Form 6-K IAMGOLD CORP For: Apr 13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

Date: April 13, 2015

Commission File Number 001-31528

IAMGOLD Corporation

(Translation of registrant’s name into English)

401 Bay Street Suite 3200, PO Box 153

Toronto, Ontario, Canada M5H 2Y4

Tel: (416) 360-4710

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ¨ Form 40-F x

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Description of Exhibit

| Exhibit | Description of Exhibit | |

| 99.1 | Notice of Annual Meeting of Shareholders | |

| 99.2 | Management information circular | |

| 99.3 | Form of Proxy | |

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| IAMGOLD CORPORATION | ||||||

| Date: April 13, 2015 | By: | /s/ Tim Bradburn | ||||

| Vice President, Legal and Corporate Secretary | ||||||

Exhibit 99.1

IAMGOLD CORPORATION

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

NOTICE IS HEREBY GIVEN that an annual meeting (the “Meeting”) of the shareholders of IAMGOLD Corporation (the “Corporation” or “IAMGOLD”) will be held at the Grand Banking Hall, One King West Hotel & Residence, located at 1 King Street West, Toronto ON, M5H 1A1, on Monday, May 11, 2015 at 4:00 p.m. (EDT), for the following purposes:

| 1. | to receive and consider the annual report of management to shareholders and the annual audited consolidated financial statements of the Corporation for the year ended December 31, 2014 and the report of the auditor thereon; |

| 2. | to elect directors of the Corporation for the ensuing year; |

| 3. | to re-appoint KPMG LLP, Chartered Accountants, as auditor of the Corporation for the ensuing year and to authorize the directors to fix their remuneration; |

| 4. | to vote, in a non-binding, advisory manner, on the Corporation’s approach to executive compensation; and |

| 5. | to transact such other business as may properly come before the Meeting or any adjournment or postponement thereof. |

Particulars of the foregoing matters are set forth in the accompanying management information circular. Only shareholders of record as at the close of business on April 6, 2015 are entitled to receive notice of, and vote at, the Meeting and any adjournment or postponement thereof.

Shareholders who are unable to be present in person at the Meeting are requested to complete, date, sign and return, in the envelope provided for that purpose, the enclosed form of proxy. In order to be voted, proxies must be received by IAMGOLD Corporation, c/o its registrar and transfer agent, Computershare Trust Company of Canada, by no later than 5:00 p.m. (Toronto time) on May 7, 2015 or, in the case of any adjournment or postponement of the Meeting, by no later than 48 hours (excluding Saturdays, Sundays and holidays) before the time for the adjourned or postponed Meeting. Electronic voting is also available to registered shareholders for this Meeting through www.investorvote.com using the control and access numbers printed on the proxy. Votes cast electronically are in all respects equivalent to, and will be treated in the exact same manner as, votes cast via a paper form of proxy. Further details on the electronic voting process are provided in the enclosed form of proxy. The time limit for deposit of proxies may be waived by the Chairman, at his discretion, and without notice.

DATED at Toronto, Ontario as of this 6th day of April, 2015.

| BY ORDER OF THE BOARD |

| “STEPHEN J. J. LETWIN” |

| STEPHEN J.J. LETWIN |

| President and Chief Executive Officer |

Exhibit 99.2

IAMGOLD CORPORATION

MANAGEMENT INFORMATION CIRCULAR

GENERAL PROXY INFORMATION

Solicitation of Proxies

The information contained in this management information circular (“Circular”) is furnished in connection with management’s solicitation of proxies to be used at the annual General meeting (the “Meeting”) of the shareholders of IAMGOLD Corporation (the “Corporation” or “IAMGOLD”), to be held at One King West Hotel & Residence, located at 1 King Street West, Toronto, Ontario, on Monday, May 11, 2015 at 4:00 p.m. (Toronto time), for the purposes set out in the accompanying notice of the Meeting (the “Notice of Meeting”).

It is expected that management’s solicitation of proxies for the Meeting will be made primarily by mail, however, directors, officers and employees of the Corporation may also solicit proxies by telephone, telecopier or in person in respect of the Meeting. This solicitation of proxies for the Meeting is being made by or on behalf of the directors and management of the Corporation and the Corporation will bear the costs of this solicitation of proxies for the Meeting. In addition, the Corporation will reimburse brokers and nominees for their reasonable expenses in forwarding proxies and accompanying materials to beneficial owners of the common shares of the Corporation (the “Common Shares”).

Registered Shareholders Voting by Proxy

Enclosed with this Circular is a form of proxy. The persons named in the enclosed form of proxy are officers and/or directors of the Corporation. A shareholder of the Corporation may appoint a person (who need not be a shareholder of the Corporation) other than the persons already named in the enclosed form of proxy to represent such shareholder of the Corporation at the Meeting by striking out the printed names of such persons and inserting the name of such other person in the blank space provided therein for that purpose. In order to be valid, a proxy must be received by Computershare Trust Company of Canada, 8th Floor, 100 University Avenue, Toronto, Ontario, M5J 2Y1, no later than 5:00 p.m. (Toronto time) on May 7, 2015 or, in the event of an adjournment or postponement of the Meeting, no later than 48 hours (excluding Saturdays, Sundays and holidays) before the time for holding the adjourned or postponed Meeting.

As noted in the Notice of Meeting accompanying this Circular, shareholders may also elect to vote electronically in respect of any matter to be acted upon at the Meeting. Votes cast electronically are in all respects equivalent to, and will be treated in the exact same manner as, votes cast via a paper form of proxy. To vote electronically, registered shareholders are asked to go to the website shown on the form of proxy and follow the instructions on the screen. Please note that each shareholder exercising the electronic voting option will need to refer to the control number indicated on their proxy form to identify themselves in the electronic voting system. Shareholders should also refer to the instructions on the proxy form for information regarding the deadline for voting shares electronically. If a shareholder votes electronically he or she is asked not to return the paper form of proxy by mail.

In order to be effective, a form of proxy must be executed by a shareholder exactly as his or her name appears on the register of shareholders of the Corporation. Additional execution instructions are set out in the notes to the form of proxy. The proxy must also be dated where indicated. If the date is not completed, the proxy will be deemed to be dated on the day on which it was mailed to shareholders.

1

The management representatives designated in the enclosed form of proxy will vote the Common Shares in respect of which they are appointed proxy in accordance with the instructions of the shareholder as indicated on the proxy and, if the shareholder specifies a choice with respect to any matter to be acted upon, the Common Shares will be voted accordingly. In the absence of such direction, such Common Shares will be voted by the management representatives named in such form of proxy in favour of each of the matters referred to in the Notice of Meeting and will be voted by such representatives on all other matters which may come before the Meeting in their discretion.

The enclosed form of proxy, when properly signed, confers discretionary voting authority on those persons designated therein with respect to amendments or variations to the matters identified in the Notice of Meeting and with respect to other matters which may properly come before the Meeting. At the date of this Circular, management of the Corporation does not know of any such amendments, variations or other matters. However, if such amendments, variations or other matters which are not now known to management of the Corporation should properly come before the Meeting, the persons named in the enclosed form of proxy will be authorized to vote the Common Shares represented thereby in their discretion.

Non-Registered Shareholders

Only registered shareholders of the Corporation, or the persons they appoint as their proxies, are entitled to attend and vote at the Meeting. However, in many cases, Common Shares beneficially owned by a person (a “Non-Registered Shareholder”) are registered either:

| (a) | in the name of an intermediary (an “Intermediary”) with whom the Non-Registered Shareholder deals in respect of the Common Shares (Intermediaries include, among others, banks, trust companies, securities dealers or brokers, trustees or administrators of a self-administered registered retirement savings plan, registered retirement income fund, registered education savings plan and similar plans); or |

| (b) | in the name of a clearing agency (such as The Canadian Depository for Securities Limited, in Canada, and the Depositary Trust Company, in the United States) of which the Intermediary is a participant. |

In accordance with the requirements of National Instrument 54-101 – Communication with Beneficial Owners of Securities of a Reporting Issuer of the Canadian Securities Administrators, the Corporation has distributed copies of the Notice of Meeting, this Circular and its form of proxy (collectively the “Meeting Materials”) to the Intermediaries and clearing agencies for onward distribution to Non-Registered Shareholders. Intermediaries are required to forward the Meeting Materials to Non-Registered Shareholders unless the Non-Registered Shareholders have waived the right to receive them. Intermediaries often use service companies to forward the Meeting Materials to Non-Registered Shareholders. Generally, Non-Registered Shareholders who have not waived the right to receive Meeting Materials will either:

| (c) | be given a voting instruction form which must be completed and returned by the Non-Registered Shareholder in accordance with the directions printed on the form (in some cases, the completion of the voting instruction form by telephone, facsimile or over the Internet is permitted) or |

| (d) | be given a form of proxy which has already been signed by the Intermediary (typically by a facsimile, stamped signature), which is restricted as to the number of Common Shares beneficially owned by the Non-Registered Shareholder but which is otherwise not |

2

| completed by the Intermediary. Because the Intermediary has already signed the form of proxy, this form of proxy is not required to be signed by the Non-Registered Shareholder when submitting the proxy. In this case, the Non-Registered Shareholder who wishes to submit a proxy should properly complete the form of proxy and deposit it with Computershare Trust Company of Canada, 8th Floor, 100 University Avenue, Toronto, Ontario, M5J 2Y1. |

In either case, the purpose of these procedures is to permit Non-Registered Shareholders to direct the voting of the Common Shares they beneficially own. Should a Non-Registered Shareholder who receives either a voting instruction form or a form of proxy wish to attend the Meeting and vote in person (or have another person attend and vote on behalf of the Non-Registered Shareholder), the Non-Registered Shareholder should strike out the names of the persons named in the form of proxy and insert the Non-Registered Shareholder’s (or such other person’s) name in the blank space provided or, in the case of a voting instruction form, follow the directions indicated on the form. In either case, Non-Registered Shareholders should carefully follow the instructions of their Intermediaries and their service companies, including those regarding when and where the voting instruction form or the proxy is to be delivered.

Revocation of Proxies

A registered shareholder of the Corporation who has submitted a proxy may revoke it by: (a) depositing an instrument in writing signed by the registered shareholder or by an attorney authorized in writing or, if the registered shareholder is a corporation, by a duly authorized officer or attorney, either (i) at the registered office of the Corporation, 401 Bay Street, Suite 3200, PO Box 153, Toronto, Ontario, M5H 2Y4, at any time up to and including the last business day preceding the day of the Meeting, or (ii) with the Chairman of the Meeting prior to the commencement of the Meeting on the day of the Meeting; (b) transmitting, by telephonic or electronic means, a revocation that complies with (i) or (ii) above and that is signed by electronic signature provided that the means of electronic signature permit a reliable determination that the document was created or communicated by or on behalf of the registered shareholder or the attorney, as the case may be; or (c) in any other manner permitted by law.

A Non-Registered Shareholder who has submitted voting instructions to an Intermediary should contact their Intermediary for information with respect to revoking their voting instructions.

3

VOTING SECURITIES AND PRINCIPAL HOLDERS THEREOF

Description of Share Capital and Quorum

The Corporation is authorized to issue an unlimited number of Common Shares. Each Common Share entitles the holder of record to notice of and one vote at all meetings of the shareholders of the Corporation. As at the close of business on April 6, 2015, there were 391,335,664 Common Shares outstanding. The presence of two persons entitled to vote at the Meeting, either as shareholders or proxy holders, and holding or representing not less than twenty-five per cent of the Common Shares entitled to be voted thereat will constitute a quorum for the Meeting.

Record Date

The directors of the Corporation have fixed the close of business on April 6, 2015 as the record date for the determination of those holders of Common Shares entitled to receive notice of the Meeting. In addition to notice, holders of Common Shares of record at the close of business on April 6, 2015 will be entitled to vote at the Meeting and at all adjournments or postponements thereof.

Ownership of Securities of the Corporation

As at April 6, 2015, to the knowledge of the directors and officers of the Corporation, and according to securities regulatory filings of which the Corporation has notice, other than Van Eck Associates Corporation, which owns 61,233,568 Common Shares or 15.65% of the Common Shares outstanding, no person or company, directly or indirectly, beneficially owned, and/or exercised control or direction over, more than ten per cent of the votes attached to all of the Common Shares outstanding.

Currency

Unless stated otherwise, all references to dollar amounts in this Circular are to Canadian dollars.

4

BUSINESS OF THE MEETING

Election of Directors

The shareholders of the Corporation will be asked to elect 7 directors for the Corporation. Each director elected will hold office until the close of the next annual meeting of the shareholders of the Corporation, unless his office is earlier vacated or until his successor is appointed or elected.

The Board recommends that shareholders vote FOR the election of each of the nominees whose names are set forth below.

In the absence of any instructions to withhold a vote in respect of a nominee, the Common Shares represented by proxies received by management will be voted FOR each of the nominees whose names are set forth below.

Management of the Corporation does not contemplate that any of the nominees will be unable to serve as a director of the Corporation for the ensuing year, however, if that should occur for any reason at or prior to the Meeting or any adjournment or postponement thereof, the persons named in the enclosed form of proxy have the right to vote the proxy for the election of the remaining nominees and may vote in their discretion for the election of any person or persons in place of any nominees unable to serve.

The following table sets forth the name, the municipality of residence, the principal occupation or employment, the year upon which directorship commenced and the number of Common Shares currently owned, or over which control or direction is exercised, whether directly or indirectly, for each nominee for election as a director of the Corporation.

| Name and Municipality of Residence |

Principal Occupation or Employment |

Year First Became a Director of the Corporation |

Number of Common Shares (6) |

|||||

| STEPHEN J. J. LETWIN Toronto, Ontario, Canada |

President & CEO of the Corporation | 2010 | 388,824 | |||||

| JOHN E. CALDWELL(1, 3) Toronto, Ontario, Canada |

Corporate Director | 2006 | 28,614 | |||||

| DONALD K. CHARTER(2, 3, 5) Toronto, Ontario, Canada |

Corporate Director | 1994 | 161,592 | |||||

| W. ROBERT DENGLER(3, 4) Aurora, Ontario, Canada |

Corporate Director | 2005 | 59,632 | |||||

| RICHARD J. HALL(1, 5) Silverthorne, Colorado, USA |

Corporate Director | 2012 | 30,225 | |||||

| MAHENDRA NAIK(1, 2) Markham, Ontario, Canada |

President – FinSec Services Inc. (Management Services) | 1990 | 472,259 | |||||

| TIMOTHY R. SNIDER(2, 4) Tucson, Arizona, USA |

Chairman of Cupric Canyon Capital | 2011 | 121,063 | |||||

5

| (1) | Member of the Audit and Finance Committee of the board of directors of the Corporation |

| (2) | Member of the Human Resources and Compensation Committee of the board of directors of the Corporation |

| (3) | Member of the Nominating and Corporate Governance Committee of the board of directors of the Corporation |

| (4) | Member of the Environmental, Health and Safety Committee of the board of directors of the Corporation |

| (5) | Member of the Reserves and Resources Committee of the board of directors of the Corporation |

| (6) | Owned, or over which control or direction is exercised, whether directly or indirectly. |

Information as to the number of Common Shares owned and/or over which control or direction is exercised, whether directly or indirectly, by the nominees for election as directors of the Corporation is, in each case, based upon information furnished by the respective nominee on the System for Electronic Disclosure by Insiders (“SEDI”), at www.sedi.ca, and information otherwise available to the Corporation as at April 6, 2015.

Biographies of each of the director nominees are set out in Appendix “A” to this Circular. In respect of the election of directors, in non-contested elections, the Corporation has adopted a majority voting policy that is described in the Corporation’s Statement of Corporate Governance Practices found later in this Circular. Essentially, in order to qualify as a director, a nominee must receive more votes for his/her election than are withheld.

Further information about the nominees for election as directors of the Corporation may be found in the most recent Annual Information Form of the Corporation, under the heading “Item VII—Directors and Officers”, at pages 79-82, which has been filed on the System for Electronic Document Analysis and Retrieval (“SEDAR”), at www.sedar.com, and incorporated in the most recent Form 40-F of the Corporation filed in the United States on the system for Electronic Data-Gathering, Analysis and Retrieval (“EDGAR”), at www.sec.gov/edgar.shtml, which information is hereby incorporated by reference in this Circular. A copy of the Annual Information Form is available, free of charge, to any shareholder upon request to the Secretary of the Corporation.

Re-appointment of Auditor

The Board recommends that shareholders vote FOR the re-appointment of KPMG LLP, Chartered Accountants, as auditor of the Corporation until the close of the next annual meeting of shareholders or until their successor is appointed and to authorize the directors to fix their remuneration. KPMG LLP has been the auditor of the Corporation since June 18, 1998.

In the absence of any instructions to withhold a vote, the Common Shares represented by proxies received by management will be voted FOR the re-appointment of KPMG LLP, Chartered Accountants, as auditor of the Corporation until the close of the next annual meeting of shareholders or until their successor is appointed and to authorize the directors to fix their remuneration.

6

The aggregate fees billed by KPMG LLP in each of the last two financial years of the Corporation are as follows:

| Amounts in USD |

2014 | 2013 | ||||||

| Audit Fees(1) |

1,288,000 | 1,575,000 | ||||||

| Audit-Related Fees(2) |

175,000 | 55,000 | ||||||

| Tax Fees(3) |

119,000 | 84,000 | ||||||

| Other Fees(4) |

24,000 | 15,000 | ||||||

|

|

|

|

|

|||||

| Total – USD |

1,606,000 | 1,729,000 | ||||||

|

|

|

|

|

|||||

| (1) | “Audit Fees” the aggregate fees billed by the Corporation’s external auditor in each of the last two fiscal years for audit services were $1,288,000 in 2014 and 1,575,000 in 2013. |

| (2) | “Audit-Related Fees” the aggregate fees billed in each of the last two fiscal years for assurance and related services by the Corporation’s external auditor that are not included in the above paragraph were $175,000 in 2014 and $55,000 in 2013. The audit-related fees relate to services provided in connection with statutory filings and transactions completed by the Corporation. |

| (3) | “Tax Fees” the aggregate fees billed in each of the last two fiscal years for professional tax services rendered by the Corporation’s external auditor were $119,000 in 2014 and $84,000 in 2013. The professional tax services related to corporate tax compliance, tax planning and other related tax services. |

| (4) | “Other Fees” the aggregate fees billed in each of the last two fiscal years for other services rendered by the Corporation’s external auditor were $24,000 in 2014 and 15,000 in 2013. The other services related to assurance work and readiness assessments performed for the Corporation related to the World Gold Council conflict free gold standard. |

Advisory Vote on the Corporation’s Approach to Executive Compensation

The Board has adopted a shareholder advisory vote on the Corporation’s approach to executive compensation, as disclosed under the heading “Statement of Executive Compensation,” elsewhere in this Circular. As a formal opportunity to provide their views on the disclosed objectives of the Corporation’s pay for performance compensation model, shareholders are asked to review and vote, in a non-binding, advisory manner, on the following resolution:

Resolved, on an advisory basis and not to diminish the role and responsibilities of the Board, that the shareholders accept the approach to executive compensation disclosed in the Circular.

The Human Resources and Compensation Committee (the “HRCC”), and the Board, will take the results of the vote into account, as appropriate, when considering future compensation policies, procedures and decisions, all of which are to be consistent with its pay for performance compensation model (see the Statement of Executive Compensation for details regarding the compensation philosophy and guidelines of the Board and the metrics and process used to assess performance as well as whether any compensation consultant was retained last year and, if so, the mandate of such consultant). The pay for performance

7

compensation model is designed to attract, retain and motivate talented management and pay for actual performance which drives the long-term creation and preservation of shareholder value.

The Board recommends that shareholders vote FOR the resolution to accept the Corporation’s approach to executive compensation.

In the absence of any instructions to the contrary, the Common Shares represented by proxies received by management will be voted FOR the approval of the resolution to accept the Corporation’s approach to executive compensation.

8

STATEMENT OF EXECUTIVE COMPENSATION

To Our Fellow Shareholders

On behalf of the Human Resources & Compensation Committee (“HRCC”) and the Board of Directors, we are pleased to share with you our report on executive compensation. As described below and throughout the Compensation Discussion & Analysis, the HRCC believes that the Corporation’s executive compensation program demonstrates a pay-for-performance philosophy, in particular:

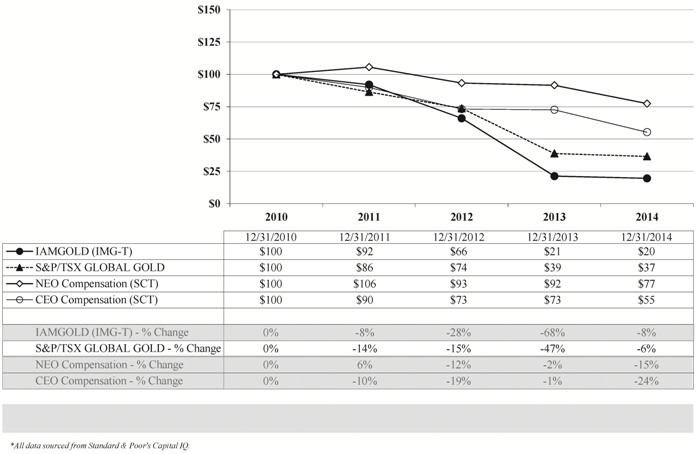

| • | Total compensation of senior executives, including the Named Executive Officers (“NEOs”) aligns directly with the shareholder experience; |

| • | For the last three years, “at risk” compensation (expressed as a percentage of total direct compensation) for NEOs as a group, has been significant: 2012 – 64%, 2013 – 61% and for 2014 – 55% and; |

| • | 100% of “at-risk” compensation, including both the short-term (“STIP”) and long-term incentive plans (“LTIP”) are performance-based; and |

| • | CEO total compensation has decreased year-over-year for the past 3 years. For 2012 and 2013 the CEO received his STIP awards earned in restricted share units and in 2014 waived his STIP award receiving only his annual LTIP grant, both increasing his equity exposure and long-term “at risk” compensation. Further, all vested share units have been held by the CEO on a gross basis, whereby he elected to fund the income tax payable from his personal resources as opposed to reducing his equity holdings. Total equity holdings (held directly and indirectly) of the CEO is 318,949 Common Shares, as of December 31, 2014 and unvested shares total an additional 338,450 for total share holdings of 657,399 shares. |

Holistic Review of Performance

While share price performance is a factor in assessing management, it is only one criterion used. In times of a dramatic drop in commodity prices, the HRCC and Board believes it is very important to ensure that an effective management team is retained and that they are focused on the goals required to ensure that the Corporation remains competitive in a difficult environment. The loss of management experience and expertise in a challenging environment can be detrimental to both the near-term and long-term performance of the Corporation. In addition to ensuring a link between executive compensation and performance, it is also important for sustained shareholder value that the Corporation’s compensation program remain competitive in the market place to attract and retain key talent.

The balance among these objectives is reflected in the Company’s compensation programs with relative mix between share price performance and specific operating targets to assess management, together with the use of both cash and equity grants with long-term vesting provisions.

Alignment of Pay and Performance for 2014

Management performance is measured against a number of critical metrics which address the near-term and longer-term goals and priorities of the Corporation. In the most recent few years the dramatic fall in the price of gold has required a quick response from management and the Board in order to ensure that the Corporation’s strategy reflects the reality of the market. For 2014, the capital markets changed the assessment criteria for gold miners to a focus on the “all-in sustaining costs” and free cash flow. In tandem, the Corporation shifted immediate focus to cost reduction, cash preservation and free cash flow. This required careful review by the HRCC to ensure that management was being rewarded for focusing

9

on and achieving appropriate targets in the short-term and near-term that would provide long-term sustainable value creation for shareholders.

The following outlines key factors and outcomes relating to 2014 pay for performance decisions:

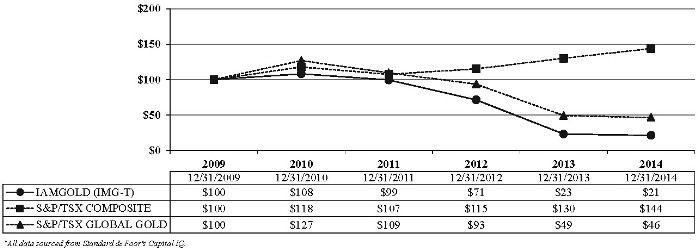

| • | Commodity price impacted total compensation levels and value of outstanding equity – 2013 and 2014 saw a significant and rapid decline in the price of gold and a resulting sharp decline in gold stocks and the S&P/TSX Global Gold Index which is used as a benchmark for the Corporation. These events required an immediate change in corporate strategy to meet the challenges and focusing executive compensation on a number of near-term high priority items to ensure the Corporation’s continued success. However these events adversely affected the compensation of the executives in the Corporation in two ways: (a) Total compensation (reported in the Summary Compensation Table) awarded is down year-over-year, in particular for our CEO, and (b) the grant value of equity awards is down significantly relative to prior years. |

| 1. | No merit salary increases – despite market research suggesting that the industry average salary increase is between 2% to 3%, there were no merit-based salary increases for either 2014 or 2015 for the Executive Leadership Team (“ELT”). |

| 2. | Cost savings and significant executive restructuring – as part of the significant cost savings initiatives undertaken in 2014 which achieved approximately $70 million in savings (in addition to the $125 million of savings achieved in 2013), there was a significant reduction in the size of the Corporation’s ELT (from 10 to 6 individuals) and a consolidation of a number of corporate functions reporting into fewer executives. This resulted in overall permanent cost savings among the ELT in excess of $2.4 million. |

| 3. | Alignment with Total Shareholder Return and Return on Capital performance – challenging share price performance both in absolute terms and relative to the Corporation’s benchmark (the S&P/TSX Global Gold Index) resulted in the portion of STIP and LTIP incentive awards related to 1-year and 3-year relative total shareholder return (“TSR”) receiving a score of 0. Under the Corporation’s guidelines the rating will be 0 where the absolute TSR performance is negative. The portion of the Corporate Performance metrics of the STIP and LTIP related to return on capital also received a score of 0. |

| 4. | Alignment with successful achievement of goals related to cash preservation, improvement in free cash flow and reduction in production costs – as a result of the weak gold price in 2013 and the outlook for 2014, the HRCC determined that priorities for the year included preserving cash, improving free cash flow and reducing production costs. The 2014 targets which were set at the start of 2014 were focused on free cash flow, production, cash costs, sustaining capital, working capital and reserve replacement. This was done in the context of an aggressive budgeting process: |

| – | The immediate goal of achieving targeted corporate net free cash flow was a high priority. An aggressive target for free cash flow was set which the Corporation outperformed by $77 million and as a result received a score of 1.5 (out of 1.5). |

| – | Gold production was 4% below target (but above 2013 gold production), offset by niobium production exceeding target for an overall score of 0.65 (out of 1.5) |

| – | Gold production costs achieved target and niobium production costs outperformed target for an overall score of 1.08 (out of 1.5). |

| – | Sustaining capital expenditure savings significantly outperformed target, improving the Corporation’s cash position for a score of 1.5 (out of 1.5). |

| – | Working capital reduction significantly outperformed target improving the Corporation’s cash position with a score of 1.5 (out of 1.5). |

10

| – | Reserve replacement underperformed target with a score of 0 (out of 1.5). |

| 5. | Successful focus and achievement of continued Health & Safety, and Sustainability objectives – HSS is now a distinct performance criterion reflecting its overriding importance in all aspects. The Corporation outperformed its targets in 2014 resulting in a score of 1.375 (out of 1.5). |

| 6. | Successful completion of the Niobec sale – The ELT completed the sale of Niobec for US$500 million. This was an important and game changing event for the Corporation and was the result of a high level of performance by a number of executives. This important achievement was reflected in the personal performance scores of a number of executives along with other important individual accomplishments. |

| 7. | STIP & LTIP payouts for 2014 were below target for all NEOs – STIP payments ranged between 77% and 94.6% of target depending on the balance between Corporate, Operating, HSS and Personal performance. LTIP awards ranged between 77% and 137% below the target of 200% of STIP. LTIP awards reduced dilution at low share prices. |

| 8. | PSUs expired unvested – PSUs granted in 2012 did not vest and expired as a result of the failure to meet the performance vesting criteria. There were no changes to vesting criteria for expired PSUs. |

Pay for Performance of Past Equity Grants

The HRCC believes the purpose of equity compensation is to align the interests of management with shareholders over time, such that the value of their equity holdings increases or decreases in a manner similar to shareholders. While shareholders can buy or sell at any time, the equity-based awards for management vest over 3 to 5 years and therefore represent a more restricted shareholding than that of shareholders. Also, management is encouraged to hold a portion of their equity throughout their tenure with the Corporation under the Share Ownership Guidelines. To assess the effectiveness of the Corporation’s equity plan, the HRCC regularly reviews the value of equity awards over time against share price performance for both the CEO and the NEOs as a group.

The analysis below demonstrates that the CEO has experienced a greater reduction in value than a shareholder over similar periods of time ending December 31, 2014 – for each period, the reduction in value of the equity awards exceeded the corresponding percent decline in share price.

| Total Loss in Value Since Grant Date | ||||||||

| Time Period 1 |

CEO LTIP Compensation 2 |

IAM GOLD Share Price | ||||||

| (vs. Grant Date Value) |

(Since Date of Grant) | |||||||

| November 11, 2010 to December 31, 2014 |

-86 | % | -81 | % | ||||

| May 16, 2011 to December 31, 2014 |

-100 | % | -81 | % | ||||

| March 30, 2012 to December 31, 2014 |

-100 | % | -74 | % | ||||

| February 26, 2013 to December 31, 2014 |

-67 | % | -57 | % | ||||

| February 25, 2014 to December 31, 2014 |

-52 | % | -24 | % | ||||

| 1. | Start of period based on the actual LTIP grant date for each respective year. |

| 2. | CEO LTIP compensation value reflects the sum of: (a) vested equity on the date of settlement, (b) current value of unvested equity awards, and (c) “in-the- money” value of stock options outstanding (i.e., $0 if current share price is less than the exercise price). |

11

In Summary

IAMGOLD’s executive compensation program and practices are described in detail over the following pages of the Compensation Discussion and Analysis. The HRCC believes that the compensation program continues to be heavily oriented towards pay for performance, shareholder alignment and supports its goal of rewarding executives for the long-term creation and preservation of value for shareholders as well as near term industry and corporate challenges in a time of gold price volatility.

Submitted by the HRCC on behalf of the Board of Directors,

Donald K. Charter (Chairman), Mahendra Naik and Timothy Snider

12

COMPENSATION DISCUSSION AND ANALYSIS

This Compensation Discussion and Analysis describes the Corporation’s approach to executive compensation by outlining the processes and decisions behind what the Corporation paid its executive officers who were, during, or as at the end of the Corporation’s financial year ended December 31, 2014, the CEO, CFO and three other most highly compensated executive officers of the Corporation (the “Named Executive Officers” or “NEOs”). The NEOs for 2014 are:

| • | Stephen J.J. Letwin, President and CEO (“President & CEO”); |

| • | Gordon Stothart, Executive Vice President and Chief Operating Office (“EVP & COO”) ; |

| • | Carol Banducci, Executive Vice President and Chief Financial Officer (“EVP & CFO”); |

| • | Jeffery Snow, General Counsel, Senior Vice President, Business Development (“SVP, Legal”); and |

| • | Craig MacDougall, Senior Vice President, Exploration (“SVP, Exploration”). |

Compensation Program Oversight and Governance

The fundamental objective of IAMGOLD’s executive compensation practices is to motivate and reward executives for the long-term creation and preservation of shareholder value. In addition, it must reflect the annual challenges faced by the Corporation in the context of the price of gold. To meet this objective the Corporation’s executive compensation programs and policies are designed with the following principles:

| • | attract, retain, motivate and reward high-calibre executive talent through competitive pay practices; |

| • | link the compensation model directly to specific and measurable corporate, operational, Health, Safety & Sustainability (“HSS”) and individual performance objectives which are set annually to reflect the challenges faced by the Corporation; |

| • | motivate high-performers to achieve exceptional levels of performance through rewards; |

| • | provide the Human Resources and Compensation Committee (“HRCC”) with the flexibility to exercise discretion to ensure appropriate overall compensation results; |

| • | align compensation with the risk profile of the Corporation; and |

| • | encourage and require executives to own shares of the Corporation to more fully align the interests of management with the interests of shareholders. |

Role of the HRCC

As part of its Board-approved mandate, the HRCC:

| • | recommends to the Board for approval the goals and objectives comprising the executive compensation plan based on the Board-approved budget and corporate strategy, against which the performance of the President & CEO and other executives are assessed; |

| • | reviews the President & CEO’s responsibilities periodically and from time to time recommends to the Board changes to such responsibilities; |

| • | leads the annual review and evaluation process of the President & CEO’s performance and reports results to the Board; |

| • | reviews the performance of the other executives, based on a report submitted by the President& CEO; |

13

| • | recommends to the Board for approval, the salaries and short-term incentives of the Corporation’s executive officers, on an individual basis, and the compensation of non-executive employees on an aggregate basis; |

| • | recommends to the Board for approval, equity-related compensation in the form of PRSUs and/or stock options as part of the compensation of executives and non-executives provided for under the Share Incentive Plan; |

| • | administers the Corporation’s share incentive plan under which such equity-related compensation is granted; |

| • | reports to the Board on the Corporation’s organizational structure, implementation of executive officer succession programs, total compensation practices, talent management practices and executive development programs; |

| • | reviews any employment agreement between the Corporation and an executive officer including terms addressing retirement, termination of employment or other special circumstances, and if appropriate, recommends to the Board for approval; and |

| • | reviews the operation and administration of the Corporation’s retirement benefit plans. |

Composition of the HRCC

The Board has determined that the HRCC is to be comprised of at least three directors, each of whom must be independent under applicable laws, policies and stock exchange rules. In addition, keeping with governance best practice, the HRCC should consist of directors who are knowledgeable about issues related to human resources, talent management, compensation, governance and risk management.

The current members of the HRCC are Mr. Donald K. Charter, Mr. Mahendra Naik, and Mr. Timothy Snider. Collectively, the HRCC has extensive compensation-related experience in the natural resources sector as senior executive officers and members of Boards and committees of other public corporations:

| • | Mr. Charter is a corporate director with operational and executive leadership experience. Most recently he was the President and CEO of Corsa Coal Corp., an international public coal mining company. He currently is the Chairman of the Board of Adriana Resources and a member of the Compensation Committee, and Chairman of the Compensation Committee and member of the Audit Committee of Lundin Mining Corporation, an international public metals and mining company. Mr. Charter also has compensation-related experience through his roles as a member of Compensation Committees for a number of public companies over his career and as a senior executive, including President & CEO of a large financial services organization. |

| • | Mr. Naik is President & CEO of FinSec Services Inc., a private management services company. Mr. Naik is also Chairman of the Board, Chairman of the Audit Committee and member of the Compensation Committee of Fortune Minerals Inc., a diversified public minerals and resources company. In addition, Mr. Naik is also a member of the Compensation Committee of FirstGlobal Data Limited and of several large private companies including Goldmoney Network Limited. Mr. Naik has compensation-related experience through his background as a Chartered Public Accountant and as a senior executive of several large companies. Mr. Naik is also a member of IAMGOLD’s Audit and Finance Committee, which helps the HRCC understand and discuss relevant issues for both Committees. |

| • | Mr. Snider is the Chairman of Cupric Canyon Capital, LLC., a private equity company that invests in copper mining assets worldwide. He was formerly President and Chief Operating Officer of Freeport McMoRan Copper and Gold, and its predecessor Phelps Dodge Corporation where he spent 38 years of his career. In addition to IAMGOLD, Mr. Snider is also a director of Cia. De Minas Buenaventura |

14

based in Lima Peru. He was formerly a director of Compass Minerals based in Overland Park, Kansas where he served as Chairman of the Compensation Committee. Mr. Snider is also involved in several non-profit organizations, including the University of Arizona’s Institute for Mineral Resources (founding Chairman), the Northern Arizona University Foundation Board, and the Mining Foundation of the Southwest. He was inducted into the American Mining Hall of Fame and received the Jackling Award and Richards Award for innovation from the Society of Mining and Metallurgical Engineers.

Further, the HRCC members have no interlocking relationships as Board members of other companies. The table below summarizes the relevant IAMGOLD Board committee experiences of each HRCC member, followed by additional commentary:

| HRCC Member |

Board Member Experience (Present and Past 4 Years) (1) | |||||||||||||||||||

| Human Resources | Audit | Reserves & Resources |

Environmental Health and Safety |

Nominating & Corp. Gov. | ||||||||||||||||

| Member | Chair | Member | Chair | Member | Chair | Member | Chair | Member | Chair | |||||||||||

| D.K. Charter | ü | ü | ü | ü | ||||||||||||||||

| M. Naik | ü | ü | ||||||||||||||||||

| T. Snider | ü | ü | ||||||||||||||||||

| 1. | Most HRCC members also have extensive experience beyond the past 4 years. |

Activities of the HRCC with respect to 2014

Each year, the HRCC finalizes the executive compensation plan once the strategic plan and annual budget for the following year are approved by the Board (at the end of the preceding financial year). The HRCC determines STIP and LTIP awards in the first quarter of the fiscal year following the relevant period, once audited year-end financial statements are available. Accordingly, deliberations with respect to the 2014 financial year occurred in Q4 2013, during 2014 and in Q1 2015. The HRCC met six times in 2014.

In the execution of its mandate, the HRCC:

| • | assessed the effectiveness of the existing compensation plan, including a review of the Corporation’s compensation philosophy, methodology and program design compared to the Corporation’s peer groups (identified below under “Pay Peer Groups”) to ensure relevancy and appropriateness; |

| • | assessed the performance of executives against Board-approved objectives; |

| • | reviewed minimum share ownership guidelines for the executives; |

| • | engaged the services of an external compensation consultant to provide independent advice and expertise on executive compensation matters; |

| • | recommended to the Board for approval the corporate, operational, HSS and individual performance objectives for 2014 and 2015 in conjunction with the 2014 and 2015 approved budgets and with a view to advancing the corporate strategy adopted by the Board; |

| • | recommended to the Board for approval 2014 compensation payable consistent with the 2014 executive compensation plan, the individual performance of the CEO and the recommendation of the CEO for the other NEOs; and |

| • | reviewed the potential for any material risks arising from the executive compensation plan. |

Compensation Risk Management and Good Governance Practices

IAMGOLD’s compensation program and practices have been established to ensure appropriate alignment with the long-term success of the organization, near term challenges and good governance practices. The

15

executive compensation plan is comprised of four components, including base salary, short-term incentive plan (“STIP”, cash-settled), long-term incentive plan (“LTIP”, equity-settled), and benefits and perquisites. The HRCC believes the compensation program:

| • | effectively balances pay for performance and retention of highly skilled executives; |

| • | mitigates the risk of unanticipated or unwarranted payouts; and |

| • | encourages executives to consider how short-term actions will contribute to long-term success. |

The HRCC and the Board regularly review and evaluate potential risks to the Corporation resulting from the design of the Corporation’s executive compensation program. Some of these risks include executive retention, short-term risky behaviours and unexpected payouts that are not aligned with performance. Neither the HRCC nor the Board has identified any potential risks associated with the compensation policies or practices of the Corporation that would reasonably be likely to have a material adverse effect on the Corporation. Some specific risk-mitigating and good governance design features of the 2014 executive compensation program include:

| Area of Focus |

Executive Compensation Design Features | |||

| Program Design |

• | Majority of the NEO total compensation is performance-based and “at risk” with an average performance portion of total compensation for the last three years of [TBD]% of total compensation; | ||

| • | Cash and equity awards are 100% performance-based and earned, not guaranteed with significant vesting periods to ensure that executive interests are aligned with shareholders over a long term. | |||

| • | Isolates (as much as possible) for the impact of commodity prices through relative performance metrics and applies budgeted commodity prices rather than allowing for the influence of actual prices. | |||

| • | Short-term and long-term incentive formula factors are capped to avoid excessive or extreme compensation awards. | |||

| • | HRCC retains discretion to adjust the compensation of an executive, as it deems appropriate, to ensure that pay outcomes match actual performance outcomes. Both the STIP and LTIP frameworks are intended to serve only as guidelines for the Committee. | |||

| • | Performance objectives and related compensation outcomes are pre-defined | |||

| STIP | • | Includes multiple layers of performance measurement including corporate, operational, HSS and individual performance goals. | ||

| • | Challenging performance targets are pre-defined in conjunction with the annual budgeting process and based on actual past performance. | |||

| • | The STIP design incorporates risk mitigating performance measures such as absolute Return on Capital Employed (“ROCE”) and relative Total Shareholder Return (“TSR”) measures and performance targets; | |||

| • | The impact of gold commodity prices are neutralized through use of relative TSR performance (1-year and 3-year) against the S&P Global Gold Index and using a budgeted gold price to set operating goals. | |||

| • | Reserve increases resulting solely from gold price increases are not included in the reserve calculation for incentive awards. | |||

| LTIP | • | Grant levels are determined based on specific measures included in the STIP; the HRCC uses the STIP outcomes and overall performance as a guideline to determine LTIP grant levels. | ||

| • | LTIP vehicles including Performance-based Restricted Share Units (“PRSUs”) and performance-based stock options have performance cycles of 3-years and up to 7-years, respectively. | |||

| • | Annual grants with staggered and overlapping vesting schedules (PRSUs cliff vest after 35 months and stock options vest over 5-years) ensure executives continually focus on future value creation. | |||

| Additional Governance |

• | Potential awards under the STIP and LTIP are regularly “stress-tested” to avoid unintended behaviours and compensation outcomes. | ||

| • | Clawback Policy provision is included in the executive compensation plan for incentive compensation granted and/or settled, where the underlying performance for such grant / award is subsequently unfounded (e.g., upon a material earnings restatement). | |||

| • | Share ownership guidelines for executives that must be maintained through their tenure. | |||

| • | An advisory vote on the Corporation’s approach to executive compensation (“Say on Pay”) which has | |||

16

| received positive support since adoption. | ||||

| • | An Anti-hedging Policy that prohibits executives and directors from hedging against a decrease in the market value of the Corporation’s equity securities. | |||

| • | the HRCC meets in-camera after each meeting for additional compensation discussions; | |||

| • | Retention of an independent advisor by the HRCC to provide external perspective on market changes and best practices related to compensation design, governance and compensation risk management. | |||

Anti-hedging Policy

To further align the interests of executives and directors with the creation and protection of short-term and long-term value for shareholders, the Corporation prohibits officers and directors from engaging in hedging against a decrease in the market value of IAMGOLD’s equity securities.

Management’s Role in Compensation Decision-Making

As part of the annual compensation cycle, the President & CEO recommends corporate, operational, HSS and individual objectives for each executive. Objectives are consistent with the Board-approved annual budget and corporate strategy. Based upon the President & CEO’s year-end assessment of performance, policy guidelines, competitive benchmark data and industry practice, the President & CEO provides to the HRCC recommendations with respect to executive base salary increases, short-term cash incentives, and long-term equity incentives.

At the beginning of each year the President & CEO provides the HRCC with a draft of his individual objectives. These objectives are finalized after feedback is received from the HRCC and the Board. At the end of the year, the HRCC reviews CEO performance against these individual objectives and overall corporate performance. Compensation recommendations are then made to the Board for approval. The SVP Corporate Affairs, HSS, & People assists the CEO with compensation recommendations regarding the executives. Other executives are not typically involved in any compensation-related decisions with respect to executives (including NEOs).

Management also collects and summarizes competitive compensation data and company financial and market performance data for the HRCC’s consideration in its decision making. The specific comparator group against which compensation practices are assessed is described further under “Pay Peer Group”.

Compensation Consultants

The HRCC from time to time retains compensation consultants to provide expert, independent advice regarding compensation policy and decisions. The consultants provide support to the HRCC and act only on instructions provided or approved by the HRCC Chair. The consultant does not perform work other than work pre-approved in writing by the HRCC Chair. HRCC decisions and recommendations to the Board are its responsibility and may reflect factors and considerations other than the information and recommendations provided by compensation consultants.

Towers Watson has been retained since 2011 for services related to executive compensation, reporting directly to the HRCC. In 2014, Towers Watson provided support to the HRCC as follows:

| • | reviewed HRCC materials prepared by management and attended HRCC meetings; |

| • | assisted with a shareholder request to increase the number of common shares issuable from treasury pursuant to the Share Incentive Plan; |

| • | reviewed executive compensation disclosure; |

17

| • | reviewed the short-term incentive plan design; and |

| • | reviewed competitive total direct compensation levels for peer group provided by management; |

The HRCC reviewed and ensured the independence of Towers Watson in connection with the advice provided. The table below summarizes fees billed by Towers Watson over the past two years in respect of executive compensation and non-executive compensation consulting services:

| 2013 |

2014 | |||||||||

| Executive Compensation |

Non-Executive |

TOTAL |

Executive Compensation |

Non-Executive |

TOTAL | |||||

| $172,596 |

$150,911(1) | $323,507 | $97,693 | — | $97,693 | |||||

| 1. | The non-executive compensation consulting services related to administering the Corporation’s employee satisfaction survey which is generally conducted every other year. The executive compensation advisors were not involved in any way with employee satisfaction survey. |

Executive Share Ownership

To further align the interests of executives and our shareholders, in 2010, the Corporation implemented Share Ownership Guidelines for its executives. Ownership levels can be achieved through the accumulation of Common Shares and vested and unvested share units. Share ownership guidelines suggest ownership to be achieved within three years of joining the Corporation or appointment to the relevant executive level.

Current share ownership guidelines include the following, by executive level. As of December 31, 2014, all NEOs have achieved and exceeded their share ownership guideline.

| Executive Position / Level |

Share Ownership Guideline (Number of Shares) | |

| President & CEO |

125,000 | |

| Executive Vice President |

48,000 | |

| Senior Vice President |

30,000 | |

| Vice President |

20,000 |

Compensation Program Design

Annually, the Corporation conducts a review of its compensation practices and plan designs. As a result of the review for the 2014 plan, updates to the STIP design were as follows:

| • | enhanced focus on cost management, cash preservation, and disciplined capital management; |

| • | added a free cash flow metric to the Corporate Performance factor; |

| • | redefined metrics for gold production, cash costs, sustaining capital, and working capital included in Operating Performance factor; |

| • | promoted Health, Safety and Sustainability from a sub-metric of Operating Performance to its own primary performance factor, similar to Corporate and Operating Performance; |

| • | modified the relative TSR metric such that negative absolute TSR performance, regardless of relative performance receives a “0” score (unless determined otherwise at the discretion of the HRCC); |

18

| • | redefined Individual Performance with focus on leadership performance, game changing initiatives, general and administrative cost management, and other individual objectives; and |

| • | modified the Corporation’s pay peer group to meet specific criteria including industry, size (as measured by revenue and market capitalization), and complexity as a Canadian publicly-traded corporation with international operations. As a result, First Quantum was removed, and B2Gold was added to the peer group. |

Looking ahead to 2015, the Corporation made further changes to the STIP design in conjunction with the Corporation’s updated strategic plan and the 2015 budget:

| • | clarified the definitions of performance measures. |

| • | the relative TSR component of Corporate Performance will be based on 1-year relative performance rather than 1-year and 3-year relative performance. |

| • | free cash flow has a higher weighting and is assessed on an absolute basis against budget without adjustment for gold price. This reflects the high importance attached to this metric in the current price environment and to ensure timely response of management to changes in the environment the ROCE metric will be removed from Corporate Performance placing greater weight on free cash flow. |

Pay Peer Group

To assist with compensation decisions each year, the HRCC reviews market data to assess the competitiveness of total compensation (base salary, short-term and long-term incentives) for executives (including NEOs). The market data is used as a reference point only and the HRCC does not target a specific competitive position of the comparator group to set NEO compensation levels.

When developing comparator groups, the Corporation considers organizations that are similar in size and scope of operations and are representative of the market within which the Corporation competes for senior executive talent. When selecting comparators, the Corporation applies the following criteria:

| • | Industry: gold, diversified metals & mining and precious metals & minerals; |

| • | Geography: headquartered in Canada with international operations; |

| • | Corporate structure: publicly-traded on the TSX; and |

| • | Similar size: revenue greater than $100 million and market capitalization between $750 million and $10 billion. |

In 2014, the HRCC approved a comparator group for senior executives, comprised of the following 10 Canadian organizations:

| Alamos Gold | Kinross Gold Corp. | |

| Agnico Eagle Mines Ltd. | Lundin Mining Corporation | |

| B2 Gold Corp. (new 2014) | New Gold Inc. | |

| Centerra Gold Corp. | Pan American Silver Corp. | |

| Eldorado Gold Corp. | Yamana Gold Inc. |

19

| Percentile |

Scope Information ($Millions) (1) | |||||||||||||||

| Market Capitalization | Revenue | |||||||||||||||

| Dec. 31, 2013 | Dec. 31, 2012 | FYE 2013 | FYE 2012 | |||||||||||||

| 25th Percentile |

$ | 1,601 | $ | 2,178 | $ | 724 | $ | 576 | ||||||||

| 50th Percentile |

$ | 2,743 | $ | 4,114 | $ | 940 | $ | 857 | ||||||||

| 75th Percentile |

$ | 4,974 | $ | 9,601 | $ | 1,795 | $ | 2,016 | ||||||||

| Average |

$ | 3,289 | $ | 5,876 | $ | 1,327 | $ | 1,336 | ||||||||

| IAMGOLD Corp. |

$ | 1,330 | $ | 4,288 | $ | 1,007 | $ | 1,665 | ||||||||

| 1. | As reported by Standard & Poor’s Capital IQ, $CAD. |

For additional market comparisons, industry surveys from Mercer, and Towers Watson were also reviewed as a general indicator of competitive compensation levels (no specific peer groups were used in this survey data).

Components of Executive Compensation

Total compensation for executives (including NEOs) is comprised of the following four elements, all designed to align the interests of executives and shareholders with the long-term creation and preservation of shareholder value.

| Pay Element |

Type |

Description |

Purpose | |||

| Base Salary | Fixed | Base salary levels for NEOs and executives reflect:

• scope, complexity and responsibility of the role of the executive;

• competitiveness with salary levels for similar positions at

companies

• executive’s experience and sustained performance level.

Comparative market analysis and individual performance assessments occur annually to ensure compensation remains competitive, resulting in periodic base salary adjustments, when necessary. |

Provide competitive compensation

Recognize skills and experience

Attract and retain key talent | |||

| STIP | Performance based Variable At risk |

All executives participate in the STIP whereby awards are based on achievement of corporate, operational, HSS and individual objectives.

• A target STIP level is set as a percentage of base salary.

While

• Award levels range from 0x to a maximum (payout cap) of 2x

target

The STIP directly links executive performance to the accomplishment of key performance indicators of the Corporation that drive shareholder value. Performance measures are selected based on their relationship to immediate objectives and long-term value creation. |

Motivate the achievement of annual goals and objectives

Reward performance that supports the creation of long-term shareholder value

Provide competitive compensation

Attract and retain key talent | |||

|

Pay Element |

Type |

Description |

Purpose |

20

| LTIP | Performance based Variable At risk |

Equity mix is targeted at 50% stock options and 50% PRSUs.

LTIP grant values are based on the performance of the Corporation and the individual executive consistent with the performance criteria used to determine STIP awards.

In general, the total LTIP grant is targeted to have a compensation value in the range of 0% to 300% of an executive’s STIP award. Actual LTIP grants are determined at the discretion of the Board based on HRCC recommendations. The HRCC also considers the value of previous equity awards, share ownership levels, total equity granted as a percentage of the outstanding common shares of the Corporation, the price of current options, and other factors the HRCC and Board may consider appropriate. |

Motivate the achievement of longer-term goals and objectives

Reward performance that is aligned with the creation of long-term shareholder value

Provide competitive compensation

Attract and retain key talent | |||

| Benefits & Perquisites | Fixed | Executives participate in the same benefits provided to all employees including health and life insurance benefits, a defined contribution pension plan and a share purchase plan. Select NEOs receive a parking perquisite as part of their employment agreements.

In addition, the President & CEO receives a Toronto residential apartment subsidy at net neutral cost. At present, due to a demanding travel schedule he occupies the apartment 20% – 25% of the time. |

Provide competitive compensation

Attract and retain key talent | |||

Compensation Decisions Related to 2014 Performance

2014 Total Direct Compensation Decisions

The following section provides a detailed discussion of the decisions made to determine each NEO’s total direct compensation (“TDC”) for 2014, including the following compensation elements:

2014 Base Salary

Due to sustained challenging market conditions, and IAMGOLD’s financial performance below expectations, the HRCC accepted management’s recommendation to forego base salary increases for executives, including the NEOs for 2014 and 2015. The exception was for Mr. MacDougall and Mr. Snow who received a 2015 base salary increase to recognize greater levels of responsibility resulting from the consolidation of other executive roles into their respective responsibilities and/or to ensure relative alignment.

| Named Executive |

2014 | 2015 | ||||||||||||||

| Base Salary | Increase from 2013 |

Base Salary | Increase from 2013 |

|||||||||||||

| Stephen J.J. Letwin |

$ | 881,450 | 0% | $ | 881,450 | 0% | ||||||||||

| Gordon Stothart |

$ | 538,647 | 0% | $ | 538,647 | 0% | ||||||||||

| Carol Banducci |

$ | 453,851 | 0% | $ | 453,851 | 0% | ||||||||||

| Jeffery Snow SVP, Legal |

$ | 352,565 | 0% | $ | 400,000 | 13% | ||||||||||

21

| Craig MacDougall |

$ | 336,375 | 0% | $ | 360,000 | 7% |

2014 Short-term Incentive Plan

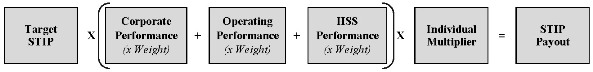

The formula below provides a starting point for the HRCC to determine short-term incentive plan (STIP) payouts. Target levels of performance on these criteria are established as guidelines and are not applied as an absolute formula. The HRCC believes that fixed formulas may lead to an unwanted payout result that does not accurately reflect actual performance when viewed holistically; as a result, the experienced discretion of the Board should be the ultimate determinant of final, overall compensation within the context of those pre-determined guidelines.

| Corporate Performance |

Operating Performance | |||||||

| 35% |

Free cash flow vs. target | 25% | Production vs. target | |||||

| 35% |

ROCE vs. target | 25% | Cash cost vs. target | |||||

| 15% |

1-year relative TSR (vs. S&P/TSX Global Gold Index) | 20% | Sustaining capital vs. target | |||||

| 15% |

3-year relative TSR (vs. S&P/TSX Global Gold Index) | 20% | Reserve replacement vs. target | |||||

| 10% | Working capital vs. target | |||||||

| Health, Safety and Sustainability (HSS) Performance |

Individual Multiplier | |||||||

| 50% |

Health & Safety | Varies for each NEO | ||||||

| 50% |

Sustainability | |||||||

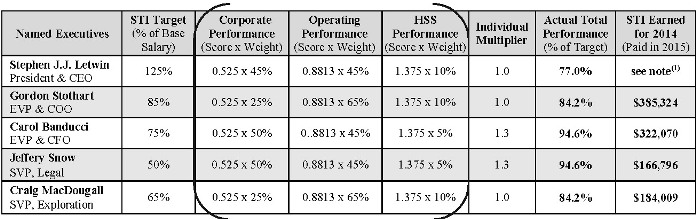

Performance Criteria and Weightings

The nature of an executive’s role and responsibilities determines the performance factors and respective weights used to assess short-term performance. The STIP targets, performance factors, and weights assigned by the Board for each NEO in 2014 were as follows:

| Named Executive Officer |

STIP Target (% of Base Salary) |

Corporate Performance Weight |

Operating Performance Weight |

HSS Performance Weight |

||||||||||||

| Stephen J.J. Letwin |

125% | 45% | 45% | 10% | ||||||||||||

| Gordon Stothart |

85% | 25% | 65% | 10% | ||||||||||||

| Carol Banducci |

75% | 50% | 45% | 5% | ||||||||||||

| Jeffery Snow |

50% | 50% | 45% | 5% | ||||||||||||

| Craig MacDougall |

65% | 25% | 65% | 10% | ||||||||||||

All performance measures used to determine STIP payments for NEOs are as disclosed below. Some measures are not consistent with generally accepted accounting principles (“non-GAAP”). The HRCC believes that the adjusted measures provide a better reflection of annual performance for purposes of STIP compensation – a description of each non-GAAP measure is disclosed in the footnotes below. Performance outcomes relative to pre-defined targets are determined at the end of the year and subject to HRCC discretion. For 2014 the HRCC did not use its discretion to adjust the STIP awards up or down.

22

Short-term Incentive Plan – Corporate, Operating, and HSS Performance Targets and 2014 Outcomes

| Performance Category |

Performance Measures |

Weight | Performance Range | 2014 Performance |

2014 Score | |||||||||

| Threshold | Target | Maximum | ||||||||||||

| Corporate Performance |

Relative TSR1 -1 year |

15% | 75% of Index | 125% of S&P/TSX Global Gold Index | 200% of Index | Below Threshold | 0 (out of 2.0) | |||||||

| Relative TSR1 -3 years |

15% | 75% of Index | 125% of S&P/TSX Global Gold Index | 200% of Index | Below Threshold | 0 (out of 2.0) | ||||||||

| ROCE2 | 35% | 80% of target | 3.10% | 150% of target | Below Threshold | 0 (out of 1.5) | ||||||||

| Free Cash Flow3 | 35% | 70% of target | $-87M | 170% of target | Above Maximum | 1.5 (out of 1.5) | ||||||||

| Overall Corporate Score |

0.525 | |||||||||||||

| Operating Performance |

Production4 -Gold |

21.25% | 95% of target | 875,000oz | 105% of target | Achieved Threshold | 0.5 (out of 1.5) | |||||||

| Production4 -Niobium |

3.75% | 90% of target | 4.9Mkg | 110% of target | Above Maximum | 1.5 (out of 1.5) | ||||||||

| Cash Cost5 -Gold |

21.25% | 90% of target | $850/oz | 110% of target | At Target | 1.0 (out of 1.5) | ||||||||

| Cash Cost5 -Niobium |

3.75% | 90% of target | $16/kg | 110% of target | Above Maximum | 1.5 (out of 1.5) | ||||||||

| Sustaining Capital6 | 20% | 90% of target | $240M | 110% of target | Above Maximum | 1.5 (out of 1.5) | ||||||||

| Working Capital7 | 10% | 10% of target | 10% improvement | 150% of target | Above Maximum | 1.5 (out of 1.5) | ||||||||

| Reserve Replacement8 | 20% | 50% of Target | 852,000oz | 150% of Target | Below Threshold | 0 (out of 1.5) | ||||||||

|

Overall Operating Performance Score |

0.8813 | |||||||||||||

|

Health Safety and Sustainability |

Health & Safety9 |

50% | DART of 1.1 | DART of 1.0 | DART of 0.5 | Achieved Threshold | 1.25 (out of 1.5) | |||||||

| Sustainability10 |

50% | One level 5 community incident |

No level 4 or 5 environment or community incidents | Top 10 external sustainability ranking |

Achieved maximum | 1.5 (out of 1.5) | ||||||||

| Overall Health Safety and Sustainability |

1.375 | |||||||||||||

| 1. | Total Shareholder Return (“TSR”): To reduce the impact of any extraordinarily positive or negative year due to a non-recurring event, TSR is considered equally in terms of TSR over 1-year (25% weighting) and 3-year (25% weighting) periods. Furthermore, to offset the effect of gold price fluctuation on the Corporation’s return, TSR is assessed relatively against the S&P/TSX Global Gold Index. |

| 2. | Return on Capital Employed (“ROCE”): ROCE is defined as earnings before interest and tax (EBIT) divided by total assets less current liabilities and is compared to the budget ROCE of the Corporation adjusted for actual gold price fluctuation. |

| 3. | Free Cash Flow is the cash flow generated from operations after tax, less annual capital expenditures. |

| 4. | Production reflects the actual production of gold and niobium relative to their respective budgets. |

| 5. | Cash Cost includes mine site operating costs but are exclusive of depreciation, reclamation, capital, and exploration and development costs. Cash cost for Niobium refers to operating margin. |

23

| 6. | Sustaining Capital refers to capital required to maintain production rates at each of the mines sites and excludes developmental capital |

| 7. | Working Capital takes into account operating current assets and current liabilities. |

| 8. | Reserve replacement takes into account only the mines that are currently operating and does not account for the contribution of exploration or development projects, new projects or acquisitions or the impact of increases in gold price alone. Performance is measured based on the amount of ounces reserved, as a percentage of target. |

| 9. | Health and Safety score is based, among other related components, on the severity and frequency of disabling incidents during the year, noting that a fatality may result in a zero score. Safety is based on the Corporation’s current objective of a 10% reduction in Days Away, Restricted Duty and Transferred Duty (“DART”) for every mine pro-rated regionally and corporately or, ultimately, zero accidents. The benchmark is DART frequency per 200,000 hours. |

| 10. | Sustainability: the sustainability factor is based on the severity of incidents and other environmental accomplishments within the given year. |

Short-term Incentive Plan – Individual Performance Multiplier

Individual performance is evaluated by the HRCC, taking into consideration the accomplishment of the functional goals established by the President & CEO and approved by the HRCC and an assessment of each executive’s performance in the areas of leadership, teamwork, game changing innovation, general and administrative cost management, and other individual objectives for the year. Individual performance modifies the total performance score by a factor of 0 to 1.5. Individual performance goals for each executive for 2014 were set by the HRCC and are dependent on the particular position held by the executive. For 2014, individual performance scores ranged between 1.0 and 1.3.

|

NEO |

2014 Individual Performance Objectives |

2014 Score | ||

| Stephen J.J. Letwin President & CEO |

• Promote and uphold Safety and Zero harm practices • Attract, develop and retain the best people • Optimize production with a focus on producing profit • Ensure cost containment/reduction, disciplined capital spending and cash preservation are instilled in the company’s culture • Optimize asset portfolio with strict focus on economic returns • Pursue opportunities to increase reserves and resources • Evaluate and establish scalable organization structure staffed with high performing and accountable talent • Develop and solidify credibility with external and internal stakeholders |

1.0 | ||

| Gordon Stothart EVP & COO |

• Zero fatalities, decrease serious injury and total injury frequency by 10% • Complete 100% of safety leading indicators • Ensure adherence with IAMGOLD’s Compliance and Governance Framework • Develop IAMGOLD leadership capability • Drive improvement of business systems • Achieve cash cost goal for existing operations • Implement operations and project development succession plans |

1.0 | ||

| Carol Banducci EVP & CFO |

• Promote and uphold Safety and Zero harm practices • Lead and complete the sale of Niobec • Ensure adherence with IAMGOLD’s Compliance and Governance framework • Execute long-term capital structure in support of project development • Implement company-wide working capital initiative to monetize levels of operational working capital • Capital management monitoring and reporting • Develop and implement tax efficient strategies and structures for projects |

1.3 | ||

| Jeffery Snow SVP, Legal |

• Successfully defend or settle litigation matters • Complete Niobec sale • Successfully defend arbitration proceedings |

1.3 | ||

| Craig MacDougall, SVP, Exploration | • Ensure zero fatalities, and no serious injuries • Ensure adherence with IAMGOLD’s Compliance and Governance framework • Make an economic discovery on one or more projects • Add to the company’s resource inventory • Build leadership and management capabilities |

1.0 | ||

24

2014 Short-term Incentive Plan Individual Award Determinations

Based on 2014 performance, the following chart illustrates the calculation of the actual performance result and award for each NEO:

| 1. | For 2014, in recognition of sustained challenging market conditions and the Corporation’s financial performance below expectations, Mr. Letwin advised the HRCC that in his opinion a STIP award was not appropriate and accordingly the Board agreed to forfeit his STI award earned. In addition the Board approved a grant date fair value of LTIP for 2014, including PRSUs and stock options that was below target, similar to the grant date fair value of the previous year’s LTIP grant. |

Long-term Incentive Plan Grant Determinations