Form 8-K IHS Inc. For: Oct 07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________

FORM 8-K

________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): October 7, 2015

Commission file number 001-32511

______________________

IHS INC.

(Exact name of registrant as specified in its charter)

Delaware (State or Other Jurisdiction of Incorporation or Organization) | 13‑3769440 (I.R.S. Employer Identification Number) | |

15 Inverness Way East

Englewood, CO 80112

(Address of principal executive offices)

(303) 790‑0600

(Registrant's telephone number, including area code)

Former name or former address, if changed since last report: Not Applicable

______________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02. Results of Operations and Financial Condition.

IHS Inc. ("IHS" or "we" or "us" or "our") is furnishing historical product category revenue information and expected new segment revenue information as an exhibit to this current report on Form 8-K. We anticipate discussing this new segment revenue information as part of our previously announced Investor Day presentation on October 7, 2015, which will be simultaneously webcast through our website (www.ihs.com).

Item 7.01. Regulation FD Disclosure.

On October 7, 2015, we issued a media release to publicly reaffirm our previously announced financial guidance for fiscal year 2015. The release, furnished as an exhibit to this current report on Form 8-K, was posted on our website (www.ihs.com) and distributed to the media through a newswire service.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

99.1 Media Release dated October 7, 2015.

99.2 Supplemental historical product category revenue information and expected new segment revenue information.

The information furnished in connection with this current report on Form 8-K shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in any such filing.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

IHS INC. | ||

October 7, 2015 | By: | /s/ Stephen Green |

Stephen Green | ||

Executive Vice President, Legal and Corporate Secretary | ||

Exhibit 99.1

| News Release |

FOR IMMEDIATE RELEASE

News Media Contact: | Investor Relations Contact: | ||

Ed Mattix | Eric Boyer | ||

+1 720 587 9973 | +1 303 397 2969 | ||

IHS Reaffirms 2015 Financial Guidance

ENGLEWOOD, Colo. (October 7, 2015) - IHS Inc. (NYSE: IHS), the leading global source of information and analytics, will publicly reaffirm its earnings guidance during its previously announced Investor Day presentation to be made today in New York City.

For the year ending November 30, 2015, IHS expects:

• | Revenue at the mid-point of the range of $2.30 billion to $2.34 billion, including the low end of 5-6 percent subscription organic growth, negative non-subscription organic growth, and total organic growth of 1-2 percent; |

• | Adjusted EBITDA toward the high end of the range of $725 million to $740 million; and |

• | Adjusted EPS toward the high end of the range of $5.80 to $6.00 per diluted share. |

The above outlook assumes no further currency movements, acquisitions, divestitures, pension mark-to-market adjustments or unanticipated events. See discussion of non-GAAP financial measures at the end of this release.

The Investor Day conference is by invitation only and registration is required. To listen to the meeting and view the presentations via webcast, log on to investor.ihs.com by 11:45 a.m. EDT on October 7. A replay of the IHS Investor Day webcast will be available approximately two hours after the end of the presentation through the same website link.

# # #

Use of Non-GAAP Financial Measures

Non-GAAP results are presented only as a supplement to our financial statements based on U.S. generally accepted accounting principles (GAAP). Non-GAAP financial information is provided to enhance the reader’s understanding of our financial performance, but none of these non-GAAP financial measures are recognized terms under GAAP and non-GAAP measures should not be considered in isolation or as a substitute for financial measures calculated in accordance with GAAP. Our most recent non-GAAP reconciliations were furnished as an exhibit to a Form 8-K on September 29, 2015, and are available on our website (www.ihs.com).

We use non-GAAP measures in our operational and financial decision-making, believing that it is useful to exclude certain items in order to focus on what we deem to be a more reliable indicator of ongoing operating performance and our ability to generate cash flow from operations. As a result, internal management reports used during monthly operating reviews feature the Adjusted EBITDA, Adjusted net income, Adjusted EPS, and free cash flow metrics. We also believe that investors may find non-GAAP financial measures useful for the same reasons, although investors are cautioned that non-GAAP financial measures are not a substitute for GAAP disclosures.

Because not all companies use identical calculations, our presentation of non-GAAP financial measures may not be comparable to other similarly-titled measures of other companies. However, these measures can still be useful in evaluating our performance against our peer companies because we believe the measures provide users with valuable insight into key components of GAAP financial disclosures.

IHS Forward-Looking Statements

This release contains “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as: “anticipate,” “intend,” “plan,” “goal,” “seek,” “aim,” “strive,” “believe,” “project,” “predict,” "estimate," "expect," “continue,” "strategy," "future," "likely," "may," “might,” "should," "will," the negative of these terms and similar references to future periods. Examples of forward-looking statements include, among others, statements we make regarding guidance relating to net income, net income per share, and expected operating results, such as revenue growth and earnings.

Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Our actual results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not rely on any of these forward-looking statements. Important factors that could cause our actual results and financial condition to differ materially from those indicated in the forward-looking statements include, among others, the following: economic and financial conditions, including volatility in interest and exchange rates; our ability to manage system failures, capacity constraints, and cyber risks; our ability to successfully manage risks associated with changes in demand for our products and services as well as changes in our targeted industries; our ability to develop new platforms to deliver our products and services, pricing, and other competitive pressures, and changes in laws and regulations governing our business; the extent to which we are successful in gaining new long-term relationships with customers or retaining existing ones and the level of service failures that could lead customers to use competitors' services; our ability to successfully identify and integrate acquisitions into our existing businesses and manage risks associated therewith; our ability to satisfy our debt obligations and our other ongoing business obligations; and the other factors described under the caption “Risk Factors” in our most recent annual report on Form 10-K, along with our other filings with the U.S. Securities and Exchange Commission.

Any forward-looking statement made by us in this release is based only on information currently available to us and speaks only as of the date on which it is made. We undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise.

Please consult our public filings at www.sec.gov or www.ihs.com.

About IHS Inc. (www.ihs.com)

IHS Inc. (NYSE: IHS) is the leading source of information, insight and analytics in critical areas that shape today’s business landscape. Businesses and governments in more than 150 countries around the globe rely on the comprehensive content, expert independent analysis and flexible delivery methods of IHS to make high-impact decisions and develop strategies with speed and confidence. IHS has been in business since 1959 and became a publicly traded company on the New York Stock Exchange in 2005. Headquartered in Englewood, Colorado, USA, IHS is committed to sustainable, profitable growth and employs about 8,800 people in 32 countries around the world.

IHS is a registered trademark of IHS Inc. All other company and product names may be trademarks of their respective owners.

© 2015 IHS Inc. All rights reserved.

© 2015 IHS. ALL RIGHTS RESERVED. SUPPLEMENTAL SCHEDULES IHS Investor Day October 7, 2015 OCTOBER 2015 1

© 2015 IHS. ALL RIGHTS RESERVED. Our transition to a business line operating model drives new reporting segments and aligns with our strategy Resources ~39% of Total Revenue1 Energy ~91% Chemicals ~9% Transportation ~32% of Total Revenue1 Autos ~76% AD&S ~10% Maritime ~14% Consolidated Markets ~29% of Total Revenue1 Technology ~17% ECR ~15% PD ~50% OERM ~18% 1 Revenue percentages based on YTD 2015. Higher margin, more profitable models Primarily INFORMATION BUSINESSES Royalty-bearing (PD) Primarily MARKET RESEARCH 2

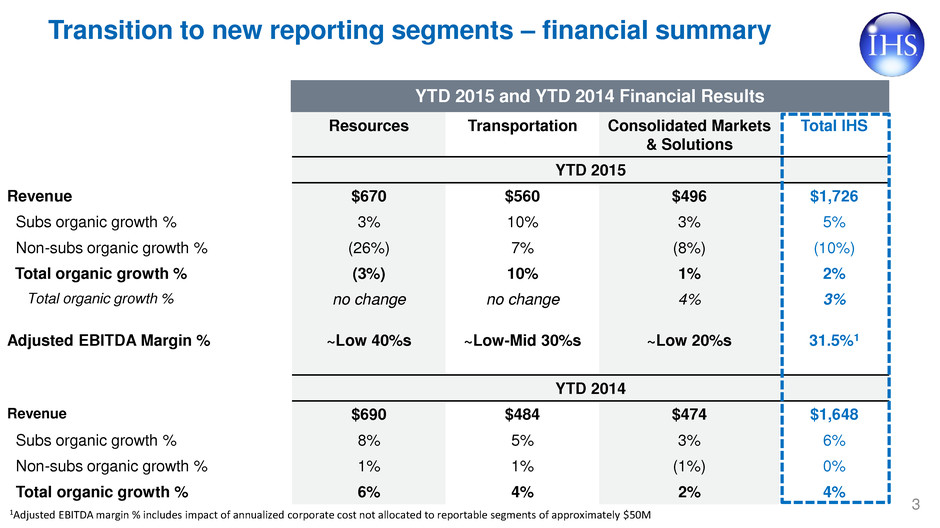

Transition to new reporting segments ‒ financial summary Resources Transportation Consolidated Markets & Solutions Total IHS YTD 2015 Revenue $670 $560 $496 $1,726 Subs organic growth % 3% 10% 3% 5% Non-subs organic growth % (26%) 7% (8%) (10%) Total organic growth % (3%) 10% 1% 2% Total organic growth % no change no change 4% 3% Adjusted EBITDA Margin % ~Low 40%s ~Low-Mid 30%s ~Low 20%s 31.5%1 YTD 2014 Revenue $690 $484 $474 $1,648 Subs organic growth % 8% 5% 3% 6% Non-subs organic growth % 1% 1% (1%) 0% Total organic growth % 6% 4% 2% 4% YTD 2015 and YTD 2014 Financial Results 1Adjusted EBITDA margin % includes impact of annualized corporate cost not allocated to reportable segments of approximately $50M 3

© 2015 IHS. ALL RIGHTS RESERVED. 2015 Supplemental Product Category Revenue and Expected New Segments 4 Q1 Q2 Q3 Q1 Q2 Q3 Q1 Q2 Q3 Resources 189,996 188,824 187,684 6% 2% 1% 6% 2% 2% Transportation 136,320 141,031 144,340 13% 16% 16% 9% 10% 12% CMS 121,491 129,826 134,576 4% 8% 11% 4% 3% 3% Subscriptions 447,807 459,681 466,600 7% 8% 8% 7% 5% 5% Resources 27,573 45,849 30,029 -27% -22% -29% -28% -23% -30% Transportation 39,398 49,261 49,027 16% 18% 16% 3% 5% 12% CMS 31,483 36,616 42,289 -11% -10% 8% -15% -15% 5% Non-Subscriptions 98,454 131,726 121,345 -8% -7% -2% -14% -12% -4% Resources 217,569 234,673 217,713 0% -4% -5% 0% -4% -4% Transportation 175,718 190,292 193,367 14% 17% 16% 7% 9% 12% CMS 152,974 166,442 176,865 1% 3% 10% 0% -2% 3% Total 546,261 591,407 587,945 4% 4% 6% 2% 1% 3% New Se gm ent s 2015 Organic Growth %2015 Actual 2015 Total Growth % Resources 189,996 188,824 187,684 6% 2% 1% 6% 2% 2% Indust ial 150,527 163,090 0,641 14% 23% 26% 8% 10% 11% Horizontal products 107,284 107,767 108,2 5 2% -1% -1% 4% 3% 2% Subscriptions 447,807 459,681 4 6, 00 7% 8% 8% 7% 5% 5% Resources 27,573 45,849 30,029 -27% -22% -29% - 8% -23% - 0% Industrials 46,063 57,446 57,586 16% 19% 17% 0% 2% 9% Horizontal products 24,818 28,431 33,730 -17% -17% 5% -15% -14% 8% Non-Subscriptions 98,454 131,726 121,345 -8% -7% -2% -14% -12% -4% Resources 217,569 234,673 217,713 0% -4% -5% 0% -4% -4% Industrials 196,590 220,536 228,227 14% 22% 23% 7% 8% 11% Horizontal products 132,102 136,198 142,005 -2% -5% 0% 0% -1% 4% Total 546,261 591,407 587,945 4% 4% 6% 2% 1% 3% Curr ent P rodu ct C ateg ories

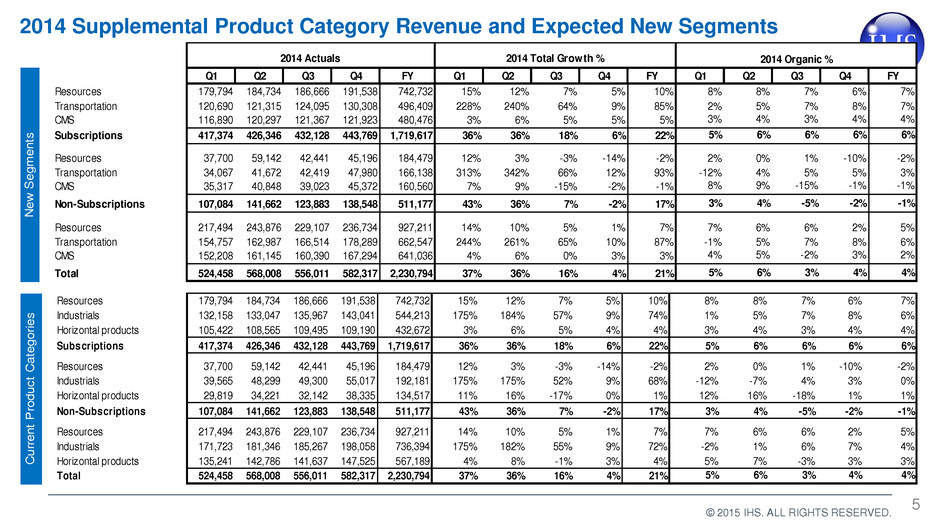

© 2015 IHS. ALL RIGHTS RESERVED. 5 2014 Supplemental Product Category Revenue and Expected New Segments Q1 Q2 Q3 Q4 FY Q1 Q2 Q3 Q4 FY Q1 Q2 Q3 Q4 FY Resources 179,794 184,734 186,666 191,538 742,732 15% 12% 7% 5% 10% 8% 8% 7% 6% 7% Transportation 120,690 121,315 124,095 130,308 496,409 228% 240% 64% 9% 85% 2% 5% 7% 8% 7% CMS 116,890 120,297 121,367 121,923 480,476 3% 6% 5% 5% 5% 3% 4% 3% 4% 4% Subscriptions 417,374 426,346 432,128 443,769 1,719,617 36% 36% 18% 6% 22% 5% 6% 6% 6% 6% Resources 37,700 59,142 42,441 45,196 184,479 12% 3% -3% -14% -2% 2% 0% 1% -10% -2% Transportation 34,067 41,672 42,419 47,980 166,138 313% 342% 66% 12% 93% -12% 4% 5% 5% 3% CMS 35,317 40,848 39,023 45,372 160,560 7% 9% -15% -2% -1% 8% 9% -15% -1% -1% Non-Subscriptions 107,084 141,662 123,883 138,548 511,177 43% 36% 7% -2% 17% 3% 4% -5% -2% -1% Resources 217,494 243,876 229,107 236,734 927,211 14% 10% 5% 1% 7% 7% 6% 6% 2% 5% Transportation 154,757 162,987 166,514 178,289 662,547 244% 261% 65% 10% 87% -1% 5% 7% 8% 6% CMS 152,208 161,145 160,390 167,294 641,036 4% 6% 0% 3% 3% 4% 5% -2% 3% 2% Total 524,458 568,008 556,011 582,317 2,230,794 37% 36% 16% 4% 21% 5% 6% 3% 4% 4% New Seg men ts 2014 Total Growth %2014 Actuals 2014 Organic % Resources 179,794 184,734 186,666 191,538 742,732 15 12 7 5 10 8% 8% 7% 6% 7% Indust ial 132,158 133,047 135,967 143,041 544,213 175 184 57 9 74 1 5 7 8 6 Horizontal products 105,422 108,565 109,495 109,190 432,672 3 6 5 4 4 3% 4% 3% 4% 4% Sub cripti s 417,374 426,346 432,128 443,769 1,719,617 36% 36% 18% 6% 22% 5% 6% 6% 6% 6% Resources 37,700 59,142 42,441 45,196 184,479 12 3 -3 -14 -2 2% 0% 1% -10% -2% Industrials 39,565 48,299 49,300 55,017 192,181 175 175 52 9 68 -12 -7 4 3 0 Horizontal products 29,819 34,221 32,142 38,335 134,517 11% 16% -17% 0% 1% 12% 16% -18% 1% 1% Non-Subscriptions 107,084 141,662 123,883 138,548 511,177 43% 36% 7% -2% 17% 3% 4% -5% -2% -1% Resources 217,494 243,876 229,107 236,734 927,211 14% 10% 5% 1% 7% 7% 6% 6% 2% 5% Industrials 171,723 181,346 185,267 198,058 736,394 175 182 55 9 72 -2 1 6 7 4 Horizontal products 135,241 142,786 141,637 147,525 567,189 4% 8% -1% 3% 4% 5% 7% -3% 3% 3% Total 524,458 568,008 556,011 582,317 2,230,794 37 36 16 4 21 5 6 3 4 4 Curre nt Pro duct C atego ries

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- WEX Signs Agreement with Leading Online Travel Platform Booking.com

- Sunlands Technology Group Files its Annual Report on Form 20-F

- TransUnion Announces First Quarter 2024 Results

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share