Form 6-K UBS Group AG For: Nov 03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

Date: November 3, 2015

UBS Group AG

Commission File Number: 1-36764

UBS AG

Commission File Number: 1-15060

(Registrants' Names)

Bahnhofstrasse 45, Zurich, Switzerland, and

Aeschenvorstadt 1, Basel, Switzerland

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20‑F or Form 40-F.

Form 20-F x Form 40-F o

This Form 6-K consists of the presentation materials related to the Third Quarter 2015 Results of UBS Group AG and UBS AG, and the related speaker notes, which appear immediately following this page.

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

UBS Third Quarter 2015 Earnings Call Remarks

November 3, 2015

Sergio P. Ermotti (Group CEO): Opening remarks

SLIDE 2 – 3Q15 highlights – Group

Thank you, Caroline. Good morning everyone.

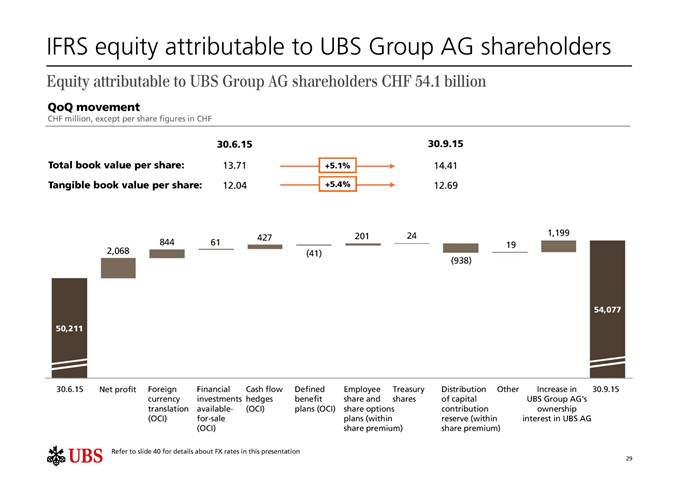

For the quarter, we reported a net profit attributable to UBS shareholders of 2.1 billion francs, which included a net tax benefit of 1.3 billion largely due to the revaluation of deferred tax assets, and a provision of 592 million for litigation, regulatory and similar matters. Adjusted profit before tax was 1 billion. These results led to a 5.4% quarter-on-quarter increase in tangible book value per share to 12.7 francs. We also made further progress in our cost reduction program, despite the cumulative impact of incremental permanent regulatory costs, with annualized net cost reductions of 1 billion francs so far.

The macroeconomic backdrop for the quarter was very challenging, as events in China and the expectation of a Fed hike followed by the Fed's decision not to raise rates, elevated levels of uncertainty and volatility. These issues added to the typical seasonality and client activity levels hit post-crisis lows, particularly in wealth management. Given this exceptionally challenging environment, our results were solid.

I am most pleased with our performance because we managed risk effectively – for our clients and shareholders, both when markets were booming and also when markets fell. Despite the extreme market volatility that during the summer prompted four times the normal level of margin calls in the quarter in Wealth Management, we did not record credit losses.

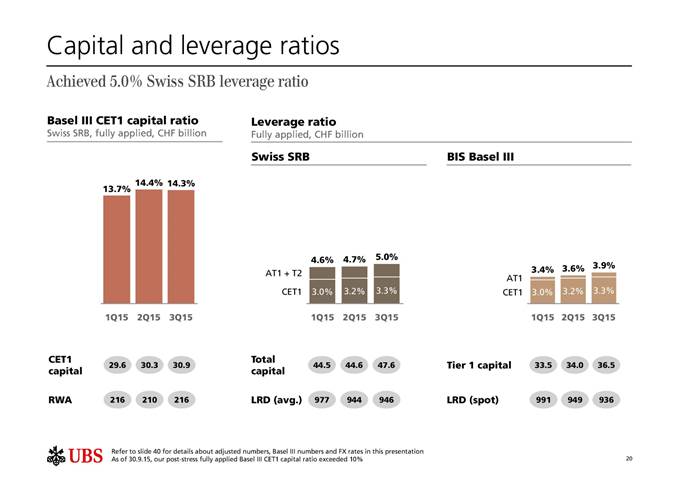

42

We remain the best capitalized large global bank, with a Basel 3 fully applied CET1 ratio of 14.3%. Our fully applied Swiss SRB leverage ratio increased to 5% and our BIS fully applied leverage ratio increased to 3.9%. Achieving a 5% leverage ratio under the current rules equates broadly to the requirements under the new rules, and underlines our view that we've never had a leverage ratio issue, but instead a definition problem.

SLIDE 3 – 3Q15 highlights - Business divisions

Turning to the business divisions, Wealth Management delivered a resilient performance, with around 700 million francs of high-quality pre-tax profit. Recurring income increased, reflecting continued success in our strategic initiatives, however transaction activity declined substantially as clients reacted to extreme volatility.

Costs have been carefully managed, and through the targeted front office headcount reductions we have already implemented, the business is freeing up capacity to invest in long-term growth.

Our balance sheet and capital optimization program is a great example of this, and we are very pleased with the results. It was a win-win result for clients and for the bank. The vast majority of the clients chose to invest in products with more attractive returns for them, at the same time improving our economic profitability and reducing our leverage ratio denominator.

Adjusted for the program and including almost four billion in outflows mostly related to deleveraging in Asia, net new money was 3.5 billion, with positive inflows in all regions. As I have said in the past and just explained, while net new money is an important indicator of growth for the business, quality is far more important to us than quantity, and our focus remains on sustainable long-term performance.

Wealth Management Americas delivered pre-tax profit of 287 million dollars on record recurring income. Net new money was 500 million dollars and our advisors remain the most productive in our peer group, with continued low attrition rates.

This quarter was an excellent example of how consistent client engagement, especially with the benefit of our insight and advice, has helped clients navigate difficult times. Our clients have benefitted from our disciplined focus on active risk profiling, strategic asset allocation and diversification, all of which helped mitigate the impacts of the severe market volatility.

43

At UBS, wealth management is not just a business that we are in; it's part of our DNA. As the only truly global wealth manager in the world, we are benefitting from the strong long-term fundamentals of this business and will seek opportunities and continue to capitalize on any dislocations the industry may experience.

Retail and Corporate delivered its best first nine months since 2010, with a very solid pre-tax quarterly profit of 428 million francs. Retail client assets and loans continued to grow, and once again, all KPIs were within their target range. Once again, these results reflect the significant investments we've made in our home market over the last four years, and they underline our leading position in, and commitment to, the Swiss market.

Asset Management delivered a pre-tax profit of 137 million on strong management fees. The business experienced net new money outflows of eight billion, much of which related to low-margin passive products, reflecting elevated client liquidity needs.

The Investment Bank delivered very good results, both on an absolute and relative basis, with a pre-tax profit of 614 million and strong performance in all areas. Equities delivered its best third quarter since 2010 and revenues in FX, rates and credit were up 37% year-over-year. We participated in several notable transactions, including lead financial advisor on Anthem's acquisition of Cigna; financial advisor to Ladbrokes on its merger with Coral and joint sponsor and global coordinator for the China Reinsurance IPO, to name a few. The IB again delivered high risk-adjusted returns within its allocated resources, underlining the success of its client centric, low-inventory business model, which is absolutely the right one for UBS.

So overall, I'm pleased with the quarter. We stayed close to our clients in a very challenging environment. Disciplined execution and our diversified business model allowed us to deliver strong returns for our shareholders while continuing to invest in our future.

44

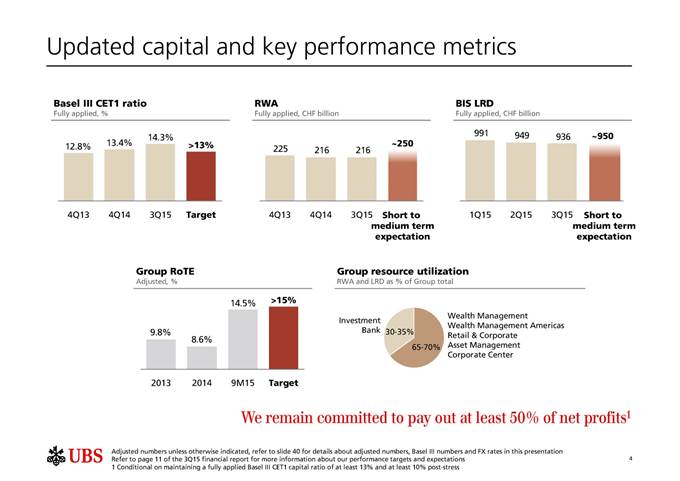

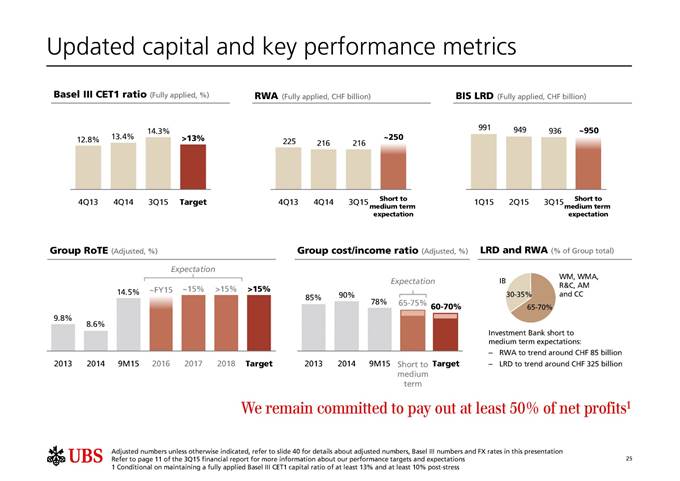

SLIDE 4 - Updated capital and key performance metrics

The Swiss Federal Council recently proposed stricter capital rules for global systemically important banks, making the Swiss regime by far the most demanding in the world on a relative basis. Tom will take you through the details of the proposals but I can confirm that UBS will be compliant with the new rules at inception and we intend to use the four year period to fully implement the new requirements.

Compliance with the new requirements will come at a significant additional cost, which will have an impact on return on tangible equity of up to 300 basis points. We will continue to work hard to offset these headwinds through further balance sheet optimization, executing our existing efficiency programs and by reflecting the increased cost of capital in the pricing of our products and services.

At the same time the market environment has become more challenging. Implied forward rates are materially lower than previously expected, we continue to operate with negative interest rates in Switzerland and Europe, and market returns are lower than long term averages, which has impacted invested asset levels.

At UBS targets do matter, as we believe we cannot run a successful business and create the appropriate accountability without them. They encourage management to take the right actions and despite very challenging markets have helped drive our successful transformation. In the real world things do change, and as I just described, regulation and the macroeconomic environment have changed materially, so we need to adjust both our actions and our expectations accordingly, but what must remain constant is our discipline and determination to deliver what we have promised in areas which we can control.

Despite some of the challenges I've mentioned, we've generated an adjusted year to date return on tangible equity of 14.5%, substantially above our target of around 10% for the year. We firmly believe our business model can generate adjusted returns on tangible equity of greater than 15%, but due to the macroeconomic and regulatory environment, and substantial DTA write-ups in the past two years, it is only realistic to temper our expectations in terms of timing. Due to regulatory inflation, we expect the Group's RWAs to trend to around 250 billion in the short-to-medium term. This represents de-facto, no overall change in our risk taking capacity.

45

The Group's LRD is likely to trend around 950 billion, providing modest additional capacity for our businesses. This may seem like a counter-intuitive reaction to higher leverage requirements, but as the rules are now more clearly defined. So this is now simply reflecting those and other minor adjustments, and the fact that it would be impossible to deliver long term sustainable growth and attractive and increasing capital returns by cutting our resources further. As I've said in the past, our strategic transformation is complete, we have the right strategy and shrinking to greatness is not part of it.

But let me be absolutely clear about two issues. First, there will be no change in our capital allocation philosophy and our discipline around limits, therefore the Investment Bank for example, will continue to represent no more than 30-35% of the Group's total LRD and RWA. Second, while for the foreseeable future, leverage ratio will be the binding constraint, we will continue to manage the risk of the bank based on risk weighted assets under advanced models, with leverage and stress as additional components. We believe this is the most appropriate approach to prudently manage risk for a bank like ours, and to produce sustainable risk adjusted results.

Most importantly our commitment to our capital returns policy is unchanged and we will continue to target a pay-out ratio of at least 50% of net profit, subject to maintaining a fully applied Basel III CET1 ratio of at least 13%, and 10% post-stress.

Thank you and I will now turn it over to Tom for detail on the quarter.

46

Tom Naratil (Group CFO & Group COO): Walk-through of the quarter

SLIDE 5 – UBS Group AG results (consolidated)

As usual, my commentary will reference adjusted results unless otherwise stated.

This quarter, we excluded an own credit gain of 32 million Swiss francs, a gain of 81 million related to our investment in the SIX Group, foreign currency translation losses of 27 million from the disposal of a subsidiary, net restructuring charges of 298 million, and a 21 million credit related to a change to retiree benefit plans in the US.

Profit before tax was one billion francs, and net profit attributable to UBS Group AG shareholders was 2.1 billion, including a net tax benefit of 1.3 billion. Return on tangible equity was 19.5% for the quarter, and 14.5% year-to-date.

Slide 6 – The World's leading wealth management franchise

Our wealth management businesses delivered another solid quarter, with a combined profit before tax of one billion, bringing us to 3.1 billion year-to-date, at a compound annual growth rate of 14% since 2012. As always, our focus is on long-term profitable growth, and we're targeting a combined annual pre-tax profit growth rate of 10-15% through the cycle for the combined businesses.

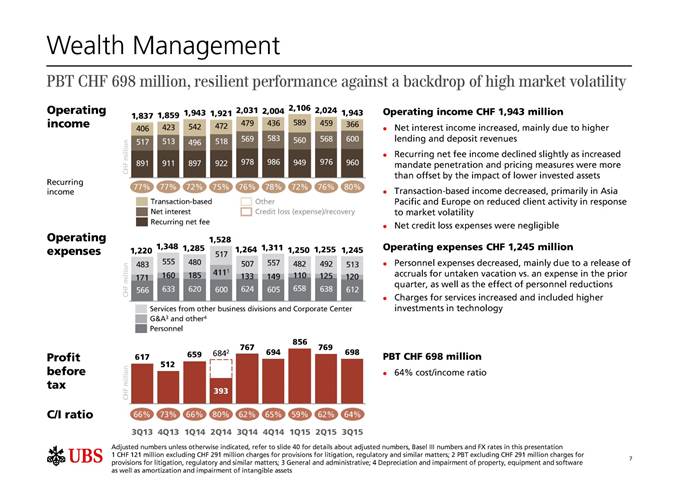

Slide 7 - Wealth Management

Wealth Management delivered a profit before tax of 698 million, as continued growth in recurring income was more than offset by lower transaction-based revenues.

Recurring revenues increased on higher net interest income, which rose 6% to 600 million on higher lending and deposit revenues. Recurring net fee income declined slightly as the benefits from our strategic initiatives to increase mandate penetration and improve pricing were more than offset by the impact of lower invested assets.

Transaction-based income declined to its lowest level since the financial crisis, as high volatility led to a substantial reduction in client activity, primarily in APAC and Europe.

The business demonstrated solid cost control, with expenses down 1% to 1.2 billion. The cost/income ratio was 64%, within our target range of 55 to 65%.

47

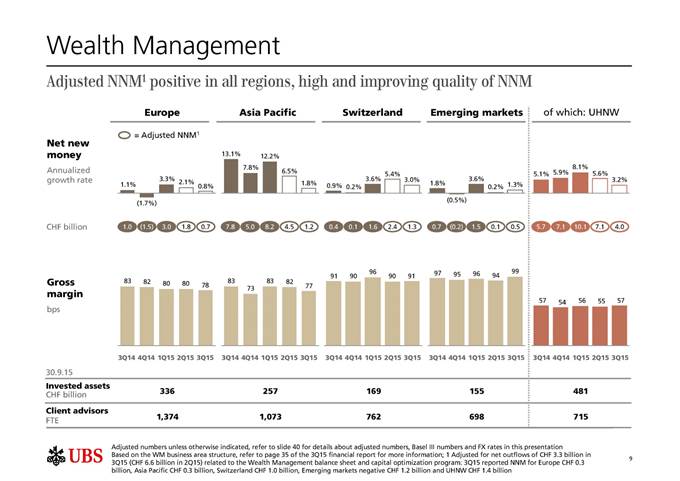

Slide 8 - Wealth Management

We're pleased with the quality of the net new money we've delivered so far this year. Internally, we measure our performance using return-adjusted net new money. On this measure, we've seen an improving quality of flows in the quarter and year-to-date.

Mandate penetration increased by 70 basis points to 27%, as the business delivered 4.8 billion in net new mandates, with balanced distribution across regions.

Loan balances were down marginally as positive currency translation effects were more than offset by the impact of deleveraging.

Invested assets declined for the third consecutive quarter, which last occurred at the onset of the Eurozone crisis.

Monthly gross margin trended down throughout the quarter, from 86 basis points in July, to 81 basis points in August, and to 80 basis points in September. Fourth quarter revenues will be affected by invested asset levels at the end of the third quarter, as well as the gross margin in September.

Slide 9 - Wealth Management

Adjusted net new money was positive in all regions, despite client deleveraging.

Operating income was down slightly in Switzerland, but gross margin increased on a lower invested asset base. Operating income increased in Emerging markets, while decreasing in Europe and APAC, with sharp declines in transaction-based income.

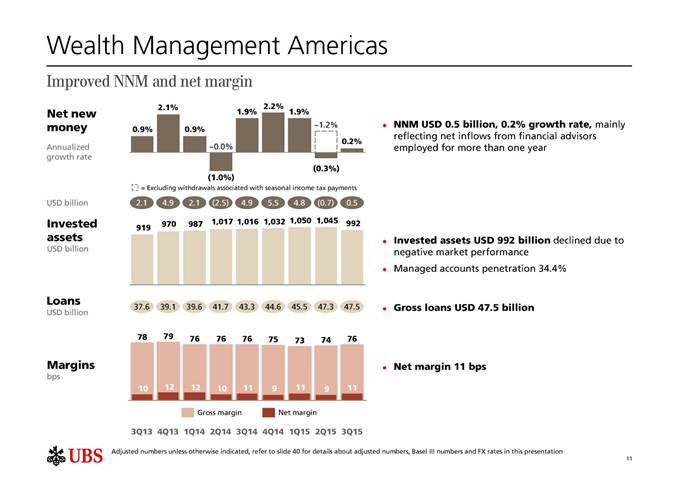

Slide 10 - Wealth Management Americas

Wealth Management Americas delivered a profit before tax of 287 million dollars, up 24% on record recurring income and lower expenses, partly offset by lower transaction-related income.

Operating income was 1.9 billion, with recurring income increasing 2% to 1.5 billion, accounting for a record 80% of total income. Strong recurring income reflected record net fees, which increased 1% on higher managed account fees, and also record net interest income, which increased 3% on growth in lending and deposit balances.

48

Operating expenses decreased by 4%, mainly due to lower net charges for provisions for litigation, regulatory and other matters, as well as lower legal fees.

Slide 11 - Wealth Management Americas

Net new money was half a billion dollars, driven by inflows from advisors who've been with the firm for more than one year.

Invested assets declined to just under a trillion dollars, mainly due to negative market performance. Managed account penetration increased by 20 basis points, to a record 34.4% of invested assets.

Both gross and net margins were up 2 basis points in the quarter. Gross margin was steady for most of the quarter, but, fell slightly in September to 75 basis points. Wealth Management Americas' fourth quarter will be impacted by the closing level of invested assets from the third quarter, which is 5% lower than for 2Q.

Slide 12 - Wealth Management Americas

FA productivity remained industry-leading with annualized revenue per FA of over 1.1 million dollars and invested assets per FA of 142 million. Since 2009, our revenue per FA has increased at a compound annual growth rate of 9.4%.

Loan balances continued to grow, as they increased 200 million to 47.5 billion dollars. Average mortgage balances increased 4% to 8.4 billion dollars and securities-backed lending balances were up 2% to 33.5 billion.

49

Slide 13 - Retail & Corporate

Retail and Corporate delivered another strong quarter with profit before tax up 3% to 428 million, and all KPIs within their target ranges. Year-to-date, the business has delivered 1.3 billion in profit before tax, the highest since 2010.

Operating income increased 1%, mainly due to higher net interest income from lending and deposits, and also from lower credit loss expenses.

Net credit losses were negligible, as we saw no new material cases in the quarter.

Notwithstanding the continued low levels of credit loss expenses, we're closely monitoring developments in the Swiss economy where we remain mindful that the continued strength in the Swiss franc could have a negative effect on the economy and exporters in particular, which may impact some of the counterparties in our domestic lending portfolio.

Annualized net new business volume growth for our retail business remained solid at 2.5%. This was driven by growth in deposits and, to a lesser extent, growth in lending balances, which is consistent with our strategy to grow our high-quality loan business moderately and selectively.

We continued to attract new domestic clients, with year-to-date net new client accounts rising to a record of over 22,000, up 35%.

Wealth Management Switzerland has recently undertaken a review of its client portfolio, and identified relationships which would be better served by the Retail business. As a result, in the fourth quarter, Retail & Corporate will pay a one-time acquisition fee of approximately 50 million to Wealth Management for anticipated annual revenues of 30 million and new business volume of around 4 billion. The 50 million fee will not be treated as an adjusting item, and there will be no significant impact on net new money in Wealth Management or net new business volume in Retail & Corporate.

50

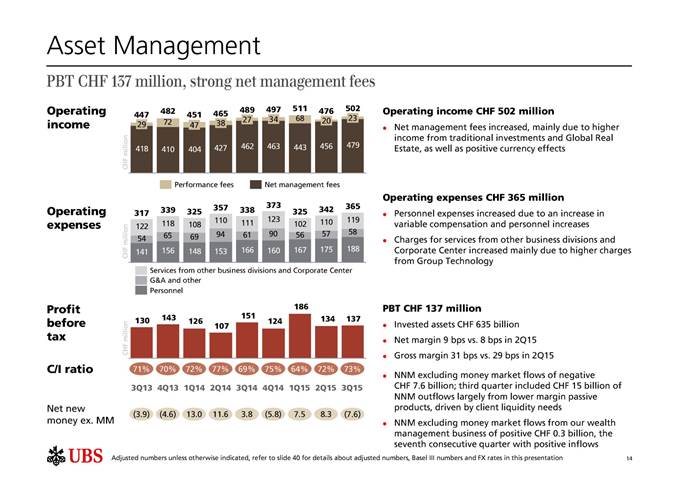

Slide 14 - Asset Management

In Asset Management, operating income increased by 5% to 502 million, on higher net management fees, with increases in traditional investments and Global Real Estate.

Performance fees increased slightly to 23 million, as investment performance continued to be subdued in O'Connor and Hedge Fund Solutions, in very challenging market conditions for alternative asset managers.

Expenses were 365 million, up 7% on higher personnel expenses and net charges from other business divisions and Corporate Center.

Net new money excluding money markets was negative 7.6 billion, as the third quarter included 15 billion of outflows, mainly from lower margin passive products, driven by client liquidity needs. The combined annual revenue loss from these large outflows is only about 5 million. Excluding this small number of clients, net new money was positive 7.4 billion. Net new money from our wealth management clients, excluding money markets, was around 300 million, and was positive for the 7th consecutive quarter.

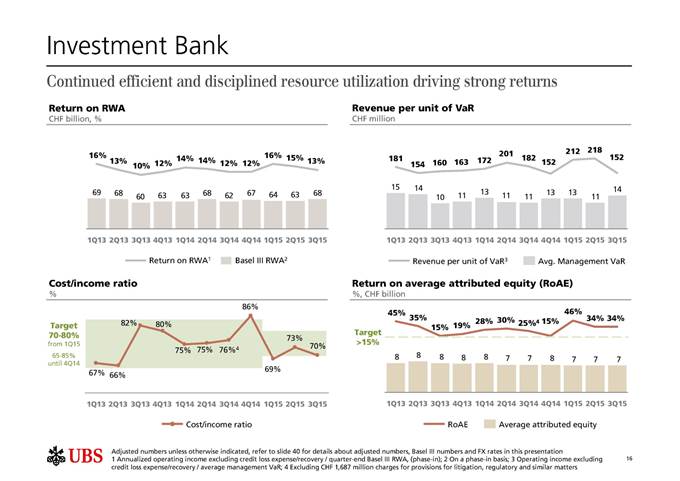

Slide 15 - Investment Bank

The Investment Bank delivered a very strong quarter with profit before tax of 614 million. Operating income was up 6% year-on-year to 2.1 billion, the highest it's been in a third quarter since 2012.

ICS revenues increased 13% to 1.4 billion.

FX, Rates and Credit revenues were up 37%, driven by a strong flow Rates and Credit performance, and only partially due to a comparatively weak 3Q14. The business continued to carefully manage inventory, operating at a high velocity, and managing within tight risk and balance sheet limits.

Equities revenues were up 4%, with strong performance in Cash Equities. Regionally, the Americas saw increases in all business lines, particularly in Derivatives.

51

Corporate Client Solutions revenues declined by 4%, as strong performances from DCM and ECM were more than offset by lower revenues from Financing Solutions, Advisory and Risk Management. We performed better than the market fee pool across our capital markets businesses.

Operating expenses decreased 54% year-on-year, as the prior period included substantial charges for litigation, regulatory and similar matters. Excluding these charges, expenses were down 2%, reflecting positive operating leverage and continued improvements in cost efficiency. The IB's cost/income ratio was 70%, at the bottom end of our target range of 70-80%.

Slide 16 - Investment Bank

Our model focuses on our clients, and is designed to capture client flows, with limited mark-to-market risk, in order to deliver strong risk adjusted returns.

Our resource utilization has been consistent, and we've delivered industry leading returns on RWA, and average revenue per unit of VaR of around 180 million over the last 11 quarters.

Our teams in the Investment Bank achieved good productivity in the quarter despite the extraordinary market volatility, and we continued to operate with comparatively low levels of VaR and RWA.

Slide 17 - Corporate Center

Profit before tax in Corporate Center Services was negative 255 million, roughly unchanged from the prior quarter. Operating expenses before allocations decreased due to lower personnel expenses and occupancy costs.

Profit before tax in Group Asset and Liability Management was negative 116 million compared with negative 127 million in the prior quarter. We saw a loss of 201 million from interest rate derivatives used to hedge our high-quality liquid asset portfolio. Declining USD interest rates resulted in losses on these derivatives, which are marked-to-market through P&L, whereas the respective high-quality liquid assets are held as available-for-sale, with unrealized fair value gains recorded in OCI.

52

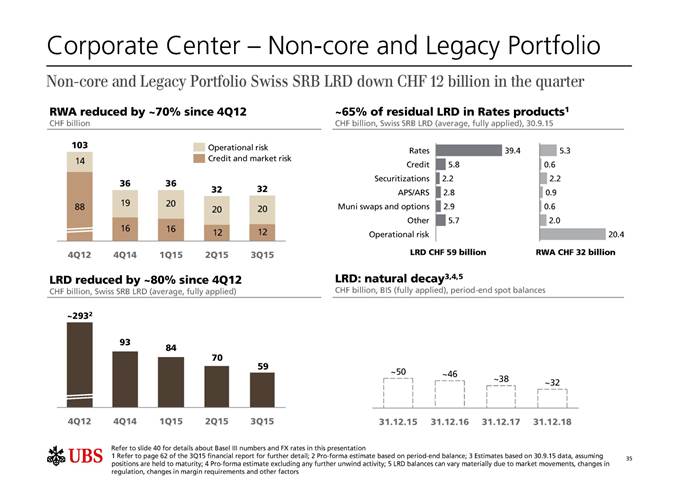

Profit before tax in Non-core and Legacy Portfolio was negative 803 million. Operating income of negative 126 million included valuation losses of 20 million, and higher losses, primarily in rates, from ongoing novation and unwind activity in addition to re-hedging costs.

Operating expenses increased by 510 million, as net charges for provisions for litigation, regulatory and similar matters increased.

Once again, we had a significant reduction in LRD in the quarter, and the balance now stands at roughly 20% of what it was when NCL was created in 2012.

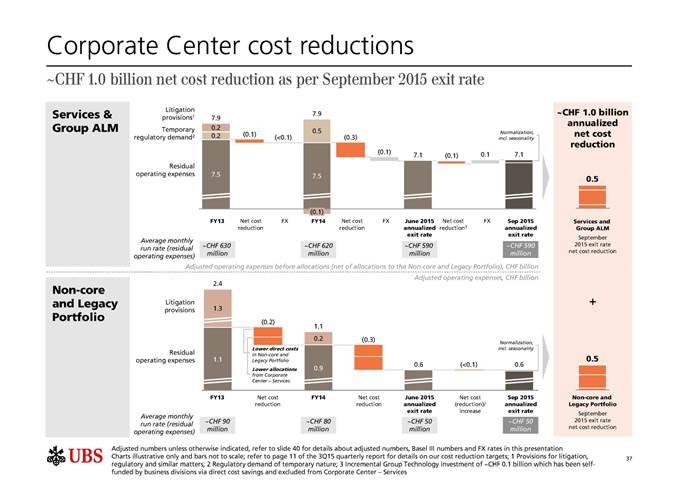

Slide 18 - Corporate Center cost reductions

We achieved an additional 100 million of annualized net cost reduction in the Corporate Center, bringing the total to one billion, based on the September exit rate versus full-year 2013. Savings in the quarter were driven by decreases in Corporate Real Estate and Services, operations and NCL.

Regulatory demand continues to be a headwind, amounting to an estimated 1.1 billion francs for 2015, including approximately 400 million of a permanent nature and 700 million of a temporary nature. We'll continue to work hard to offset permanent regulatory costs in order to achieve our targeted net cost reductions. We've taken out a billion of net costs in the Corporate Center since 2013, and we're committed to taking out an additional 1.1 billion by 2017.

Slide 19 – Net tax benefit and deferred tax assets

In the third quarter, our net tax benefit included a net increase in recognized deferred tax assets of 1.5 billion. This included 1.3 billion related to the net upward revaluation of US DTAs, reflecting updated profit forecasts, which contributed approximately 200 million, and an extension of the recognition period for future profits from 6 to 7 years, which contributed the remaining 1.1 billion.

We recognized 75% of the expected full-year DTA write-up in the third quarter, and we expect to book the remaining 25%, or approximately 500 million, in the fourth quarter.

Our future profits in the US, where we still have over 15 billion francs of unrecognized DTAs, will be the main driver of recognition and usage of DTAs in the long-term, reinforcing the value of our US franchise.

53

As a reminder, the recognition of tax loss DTAs does not immediately affect fully applied CET1 capital, since higher tax loss DTA recognition in the P&L is offset by an equivalent deduction in the capital account. However, the utilization of tax losses against taxable income over time, leads to reduced tax expenses, which will benefit CET1 capital.

As we look to 2016 and beyond, our internal thresholds to extend the recognition periods for US DTAs become more challenging, and at this point in time, we expect no further extension in the recognition period. We currently expect a net upward revaluation of tax loss DTAs of approximately 500 million for 2016.

Slide 20 - Capital and leverage ratios

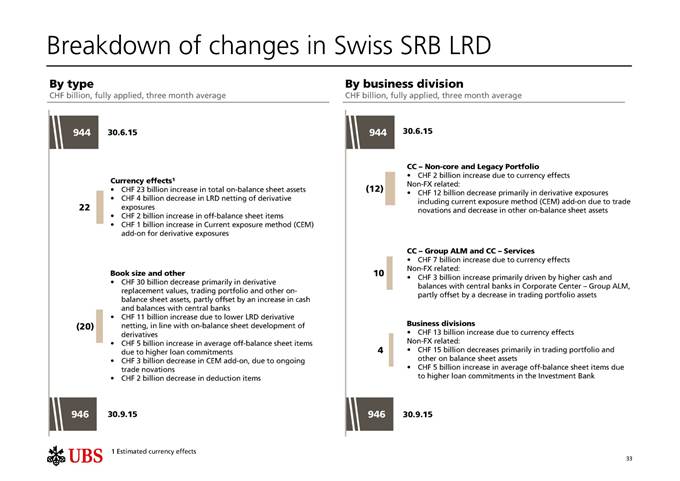

We continued to improve our leverage ratio, increasing our fully applied Swiss SRB ratio by 30 bps to 5%, on increased CET1 capital and AT1 issuance. Fully applied CET1 capital increased by around 700 million to 30.9 billion, mainly reflecting operating profit from the quarter.

Previously, we flagged that our SRB and BIS spot LRD would converge at year-end. At this point in time, we're likely to see BIS LRD slightly lower than SRB on a spot basis at year-end.

Our fully applied CET1 ratio remained the highest among large global banks, at 14.3%, despite a 6 billion increase in RWA.

Slide 21 - Capital requirements under revised Swiss TBTF proposal

Sergio already touched on the Swiss Federal Council's proposals for higher capital requirements for Swiss global systemically important banks, which are required to be fully compliant by the end of 2019. We intend to use the four year transitional period to implement the new requirements.

The proposal sets out a required going concern leverage ratio of 5% of the BIS leverage ratio denominator, in order to qualify as well capitalized. Of the 5%, at least 3.5% must be held in CET1 with the remainder in high-trigger AT1.

54

The corresponding risk-weighted requirement is 14.3%, with at least 10% from CET1 and up to 4.3% in high-trigger AT1. The going concern element in both ratios includes a progressive component, driven by the bank's total exposure and market share.

The gone concern requirement mirrors the going concern requirement, at 5% of LRD and 14.3% of RWA, which is to be met with bail-in eligible instruments. This amount may be reduced by up to 2% of LRD and 5.7% of RWA, depending on a bank's progress in implementing measures to improve its resilience and resolvability. As we've made significant progress in addressing our resolvability, we're confident that we'll qualify for a meaningful rebate and we look forward to further clarifications on the process in due course.

The TBTF proposal also includes transitional arrangements for existing capital instruments. AT1 low-trigger instruments can be counted towards the AT1 high-trigger going concern requirement until their first call date, which can be after 2019. Tier 2 capital will be recognized as AT1 high-trigger going concern until the earlier of its first call date or the end of 2019, and as gone concern capital thereafter.

Slide 22 - Capital requirements under revised Swiss TBTF proposal

We'll be compliant with the new rules at inception, and we're well prepared to meet the final 2019 requirements. We have the best capital position among our peer group, and we operate a strong, successful and highly capital generative business.

Our CET1 leverage ratio already stands at 3.3%, and we can achieve the required 3.5% by retaining a further 2 billion of CET1 capital through earnings over the next 4 years.

Based on our current BIS exposure and under the grandfathering proposals, we've met the 1.5% high-trigger Tier 1 going concern requirement. We also continue to plan on issuing around 2 billion of high-trigger AT1 to our employees through our deferred contingent capital plan, bringing us to a sustained balance of 2.5 billion, and we expect to replace maturing grandfathered instruments with Group-issued high-trigger AT1 over the transition period.

55

As for the gone concern requirements, we completed our inaugural TLAC issuance in September, successfully placing four billion of bail-in debt out of UBS Group AG, and today, we've announced our inaugural Euro TLAC issuance shortly. We currently have 6.5 billion of Tier 2 low-trigger capital maturing after 2019, which will count towards our gone concern leverage ratio on a grandfathered basis until first call date, even after the full phase-in of the requirements.

We have 33 billion of senior unsecured debt and covered bonds which will mature through 2019. Any remaining gone concern requirement will be met by replacing this maturing UBS AG debt. We expect to absorb the TLAC requirements without the need to increase the overall funding for the Group.

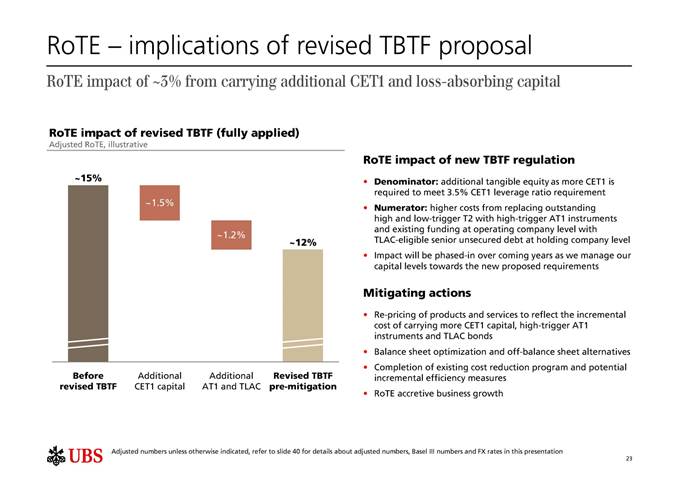

Slide 23 - ROTE – implications of revised TBTF proposal

We estimate the new proposals to have a combined ROTE drag of approximately 270 basis points, reflecting higher tangible equity and additional funding costs.

A response to increased capital requirements could be to attempt to drive RoTE higher by robotically slashing resources. However, we think it's more appropriate to manage our resource levels to balance increasing returns on tangible equity with growing capital returns to shareholders.

Slide 24 - Impact of regulation on RWA

Since we announced our targets in 2012, Group operational risk RWA have increased by around 20 billion, mostly from the FINMA add-on. In addition, regulatory multipliers on credit risk are estimated to add approximately 30 billion of increased RWA. As a result of current and known future regulatory inflation, we expect our current RWA to trend to around 250 billion in the short to medium term. This represents no increase in useable RWAs and no change in our risk appetite.

There is certainly future upward pressure in the regulatory pipeline, but we don't believe that RWA should increase to binding levels, and as a result, leverage ratio will likely remain the binding constraint for UBS.

56

Slide 25 – Updated capital and key performance metrics

Earlier, Sergio walked through our updated expectations after taking into account new capital requirements and the current market environment.

Next year, we expect our adjusted return on tangible equity to be around the same level as full-year 2015, with it increasing towards 15% in 2017, achieving the target in 2018.

In addition to these revised expectations on returns, we also expect our cost/income ratio to be around 65-75% for the short to medium term, potentially above our target range, as we absorb regulatory costs and macroeconomic headwinds.

Our expected LRD and RWA mix among our business divisions remains the same, and the Investment Bank is expected to have RWA of around 85 billion and LRD around 325 billion in the short to medium term.

As for the Non-core and Legacy Portfolio, since its inception, we've reduced LRD by around 80% and RWA by around 70%. Our objective is to continue to reduce exposures, while actively optimizing shareholder value.

On a personal note, to the analysts on the call, this is our eighteenth quarterly result together and I appreciate the challenge, questions, advice and insight you've provided over the years. You're left in the hands of Caroline Stewart and a superb Investor Relations team and a very capable CFO-designate, Kirt Gardner. Hopefully, our paths will cross in the future.

Now, I'll pass it back to Sergio, who will provide some concluding remarks.

57

Sergio P. Ermotti (Group CEO): Closing remarks

SLIDE 26 – Executing our strategy…

Thank you Tom

The strategic change we initiated 4 years ago was driven by our desire to focus on our strength and by expectations of more demanding regulation. So having completed our transformation we have the right business model today, with no need for further radical change to comply with the strict new TBTF proposals. This puts UBS in a unique position among our peers. Therefore we can capitalize on our early-mover advantage, build on our execution track record and continue to implement our strategy to better serve our clients, drive shareholder value and grow capital returns.

In the current macroeconomic and regulatory environment our commitment to our remaining cost reduction programs and our efforts to drive operational excellence remains resolute.

But we also have a strategy for growth. We will modestly increase balance sheet capacity for our businesses to support sustained long term growth, in a disciplined way. And, we will continue to invest both in technology and digitization, strengthen our position in the Asia Pacific region and the Americas and ensure we have the right people to drive our future success.

You will have noticed that we announced changes to our leadership team today. Let me start by thanking Bob, who will continue to play an important role working with clients and on strategic priorities, as well as Phil and Chi-Won, not only for their tremendous contributions to the firm, but also for working with me for the last few months in order to allow me to align the changes to the time I believe is right for the firm. I welcome Kathy, Sabine, Axel, Kirt and Christian to the Group Executive Board and Tom to his new role. Following the completion of our strategic transformation earlier this year and as we continue executing our plans, this team will help take the firm to the next level providing the right mix of expertise and continuity.

58

Back to our results. We reported another set of solid numbers, which once again demonstrated strong risk control and discipline.

For the past four years, we have demonstrated that our business model works for our clients and investors, and we will continue with the same determination to execute our strategy in order to create sustainable value for our shareholders.

Thank you and now Tom and I will take your questions.

59

Cautionary statement regarding forward –looking statements: This presentation contains statements that constitute “forward-looking statements,” including but not limited to management’s outlook for UBS’s financial performance and statements relating to the anticipated effect of transactions and strategic initiatives on UBS’s business and future development. While these forward-looking statements represent UBS’s judgments and expectations concerning the matters described, a number of risks, uncertainties and other important factors could cause actual developments and results to differ materially from UBS’s expectations. These factors include, but are not limited to: (i) the degree to which UBS is successful in executing its announced strategic plans, including its cost reduction and efficiency initiatives and its planned further reduction in its Basel III risk-weighted assets (RWA) and leverage ratio denominator (LRD), and the degree to which UBS is successful in implementing changes to its business to meet changing market, regulatory and other conditions; (ii) developments in the markets in which UBS operates or to which it is exposed, including movements in securities prices or liquidity, credit spreads, currency exchange rates and interest rates and the effect of economic conditions and market developments on the financial position or creditworthiness of UBS’s clients and counterparties; (iii) changes in the availability of capital and funding, including any changes in UBS’s credit spreads and ratings, as well as availability and cost of funding to meet requirements for bail-in debt or loss-absorbing capital; (iv) changes in or the implementation of financial legislation and regulation in Switzerland, the US, the UK and other financial centers that may impose, or result in, more stringent capital (including leverage ratio), liquidity and funding requirements, incremental tax requirements, additional levies, limitations on permitted activities, constraints on remuneration or other measures; (v) uncertainty as to when and to what degree the Swiss Financial Market Supervisory Authority (FINMA) will approve reductions to the incremental RWA resulting from the supplemental operational risk capital analysis mutually agreed to by UBS and FINMA, or will approve a limited reduction of capital requirements due to measures to reduce resolvability risk; (vi) the degree to which UBS is successful in implementing changes to its legal structure to improve its resolvability and meet related regulatory requirements, including changes in legal structure and reporting required to implement US enhanced prudential standards, implementing a service company model, the transfer of the Asset Management business to a holding company, and the potential need to make further changes to the legal structure or booking model of UBS Group in response to legal and regulatory requirements relating to capital requirements, resolvability requirements and proposals in Switzerland and other countries for mandatory structural reform of banks; (vii) changes in UBS’s competitive position, including whether differences in regulatory capital and other requirements among the major financial centers will adversely affect UBS’s ability to compete in certain lines of business; (viii) changes in the standards of conduct applicable to our businesses that may result from new regulation or new enforcement of existing standards, including measures to impose new or enhanced duties when interacting with customers or in the execution and handling of customer transactions; (ix) the liability to which UBS may be exposed, or possible constraints or sanctions that regulatory authorities might impose on UBS, due to litigation, contractual claims and regulatory investigations, including the potential for disqualification from certain businesses or loss of licenses or privileges as a result of regulatory or other governmental sanctions; (x) the effects on UBS’s cross-border banking business of tax or regulatory developments and of possible changes in UBS’s policies and practices relating to this business; (xi) UBS’s ability to retain and attract the employees necessary to generate revenues and to manage, support and control its businesses, which may be affected by competitive factors including differences in compensation practices; (xii) changes in accounting or tax standards or policies, and determinations or interpretations affecting the recognition of gain or loss, the valuation of goodwill, the recognition of deferred tax assets and other matters; (xiii) limitations on the effectiveness of UBS’s internal processes for risk management, risk control, measurement and modeling, and of financial models generally; (xiv) whether UBS will be successful in keeping pace with competitors in updating its technology, particularly in trading businesses; (xv) the occurrence of operational failures, such as fraud, misconduct, unauthorized trading and systems failures; (xvi) restrictions to the ability of subsidiaries of the Group to make loans or distributions of any kind, directly or indirectly, to UBS Group AG; (xvii) the effect that these or other factors or unanticipated events may have on our reputation and the additional consequences that this may have on our business and performance; and (xviii) the degree to which changes in regulation, capital or legal structure, financial results or other factors may affect UBS’s ability to maintain its stated capital return objective. The sequence in which the factors above are presented is not indicative of their likelihood of occurrence or the potential magnitude of their consequences. Our business and financial performance could be affected by other factors identified in our past and future filings and reports, including those filed with the SEC. More detailed information about those factors is set forth in documents furnished by UBS and filings made by UBS with the SEC, including UBS’s Annual Report on Form 20-F for the year ended 31 December 2014. UBS is not under any obligation to (and expressly disclaims any obligation to) update or alter its forward-looking statements, whether as a result of new information, future events, or otherwise.

60

Disclaimer: This presentation and the information contained herein are provided solely for information purposes, and are not to be construed as a solicitation of an offer to buy or sell any securities or other financial instruments in Switzerland, the United States or any other jurisdiction. No investment decision relating to securities of or relating to UBS Group AG, UBS AG or their affiliates should be made on the basis of this document. Refer to UBS's third quarter 2015 report and its Annual report on Form 20-F for the year ended 31 December 2014. No representation or warranty is made or implied concerning, and UBS assumes no responsibility for, the accuracy, completeness, reliability or comparability of the information contained herein relating to third parties, which is based solely on publicly available information. UBS undertakes no obligation to update the information contained herein.

Adjusted results: Unless otherwise indicated, “adjusted” figures exclude the adjustment items listed on slide 39 of the 3Q15 presentation, to the extent applicable, on a Group and business division level. Adjusted results are a non-GAAP financial measure as defined by SEC regulations. Refer to page 17 of the 3Q15 financial report for an overview of adjusted numbers. If applicable for a given adjusted KPI (i.e., adjusted return on tangible equity), adjustment items are calculated on an after-tax basis by applying indicative tax rates (i.e., 2% for own credit, 22% for other items, and with certain large items assessed on a case-by-case basis). Refer to page 27 of the 3Q15 financial report for more information.

© UBS 2015. The key symbol and UBS are among the registered and unregistered trademarks of UBS. All rights reserved.

61

This Form 6-K is hereby incorporated by reference into each of (1) the registration statement of UBS AG on Form F-3 (Registration Number 333-204908) and (2) the registration statements of UBS Group AG on Form S-8 (Registration Numbers 333-200634; 333-200635; 333-200641; and 333-200665), and into each prospectus outstanding under any of the foregoing registration statements; and also into (3) any outstanding offering circular or similar document issued or authorized by UBS AG that incorporates by reference any Form 6-K’s of UBS AG that are incorporated into its registration statements filed with the SEC, and (4) the base prospectus of Corporate Asset Backed Corporation (“CABCO”) dated June 23, 2004 (Registration Number 333-111572), the Form 8-K of CABCO filed and dated June 23, 2004 (SEC File Number 001-13444), and the Prospectus Supplements relating to the CABCO Series 2004-101 Trust dated May 10, 2004 and May 17, 2004 (Registration Number 033-91744 and 033-91744-05).

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

UBS Group AG

By: _/s/ David Kelly______________

Name: David Kelly

Title: Managing Director

By: _/s/ Sarah M. Starkweather______

Name: Sarah M. Starkweather

Title: Executive Director

UBS AG

By: _/s/ David Kelly______________

Name: David Kelly

Title: Managing Director

By: _/s/ Sarah M. Starkweather______

Name: Sarah M. Starkweather

Title: Executive Director

Date: November 3, 2015

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- UBS AG (UBSG:SW) (UBS) PT Lowered to CHF28 at RBC Capital

- Marex Group (MRX) Prices 15.38M Share IPO at $19/sh

- UBS AG (UBSG:SW) (UBS) PT Lowered to CHF31 at Morgan Stanley

Create E-mail Alert Related Categories

SEC FilingsRelated Entities

UBSSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share