Form 8-K Western Refining, Inc. For: Nov 03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 3, 2015

WESTERN REFINING, INC.

(Exact name of Registrant as specified in its charter)

Delaware | 001-32721 | 20-3472415 | ||

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification Number) | ||

123 West Mills Ave., Suite 200

El Paso, Texas 79901

(Address of principal executive offices)

(915) 534-1400

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02 | Results of Operations and Financial Condition. |

On November 3, 2015, Western Refining, Inc. (“Western” or the “Company”) issued a press release announcing its results of operations for the third quarter ended September 30, 2015. A copy of the press release and earnings presentation are attached hereto as Exhibit 99.1 and Exhibit 99.2, respectively, and are incorporated herein by reference.

The information contained in this Current Report on Form 8-K (including the exhibit) is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section. The information contained in this Current Report on Form 8-K shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in any such filing.

Item 9.01 | Financial Statements and Exhibits |

(d) | Exhibits |

Exhibit No. | Description | |

99.1 | Press Release, dated November 3, 2015. | |

99.2 | Earnings Presentation, dated November 3, 2015. | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

WESTERN REFINING, INC. | |

By: | /s/ Gary R. Dalke |

Name: | Gary R. Dalke |

Title: | Chief Financial Officer |

Dated: November 3, 2015

EXHIBIT INDEX

Exhibit No. | Description | |

99.1 | Press Release, dated November 3, 2015. | |

99.2 | Earnings Presentation, dated November 3, 2015. | |

FOR IMMEDIATE RELEASE | Exhibit 99.1 |

Investor and Analyst Contact: | Media Contact: |

Jeffrey S. Beyersdorfer | Gary W. Hanson |

(602) 286-1530 | (602) 286-1777 |

Michelle Clemente | |

(602) 286-1533 | |

WESTERN REFINING ANNOUNCES THIRD QUARTER 2015 RESULTS

EL PASO, Texas - November 3, 2015 - Western Refining, Inc. (NYSE: WNR) today reported results for its third quarter ended September 30, 2015. Net income attributable to Western, excluding special items, was $160 million, or $1.69 per diluted share. This compares to third quarter 2014 net income, excluding special items, of $175.3 million, or $1.73 per diluted share. Including special items, the Company recorded third quarter 2015 net income attributable to Western of $153.3 million, or $1.61 per diluted share, as compared to net income attributable to Western of $186.7 million, or $1.84 per diluted share for the third quarter of 2014. A reconciliation of reported earnings and description of special items can be found in the accompanying financial tables.

Jeff Stevens, Western's President and Chief Executive Officer, said, "This was another excellent quarter operationally and financially for all of our business segments. Our financial results benefited from solid overall margin performance and a continued focus on cost control. The El Paso refinery had an outstanding quarter operationally, with expense per barrel results being one of the lowest quarters on record. In our Retail business, we saw an increase in same store fuel volumes, fuel margins, and merchandise sales, resulting in a record quarter from a profit perspective. NTI and WNRL also performed well in the quarter, which contributed to our outstanding financial results."

Western paid a dividend of $0.34 per share of common stock to shareholders in the third quarter. In October, Western's Board of Directors approved a $0.38 per share dividend for the fourth quarter. Including the fourth quarter dividend, Western will have returned approximately $234 million to shareholders through dividends and share repurchases in 2015.

Looking forward, Stevens said, "The fourth quarter has started off well. We just completed the sale of the TexNew Mex pipeline to WNRL for $180 million. Construction of Phase One of the Bobcat pipeline is complete and now gives us the ability to move crude oil to Midland and the US Gulf Coast. We also announced a proposal to purchase all of the remaining publicly-held units of NTI. Finally, the refining margin environment has been good during October and we still see strong demand for gasoline and diesel in our region."

Conference Call Information

A conference call is scheduled for Tuesday, November 3, 2015, at 10:00 am ET to discuss Western's financial results for the third quarter ended September 30, 2015. A slide presentation, which includes our quarterly guidance, will be available for reference during the conference call. The call, press release and slide presentation can be accessed on the Investor Relations section on Western's website, www.wnr.com. The call can also be heard by dialing (866) 566-8590 or (702) 224-9819, passcode: 47810509. The audio replay will be available two hours after the end of the call through November 17, 2015, by dialing (800) 585-8367 or (404) 537-3406, passcode: 47810509.

Non-GAAP Financial Measures

In a number of places in the press release and related tables, we have excluded certain income and expense items from GAAP measures. The excluded items are generally non-cash in nature such as unrealized net gains and losses from commodity hedging activities or losses on disposal of assets; however, other items that have a cash impact, such as gains on disposal of assets are also excluded. We believe it is useful for investors and financial analysts to understand our financial performance excluding such items so that they can see the operating trends underlying our business. Readers of this press release should not consider these non-GAAP measures in isolation from, or as a substitute for, the financial information that we report in accordance with GAAP.

About Western Refining

Western Refining, Inc. is an independent refining and marketing company headquartered in El Paso, Texas. The refining segment operates refineries in El Paso, and Gallup, New Mexico. The retail segment includes retail service stations, convenience stores, and unmanned fleet fueling locations in Arizona, Colorado, New Mexico, and Texas.

Western Refining, Inc. owns the general partner and approximately 66% of the limited partnership interest of Western Refining Logistics, LP (NYSE:WNRL) and the general partner and approximately 38% of the limited partnership interest in Northern Tier Energy LP (NYSE:NTI).

More information about Western Refining is available at www.wnr.com.

Cautionary Statement on Forward-Looking Statements

This press release contains forward-looking statements which are protected by the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. The forward-looking statements reflect Western’s current expectations regarding future events, results or outcomes. The forward-looking statements contained herein include statements about: financial results for the fourth quarter of 2015; the ability of the Bobcat pipeline to move crude oil to Midland and the US Gulf Coast; Western’s proposal to acquire all of the remaining publicly-held common units of NTI; refining margins; gasoline and diesel demand; and the positioning of Western’s refineries to capture refining margins through the end of the year. These statements are subject to the general risks inherent in Western’s business. These expectations may or may not be realized. Some of these expectations may be based upon assumptions or judgments that prove to be incorrect. In addition, Western’s business and operations involve numerous risks and uncertainties, many of which are beyond its control, which could result in Western’s expectations not being realized, or otherwise materially affect Western’s financial condition, results of operations, and cash flows. Additional information relating to the uncertainties affecting Western's business is contained in its filings with the Securities and Exchange Commission to which you are referred. The forward-looking statements are only as of the date made. Except as required by law, Western does not undertake any obligation to (and expressly disclaims any obligation to) update any forward-looking statements to reflect events or circumstances after the date such statements were made, or to reflect the occurrence of unanticipated events.

Consolidated Financial Data

We report our operating results in four business segments: refining, NTI, WNRL and retail.

• | Our refining segment owns and operates two refineries in the Southwest that process crude oil and other feedstocks primarily into gasoline, diesel fuel, jet fuel and asphalt. Our refining segment also owns and operates certain logistics assets including a 375 mile section of the TexNew Mex Pipeline system that extends from WNRL's crude oil station in Star Lake, New Mexico, in the Four Corners region to its T station in Eddy County, New Mexico. We market refined products to a diverse customer base including wholesale distributors and retail chains. The refining segment also sells refined products in the Mid-Atlantic region and Mexico. |

• | NTI owns and operates refining and transportation assets and operates and supports retail convenience stores primarily in Minnesota and Wisconsin. |

• | WNRL owns and operates terminal, storage and transportation assets and provides related services primarily to our refining segment in the Southwest. The WNRL segment also includes wholesale assets consisting of a fleet of crude oil and refined product truck transports and wholesale petroleum product and lubricant distribution operations in the Southwest region. WNRL receives its product supply from the refining segment and third-party suppliers. |

• | Our retail segment operates retail convenience stores and unmanned commercial fleet fueling ("cardlock") locations located in the Southwest. The retail convenience stores sell gasoline, diesel fuel and convenience store merchandise. |

The following tables set forth our unaudited summary historical financial and operating data for the periods indicated below:

Three Months Ended | Nine Months Ended | ||||||||||||||

September 30, | September 30, | ||||||||||||||

2015 | 2014 | 2015 | 2014 | ||||||||||||

(Unaudited) | |||||||||||||||

(In thousands, except per share data) | |||||||||||||||

Statements of Operations Data | |||||||||||||||

Net sales (1) | $ | 2,569,090 | $ | 4,052,324 | $ | 7,716,712 | $ | 12,128,757 | |||||||

Operating costs and expenses: | |||||||||||||||

Cost of products sold (exclusive of depreciation and amortization) (1) | 1,895,772 | 3,379,555 | 5,814,969 | 10,271,461 | |||||||||||

Direct operating expenses (exclusive of depreciation and amortization) (1) | 234,440 | 218,183 | 674,474 | 619,995 | |||||||||||

Selling, general and administrative expenses | 54,465 | 57,206 | 169,808 | 170,578 | |||||||||||

Affiliate severance costs | — | — | — | 12,878 | |||||||||||

Loss (gain) on disposal of assets, net | (52 | ) | (66 | ) | (157 | ) | 939 | ||||||||

Maintenance turnaround expense | 490 | 1,883 | 1,188 | 48,329 | |||||||||||

Depreciation and amortization | 51,377 | 46,910 | 152,446 | 141,168 | |||||||||||

Total operating costs and expenses | 2,236,492 | 3,703,671 | 6,812,728 | 11,265,348 | |||||||||||

Operating income | 332,598 | 348,653 | 903,984 | 863,409 | |||||||||||

Other income (expense): | |||||||||||||||

Interest income | 186 | 483 | 550 | 899 | |||||||||||

Interest expense and other financing costs | (26,896 | ) | (18,250 | ) | (79,169 | ) | (75,008 | ) | |||||||

Loss on extinguishment of debt | — | — | — | (9 | ) | ||||||||||

Other, net | 4,327 | (2,816 | ) | 11,557 | (351 | ) | |||||||||

Income before income taxes | 310,215 | 328,070 | 836,922 | 788,940 | |||||||||||

Provision for income taxes | (92,117 | ) | (80,713 | ) | (229,989 | ) | (223,319 | ) | |||||||

Net income | 218,098 | 247,357 | 606,933 | 565,621 | |||||||||||

Less net income attributable to non-controlling interests (2) | 64,795 | 60,608 | 213,722 | 136,630 | |||||||||||

Net income attributable to Western Refining, Inc. | $ | 153,303 | $ | 186,749 | $ | 393,211 | $ | 428,991 | |||||||

Basic earnings per share | $ | 1.61 | $ | 1.85 | $ | 4.12 | $ | 4.86 | |||||||

Diluted earnings per share | 1.61 | 1.84 | 4.12 | 4.28 | |||||||||||

Dividends declared per common share | 0.34 | 0.26 | 0.98 | 0.78 | |||||||||||

Weighted average basic shares outstanding | 94,826 | 101,199 | 95,308 | 88,240 | |||||||||||

Weighted average dilutive shares outstanding (3) | 94,924 | 101,325 | 95,408 | 102,207 | |||||||||||

Three Months Ended | Nine Months Ended | ||||||||||||||

September 30, | September 30, | ||||||||||||||

2015 | 2014 | 2015 | 2014 | ||||||||||||

(Unaudited) | |||||||||||||||

(In thousands) | |||||||||||||||

Economic Hedging Activities Recognized Within Cost of Products Sold | |||||||||||||||

Realized hedging gain, net | $ | 26,949 | $ | 26,716 | $ | 52,325 | $ | 44,272 | |||||||

Unrealized hedging gain (loss), net | 271 | 17,020 | (42,073 | ) | 136,371 | ||||||||||

Total hedging gain, net | $ | 27,220 | $ | 43,736 | $ | 10,252 | $ | 180,643 | |||||||

Cash Flow Data | |||||||||||||||

Net cash provided by (used in): | |||||||||||||||

Operating activities | $ | 373,620 | $ | 208,959 | $ | 665,664 | $ | 494,058 | |||||||

Investing activities | (20,321 | ) | (46,875 | ) | (34,454 | ) | (142,036 | ) | |||||||

Financing activities | (187,665 | ) | (43,743 | ) | (352,799 | ) | (169,938 | ) | |||||||

Capital expenditures | $ | 76,431 | $ | 49,923 | $ | 195,976 | $ | 147,254 | |||||||

Cash distributions received by Western from: | |||||||||||||||

NTI | $ | 42,391 | $ | 18,880 | $ | 98,318 | $ | 60,914 | |||||||

WNRL | 11,630 | 9,167 | 32,845 | 25,210 | |||||||||||

Other Data | |||||||||||||||

Adjusted EBITDA (4) | $ | 425,450 | $ | 378,027 | $ | 1,094,510 | $ | 918,022 | |||||||

Balance Sheet Data (at end of period) | |||||||||||||||

Cash and cash equivalents | $ | 709,570 | $ | 650,154 | |||||||||||

Restricted cash | 12,328 | — | |||||||||||||

Working capital | 1,137,952 | 1,078,164 | |||||||||||||

Total assets | 5,881,886 | 5,863,884 | |||||||||||||

Total debt and lease financing obligation | 1,595,650 | 1,279,435 | |||||||||||||

Total equity | 3,032,495 | 3,127,805 | |||||||||||||

(1) | Excludes $885.2 million, $2,517.3 million, $1,193.0 million and $3,487.8 million of intercompany sales and $885.2 million, $2,517.3 million, $1,189.0 million and $3,475.5 million of intercompany cost of products sold for three and nine months ended September 30, 2015 and 2014, respectively, and $4.0 million and $12.3 million of intercompany direct operating expenses for the three and nine months ended September 30, 2014, respectively, with no comparable activity for three and nine months ended September 30, 2015. |

(2) | Net income attributable to non-controlling interests for the three and nine months ended September 30, 2015, consisted of income from NTI and WNRL in the amount of $59.2 million, $197.6 million, $5.6 million and $16.2 million, respectively. Net income attributable to non-controlling interests for the three and nine months ended September 30, 2014, consisted of income from NTI and WNRL in the amount of $56.4 million, $124.8 million, $4.3 million and $11.8 million, respectively. |

(3) | Our computation of diluted earnings per share includes our Convertible Senior Unsecured Notes and any unvested restricted shares units. If determined to be dilutive to period earnings, these securities are included in the denominator of our diluted earnings per share calculation. For purposes of the diluted earnings per share calculation, we assumed issuance of 0.1 million restricted share units for the three and nine months ended September 30, 2015. We assumed issuance of 0.1 million restricted share units for both the three and nine months ended September 30, 2014 and 13.8 million shares related to the Convertible Senior Unsecured Notes for the nine months ended September 30, 2014. |

(4) | Adjusted EBITDA represents earnings before interest expense and other financing costs, provision for income taxes, depreciation, amortization, maintenance turnaround expense and certain other non-cash income and expense items. However, Adjusted EBITDA is not a recognized measurement under U.S. GAAP. Our management believes that the presentation of Adjusted EBITDA is useful to investors because it is frequently used by securities analysts, investors and other interested parties in the evaluation of companies in our industry. In addition, our management believes that Adjusted EBITDA is useful in evaluating our operating performance compared to that of other companies in our industry because the calculation of Adjusted EBITDA generally eliminates the effects of financings, income taxes, the accounting effects of significant turnaround activities (that many of our competitors capitalize and thereby exclude from their measures of |

EBITDA) and certain non-cash charges that are items that may vary for different companies for reasons unrelated to overall operating performance.

Adjusted EBITDA has limitations as an analytical tool, and you should not consider it in isolation, or as a substitute for analysis of our results as reported under GAAP. Some of these limitations are:

• | Adjusted EBITDA does not reflect our cash expenditures or future requirements for significant turnaround activities, capital expenditures or contractual commitments; |

• | Adjusted EBITDA does not reflect the interest expense or the cash requirements necessary to service interest or principal payments on our debt; |

• | Adjusted EBITDA does not reflect changes in, or cash requirements for, our working capital needs; and |

• | Adjusted EBITDA, as we calculate it, may differ from the Adjusted EBITDA calculations of other companies in our industry, thereby limiting its usefulness as a comparative measure. |

Because of these limitations, Adjusted EBITDA should not be considered a measure of discretionary cash available to us to invest in the growth of our business. We compensate for these limitations by relying primarily on our GAAP results and using Adjusted EBITDA only supplementally.

Three Months Ended | Nine Months Ended | ||||||||||||||

September 30, | September 30, | ||||||||||||||

2015 | 2014 | 2015 | 2014 | ||||||||||||

(Unaudited) | |||||||||||||||

(In thousands) | |||||||||||||||

Net income attributable to Western Refining, Inc. | $ | 153,303 | $ | 186,749 | $ | 393,211 | $ | 428,991 | |||||||

Net income attributable to non-controlling interest | 64,795 | 60,608 | 213,722 | 136,630 | |||||||||||

Interest expense and other financing costs | 26,896 | 18,250 | 79,169 | 75,008 | |||||||||||

Provision for income taxes | 92,117 | 80,713 | 229,989 | 223,319 | |||||||||||

Loss (gain) on disposal of assets, net | (52 | ) | (66 | ) | (157 | ) | 939 | ||||||||

Depreciation and amortization | 51,377 | 46,910 | 152,446 | 141,168 | |||||||||||

Maintenance turnaround expense | 490 | 1,883 | 1,188 | 48,329 | |||||||||||

Loss on extinguishment of debt | — | — | — | 9 | |||||||||||

Net change in lower of cost or market inventory reserve | 36,795 | — | (17,131 | ) | — | ||||||||||

Unrealized loss (gain) on commodity hedging transactions | (271 | ) | (17,020 | ) | 42,073 | (136,371 | ) | ||||||||

Adjusted EBITDA | $ | 425,450 | $ | 378,027 | $ | 1,094,510 | $ | 918,022 | |||||||

EBITDA by Reporting Entity | |||||||||||||||

Western Adjusted EBITDA | $ | 233,954 | $ | 248,943 | $ | 623,097 | $ | 593,594 | |||||||

NTI Adjusted EBITDA | 163,826 | 112,991 | 392,711 | 278,801 | |||||||||||

WNRL EBITDA | 27,670 | 16,093 | 78,702 | 45,627 | |||||||||||

Consolidated Adjusted EBITDA | $ | 425,450 | $ | 378,027 | $ | 1,094,510 | $ | 918,022 | |||||||

Three Months Ended | |||||||||||

September 30, | |||||||||||

2015 | |||||||||||

Western | NTI | WNRL | |||||||||

(Unaudited) | |||||||||||

(In thousands) | |||||||||||

Net income attributable to Western Refining, Inc. | $ | 102,279 | $ | 40,117 | $ | 10,907 | |||||

Net income attributable to non-controlling interest | — | 59,209 | 5,586 | ||||||||

Interest expense and other financing costs | 13,960 | 6,732 | 6,204 | ||||||||

Provision for income taxes | 92,114 | — | 3 | ||||||||

Gain on disposal of assets, net | (6 | ) | (33 | ) | (13 | ) | |||||

Depreciation and amortization | 26,648 | 19,746 | 4,983 | ||||||||

Maintenance turnaround expense | 490 | — | — | ||||||||

Net change in lower of cost or market inventory reserve | — | 36,795 | — | ||||||||

Unrealized loss (gain) on commodity hedging transactions | (1,531 | ) | 1,260 | — | |||||||

Adjusted EBITDA | $ | 233,954 | $ | 163,826 | $ | 27,670 | |||||

Nine Months Ended | |||||||||||

September 30, | |||||||||||

2015 | |||||||||||

Western | NTI | WNRL | |||||||||

(Unaudited) | |||||||||||

(In thousands) | |||||||||||

Net income attributable to Western Refining, Inc. | $ | 232,394 | $ | 129,245 | $ | 31,572 | |||||

Net income attributable to non-controlling interest | — | 197,563 | 16,159 | ||||||||

Interest expense and other financing costs | 42,511 | 20,242 | 16,416 | ||||||||

Provision for income taxes | 229,635 | — | 354 | ||||||||

Loss (gain) on disposal of assets, net | 444 | (344 | ) | (257 | ) | ||||||

Depreciation and amortization | 79,362 | 58,626 | 14,458 | ||||||||

Maintenance turnaround expense | 1,188 | — | — | ||||||||

Net change in lower of cost or market inventory reserve | (4,883 | ) | (12,248 | ) | — | ||||||

Unrealized loss (gain) on commodity hedging transactions | 42,446 | (373 | ) | — | |||||||

Adjusted EBITDA | $ | 623,097 | $ | 392,711 | $ | 78,702 | |||||

Three Months Ended | |||||||||||

September 30, | |||||||||||

2014 | |||||||||||

Western | NTI | WNRL | |||||||||

(Unaudited) | |||||||||||

(In thousands) | |||||||||||

Net income attributable to Western Refining, Inc. | $ | 144,024 | $ | 34,711 | $ | 8,014 | |||||

Net income attributable to non-controlling interest | — | 56,357 | 4,251 | ||||||||

Interest expense and other financing costs | 13,617 | 4,271 | 362 | ||||||||

Provision for income taxes | 80,578 | — | 135 | ||||||||

Gain on disposal of assets, net | (66 | ) | — | — | |||||||

Depreciation and amortization | 25,097 | 18,482 | 3,331 | ||||||||

Maintenance turnaround expense | 1,883 | — | — | ||||||||

Unrealized gain on commodity hedging transactions | (16,190 | ) | (830 | ) | — | ||||||

Adjusted EBITDA | $ | 248,943 | $ | 112,991 | $ | 16,093 | |||||

Nine Months Ended | |||||||||||

September 30, | |||||||||||

2014 | |||||||||||

Western | NTI | WNRL | |||||||||

(Unaudited) | |||||||||||

(In thousands) | |||||||||||

Net income attributable to Western Refining, Inc. | $ | 324,825 | $ | 81,837 | $ | 22,329 | |||||

Net income attributable to non-controlling interest | — | 124,786 | 11,844 | ||||||||

Interest expense and other financing costs | 57,360 | 16,575 | 1,073 | ||||||||

Provision for income taxes | 222,980 | — | 339 | ||||||||

Loss (gain) on disposal of assets, net | 1,040 | (101 | ) | — | |||||||

Depreciation and amortization | 74,297 | 56,829 | 10,042 | ||||||||

Maintenance turnaround expense | 48,329 | — | — | ||||||||

Loss on extinguishment of debt | 9 | — | — | ||||||||

Unrealized gain on commodity hedging transactions | (135,246 | ) | (1,125 | ) | — | ||||||

Adjusted EBITDA | $ | 593,594 | $ | 278,801 | $ | 45,627 | |||||

Consolidating Financial Data

The following tables set forth our consolidating historical financial data for the periods presented below.

Three Months Ended | Nine Months Ended | ||||||||||||||

September 30, | September 30, | ||||||||||||||

2015 | 2014 | 2015 | 2014 | ||||||||||||

(Unaudited) | |||||||||||||||

(In thousands) | |||||||||||||||

Operating Income | |||||||||||||||

Western, excluding NTI and WNRL | $ | 208,253 | $ | 239,093 | $ | 504,751 | $ | 605,093 | |||||||

NTI | 101,661 | 96,799 | 334,783 | 222,735 | |||||||||||

WNRL | 22,684 | 12,761 | 64,450 | 35,581 | |||||||||||

Operating income | $ | 332,598 | $ | 348,653 | $ | 903,984 | $ | 863,409 | |||||||

Depreciation and Amortization | |||||||||||||||

Western, excluding NTI and WNRL | $ | 26,648 | $ | 25,097 | $ | 79,362 | $ | 74,297 | |||||||

NTI | 19,746 | 18,482 | 58,626 | 56,829 | |||||||||||

WNRL | 4,983 | 3,331 | 14,458 | 10,042 | |||||||||||

Depreciation and amortization expense | $ | 51,377 | $ | 46,910 | $ | 152,446 | $ | 141,168 | |||||||

Capital Expenditures | |||||||||||||||

Western, excluding NTI and WNRL | $ | 52,293 | $ | 37,938 | $ | 138,246 | $ | 101,490 | |||||||

NTI | 17,439 | 9,237 | 35,267 | 34,339 | |||||||||||

WNRL | 6,699 | 2,748 | 22,463 | 11,425 | |||||||||||

Capital expenditures | $ | 76,431 | $ | 49,923 | $ | 195,976 | $ | 147,254 | |||||||

Balance Sheet Data (at end of period) | |||||||||||||||

Cash and cash equivalents | |||||||||||||||

Western, excluding NTI and WNRL | $ | 523,590 | $ | 465,010 | |||||||||||

NTI | 114,608 | 106,035 | |||||||||||||

WNRL | 71,372 | 79,109 | |||||||||||||

Cash and cash equivalents | $ | 709,570 | $ | 650,154 | |||||||||||

Total debt | |||||||||||||||

Western, excluding NTI and WNRL | $ | 890,375 | $ | 896,026 | |||||||||||

NTI | 356,209 | 357,312 | |||||||||||||

WNRL | 300,000 | — | |||||||||||||

Total debt | $ | 1,546,584 | $ | 1,253,338 | |||||||||||

Total working capital | |||||||||||||||

Western, excluding NTI and WNRL | $ | 784,497 | $ | 726,937 | |||||||||||

NTI | 287,113 | 271,540 | |||||||||||||

WNRL | 66,342 | 79,687 | |||||||||||||

Total working capital | $ | 1,137,952 | $ | 1,078,164 | |||||||||||

Refining Segment

El Paso and Gallup Refineries and Related Operations

Three Months Ended | Nine Months Ended | ||||||||||||||

September 30, | September 30, | ||||||||||||||

2015 | 2014 | 2015 | 2014 | ||||||||||||

(In thousands, except per barrel data) | |||||||||||||||

Statement of Operations Data (Unaudited): | |||||||||||||||

Net sales (including intersegment sales) (1) | $ | 1,652,934 | $ | 2,498,226 | $ | 4,963,407 | $ | 7,566,741 | |||||||

Operating costs and expenses: | |||||||||||||||

Cost of products sold (exclusive of depreciation and amortization) (2) | 1,335,326 | 2,145,984 | 4,098,734 | 6,578,731 | |||||||||||

Direct operating expenses (exclusive of depreciation and amortization) | 77,249 | 78,184 | 232,160 | 225,224 | |||||||||||

Selling, general and administrative expenses | 7,509 | 7,216 | 24,211 | 21,700 | |||||||||||

Loss on disposal of assets, net | — | 103 | 495 | 775 | |||||||||||

Maintenance turnaround expense | 490 | 1,883 | 1,188 | 48,329 | |||||||||||

Depreciation and amortization | 22,013 | 20,280 | 65,535 | 60,145 | |||||||||||

Total operating costs and expenses | 1,442,587 | 2,253,650 | 4,422,323 | 6,934,904 | |||||||||||

Operating income | $ | 210,347 | $ | 244,576 | $ | 541,084 | $ | 631,837 | |||||||

Key Operating Statistics | |||||||||||||||

Total sales volume (bpd) (1) (3) | 247,839 | 219,755 | 238,375 | 216,009 | |||||||||||

Total production (bpd) | 162,058 | 156,291 | 162,377 | 151,697 | |||||||||||

Total throughput (bpd) | 164,580 | 158,452 | 164,616 | 153,937 | |||||||||||

Per barrel of throughput: | |||||||||||||||

Refinery gross margin (2) (4) | $ | 21.11 | $ | 24.04 | $ | 19.22 | $ | 23.45 | |||||||

Direct operating expenses (5) | $ | 5.10 | $ | 5.36 | $ | 5.17 | $ | 5.36 | |||||||

Mid-Atlantic sales volume (bbls) | 2,144 | 2,005 | 6,597 | 6,883 | |||||||||||

Mid-Atlantic margin per barrel | $ | (1.10 | ) | $ | 0.91 | $ | 0.15 | $ | 0.37 | ||||||

The following tables set forth our summary refining throughput and production data for the periods and refineries presented:

El Paso and Gallup Refineries

Three Months Ended | Nine Months Ended | ||||||||||

September 30, | September 30, | ||||||||||

2015 | 2014 | 2015 | 2014 | ||||||||

Key Operating Statistics | |||||||||||

Product yields (bpd): | |||||||||||

Gasoline | 87,816 | 81,350 | 87,678 | 77,732 | |||||||

Diesel and jet fuel | 63,545 | 65,786 | 63,941 | 63,692 | |||||||

Residuum | 4,121 | 5,569 | 4,730 | 5,241 | |||||||

Other | 6,576 | 3,586 | 6,028 | 5,032 | |||||||

Total production (bpd) | 162,058 | 156,291 | 162,377 | 151,697 | |||||||

Throughput (bpd): | |||||||||||

Sweet crude oil | 131,465 | 122,282 | 131,626 | 120,873 | |||||||

Sour crude oil | 23,854 | 26,319 | 23,055 | 24,841 | |||||||

Other feedstocks and blendstocks | 9,261 | 9,851 | 9,935 | 8,223 | |||||||

Total throughput (bpd) | 164,580 | 158,452 | 164,616 | 153,937 | |||||||

El Paso Refinery

Three Months Ended | Nine Months Ended | ||||||||||||||

September 30, | September 30, | ||||||||||||||

2015 | 2014 | 2015 | 2014 | ||||||||||||

Key Operating Statistics | |||||||||||||||

Product yields (bpd): | |||||||||||||||

Gasoline | 71,855 | 64,614 | 70,613 | 60,904 | |||||||||||

Diesel and jet fuel | 55,667 | 56,278 | 55,804 | 54,911 | |||||||||||

Residuum | 4,121 | 5,569 | 4,730 | 5,241 | |||||||||||

Other | 5,016 | 2,517 | 4,503 | 3,588 | |||||||||||

Total production (bpd) | 136,659 | 128,978 | 135,650 | 124,644 | |||||||||||

Throughput (bpd): | |||||||||||||||

Sweet crude oil | 107,577 | 97,514 | 106,850 | 95,881 | |||||||||||

Sour crude oil | 23,854 | 26,319 | 23,055 | 24,841 | |||||||||||

Other feedstocks and blendstocks | 7,485 | 6,844 | 7,604 | 5,709 | |||||||||||

Total throughput (bpd) | 138,916 | 130,677 | 137,509 | 126,431 | |||||||||||

Total sales volume (bpd) (3) | 149,861 | 138,212 | 150,404 | 138,851 | |||||||||||

Per barrel of throughput: | |||||||||||||||

Refinery gross margin (2) (4) | $ | 18.51 | $ | 20.99 | $ | 18.65 | $ | 19.50 | |||||||

Direct operating expenses (5) | 3.64 | 4.32 | 3.96 | 4.31 | |||||||||||

Gallup Refinery

Three Months Ended | Nine Months Ended | ||||||||||||||

September 30, | September 30, | ||||||||||||||

2015 | 2014 | 2015 | 2014 | ||||||||||||

Key Operating Statistics | |||||||||||||||

Product yields (bpd): | |||||||||||||||

Gasoline | 15,961 | 16,736 | 17,065 | 16,828 | |||||||||||

Diesel and jet fuel | 7,878 | 9,508 | 8,137 | 8,781 | |||||||||||

Other | 1,560 | 1,069 | 1,525 | 1,444 | |||||||||||

Total production (bpd) | 25,399 | 27,313 | 26,727 | 27,053 | |||||||||||

Throughput (bpd): | |||||||||||||||

Sweet crude oil | 23,888 | 24,768 | 24,776 | 24,992 | |||||||||||

Other feedstocks and blendstocks | 1,776 | 3,007 | 2,331 | 2,514 | |||||||||||

Total throughput (bpd) | 25,664 | 27,775 | 27,107 | 27,506 | |||||||||||

Total sales volume (bpd) (3) | 33,489 | 35,705 | 33,339 | 34,257 | |||||||||||

Per barrel of throughput: | |||||||||||||||

Refinery gross margin (2) (4) | $ | 23.08 | $ | 20.65 | $ | 19.85 | $ | 16.54 | |||||||

Direct operating expenses (5) | 9.10 | 8.29 | 8.30 | 8.58 | |||||||||||

(1) | Refining net sales for the three and nine months ended September 30, 2015 and 2014 include $279.4 million, $753.8 million, $410.4 million and $1,163.8 million, respectively, representing a period average of 64,488 bpd, 54,631 bpd, 45,837 bpd and 42,901 bpd, respectively, in crude oil sales to third-parties. |

(2) | Cost of products sold for the refining segment includes the segment's net realized and net non-cash unrealized hedging activity shown in the table below. The hedging gains and losses are also included in the combined gross profit and refinery gross margin but are not included in those measures for the individual refineries. |

Three Months Ended | Nine Months Ended | ||||||||||||||

September 30, | September 30, | ||||||||||||||

2015 | 2014 | 2015 | 2014 | ||||||||||||

(Unaudited) | |||||||||||||||

(In thousands) | |||||||||||||||

Realized hedging gain, net | $ | 23,134 | $ | 20,737 | $ | 51,275 | $ | 41,399 | |||||||

Unrealized hedging gain (loss), net | 1,531 | 16,190 | (42,446 | ) | 135,246 | ||||||||||

Total hedging gain, net | $ | 24,665 | $ | 36,927 | $ | 8,829 | $ | 176,645 | |||||||

(3) | Sales volume includes sales of refined products sourced primarily from our refinery production as well as refined products purchased from third parties. We purchase additional refined products from third parties to supplement supply to our customers. These products are similar to the products that we currently manufacture and represented 8.4%, 9.4%, 8.7% and 10.3% of our total consolidated sales volumes for the three and nine months ended September 30, 2015 and 2014, respectively. The majority of the purchased refined products are distributed through our refined product sales activities in the Mid-Atlantic region where we satisfy our refined product customer sales requirements through a third-party supply agreement. |

(4) | Refinery gross margin for the respective periods presented is a per barrel measurement calculated by subtracting cost of products sold from net sales and dividing that difference by our refineries’ total throughput volumes. Net realized and net non-cash unrealized economic hedging gains and losses included in the combined refining segment gross margin are not allocated to the individual refineries. Refinery gross margin is a non-GAAP performance measure that we believe is useful for evaluating our refinery performance as a general indication of the excess of the refined product sales amount over the related cost of products sold. Our calculation of refinery gross margin excludes the sales and costs related to our Mid-Atlantic business that we report within the refining segment. The following table reconciles the sales and cost of sales used to calculate refinery gross margin with the total sales and cost of sales reported in the refining statement of operations data above: |

Three Months Ended | Nine Months Ended | ||||||||||||||

September 30, | September 30, | ||||||||||||||

2015 | 2014 | 2015 | 2014 | ||||||||||||

(Unaudited) | |||||||||||||||

(In thousands) | |||||||||||||||

Refinery net sales (including intersegment sales) | $ | 1,498,049 | $ | 2,263,053 | $ | 4,466,544 | $ | 6,734,253 | |||||||

Mid-Atlantic sales | 154,885 | 235,173 | 496,863 | 832,488 | |||||||||||

Net sales (including intersegment sales) | $ | 1,652,934 | $ | 2,498,226 | $ | 4,963,407 | $ | 7,566,741 | |||||||

Refinery cost of products sold (exclusive of depreciation and amortization) | $ | 1,178,412 | $ | 1,912,640 | $ | 3,602,870 | $ | 5,748,784 | |||||||

Mid-Atlantic cost of products sold | 156,914 | 233,344 | 495,864 | 829,947 | |||||||||||

Cost of products sold (exclusive of depreciation and amortization) | $ | 1,335,326 | $ | 2,145,984 | $ | 4,098,734 | $ | 6,578,731 | |||||||

Our calculation of refinery gross margin may differ from similar calculations of other companies in our industry, thereby limiting its usefulness as a comparative measure. The following table reconciles combined gross profit for our refineries to combined gross margin for our refineries for the periods presented:

Three Months Ended | Nine Months Ended | ||||||||||||||

September 30, | September 30, | ||||||||||||||

2015 | 2014 | 2015 | 2014 | ||||||||||||

(Unaudited) | |||||||||||||||

(In thousands, except per barrel data) | |||||||||||||||

Refinery net sales (including intersegment sales) | $ | 1,498,049 | $ | 2,263,053 | $ | 4,466,544 | $ | 6,734,253 | |||||||

Refinery cost of products sold (exclusive of depreciation and amortization) | 1,178,412 | 1,912,640 | 3,602,870 | 5,748,784 | |||||||||||

Depreciation and amortization | 22,013 | 20,280 | 65,535 | 60,145 | |||||||||||

Gross profit | 297,624 | 330,133 | 798,139 | 925,324 | |||||||||||

Plus depreciation and amortization | 22,013 | 20,280 | 65,535 | 60,145 | |||||||||||

Refinery gross margin | $ | 319,637 | $ | 350,413 | $ | 863,674 | $ | 985,469 | |||||||

Refinery gross margin per throughput barrel | $ | 21.11 | $ | 24.04 | $ | 19.22 | $ | 23.45 | |||||||

Gross profit per throughput barrel | $ | 19.66 | $ | 22.65 | $ | 17.76 | $ | 22.02 | |||||||

(5) | Refinery direct operating expenses per throughput barrel is calculated by dividing direct operating expenses by total throughput volumes for the respective periods presented. Direct operating expenses do not include any depreciation or amortization. |

NTI

The following table sets forth the summary operating results for NTI.

Three Months Ended | Nine Months Ended | ||||||||||||||

September 30, | September 30, | ||||||||||||||

2015 | 2014 | 2015 | 2014 | ||||||||||||

(Unaudited) | |||||||||||||||

(In thousands, except per barrel data) | |||||||||||||||

Net sales | $ | 798,025 | $ | 1,449,033 | $ | 2,348,621 | $ | 4,205,732 | |||||||

Operating costs and expenses: | |||||||||||||||

Cost of products sold (exclusive of depreciation and amortization) (1) | 573,686 | 1,235,697 | 1,662,948 | 3,631,911 | |||||||||||

Direct operating expenses (exclusive of depreciation and amortization) | 82,203 | 75,909 | 228,256 | 209,597 | |||||||||||

Selling, general and administrative expenses | 20,762 | 22,146 | 64,352 | 71,883 | |||||||||||

Affiliate severance costs | — | — | — | 12,878 | |||||||||||

Gain on disposal of assets, net | (33 | ) | — | (344 | ) | (101 | ) | ||||||||

Depreciation and amortization | 19,746 | 18,482 | 58,626 | 56,829 | |||||||||||

Total operating costs and expenses | 696,364 | 1,352,234 | 2,013,838 | 3,982,997 | |||||||||||

Operating income | $ | 101,661 | $ | 96,799 | $ | 334,783 | $ | 222,735 | |||||||

Key Operating Statistics | |||||||||||||||

Total sales volume (bpd) | 99,617 | 100,064 | 100,630 | 97,252 | |||||||||||

Total refinery production (bpd) | 90,362 | 96,625 | 94,451 | 94,314 | |||||||||||

Total refinery throughput (bpd) (2) | 90,590 | 96,464 | 94,538 | 94,054 | |||||||||||

Per barrel of throughput: | |||||||||||||||

Refinery gross margin (1) (3) | $ | 20.65 | $ | 18.87 | $ | 21.15 | $ | 17.35 | |||||||

Direct operating expenses (4) | 4.84 | 4.46 | 4.74 | 4.37 | |||||||||||

Retail fuel gallons sold (in thousands) | 78,414 | 79,674 | 227,673 | 229,453 | |||||||||||

Retail fuel margin per gallon (5) | $ | 0.27 | $ | 0.20 | $ | 0.23 | $ | 0.20 | |||||||

Merchandise sales | $ | 100,645 | $ | 95,647 | $ | 279,058 | $ | 264,090 | |||||||

Merchandise margin (6) | 25.8 | % | 25.7 | % | 25.9 | % | 26.0 | % | |||||||

Company-operated retail outlets at period end | 165 | 165 | |||||||||||||

Franchised retail outlets at period end | 102 | 82 | |||||||||||||

(1) | Cost of products sold for NTI includes the net realized and net non-cash unrealized hedging activity shown in the table below. Hedging gains and losses are also included in the combined gross profit and refinery gross margin. |

Three Months Ended | Nine Months Ended | ||||||||||||||

September 30, | September 30, | ||||||||||||||

2015 | 2014 | 2015 | 2014 | ||||||||||||

(Unaudited) | |||||||||||||||

(In thousands) | |||||||||||||||

Realized hedging gain, net | $ | 3,815 | $ | 5,978 | $ | 1,050 | $ | 2,874 | |||||||

Unrealized hedging gain (loss), net | (1,260 | ) | 830 | 373 | 1,125 | ||||||||||

Total hedging gain, net | $ | 2,555 | $ | 6,808 | $ | 1,423 | $ | 3,999 | |||||||

(2) | Total refinery throughput includes crude oil, other feedstocks and blendstocks. |

(3) | Refinery gross margin is a per barrel measurement calculated by dividing the difference between net sales and cost of products sold by the refinery's total throughput volumes for the respective periods presented. Refinery net sales include $35.3 million, $94.4 million, $322.6 million and $891.7 million related to crude oil sales during the three and nine months |

ended September 30, 2015 and 2014, respectively. Refinery gross margin is a non-GAAP performance measure that we believe is useful in evaluating refinery performance as a general indication of the excess of the refined product sales amount over the related cost of products sold. Each of the components used in this calculation (net sales and cost of products sold) can be reconciled to corresponding amounts included in the statement of operations. Our calculation of refinery gross margin may differ from similar calculations of other companies in our industry, thereby limiting its usefulness as a comparative measure. Cost of products sold for the three and nine months ended September 30, 2015 includes a non-cash adjustment of $36.8 million and a non-cash recovery of $12.2 million, respectively, in order to state the inventories value at market prices which were lower than cost.

The following table reconciles gross profit to gross margin for the St. Paul Park refinery for the periods presented:

Three Months Ended | Nine Months Ended | ||||||||||||||

September 30, | September 30, | ||||||||||||||

2015 | 2014 | 2015 | 2014 | ||||||||||||

(Unaudited) | |||||||||||||||

(In thousands, except per barrel data) | |||||||||||||||

Net refinery sales (including intersegment sales) | $ | 762,275 | $ | 1,425,308 | $ | 2,291,681 | $ | 4,155,644 | |||||||

Refinery cost of products sold (exclusive of depreciation and amortization) | 590,138 | 1,257,837 | 1,745,756 | 3,710,268 | |||||||||||

Refinery depreciation and amortization | 17,366 | 15,890 | 51,734 | 50,378 | |||||||||||

Gross profit | 154,771 | 151,581 | 494,191 | 394,998 | |||||||||||

Plus depreciation and amortization | 17,366 | 15,890 | 51,734 | 50,378 | |||||||||||

Refinery gross margin | $ | 172,137 | $ | 167,471 | $ | 545,925 | $ | 445,376 | |||||||

Refinery gross margin per refinery throughput barrel | $ | 20.65 | $ | 18.87 | $ | 21.15 | $ | 17.35 | |||||||

Gross profit per refinery throughput barrel | $ | 18.57 | $ | 17.08 | $ | 19.15 | $ | 15.38 | |||||||

(4) | NTI's direct operating expenses per throughput barrel are calculated by dividing refining direct operating expenses by total throughput volumes for the respective periods presented. Direct operating expenses do not include any depreciation or amortization. |

(5) | Retail fuel margin per gallon is a measurement calculated by dividing the difference between retail fuel sales and retail fuel cost of products sold by the number of gallons sold. Retail fuel margin per gallon is a measure frequently used in the retail industry to measure operating results related to fuel sales. |

(6) | Merchandise margin is a measurement calculated by dividing the difference between merchandise sales and merchandise cost of products sold by merchandise sales. Merchandise margin is a measure frequently used in the retail industry to measure operating results related to merchandise sales. |

WNRL

The WNRL financial and operational data presented include the historical results of all assets acquired from Western in the Wholesale Acquisition. This acquisition from Western was a transfer of assets between entities under common control. We have retrospectively adjusted historical financial and operational data of WNRL, for all periods presented, to reflect the purchase and consolidation of WRW into WNRL.

Three Months Ended | Nine Months Ended | ||||||||||||||

September 30, | September 30, | ||||||||||||||

2015 | 2014 | 2015 | 2014 | ||||||||||||

(Unaudited) | |||||||||||||||

(In thousands) | |||||||||||||||

Statement of Operations Data: | |||||||||||||||

Net sales (net of excise taxes) | $ | 674,479 | $ | 915,719 | $ | 2,016,376 | $ | 2,750,666 | |||||||

Operating costs and expenses: | |||||||||||||||

Cost of products sold (net of excise taxes) | 601,557 | 851,242 | 1,807,284 | 2,561,785 | |||||||||||

Direct operating expenses | 39,705 | 37,112 | 112,697 | 107,769 | |||||||||||

Selling, general and administrative expenses | 5,563 | 6,388 | 17,744 | 17,276 | |||||||||||

Gain on disposal of assets, net | (13 | ) | (34 | ) | (257 | ) | (16 | ) | |||||||

Depreciation and amortization | 4,983 | 4,292 | 14,458 | 12,898 | |||||||||||

Total operating costs and expenses | 651,795 | 899,000 | 1,951,926 | 2,699,712 | |||||||||||

Operating income | $ | 22,684 | $ | 16,719 | $ | 64,450 | $ | 50,954 | |||||||

Three Months Ended | Nine Months Ended | ||||||||||||||

September 30, | September 30, | ||||||||||||||

2015 | 2014 | 2015 | 2014 | ||||||||||||

(Unaudited) | |||||||||||||||

(In thousands, except key operating statistics) | |||||||||||||||

Key Operating Statistics | |||||||||||||||

Pipeline and gathering (bpd): | |||||||||||||||

Mainline movements: | |||||||||||||||

Permian/Delaware Basin system | 56,745 | 27,382 | 45,784 | 22,351 | |||||||||||

Four Corners system (1) | 66,602 | 38,623 | 54,719 | 38,483 | |||||||||||

Gathering (truck offloading): | |||||||||||||||

Permian/Delaware Basin system | 25,961 | 24,250 | 24,207 | 24,205 | |||||||||||

Four Corners system | 16,487 | 10,979 | 13,387 | 11,187 | |||||||||||

Terminalling, transportation and storage (bpd): | |||||||||||||||

Shipments into and out of storage (includes asphalt) | 408,787 | 389,773 | 396,506 | 379,261 | |||||||||||

Wholesale: | |||||||||||||||

Fuel gallons sold (in thousands) | 305,566 | 289,822 | 919,808 | 850,840 | |||||||||||

Fuel gallons sold to retail (included in fuel gallons sold above) (in thousands) | 81,538 | 68,064 | 235,824 | 194,753 | |||||||||||

Fuel margin per gallon (2) | $ | 0.029 | $ | 0.019 | $ | 0.031 | $ | 0.021 | |||||||

Lubricant gallons sold (in thousands) | 2,998 | 3,071 | 8,969 | 9,163 | |||||||||||

Lubricant margin per gallon (3) | $ | 0.70 | $ | 0.83 | $ | 0.71 | $ | 0.81 | |||||||

Crude oil trucking volume (bpd) | 49,620 | 39,473 | 47,245 | 34,610 | |||||||||||

Average crude oil revenue per barrel | $ | 2.51 | $ | 2.78 | $ | 2.58 | $ | 2.94 | |||||||

(1) | Some barrels of crude oil in route to Western's Gallup refinery and Permian/Delaware Basin are transported on more than one mainline. Mainline movements for the Four Corners and Delaware Basin systems include each barrel transported on each mainline. |

(2) | Fuel margin per gallon is a measurement calculated by dividing the difference between fuel sales, net of transportation charges, and cost of fuel sales for WNRL's wholesale business by the number of gallons sold. Fuel margin per gallon is a measure frequently used in the petroleum products wholesale industry to measure operating results related to fuel sales. |

(3) | Lubricant margin per gallon is a measurement calculated by dividing the difference between lubricant sales, net of transportation charges, and lubricant cost of products sold by the number of gallons sold. Lubricant margin is a measure frequently used in the petroleum products wholesale industry to measure operating results related to lubricant sales. |

Retail Segment

Three Months Ended | Nine Months Ended | ||||||||||||||

September 30, | September 30, | ||||||||||||||

2015 | 2014 | 2015 | 2014 | ||||||||||||

(Unaudited) | |||||||||||||||

(In thousands, except per gallon data) | |||||||||||||||

Statement of Operations Data | |||||||||||||||

Net sales (including intersegment sales) | $ | 328,895 | $ | 381,873 | $ | 905,569 | $ | 1,092,389 | |||||||

Operating costs and expenses: | |||||||||||||||

Cost of products sold (exclusive of depreciation and amortization) | 270,216 | 335,377 | 763,034 | 973,883 | |||||||||||

Direct operating expenses (exclusive of depreciation and amortization) | 35,283 | 30,710 | 101,278 | 89,115 | |||||||||||

Selling, general and administrative expenses | 3,263 | 2,654 | 9,636 | 7,962 | |||||||||||

Gain on disposal of assets, net | (6 | ) | (140 | ) | (51 | ) | (140 | ) | |||||||

Depreciation and amortization | 3,676 | 3,069 | 10,993 | 8,821 | |||||||||||

Total operating costs and expenses | 312,432 | 371,670 | 884,890 | 1,079,641 | |||||||||||

Operating income | $ | 16,463 | $ | 10,203 | $ | 20,679 | $ | 12,748 | |||||||

Key Operating Statistics | |||||||||||||||

Retail fuel gallons sold | 92,939 | 80,705 | 267,102 | 232,236 | |||||||||||

Average retail fuel sales price per gallon (net of excise taxes) | $ | 2.26 | $ | 3.12 | $ | 2.10 | $ | 3.07 | |||||||

Average retail fuel cost per gallon (net of excise taxes) | 1.95 | 2.86 | 1.89 | 2.88 | |||||||||||

Fuel margin per gallon (1) | 0.31 | 0.26 | 0.21 | 0.19 | |||||||||||

Merchandise sales | $ | 83,146 | $ | 70,900 | 234,014 | 199,684 | |||||||||

Merchandise margin (2) | 29.4 | % | 28.7 | % | 29.5 | % | 28.8 | % | |||||||

Operating retail outlets at period end | 261 | 230 | |||||||||||||

Cardlock fuel gallons sold | 16,990 | 16,906 | 50,013 | 51,235 | |||||||||||

Cardlock fuel margin per gallon | $ | 0.176 | $ | 0.185 | $ | 0.174 | $ | 0.176 | |||||||

Operating cardlocks at period end | 52 | 54 | |||||||||||||

Three Months Ended | Nine Months Ended | ||||||||||||||

September 30, | September 30, | ||||||||||||||

2015 | 2014 | 2015 | 2014 | ||||||||||||

(Unaudited) | |||||||||||||||

(In thousands, except per gallon data) | |||||||||||||||

Net Sales | |||||||||||||||

Retail fuel sales (net of excise taxes) | $ | 209,705 | $ | 251,709 | $ | 561,416 | $ | 712,839 | |||||||

Merchandise sales | 83,146 | 70,900 | 234,014 | 199,684 | |||||||||||

Cardlock sales | 33,184 | 56,831 | 100,960 | 171,755 | |||||||||||

Other sales | 2,860 | 2,433 | 9,179 | 8,111 | |||||||||||

Net sales | $ | 328,895 | $ | 381,873 | $ | 905,569 | $ | 1,092,389 | |||||||

Cost of Products Sold | |||||||||||||||

Retail fuel cost of products sold (net of excise taxes) | $ | 181,282 | $ | 231,143 | $ | 505,875 | $ | 668,642 | |||||||

Merchandise cost of products sold | 58,737 | 50,531 | 164,906 | 142,235 | |||||||||||

Cardlock cost of products sold | 30,141 | 53,671 | 92,077 | 162,656 | |||||||||||

Other cost of products sold | 56 | 32 | 176 | 350 | |||||||||||

Cost of products sold | $ | 270,216 | $ | 335,377 | $ | 763,034 | $ | 973,883 | |||||||

Retail fuel margin per gallon (1) | $ | 0.31 | $ | 0.26 | $ | 0.21 | $ | 0.19 | |||||||

(1) | Retail fuel margin per gallon is a measurement calculated by dividing the difference between retail fuel sales and cost of retail fuel sales by the number of gallons sold. Retail fuel margin per gallon is a measure frequently used in the convenience store industry to measure operating results related to retail fuel sales. |

(2) | Merchandise margin is a measurement calculated by dividing the difference between merchandise sales and merchandise cost of products sold by merchandise sales. Merchandise margin is a measure frequently used in the convenience store industry to measure operating results related to merchandise sales. |

Reconciliation of Special Items

We present certain additional financial measures below and elsewhere in this press release that are non-GAAP measures within the meaning of Regulation G under the Securities Exchange Act of 1934.

We present these non-GAAP measures to provide investors with additional information to analyze our performance from period to period. We believe it is useful for investors to understand our financial performance excluding these special items so that investors can see the operating trends underlying our business. Investors should not consider these non-GAAP measures in isolation from, or as a substitute for, the financial information that we report in accordance with GAAP. These non-GAAP measures reflect subjective determinations by management and may differ from similarly titled non-GAAP measures presented by other companies.

Three Months Ended | |||||||

September 30, | |||||||

2015 | 2014 | ||||||

(Unaudited) | |||||||

(In thousands, except per share data) | |||||||

Reported diluted earnings per share | $ | 1.61 | $ | 1.84 | |||

Income before income taxes | $ | 310,215 | $ | 328,070 | |||

Special items: | |||||||

Unrealized gain on commodity hedging transactions | (271 | ) | (17,020 | ) | |||

Gain on disposal of assets, net | (52 | ) | (66 | ) | |||

Net change in lower of cost or market inventory reserve | 36,795 | — | |||||

Earnings before income taxes excluding special items | 346,687 | 310,984 | |||||

Recomputed income taxes excluding special items (1) | (96,254 | ) | (75,567 | ) | |||

Net income excluding special items | 250,433 | 235,417 | |||||

Net income attributable to non-controlling interest | 90,215 | 60,099 | |||||

Net income attributable to Western excluding special items | $ | 160,218 | $ | 175,318 | |||

Diluted earnings per share excluding special items | $ | 1.69 | $ | 1.73 | |||

(1) | We recompute income taxes after deducting special items and earnings attributable to non-controlling interest. |

Q3 2015 Earnings Review November 3, 2015

2 Cautionary Statement on Forward-Looking Statements This presentation contains forward-looking statements which are protected by the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. The forward-looking statements reflect Western’s current expectations regarding future events, results or outcomes. Words such as “anticipate,” “assume,” “believe,” “budget,” “continue,” “could,” “estimate,” “expect,” “forecast,” “intend,” “may,” “plan,” “position,” “potential,” “predict,” “project,” “strategy,” “will,” “future” and other similar terms and phrases are used to identify forward-looking statements. The forward-looking statements contained herein include, but are not limited to, statements about: Western’s share repurchases and its commitment to maintain a dividend yield in the top quartile of its peer group; and fourth quarter 2015 guidance, including total throughput, direct operating expenses, selling, general and administrative expenses (“SG&A”), depreciation and amortization, interest expense and other financing costs, fiscal year 2015 capital expenditures which include maintenance/ regulatory expenditures and discretionary expenditures. These statements are subject to the general risks inherent in Western Refining, Inc.’s business. These expectations may or may not be realized. Some of these expectations may be based upon assumptions or judgments that prove to be incorrect. In addition, Western’s business and operations involve numerous risks and uncertainties, many of which are beyond its control, which could result in Western’s expectations not being realized or otherwise materially affect Western’s financial condition, results of operations, and cash flows. Additional information relating to the uncertainties affecting Western’s business is contained in its filings with the Securities and Exchange Commission. The forward-looking statements are only as of the date made. Except as required by law, Western does not undertake any obligation to (and expressly disclaims any obligation to) update any forward-looking statements to reflect events or circumstances after the date such statements were made, or to reflect the occurrence of unanticipated events.

3 Q3 2015 Highlights S Safe and reliable operations; strong throughput at El Paso and Gallup S Adjusted EBITDA of $425 million S Western Standalone: $234 million S WNRL: $28 million S NTI: $164 million S Share repurchases of $80 million; dividend of $0.34 per share S Completion of Phase One of the Bobcat Crude Oil Pipeline System in October ($ in millions, except per share data) Q3 2015 Q3 2014 Net income attributable to Western Refining, Inc. $153 $187 per Diluted Share $1.61 $1.84 Net income attributable to Western excluding special items1 $160 $175 per Diluted Share, excluding special items $1.69 $1.73 Adjusted EBITDA2 $425 $378 1 See Appendix for further detail on Net Income (loss) excluding special items. 2 Adjusted EBITDA excludes an adjustment for non-cash unrealized mark-to-market hedging gains and losses; see Appendix for reconciliation of Net Income to Adjusted EBITDA and the definition of Adjusted EBITDA.

4 Refining Operating Metrics Gross Margin ($ per throughput barrel) 1 Operating margin is defined as gross margin minus direct operating expenses. Direct Operating Expenses ($ per throughput barrel) Operating Margin ($ per throughput barrel) Q3 2015 Q3 2014 El Pas o Gallu p $25 $0 $20.99 $18.51 $25 $0 $4.32 $3.64 $25 $0 $16.67 $14.87 $25 $0 $20.65 $23.08 $25 $0 $8.29 $9.10 $25 $0 $12.36 $13.98 1

5 1,200 1,000 800 600 400 200 0 $ m illi on s Beginning Cash and Restricted Cash 6/30/15 Adjusted EBITDA Payments on Debt and Capital Leases Cash Taxes and Cash Interest Paid Share Repurchases Dividends Paid CAPEX Change in Working Cap & Other NTI and WNRL Distributions Change in Restricted Cash Ending Cash and Restricted Cash 9/30/15 $612 $722 $426 $56 $2 $86 $80 $33 $76 $22 $73 Q2 2015 to Q3 2015 Consolidated Cash Flow Bridge 1 Adjusted EBITDA includes both controlling and non-controlling interests of NTI and WNRL; see Appendix for a reconciliation of Net Income to Adjusted EBITDA and the definition of Adjusted EBITDA. 2 NTI and WNRL cash distributions to the non-controlling interests. 2 Western $ 405.7 $ 234.0 $ (1.6) $ (71.7) $ (80.0) $ (32.5) $ (52.3) $ 78.4 $ — $ 55.9 $ 535.9 NTI 127.9 163.8 (0.2) (2.0) — — (17.4) (89.9) (67.6) — 114.6 WNRL 78.6 27.7 — (11.9) — — (6.7) (10.5) (5.8) — 71.4 Total $ 612.2 $ 425.5 $ (1.8) $ (85.6) $ (80.0) $ (32.5) $ (76.4) $ (22.0) $ (73.4) $ 55.9 $ 721.9 1

6 Balanced Approach to Capital Allocation Growth Capital S Investment in refineries and logistics infrastructure S TexNew Mex Reversal and Extension S Bobcat Crude Oil Pipeline Dividends S Committed to maintaining a top quartile of peer group dividend yield Share Repurchase S Opportunistically repurchase WNR shares 2015E Western Standalone Capital Allocation Capital Expenditures: 40% Share Repurchase: 27% Dividends: 33% 1 Total capital allocation includes declared Q4 15 dividend of $0.38 per share, full year 2015E discretionary capital of $155.2 million, and total share repurchases through 9-30-15 of $105 million. 1Total = $389 million

7 Capital Structure 1 Western Standalone excludes NTI and WNRL. 2 Includes Restricted Cash of $12 million 3 Debt levels shown are net of premium and conversion feature. 4 See Appendix for a reconciliation of Net Income to Adjusted EBITDA and the definition of Adjusted EBITDA. As of September 30, 2015 ($ millions) WNR Consolidated Western1 Standalone Total Cash and Restricted Cash 2 $ 722 $ 536 Western Revolving Credit Facility $ — $ — Term Loan, due 2020 540 540 6.25% Senior Unsecured Notes due 2021 350 350 NTI Revolving Credit Facility — 7.125% Senior Secured Notes due 2020 356 WNRL Revolving Credit Facility — 7.5% Senior Notes, due 2023 300 Total Long-term Debt 3 1,546 890 Shareholders' Equity 3,032 1,318 Total Capitalization $ 4,578 $ 2,208 LTM Adjusted EBITDA 4 $ 1,408 $ 1,058 Total Debt / LTM Adjusted EBITDA 1.1x 0.8x Total Debt / Total Capitalization 34% 40%

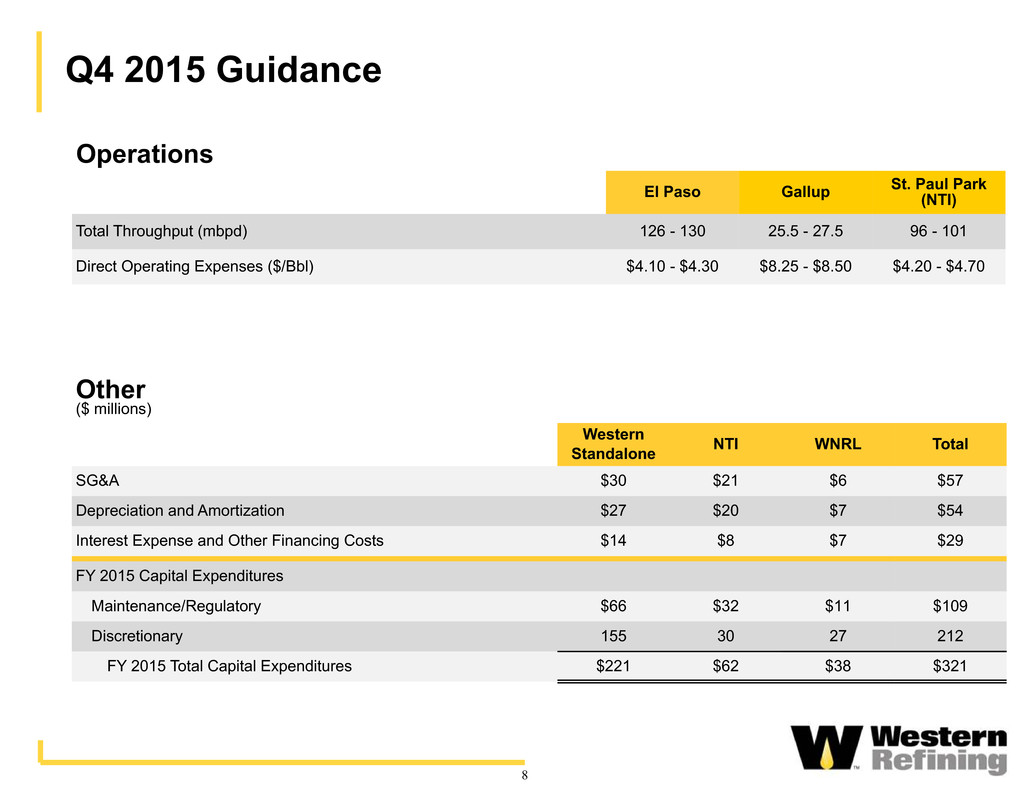

8 Operations El Paso Gallup St. Paul Park(NTI) Total Throughput (mbpd) 126 - 130 25.5 - 27.5 96 - 101 Direct Operating Expenses ($/Bbl) $4.10 - $4.30 $8.25 - $8.50 $4.20 - $4.70 Q4 2015 Guidance Other ($ millions) Western Standalone NTI WNRL Total SG&A $30 $21 $6 $57 Depreciation and Amortization $27 $20 $7 $54 Interest Expense and Other Financing Costs $14 $8 $7 $29 FY 2015 Capital Expenditures Maintenance/Regulatory $66 $32 $11 $109 Discretionary 155 30 27 212 FY 2015 Total Capital Expenditures $221 $62 $38 $321

Appendix

10 Reconciliation of Special Items 1 Income taxes recalculated after deducting special items and earnings attributable to non-controlling interest from Income before income taxes. Three Months Ended September 30, 2015 2014 (In thousands, except per share data) Reported diluted earnings per share $ 1.61 $ 1.84 Income before income taxes $ 310,215 $ 328,070 Special items: Unrealized gain on commodity hedging transactions (271) (17,020) Loss (gain) on disposal of assets, net (52) (66) Net change in lower of cost or market inventory reserve 36,795 — Earnings before income taxes excluding special items 346,687 310,984 Recomputed income taxes excluding special items 1 (96,254) (75,567) Net income excluding special items 250,433 235,417 Net income attributable to non-controlling interest 90,215 60,099 Net income attributable to Western excluding special items $ 160,218 $ 175,318 Diluted earnings per share excluding special items $ 1.69 $ 1.73

11 Consolidated Adjusted EBITDA Reconciliation 1 Adjusted EBITDA includes an adjustment for non-cash unrealized mark-to-market hedging gains and losses; see Appendix for reconciliation of Net Income to Adjusted EBITDA and the definition of Adjusted EBITDA. Three Months Ended September 30, 2015 2014 (In thousands) Net income attributable to Western Refining, Inc. $ 153,303 $ 186,749 Net income attributable to non-controlling interest 64,795 60,608 Interest expense and other financing costs 26,896 18,250 Provision for income taxes 92,117 80,713 Depreciation and amortization 51,377 46,910 Maintenance turnaround expense 490 1,883 Loss (gain) on disposal of assets, net (52) (66) Net change in lower of cost or market inventory reserve 36,795 — Unrealized loss (gain) on commodity hedging transactions (271) (17,020) Adjusted EBITDA 1 $ 425,450 $ 378,027

12 Consolidated Adjusted EBITDA Reconciliations Three Month Period Ending Twelve Months Ended (In Thousands) Consolidated Western Refining, Inc. Dec 2014 Mar 2015 Jun 2015 Sep 2015 Sep 2015 Net income attributable to Western Refining, Inc. $ 130,935 $ 105,989 $ 133,919 $ 153,303 $ 524,146 Net income attributable to non-controlling interest 13,516 68,979 79,948 64,795 227,238 Interest expense and other financing costs 22,054 24,957 27,316 26,896 101,223 Provision for income taxes 69,285 59,437 78,435 92,117 299,274 Depreciation and amortization 49,398 49,926 51,143 51,377 201,844 Maintenance turnaround expense 140 105 593 490 1,328 Loss (gain) on disposal of assets, net 7,591 282 (387) (52) 7,434 Net change in lower of cost or market inventory reserve 78,554 (15,722) (38,204) 36,795 61,423 Unrealized (gain) loss on commodity hedging transactions (58,052) 20,057 22,287 (271) (15,979) Adjusted EBITDA 1 $ 313,421 $ 314,010 $ 355,050 $ 425,450 $ 1,407,931 1 Adjusted EBITDA includes an adjustment for non-cash unrealized mark-to-market hedging gains and losses; see Appendix for reconciliation of Net Income to Adjusted EBITDA and the definition of Adjusted EBITDA.

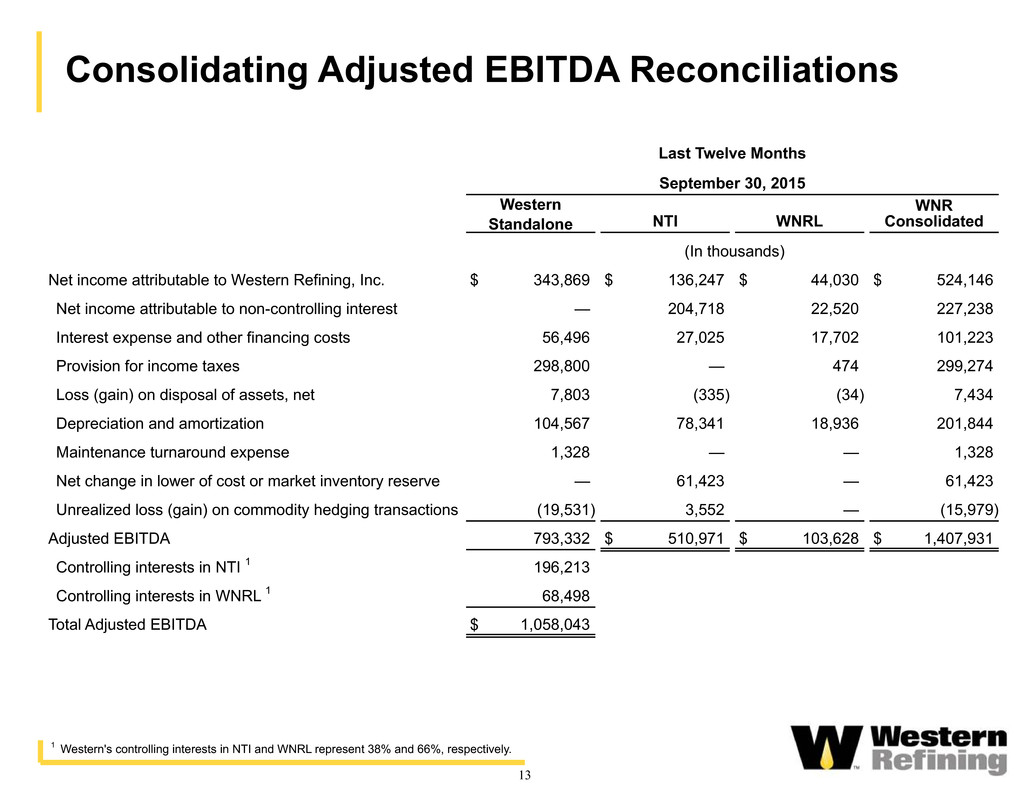

13 Last Twelve Months September 30, 2015 Western Standalone NTI WNRL WNR Consolidated (In thousands) Net income attributable to Western Refining, Inc. $ 343,869 $ 136,247 $ 44,030 $ 524,146 Net income attributable to non-controlling interest — 204,718 22,520 227,238 Interest expense and other financing costs 56,496 27,025 17,702 101,223 Provision for income taxes 298,800 — 474 299,274 Loss (gain) on disposal of assets, net 7,803 (335) (34) 7,434 Depreciation and amortization 104,567 78,341 18,936 201,844 Maintenance turnaround expense 1,328 — — 1,328 Net change in lower of cost or market inventory reserve — 61,423 — 61,423 Unrealized loss (gain) on commodity hedging transactions (19,531) 3,552 — (15,979) Adjusted EBITDA 793,332 $ 510,971 $ 103,628 $ 1,407,931 Controlling interests in NTI 1 196,213 Controlling interests in WNRL 1 68,498 Total Adjusted EBITDA $ 1,058,043 Consolidating Adjusted EBITDA Reconciliations 1 Western's controlling interests in NTI and WNRL represent 38% and 66%, respectively.

14 Adjusted EBITDA Reconciliation The tables on the previous page reconcile net income to Adjusted EBITDA for the periods presented. Adjusted EBITDA represents earnings before interest expense and other financing costs, provision for income taxes, depreciation, amortization, maintenance turnaround expense, and certain other non-cash income and expense items. However, Adjusted EBITDA is not a recognized measurement under United States generally accepted accounting principles ("GAAP"). Our management believes that the presentation of Adjusted EBITDA is useful to investors because it is frequently used by securities analysts, investors, and other interested parties in the evaluation of companies in our industry. In addition, our management believes that Adjusted EBITDA is useful in evaluating our operating performance compared to that of other companies in our industry because the calculation of Adjusted EBITDA generally eliminates the effects of financings, income taxes, the accounting effects of significant turnaround activities (that many of our competitors capitalize and thereby exclude from their measures of EBITDA), and certain non-cash charges that are items that may vary for different companies for reasons unrelated to overall operating performance. Adjusted EBITDA has limitations as an analytical tool, and you should not consider it in isolation, or as a substitute for analysis of our results as reported under GAAP. Some of these limitations are: • Adjusted EBITDA does not reflect our cash expenditures or future requirements for significant turnaround activities, capital expenditures, or contractual commitments; • Adjusted EBITDA does not reflect the interest expense or the cash requirements necessary to service interest or principal payments on our debt; • Adjusted EBITDA does not reflect changes in, or cash requirements for, our working capital needs; and • Adjusted EBITDA, as we calculate it, differs from the NTI and WNRL Adjusted EBITDA calculation and may differ from the Adjusted EBITDA calculations of other companies in our industry, thereby limiting its usefulness as a comparative measure. Because of these limitations, Adjusted EBITDA should not be considered a measure of discretionary cash available to us to invest in the growth of our business. We compensate for these limitations by relying primarily on our GAAP results and using Adjusted EBITDA only supplementally.

15 Volume Hedged (000 barrels) % of Planned Production Hedged Strike Price Mark-to-Market Price1 September 30, 2015 Offsetting Unrealized Gain Period Gasoline Distillate Gasoline Distillate Gasoline Distillate Gasoline Distillate Positions ($MM) 2 2015 Q4 750 1,772 10% 33.0% 9.70 26.38 7.36 14.68 8.9 2016 Q1 150 645 2.4% 14.0% 10.20 26.38 8.25 15.04 5.9 Q2 — 795 —% 13.2% — 26.35 — 16.04 4.7 Q3 — 1,545 —% 25.4% — 26.93 — 16.72 4.7 Q4 — 795 —% 13.1% — 26.35 — 16.02 4.7 2017 Q1 — 375 —% 8.1% — 23.49 — 16.36 — Q2 — 150 —% 2.5% — 23.60 — 17.26 — Q3 — 150 —% 2.5% — 23.60 — 18.04 — Q4 — 150 —% 2.5% — 23.60 — 17.02 — 1 Mark-to-market pricing based on data obtained from the CME Group. 2 Represents unrealized gains on short positions that were closed by the purchase of an offsetting long position as of Q3 2015, neither of which position will be realized until maturity. Western Standalone Crack Spread Hedge Positions As of September 30, 2015

Western Standalone Hedging Gain/(Loss) As of September 30, 2015 ($ millions) Hedging Period Realized Gain/(Loss) Total Realized Gain / (Loss) Crack Spread Inventory/Other Q1 2015 $17.1 $0.4 $17.5 Q2 2015 18.1 (7.4) 10.7 Q3 2015 16.8 6.3 23.1 Hedging Period Unrealized Gain/(Loss) Total Unrealized Gain / (Loss)Crack Spread Inventory/Other Q1 2015 $(20.3) $(0.9) $(21.2) Q2 2015 (23.7) 0.9 (22.8) Q3 2015 2.7 (1.2) 1.5 16

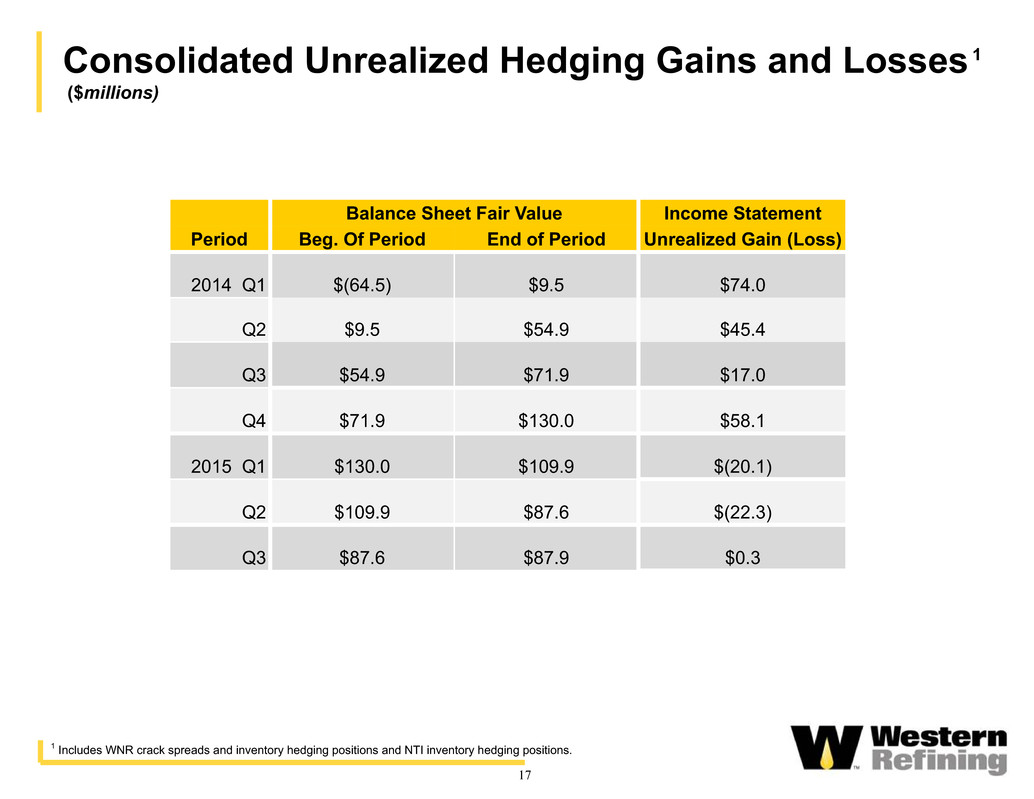

17 Consolidated Unrealized Hedging Gains and Losses 1 ($millions) Balance Sheet Fair Value Income Statement Period Beg. Of Period End of Period Unrealized Gain (Loss) 2014 Q1 $(64.5) $9.5 $74.0 Q2 $9.5 $54.9 $45.4 Q3 $54.9 $71.9 $17.0 Q4 $71.9 $130.0 $58.1 2015 Q1 $130.0 $109.9 $(20.1) Q2 $109.9 $87.6 $(22.3) Q3 $87.6 $87.9 $0.3 1 Includes WNR crack spreads and inventory hedging positions and NTI inventory hedging positions.

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Rubrik Announces Pricing of Upsized Initial Public Offering

- Marex Group plc Announces Pricing of Initial Public Offering

- ITE HCMC 2024: Pioneering Sustainable Tourism for a Creating Future

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share