Form 6-K UBS Group AG For: Aug 31

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

Date: August 31, 2015

UBS Group AG

Commission File Number: 1-36764

(Registrant’s Name)

Bahnhofstrasse 45, Zurich, Switzerland

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Table of Contents

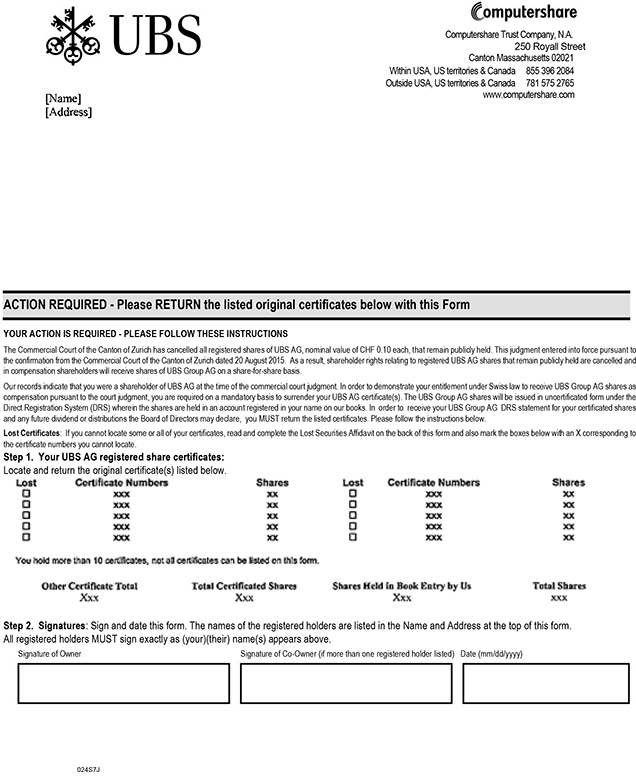

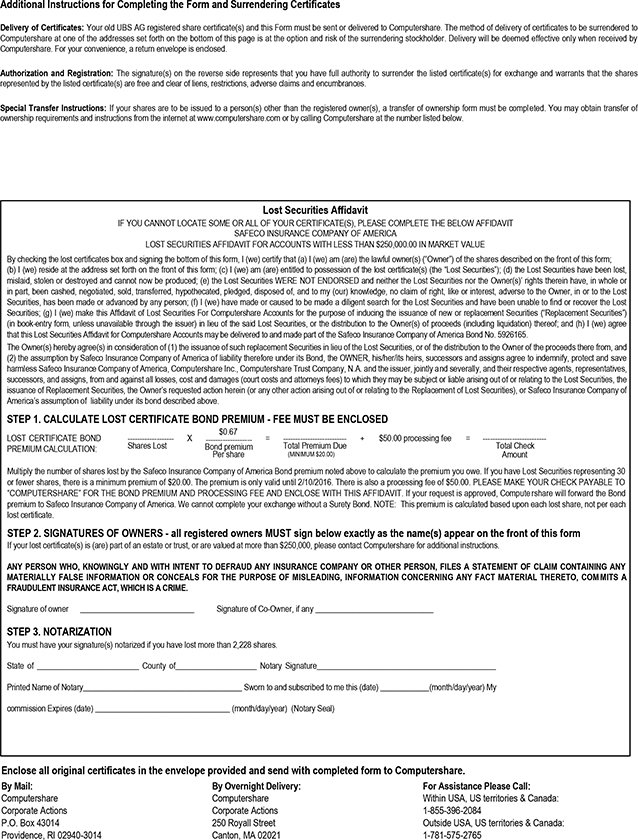

Following the successful completion of the 2014 exchange offer by UBS Group AG (“UBS Group”) to acquire all issued shares of UBS AG (“UBS AG”), UBS Group filed a request with the Commercial Court of the Canton of Zurich on March 9, 2015 for a procedure under article 33 of the Swiss Stock Exchange Act (the “SESTA Procedure”) to cancel all shares of UBS AG that remain publicly held, with shares of UBS Group (“UBS Group Shares”) being delivered as compensation. The Commercial Court of the Canton of Zurich has now declared UBS AG shares of the remaining minority shareholders to be invalid. This judgment entered into force pursuant to the confirmation from the Commercial Court of the Canton of Zurich dated 20 August 2015. New UBS Group Shares are therefore being delivered to holders of the now-cancelled UBS Group AG shares, including to holders thereof in the United States, sourced from the creation of new registered shares out of authorized share capital and from existing treasury shares. The total issued share capital of UBS Group post capital increase will consist of 3,844,779,030 shares, nominal value of CHF 0.10 each.

Under this Report on Form 6-K, the following documents are being filed: the English translation of the amended and restated Articles of Association of UBS Group adopted on August 28, 2015 in the context of the SESTA Procedure; the opinion of Bär & Karrer with respect to the validity of the UBS Group Shares issued pursuant to the SESTA Procedure; and transmittal letter of Computershare Trust Company, N.A. to be used by holders of UBS AG shares in certificated form to submit their cancelled UBS Shares and receive new UBS Group Shares.

This Form 6-K is hereby incorporated by reference into the registration statement of UBS Group AG on Form F-4 (Registration number 333-199011), and into each prospectus outstanding thereunder.

Table of Contents

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| UBS Group AG | ||||

| By: | /s/ David Kelly | |||

| Name: | David Kelly | |||

| Title: | Managing Director | |||

| By: | /s/ Sarah M. Starkweather | |||

| Name: | Sarah M. Starkweather | |||

| Title: | Executive Director | |||

Date: August 31, 2015

Table of Contents

Articles of Association

UBS Group AG

(UBS Group SA)

(UBS Group Inc.)

28 August 2015

Table of Contents

The present text is a translation of the original German Articles of Association (“Statuten”) which constitute the definitive text and are binding in law.

In these Articles of Association, references to the generic masculine equally apply to both sexes.

2

Table of Contents

| Name, registered office, business object and duration of the Corporation |

4 | |||

| 5 | ||||

| 9 | ||||

| 9 | ||||

| 13 | ||||

| 19 | ||||

| 21 | ||||

| 22 | ||||

| Compensation of the members of the Board of Directors and the Group Executive Board |

23 | |||

| 26 | ||||

| 27 | ||||

3

Table of Contents

Name, registered office, business object and duration of the Corporation

| Article 1 | ||

| Name and registered office | A corporation limited by shares under the name of UBS Group AG / UBS Group SA / UBS Group Inc. is established with its registered office in Zurich. | |

| Article 2 | ||

| Purpose |

1 The purpose of the Corporation is to acquire, hold, manage and sell direct and indirect participations in enterprises of any kind, in particular in the area of banking, financial, advisory, trading and service activities in Switzerland and abroad.

2 The Corporation may establish enterprises of any kind in Switzerland and abroad, hold equity interests in these enterprises, and conduct their management.

3 The Corporation is authorized to acquire, mortgage and sell real estate and building rights in Switzerland and abroad.

4 The Corporation may provide loans, guarantees and other kinds of financing and security for Group companies and borrow and invest money on the money and capital markets. | |

| Article 3 | ||

| Duration | The duration of the Corporation shall not be limited by time. | |

4

Table of Contents

| Article 4 | ||

| Share capital | 1 The share capital of the Corporation is CHF 384,477,903.00, divided into 3,844,779,030 registered shares with a par value of CHF 0.10 each. The share capital is fully paid up.

2 Registered shares may be converted into bearer shares and bearer shares into registered shares by resolution of the General Meeting. | |

| Article 4a | ||

| Conditional capital |

1 The share capital may be increased by a maximum of CHF 13,598,219.50 through the issuance of a maximum of 135,982,195 fully paid registered shares with a par value of CHF 0.10 each upon exercise of employee options issued to employees and members of the management and of the Board of Directors of the Corporation and its subsidiaries. The preemptive rights and the advance subscription rights of the shareholders shall be excluded. The issuance of these options to employees and members of the management and of the Board of Directors of the Corporation and its subsidiaries will take place in accordance with the plan rules issued by the Board of Directors and its compensation committee. The acquisition of shares through the exercise of option rights as well as every subsequent transfer of these shares shall be subject to the registration requirements set forth in Article 5 of the Articles of Association.

2 The share capital may be increased in an amount not to exceed CHF 38,000,000 by the issuance of up to 380,000,000 fully paid registered shares with a nominal value of CHF 0.10 each through the voluntary or mandatory exercise of conversion rights and/or warrants granted in connection with the issuance of bonds or similar financial instruments by the Corporation or one of its Group companies on national or international capital markets. The pre-emptive rights of the shareholders shall be excluded. The then current owners of conversion rights and/or warrants shall be entitled to subscribe for the new shares. The conditions of the conversion rights and/or warrants shall be determined by the Board of Directors. | |

5

Table of Contents

|

The acquisition of shares through voluntary or mandatory exercise of conversion rights and/or warrants, as well as each subsequent transfer of the shares, shall be subject to the registration requirements set forth in Article 5 of the Articles of Association.

In connection with the issuance of convertible bonds or bonds with warrants or similar financial instruments, the Board of Directors shall be authorized to restrict or exclude the advance subscription rights of shareholders if such instruments are issued (i) on national or international capital markets or (ii) to one or more financial investors. If the advance subscription rights are restricted or excluded by the Board of Directors, the following shall apply: the issuance of such instrument shall be made at prevailing market conditions, and the new shares shall be issued pursuant to the relevant conditions of that financial instrument. Conversion rights may be exercised during a maximum 10-year period, and warrants may be exercised during a maximum 7-year period, in each case from the date of the respective issuance. The issuance of the new shares upon voluntary or mandatory exercise of conversion rights and/or warrants shall be made at conditions taking into account the market price of the shares and/or comparable instruments with a market price at the time of the issuance of the relevant financial instrument. | ||

| Article 5 | ||

| Share register and nominees | 1 A share register is maintained for the registered shares, in which owners’ and usufructuaries’ family and given names are entered, with their complete address and nationality (or registered office for legal entities). Shares held in joint accounts may be registered jointly with voting rights, if all registered owners of the shares provide the declaration requested in paragraph 3 below. | |

6

Table of Contents

|

2 If the mailing address of a shareholder changes, the new address must be communicated to the Corporation. As long as this has not been done, all written communications will be sent to the address entered in the share register, this being valid according to the requirements of the law.

3 Those who acquire registered shares shall be entered in the share register as shareholders with voting rights if they expressly declare that they acquired these registered shares in their own names and for their own account. If the party acquiring the shares is not prepared to provide such a declaration, the Board of Directors may refuse to allow the shares to be entered with voting rights.

4 The restriction on registration under paragraph 3 above also applies to shares acquired by the exercise of preemptive, option or conversion rights.

5 The Board of Directors is authorized, after hearing the position of the registered shareholder or nominee affected, to strike the entry of a shareholder with voting rights from the share register retroactively with effect to the date of the entry, if it was obtained under false pretenses. The party affected must be informed of the action immediately.

6 The Board of Directors formulates general principles relating to the registration of fiduciaries/nominees and issues the necessary regulations to ensure compliance with the above provisions. | ||

| Article 6 | ||

| Form of shares | 1 Registered shares of the Corporation will be, subject to paragraph 2, in the form of uncertificated securities (in the sense of the Swiss Code of Obligations) and intermediary-held securities (in the sense of the Swiss Federal Intermediated Securities Act).

2 Following his registration in the share register, the shareholder may request the Corporation to issue a written statement in respect of his registered shares at any time; however, he has no entitlement to the printing and delivery of share certificates. In contrast, the Corporation may print and deliver share certificates for registered shares (single certificates, certificates representing multiples of shares or global certificates) at any time. It may withdraw registered shares issued as intermediary-held securities from the respective custody system. With the consent of the shareholder, the Corporation may cancel issued certificates which are returned to it without replacement. | |

7

Table of Contents

| Article 7 | ||

| Exercise of rights | 1 The Corporation recognizes only one representative per share.

2 Voting rights and associated rights may only be exercised in relation to the Corporation by a party entered in the share register as having the right to vote. | |

8

Table of Contents

| Article 8 | ||

| Authority | The General Meeting is the Corporation’s supreme corporate body. | |

| Article 9 | ||

| Types of General Meetings a. Annual General Meeting |

The Annual General Meeting takes place every year within six months after the close of the financial year; the annual report, the compensation report and the reports of the Auditors must be available for inspection by shareholders at the Corporation’s registered office at least twenty days before the meeting. | |

| Article 10 | ||

| b. Extraordinary General Meetings | 1 Extraordinary General Meetings are convened whenever the Board of Directors or the Auditors consider it necessary.

2 Such a meeting must also be convened upon a resolution of the General Meeting or a written request from one or more shareholders representing together at least one tenth of the share capital, specifying the items to be included on the agenda and the proposals to be put forward. | |

| Article 11 | ||

| Convening | 1 The General Meeting shall be called by the Board of Directors or, if need be, by the Auditors at least twenty days before the meeting is to take place. The meeting is called by publishing a single notice in the publication of record designated by the Corporation. An invitation will be sent to all registered shareholders.

2 The notice to convene the General Meeting shall specify the agenda with the proposals of the Board of Directors and proposals from shareholders and, in the event of elections, the names of the proposed candidates. | |

9

Table of Contents

| Article 12 | ||

| Placing of items on the agenda | 1 Shareholders representing shares with an aggregate par value of CHF 62,500 may submit proposals for matters to be placed on the agenda for consideration by the General Meeting, provided that their proposals are submitted in writing within the deadline published by the Corporation and include the actual motion(s) to be put forward.

2 No resolutions may be passed concerning matters which have not been duly placed on the agenda, except on a motion put forward at the General Meeting to call an Extraordinary General Meeting or a motion for a special audit to be carried out. | |

| Article 13 | ||

| Chairmanship, tellers, minutes | 1 The Chairman of the Board of Directors or, if the Chairman cannot attend, a Vice Chairman or another member designated by the Board of Directors, shall preside over the General Meeting and appoint a secretary and the necessary tellers.

2 Minutes are kept of the proceedings and must be signed by the presiding chair of the meeting and the secretary. | |

| Article 14 | ||

| Shareholder proxies | 1 The Board of Directors issues procedural rules for participation and representation of shareholders at the General Meeting, including the requirements as to powers of attorney.

2 A shareholder may only be represented at the General Meeting by his legal representative, under a written power of attorney by another shareholder eligible to vote or, under a written or electronic power of attorney, by the Independent Proxy.

3 The presiding chair of the meeting decides whether to recognize the power of attorney. | |

10

Table of Contents

| Article 15 | ||

| Independent Proxy | 1 The Independent Proxy shall be elected by the General Meeting for a term of office expiring after completion of the next Annual General Meeting.

2 Re-election is permitted.

3 If the Corporation does not have an Independent Proxy, the Board of Directors shall appoint the Independent Proxy for the next General Meeting. | |

| Article 16 | ||

| Voting right | Each share conveys the right to cast one vote. | |

| Article 17 | ||

| Resolutions, elections | 1 Resolutions and elections are decided at the General Meeting by an absolute majority of the votes cast, excluding blank and invalid ballots, subject to these Articles of Association and the compulsory provisions of the law.

2 A resolution to change Article 19 of the Articles of Association, to remove one fourth or more of the members of the Board of Directors or to delete or modify Article 17 paragraph 2 of the Articles of Association must receive at least two thirds of the votes represented.

3 The presiding chair of the meeting shall decide whether voting on resolutions and elections be conducted electronically, by a show of hands or by a written ballot. Shareholders representing at least 3% of the votes represented may always request that a vote or election take place electronically or by a written ballot.

4 In the case of a written ballot, the presiding chair of the meeting may rule that only the ballots of those shareholders shall be collected who choose to abstain or to cast a negative vote, and that all other shares represented at the General Meeting at the time of the vote shall be counted in favor, in order to expedite the counting of the votes. | |

11

Table of Contents

|

5 The presiding chair of the meeting may order that a resolution or election be repeated if, in his view, the results of the vote are in doubt. In this case, the preceding resolution or election shall be deemed to have not occurred. | ||

| Article 18 | ||

| Powers | The General Meeting has the following powers:

a) To establish and amend the Articles of Association

b) To elect the members and the Chairman of the Board of Directors and the members of the compensation committee

c) To elect the Auditors

d) To elect the Independent Proxy

e) To approve the management report and the Group financial statements

f) To approve the financial statements and to decide upon the appropriation of the net profit shown in the balance sheet

g) To approve the compensation for the Board of Directors and the Group Executive Board pursuant to Article 43 of the Articles of Association

h) To give the members of the Board of Directors and of the Group Executive Board a discharge

i) To take decisions on all matters reserved to the General Meeting by law or by the Articles of Association, or which are placed before it by the Board of Directors. | |

12

Table of Contents

| Article 19 | ||

| Number of Board members | The Board of Directors shall consist of at least six and no more than twelve members. | |

| Article 20 | ||

| Term of office | 1 The term of office for members of the Board of Directors and its Chairman expires after completion of the next Annual General Meeting.

2 Members whose term of office has expired are immediately eligible for re-election. | |

| Article 21 | ||

| Organization | 1 Except for the election of the Chairman and the members of the compensation committee by the General Meeting, the Board of Directors shall constitute itself. It shall elect at least one Vice Chairman and a Senior Independent Director from among its members.

2 The Board of Directors shall appoint its secretary, who need not be a member of the Board.

3 If the office of the Chairman is vacant, the Board of Directors shall appoint a new Chairman from among its members for the remaining term of office. | |

| Article 22 | ||

| Convening, participation | 1 The Chairman shall convene the Board of Directors as often as business requires, but at least six times a year.

2 The Board of Directors shall also be convened if one of its members or the Group Chief Executive Officer submits a written request to the Chairman to hold such a meeting. | |

13

Table of Contents

| Article 23 | ||

| Decisions | 1 Decisions of the Board of Directors are taken by an absolute majority of the votes cast. In case of a tie, the presiding chair of the meeting shall cast the deciding vote.

2 The number of members who must be present to constitute a quorum and the modalities for the passing of resolutions shall be laid down by the Board of Directors in the Organization Regulations. No such quorum is required for decisions confirming and amending resolutions relating to capital increases. | |

| Article 24 | ||

| Duties and powers | 1 The Board of Directors has ultimate responsibility for the management of the Corporation and the supervision and control of its executive management.

2 The Board of Directors may also take decisions on all matters which are not expressly reserved to the General Meeting or to another corporate body by law or by the Articles of Association. | |

| Article 25 | ||

| Ultimate responsibility for the management of the Corporation | The ultimate responsibility for the management of the Corporation comprises in particular:

a) Preparing of and deciding on proposals to be placed before the General Meeting

b) Issuing the regulations necessary for the conduct of business and for the delineation of authority, in particular the Organization Regulations and the regulations governing the Group Internal Audit

c) Laying down the principles for the accounting, financial and risk controls and financial planning, in particular the allocation of equity resources and risk capital for business operations

d) Decisions on Group strategy and other matters reserved to the Board of Directors under the Organization Regulations | |

14

Table of Contents

|

e) Appointment and removal of (i) the Group Chief Executive Officer, (ii) such other members of the Group Executive Board as the Organization Regulations require to be appointed by the Board of Directors and (iii) the Head of Group Internal Audit

f) Decisions on increasing the share capital, to the extent this falls within the authority of the Board of Directors (Article 651 paragraph 4 of the Swiss Code of Obligations), on the report concerning an increase in capital (Article 652e of the Swiss Code of Obligations) and on the ascertainment of capital increases and the corresponding amendments to the Articles of Association. | ||

| Article 26 | ||

| Supervision, control | Supervision and control of the business management comprises in particular the following:

a) Review of the management report, Group and parent company financial statements, the compensation report as well as quarterly financial statements

b) Acceptance of regular reports covering the course of business and the position of the Group, the status and development of country, counterparty and market risks and the extent to which equity and risk capital are tied up due to business operations

c) Consideration of reports prepared by the Auditors. | |

| Article 27 | ||

| Delegation, Organization Regulations | The Board of Directors may delegate part of its authority to one or more of its members or to third parties, subject to Articles 25 and 26 of the Articles of Association. The allocation of authority and functions shall be defined in the Organization Regulations. | |

15

Table of Contents

| Article 28 | ||

| Number of members, term of office and organization of the compensation committee | 1 The compensation committee shall consist of at least three members of the Board of Directors.

2 The compensation committee shall organize itself within the limits of the law and of the Articles of Association. The Board of Directors shall appoint a chairperson.

3 If there are vacancies on the compensation committee, the Board of Directors shall appoint the missing members from among its members for the remaining term of office. | |

| Article 29 | ||

| Duties and powers of the compensation committee | 1 The compensation committee supports the Board of Directors in establishing and reviewing the Corporation’s compensation strategy and guidelines and in articulating the performance criteria relevant for determining individual total compensation for each member of the Group Executive Board. The compensation committee also prepares the proposals to the General Meeting regarding the compensation of the Board of Directors and of the Group Executive Board and may submit proposals to the Board of Directors on other compensation-related issues.

2 The Board of Directors shall determine, and codify in the Organization Regulations, for which functions of the Group Executive Board the compensation committee shall establish and review financial and non-financial performance targets and assess the performance against these targets to determine compensation recommendations for the members of the Group Executive Board. In accordance with the Organization Regulations, these recommendations shall be presented to the Board of Directors for review or approval, subject to the approval by the General Meeting as set out in Article 43 of the Articles of Association. The compensation committee shall, in accordance with the Organization Regulations, also submit a proposal for the compensation for the members of the Board of Directors to the Board of Directors, subject to the approval by the General Meeting as set out in Article 43 of the Articles of Association. | |

16

Table of Contents

|

3 The Board of Directors may delegate further tasks to the compensation committee which shall be determined in the Organization Regulations approved by the Board of Directors. | ||

| Article 30 | ||

| Signatures | The due and valid representation of the Corporation by members of the Board of Directors or further persons shall be determined in the Organization Regulations and a specific directive. | |

| Article 31 | ||

| Mandates | 1 No member of the Board of Directors may hold more than four additional mandates in listed companies and five additional mandates in non-listed companies.

2 The following mandates are not subject to the limitations set forth in paragraph 1:

a) Mandates in companies which are controlled by the Corporation or which control the Corporation

b) Mandates held at the request of the Corporation or companies controlled by it. No member of the Board of Directors shall hold more than ten such mandates

c) Mandates in associations, charitable organizations, foundations, trusts and employee welfare foundations. No member of the Board of Directors shall hold more than ten such mandates.

3 Mandates shall mean mandates in the supreme governing body of a legal entity which is required to be registered in the commercial register or a comparable foreign register. Mandates in different legal entities which are under joint control are deemed one mandate. | |

17

Table of Contents

| Article 32 | ||

| Terms of agreements relating to compensation | The Corporation or companies controlled by it may enter into agreements for a fixed term with members of the Board of Directors relating to their compensation. Duration and termination shall comply with the term of office and the law. | |

| Article 33 | ||

| Loans | Loans to the independent members of the Board of Directors shall be made in accordance with the customary business and market conditions. Loans to the non-independent members of the Board of Directors shall be made in the ordinary course of business on substantially the same terms as those granted to employees of the Corporation or companies controlled by it. The total amount of such loans shall not exceed CHF 20,000,000 per member. | |

18

Table of Contents

| Article 34 | ||

| Organization | The Group Executive Board is composed of the Group Chief Executive Officer and at least three other members as further set forth in the Organization Regulations. | |

| Article 35 | ||

| Functions, authorities | 1 The Group Executive Board acting under the leadership of the Group Chief Executive Officer is responsible for the management of the Group. It is the supreme executive body as defined by the Swiss Federal Law on Banks and Savings Banks. It implements the Group strategy decided by the Board of Directors and ensures the execution of the decisions of the Board of Directors. It is responsible for the Group’s results.

2 The responsibilities and authorities of the Group Executive Board and other management units designated by the Board of Directors are set forth in the Organization Regulations. | |

| Article 36 | ||

| Mandates | 1 No member of the Group Executive Board may hold more than one additional mandate in a listed company and five additional mandates in non-listed companies, subject to approval by the Board of Directors.

2 The following mandates are not subject to the limitations set forth in paragraph 1:

a) Mandates in companies which are controlled by the Corporation or which control the Corporation

b) Mandates held at the request of the Corporation or companies controlled by it. No member of the Group Executive Board shall hold more than ten such mandates

c) Mandates in associations, charitable organizations, foundations, trusts and employee welfare foundations. No member of the Group Executive Board shall hold more than eight such mandates. | |

19

Table of Contents

|

3 Mandates shall mean mandates in the supreme governing body of a legal entity which is required to be registered in the commercial register or a comparable foreign register. Mandates in different legal entities which are under joint control are deemed one mandate. | ||

| Article 37 | ||

| Employment contract terms | 1 The term of employment contracts with the members of the Group Executive Board may be unlimited with a notice period of up to twelve months or may be fixed with a term of up to one year.

2 The Corporation or companies controlled by it may enter into non-compete agreements with the members of the Group Executive Board for the time after termination of the employment agreement for a duration of up to one year. The respective consideration shall not exceed the total compensation paid or granted to such member of the Group Executive Board for the last full financial year prior to termination. | |

| Article 38 | ||

| Loans | Loans to the members of the Group Executive Board shall be made in the ordinary course of business on substantially the same terms as those granted to employees of the Corporation or companies controlled by it. The total amount of such loans shall not exceed CHF 20,000,000 per member. | |

20

Table of Contents

| Article 39 | ||

| Term of office, authority and duties | 1 An auditing company subject to governmental supervision as required by law is to be appointed as Auditors.

2 The General Meeting shall elect the Auditors for a term of office of one year. The rights and duties of the Auditors are determined by the provisions of the law.

3 The General Meeting may appoint Special Auditors for a term of three years, who provide the attestations required for capital increases. | |

21

Table of Contents

Financial statements and appropriation of profit, reserves

| Article 40 | ||

| Financial year | The financial statements and the Group financial statements are closed on 31 December of each year. | |

| Article 41 | ||

| Appropriation of disposable profit | 1 At least 5% of the profit for the year is allocated to the general statutory reserve until such time as said reserve amounts to 20% of the share capital.

2 The remaining profit is, subject to the provisions of the Swiss Code of Obligations and of the Swiss Federal Banking Act, at the disposal of the General Meeting who may also use it for the formation of free or special reserves. | |

| Article 42 | ||

| Reserves | The General Meeting determines the utilization of the general statutory reserve in accordance with the legal provisions acting upon the proposal of the Board of Directors. | |

22

Table of Contents

Compensation of the members of the Board of Directors and the Group Executive Board

| Article 43 | ||

| Approval of the compensation of the Board of Directors and the Group Executive Board | 1 The General Meeting shall approve the proposals of the Board of Directors in relation to:

a) The maximum aggregate amount of compensation of the Board of Directors for the period until the next Annual General Meeting

b) The maximum aggregate amount of fixed compensation of the Group Executive Board for the following financial year

c) The aggregate amount of variable compensation of the Group Executive Board for the preceding financial year.

2 The Board of Directors may submit for approval by the General Meeting deviating or additional proposals relating to the same or different periods.

3 In the event the General Meeting does not approve a proposal of the Board of Directors, the Board of Directors shall determine, taking into account all relevant factors, the respective (maximum) aggregate amount or (maximum) partial amounts and submit the amount(s) so determined for approval by the General Meeting.

4 The Corporation or companies controlled by it may pay or grant compensation prior to approval by the General Meeting, subject to subsequent approval. | |

| Article 44 | ||

| General compensation principles | 1 The compensation system of the Corporation is designed to align reward with sustainable performance and to support appropriate and controlled risk-taking.

2 When determining individual compensation, the Board of Directors or, where delegated to it, the compensation committee takes into account position and level of responsibility of the recipient and performance of the Corporation and companies controlled by it. It ensures compliance with applicable regulatory requirements. | |

23

Table of Contents

|

3 Compensation may be paid or granted in the form of cash, shares, financial instruments or units, in kind, or in the form of benefits. The Board of Directors or, where delegated to it, the compensation committee determines the key features, such as grant, vesting, exercise and forfeiture conditions and applicable harmful acts provisions. The Board of Directors, or where delegated to it, the compensation committee may provide, among other things, for continuation, acceleration or removal of vesting and exercise conditions, for payment or grant of compensation assuming target achievement or for forfeiture in the event of predetermined events such as a change-of-control or termination of an employment or mandate agreement. The Corporation or companies controlled by it may procure any shares required to meet any resulting payment obligations through purchases in the market or, to the extent available, by using the Corporation’s conditional share capital.

4 Compensation may be paid or granted by the Corporation or companies controlled by it. | ||

| Article 45 | ||

| Compensation of the Board of Directors | 1 Compensation of the members of the Board of Directors shall comprise a base remuneration and may comprise other compensation elements and benefits.

2 Compensation of the members of the Board of Directors is intended to recognize the responsibility and governance nature of their role, to attract and retain qualified individuals and to ensure alignment with shareholders’ interest. | |

| Article 46 | ||

| Compensation of the Group Executive Board | 1 Compensation of the members of the Group Executive Board shall comprise fixed and variable compensation elements.

2 Fixed compensation shall comprise the base salary and may comprise other compensation elements and benefits. | |

24

Table of Contents

|

3 Variable compensation elements shall be governed by financial and non-financial performance measures that take into account the performance of the Corporation and/or parts thereof, targets in relation to the market, other companies or comparable benchmarks, short- and long-term strategic objectives and/or individual targets. The Board of Directors or, where delegated to it, the compensation committee determines the respective performance measures, the overall and individual performance targets, and their achievements.

4 The Board of Directors or, where delegated to it, the compensation committee aims to ensure alignment with sustainable performance and appropriate risk-taking through adequate deferrals, forfeiture conditions, caps on compensation, harmful acts provisions and similar means with regard to parts of or all of the compensation. Parts of variable compensation shall be subject to a multi-year vesting period.

5 If the maximum aggregate amount of compensation already approved by the General Meeting is not sufficient to also cover the compensation of a person who becomes a member of or is being promoted within the Group Executive Board after the General Meeting has approved the compensation, the Corporation or companies controlled by it shall be authorized to pay or grant each such Group Executive Board member a supplementary amount during the compensation period(s) already approved. The aggregate pool for such supplementary amounts per compensation period shall not exceed 40% of the average of total annual compensation paid or granted to the Group Executive Board during the previous three years. |

25

Table of Contents

| Article 47 | ||

| Official publication media | Public notices appear in the Swiss Official Gazette of Commerce (in French “Feuille Officielle Suisse du Commerce”, or German “Schweizerisches Handelsamtsblatt”). The Board of Directors may designate other publications as well. | |

| Article 48 | ||

| Jurisdiction | Jurisdiction for any disputes arising out of the corporate relationship shall solely be at the registered office of the Corporation. | |

26

Table of Contents

Disclosure of contributions in kind

| Article 49 | ||

| Contribution in kind | 1 In connection with the capital increase dated 26 November 2014, the Corporation acquires from UBS AG, Zurich and Basel, acting as contributor in kind and exchange agent in its own name but for account of certain shareholders of UBS AG, Zurich and Basel, who have tendered their shares in the course of the public exchange offer of the Corporation, 3,183,370,731 shares of UBS AG, Zurich and Basel, with a par value of CHF 0.10 each and a total value of CHF 32,718,731,974.95. In return, the Corporation has issued 3,183,370,731 registered shares in the Corporation with a par value of CHF 0.10 each to the contributor in kind.

2 In connection with the capital increase dated 26 November 2014, the Corporation acquires from UBS Securities LLC, 1285 Avenue of the Americas, New York, NY 10019, U.S., acting as contributor in kind and exchange agent in its own name but for account of certain shareholders of UBS AG, Zurich and Basel, who have tendered their shares in the course of the public exchange offer of the Corporation, 201,494,824 shares of UBS AG, Zurich and Basel, with a par value of CHF 0.10 each and a total value of CHF 2,070,966,814.07. In return, the Corporation has issued 201,494,824 registered shares in the Corporation with a par value of CHF 0.10 each to the contributor in kind.

3 In connection with the capital increase dated 26 November 2014, the Corporation acquires from UBS AG, Zurich and Basel, acting as contributor in kind in its own name and in relation to shares tendered during the initial offer period in the course of the public exchange offer of the Corporation, 90,490,886 shares of UBS AG, Zurich and Basel, with a par value of CHF 0.10 each and a total value of CHF 968,693,952.29. In return, the Corporation has issued, on a one-to-one basis, 90,490,886 registered shares in the Corporation with a par value of CHF 0.10 each to the contributor in kind. | |

27

Table of Contents

|

4 In connection with the capital increase dated 16 December 2014, the Corporation acquires from UBS AG, Zurich and Basel, acting as contributor in kind in its own name but for account of certain shareholders of UBS AG, Zurich and Basel, who (i) have tendered their shares in the course of the public exchange offer of the Corporation or (ii) have offered their registered shares for a private exchange under the terms of this public exchange offer, 229,042,914 shares of UBS AG, Zurich and Basel, with a par value of CHF 0.10 each and a total value of CHF 2,244,527,510.81. In return, the Corporation has issued, on a one-to-one basis, 229,042,914 registered shares in the Corporation with a par value of CHF 0.10 each to the contributor in kind.

5 In connection with the capital increase dated 16 December 2014, the Corporation acquires from UBS Securities LLC, 1285 Avenue of the Americas, New York, NY 10019, U.S., acting as contributor in kind in its own name but for account of certain shareholders of UBS AG, Zurich and Basel, who have tendered their shares in the course of the public exchange offer of the Corporation, 12,510,852 shares of UBS AG, Zurich and Basel, with a par value of CHF 0.10 each and a total value of CHF 122,601,267.19. In return, the Corporation has issued, on a one-to-one basis, 12,510,852 registered shares in the Corporation with a par value of CHF 0.10 each to the contributor in kind.

6 In connection with the capital increase dated 10 February 2015, the Corporation acquires from UBS AG, Zurich and Basel, 11,800,250 shares of UBS AG, Zurich and Basel, with a par value of CHF 0.10 each and a total value of CHF 130,476,501.09. In return, the Corporation has issued 11,800,250 registered shares in the Corporation with a par value of CHF 0.10 each to the contributor in kind.

7 In connection with the capital increase dated 9 March 2015, the Corporation acquires from UBS AG, Zurich and Basel, 9,525,000 shares of UBS AG, Zurich and Basel, with a par value of CHF 0.10 each and a total value of CHF 104,986,854.19. In return, the Corporation has issued, on a one-to-one basis, 9,525,000 registered shares in the Corporation with a par value of CHF 0.10 each to the contributor in kind. |

28

Table of Contents

|

8 In connection with the capital increase dated 12 June 2015, the Corporation acquires from UBS AG, Zurich and Basel, 17,500,000 shares of UBS AG, Zurich and Basel, with a par value of CHF 0.10 each and a total value of CHF 199,898,088.25. In return, the Corporation has issued, on a one-to-one basis, 9,525,000 registered shares in the Corporation with a par value of CHF 0.10 each to the contributor in kind.

9 In connection with the capital increase dated 28 August 2015, the Corporation acquires from UBS AG, Zurich and Basel, 88,825,456 shares of UBS AG, Zurich and Basel, with a par value of CHF 0.10 each and a total value of CHF 968,693,952.29. In return, the Corporation has issued, on a one-to-one basis, 88,825,456 registered shares in the Corporation with a par value of CHF 0.10 each to the contributor in kind. |

29

Table of Contents

UBS Group AG

P.O. Box, CH-8098 Zurich

www.ubs.com

© UBS 2015. The key symbol and UBS are among the registered and unregistered trademarks of UBS. All rights reserved.

Table of Contents

UBS Group AG

Bahnhofstrasse 45

CH-8001 Zurich

Switzerland

Zurich, 28 August 2015

Form F-4 Registration Statement

Dear Sir or Madam,

We have been asked to issue a legal opinion letter as special Swiss legal counsel of UBS Group AG, Bahnhofstrasse 45, CH-8001 Zurich, Switzerland, Swiss business identification number CHE-395.345.924 (the “Company”) in connection with the registration statement on Form F-4 (File No. 333-199011) (the “Registration Statement”), including all amendments or supplements thereto, filed with the Securities and Exchange Commission (the “Commission”) under the United States Securities Act of 1933, as amended (the “Act”) for the registration of the ordinary registered shares of the Company with a nominal value of CHF 0.10 (the “Shares”) in connection with the exchange offer described therein (the “Exchange Offer”). The Exchange Offer is comprised of two separate offers made respectively to (i) all holders of outstanding ordinary shares of UBS AG, a Swiss stock corporation (Aktiengesellschaft), Bahnhofstrasse 45, CH-8001 Zurich and Aeschenvorstadt 1, CH-4051 Basel, Swiss business identification number CHE-101.329.561 (“UBS Shareholders”) located in the United States and (ii) all UBS Shareholders wherever located.

| Bär & Karrer Rechtsanwälte |

Zürich Bär & Karrer AG Brandschenkestrasse 90 CH-8027 Zürich Phone: +41 58 261 50 00 Fax: +41 58 261 50 01 |

Genf Bär & Karrer SA 12, quai de la Poste CH-1211 Genève 11 Phone: +41 58 261 57 00 Fax: +41 58 261 57 01 |

Lugano Bär & Karrer SA Via Vegezzi 6 CH-6901 Lugano Phone: +41 58 261 58 00 Fax: +41 58 261 58 01 |

Zug Bär & Karrer AG Baarerstrasse 8 CH-6301 Zug Phone: +41 58 261 59 00 Fax: +41 58 261 59 01 |

www.baerkarrer.ch |

Table of Contents

The Shares comprise (i) 3,475,356,441 Shares issued by way of a capital increase approved by a resolution of the general meeting of the sole shareholder of the Company on 26 November 2014 (the “General Meeting”) in exchange of the shares of UBS AG tendered into and not withdrawn from the Exchange Offer during the initial offer period, (ii) a portion of the 241,553,766 Shares issued out of the Company’s authorized capital (“Authorized Capital”) by way of a capital increase implemented by the board of directors of the Company on 16 December 2014, such portion being issued in exchange of the shares of UBS AG that have been tendered into the Exchange Offer during the subsequent offer period, and (iii) a portion of the 88,825,456 Shares (the “Issued Shares”) issued out of the Company’s Authorized Capital by way of capital increase following a legally effective judgment on the petition regarding a squeeze-out pursuant to the Swiss Federal Act on Stock Exchanges and Securities Dealings of 24 March 1995, confirmed to be implemented by the board of directors of the Company on 28 August 2015, such portion corresponding to the number of shares of UBS AG held by minority shareholders of UBS AG as of the legal effectiveness of the cancellation of such publicly held shares in accordance with art. 33 SESTA. For the avoidance of doubt, the opinions expressed in this legal opinion letter only relate to the Issued Shares.

All capitalized terms used in this legal opinion letter shall have the meaning as defined herein.

| I | DOCUMENTS |

In arriving at the opinions expressed in clause III below, we have exclusively reviewed and relied on the following documents, the sufficiency of which we confirm for purposes of this legal opinion letter (the documents referred to in this clause I collectively the “Documents” and any individual document thereof a “Document”):

| a) | an excerpt from the daily journal (Tagesregister) of the commercial register of the Canton of Zurich, Switzerland, in relation to the Company, certified by said register as of 28 August 2015 (the “Excerpt”); |

| b) | a copy of the articles of association of the Company, certified by the commercial register of the Canton of Zurich, Switzerland, to be up-to-date as deposited with such register as of 28 August 2015 (the “Articles”); |

| c) | a copy of the public deed of the resolutions of the board of directors of the Company containing the declarations of the board of directors of the Company regarding the Authorized Capital increase by issuance of the Issued Shares dated 28 August 2015. |

| II | ASSUMPTIONS |

In arriving at the opinions expressed in clause III below, we have assumed (without verification) cumulatively that:

| a) | the information set out in the Documents is true, accurate, complete and up-to-date as of the date of this legal opinion letter and no changes have been made or will be made that should have been or should be reflected in the Documents as of the date of this legal opinion letter; |

2

Table of Contents

| b) | the Documents submitted to us as (hard or electronic) copies are complete and conform to the original document; |

| c) | all signatures and seals on any Document are genuine; |

| d) | where a name is indicated (in print or in handwriting) next to a signature appearing on any Document, the signature has been affixed by the person whose name is indicated, and where no name is indicated (in print or in handwriting) next to a signature appearing on any Document, the relevant Documents have been duly signed by authorized signatories; and |

| e) | to the extent any authorizations, approvals, consents, licenses, exemptions or other requirements (collectively the “Authorizations”) had to be obtained outside Switzerland in connection with the Exchange Offer and/or the issuance of the Shares, such Authorizations have been obtained or fulfilled in due time, and have remained in full force and effect at all times through the issuance of the Shares. |

| III | OPINIONS |

Based upon the foregoing, and subject to the qualifications and reliance limitations set out in clause IV and clause V below, we are of the opinion that under the laws of Switzerland as currently in force and interpreted:

| a) | the Company is a stock corporation (Aktiengesellschaft) duly organized and validly existing under the laws of Switzerland, with corporate power and authority to conduct its business in accordance with its Articles; |

| b) | the Issued Shares have been validly issued and are fully paid and non-assessable (i.e. no further contributions in respect thereof will be required to be made to the Company by the holders thereof, by reason only of their being such holders). |

| IV | QUALIFICATIONS |

The opinions given under clause III above are each subject to the following cumulative qualifications:

| a) | The opinions expressed herein are strictly limited to matters governed by the laws of Switzerland and thus to opinions on certain Swiss law matters. |

3

Table of Contents

| b) | The opinions expressed herein are based on and subject to the laws of Switzerland as in force and generally interpreted based on available legal sources as of the date of this legal opinion letter, and where this legal opinion letter refers to “Swiss law” or “the laws of Switzerland”, it solely refers to Swiss law as in force and generally interpreted based on available legal sources as of the date of this legal opinion letter. Such laws are subject to change. |

| c) | We have made no investigation of the laws of any other jurisdiction (but the laws of Switzerland) as a basis for this legal opinion letter and do not express or imply any opinion thereon. |

| d) | The opinions expressed herein relate only to legal matters explicitly covered by this legal opinion letter (taking into account cumulatively all assumptions and qualifications) and no opinion is given by implication or otherwise on any other matter. |

| e) | In issuing this legal opinion letter, we based ourselves solely on the Documents and were not instructed to, and did not, make any further independent search or due diligence; we do not opine as to any facts or circumstances occurring or coming to our attention subsequently to the date hereof. |

| f) | The assumptions and qualifications apply to all opinions expressed in this legal opinion letter. |

| g) | We express no opinion herein as to the accuracy or completeness of the information set out in the Registration Statement or of the representation and warranties set out in the Registration Statement. |

| h) | We express no opinion herein as to regulatory matters or as to any commercial, accounting, calculating, auditing, tax, or other non-corporate law matter. |

| i) | As a matter of mandatory Swiss law, shareholders as well as the board of directors of a company are entitled to challenge resolutions adopted by a general shareholders’ meeting believed to violate the law or the company’s articles of association by initiating legal proceedings against such company within two months following such meeting. Therefore, notwithstanding registration of the Shares in the competent commercial register, any shareholder or the board of directors of the Company may challenge the resolutions taken by the general shareholders’ meeting of the Company on which such registration of the Shares in the competent commercial register may be based. |

| j) | In this opinion, Swiss legal concepts are expressed in English terms and not in any official Swiss language; these concepts may not be identical to the concepts described by the same English terms as they exist under the laws of other jurisdictions. |

4

Table of Contents

| V | RELIANCE |

This legal opinion letter is addressed to the Company. We hereby consent to the filing of this legal opinion letter as an exhibit to the report on Form 6-K on or around the date hereof (the “Form 6-K”) to be incorporated by reference into the Registration Statement and to the references to us under the headings “The Transaction” and “Validity of UBS Group AG Shares” in the Registration Statement. In giving such consent, we do not admit or imply that we are in the category of persons whose consent is required under section 7 of the Act or the rules and regulations of the Commission issued thereunder.

This legal opinion letter is furnished by us, as special Swiss legal counsel to the Company, in connection with the filing of the Form 6-K. Without our prior consent, it may not be used by, copied by, circulated by, quoted by, referred to, or disclosed to any party or for any purpose, except for such filing or in connection with any reliance by investors on such filing pursuant to US securities laws.

Any reliance on this opinion is limited to the legal situation existing at the date of this legal opinion letter, and we shall be under no obligation to advise you on or to amend this legal opinion letter to reflect any change in circumstances or applicable laws or regulations for any period after the date of issuance of this legal opinion letter.

This legal opinion letter shall be governed by and construed in accordance with the laws of Switzerland. This legal opinion letter may only be relied upon on the express condition that any issues of interpretation arising hereunder will be governed by the laws of Switzerland.

Yours faithfully,

| Dr. Dieter Dubs | Dr. Urs Kaegi |

5

Table of Contents

Table of Contents

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- UBS AG (UBS) Shuts Some China Private Funds, Will Lay Off Staff - Reuters

- UBS Private Wealth Management hires Regina Bronson and Alex Gitomer in New York City

- Dell (DELL) PT Raised to $141 at UBS

Create E-mail Alert Related Categories

SEC FilingsRelated Entities

UBSSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share