Form 8-K PDL BIOPHARMA, INC. For: May 06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): May 6, 2015

PDL BioPharma, Inc.

(Exact name of Company as specified in its charter)

000-19756

(Commission File Number)

Delaware | 94-3023969 | |

(State or Other Jurisdiction of Incorporation) | (I.R.S. Employer Identification No.) | |

932 Southwood Boulevard

Incline Village, Nevada 89451

(Address of principal executive offices, with zip code)

(775) 832-8500

(Company’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Company under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition.

On May 6, 2015, PDL BioPharma, Inc. (the Company) issued a press release announcing the financial results for the first quarter ended March 31, 2015. A copy of this earnings release is attached hereto as Exhibit 99.1. The Company will host an earnings call and webcast on May 6, 2015, during which the Company will discuss its financial results for the first quarter ended March 31, 2015.

Item 7.01 Regulation FD Disclosure.

Presentation Materials

On May 6, 2015, the Company posted to its website a set of presentation materials that it will use during its earnings call and webcast to assist participants with understanding the Company’s financial results. A copy of this presentation is attached hereto at Exhibit 99.2.

Information Sheet

On May 6, 2015, the Company distributed to analysts covering the Company’s securities a summary of certain information regarding the Company’s net income, dividends, recent transactions and licensed product development and sales (the Information Sheet) to assist those analysts in valuing the Company’s securities. The Information Sheet and its associated tables are attached hereto as Exhibit 99.3.

Limitation of Incorporation by Reference

In accordance with General Instruction B.2. of Form 8-K, the information in this report, including the exhibits, is furnished pursuant to Items 2.02 and 7.01 and shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section.

Cautionary Statements

This filing and its exhibits include “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we can give no assurance that such expectations will prove to be correct. Important factors that could impair the Company’s royalty assets or business are disclosed in the “Risk Factors” contained in the Company’s Annual Report on Form 10-K filed with the Securities and Exchange Commission. All forward-looking statements are expressly qualified in their entirety by such factors. We do not undertake any duty to update any forward-looking statement except as required by law.

Item 9.01 Financial Statements and Exhibits.

Exhibit No. | Description | |

99.1 | Press Release | |

99.2 | Presentation | |

99.3 | Information Sheet | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

PDL BIOPHARMA, INC. | ||

(Company) | ||

By: | /s/ Peter S. Garcia | |

Peter S. Garcia | ||

Vice President and Chief Financial Officer | ||

Dated: May 6, 2015

Exhibit Index

Exhibit No. | Description | |

99.1 | Press Release | |

99.2 | Presentation | |

99.3 | Information Sheet | |

Exhibit 99.1

Contacts: | ||

Peter Garcia | Jennifer Williams | |

PDL BioPharma, Inc. | Cook Williams Communications, Inc. | |

775-832-8500 | 360-668-3701 | |

PDL BioPharma Announces First Quarter 2015 Financial Results

-Net Income Increased 16 percent-

INCLINE VILLAGE, NV, May 6, 2015 – PDL BioPharma, Inc. (PDL) (NASDAQ: PDLI) today reported financial results for the first quarter ended March 31, 2015.

Total revenues for the first quarter of 2015 increased nine percent to $149.7 million from $136.8 million in the first quarter of 2014. Revenues for the quarter ended March 31, 2015 included $127.8 million in royalty and license payments from PDL's licensees to the Queen et al. patents, $11.4 million in net royalty payments from acquired royalty rights and a change in fair value of the royalty rights assets, which included approximately $0.9 million in net cash royalty rights payments, and $10.5 million in interest revenue from notes receivable debt financings to late-state healthcare companies. The first quarter of 2015 royalty revenue growth over the first quarter of 2014 is driven by increased sales of Perjeta®, Xolair®, Kadcyla®, Entyvio®, Actemra® and Tysabri® by PDL's licensees and a $1.5 million increase in interest revenue related to acquisitions of new revenue generating assets.

Operating expenses in the first quarter of 2015 were $7.7 million, compared with $4.6 million in the first quarter of 2014. The increase in operating expenses for the quarter ended March 31, 2015, when compared to the quarter ended March 31, 2014, was primarily the result of an increase in general and administrative expenses of $1.8 million for professional service expenses mostly related to the asset management of Wellstat Diagnostics, $0.9 million for compensation and $0.3 million for stock compensation.

Net income in the first quarter of 2015 was $84.5 million, or $0.50 per diluted share as compared with net income in the first quarter of 2014 of $72.9 million, or $0.44 per diluted share. The increase in net income in the first quarter of 2015 over the same period in 2014 is primarily due to the increase in royalty revenues from the Queen et al. patents.

Net cash provided by operating activities in the first quarter of 2015 was $71.8 million, compared with $68.1 million in the first quarter of 2014. At March 31, 2015, PDL had cash, cash equivalents and investments of $418.9 million, compared with $293.7 million at December 31, 2014. The increase was primarily attributable to net cash provided by the proceeds from the March 2015 Term Loan of $100.0 million, proceeds from royalty rights of $0.9 million, and cash generated by operating activities of $71.8 million, offset in part by payment of dividends of $24.5 million, extinguishment of the Series 2012 Notes for $22.3 million, and the payment of $0.6 million for debt issuance costs related to the March 2015 Term Loan.

Recent Developments

LENSAR Forbearance Agreement

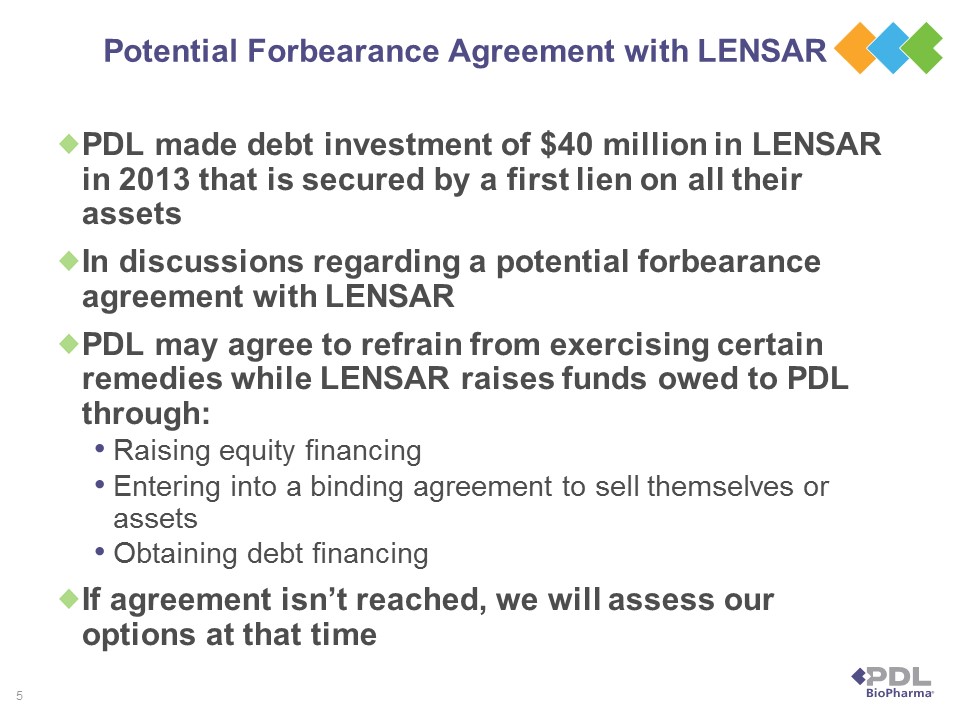

PDL and LENSAR are currently in discussions regarding a forbearance agreement whereby PDL may agree to refrain from exercising certain remedies under the LENSAR loan agreement for a period of time while LENSAR either raises funds through an equity based financing, enters into a binding agreement to complete a sale of itself or of its assets, or obtains a debt financing sufficient to repay PDL for all amounts owed. There can be no assurances of the timing of the forbearance agreement

or whether PDL will enter into such forbearance agreement. Should the parties be unable to reach agreement, PDL will assess its options at that time.

Retirement of May 2015 Notes

On May 1, 2015, the Company completed the retirement of the remaining $155.1 million of aggregate principal of its May 2015 notes at their stated maturity for $155.1 million, plus approximately 5.2 million shares of its common stock for the excess conversion value. In connection with the conversion of our May 2015 Notes and an associated bond hedge, we exercised purchased call options and the hedge counterparties delivered to the Company approximately 5.2 million of PDL common shares, which was the amount equal to the shares required to be delivered by us to the note holders for the excess conversion value.

2015 Dividends

On January 27, 2015, our board of directors declared that the regular quarterly dividends to be paid to our stockholders in 2015 will be $0.15 per share of common stock, payable on March 12, June 12, September 11 and December 11 of 2015 to stockholders of record on March 5, June 5, September 4 and December 4 of 2015, the record dates for each of the dividend payments, respectively. On March 12, 2015, we paid the regular quarterly dividend to our stockholders totaling $24.5 million using earnings generated in the three months ended March 31, 2015.

Conference Call Details

PDL will hold a conference call to discuss financial results at 4:30 p.m. Eastern Time today, May 6, 2015.

To access the live conference call via phone, please dial (800) 668-4132 from the United States and Canada or (224) 357-2196 internationally. The conference ID is 38498993. Please dial in approximately 10 minutes prior to the start of the call. A telephone replay will be available beginning approximately one hour after the call through May 12, 2015, and may be accessed by dialing (855) 859-2056 from the United States and Canada or (404) 537-3406 internationally. The replay passcode is 38498993.

To access the live and subsequently archived webcast of the conference call, go to the Company’s website at http://www.pdl.com and go to “Events & Presentations.” Please connect to the website at least 15 minutes prior to the call to allow for any software download that may be necessary.

About PDL BioPharma, Inc.

PDL manages a portfolio of patents and royalty assets, consisting of its Queen et al. patents, license agreements with various biotechnology and pharmaceutical companies, and royalty and other assets acquired. To acquire new income generating assets, PDL provides non-dilutive growth capital and financing solutions to late-stage public and private healthcare companies and offers immediate financial monetization of royalty streams to companies, academic institutions, and inventors. PDL has invested approximately $780 million to date. PDL evaluates its investments based on the quality of the income generating assets and potential returns on investment. PDL is currently focused on intellectual property asset management, acquiring new income generating assets and maximizing value for its shareholders.

The Company was formerly known as Protein Design Labs, Inc. and changed its name to PDL BioPharma, Inc. in 2006. PDL was founded in 1986 and is headquartered in Incline Village, Nevada. PDL pioneered the humanization of monoclonal antibodies and, by doing so, enabled the discovery of a new generation of targeted treatments for cancer and immunologic diseases for which it receives significant royalty revenue.

PDL BioPharma and the PDL BioPharma logo are considered trademarks of PDL BioPharma, Inc.

Forward-looking Statements

This press release contains "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Each of these forward-looking statements involves risks and uncertainties. Actual results may differ materially from those, express or implied, in these forward-looking statements. Important factors that could impair the value of the Company's royalty assets, restrict or impede the ability of the Company to invest in new royalty bearing assets and limit the Company's ability to pay dividends are disclosed in the risk factors contained in the Company's Annual Report on Form 10-K filed with the Securities and Exchange Commission. All forward-looking statements are expressly qualified in their entirety by such factors. We do not undertake any duty to update any forward-looking statement except as required by law.

PDL BIOPHARMA, INC.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME DATA

(Unaudited)

(In thousands, except per share amounts)

Three Months Ended | ||||||||

March 31, | ||||||||

2015 | 2014 | |||||||

Revenues | ||||||||

Royalties from Queen et al. patents | $ | 127,810 | $ | 116,026 | ||||

Royalty rights - change in fair value | 11,362 | 11,707 | ||||||

Interest revenue | 10,534 | 9,071 | ||||||

Total revenues | 149,706 | 136,804 | ||||||

Operating Expenses | ||||||||

General and administrative expenses | 7,666 | 4,582 | ||||||

Operating income | 142,040 | 132,222 | ||||||

Non-operating expense, net | ||||||||

Interest and other income, net | 86 | 50 | ||||||

Interest expense | (8,610 | ) | (10,525 | ) | ||||

Loss on extinguishment of debt | — | (6,143 | ) | |||||

Total non-operating expense, net | (8,524 | ) | (16,618 | ) | ||||

Income before income taxes | 133,516 | 115,604 | ||||||

Income tax expense | 49,018 | 42,721 | ||||||

Net income | $ | 84,498 | $ | 72,883 | ||||

Net income per share | ||||||||

Basic | $ | 0.52 | $ | 0.48 | ||||

Diluted | $ | 0.50 | $ | 0.44 | ||||

Shares used to compute income per basic share | 162,829 | 151,198 | ||||||

Shares used to compute income per diluted share | 170,412 | 164,571 | ||||||

Cash dividends declared per common share | $ | 0.60 | $ | 0.60 | ||||

PDL BIOPHARMA, INC.

CONDENSED CONSOLIDATED BALANCE SHEET DATA

(Unaudited)

(In thousands)

March 31, | December 31, | |||||||

2015 | 2014 | |||||||

Cash, cash equivalents and investments | $ | 418,920 | $ | 293,687 | ||||

Total notes receivable | $ | 365,806 | $ | 363,212 | ||||

Total royalty rights - at fair value | $ | 269,668 | $ | 259,244 | ||||

Total assets | $ | 1,114,133 | $ | 962,350 | ||||

Total term loan payable | $ | 99,393 | $ | — | ||||

Total convertible notes payable | $ | 432,567 | $ | 451,724 | ||||

Total stockholders' equity | $ | 451,944 | $ | 460,437 | ||||

PDL BIOPHARMA, INC.

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOW DATA

(Unaudited)

(In thousands)

Three Months Ended | ||||||||

March 31, | ||||||||

2015 | 2014 | |||||||

Net income | $ | 84,498 | $ | 72,883 | ||||

Adjustments to reconcile net income to net cash provided by (used in) operating activities | (3,442 | ) | (1,612 | ) | ||||

Changes in assets and liabilities | (9,210 | ) | (3,130 | ) | ||||

Net cash provided by operating activities | $ | 71,846 | $ | 68,141 | ||||

Exhibit 99.2

Exhibit 99.3

PDL BioPharma, Inc.

Q1 2015

May 6, 2015

Following are some of the key points regarding PDL’s first quarter 2015 financial and business results.

Net Income

Net income in the first quarter of 2015 was $84.5 million, or $0.50 per diluted share, as compared with net income of $72.9 million in the first quarter of 2014, or $0.44 per diluted share.

Updates on Approved Royalty Bearing Products related to Queen et al. patents

Avastin® (bevacizumab):

• | On April 22, 2015, Genentech/Roche reported that 1Q15 worldwide sales were CHF 1.61 billion and increased by 6%. |

◦ | EU: Growth driven by further uptake in ovarian and breast cancer. |

◦ | US: Sales largely driven by cervical, ovarian and lung cancer. |

◦ | Japan: Growth in all indications. |

◦ | International: Strong growth in all regions. |

• | On August 14, 2014 and April 8, 2015, Genentech/Roche announced US and EU approval for the treatment of persistent, recurrent or metastatic cervical cancer in combination with chemotherapy, respectively. |

• | On August 6, 2014 and November 14, 2014, Genentech/Roche announced EU and US approval for the treatment of recurrent platinum-resistant ovarian cancer, respectively. |

Herceptin® (trastuzumab):

• | On April 22, 2015, Genentech/Roche reported that 1Q15 worldwide sales were CHF 1.652 billion and increased by 12%. |

◦ | US: Strong growth in first line metastatic breast cancer due to longer treatment times. |

◦ | EU: Stable sales with continuing conversion to subcutaneous formulation. |

◦ | International: Strong growth in Latin America due to access to public markets and in China due to patient assistance program. |

Lucentis® (ranibizumab):

• | On April 23, 2015, Novartis reported that 1Q15 ex-US sales were $539 million and were flat. |

Xolair® (omalizumab):

• | On April 22, 2015, Genentech/Roche reported that 1Q15 US sales were CHF 281 million and increased by 28%. |

◦ | Growth in asthma and chronic idiopathic urticaria (hives) post-FDA approval in 1Q14. |

• | On April 23, 2015, Novartis reported that 1Q15 ex-US sales were $180 million and increased by 22%. |

Tysabri® (natalizumab):

• | On April 24, 2015, Biogen reported that 1Q15 worldwide sales were $463 million and increased by 5%. |

Actemra® (tocilizumab):

• | On April 22, 2015, Genentech/Roche reported that 1Q15 worldwide sales were CHF 334 million and increased by 27%. |

◦ | EU: Strong uptake in first line monotherapy and subcutaneous launch. |

◦ | US: Over 35% growth driven by continued uptake of new subcutaneous formulation. |

◦ | International: Over 55% growth driven by all regions, especially Latin America. |

Perjeta® (pertuzumab):

• | On April 22, 2015, Genentech/Roche reported that 1Q15 worldwide sales were CHF 322 million and increased by 82%. |

Page 1

PDL BioPharma, Inc.

Q1 2015

May 6, 2015

◦ | Perjeta sales grew in all regions with strong uptake in the US, Germany and France. |

◦ | Benefiting from increase in overall survival in first line metastatic breast cancer when combined with Herceptin and docetaxel which data was added to US label in 1Q15 and neoadjuvant indication approved in US and 17 countries. |

Kadcyla® (TDM-1 or ado-trastuzumab emtansine):

• | On April 22, 2015, Genentech/Roche reported that 1Q15 worldwide sales were CHF 179 million and increased by 80%. |

• | EU: Strong uptake in second line metastatic breast cancer. |

• | On December 18, 2014, Genentech reported that the two Kadcyla arms in MARIANNE trial in first line metastatic breast cancer failed to demonstrate superiority over Herceptin + chemotherapy. This does not affect its current approval as second line treatment for HER2+ metastatic breast cancer. |

Solanezumab

• | On April 23, 2015, Lilly stated that its new Phase 3 trial in patients with mild Alzheimer’s Disease is fully enrolled with the last patient visit expected in October 2016 and topline results thereafter. |

• | Lilly also stated that two year data from the extension of its earlier Phase 3 Expedition trials in patients with mild-to-moderate Alzheimer’s Disease will be available in the middle of this year, that disease modification is the focus of the dataset and that they will break out patients with mild disease in the analysis. |

◦ | Unlike in the new Phase 3, Lilly did not use PET scans or similar tests to screen potential trial enrollees for beta amyloid build up. |

• | If solanezumab were to receive marketing authorization, PDL would receive a 12.5 year know-how royalty of 2% from date of first sale. |

Updates on Acquired Royalties from Depomed

• | Effective April 1, 2015 Valeant Pharmaceuticals International, Inc. completed its acquisition of Salix Pharmaceuticals. |

• | Current royalty bearing products include: |

◦ | Glumetza (U.S, sold by Salix/Valeant Pharmaceuticals) |

◦ | Glumetza (Canada, sold by Valeant Pharmaceuticals) |

◦ | Glumetza (Korea, sold by LG Life Sciences) |

◦ | Janumet XR (world-wide, Sold by Merck) |

• | Additional products for which we may receive milestones and royalties: |

◦ | Combination of Invokana® (canagliflozin) and extended-release metformin (Janssen Pharmaceutica) |

◦ | Two investigational fixed-dose combinations of drugs and extended-release metformin (Boehringer Ingelheim) |

• | In the first quarter of 2015 we recorded a $9.1 million increase in revenue related to the royalty rights- change in fair value of the Depomed asset, which included a net cash payment of approximately $0.5 million. PDL expects that the sales of Glumetza in the U.S., and therefore royalties on such sales paid to the Company, will be minimal through the second quarter of 2015 as distributors continue to reduce their excess levels of inventory of Glumetza. |

• | Our forecast of $49 million in cash receipts in 2015 related to the Depomed transaction remains unchanged from estimates given in February of 2015. |

• | Since inception of the transaction (October 2013) to date we have received $113.5 million in cash from this transaction. |

Forward-looking Statements

This document contains "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Each of these forward-looking statements involves risks and uncertainties. Actual results may differ materially from those, express or implied, in these forward-looking statements. Important factors that could impair the value of the Company's royalty assets, restrict or impede the ability of the Company to invest in new income generating assets and limit the Company's ability to pay dividends are disclosed in the risk factors contained in the Company's Annual Report on Form 10-K filed with the Securities and Exchange Commission, as updated by subsequent filings. All forward-looking statements are

Page 2

PDL BioPharma, Inc.

Q1 2015

May 6, 2015

expressly qualified in their entirety by such factors. We do not undertake any duty to update any forward looking statement except as required by law.

Page 3

PDL BioPharma, Inc.

Q1 2015

May 6, 2015

Queen et al. Royalties | ||||||||||

Royalty Revenue by Product ($ in 000's) * | ||||||||||

Avastin | Q1 | Q2 | Q3 | Q4 | Total | |||||

2015 | 38,809 | — | — | — | 38,809 | |||||

2014 | 38,122 | 38,924 | 38,864 | 40,723 | 156,632 | |||||

2013 | 33,234 | 46,720 | 32,224 | 32,287 | 144,464 | |||||

2012 | 23,215 | 41,670 | 25,955 | 30,041 | 120,882 | |||||

2011 | 22,283 | 41,967 | 23,870 | 22,886 | 111,006 | |||||

2010 | 16,870 | 44,765 | 29,989 | 24,922 | 116,547 | |||||

2009 | 13,605 | 35,161 | 21,060 | 15,141 | 84,966 | |||||

2008 | 9,957 | 30,480 | 19,574 | 12,394 | 72,405 | |||||

2007 | 8,990 | 21,842 | 17,478 | 9,549 | 57,859 | |||||

2006 | 10,438 | 15,572 | 15,405 | 12,536 | 53,952 | |||||

Herceptin | Q1 | Q2 | Q3 | Q4 | Total | |||||

2015 | 37,875 | — | — | — | 37,875 | |||||

2014 | 36,646 | 38,292 | 39,407 | 40,049 | 154,394 | |||||

2013 | 30,287 | 47,353 | 30,961 | 33,038 | 141,640 | |||||

2012 | 25,702 | 44,628 | 30,433 | 28,307 | 129,070 | |||||

2011 | 25,089 | 42,209 | 31,933 | 21,812 | 121,042 | |||||

2010 | 23,402 | 38,555 | 27,952 | 25,441 | 115,350 | |||||

2009 | 16,003 | 32,331 | 26,830 | 18,615 | 93,779 | |||||

2008 | 14,092 | 34,383 | 28,122 | 20,282 | 96,880 | |||||

2007 | 19,035 | 28,188 | 22,582 | 14,802 | 84,608 | |||||

2006 | 15,142 | 19,716 | 21,557 | 20,354 | 76,769 | |||||

Lucentis | Q1 | Q2 | Q3 | Q4 | Total | |||||

2015 | 15,920 | — | — | — | 15,920 | |||||

2014 | 17,390 | 16,777 | 16,883 | 16,695 | 67,746 | |||||

2013 | 12,032 | 30,066 | 13,536 | 12,127 | 67,760 | |||||

2012 | 10,791 | 27,938 | 12,552 | 11,097 | 62,377 | |||||

2011 | 8,878 | 24,313 | 12,157 | 10,750 | 56,099 | |||||

2010 | 7,220 | 19,091 | 10,841 | 8,047 | 45,198 | |||||

2009 | 4,621 | 12,863 | 8,123 | 6,152 | 31,759 | |||||

2008 | 3,636 | 11,060 | 7,631 | 4,549 | 26,876 | |||||

2007 | 2,931 | 6,543 | 6,579 | 3,517 | 19,570 | |||||

2006 | — | — | 289 | 3,335 | 3,624 | |||||

Xolair | Q1 | Q2 | Q3 | Q4 | Total | |||||

2015 | 10,971 | — | — | — | 10,971 | |||||

2014 | 8,886 | 9,099 | 10,442 | 11,237 | 39,663 | |||||

2013 | 5,930 | 10,025 | 7,334 | 7,330 | 30,619 | |||||

2012 | 5,447 | 8,609 | 6,504 | 6,145 | 26,705 | |||||

2011 | 4,590 | 7,621 | 5,916 | 5,823 | 23,949 | |||||

2010 | 3,723 | 6,386 | 4,980 | 4,652 | 19,741 | |||||

2009 | 2,665 | 5,082 | 4,085 | 3,722 | 15,553 | |||||

2008 | 1,488 | 4,866 | 3,569 | 2,927 | 12,850 | |||||

2007 | 1,684 | 3,942 | 3,332 | 2,184 | 11,142 | |||||

2006 | 2,263 | 2,969 | 3,041 | 2,495 | 10,768 | |||||

Perjeta | Q1 | Q2 | Q3 | Q4 | Total | |||||

2015 | 6,596 | — | — | — | 6,596 | |||||

2014 | 3,375 | 4,385 | 5,157 | 5,850 | 18,767 | |||||

2013 | 340 | 1,414 | 748 | 879 | 3,381 | |||||

2012 | — | — | 58 | 250 | 308 | |||||

Page 4

PDL BioPharma, Inc.

Q1 2015

May 6, 2015

Queen et al. Royalties | ||||||||||

Royalty Revenue by Product ($ in 000's) * | ||||||||||

Kadcyla | Q1 | Q2 | Q3 | Q4 | Total | |||||

2015 | 3,852 | — | — | — | 3,852 | |||||

2014 | 1,934 | 2,491 | 3,048 | 3,464 | 10,937 | |||||

2013 | — | 551 | 830 | 859 | 2,240 | |||||

Tysabri | Q1 | Q2 | Q3 | Q4 | Total | |||||

2015 | 14,385 | — | — | — | 14,385 | |||||

2014 | 12,857 | 13,350 | 16,048 | 15,015 | 57,270 | |||||

2013 | 12,965 | 13,616 | 11,622 | 12,100 | 50,304 | |||||

2012 | 11,233 | 12,202 | 11,749 | 12,255 | 47,439 | |||||

2011 | 9,891 | 10,796 | 11,588 | 11,450 | 43,725 | |||||

2010 | 8,791 | 8,788 | 8,735 | 9,440 | 35,754 | |||||

2009 | 6,656 | 7,050 | 7,642 | 8,564 | 29,912 | |||||

2008 | 3,883 | 5,042 | 5,949 | 6,992 | 21,866 | |||||

2007 | 839 | 1,611 | 2,084 | 2,836 | 7,370 | |||||

2006 | — | — | — | 237 | 237 | |||||

Actemra | Q1 | Q2 | Q3 | Q4 | Total | |||||

2015 | 4,990 | — | — | — | 4,990 | |||||

2014 | 3,446 | 3,932 | 4,419 | 5,406 | 17,202 | |||||

2013 | 2,631 | 2,816 | 2,939 | 3,744 | 12,131 | |||||

2012 | 1,705 | 2,074 | 2,145 | 2,462 | 8,385 | |||||

2011 | 913 | 1,136 | 1,401 | 1,460 | 4,910 | |||||

2010 | 1,587 | 237 | 315 | 688 | 2,827 | |||||

2009 | 585 | 537 | 909 | 1,197 | 3,228 | |||||

2008 | 44 | — | 146 | 369 | 559 | |||||

2007 | 32 | — | — | 17 | 49 | |||||

Gazyva | Q1 | Q2 | Q3 | Q4 | Total | |||||

2015 | 313 | — | — | — | 313 | |||||

2014 | 51 | 283 | 325 | 436 | 1,094 | |||||

Entyvio | Q1 | Q2 | Q3 | Q4 | Total | |||||

2015 | 2,223 | — | — | — | 2,223 | |||||

2014 | — | — | 153 | 2,192 | 2,344 | |||||

* As reported to PDL by its licensees. Totals may not sum due to rounding. | ||||||||||

Q1 2014 royalty revenue by product above do not include a $5 million payment received from Genentech in Q1 2014 for a retroactive settlement payment from 2013. | ||||||||||

Page 5

PDL BioPharma, Inc.

Q1 2015

May 6, 2015

Queen et al. Sales Revenue | ||||||||||

Reported Licensee Net Sales Revenue by Product ($ in 000's) * | ||||||||||

Avastin | Q1 | Q2 | Q3 | Q4 | Total | |||||

2015 | 1,826,289 | — | — | — | 1,826,289 | |||||

2014 | 1,786,912 | 1,838,764 | 1,828,900 | 1,916,353 | 7,370,929 | |||||

2013 | 1,653,108 | 1,694,678 | 1,746,135 | 1,819,877 | 6,913,798 | |||||

2012 | 1,502,757 | 1,573,727 | 1,551,327 | 1,662,977 | 6,290,788 | |||||

2011 | 1,597,461 | 1,582,705 | 1,581,095 | 1,469,994 | 6,231,255 | |||||

2010 | 1,506,788 | 1,596,892 | 1,594,707 | 1,646,218 | 6,344,605 | |||||

2009 | 1,345,487 | 1,295,536 | 1,439,730 | 1,514,053 | 5,594,806 | |||||

2008 | 980,715 | 1,084,930 | 1,180,427 | 1,239,382 | 4,485,454 | |||||

2007 | 678,068 | 746,587 | 797,013 | 875,084 | 3,096,752 | |||||

2006 | 439,318 | 516,052 | 570,551 | 592,897 | 2,118,817 | |||||

Herceptin | Q1 | Q2 | Q3 | Q4 | Total | |||||

2015 | 1,789,404 | — | — | — | 1,789,404 | |||||

2014 | 1,731,564 | 1,801,990 | 1,854,452 | 1,877,614 | 7,265,621 | |||||

2013 | 1,681,574 | 1,744,145 | 1,681,860 | 1,726,551 | 6,834,130 | |||||

2012 | 1,515,255 | 1,625,313 | 1,663,695 | 1,650,495 | 6,454,759 | |||||

2011 | 1,391,568 | 1,559,975 | 1,642,898 | 1,432,771 | 6,027,211 | |||||

2010 | 1,270,846 | 1,349,512 | 1,300,934 | 1,409,310 | 5,330,602 | |||||

2009 | 1,210,268 | 1,133,993 | 1,226,435 | 1,278,626 | 4,849,323 | |||||

2008 | 1,105,426 | 1,195,215 | 1,211,982 | 1,186,806 | 4,699,428 | |||||

2007 | 891,761 | 949,556 | 979,602 | 1,015,033 | 3,835,952 | |||||

2006 | 529,585 | 659,719 | 761,099 | 803,576 | 2,753,979 | |||||

Lucentis | Q1 | Q2 | Q3 | Q4 | Total | |||||

2015 | 749,182 | — | — | — | 749,182 | |||||

2014 | 818,376 | 789,483 | 794,505 | 785,669 | 3,188,031 | |||||

2013 | 1,203,179 | 1,171,423 | 1,200,791 | 1,212,651 | 4,788,045 | |||||

2012 | 1,079,092 | 1,086,543 | 1,097,541 | 1,109,695 | 4,372,871 | |||||

2011 | 887,757 | 943,418 | 1,052,809 | 1,075,015 | 3,958,999 | |||||

2010 | 721,967 | 698,890 | 745,376 | 804,684 | 2,970,917 | |||||

2009 | 462,103 | 469,736 | 555,296 | 615,212 | 2,102,347 | |||||

2008 | 363,615 | 393,682 | 460,167 | 454,922 | 1,672,386 | |||||

2007 | 224,820 | 219,579 | 299,995 | 322,300 | 1,066,695 | |||||

2006 | — | — | 10,689 | 157,742 | 168,431 | |||||

Xolair | Q1 | Q2 | Q3 | Q4 | Total | |||||

2015 | 523,340 | — | — | — | 523,340 | |||||

2014 | 425,243 | 428,171 | 491,372 | 521,726 | 1,866,512 | |||||

2013 | 341,309 | 365,778 | 391,900 | 401,333 | 1,500,321 | |||||

2012 | 310,234 | 314,638 | 347,796 | 340,431 | 1,313,100 | |||||

2011 | 267,754 | 277,642 | 310,874 | 314,911 | 1,171,182 | |||||

2010 | 228,859 | 225,878 | 251,055 | 263,389 | 969,179 | |||||

2009 | 184,669 | 181,086 | 211,006 | 219,693 | 796,454 | |||||

2008 | 137,875 | 169,521 | 177,179 | 183,753 | 668,329 | |||||

2007 | 129,172 | 130,700 | 144,250 | 147,754 | 551,876 | |||||

2006 | 95,241 | 99,354 | 112,608 | 118,002 | 425,204 | |||||

Perjeta | Q1 | Q2 | Q3 | Q4 | Total | |||||

2015 | 310,410 | — | — | — | 310,410 | |||||

2014 | 158,809 | 206,333 | 242,700 | 275,311 | 883,153 | |||||

2013 | 34,008 | 55,076 | 66,353 | 87,949 | 243,386 | |||||

2012 | — | — | 5,080 | 25,000 | 30,079 | |||||

Page 6

PDL BioPharma, Inc.

Q1 2015

May 6, 2015

Queen et al. Sales Revenue | ||||||||||

Reported Licensee Net Sales Revenue by Product ($ in 000's) * | ||||||||||

Kadcyla | Q1 | Q2 | Q3 | Q4 | Total | |||||

2015 | 181,275 | — | — | — | 181,275 | |||||

2014 | 91,031 | 117,212 | 143,414 | 163,028 | 514,685 | |||||

2013 | — | 21,459 | 73,626 | 85,906 | 180,991 | |||||

Tysabri | Q1 | Q2 | Q3 | Q4 | Total | |||||

2015 | 479,526 | — | — | — | 479,526 | |||||

2014 | 428,561 | 442,492 | 534,946 | 500,511 | 1,906,510 | |||||

2013 | 434,677 | 451,358 | 387,407 | 403,334 | 1,676,776 | |||||

2012 | 374,430 | 401,743 | 391,623 | 408,711 | 1,576,508 | |||||

2011 | 329,696 | 356,876 | 388,758 | 381,618 | 1,456,948 | |||||

2010 | 293,047 | 287,925 | 293,664 | 316,657 | 1,191,292 | |||||

2009 | 221,854 | 229,993 | 257,240 | 285,481 | 994,569 | |||||

2008 | 129,430 | 163,076 | 200,783 | 233,070 | 726,359 | |||||

2007 | 30,468 | 48,715 | 71,972 | 94,521 | 245,675 | |||||

2006 | — | — | — | 7,890 | 7,890 | |||||

Actemra | Q1 | Q2 | Q3 | Q4 | Total | |||||

2015 | 166,338 | — | — | — | 166,338 | |||||

2014 | 114,865 | 124,736 | 147,285 | 180,197 | 567,082 | |||||

2013 | 87,703 | 91,374 | 97,961 | 124,815 | 401,852 | |||||

2012 | 56,662 | 66,624 | 71,505 | 82,053 | 276,843 | |||||

2011 | 30,433 | 35,370 | 46,709 | 48,671 | 161,183 | |||||

2010 | 52,908 | 5,405 | 10,493 | 22,919 | 91,725 | |||||

2009 | 19,504 | 17,920 | 30,313 | 39,888 | 107,625 | |||||

2008 | 1,452 | 1,377 | 5,981 | 12,305 | 21,115 | |||||

2007 | — | — | — | 1,137 | 1,137 | |||||

Gazyva | Q1 | Q2 | Q3 | Q4 | Total | |||||

2015 | 9,627 | — | — | — | 9,627 | |||||

2014 | 3,095 | 8,697 | 11,531 | 13,428 | 36,750 | |||||

Entyvio | Q1 | Q2 | Q3 | Q4 | Total | |||||

2015 | 59,287 | — | — | — | 59,287 | |||||

2014 | — | — | 5,347 | 58,500 | 63,848 | |||||

* As reported to PDL by its licensee. Dates in above charts reflect when PDL receives | ||||||||||

royalties on sales. Sales occurred in the quarter prior to the dates in the above charts. | ||||||||||

Totals may not sum due to rounding. | ||||||||||

Page 7

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- BiomX Inc. (PHGE) Appoints Susan Blum to its Board

- Renesas Reports Financial Results for the First Quarter Ended March 31, 2024

- Futu Holdings Limited Announces Filing of Its Annual Report on Form 20-F for Fiscal Year 2023

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share