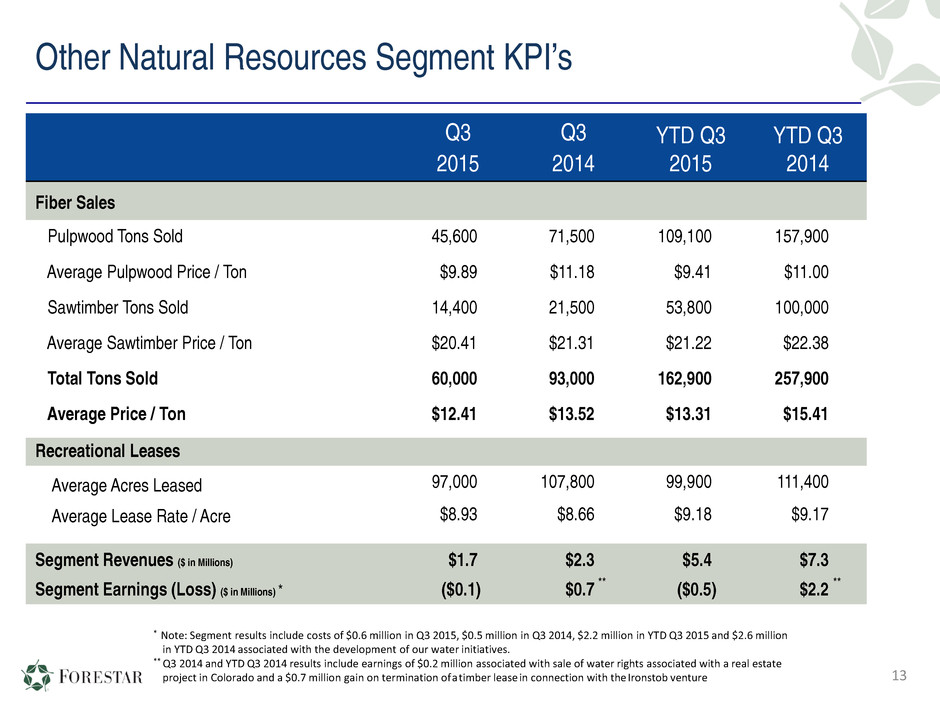

Harvesting Value From Timberland Segment Earnings (Loss) Reconciliation Q3 2014 vs. Q3 2015 ($ in millions) $0.7 ($0.5) ($0.2) ($0.2) $0.1 ($0.1) ($0.5) $0.0 $0.5 $1.0 Q3 2014 Operating Costs Fiber Earnings Gain on Timber Lease Termination Water Earnings Q3 2015 Se gm en t E ar ni ng s (L os s) Q3 2015 Highlights • Sold > 60,000 tons of fiber, 35% lower vs. Q3 2014 due to reduced harvest schedules • Average fiber pricing $12.41 per ton, down 8% vs. Q3 2014 due to lower pulpwood and sawtimber pricing 12Note: Includes ventures Note: Q3 2014 segment results include $0.2 million gain associated with the sale of water rights related to a real estate project in Colorado

Other Natural Resources Segment KPI’s Q3 2015 Q3 2014 YTD Q3 2015 YTD Q3 2014 Fiber Sales Pulpwood Tons Sold 45,600 71,500 109,100 157,900 Average Pulpwood Price / Ton $9.89 $11.18 $9.41 $11.00 Sawtimber Tons Sold 14,400 21,500 53,800 100,000 Average Sawtimber Price / Ton $20.41 $21.31 $21.22 $22.38 Total Tons Sold 60,000 93,000 162,900 257,900 Average Price / Ton $12.41 $13.52 $13.31 $15.41 Recreational Leases Average Acres Leased 97,000 107,800 99,900 111,400 Average Lease Rate / Acre $8.93 $8.66 $9.18 $9.17 Segment Revenues ($ in Millions) $1.7 $2.3 $5.4 $7.3 Segment Earnings (Loss) ($ in Millions) * ($0.1) $0.7 ($0.5) $2.2 * Note: Segment results include costs of $0.6 million in Q3 2015, $0.5 million in Q3 2014, $2.2 million in YTD Q3 2015 and $2.6 million in YTD Q3 2014 associated with the development of our water initiatives. ** Q3 2014 and YTD Q3 2014 results include earnings of $0.2 million associated with sale of water rights associated with a real estate project in Colorado and a $0.7 million gain on termination ofatimber lease in connection with the Ironstob venture 13 ** **

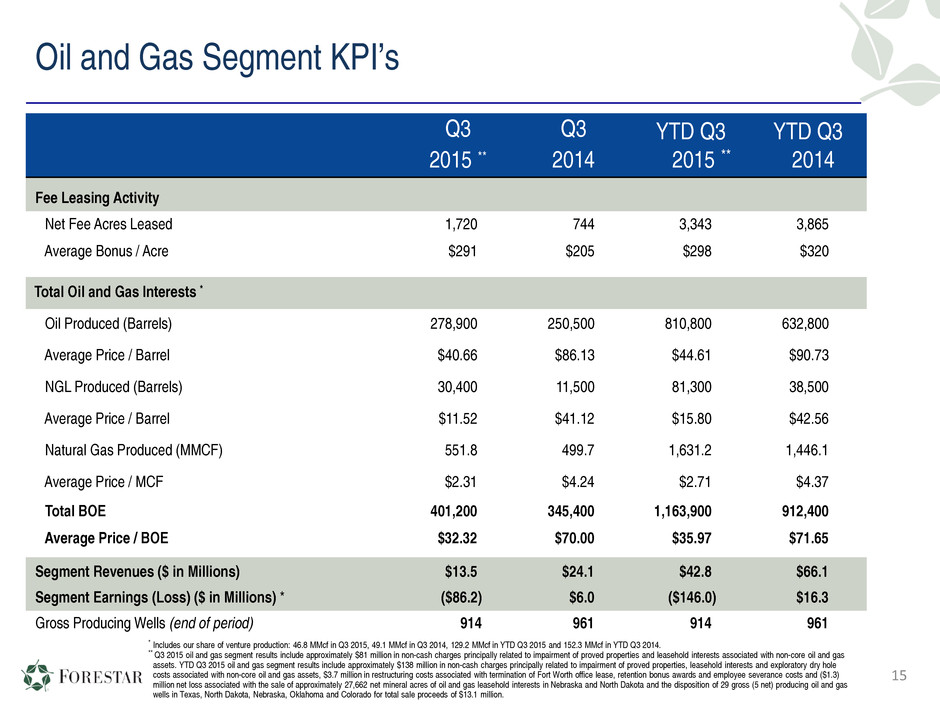

Continued Declining Oil Price Negatively Impact Oil & Gas Results $6.0 $1.2 $4.2 ($5.5) ($1.5) ($5.0) ($13.4) ($10) ($5) $0 $5 $10 $15 $20 Q3 2014 Exploratroy Dry Hole Costs Working Interest Volume Operating Expenses Working Interest Cost of Sales Working Interest Pricing Gain on Sale Legacy Minerals Q3 2015 (Exluding Non-Cash Impairments) Se gm en t E ar ni ng s (L os s) $0.4 $3.6 Segment Earnings (Loss) Reconciliation Q3 2014 vs. Q3 2015 ($ in millions) Q3 2015 Highlights • Incurred non-cash impairment charges of ($81.2) million • Principally related to proved properties and unproved leasehold interests in North Dakota, Nebraska and Kansas • Oil production up >18% vs. Q3 2014** • Avg. working interest oil price down nearly 56% vs. Q3 2014** • Segment G&A expenses down 36% in Q3 2015 vs. Q3 2014 • Generated positive cash flow Q3 2015 vs Q3 2014 • Generated approximately $18.4 million in net cash flow in Q3 2015, including approximately $10.6 million from non-core asset sales, compared with ($4) million negative cash flow in Q3 2014 14 * Q3 2015 non-cash charges Include ($81.2) million principally associated with proved property and unproved leasehold interest impairments, primarily associated with non-core oil and gas assets in North Dakota, Nebraska and Kansas. ** Oil volumes and prices include NGL’s Note: Includes ventures Excluding Non-Cash Impairments

Oil and Gas Segment KPI’s Q3 2015 ** Q3 2014 YTD Q3 2015 ** YTD Q3 2014 Fee Leasing Activity Net Fee Acres Leased 1,720 744 3,343 3,865 Average Bonus / Acre $291 $205 $298 $320 Total Oil and Gas Interests * Oil Produced (Barrels) 278,900 250,500 810,800 632,800 Average Price / Barrel $40.66 $86.13 $44.61 $90.73 NGL Produced (Barrels) 30,400 11,500 81,300 38,500 Average Price / Barrel $11.52 $41.12 $15.80 $42.56 Natural Gas Produced (MMCF) 551.8 499.7 1,631.2 1,446.1 Average Price / MCF $2.31 $4.24 $2.71 $4.37 Total BOE 401,200 345,400 1,163,900 912,400 Average Price / BOE $32.32 $70.00 $35.97 $71.65 Segment Revenues ($ in Millions) $13.5 $24.1 $42.8 $66.1 Segment Earnings (Loss) ($ in Millions) * ($86.2) $6.0 ($146.0) $16.3 Gross Producing Wells (end of period) 914 961 914 961 15 * Includes our share of venture production: 46.8 MMcf in Q3 2015, 49.1 MMcf in Q3 2014, 129.2 MMcf in YTD Q3 2015 and 152.3 MMcf in YTD Q3 2014. ** Q3 2015 oil and gas segment results include approximately $81 million in non-cash charges principally related to impairment of proved properties and leasehold interests associated with non-core oil and gas assets. YTD Q3 2015 oil and gas segment results include approximately $138 million in non-cash charges principally related to impairment of proved properties, leasehold interests and exploratory dry hole costs associated with non-core oil and gas assets, $3.7 million in restructuring costs associated with termination of Fort Worth office lease, retention bonus awards and employee severance costs and ($1.3) million net loss associated with the sale of approximately 27,662 net mineral acres of oil and gas leasehold interests in Nebraska and North Dakota and the disposition of 29 gross (5 net) producing oil and gas wells in Texas, North Dakota, Nebraska, Oklahoma and Colorado for total sale proceeds of $13.1 million.

Reconciliation of Non-GAAP Financial Measures (Unaudited) Forestar’s Segment EBITDA is a non-GAAP financial measure within the meaning of Regulation G of the Securities and Exchange Commission. Non-GAAP financial measures are not in accordance with, or an alternative to, U.S. Generally Accepted Accounting Principles (GAAP). The company believes presenting non-GAAP Segment EBITDA is helpful to analyze financial performance without the impact of items that may obscure trends in the company’s underlying performance. A detailed reconciliation is provided below outlining the differences between these non- GAAP measures and the directly related GAAP measures. Third Quarter Year-to-Date ($ in millions) 2015 2014 2015 2014 Real Estate Segment Earnings in accordance with GAAP $5.2 $16.0 $29.7 $66.9 Depreciation, Depletion & Amortization 2.1 0.7 5.9 2.0 Real Estate Segment EBITDA $7.3 $16.7 $35.6 $68.9 Oil & Gas Segment Earnings (Loss) in accordance with GAAP ($86.2) $6.0 ($146.0) $16.3 Depreciation, Depletion & Amortization 9.2 8.3 24.6 20.7 Oil and Gas Segment EBITDA ($77.0) $14.3 ($121.4) $37.0 Other Natural Resources Segment Earnings (Loss) in accordance with GAAP ($0.1) $0.7 ($0.5) $2.2 Depreciation, Depletion & Amortization 0.1 0.1 0.4 0.4 Other Natural Resources Segment EBITDA $0.0 $0.8 ($0.1) $2.6 Total Segment Total Segment Earnings (Loss) in accordance with GAAP ($81.1) $22.7 ($116.8) $85.4 Depreciation, Depletion & Amortization 11.4 9.1 30.9 23.1 Total Segment EBITDA ($69.7) $31.8 ($85.9) $108.5 16

Reconciliation of Non-GAAP Financial Measures (Unaudited) 17 In our third quarter and first nine months 2015 earnings release and conference call presentation materials furnished to the Securities and Exchange Commission on Form 8-K on November 4, 2015, we used certain non-GAAP financial measures. The non-GAAP financial measures should not be relied upon to the exclusion of GAAP financial measures. These non-GAAP financial measures reflect an additional way of viewing aspects of our operations that, when viewed with our GAAP financial statements and the accompanying reconciliations to corresponding GAAP financial measures, may provide a more complete understanding of our business. We strongly encourage investors to review our consolidated financial statements and publicly filed reports in their entirety. Reconciliation of Non-GAAP Financial Measures (Unaudited) The following table shows a reconciliation of net income before special items and earnings per share excluding special items to net income and earnings per share (the most directly comparable measure calculated and presented in accordance with generally accepted accounting principles, or GAAP). Net income excluding special items and earnings per share excluding special items are useful to evaluate the performance of the company because it excludes non-recurring non-cash impairments and other costs, which management believes are not indicative of the ongoing operating results of the business. A reconciliation of net income and earnings per share excluding special items to net income and earnings per share as computed under GAAP is illustrated below: Third Quarter Year-to-Date ($ in millions except per share data) 2015 2014 2015 2014 Net Income (Loss) – As Reported ($164.2) $5.2 ($206.9) $28.4 Earnings (Loss) Per Share – As Reported ($4.79) $0.12 ($6.04) $0.65 Special Items Proved Property Impairments – oil & gas 42.5 ---- 58.8 ---- Unproved Leasehold Interest Impairments – oil & gas 10.3 ---- 23.8 ---- Exploratory Dry Hole Expense and Other Charges ---- ---- 6.9 ---- Severance-Related Charges 2.2 ---- 2.2 ---- Deferred Tax Asset Valuation Allowance 98.9 ---- 98.9 ---- Total Special Items (after-tax) $153.9 $---- $190.6 $---- Total Special Items Per Share (after-tax) $4.48 $---- $5.57 $---- Net Income (Loss) – Excluding Special Items ($10.3) $5.2 ($16.3) $28.4 Net Income (Loss) Per Share – Excluding Special Items ($0.31) $0.12 ($0.47) $0.65

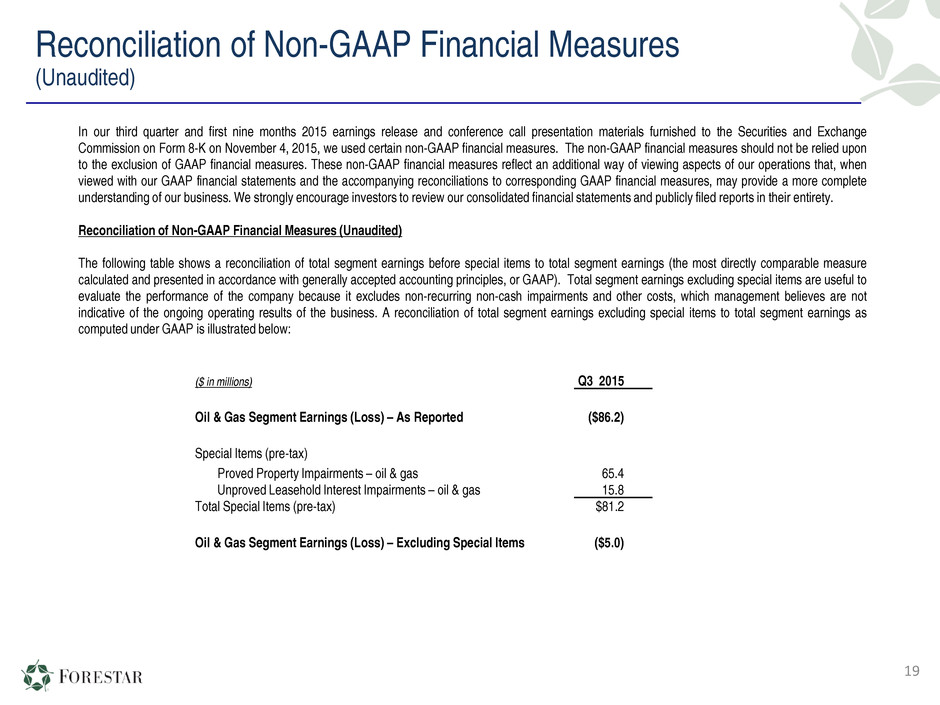

Reconciliation of Non-GAAP Financial Measures (Unaudited) 18 In our third quarter and first nine months 2015 earnings release and conference call presentation materials furnished to the Securities and Exchange Commission on Form 8-K on November 4, 2015, we used certain non-GAAP financial measures. The non-GAAP financial measures should not be relied upon to the exclusion of GAAP financial measures. These non-GAAP financial measures reflect an additional way of viewing aspects of our operations that, when viewed with our GAAP financial statements and the accompanying reconciliations to corresponding GAAP financial measures, may provide a more complete understanding of our business. We strongly encourage investors to review our consolidated financial statements and publicly filed reports in their entirety. Reconciliation of Non-GAAP Financial Measures (Unaudited) The following table shows a reconciliation of total segment earnings before special items to total segment earnings (the most directly comparable measure calculated and presented in accordance with generally accepted accounting principles, or GAAP). Total segment earnings excluding special items are useful to evaluate the performance of the company because it excludes non-recurring non-cash impairments and other costs, which management believes are not indicative of the ongoing operating results of the business. A reconciliation of total segment earnings excluding special items to total segment earnings as computed under GAAP is illustrated below: Third Quarter Year-to-Date ($ in millions except per share data) 2015 2014 2015 2014 Total Segment Earnings (Loss) – As Reported ($81.1) $22.7 ($116.8) $85.4 Special Items (pre-tax) Proved Property Impairments – oil & gas 65.4 ---- 90.4 ---- Unproved Leasehold Interest Impairments – oil & gas 15.8 ---- 36.8 ---- Exploratory Dry Hole Expense and Other Charges ---- ---- 10.6 ---- Total Special Items (pre-tax) $81.2 $---- $137.8 $---- Total Segment Earnings – Excluding Special Items $0.1 $22.7 $21.0 $85.4

Reconciliation of Non-GAAP Financial Measures (Unaudited) 19 In our third quarter and first nine months 2015 earnings release and conference call presentation materials furnished to the Securities and Exchange Commission on Form 8-K on November 4, 2015, we used certain non-GAAP financial measures. The non-GAAP financial measures should not be relied upon to the exclusion of GAAP financial measures. These non-GAAP financial measures reflect an additional way of viewing aspects of our operations that, when viewed with our GAAP financial statements and the accompanying reconciliations to corresponding GAAP financial measures, may provide a more complete understanding of our business. We strongly encourage investors to review our consolidated financial statements and publicly filed reports in their entirety. Reconciliation of Non-GAAP Financial Measures (Unaudited) The following table shows a reconciliation of total segment earnings before special items to total segment earnings (the most directly comparable measure calculated and presented in accordance with generally accepted accounting principles, or GAAP). Total segment earnings excluding special items are useful to evaluate the performance of the company because it excludes non-recurring non-cash impairments and other costs, which management believes are not indicative of the ongoing operating results of the business. A reconciliation of total segment earnings excluding special items to total segment earnings as computed under GAAP is illustrated below: ($ in millions) Q3 2015 Oil & Gas Segment Earnings (Loss) – As Reported ($86.2) Special Items (pre-tax) Proved Property Impairments – oil & gas 65.4 Unproved Leasehold Interest Impairments – oil & gas 15.8 Total Special Items (pre-tax) $81.2 Oil & Gas Segment Earnings (Loss) – Excluding Special Items ($5.0)

20

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Forestar Group (FOR) Tops Q2 EPS by 16c

- Stockholder Alert: Robbins LLP Informs Investors of the Class Action Filed Against Sharecare, Inc. (SHCR)

- FangDD Files 2023 Annual Report on Form 20-F

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share