Form 8-K Sucampo Pharmaceuticals, For: Aug 26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 26, 2015

Sucampo Pharmaceuticals, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 001-33609 | 30-0520478 |

| (State or other jurisdiction of incorporation) |

(Commission File Number) | (IRS Employer Identification No.) |

4520 East-West Highway, 3rd Floor

Bethesda, MD 20814

(Address of principal executive offices, including zip code)

(301) 961-3400

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01 Entry into a Material Definitive Agreement.

Share Purchase Agreement

On August 26, 2015, Sucampo Pharmaceuticals, Inc., a Delaware corporation (the “Registrant”), entered into a Share Purchase Agreement (the “Purchase Agreement”) by and between the Registrant and certain stockholders (the “Sellers”) of R-Tech Ueno, a corporation organized under Japanese law (the “Target”). The Purchase Agreement provides for the Registrant to purchase from the Sellers an aggregate of 8,571,900 shares of the common stock of the Target (the “Seller Shares”) in exchange for cash consideration of 1,400 Japanese Yen (“JPY”) per share, which is equivalent to approximately $11.72 per share.

The Purchase Agreement contains customary representations, warranties and covenants made by the Registrant and the Sellers. Consummation of the sale and purchase of the Seller Shares is subject to customary closing conditions, including receipt of any required governmental or third party approvals and the absence of any liens or encumbrances on the Seller Shares, as well as conditions that (i) the Registrant shall have obtained debt financing sufficient to purchase the Seller Shares and fund the Tender Offer (as defined below), and (ii) that the Tender Offer (as defined below) shall have been completed with the Offeror (as defined below) acquiring more than fifty percent (50%) of the outstanding shares of common stock of the Target (calculated on a fully-diluted basis) held by persons other than the Sellers. The Registrant, on the one hand, and the Sellers, on the other hand, are entitled to terminate the Purchase Agreement if the Tender Offer (as defined below) (x) has not closed on or before the date that is ninety (90) business days following the date of the Purchase Agreement, or (y) is withdrawn. The Registrant intends to finance the purchase of the Seller Shares with debt financing (see Item 8.01 below) and cash on hand. The Purchase Agreement and the transactions contemplated in the Purchase Agreement have been unanimously approved by the Registrant’s board of directors.

Tender Offer and Strategic Alliance Agreement

In connection with the execution of the Purchase Agreement, on August 26, 2015, the Registrant announced its intention to launch, through its wholly-owned subsidiary, Sucampo Pharma LLC, a corporation organized under Japanese law (the “Offeror”), an all-cash tender offer (the “Tender Offer”) to acquire all of the outstanding shares of common stock of the Target (and options to acquire shares of Target common stock), other than the Seller Shares, in exchange for cash consideration of 1,900 JPY per share, which is equivalent to approximately $15.90 per share, for a total consideration of 33 billion JPY, or approximately $278 million. The Tender Offer will be conducted in Japan pursuant to a tender offer registration statement filed with the Kanto Local Finance Bureau in accordance with applicable Japanese law. The Tender Offer period will begin on August 27, and expire on October 13, thirty (30) business days following the launch, provided, however, that the Offeror will have the right to extend the Tender Offer period. Subject to the Tender Offer achieving a minimum acceptance threshold, receipt of certain regulatory approvals, and other conditions to the Tender Offer, the Offeror will consummate the purchase of the Target shares tendered into the Tender Offer and, following the consummation of purchase of the Seller Shares, the Registrant, the Offeror, and the Target will complete a “squeeze-out” transaction (the “Squeeze-out”) to acquire all remaining outstanding shares of Target common stock not acquired through the Tender Offer.

In connection with the Tender Offer, on August 26, 2015, the Offeror entered into a Strategic Alliance Agreement (the “Alliance Agreement”) by and between the Offeror and the Target. The Alliance Agreement sets forth the conditions to the obligation of the Offeror to commence the Tender Offer, including a condition that the Registrant shall have obtained debt financing sufficient to permit the Offeror to consummate the Tender Offer, the absence of a “material adverse effect” (as such term is defined in the Alliance Agreement) with respect to the Target, and the unanimous approval and public announcement by the Target’s board of directors of a statement of opinion in support of the Tender Offer and recommending that the holders of shares of the Target’s common stock (and options to acquire shares of Target common stock) tender their shares of common stock (and options) to the Offeror, with a recommendation by an independent committee of the Target’s board of directors, which statement shall not have been revoked; additionally, the Alliance Agreement specifies the limited circumstances under which the Offeror, in accordance with applicable Japanese law, will be permitted to withdraw the Tender Offer. The Alliance Agreement also sets forth the covenants of the Target to (i) support and cooperate with the Tender Offer and, upon commencement of the Tender Offer, to make an appropriate public notice and file the Target’s position statement with respect to the Tender Offer with the Kanto Local Finance Bureau, (ii) operate in the ordinary course of business during the period beginning on the date of the Alliance Agreement and ending on the date that the Squeeze-out is completed (such period, the “Restricted Period”), (iii) refrain from taking specified actions during the Restricted Period, and (iv) take specified actions to assist the Registrant in securing debt financing needed to consummate the Tender Offer. In addition to the foregoing, the Alliance Agreement contains customary representations, warranties and covenants made by the Offeror and the Target. The Alliance Agreement will terminate automatically if the Tender Offer is withdrawn or not successful due to a failure to obtain a minimum threshold of tendered shares of Target common stock, and the Offeror, on the one hand, or the Target, on the other hand, are permitted in limited circumstances to terminate the Alliance Agreement upon a breach of the agreement by the other party. The Offeror will finance the consummation of the Tender Offer with debt financing obtained by the Registrant and contributed to the Offeror and cash on hand. The Alliance Agreement has been unanimously approved by the board of directors of each of the Registrant and the Target.

Item 7.01. Regulation FD Disclosure.

On August 26, 2015, the Registrant issued a press release announcing the Purchase Agreement, the Tender Offer, and the Alliance Agreement. A copy of this press release is furnished as Exhibit 99.1 to this Current Report.

On August 26, 2015, the Registrant intends to hold a conference call to discuss the Purchase Agreement, the Tender Offer, and the Alliance Agreement. A copy of the presentation materials for this conference call is furnished as Exhibit 99.2 to this Current Report.

The foregoing information in this Item 7.01, including Exhibits 99.1 and 99.2 hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section, nor shall it be deemed incorporated by reference in any of the Registrant's filings under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof, regardless of any incorporation language in such a filing, except as expressly set forth by specific reference in such a filing.

Item 8.01. Other Events.

On August 26, 2015, in connection with the execution of the Purchase Agreement and the Alliance Agreement and in anticipation of the Tender Offer, the Registrant entered into a Commitment Letter (the “Commitment Letter”) by and between the Registrant and Jefferies Finance LLC (“Jefferies”), pursuant to which Jefferies has committed to provide, subject to the terms and conditions set forth in the Commitment Letter, a 6-year senior secured term loan facility in the aggregate principal amount of $250,000,000 (the “Facility” and the provision of such Facility as set forth in the Commitment Letter, the “Financing”). The Facility will be available to finance the purchase and sale of the Seller Shares, the Tender Offer, and the Squeeze-out (and to repay approximately $21 million of indebtedness of the Registrant owes to certain of its stockholders) and to pay fees and expenses related thereto to the extent that the Registrant and the Offeror do not finance such amounts through available cash on hand. The Registrant’s obligation to repay loans extended under the Facility would be secured by a first priority lien on substantially all of the assets of the Registrant and its domestic subsidiaries, subject to customary exceptions. Under the Commitment Letter, Jefferies’ obligation to provide the Financing is subject to the closing of the purchase of the Seller Shares under the Purchase Agreement, the closing of the Tender Offer, the acquisition by the Registrant and its subsidiaries of at least two thirds of the issued and outstanding capital stock of the Target, the absence, since December 31, 2014, of a “material adverse effect” (as such term is defined in the Commitment Letter) with respect to the Registrant, the Target and their subsidiaries taken as a whole, the truth and correctness of certain specified representations and other customary closing conditions. The Registrant’s board of directors has unanimously approved the Commitment Letter.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| Exhibit | ||

| Number | Exhibit Description | |

| 99.1 | Press Release, dated August 26, 2015, “Sucampo Launches Tender Offer to Acquire R-Tech Ueno” | |

| 99.2 | Presentation dated August 26, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| SUCAMPO PHARMACEUTICALS, INC. | |||

| By: | /s/ Matthias Alder | ||

|

Date: August 26, 2015 |

Name: Matthias Alder Title: Executive Vice President, Business Development and Licensing, General Counsel and Corporate Secretary | ||

EXHIBIT INDEX

| Exhibit | ||

| Number | Exhibit Description | |

| 99.1 | Press Release, dated August 26, 2015, “Sucampo Launches Tender Offer to Acquire R-Tech Ueno” | |

| 99.2 | Presentation dated August 26, 2015. |

EXHIBIT 99.1

Sucampo Launches Tender Offer to Acquire R-Tech Ueno

Acquisition Expected to be Immediately Accretive

Advances Sucampo Strategy to Strengthen Financial Performance and Diversify Pipeline

Acquisition Expected to Close in Q4 2015

Company to Host Conference Call Today at 8:00 a.m. EDT

BETHESDA, Md., Aug. 26, 2015 (GLOBE NEWSWIRE) -- Sucampo Pharmaceuticals, Inc. (NASDAQ: SCMP) today announced the launch of an all-cash tender offer in Japan by Sucampo's Japanese subsidiary and the execution of a separate share purchase agreement with certain shareholders of R-Tech Ueno (TSE:4573:JP) to acquire all outstanding shares of R-Tech Ueno for a total consideration of JPY33 billion, or approximately $278 million, inclusive of approximately $54 million in cash1 and 2.5 million Sucampo shares (5.5% of shares outstanding), held by R-Tech Ueno. The purchase price reflects a 16% premium over R-Tech Ueno's one-month volume weighted average price and a 16% premium over R-Tech Ueno's three-month volume weighted average price.

Assuming a successful completion of the acquisition, for full year 2016, excluding amortization and debt costs related to the proposed transaction, Sucampo expects to achieve net income of $55 million to $60 million, earnings per share of $1.20 to $1.30, and adjusted EBITDA of $95 million to $100 million. In addition, Sucampo expects to achieve pre-tax operational synergies of approximately $5 million on an annualized basis in 2016. Sucampo does not expect the acquisition to have a material impact on 2015 results given the expected timing of transaction close.

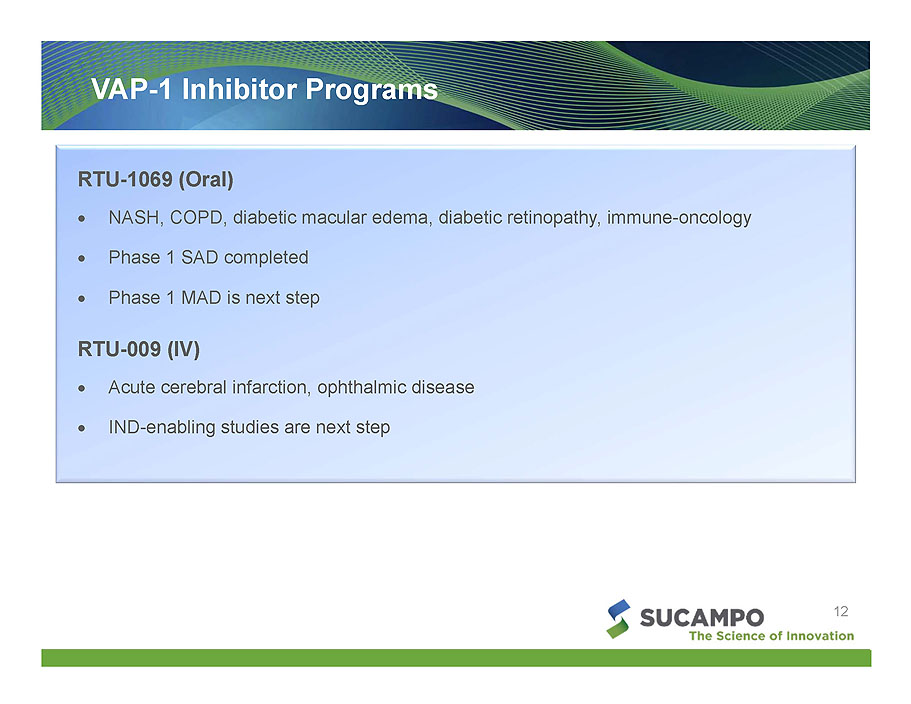

R-Tech Ueno is a Japanese pharmaceutical company that manufactures AMITIZA® (lubiprostone) for Sucampo and Sucampo's commercialization partners, Takeda Pharmaceuticals, Mylan N.V. and Harbin Gloria Pharmaceuticals. R-Tech Ueno also receives revenue from sales of RESCULA® (unoprostone isopropyl) in Japan. In addition, the company has a diverse pipeline of drug candidates in various stages of development in gastroenterology, ophthalmology, autoimmune and inflammatory diseases, and oncology.

"This immediately accretive transaction accelerates Sucampo's growth and delivers on our strategic objectives of strengthening our financial performance and diversifying and expanding our product development pipeline," said Peter Greenleaf, Chief Executive Officer of Sucampo. "By securing a larger portion of the global economics of AMITIZA and control over the manufacturing and supply chain for the product, we will not only increase our revenues but also create the opportunity for greater efficiencies. In addition, this deal strengthens our early pipeline with product candidates across multiple different diseases of high unmet medical need, including nonalcoholic steatohepatitis (NASH) and chronic obstructive pulmonary disease (COPD). I believe that this transaction will continue to drive both the transformation of our company and increased value for our shareholders."

Strategic Benefits of the Transaction

- Improved financial position and immediate accretion, with increased revenues, enhanced profitability, and stronger cash flow generation.

- Manufacturing and supply chain control, with resulting efficiencies in cost of goods.

- Expansion and diversification of Sucampo's pipeline for development or outlicensing, through acquisition of several assets in major therapeutic areas (gastroenterology, ophthalmology, autoimmune and inflammation, and oncology).

Terms of the Transaction

In the tender offer, which has been unanimously approved by the Board of Directors of both companies, Sucampo's Japanese subsidiary Sucampo Pharma, LLC will offer JPY1,900 per share in cash for the shares of R-Tech Ueno. The tender offer will be conducted in Japan under a tender offer registration statement filed with the Kanto Local Finance Bureau in accordance with applicable Japanese law. Sucampo is expecting to acquire 56% of the outstanding shares of R-Tech Ueno in the tender offer. Separately, Sucampo has entered into agreement with R-Tech Ueno's founders and a related entity to acquire the remaining 44% of R-Tech Ueno shares for JPY1,400 per share; the closing of this share purchase is conditioned on the closing of the tender offer. The tender offer period is expected to end on October 13, 2015, assuming the tender offer achieves the minimum acceptance threshold, regulatory approvals and other customary conditions, subject to our right to extend the offer. Following completion of the tender offer and the closing of the share purchase agreement with the founders, Sucampo will acquire all remaining outstanding shares of R-Tech Ueno not acquired through the tender offer through a squeeze-out process. The squeeze out process may take up to 13 weeks to complete. The aggregate acquisition price of R-Tech Ueno will be approximately $278 million. Sucampo expects to close the acquisition in the fourth quarter of 2015.

Financing

Sucampo intends to finance the acquisition of R-Tech Ueno through a term loan of $250 million committed by Jefferies Finance LLC as well as cash on hand. Jefferies Finance LLC is acting as sole lead bookrunner and sole lead arranger of the financing.

Moelis & Company LLC served as Sucampo's exclusive financial advisor; Cooley LLP served as U.S. legal advisor; Mori, Hamada & Matsumoto served as Japanese legal advisor; and PricewaterhouseCoopers served as tax and diligence advisor to Sucampo. Nomura Securities International, Inc., is acting as tender offer agent.

Company to Host Conference Call Today

Sucampo will host a conference call and webcast today at 8:00 am EDT. To participate on the live call, please dial 866-318-8617 (domestic) or 617-399-5136 (international) and use passcode 81159147, five to ten minutes ahead of the start of the call. A replay of the call will be available within a few hours after the call ends. Investors may listen to the replay by dialing 888-286-8010 (domestic) or 617-801-6888 (international), passcode 60462485. Investors interested in accessing the live audio webcast of the teleconference may do so at http://www.sucampo.com/investors and should log on before the teleconference begins in order to download any software required. The archive of the teleconference will remain available for 30 days.

About lubiprostone (AMITIZA®)

AMITIZA (lubiprostone) is a prostone, and is a locally acting chloride channel activator, indicated in the U.S. for the treatment of CIC in adults and OIC in adults with chronic, non-cancer pain (24 mcg twice daily). The effectiveness in patients with OIC taking diphenylheptane opioids (e.g., methadone) has not been established. AMITIZA is also indicated in the U.S. for irritable bowel syndrome with constipation (8 mcg twice daily) in women 18 years of age and older in the U.S. In Japan, AMITIZA (24 mcg twice daily) is indicated for the treatment of chronic constipation (excluding constipation caused by organic diseases). In the U.K., AMITIZA (24 mcg twice daily) is indicated for the treatment of CIC and associated symptoms in adults, when response to diet and other non-pharmacological measures (e.g., educational measures, physical activity) are inappropriate. In Switzerland, AMITIZA (24 mcg twice daily) is indicated for the treatment of CIC in adults and for the treatment of OIC and associated signs and symptoms such as stool consistency, straining, constipation severity, abdominal discomfort, and abdominal bloating in adults with chronic, non-cancer pain. The efficacy of AMITIZA for the treatment of OIC in patients taking opioids of the diphenylheptane class, such as methadone, has not been established.

About Sucampo Pharmaceuticals, Inc.

Sucampo Pharmaceuticals, Inc. is focused on the development and commercialization of medicines that meet major unmet medical needs of patients worldwide. Sucampo has one marketed product – AMITIZA – and a pipeline of product candidates in clinical development. A global company, Sucampo is headquartered in Bethesda, Maryland, and has operations in Japan, Switzerland and the U.K. For more information, please visit www.Sucampo.com.

The Sucampo logo and the tagline, The Science of Innovation, are registered trademarks of Sucampo AG. AMITIZA is a registered trademark of Sucampo AG.

Follow us on Twitter (@Sucampo_Pharma). Follow us on LinkedIn (Sucampo Pharmaceuticals).

Twitter LinkedIn

About R-Tech Ueno

R-Tech Ueno is a publicly traded company listed on the Tokyo Stock Exchange. It is a bio venture company established in September 1989 for the purpose of R&D and marketing of drugs, targeting diseases that previously had no effective therapeutic agent. R-Tech Ueno is focused on promoting the development of new drugs focusing on three areas: drugs for unmet medical needs and eligible for government support, drugs for orphan diseases, and drugs that focus on diseases of the aging population.

Sucampo Forward-Looking Statement

This press release contains "forward-looking statements" as that term is defined in the Private Securities Litigation Reform Act of 1995, including the statements relating to the expected benefits of the acquisition of R-Tech Ueno and statements relating to the expected closing and timing of the closing the acquisition and other statements that are not historical facts. These statements are based on management's current expectations and involve risks and uncertainties, which may cause results to differ materially from those set forth in the statements. The following factors, among others, could cause actual results to differ from those set forth in the forward-looking statements: the risk that the tender offer fails to meet the minimum condition and other conditions to closing, risks arising from the potential delay in closing, risks relating to Sucampo's financing for the acquisition and risks relating to the ability of Sucampo to achieve expected revenue, operating and cost synergies and risks relating to R-Tech Ueno's operations, including development programs that were not disclosed through due diligence, the impact of pharmaceutical industry regulation and health care legislation; the ability of Sucampo to continue to develop the market for AMITIZA; the ability of Sucampo to develop, commercialize or license existing pipeline products or compounds or license or acquire non-prostone products or drug candidates; Sucampo's ability to accurately predict future market conditions; dependence on the effectiveness of Sucampo's patents and other protections for innovative products; he risk of new and changing regulation and health policies in the U.S. and internationally; the effects of competitive products on Sucampo's products; and the exposure to litigation and/or regulatory actions.

No forward-looking statement can be guaranteed and actual results may differ materially from those projected. Sucampo undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future events, or otherwise. Forward-looking statements in this presentation should be evaluated together with the many uncertainties that affect Sucampo's business, particularly those mentioned in the risk factors and cautionary statements in Sucampo's most recent Form 10-K as filed with the Securities and Exchange Commission on March 9, 2015 as well as its filings with the Securities and Exchange Commission on Forms 8-K and 10-Q since the filing of the Form 10-K, all of which Sucampo incorporates by reference.

Note Regarding Use of Non-GAAP Financial Measures

This press release contains non-GAAP earnings, which is adjusted EBITDA consisting of GAAP net income (loss) before interest, tax, depreciation, amortization and stock option expense. Sucampo believes that this non-GAAP measure of financial results provides useful information to management and investors relating to its results of operations. Sucampo's management uses this non-GAAP measure to compare Sucampo's performance to that of prior periods for trend analyses, and for budgeting and planning purposes. Sucampo believes that the use of non-GAAP financial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends and in comparing the Sucampo's financial measures with other companies in its industry, many of which present similar non-GAAP financial measures to investors, and that it allows for greater transparency with respect to key metrics used by management in its financial and operational decision-making.

Management of the company does not consider non-GAAP measures in isolation or as an alternative to financial measures determined in accordance with GAAP. The principal limitation of non-GAAP financial measures is that they exclude significant expenses that are required by GAAP to be recorded in the Sucampo's financial statements. In order to compensate for these limitations, management presents non-GAAP financial measures together with GAAP results. Non-GAAP measures should be considered in addition to results and guidance prepared in accordance with GAAP, but should not be considered a substitute for, or superior to, GAAP results. Reconciliation tables of the most comparable GAAP financial measure to the non-GAAP financial measure used in this press release are included with the financial tables at the end of this release. Sucampo urges investors to review the reconciliation and not to rely on any single financial measure to evaluate the Sucampo's business. In addition, other companies, including companies in our industry, may calculate similarly named non-GAAP measures differently than we do, which limits their usefulness in comparing our financial results with theirs.

Important Information for Investors and Shareholders

The offer described in this press release has not yet commenced and is being conducted in Japan, and this press release is neither an offer to purchase nor a solicitation of an offer to purchase or sell any shares of the common stock of R-Tech Ueno or any other securities.

1 As of June 30, 2015

CONTACT: Sucampo Pharmaceuticals, Inc.

Silvia Taylor

Senior Vice President, Investor Relations and

Corporate Communications

+1-240-223-3718

[email protected]

In Japan:

COSMO Public Relations Corporation

Ambrose Lau

International Account Manager

+81 (0) 3-5561-2915

[email protected]

EXHIBIT 99.2

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Share Buyback Transaction Details April 18 – April 24, 2024

- Significant Improvement in Vanadium Grade in Phase 1 Sizing Metallurgical Testwork

- AGILITI ALERT: Bragar Eagel & Squire, P.C. Investigates Merger of AGTI and Encourages Investors to Contact the Firm

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share