Form 8-K ATMEL CORP For: Sep 19

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________

FORM 8-K

CURRENT

REPORT

Pursuant to Section 13 OR 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 19, 2015

___________________

atmel corporation

(Exact name of registrant as specified in its charter)

___________________

| Delaware | 0-19032 | 77-0051991 |

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

1600 Technology Drive

San Jose, CA 95110

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (408) 441-0311

Not applicable

(Former name or former address, if changed since last report)

___________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| x | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 1.01 Entry into a Material Definitive Agreement.

The Merger

On September 19, 2015, Atmel Corporation, a Delaware corporation (“Atmel”), entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Dialog Semiconductor plc, a corporation organized under the laws of England and Wales (“Dialog”), and Avengers Acquisition Corporation, a Delaware corporation and a wholly-owned direct subsidiary of Dialog (“Merger Sub”).

Under the terms of the Merger Agreement, the acquisition of Atmel will be accomplished through a merger of Merger Sub with and into Atmel (the “Merger”), with Atmel being the surviving corporation (the “Surviving Corporation”).

At the effective time of the Merger (the “Effective Time”), each share of Atmel’s common stock, par value $0.001 per share (the “Common Stock”), issued and outstanding immediately prior to the Merger (other than dissenting shares and shares held by Dialog, Merger Sub, Atmel or any of their respective subsidiaries) will be converted into the right to receive (A) 0.112 American Depositary Shares of Dialog (the “ADSs”), with each whole ADS representing one ordinary share of Dialog (each, a “Dialog Share”), (B) $4.65 in cash, without interest, and (C) cash in lieu of fractional ADSs as contemplated in the Merger Agreement (the “Merger Consideration”). The number of ADSs to be received by Atmel’s stockholders is fixed and will not change and, as a result, the value of the Merger Consideration to be received by Atmel’s stockholders in respect of Common Stock may vary with the trading price of Dialog Shares. The Merger is expected to be fully taxable to the stockholders of Atmel for U.S. federal income tax purposes.

Treatment of Compensatory Equity Awards

Pursuant to the terms of the Merger Agreement, at the Effective Time, each outstanding option to acquire shares of Common Stock will, contingent upon the occurrence of the Effective Time, accelerate and become vested in full and, to the extent not exercised prior to the Effective Time, will be automatically “net exercised” immediately prior to the Effective Time, with the exercise price and applicable withholding taxes paid by withholding of shares of Common Stock otherwise issuable to the option holder upon the exercise of the option. Each outstanding restricted stock unit, deferred stock unit, performance-based restricted stock unit or similar right (each such unit or right, an “Atmel Unit”) that is vested but not yet issued, will be converted into the right to receive the Merger Consideration. In addition, each Atmel Unit that is unvested and held by an employee or other service provider of Atmel who will continue to be employed by or provide services to, Dialog or the Surviving Corporation will be converted into equivalent awards in respect of Dialog Shares using a customary exchange ratio. For the performance-based Atmel Units granted with a performance period that was intended to end December 31, 2015 (the “2015 PRSUs”), Atmel’s board of directors determined that 57.0% of the target awards should vest contingent upon, and immediately prior to, the occurrence of the Effective Time, with the remaining 2015 PRSUs being converted into time-based awards that vest through November 15, 2017. In addition, in connection with the Merger, Atmel’s board of directors determined that the Atmel Units granted in August 2015, for which performance criteria had not been established

| - 2 - |

prior to the date of the Merger Agreement, will be converted, contingent upon the occurrence of the Effective Time, into time-based awards vesting through November 15, 2018.

If Dialog determines that the assumption and conversion of an Atmel Unit would violate, in respect of the holder thereof, the applicable laws of a non-U.S. jurisdiction set forth in the Merger Agreement, Dialog may treat such Atmel Unit in a different manner so long as the holder of such Atmel Unit receives the full value of the Merger Consideration (less applicable withholdings) in cash not later than the vesting date originally applicable to such Atmel Unit.

Atmel has entered into indemnity agreements with each of its Section 16 officers pursuant to which Atmel will indemnify them for excise and related taxes they could incur with respect to their specified stock compensation if Section 4985 of the Internal Revenue Code of 1986, as amended (the “Code”), applies to the Merger. The Merger is not expected, nor intended, to be subject to Section 4985 of the Code, and no payment will be made if that Section does not apply to the Merger or if the Merger is not completed. The amount of the excise tax that could be payable by each affected officer would depend, among other things, on the fair market value of the Dialog Shares at the Effective Time.

Closing Conditions

Each of Dialog’s and Atmel’s obligation to consummate the Merger is subject to a number of conditions specified in the Merger Agreement, including the following: (i) adoption of the Merger Agreement by Atmel’s stockholders, (ii) approval by Dialog’s shareholders of the granting of authority to Dialog’s board of directors to issue and allot the Dialog Shares underlying the ADSs and the amendment of Dialog’s Articles of Association (the “Articles”) required in order to permit the issuance of the American depositary receipts (“ADRs”) evidencing ADSs and ADSs in the manner contemplated by the Merger Agreement; (iii) approval for listing on either The NASDAQ Stock Market or the New York Stock Exchange of the ADSs to be issued in the Merger, and written confirmation from the Frankfurt Stock Exchange that it will admit the Dialog Shares underlying the ADSs to trading on the FSE immediately upon issuance of the Dialog Shares; (iv) expiration or termination of the waiting period under the Hart-Scott-Rodino Antitrust Improvement Act of 1976 and receipt of customary antitrust clearances in certain other jurisdictions; (v) approval of the Merger by the Committee on Foreign Investment in the United States; (vi) absence of laws, orders, judgments and injunctions that enjoin or otherwise prohibit consummation of the Merger or any proceedings instituted by a governmental entity with competent jurisdiction seeking any of the foregoing; (vii) effectiveness under the Securities Act of 1933 of the Form F-4 registration statement to be filed with the U.S. Securities and Exchange Commission (the “SEC”) by Dialog and the Form F-6 registration statement to be filed with the SEC by the depositary bank and effectiveness under the Exchange Act of 1934 of the Form 8-A registration statement to be filed by Dialog; (viii) subject to certain materiality related standards contained in the Merger Agreement, the accuracy of representations and warranties of Atmel and Dialog and material compliance by Atmel and Dialog with their respective covenants contained in the Merger Agreement and (ix) the absence of a material adverse effect with respect to the other party. The consummation of the Merger is not subject to a financing condition.

| - 3 - |

Representations and Warranties; Covenants

The Merger Agreement contains customary representations, warranties and covenants by the parties. Atmel and Dialog have each agreed not to (i) solicit any offers or proposals for alternative acquisition transactions, (ii) engage in discussions or participate in negotiations regarding, or provide any nonpublic information regarding Atmel or Dialog, respectively, to any person that has made, a proposal that is or would reasonably be expected to lead to an alternative acquisition proposal, (iii) enter into an agreement relating to an alternative acquisition transaction, or (iv) approve or recommend, or submit to their respective stockholders and shareholders, any alternative acquisition transaction. Notwithstanding the foregoing, if Atmel’s board of directors determines that a proposal not resulting from a breach of the non solicitation-related prohibitions contained in the Merger Agreement constitutes, or would reasonably be expected to result in, a “Company Superior Proposal” (as defined in the Merger Agreement) and the failure to participate in negotiations with, or furnish information to, the person making the proposal would reasonably be expected to be inconsistent with the directors’ fiduciary duties, Atmel will be entitled to furnish the person making such proposal with non-public information and negotiate with such person. The Merger Agreement does not prevent Dialog from taking any action which the UK Takeover Panel determines is inconsistent with or in breach of Dialog’s obligations under the UK City Code on Takeovers and Mergers or which would prevent Dialog from complying with its obligations under such code.

The Merger Agreement also requires each of Dialog and Atmel to call and hold stockholder meetings and requires, in the case of Atmel, for its board of directors to recommend approval and adoption by Atmel’s stockholders of the Merger Agreement, the Merger and the other transactions contemplated by the Merger Agreement and, in the case of Dialog, for its board of directors to recommend that Dialog’s shareholders approve the transactions contemplated by the Merger Agreement, including the issuance and allotment of Dialog Shares and the amendment of Dialog’s Articles required in order to permit the issuance of the ADRs and ADSs in the manner contemplated by the Merger Agreement. Atmel’s board of directors is permitted to change its recommendation in response to a “Company Intervening Event” (as defined in the Merger Agreement) and Dialog’s board of directors is permitted to change its recommendation if failing to do so would reasonably be expected to be inconsistent with the directors’ fiduciary duties. Atmel’s board of directors is also permitted to change its recommendation if it determines that a competing proposal constitutes a Company Superior Proposal.

Each of the parties has agreed, subject to the terms and conditions of the Merger Agreement, to use its reasonable best efforts to satisfy the conditions to the Merger. Dialog has also agreed to use its reasonable best efforts to arrange or obtain the proceeds of the debt financing to be used in connection with the Merger at or prior to the closing of the Merger.

The Merger Agreement also provides that Atmel may not pay dividends to its stockholders, other than the dividend declared by Atmel’s board of directors on July 7, 2015 and scheduled to be paid by Atmel on September 24, 2015 in the amount of $0.04 per share of Common Stock.

Termination and Termination Fees

The Merger Agreement contains several termination rights, including, among others, (i) the right of either Dialog or Atmel to terminate the Merger Agreement if Atmel’s stockholders fail to adopt the Merger Agreement or if Dialog’s shareholders fail to approve the issuance and

| - 4 - |

allotment of Dialog Shares and the amendment of Dialog’s Articles required in order to permit the issuance of the ADRs and ADSs in the manner contemplated by the Merger Agreement, (ii) the right of either party to terminate the Merger Agreement if the board of directors of the other party changes its recommendation, (iii) the right of Atmel to terminate the Merger Agreement to accept a Company Superior Proposal, (iv) the right of Atmel to terminate the Merger Agreement if Dialog has not concluded its shareholders meeting or its shareholders have not voted to provide the necessary approvals by the 75th day following the date of the Merger Agreement, (v) the right of Atmel to terminate the Merger Agreement if Dialog has not initially filed the Form F-4 by the date that is the 90th day following the date of the Merger Agreement, (vi) the right of either Dialog or Atmel to terminate the Merger Agreement if the Merger has not occurred by June 30, 2016 (the “Outside Date”, which date the Merger Agreement provides may be extended by written agreement of Dialog and Atmel), (vii) the right of either party to terminate the Merger Agreement if the other party has willfully or intentionally violated its respective non-solicitation covenants in any material respect, and (viii) the right of either party to terminate the Merger Agreement due to a material breach by the other party of any of its representations, warranties or covenants, subject to certain conditions.

The Merger Agreement provides for Dialog to pay a termination fee of $41.1 million if the Merger Agreement is terminated (i) by Atmel, as a result of Dialog not having concluded its shareholders meeting or its shareholders not having voted to provide the necessary approvals by the 75th day following the date of the Merger Agreement, (ii) by Atmel, as a result of Dialog’s board of directors changing its recommendation that Dialog’s shareholders approve the transactions contemplated by the Merger Agreement, including the issue and allotment of Dialog Shares and the amendment of Dialog’s Articles required in order to permit the issuance of the ADRs and ADSs in the manner contemplated by the Merger Agreement, (iii) as a result of (A) the Merger not being consummated by the Outside Date, Dialog having concluded its shareholders meeting and the shareholders, after voting, not having provided the necessary approvals, or Dialog having intentionally breached any representation, warranty or covenant in the Merger Agreement, (B) a competing proposal being publicly announced and not withdrawn prior to the termination of the Merger Agreement and (C) within twelve months of the termination of the Merger Agreement, Dialog consummating a competing proposal or entering into a definitive agreement for a competing proposal and such competing proposal having been consummated (whether or not during the twelve month period), or (iv) by Atmel, if Dialog willfully or intentionally breaches in any material respect any of its covenants relating to the non solicitation provisions of the Merger Agreement.

The Merger Agreement provides for Atmel to pay a termination fee of $137.3 million if the Merger Agreement is terminated (i) by Atmel, in order for Atmel to concurrently enter into an alternative acquisition agreement for a Company Superior Proposal, (ii) by Dialog, as a result of Atmel’s board of directors changing its recommendation that Atmel’s stockholders approve and adopt the Merger Agreement, (iii) as a result of (A) the Merger not being consummated by the Outside Date, Atmel having concluded its stockholders meeting and the stockholders, after voting, not having provided the necessary approvals, or Atmel having intentionally breached any representation, warranty or covenant in the Merger Agreement, (B) a competing proposal being publicly announced and not withdrawn prior to the termination of the Merger Agreement and (C) within twelve months of the termination of the Merger Agreement, Atmel consummating a competing proposal or entering into a definitive agreement for a competing proposal and such

| - 5 - |

competing proposal having been subsequently consummated (whether or not during the twelve month period), or (iv) by Dialog, if Atmel willfully or intentionally breaches in any material respect any of its covenants relating to the non solicitation provisions of the Merger Agreement.

If the Merger Agreement is terminated as a result of Atmel stockholder approval not being obtained, the Merger Agreement provides for Atmel to reimburse Dialog for up to $41.1 million in expenses incurred by Dialog in connection with the Merger. If the Merger Agreement is terminated as a result of the Dialog shareholder approval not being obtained or the failure of Dialog to initially file the Form F-4 by the 75th day following the date of the Merger Agreement, the Merger Agreement provides for Dialog to reimburse Atmel for up to $41.1 million in expenses incurred by Atmel in connection with the Merger.

Governance

Dialog has agreed that it will appoint two directors of Atmel that are reasonably acceptable to Dialog to the board of directors of Dialog immediately after the closing of the Merger.

The foregoing description of the Merger and the Merger Agreement does not purport to be complete and is qualified in its entirety by reference to the Merger Agreement, a copy of which is attached hereto as Exhibit 2.1 and incorporated herein by reference. A copy of the Merger Agreement has been included to provide Atmel’s stockholders with information regarding its terms and is not intended to provide any factual information about Atmel or Dialog. The representations and warranties of Atmel contained in the Merger Agreement have been made solely for the benefit of Dialog and Merger Sub. In addition, such representations and warranties (1) have been made only for purposes of the Merger Agreement, (2) have been qualified by certain disclosures made to Dialog and Merger Sub not reflected in the text of the Merger Agreement, (3) may be subject to materiality qualifications contained in the Merger Agreement which may differ from what may be viewed as material by investors, (4) were made only as of the date of the Merger Agreement or other specific dates and (5) have been included in the Merger Agreement for the purpose of allocating risk between the contracting parties rather than establishing matters as facts. Accordingly, the Merger Agreement is included with this filing only to provide investors with information regarding the terms of the Merger and not to provide investors with any other factual information regarding Atmel or its business. Investors should not rely on the representations and warranties or any descriptions thereof as characterizations of the actual state of facts or condition of Atmel or any of its subsidiaries or affiliates. Moreover, information concerning the subject matter of the representations and warranties may change after the date of the Merger Agreement, which subsequent information may or may not be fully reflected in Atmel’s public disclosures. The Merger Agreement should not be read alone, but should instead be read in conjunction with the other information regarding Atmel that is or will be contained in, or incorporated by reference into, the Forms 10-K, Forms 10-Q, Forms 8-K, proxy statements and other reports and documents that Atmel files with the SEC.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

The information set forth in Item 1.01 under the heading “Treatment of Compensatory Equity Awards” is incorporated herein by reference.

| - 6 - |

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

On September 19, 2015, and effective on such date, Atmel’s board of directors amended Atmel’s Amended and Restated Bylaws (the “Bylaws”) by renumbering the existing ARTICLE X as ARTICLE XI and adding a new ARTICLE X providing that, unless Atmel consents in writing to the selection of an alternative forum, the Court of Chancery of the State of Delaware (or, if the Court of Chancery does not have jurisdiction, the United States District Court for the District of Delaware) shall be the sole and exclusive forum for any action by a stockholder (in their capacity as such) that is (i) a derivative action or proceeding brought on behalf of Atmel, (ii) asserting a claim of breach of a fiduciary duty owed by any director, officer or other employee of Atmel to Atmel or Atmel’s stockholders, (iii) asserting a claim arising pursuant to any provision of the Delaware General Corporation Law, Atmel’s certificate of incorporation or the Bylaws (in each case, as amended from time to time), or (iv) asserting a claim governed by the internal affairs doctrine. If a stockholder files an action the subject matter of which is within the scope of the new ARTICLE X in a court other than a court located within the State of Delaware (a “Foreign Action”), such stockholder shall be deemed to have consented to (i) the personal jurisdiction of the state and federal courts located within the State of Delaware in connection with any action brought in any such court to enforce the new ARTICLE X and (ii) having service of process made upon such stockholder in any such action by service upon such stockholder’s counsel in the Foreign Action as agent for such stockholder (the “Amendment”).

The foregoing description is qualified in its entirety by reference to the text of the Amendment, which is included as Exhibit 3.1 and incorporated herein by reference.

Item 8.01 Other Events.

On September 20, 2015, Atmel issued a press release relating to the entry into the Merger Agreement. A copy of the press release is attached hereto as Exhibit 99.1 and incorporated herein by reference.

On September 20, 2015, Steven Laub, the President and Chief Executive Officer of Atmel, sent a communication to employees of Atmel concerning the announcement of the Merger. A copy of the communication is attached hereto as Exhibit 99.2.

On September 20, 2015, Atmel sent a communication to customers and suppliers of Atmel concerning the announcement of the Merger. A copy of each communication is attached hereto as Exhibit 99.3 and Exhibit 99.4.

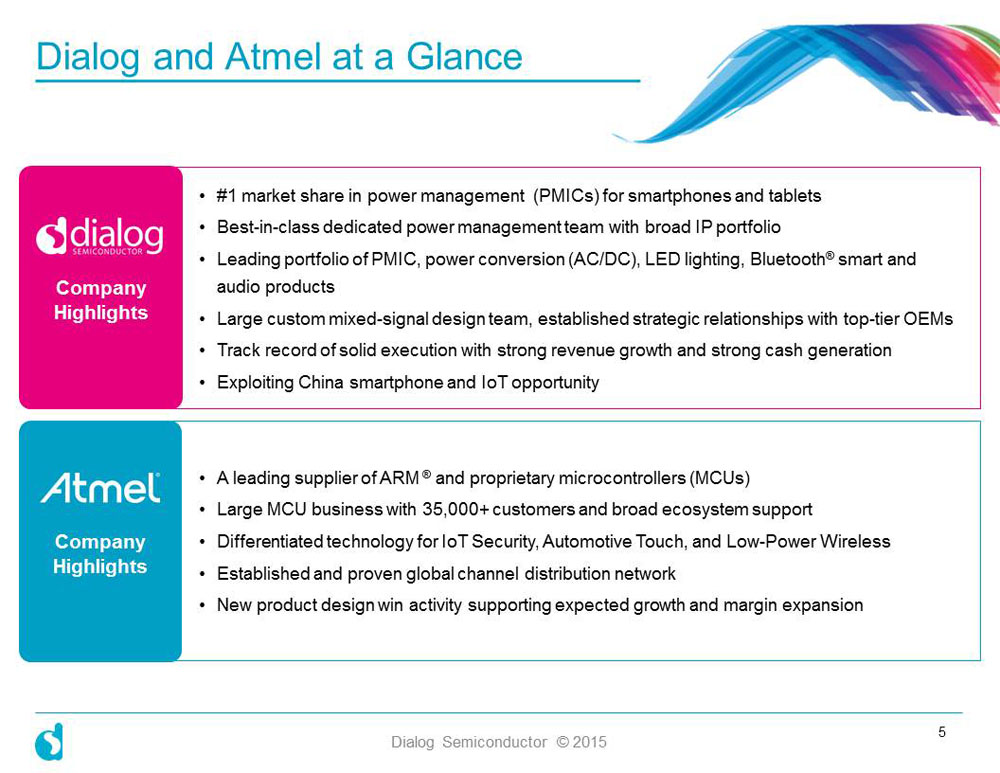

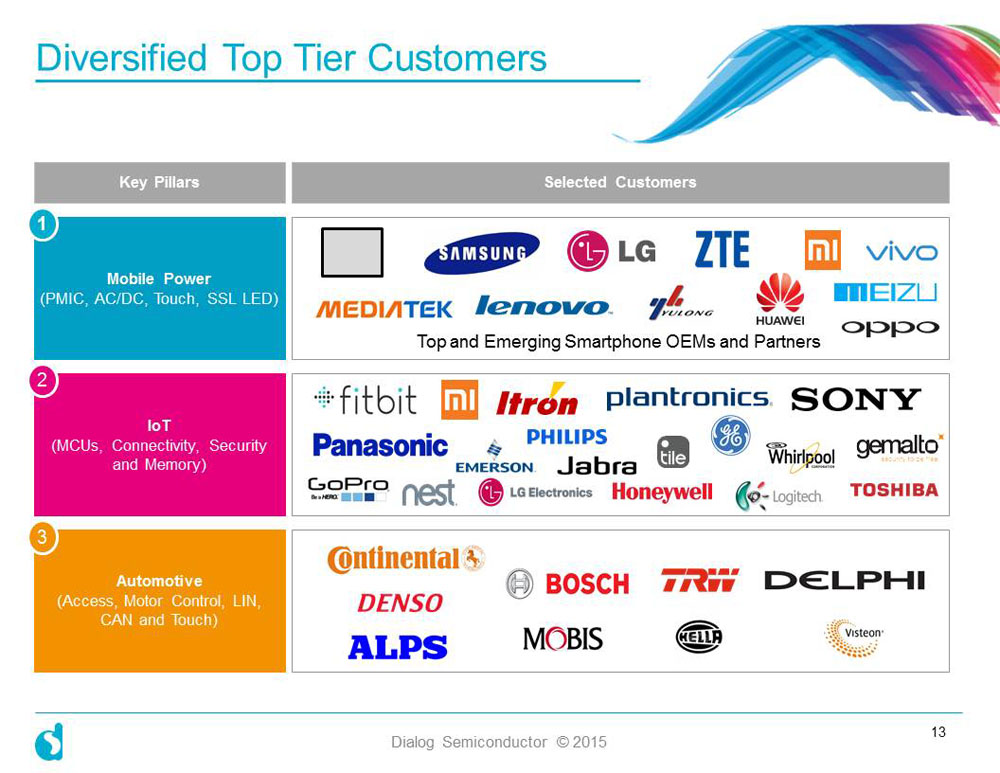

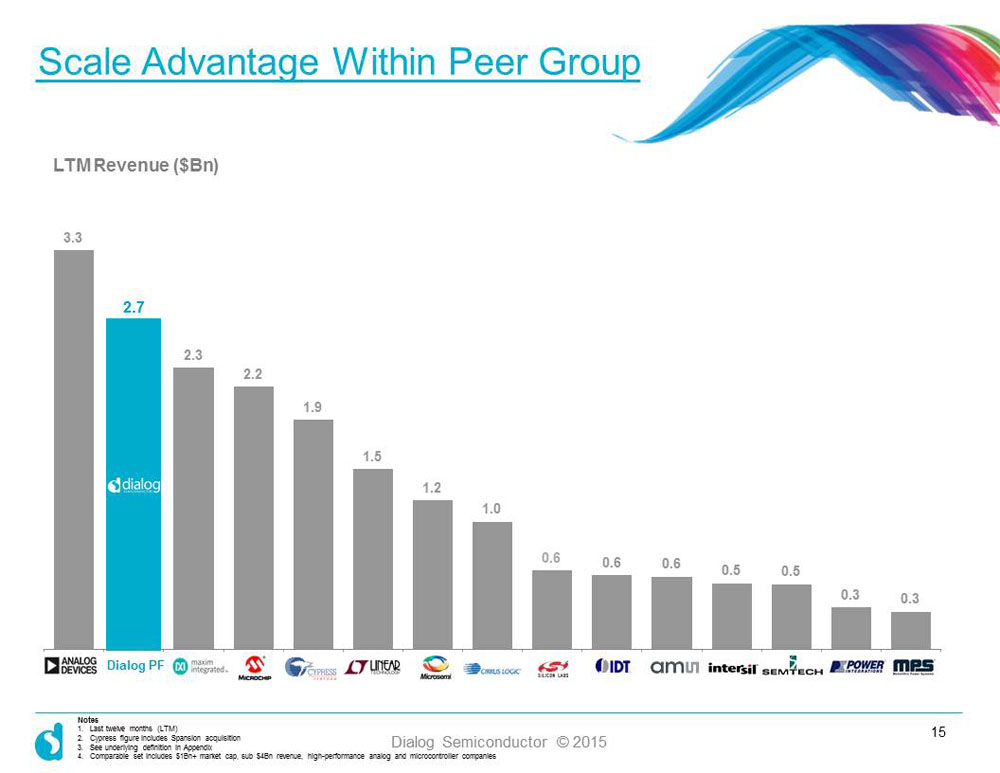

On September 20, 2015, Atmel published a presentation concerning the Merger. A copy of the presentation is attached hereto as Exhibit 99.5.

Additional Information

This communication is not a prospectus as required by the Prospectus Directive of the European Parliament and of the Council of 4 November 2003 (No 2003/71/EC). It does not constitute or form part of an offer to sell or any invitation to purchase or subscribe for any securities or the solicitation of an offer to purchase, otherwise acquire, subscribe for, sell or otherwise dispose of any securities or the solicitation of any vote or approval in any jurisdiction pursuant to the

| - 7 - |

proposed Merger or otherwise. Any acceptance or response to the proposed Merger should be made only on the basis of the information referred to, in respect of Dialog shareholders, a shareholder circular seeking the approval of Dialog shareholders for the proposed Merger, and the issuance of ordinary shares in the form of ADSs to Atmel’s stockholders (the “Circular”), or, in respect of Atmel’s stockholders, a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

This communication may be deemed to be solicitation material in respect of the proposed Merger involving Dialog and Atmel. In connection with the proposed Merger, Dialog will file with the SEC a Registration Statement on Form F-4 (the “Registration Statement”) containing a prospectus with respect to Dialog’s ordinary shares to be issued in the proposed Merger and a proxy statement of Atmel in connection with the proposed Merger (the “Proxy Statement/Prospectus”). Each of Dialog and Atmel intends to file other documents with the SEC regarding the proposed Merger. The definitive Proxy Statement/Prospectus will be mailed to stockholders of Atmel and will contain important information about the proposed Merger and related matters. Shareholders of Dialog and stockholders of Atmel are advised to read carefully the formal documentation in relation to the proposed Merger once it has been dispatched. The proposals for the proposed Merger will, in respect of Dialog shareholders, be made solely through the Circular, and, in respect of Atmel’s stockholders, be made solely through the Proxy Statement/Prospectus. Both the Circular and the final Proxy Statement/Prospectus will contain the full terms and conditions of the way in which the proposed Merger will be implemented, including details of how to vote with respect to the implementation of the proposed Merger. Any acceptance or other response to the proposals should be made only on the basis of the information in respect of the Dialog shareholders, in the Circular, or, in respect of Atmel’s stockholders, in the Proxy Statement/Prospectus.

This communication comprises an advertisement for the purposes of paragraph 3.3R of the Prospectus Rules made under Part VI of the FSMA and not a prospectus. Any prospectus in connection with the admission of Dialog Shares to the Regulated Market of, and to trading on, the Frankfurt Stock Exchange (the “UK Prospectus”) will be published at a later date.

Copies of the UK Prospectus and the Circular will, from the date of posting to Dialog shareholders, be filed with the UK Listing Authority and submitted to the National Storage Mechanism and available for inspection at www.Hemscott.com/nsm.do and available for inspection by Dialog shareholders at the registered office of Dialog Semiconductor plc, Tower Bridge House, St. Katharine’s Way, London E1W 1AA, United Kingdom, during normal business hours on any weekday (Saturdays, Sundays and public holidays excepted) and in the Investor Relations section of Dialog’s website at www.dialog-semiconductor.com. Investors may obtain, free of charge, copies of the Proxy Statement/Prospectus and Registration Statement, and any other documents filed by Atmel and Dialog with the SEC in connection with the proposed Merger at the SEC’s website at www.sec.gov. Investors may obtain, free of charge, copies of the Proxy Statement/Prospectus and any other documents filed by Atmel with the SEC in connection with the proposed Merger in the “Investors” section of Atmel’s website at www.atmel.com. Investors may also obtain, free of charge, copies of the Registration Statement, and any other documents filed by Dialog with the SEC in connection with the proposed Merger on Dialog’s website at www.dialog-semiconductor.com.

| - 8 - |

BEFORE MAKING AN INVESTMENT OR VOTING DECISION, WE URGE INVESTORS OF DIALOG AND INVESTORS OF ATMEL TO READ CAREFULLY THE CIRCULAR, UK PROSPECTUS, PROXY STATEMENT/PROSPECTUS AND REGISTRATION STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS THAT DIALOG OR ATMEL WILL FILE WITH THE UKLA OR SEC WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER.

Participants in the Solicitation

Dialog, Atmel and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from stockholders in connection with the approval of the proposed Merger and may have direct or indirect interests in the proposed Merger. Information about Dialog’s directors and executive officers is set forth in Dialog’s Annual report and accounts 2014, which may be obtained free of charge at Dialog’s website at www.dialog-semiconductor.com. Information about Atmel’s directors and executive officers and their respective interests in Atmel by security holdings or otherwise is set forth in Atmel’s Proxy Statement on Schedule 14A for its 2015 Annual Meeting of Stockholders, which was filed with the SEC on April 3, 2015, and its Annual Report on Form 10-K for the fiscal year ended December 31, 2014, which was filed with the SEC on February 26, 2015. These documents are available free of charge at the SEC’s website at www.sec.gov and from the “Investors” section of Atmel’s website at www.atmel.com. Additional information regarding the interests of participants in the solicitation of proxies in connection with the proposed Merger will be included in the Proxy Statement/Prospectus and the Registration Statement that Dialog will file with the SEC in connection with the solicitation of proxies to approve the proposed Merger.

Cautionary Statements Related to Forward-Looking Statements

This announcement contains, or may contain, “forward-looking statements” in relation to Dialog and Atmel and the future operating performance and outlook of Dialog and the combined company, as well as other future events and their potential effects on Dialog and the combined company that are subject to risks and uncertainties. Generally, the words “will,” “may,” “should,” “continue,” “believes,” “targets,” “plans,” “expects,” “estimates,” “aims,” “intends,” “anticipates” or similar expressions or negatives thereof identify forward-looking statements. Forward-looking statements include, but are not limited to, statements relating to (i) the benefits of the Merger, including future financial and operating results of the combined company, Dialog’s or Atmel’s plans, objectives, expectations and intentions, and the expected timing of completion of the transaction; (ii) expected developments in product portfolio, expected revenues, expected annualised operating costs savings, expected future cash generation, expected future design wins and increase in market share, expected incorporation of products in those of customers, adoption of new technologies, the expectation of volume shipments of products, opportunities in the semiconductor industry and the ability to take advantage of those opportunities, the potential success to be derived from strategic partnerships, the potential impact of capacity constraints, the effect of financial performance on share price, the impact of government regulation, expected performance against adverse economic conditions, and other

| - 9 - |

expectations and beliefs of the management of Dialog and Atmel; (iii) the expansion and growth of Dialog’s or Atmel’s operations; (iv) the expected cost, revenue, technology and other synergies of the proposed Merger, the expected impact of the proposed Merger on customers and end-users, the combined company’s future capital expenditures, expenses, revenues, earnings, economic performance, financial condition, losses and future prospects; (v) business and management strategies and the expansion and growth of the combined company’s operations; and (vi) the anticipated timing of shareholder meetings and completion of the proposed Merger.

These forward-looking statements are based upon the current beliefs and expectations of the management of Dialog and Atmel and involve risks and uncertainties that could cause actual results to differ materially from those expressed in the forward-looking statements. Many of these risks and uncertainties relate to factors that are beyond Dialog’s and Atmel’s or the combined company’s ability to control or estimate precisely and include, without limitation: (i) the ability to obtain governmental and regulatory approvals of the proposed Merger, including the approval of antitrust authorities necessary to complete the Merger, or to satisfy other conditions to the proposed Merger, including the ability to obtain the requisite Dialog shareholder approvals and Atmel stockholder approvals, on the proposed terms and timeframe; (ii) the possibility that the proposed Merger does not close when expected or at all, or that the companies, in order to achieve governmental and regulatory approvals, may be required to modify aspects of the proposed Merger or to accept conditions that could adversely affect the combined company or the expected benefits of the proposed Merger; (iii) the risk that competing offers or acquisition proposals will be made; (iv) the inherent uncertainty associated with financial projections; (v) the ability to realize the expected synergies or savings from the proposed Merger in the amounts or in the timeframe anticipated; (vi) the potential harm to customer, supplier, employee and other relationships caused by the announcement or closing of the proposed Merger; (vii) the ability to integrate Atmel’s businesses into those of Dialog’s in a timely and cost-efficient manner; (viii) the development of the markets for Atmel’s and Dialog’s products; (ix) the combined company’s ability to develop and market products containing the respective technologies of Atmel and Dialog in a timely and cost-effective manner; (x) general global macroeconomic and geo-political conditions; (xi) the cyclical nature of the semiconductor industry; (xii) an economic downturn in the semiconductor and telecommunications markets; (xiii) the inability to realize the anticipated benefits of transactions related to the proposed Merger and other acquisitions, restructuring activities, including in connection with the proposed Merger, or other initiatives in a timely manner or at all; (xiv) consolidation occurring within the semiconductor industry through mergers and acquisitions; (xv) the impact of competitive products and pricing; (xvi) disruption to Atmel’s business caused by increased dependence on outside foundries, financial instability or insolvency proceedings affecting some of those foundries, and associated litigation in some cases; (xvii) industry and/or company overcapacity or under-capacity, including capacity constraints of independent assembly contractors; (xviii) insufficient, excess or obsolete inventory; (xix) the success of customers’ end products and timely design acceptance by customers; (xx) timely introduction of new products and technologies and implementation of new manufacturing technologies; (xxi) the combined company’s ability to ramp new products into volume production; (xxii) reliance on non-binding customer forecasts and the absence of long-term supply contracts with customers; (xxiii) financial stability in foreign markets and the impact or volatility of foreign exchange rates and significant devaluation of the Euro against the U.S. dollar; (xxiv) unanticipated changes in

| - 10 - |

environmental, health and safety regulations; (xxv) Atmel’s dependence on selling through independent distributors; (xxvi) the complexity of the combined company’s revenue recognition policies; (xxvii) information technology system failures; (xxviii) business interruptions, natural disasters or terrorist acts; (xxix) unanticipated costs and expenses or the inability to identify expenses which can be eliminated; (xxx) disruptions in the availability of raw materials; (xxxi) compliance with U.S. and international laws and regulations by the combined company and its distributors; (xxxii) dependence on key personnel; (xxxiii) the combined company’s ability to protect intellectual property rights; (xxxiv) litigation (including intellectual property litigation in which the combined company may be involved or in which customers of the combined company may be involved, especially in the mobile device sector), and the possible unfavorable results of legal proceedings; (xxxv) the market price or increased volatility of Dialog’s ordinary shares and ADSs (if the Merger is completed); and (xxxvi) other risks and uncertainties, including those detailed from time to time in Dialog’s and Atmel’s periodic reports and other filings with the SEC or other regulatory authorities, including Atmel’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014 and Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2015 (whether under the caption Risk Factors or Forward Looking Statements or elsewhere). Neither Dialog nor Atmel can give any assurance that such forward-looking statements will prove to be correct. The reader is cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this announcement. Neither Dialog nor Atmel nor any other person undertakes any obligation to update or revise publicly any of the forward-looking statements set out herein, whether as a result of new information, future events or otherwise, except to the extent legally required.

Nothing contained herein shall be deemed to be a forecast, projection or estimate of the future financial performance of Dialog, Atmel, or the combined company, following the implementation of the proposed Merger or otherwise. No statement in this announcement should be interpreted to mean that the earnings per share, profits, margins or cash flows of Dialog or the combined company for the current or future financial years would necessarily match or exceed the historical published figures.

Overseas jurisdictions

The release, publication or distribution of this announcement in jurisdictions other than the United Kingdom may be restricted by the laws of those jurisdictions and therefore persons into whose possession this announcement comes should inform themselves about and observe any such restrictions. Failure to comply with any such restrictions may constitute a violation of the securities laws of any such jurisdiction.

This announcement has been prepared for the purposes of complying with English Law and the information disclosed may not be the same as that which would have been disclosed if this announcement had been prepared in accordance with the laws and regulations of any jurisdiction outside the United Kingdom.

| - 11 - |

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| Exhibit Number |

Description | |

| 2.1* | Agreement and Plan of Merger, dated as of September 19, 2015, by and among Atmel, Dialog and Merger Sub. | |

| 3.1 | Amendment to Amended and Restated Bylaws, dated as of September 19, 2015. | |

| 99.1 | Press Release, dated September 20, 2015. | |

| 99.2 | Employee Communication, dated September 20, 2015. | |

| 99.3 | Customer Communication, dated September 20, 2015. | |

| 99.4 | Supplier Communication, dated September 20, 2015. | |

| 99.5 | Atmel Presentation, dated September 20, 2015. |

______________

* Atmel Corporation has omitted schedules and other similar attachments to such agreement pursuant to Item 601(b) of Regulation S-K. Atmel Corporation will furnish a copy of such omitted document to the SEC upon request.

| - 12 - |

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: September 21, 2015 | ATMEL CORPORATION | |

| By: | /s/ Scott Wornow | |

| Scott Wornow | ||

| Senior Vice President and Chief Legal Officer | ||

| - 13 - |

Exhibit Index

| Exhibit Number |

Description | |

| 2.1* | Agreement and Plan of Merger, dated as of September 19, 2015, by and among Atmel, Dialog and Merger Sub. | |

| 3.1 | Amendment to Amended and Restated Bylaws, dated as of September 19, 2015. | |

| 99.1 | Press Release, dated September 20, 2015. | |

| 99.2 | Employee Communication, dated September 20, 2015. | |

| 99.3 | Customer Communication, dated September 20, 2015. | |

| 99.4 | Supplier Communication, dated September 20, 2015. | |

| 99.5 | Atmel Presentation, dated September 20, 2015. |

______________

* Atmel Corporation has omitted schedules and other similar attachments to such agreement pursuant to Item 601(b) of Regulation S-K. Atmel Corporation will furnish a copy of such omitted document to the SEC upon request.

| - 14 - |

Exhibit 2.1

EXECUTION VERSION

AGREEMENT AND PLAN OF MERGER

among

DIALOG SEMICONDUCTOR PLC,

AVENGERS ACQUISITION CORPORATION

and

ATMEL CORPORATION

Dated as of September 19, 2015

Table of Contents

| Page | ||

| Article I | THE MERGER | 2 |

| 1.1 | The Merger | 2 |

| 1.2 | Closing | 2 |

| 1.3 | Effective Time | 2 |

| 1.4 | Effects of the Merger | 2 |

| 1.5 | Certificate of Incorporation and Bylaws | 3 |

| 1.6 | Directors and Officers of the Surviving Company | 3 |

| Article II | EFFECT OF THE MERGER ON THE CAPITAL STOCK OF THE COMPANY; EXCHANGE OF CERTIFICATES AND PAYMENT | 3 |

| 2.1 | Effect on Capital Stock | 3 |

| 2.2 | Exchange of Certificates | 4 |

| 2.3 | Certain Adjustments | 9 |

| 2.4 | Appraisal Rights | 9 |

| 2.5 | Further Assurances | 10 |

| 2.6 | Withholding Rights | 10 |

| Article III | REPRESENTATIONS AND WARRANTIES OF THE COMPANY | 10 |

| 3.1 | Organization, Good Standing and Qualification | 11 |

| 3.2 | Capital Structure | 11 |

| 3.3 | Corporate Authority; Approvals; Fairness Opinion | 13 |

| 3.4 | Governmental Filings; No Violations | 13 |

| 3.5 | SEC Filings | 14 |

| 3.6 | Financial Statements; Liabilities | 15 |

| 3.7 | Absence of Certain Changes | 16 |

| 3.8 | Compliance with Law | 17 |

| 3.9 | Litigation | 18 |

| 3.10 | Employee Benefits | 18 |

| 3.11 | Environmental Matters | 20 |

| 3.12 | Taxes | 20 |

| 3.13 | Labor Matters | 21 |

| 3.14 | Intellectual Property | 21 |

| -i- |

Table of Contents

(continued)

| Page | ||

| 3.15 | Insurance | 22 |

| 3.16 | Properties | 22 |

| 3.17 | Material Contracts | 23 |

| 3.18 | Customers and Suppliers | 25 |

| 3.19 | Information Supplied | 25 |

| 3.20 | Brokers and Finders | 26 |

| 3.21 | Interested Stockholder | 26 |

| 3.22 | Voting Requirement | 26 |

| Article IV | REPRESENTATIONS AND WARRANTIES OF PARENT AND MERGER SUB | 26 |

| 4.1 | Organization, Good Standing and Qualification | 27 |

| 4.2 | Capital Structure | 27 |

| 4.3 | Corporate Authority; Approvals; Fairness Opinion | 29 |

| 4.4 | Governmental Filings; No Violations | 30 |

| 4.5 | Parent Filings | 31 |

| 4.6 | Financial Statements; Liabilities | 32 |

| 4.7 | Absence of Certain Changes | 33 |

| 4.8 | Compliance with Law | 33 |

| 4.9 | Litigation | 34 |

| 4.10 | Employee Benefits | 34 |

| 4.11 | Environmental Matters | 36 |

| 4.12 | Taxes | 36 |

| 4.13 | Labor Matters | 37 |

| 4.14 | Intellectual Property | 37 |

| 4.15 | Insurance | 38 |

| 4.16 | Properties | 38 |

| 4.17 | Material Contracts | 39 |

| 4.18 | Customers and Suppliers | 41 |

| 4.19 | Information Supplied | 41 |

| -ii- |

Table of Contents

(continued)

| Page | ||

| 4.20 | Brokers and Finders | 41 |

| 4.21 | Financing | 42 |

| 4.22 | Interested Stockholder | 42 |

| 4.23 | Voting Requirement | 43 |

| Article V | COVENANTS RELATING TO CONDUCT OF BUSINESS | 43 |

| 5.1 | Company Interim Operations | 43 |

| 5.2 | Parent Interim Operations | 47 |

| 5.3 | Conduct of Business by Merger Sub | 49 |

| 5.4 | Company Acquisition Proposals | 49 |

| 5.5 | Parent Acquisition Proposals | 52 |

| 5.6 | Reasonable Best Efforts | 54 |

| 5.7 | Advice of Changes | 56 |

| 5.8 | Preparation of the Form F-4 and the Proxy Statement/Prospectus; Preparation of Parent Shareholder Circular and Parent Prospectus; Stockholders Meetings | 57 |

| 5.9 | Access to Information; Confidentiality | 60 |

| 5.10 | Publicity | 61 |

| 5.11 | Employee Benefits | 62 |

| 5.12 | Expenses | 63 |

| 5.13 | Indemnification; Directors’ and Officers’ Insurance | 63 |

| 5.14 | Takeover Statutes | 65 |

| 5.15 | Section 16 Matters | 65 |

| 5.16 | Parent Vote | 65 |

| 5.17 | Company Stock Options; Company Stock-Based Awards; Company Units; Company ESPP | 66 |

| 5.18 | Company Stock Options and Company Unit Information | 67 |

| 5.19 | [RESERVED] | 67 |

| 5.20 | Stockholder Litigation | 67 |

| 5.21 | Financing | 68 |

| 5.22 | Obligations of Merger Sub | 73 |

| -iii- |

Table of Contents

(continued)

| Page | ||

| 5.23 | Parent Board of Directors | 73 |

| 5.24 | Establishment of ADR Facility; Stock Exchange Listings | 73 |

| Article VI | CONDITIONS PRECEDENT | 74 |

| 6.1 | Conditions to Each Party’s Obligation to Effect the Merger | 74 |

| 6.2 | Conditions to Obligations of Parent and Merger Sub | 75 |

| 6.3 | Conditions to Obligations of the Company | 76 |

| 6.4 | Frustration of Closing Conditions | 77 |

| Article VII | TERMINATION | 77 |

| 7.1 | Termination by Mutual Consent | 77 |

| 7.2 | Termination by Either Parent or the Company | 78 |

| 7.3 | Termination by the Company | 78 |

| 7.4 | Termination by Parent | 79 |

| 7.5 | Effect of Termination and Abandonment | 79 |

| Article VIII | GENERAL PROVISIONS | 83 |

| 8.1 | Nonsurvival of Representations and Warranties | 83 |

| 8.2 | Notices | 83 |

| 8.3 | Interpretation | 84 |

| 8.4 | Counterparts | 101 |

| 8.5 | Entire Agreement | 101 |

| 8.6 | No Third Party Beneficiaries | 101 |

| 8.7 | Governing Law; Venue; Waiver of Jury Trial | 101 |

| 8.8 | Assignment | 102 |

| 8.9 | Specific Performance | 103 |

| 8.10 | Amendment | 103 |

| 8.11 | Waiver of Conditions | 104 |

| 8.12 | Severability | 104 |

| 8.13 | Obligations of Subsidiaries | 104 |

Exhibit A: Certificate of Incorporation of the Surviving Company

| -iv- |

Table of Contents

(continued)

| Page | |

| Company Disclosure Schedule | |

| 3.1 – Organization, Good Standing and Qualification | |

| 3.2 – Capital Structure | |

| 3.3 – Corporate Authority; Approval; Fairness Opinion | |

| 3.4 – Governmental Filings; No Violations | |

| 3.5 – SEC Filings | |

| 3.6 – Financial Statements; Liabilities | |

| 3.7 – Absence of Certain Changes | |

| 3.8 – Compliance with Law | |

| 3.9 – Litigation | |

| 3.10 – Employee Benefits | |

| 3.11 – Environmental Matters | |

| 3.12 – Taxes | |

| 3.13 – Labor Matters | |

| 3.14 – Intellectual Property | |

| 3.15 – Insurance | |

| 3.16 – Properties | |

| 3.17 – Material Contracts | |

| 3.18 – Customers and Suppliers | |

| 3.19 – Information Supplied | |

| 3.20 – Brokers and Finders | |

| 3.21 – Interested Stockholder | |

| 3.22 – Voting Requirements | |

| 5.1 – Company Interim Operations | |

| 5.6 – Reasonable Best Efforts | |

| Annex A – Knowledge Group | |

| Section A – Specified Governmental Entities | |

| Parent Disclosure Schedule | |

| 4.1 – Organization, Good Standing and Qualification | |

| 4.4 – Governmental Filings; No Violations | |

| 4.5 – Parent Filings | |

| 4.10 – Employee Benefits | |

| 4.12 – Taxes | |

| 4.14 – Intellectual Property | |

| 4.17 – Material Contracts | |

| 4.18 – Customers and Suppliers | |

| 4.20 – Brokers and Finders | |

| 5.6 – Reasonable Best Efforts | |

| 5.17 – Company Stock Options; Company Stock-Based Awards; Company Units; Company ESPP |

| -v- |

Table of Contents

(continued)

| Page | |

| 5.21 – Financing | |

| Annex A – Knowledge Group |

| -vi- |

AGREEMENT AND PLAN OF MERGER

This AGREEMENT AND PLAN OF MERGER, dated as of September 19, 2015 (this “Agreement”), is by and among Dialog Semiconductor plc, a company incorporated in England and Wales (“Parent”), Avengers Acquisition Corporation, a Delaware corporation and a wholly owned Subsidiary of Parent (“Merger Sub”), and Atmel Corporation, a Delaware corporation (the “Company”). Capitalized terms used in this Agreement and not defined where first used have the respective meanings ascribed to them in Section 8.3(e).

RECITALS

A. The respective Boards of Directors of the Company, Parent and Merger Sub have determined that the transactions described herein are in the best interests of their respective companies and stockholders and, accordingly, the Board of Directors of the Company and Parent have agreed to effect the merger of the Merger Sub with and into the Company (the “Merger”), upon the terms and subject to the conditions set forth in this Agreement and in accordance with the General Corporation Law of the State of Delaware (the “DGCL”), whereby each issued and outstanding share of common stock, par value $0.001 per share, of the Company (“Company Common Stock”), other than any shares of Company Common Stock owned by Parent or any direct or indirect subsidiary of Parent or held in the treasury of the Company, will be converted into the right to receive (i) 0.1120 (the “Exchange Ratio,” which, for the avoidance of doubt, may also be expressed as 0.1120 ordinary shares of 10 pence each of Parent (the “Parent Ordinary Shares”) per share of Company Common Stock) American Depositary Shares of Parent, with each ADS representing one Parent Ordinary Shares (the “ADSs”), and (ii) an amount of cash as provided in Section 2.1.

B. The Board of Directors of the Company (the “Company Board”) has unanimously determined that the Merger is advisable and fair to the Company and its stockholders (the “Company Stockholders”).

C. The Board of Directors of Parent (the “Parent Board”) has unanimously determined that the Merger is advisable and fair to Parent and its shareholders (the “Parent Shareholders”).

D. The Company, Parent and Merger Sub desire to make certain representations, warranties, covenants and agreements in connection with the Merger and also to prescribe various conditions to the Merger.

NOW, THEREFORE, Company, Parent and Merger Sub, in consideration of the representations, warranties and covenants contained in this Agreement, agree as follows:

Article

I

THE MERGER

1.1 The Merger. On the terms and subject to the satisfaction or, if permitted, waiver of conditions set forth herein, and in accordance with the DGCL, Merger Sub will be merged with and into the Company at the Effective Time, and the separate corporate existence of Merger Sub will thereupon cease. Following the Effective Time, the Company will be the surviving company (the “Surviving Company”).

1.2 Closing. The closing of the Merger (the “Closing”) will take place at the offices of Jones Day, 1755 Embarcadero Road, Palo Alto, California, at 8:00 a.m. (California time) no later than the second Business Day following the satisfaction or waiver of the conditions set forth in Article VI (other than those conditions that by their nature are to be satisfied at the Closing, but subject to the satisfaction or waiver of those conditions) (the “Closing Date”), or at such other place, date and time as the Company and Parent may agree in writing; provided, however, that the Closing Date shall not occur on or prior to the 15th calendar day period immediately following the date on which the SEC has declared the effectiveness of the Form F-4, provided that (i) such period shall exclude the days from November 26, 2015 to November 29, 2015 and (ii) the entirety of such period must end prior to December 18, 2015 or commence after January 4, 2016 (the “Marketing Period”), in which case the Closing Date shall occur on the first Business Day immediately following the final day of the Marketing Period (subject in each case to the satisfaction or waiver of all of the conditions set forth in Article VI for the Closing as of the date that would have been the Closing Date if not for this proviso and provided that in no event will the extension of the Closing Date pursuant to this proviso be deemed to create any condition to Closing in addition to those set forth in Article VI). Notwithstanding the preceding sentence, Parent may shorten the Marketing Period by delivering written notice to the Company specifying an earlier Closing Date during the Marketing Period (the “Parent Specified Closing Date”), provided that notice of the Parent Specified Closing Date is delivered to the Company at least two Business Days prior to the Parent Specified Closing Date.

1.3 Effective Time. On the terms and subject to the conditions set forth in this Agreement, (i) as soon as practicable on the Closing Date, the parties shall file a certificate of merger (the “Certificate of Merger”) in such form as is required by, and executed in accordance with, the relevant provisions of the DGCL and the terms of this Agreement and (ii) as soon as practicable on or after the Closing Date, the parties shall make all other filings or recordings required under the DGCL. The Merger will become effective at such time as the Certificate of Merger is duly filed with the Secretary of State of the State of Delaware on the Closing Date, or at such subsequent date or time as the Company, Parent and Merger Sub agree and specify in the Certificate of Merger (the date and time the Merger becomes effective is hereinafter referred to as the “Effective Time”).

1.4 Effects of the Merger. The Merger will have the effects set forth in the DGCL. Without limiting the generality of the foregoing, and subject thereto, at the Effective Time, all the property, rights, privileges, powers and franchises of the Company and Merger Sub will be vested in the Surviving Company, and all debts, liabilities and duties of the Company and

| 2 |

Merger Sub will become the debts, liabilities and duties of the Surviving Company all as provided in the DGCL.

1.5 Certificate of Incorporation and Bylaws. At the Effective Time, the Company Charter in effect immediately prior to the Effective Time shall be amended so as to read in its entirety as set forth on Exhibit A and, as so amended, shall be from and after the Effective Time the certificate of incorporation of the Surviving Company until amended in accordance with applicable Law. At the Effective Time, the bylaws of Merger Sub as in effect immediately prior to the Effective Time shall be the bylaws of the Surviving Company from and after the Effective Time, until amended in accordance with applicable Law. For the avoidance of doubt, the provisions of the Company Charter and Company Bylaws and any Contracts between a director, officer or employee of the Company and the Company in effect as of immediately prior to the Closing will govern the rights of all directors, officers and employees of the Company (including, without limitation, persons who were, at any time, directors, officers and employees of the Company prior to Closing), as applicable, and the obligations of the Company and the Surviving Company, in respect of claims for indemnification based in whole or in part on actions or failures to take action at or prior to the Closing, and neither the amendments thereto contemplated hereby or any amendments or modifications, if any, effected following the Closing will affect, in any manner, the rights of any directors, officers and employees, or the obligations of the Company, including the Surviving Company, thereunder relating to such actions or failures to take action.

1.6 Directors and Officers of the Surviving Company. From and after the Effective Time, until successors are duly elected or appointed and qualified in accordance with applicable Law, (i) the directors of Merger Sub at the Effective Time shall be the directors of the Surviving Company and (ii) the officers of Merger Sub at the Effective Time shall be the officers of the Surviving Company.

Article

II

EFFECT OF THE MERGER ON THE CAPITAL STOCK OF THE COMPANY; EXCHANGE OF CERTIFICATES AND PAYMENT

2.1 Effect on Capital Stock. At the Effective Time, as a result of the Merger and without any action on the part of the holder of any securities of the Company, Parent or Merger Sub:

(a) Merger Sub’s Capital Stock. Each share of common stock of Merger Sub outstanding immediately prior to the Effective Time shall be converted into and become one share of common stock of the Surviving Company with the same rights, powers and privileges as the shares so converted and shall constitute the only outstanding shares of capital stock of the Surviving Company, subject to Section 2.1(b).

(b) Cancellation of Treasury Stock and Parent Owned Stock and Conversion of Subsidiary Owned Stock. (i) Each share of Company Common Stock that is owned by Parent immediately prior to the Effective Time and any Company Common Stock held in the treasury of the Company immediately prior to the Effective Time will automatically be canceled and

| 3 |

retired and will cease to exist, and no consideration will be delivered in exchange therefor and (ii) each share of Company Common Stock held by any Subsidiary of either the Company or Parent immediately prior to the Effective Time shall be converted into such number of shares of common stock of the Surviving Company such that each such Subsidiary owns the same percentage of the outstanding capital stock of the Surviving Company immediately following the Effective Time as such Subsidiary owned in the Company immediately prior to the Effective Time.

(c) Conversion of Company Common Stock. Subject to Section 2.2(e), each issued and outstanding share of Company Common Stock, other than shares of Company Common Stock to be canceled or converted in accordance with Section 2.1(b) and Dissenting Shares to be treated in accordance with Section 2.4, will be converted into the right to receive (i) $4.65 in cash (the “Cash Consideration”) without interest and (ii) a number of ADSs equal to the Exchange Ratio (the “Stock Consideration”). The Cash Consideration, the Stock Consideration and cash in lieu of fractional ADSs as contemplated by Section 2.2(e) are consideration for the acquisition of the shares in the Company and are referred to collectively as the “Merger Consideration.”

(d) Cancellation of Shares of Company Common Stock. As of the Effective Time, all shares of Company Common Stock shall no longer be outstanding and will automatically be canceled and retired and shall cease to exist, and each holder of a certificate formerly representing any shares of Company Common Stock (a “Company Certificate”) or book entry shares (“Book-Entry Shares”) shall cease to have any rights with respect thereto, except the right to receive the Merger Consideration, certain dividends or other distributions, if any, upon surrender or transfer of such Company Certificate or Book-Entry Shares, in each case, in accordance with this Article II, without interest.

2.2 Exchange of Certificates.

(a) Exchange Agent. Prior to the Effective Time, Parent will designate a U.S. bank or trust company reasonably acceptable to the Company to act as agent of Parent for purposes of, among other things, mailing and receiving transmittal letters and distributing the Merger Consideration to the Company Stockholders (the “Exchange Agent”). At or substantially concurrently with the Effective Time, Parent shall (i) deposit, or cause to be deposited with the Depositary Bank, or any successor depositary thereto, a number of Parent Ordinary Shares equal to the aggregate number of ADSs to be issued as Merger Consideration and (ii) deposit with the Exchange Agent, for the benefit of the holders of shares of Company Common Stock, for exchange in accordance with this Article II, through the Exchange Agent, (x) immediately available funds sufficient to pay the aggregate Cash Consideration and (y) the receipts (or uncertificated book-entries, as applicable) representing such aggregate number of ADSs, and the Depositary Bank shall be authorized to issue the ADSs representing such Parent Ordinary Shares in accordance with this Agreement (such cash and such ADSs (whether evidenced by receipts or book-entries), together with any dividends or distributions with respect thereto with a record date after the Effective Time and any cash payable in lieu of any fractional ADSs, in each case to be held by the Exchange Agent in trust for the benefit of the holders of the Company Common Stock being hereinafter referred to as the “Exchange Fund”). No later than 10 Business Days prior to the Closing, Parent shall enter into an agreement with the Exchange Agent, in form and

| 4 |

substance reasonably satisfactory to the Company, to effect the applicable terms of this Agreement (the “Exchange Agent Agreement”).

(b) Exchange Procedures.

(i) Promptly, and in any event within 10 Business Days, after the Effective Time, Parent shall cause the Exchange Agent to mail to each holder of record of a Company Certificate or Book-Entry Share whose shares of Company Common Stock were converted into the right to receive the Merger Consideration (A) a letter of transmittal (which will specify that delivery will be effected, and risk of loss and title to the Company Certificates will pass, only upon proper delivery of the Company Certificates to the Exchange Agent or, in the case of Book-Entry Shares, upon adherence to the procedures set forth in the letter of transmittal, and such letter of transmittal will be in customary form and have such other provisions as Parent may reasonably specify consistent with this Agreement) and (B) instructions for use in effecting the surrender of the Company Certificates or, in the case of Book-Entry Shares, the transfer of such Book-Entry Shares in exchange for the Merger Consideration.

(ii) After the Effective Time, and reasonably promptly following surrender or transfer in accordance with this Article II of a Company Certificate or Book-Entry Shares for cancellation to the Exchange Agent, together with such letter of transmittal, duly executed, and such other documents as may reasonably be required by the Exchange Agent, the holder of such Company Certificate or Book-Entry Shares will be entitled to receive in exchange therefor the Merger Consideration in the form of (A) the number of whole ADSs that such holder has the right to receive pursuant to the provisions of this Article II, after taking into account all the shares of Company Common Stock then held by such holder under all such Book-Entry Shares or Company Certificates so surrendered or transferred, and (B) a check or wire for the full amount of cash that such holder has the right to receive pursuant to the provisions of this Article II, including the Cash Consideration, cash in lieu of fractional ADSs, certain dividends or other distributions, if any, in accordance with Section 2.2(c), in each case less any required withholding of Taxes, and the Company Certificate or Book-Entry Shares so surrendered or transferred will forthwith be canceled, and Parent’s register of members shall be updated accordingly. The ADSs shall be accepted into The Depository Trust Company (“DTC”) and issued in uncertificated book-entry form to such account as shall be specified in the completed letter of transmittal, unless a physical ADR is requested or otherwise required by applicable Law, in which case Parent shall cause the Exchange Agent to send such receipt representing such ADSs to such holder promptly in accordance with the Exchange Agent Agreement. If payment of the Merger Consideration (along with any cash in lieu of fractional ADSs as provided in Section 2.2(e) and any unpaid dividends and other distributions with respect to such ADSs as provided in Section 2.2(c)) is to be made to a person other than the person in whose name the surrendered Company Certificate or Book-Entry Shares so transferred is registered on the stock transfer books of the Company or the systems of DTC, as the case may be, it will be a condition of payment that (1) the Company Certificate so surrendered or the Book-Entry Shares so transferred will be endorsed properly or otherwise be in proper form for transfer, and (2) the person requesting such payment (x) will have paid all transfer and other Taxes required by

| 5 |

reason of the payment of the Merger Consideration to a person other than the registered holder of the Certificate surrendered or Book-Entry Shares so transferred or (y) will have established to the satisfaction of the Surviving Company and the Exchange Agent that such Taxes either have been paid or are not applicable. Until surrendered or transferred as contemplated by this Section 2.2(b), each Company Certificate and each Book-Entry Share will be deemed at any time after the Effective Time to represent only the right to receive upon such surrender or transfer the Merger Consideration that the holder thereof has the right to receive in respect of such Company Certificate pursuant to the provisions of this Article II and certain dividends or other distributions, if any, in accordance with Section 2.2(c). No interest will be paid or will accrue on any Merger Consideration or unpaid dividends and other distributions, if any, payable to holders of Company Certificates or Book-Entry Shares pursuant to the provisions of this Article II.

(c) Dividends; Other Distributions. No dividends or other distributions with respect to ADSs or the underlying Parent Ordinary Shares with a record date after the Effective Time will be paid to the holder of any Company Certificate or Book-Entry Shares that have not been surrendered or transferred with respect to the ADSs represented thereby and no cash payment in lieu of fractional ADSs will be paid to any such holder pursuant to Section 2.2(e), and all such dividends, other distributions and cash in lieu of fractional ADSs will be paid by Parent to the Exchange Agent and will be included in the Exchange Fund, in each case until the surrender or transfer of such Company Certificate or Book-Entry Share in accordance with this Article II. Subject to the effect of applicable escheat or similar Laws, following surrender or transfer of any such Company Certificate or Book-Entry Share in accordance herewith, (A) there will be paid to the holder of whole ADSs issued in exchange therefor, without interest, in addition to all other amounts to which such holder is entitled under this Article II, (i) at the time of such surrender or transfer, the amount of dividends or other distributions with a record date after the Effective Time theretofore paid with respect to such whole ADSs or the underlying Parent Ordinary Shares and the amount of any cash payable in lieu of a fractional ADS to which such holder is entitled pursuant to Section 2.2(e) and (ii) at the appropriate payment date, the amount of dividends or other distributions with a record date after the Effective Time but prior to such surrender or transfer and with a payment date subsequent to such surrender or transfer payable with respect to such whole ADSs or the underlying Parent Ordinary Shares and (B) Parent shall pay or cause the Surviving Company to pay all dividends or other distributions, in each case with a record date prior to the Effective Time, that have been declared or made by the Company with respect to the shares of Company Common Stock in accordance with the terms of this Agreement, but that have not been paid on such shares.

(d) No Further Ownership Rights in Company Common Stock. All ADSs issued and all Cash Consideration paid upon the surrender or transfer for exchange of Company Certificates and Book-Entry Shares in accordance with the terms of this Article II (including any cash paid pursuant to Section 2.2(c) and Section 2.2(e)) will be deemed to have been issued or paid, as the case may be, in full satisfaction of all rights pertaining to the shares of Company Common Stock theretofore represented by such Company Certificates and such Book-Entry Shares, and there will be no further registration of transfers on the stock transfer books of the Surviving Company of the shares of Company Common Stock that were outstanding immediately prior to the Effective Time. If, after the Effective Time, Company Certificates or Book-Entry Shares are

| 6 |

presented to Parent, the Surviving Company or the Exchange Agent for any reason, they will be canceled and exchanged as provided in this Article II.

(e) No Fractional Shares.

(i) No certificates, receipts or scrip representing fractional ADSs shall be issued upon the surrender or transfer for exchange of Company Certificates or Book-Entry Shares, no dividend or distribution of Parent will relate to such fractional ADS interests and such fractional ADS interests will not entitle the owner thereof to vote or to any rights of a shareholder of Parent.

(ii) Notwithstanding any other provision of this Agreement, each holder of Company Common Stock converted pursuant to the Merger who would otherwise be entitled to receive a fraction of an ADS (after taking into account all shares of Company Common Stock held at the Effective Time by such holder) shall receive, in lieu thereof, from the Exchange Agent, a cash payment in United States dollars in lieu of such fractional ADS interest either (A) representing that holder’s proportionate interest in the net proceeds from the sale by the Exchange Agent in one or more transactions of the aggregate of the fractional ADSs which would otherwise have been issued under this Article II (the “Excess ADSs”) or (B) cash in accordance with Section 2.2(e)(iii) below. The sale of the Excess ADSs shall be (A) executed on The NASDAQ Stock Market or the New York Stock Exchange, as applicable, and (B) made at such times, in such manner and on such terms as the Exchange Agent shall determine in its reasonable discretion. Until the net proceeds of such sale or sales have been distributed to the holders of Company Certificates or Book-Entry Shares in accordance with this Section 2.2, the Exchange Agent shall hold the net proceeds in trust (the “Exchange Trust”) for those holders. All commissions, fees, transfer taxes and other out-of-pocket transaction costs, including the expenses and compensation of the Exchange Agent, incurred in connection with the sale of the Excess ADSs shall be paid by Parent and the Surviving Company. As soon as practicable after the determination of the amount of cash to be paid to holders of Company Certificates and Book Entry Shares in lieu of fractional ADSs, the Exchange Agent shall make that amount available to those holders, without interest. The Exchange Agent shall determine the portion of the net proceeds to which each holder of Company Certificates or Book Entry Shares shall be entitled by multiplying the aggregate amount of the net proceeds by a fraction of which (1) the numerator is the amount of the fractional ADS interest to which such holder of Company Certificates or Book Entry Shares is entitled (after taking into account all Company Certificates delivered by such holder) and (2) the denominator is the aggregate amount of fractional ADSs interests to which all holders of Company Certificates and Book Entry Shares are entitled.

(iii) Notwithstanding the provisions of Section 2.2(e)(ii), Parent may elect, at its option exercised prior to the Effective Time, to pay to the Exchange Agent an amount in cash in United States dollars, to be deposited promptly following the Effective Time, sufficient for the Exchange Agent to pay each holder of Company Certificates or Book Entry Shares an amount in cash equal to the product obtained by multiplying (A) the fraction of an ADS to which such holder would otherwise have been entitled by (B) the closing price for an ADS on The NASDAQ Stock Market or the New York Stock

| 7 |

Exchange, as applicable, on the first Business Day immediately following the Effective Time. In such event, all references in this Agreement to the net proceeds from the sale of the Excess ADSs and similar references shall be deemed to refer to the payments calculated in the manner set forth in this Section 2.2(e)(iii).

(f) Termination of Exchange Fund and Exchange Trust. Any portion of the Exchange Fund or the Exchange Trust that remains undistributed to the holders of the Company Certificates or Book-Entry Shares for one year after the Effective Time will be delivered to Parent, upon demand, and any holders of Company Certificates or Book-Entry Shares who have not theretofore complied with this Article II may thereafter look only to Parent (subject to abandoned property, escheat or other similar Laws) as general creditors thereof for payment of their claim for Merger Consideration and any dividends or distributions, if any, with respect to ADSs. Any amounts remaining unclaimed by such holders at such time at which such amounts would otherwise escheat to or become property of any Governmental Entity shall become, to the extent permitted by applicable Law, the property of the Surviving Company or its designee, free and clear of all claims or interest of any person previously entitled thereto.

(g) No Liability. None of Parent, Merger Sub, the Surviving Company or the Exchange Agent will be liable to any person in respect of any ADSs or the underlying Parent Ordinary Shares, any dividends or distributions with respect thereto, any cash in lieu of fractional ADSs or any cash from the Exchange Fund or Exchange Trust, in each case, delivered to a public official pursuant to any applicable abandoned property, escheat or similar Law.

(h) Investment of Exchange Fund and Exchange Trust. The Exchange Agent will invest any cash in the Exchange Fund and Exchange Trust as directed by Parent; provided, however, that any investment of such cash will in all events be limited to direct short-term obligations of, or short-term obligations fully guaranteed as to principal and interest by, the U.S. government, in commercial paper rated A-1 or P-1 or better by Moody’s Investors Service, Inc. or Standard & Poor’s Corporation, respectively, or in certificates of deposit, bank repurchase agreements or banker’s acceptances of commercial banks with capital exceeding $25 billion (based on the most recent financial statements of such bank that are then publicly available), and that no such investment or loss thereon will affect the amounts payable pursuant to this Agreement. Any interest and other income resulting from such investments will be paid to Parent. In the event that the Exchange Fund and Exchange Trust is insufficient to make the payments contemplated by this Article II, Parent will, or will cause the Surviving Company, promptly to deposit additional funds with the Exchange Agent in an amount that is equal to the deficiency in the amount required to make such payment. The Exchange Fund and Exchange Trust will not be used for any purpose not expressly provided for in this Agreement.

(i) Lost Certificates. If any Company Certificate has been lost, stolen or destroyed, upon the making of an affidavit of that fact by the person claiming such Company Certificate to be lost, stolen or destroyed and, if required by the Exchange Agent, the posting by such person of a bond in such customary and reasonable amount as the Exchange Agent may direct as indemnity against any claim that may be made against it with respect to such Company Certificate, the Exchange Agent shall issue, in exchange for such lost, stolen or destroyed Company Certificate, the Merger Consideration and, if applicable, any unpaid dividends and

| 8 |

distributions on ADSs deliverable in respect thereof, due to such person pursuant to this Agreement.

2.3 Certain Adjustments. If at any time during the period between the date of this Agreement and the Effective Time, any change in the outstanding shares of capital stock, or securities convertible or exchangeable into or exercisable for shares of capital stock, of the Company or Parent shall occur as a result of any merger, business combination, reclassification, recapitalization, stock split (including a reverse stock split) or subdivision or combination, exchange or readjustment of shares, or any stock dividend or stock distribution with a record date during such period, the Merger Consideration, the Exchange Ratio, and any other similarly dependent items, as the case may be, shall be equitably adjusted, without duplication, to provide the holders of Company Common Stock (or such rights that are convertible into shares of Company Common Stock) the same economic effect as contemplated by this Agreement prior to such event; provided that nothing in this Section 2.3 shall be construed to permit either the Company or Parent to take any action with respect to its respective securities that is prohibited or not expressly permitted by the terms of this Agreement.