Form 6-K TOYOTA MOTOR CORP/ For: Jun 24

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 under

the Securities Exchange Act of 1934

For the month of June, 2015

Commission File Number 001-14948

Toyota Motor Corporation

(Translation of Registrant’s Name Into English)

1, Toyota-cho, Toyota City,

Aichi Prefecture 471-8571,

Japan

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F. Form 20-F X Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Material Contained in this Report:

| I. |

English translation of the Japanese-language report on corporate governance publicly disclosed with the Tokyo Stock Exchange on June 29, 2006 by the registrant and amended on June 24, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Toyota Motor Corporation | ||||

| By: |

/s/ Yasushi Kyoda | |||

| Name: |

Yasushi Kyoda | |||

| Title: |

General Manager of Accounting Division | |||

Date: June 24, 2015

(Translation)

June 24, 2015

TOYOTA MOTOR CORPORATION

Akio Toyoda

Telephone Number: 0565-28-2121

Code Number: 7203

http://www.toyota.co.jp

Corporate governance at Toyota Motor Corporation (“TMC”) is as follows:

| I. | TMC’s Basic Policy on Corporate Governance and Capital Structure, Business Attributes and Other Basic Information |

| 1. | Basic Policy |

TMC has positioned the stable long-term growth of corporate value as a top-priority management issue. It believes that in carrying this out, it is essential that it achieves long-term and stable growth by building positive relationships with all stakeholders, including shareholders and customers as well as business partners, local communities and employees, and by supplying products that will satisfy its customers. This position is reflected in the “Guiding Principles at Toyota”, which is a statement of TMC’s fundamental business policies. Also, TMC adopted and presented the CSR Policy “Contribution towards Sustainable Development”, an interpretation of the “Guiding Principles at Toyota” that organizes the relationships with its stakeholders. It is working to enhance corporate governance through a variety of measures designed to further increase its competitiveness as a global company.

TMC also supports “Japan’s Corporate Governance Code” formulated and published by financial instruments exchanges.

[Reason not to implement each principle of Corporate Governance Code]

TMC implements each principle of Corporate Governance Code

[Disclosure based on each principle of Corporate Governance Code]

[Principle 1.4]

| (1) | Policies on strategic shareholdings |

TMC’s primary business is the manufacturing of automobiles, which requires comprehensive capacities and strengths that extend from raw materials to new technologies. TMC considers essential the cooperative relationships with numerous companies throughout the entire process of development, procurement, production, distribution and sales in order to prevail in global-scale competition and continue to grow over the long-term. TMC therefore maintains strategic shareholdings based on a comprehensive consideration of business strategy and relationships with business partners as well as improvement of corporate value over the medium and long term.

| (2) | Purposes and rationale of TMC’s strategic shareholdings |

When necessary, TMC engages in constructive dialogue with the issuers of shares to encourage them to improve corporate value and achieve sustainable growth. These dialogues provide opportunities to share business challenges and address problem areas. The Board of Directors verifies the medium and long-term economic rationality and outlook of major strategic shareholdings from the perspective of risk and return, and provides concrete explanations of the purpose and rationale of the holdings.

| (3) | Basic policy on the exercise of voting rights |

| 1) | Basic thinking on the exercise of voting rights |

TMC does not exercise voting rights as a mechanical yes or no decision based on formalized, short-term standards. Rather, decisions attempt to fully respect business policies and strategies of the issuer and facilitate the improvement of corporate value and returns to shareholders over the medium and long-term.

| 2) | Process for exercising voting rights |

In the exercise of voting rights, TMC confirms each item on the agenda, focusing on whether the proposal will contribute to the issuer’s development, whether it emphasizes the interests of shareholders, and whether it would result in antisocial actions. When necessary, it also performs detailed, individual investigations of the following matters, and engages in dialogue with the issuer before determining its support for a proposal (returns to shareholders, increase in authorized capital, anti-takeover measures, realignment of businesses etc.).

– 1 –

[Principle 1.7]

TMC complies with the procedures set forth in the Companies Act regarding conflict-of-interest transactions with officers, and all transactions with non-director senior managing officers and managing officers require reporting to and approval of the Board of Directors.

With regard to procurement, production, distribution, and sales transactions, Toyota Code of Conduct requires compliance with all relevant laws and ordinances, transactions based on mutual trust and mutual benefit for TMC and the counterparty, and open, fair and free competition. These principles apply to transactions even if the counterparty is a major shareholder.

All relevant business units formulate their own guidelines and other procedural documents based on this policy, and take care to ensure that transactions with related parties do not harm the interests of the company or the common interests of all shareholders.

[Principle 3.1]

| (1) | Business Principles, business strategies and business plans |

TMC formulated the “Guiding Principles at Toyota” in January 1992 (revised April 1997) because it understood the importance of defining its philosophy and identifying the path on which TMC should proceed within the context of constantly changing business environments. These principles were based on “Five Main Principles of Toyoda” (October 1935), a collection of insights from Sakichi Toyoda, the founder of the Toyota Group, that has served as the foundation for Toyota’s management since the very beginning. To this was added the “Toyota Global Vision” published in March 2011, which articulates the kind of company that Toyota aspires to be, the values that it considers important, its views on the nature and functions of companies, and the course that it charts for the future. This document states TMC’s values clearly: “Toyota aspires to be a company that is chosen by its customers. Toyota wants to be a company that brings smiles to the faces of customers who have chosen us”.

“Guiding Principles at Toyota” and “Five Main Principles of Toyoda”

(http://www.toyota-global.com/company/vision_philosophy/guiding_principles.html)

“Toyota Global Vision”

(http://www.toyota-global.com/company/vision_philosophy/toyota_global_vision_2020.html)

TMC moves forward boldly and steadily towards the achievement of its Toyota Global Vision, organizing its activities on two long axes. The first is to strengthen true competitiveness to lay the foundation for steady growth. TMC is strengthening its business platform with the innovative approach to manufacturing technology and methods found in the “TNGA” (Toyota New Global Architecture), the simplification and slimming of its production lines, and the introduction of lines to be used specifically to transmit techniques and approaches to younger generations. The goal of all of these activities is to create cars that are smarter and more attractive, and to develop its human resources. The second is a challenge toward the future as TMC creates new values and products that will meet and exceed the expectations of its customers. Last year, TMC announced initiatives to achieve a hydrogen-based society with the “MIRAI” fuel-cell vehicle. Other examples include ITS (Intelligent Transport System)-linked driver assistance systems and personal mobility programs that will create safer and more secure societies. In motor sports, its participation in races enables it to develop and refine its people, and also its vehicles and technologies. The experiences and expertise gained there are put to work in the development of the exciting, imaginative cars of the future.

TMC’s business plan based on these ideas is published on the official corporate site.

“Investors / Presentation”

(http://www.toyota-global.com/investors/presentation/)

– 2 –

| (2) | Basic views and guidelines on corporate governance |

Please see “I.1 Basic Policy” of this report.

(3) The remuneration of Members of the Board of Directors and Audit & Supervisory Board Members

Please see “II.2. Matters pertaining to functions relating to the execution of duties, audit and supervision, appointment and decisions regarding remuneration, etc. (Outline of the current corporate governance system)” of this report.

| (4) | The appointment of senior management and the nomination of Members of the Board of Directors and Audit & Supervisory Board Members |

Please see “II.2. Matters pertaining to functions relating to the execution of duties, audit and supervision, appointment and decisions regarding remuneration, etc. (Outline of the current corporate governance system)” of this report.

| (5) | Explanations with respect to individual appointments and nominations |

The reasons for the elections of individual outside members of the board of directors and audit & supervisory board members are described in the Notice of Convocation of General Shareholders’ Meeting.

The Notice of Convocation of General Shareholders’ Meeting contains the individual profiles and professional histories of candidates nominated and elected for member of the board of directors and audit & supervisory board member positions.

[Supplementary Principle 4.1.1]

The following matters require a resolution of the Board of Directors.

(1) Matters stipulated in the Companies Act and other laws and ordinances; (2) matters stipulated in the Articles of Incorporation; (3) matters delegated for resolution at the General Shareholders’ Meeting; and (4) other material business matters

The following matters are reported to the Board of Directors.

(1) Status of execution of business and other matters stipulated in the Companies Act and other laws and ordinances; and (2) other matters deemed necessary by the Board of Directors

[Principle 4.8] [Principle 4.9]

Independent Outside Members of the Board of Directors are elected in accordance with the requirements for outside directors set forth in the Companies Act and the independence standards set forth by financial instruments exchanges.

[Supplementary Principle 4.11.1]

Please see “II.2. Matters pertaining to functions relating to the execution of duties, audit and supervision, appointment and decisions regarding remuneration, etc. (Outline of the current corporate governance system)” of this report.

[Supplementary Principle 4.11.2]

Concurrent service as officers of listed companies is noted each year in the Notice of Convocation of General Shareholders’ Meeting.

[Supplementary Principle 4.11.3]

The Secretariat of the Board of Directors’ Meeting conducts regular interviews with outside members of the board of directors and audit & supervisory board members on the effectiveness of the Board of Directors, reports the findings to companywide executives’ meetings, and makes improvements where necessary.

[Supplementary Principle 4.14.2]

TMC provides members of the board of directors and audit & supervisory board members with training and activity opportunities to improve understanding and practice of the core ideals of “manufacturing even better cars” and problem solving based on the actual situation on-site (Genchi Genbutsu), and to encourage their contributions to sustainable growth into the future.

– 3 –

[Principle 5.1]

| (1) | Basic concepts |

TMC understands the crucial importance of shareholder and investor understanding and support in the achievement of sustainable growth and improvement of medium and long-term corporate value. It engages in constructive dialogue to furnish shareholders and investors with accurate information on a fair basis in order to build long-term relationships of trust.

| (2) | IR organization |

Dialogues with shareholders and investors are overseen by the accounting officer, and are conducted by the accounting officer and IR staff in Accounting Division and Public Affairs Division, as well as IR staff stationed full-time in New York and London. To enhance dialogues, IR staff seeks information and cooperation on specific topics from relevant divisions. When necessary, such divisions also conduct briefings.

| (3) | Method of dialogue |

TMC holds quarterly results briefings for the press, analysts and institutional investors. It also holds briefings on management strategy, business and products as appropriate. In addition, it holds briefings from time to time for individual investors, and also has a dedicated page for individual investors on its website that contains easy-to-understand information about results, business and management policy.

| (4) | Feedback to the organization |

Feedback regarding the content of dialogues with shareholders and investors is provided as necessary through the accounting officer to the Board of Directors and executives’ meetings.

| (5) | Insider information and quiet periods |

No insider information (material nonpublic information) is communicated to shareholders or investors in dialogues. TMC also has a “quiet period” from the day after the close of the quarter until the day on which results are announced during which it refrains from dialogues regarding results.

| 2. | Capital Structure |

| Percentage of Shares Held by Foreign Investors |

Greater than 30% |

[Description of Major Shareholders]

| Name of Shareholders |

Number of Shares Held (Shares) |

Ownership Interest (%) |

||||||

| Japan Trustee Services Bank, Ltd. |

351,323,830 | 10.28 | ||||||

| Toyota Industries Corporation |

224,515,684 | 6.57 | ||||||

| The Master Trust Bank of Japan, Ltd. |

160,750,968 | 4.70 | ||||||

| State Street Bank and Trust Company (standing proxy: Settlement & Clearing Services Division, Mizuho Bank, Ltd.) |

128,583,321 | 3.76 | ||||||

| Nippon Life Insurance Company |

120,084,490 | 3.51 | ||||||

| The Bank of New York Mellon as Depositary Bank for Depositary Receipt Holders |

82,545,759 | 2.42 | ||||||

| DENSO CORPORATION |

82,533,366 | 2.41 | ||||||

| Trust & Custody Services Bank, Ltd. |

67,407,546 | 1.97 | ||||||

| JPMorgan Chase Bank, N.A. (standing proxy: Settlement & Clearing Services Division, Mizuho Bank, Ltd.) |

65,062,984 | 1.90 | ||||||

| Mitsui Sumitomo Insurance Company, Limited |

64,063,595 | 1.87 | ||||||

– 4 –

| Existence of Controlling Shareholders (excluding parent company) |

— | |

| Existence of Parent Company |

None |

| Supplementary Information |

The information set forth in this Description of Major Shareholders section is dated as of March 31, 2015. In addition to the above, TMC owns 271,183,861 of its own shares as treasury stock.

| 3. | Business Attributes |

| Stock exchange and section |

Tokyo: 1st Section, Nagoya: 1st Section, Fukuoka: Existing Market, Sapporo: Existing Market | |

| Fiscal year end |

End of March | |

| Line of business |

Transportation equipment | |

| Number of employees at the end of the previous fiscal year (consolidated) |

Greater than 1000 persons | |

| Sales during the previous fiscal year (consolidated) |

Greater than JPY 1 trillion | |

| Number of consolidated subsidiaries at the end of the previous fiscal year |

Greater than 300 companies |

| 4. | Guidelines for measures to protect minority shareholders in the event of transactions with controlling shareholders |

-

| 5. | Other particular conditions that may materially affect corporate governance |

Daihatsu Motor Co., Ltd. and Hino Motors, Ltd. are listed subsidiaries of TMC in which it holds the majority of the total issued and outstanding shares. While TMC continues to maintain a close cooperative relationship with these two companies, it respects the independence of their business activities.

– 5 –

II. Corporate Governance System of Management Business Organization, Etc. for Management Decision Making, Execution of Duties and Management Audit

| 1. | Organization structures and organizational operations |

| Organizational form |

Company with an Audit & Supervisory Board |

[Members of the Board of Directors]

| Number of Members of the Board of Directors pursuant to the Articles of Incorporation |

20 persons | |

| Term of Members of the Board of Directors pursuant to the Articles of Incorporation |

1 year | |

| Chairperson of the Board of Directors |

Chairman (excluding concurrently serving as President) | |

| Number of Members of the Board of Directors |

12 persons | |

| Election of Outside Members of the Board of Directors |

Elected | |

| Number of Outside Members of the Board of Directors |

3 persons | |

| Established number of Independent Members of the Board of Directors within the Outside Members of the Board of Directors |

3 persons |

Relationship with the Company (1)

| Name |

Attribution |

Relationship with the Company (*) | ||||||||||||||||||||||

| a | b | c | d | e | f | g | h | i | j | k | ||||||||||||||

| Ikuo Uno |

Comes from other company | D | ||||||||||||||||||||||

| Haruhiko Kato |

Comes from other company | ¡ | ||||||||||||||||||||||

| Mark T. Hogan |

Comes from other company | D | ||||||||||||||||||||||

| * | Selected the relevant “Relationship with the Company” |

| * |

¡ indicates the relevant item that the person falls under as of “today or recently”. D indicates the relevant item that the person falls under as of “previously”. |

| * | l indicates the relevant item that the person’s close family member falls under as of “today or recently”. p indicates the relevant item that the person’s close family member falls under as of “previously”. |

| a | A management executive officer of the listed company or its subsidiary |

| b | A management executive officer or non-management executive director of a parent company of the listed company |

| c | A management executive officer of a subsidiary of a parent company of the listed company |

| d | A person who has a significant business relationship with the listed company or who is a management executive officer of entity which has such significant business relationship |

| e | A person with whom the listed company has a significant business relationship or who is a management executive officer of entity with whom the listed company has a significant business relationship |

| f | A consultant, accounting expert or legal expert who receives significant remuneration or other assets from the listed company other than remuneration as a director or executive officer |

| g | A principal shareholder of the listed company (if a principal shareholder is a legal entity, a management executive officer of such legal entity) |

| h | A management executive officer of entity with whom the listed company has a business relationship (does not fall under d, e, and f) (only with respect to the person) |

| i | A management executive officer of a company whose outside director assumes the post on a reciprocal basis with the listed company (only with respect to the person) |

| j | A management executive officer of an entity to whom the listed company makes a donation |

| k | Other |

– 6 –

Relationship with the Company (2)

| Name |

Independent Member of the |

Supplementary Information |

Reason for election as Outside Member of the Board

of | |||

| Ikuo Uno | ¡ | TMC’s current Outside Member of the Board of Directors, Mr. Ikuo Uno, formerly served as an executive of Nippon Life Insurance Company. A summary of the business transactions entered into between TMC and Nippon Life Insurance Company has been omitted, since TMC has determined that the size and nature of the business transactions should not influence the judgment of shareholders and investors. | In order to reflect his broad experiences and insight in his field of expertise in TMC’s management decision-making. Designated as an Independent Member of the Board of Directors of TMC as he would be able to supervise the appropriateness of business conduct from a fair and neutral perspective because he is not (i) a person who executes business of the parent company or fellow subsidiary of TMC, (ii) a person who executes business of a major business counterparty of TMC, or (iii) an attorney, an accountant, a consultant or a relative (up to a second degree of kinship) of the foregoing who receives a large amount of money or other financial asset other than remuneration for directorship from TMC, and he does not fall under any of the categories of people who are required by stock exchange rules to explain their independence. |

– 7 –

| Haruhiko Kato | ¡ | TMC’s current Outside Member of the Board of Directors, Mr. Haruhiko Kato, concurrently serves as an executive of Japan Securities Depository Center, Inc. A summary of the business transactions entered into between TMC and Japan Securities Depository Center, Inc. has been omitted, since TMC has determined that the size and nature of the business transactions should not influence the judgment of shareholders and investors. | In order to reflect his broad experiences and insight in his field of expertise in TMC’s management decision-making. Designated as an Independent Member of the Board of Directors of TMC as he would be able to supervise the appropriateness of business conduct from a fair and neutral perspective because he is not (i) a person who executes business of the parent company or fellow subsidiary of TMC, (ii) a person who executes business of a major business counterparty of TMC, or (iii) an attorney, an accountant, a consultant or a relative (up to a second degree of kinship) of the foregoing who receives a large amount of money or other financial asset other than remuneration for directorship from TMC, and he does not fall under any of the categories of people who are required by stock exchange rules to explain their independence. | |||

| Mark T. Hogan | ¡ | TMC’s current Outside Member of the Board of Directors, Mr. Mark T. Hogan, formerly served as an executive of General Motors Corporation. General Motors Company acquired substantially all of the assets and assumed certain liabilities of General Motors Corporation. A summary of the business transactions entered into between TMC and General Motors Company has been omitted, since TMC has determined that the size and nature of the business transactions should not influence the judgment of shareholders and investors. | In order to reflect his broad experiences and insight in his field of expertise in TMC’s management decision-making. Designated as an Independent Member of the Board of Directors of TMC as he would be able to supervise the appropriateness of business conduct from a fair and neutral perspective because he is not (i) a person who executes business of the parent company or fellow subsidiary of TMC, (ii) a person who executes business of a major business counterparty of TMC, or (iii) an attorney, an accountant, a consultant or a relative (up to a second degree of kinship) of the foregoing who receives a large amount of money or other financial asset other than remuneration for directorship from TMC, and he does not fall under any of the categories of people who are required by stock exchange rules to explain their independence. | |||

| Establishment or non-establishment of an optional committee which corresponds to the Nominating

Committee or |

Established |

– 8 –

Status of establishment of an optional committee, members of the committee, and attributes of the chairperson of the committee

| Name of the Committee |

Total Number of Members |

Number of Full-time Members |

Number of Inside Members of the Board of Directors |

Number of Outside Members of the Board of Directors |

Number of Outside Experts |

Number of Others |

Committee Chair (Chair-person) | |||||||||||||||||||||

| Optional Committee Corresponding to the Nominating Committee |

Executive Appointment Meeting |

4 | — | 3 | 1 | — | — | Inside Member of the Board of Directors | ||||||||||||||||||||

| Optional Committee Corresponding to the Compensation Committee |

Executive Compensation Meeting |

4 | — | 3 | 1 | — | — | Inside Member of the Board of Directors | ||||||||||||||||||||

Supplementary Information

-

[Auditors]

| Establishment or non-establishment of an Audit & Supervisory Board |

Established | |

| Number of Audit & Supervisory Board Members pursuant to the Articles of Incorporation |

7 persons | |

| Number of Audit & Supervisory Board Members | 6 persons |

Cooperative relationships between Audit & Supervisory Board Members, Independent Accountants, and Internal Audit Division

Audit & Supervisory Board Members periodically receive reports from Independent Accountants on audit plans, methods and results of auditing at meetings of the Audit & Supervisory Board. They also hold meetings and exchange their opinions as they consider necessary concerning auditing in general.

As for internal auditing, a specialized independent department evaluates the effectiveness of internal controls over financial reporting. Audit & Supervisory Board Members receive reports from the department on audit plans, methods and results of auditing periodically or whenever necessary.

| Election or non-election of Outside Audit & Supervisory Board Members |

Elected | |

| Number of Outside Audit & Supervisory Board Members |

3 persons | |

| Established number of Independent Audit & Supervisory Board Members within the Outside Audit & Supervisory Board Members |

3 persons |

Relationship with the Company (1)

| Name |

Attribution |

Relationship with the Company (*) | ||||||||||||||||||||||||||

| a | b | c | d | e | f | g | h | i | j | k | l | m | ||||||||||||||||

| Yoko Wake |

Academic | ¡ | ||||||||||||||||||||||||||

| Teisuke Kitayama |

Comes from other company | D | ||||||||||||||||||||||||||

| Hiroshi Ozu |

Attorney-at-law | |||||||||||||||||||||||||||

| * | Selected the relevant “Relationship with the Company” |

| * |

¡ indicates the relevant item that the person falls under as of “today or recently”. D indicates the relevant item that the person falls under as of “previously”. |

– 9 –

| * | l indicates the relevant item that the person’s close family member falls under as of “today or recently”. p indicates the relevant item that the person’s close family member falls under as of “previously”. |

| a | A management executive officer of the listed company or its subsidiary |

| b | A non-management executive director or accounting advisor of the listed company or its subsidiary |

| c | A management executive officer or non-management executive director of a parent company of the listed company |

| d | An audit & supervisory board member of a parent company of the listed company |

| e | A management executive officer of a subsidiary of a parent of the listed company |

| f | A person who has a significant business relationship with the listed company or who is a management executive officer of entity which has such significant business relationship |

| g | A person with whom the listed company has a significant business relationship or who is a management executive officer of entity with whom the listed company has a significant business relationship |

| h | A consultant, accounting expert or legal expert who receives significant remuneration or other assets from the listed company other than remuneration as a director or executive officer |

| i | A principal shareholder of the listed company (if a principal shareholder is a legal entity, a management executive officer of such legal entity) |

| j | A management executive officer of entity with whom the listed company has a business relationship (does not fall under f, g, and h) (only with respect to the person) |

| k | A management executive officer of a company whose outside director assumes the post on a reciprocal basis with the listed company (only with respect to the person) |

| l | A management executive officer of an entity to whom the listed company makes a donation |

| m | Other |

Relationship with the Company (2)

| Name |

Independent Audit |

Supplementary Information |

Reason for election as Outside Audit & Supervisory Board Members (and the reason for designation as an Independent Audit & Supervisory Board Member if so designated) | |||

| Yoko Wake |

¡ | TMC’s current Outside Audit & Supervisory Board Member, Ms. Yoko Wake, concurrently serves as an executive of the Association for World Economic Studies. A summary of the business transactions entered into between TMC and the Association for World Economic Studies has been omitted, since TMC has determined that the size and nature of the business transactions should not influence the judgment of shareholders and investors. | In order to receive advice based on her broad experiences and insight in her field of expertise. Designated as an Independent Audit & Supervisory Board Member of TMC as she would be able to undertake audits from a fair and neutral perspective because she is not (i) a person who executes business of the parent company or fellow subsidiary of TMC, (ii) a person who executes business of a major business counterparty of TMC, or (iii) an attorney, an accountant, a consultant or a relative (up to a second degree of kinship) of the foregoing who receives a large amount of money or other financial asset other than remuneration for directorship from TMC, and she does not fall under any of the categories of people who are required by stock exchange rules to explain their independence. |

– 10 –

| Teisuke Kitayama |

¡ | TMC’s current Outside Audit & Supervisory Board Member, Mr. Teisuke Kitayama, formerly served as an executive of Sumitomo Mitsui Banking Corporation. A summary of the business transactions entered into between TMC and Sumitomo Mitsui Banking Corporation has been omitted, since TMC has determined that the size and nature of the business transactions should not influence the judgment of shareholders and investors. | In order to receive advice based on his broad experiences and insight in his field of expertise. Designated as an Independent Audit & Supervisory Board Member of TMC as he would be able to undertake audits from a fair and neutral perspective because he is not (i) a person who executes business of the parent company or fellow subsidiary of TMC, (ii) a person who executes business of a major business counterparty of TMC, or (iii) an attorney, an accountant, a consultant or a relative (up to a second degree of kinship) of the foregoing who receives a large amount of money or other financial asset other than remuneration for directorship from TMC, and he does not fall under any of the categories of people who are required by stock exchange rules to explain their independence. | |||

| Hiroshi Ozu | ¡ | — | In order to receive advice based on his broad experiences and insight in his field of expertise. Designated as an Independent Audit & Supervisory Board Member of TMC as he would be able to undertake audits from a fair and neutral perspective because he is not (i) a person who executes business of the parent company or fellow subsidiary of TMC, (ii) a person who executes business of a major business counterparty of TMC, or (iii) an attorney, an accountant, a consultant or a relative (up to a second degree of kinship) of the foregoing who receives a large amount of money or other financial asset other than remuneration for directorship from TMC, and he does not fall under any of the categories of people who are required by stock exchange rules to explain their independence. | |||

[Independent Members of the Board of Directors / Audit & Supervisory Board Members]

| Number of Independent Members of the Board of |

6 persons |

– 11 –

Other matters relating to Independent Members of the Board of Directors / Audit & Supervisory Board Members

All Outside Members of the Board of Directors / Audit & Supervisory Board Members that qualify as Independent Members of the Board of Directors / Audit & Supervisory Board Members have been designated as Independent Members of the Board of Directors / Audit & Supervisory Board Members.

[Incentives]

| Implementation of measures on incentive allotment to Members of the Board of Directors |

Adoption of stock option plans |

Supplementary Information

TMC had granted stock options up to and including August 2010, but have not made such offerings since 2011.

| Grantees of stock options |

Members of the Board of Directors (other than Outside Members of the Board of Directors), Employees, Members of the Board of Directors of subsidiaries, Employees of subsidiaries and Others |

Supplementary Information

The Grantees of stock options listed above are those who hold unexpired options that were granted to them up to and including August 2010.

[Remuneration for Members of the Board of Directors]

| Disclosure Status (of individual Member of the Board of Directors remuneration) |

Only a portion of remuneration is individually disclosed. |

Supplementary Information

Names and details of those who receive, in aggregate, consolidated remuneration of one hundred million Japanese yen or more will be disclosed on an individual basis in annual securities reports.

Annual securities reports and business reports are also made available for public inspection on TMC’s Internet website.

| Existence of guidelines for the amount and calculation method of remuneration |

Yes |

Information regarding guidelines for the amount and calculation method of remuneration

Remuneration for Members of the Board of Directors was set at 130 million yen or less per month, pursuant to the resolution of the 107th Ordinary General Shareholders’ Meeting held on June 17, 2011. In addition, the amount of Audit & Supervisory Board Members’ remuneration was set at 30 million yen or less per month, pursuant to the resolution of the 104th Ordinary General Shareholders’ Meeting, held on June 24, 2008. For basic policy on remuneration, please refer to “II.2. Matters pertaining to functions relating to the execution of duties, audit and supervision, appointment and decisions regarding remuneration, etc. (Outline of the current corporate governance system).”

– 12 –

[Support System for Outside Members of the Board of Directors (Outside Audit & Supervisory Board Members)]

Full-time Audit & Supervisory Board Members, Members of the Board of Directors and others disclose adequate information to Outside Members of the Board of Directors and Outside Audit & Supervisory Board Members, such as by giving prior explanations on agenda items to be proposed to the Board of Directors. In addition, the Audit & Supervisory Board Office has been established as a specialized independent organization to assist the Audit & Supervisory Board Members.

2. Matters pertaining to functions relating to the execution of duties, audit and supervision, appointment and decisions regarding remuneration, etc. (Outline of the current corporate governance system)

[Basic policy]

In order to achieve long-term and stable improvement in corporate value, TMC is continuously working to increase transparency in global management by building favorable relationships with all stakeholders through communication and by fulfilling social responsibility.

In March 2011, TMC announced the “Toyota Global Vision” and commenced “Visionary Management”. This is based on Toyota’s values that have guided Toyota since its founding, such as “The Toyoda Precepts”, the “Guiding Principles at Toyota” and the “Toyota Way”, which aim to exceed customer expectations by manufacturing ever-better cars and enriching the lives of societies, and to be rewarded with a smile that ultimately leads to the stable base of business.

[Execution of duties and supervision]

Toyota’s management structure towards “fulfillment of the Toyota Global Vision” is based on the structure introduced in April 2011. Toyota has reduced the Board of Directors and decision-making layers, and has endeavored to swiftly communicate the views of customers and information from operations on-ground to management and facilitate rapid management decision making.

In April 2013, TMC made organizational changes with the aim of further increasing the speed of decision-making by clarifying responsibilities for operations and earnings, specifically by dividing the automotive business into the following four units — Lexus International, which covers the Lexus business; Toyota No. 1 and Toyota No. 2, which unify regional operations; and Unit Center, which covers engine, transmission and other “unit”-related operations — in order to realize organizational change that supports operations and earnings responsibility of each unit.

Additionally, in order to achieve sustainable growth through the continuous manufacturing of even-better cars that exceed customer expectations around the world, the TNGA Planning Division, an organization directly under Toyota’s top management, was established in order to rapidly promote the implementation of the “Toyota New Global Architecture (TNGA)”.

In April 2015, with the aim of enhancing operational oversight and further increasing the speed of decision-making and execution of operations, the responsibility for executive vice presidents was changed to making decisions regarding management from a medium to long-term perspective and supervising execution of operations, with executives at senior managing officer level and below now responsible for execution of operations, such as business units, regional operations and key functions.

[System regarding Members of the Board of Directors]

With respect to the system regarding members of the Board of Directors, TMC has comprehensively considered and appointed the right person for the right position to make appropriate and prompt decision-making. TMC believes that it is important to elect individuals that comprehend and engage in the manufacturing of ever-better cars and problem solving based on the actual situation on-site (Genchi Genbutsu) that TMC emphasizes, and contribute to sustainable growth into the future. TMC is examining a proposal to have an “Executive Appointment Meeting”, which is comprised of the Chairman, President, Executive Vice President in charge of Human Resources and Outside Member of the Board of Directors, recommend appointment of Members of the Board of Directors to the Board of Directors.

At the 109th Ordinary General Shareholders’ Meeting held in June 2013, three Outside Members of the Board of Directors were appointed in order to further reflect the opinions of those from outside the company in management’s decision-making process, and all of them are registered as independent officer with the relevant financial instruments exchanges. TMC considers the appointment of Outside Members of the Board of Directors as independent officer in accordance with requirements for Outside Members of the Board of Directors set forth in the Companies Act and independence standards established by the relevant financial instruments exchanges. TMC’s Outside Members of the Board of Directors advise it in its management decision-making process based on their broad experiences and insight in their respective fields of expertise, independently from management structure.

– 13 –

[System regarding Audit & Supervisory Board Members]

TMC has adopted an Audit & Supervisory Board system. Six Audit & Supervisory Board Members (including three Outside Audit & Supervisory Board Members) play a role in TMC’s corporate governance efforts by undertaking audits in accordance with the audit policies and plans determined by the Audit & Supervisory Board. In appointing Audit & Supervisory Board Members, TMC has appointed individuals who have broad experiences and insight in their respective fields of expertise and can advise management from a fair and neutral perspective, as well as audit the execution of business. TMC is examining a proposal to have an “Executive Appointment Meeting”, which is comprised of the Chairman, President, Executive Vice President in charge of Human Resources and Outside Member of the Board of Directors, recommend appointment of Audit & Supervisory Board Members to the Audit & Supervisory Board.

TMC has appointed three Outside Audit & Supervisory Board Members, all of whom are registered as independent officers with the relevant financial instruments exchanges. TMC considers the appointment of Outside Audit & Supervisory Board Members in accordance with requirements for Outside Audit & Supervisory Board Members set forth in the Companies Act and independence standards established by the relevant financial instruments exchanges.

[Remuneration for Members of the Board of Directors and Audit & Supervisory Board Members]

Remuneration for Members of the Board of Directors consists of fixed monthly payment and variable bonus. TMC’s remuneration structure ensures a link with company performance, reflecting job responsibilities and performance of individuals. Level of remuneration is considered based on countries of origin. Bonus is determined based on consolidated operating income of each year, comprehensively taking into account dividends, level of bonus for employees, trends of other companies, mid- to long-term business performance and amounts paid in the past. With respect to remuneration for Outside Members of the Board of Directors, bonus will not be paid in light of their role of monitoring and supervising management from an independent position. TMC is examining a proposal to have an “Executive Appointment Meeting”, which is comprised of the Chairman, President, Executive Vice President in charge of Human Resources and Outside Member of the Board of Directors, recommend to the Board of Directors remuneration for Members of the Board of Directors.

Remuneration for Audit & Supervisory Board Members consists only of fixed monthly payment and bonus is not paid. By making the compensation structure less susceptible to business performance, independence from management is ensured. Remuneration for Audit & Supervisory Board Members is determined upon consultation among Audit & Supervisory Board Members within the scope of remuneration determined by the resolution at the Ordinary General Shareholders’ Meeting.

[Training of Members of the Board of Directors and Audit & Supervisory Board Members]

TMC provides members of the board of directors and audit & supervisory board members with training and activity opportunities to improve understanding and practice of the core ideals of manufacturing even better cars and problem solving based on the actual situation on-site (Genchi Genbutsu), and to encourage their contributions to sustainable growth into the future.

[Limited liability agreements]

TMC has entered into limited liability agreements with Outside Members of the Board of Directors and Outside Audit & Supervisory Board Members pursuant to Article 427, Paragraph 1 of the Companies Act to limit the amount of their liabilities stipulated in Article 423, Paragraph 1 of the Companies Act to the amount stipulated in Article 425, Paragraph 1 of the Companies Act.

– 14 –

[IAB]

TMC has an “International Advisory Board” consisting of advisors from each region overseas, and, as appropriate, receives advice on a wide range of management issues from a global perspective. In addition, TMC deliberates on and monitors management and corporate activities based on views of various stakeholders through a wide variety of bodies for deliberations, including the “Labor-Management Council, the Joint Labor-Management Round Table Conference”.

[Internal controls and internal audits]

The state of internal controls and internal audits are reported to Audit & Supervisory Board Members (including Outside Audit & Supervisory Board Members) through the Audit & Supervisory Board and the “Corporate Governance Committee”, and the status of accounting audits is reported by Independent External Auditors to the Audit & Supervisory Board Members (including Outside Audit & Supervisory Board Members) through the Audit & Supervisory Board. To enhance the system for internal audits, a specialized organization made independent of direct control by the management evaluates the effectiveness of the system to secure the appropriateness of documents regarding financial calculation and other information in accordance with Section 404 of the U.S. Sarbanes Oxley Act and Article 24-4-4 (1) of the Financial Instruments and Exchange Law of Japan. In order to enhance the reliability of the financial reporting of TMC, the three auditing functions — audit by Audit & Supervisory Board Members, internal audit, and accounting audit by Independent External Auditors — aid in conducting an effective and efficient audit through meetings held periodically and as necessary to share information and come to understandings through discussion on audit plans and results.

TMC has also created a number of channels for employees to make inquiries concerning compliance matters, including the Compliance Hotline, which enables them to consult with an outside attorney, and takes measures to ensure that TMC is aware of significant information concerning legal compliance as quickly as possible. TMC will continue to promote the “Toyota Code of Conduct” which is a guideline for employees’ behavior and conduct for employees of TMC and its consolidated subsidiaries all around the world. TMC will work to advance corporate ethics through training and education at all levels and in all departments.

[Efforts to enhance corporate value]

In terms of CSR and enhancement of corporate value, under the Board of Directors, the “Corporate Planning Committee” considers growth strategies that weave in TMC’s contributions to various social issues and TMC promotes on a company-wide basis CSR and enhancement of corporate value as part of business operations. As part of management of operations, the “Corporate Governance Committee” deliberates the corporate governance structure that executes such strategies.

Through these efforts, TMC is continuously committed to enhancing corporate value.

| 3. | Reason for the selection of the current corporate governance system |

TMC believes it is important to put in place a system that enables customer opinions and on-site information to be swiftly communicated to management in order to make a prompt management decision, and enables it to review whether such management decisions are accepted by its customers and society. TMC believes that its current system, involving the supervision and auditing of the execution of business by its Board of Directors (including Outside Members of the Board of Directors) and Audit & Supervisory Board Members (including Outside Audit & Supervisory Board Members), is the most appropriate system.

– 15 –

| III. | Implementation of measures for shareholders and other stakeholders |

1. Approach toward the vitalization of General Shareholders’ Meeting and the facilitation of exercise of voting rights

| Supplementary Information | ||

| Early distribution of notice of convocation of General Shareholders’ Meeting |

In connection with the 111th Ordinary General Shareholders’ Meeting held on June 16, 2015, TMC distributed the notice of convocation of General Shareholders’ Meeting 22 days prior to the date of the meeting and posted the notice of convocation on its homepage prior to distribution. | |

| Scheduling of General Shareholders’ Meeting avoiding the date on which General Shareholders’ Meeting of companies are concentrated |

TMC convenes General Shareholders’ Meeting avoiding the date on which General Shareholders’ Meeting of companies are most and second most concentrated on. | |

| Exercise of voting rights by electronic means |

TMC enables shareholders to exercise voting rights on the Internet. | |

| Measures aimed at participation in electronic voting platforms and other improvements in voting environments geared towards institutional investors |

TMC participates in an electronic voting platform for institutional investors operated by ICJ Corporation. | |

| Provision of summary English-language convocation notices |

TMC creates English-language convocation notices, and makes them available on both its company homepage as well as within electronic voting platforms for institutional investors. | |

| 2. | IR activities |

| Explanation by representative members of the board |

Supplementary Information | |||

| Convene periodic briefing for individual investors |

No | In addition to convening briefings a few times a year (not regularly scheduled), on the exclusive site for individual investors, the operating summary and business activities are clearly disclosed. | ||

| Convene periodic briefing for analysts and institutional investors |

Yes | Explaining financial results and business strategies of the relevant business year every quarter. Also convenes business briefings (unscheduled) concerning the medium- and long-term direction of the business. | ||

| Convene periodic briefing for foreign investors |

Yes | Explaining financial results and business strategies of the relevant business year by visiting foreign investors and holding conference calls every quarter. In addition, business briefings (unscheduled) concerning the medium- and long-term direction of the business are convened in the United States and in Europe. | ||

| Disclosure of IR documents on the website |

— | In addition to legal disclosure documents such as annual securities reports, reference materials for earnings results briefings, etc. are timely disclosed as well. TMC works to enhance its information services by distributing videos of TMC’s press conferences, such as announcements of new model launches. | ||

| IR related divisions (personnel) |

— | TMC maintains IR personnel in the Accounting Division and Public Affairs Division, and offices resident IR personnel in New York and London. | ||

| Other |

— | Implementing one-on-one meetings with investors, plant tours, etc. | ||

– 16 –

| 3. | Activities concerning respect for stakeholders |

| Supplementary Information | ||

| Setting forth provisions in the internal regulations concerning respect for the stakeholders’ position |

For sustainable development, TMC has engaged in management emphasizing all of its stakeholders, and worked to maintain and develop favorable relationships with its stakeholders through open and fair communication. This philosophy is outlined and disclosed in the CSR Policy “Contribution towards Sustainable Development”. | |

| Promotion of environmental preservation activities and CSR activities |

TMC has long engaged in business with the idea of corporate social responsibility (“CSR”) in mind. This idea is clarified in the CSR Policy “Contribution towards Sustainable Development”, and it clearly conveys TMC’s basic policies concerning CSR to both internal and external stakeholders. Regarding the environment, TMC has positioned it as a top management priority and adopted the “Toyota Earth Charter” in 1992. TMC created the “Toyota Environmental Action Plan” that sets forth mid-term targets and action plans on a global basis, and promotes continuous environmental preservation activities. As for philanthropic activities, TMC newly adopted the “Basic Philosophy and Policy on Philanthropic Activities” in 2005 in light of the global expansion of its business and the increasing societal expectations towards Toyota. TMC vigorously promotes philanthropic activities according to local conditions in each country and region in order to contribute to the development of a prosperous society and to promote its continuous development. These CSR activities are disclosed in the report titled “Sustainability Report”. | |

| Establishment of policy concerning disclosure of information to stakeholders |

TMC has engaged in timely and fair disclosure of corporate and financial information as stated in the CSR Policy “Contribution towards Sustainable Development”. In order to ensure the accurate, fair, and timely disclosure of information, TMC has established the Disclosure Committee chaired by an officer of the Accounting Division. The Committee holds regular meetings for the purpose of preparation, reporting and assessment of its annual securities report and quarterly report under the Financial Instruments and Exchange Law of Japan and Form 20-F under the U.S. Securities Exchange Act, and also holds extraordinary committee meetings from time to time whenever necessary. | |

– 17 –

| Others | [Independent Action Plan to Increase Opportunities for Women] Since TMC began full-scale hiring of women for office and technical positions in 1992 as part of its HR policy to respect diversity, it has focused on various actions aimed at enhancing and strengthening support for working mothers from the standpoint of long-term employment and human resource development. As a result of these actions, over the last 10 years, the turnover rate for women in office and technical positions has declined (from 5.8% in fiscal year ended March 31, 2003 to 1.2% in fiscal year ended March 31, 2014), and the number of female managers has increased (from 16 in 2004 to 111 in 2015).

Currently, activities center around further promotion of women in the workforce, taking further actions to enhance and strengthen the following activities, with the aim of encouraging female workers to return to work early from maternity leave in order to minimize career break or delay after taking long-term maternity leave.

<<Main Activities>> [Hiring] | |||

| n |

Higher new employee hiring rates for female graduates (office: 40%, technical: 10%) Over the mid- to long-term, stronger hiring efforts will be made to achieve employment and manager position rates for women in office and technical positions that are equivalent to the rates in the relevant labor market (office: 40%, technical: 10%). | |||

| [Expansion of policies providing support for work and raising a family and minimizing a career break] | ||||

| n |

In-house child care facilities (in 3 locations) and measures to support child rearing under review | |||

| n |

Expansion of maternity leave (maximum of 2 years) | |||

| n |

Expansion of systems to allow shorter work hours and working at home (until the child reaches 4th grade) | |||

| * |

Introduction of a system to allow women to work at home all day until the child reaches one year of age in order to provide support for early return to workplace | |||

| n |

Introduction of work leave in order to take care of a sick or injured child (until the child reaches the 4th grade) | |||

| [Formation of career consciousness in early stages and systematic and thorough human resource development] | ||||

| n |

Establish and carry out tailored career plans for all women which take into account individual office/technical worker’s life events | |||

| n |

Provide support for creating networks among women in office and technical positions through meetings and SNS | |||

| n |

Establishment of the “Sodatete Net” website offering information for women striving to achieve a balance between working and parenting as well as career formation | |||

| n |

Holding pre-maternity leave seminars for women about to take leave, their superiors and their spouses | |||

| n |

Introduction of the Pro Career Comeback System for the rehiring of employees who resign when a spouse is transferred, etc. | |||

| n |

Conversations with foreign female executives | |||

| [Others] | ||||

| n |

Establishment of a “Toyota Group Female Engineer Fund / Foundation” | |||

| In order to support students going on to higher education in science courses, TMC, together with its group companies, established the “Toyota Group Female Engineer Fund/Foundation” to carry out such actions as providing scholarships and sending engineers to lecture at junior and senior high schools in collaboration with Toyota Group companies and Aichi Prefecture. | ||||

| <<Target to appoint women to managers>> | ||||

| Through the efforts above, TMC aims to triple the number of female managers by 2020 and achieve a five-fold increase by 2030 compared to 2014 when the target was set. | ||||

| [Appointment of female managers] As of the filing date of this report, Yoko Wake is the only female out of twelve Members of the Board of Directors and six Audit & Supervisory Board Members. | ||||

– 18 –

| IV. | Basic Approach to Internal Control System and its Development |

| 1. | Basic Policy Regarding the System to Secure the Appropriateness of Business |

TMC, together with its subsidiaries, has created and maintained a sound corporate climate based on the “Guiding Principles at Toyota” and the “Toyota Code of Conduct”. TMC integrates the principles of problem identification and continuous improvement into its business operation process and makes continuous efforts to train employees who will put these principles into practice.

Accordingly, TMC has developed its basic policy regarding the following items as stipulated in the Companies Act:

| (1) | System to ensure that the Members of the Board of Directors execute their responsibilities in compliance with relevant laws and regulations and the Articles of Incorporation |

1) TMC will ensure that Members of the Board of Directors act in compliance with relevant laws and regulations and the Articles of Incorporation, based on the Code of Ethics and other explanatory documents that include necessary legal information, presented on occasions such as trainings for new Members of the Board of Directors.

2) TMC will make decisions regarding business operations after comprehensive discussions at the Board of Directors’ meeting and other meetings of various cross-sectional decision-making bodies. Matters to be decided are properly submitted and discussed at the meetings of those decision-making bodies in accordance with the relevant rules.

3) TMC will appropriately discuss significant matters and measures relating to issues such as corporate ethics, compliance and risk management at the Corporate Governance Meeting and other meetings.

| (2) | System to retain and manage information relating to the execution of the duties of Members of the Board of Directors |

Information relating to exercising duties by Members of the Board of Directors shall be appropriately retained and managed by each division in charge pursuant to the relevant internal rules and laws and regulations.

| (3) | Rules and systems related to the management of risk of loss |

1) TMC will properly manage the capital fund through its budgeting system and other forms of control, conduct business operations, and manage the budget, based on the authorities and responsibilities in accordance with the “Ringi” system (effective consensus-building and approval system) and other systems. Significant matters will be properly submitted and discussed at the Board of Directors’ meeting and other meetings of various bodies in accordance with the standards stipulated in the relevant rules.

2) TMC will ensure accurate financial reporting by issuing documentation on the financial flow and the control system, etc., and by properly and promptly disclosing information through the Disclosure Committee.

3) TMC will manage various risks relating to safety, quality, the environment, etc. and compliance by establishing coordinated systems with all regions, establishing rules or preparing and delivering manuals and by other means, as necessary through each relevant division.

4) As a precaution against events such as natural disasters, TMC will prepare manuals, conduct emergency drills, arrange risk diversification and insurance, etc. as needed.

| (4) | System to ensure that Members of the Board of Directors exercise their duties efficiently |

1) TMC will manage consistent policies by specifying the policies at each level of the organization based on the medium- to long-term management policies and the Company’s policies for each fiscal term.

2) The Members of the Board of Directors will promptly determine the management policies based on precise on-the-spot information and, in accordance with Toyota’s advantageous “field-oriented” approach, appoint and delegate a high level of authority to officers who take responsibility for business operations in each region, function, and process. The responsible officers will proactively compose relevant business plans under their leadership and execute them in a swift and timely manner in order to carry out Toyota’s management policies. The Members of the Board of Directors will supervise the execution of duties by the responsible officers.

3) TMC, from time to time, will make opportunities to listen to the opinions of various stakeholders, including external experts in each region, and reflect those opinions in TMC’s management and corporate activities.

– 19 –

| (5) | System to ensure that employees conduct business in compliance with relevant laws and regulations and the Articles of Incorporation |

1) TMC will clarify the responsibilities of each organization unit and maintain a basis to ensure continuous improvements in the system.

2) TMC will continuously review the legal compliance and risk management framework to ensure effectiveness. For this purpose, each organization unit shall confirm the effectiveness by conducting self-checks, among others, and report the result to the Corporate Governance Meeting and other meetings.

3) TMC will promptly obtain information regarding legal compliance and corporate ethics and respond to problems and questions related to compliance through its Compliance Hotline that TMC established outside the company, as well as through other channels.

| (6) | System to ensure the appropriateness of business operations of the corporation and the business group consisting of the parent company and subsidiaries |

To share Toyota’s management principles, TMC will expand the “Guiding Principles at Toyota” and the “Toyota Code of Conduct” to its subsidiaries, and develop and maintain a sound environment of internal controls for the business group by also promoting its management principles through exchanges of personnel. In addition, TMC will manage its subsidiaries in a comprehensive manner appropriate to their positioning by clarifying the roles of the division responsible for the subsidiaries’ financing and management and the roles of the division responsible for the subsidiaries’ business activities. Those divisions will confirm the appropriateness and legality of the operations of the subsidiaries by exchanging information with those subsidiaries, periodically and as needed.

1 System concerning a report to the corporation on matters relating to the execution of the duties of Members of the Board of Directors, etc. of subsidiaries

TMC will require prior consent of TMC or a report to TMC on important managerial matters of subsidiaries based on the internal rules agreed between TMC and its subsidiaries. The important managerial matters of subsidiaries will be discussed at TMC’s Board of Directors’ meeting and other meetings in accordance with the standards stipulated in the relevant rules relating to submission of matters to such meetings.

2 Rules and systems related to the management of risk of loss at subsidiaries

TMC will require its subsidiaries to establish a system to implement initiatives related to the management of risk, such as finance, safety, quality, environment, and natural disasters, and require them to immediately report to TMC on significant risks. TMC will discuss significant matters and measures at the Corporate Governance Meeting and other meetings in accordance with the standards stipulated in the relevant rules relating to submission of matters to such meetings.

3 System to ensure that Members of the Board of Directors, etc. of subsidiaries exercise their duties efficiently

TMC will require Members of the Board of Directors of its subsidiaries to promptly determine the management policies based on precise on-the-ground information, determine responsibilities, implement appropriate delegation of authority based on the responsibilities, and efficiently conduct business.

4 System to ensure that the Members of Board of Directors, etc. and employees of subsidiaries conduct business in compliance with relevant laws and regulations and the Articles of Incorporation

TMC will require its subsidiaries to establish a system concerning compliance. TMC will periodically confirm its status and report the result to TMC’s Corporate Governance Meeting and other meetings. TMC will promptly obtain information regarding legal compliance and corporate ethics of its subsidiaries and respond to problems and questions related to compliance of its subsidiaries through the whistleblower offices established by its subsidiaries and through the whistleblower office that TMC has established outside the company and cover its subsidiaries in Japan and other channels.

– 20 –

| (7) | System concerning employees who assist the Audit & Supervisory Board Members when required; system concerning independence of the said employees from Members of Board of Directors; and system to ensure the effectiveness of instructions from the Audit & Supervisory Board Members to the said employees |

TMC has established the Audit & Supervisory Board Office and has assigned a number of full-time staff to support this function. The said employees must follow the directions and orders from the Audit & Supervisory Board Members, and any changes in its personnel will require prior consent of the Audit & Supervisory Board or a full-time Audit & Supervisory Board Member selected by the Audit & Supervisory Board.

| (8) | System concerning a report to Audit & Supervisory Board Members and system to ensure that a person who has made the said report does not receive unfair treatment due to the making of said report |

1) Members of the Board of Directors, from time to time, will properly report to the Audit & Supervisory Board Members any major business operations through the divisions in charge. If any fact that may cause significant damage to TMC and its subsidiaries is discovered, they will report the matter to the Audit & Supervisory Board Members immediately.

2) Members of the Board of Directors, Senior Managing Officers, Managing Officers, and employees will report on the business upon requests by the Audit & Supervisory Board Members periodically and as needed, and Members of the Board of Directors, etc. of subsidiaries will report as necessary. In addition, Members of the Board of Directors, Senior Managing Officers, Managing Officers, and employees will report to Audit & Supervisory Board Members on the significant matters that have been reported to the whistleblower offices established by TMC or its subsidiaries.

3) TMC will maintain internal rules stipulating that a person who has made a report to the Audit & Supervisory Board Members will not receive unfair treatment due to the making of said report.

| (9) | Policies on prepaid expenses for the execution of the duties of the Audit & Supervisory Board Members, on expenses for procedures for repayment and the execution of other relevant duties, or on debt processing |

Regarding the expenses necessary for the Audit & Supervisory Board Members to execute their duties, TMC will take appropriate budgetary steps to secure the amount that the Audit & Supervisory Board Members deem necessary. TMC will also pay for expenses that become necessary as a result of circumstances that were not expected at the time of the taking of budgetary steps.

| (10) | Other systems to ensure that the Audit & Supervisory Board Members conducted audits effectively |

TMC will ensure that the Audit & Supervisory Board Members attend major Executives’ Meetings, inspect important Company documents, and make opportunities to exchange information between the Audit & Supervisory Board Members and Accounting Auditor periodically and as needed, as well as appoint external experts.

| 2. | Basic Policy and Preparation towards the Elimination of Antisocial Forces |

| (1) | Basic Policy for Elimination of Antisocial Forces |

Based upon the “Guiding Principles at Toyota” and the “Toyota Code of Conduct”, TMC’s basic policy is to have no relationship with antisocial forces. TMC will take resolute action as an organization against any undue claims and actions by antisocial forces or groups, and has drawn the attention of such policy to its employees by means such as clearly stipulating it in the “Toyota Code of Conduct”.

– 21 –

| (2) | Preparation towards Elimination of Antisocial Forces |

| 1) | Establishment of Divisions Overseeing Measures Against Antisocial Forces and Posts in Charge of Preventing Undue Claims |

TMC established divisions that oversee measures against antisocial forces (“Divisions Overseeing Measures Against Antisocial Forces”) in its major offices as well as assigned persons in charge of preventing undue claims. TMC also established a system whereby undue claims, organized violence and criminal activities conducted by antisocial forces are immediately reported to and consulted with Divisions Overseeing Measures Against Antisocial Forces.

| 2) | Liaising with Specialist Organizations |

TMC has been strengthening its liaison with specialist organizations by joining liaison committees organized by specialists such as the police. It has also been receiving guidance on measures to be taken against antisocial forces from such committees.

| 3) | Collecting and Managing Information concerning Antisocial Forces |

By liaising with experts and the police, Divisions Overseeing Measures Against Antisocial Forces share up-to-date information on antisocial forces and utilize such information to call TMC’s employees’ attention to antisocial forces.

| 4) | Preparation of Manuals |

TMC compiles cases concerning measures against antisocial forces and distributes them to each department within TMC.

| 5) | Training Activities |

TMC promotes training activities to prevent damages caused by antisocial forces by sharing information on antisocial forces within the company as well as holding lectures at TMC and its group companies.

| V. | Others |

| 1. | Matters regarding defense against a takeover bid |

| Matters regarding defense against a takeover bid |

None |

Supplementary Information

No measures to defend against a takeover bid are scheduled to be adopted.

| 2. | Matters regarding other corporate governance systems, etc. |

Company Structure and Procedures Regarding Timely Disclosure

The following describes Toyota’s company structure and procedures regarding the timely disclosure of Company information.

(Guiding Principles)

Toyota practices its guiding principle of disclosing operating results, business and financial information in a timely and appropriate manner. Such guiding principles are set forth in the CSR Policy “Contribution towards Sustainable Development.”

(Disclosure Committee and its Purpose)

Toyota has established a Disclosure Committee that is chaired by the officer responsible for the accounting division in an effort to ensure that the information disclosed is accurate, fair and timely.

The Disclosure Committee meets periodically to draft, report and assess annual and quarterly reports prepared pursuant to the Japanese Financial Instruments and Exchange Act, and annual reports prepared pursuant to the U.S. Securities Exchange Act of 1934, as amended. The Disclosure Committee also holds meetings on an ad hoc basis as necessary.

– 22 –

(Procedures of the Disclosure Committee)

The Disclosure Committee performs the following procedures:

| (1) | Collection of information |

Collect information of Toyota and its subsidiaries that may be subject to disclosure based on the materiality standards set forth by the Disclosure Committee through periodic and timely communications with the heads of the relevant divisions responsible for information disclosure.

| (2) | Assessment of material information to be disclosed |

Assess disclosure of collected information based on applicable laws, regulations and guidelines, such as stock exchange rules, the Japanese Financial Instruments and Exchange Act, and the U.S. Securities Exchange Act.

| (3) | Disclosure based on assessment |

Based on the assessment made above, disclose information in a timely manner. When necessary, a report to the company representative and certification procedures on the disclosure documents will precede the disclosure. The Audit & Supervisory Board Members (or the Audit & Supervisory Board) may receive reports from the Disclosure Committee as necessary and may provide opportunities for reporting and Q & A sessions with company representatives.

| (4) | Ensuring of appropriate information collection and disclosure procedures |

Make further efforts to enhance the company structure pertaining to timely and fair disclosure: the internal auditing division assesses the overall information disclosure process, and independent external auditors and outside legal counsel provide support in establishing disclosure controls and procedures, and offer guidance on the sufficiency and appropriateness of the disclosure information.

| (5) | Provision of company regulation |

Details of the procedures and the organizational structure mentioned above are stipulated in the Company’s internal disclosure guidelines.

– 23 –

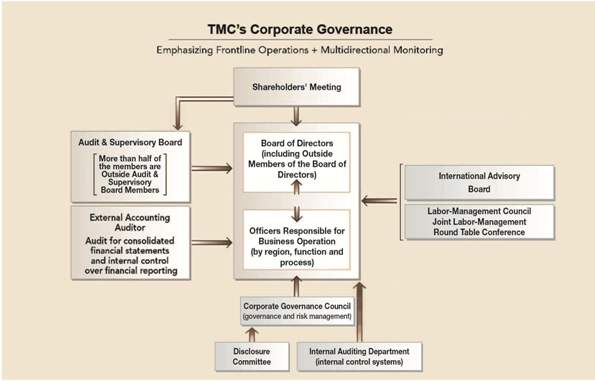

Diagram as Supplementary Information

– 24 –

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Salesforce talks to buy Informatica fall through- reports

- Toyota Camry Goes Exclusively Hybrid Plus a New Look and More Technology

- Toyota Reignites 'Start Your Impossible' Campaign: A Global Vision with Local Action, Emphasizing Belief that No Journey is Taken Alone

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share