Form 8-K Under Armour, Inc. For: Jun 15

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): June 15, 2015

UNDER ARMOUR, INC.

(Exact name of Registrant as Specified in its Charter)

| Maryland | 001-33202 | 52-1990078 | ||

| (State or other Jurisdiction of Incorporation or Organization) |

(Commission File Number) |

(IRS Employer Identification No.) | ||

| 1020 Hull Street, Baltimore, Maryland | 21230 | |||

| (Address of principal executive offices) | (Zip code) | |||

Registrant’s telephone number, including area code: (410) 454-6428

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| x | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 1.01. | Entry into a Material Definitive Agreement. |

On June 15, 2015, Under Armour, Inc. (“Under Armour” or the “Company”) and Kevin Plank, Under Armour’s founder, Chairman of the Board and Chief Executive Officer, entered into a Confidentiality, Non-Competition and Non-Solicitation Agreement (the “Noncompete Agreement”). Under the terms of the Noncompete Agreement, Mr. Plank has agreed not to compete with Under Armour or solicit its employees, customers and suppliers and prospective customers and suppliers (other than on behalf of Under Armour) during Mr. Plank’s tenure with Under Armour and for five years thereafter.

Under Armour and Mr. Plank entered into the Noncompete Agreement in connection with certain proposed stock and governance changes approved by the Board of Directors of the Company (the “Board”). These include the creation of a new class of non-voting common stock designated as the Class C Common Stock (described below), certain proposed amendments to Under Armour’s charter (the “Charter”) that provide various governance and other benefits to the Company and its stockholders, other than Mr. Plank (the “Charter Amendments”), and the proposed declaration and payment of a dividend by Under Armour of one share of Class C Common Stock for each outstanding share of Under Armour Class A Common Stock and Class B Common Stock (the “Class C Dividend”). Under Armour’s stockholders will vote on the Charter Amendments at a special meeting scheduled to be held on August 26, 2015 (the “Special Meeting”).

The Noncompete Agreement requires Mr. Plank (and the manager with voting power over certain shares of Class B Common Stock held by two limited liability companies controlled by Mr. Plank) to vote, and to cause to be voted, at the Special Meeting all shares of Under Armour Class A Common Stock and Class B Common Stock beneficially owned by Mr. Plank and his affiliates and associates in favor of each of the Charter Amendments and certain other matters recommended by the Board for approval by Under Armour’s stockholders at the Special Meeting. The Noncompete Agreement also specifies the circumstances under which Mr. Plank may be terminated for “cause” and the process for any termination for “cause,” which, giving effect to the Charter Amendments, would result in the conversion of Under Armour’s Class B Common Stock into Class A Common Stock.

The Noncompete Agreement became effective on June 15, 2015; however, if the Board determines not to proceed with the Class C Dividend, the Noncompete Agreement will automatically terminate.

The summary of the terms of the Noncompete Agreement described above is qualified in its entirety by reference to the full text of the provisions of the Noncompete Agreement filed as Exhibit 10.1 to this Current Report on Form 8-K, which is incorporated herein by reference.

| Item 3.03. | Material Modification to Rights of Security Holders. |

The information disclosed under Item 5.03 is incorporated herein by reference.

| Item 5.03. | Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year. |

In connection with the anticipated Class C Dividend described in Item 1.01 above, the Board approved an amendment to the Charter (the “Share Increase Amendment”) to increase the total number of shares of stock that the Company is authorized to issue to 835,700,000 shares, of which 400,000,000 shares are designated as shares of Class A Common Stock and 35,700,000 shares are designated as shares of Class B Common Stock. The Share Increase Amendment created an additional 400,000,000 shares of common stock that were not designated as any class by the Board. The Share Increase Amendment did not require shareholder approval and became effective on June 15, 2015. The summary of the terms of the Share Increase Amendment described above is qualified in its entirety by reference to the full text of the provisions of the Share Increase Amendment filed as Exhibit 3.1 to this Current Report on Form 8-K, which is incorporated herein by reference.

The Board also approved Articles Supplementary to the Charter which designate the new 400,000,000 shares of common stock created through the Share Increase Amendment as a new class of common stock, referred to as the Class C Common Stock, par value $.0003 1/3 per share. The Articles Supplementary establish the terms of the Class C Common Stock, which are substantially identical to Under Armour’s Class A Common Stock, except that the Class C Common Stock has no voting rights (except in certain limited circumstances as described below), will

automatically convert into Class A Common Stock under certain circumstances and includes provisions intended to ensure equal treatment of Class C Common Stock and Class B Common Stock in certain corporate transactions, such as mergers, consolidations, statutory share exchanges, conversions or negotiated tender offers, and including consideration incidental to these transactions.

The Articles Supplementary became effective on June 15, 2015, upon filing with the Maryland State Department of Assessments and Taxation. Under Armour has not yet issued any shares of Class C Common Stock and expects that it will not issue any such shares until the declaration and payment of the Class C Dividend. The Board currently intends to declare and pay the Class C Dividend following the approval of the Charter Amendments by stockholders at the Special Meeting. However, the decision to proceed with, and timing of, the Class C Dividend will be made by the Board in its discretion and there can be no assurance that the Class C Dividend will be declared or paid.

The terms of the Class C Common Stock are more fully described in the Articles Supplementary filed as Exhibit 3.2 to this Current Report on Form 8-K and incorporated herein by reference. The following summary of the terms of the Class C Common Stock should be read in conjunction with, and is qualified in its entirety by reference to, the full text of the provisions of the Articles Supplementary.

Voting Rights. Holders of shares of Class C Common Stock have no voting rights, except (a) as may be required by law, (b) with respect to amendments to the provisions of the Charter that set forth the terms of the Class C Common Stock and have a material adverse effect on the rights of the Class C Common Stock, which require the affirmative vote of a majority of the votes entitled to be cast thereon by holders of Class C Common Stock, voting as a single class, (c) with respect to amendments to the equal treatment provision described below affecting the holders of the Class C Common Stock, which must be declared advisable by the Board, including at least 75% of the independent members of the Board, and approved by at least 75% of the votes entitled to be cast thereon by the holders of (1) Class C Common Stock (other than Mr. Plank, his family entities, his family members or executive officers of Under Armour), voting as a single class, and (2) Class B Common Stock, voting as a single class, and (d) upon the conversion of the outstanding shares of Class B Common Stock into shares of Class A Common Stock, upon which holders of shares of Class C Common Stock will immediately have voting rights equal to holders of shares of Class A Common Stock and will vote together with the Class A Common Stock as a single class.

Dividends. Subject to preferences that may apply to any shares of preferred stock outstanding at the time, the holders of shares of Class C Common Stock will be entitled to share equally with the holders of Class A Common Stock and Class B Common Stock, on a per share basis, in any dividends that our Board may determine to issue from time to time. In the event that a dividend is paid in the form of shares of Class A Common Stock or Class B Common Stock, or rights to acquire shares of Class A Common Stock or Class B Common Stock, the holders of shares of Class C Common Stock will receive shares of Class C Common Stock, or rights to acquire shares of Class C Common Stock, as the case may be.

Liquidation. Upon our liquidation, dissolution or winding-up, the holders of Class C Common Stock will be entitled to share proportionately, on a per share basis, with the holders of the Class A Common Stock and Class B Common Stock in the assets of Under Armour available for distribution after payment of any liabilities and the liquidation preferences on any outstanding preferred stock.

Conversion. Upon conversion of the outstanding shares of Class B Common Stock into shares of Class A Common Stock, the Class C Common Stock will be automatically converted into shares of Class A Common Stock on a one-for-one basis on a date fixed by Under Armour that is as soon as reasonably practicable and in accordance with the Articles Supplementary and any further procedures required by Under Armour. As described above, upon conversion of the Class B Common Stock into Class A Common Stock but prior to the conversion of the Class C Common Stock into Class A Common Stock, the Class C Common Stock will immediately be entitled to vote together with the Class A Common Stock as a single class on all matters. Except as so provided, the Class C Common Stock will not be convertible into any other class of capital stock.

Giving effect to the Charter Amendments (which, following approval by stockholders at the Special Meeting, are expected to become effective immediately prior to the declaration and payment of the Class C Dividend), the Charter will provide that each share of Class B Common Stock will automatically convert into one share of Class A Common Stock (thereby triggering the conversion of the Class C Common Stock into Class A Common Stock) upon (a) the record date for any

meeting of Company stockholders, if the aggregate number of shares of Class A Common Stock and Class B Common Stock beneficially owned on that record date by Mr. Plank and his family entities, when taken together, is less than 15.0% of the total number of shares of Class A Common Stock and Class B Common Stock outstanding on that record date, (b) the death of Mr. Plank, (c) Mr. Plank ceasing to be affiliated with Under Armour in any capacity as a result of permanent disability, (d) Mr. Plank’s resignation from Under Armour or termination for “cause,” or (e) the sale, or other disposition, by Mr. Plank of more than 2.5 million shares of Under Armour’s common stock in any calendar year beginning in the year of the record date for the Class C Dividend (such number giving effect to the split resulting from the Class C Dividend), subject to a rollover feature that will allow Mr. Plank to sell additional shares in any calendar year without such conversion taking place to the extent his sales in prior calendar years commencing with the calendar year of the Class C Dividend are below 2.5 million shares.

Equal Treatment. In the event of any merger or consolidation of Under Armour with or into another entity, a statutory share exchange between Under Armour and any other entity or the conversion of Under Armour into another entity (whether or not Under Armour is the surviving entity) or a third party tender offer entered into pursuant to an agreement with Under Armour, each holder of shares of Class C Common Stock will be entitled to receive the same consideration as each holder of shares of Class B Common Stock on a per share basis, and each holder of shares of Class C Common Stock will be entitled to receive the same consideration on a per share basis as each holder of shares of Class B Common Stock is entitled to receive on a per share basis in connection with a transfer of such shares of Class B Common Stock incidental to such merger, consolidation, statutory share exchange, conversion or negotiated tender offer, even if the consideration for such transfer is not paid as consideration in such merger, consolidation, statutory share exchange, conversion or negotiated tender offer. However, any amounts paid to Mr. Plank as compensation for services rendered or to be rendered by Mr. Plank to Under Armour or any acquiring entity or any of their respective affiliates (for example, participating in a retention bonus pool established in connection with a proposed merger or compensation paid for pre- or post-merger services), which payment was approved by a majority of the independent members of the Board, will not be deemed to be part of such consideration. Giving effect to the Charter Amendments, the equal treatment provisions of the Class A Common Stock and Class C Common Stock will be substantially identical.

| Item 8.01. | Other Events. |

On June 15, 2015, Under Armour announced that its Board had unanimously approved the creation of the Class C Common Stock and the Charter Amendments described above. A copy of the press release issued by Under Armour relating to these changes is filed as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference. A copy of a letter from Mr. Plank to Under Armour’s stockholders relating to these changes is filed as Exhibit 99.2 to this Current Report on Form 8-K and is incorporated herein by reference. Under Armour’s internal communication documents describing these changes are filed as Exhibit 99.3 to this Current Report on Form 8-K and are incorporated herein by reference.

Note About Forward-Looking Statements

This Current Report on Form 8-K includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 about Under Armour’s planned dividend of shares of the new Class C Common Stock, its Charter Amendments and the upcoming special meeting of Under Armour’s stockholders expected to be held on August 26, 2015 (the “Special Meeting”). These forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties, which could cause actual events to differ materially from those reflected in the forward-looking statements. Factors that could affect expectations and assumptions include, among others, the timing of the declaration of the Class C Dividend.

Additional Information and Where to Find It

This Current Report on Form 8-K may be deemed to be solicitation material in respect of the solicitation of proxies from stockholders for the Special Meeting. Under Armour intends to file with the Securities and Exchange Commission (the “SEC”) and make available to the holders of Under Armour common stock as of the record date for the Special Meeting a proxy statement containing important information relating to certain stock and governance related amendments to Under Armour’s charter and other matters to be considered by the stockholders of Under

Armour at the Special Meeting (the “Proposals”). BEFORE MAKING ANY VOTING DECISION, UNDER ARMOUR’S STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO), WHEN IT BECOMES AVAILABLE, CAREFULLY AND IN ITS ENTIRETY BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION RELATING TO THE PROPOSALS.

Investors will be able to obtain the proxy statement and other relevant materials, when available, free of charge at the SEC’s website (http://www.sec.gov). In addition, documents filed with the SEC by Under Armour, including the proxy statement when available, will be available free of charge from Under Armour at Under Armour’s website (http://www.uabiz.com), or by writing to Under Armour, Inc., 1020 Hull Street, Baltimore, Maryland 21230, Attn: Secretary.

Participants in the Solicitation

Under Armour and its directors and executive officers may be deemed to be participants in the solicitation of proxies from Under Armour’s stockholders with respect to the Proposals to be considered at the Special Meeting. Information regarding the names, affiliations, and direct or indirect interests (by security holdings or otherwise) of these individuals will be set forth in the proxy statement and the other relevant documents to be filed with the SEC. Stockholders can find information about Under Armour and its directors and executive officers and their ownership of Under Armour’s common stock in Under Armour’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014 and in its definitive proxy statement for the 2015 annual meeting filed with the SEC on March 13, 2015. Additional information regarding the interests of these individuals in the Proposals and their ownership of Under Armour’s common stock will also be included in the definitive proxy statement for the Special Meeting.

| Item 9.01. | Financial Statements and Exhibits. |

| (d) | Exhibits: |

| Exhibit No. |

Description | |

| 3.1 | Articles of Amendment to the Under Armour, Inc. Charter. | |

| 3.2 | Articles Supplementary setting forth the terms of the Class C Common Stock, dated June 15, 2015 (incorporated by reference to Appendix F to the Preliminary Proxy Statement filed by Under Armour, Inc. on June 15, 2015). | |

| 10.1 | Confidentiality, Non-Competition and Non-Solicitation Agreement, dated June 15, 2015, between Under Armour, Inc. and Kevin Plank (incorporated by reference to Appendix E to the Preliminary Proxy Statement filed by Under Armour, Inc. on June 15, 2015). | |

| 99.1 | Press release of Under Armour, Inc., dated June 15, 2015. | |

| 99.2 | Letter from Kevin Plank to the stockholders of Under Armour, Inc., dated June 15, 2015. | |

| 99.3 | Under Armour’s internal communication documents relating to the stock and governance changes. | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| UNDER ARMOUR, INC. | ||||||

| By: | /s/ John P. Stanton | |||||

| John P. Stanton | ||||||

| Date: June 15, 2015 | Senior Vice President, General Counsel & Secretary | |||||

Exhibit 3.1

UNDER ARMOUR, INC.

ARTICLES OF AMENDMENT

Under Armour, Inc., a Maryland corporation (the “Corporation”), hereby certifies to the State Department of Assessments and Taxation of Maryland (the “Department”) that:

FIRST: The first sentence of Article SIXTH of the charter of the Corporation (the “Charter”) is hereby deleted and the following is inserted in lieu thereof:

SIXTH: The total number of shares of capital stock that the Corporation has the authority to issue is Eight Hundred and Thirty-Five Million, Seven Hundred Thousand (835,700,000) shares, all of which consist of common stock, par value $0.0003 1/3 per share (the “Common Stock”), of which Four Hundred Million (400,000,000) shares are designated as shares of Class A Common Stock, par value $0.0003 1/3 per share (the “Class A Common Stock”), and Thirty-Five Million, Seven Hundred Thousand (35,700,000) shares are designated as shares of Class B Common Stock, par value $0.0003 1/3 per share (the “Class B Common Stock”), having an aggregate par value of Two Hundred and Seventy-Eight Thousand, Five Hundred and Sixty-Six Dollars and Sixty-Six and Two-Thirds Cents ($278,566.66 2/3).

SECOND: The foregoing amendment to the Charter was approved by a majority of the Corporation’s entire Board of Directors as required by law and was limited to a change expressly authorized by Section 2-105(a)(13) of the Maryland General Corporation Law (the “MGCL”) and Article SIXTH of the Charter without any action by the stockholders of the Corporation.

THIRD: The information required by Section 2-607(b)(2)(i) of the MGCL is not changed by foregoing amendment.

FOURTH: The total number of shares of all classes of stock of the Corporation that the Corporation had the authority to issue immediately before the foregoing amendment to the Charter, and the number and par value of the shares of each class, 3,675,000 shares of Class B Common Stock having been cancelled pursuant to Section (a)(ix)(3) of Article SIXTH of the Charter upon their conversion to shares of Class A Common Stock, were:

435,700,000 shares of capital stock, consisting of 435,700,000 shares of common stock, par value $0.0003 1/3 per share, of which 400,000,000 shares were classified and designated as shares of Class A Common Stock and 35,700,000 shares were classified and designated as shares of Class B Common Stock, having an aggregate par value of $145,233.33 1/3.

FIFTH: The total number of shares of all classes of stock of the Corporation that the Corporation has the authority to issue pursuant to the foregoing amendment to the Charter, and the number and par value of the shares of each class, are:

835,700,000 shares of capital stock, consisting of 835,700,000 shares of common stock, par value $0.0003 1/3 per share, of which 400,000,000 shares are classified and designated as shares of Class A Common Stock and 35,700,000 shares are classified and designated as shares of Class B Common Stock, having an aggregate par value of $278,566.66 2/3.

SIXTH: The undersigned acknowledges these Articles of Amendment to be the corporate act of the Corporation and as to all matters or facts required to be verified under oath, the undersigned acknowledges that to the best of his knowledge, information and belief, these matters and facts are true in all material respects and that this statement is made under the penalties for perjury.

[Signatures appear on next page]

2

IN WITNESS WHEREOF, Under Armour, Inc. has caused these Articles of Amendment to be signed and acknowledged in its name and on its behalf by its Chief Executive Officer and attested by its Secretary, as of the 15th day of June, 2015.

| ATTEST: | UNDER ARMOUR, INC. | |||||

| /s/ John P. Stanton |

By: | /s/ Kevin A. Plank | ||||

| Name: John P. Stanton | Name: Kevin A. Plank | |||||

| Title: Secretary | Title: Chief Executive Officer | |||||

Exhibit 99.1

| Under Armour, Inc. |

| |

| 1020 Hull Street |

||

| Baltimore, MD 21230

|

||

| CONTACTS |

||

| Investors: |

||

| Tom Shaw, CFA |

||

| Under Armour, Inc. |

||

| Tel: 410.843.7676

|

||

| Media: |

||

| Diane Pelkey |

||

| Under Armour, Inc. |

||

| Tel: 410.246.5927 |

FOR IMMEDIATE RELEASE

UNDER ARMOUR ANNOUNCES CREATION OF NEW

NON-VOTING CLASS C COMMON STOCK

Baltimore, MD (June 15, 2015) - Under Armour, Inc. (NYSE: UA) today announced that its Board of Directors (the “Board”) unanimously approved the creation of a new class of non-voting common stock, the Class C common stock.

Under Armour expects to issue Class C stock through a stock dividend to all existing holders of Under Armour’s Class A and Class B common stock, which will have the same effect as a two-for-one stock split. Each holder of a share of Class A or Class B stock will receive one share of the new Class C stock. Except for voting rights, the Class C stock will have the same rights as the existing Class A stock. Application to the New York Stock Exchange will be made to list the new Class C stock, which will trade under a different ticker symbol than Under Armour’s existing Class A stock. The ticker symbol for the Class C stock and the record date for the stock dividend have not been determined.

Prior to the dividend occurring, the Board has called a special meeting of Under Armour’s stockholders expected to be held on August 26, 2015 to approve certain amendments to Under Armour’s charter, which are being recommended for approval by the Board in connection with the creation of the Class C stock. The Board acted on the recommendation of a special committee of independent board members. The Board intends that these charter amendments be implemented before the Class C stock dividend is declared. Kevin Plank, Under Armour’s Chairman and CEO and controlling stockholder, has agreed to support the proposed changes to the charter.

In connection with this special meeting of stockholders, today Under Armour also filed a preliminary proxy statement with the Securities and Exchange Commission (the “SEC”), which contains further details regarding the creation and dividend of the Class C stock, the charter amendments, certain other agreements entered into in connection with the creation of Class C stock, and the reasons the Board considers these matters to be in the best interests of stockholders generally. A definitive proxy statement is forthcoming.

Under Armour also released a letter from Mr. Plank providing his views on the creation of the Class C stock, which has also been filed with the SEC and is available on Under Armour’s website (http://www.uabiz.com).

Under Armour stockholders with any questions or who need assistance regarding how to vote shares should contact Under Armour’s proxy solicitation firm, Georgeson Inc., toll-free at 866-295-4321.

ABOUT UNDER ARMOUR, INC.

Under Armour (NYSE: UA), the originator of performance footwear, apparel and equipment, revolutionized how athletes across the world dress. Designed to make all athletes better, the brand’s innovative products are sold worldwide to athletes at all levels. The Under Armour Connected Fitness™ platform powers the world’s largest digital health and fitness community through a suite of applications: UA Record, MapMyFitness, Endomondo and MyFitnessPal. The Under Armour global headquarters is in Baltimore, Maryland. For further information, please visit Under Armour’s website at www.uabiz.com.

NOTE ABOUT FORWARD-LOOKING STATEMENTS

This press release includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 about Under Armour’s planned dividend of shares of a new Class C common stock, its charter amendments and the upcoming special meeting of Under Armour’s stockholders expected to be held on August 26, 2015 (the “Special Meeting”). These forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties, which could cause actual events to differ materially from those reflected in the forward-looking statements. Factors that could affect expectations and assumptions include, among others, the timing of the declaration of the Class C common stock dividend.

ADDITIONAL INFORMATION AND WHERE TO FIND IT

This press release may be deemed to be solicitation material in respect of the solicitation of proxies from stockholders for the Special Meeting. Under Armour intends to file with the Securities and Exchange Commission (the “SEC”) and make available to the holders of Under Armour common stock as of the record date for the Special Meeting a proxy statement containing important information relating to certain stock and governance related amendments to Under Armour’s charter and other matters to be considered by the stockholders of Under Armour at the Special Meeting (the “Proposals”). BEFORE MAKING ANY VOTING DECISION, UNDER ARMOUR’S STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) WHEN IT BECOMES AVAILABLE CAREFULLY AND IN ITS ENTIRETY BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION RELATING TO THE PROPOSALS.

Investors will be able to obtain the proxy statement and other relevant materials, when available, free of charge at the SEC’s website (http://www.sec.gov). In addition, documents filed with the SEC by Under Armour, including the proxy statement when available, will be available free of charge from Under Armour at Under Armour’s website (http://www.uabiz.com), or by writing to Under Armour, Inc., 1020 Hull Street, Baltimore, Maryland 21230, Attn: Secretary.

PARTICIPANTS IN THE SOLICITATION

Under Armour and its directors and executive officers may be deemed to be participants in the solicitation of proxies from Under Armour’s stockholders with respect to the Proposals to be considered at the Special Meeting. Information regarding the names, affiliations, and direct or indirect interests (by security holdings or otherwise) of these individuals will be set forth in the proxy statement and the other relevant documents to be filed with the SEC. Stockholders can find information about Under Armour and its directors and executive officers and their ownership of Under Armour’s common stock in Under Armour’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014 and in its definitive proxy statement for the 2015 annual meeting filed with the SEC on March 13, 2015. Additional information regarding the interests of these individuals in the Proposals and their ownership of Under Armour’s common stock will also be included in the definitive proxy statement for the Special Meeting.

Exhibit 99.2

Dear Shareholders

I am writing to you to discuss some significant changes that are being made to the capital structure of Under Armour. When Under Armour went public in 2005, we created a dual-class stock structure under which I own Class B shares that have greater voting power. This dual-class structure meant that I would retain control over significant decisions impacting Under Armour’s future, allowing our team to focus on driving long-term growth and developing game-changing innovative products, as we continue on our path to become the number one global athletic brand.

I believe this dual-class structure has served us well, and since the time of our IPO we have consistently beat expectations and delivered incredible performance for our stockholders. Our net revenues have grown from $281 million in 2005 to $3.1 billion in 2014, and our net income increased from $19.7 million to $208 million, each representing a compound annual growth rate of 30%. At the same time, the stock price of our Class A shares (as adjusted for the two stock splits we have completed to date) has increased from $3.25 at the time of our IPO to $81.29 per share, which was the closing price of our Class A stock on June 12, 2015, representing an increase of approximately 2,401%. Compare that to the S&P 500 Index, which grew by 68% over the same time period.

Underlying this strong performance, our mission has always been simple: To Make All Athletes Better. That mission has been the driving force that has propelled us to become far more than a compression T-shirt company – we are now a fully integrated, global athletic brand committed to keeping innovation and performance at the heart of everything we do. Since I sold my first T-shirt out of my grandmother’s basement in Georgetown nearly 20 years ago, Under Armour has been my passion. I am only 42 years old, and there is much more to do in the years to come.

Importantly, I want to ensure that our corporate governance structure continues to support these efforts and keeps us focused on our mission. Our current dual-class voting structure is set to end when I own less than 15% of our total Class A and Class B shares outstanding. Dilution from regular employee equity-based compensation and other possible dilution, such as stock-based acquisitions or equity financings, as well as any sales of stock by me, bring us closer to this 15% sunset provision and could ultimately undermine our current governance structure.

After careful consideration by a Special Committee of independent Board members and our Board of Directors, as well as advice from outside legal and financial advisors, the Board has agreed that maintaining our founder-led approach is in the best interests of Under Armour and all of its stockholders. Accordingly, Under Armour today announced plans to create a new class of non-voting stock—Class C common stock—which will be listed on the NYSE. These shares will be distributed through a stock dividend to all existing stockholders. The owner of each existing share of our common stock will receive one new share of the non-voting stock, giving investors twice the number of shares they had before. This is effectively a two-for-one stock split – something we have done twice in the past three years, though not with a new class of stock.

These non-voting shares will give us a new form of currency for corporate uses, including equity-based employee compensation and stock-based acquisitions. The change will also allow me the flexibility of selling these non-voting shares of Under Armour over time while maintaining our founder-led approach. One thing to keep in mind is that immediately after the Class C dividend, all stockholders, including me, will retain the same voting interests they hold prior to the dividend. The dividend is designed to maintain our governance structure over the long-term, not result in any immediate changes to any stockholder’s voting power.

I love Under Armour, and I would like stockholders to know that I am very committed to our company. Through my ownership of my founder’s shares, I have benefited, along with all of Under Armour’s stockholders, from the incredible growth we have realized in the value of Under Armour’s stock over the years. My personal long-term financial success does not come from my compensation as CEO, but is driven almost entirely by the performance and success of our stock. To that end, the Special Committee required a number of governance changes designed to ensure this continued alignment with our stockholders, which I have agreed to support. These changes include the following:

| • | There will be a cap on how many shares I can sell in any year while maintaining the dual-class voting structure. |

| • | If I leave Under Armour, the dual-class voting structure would end. |

| • | I have signed a non-compete agreement, which I did not have before, and it will last for 5 years if I were to leave. |

| • | Our charter will be amended to enhance provisions that help ensure that all stockholders are treated fairly from an economic perspective in change of control transactions, and that implement certain other governance related changes designed to benefit stockholders. These governance changes include heightened independence requirements for Board members, and agreeing not to use certain exemptions available to controlled companies under stock exchange listing standards. |

Today Under Armour filed a preliminary proxy statement with the SEC, which contains further details regarding the Class C stock, as well as the process our Board of Directors undertook in reaching its decision to create the Class C stock, require my non-compete agreement and recommend other changes to our charter. A definitive proxy statement that will be delivered to stockholders will follow in the coming weeks.

I am honored that so many of you have put your trust in me and in Under Armour, and I recognize the tremendous responsibility that rests on our shoulders. I am excited for what lies ahead and will continue to do my best to build Under Armour to new heights as we continue to focus on Making All Athletes Better Through Passion, Design and the Relentless Pursuit of Innovation.

Kevin Plank,

Chairman, CEO and Founder

Under Armour

June 15, 2015

2

Note About Forward-Looking Statements

This document includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 about Under Armour’s planned dividend of shares of a new Class C common stock, its charter amendments and the upcoming special meeting of Under Armour’s stockholders expected to be held on August 26, 2015 (the “Special Meeting”). These forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties, which could cause actual events to differ materially from those reflected in the forward-looking statements. Factors that could affect expectations and assumptions include, among others, the timing of the declaration of the Class C common stock dividend.

Additional Information and Where to Find It

This document may be deemed to be solicitation material in respect of the solicitation of proxies from stockholders for the Special Meeting. Under Armour intends to file with the Securities and Exchange Commission (the “SEC”) and make available to the holders of Under Armour common stock as of the record date for the Special Meeting a proxy statement containing important information relating to certain stock and governance related amendments to Under Armour’s charter and other matters to be considered by the stockholders of Under Armour at the Special Meeting (the “Proposals”). BEFORE MAKING ANY VOTING DECISION, UNDER ARMOUR’S STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) WHEN IT BECOMES AVAILABLE CAREFULLY AND IN ITS ENTIRETY BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION RELATING TO THE PROPOSALS.

Investors will be able to obtain the proxy statement and other relevant materials, when available, free of charge at the SEC’s website (http://www.sec.gov). In addition, documents filed with the SEC by Under Armour, including the proxy statement when available, will be available free of charge from Under Armour at Under Armour’s website (http://www.uabiz.com), or by writing to Under Armour, Inc., 1020 Hull Street, Baltimore, Maryland 21230, Attn: Secretary.

Participants in the Solicitation

Under Armour and its directors and executive officers may be deemed to be participants in the solicitation of proxies from Under Armour’s stockholders with respect to the Proposals to be considered at the Special Meeting. Information regarding the names, affiliations, and direct or indirect interests (by security holdings or otherwise) of these individuals will be set forth in the proxy statement and the other relevant documents to be filed with the SEC. Stockholders can find information about Under Armour and its directors and executive officers and their ownership of Under Armour’s common stock in Under Armour’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014 and in its definitive proxy statement for the 2015 annual meeting filed with the SEC on March 13, 2015. Additional information regarding the interests of these individuals in the Proposals and their ownership of Under Armour’s common stock will also be included in the definitive proxy statement for the Special Meeting.

3

Exhibit 99.3

Under Armour Internal Communication Documents

Internal Under Armour Email Communication to Employee Equity Award Recipients

Dear Under Armour Equity Award Holder,

As we posted on Our House, today Under Armour announced that our Board of Directors has approved a new class of non-voting common stock, the Class C stock. At some point following a stockholders meeting in late August, we expect shares of Class C stock to be distributed through a stock dividend to all of Under Armour’s stockholders – effectively a two-for-one stock split. This new Class C stock will help Under Armour maintain our current founder-led governance approach under Kevin Plank and let us continue to focus on our long-term goals.

Although this stock dividend is not expected to occur for a while, when it does occur your outstanding equity awards will become a combination of Class A and Class C awards. To learn more about the stock dividend, please see:

| (1) | A letter from Kevin Plank to stockholders regarding the creation of Class C, |

| (2) | A copy of the press release that Under Armour issued this afternoon regarding this matter, and |

| (3) | A set of FAQs regarding equity awards. |

We will keep you updated as we get closer to completing the stock dividend. In the meantime, if you have any questions, please contact Mehri Shadman in the Legal Department by phone at (410) 246-6881 or by email at [email protected].

Thank you,

TOTAL REWARDS

Additional Information and Where to Find It

This document may be deemed to be solicitation material in respect of the solicitation of proxies from stockholders for the Special Meeting. Under Armour intends to file with the Securities and Exchange Commission (the “SEC”) and make available to the holders of Under Armour common stock as of the record date for the Special Meeting a proxy statement containing important information relating to certain stock and governance related amendments to Under Armour’s charter and other matters to be considered by the stockholders of Under Armour at the Special Meeting (the “Proposals”). BEFORE MAKING ANY VOTING DECISION, UNDER ARMOUR’S STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) WHEN IT BECOMES AVAILABLE CAREFULLY AND IN ITS ENTIRETY BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION RELATING TO THE PROPOSALS.

Investors will be able to obtain the proxy statement and other relevant materials, when available, free of charge at the SEC’s website (http://www.sec.gov). In addition, documents filed with the SEC by Under Armour, including the proxy statement when available, will be available free of charge from Under Armour at Under Armour’s website (http://www.uabiz.com), or by writing to Under Armour, Inc., 1020 Hull Street, Baltimore, Maryland 21230, Attn: Secretary.

Participants in the Solicitation

Under Armour and its directors and executive officers may be deemed to be participants in the solicitation of proxies from Under Armour’s stockholders with respect to the Proposals to be considered at the Special Meeting. Information regarding the names, affiliations, and direct or indirect interests (by security holdings or otherwise) of these individuals will be set forth in the proxy statement and the other relevant documents to be filed with the SEC. Stockholders can find information about Under Armour and its directors and executive officers and their ownership of Under Armour’s common stock in Under Armour’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014 and in its definitive proxy statement for the 2015 annual meeting

filed with the SEC on March 13, 2015. Additional information regarding the interests of these individuals in the Proposals and their ownership of Under Armour’s common stock will also be included in the definitive proxy statement for the Special Meeting.

CLASS C CAPITAL STOCK CHANGES

FAQs FOR UNDER ARMOUR EQUITY AWARD HOLDERS

Defined terms

Class A stock: Under Armour Class A common stock which has one vote for each share

Class B stock: Under Armour Class B common stock which has ten votes for each share

Class C stock: Under Armour Class C common stock which would not have any voting rights

General

| 1. | What is happening? |

Under Armour has created a new class of non-voting stock (Class C), in addition to the current voting Class A and Class B stock. This new Class C stock will be issued through a stock dividend for all outstanding Under Armour Class A and Class B shares. Each stockholder would receive a share of Class C stock for each share of Class A and Class B stock they hold as of a specified dividend record date. The record date will be announced once all required approvals have been obtained.

This is effectively a stock split — people who previously had one share would have two shares. We have completed two stock splits in the last three years, though never for a new class of stock. Class A shares would retain one stockholder vote per share. Class C shares would not have any voting rights. The Class A and Class C shares would be traded under different ticker symbols and their prices may vary over time. The new ticker symbol for the Class C shares has not been determined.

| 2. | How is this different from what we have today? |

Currently, Under Armour has two types of common stock: (1) Class A stock, which has one vote per share (this is the type of stock that is publicly traded and that eligible Under Armour teammates receive through their restricted stock units (“RSUs”) and stock options), and (2) Class B stock, which has 10 votes per share (which is held by Kevin Plank). If the dividend is declared, we’ll have three types of stock – Class A stock and Class B stock, which retain their voting rights, and a new Class C stock, which would have no voting rights. After the dividend is declared, all teammate equity award grants are expected to be made using Class C stock.

| 3. | You’re calling this a dividend? Does this mean we’re getting cash? |

No, the dividend will be issued in shares of Class C stock.

| 4. | When is this happening? |

No specific date has been set for the dividend, though we expect the dividend to occur sometime following a special meeting of our stockholders currently scheduled for August 26, 2015. We will update you when the date has been set.

| 5. | Why are we doing this? |

Please see the letter from Kevin Plank that can be found on our Investor Relations website (www.uabiz.com) for more information.

| 6. | To whom would this change apply? |

If the dividend is approved by our Board, these changes would apply to all stockholders who own Class A or Class B stock and all teammates, directors and other persons who have unvested RSUs (including both time based RSUs and performance based RSUs) and/or unexercised options as of a date to be set by the Board.

After the dividend is declared, all teammate equity award grants are expected to be made using Class C stock.

1

| 7. | What would happen to shares I own (i.e., RSUs that have vested or options I have exercised)? |

For each share of Class A stock that you own as of the record date for the stock dividend from the previous vesting of an RSU or exercise of an option, you would receive a Class C share. So, after the stock dividend, you would have one share of Class A stock and one share of Class C stock.

Restricted Stock Units (Time Based and Performance Based)

| 8. | What does this mean if I have unvested RSUs? |

For each unvested Class A RSU you have as of the record date for the stock dividend (both time based RSUs and performance based RSUs), you would receive an additional unvested RSU that covers one share of Class C stock. So after the stock dividend, you would have one unvested RSU that covers one share of Class A stock and one unvested RSU that covers one share of Class C stock.

| 9. | What about the vesting schedule for my RSUs? |

Your vesting schedule would remain the same. When an RSU covering a Class A share vests, the corresponding RSU covering a Class C share would also vest.

| 10. | Will there be any changes to the performance targets for my performance based RSUs? |

No, all outstanding performance based RSUs will continue to have their original performance vesting conditions.

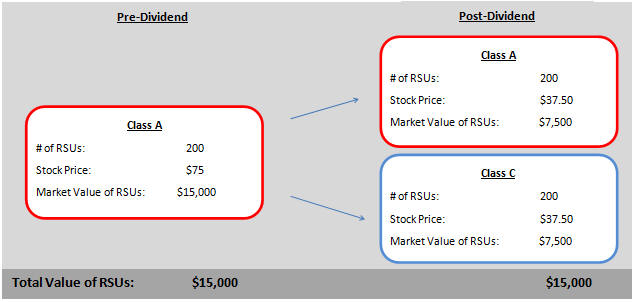

Example: RSUs Before and After the Stock Dividend

In this example, 200 pre-dividend Restricted Stock Units (RSUs) for 200 shares of Class A common stock would be adjusted as part of the dividend to yield an additional 200 RSUs for shares of Class C common stock. If the RSUs included performance criteria for vesting (which we commonly refer to as performance based RSUs), the same pre-dividend performance criteria would continue to apply.

| NOTE: | The pre-dividend and post-dividend stock prices and market values of RSUs shown above are illustrative only. The actual stock prices and RSU market values are determined by the trading prices on the New York Stock Exchange of Under Armour’s Class A shares and Class C shares (when the dividend is distributed). |

2

Stock Options

| 11. | What does this mean if I have unexercised options? |

For each unexercised option you have as of the record date for the stock dividend, you would receive an additional unexercised Class C stock option that covers one share of Class C stock. So after the stock dividend you would have one unexercised Class A option and one unexercised Class C option.

The original strike price of your Class A options (prior to the stock dividend) will be allocated between the strike price of our Class A and Class C options. This allocation will be based on the trading prices of the Class A and Class C shares following the dividend. We will provide more detail on the calculation of the adjusted strike price before the dividend date.

| 12. | What about the vesting schedule for my options? |

Your vesting schedule would remain the same. When a Class A option vests, the corresponding Class C option would also vest.

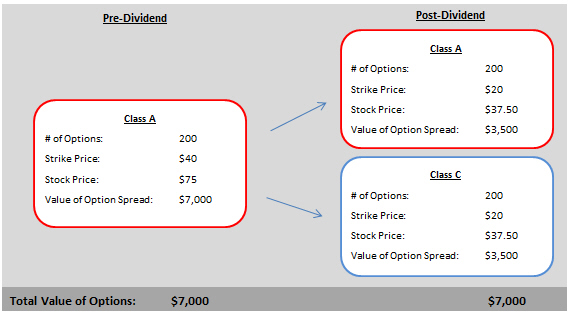

Example: Options Before and After Proposed Stock Dividend

In this example, 200 pre-dividend options to purchase 200 shares of Class A common stock with a strike price of $40 per share would be adjusted as part of the dividend to yield an additional 200 options to purchase shares of Class C common stock. If the options included performance criteria for vesting (which we commonly refer to as performance-based options), the same pre-dividend performance criteria would continue to apply.

| NOTE: | The pre-dividend and post-dividend stock prices, strike prices and value of the option spreads shown above are illustrative only. The actual stock prices and the value of the option spreads are determined by the trading prices on the New York Stock Exchange of Under Armour’s Class A shares and Class C shares (when the dividend is distributed). The actual post-dividend strike prices are expected to be based on an allocation of the original strike price of each Class A option (pre-dividend) between the new post-dividend strike prices for the post-dividend Class A option and the Class C option based on the trading prices of Under Armour’s Class A shares and Class C shares on the New York Stock Exchange following the dividend. |

3

Other Questions

| 13. | Will there be any changes to how I can trade these new Class C shares? |

No, as long as Under Armour is not in a blackout period and the trading window is open, you would be able to trade these new shares normally, consistent with our insider trading policy. Class A and Class C shares would each have their own ticker symbols and would be traded independently.

| 14. | How would this affect ongoing equity grants? |

After the dividend is declared, all teammate equity award grants are expected to be made using Class C stock.

| 15. | What would this look like in my Charles Schwab account? |

Once the dividend has been paid, when you log into your Charles Schwab account, you will see both your Class A and Class C shares in aggregate on your account home page.

| 16. | Do I need to do anything? |

Please log in to your Charles Schwab account and verify that you have accepted all of your existing grants. As long as you have done this, the administration of the stock dividend would happen automatically through your account.

| 17. | I haven’t accepted my grants yet. How will this impact me? |

Please accept your existing grants as soon as possible. Instructions on how to accept your grants are available from the Total Rewards Team (email [email protected]).

| 18. | What if I moved my vested shares to another broker? How would the dividend work for me? |

The dividend would happen automatically, and your new Class C shares would be deposited into your brokerage account.

| 19. | How would this affect my voting rights on issues subject to a vote of stockholders? |

After the dividend is paid, you will continue to have the same number of votes — one for each Under Armour Class A share you own. You would not have any votes for any Under Armour Class C shares that you own.

| 20. | What can I share with my financial adviser? |

You can share these FAQs and our proxy statement that will be filed with the SEC and will be available on the SEC’s site.

| 21. | I live and work in the United States. How would this affect my taxes? |

For US taxpayers the stock dividend should not be taxable for federal income tax purposes, but you should discuss the dividend with your financial adviser if you have any questions about your particular tax situation.

| 22. | I live outside of the United States. Anything different for my country? |

We do not expect this stock dividend to be a taxable event in most countries, but are in the process of confirming this for each country. We will update you with more country-specific information as it becomes available. You should discuss the dividend with your financial adviser if you have any questions about your particular tax situation.

| 23. | I still have more questions. Where should I go? |

The Total Rewards team is available for questions relating to the administration of your RSUs, options and stock. You can email the Total Rewards Team at [email protected]. You can also contact Mehri Shadman in the Legal Department by email at [email protected] with any questions regarding the Class C stock and dividend.

4

Note About Forward-Looking Statements

This document includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 about Under Armour’s planned dividend of shares of a new Class C common stock, its charter amendments and the upcoming special meeting of Under Armour’s stockholders expected to be held on August 26, 2015 (the “Special Meeting”). These forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties, which could cause actual events to differ materially from those reflected in the forward-looking statements. Factors that could affect expectations and assumptions include, among others, the timing of the declaration of the Class C common stock dividend.

Additional Information and Where to Find It

This document may be deemed to be solicitation material in respect of the solicitation of proxies from stockholders for the Special Meeting. Under Armour intends to file with the Securities and Exchange Commission (the “SEC”) and make available to the holders of Under Armour common stock as of the record date for the Special Meeting a proxy statement containing important information relating to certain stock and governance related amendments to Under Armour’s charter and other matters to be considered by the stockholders of Under Armour at the Special Meeting (the “Proposals”). BEFORE MAKING ANY VOTING DECISION, UNDER ARMOUR’S STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) WHEN IT BECOMES AVAILABLE CAREFULLY AND IN ITS ENTIRETY BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION RELATING TO THE PROPOSALS.

Investors will be able to obtain the proxy statement and other relevant materials, when available, free of charge at the SEC’s website (http://www.sec.gov). In addition, documents filed with the SEC by Under Armour, including the proxy statement when available, will be available free of charge from Under Armour at Under Armour’s website (http://www.uabiz.com), or by writing to Under Armour, Inc., 1020 Hull Street, Baltimore, Maryland 21230, Attn: Secretary.

Participants in the Solicitation

Under Armour and its directors and executive officers may be deemed to be participants in the solicitation of proxies from Under Armour’s stockholders with respect to the Proposals to be considered at the Special Meeting. Information regarding the names, affiliations, and direct or indirect interests (by security holdings or otherwise) of these individuals will be set forth in the proxy statement and the other relevant documents to be filed with the SEC. Stockholders can find information about Under Armour and its directors and executive officers and their ownership of Under Armour’s common stock in Under Armour’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014 and in its definitive proxy statement for the 2015 annual meeting filed with the SEC on March 13, 2015. Additional information regarding the interests of these individuals in the Proposals and their ownership of Under Armour’s common stock will also be included in the definitive proxy statement for the Special Meeting.

5

Internal Under Armour Email Communication to ESPP Participants

Dear Under Armour ESPP Participant,

As we posted on Our House, today Under Armour announced that our Board of Directors has approved a new class of non-voting common stock, the Class C stock. At some point following a stockholders meeting in late August, we expect shares of Class C stock to be distributed through a stock dividend to all of Under Armour’s stockholders – effectively a two-for-one stock split. This new Class C stock will help Under Armour maintain our current founder-led governance approach under Kevin Plank and let us continue to focus on our long-term goals.

Although this stock dividend is not expected to occur for a while, when it does occur shares you have purchased through the ESPP will receive this dividend, and we expect to begin utilizing a new ESPP related to the Class C stock. To learn more about the stock dividend, please see:

| (1) | A letter from Kevin Plank to stockholders regarding the creation of Class C, |

| (2) | A copy of the press release that Under Armour issued this afternoon regarding this matter, and |

| (3) | A set of FAQs regarding the ESPP. |

We will keep you updated as we get closer to completing the stock dividend. In the meantime, if you have any questions, please contact Mehri Shadman in the Legal Department by phone at (410) 246-6881 or by email at [email protected].

Thank you,

TOTAL REWARDS

Additional Information and Where to Find It

This document may be deemed to be solicitation material in respect of the solicitation of proxies from stockholders for the Special Meeting. Under Armour intends to file with the Securities and Exchange Commission (the “SEC”) and make available to the holders of Under Armour common stock as of the record date for the Special Meeting a proxy statement containing important information relating to certain stock and governance related amendments to Under Armour’s charter and other matters to be considered by the stockholders of Under Armour at the Special Meeting (the “Proposals”). BEFORE MAKING ANY VOTING DECISION, UNDER ARMOUR’S STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) WHEN IT BECOMES AVAILABLE CAREFULLY AND IN ITS ENTIRETY BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION RELATING TO THE PROPOSALS.

Investors will be able to obtain the proxy statement and other relevant materials, when available, free of charge at the SEC’s website (http://www.sec.gov). In addition, documents filed with the SEC by Under Armour, including the proxy statement when available, will be available free of charge from Under Armour at Under Armour’s website (http://www.uabiz.com), or by writing to Under Armour, Inc., 1020 Hull Street, Baltimore, Maryland 21230, Attn: Secretary.

Participants in the Solicitation

Under Armour and its directors and executive officers may be deemed to be participants in the solicitation of proxies from Under Armour’s stockholders with respect to the Proposals to be considered at the Special Meeting. Information regarding the names, affiliations, and direct or indirect interests (by security holdings or otherwise) of these individuals will be set forth in the proxy statement and the other relevant documents to be filed with the SEC. Stockholders can find information about Under Armour and its directors and executive officers and their ownership of Under Armour’s common stock in Under Armour’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014 and in its definitive proxy statement for the 2015 annual meeting filed with the SEC on March 13, 2015. Additional information regarding the interests of these individuals in the Proposals and their ownership of Under Armour’s common stock will also be included in the definitive proxy statement for the Special Meeting.

CLASS C CAPITAL STOCK CHANGES

FAQs FOR UNDER ARMOUR ESPP PARTICIPANTS

Defined terms

Class A stock: Under Armour Class A common stock which has one vote for each share

Class B stock: Under Armour Class B common stock which has ten votes for each share

Class C stock: Under Armour Class C common stock which would not have any voting rights

| 1. | What is happening? |

Under Armour has created a new class of non-voting stock (Class C), in addition to the current voting Class A and Class B stock. This new Class C stock will be issued through a stock dividend for all outstanding Under Armour Class A and Class B shares. Each stockholder would receive a share of Class C stock for each share of Class A and Class B stock they hold as of a specified dividend record date. The record date will be announced once all required approvals have been obtained.

This is effectively a stock split — people who previously had one share would have two shares. We have completed two stock splits in the last three years, though never for a new class of stock. Class A shares would retain one stockholder vote per share. Class C shares would not have any voting rights. The Class A and Class C shares would be traded under different ticker symbols and their prices may vary over time. The new ticker symbol for the Class C shares has not been determined.

| 2. | How is this different from what we have today? |

Currently, Under Armour has two types of common stock: (1) Class A stock, which has one vote per share (this is the type of stock that is publicly traded and that eligible Under Armour teammates purchase through the Employee Stock Purchase Plan (the “ESPP”)), and (2) Class B stock, which has 10 votes per share (which is held by Kevin Plank). If the dividend is declared, we’ll have three types of stock – Class A stock and Class B stock, which retain their voting rights, and a new Class C stock, which would have no voting rights. After the dividend is declared, we expect that Class C stock will be available for purchase through a new ESPP rather than Class A stock.

| 3. | You’re calling this a dividend? Does this mean we’re getting cash? |

No, the dividend will be issued in shares of Class C stock.

| 4. | When is this happening? |

No specific date has been set for the dividend, though we expect the dividend to occur sometime following a special meeting of our stockholders currently scheduled for August 26, 2015. We will update you when the date has been set.

| 5. | Why are we doing this? |

Please see the letter from Kevin Plank that can be found on our Investor Relations website (www.uabiz.com) for more information.

| 6. | Will I still be able to purchase shares of stock through the ESPP? |

If the dividend is approved by our Board, we will have a new ESPP that allows purchases of shares of our Class C stock rather than the Class A stock. The terms of this new ESPP will be identical to the existing ESPP that you are participating in, other than the fact that you will now purchase shares of Class C stock. We do not expect to continue to allow teammates to purchase shares of Class A stock through the existing ESPP after the dividend occurs.

| 7. | What will happen to the shares I have already purchased and continue to hold through the existing ESPP? |

For each share of Class A stock you have already purchased through the existing ESPP before the record date for the dividend, you would receive a Class C share. So, after the stock dividend, you would have one share of Class A stock and one share of Class C stock.

1

| 8. | Will there be any changes to how I can trade these new Class C shares? |

No, as long as Under Armour is not in a blackout period and the trading window is open, you would be able to trade these new shares normally, consistent with our insider trading policy. Class A and Class C shares would each have their own ticker symbols and would be traded independently.

| 9. | What if I moved my shares to another broker? How would the dividend work for me? |

The dividend would happen automatically, and your new Class C shares would be deposited into your brokerage account.

| 10. | How would this affect my voting rights on issues subject to a vote of stockholders? |

After the dividend is paid, you will continue to have the same number of votes — one for each Under Armour Class A share you own. You would not have any votes for any Under Armour Class C shares that you own.

| 11. | What can I share with my financial adviser? |

You can share these FAQs and our proxy statement that will be filed with the SEC and will be available on the SEC’s site.

| 12. | I live and work in the United States. How would this affect my taxes? |

For US taxpayers the stock dividend should not be taxable for federal income tax purposes, but you should discuss the dividend with your financial adviser if you have any questions about your particular tax situation.

| 13. | I live outside of the United States. Anything different for my country? |

We do not expect this stock dividend to be a taxable event in most countries, but are in the process of confirming this for each country. We will update you with more country-specific information as it becomes available. You should discuss the dividend with your financial adviser if you have any questions about your particular tax situation.

| 14. | I still have more questions. Where should I go? |

The Total Rewards team is available for questions relating to the ESPP. You can email the Total Rewards Team at [email protected]. You can also contact Mehri Shadman in the Legal Department by email at [email protected] with any questions regarding the Class C stock and dividend.

Note About Forward-Looking Statements

This document includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 about Under Armour’s planned dividend of shares of a new Class C common stock, its charter amendments and the upcoming special meeting of Under Armour’s stockholders expected to be held on August 26, 2015 (the “Special Meeting”). These forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties, which could cause actual events to differ materially from those reflected in the forward-looking statements. Factors that could affect expectations and assumptions include, among others, the timing of the declaration of the Class C common stock dividend.

Additional Information and Where to Find It

This document may be deemed to be solicitation material in respect of the solicitation of proxies from stockholders for the Special Meeting. Under Armour intends to file with the Securities and Exchange Commission (the “SEC”) and make available to the holders of Under Armour common stock as of the record date for the Special Meeting a proxy statement containing important information relating to certain stock and governance related amendments to Under Armour’s charter and other matters to be considered by the stockholders of Under Armour at the Special Meeting (the “Proposals”). BEFORE MAKING ANY VOTING DECISION, UNDER ARMOUR’S STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) WHEN IT BECOMES AVAILABLE CAREFULLY AND IN ITS ENTIRETY BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION RELATING TO THE PROPOSALS.

2

Investors will be able to obtain the proxy statement and other relevant materials, when available, free of charge at the SEC’s website (http://www.sec.gov). In addition, documents filed with the SEC by Under Armour, including the proxy statement when available, will be available free of charge from Under Armour at Under Armour’s website (http://www.uabiz.com), or by writing to Under Armour, Inc., 1020 Hull Street, Baltimore, Maryland 21230, Attn: Secretary.

Participants in the Solicitation

Under Armour and its directors and executive officers may be deemed to be participants in the solicitation of proxies from Under Armour’s stockholders with respect to the Proposals to be considered at the Special Meeting. Information regarding the names, affiliations, and direct or indirect interests (by security holdings or otherwise) of these individuals will be set forth in the proxy statement and the other relevant documents to be filed with the SEC. Stockholders can find information about Under Armour and its directors and executive officers and their ownership of Under Armour’s common stock in Under Armour’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014 and in its definitive proxy statement for the 2015 annual meeting filed with the SEC on March 13, 2015. Additional information regarding the interests of these individuals in the Proposals and their ownership of Under Armour’s common stock will also be included in the definitive proxy statement for the Special Meeting.

3

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Alberto Castillo Injured in Truck Accident on Veterans Memorial Drive in Northwest Houston

- Elavon and FreedomPay to transform payments for hospitality and retail in Europe

- Orion Group’s Facilities Maintenance Business Enters Lock, Door, Safe, and Access Control Market Through Partnership with Academy Locksmith

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share