Form 10-Q WAGEWORKS, INC. For: Mar 31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________________________________

FORM 10-Q

__________________________________________________________

|

|

|

|

(Mark One) |

|

|

☒ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2015

OR

|

|

|

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from____________ to ____________

Commission File Number: 001-35232

__________________________________________________________

WAGEWORKS, INC.

(Exact name of Registrant as specified in its charter)

__________________________________________________________

|

|

|

|

|

Delaware |

|

94-3351864 |

|

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer |

|

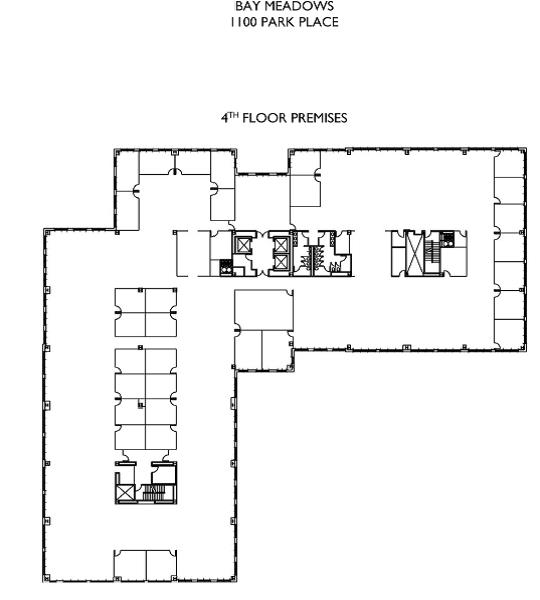

1100 Park Place, 4th Floor San Mateo, California (Address of principal executive offices |

|

94403 (Zip Code) |

(650) 577-5200

(Registrant’s telephone number, including area code)

__________________________________________________________

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 (“Exchange Act”) during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted to its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

||||||

|

Large accelerated filer |

Accelerated filer |

|||||||

|

|

|

|

|

|||||

|

Non-accelerated filer |

☐ (Do not check if a smaller reporting company) |

Smaller reporting company |

||||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of April 30, 2015, there were 35,735,388 shares of the registrant’s common stock outstanding.

WAGEWORKS, INC.

FORM 10-Q QUARTERLY REPORT

2

WAGEWORKS, INC.

(In thousands, except per share amounts)

|

December 31, 2014 |

March 31, 2015 |

||||

|

Derived from |

|||||

|

Audited Financial |

|||||

|

Statements |

(unaudited) |

||||

|

Assets |

|||||

|

Current assets: |

|||||

|

Cash and cash equivalents |

$ |

413,301 |

$ |

451,842 | |

|

Restricted cash |

332 | 332 | |||

|

Accounts receivable, net |

54,453 | 62,597 | |||

|

Deferred tax assets - current |

11,006 | 11,006 | |||

|

Prepaid expenses and other current assets |

14,215 | 17,290 | |||

|

Total current assets |

493,307 | 543,067 | |||

|

Property and equipment, net |

39,137 | 41,480 | |||

|

Goodwill |

157,109 | 157,109 | |||

|

Acquired intangible assets, net |

94,776 | 94,144 | |||

|

Deferred tax assets |

699 | 699 | |||

|

Other assets |

9,687 | 6,344 | |||

|

Total assets |

$ |

794,715 |

$ |

842,843 | |

|

Liabilities and Stockholders' Equity |

|||||

|

Current liabilities: |

|||||

|

Accounts payable and accrued expenses |

$ |

54,285 |

$ |

49,501 | |

|

Customer obligations |

362,451 | 399,725 | |||

|

Short-term contingent payment |

3,180 | 3,940 | |||

|

Other current liabilities |

11,924 | 11,444 | |||

|

Total current liabilities |

431,840 | 464,610 | |||

|

Long-term debt |

79,219 | 79,256 | |||

|

Long-term contingent payment, net of current portion |

695 |

— |

|||

|

Other non-current liability |

3,537 | 3,681 | |||

|

Total liabilities |

515,291 | 547,547 | |||

|

Stockholders' Equity: |

|||||

|

Common stock, $0.001 par value. Authorized 1,000,000 shares; issued 35,479 shares at December 31, 2014 and 35,725 shares at March 31, 2015 |

36 | 36 | |||

|

Additional paid-in capital |

303,568 | 313,801 | |||

|

Accumulated deficit |

(24,180) | (18,541) | |||

|

Total stockholders’ equity |

279,424 | 295,296 | |||

|

Total liabilities and stockholders’ equity |

$ |

794,715 |

$ |

842,843 | |

The accompanying notes are an integral part of the consolidated financial statements.

3

WAGEWORKS, INC.

Consolidated Statements of Income

(In thousands, except per share amounts)

(Unaudited)

|

Three Months Ended March 31, |

|||||

|

2014 |

2015 |

||||

|

Revenues: |

|||||

|

Healthcare |

$ |

39,984 |

$ |

47,289 | |

|

Commuter |

16,043 | 15,897 | |||

|

COBRA |

4,038 | 12,570 | |||

|

Other |

2,555 | 9,540 | |||

|

Total revenue |

62,620 | 85,296 | |||

|

Operating expenses: |

|||||

|

Cost of revenues (excluding amortization of internal use software) |

22,797 | 32,071 | |||

|

Technology and development |

5,199 | 10,585 | |||

|

Sales and marketing |

9,367 | 13,131 | |||

|

General and administrative |

9,932 | 13,565 | |||

|

Amortization and change in contingent consideration |

4,420 | 6,279 | |||

|

Total operating expenses |

51,715 | 75,631 | |||

|

Income from operations |

10,905 | 9,665 | |||

|

Other income (expense): |

|||||

|

Interest income |

1 | 2 | |||

|

Interest expense |

(257) | (575) | |||

|

Other income |

13 | 66 | |||

|

Income before income taxes |

10,662 | 9,158 | |||

|

Income tax provision |

(4,218) | (3,519) | |||

|

Net income |

$ |

6,444 |

$ |

5,639 | |

|

Basic net income per share |

$ |

0.19 |

$ |

0.16 | |

|

Diluted net income per share |

$ |

0.18 |

$ |

0.15 | |

|

Shares used in basic net income per share calculations |

34,831 | 35,555 | |||

|

Shares used in diluted net income per share calculations |

36,303 | 36,668 | |||

The accompanying notes are an integral part of the consolidated financial statements.

4

WAGEWORKS, INC.

Consolidated Statements of Cash Flows

(In thousands)

(Unaudited)

|

Three Months Ended March 31, |

|||||

|

2014 |

2015 |

||||

|

Cash flows from operating activities: |

|||||

|

Net income |

$ |

6,444 |

$ |

5,639 | |

|

Adjustments to reconcile net income to net cash provided by (used in) operating activities: |

|||||

|

Depreciation |

777 | 1,554 | |||

|

Amortization and change in contingent consideration |

4,420 | 6,279 | |||

|

Stock-based compensation |

2,038 | 4,436 | |||

|

Loss on disposal of fixed assets |

— |

4 | |||

|

Provision for doubtful accounts |

94 | 44 | |||

|

Deferred taxes |

3,284 | 2,120 | |||

|

Excess tax benefit from the exercise of stock options |

(4,213) | (3,519) | |||

|

Changes in operating assets and liabilities: |

|||||

|

Accounts receivable |

(18,492) | (8,188) | |||

|

Prepaid expenses and other current assets |

258 | (2,791) | |||

|

Other assets |

(2,376) | 200 | |||

|

Accounts payable and accrued expenses |

(8,734) | (5,835) | |||

|

Customer obligations |

6,282 | 37,274 | |||

|

Other liabilities |

(577) | 813 | |||

|

Net cash provided by (used in) operating activities |

(10,795) | 38,030 | |||

|

Cash flows from investing activities: |

|||||

|

Purchases of property and equipment |

(3,233) | (5,972) | |||

|

Net cash used in investing activities |

(3,233) | (5,972) | |||

|

Cash flows from financing activities: |

|||||

|

Proceeds from exercise of common stock options |

2,495 | 2,366 | |||

|

Proceeds from issuance of common stock (Employee Stock Purchase Plan) |

702 | 598 | |||

|

Excess tax benefit from the exercise of stock options |

4,213 | 3,519 | |||

|

Net cash provided by financing activities |

7,410 | 6,483 | |||

|

Net increase (decrease) in cash and cash equivalents |

(6,618) | 38,541 | |||

|

Cash and cash equivalents at beginning of period |

359,958 | 413,301 | |||

|

Cash and cash equivalents at end of period |

$ |

353,340 |

$ |

451,842 | |

|

Supplemental cash flow disclosure: |

|||||

|

Cash paid during the period for: |

|||||

|

Interest |

$ |

444 |

$ |

1,053 | |

|

Taxes |

25 | 317 | |||

The accompanying notes are an integral part of the consolidated financial statements.

5

(1) Summary of Business and Significant Accounting Policies

Business

WageWorks, Inc., or the Company, is a leader in administering Consumer-Directed Benefits, or CDBs, which empower employees to save money on taxes while also providing corporate tax advantages for employers. The Company is solely dedicated to administering CDBs, including pre-tax spending accounts such as health and dependent care Flexible Spending Accounts, or FSAs, Health Savings Accounts, or HSAs, Health Reimbursement Arrangements, or HRAs, as well as commuter benefit services, including transit and parking programs, wellness programs, COBRA and other employee spending account benefits, in the United States.

The Company delivers its CDB programs through a highly scalable delivery model that employer clients and their employee participants may access through a standard web browser on any internet-enabled device, including computers, smart phones and other mobile devices such as tablet computers. The Company’s on-demand delivery model eliminates the need for its employer clients to install and maintain hardware and software in order to support CDB programs and enables the Company to rapidly implement product enhancements across the Company’s entire user base.

The Company’s CDB programs assist employees and their families in saving money by using pre-tax dollars to pay for certain of their healthcare, dependent care and commuter expenses. Employers financially benefit from the Company’s programs through reduced payroll taxes, even after factoring in the Company’s fees. Under the Company’s FSA, HSA and commuter programs, employee participants contribute funds from their pre-tax income to pay for qualified out-of-pocket healthcare expenses not fully covered by insurance, such as co-pays, deductibles and over-the-counter medical products or for commuting costs. Under the Company’s HRA programs, employer clients provide their employee participants with a specified amount of available reimbursement funds to help their employee participants defray out-of-pocket medical expenses such as deductibles, co-insurance and co-payments. All amounts paid by the employer into HRAs are deductible by the employer as an ordinary business expense and are tax-free to the employee.

The Company operates as a single reportable segment on an entity level basis. The Company generates revenue from the administration of healthcare, commuter, COBRA and other employer sponsored tax-advantaged benefit services. The entity level is the aggregation of these four revenue streams.

Unaudited Interim Financial Statements

In the opinion of the Company’s management, the unaudited interim consolidated financial statements and condensed notes have been prepared on the same basis as the audited consolidated financial statements and reflect all adjustments that, in the opinion of management, are necessary for a fair presentation of the results for the interim periods presented in accordance with accounting principles generally accepted in the United States of America (GAAP). The results of the interim period presented herein are not necessarily indicative of the results of future periods or annual results for the year ending December 31, 2015.

These unaudited interim consolidated financial statements and condensed notes should be read in conjunction with the December 31, 2014 audited financial statements and related notes, together with management’s discussion and analysis of financial condition and results of operations, included in the Company’s Annual Report on Form 10-K. The December 31, 2014 consolidated balance sheet included in this interim Quarterly Report on Form 10-Q was derived from audited financial statements.

There have been no changes in the Company’s significant accounting policies from those that were disclosed in the Company’s audited consolidated financial statements for the fiscal year ended December 31, 2014 included in the Company’s Annual Report on Form 10-K.

Principles of Consolidation

The unaudited consolidated financial statements include the accounts of the Company and its wholly owned subsidiaries. Acquisitions of businesses are accounted for as business combinations, and accordingly, the results of operations of acquired businesses are included in the consolidated financial statements from the date of acquisition. All significant intercompany accounts and transactions have been eliminated in consolidation.

Use of Estimates

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial

6

statements and the reported amounts of revenue and expenses during the reporting period. Significant estimates in these consolidated financial statements include allowances for doubtful accounts, estimates of future cash flows associated with assets, asset impairments, useful lives for depreciation and amortization, loss contingencies, expired and unredeemed products, deferred tax assets, reserve for income tax uncertainties, the assumptions used for stock-based compensation, the assumptions used for software and web site development cost classification, and the assumptions used to fair value contingent consideration associated with acquisitions and purchase accounting. Actual results could differ from those estimates. In making its estimates, the Company considers the current economic and legislative environment in the estimates and has considered those factors when reviewing the assumptions and estimates.

Fair Value of Financial Instruments

Financial Accounting Standards Board (FASB) ASC 820, Fair Value Measurements and Disclosures, or ASC 820, provides a consistent framework to define, measure, and disclose the fair value of assets and liabilities in financial statements. ASC 820 establishes a three-level hierarchy priority for disclosure of assets and liabilities recorded at fair value. The ordering of priority reflects the degree to which objective prices in external active markets are available to measure fair value. The classification of assets and liabilities within the hierarchy is based on whether the inputs to the valuation methodology used for measurement are observable or unobservable.

The Company utilizes valuation techniques that maximize the use of observable inputs and minimize the use of unobservable inputs to the extent possible. The Company determines fair value based on assumptions that market participants would use in pricing an asset or liability in the principal or most advantageous market. When considering market participant assumptions in fair value measurements, the following fair value hierarchy distinguishes between observable and unobservable inputs, which are categorized in one of the following levels:

|

· |

Level 1 Inputs: Unadjusted quoted prices in active markets for identical assets or liabilities accessible to the reporting entity at the measurement date. |

|

· |

Level 2 Inputs: Other than quoted prices included in Level 1 inputs that are observable for the asset or liability, either directly or indirectly, for substantially the full term of the asset or liability. |

|

· |

Level 3 Inputs: Unobservable inputs for the asset or liability used to measure fair value to the extent that observable inputs are not available, thereby allowing for situations in which there is little, if any, market activity for the asset or liability at measurement date. |

The contingent consideration payables related to the acquisitions of Benefit Concepts, Inc. (BCI) and Crosby Benefit Systems, Inc. (CBS), are recorded at fair value on the acquisition date and are adjusted quarterly to fair value. The increases or decreases in the fair value of contingent consideration payable can result from changes in anticipated revenue levels and changes in assumed discount periods and rates. As the fair value measure is based on significant inputs that are not observable in the market, it is categorized as Level 3.

Other financial instruments not measured at fair value on the Company’s unaudited consolidated balance sheet at March 31, 2015, but which require disclosure of their fair values include: cash and cash equivalents (including restricted cash), accounts receivable, accounts payable and accrued expenses and debt under the line of credit with MUFG Union Bank, N.A. (formerly Union Bank, N.A.) The estimated fair value of such instruments at March 31, 2015 approximates their carrying value as reported on the consolidated balance sheet. The fair value of all of these instruments are categorized as Level 2 of the fair value hierarchy, with the exception of cash and cash equivalents, which is categorized as Level 1 due to its short term nature.

The following table provides a reconciliation between the beginning and ending balances of items measured at fair value on a recurring basis that used significant unobservable inputs (Level 3) (dollars in thousands):

|

Contingent |

Contingent |

||||

|

Consideration |

Consideration |

||||

|

BCI |

CBS |

||||

|

Balances at December 31, 2014 |

2,705 | 1,170 | |||

|

Gains or losses included in earnings: |

|||||

|

Losses on revaluation of contingent consideration |

46 | 19 | |||

|

Balances at March 31, 2015 |

$ |

2,751 |

$ |

1,189 | |

The Company measures contingent consideration elements each reporting period at fair value and recognizes changes in fair value in earnings each period in the amortization and change in contingent consideration line item on the consolidated statements of income, until the contingency is resolved.

7

The Company recorded a $0.1 million charge related to the change in fair value of the contingent considerations for BCI and CBS, for both the three months ended March 31, 2014 and 2015, as a result of accretion charges due to the passage of time.

Quantitative Information about Level 3 Fair Value Measurements

The significant unobservable inputs used in the fair value measurement of the Company’s contingent consideration designated as Level 3 are as follows:

|

Significant |

||||||

|

Fair Value at |

Valuation |

Unobservable |

||||

|

March 31, 2015 |

Technique |

Input |

||||

|

(in thousands) |

||||||

|

Contingent consideration - BCI |

$2,751 |

Discounted cash flow |

Annualized revenue and probability of achievement |

|||

|

Contingent consideration - CBS |

$1,189 |

Discounted cash flow |

Annualized revenue and probability of achievement |

Sensitivity to Changes in Significant Unobservable Inputs

As presented in the table above, the significant unobservable inputs used in the fair value measurement of contingent consideration related to the acquisitions are annualized revenue forecasts developed by the Company’s management and the probability of achievement of those revenue forecasts. Significant increases (decreases) in these unobservable inputs in isolation would result in a significantly lower (higher) fair value measurement.

Recently Issued Accounting Pronouncements

In May 2014, the Financial Accounting Standards Board, or FASB, issued Accounting Standards Update No. 2014-09, Revenue from Contracts with Customers, or ASU 2014-09, which clarifies existing accounting literature relating to how and when a company recognizes revenue. Under ASU 2014-09, a company will recognize revenue when it transfers promised goods or services to customers in an amount that reflects the consideration to which the company expects to be entitled in exchange for those goods and services. Additionally, the guidance requires improved disclosures to help users of financial statements better understand the nature, amount, timing, and uncertainty of revenue and cash flows arising from contracts with customers. The new standard allows for either a full retrospective or a modified retrospective transition method. The FASB tentatively decided on April 1, 2015 to defer for one year the effective date of the new revenue standard for public and nonpublic entities reporting under U.S. GAAP. The FASB also tentatively decided to permit entities to early adopt the standard. The tentative decisions will be exposed in an upcoming proposed Accounting Standards Update (ASU) with a 30-day comment period. The Company is in the process of determining what impact, if any, the adoption of this ASU will have on its consolidated financial statements and related disclosures.

(2) Net Income per Share

The following table sets forth the computation of basic and diluted net income per share (in thousands, except per share data):

|

Three Months Ended March 31, |

|||||

|

2014 |

2015 |

||||

|

Numerator (basic and diluted): |

|||||

|

Net income |

$ |

6,444 |

$ |

5,639 | |

|

Denominator (basic): |

|||||

|

Weighted average common shares outstanding |

34,831 | 35,555 | |||

|

Denominator (diluted): |

|||||

|

Weighted average common shares outstanding |

34,831 | 35,555 | |||

|

Dilutive stock options |

1,472 | 1,113 | |||

|

Diluted weighted average common shares outstanding |

36,303 | 36,668 | |||

|

Net income per share: |

|||||

|

Basic |

$ |

0.19 |

$ |

0.16 | |

|

Diluted |

$ |

0.18 |

$ |

0.15 | |

Diluted net income per share does not include the effect of the following anti-dilutive common equivalent shares (in thousands):

8

|

Three Months Ended March 31, |

|||

|

2014 |

2015 |

||

|

Stock options outstanding |

47 | 326 | |

(3) Acquisitions and Channel Partner Arrangement

Ceridian Channel Partner Arrangement

In July 2013, the Company entered into a channel partner arrangement with Ceridian Corporation, or Ceridian, a global product and services company. Pursuant to the arrangement, Ceridian’s CDB account administration business was transitioned to the Company as of January 2015. In conjunction with the transition, the Company also entered into a separate reseller arrangement with Ceridian.

CONEXIS Acquisition

On August 1, 2014, the Company entered into an Asset Purchase Agreement with CONEXIS Benefits Administrators, LP (“CONEXIS”), a Texas limited partnership and Word & Brown Insurance Administrator, Inc., a California corporation, pursuant to which the Company acquired substantially all of the assets of CONEXIS. CONEXIS is a leader in employee benefits administration and serves approximately 16,000 organizations of all sizes. This acquisition added a new base of Consumer-Directed Benefits customers and participant relationships. The purchase price was $118.0 million, adjusted for working capital adjustments, of which $108.0 million was paid at closing with the remaining balance classified in the consolidated balance sheet in the other current liabilities line item. The remaining balance is expected to be paid on August 1, 2015 after adjustment for any indemnification losses incurred by the Company for which it is entitled to recover.

The Company accounted for the acquisition of CONEXIS as a purchase of a business under ASC 805. The results of operations for CONEXIS have been included in the Company’s financial results since the acquisition.

As part of the purchase price allocation, the Company determined that CONEXIS’s separately identifiable intangible assets were its customer relationships, developed technology and trade name. The Company used the income approach to value the customer relationships and trade name. This approach calculates fair value by discounting the after-tax cash flows back to a present value. The baseline data for this analysis was the cash flow estimates used to price the transaction. Cash flows were forecasted and then discounted using a discount rate for customer relationships of 15% and trade name of 12%, based on the estimated IRR and weighted average cost of capital, which employs an estimate of the required equity rate of return and after-tax cost of debt. The Company used a replacement cost approach to estimate the fair value of developed technology in which estimates of development time and cost per man month are used to calculate total replacement cost.

Goodwill was calculated as the difference between the acquisition-date fair value of the consideration transferred and the values assigned to the assets acquired and liabilities assumed. The recognized amount of goodwill is provisional and subject to change pending the completion of the allocation of the consideration transferred to the assets acquired and liabilities assumed. Goodwill recognized from the transaction results from the acquired workforce, the opportunity to expand our client base and achieve greater long-term growth opportunities than either company had operating alone. All of the recognized goodwill is expected to be deductible for tax purposes.

The following table summarizes the allocation of the purchase price at the date of acquisition (in millions):

|

Weighted |

||||

|

Average |

||||

|

Useful Life |

||||

|

Amount |

(in years) |

|||

|

Other net tangible assets acquired |

$ |

4.7 | ||

|

Customer relationships |

48.1 | 10 | ||

|

Developed technology |

3.9 | 5 | ||

|

Trade name |

1.6 | 3 | ||

|

Non-compete agreement |

0.2 | 7 | ||

|

Goodwill |

59.5 | |||

|

Total allocation of acquisition costs |

$ |

118.0 | ||

9

The valuation of certain software licenses, deferred costs and other immaterial working capital balances are provisional and are based on the information that was available as of the acquisition date to estimate the fair value of the assets acquired. The Company believes that information provides a reasonable basis for estimating the fair value but the Company is waiting for additional information necessary to finalize those amounts. Thus, the provisional measurements of fair value reflected are subject to change. Such changes are not expected to be significant. These adjustments to our tangible assets will have an impact on our overall valuation of CONEXIS and in turn may impact the amounts currently recognized for intangible assets and goodwill. The Company expects to finalize the valuation and complete the purchase price allocation as soon as practicable but no later than one year from the acquisition date.

(4) Intangible Assets

Acquired intangible assets at December 31, 2014 and March 31, 2015 were comprised of the following (dollars in thousands):

|

December 31, 2014 |

March 31, 2015 |

||||||||||||||||

|

Gross |

Gross |

||||||||||||||||

|

carrying |

Accumulated |

carrying |

Accumulated |

||||||||||||||

|

amount |

amortization |

Net |

amount |

amortization |

Net |

||||||||||||

|

Amortizable intangible assets: |

|||||||||||||||||

|

Client contracts and broker relationships |

$ |

120,723 |

$ |

33,885 |

$ |

86,838 |

$ |

123,865 |

$ |

36,924 |

$ |

86,941 | |||||

|

Trade names |

3,880 | 1,657 | 2,223 | 3,880 | 1,845 | 2,035 | |||||||||||

|

Technology |

13,846 | 9,390 | 4,456 | 13,846 | 9,895 | 3,951 | |||||||||||

|

Noncompete agreements |

2,232 | 1,798 | 434 | 2,232 | 1,816 | 416 | |||||||||||

|

Favorable lease |

1,137 | 312 | 825 | 1,137 | 336 | 801 | |||||||||||

|

Total |

$ |

141,818 |

$ |

47,042 |

$ |

94,776 |

$ |

144,960 |

$ |

50,816 |

$ |

94,144 | |||||

Amortization expense for acquired intangible assets totaled $2.2 million and $3.8 million for the three months ended March 31, 2014 and 2015, respectively.

The estimated expected amortization expense in future periods is as follows (dollars in thousands):

|

Remainder of 2015 |

$ |

11,232 |

|

2016 |

13,995 | |

|

2017 |

13,440 | |

|

2018 |

12,814 | |

|

2019 |

12,254 | |

|

Thereafter |

30,409 | |

|

Total |

$ |

94,144 |

(5) Accounts Receivable

Accounts receivable at December 31, 2014 and March 31, 2015 were comprised of the following (dollars in thousands):

|

December 31, |

March 31, |

||||

|

2014 |

2015 |

||||

|

Trade receivables |

$ |

35,762 |

$ |

41,127 | |

|

Unpaid amounts for benefit services |

19,458 | 22,290 | |||

| 55,220 | 63,417 | ||||

|

Less allowance for doubtful accounts |

(767) | (820) | |||

|

Accounts receivable, net |

$ |

54,453 |

$ |

62,597 | |

10

(6) Property and Equipment

Property and equipment at December 31, 2014 and March 31, 2015 were comprised of the following (dollars in thousands):

|

December 31, |

March 31, |

||||

|

2014 |

2015 |

||||

|

Computers and equipment |

$ |

13,670 |

$ |

14,620 | |

|

Software and software development costs |

77,104 | 82,083 | |||

|

Furniture and fixtures |

3,306 | 3,293 | |||

|

Leasehold improvements |

8,285 | 8,298 | |||

|

$ |

102,365 |

$ |

108,294 | ||

|

Less accumulated depreciation and amortization |

(63,228) | (66,814) | |||

|

Property and equipment, net |

$ |

39,137 |

$ |

41,480 | |

In the three months ended March 31, 2015, the Company capitalized software development costs of $4.7 million. In the three months ended March 31, 2014 and 2015, the Company amortized $2.1 million and $2.4 million of capitalized software development costs, respectively. These costs are included in amortization and change in contingent consideration in the accompanying consolidated statements of income. At March 31, 2015, the unamortized software development costs included in property and equipment in the accompanying consolidated balance sheet was $26.0 million.

Total depreciation expense, including amortization of capitalized software development costs, in the three months ended March 31, 2014 and 2015 was $2.9 million and $4.0 million, respectively.

(7) Accounts Payable and Accrued Expenses

Accounts payable and accrued expenses at December 31, 2014 and March 31, 2015 were comprised of the following (dollars in thousands):

|

December 31, |

March 31, |

||||

|

2014 |

2015 |

||||

|

Accounts payable |

$ |

1,180 |

$ |

3,515 | |

|

Payable to benefit providers and transit agencies |

19,500 | 18,510 | |||

|

Accrued payables |

11,099 | 8,511 | |||

|

Accrued compensation and related benefits |

16,045 | 12,009 | |||

|

Other accrued expenses |

3,156 | 2,321 | |||

|

Deferred revenue |

3,305 | 4,635 | |||

|

Accounts payable and accrued expenses |

$ |

54,285 |

$ |

49,501 | |

(8) Employee Benefit Plans

Employee Stock Option Plan

The Company’s stock option program is a long-term retention program that is intended to attract, retain, and provide incentives for talented employees, officers, and directors, and to align stockholder and employee interests. The Company considers its option program critical to its operation and productivity.

11

The following table summarizes the weighted-average fair value of stock options granted during the period:

|

Three Months Ended March 31, |

|||||

|

2014 |

2015 |

||||

|

Stock options granted (in thousands) |

210 | 37 | |||

|

Weighted average fair value at date of grant |

$ |

27.00 |

$ |

24.05 | |

Stock option activity for the three months ended March 31, 2015 is as follows (shares in thousands):

|

Remaining |

Aggregate intrinsic |

||||||||

|

Weighted average |

contractual term |

value (dollars in |

|||||||

|

Shares |

exercise price |

(years) |

thousands) |

||||||

|

Outstanding at December 31, 2014 |

3,206 |

$ |

20.90 | 6.75 |

$ |

140,029 | |||

|

Granted |

37 | 61.08 | |||||||

|

Exercised |

(214) | 11.04 | |||||||

|

Forfeited |

(16) | 28.20 | |||||||

|

Outstanding as of March 31, 2015 |

3,013 |

$ |

22.05 | 6.74 |

$ |

95,509 | |||

|

Vested and expected to vest at March 31, 2015 |

2,914 |

$ |

21.53 | 6.67 |

$ |

93,843 | |||

|

Exercisable at March 31, 2015 |

1,780 |

$ |

11.48 | 5.31 |

$ |

74,683 | |||

As of March 31, 2015, there was $17.2 million of total unrecognized compensation cost related to unvested stock options which are expected to vest. The cost is expected to be recognized over a weighted average period of approximately 2.8 years as of March 31, 2015.

The weighted average assumptions used in the Black-Scholes option pricing model to value option grants during the three months ended March 31, 2014 and 2015 were as follows:

|

Three Months Ended March 31, |

|||

|

2014 |

2015 |

||

|

Expected volatility |

47.37% | 44.32% | |

|

Risk-free interest rate |

1.91% | 1.55% | |

|

Expected term (in years) |

6.07 | 4.74 | |

|

Dividend yield |

—% |

—% |

|

Stock-based compensation cost is measured at the grant date based on the fair value of the award. The determination of the fair value of stock-based awards on the date of grant using an option pricing model is affected by the Company’s stock price as well as assumptions regarding a number of complex and subjective variables. Expected volatility is determined using weighted average volatility of peer publicly traded companies as well as the Company’s own historical volatility. The Company expects that it will increase weighting of its own historical data in future periods, as that history grows over time. The risk-free interest rate is determined by using published zero coupon rates on treasury notes for each grant date given the expected term of the options. The dividend yield of zero is based on the fact that the Company expects to invest cash in operations and has never paid cash dividends on common stock. The Company’s expected term represents the period that the Company’s stock-based awards are expected to be outstanding and was determined based on historical experience, giving consideration to the contractual terms of the stock-based awards, vesting schedules and expectations of future employee behavior as evidenced by changes to the terms of its stock-based awards.

Restricted Stock Units

The Company grants restricted stock units to certain employees, officers, and directors under the 2010 Equity Incentive Plan. Restricted stock units vest upon performance-based, market-based or service-based criteria.

Performance-based restricted stock units vest based on the satisfaction of specific performance criteria. At each vesting date, the holder of the award is issued shares of the Company’s common stock. Compensation expense from these awards is equal to the fair market value of the Company’s common stock on the date of grant and is recognized over the remaining service period based on the probable outcome of achievement of the financial metrics. Management’s estimate of the number of shares expected to vest is based on the anticipated achievement of the specified performance criteria.

Market-based performance restricted stock units are granted such that they vest upon the achievement of certain per share price targets of the Company’s common stock during a specified performance period. The fair market values of market-based performance

12

restricted stock units are determined using the Monte Carlo simulation method. The Monte Carlo simulation method is subject to variability as several factors utilized must be estimated including the future daily stock price of the Company’s common stock over the specified performance period, the Company’s stock price volatility and risk-free interest rate. The amount of compensation expense is equal to the per share fair value calculated under the Monte Carlo simulation multiplied by the number of market-based performance restricted stock units granted, recognized over the specified performance period.

Generally, service-based restricted stock units vest over four years with 25% vesting after one year and the balance vesting monthly over the remaining period. Compensation expense is recognized over the requisite service period.

In the first quarter of 2014, the Company granted a total of 106,500 performance-based restricted stock units to certain executive officers and employees. Performance-based restricted stock units are typically granted such that they vest upon the achievement of certain revenue growth rates, and other financial metrics, during a specified performance period for which participants have the ability to receive up to 150% of the target number of shares originally granted.

In the first quarter of 2015, the Company granted a total of 140,000 performance-based restricted stock units to certain executive officers. Performance-based restricted stock units are typically granted such that they vest upon the achievement of certain revenue growth rates, and other financial metrics, during a specified performance period for which participants have the ability to receive up to 150% of the target number of shares originally granted.

The restricted stock units will be eligible to vest based on the Company’s achievement against an average annual EBITDA margin target equal to or greater than 22% and compound revenue growth target for the specified performance period.

The following table describes the levels of revenue growth target for the specified performance period for the restricted stock units to vest:

|

Achievement of Revenue Growth Objective |

Percentage of RSU Vesting |

|

20% and Greater |

150% will vest |

|

Between 15% but less than 20% |

Between 100% and 150% will vest |

|

Between 10% but less than 15% |

Between 50% and 100% will vest |

|

Below 10% |

None will vest |

In the second quarter of 2014, the Company granted a total of 199,000 market-based performance restricted stock units to certain executive officers. The number of shares to be vested is subject to change based on certain market conditions. In the third quarter of 2014, one of the executives notified the Company he would resign and 33,000 market-based performance restricted stock units were forfeited and canceled.

The market-based performance restricted stock units will be eligible to vest based on the Company’s achievement of certain per share price of its common stock as reported on the New York Stock Exchange, or NYSE, for any twenty consecutive trading day period during the specified performance period.

The following table describes the price per share targets that must be achieved for the specified performance period for the restricted stock units to vest:

|

WageWorks Per Share Price on NYSE |

Payout Percentage |

|

$100 |

200% |

|

$90 |

100% |

|

$75 |

50% |

|

Below $75 |

0% |

Stock-based compensation expense related to restricted stock units was $0.8 million and $2.6 million for the three months ended March 31, 2014 and 2015, respectively. As of March 31, 2015, there was $26.1 million of total unrecognized compensation cost related to unvested restricted stock units which are expected to vest. The cost is expected to be recognized over a weighted average period of approximately 2.0 years as March 31, 2015.

13

The following table summarizes information about restricted stock units issued to officers, directors, and employees under our 2010 Plan:

|

Weighted Average |

||||

|

Grant Date |

||||

|

Shares |

Fair Value |

|||

|

(in thousands) |

||||

|

Unvested at December 31, 2014 |

637 |

$ |

37.99 | |

|

Granted |

190 | 61.10 | ||

|

Vested |

(32) | 23.76 | ||

|

Forfeitures |

(8) | 23.76 | ||

|

Unvested at March 31, 2015 |

787 |

$ |

44.27 | |

Stock-based compensation is classified in the consolidated statements of income in the same expense line items as cash compensation. None of the stock-compensation cost was capitalized as amounts were immaterial. Amounts recorded as expense in the consolidated statements of income are as follows (in thousands):

|

Three Months Ended March 31, |

|||||

|

2014 |

2015 |

||||

|

Cost of revenue |

$ |

232 |

$ |

801 | |

|

Technology and development |

208 | 48 | |||

|

Sales and marketing |

329 | 664 | |||

|

General and administrative |

1,269 | 2,923 | |||

|

Total |

$ |

2,038 |

$ |

4,436 | |

(9) Income Taxes

The income tax provision for the three months ended March 31, 2014 and 2015 was $4.2 million and $3.5 million, respectively. The Company provides for income taxes using an asset and liability approach, under which deferred income taxes are provided based upon enacted tax laws and rates applicable to periods in which the taxes become payable.

The Company is subject to income taxes in the U.S. federal and various state jurisdictions. Presently, there are no income tax examinations going on in the jurisdictions where the Company operates.

As of March 31, 2015, the Company remains in a net deferred tax asset position. The realization of the Company’s deferred tax assets depends primarily on its ability to generate sufficient U.S. taxable income in future periods. The amount of deferred tax assets considered realizable may increase or decrease in subsequent quarters as management reevaluates the underlying basis for the estimates of future domestic taxable income.

14

(10) Commitments and Contingencies

(a) Operating Leases

The Company leases office space and equipment under noncancelable operating leases with various expiration dates through 2023. Future minimum lease payments under noncancelable operating leases are as follows (dollars in thousands):

|

Operating leases |

||

|

As of |

||

|

March 31, 2015 |

||

|

Remainder of 2015 |

$ |

5,404 |

|

2016 |

6,550 | |

|

2017 |

6,721 | |

|

2018 |

6,840 | |

|

2019 |

6,980 | |

|

Thereafter |

18,336 | |

|

Total future minimum lease payments |

$ |

50,831 |

Rent expense in the three months ended March 31, 2014 and 2015 was $0.9 million and $1.9 million, respectively. Future minimum lease payments under capital leases, not included in the table above, as of March 31, 2015 are $1.0 million and $0.3 million for remainder of 2015 and 2016, respectively. We have no future minimum lease payments under capital leases extending beyond 2016.

(b) Legal Matters

The Company is involved from time to time in claims that arise in the normal course of its business. The Company is not presently subject to any material litigation nor, to management’s knowledge, is any litigation threatened against the Company that collectively is expected to have a material adverse effect on the Company’s cash flows, financial condition or results of operations.

15

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with our consolidated financial statements and related notes appearing elsewhere in this Quarterly Report on Form 10-Q. The following discussion and analysis contains forward-looking statements that involve risks and uncertainties, as well as assumptions that, if they never materialize or prove incorrect, could cause our results to differ materially from those expressed or implied by such forward-looking statements. Statements that are not purely historical are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements are often identified by the use of words such as, but not limited to, “anticipate,” “believe,” “can,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “project,” “seek,” “should,” “target,” “will,” “would” and similar expressions or variations intended to identify forward-looking statements. Such statements include, but are not limited to, statements concerning market opportunity, our future financial and operating results, investment strategy, sales and marketing strategy, management’s plans, beliefs and objectives for future operations, technology and development, economic and industry trends or trend analysis, expectations about seasonality, opportunity for portfolio purchases, use of non-GAAP financial measures, operating expenses, anticipated income tax rates, capital expenditures, cash flows and liquidity. These statements are based on the beliefs and assumptions of our management based on information currently available to us. Such forward-looking statements are subject to risks, uncertainties and other important factors that could cause actual results and the timing of certain events to differ materially from future results expressed or implied by such forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those identified below, and those discussed in the section titled “Risk Factors” included under Part II, Item 1A below. Furthermore, such forward-looking statements speak only as of the date of this report. Except as required by law, we undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date of such events.

Overview

We are a leader in administering Consumer-Directed Benefits, or CDBs, which empower employees to save money on taxes while also providing corporate tax advantages for employers. We are solely dedicated to administering CDBs, including pre-tax spending accounts such as health and dependent care Flexible Spending Accounts, or FSAs, Health Savings Accounts, or HSAs, Health Reimbursement Arrangements, or HRAs, as well as commuter benefit services, including transit and parking programs, wellness programs, COBRA and other employee spending account benefits, in the United States.

We deliver our CDB programs through a highly scalable delivery model that employer clients and their employee participants may access through a standard web browser on any internet-enabled device, including computers, smart phones and other mobile devices such as tablet computers. Our on-demand delivery model eliminates the need for our employer clients to install and maintain hardware and software in order to support CDB programs and enables us to rapidly implement product enhancements across our entire user base.

Our CDB programs assist employees and their families in saving money by using pre-tax dollars to pay for certain of their healthcare, dependent care and commuter expenses. Employers financially benefit from our programs through reduced payroll taxes, even after factoring in our fees. Under our FSA, HSA and commuter programs, employee participants contribute funds from their pre-tax income to pay for qualified out-of-pocket healthcare expenses not fully covered by insurance, such as co-pays, deductibles and over-the-counter medical products or for commuting costs.

These employee contributions result in savings to both employees and employers. As an example, based on our average employee participant’s annual FSA contribution of approximately $1,300 and an assumed personal combined federal and state income tax rate of 35%, an employee participant will reduce his or her taxes by approximately $455 per year by participating in an FSA. Our employer clients also realize payroll tax (i.e., FICA and Medicare) savings on the pre-tax contributions made by their employees. In the above FSA example, an employer client would save approximately $56 per participant per year, even after the payment of our fees.

Under our HRA programs, employer clients provide their employee participants with a specified amount of available reimbursement funds to help their employee participants defray out-of-pocket medical expenses such as deductibles, co-insurance and co-payments. All amounts paid by the employer into HRAs are deductible by the employer as an ordinary business expense and are tax-free to the employee.

We administer COBRA continuation services to employer clients to meet the employer’s obligation to make available continuation of coverage for participants who are no longer eligible for the employer’s COBRA covered benefits. As part of our COBRA program, we offer a direct billing service where former employee participants pay for coverage they elect to continue and we ensure our employer clients meet the challenging aspects of COBRA compliance and administration.

Benefit plan years customarily run concurrently with the calendar year and have an open enrollment period that typically occurs at benefit plan year-end during the fourth quarter of the calendar year. Most of our healthcare CDB agreements are executed in the last

16

quarter of the calendar year. Because the signing of our contract often coincides with open enrollment, employer clients are able to offer our CDB programs to their employees during open enrollment for the upcoming benefit year. As a result of this timing, we are able to obtain significant visibility into our healthcare-related revenue early on in each plan year because healthcare benefit plans are administered on an annual basis, contractual revenue is based on the number of participants enrolled in our CDB programs on a per month basis and the minimum number of enrolled participants for the plan year is usually established at the close of the open enrollment period. In contrast to healthcare CDB programs, enrollment in commuter programs occurs on a monthly basis. Therefore, there is less visibility and some variability in commuter revenue from month-to-month, particularly during the summer vacation period when employee participants are less likely to participate in commuter programs for those months.

Key Components of Our Results of Operations

Revenue

We generate revenue from the following sources: healthcare solutions, commuter solutions, COBRA, and other services.

Healthcare Revenue

We derive our healthcare revenue from the service fees paid by our employer clients for the administration services we provide in connection with their employee participants’ healthcare FSA, dependent care FSA, HRA and HSA tax-advantaged accounts. Our fee is generally fixed for the duration of the written agreement with our employer client, which is typically three years for our enterprise clients and one to three years for our small-and medium-sized business, or SMB, clients. These fees are paid to us on a monthly basis by our employer clients, and the related services are made available to employee participants pursuant to written agreements between us and each employer client. Almost all of the healthcare benefit plans we service on behalf of our enterprise employer clients are subject to contractual minimum monthly billing amounts. Generally, such minimum billing amounts are subject to upward revision on a monthly basis as our employer clients hire new employees who elect to participate in our programs, but generally are not subject to downward revision when employees leave their employers because we continue to administer those former employee participants’ accounts for the remainder of the plan year. For SMB employer clients, the monthly fee remains constant for the plan year unless there is a 10% or greater increase in the number of employee participants in which case it is subject to upward revision. Revenue is recognized monthly as services are rendered under our written service agreements.

We also earn interchange revenue from debit cards used by employee participants in connection with all of our healthcare programs and through our wholesale card program, which we recognize monthly based on reports received from third parties. We also earn revenue from self-service plan kits called Premium Only Plan kits, or POP revenue.

Commuter Revenue

For our Commuter Order Model, or COM, Commuter Account Model, or CAM and Commuter Express, we derive our commuter revenue from monthly service fees paid by our employer clients, interchange revenue that we receive from debit cards used by employee participants in connection with our commuter solutions and revenue from the sale of transit passes used in our commuter solutions. Our fees from employer clients are normally paid monthly in arrears based on the number of employee participants enrolled for the month. Most agreements have volume tiers that adjust the per participant price based upon the number of participants enrolled during that month. Revenue is recognized monthly as services are rendered under these written service agreements. We earn interchange revenue from the debit cards used by employee participants in connection with our commuter programs, which we recognize monthly based on reports received from third parties. We also receive commissions from transit passes, which we purchase from various transit agencies on behalf of employee participants. Due to our significant volume, we receive commissions on these passes which we recognize as vendor commission revenue. Commission revenue is recognized on a monthly basis as transactions are placed under written purchase agreements having stipulated terms and conditions, which do not require management to make any significant judgments or assumptions regarding any potential uncertainties.

Revenue from the TransitChek Basic program is based on a percentage of the face value of the transit and parking passes ordered by employer clients and revenue from the TransitChek Premium program is derived from monthly service fees paid by employer clients based on the number of participants. In both programs, revenues also include interchange revenue that we receive from debit cards used by employee participants in connection with our commuter solutions. We also recognize revenue on our estimate of certain passes that will expire unused over the estimated useful life of the passes, as the amounts paid for these passes are nonrefundable to both the employer client and the employee participant.

COBRA Revenue

Our COBRA revenue, is derived from the administration services we provide to employer clients for continuation of coverage for participants who are no longer eligible for the employer’s health benefits, such as medical, dental, vision, and for the continued

17

administration of the employee participants’ HRAs and certain healthcare FSAs. Our agreements to provide COBRA services are not consistently structured and we receive fees based on a variety of methodologies.

Other Revenue

Other revenue includes enrollment and eligibility services, employee account administration (i.e., tuition and health club reimbursements) and project-related professional fees. We also derive other revenue from administrative services we provide to a customer to operate their health insurance exchange business which includes enrollment, billing, customer service and payment processing services. Other services revenue is recognized as services are rendered under our written service agreements.

Costs and Expenses

Cost of Revenues (excluding the amortization of internal use software)

Cost of revenues includes the costs of providing services to our employer clients’ employee participants.

The primary component of cost of revenues is personnel expenses and the expenses related to our claims processing, product support and customer service personnel. Cost of revenues includes outsourced and temporary help costs, check/ACH payment processing services, debit card processing services, shipping and handling costs for cards and passes and employee participant communications costs.

Cost of revenues also includes the losses or gains associated with processing our large volume of transactions, which we refer to as “net processing losses or gains.” In the normal course of our business, we make administrative and processing errors that we cannot bill to our employer clients. For example, we may over-reimburse employee participants for claims they submit or incur the cost of replacing commuter passes that are not received by employee participants. Upon identifying such an error, we record the expense as a processing loss. In certain circumstances, we experience recoveries with respect to these amounts which are recorded as processing gains.

Cost of revenues does not include amortization of internal use software or change in contingent consideration, which are included in amortization and change in contingent consideration, or the cost of operating on-demand technology infrastructure, which is included in technology and development expenses.

Technology and Development

Technology and development expenses include personnel and related expenses for our technology operations and development personnel as well as outsourced programming services, the costs of operating our on-demand technology infrastructure, depreciation of equipment and software licensing expenses. During the planning and post-implementation phases of development, we expense, as incurred, all internal use software and website development expenses associated with our proprietary scalable delivery model. During the development phase, costs incurred for internal use software are capitalized and subsequently amortized once the software is available for its intended use. See “Amortization and Change in Contingent Consideration” below. Expenses associated with the platform content or the repair or maintenance of the existing platforms are expensed as incurred.

Sales and Marketing

Sales and marketing expenses consist primarily of personnel and related expenses for our sales, client services and marketing staff, including sales commissions for our direct sales force and external agent/broker commission expense, as well as communication, promotional, public relations and other marketing expenses.

General and Administrative

General and administrative expenses include personnel and related expenses of and professional fees incurred by our executive, finance, legal, human resources and facilities departments.

Amortization and Change in Contingent Consideration

Amortization and change in contingent consideration expense includes amortization of internal use software, amortization of acquired intangible assets and changes in contingent consideration in connection with portfolio purchases and acquisitions.

18

We capitalize internal use software and website development costs incurred during the development phase and we amortize these costs over the technology’s estimated useful life, which is generally four years. These capitalized costs include personnel costs and fees for outsourced programming and consulting services.

We also amortize acquired intangible assets consisting primarily of employer client agreements and relationships and broker relationships. Employer client agreements and relationships and broker relationships are amortized on a straight-line basis over an average estimated life.

We measure acquired contingent consideration payable each reporting period at fair value and recognize changes in fair value in our consolidated statements of income each period, until the final amount payable is determined. Increases or decreases in the fair value of the contingent consideration payable can result from changes in revenue forecasts, discount rates and risk and probability assumptions. Significant judgment is employed in determining the appropriateness of these assumptions in each period.

Other Income (Expense)

Other income (expense) primarily consists of (i) interest income; (ii) interest expense; and (iii) gain (loss) on settlements and other investments.

Provision for Income Taxes

We are subject to taxation in the United States. Income taxes are computed using the asset and liability method, under which deferred tax assets and liabilities are determined based on the difference between the financial statement and tax basis of assets and liabilities using enacted tax rates in effect for the year in which the differences are expected to affect taxable income. As of March 31, 2015, we remain in a net deferred tax asset position. Valuation allowances are established when necessary to reduce net deferred tax assets to the amount expected to be realized.

At December 31, 2014, we had federal and state operating loss carryforwards of approximately $38.5 million and $47.0 million, respectively, available to offset future regular and alternative minimum taxable income. The state net operating loss carryforward is on the post-apportionment basis. Our federal net operating loss carryforwards expire in the years 2024 through 2033, if not utilized. The state net operating loss carryforwards expire in the years 2018 through 2033. The federal and state net operating loss carryforwards include excess tax deductions related to stock options in the amount of $21.8 million and $16.2 million, respectively. When utilized, the related excess tax benefit will be booked to additional paid-in capital. We also have tax deductible goodwill related to asset acquisitions.

We have federal and California research and development credit carryforwards of approximately $4.7 million and $2.4 million respectively, available to offset future tax liabilities. The federal research credit carryforwards expire beginning in 2022 through 2034, if not fully utilized. The California tax credit carryforward can be carried forward indefinitely.

Our ability to utilize the net operating losses and tax credit carryforwards are subject to restrictions, including limitations in the event of past or future ownership changes as defined in Section 382 of the Internal Revenue Code (“IRC”) of 1986, as amended, and similar state tax law. In general, an ownership change occurs if the aggregate stock ownership of certain stockholders increases by more than 50 percentage points over such stockholders’ lowest percentage ownership during the testing period (generally three years). We have considered Section 382 of the IRC and concluded that any ownership change would not diminish our utilization of the net operating loss or research and development credits during the carryover periods.

We make estimates and judgments about our future taxable income that are based on assumptions that are consistent with our plans and estimates. Should the actual amounts differ from our estimates, our provision for income taxes could be materially affected.

Critical Accounting Policies and Significant Management Estimates

There have been no material changes to our critical accounting policies and estimates during the three months ended March 31, 2015, as compared to the critical accounting policies and estimates disclosed in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in our Annual Report on Form 10-K for the year ended December 31, 2014.

19

Results of Operations

Comparison of the Three Months Ended March 31, 2014 and 2015

Revenue

|

Three Months Ended March 31, |

Change from |

|||||||

|

2014 |

2015 |

prior year |

||||||

|

Revenue: |

(in thousands, unaudited) |

|||||||

|

Healthcare |

$ |

39,984 |

$ |

47,289 | 18% | |||

|

Commuter |

16,043 | 15,897 |

-1% |

|||||

|

COBRA |

4,038 | 12,570 | 211% | |||||

|

Other |

2,555 | 9,540 | 273% | |||||

|

Total revenue |

$ |

62,620 |

$ |

85,296 | 36% | |||

Healthcare Revenue

The $7.3 million increase in healthcare revenue for the first quarter of 2015 as compared to the first quarter of 2014 was primarily driven by a $6.7 million increase in FSA and HRA revenue. The FSA and HRA revenue increase was primarily driven by $4.9 million in post-purchase revenues for CONEXIS, which was acquired in August 2014, with the remaining increase being driven by the addition of two significant clients and growth in new employee participation in our programs. Healthcare revenue was further increased by a $0.6 million increase in HSA revenue, due to growth in employee participation in this program.

Commuter Revenue

The $0.1 million decrease in commuter revenue for the first quarter of 2015 as compared to the first quarter of 2014 was driven by the reduction in the maximum pre-tax monthly benefit for transit and vanpooling, which for 2015 is at $130 per month.

COBRA Revenue

The $8.5 million increase in COBRA revenue for the first quarter of 2015 as compared to the first quarter of 2014 was primarily driven by post-purchase revenues for CONEXIS.

Other Revenue

The $7.0 million increase in other revenue for the first quarter of 2015 as compared to the first quarter of 2014 was primarily driven by post-purchase revenues for CONEXIS, related to administrative services we provide to a customer to operate their health insurance exchange business.

Cost of Revenues

|

Three Months Ended March 31, |

Change from |

||||||||||

|

2014 |

2015 |

prior year |

|||||||||

|

(in thousands, unaudited) |

|||||||||||

|

Cost of revenues (excluding amortization of internal use software) |

$ |

22,797 |

$ |

32,071 | 41% | ||||||

|

Percent of revenue |

36% | 38% | |||||||||

20

The $9.3 million increase in cost of revenues for the first quarter of 2015 as compared to the first quarter of 2014 was primarily due to the inclusion of post-purchase expense of $7.6 million for CONEXIS, which was acquired in August 2014. Cost of revenues was also increased by outsourced services costs of $0.6 million due to processing and supporting an increased number of employee participants and by a $0.6 million increase in stock-based compensation expense due to new grants, since the first quarter of 2014, of performance-based restricted stock units as well as stock options. Cost of revenues was further driven by an increase in salaries and personnel-related costs of $0.5 million due to an increase in headcount to support employee participant growth.

As we continue to scale our operations, we expect our cost of revenues to increase in dollar amount to support increased employer client and employee participant levels. Cost of revenues will continue to be affected by our portfolio purchases, acquisitions and channel partner arrangements. Prior to migrating to our proprietary technology platforms, these new portfolios often operate with higher service delivery costs that result in increased cost of revenues until we are able to complete the migration process, which typically occurs over the 12- to 24-month period following closing of the portfolio purchase or acquisition.

Technology and Development

|

Three Months Ended March 31, |

Change from |

||||||||||

|

2014 |

2015 |

prior year |

|||||||||

|

(in thousands, unaudited) |

|||||||||||

|

Technology and development |

$ |

5,199 |

$ |

10,585 | 104% | ||||||

|

Percent of revenue |

8% | 12% | |||||||||

The $5.4 million increase in technology and development expenses for the first quarter of 2015 as compared to the first quarter of 2014 was primarily due to the inclusion of post-purchase expense of $4.8 million for CONEXIS, which was acquired in August 2014. Excluding CONEXIS, technology and development expenses increased by $0.4 million, due to greater capitalization of software development costs in the first quarter of 2014 compared to the first quarter of 2015.

We intend to continue enhancing the functionality of our software platform as part of our continuous effort to improve our employer client and employee participant experience and to maintain and enhance our control and compliance environment. As we realize synergies and consolidate projects, the dollar amount spent on technology and development has decreased. The timing of development and enhancement projects, including whether they are in phases where costs are capitalized or expensed, will significantly affect our technology and development expense both in dollar amount and as a percentage of revenue.

Sales and Marketing

|

Three Months Ended March 31, |

Change from |

||||||||||

|

2014 |

2015 |

prior year |

|||||||||

|

(in thousands, unaudited) |

|||||||||||

|

Sales and marketing |

$ |

9,367 |

$ |

13,131 | 40% | ||||||

|

Percent of revenue |

15% | 15% | |||||||||

The $3.8 million increase in sales and marketing expense for the first quarter of 2015 as compared to the first quarter of 2014 was primarily due to the inclusion of post-purchase expense of $2.8 million for CONEXIS, which was acquired in August 2014, as well as an increase in salaries and personnel-related costs of $0.4 million due to increased hiring of sales and marketing personnel to support ongoing sales and marketing programs. Sales and marketing expenses were further driven by an increase in stock-based compensation expense of $0.3 million due to new grants, since the first quarter of 2014, of performance-based restricted stock units as well as stock options.

We intend to continue to invest in sales, client services and marketing by hiring additional personnel and continuing to build our broker and channel relationships. We also intend to promote our brand through a variety of marketing and public relations activities. As a result, we expect our sales and marketing expenses to increase in dollar amount in future periods.

21

General and Administrative

|

Three Months Ended March 31, |

Change from |

||||||||||

|

2014 |

2015 |

prior year |

|||||||||

|

(in thousands, unaudited) |

|||||||||||

|

General and administrative |

$ |

9,932 |

$ |

13,565 | 37% | ||||||

|

Percent of revenue |

16% | 16% | |||||||||

The $3.6 million increase in general and administrative expenses for the first quarter of 2015 as compared to the first quarter of 2014 was primarily due to the inclusion of post-purchase expense of $1.6 million for CONEXIS, which was acquired in August 2014. The increase in general and administrative expenses were further driven by an increase of $1.6 million in stock-based compensation expense primarily due to new grants, since the first quarter of 2014, of stock options, restricted stock units and performance-based restricted stock units. The remaining increase in general and administrative expenses were primarily driven by an increase in rent expense.

As we continue to grow, we expect our general and administrative expenses to continue to increase in dollar amount as we expand general and administrative headcount to support our continued growth.

Amortization and Change in Contingent Consideration

|

Three Months Ended March 31, |

Change from |

||||||||

|

2014 |

2015 |

prior year |

|||||||

|

(in thousands, unaudited) |

|||||||||

|

Amortization and change in contingent consideration |

$ |

4,420 |

$ |

6,279 | 42% | ||||

The increase in the amortization and change in contingent consideration line item for the first quarter of 2015 when compared to the first quarter of 2014, was primarily driven by an increase in amortization of acquired intangible assets expense related to the CONEXIS acquisition and Ceridian channel partnership arrangement.

Other Income (Expense)

|

Three Months Ended March 31, |

||||||

|

2014 |

2015 |

|||||

|

(in thousands, unaudited) |

||||||

|

Interest income |

$ |

1 |

$ |

2 | ||

|

Interest expense |

(257) | (575) | ||||

|

Other income |

13 | 66 | ||||

The increase in the interest expense line item for the first quarter of 2015 when compared to the first quarter of 2014, is due to the increase in borrowing under the line of credit with MUFG Union Bank related to the acquisition of CONEXIS.

Income Taxes

|

Three Months Ended March 31, |

||||||

|

2014 |

2015 |

|||||

|

(in thousands, unaudited) |

||||||

|

Income tax provision |

$ |

(4,218) |

$ |

(3,519) | ||

Our provision for income taxes decreased from $4.2 million for the first quarter of 2014 to $3.5 million for the first quarter of 2015 due primarily to a decrease in income before income taxes for the first quarter of 2015.

22

Liquidity and Capital Resources

At March 31, 2015, our principal sources of liquidity were cash and cash equivalents totaling $451.8 million comprised primarily of prefunds by clients of amounts to be paid on behalf of employee participants as well as, in recent years, other cash flows from operating activities.