Form 8-K SCANSOURCE INC For: Apr 30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 30, 2015

ScanSource, Inc.

(Exact name of registrant as specified in its charter)

Commission File Number: 000-26926

SC | 00-26926 | 57-0965380 | ||

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) | ||

6 Logue Court, Greenville, SC 29615

(Address of principal executive offices, including zip code)

864-288-2432

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02. Results of Operations and Financial Condition

On April 30, 2015 ScanSource, Inc. issued a press release announcing its financial results for its third quarter fiscal year 2015 for the period ended March 31, 2015. A copy of the press release and accompanying presentation slides are attached as Exhibit 99.1 and 99.2 hereto and incorporated herein by reference and also made available through the Company’s website at www.scansource.com.

The information in this Item 2.02 Current Report on Form 8-K, including the exhibits, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

99.1 – Press release issued by ScanSource, Inc. on April 30, 2015. The information contained in the attached exhibit is unaudited and should be read in conjunction with the Registrant’s annual and quarterly reports filed with the Securities and Exchange Commission.

99.2 – Presentation slides for the financial results conference call issued on April 30, 2015. The information contained in the attached exhibit is unaudited and should be read in conjunction with the Registrant’s annual and quarterly reports filed with the Securities and Exchange Commission.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

ScanSource, Inc. | ||||||

Date: April 30, 2015 | By: | /s/ Charles A. Mathis | ||||

Name: | Charles A. Mathis | |||||

Its: | Executive Vice President and Chief Financial Officer | |||||

Exhibit 99.1

FOR IMMEDIATE RELEASE

Contact: | ||

Charles A. Mathis | Mary M. Gentry | |

Executive Vice President and Chief Financial Officer | - or - | Vice President, Treasurer and Investor Relations |

ScanSource, Inc. | ScanSource, Inc. | |

(864) 286-4975 | (864) 286-4892 | |

SCANSOURCE REPORTS THIRD QUARTER RESULTS

Key Initiatives Accomplished to Grow the Business

GREENVILLE, SC -- April 30, 2015 -- ScanSource, Inc. (NASDAQ: SCSC), the leading international value-added distributor of specialty technology products, today announced financial results for fiscal year 2015 third quarter ended March 31, 2015.

Net sales for the quarter ended March 31, 2015 totaled $763.2 million, a 12% increase over net sales of $683.0 million for the quarter ended March 31, 2014. Excluding the translation impact of foreign currencies, net sales increased 16% year-over-year. The increase in net sales included a full quarter of net sales from the acquisitions of Imago and Network1, each completed during the current fiscal year.

"We had a busy quarter and completed several key strategic initiatives," said Mike Baur, CEO, ScanSource, Inc. "Our successful acquisitions of Network1 and Imago contributed to the strong sales growth in our Worldwide Communications and Services segment. As planned, we implemented our new global ERP system in Europe with minimal disruption to our business."

Operating income for quarter ended March 31, 2015 totaled $21.5 million, compared with $25.7 million in the prior year quarter. Excluding adjustments, non-GAAP operating income for the quarter ended March 31, 2015 decreased 12% over the prior year quarter to $24.2 million from $27.6 million. Selling, general and administrative expenses for the quarter ended March 31, 2015 included $2.6 million pre-tax ($1.6 million after-tax, or $0.06 per diluted share) non-recurring SAP-related expenses associated with the implementation of the Company's Enterprise Resource Planning (ERP) system.

“We are deploying capital in accordance with our plan of strategic acquisitions, share repurchases, and investment in our global ERP system,” said Charlie Mathis, CFO, ScanSource, Inc.

On a GAAP basis, net income for the quarter ended March 31, 2015 totaled $12.9 million, or $0.45 per diluted share, compared with net income of $16.9 million, or $0.59 per diluted share, for the prior year quarter. Excluding adjustments, non-GAAP net income for the quarter ended March 31, 2015 decreased to $14.9 million, or $0.52 per diluted share, from $18.2 million, or $0.63 per diluted share.

Forecast for Next Quarter

The Company announced its current expectations for the fourth quarter of fiscal year 2015. ScanSource expects net sales for the quarter ending June 30, 2015 to range from $800 million to $850 million and non-GAAP diluted earnings per share to range from $0.56 to $0.62 per share. Non-GAAP diluted earnings per share exclude amortization of intangibles and change in fair value of contingent consideration, and acquisition costs.

Webcast Details

ScanSource will present additional information about its financial results and outlook in a conference call with presentation slides today, April 30, 2015 at 5:00 p.m. (ET). A webcast of the call and accompanying presentation slides will be available for all interested parties and can be accessed at www.scansource.com (Investor Relations section). The webcast will be available for replay for 60 days.

Safe Harbor Statement

This press release contains comments that are “forward-looking” statements that involve risks and uncertainties; these statements are subject to the safe harbor created by the Private Securities Litigation Reform Act of 1995. Any number of important factors could cause actual results to differ materially from anticipated or forecasted results, including, but not limited to, expanded

ScanSource Reports Third Quarter Results

international operations that expose the Company to greater risks than its operations in domestic markets; risks in connection with our growth which includes strategic acquisitions; costs and delays in connection with the Company's new ERP system; the ability to forecast volatility in earnings resulting from the quarterly revaluation of the Company's earnout obligations; risks associated with consolidation of the Company's vendors; risks in connection with compliance with laws and regulations governing the Company's international business; macroeconomic circumstances that could impact the business, such as currency fluctuations, credit market conditions, and an economic downturn; the timing and amount of any share repurchases; the exercise of discretion by the Company to make any repurchase or continue the share repurchase authorization; and changes to the source of funds for any repurchases. For more information concerning factors that could cause actual results to differ from anticipated results, see the Company's annual report on Form 10-K for the year ended June 30, 2014, filed with the Securities and Exchange Commission. Except as may be required by law, the Company expressly disclaims any obligation to update these forward-looking statements to reflect events or circumstances after the date of this press release or to reflect the occurrence of unanticipated events.

Non-GAAP Financial Information

In addition to disclosing results that are determined in accordance with United States Generally Accepted Accounting Principles ("GAAP"), the Company also discloses certain non-GAAP financial measures, which are summarized below. Non-GAAP financial measures are used to better understand and evaluate performance, including comparisons from period to period. The Company completed acquisitions on September 19, 2014 and January 13, 2015, which were both structured with earnout payments. Given the size of the acquisitions and potential variability of fair value adjustments on operating results, non-GAAP results exclude amortization of intangible assets related to acquisitions and change in fair value of contingent consideration.

Net sales excluding the translation impact of foreign currencies: The Company discusses the percentage change in net sales excluding the translation impact from changes in foreign currency exchange rates between reporting periods. This measure enhances comparability between periods to help analyze underlying trends.

Non-GAAP operating income, non-GAAP net income and non-GAAP EPS: To evaluate current period performance on a clearer and more consistent basis with prior periods, the Company discloses non-GAAP operating income, non-GAAP net income and non-GAAP diluted earnings per share. Non-GAAP results exclude amortization of intangible assets related to acquisitions, change in the fair value of contingent consideration, and acquisition costs. Non-GAAP operating income, non-GAAP net income, and non-GAAP EPS measures are useful in better assessing and understanding the Company's operating performance, especially when comparing results with previous periods or forecasting performance for future periods.

Return on invested capital ("ROIC"): Management uses ROIC as a performance measurement to assess efficiency in allocating capital under the Company's control to generate returns. Management believes this metric balances the Company's operating results with asset and liability management, is not impacted by capitalization decisions and is considered to have a strong correlation with shareholder value creation. In addition, it is easily computed, communicated and understood. ROIC also provides management a measure of the Company's profitability on a basis more comparable to historical or future periods.

ROIC assists management in comparing the Company's performance over various reporting periods on a consistent basis because it removes from operating results the impact of items that do not reflect core operating performance. Adjusted earnings before interest expense, income taxes, depreciation and amortization ("EBITDA") excludes the change in fair value of contingent consideration, in addition to other non-GAAP adjustments. Management believes the calculation of ROIC provides useful information to investors and is an additional relevant comparison of the Company's performance during the year. In addition, the Company's Board of Directors uses ROIC in evaluating business and management performance. Certain management incentive compensation targets are set and measured relative to ROIC.

These non-GAAP financial measures have limitations as analytical tools, and the non-GAAP financial measures that the Company reports may not be comparable to similarly titled amounts reported by other companies. Analysis of results and outlook on a non-GAAP basis should be considered in addition to, and not in substitution for or as superior to, measurements of financial performance prepared in accordance with GAAP. A reconciliation of the Company's non-GAAP financial information to GAAP is set forth in the following Supplementary Information tables.

About ScanSource, Inc.

ScanSource, Inc. (NASDAQ: SCSC) is the leading international distributor of specialty technology products, focusing on point-of-sale (POS) and barcode, communications and physical security solutions. ScanSource's teams provide value-added services and operate from two technology segments, Worldwide Barcode & Security and Worldwide Communications & Services. ScanSource is committed to helping its reseller customers choose, configure and deliver the industry's best products across almost every vertical market in North America, Latin America and Europe. Founded in 1992, the Company ranks #751 on the Fortune 1000. For more information, visit www.scansource.com.

ScanSource Reports Third Quarter Results

ScanSource, Inc. and Subsidiaries | ||||||||

Condensed Consolidated Balance Sheets (Unaudited) | ||||||||

(in thousands) | ||||||||

March 31, 2015 | June 30, 2014* | |||||||

Assets | ||||||||

Current assets: | ||||||||

Cash and cash equivalents | $ | 93,578 | $ | 194,851 | ||||

Accounts receivable, less allowance of $30,859 at March 31, 2015 | 487,148 | 464,405 | ||||||

and $26,257 at June 30, 2014 | ||||||||

Inventories | 485,603 | 504,758 | ||||||

Prepaid expenses and other current assets | 47,145 | 33,558 | ||||||

Deferred income taxes | 20,879 | 18,109 | ||||||

Total current assets | 1,134,353 | 1,215,681 | ||||||

Property and equipment, net | 47,401 | 31,823 | ||||||

Goodwill | 64,848 | 32,342 | ||||||

Other non-current assets, including net identifiable intangible assets | 100,317 | 55,278 | ||||||

Total assets | $ | 1,346,919 | $ | 1,335,124 | ||||

Liabilities and Shareholders' Equity | ||||||||

Current liabilities: | ||||||||

Current debt | $ | 5,171 | $ | — | ||||

Accounts payable | 392,396 | 421,721 | ||||||

Accrued expenses and other current liabilities | 71,132 | 63,574 | ||||||

Current portion of contingent consideration | 9,955 | 5,851 | ||||||

Income taxes payable | 2,328 | 8,685 | ||||||

Total current liabilities | 480,982 | 499,831 | ||||||

Deferred income taxes | 3,636 | 185 | ||||||

Long-term debt | 6,696 | 5,429 | ||||||

Long-term portion of contingent consideration | 21,403 | 5,256 | ||||||

Other long-term liabilities | 35,151 | 21,780 | ||||||

Total liabilities | 547,868 | 532,481 | ||||||

Shareholders' equity: | ||||||||

Common stock | 171,084 | 168,447 | ||||||

Retained earnings | 699,868 | 650,896 | ||||||

Accumulated other comprehensive income (loss) | (71,901 | ) | (16,700 | ) | ||||

Total shareholders' equity | 799,051 | 802,643 | ||||||

Total liabilities and shareholders' equity | $ | 1,346,919 | $ | 1,335,124 | ||||

* | Derived from audited financial statements. |

ScanSource Reports Third Quarter Results

ScanSource, Inc. and Subsidiaries | ||||||||||||||||

Condensed Consolidated Income Statements (Unaudited) | ||||||||||||||||

(in thousands, except per share data) | ||||||||||||||||

Quarter ended March 31, | Nine months ended March 31, | |||||||||||||||

2015 | 2014 | 2015 | 2014 | |||||||||||||

Net sales | $ | 763,203 | $ | 682,998 | $ | 2,361,941 | $ | 2,155,520 | ||||||||

Cost of goods sold | 683,187 | 609,647 | 2,126,168 | 1,928,414 | ||||||||||||

Gross profit | 80,016 | 73,351 | 235,773 | 227,106 | ||||||||||||

Selling, general and administrative expenses | 58,235 | 46,705 | 158,047 | 143,541 | ||||||||||||

Change in fair value of contingent consideration | 285 | 981 | 1,262 | 2,218 | ||||||||||||

Operating income | 21,496 | 25,665 | 76,464 | 81,347 | ||||||||||||

Interest expense | 891 | 217 | 1,288 | 698 | ||||||||||||

Interest income | (731 | ) | (545 | ) | (2,057 | ) | (1,644 | ) | ||||||||

Other, net | 1,515 | 13 | 2,238 | 65 | ||||||||||||

Income before income taxes | 19,821 | 25,980 | 74,995 | 82,228 | ||||||||||||

Provision for income taxes | 6,878 | 9,031 | 26,023 | 27,544 | ||||||||||||

Net income | $ | 12,943 | $ | 16,949 | $ | 48,972 | $ | 54,684 | ||||||||

Per share data: | ||||||||||||||||

Net income per common share, basic | $ | 0.45 | $ | 0.59 | $ | 1.71 | $ | 1.93 | ||||||||

Weighted-average shares outstanding, basic | 28,646 | 28,502 | 28,590 | 28,275 | ||||||||||||

Net income per common share, diluted | $ | 0.45 | $ | 0.59 | $ | 1.70 | $ | 1.92 | ||||||||

Weighted-average shares outstanding, diluted | 28,855 | 28,730 | 28,825 | 28,548 | ||||||||||||

ScanSource Reports Third Quarter Results

ScanSource, Inc. and Subsidiaries | |||||||||||||

Supplementary Information (Unaudited) | |||||||||||||

(in thousands) | |||||||||||||

Net Sales by Segment: | |||||||||||||

Quarter ended March 31, | Non-GAAP % Change | ||||||||||||

2015 | 2014 | % Change | Excluding FX(a) | ||||||||||

Worldwide Barcode & Security | $ | 422,061 | $ | 455,822 | (7.4 | )% | (2.0 | )% | |||||

Worldwide Communications & Services | 341,142 | 227,176 | 50.2 | % | 51.5 | % | |||||||

Consolidated | $ | 763,203 | $ | 682,998 | 11.7 | % | 15.8 | % | |||||

Nine months ended March 31, | Non-GAAP % Change | ||||||||||||

2015 | 2014 | % Change | Excluding FX(a) | ||||||||||

Worldwide Barcode & Security | $ | 1,422,793 | $ | 1,382,672 | 2.9 | % | 5.8 | % | |||||

Worldwide Communications & Services | 939,148 | 772,848 | 21.5 | % | 22.1 | % | |||||||

Consolidated | $ | 2,361,941 | $ | 2,155,520 | 9.6 | % | 11.6 | % | |||||

Net Sales by Geography: | |||||||||||||

Quarter ended March 31, | Non-GAAP % Change | ||||||||||||

2015 | 2014 | % Change | Excluding FX(b) | ||||||||||

North American (U.S. and Canada) | $ | 534,742 | $ | 498,773 | 7.2 | % | 7.2 | % | |||||

International | 228,461 | 184,225 | 24.0 | % | 39.1 | % | |||||||

Consolidated | $ | 763,203 | $ | 682,998 | 11.7 | % | 15.8 | % | |||||

Nine months ended March 31, | Non-GAAP % Change | ||||||||||||

2015 | 2014 | % Change | Excluding FX(b) | ||||||||||

North American (U.S. and Canada) | $ | 1,717,600 | $ | 1,602,202 | 7.2 | % | 7.2 | % | |||||

International | 644,341 | 553,318 | 16.5 | % | 24.4 | % | |||||||

Consolidated | $ | 2,361,941 | $ | 2,155,520 | 9.6 | % | 11.6 | % | |||||

Notes: | |||||||||||||

(a) Year-over-year net sales growth rate excluding the translation impact of changes in foreign currency exchange rates. Calculated by translating the net sales for the quarter and nine months ended March 31, 2015 into U.S. dollars using the weighted average foreign exchange rates for the quarter and nine months ended March 31, 2014, respectively. Worldwide Barcode & Security net sales excluding the translation impact of foreign currencies for the quarter and nine months ended March 31, 2015, as adjusted, totaled $446.9 million and $1.5 billion, respectively. Worldwide Communications & Services net sales excluding the translation impact of foreign currencies for the quarter and nine months ended March 31, 2015, as adjusted, totaled $344.2 million and $943.6 million, respectively. | |||||||||||||

(b) Year-over-year net sales growth rate excluding the translation impact of changes in foreign currency exchange rates. Calculated by translating the net sales for the quarter and nine months ended March 31, 2015 into U.S. dollars using the weighted average foreign exchange rates for the quarter and nine months ended March 31, 2014, respectively. International net sales excluding the translation impact of foreign currencies for the quarter and nine months ended March 31, 2015 totaled $256.3million and $688.3 million, respectively. | |||||||||||||

ScanSource Reports Third Quarter Results

ScanSource, Inc. and Subsidiaries | ||||||||||||||||

Supplementary Information (Unaudited) | ||||||||||||||||

(in thousands) | ||||||||||||||||

Non-GAAP Financial Information: | ||||||||||||||||

Quarter ended March 31, 2015 | ||||||||||||||||

Operating income | Pre-tax income | Net income | Diluted EPS | |||||||||||||

GAAP measure | $ | 21,496 | $ | 19,821 | $ | 12,943 | $ | 0.45 | ||||||||

Adjustments: | ||||||||||||||||

Amortization of intangible assets | 2,114 | 2,114 | 1,464 | 0.05 | ||||||||||||

Change in fair value of contingent consideration | 285 | 285 | 200 | 0.01 | ||||||||||||

Acquisition costs | 292 | 292 | 292 | 0.01 | ||||||||||||

Non-GAAP measure | $ | 24,187 | $ | 22,512 | $ | 14,899 | $ | 0.52 | ||||||||

Quarter ended March 31, 2014 | ||||||||||||||||

Operating income | Pre-tax income | Net income | Diluted EPS | |||||||||||||

GAAP measure | $ | 25,665 | $ | 25,980 | $ | 16,949 | $ | 0.59 | ||||||||

Adjustments: | ||||||||||||||||

Amortization of intangible assets | 909 | 909 | 595 | 0.02 | ||||||||||||

Change in fair value of contingent consideration | 981 | 981 | 647 | 0.02 | ||||||||||||

Non-GAAP measure | $ | 27,555 | $ | 27,870 | $ | 18,191 | $ | 0.63 | ||||||||

ScanSource Reports Third Quarter Results

ScanSource, Inc. and Subsidiaries | |||||||||

Supplementary Information (Unaudited) | |||||||||

(in thousands) | |||||||||

Non-GAAP Financial Information: | |||||||||

Quarter ended March 31, | |||||||||

2015 | 2014 | ||||||||

Return on invested capital (ROIC), annualized (a) | 12.1 | % | 15.3 | % | |||||

Reconciliation of Net Income to Adjusted EBITDA | |||||||||

Net income - GAAP | $ | 12,943 | $ | 16,949 | |||||

Plus: Income taxes | 6,878 | 9,031 | |||||||

Plus: Interest expense | 891 | 217 | |||||||

Plus: Depreciation and amortization | 3,710 | 1,743 | |||||||

EBITDA | 24,422 | 27,940 | |||||||

Plus: Change in fair value of contingent consideration | 285 | 981 | |||||||

Plus: Acquisition costs | 292 | — | |||||||

Adjusted EBITDA (numerator for ROIC) (non-GAAP) (b) | $ | 24,999 | $ | 28,921 | |||||

Invested Capital Calculation | |||||||||

Equity - beginning of quarter/year | $ | 818,748 | $ | 751,446 | |||||

Equity - end of quarter/year | 799,051 | 772,786 | |||||||

Add: | |||||||||

Change in fair value of contingent consideration, net of tax | 200 | 647 | |||||||

Acquisition costs, net of tax(c) | 292 | — | |||||||

Average equity | 809,146 | 762,440 | |||||||

Average funded debt (d) | 32,046 | 5,429 | |||||||

Invested capital (denominator for ROIC) (non-GAAP) | $ | 841,192 | $ | 767,869 | |||||

Notes: | |||||||||

(a) Calculated as net income plus interest expense, income taxes, depreciation and amortization (EBITDA), plus change in fair value of contingent consideration and acquisition costs, annualized and divided by invested capital for the period. Invested capital is defined as average equity plus average daily funded interest-bearing debt for the period. | |||||||||

(b) Adjusted EBITDA removes the impact of change in fair value of contingent consideration for the quarters ended March 31, 2015 and 2014 and acquisition costs for the quarter ended March 31, 2015. Adjusted EBITDA and the resulting change in ROIC is shown retrospectively. | |||||||||

(c) Acquisition costs are nondeductible for tax purposes. | |||||||||

(d) Average funded debt is calculated as the average daily amounts outstanding on short-term and long-term interest-bearing debt. | |||||||||

Q3 FY 2015 FINANCIAL RESULTS CONFERENCE CALL April 30, 2015 at 5:00 pm ET Exhibit 99.2

SAFE HARBOR This presentation may contain certain comments, which are “forward-looking” statements that involve plans, strategies, economic performance and trends, projections, expectations, costs or beliefs about future events and other statements that are not descriptions of historical facts, may be forward- looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking information is inherently subject to risks and uncertainties; these statements are subject to the safe harbor created by the Private Securities Litigation Reform Act of 1995. Any number of factors could cause actual results to differ materially from anticipated results. For more information concerning factors that could cause actual results to differ from anticipated results, see the “Risk Factors” included in the Company’s annual report on Form 10-K for the fiscal year ended June 30, 2014, as well as the quarterly report on Form 10-Q for the quarter ended December 31, 2014, filed with the Securities and Exchange Commission (“SEC”). Although ScanSource believes the expectations in its forward-looking statements are reasonable, it cannot guarantee future results, levels of activity, performance or achievement. ScanSource disclaims any intentions or obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, except as may be required by law. In addition to disclosing results that are determined in accordance with United States Generally Accepted Accounting Principles (“GAAP”), the Company also discloses certain non-GAAP measures, including non-GAAP operating income, non-GAAP operating margin, non-GAAP net income, non-GAAP diluted earnings per share, return on invested capital (“ROIC”) and the percentage change in net sales excluding the impact of foreign currency exchange rates. A reconciliation of the Company's non-GAAP financial information to GAAP financial information is provided in the Appendix and in the Company’s Form 8-K, filed with the SEC, with the quarterly earnings press release for the period indicated. 2

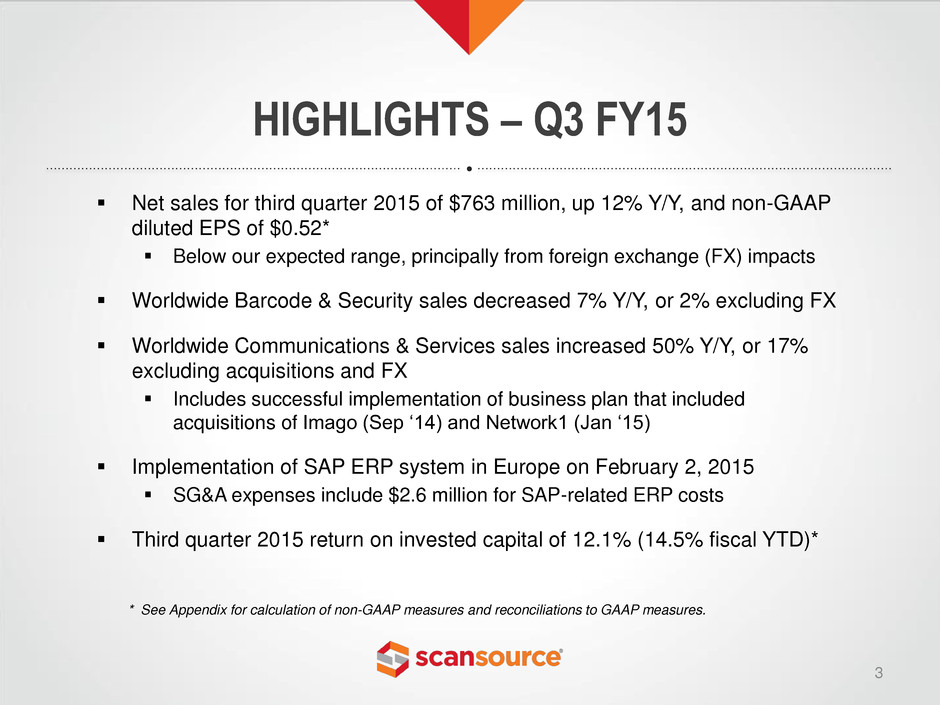

HIGHLIGHTS – Q3 FY15 3 Net sales for third quarter 2015 of $763 million, up 12% Y/Y, and non-GAAP diluted EPS of $0.52* Below our expected range, principally from foreign exchange (FX) impacts Worldwide Barcode & Security sales decreased 7% Y/Y, or 2% excluding FX Worldwide Communications & Services sales increased 50% Y/Y, or 17% excluding acquisitions and FX Includes successful implementation of business plan that included acquisitions of Imago (Sep ‘14) and Network1 (Jan ‘15) Implementation of SAP ERP system in Europe on February 2, 2015 SG&A expenses include $2.6 million for SAP-related ERP costs Third quarter 2015 return on invested capital of 12.1% (14.5% fiscal YTD)* * See Appendix for calculation of non-GAAP measures and reconciliations to GAAP measures.

Q3 FY15 Q3 FY14 GAAP Non- GAAP* GAAP Non- GAAP* Y/Y Change (non-GAAP): Net sales $763.2 $763.2 $683.0 $683.0 12% increase; 16% excl. FX Gross profit 80.0 80.0 73.4 73.4 9% increase Gross profit margin % (of net sales) 10.5% 10.5% 10.7% 10.7% 26 bp margin decrease SG&A expenses 53.2 53.2 45.8 45.8 16% higher SG&A SAP-related ERP costs 2.6 2.6 -- -- Amortization of intangible assets 2.1 -- 0.9 -- Change, FV contingent consideration 0.3 -- 1.0 -- Acquisition costs 0.3 -- -- -- Operating income 21.5 24.2 25.7 27.6 12% decrease Operating income % (of net sales) 2.8% 3.2% 3.8% 4.0% 86 bp margin decrease Net income $12.9 $14.9 $16.9 $18.2 18% decrease Diluted EPS $0.45 $0.52 $0.59 $0.63 17% decrease HIGHLIGHTS – Q3 FY15 4 * See Appendix for calculation of non-GAAP measures and reconciliations to GAAP measures. In millions, except EPS

Q3 FY15 SALES MIX 5 By Technology By Geography 55% Barcode & Security 45% Communications & Services 70% North America* 30% International Barcode & Security = Worldwide Barcode and Security Communications & Services = Worldwide Communications and Services As a % of Q3 FY15 net sales of $763.2 million * Includes the United States and Canada.

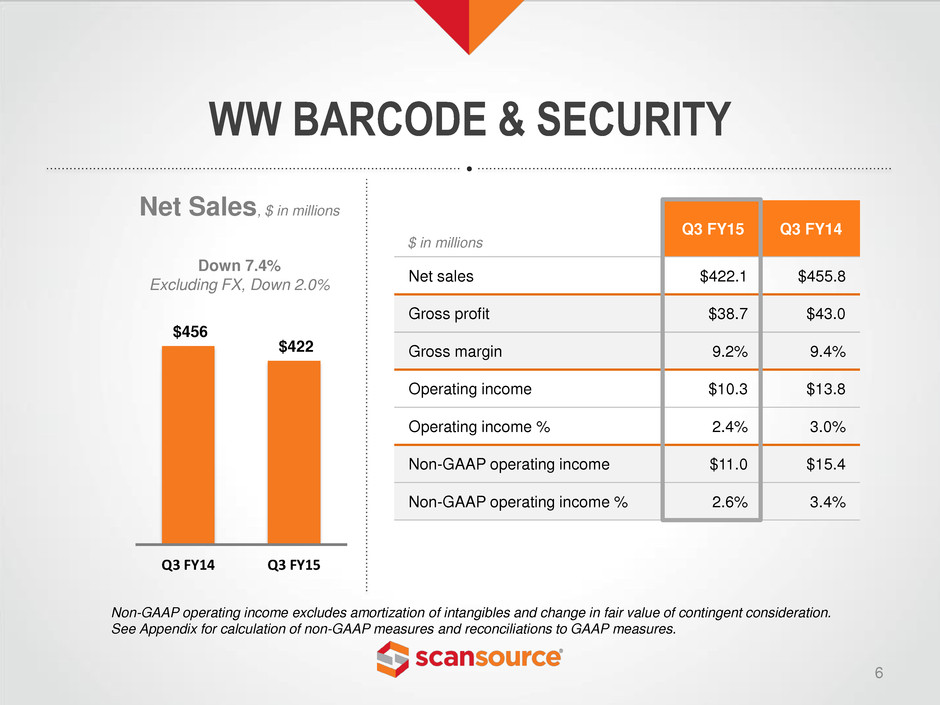

Q3 FY15 Q3 FY14 Net sales $422.1 $455.8 Gross profit $38.7 $43.0 Gross margin 9.2% 9.4% Operating income $10.3 $13.8 Operating income % 2.4% 3.0% Non-GAAP operating income $11.0 $15.4 Non-GAAP operating income % 2.6% 3.4% WW BARCODE & SECURITY 6 $456 $422 Q3 FY14 Q3 FY15 Net Sales, $ in millions Down 7.4% Excluding FX, Down 2.0% $ in millions Non-GAAP operating income excludes amortization of intangibles and change in fair value of contingent consideration. See Appendix for calculation of non-GAAP measures and reconciliations to GAAP measures.

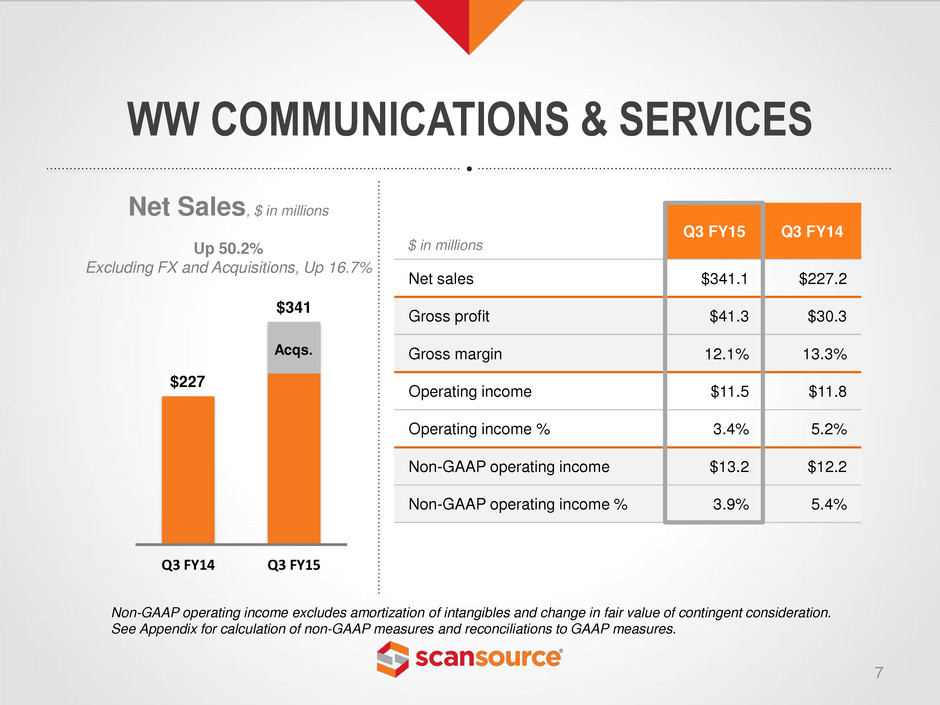

Q3 FY15 Q3 FY14 Net sales $341.1 $227.2 Gross profit $41.3 $30.3 Gross margin 12.1% 13.3% Operating income $11.5 $11.8 Operating income % 3.4% 5.2% Non-GAAP operating income $13.2 $12.2 Non-GAAP operating income % 3.9% 5.4% WW COMMUNICATIONS & SERVICES 7 Q3 FY14 Q3 FY15 Net Sales, $ in millions Up 50.2% Excluding FX and Acquisitions, Up 16.7% $ in millions Non-GAAP operating income excludes amortization of intangibles and change in fair value of contingent consideration. See Appendix for calculation of non-GAAP measures and reconciliations to GAAP measures. $341 $227 Acqs.

Q3 FY15 Q2 FY15 Q3 FY14 Return on invested capital (“ROIC”)* 12.1% 14.8% 15.3% Cash and cash equivalents (Q/E) $93.6 $121.5 $183.6 Operating cash flow, trailing 12-months $39.1 $36.7 $86.1 Days sales outstanding in receivables 57 55 55 Inventory (Q/E) $485.6 $518.4 $479.9 Inventory turns 5.4 5.8 5.1 Paid for inventory days 12.3 12.2 15.3 Shares repurchased – # of shares 69,965 -- -- Shares repurchased – dollars $2.7 -- -- Q3 FY15 KEY MEASURES $ in millions 8 * Excludes non-GAAP adjustments and change in fair value of contingent consideration. See Appendix for calculation of ROIC, a non-GAAP measure.

ERP Costs, $2.2 ERP Costs, $2.6 SAP- related, $2.6 SAP- related, $1.9 $- $1.0 $2.0 $3.0 $4.0 $5.0 Q3 FY15 Actual* Q4 FY15 Forecast* SUMMARY OF ERP COSTS 9 $ in millions * Following 2/2/15 implementation in Europe, we can no longer capitalize ERP project costs; reflects amounts included in SG&A expenses. ** Following implementation in North America (expected July 2015); includes depreciation of $0.7 million per quarter and other expenses incremental to legacy system. Estimated Ongoing Incremental ERP Costs: $1.5 million per quarter** Estimated SAP-related Costs Second half of FY15: $4.5 million Q1 FY16: $1.5 million

Q4 FY15 OUTLOOK* 10 * Outlook as of April 30, 2015. Non-GAAP diluted EPS excludes amortization of intangible assets, change in fair value of contingent consideration, and acquisition costs. Reflects the following FX rates: $1.08 to EUR 1.00 for the Euro, $0.336 to R$1.00 for the Brazilian real (R$2.98 to $1), and $1.51 to GBP 1.00 for the British pound. For the quarter ending June 30, 2015, excluding amortization of intangible assets, change in fair value of contingent consideration, and acquisition costs: Net Sales Non-GAAP Diluted Earnings Per Share Range from $800 million to $850 million Range midpoint: $825 million Range from $0.56 to $0.62 per share Range midpoint: $0.59

WW BARCODE & SECURITY 11 $456 $422 Q3 FY14 Q3 FY15 Net Sales, $ in millions Down 7.4% Excluding FX, Down 2.0%* * See Appendix for reconciliation of net sales excluding impact of foreign exchange to a GAAP measure. 55% of overall sales Lower big deals across all geographies Strong growth for payment processing hardware continues Physical security grew 9% Y/Y; launched cable and outdoor wireless networking initiatives Expanded key vendor relationships into additional geographies

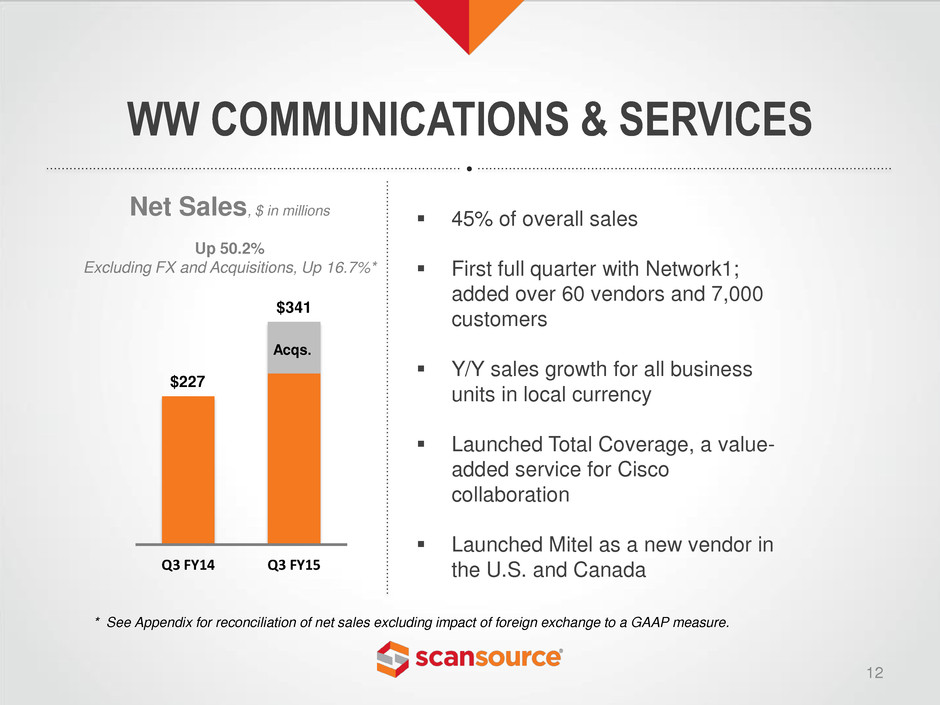

WW COMMUNICATIONS & SERVICES 12 Q3 FY14 Q3 FY15 Net Sales, $ in millions Up 50.2% Excluding FX and Acquisitions, Up 16.7%* $341 $227 Acqs. 45% of overall sales First full quarter with Network1; added over 60 vendors and 7,000 customers Y/Y sales growth for all business units in local currency Launched Total Coverage, a value- added service for Cisco collaboration Launched Mitel as a new vendor in the U.S. and Canada * See Appendix for reconciliation of net sales excluding impact of foreign exchange to a GAAP measure.

APPENDIX: NON-GAAP FINANCIAL INFORMATION 13 ($ in thousands) Quarter Ended March 31, 2015 Operating Income Pre-tax income Net income Diluted EPS GAAP measure $ 21,496 $ 19,821 $ 12,943 $ 0.45 Adjustment: Amortization of intangible assets 2,114 2,114 1,464 0.05 Change in fair value of contingent consideration 285 285 200 0.01 Acquisition costs (a) 292 292 292 0.01 Non-GAAP measure $ 24,187 $ 22,512 $ 14,899 $ 0.52 Quarter Ended March 31, 2014 Operating Income Pre-tax income Net income Diluted EPS GAAP measure $ 25,665 $ 25,980 $ 16,949 $ 0.59 Adjustment: Amortization of intangible assets 909 909 595 0.02 Change in fair value of contingent consideration 981 981 647 0.02 Non-GAAP measure $ 27,555 $ 27,870 $ 18,191 $ 0.63 (a) Acquisition costs are nondeductible for tax purposes.

APPENDIX: NON-GAAP FINANCIAL INFORMATION 14 ($ in thousands) Quarter Ended March 31, 2015 WW Barcode & Security WW Comms. & Services Corporate Consolidated Net sales $ 422,061 $ 341,142 $ - $ 763,203 GAAP operating income $ 10,327 $ 11,461 $ (292) $ 21,496 Adjustments: Amortization of intangible assets 464 1,650 - 2,114 Change in fair value of contingent consideration 172 113 - 285 Acquisition costs - - 292 292 Non-GAAP operating income $ 10,963 $ 13,224 $ - $ 24,187 GAAP operating income % (of net sales) 2.4% 3.4% n/m 2.8% Non-GAAP operating income % (of net sales) 2.6% 3.9% n/m 3.2% Quarter Ended March 31, 2014 WW Barcode & Security WW Comms. & Services Corporate Consolidated Net sales $ 455,822 $ 227,176 $ - $ 682,998 GAAP operating income $ 13,820 $ 11,845 $ - $ 25,665 Adjustments: Amortization of intangible assets 558 351 - 909 Change in fair value of contingent consideration 981 - - 981 Non-GAAP operating income $ 15,359 $ 12,196 $ - $ 27,555 GAAP operating income % (of net sales) 3.0% 5.2% n/m 3.8% Non-GAAP operating income % (of net sales) 3.4% 5.4% n/m 4.0% n/m = not meaningful

APPENDIX: NON-GAAP FINANCIAL INFORMATION 15 ($ in thousands) Q3 FY15 Q2 FY15 Q3 FY14 Return on invested capital (ROIC), annualized (a) 12.1% 14.8% 15.3% Reconciliation of Net Income to EBITDA Net income - GAAP $ 12,943 $ 16,821 $ 16,949 Plus: Income taxes 6,878 9,117 9,031 Plus: Interest expense 891 207 217 Plus: Depreciation and amortization 3,710 2,443 1,743 EBITDA 24,422 28,588 27,940 Change in fair value of contingent consideration 285 463 981 Acquisition costs 292 1,474 - Adjusted EBITDA (numerator for ROIC)(non-GAAP) $ 24,999 $ 30,525 $ 28,921 Invested Capital Calculation Equity - beginning of the quarter $ 818,748 $ 810,265 $ 751,446 Equity - end of quarter 799,051 818,748 772,786 Add: Change in fair value of contingent consideration, net of tax 200 346 647 Add: Acquisition costs, net of tax 292 1,474 - Average equity 809,146 815,417 762,440 Average funded debt (b) 32,046 5,429 5,429 Invested capital (denominator for ROIC)(non-GAAP) $ 841,192 $ 820,846 $ 767,869 Notes: (a) Calculated as net income plus interest expense, income taxes, depreciation and amortization (EBITDA), annualized divided by invested capital for the period. Adjusted EBITDA reflects other adjustments for non-GAAP measures. (b) Average daily amounts outstanding on short-term and long-term interest-bearing debt.

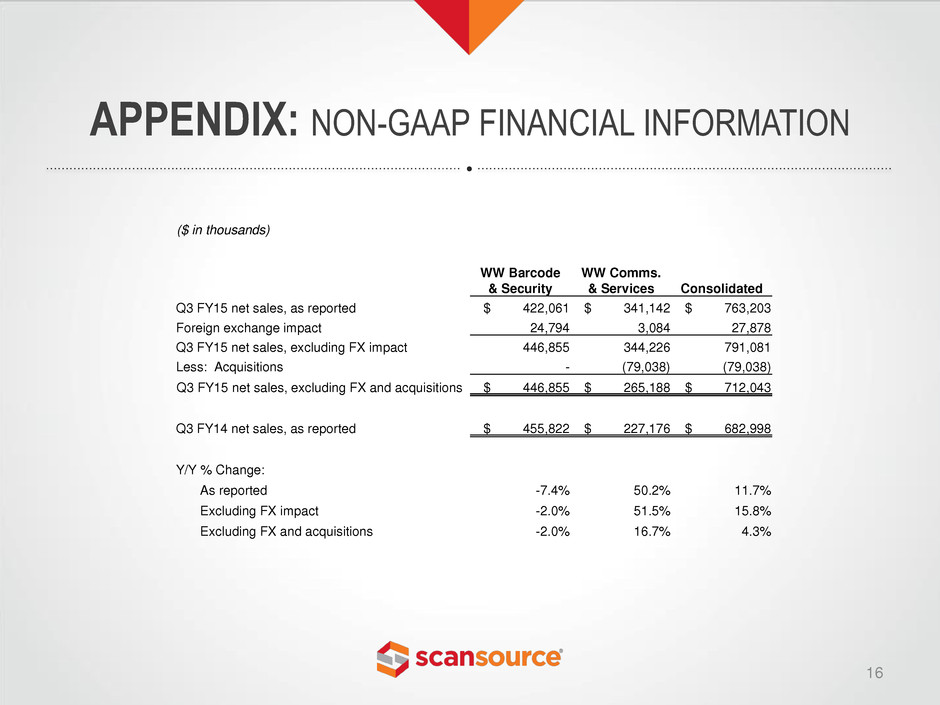

APPENDIX: NON-GAAP FINANCIAL INFORMATION 16 ($ in thousands) WW Barcode & Security WW Comms. & Services Consolidated Q3 FY15 net sales, as reported $ 422,061 $ 341,142 $ 763,203 Foreign exchange impact 24,794 3,084 27,878 Q3 FY15 net sales, excluding FX impact 446,855 344,226 791,081 Less: Acquisitions - (79,038) (79,038) Q3 FY15 net sales, excluding FX and acquisitions $ 446,855 $ 265,188 $ 712,043 Q3 FY14 net sales, as reported $ 455,822 $ 227,176 $ 682,998 Y/Y % Change: As reported -7.4% 50.2% 11.7% Excluding FX impact -2.0% 51.5% 15.8% Excluding FX and acquisitions -2.0% 16.7% 4.3%

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Granite Creek Announces Investment in The District Communications Group (DCG)

- SHAREHOLDER ACTION NOTICE: The Schall Law Firm Encourages Investors in Evolv Technologies Holdings, Inc. with Losses to Contact the Firm

- INVESTOR ACTION NOTICE: The Schall Law Firm Encourages Investors in bluebird bio, Inc. with Losses of $100,000 to Contact the Firm

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share