Form 8-K KCG Holdings, Inc. For: May 20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 20, 2015

KCG HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| DELAWARE | 000-54991 | 38-3898306 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

545 Washington Boulevard, Jersey City, NJ 07310

(Address of principal executive offices) (Zip Code)

(201) 222-9400

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 7.01 Regulation FD Disclosure

Exhibit 99.1 is a copy of a slide presentation to be used by Daniel Coleman, Chief Executive Officer of KCG Holdings, Inc. (“KCG”), at the Barclays Americas Select Franchise Conference held on May 20, 2015. The presentation will be webcast live at http://cc.talkpoint.com/barc002/051915a_ae/?entity=20_UYBMW2P (as announced by a press release dated May 18, 2015). A replay of Mr. Coleman’s presentation will be archived at http://investors.kcg.com. Exhibit 99.1 is incorporated by reference under this Item 7.01. In accordance with general instruction B.2. of Form 8-K, the slides are being furnished pursuant to Item 7.01 and the information contained therein shall not be deemed “filed” for purposes of Section 18 of the Securities and Exchange Act of 1934.

Item 9.01 Financial Statements and Exhibits

(d)

Exhibit 99.1 – Slide Presentation for Barclays Americas Select Franchise Conference held on May 20, 2015.

Certain statements contained herein may constitute “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements are typically identified by words such as “believe,” “expect,” “anticipate,” “intend,” “target,” “estimate,” “continue,” “positions,” “prospects” or “potential,” by future conditional verbs such as “will,” “would,” “should,” “could” or “may,” or by variations of such words or by similar expressions. These “forward-looking statements” are not historical facts and are based on current expectations, estimates and projections about KCG’s industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond our control. Any forward-looking statement contained herein speaks only as of the date on which it is made. Accordingly, readers are cautioned that any such forward-looking statements are not guarantees of future performance and are subject to certain risks, uncertainties and assumptions that are difficult to predict including, without limitation, risks associated with: (i) the strategic business combination (the “Mergers”) of Knight Capital Group, Inc. (“Knight”) and GETCO Holding Company, LLC (“GETCO”), including, among other things, (a) difficulties and delays in integrating the Knight and GETCO businesses or fully realizing cost savings and other benefits, (b) the inability to sustain revenue and earnings growth, and (c) customer and client reactions to the Mergers; (ii) the August 1, 2012 technology issue that resulted in Knight’s broker-dealer subsidiary sending numerous erroneous orders in NYSE-listed and NYSE Arca securities into the market and the impact to Knight’s business as well as actions taken in response thereto and consequences thereof; (iii) the sales of KCG’s reverse mortgage origination and securitization business, KCG’s futures commission merchant and KCG Hotspot; (iv) changes in market structure, legislative, regulatory or financial reporting rules, including the increased focus by regulators, the New York Attorney General, Congress and the media on market structure issues, and in particular, the scrutiny of high frequency trading, alternative trading systems, market fragmentation, colocation, access to market data feeds, and remuneration arrangements such as payment for order flow and exchange fee structures; (v) past or future changes to KCG’s organizational structure and management; (vi) KCG’s ability to develop competitive new products and services in a timely manner and the acceptance of such products and services by KCG’s customers and potential customers; (vii) KCG’s ability to keep up with technological changes; (viii) KCG’s ability to effectively identify and manage market risk, operational and technology risk, legal risk, liquidity risk, reputational risk, counterparty and credit risk, international risk, regulatory risk, and compliance risk; (ix) the cost and other effects of material contingencies, including litigation contingencies, and any adverse judicial, administrative or arbitral rulings or proceedings; (x) the effects of increased competition and KCG’s ability to maintain and expand market share; and (xi) the completion of the tender offer commenced by KCG on May 4, 2015. The list above is not exhaustive. Readers should carefully review the risks and uncertainties disclosed in KCG’s reports with the SEC, including, without limitation, those detailed under “Risk Factors” in KCG’s Annual Report on Form 10-K for the year-ended December 31, 2014, Quarterly Report on Form 10-Q for the quarter-ended March 31, 2015, and other reports or documents KCG files with, or furnishes to, the SEC from time to time.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned’s duly authorized signatory.

Dated: May 20, 2015

| KCG HOLDINGS, INC. | ||

| By: | /s/ John McCarthy | |

| Name: | John McCarthy | |

| Title: | General Counsel | |

EXHIBIT INDEX

| Exhibit No. |

Description | |

| 99.1 | Slide Presentation for Barclays Americas Select Franchise Conference held on May 20, 2015. |

KCG Holdings, Inc. (NYSE: KCG)

Barclays Americas Select Franchise Conference, London

May 20, 2015

Exhibit 99.1 |

Safe Harbor

Certain statements contained herein may constitute "forward-looking

statements" within the meaning of the safe harbor provisions of the U.S.

Private Securities Litigation Reform Act of 1995. Forward-looking statements

are typically identified by words such as "believe," "expect,"

"anticipate," "intend," "target," "estimate,"

"continue," "positions," "prospects" or "potential," by future conditional verbs such as "will," "would,"

"should,"

"could"

or

"may,"

or

by

variations

of

such

words

or

by

similar

expressions.

These

"forward-looking

statements"

are

not

historical

facts

and

are

based

on

current

expectations,

estimates

and

projections

about

KCG's

industry,

management's

beliefs

and

certain

assumptions

made

by

management, many of which, by their nature, are inherently uncertain and beyond

our control. Any forward-looking statement contained herein speaks

only as of the date on which it is made. Accordingly, readers are cautioned that any such forward-looking statements are not guarantees of

future performance and are subject to certain risks, uncertainties and

assumptions that are difficult to predict including, without limitation, risks

associated with: (i) the strategic business combination (the "Mergers")

of Knight Capital Group, Inc. ("Knight") and GETCO Holding Company,

LLC ("GETCO"), including, among other things, (a) difficulties and delays

in integrating the Knight and GETCO businesses or fully realizing cost

savings

and

other

benefits,

(b)

the

inability

to

sustain

revenue

and

earnings

growth,

and

(c)

customer

and

client

reactions

to

the

Mergers;

(ii)

the

August 1, 2012 technology issue that resulted in Knight's broker-dealer

subsidiary sending numerous erroneous orders in NYSE-listed and NYSE

Arca securities into the market and the impact to Knight's business as well as

actions taken in response thereto and consequences thereof; (iii) the

sales

of

KCG's

reverse

mortgage

origination

and

securitization

business,

KCG's

futures

commission

merchant

and

KCG

Hotspot;

(iv)

changes

in

market

structure,

legislative,

regulatory

or

financial

reporting

rules,

including

the

increased

focus

by

regulators,

the

New

York

Attorney

General,

Congress and the media on market structure issues, and in particular, the

scrutiny of high frequency trading, alternative trading systems, market

fragmentation, colocation, access to market data feeds, and remuneration

arrangements such as payment for order flow and exchange fee

structures;

(v)

past

or

future

changes

to

KCG’s

organizational

structure

and

management;

(vi)

KCG's

ability

to

develop

competitive

new

products

and services in a timely manner and the acceptance of such products and services

by KCG's customers and potential customers; (vii) KCG's ability to keep up

with technological changes; (viii) KCG's ability to effectively identify and manage market risk, operational and technology risk, legal

risk,

liquidity

risk,

reputational

risk,

counterparty

and

credit

risk,

international

risk,

regulatory

risk,

and

compliance

risk;

(ix)

the

cost

and

other

effects of material contingencies, including litigation contingencies, and any

adverse judicial, administrative or arbitral rulings or proceedings; (x)

the effects of increased competition and KCG's ability to maintain and expand

market share; and (xi) the completion of the tender offer commenced by KCG

on May 4, 2015. The list above is not exhaustive. Readers should carefully review the risks and uncertainties disclosed in

KCG's

reports

with

the

SEC,

including,

without

limitation,

those

detailed

under

"Risk

Factors"

in

KCG's

Annual

Report

on

Form

10-K

for

the

year-

ended December 31, 2014, Quarterly Report on Form 10-Q for the

quarter-ended March 31, 2015, and other reports or documents KCG files with,

or furnishes to, the SEC from time to time.

For additional disclosures, please see

https://www.kcg.com/legal/global-disclosures. |

Investment Rationale

1.

A better model for the emerging competitive landscape –

agile, scalable,

pure-play, execution-only, non-bank

2.

A developer of advanced technologies driving the shift in trading from analog

to digital across asset classes

3.

Prospects for multiyear organic growth direct from core capabilities

4.

Strong cash flow generation and early record of capital return

5.

Long-term growth opportunities from the after effects of new regulations

instituted in response to the global financial crisis of 2008

1 |

The KCG Model

Market

Making

Agency

Execution

Trading

Venues

KCG helps retail and institutional investors

efficiently buy and sell liquid financial assets

around the world.

Direct-to-client and non-client,

exchange-based market making

Agency-based trading

on behalf of clients

Agency-based trading between

principals to transactions

2

A leading, independent global securities firm

dedicated exclusively to trading

Developer of advanced technologies applicable to

market making, agency execution and trading

venues in multiple asset classes

Delivers consistent, high-quality trade executions

that drive trading performance for retail and

institutional investors

Contributes to better price discovery, deeper

liquidity, tighter spreads and lower costs for all

market participants |

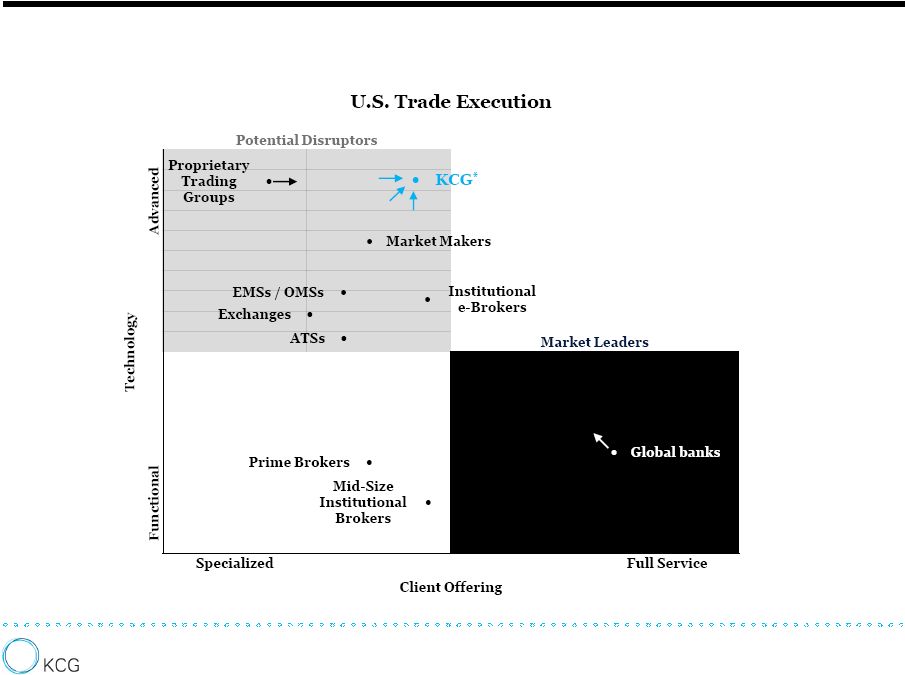

The Competitive Landscape

* KCG Holdings, Inc. was formed July 1, 2013 by the merger of GETCO Holding

Company, LLC and Knight Capital Group, Inc. 3

|

Integration and Restructuring Activities

3Q13

4Q13

1Q14

2Q14

3Q14

4Q14

1Q15

2Q15

4

Closing of sale of

Urban Financial

(12/2)

Inception of share

repurchase

program

(5/2)

U.K. broker-dealer

consolidation

(7/1)

Debt refinancing into

$500 mn Sr Secured

Notes due in 2020 (3/13)

Full prepayment

of $535 mn first

lien credit facility

(4/15)

U.S. broker-dealer

consolidation

(1/2)

Appointment of

Steffen Parratt

as CFO (1/6)

Announcement

of modified

Dutch auction

tender offer

(5/1)

A 35% reduction in

headcount since the

merger close to 1,038

full-time employees

(3/31)

Appointment of Philip

Allison as CEO of KCG

Europe Ltd (9/22)

Realization of the estimated

merger-related cost synergies

of $110 mn on an annualized

run-rate basis (12/31)

Closing of sale of

KCG Futures

(12/1)

Appointment of

Charles Haldeman

as Non-Executive

Chairman of the

Board (10/30)

Consolidation of legacy

alternative trading

systems (8/4)

Reorganization of

KCG Europe Ltd

(10/28)

Closing of sale of

KCG Hotspot (3/13) |

Cash Management: Deleveraging to Capital Return

Debt level

Cumulative share repurchases

Cash

(in $ millions)

Sources

Uses

Approximate cash and cash equivalents

at July 1, 2013²

$ 730

Asset sales³

304

Free

cash

flow

278

Debt

repayments

857

Funds

received

from

issuance

of

debt,

net

6

488

Distributions

from

investments,

net

58

Share

repurchases

8

95

Tender

Offer

330

Subtotal

575

Targeted liquidity pool of cash and highly-liquid

instruments

350

Approximate

remaining

cash

$ 225

NOTE: Totals may not add due to rounding

1

Debt level and share repurchases for May 2015 and June 2015 assume no principal

debt prepayments are made and the $330 million modified Dutch auction tender offer is fully subscribed

2

Represents the aggregate cash and cash equivalents held by GETCO Holding Company,

LLC and Knight Capital Group, Inc. at June 30, 2013; also factors in cash activity related to the Mergers on 7/1 including issuance of $535 million First

Lien Credit Facility, contribution of $55 million from GA offset

by payment to Knight shareholders of $720 million, funding of escrow account to

paydown Knight Convertibles of $375 million, payment of debt (and interest on debt) on GETCO's

books and fees on Merger-related debt issuances

3

Asset sales represent aggregate cash received to date from sales of Urban

Financial of America, KCG's futures commission merchant (FCM) and KCG Hotspot, less estimated taxes payable on the applicable gains and excluding all future

consideration

4

Free cash flow represents income from continuing operations less capital

expenditures plus non-cash items such as depreciation and amortization, stock-based compensation and non-GAAP adjustments included in Regulation G tables

5

Debt repayments represents total cash used to repay 8.25% $305 million Senior

Secured Notes plus its make-whole premium plus $535 million First Lien Credit Facility ($117

million of the paydown of this facility came from the Collateral

Account funded on 7/1; $117 million of KCG's cash was then used for the repayment

of the remaining principal outstanding of KCG's Convertible Notes 6

Funds received from issuance of debt, net represents issuance of 6.875% $500

million Senior Secured Notes, net of fees paid to third parties directly attributable to the debt issuance

7

Distributions from investments, net represents cash received as

returns on capital related to KCG's investments, net of additional investments

made 8

Represents share repurchases under the initial $150 million share repurchase

program authorized by the KCG Board of Directors on May 1, 2014 9

Represents the maximum amount available for share repurchases under the modified

Dutch auction tender offer announced in May 2015. 10

Targeted liquidity pool, as described in KCG's SEC filings within Item 3

‘Quantitative and Qualitative Disclosures About Market Risk’

11

Represents cash in excess of the targeted liquidity pool, a portion of which is

contained in Cash and cash equivalents and the remainder is used to fund

daily operations and contained elsewhere on the balance sheet including within Receivable from brokers, dealers and clearing organizations

5

5

7

9

11

4

10 |

Consolidated Financials

6

Compensation and benefits

Communications and data processing

Depreciation and amortization

Debt interest expense

Professional fees

Occupancy and equipment rentals

Business development

Other

KCG balance sheet

As of March 31, 2015

(in $ millions)

Cash and cash equivalents

990.5

Debt³

799.8

Stockholders’

equity

1,783.3

-

-

-

Debt-to-tangible

equityratio

4

0.30

-

-

-

Bookvalue

per

share

5

$15.10

Tangible

book

value

per

share

5

$13.86

1

See addendum for a reconciliation of GAAP to non-GAAP financial results;

quarterly averages are derived from totals provided in the charts

2

Free cash flow represents income from continuing operations less capital

expenditures plus non-cash items such as depreciation and

amortization, stock-based compensation and non-GAAP adjustments

included in the Regulation G tables

3

Debt at March 31, 2015 included the 8.25% $305 million Senior Secured Notes,

which were redeemed subsequent to the quarter close using funds held in

escrow 4

Debt-to-tangible equity ratio at March 31, 2015 excludes the 8.25% $305

million Senior Secured Notes redeemed subsequent to the quarter close;

tangible equity is calculated by subtracting goodwill and intangible

assets from equity 5

Tangible book value is calculated by subtracting goodwill and intangible assets

from equity; based on shares outstanding of 118.1 million, including

restricted stock units (RSUs) Non-GAAP pre-tax income from

continuing operations Free cash flow from operating

income² |

Prospects for Multiyear Organic Growth

7

Market

Making

Agency

Execution

Trading

Venues

Market Making:

Agency Execution:

Trading Venues:

Incremental market share gains in U.S. equities from

strategic clients and expanded capabilities,

Market making in fixed income, currencies and

commodities on a global basis,

Building out the client network in Europe

Expansion of algorithmic trading among U.S.

and European asset managers,

The continued growth of ETF assets under

management and trading volume,

The potential for unbundling

Expansion of the KCG BondPoint offering for

institutional clients

Industry consolidation among ATSs |

|

Regulation G Reconciliation of Non-GAAP

Financial Measures (Continuing Operations)

3 months ended March 31, 2015

Market Making

Global Execution

Services

Corporate and

Other

Consolidated

Reconciliation

of

GAAP

pre-tax

to

non-GAAP

pre-tax:

GAAP

income

(loss)

from

continuing

operations

before

income

taxes

$ 39,340

$ 381,058

$ (14,270)

$ 406,128

Gain

on

sale

of

KCG

Hotspot

-

(385,026)

-

(385,026)

Professional

fees

related

to

sale

of

KCG

Hotspot

-

6,736

-

6,736

Compensation

expense

related

to

sale

of

KCG

Hotspot

-

4,457

-

4,457

Lease

loss

accrual,

net

-

-

132

132

Non-GAAP

income

(loss)

from

continuing

operations

before

income

taxes

$ 39,340

$ 7,225

$ (14,138)

$ 32,427

9 |

Regulation G Reconciliation of Non-GAAP

Financial Measures (Continuing Operations)

3 months ended December 31, 2014

Market Making

Global Execution

Services

Corporate and

Other

Consolidated

Reconciliation

of

GAAP

pre-tax

to

non-GAAP

pre-tax:

GAAP

income

(loss)

from

continuing

operations

before

income

taxes

$ 42,710

$ 9,968

$ (26,147)

$ 26,531

Gain

on

sale

of

FCM

-

(2,116)

-

(2,116)

Lease

loss

accrual,

net

-

-

6,117

6,117

Non-GAAP

income

(loss)

from

continuing

operations

before

income

taxes

$ 42,710

$ 7,852

$ (20,030)

$ 30,532

10 |

3

months ended September 30, 2014 Market Making

Global Execution

Services

Corporate and

Other

Consolidated

Reconciliation

of

GAAP

pre-tax

to

non-GAAP

pre-tax:

GAAP

loss

from

continuing

operations

before

income

taxes

$ (8,033)

$ (1,664)

$ (5,538)

$ (15,235)

Net

gain

related

to

tradeMONSTER

combination

with

OptionsHouse

-

-

(15,105)

(15,105)

Compensation

related

to

reduction

in

workforce

and

other

employee

separations

2,786

3,577

4,158

10,521

Writedown

of

assets

and

lease

loss

accrual,

net

-

-

301

301

Non-GAAP

(loss)

income

from

continuing

operations

before

income

taxes

$ (5,247)

$ 1,913

$ (16,184)

$ (19,518)

Regulation G Reconciliation of Non-GAAP

Financial Measures (Continuing Operations)

11 |

Regulation G Reconciliation of Non-GAAP

Financial Measures (Continuing Operations)

3 months ended June 30, 2014

Market Making

Global Execution

Services

Corporate and

Other

Consolidated

Reconciliation

of

GAAP

pre-tax

to

non-GAAP

pre-tax:

GAAP

income

(loss)

from

continuing

operations

before

income

taxes

$ 36,004

$ 736

$ (22,233)

$ 14,507

Writedown

of

capitalized

debt

costs

-

-

1,995

1,995

Compensation

related

to

reduction

in

workforce

383

1,886

800

3,069

Writedown

of

assets

and

lease

loss

accrual,

net

452

-

1,489

1,941

Non-GAAP

income

(loss)

from

continuing

operations

before

income

taxes

$ 36,839

$ 2,622

$ (17,949)

$ 21,512

12 |

Regulation G Reconciliation of Non-GAAP

Financial Measures (Continuing Operations)

3 months ended March 31, 2014

Market Making

Global Execution

Services

Corporate and

Other

Consolidated

Reconciliation

of

GAAP

pre-tax

to

non-GAAP

pre-tax:

GAAP

income

(loss)

from

continuing

operations

before

income

taxes

$ 76,032

$ 2,016

$ (18,664)

$ 59,384

Writedown

of

capitalized

debt

costs

-

-

7,557

7,557

Income

resulting

from

the

merger

of

BATS

and

Direct

Edge,

net

-

-

(9,644)

(9,644)

Lease

loss

accrual,

net

359

-

(93)

266

Non-GAAP

income

(loss)

from

continuing

operations

before

income

taxes

$ 76,391

$ 2,016

$ (20,844)

$ 57,563

13 |

Regulation G Reconciliation of Non-GAAP

Financial Measures (Continuing Operations)

3 months ended December 31, 2013

Market Making

Global Execution

Services

Corporate and

Other

Consolidated

Reconciliation

of

GAAP

pre-tax

to

non-GAAP

pre-tax:

GAAP

income

(loss)

from

continuing

operations

before

income

taxes

$ 47,951

$ (4,491)

$ (60,159)

$ (16,699)

Compensation

and

other

expenses

related

to

a

reduction

in

workforce

5,254

5,447

708

11,409

Professional

and

other

fees

related

to

Mergers

and

August

1st

technology

issue

-

-

2,785

2,785

Writedown

of

capitalized

debt

costs

-

-

13,209

13,209

Gain

on

strategic

asset

-

-

(1,359)

(1,359)

Writedown

of

assets

and

lease

loss

accrual

-

1,681

8,819

10,500

Non-GAAP

income

(loss)

from

continuing

operations

before

income

taxes

$ 53,205

$ 2,637

$ (35,997)

$ 19,845

14 |

Regulation G Reconciliation of Non-GAAP

Financial Measures (Continuing Operations)

3 months ended September 30, 2013

Market Making

Global Execution

Services

Corporate and

Other

Consolidated

Reconciliation

of

GAAP

pre-tax

to

non-GAAP

pre-tax:

GAAP

income

(loss)

from

continuing

operations

before

income

taxes

$ 47,853

$ (16,354)

$ 89,874

$ 121,373

Gain

on

investment

in

Knight

Capital

Group,

Inc.

-

-

(127,972)

(127,972)

Compensation

and

other

expenses

related

to

reduction

in

workforce

2,309

15,132

-

17,441

Professional

and

other

fees

related

to

Mergers

and

August

1st

technology

issue

-

-

7,269

7,269

Writedown

of

assets

and

lease

loss

accrual,

net

108

-

828

936

Non-GAAP

income

(loss)

from

continuing

operations

before

income

taxes

$ 50,270

$ (1,222)

$ (30,001)

$ 19,047

15 |

Regulation G Reconciliation of Non-GAAP

Financial Measures (Continuing Operations)

3 months ended March 31, 2015

GAAP

Adjustments for

non-GAAP presentation

KCG non-GAAP, normalized

expenses

Reconciliation of GAAP expenses to KCG non-GAAP,

normalized expenses:

Employee compensation and benefits

106,718

4,457

102,261

Communications and data processing

33,764

-

33,764

Depreciation and amortization

20,615

-

20,615

Debt interest expense

8,463

-

8,463

Professional fees

11,181

6,736

4,445

Occupancy and equipment rentals

7,340

-

7,340

Business development

1,857

-

1,857

Lease loss accrual, net

132

132

-

Other

7,808

-

7,808

Total expenses¹

$ 197,878

$ 11,325

$ 186,553

16

1

Total expenses exclude transaction-based expenses which fluctuate based on

market conditions and client activity. |

3

months ended December 31, 2014 GAAP

Adjustments for

non-GAAP presentation

KCG non-GAAP, normalized

expenses

Reconciliation of GAAP expenses to KCG non-GAAP,

normalized expenses:

Employee compensation and benefits

116,214

-

116,214

Communications and data processing

36,945

-

36,945

Depreciation and amortization

21,224

-

21,224

Debt interest expense

7,721

-

7,721

Professional fees

5,695

-

5,695

Occupancy and equipment rentals

8,514

-

8,514

Business development

2,308

-

2,308

Lease loss accrual, net

6,117

6,117

-

Other

9,822

-

9,822

Total expenses¹

$ 214,561

$ 6,117

$ 208,444

Regulation G Reconciliation of Non-GAAP

Financial Measures (Continuing Operations)

17

1

Total expenses exclude transaction-based expenses which fluctuate based on

market conditions and client activity. |

Regulation G Reconciliation of Non-GAAP

Financial Measures (Continuing Operations)

3 months ended September 30, 2014

GAAP

Adjustments for

non-GAAP presentation

KCG non-GAAP, normalized

expenses

Reconciliation of GAAP expenses to KCG non-GAAP,

normalized expenses:

Employee compensation and benefits

95,307

10,521

84,786

Communications and data processing

38,576

-

38,576

Depreciation and amortization

20,298

-

20,298

Debt interest expense

7,714

-

7,714

Professional fees

7,161

-

7,161

Occupancy and equipment rentals

7,672

-

7,672

Business development

3,163

-

3,163

Writedown of assets and lease loss accrual, net

301

301

-

Other

10,580

-

10,580

Total expenses¹

$ 190,772

$ 10,822

$ 179,950

18

1

Total expenses exclude transaction-based expenses which fluctuate based on

market conditions and client activity. |

3

months ended June 30, 2014 GAAP

Adjustments for

non-GAAP presentation

KCG non-GAAP, normalized

expenses

Reconciliation of GAAP expenses to KCG non-GAAP,

normalized expenses:

Employee compensation and benefits

103,430

3,069

100,361

Communications and data processing

38,279

-

38,279

Depreciation and amortization

19,823

-

19,823

Debt interest expense

7,497

-

7,497

Professional fees

7,337

-

7,337

Occupancy and equipment rentals

8,235

-

8,235

Business development

2,609

-

2,609

Writedown of assets, lease loss accrual and capitalized debt costs

3,936

3,936

-

Other

10,767

-

10,767

Total expenses¹

$ 201,913

$ 7,005

$ 194,908

Regulation G Reconciliation of Non-GAAP

Financial Measures (Continuing Operations)

19

1

Total expenses exclude transaction-based expenses which fluctuate based on

market conditions and client activity. |

3

months ended March 31, 2014 GAAP

Adjustments for

non-GAAP presentation

KCG non-GAAP, normalized

expenses

Reconciliation of GAAP expenses to KCG non-GAAP,

normalized expenses:

Employee compensation and benefits

122,319

-

122,319

Communications and data processing

36,796

-

36,796

Depreciation and amortization

20,103

-

20,103

Debt interest expense

9,524

-

9,524

Professional fees

5,402

-

5,402

Occupancy and equipment rentals

8,285

-

8,285

Business development

1,683

-

1,683

Lease loss accrual and writedown of capitalized debt costs

7,823

7,823

-

Other

8,643

-

8,643

Total expenses¹

$ 220,578

$ 7,823

$ 212,755

Regulation G Reconciliation of Non-GAAP

Financial Measures (Continuing Operations)

20

1

Total expenses exclude transaction-based expenses which fluctuate based on

market conditions and client activity. |

3

months ended December 31, 2013 GAAP

Adjustments for

non-GAAP presentation

KCG non-GAAP, normalized

expenses

Reconciliation of GAAP expenses to KCG non-GAAP,

normalized expenses:

Employee compensation and benefits

112,209

11,409

100,800

Communications and data processing

37,512

-

37,512

Depreciation and amortization

19,566

-

19,566

Debt interest expense

12,943

-

12,943

Professional fees

7,734

2,491

5,243

Occupancy and equipment rentals

9,358

-

9,358

Business development

1,923

-

1,923

Lease loss accrual and writedown of capitalized debt costs

23,709

23,709

-

Other

13,066

294

12,772

Total expenses¹

$ 238,020

$ 37,903

$ 200,117

Regulation G Reconciliation of Non-GAAP

Financial Measures (Continuing Operations)

21

1

Total expenses exclude transaction-based expenses which fluctuate based on

market conditions and client activity. |

3

months ended September 30, 2013 GAAP

Adjustments for

non-GAAP presentation

KCG non-GAAP, normalized

expenses

Reconciliation of GAAP expenses to KCG non-GAAP,

normalized expenses:

Employee compensation and benefits

129,631

17,441

112,190

Communications and data processing

44,046

-

44,046

Depreciation and amortization

20,091

-

20,091

Debt interest expense

19,350

2,982

16,368

Professional fees

9,077

4,087

4,990

Occupancy and equipment rentals

8,898

-

8,898

Business development

2,644

200

2,444

Writedown of assets and lease loss accrual, net

936

936

-

Other

11,318

-

11,318

Total expenses¹

$ 245,991

$ 25,647

$ 220,345

Regulation G Reconciliation of Non-GAAP

Financial Measures (Continuing Operations)

22

1

Total expenses exclude transaction-based expenses which fluctuate based on

market conditions and client activity. |

|

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Trailbreaker Commences Drilling at the Liberty Copper Property, BC.

- Ocwen Financial Schedules Conference Call – First Quarter 2024 Results and Business Update

- Green Rise Foods Announces Director Options

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share