Form 8-K INFINITY PHARMACEUTICALS For: May 07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): May 7, 2015

Infinity Pharmaceuticals, Inc.

(Exact name of registrant as specified in charter)

| Delaware | 000-31141 | 33-0655706 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) | ||

| 784 Memorial Drive, Cambridge, MA | 02139 | |||

| (Address of principal executive offices) | (Zip Code) | |||

Registrant’s telephone number, including area code: (617) 453-1000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 7.01. | Regulation FD Disclosure |

From time to time, we intend to conduct meetings with third parties in which our current corporate slide presentation is presented. A copy of this slide presentation, dated May 7, 2015, is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information responsive to Item 7.01 of this Form 8-K and Exhibit 99.1 hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as expressly set forth by specific reference in such a filing.

| Item 9.01. | Financial Statements and Exhibits |

(d) The following exhibit is included in this report:

| Exhibit No. |

Description | |

| 99.1 | Presentation dated May 7, 2015 | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| INFINITY PHARMACEUTICALS, INC. | ||||||

| Date: May 7, 2015 | By: | /s/ Lawrence E. Bloch, MD, JD | ||||

| Lawrence E. Bloch, MD, JD | ||||||

| EVP, Chief Financial Officer and | ||||||

| Chief Business Officer | ||||||

Building a Fully Integrated

Biopharmaceutical Company

May 7, 2015

Exhibit 99.1 |

Forward-Looking Statements

This

presentation

contains

forward-looking

statements

within

the

meaning

of

The

Private

Securities

Litigation

Reform

Act

of

1995.

Such

forward-

looking

statements

include

those

regarding

the

Company’s

expectations

about:

its

plans

to

complete

patient

enrollment

in

DYNAMO

and

DUO

in

the

second

half

of

2015;

plans

to

initiate

additional

studies

of

duvelisib

in

2015;

its

ability

to

execute

on

its

strategic

plans;

the

potential

complementary

effects

of

inhibiting

PI3K-delta

and

PI3K-gamma;

the

therapeutic

potential

of

PI3K

inhibition

and

duvelisib,

including

in

combination

with

venetoclax;

market

size;

and

2015

financial

guidance.

Such

statements

are

subject

to

numerous

important

factors,

risks

and

uncertainties

that

may

cause

actual

events

or

results

to

differ

materially

from

the

company’s

current

expectations.

For

example,

there

can

be

no

guarantee

that

Infinity

will

report

data

in

the

time

frames

it

has

estimated,

that

any

product

candidate

Infinity

is

developing

will

successfully

complete

necessary

preclinical

and

clinical

development

phases,

or

that

development

of

any

of

Infinity’s

product

candidates

will

continue.

Further,

there

can

be

no

guarantee

that

Infinity's

strategic

collaboration

with

AbbVie

will

continue

or

that

any

positive

developments

in

Infinity’s

product

portfolio

will

result

in

stock

price

appreciation.

Management’s

expectations

and,

therefore,

any

forward-looking

statements

in

this

press

release

could

also

be

affected

by

risks

and

uncertainties

relating

to

a

number

of

other

factors,

including

the

following:

Infinity’s

results

of

clinical

trials

and

preclinical

studies,

including

subsequent

analysis

of

existing

data

and

new

data

received

from

ongoing

and

future

studies;

a

failure

of

Infinity

and/or

AbbVie

to

fully

perform

under

the

strategic

collaboration

and/or

an

early

termination

of

the

collaboration

and

license

agreement;

the

content

and

timing

of

decisions

made

by

the

U.S.

FDA

and

other

regulatory

authorities,

investigational

review

boards

at

clinical

trial

sites

and

publication

review

bodies;

Infinity’s

ability

to

obtain

and

maintain

requisite

regulatory

approvals

and

to

enroll

patients

in

its

clinical

trials;

unplanned

cash

requirements

and

expenditures;

development

of

agents

by

Infinity’s

competitors

for

diseases

in

which

Infinity

is

currently

developing

or

intends

to

develop

its

product

candidates;

and

Infinity’s

ability

to

obtain,

maintain

and

enforce

patent

and

other

intellectual

property

protection

for

any

product

candidates

it

is

developing.

These

and

other

risks

which

may

impact

management’s

expectations

are

described

in

greater

detail

under

the

caption

“Risk

Factors”

included

in

Infinity’s

quarterly

report

on

Form

10-Q

filed

with

the

Securities

and

Exchange

Commission

(SEC)

on

May

6,

2015,

and

other

filings

filed

by

Infinity

with

the

SEC.

Any

forward-looking

statements

contained

in

this

press

release

speak

only

as

of

the

date

hereof,

and

Infinity

expressly

disclaims

any

obligation

to

update

any

forward-looking

statements,

whether

as

a

result

of

new

information,

future

events

or

otherwise.

Infinity’s

website

is

http://www.infi.com.

Infinity

regularly

uses

its

website

to

post

information

regarding

its

business,

product

development

programs

and

governance.

Infinity

encourages

investors

to

use

www.infi.com,

particularly

the

information

in

the

section

entitled

“Investors/Media,”

as

a

source

of

information

about

Infinity.

References

to

www.infi.com

in

this

presentation

are

not

intended

to,

nor

shall

they

be

deemed

to,

incorporate

information

on

www.infi.com

into

this

presentation

by

reference.

2 |

Infinity Today

3

Growing Hem/Onc

Market with Unmet

Medical Need

Commitment to

Building a Novel

Pipeline

Key Strategic

Partner

Registration

Focused Studies

Underway

Experienced

Team

Duvelisib

1

st

in Class Dual

Inhibitor of PI3k- |

4

Current Landscape

An estimated 1.1M

people in the U.S. are

either living with, or

are in remission from,

leukemia or lymphoma.

Leukemia & Lymphoma Society, Facts and Statistics 2015

|

5

Current Landscape

Every 10 minutes,

someone in the

U.S. dies from a

blood cancer.

Leukemia & Lymphoma Society, Facts and Statistics 2015

iNHL and CLL are incurable |

Duvelisib Overview

•

Only dual inhibitor of PI3K-

in Phase 3 development

•

Broad activity observed from Phase 1 study in advanced

hematologic malignancies

1

•

Early evidence of durability in patients with

relapsed/refractory iNHL and CLL

2

•

Registration-focused studies ongoing

6

1

Flinn et al., ASH 2014 Phase 1 data; O’Brien et al., ASH 2014 Phase 1 data;

Porcu et al., ASH 2014 Phase 1 data; Horwitz et al., T-Cell Lymphoma

Forum 2015 Phase 1 data. 2

Flinn et al., ASH 2014 Phase 1 data; O’Brien et al., ASH 2014 Phase 1

data. |

Follicular Lymphoma (FL) Market Growth

7

44,000 drug-treated FL patients

Growth Drivers

•

Growing and aging

population

•

Increased number of

approved treatments

•

Availability of oral treatment

options

•

Longer duration of treatment

•

Availability of chemo-free

treatment options, including

novel combinations

Markets include: US, EU5, and Japan

Source: Decision Resources 2012 |

The

Need for New Treatment Options in FL 8

Newly

Diagnosed

Relapsed

Relapsed/

Refractory

Source: Product prescribing information; physician interviews

•

More

effective

treatment

options

for

frail

patients

•

Cure, increase minimal residual disease

negativity

•

Longer remissions

•

Deeper responses and complete responses

•

Improved tolerability profile

•

Effective treatment options that preserve

patient QoL

Unmet Need

Current Therapy

R-CHOP

R-CVP

BR

R-mono

R-chemo

R-mono

R-chemo

R-mono

Idelalisib |

DYNAMO™: Opportunity to Provide a New

Treatment Option for Refractory iNHL Patients

9

•

Open-label, single-arm monotherapy study under way

•

Primary endpoint: Objective response rate

•

Enrollment completion anticipated 2H15

•

Regulatory support for potential accelerated approval

*Includes follicular lymphoma, marginal zone lymphoma, small lymphocytic

lymphoma. Duvelisib dosed at 25 mg BID; Clinicaltrials.gov NCT01882803.

~120 iNHL

patients*

duvelisib |

DYNAMO+R: Opportunity to Provide a New

Treatment Option for Relapsed FL Patients

10

•

Randomized, placebo-controlled combination study

•

Primary endpoint: Progression-free survival

•

Regulatory support that DYNAMO+R could serve as confirmatory

trial for DYNAMO

~400

Patients

with

Relapsed FL

duvelisib + Rituxan

®

placebo + Rituxan

®

Duvelisib dosed at 25 mg BID; Clinicaltrials.gov NCT02204982.

|

Duvelisib Active in Relapsed/Refractory Indolent

Non-Hodgkin Lymphoma (R/R iNHL): 72% ORR*

11

•

72% (13/18) ORR, including 33% (6/18) CR, at 25 mg BID

–

69% (9/13) ORR in follicular lymphoma patients, including 38% (5/13) CR

•

Majority of adverse events Grade 1 or 2, reversible and clinically manageable

Flinn et al., ASH 2014 Phase 1 data.

*25 mg BID dose. |

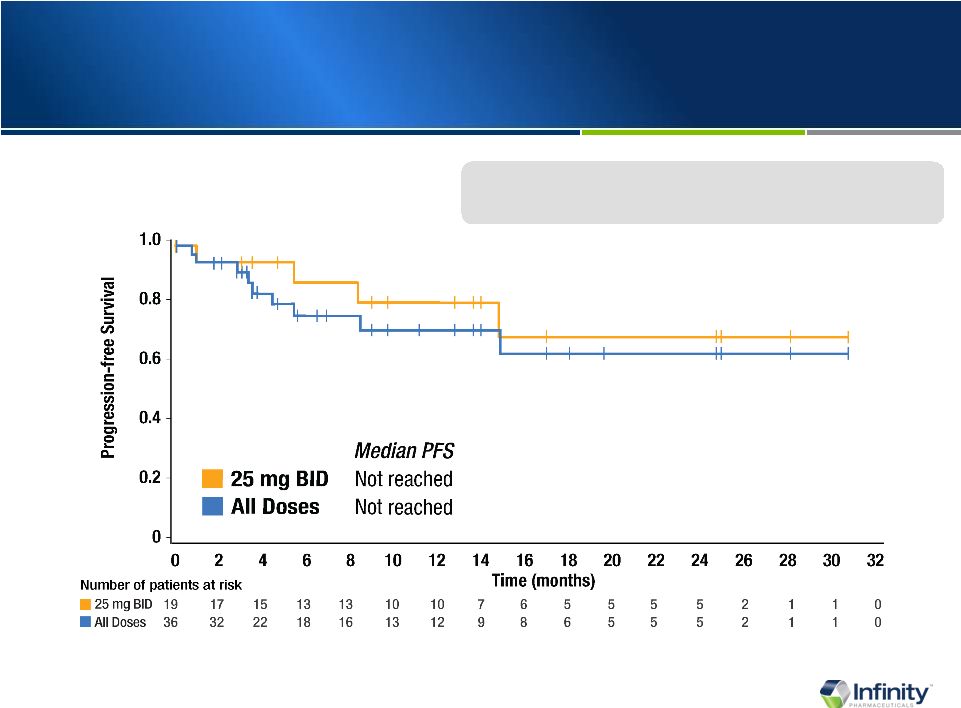

Early Evidence of Durability in R/R iNHL

Median PFS Not Reached

12

Flinn et al., ASH 2014 Phase 1 data.

*25 mg BID dose.

69% progression-free at 24 months* |

Early Evidence of Durability in R/R iNHL

Median OS Not Reached

13

Flinn et al., ASH 2014 Phase 1 data.

*25 mg BID dose.

89% survival at 24 months* |

CONTEMPO: Addressing First-Line Therapy in FL

14

•

Phase 1b/2 study in ~120 patients with previously untreated FL

•

Primary objectives:

–

Confirm safety of the combinations

–

Assess clinical activity

Phase 1b Safety Lead in:

duvelisib + Gazyva

®

duvelisib + Rituxan

®

Phase 2:

duvelisib + Gazyva

®

Phase 2:

duvelisib + Rituxan

® |

Novel Targeted

Combinations

4

duvelisib + venetoclax

1

st

Line

Development

3

Duvelisib Development Strategy in iNHL

15

Improve Upon

and/or Replace

Chemotherapy

2

Initiate two clinical studies in 2015

Initial Registration

Studies:

Refractory and

Relapsed

1 |

CLL

Market Growth 16

*Includes SLL

Markets include: US, EU5, and Japan

Source: Decision Resources 2012

56,000 drug-treated CLL* patients

Growth Drivers

•

Growing and aging

population

•

Increased number of

approved treatments

•

Availability of oral treatment

options

•

Longer duration of treatment

•

Availability of chemo-free

treatment options, including

novel combinations |

The

Need for New Treatment Options in CLL 17

*Indicated in first-line for CLL patients with 17p deletion

Source: Product prescribing information; physician interviews

Newly

Diagnosed

Relapsed

Relapsed/

Refractory

Unmet Need

•

Improved overall survival

•

More

effective

treatment

options

for

frail

patients

•

Low MRD, cure

•

Longer remissions

•

Deeper responses and complete responses

•

Shorter time to response

•

Effective treatment options that preserve

patient QoL

Current Therapy

FCR

BR

R-mono

Ibrutinib*

R-chemo

R-mono

Ibrutinib

R-chemo

R-mono

Ibrutinib

Idelalisib + R |

•

Randomized, monotherapy study

•

Primary endpoint: Progression-free survival by

independent review

•

Completion of enrollment expected in 2H15

Duvelisib dosed at 25 mg BID; Clinicaltrials.gov NCT02004522.

~300 patients

duvelisib

(n = ~150)

Arzerra

®

(ofatumumab)

(n = ~150)

DUO™: Opportunity to Provide a New Treatment

Option for Relapsed/Refractory CLL Patients

18 |

Duvelisib Monotherapy Active in R/R CLL: 57% ORR*

19

•

57% ORR by IWCLL at 25 mg BID, including 1 CR

–

83% (25/30) nodal response rate (

50% reduction in adenopathy)

•

Adverse

events

were

mostly

Grade

1

or

2,

reversible

and

clinically

manageable

O’Brien et al., ASH 2014 Phase 1 data.

*25 mg BID dose. |

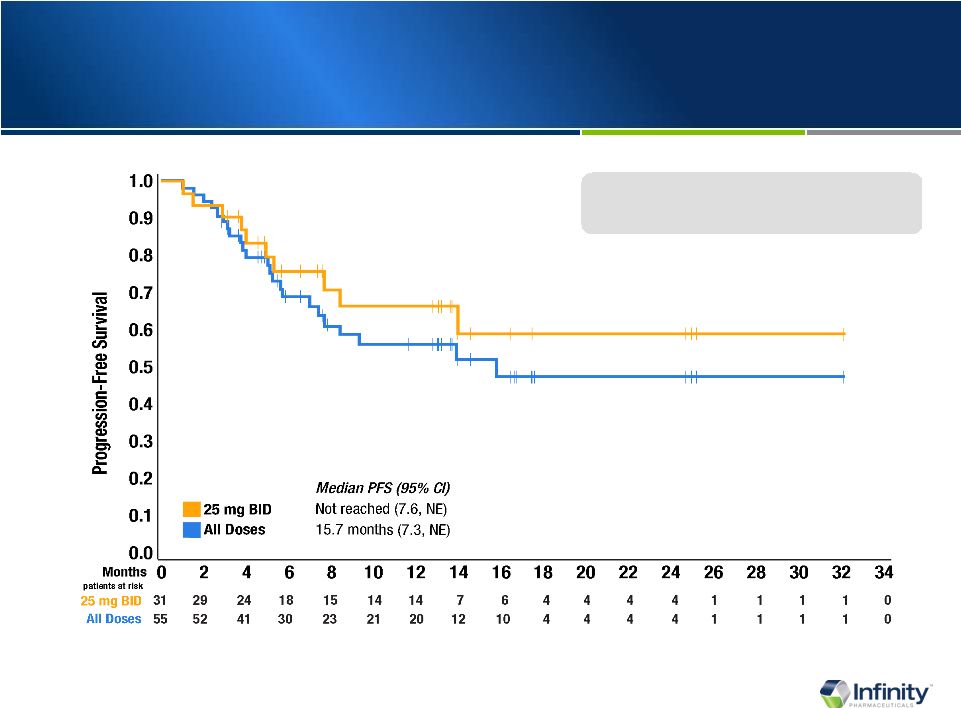

Early Evidence of Durability in R/R CLL

Median PFS Not Reached*

20

66% progression-free at 12 months*

59% progression-free at 24 months*

O’Brien et al., ASH 2014 Phase 1 data.

*25 mg BID dose. |

Early Evidence of Durability in R/R CLL

Median OS Not Reached*

21

74% survival at 12 months*

63% survival at 24 months*

O’Brien et al., ASH 2014 Phase 1 data.

*25 mg BID dose. |

Duvelisib Shows Early Evidence of Activity in

Patients Previously Treated with Ibrutinib

•

CLL (N = 6): 1 PR, 5 SD

•

Aggressive NHL (N = 5): 2 PR, 1SD, 2PD

•

Adverse event profile similar to larger Phase 1 study population

22

Porcu et al., ASH 2014 Phase 1 data; O’Brien et al. ASH 2014 Phase 1 data;

Campbell et al. ASH 2013 Phase 1 data. |

SYNCHRONY: Anticipating a Growing Medical Need

for CLL Patients Relapsing on BTK Inhibitor Therapy

23

•

Phase 1b, open-label, dose-escalation study in ~60 CLL

patients whose disease has progressed following

treatment with a BTK inhibitor

•

Objectives: Determine doses, evaluate clinical activity

and safety

Clinicaltrials.gov NCT02292225

Dose-Escalation Phase:

•

duvelisib + Gazyva

®

Expansion Phase:

•

duvelisib + Gazyva

® |

CLL

Cells From Duvelisib Treated Patients “Primed” for Apoptosis

24

Patel et al., AACR 2015.

BIK

BIM

BMF

HRK

NOXA

PUMA

BCL-2

BH3-only protein

Pro-apoptotic

Pro-survival

protein

anti-apoptotic |

Rationale For Combining Duvelisib with Venetoclax

25

Cells from Patients Treated with Duvelisib Show Increased Sensitivity

to Ex-Vivo Venetoclax Treatment

Patel et al., AACR 2015.

N=5

Paired t test

p=0.0041 |

Duvelisib Development Strategy in CLL

26

Initial Registration

Study:

Relapsed or Refractory

1

Novel Targeted

Combinations

3

duvelisib + venetoclax

First and Best

Treatment Post

BTK Inhibitor

2 |

Strategic Partnership with AbbVie for Duvelisib

in Oncology

27

•

$275M up-front payment

•

$530M in potential development and commercial milestones

Up to $405 million for the achievement of milestones

through first commercial sale

•

Infinity will fund the trials it conducts, up to $667 million,

after which costs will be shared equally

•

Infinity and AbbVie will equally share funding for trials

conducted by AbbVie

•

Co-promotion and 50/50 profit share in U.S.

•

Tiered royalty payments ex-U.S., ranging from 23.5% to

30.5% of net sales

Financial

Development

Commercial

Partnership Terms: |

2015 Financial Guidance

(as of May 6, 2015)

•

Cash and investments at 3/31/15 (unaudited):

$233.6M

•

Revenue:

$105M-$125M

•

Net loss:

$190M-$210M

•

Year-end cash and

investments:

$145M-$165M

28

2015 financial revenue guidance assumes receipt of a $130 million milestone payment

from AbbVie Inc. associated with the first anticipated completion of

enrollment in either DYNAMO or DUO; financial guidance is based on current operating plan and exclusive of any business

development activities. |

Anticipated 2015 Milestones

Novel Duvelisib Combinations

Initiate first clinical study of duvelisib in combination with venetoclax*

Duvelisib in iNHL

Complete enrollment in DYNAMO

TM

in 2H’15

Initiate

2

additional clinical studies

Duvelisib in CLL

Complete enrollment in DUO

TM

in 2H’15

29

*AbbVie is responsible for this study. |

Building a Fully Integrated

Biopharmaceutical Company

www.infi.com

Twitter: @infipharma

*

*

*

* |

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Genuine Parts Company Reports First Quarter 2024 Results and Updates Full-Year Outlook

- Teleflex Announces First Quarter 2024 Earnings Conference Call Information

- Earth Day 2024: Trip.com Group Reveals 8 Travel Tips to Make Your Next Trip More Sustainable

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share