Form 8-K SCANSOURCE INC For: Aug 20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 20, 2015

ScanSource, Inc.

(Exact name of registrant as specified in its charter)

Commission File Number: 000-26926

SC | 00-26926 | 57-0965380 | ||

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) | ||

6 Logue Court, Greenville, SC 29615

(Address of principal executive offices, including zip code)

864-288-2432

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02. Results of Operations and Financial Condition

On August 20, 2015 ScanSource, Inc. issued a press release announcing its financial results for its fourth quarter and full fiscal year ended June 30, 2015. A copy of the press release and accompanying presentation slides are attached as Exhibit 99.1 and 99.2 hereto and incorporated herein by reference and also made available through the Company’s website at www.scansource.com.

The information in this Item 2.02 Current Report on Form 8-K, including the exhibits, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

99.1 – Press release issued by ScanSource, Inc. on August 20, 2015. The information contained in the attached exhibit is unaudited and should be read in conjunction with the Registrant’s annual and quarterly reports filed with the Securities and Exchange Commission.

99.2 – Presentation slides for the financial results conference call issued on August 20, 2015. The information contained in the attached exhibit is unaudited and should be read in conjunction with the Registrant’s annual and quarterly reports filed with the Securities and Exchange Commission.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

ScanSource, Inc. | ||||||

Date: August 20, 2015 | By: | /s/ Charles A. Mathis | ||||

Name: | Charles A. Mathis | |||||

Its: | Executive Vice President and Chief Financial Officer | |||||

Exhibit 99.1

FOR IMMEDIATE RELEASE

Contact: | ||

Charles A. Mathis | Mary M. Gentry | |

Executive Vice President and Chief Financial Officer | - or - | Vice President, Treasurer and Investor Relations |

ScanSource, Inc. | ScanSource, Inc. | |

(864) 286-4975 | (864) 286-4892 | |

SCANSOURCE REPORTS RECORD NET SALES FOR THE

FOURTH QUARTER AND FULL-YEAR

Fourth Quarter Profitability Reflects Strong Execution

GREENVILLE, SC -- August 20, 2015 -- ScanSource, Inc. (NASDAQ: SCSC), the leading international value-added distributor of specialty technology products, today announced financial results for fiscal year 2015 fourth quarter and year ended June 30, 2015.

Quarter ended June 30, | Year ended June 30, | ||||||||||||||||||||

2015 | 2014 | Change | 2015 | 2014 | Change | ||||||||||||||||

(in millions, except per share data) | (in millions, except per share data) | ||||||||||||||||||||

Net sales | $ | 856.7 | $ | 758.1 | 13 | % | $ | 3,219 | $ | 2,914 | 10 | % | |||||||||

Operating income | 25.0 | 40.4 | (38 | )% | 101.4 | 121.8 | (17 | )% | |||||||||||||

Non-GAAP operating income(1) | 28.6 | 26.2 | 9 | % | 114.0 | 112.5 | 1 | % | |||||||||||||

GAAP net income | 16.4 | 27.1 | (39 | )% | 65.4 | 81.8 | (20 | )% | |||||||||||||

Non-GAAP net income(1) | 19.0 | 18.2 | 5 | % | 75.1 | 76.1 | (1 | )% | |||||||||||||

GAAP diluted EPS | $ | 0.57 | $ | 0.94 | (39 | )% | $ | 2.27 | $ | 2.86 | (21 | )% | |||||||||

Non-GAAP diluted EPS(1) | $ | 0.66 | $ | 0.63 | 5 | % | $ | 2.61 | $ | 2.66 | (2 | )% | |||||||||

(1) A reconciliation of non-GAAP financial information to GAAP financial information is presented in the following Supplementary Information (Unaudited) table.

Net sales for the quarter ended June 30, 2015 totaled $856.7 million, a 13% increase over net sales of $758.1 million for the quarter ended June 30, 2014. Excluding the translation impact of foreign currencies, net sales increased 18% year-over-year. The increase in net sales includes results from the acquisitions of Imago and Network1, each completed during the current fiscal year.

"Fiscal year 2015 was a year where we accomplished the successful go-live for our SAP ERP global system in Europe, completed strategic acquisitions of two value-added international communications distributors, and returned cash to shareholders through share repurchases," said Mike Baur, CEO, ScanSource, Inc. "We ended the year with record net sales and strong profitability, including 5% non-GAAP earnings per share growth in the fourth quarter."

Operating income for the quarter ended June 30, 2015 totaled $25.0 million, compared with $40.4 million in the prior year quarter, which includes a $15.5 million legal recovery, net of attorney fees. Non-GAAP operating income for the quarter ended June 30, 2015 of $28.6 million increased 9% over the prior year.

On a GAAP basis, net income for the quarter ended June 30, 2015 totaled $16.4 million, or $0.57 per diluted share, compared with net income of $27.1 million, or $0.94 per diluted share, for the prior year quarter. Non-GAAP net income for the quarter ended June 30, 2015 increased 5% to $19.0 million, or $0.66 per diluted share, from $18.2 million, or $0.63 per diluted share.

Exhibit 99.1

Full-Year Results

For the year ended June 30, 2015, net sales increased 10% to $3.2 billion from $2.9 billion. Non-GAAP operating income increased to $114.0 million for the year ended June 30, 2015 from $112.5 million for the prior year. Non-GAAP net income for the year ended June 30, 2015 totaled $75.1 million, or $2.61 per diluted share, compared with non-GAAP net income of $76.1 million, or $2.66 per diluted share, for the prior year.

On a GAAP basis, operating income totaled $101.4 million, compared with $121.8 million in the prior year. GAAP net income for the year ended June 30, 2015 totaled $65.4 million, or $2.27 per diluted share, compared with net income of $81.8 million, or $2.86 per diluted share, for the prior year.

Share Repurchase Update

Under the Company’s $120 million share repurchase authorization through August 19, 2015, the Company has repurchased approximately $39 million of shares, having executed over 30% of the total authorization.

Forecast for Next Quarter

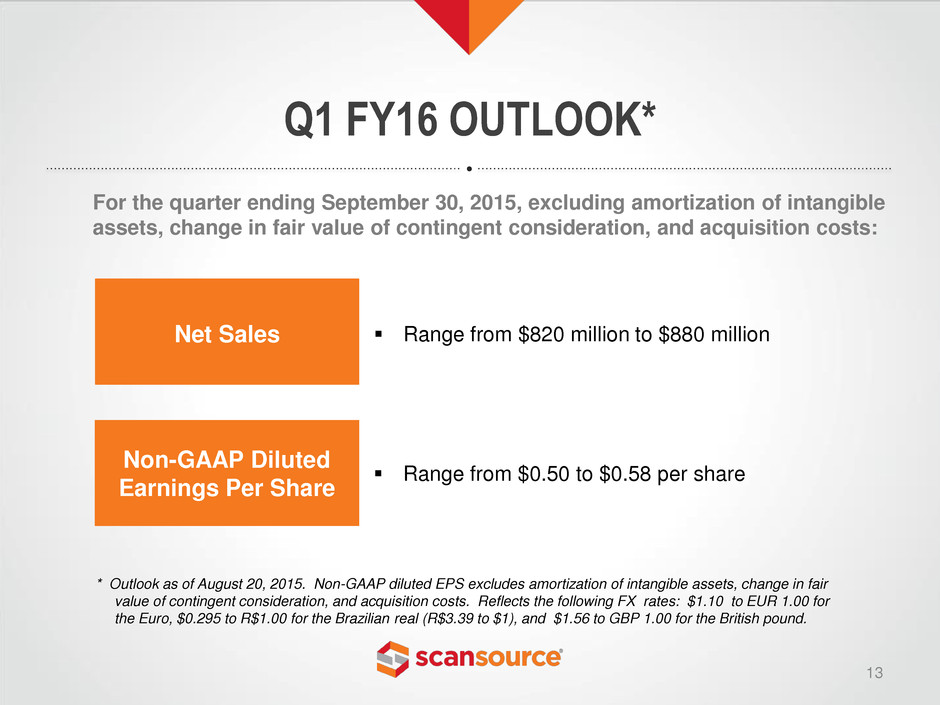

The Company announced its current expectations for the first quarter of fiscal year 2016. ScanSource expects net sales for the quarter ending September 30, 2015 to range from $820 million to $880 million and non-GAAP diluted earnings per share to range from $0.50 to $0.58 per share. Non-GAAP diluted earnings per share exclude amortization of intangibles, change in fair value of contingent consideration and acquisition costs.

Webcast Details

ScanSource will present additional information about its financial results and outlook in a conference call with presentation slides today, August 20, 2015 at 5:00 p.m. (ET). A webcast of the call and accompanying presentation slides will be available for all interested parties and can be accessed at www.scansource.com (Investor Relations section). The webcast will be available for replay for 60 days.

Safe Harbor Statement

This press release contains comments that are “forward-looking” statements that involve risks and uncertainties; these statements are subject to the safe harbor created by the Private Securities Litigation Reform Act of 1995. Any number of important factors could cause actual results to differ materially from anticipated or forecasted results, including, but not limited to, expanded international operations that expose the Company to greater risks than its operations in domestic markets; risks in connection with our growth which includes strategic acquisitions; utilization and further implementation of the Company's new ERP system; the ability to forecast volatility in earnings resulting from the quarterly revaluation of the Company's earnout obligations; risks associated with consolidation of the Company's vendors; risks in connection with compliance with laws and regulations governing the Company's international business; macroeconomic circumstances that could impact the business, such as currency fluctuations, credit market conditions, and an economic downturn; the timing and amount of any share repurchases; the exercise of discretion by the Company to make any repurchase or continue the share repurchase authorization; and changes to the source of funds for any repurchases. For more information concerning factors that could cause actual results to differ from anticipated results, see the Company's annual report on Form 10-K for the year ended June 30, 2014 and the Company's quarterly report on Form 10-Q for the quarter ended March 31, 2015, filed with the Securities and Exchange Commission. Except as may be required by law, the Company expressly disclaims any obligation to update these forward-looking statements to reflect events or circumstances after the date of this press release or to reflect the occurrence of unanticipated events.

Non-GAAP Financial Information

In addition to disclosing results that are determined in accordance with United States Generally Accepted Accounting Principles ("GAAP"), the Company also discloses certain non-GAAP financial measures, which are summarized below. Non-GAAP financial measures are used to better understand and evaluate performance, including comparisons from period to period. The Company completed acquisitions on September 19, 2014 and January 13, 2015, which were both structured with earnout payments. Given the size of the acquisitions and potential variability of fair value adjustments on operating results, non-GAAP results exclude amortization of intangible assets related to acquisitions and change in fair value of contingent consideration.

Exhibit 99.1

Net sales excluding the translation impact of foreign currencies: The Company discusses the percentage change in net sales excluding the translation impact from changes in foreign currency exchange rates between reporting periods. This measure enhances comparability between periods to help analyze underlying trends.

Non-GAAP operating income, non-GAAP net income and non-GAAP EPS: To evaluate current period performance on a clearer and more consistent basis with prior periods, the Company discloses non-GAAP operating income, non-GAAP net income and non-GAAP diluted earnings per share. Non-GAAP results exclude amortization of intangible assets related to acquisitions, change in the fair value of contingent consideration, and other non-GAAP adjustments. Non-GAAP operating income, non-GAAP net income, and non-GAAP EPS measures are useful in better assessing and understanding the Company's operating performance, especially when comparing results with previous periods or forecasting performance for future periods.

Return on invested capital ("ROIC"): Management uses ROIC as a performance measurement to assess efficiency in allocating capital under the Company's control to generate returns. Management believes this metric balances the Company's operating results with asset and liability management, is not impacted by capitalization decisions and is considered to have a strong correlation with shareholder value creation. In addition, it is easily computed, communicated and understood. ROIC also provides management a measure of the Company's profitability on a basis more comparable to historical or future periods.

ROIC assists management in comparing the Company's performance over various reporting periods on a consistent basis because it removes from operating results the impact of items that do not reflect core operating performance. Adjusted earnings before interest expense, income taxes, depreciation and amortization ("EBITDA") excludes the change in fair value of contingent consideration, in addition to other non-GAAP adjustments. Management believes the calculation of ROIC provides useful information to investors and is an additional relevant comparison of the Company's performance during the year. In addition, the Company's Board of Directors uses ROIC in evaluating business and management performance. Certain management incentive compensation targets are set and measured relative to ROIC.

These non-GAAP financial measures have limitations as analytical tools, and the non-GAAP financial measures that the Company reports may not be comparable to similarly titled amounts reported by other companies. Analysis of results and outlook on a non-GAAP basis should be considered in addition to, and not in substitution for or as superior to, measurements of financial performance prepared in accordance with GAAP. A reconciliation of the Company's non-GAAP financial information to GAAP is set forth in the following Supplementary Information (Unaudited) tables.

About ScanSource, Inc.

ScanSource, Inc. (NASDAQ: SCSC) is the leading international distributor of specialty technology products, focusing on point-of-sale (POS) and barcode, communications and physical security solutions. ScanSource's teams provide value-added services and operate from two technology segments, Worldwide Barcode & Security and Worldwide Communications & Services. ScanSource is committed to helping its reseller customers choose, configure and deliver the industry's best products across almost every vertical market in North America, Latin America and Europe. Founded in 1992, the Company is headquartered in Greenville, South Carolina and was named one of the 2015 Best Places to Work in South Carolina. ScanSource ranks #775 on the Fortune 1000. For more information, visit www.scansource.com.

ScanSource Reports Fourth Quarter and Full-Year Results

ScanSource, Inc. and Subsidiaries | ||||||||

Condensed Consolidated Balance Sheets (Unaudited) | ||||||||

(in thousands) | ||||||||

June 30, 2015 | June 30, 2014* | |||||||

Assets | ||||||||

Current assets: | ||||||||

Cash and cash equivalents | $ | 121,646 | $ | 194,851 | ||||

Accounts receivable, less allowance of $32,589 at June 30, 2015 | 522,532 | 464,405 | ||||||

and $26,257 at June 30, 2014 | ||||||||

Inventories | 553,063 | 504,758 | ||||||

Prepaid expenses and other current assets | 46,917 | 33,558 | ||||||

Deferred income taxes | 20,556 | 18,109 | ||||||

Total current assets | 1,264,714 | 1,215,681 | ||||||

Property and equipment, net | 46,574 | 31,823 | ||||||

Goodwill | 66,509 | 32,342 | ||||||

Net identifiable intangible assets | 46,272 | 15,995 | ||||||

Other non-current assets | 52,872 | 39,283 | ||||||

Total assets | $ | 1,476,941 | $ | 1,335,124 | ||||

Liabilities and Shareholders' Equity | ||||||||

Current liabilities: | ||||||||

Current debt | $ | 2,860 | $ | — | ||||

Accounts payable | 501,329 | 421,721 | ||||||

Accrued expenses and other current liabilities | 81,000 | 63,574 | ||||||

Current portion of contingent consideration | 9,391 | 5,851 | ||||||

Income taxes payable | 4,180 | 8,685 | ||||||

Total current liabilities | 598,760 | 499,831 | ||||||

Deferred income taxes | 3,773 | 185 | ||||||

Long-term debt | 5,966 | 5,429 | ||||||

Long-term portion of contingent consideration | 24,569 | 5,256 | ||||||

Other long-term liabilities | 34,888 | 21,780 | ||||||

Total liabilities | 667,956 | 532,481 | ||||||

Shareholders' equity: | ||||||||

Common stock | 157,172 | 168,447 | ||||||

Retained earnings | 716,315 | 650,896 | ||||||

Accumulated other comprehensive income (loss) | (64,502 | ) | (16,700 | ) | ||||

Total shareholders' equity | 808,985 | 802,643 | ||||||

Total liabilities and shareholders' equity | $ | 1,476,941 | $ | 1,335,124 | ||||

* | Derived from audited financial statements. |

ScanSource Reports Fourth Quarter and Full-Year Results

ScanSource, Inc. and Subsidiaries | ||||||||||||||||

Condensed Consolidated Income Statements (Unaudited) | ||||||||||||||||

(in thousands, except per share data) | ||||||||||||||||

Quarter ended June 30, | Year ended June 30, | |||||||||||||||

2015 | 2014* | 2015 | 2014* | |||||||||||||

Net sales | $ | 856,685 | $ | 758,113 | $ | 3,218,626 | $ | 2,913,634 | ||||||||

Cost of goods sold | 765,367 | 684,120 | 2,891,536 | 2,612,535 | ||||||||||||

Gross profit | 91,318 | 73,993 | 327,090 | 301,099 | ||||||||||||

Selling, general and administrative expenses | 64,935 | 48,951 | 222,982 | 192,492 | ||||||||||||

Legal recovery, net of attorney fees | — | (15,490 | ) | — | (15,490 | ) | ||||||||||

Change in fair value of contingent consideration | 1,406 | 93 | 2,667 | 2,311 | ||||||||||||

Operating income | 24,977 | 40,439 | 101,441 | 121,786 | ||||||||||||

Interest expense | 509 | 33 | 1,797 | 731 | ||||||||||||

Interest income | (580 | ) | (721 | ) | (2,638 | ) | (2,364 | ) | ||||||||

Other, net | 137 | 247 | 2,376 | 312 | ||||||||||||

Income before income taxes | 24,911 | 40,880 | 99,906 | 123,107 | ||||||||||||

Provision for income taxes | 8,464 | 13,775 | 34,487 | 41,318 | ||||||||||||

Net income | $ | 16,447 | $ | 27,105 | $ | 65,419 | $ | 81,789 | ||||||||

Per share data: | ||||||||||||||||

Net income per common share, basic | $ | 0.58 | $ | 0.95 | $ | 2.29 | $ | 2.89 | ||||||||

Weighted-average shares outstanding, basic | 28,461 | 28,525 | 28,558 | 28,337 | ||||||||||||

Net income per common share, diluted | $ | 0.57 | $ | 0.94 | $ | 2.27 | $ | 2.86 | ||||||||

Weighted-average shares outstanding, diluted | 28,722 | 28,763 | 28,799 | 28,602 | ||||||||||||

* | Derived from audited financial statements. |

ScanSource Reports Fourth Quarter and Full-Year Results

ScanSource, Inc. and Subsidiaries | |||||||||||||

Supplementary Information (Unaudited) | |||||||||||||

(in thousands) | |||||||||||||

Net Sales by Segment: | |||||||||||||

Quarter ended June 30, | Non-GAAP % Change | ||||||||||||

2015 | 2014 | % Change | Excluding FX(a) | ||||||||||

Worldwide Barcode & Security | $ | 489,559 | $ | 490,505 | (0.2 | )% | 7.0 | % | |||||

Worldwide Communications & Services | 367,126 | 267,608 | 37.2 | % | 38.3 | % | |||||||

Consolidated | $ | 856,685 | $ | 758,113 | 13.0 | % | 18.1 | % | |||||

Year ended June 30, | Non-GAAP % Change | ||||||||||||

2015 | 2014 | % Change | Excluding FX(a) | ||||||||||

Worldwide Barcode & Security | $ | 1,912,352 | $ | 1,873,177 | 2.1 | % | 6.1 | % | |||||

Worldwide Communications & Services | 1,306,274 | 1,040,457 | 25.5 | % | 26.3 | % | |||||||

Consolidated | $ | 3,218,626 | $ | 2,913,634 | 10.5 | % | 13.3 | % | |||||

Net Sales by Geography: | |||||||||||||

Quarter ended June 30, | Non-GAAP % Change | ||||||||||||

2015 | 2014 | % Change | Excluding FX(b) | ||||||||||

North American (U.S. and Canada) | $ | 629,165 | $ | 577,687 | 8.9 | % | 8.9 | % | |||||

International | 227,520 | 180,426 | 26.1 | % | 47.4 | % | |||||||

Consolidated | $ | 856,685 | $ | 758,113 | 13.0 | % | 18.1 | % | |||||

Year ended June 30, | Non-GAAP % Change | ||||||||||||

2015 | 2014 | % Change | Excluding FX(b) | ||||||||||

North American (U.S. and Canada) | $ | 2,346,764 | $ | 2,179,890 | 7.7 | % | 7.7 | % | |||||

International | 871,862 | 733,744 | 18.8 | % | 30.0 | % | |||||||

Consolidated | $ | 3,218,626 | $ | 2,913,634 | 10.5 | % | 13.3 | % | |||||

Notes: | |||||||||||||

(a) Year-over-year net sales growth rate excluding the translation impact of changes in foreign currency exchange rates. Calculated by translating the net sales for the quarter and year ended June 30, 2015 into U.S. dollars using the weighted average foreign exchange rates for the quarter and year ended June 30, 2014, respectively. Worldwide Barcode & Security net sales excluding the translation impact of foreign currencies for the quarter and year ended June 30, 2015, as adjusted, totaled $525.0 million and $2.0 billion, respectively. Worldwide Communications & Services net sales excluding the translation impact of foreign currencies for the quarter and year ended June 30, 2015, as adjusted, totaled $370.0 million and $1.3 billion, respectively. | |||||||||||||

(b) Year-over-year net sales growth rate excluding the translation impact of changes in foreign currency exchange rates. Calculated by translating the net sales for the quarter and year ended June 30, 2015 into U.S. dollars using the weighted average foreign exchange rates for the quarter and year ended June 30, 2014, respectively. International net sales excluding the translation impact of foreign currencies for the quarter and year ended June 30, 2015 totaled $265.9 million and $954.0 million, respectively. | |||||||||||||

ScanSource Reports Fourth Quarter and Full-Year Results

ScanSource, Inc. and Subsidiaries | ||||||||||||||||

Supplementary Information (Unaudited) | ||||||||||||||||

(in thousands) | ||||||||||||||||

Non-GAAP Financial Information: | ||||||||||||||||

Quarter ended June 30, 2015 | ||||||||||||||||

Operating income | Pre-tax income | Net income | Diluted EPS | |||||||||||||

GAAP measure | $ | 24,977 | $ | 24,911 | $ | 16,447 | $ | 0.57 | ||||||||

Adjustments: | ||||||||||||||||

Amortization of intangible assets | 2,091 | 2,091 | 1,450 | 0.05 | ||||||||||||

Change in fair value of contingent consideration | 1,406 | 1,406 | 955 | 0.03 | ||||||||||||

Acquisition costs | 138 | 138 | 138 | 0.01 | ||||||||||||

Non-GAAP measure | $ | 28,612 | $ | 28,546 | $ | 18,990 | $ | 0.66 | ||||||||

Quarter ended June 30, 2014 | ||||||||||||||||

Operating income | Pre-tax income | Net income | Diluted EPS | |||||||||||||

GAAP measure | $ | 40,439 | $ | 40,880 | $ | 27,105 | $ | 0.94 | ||||||||

Adjustments: | ||||||||||||||||

Amortization of intangible assets | 1,117 | 1,117 | 740 | 0.03 | ||||||||||||

Change in fair value of contingent consideration | 93 | 93 | 61 | — | ||||||||||||

Legal recovery, net of attorney fees | (15,490 | ) | (15,490 | ) | (9,756 | ) | (0.34 | ) | ||||||||

Non-GAAP measure | $ | 26,159 | $ | 26,600 | $ | 18,150 | $ | 0.63 | ||||||||

Year ended June 30, 2015 | ||||||||||||||||

Operating income | Pre-tax income | Net income | Diluted EPS | |||||||||||||

GAAP measure | $ | 101,441 | $ | 99,906 | $ | 65,419 | $ | 2.27 | ||||||||

Adjustments: | ||||||||||||||||

Amortization of intangible assets | 6,641 | 6,641 | 4,599 | 0.16 | ||||||||||||

Change in fair value of contingent consideration | 2,667 | 2,667 | 1,842 | 0.06 | ||||||||||||

Acquisition costs | 3,254 | 3,254 | 3,254 | 0.12 | ||||||||||||

Non-GAAP measure | $ | 114,003 | $ | 112,468 | $ | 75,114 | $ | 2.61 | ||||||||

Year ended June 30, 2014 | ||||||||||||||||

Operating income | Pre-tax income | Net income | Diluted EPS | |||||||||||||

GAAP measure | $ | 121,786 | $ | 123,107 | $ | 81,789 | $ | 2.86 | ||||||||

Adjustments: | ||||||||||||||||

Amortization of intangible assets | 3,880 | 3,880 | 2,550 | 0.09 | ||||||||||||

Change in fair value of contingent consideration | 2,311 | 2,311 | 1,525 | 0.05 | ||||||||||||

Legal recovery, net of attorney fees | (15,490 | ) | (15,490 | ) | (9,756 | ) | (0.34 | ) | ||||||||

Non-GAAP measure | $ | 112,487 | $ | 113,808 | $ | 76,108 | $ | 2.66 | ||||||||

ScanSource Reports Fourth Quarter and Full-Year Results

ScanSource, Inc. and Subsidiaries | |||||||||||||||||

Supplementary Information (Unaudited) | |||||||||||||||||

(in thousands) | |||||||||||||||||

Non-GAAP Financial Information: | |||||||||||||||||

Quarter ended June 30, | Year ended June 30, | ||||||||||||||||

2015 | 2014 | 2015 | 2014 | ||||||||||||||

Return on invested capital (ROIC), annualized (a) | 15.2 | % | 14.0 | % | 14.6 | % | 15.7 | % | |||||||||

Reconciliation of Net Income to Adjusted EBITDA | |||||||||||||||||

Net income - GAAP | $ | 16,447 | $ | 27,105 | $ | 65,419 | $ | 81,789 | |||||||||

Plus: Income taxes | 8,464 | 13,775 | 34,487 | 41,318 | |||||||||||||

Plus: Interest expense | 509 | 33 | 1,797 | 731 | |||||||||||||

Plus: Depreciation and amortization | 3,947 | 1,985 | 11,997 | 7,375 | |||||||||||||

EBITDA | 29,367 | 42,898 | 113,700 | 131,213 | |||||||||||||

Adjustments: | |||||||||||||||||

Change in fair value of contingent consideration | 1,406 | 93 | 2,667 | 2,311 | |||||||||||||

Acquisition costs | 138 | — | 3,254 | — | |||||||||||||

Legal recovery, net of attorney fees | — | (15,490 | ) | — | (15,490 | ) | |||||||||||

Adjusted EBITDA (numerator for ROIC) (non-GAAP) | $ | 30,911 | $ | 27,501 | $ | 119,621 | $ | 118,034 | |||||||||

Invested Capital Calculation | |||||||||||||||||

Equity - beginning of quarter/year | $ | 799,051 | $ | 772,786 | $ | 802,643 | $ | 695,956 | |||||||||

Equity - end of quarter/year | 808,985 | 802,643 | 808,985 | 802,643 | |||||||||||||

Adjustments: | |||||||||||||||||

Change in fair value of contingent consideration, net of tax | 955 | 61 | 1,842 | 1,525 | |||||||||||||

Acquisition costs, net of tax (b) | 138 | — | 3,254 | — | |||||||||||||

Legal recovery, net of attorney fees, net of tax | — | (9,756 | ) | — | (9,756 | ) | |||||||||||

Average equity | 804,565 | 782,867 | 808,362 | 745,184 | |||||||||||||

Average funded debt (c) | 10,377 | 5,429 | 13,421 | 5,429 | |||||||||||||

Invested capital (denominator for ROIC) (non-GAAP) | $ | 814,942 | $ | 788,296 | $ | 821,783 | $ | 750,613 | |||||||||

Notes: | |||||||||||||||||

(a) Calculated as net income plus interest expense, income taxes, depreciation and amortization (EBITDA), plus change in fair value of contingent consideration and other adjustments, annualized and divided by invested capital for the period. Invested capital is defined as average equity plus average daily funded interest-bearing debt for the period. | |||||||||||||||||

(b) Acquisition costs are non-deductible for tax purposes. | |||||||||||||||||

(c) Average funded debt is calculated as the average daily amounts outstanding on short-term and long-term interest-bearing debt. | |||||||||||||||||

Q4 AND FY 2015 FINANCIAL RESULTS CONFERENCE CALL August 20, 2015 at 5:00 pm ET Exhibit 99.2

SAFE HARBOR This presentation may contain certain comments, which are “forward-looking” statements that involve plans, strategies, economic performance and trends, projections, expectations, costs or beliefs about future events and other statements that are not descriptions of historical facts, may be forward- looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking information is inherently subject to risks and uncertainties; these statements are subject to the safe harbor created by the Private Securities Litigation Reform Act of 1995. Any number of factors could cause actual results to differ materially from anticipated results. For more information concerning factors that could cause actual results to differ from anticipated results, see the “Risk Factors” included in the Company’s annual report on Form 10-K for the fiscal year ended June 30, 2014, as well as the quarterly report on Form 10-Q for the quarter ended March 31, 2015, filed with the Securities and Exchange Commission (“SEC”). Although ScanSource believes the expectations in its forward-looking statements are reasonable, it cannot guarantee future results, levels of activity, performance or achievement. ScanSource disclaims any intentions or obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, except as may be required by law. In addition to disclosing results that are determined in accordance with United States Generally Accepted Accounting Principles (“GAAP”), the Company also discloses certain non-GAAP measures, including non-GAAP operating income, non-GAAP operating margin, non-GAAP net income, non-GAAP diluted earnings per share, return on invested capital (“ROIC”) and the percentage change in net sales excluding the impact of foreign currency exchange rates. A reconciliation of the Company's non-GAAP financial information to GAAP financial information is provided in the Appendix and in the Company’s Form 8-K, filed with the SEC, with the quarterly earnings press release for the period indicated. 2

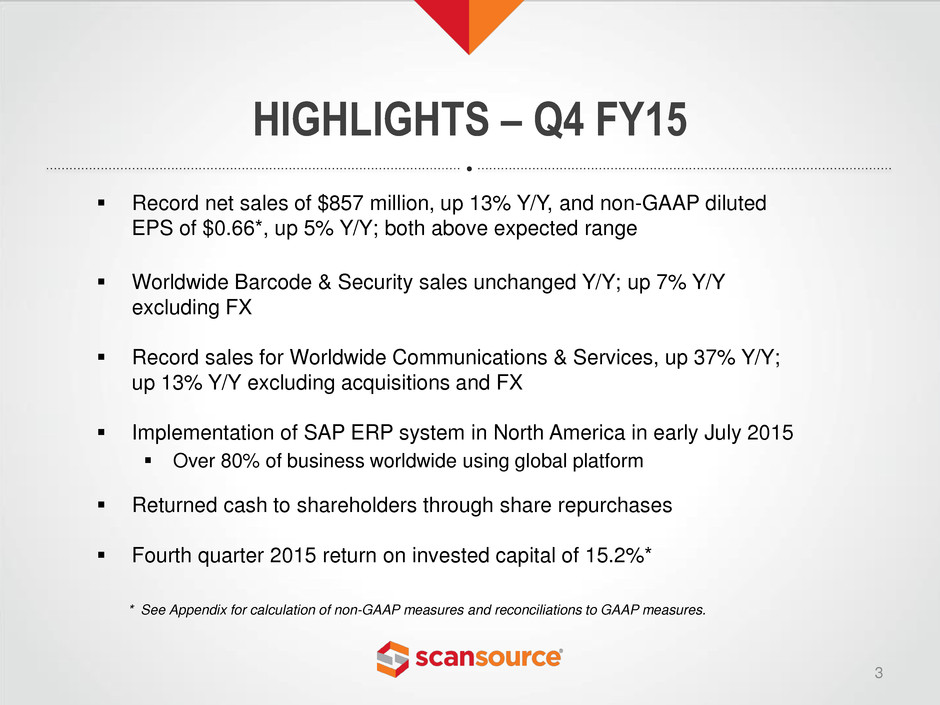

HIGHLIGHTS – Q4 FY15 3 Record net sales of $857 million, up 13% Y/Y, and non-GAAP diluted EPS of $0.66*, up 5% Y/Y; both above expected range Worldwide Barcode & Security sales unchanged Y/Y; up 7% Y/Y excluding FX Record sales for Worldwide Communications & Services, up 37% Y/Y; up 13% Y/Y excluding acquisitions and FX Implementation of SAP ERP system in North America in early July 2015 Over 80% of business worldwide using global platform Returned cash to shareholders through share repurchases Fourth quarter 2015 return on invested capital of 15.2%* * See Appendix for calculation of non-GAAP measures and reconciliations to GAAP measures.

ANNOUNCES AGREEMENT TO ACQUIRE KBZ 4 Description • Premier Cisco video conferencing distributor in the United States, formerly Tandberg’s largest distributor • Specialized focus on video, cloud and services • Sales for the TTM ended 6/30/15 ~ over $225 million • Established in 1987; HQ in Doylestown, PA Key Vendor/ Focus • Exclusive focus on Cisco (~90%) and complementary vendors • Cisco Americas Collaboration Distributor of the Year in 2014 • Cisco Americas Cloud Distributor of the Year in 2015 • Specialized public sector team for Federal, state and local Key Talent/ Employees • Currently ~ 75 employees • Operations in US with regional sales teams • Kyle Zorzi, KBZ’s Vice President, to serve as SVP of KBZ, a ScanSource Company Accretion/ Closing • Expected to be accretive to EPS and ROIC in the first year after closing, excluding one-time acquisition costs • Announced 8/18/15; expect to close in the quarter ending 9/30/15

Q4 FY15 Q4 FY14 GAAP Non- GAAP* GAAP Non- GAAP* Y/Y Change (non-GAAP): Net sales $856.7 $856.7 $758.1 $758.1 13% increase; 18% excl. FX Gross profit 91.3 91.3 74.0 74.0 23% increase Gross profit margin % (of net sales) 10.7% 10.7% 9.8% 9.8% 90 bp margin increase SG&A expenses 60.4 60.4 47.8 47.8 26% higher SG&A SAP-related ERP costs 2.3 2.3 -- -- Amortization of intangible assets 2.1 -- 1.1 -- Change, FV contingent consideration 1.4 -- 0.1 -- Acquisition costs/legal recovery 0.1 -- (15.5) -- Operating income 25.0 28.6 40.4 26.2 9% increase Operating income % (of net sales) 2.9% 3.3% 5.3% 3.5% 11 bp margin decrease Net income $16.4 $19.0 $27.1 $18.2 5% increase Diluted EPS $0.57 $0.66 $0.94 $0.63 5% increase HIGHLIGHTS – FOURTH QTR 5 * See Appendix for calculation of non-GAAP measures and reconciliations to GAAP measures. In millions, except EPS

FY15 FY14 GAAP Non-GAAP* GAAP Non-GAAP* Y/Y Change (non-GAAP): Net sales $3,218.6 $3,218.6 $2,913.6 $2,913.6 10% increase; 13% excl. FX Gross profit 327.1 327.1 301.1 301.1 9% increase Gross profit margin % (of net sales) 10.2% 10.2% 10.3% 10.3% 17 bp margin decrease SG&A expenses 208.2 208.2 188.6 188.6 10% higher SG&A SAP-related ERP costs 4.9 4.9 -- -- Amortization of intangible assets 6.6 -- 3.9 -- Change, FV contingent consideration 2.7 -- 2.3 -- Acquisition costs/legal recovery 3.3 -- (15.5) -- Operating income 101.4 114.0 121.8 112.5 1% increase Operating income % (of net sales) 3.2% 3.5% 4.2% 3.9% 32 bp margin decrease Net income $65.4 $75.1 $81.8 $76.1 1% decrease Diluted EPS $2.27 $2.61 $2.86 $2.66 2% decrease HIGHLIGHTS – FULL YEAR 6 * See Appendix for calculation of non-GAAP measures and reconciliations to GAAP measures. In millions, except EPS

SALES GROWTH SUMMARY 7 FOURTH QTR: Q4 FY15 – Y/Y % CHANGE As Reported Excluding FX Impact Excluding FX and Acquisitions WW Barcode & Security -0.2% 7.0% 7.0% WW Comms. & Services 37.2% 38.3% 13.2% Consolidated 13.0% 18.1% 9.2% FULL YEAR: FY15 – Y/Y % CHANGE As Reported Excluding FX Impact Excluding FX and Acquisitions WW Barcode & Security 2.1% 6.1% 6.1% WW Comms. & Services 25.5% 26.3% 8.8% Consolidated 10.5% 13.3% 7.1%

Q4 FY15 Q4 FY14 Net sales $489.6 $490.5 Gross profit $44.4 $41.7 Gross margin 9.1% 8.5% Operating income $12.2 $12.8 Operating income % 2.5% 2.6% Non-GAAP operating income $13.4 $13.5 Non-GAAP operating income % 2.7% 2.7% WW BARCODE & SECURITY 8 $491 $490 Q4 FY14 Q4 FY15 Net Sales, $ in millions Down 0.2% Excluding FX, Up 7.0% $ in millions Non-GAAP operating income excludes amortization of intangibles and change in fair value of contingent consideration. See Appendix for calculation of non-GAAP measures and reconciliations to GAAP measures.

FY15 FY14 Net sales $1,912.4 $1,873.2 Gross profit $168.1 $168.2 Gross margin 8.8% 9.0% Operating income $48.6 $51.5 Operating income % 2.5% 2.8% Non-GAAP operating income $52.2 $56.1 Non-GAAP operating income % 2.7% 3.0% WW BARCODE & SECURITY 9 FY14 FY15 Net Sales, $ in millions Up 2.1% Excluding FX, Up 6.1% $ in millions Non-GAAP operating income excludes amortization of intangibles and change in fair value of contingent consideration. See Appendix for calculation of non-GAAP measures and reconciliations to GAAP measures. $1,873 $1,912

Q4 FY15 Q4 FY14 Net sales $367.1 $267.6 Gross profit $46.9 $32.3 Gross margin 12.8% 12.1% Operating income $12.9 $12.2 Operating income % 3.5% 4.5% Non-GAAP operating income $15.2 $12.7 Non-GAAP operating income % 4.1% 4.7% WW COMMUNICATIONS & SERVICES 10 Q4 FY14 Q4 FY15 Net Sales, $ in millions Up 37.2% Excluding FX and Acquisitions, Up 13.2% $ in millions Non-GAAP operating income excludes amortization of intangibles and change in fair value of contingent consideration. See Appendix for calculation of non-GAAP measures and reconciliations to GAAP measures. $367 $268 Acqs.

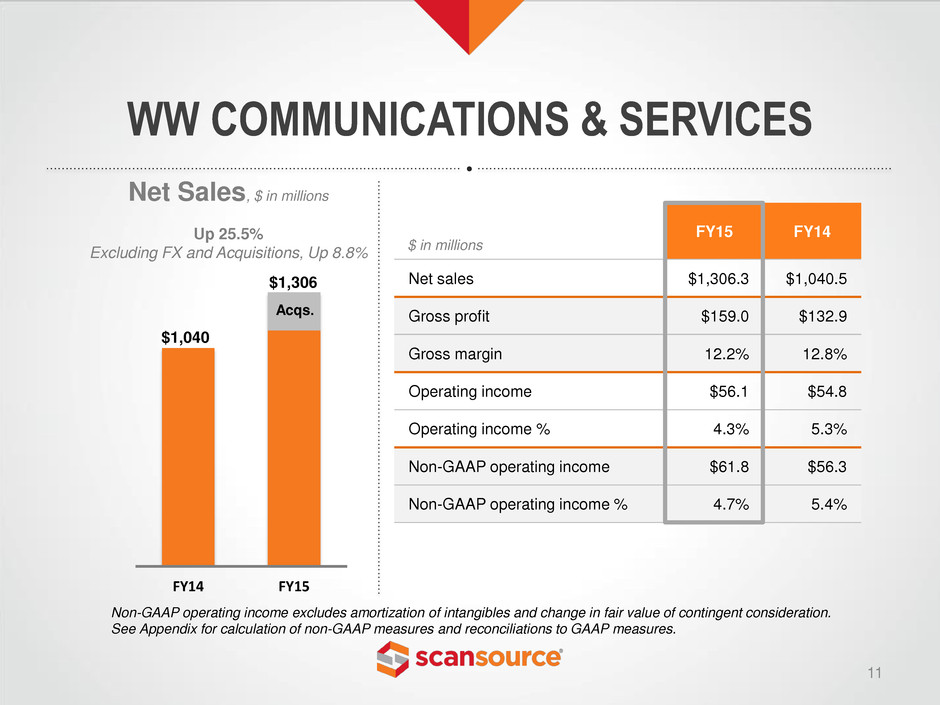

FY15 FY14 Net sales $1,306.3 $1,040.5 Gross profit $159.0 $132.9 Gross margin 12.2% 12.8% Operating income $56.1 $54.8 Operating income % 4.3% 5.3% Non-GAAP operating income $61.8 $56.3 Non-GAAP operating income % 4.7% 5.4% WW COMMUNICATIONS & SERVICES 11 FY14 FY15 Net Sales, $ in millions Up 25.5% Excluding FX and Acquisitions, Up 8.8% $ in millions Non-GAAP operating income excludes amortization of intangibles and change in fair value of contingent consideration. See Appendix for calculation of non-GAAP measures and reconciliations to GAAP measures. $1,306 $1,040 Acqs.

Q4 FY15 Q3 FY15 Q4 FY14 Return on invested capital (“ROIC”)* 15.2% 12.1% 14.0% Cash and cash equivalents (Q/E) $121.6 $93.6 $194.9 Operating cash flow, trailing 12-months $75.5 $39.1 $47.7 Days sales outstanding in receivables 55 57 55 Inventory (Q/E) $553.1 $485.6 $504.8 Inventory turns 5.9 5.4 5.6 Paid for inventory days 6.1 12.3 10.9 Shares repurchased – # of shares 409,860 69,965 -- Shares repurchased – dollars $16.1 $2.7 -- Q4 FY15 KEY MEASURES $ in millions 12 * Excludes non-GAAP adjustments and change in fair value of contingent consideration. See Appendix for calculation of ROIC, a non-GAAP measure.

Q1 FY16 OUTLOOK* 13 * Outlook as of August 20, 2015. Non-GAAP diluted EPS excludes amortization of intangible assets, change in fair value of contingent consideration, and acquisition costs. Reflects the following FX rates: $1.10 to EUR 1.00 for the Euro, $0.295 to R$1.00 for the Brazilian real (R$3.39 to $1), and $1.56 to GBP 1.00 for the British pound. For the quarter ending September 30, 2015, excluding amortization of intangible assets, change in fair value of contingent consideration, and acquisition costs: Net Sales Non-GAAP Diluted Earnings Per Share Range from $820 million to $880 million Range from $0.50 to $0.58 per share

Q4 FY15 SALES MIX 14 By Technology By Geography 57% Barcode & Security 43% Communications & Services 73% North America* 27% International Barcode & Security = Worldwide Barcode and Security Communications & Services = Worldwide Communications and Services As a % of Q4 FY15 net sales of $856.7 million * Includes the United States and Canada.

APPENDIX: NON-GAAP FINANCIAL INFORMATION 15 ($ in thousands) Quarter Ended June 30, 2015 Operating Income Pre-tax income Net income Diluted EPS GAAP measure $ 24,977 $ 24,911 $ 16,447 $ 0.57 Adjustment: Amortization of intangible assets 2,091 2,091 1,450 0.05 Change in fair value of contingent consideration 1,406 1,406 955 0.03 Acquisition costs (a) 138 138 138 0.01 Non-GAAP measure $ 28,612 $ 28,546 $ 18,990 $ 0.66 Quarter Ended June 30, 2014 Operating Income Pre-tax income Net income Diluted EPS GAAP measure $ 40,439 $ 40,880 $ 27,105 $ 0.94 Adjustment: Amortization of intangible assets 1,117 1,117 740 0.03 Change in fair value of contingent consideration 93 93 61 - Legal recovery, net of attorney fees (15,490) (15,490) (9,756) (0.34) Non-GAAP measure $ 26,159 $ 26,600 $ 18,150 $ 0.63 (a) Acquisition costs are nondeductible for tax purposes.

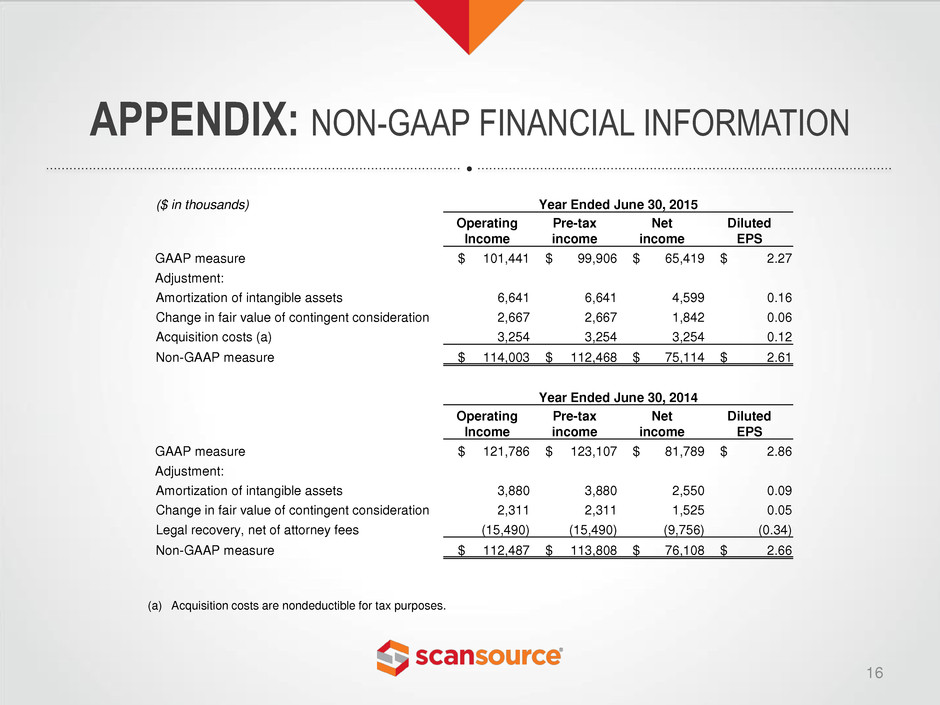

APPENDIX: NON-GAAP FINANCIAL INFORMATION 16 ($ in thousands) Year Ended June 30, 2015 Operating Income Pre-tax income Net income Diluted EPS GAAP measure $ 101,441 $ 99,906 $ 65,419 $ 2.27 Adjustment: Amortization of intangible assets 6,641 6,641 4,599 0.16 Change in fair value of contingent consideration 2,667 2,667 1,842 0.06 Acquisition costs (a) 3,254 3,254 3,254 0.12 Non-GAAP measure $ 114,003 $ 112,468 $ 75,114 $ 2.61 Year Ended June 30, 2014 Operating Income Pre-tax income Net income Diluted EPS GAAP measure $ 121,786 $ 123,107 $ 81,789 $ 2.86 Adjustment: Amortization of intangible assets 3,880 3,880 2,550 0.09 Change in fair value of contingent consideration 2,311 2,311 1,525 0.05 Legal recovery, net of attorney fees (15,490) (15,490) (9,756) (0.34) Non-GAAP measure $ 112,487 $ 113,808 $ 76,108 $ 2.66 (a) Acquisition costs are nondeductible for tax purposes.

APPENDIX: NON-GAAP FINANCIAL INFORMATION 17 ($ in thousands) Quarter Ended June 30, 2015 WW Barcode & Security WW Comms. & Services Corporate Consolidated Net sales $ 489,559 $ 367,126 $ - $ 856,685 GAAP operating income $ 12,168 $ 12,947 $ (138) $ 24,977 Adjustments: Amortization of intangible assets 431 1,660 - 2,091 Change in fair value of contingent consideration 806 600 - 1,406 Acquisition costs - - 138 138 Non-GAAP operating income $ 13,405 $ 15,207 $ - $ 28,612 GAAP operating income % (of net sales) 2.5% 3.5% n/m 2.9% Non-GAAP operating income % (of net sales) 2.7% 4.1% n/m 3.3% Quarter Ended June 30, 2014 WW Barcode & Security WW Comms. & Services Corporate Consolidated Net sales $ 490,505 $ 267,608 $ - $ 758,113 GAAP operating income $ 12,789 $ 12,160 $ 15,490 $ 40,439 Adjustments: Amortization of intangible assets 591 526 - 1,117 Change in fair value of contingent consideration 93 - - 93 Legal recovery, net of attorney fees - - (15,490) (15,490) Non-GAAP operating income $ 13,473 $ 12,686 $ - $ 26,159 GAAP operating income % (of net sales) 2.6% 4.5% n/m 5.3% Non-GAAP operating income % (of net sales) 2.7% 4.7% n/m 3.5% n/m = not meaningful

APPENDIX: NON-GAAP FINANCIAL INFORMATION 18 ($ in thousands) Year Ended June 30, 2015 WW Barcode & Security WW Comms. & Services Corporate Consolidated Net sales $ 1,912,352 $ 1,306,274 $ - $ 3,218,626 GAAP operating income $ 48,612 $ 56,083 $ (3,254) $ 101,441 Adjustments: Amortization of intangible assets 1,994 4,647 - 6,641 Change in fair value of contingent consideration 1,636 1,031 - 2,667 Acquisition costs - - 3,254 3,254 Non-GAAP operating income $ 52,242 $ 61,761 $ - $ 114,003 GAAP operating income % (of net sales) 2.5% 4.3% n/m 3.2% Non-GAAP operating income % (of net sales) 2.7% 4.7% n/m 3.5% Year Ended June 30, 2014 WW Barcode & Security WW Comms. & Services Corporate Consolidated Net sales $ 1,873,177 $ 1,040,457 $ - $ 2,913,634 GAAP operating income $ 51,523 $ 54,773 $ 15,490 $ 121,786 Adjustments: Amortization of intangible assets 2,306 1,574 - 3,880 Change in fair value of contingent consideration 2,311 - - 2,311 Legal recovery, net of attorney fees - - (15,490) (15,490) Non-GAAP operating income $ 56,140 $ 56,347 $ - $ 112,487 GAAP operating income % (of net sales) 2.8% 5.3% n/m 4.2% Non-GAAP operating income % (of net sales) 3.0% 5.4% n/m 3.9% n/m = not meaningful

APPENDIX: NON-GAAP FINANCIAL INFORMATION 19 ($ in thousands) Q4 FY15 Q3 FY15 Q4 FY14 Return on invested capital (ROIC), annualized (a) 15.2% 12.1% 14.0% Reconciliation of Net Income to EBITDA Net income - GAAP $ 16,447 $ 12,943 $ 27,105 Plus: Income taxes 8,464 6,878 13,775 Plus: Interest expense 509 891 33 Plus: Depreciation and amortization 3,947 3,710 1,985 EBITDA 29,367 24,422 42,898 Change in fair value of contingent consideration 1,406 285 93 Acquisition costs 138 292 - Legal recovery, net of attorney fees - - (15,490) Adjusted EBITDA (numerator for ROIC)(non-GAAP) $ 30,911 $ 24,999 $ 27,501 Invested Capital Calculation Equity - beginning of the quarter $ 799,051 $ 818,748 $ 772,786 Equity - end of quarter 808,985 799,051 802,643 Add: Change in fair value of contingent consideration, net of tax 955 200 61 Add: Acquisition costs, net of tax 138 292 - Less: Legal recovery, net of attorney fees, net of tax - - (9,756) Average equity 804,565 809,146 782,867 Average funded debt (b) 10,377 32,046 5,429 Invested capital (denominator for ROIC)(non-GAAP) $ 814,942 $ 841,192 $ 788,296 Notes: (a) Calculated as net income plus interest expense, income taxes, depreciation and amortization (EBITDA), annualized divided by invested capital for the period. Adjusted EBITDA reflects other adjustments for non-GAAP measures. (b) Average daily amounts outstanding on short-term and long-term interest-bearing debt.

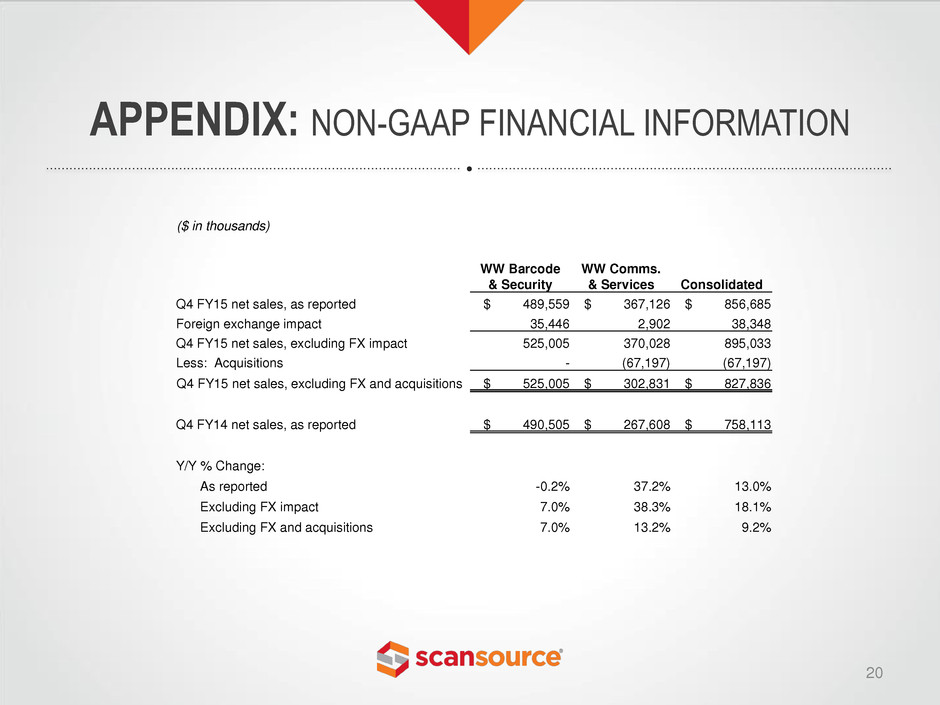

APPENDIX: NON-GAAP FINANCIAL INFORMATION 20 ($ in thousands) WW Barcode & Security WW Comms. & Services Consolidated Q4 FY15 net sales, as reported $ 489,559 $ 367,126 $ 856,685 Foreign exchange impact 35,446 2,902 38,348 Q4 FY15 net sales, excluding FX impact 525,005 370,028 895,033 Less: Acquisitions - (67,197) (67,197) Q4 FY15 net sales, excluding FX and acquisitions $ 525,005 $ 302,831 $ 827,836 Q4 FY14 net sales, as reported $ 490,505 $ 267,608 $ 758,113 Y/Y % Change: As reported -0.2% 37.2% 13.0% Excluding FX impact 7.0% 38.3% 18.1% Excluding FX and acquisitions 7.0% 13.2% 9.2%

APPENDIX: NON-GAAP FINANCIAL INFORMATION 21 ($ in thousands) WW Barcode & Security WW Comms. & Services Consolidated FY15 net sales, as reported $ 1,912,352 $ 1,306,274 $ 3,218,626 Foreign exchange impact 74,712 7,401 82,113 FY15 net sales, excluding FX impact 1,987,064 1,313,675 3,300,739 Less: Acquisitions - (181,138) (181,138) FY15 net sales, excluding FX and acquisitions $ 1,987,064 $ 1,132,537 $ 3,119,601 FY14 net sales, as reported $ 1,873,177 $ 1,040,457 $ 2,913,634 Y/Y % Change: As reported 2.1% 25.5% 10.5% Excluding FX impact 6.1% 26.3% 13.3% Excluding FX and acquisitions 6.1% 8.8% 7.1%

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- ScanSource to Announce Third Quarter Fiscal Year 2024 Results May 7, 2024

- Digital Doc Fosters Unprecedented Revenue Growth Through Its AI-Backed Practice Growth Platform

- Nykredit’s and Totalkredit’s auctions for 1 July 2024 refinancing - Nykredit Realkredit A/S

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share