Form 6-K AMERICA MOVIL SAB DE For: Apr 01

Table of Contents

United States

Securities and Exchange Commission

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant To Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of April 2015

Commission File Number: 1-16269

AMÉRICA MÓVIL, S.A.B. DE C.V.

(Exact Name of the Registrant as Specified in the Charter)

America Mobile

(Translation of Registrant’s Name into English)

Lago Zurich 245

Plaza Carso / Edificio Telcel

Colonia Ampliación Granada

11529 México, D.F., México

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Table of Contents

México City, México, April 1, 2015

Dear Shareholders,

By resolution adopted July 8, 2014, the Board of Directors of América Móvil, S.A.B. de C.V. (hereafter, “AMX,” “the Company,” or “the Issuer”) decided to propose to its shareholders a demerger of América Móvil that would establish a new Mexican corporation (sociedad anónima de capital variable) (hereafter, “Telesites”).1 We refer to this transaction as the Spin-off. The principal business of Telesites will be to construct, install, maintain, operate and market, directly or through its subsidiaries, various types of towers and other support structures, and to provide other related services. América Móvil will continue to focus on the provision of wireless, fixed line, broadband and Pay TV services, in the countries of Latin America, the Caribbean and Central and Eastern Europe, where it currently operates.

Unless otherwise expressly defined in this letter, references to capitalized terms have the meaning ascribed to such terms in the attached Information Statement.

The Spin-off is described in the Information Statement and will be implemented using a procedure under Mexican corporate law called escisión, or “split-up.” Under that procedure:

| • | Telesites will be formed as a company independent from América Móvil; |

| • | Certain assets, liabilities and capital of América Móvil will be transferred to Telesites; and |

| • | Each holder of any series of América Móvil shares will receive one share of the corresponding series of Telesites shares per América Móvil share they hold at the time of the Spin-off. |

Holders of América Móvil’s shares will receive, pursuant to the Spin-off, Telesites shares corresponding to the same number and series of, and with substantially the same rights as, the AMX shares held. After the Spin-off, you will continue to own the same shares of América Móvil that you owned prior to the Spin-off.

An extraordinary meeting of América Móvil’s shareholders will be held on April 17, 2015 to approve the Spin-off, among other related purposes. In accordance with América Móvil’s bylaws (estatutos sociales), approval of the Spin-off requires the approval of the majority of the outstanding AA and A Shares, voting together. The Company expects the Slim Family, the Control Trust and Inmobiliaria Carso, S.A. de C.V. (including its subsidiary, Control Empresarial de Capitales, S.A. de C.V.) to vote in favor of the Spin-off, and their favorable vote will be sufficient for the Spin-off to be approved.

| 1 | Or whichever other corporate name is authorized by the Mexican Ministry of Economy in accordance with the terms and provisions of the Mexican General Corporations Law. Telesites will become a public company (sociedad anónima bursátil de capital variable) once its shares are registered with the National Securities Registry. |

1

Table of Contents

Pursuant to section eight of América Móvil’s bylaws, holders of América Móvil’s L Shares and L Share ADSs will not have the right to vote at the extraordinary meeting of shareholders.

In accordance with the Mexican Securities Market Law and AMX’s bylaws, shareholders may be represented at the shareholder meeting by a representative, but must authorize such representative using the power of attorney forms that the Company will make available to (i) securities market intermediaries through S.D. Indeval Instituto para el Depósito de Valores, S.A. de C.V., and (ii) duly accredited shareholders of the Issuer at the offices of the Company, located at Lago Zurich 245, Plaza Carso, Edificio Telcel, Piso 16, Colonia Ampliación Granada, Delegación Miguel Hidalgo, 11529, México, Distrito Federal.

We are grateful for the support that you have always provided as we make important decisions for the Company, and we look forward to welcoming you as shareholders of Telesites.

| Sincerely, |

| Alejandro Cantú Jiménez |

| Corporate Secretary to the Board of Directors |

2

Table of Contents

Information Statement dated April 1, 2015

AMÉRICA MÓVIL S.A.B. DE C.V.

This Information Statement relates to a Spin-off, in which América Móvil, S.A.B. de C.V., or América Móvil, will establish a new Mexican corporation called Telesites, S.A.B de C.V., or “Telesites.” The Spin-off will be implemented using a procedure under Mexican corporate law called escisión. Capitalized terms have the meaning attributed to them in “Terms and Definitions.”

Brief Summary of the Corporate Restructuring

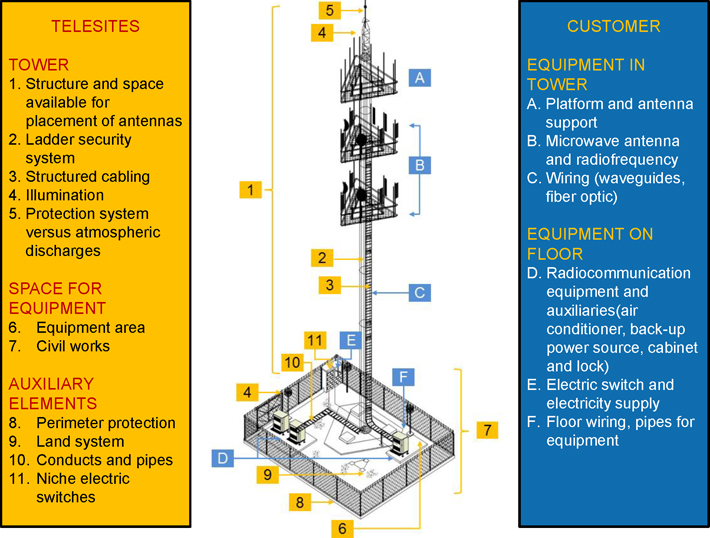

The Corporate Restructuring consists of the execution of a series of corporate steps, including a demerger of América Móvil, in which América Móvil will contribute part of its assets, liabilities and capital, corresponding to the Site Infrastructure of its Mexican wireless operations, to a spun-off company, which, upon obtaining the necessary authorizations, will be a sociedad anónima bursátil de capital variable called “Telesites, S.A.B. de C.V.” or whichever other corporate name is authorized by the Mexican Ministry of Economy in accordance with the terms and provisions of the Mexican General Corporations Law. Telesites’ business will initially be to construct, install, maintain, operate and market, directly or through its subsidiaries, various types of towers, other support structures, physical space for the location of towers, and non-electronic components, in each case used for the installation of wireless communication transmission equipment, and which comprise its Site Infrastructure, as well as to provide other relevant services related directly or indirectly to the telecommunications sector.

The Spin-off follows the creation of a business unit that operates the Site Infrastructure related to América Móvil’s wireless operations in Mexico, which was carried out during certain Preliminary Steps, as described in this Information Statement. This new business unit will grant access to, and allow use of, the Site Infrastructure by América Móvil’s subsidiaries, as well as to third party providers of wireless telecommunications services.

AMÉRICA MÓVIL IS NOT ASKING YOU FOR A PROXY, AND YOU ARE REQUESTED NOT TO SEND AMÉRICA MÓVIL A PROXY.

América Móvil is furnishing this Information Statement solely to provide information to shareholders of América Móvil, who will receive Shares of Telesites in the Spin-off. This Information Statement is not, and should not be construed as, an inducement or encouragement to buy or sell any securities of América Móvil or Telesites.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the Spin-off of the Telesites Shares or passed upon the accuracy or adequacy of this Information Statement or any document referred to herein. Any representation to the contrary is a criminal offense.

Table of Contents

On July 8, 2014, América Móvil publicly announced, among other matters, that it intended to separate some of Telcel’s assets related to its Site Infrastructure, in order to market such assets to all interested parties.

The Corporate Restructuring is subject various conditions and certain regulatory and corporate authorizations common in these types of transactions. América Móvil and its subsidiaries have already obtained some of the corporate and contractual authorizations required for this Corporate Restructuring. See “Detailed Information About the Transaction—Detailed Description of the Corporate Restructuring.” The Corporate Restructuring is not conditioned on the sale of its assets or shares to any third party, and as a result, the ownership of Telesites shares could remain indefinitely in the hands of the same major shareholders as those of América Móvil.

América Móvil intends to carry out the Corporate Restructuring as efficiently as possible, taking into consideration, among other things, financial, corporate, tax, and regulatory issues.

Characteristics of the Shares Before and After the Corporate Restructuring

If the Corporate Restructuring is approved, the holders of AMX Shares will receive one share of the corresponding series of Telesites Shares for each share that they hold in América Móvil. Only América Móvil shareholders will receive Telesites Shares as a result of the Corporate Restructuring. América Móvil will not receive any Telesites Shares as a result of the Corporate Restructuring.

As a result of the Corporate Restructuring, it is expected that only the book value and market value of the AMX Shares will change. Other than the book value and market value, the AMX Shares will retain their same rights and characteristics, and the proposed Corporate Restructuring will in no way affect the current structure of América Móvil’s capital stock. Any changes in market value will be determined in the open market in accordance with the procedures of the Mexican Stock Exchange and international markets. América Móvil shareholders will continue to hold their AMX Shares. AMX Shares will continue to be listed on the Mexican Stock Exchange with the “AMX” stock symbol and on the international markets with the symbol with which they are currently listed.

Telesites Securities

Like América Móvil, Telesites will have three series of shares. The AA and A Shares will have full voting rights. The L Shares will be allowed to vote only in those cases specified in its bylaws.

Additionally, after the Share Distribution Date, Telesites shareholders may decide to amend Telesites’ bylaws to combine all series of capital stock into one series of ordinary shares, with the same economic and corporate rights, including voting rights.

Subject to obtaining the appropriate authorization, the Telesites Shares will be registered with the National Securities Registry and listed on the Mexican Stock Exchange, so that they may be quoted and traded in Mexico without a primary offering.

The Shares issued as a result of the Corporate Restructuring will be distributed to América Móvil’s shareholder in the same proportion as such shareholders hold in América Móvil as of the Share Record Date. The total number of Telesites Shares will be equal to the total number of AMX Shares, less the total number of treasury shares held by América Móvil on the Share Record Date, pursuant to its share buyback program, so that only the AMX Shares outstanding as of the Share Record Date, and not treasury shares, will be entitled to receive Telesites Shares. For illustrative purposes, if the Corporate Restructuring had been carried out on March 31, 2015, the capital structure of Telesites would have been as follows:

| Series |

Number of shares outstanding |

Percentage of capital stock |

Percentage of shares with voting rights |

|||||||||

| AA |

23,384,632,660 | 34.63 | % | 97.33 | % | |||||||

| A |

641,795,436 | 0.95 | % | 2.67 | % | |||||||

| L |

43,499,571,904 | 64.42 | % | — | (1) | |||||||

| Total |

67,526,000,000 | 100 | % | |||||||||

| (1) | Except for matters specified in the bylaws for which the series L Shares will have voting rights. |

2

Table of Contents

Once the Telesites Shares have been registered at the National Securities Registry and listed as eligible for trading on the Mexican Stock Exchange, they will be delivered to América Móvil’s shareholders on the Share Distribution Date, directly or through Indeval, and according to the terms set forth in the notice that América Móvil will publish for its shareholders in accordance with the General Rules.

For more information on the characteristics of the AMX Shares and Telesites Shares, see “Detailed Information About the Transaction—Relevant Differences Between the América Móvil and Telesites Share Certificates as a Result of the Corporate Restructuring.”

América Móvil has prepared this Information Statement to explain the Spin-off to its shareholders, who will receive Shares of Telesites in the Spin-off. América Móvil has also filed an information statement (folleto informativo) in Spanish with the Mexican National Banking and Securities Commission and the Mexican Stock Exchange, which is available on the websites of the Mexican National Banking and Securities Commission at www.cnbv.gob.mx, the Mexican Stock Exchange at www.bmv.com.mx and América Móvil at www.americamovil.com. In accordance with Mexican law, América Móvil will not conduct any proxy solicitation for the Extraordinary Meeting of Shareholders called to approve the Spin-off. As a foreign private issuer, América Móvil is exempt from the requirements of the Securities Exchange Act of 1934, as amended, or the Exchange Act, concerning proxy solicitations and information statements.

3

Table of Contents

| 5 | ||||

| 5 | ||||

| 6 | ||||

| 10 | ||||

| 13 | ||||

| 14 | ||||

| 34 | ||||

| 42 | ||||

| 53 | ||||

| 59 | ||||

| 60 | ||||

| 61 | ||||

Table of Contents

This Information Statement contains limited information with respect to América Móvil and Telesites, which is qualified in its entirety by reference to the filings and reports of América Móvil incorporated by reference in this Information Statement. The distribution of Telesites Shares in connection with the Spin-off has not been and will not be registered under the United States Securities Act of 1933, as amended. Telesites will be relying on an exemption provided by Rule 12g3-2(b) under the United States Securities Exchange Act of 1934, as amended, and therefore will not be required to register its shares with the SEC. In accordance with Rule 12g3-2(b), prior to and after the Share Distribution Date, Telesites will make available certain documents on its website. These documents will consist primarily of English-language versions of an information statement related to the listing of its Shares on the Mexican Stock Exchange, its annual reports, press releases and certain other information made public in Mexico. However, Telesites will not be required to file with the SEC annual reports on Form 20-F or furnish reports on Form 6-K.

América Móvil files reports, including annual reports on Form 20-F, and other information with the SEC pursuant to the rules and regulations of the SEC that apply to foreign private issuers. You may read and copy any materials América Móvil files with the SEC at its Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. Any filings América Móvil makes electronically will be available to the public over the Internet at the SEC’s web site at www.sec.gov.

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

This Information Statement “incorporates by reference” certain documents that América Móvil files with the SEC, which means that important information is disclosed to you by referring you to those documents. The information incorporated by reference is considered to be part of this Information Statement, and certain later information that América Móvil files with the SEC will automatically update and supersede earlier information filed with the SEC or included in this Information Statement. The following documents are incorporated by reference:

| • | América Móvil’s annual report on Form 20-F for the year ended December 31, 2013, filed with the SEC on April 30, 2014 (SEC File No. 001-16269); |

| • | América Móvil’s report on Form 6-K filed with the SEC on March 4, 2015 (SEC File No. 001-16269) containing a discussion of América Móvil’s unaudited preliminary results of operations for the years ended December 31, 2013 and 2014 and América Móvil’s unaudited preliminary financial position as of December 31, 2014; |

| • | América Móvil’s report on Form 6-K filed with the SEC on March 4, 2015 (SEC File No. 001-16269) containing América Móvil’s unaudited interim condensed consolidated financial statements as of September 30, 2014 and for the three and nine months ended September 30, 2013 and 2014; |

| • | any future annual reports on Form 20-F filed with the SEC under the U.S. Securities Exchange Act of 1934, as amended, after the date of this Information Statement and prior to the Share Distribution Date; and |

| • | any future filings by América Móvil on Form 6-K that state that they are incorporated by reference into this Information Statement. |

You may request a copy of the Information Statement, and any and all of the information that has been incorporated by reference in this Information Statement and that has not been delivered with this Information Statement, at no cost, by writing or telephoning América Móvil at Lago Zurich 245, Edificio Telcel, Colonia Granada Ampliación, Delegación Miguel Hidalgo, 11529, México D.F., México, Attention: Investor Relations, telephone (5255) 2581-4449.

5

Table of Contents

Shareholders of América Móvil with questions relating to the Spin-off and distribution of the Telesites Shares should contact América Móvil at Lago Zurich 245, Edificio Telcel, Colonia Granada Ampliación, Delegación Miguel Hidalgo, 11529, México D.F., México, Attention: Investor Relations, telephone (5255) 2581-4449.

For more information regarding América Móvil documents of a public nature, we suggest you visit the following website: www.americamovil.com. (This URL, and all other URLs in this Information Statement, are intended to be inactive textual references only. They are not intended to be active hyperlinks to any website. Information presented on any website located at any URL in this Information Statement, is not and shall not be deemed to be incorporated into this Information Statement, unless such information is explicitly stated as being so incorporated in “Incorporation of Certain Documents by Reference”).

6

Table of Contents

SUMMARY

The following is a brief summary of certain information contained elsewhere in this Information Statement. This summary is qualified in its entirety by the more detailed information set forth in this Information Statement.

| Telesites |

Telesites, S.A.B. de C.V., a new Mexican corporation, will be established by América Móvil in a Spin-off. |

| Telesites will be a holding company focused on constructing, installing, maintaining, operating and marketing, directly or through its subsidiaries, various types of towers, other support structures, physical space for the location of towers, and non-electronic components, in each case used for the installation of wireless communication transmission equipment, as well as to providing other relevant services related directly or indirectly to the telecommunications sector. |

| Capital Structure of Telesites |

Telesites will have three series of shares. The A Shares and AA Shares will have full voting rights. The L Shares will be entitled to vote only on certain limited matters specified in its bylaws. |

| The number of Shares of each series will be the same as the number of América Móvil Shares of the corresponding series outstanding on the Share Record Date. If the Spin-off had occurred on March 31, 2015, the capital structure of Telesites would have been as follows: |

| Series |

Number of Shares Outstanding |

Percentage of Capital |

Percentage of Voting |

|||||||||

| (millions) | ||||||||||||

| AA Shares |

23,384 | 34.51 | % | 97.30 | % | |||||||

| A Shares |

643 | 0.95 | % | 2.70 | % | |||||||

| L Shares |

43,730 | 64.54 | % | — | (1) | |||||||

|

|

|

|

|

|

|

|||||||

| Total |

67,757 | 100.00 | % | 100.00 | % | |||||||

| (1) | Except for matters specified in the bylaws for which the series L Shares will have voting rights. |

| The Spin-off |

The Spin-off will be conducted by means a procedure under Mexican corporate law called escisión or “split-up.” After the approval by a majority of holders of AMX A and AA Shares at an Extraordinary Meeting of Shareholders, scheduled for April 17, 2015, Telesites will be established as a new company and specified assets, liabilities and capital of América Móvil will be transferred to Telesites. As of the Share Record Date, shareholders of América Móvil will have the right to receive Telesites Shares on the Share Distribution Date. |

7

Table of Contents

| Distribution of the Telesites Shares |

Distribution to the América Móvil shareholders will take place on the Share Distribution Date in the following manner: |

| • | Each holder of AMX AA Shares will receive one Telesites AA Share per AMX AA Share held. |

| • | Each holder of AMX L Shares will receive one Telesites L Share per AMX L Share held. |

| • | Each holder of AMX A Shares will receive one Telesites A Share per AMX A Share held. |

| • | América Móvil shareholders will also continue to own their América Móvil Shares. |

| Effects of the Spin-off on AMX’s ADS Holders |

On the Share Distribution Date, the Depositary for AMXs L Share ADS and A Share ADS programs will receive the pro rata portion of Telesites Shares corresponding to the AMX L Shares and A Shares underlying AMX L Share ADSs and A Share ADSs. The terms of distributions by the Depositary to AMX ADS holders are governed by the deposit agreements in effect for each ADS program. América Móvil and the Depositary are currently considering options for effecting a distribution to AMXs ADS holders in an efficient and equitable manner. The Depositary will inform AMX ADS holders how such distribution will be made prior to the Share Distribution Date. |

| Listing and Trading of Telesites Shares |

The Telesites Shares will not trade separately from AMX Shares prior to the Share Distribution Date. Beginning on the Share Distribution Date, América Móvil expects that the Telesites Shares will be listed on the Mexican Stock Exchange. |

| Admission to listing and trading is subject to approval. The Telesites AA Shares will not be listed or traded on any market. |

8

Table of Contents

| Shareholder Approval of the Spin-off |

An Extraordinary Meeting of Shareholders of América Móvil will be held on April 17, 2015 to approve the Spin-off and for related purposes. Approval of the Spin-off requires the approval of the majority of the outstanding AA and A Shares, voting together. The Company expects the Slim Family, the Control Trust and Inmobiliaria Carso, S.A. de C.V. (including its subsidiary, Control Empresarial de Capitales, S.A. de C.V.) to vote in favor of the Spin-off, and their favorable vote will be sufficient for the Spin-off to be approved. |

| No proxy solicitation will be conducted, and holders of AMX L Shares are not entitled to vote on the Spin-off. |

Certain Rights of Shareholders and

| Creditors |

Under limited circumstances, holders of América Móvil A Shares and América Móvil AA Shares may have the right to dissent and demand cash payment for their shares. |

| Certain Tax Consequences |

The Spin-off is not a taxable event for Mexican federal income tax purposes. The Spin-off is expected to be taxable for U.S. federal income tax purposes. See “Detailed Information About the Transaction—Tax Consequences of the Corporate Restructuring.” |

9

Table of Contents

Unless they have been expressly defined on the cover of the Information Statement or the context indicates otherwise, references to the following terms shall have the meanings below, both in singular and plural forms:

| Term | Definition | |

| “Active Infrastructure” | The components of telecommunications or radio broadcasting networks that store, issue, process, receive, or transmit writing, images, sounds, signals, signs or information of any nature. | |

| “ADSs” | American Depositary Shares whose underlying assets are AMX Shares. | |

| “América Móvil,” “AMX” or “Issuer” | América Móvil, S.A.B. de C.V. | |

| “AMX 20-F” | The América Móvil annual report on Form 20-F for the year ending December 31, 2013, filed with the SEC on April 30, 2014. | |

| “AMX Shares” or “América Móvil Shares” | All or any of the shares of the capital stock of América Móvil, regardless of their series. | |

| “Approval Date” | April 17, 2015, the date of the Extraordinary Meeting of Shareholders. | |

| “Control Trust” | Trust F/0126 of Banco Inbursa, S.A. Institución de Banca Múltiple, Grupo Financiero Inbursa, División Fiduciaria, which according to publicly available information, owns AA and L Shares of América Móvil for the benefit of the Slim Family. | |

| “Corporate Restructuring” or “Spin-off” | The Corporate Restructuring described in this Information Statement. | |

| “Depositary” | The Bank of New York Mellon, as depositary for the AMX L Share ADS program and A Share ADS program. | |

| “Dollar” or “Dollars” | The legal currency of the United States of America. | |

| “Extraordinary Meeting of Shareholders” | The extraordinary meeting of América Móvil’s shareholders that will take place on April 17, 2015, which will decide, among other related issues, whether to approve the Corporate Restructuring. | |

| “Federal Law on Telecommunications and Broadcasting” | Ley Federal de Telecomunicaciones y Radiodifusión, published in the Federal Official Gazette on July 14, 2014. | |

| “Federal Official Gazette” | Diario Oficial de la Federación. | |

10

Table of Contents

| “General Rules” | The General Rules applicable to issuers of securities and to other participants in the Mexican securities market published in the Federal Official Gazette on March 19, 2003, and amendments thereto. | |

| “IFRS” | International Financial Reporting Standards, as issued by the International Accounting Standards Board (IASB). | |

| “IFT” | The Federal Telecommunications Institute of Mexico. | |

| “Indeval” | The Mexican Central Securities Depository (S.D. Indeval, Institución para el Depósito de Valores, S.A. de C.V.). | |

| “Information Statement” | This Information Statement regarding the Corporate Restructuring. | |

| “Mexican General Corporations Law” | The Mexican General Corporations Law (Ley General de Sociedades Mercantiles) published in the Federal Official Gazette on August 4, 1934 and the amendments thereto. | |

| “Mexican Ministry of Finance” | The Ministry of Finance and Public Credit (Secretaría de Hacienda y Crédito Público). | |

| “Mexican National Banking and Securities Commission” | Comisión Nacional Bancaria y de Valores. | |

| “Mexican Securities Market Law” | The Mexican Securities Market Law published in the Federal Official Gazette on December 30, 2005, along with its amendments (Ley del Mercado de Valores). | |

| “Mexican Stock Exchange” | Bolsa Mexicana de Valores, S.A.B de C.V. | |

| “Mexico” | The United Mexican States. | |

| “National Securities Registry” | Registro Nacional de Valores. | |

| “Pesos,” “Ps.” or “$” | The legal currency of Mexico. | |

| “Preliminary Steps” | The corporate acts that América Móvil or any of its subsidiaries carried out or will carry out prior to and necessary for the Corporate Restructuring. | |

| “Public Registry of Commerce” | The Public Registry of Commerce of the Federal District (Registro Público de Comercio del Distrito Federal). | |

| “SEC” | The U.S. Securities and Exchange Commission. | |

| “Sercotel” | Sercotel, S.A. de C.V. | |

| “Share Distribution Date” | The date on which the Telesites Shares will be distributed to their rightful holders, once the conditions have been met, the necessary periods of time have elapsed and the corresponding authorizations have been obtained. | |

11

Table of Contents

| “Site Infrastructure” | The non-electronic components of telecommunications networks consisting primarily of: (i) the physical spaces on real property (or parts thereof) possessed under any legal title; (ii) the towers, masts, and other structures that provide support for radio communication antennas; and (iii) the civil engineering works, wiring, frames, ducts, and components to delimit and restrict access, as well as other on-site accessories that are useful for the installation and operation of radio equipment. | |

| “Share Record Date” | The date on which the right to receive Telesites Shares will be determined. | |

| “Slim Family” | Carlos Slim Helú and members of his immediate family. | |

| “Telcel” | Radiomóvil Dipsa, S.A. de C.V. | |

| “Telmex” | Teléfonos de México, S.A.B. de C.V. | |

| “Telesites” | The spun-off company resulting from the Corporate Restructuring, called Telesites, S.A.B. de C.V. or whichever other corporate name is authorized by the Mexican Ministry of Economy in accordance with the terms and provisions of the Mexican General Corporations Law, a corporation that will construct, install, maintain, operate, and market, directly or through its subsidiaries, various types of towers, other support structures, physical space for the location of towers, and non-electronic components, in each case used for the installation of wireless communication transmission equipment, which comprise its Site Infrastructure, as well as to provide other relevant services related directly or indirectly to the telecommunications sector. Telesites will become a public company (sociedad anónima bursátil de capital variable) once its shares are registered with the National Securities Registry. | |

| “Telesites Shares” | All or any of the shares of the capital stock of Telesites, regardless of their series. | |

| “Tower Reference Offer” | The reference offer for the grant of access and shared use of passive infrastructure approved for Telcel by the IFT pursuant to resolution P/IFT/05114/376 on November 5, 2014. | |

| “United States” | United States of America. | |

12

Table of Contents

This summary provides only a brief description of the participants and of the more relevant aspects of the Corporate Restructuring, and is not intended to contain all of the information that may be relevant to the Corporate Restructuring. Shareholders should review the detailed information included in the other sections of this Information Statement, as well as in the AMX 20-F and the other documents incorporated by reference herein, which may be consulted by visiting either the América Móvil website at www.americamovil.com or the SEC website at www.sec.gov.

On July 8, 2014, América Móvil announced its plan to separate the Site Infrastructure assets of its Mexican wireless operations in order to allow for their independent operation and their marketing to all interested parties.

The execution of the Corporate Restructuring includes a series of Preliminary Steps, as described in “Detailed Information About the Transaction—Detailed Description of the Corporate Restructuring.”

The final result of the Corporate Restructuring will be the formation of Telesites, which will be dedicated primarily to constructing, installing, maintaining, operating and marketing, directly or through its subsidiaries, various types of towers, other support structures, physical space for the location of towers, and non-electronic components, in each case used for the installation of wireless communication transmission equipment, as well as to providing other relevant services related directly or indirectly to the telecommunications sector.

The Corporate Restructuring will allow the independent operation of two different types of businesses, so that the corresponding financial, operating, technological and management needs of each can be more effectively served.

Telesites will provide access to, and allow use of, its Site Infrastructure to América Móvil’s subsidiaries, as well as to third party providers of radio communications services.

Once the applicable legal conditions are met, the Mexican National Banking and Securities Commission will be requested to register the Telesites Shares with the National Securities Registry and list them on the Mexican Stock Exchange for trading.

The distribution of Telesites Shares in connection with the Spin-off has not been and will not be registered under the United States Securities Act of 1933, as amended. Telesites will be relying on an exemption provided by Rule 12g3-2(b) under the United States Securities Exchange Act of 1934, as amended, and therefore will not be required to register its shares with the SEC.

13

Table of Contents

DETAILED INFORMATION ABOUT THE TRANSACTION

Objective of the Corporate Restructuring

Similar to many wireless telecommunications companies, América Móvil has previously pursued a strategic policy of developing of its own Site Infrastructure. However, based on business and operational assessments routinely carried out by its Board of Directors, América Móvil determined that in the medium and long term, it will be able to create more shareholder value by segmenting certain business activities and creating a new publicly listed company, which will market its assets directly to third parties. The telecommunications environment is changing and each business faces distinct challenges and opportunities.

The Corporate Restructuring will enable third parties to use the excess capacity of the Site Infrastructure, currently used exclusively by Telcel.

The principal objectives of the Corporate Restructuring are the following:

| • | create a new company independent from América Móvil, to allow investors to differentiate and select between two types of businesses, operated autonomously with separate management, commercial, and financial objectives; |

| • | improve the competitive position of the businesses of América Móvil and Telesites; by operating as independent companies, both América Móvil and Telesites will be able to focus their efforts and resources on improving and strengthening their positions in their respective industries; |

| • | maximize the value of the Site Infrastructure, allowing for its optimal development through independent management, and making it available to all telecommunications operators in Mexico or other countries; |

| • | allow the management teams of each company to develop their own strategy and operations and permitting each management team to reach its appropriate size; |

| • | allow each company to obtain a more efficient market valuation, as well as an optimal capitalization structure, according to the necessities of each business type; |

| • | maximize América Móvil’s flexibility to capitalize on growth opportunities in changing markets; and |

| • | enter into arms-length commercial relationships between Telcel and Telesites via long-term operating agreements, on terms equal to those with other telecommunications operators. |

América Móvil believes that these objectives can be met satisfactorily and quickly via the Corporate Restructuring, because allocating the Site Infrastructure related to América Móvil’s wireless operations in Mexico to Telesites and its subsidiaries will allow this new autonomous company to optimize its operating and financial position, as well as its competitive position.

In recent years, the global trend in the telecommunications industry has been the simultaneous expansion of customers and networks. In particular, the dominant belief was that the development of one’s own infrastructure was a strategic activity for companies in the industry, because when companies began deploying wireless network, coverage was a major differentiating factor. However, the evolution of the wireless telecommunications market has led telecommunications operators, in developed and emerging markets, to redefine their strategy towards differentiation in service and deployment of their Site Infrastructure.

14

Table of Contents

Such circumstances, together with the growing capital expenditures required to meet data traffic volume, resulted in the need for telecommunications companies to adjust strategies, paving the way for operators to begin sharing towers and corresponding sites, or selling their infrastructure to third parties so that it may be more efficiently marketed.

This paradigm shift is especially important in Latin America and the Caribbean, because the penetration of fixed telephone lines in the region is relatively low compared to the rest of North America or Europe, which makes the deployment of wireless telephone networks more relevant. Because of this, it is estimated that wireless services will play an increasingly relevant role in Latin America and the Caribbean, given the demand for broadband services. In particular, the deployment of long-term evolution (“LTE”) technology may drive the need to introduce new networks and increase coverage. Companies like Telefónica, Oi, Nextel, and Millicom have adopted the business model described above, and have sold more than 30 thousand wireless towers in recent years.

As a result, there has been a surge in companies specializing in the provision of radio communications infrastructure services. According to KPMG,2 in India, for example, in 2006, 100% of the towers were operated directly by telecommunications operators, while in 2010, approximately 85% were operated by independent companies.

In the United States there are three public companies that operate in the radio communications infrastructure operation sector: American Tower Corporation, Crown Castle International Corporation, and SBA Communications Corporation. According to an August 2014 report by S&P Capital IQ, American Tower Corporation is the largest independent operator of communication and broadcasting towers in North America based on the number of towers and sales; currently more than half of its sites are located outside of the United States. Generally, the main customers of these businesses are the wireless telecommunications operators with large market shares in the United States, which in the case of American Tower Corporation represented around 84% of its U.S. sales in 2013.

One of the ways in which those companies have grown in recent years is from the sale by wireless telecommunications operators of certain assets that formed part of their passive infrastructure. The wireless telecommunications operators made these sales because they determined it was more efficient and competitive to discontinue their investment in this infrastructure and to utilize the resources obtained from these sales to finance their core businesses. There are also multiple examples of telecommunications operators spinning off their passive infrastructure operations in order to have two distinct, specialized businesses.

In Mexico, the business of shared access and use of passive infrastructure and related services began more than 14 years ago and has accelerated significantly in recent years with the sale of tower portfolios by some wireless telecommunications operators. Currently more than five companies operate in this segment of the Mexican market with a combined total of more than 10 thousand towers. American Tower Corporation is currently the largest operator, followed by Mexico Tower Partners, among others. According to its 2013 annual report,3 American Tower Corporation has operated for more than a decade in Mexico and currently owns around 8,400 sites. In 2013, American Tower Corporation acquired 880 sites from Axtel, S.A.B. de C.V. and another 1,480 from NII Holdings, Inc. Currently some of América Móvil’s subsidiaries in Latin America and the Caribbean are customers of American Tower Corporation.

| 2 | Source: KPMG “Passive Infrastructure Sharing in Telecommunications,” 2011. |

| 3 | Source: www.americantower.com. |

15

Table of Contents

Additionally, in 2013, the Mexican Federal Telecommunications Commission estimated that Mexico required a four-fold increase of radio bases, which would result in an increase from 20,000 radio bases to a total of 80,000, creating an important growth opportunity for Telesites.

The Corporate Restructuring will generate important benefits for both América Móvil and Telesites, similar to those achieved by other companies that have spun off Site Infrastructure from their wireless telephone operations. Greater profits could be generated as a result of the towers being independently owned by Telesites and used by multiple operators on equal terms.

Some of the principal reasons América Móvil or its shareholders could benefit can be summarized as follows:

| • | Greater focus on end users. The Corporate Restructuring will permit América Móvil to focus on increasing global penetration of its services to new users as well as on improving the quality of customer service and technological innovation, differentiating itself based on its high operating capacity and through the continuous introduction of new business models that benefit its customers. |

| • | Refocus on investments and costs. Capital expenditures and operating expenses are the biggest costs in the telecommunications industry, especially in emerging markets like Mexico. Making the Site Infrastructure business independent will allow América Móvil to reduce costs quickly and significantly and simultaneously refocus its capital investments on the expansion of its Active Infrastructure. Additionally, in the medium-term we believe that certain costs, such as rent for the land where the Telesites towers are situated, will decrease, because such costs will be divided by the number of operators that use each one of these towers. |

| • | Capitalization or valuation. Companies that focus their operations can potentially generate additional value for shareholders, either by compensation received from the sale of their assets to a third party, or in the case of spin-offs, by an increase in aggregated market value of both companies. In the case of the Corporate Restructuring, this outcome would result from understanding towers as assets in themselves, which require investment to become income-generating business. Additionally, the Corporate Restructuring will make it possible for investors to be exposed to two businesses with highly differentiated valuations. As of December 31, 2014, the major telecommunications companies traded at 4 times EBITDA while telecommunications infrastructure service providers traded at 14 to 16 times EBITDA.4 |

Telesites, as a new specialized company, will be able to enjoy important advantages of operating its business separately, including:

| • | Business model focused on profitability: Telesites will focus on only one business which will provide the following benefits: |

| • | Increase in profitability. Most wireless telecommunications operators consider it advantageous to share Site Infrastructure rather than individually assume the costs of installing and managing such infrastructure. Telesites will therefore be able to market its assets to two or more customers, thereby increasing the profitability of its assets that are currently only utilized by Telcel in Mexico; |

| 4 | Source: Bloomberg. |

16

Table of Contents

| • | Growth opportunity. By distributing costs among a larger number of participants, Telesites will be able to extend its infrastructure to locations where it is not currently cost-effective for the operators to do so on their own; |

| • | Business differentiated by stability. Telesites will operate a business with greater stability because telecommunications infrastructure leasing businesses are generally able to anticipate their long-term revenues and costs more accurately than telecommunications operators, because leases for tower space will have a term of at least five (5) years. The result is a suitable vehicle for investors looking for greater stability in the generation and distribution of profits; |

| • | Benefit to competition. The Spin-off will increase the number of towers in Mexico that are accessible to any telecommunications operator from 45% to 90%, allowing new operators and current competitors of Telcel to utilize the deployed Site Infrastructure; these competitors will be able to develop and scale their businesses more quickly. This will benefit telecommunications infrastructure service providers such as Telesites, because the greater number and size of telecommunications operators in the industry will increase the occupancy rates of their Site Infrastructure, strengthen the demand for the services offered, and increase the rate of return on assets; |

| • | Improved operations. Creating a company centered on performing a useful service to the telecommunications sector will enable its management and employees to direct their efforts towards developing a company that is distinguished by its operating quality, which will in turn benefit its customers, and ultimately, end users; and |

| • | Strategy diversity. As a company independent of América Móvil, Telesites will have its own management and strategy. Several strategies are expected to increase the profitability of the business operated by Telesites, including emphasis on (i) cost reduction; (ii) optimal site operation and maintenance; (iii) improved planning of new site requirements, wireless operator demand and technological requirements; and (iv) management of contractual relationships with clients and suppliers. |

Telesites may have a capitalization structure that more accurately reflects its operations by leveraging the long duration of its contracts. For example, in the United States, comparable public companies record a ratio of between 5 and 7 times net debt to EBITDA.5 It is expected that América Móvil will transfer approximately $21 billion Mexican Pesos of debt to Telesites.

| • | Growing market. Several analysts predict that the increase in data traffic caused by intelligent consumer devices (smartphones, tablets, etc.) will continue to drive the demand for greater wireless telecommunications infrastructure. Wireless telecommunications operators will have to continue to invest in increasing the capacity of their networks to keep up with the large increase in the demand for data plans, as well as with the migration of users to the 4G platform. Companies that are appropriately positioned from a financial standpoint and which have experience in the industry may benefit significantly from this trend. |

| 5 | Source: Bloomberg. |

17

Table of Contents

| • | Regulatory environment. The recent telecommunications and broadcasting regulatory environment in Mexico could benefit América Móvil and Telesites, if the new telecommunications legislation is implemented in such a way as to encourage investment and competition, which would lead to higher quality services and market penetration. |

On March 7, 2014, the IFT issued a resolution (the “Resolution”) declaring that América Móvil and Telcel, among others, comprise an “economic interest group” in the telecommunications sector. In the Resolution, the IFT also imposed certain specific measures on América Móvil and Telcel, some of which set forth the obligation to grant access and shared use of passive infrastructure.

Telcel published the Tower Reference Offer, which has an initial term that expires on December 31, 2015. Under the terms of the Tower Reference Offer, the operators who wish to have access and shared used of the Site Infrastructure must execute a master services agreement, as well as specific agreements for each site, the duration of which will vary from site to site, and will be different from that of the master services agreement.

The obligations set forth in the Resolution are also applicable to entities which are successors or assignees of the rights of, or which result from corporate restructuring or modifications to the capital structure of, any of the members of the economic interest group. Therefore, the subsidiary of Telesites that will serve as the legal owner of the Site Infrastructure that will be allocated to Telesites, will be obligated to comply with the Resolution with respect to the shared access and use of the Site Infrastructure. Regardless of the regulatory requirements to do so, that subsidiary will have an inherent economic incentive to provide access to the Site Infrastructure to additional operators.

The Corporate Restructuring is not conditioned on any change to the regulatory situation of América Móvil, Telesites, or their respective subsidiaries. Nevertheless, following the Corporate Restructuring and under certain circumstances, the IFT could, at the request of Telesites, reduce or eliminate the burdens of the Resolution with respect to Telesites.

Detailed Description of the Corporate Restructuring

The Corporate Restructuring consists of the execution of a series of corporate steps, including a demerger of América Móvil, in which América Móvil will contribute part of its assets, liabilities and capital, consisting primarily of the Site Infrastructure related to its wireless operations in Mexico, to a spun-off company, which, upon obtaining the necessary authorizations, will be a sociedad anónima bursátil de capital variable called “Telesites, S.A.B. de C.V.” or whichever other corporate name is authorized by the Mexican Ministry of Economy in accordance with the terms and provisions of the Mexican General Corporations Law. Telesites’ business will initially be to construct, install, maintain, operate and market, directly or through its subsidiaries, various types of towers, other support structures, physical space for the location of towers, and non-electronic components, in each case used for the installation of wireless communication transmission equipment, and which comprise its Site Infrastructure, as well as to provide other relevant services related directly or indirectly to the telecommunications sector.

The Spin-off follows the creation of a business unit that operates the Site Infrastructure related to América Móvil’s wireless operations in Mexico, which was carried out during certain Preliminary Steps, as described in this Information Statement. This new business unit will provide access to, and allow use of, its Site Infrastructure by América Móvil’s subsidiaries, as well as to third party providers of wireless telecommunications services.

18

Table of Contents

The Corporate Restructuring is subject to various conditions and certain regulatory and corporate authorizations common in these types of transactions. América Móvil and its subsidiaries have already obtained some of the corporate and contractual authorizations required for this Corporate Restructuring.

The Corporate Restructuring will be carried out in accordance with the escisión procedure set forth in the Mexican General Corporations Law and in accordance with the terms of the Mexican Securities Market Law and the provisions contained therein. An escisión consists of a demerger of a company, to create a new spun-off company, to which a part of the assets, liabilities and capital of the original company is transferred. Only the shareholders of América Móvil will receive Telesites Shares as a consequence of the Corporate Restructuring. América Móvil will not receive any Telesites Shares as a part of the Corporate Restructuring.

Prior to the approval of the Spin-off, América Móvil has taken or will take a series of legal and corporate actions in order to reorganize specific subsidiaries for the purpose of facilitating the implementation of the Corporate Restructuring.

As a part of the Corporate Restructuring, it has been resolved to separate the elements necessary to conduct a business which consists mainly of commercializing shared access and use of Site Infrastructure services. This business will be operated by a subsidiary of Telesites, which will include holding the rights with respect to the certificates of occupancy of the sites and well as rights over the towers and the rest of the Site Infrastructure.

On the Approval Date, América Móvil’s shareholders will vote on the Corporate Restructuring at the Extraordinary Meeting of Shareholders, which was called by notice in the Reforma newspaper on April 1, 2015.

The Spin-off consists of a series of legal acts, the most significant of which are described below:

| 1. | AMX Board of Directors Approval. On July 8, 2014, the Board of Directors resolved to implement all necessary and appropriate measures needed to carry out the separation of Telcel’s Site Infrastructure for independent operation and marketing to interested third parties. |

As a result of that resolution, and on that same date, América Móvil made the following public announcement:

Mexico City, Mexico, July 8, 2014. América Móvil, S.A.B. de C.V. ( América Móvil ) (BMV: AMX; NYSE: AMX; NASDAQ: AMOV; LATIBEX: XAMXL) informs that its Board of Directors, at its ordinary meeting held today, after having analyzed several alternatives and recommendations presented by the Strategic Committee, resolved to authorize measures to reduce its national market share in the Mexican telecommunications market under fifty percent in order to cease being a preponderant economic agent , under the terms of the Constitution of the United Mexican States and its implementing legislation.

The Board of Directors of América Móvil decided upon the sale of certain assets to a new and solid carrier independent from América Móvil, with experience in the telecommunications sector, with sound economic and technical resources, being a real option to participate in this capital intensive sector, to overcome the obstacle of the insufficient investment made by our Mexican competitors.

19

Table of Contents

The decision related to the sale of assets is conditioned upon Teléfonos de México, S.A.B. de C.V. ( Telmex ) and Radiomóvil Dipsa, S.A. de C.V. ( Telcel ) ceasing to be preponderant economic agents and subject to asymmetric regulations, and being able to access the provision of convergent services. Also, the assets must be sold at market conditions at their commercial value.

In addition, all cellular cites (base stations), including towers and related passive infrastructure, will be separated from Telcel for their corresponding operation and commercialization to all interested parties.

The implementation of the approved measures is subject to certain corporate, regulatory and governmental authorizations, as well as the approval, as the case may be, of the board of directors and/or shareholders meetings of América Móvil and/or subsidiaries.

América Móvil will pay special attention to the relationship with its clients, distributors, investors and personnel, to whom the development of América Móvil and subsidiaries is attributed.

Telmex ratifies and strengthens the commercial agreement with Dish México, S. de R.L. de C.V. ( Dish México ), consisting of billing and collection services, distribution and equipment leases. The services provided to Dish México have been and will continue to be available to telecommunications carriers, including those providing cable and/or satellite television services.

Likewise, Telmex waives its rights arising from the option agreement related to the purchase of 51% of the shares representing the capital stock of Dish Mexico.

The Board of Directors commented on the transformation of the telecommunications sector during these 23 years and the role played by Telmex and Telcel. América Móvil s investments in Mexico and Latin America have been instrumental in the expansion of its telecommunications network and services, and have resulted in América Móvil having the most advanced technology. These investments have resulted in important and continuous productivity increases which have been passed on to our clients.

As such, in Mexico, prices for mobile services, national long-distance, and Internet services per kilobit, have decreased in more than 90% since the privatization of Telmex, and are currently among the lowest in Latin America and OECD member countries.

It was also highlighted how, in mobile services, Telcel began operations after Iusacell and certain other concessionaires currently known as Movistar, which then had 100% market share in the mobile market, and for years continued to hold a majority participation in such market.

During the nineties, cable operators were the only ones who could provide broadband Internet services, and by 2002, cable operators still had twice as much market share in the broadband Internet market than Telmex.

Finally, the Board commented upon the growth of América Móvil, which operates in 26 countries and whose wireless costumer base increased from 35 thousand to 292 million, an 8,300 times increase, and an increase from 5.3 million revenue generating units ( RGUs ) to over 365 million, as a result of the preference of our clients.

| 2. | AMX Board of Directors Approval to Call the Extraordinary Meeting of Shareholders. On November 4, 2014, the Board of Directors resolved, among other things, to extend the authorization necessary to convene an extraordinary meeting of shareholders, which is required for the approval of the Spin-Off. |

20

Table of Contents

| 3. | Preliminary Steps. During the fourth quarter of 2014 and the first quarter of 2015, certain subsidiaries of América Móvil took the following legal and corporate actions in order to reorganize the structure of specific subsidiaries for the purpose of facilitating the implementation of the Corporate Restructuring: |

(i) Spin-off of Telcel. On October 30, 2014, an extraordinary meeting of shareholders approved the spin-off of Telcel and transfer of certain assets (including the Site Infrastructure), liabilities and capital to a new company; and

(ii) Spin-off of Sercotel. On January 7, 2015, an extraordinary meeting of shareholders approved, subject to certain conditions precedent, the spin-off of Sercotel and transfer of certain assets, liabilities and capital to a new company.

| 4. | Approval of the Tower Reference Offer. On November 5, 2014, the IFT approved the Tower Reference Offer. |

| 5. | América Móvil Shareholders Meeting. On April 17, 2015, an Extraordinary Meeting of Shareholders of América Móvil will be held, at which América Móvil’s shareholders will vote on the approval of the Corporate Restructuring. Following the Extraordinary Meeting of Shareholders, the adopted resolutions will be recorded before a notary public and registered in the National Securities Registry. Additionally, an excerpt from the resolution related to the approval of the Spin-off will be made public via the legally available channels. |

| 6. | Conditions. The Corporate Restructuring is subject to obtaining various corporate and legal authorizations, consents and/or non-objections, as well as to the effectiveness of those authorizations already obtained. The conditions to which the Corporate Restructuring is subject are as follows: |

| • | confirmation from the Mexican Ministry of Finance, through the Tax Administration Service, that the Spin-off of América Móvil and the Preliminary Steps comply with the requirements established in Article 14-B, Section II, Subsection a) of the Mexican Federal Tax Code and therefore will not create tax consequences in Mexico; and |

| • | notification that (i) the Corporate Restructuring has been approved by the IFT, or (ii) confirmation that the Corporate Restructuring does not require IFT approval. |

The special delegates designated at the Extraordinary Meeting of Shareholders may waive any prior conditions, but waiver of any one such condition shall not be interpreted as a waiver of any other.

| 7. | Application for Registration of Telesites Shares in the National Securities Registry. Upon the completion of the Corporate Restructuring, it is expected that Telesites will apply to the Mexican National Banking and Securities Commission for the registration of the Telesites Shares with the National Securities Registry. It is also expected that Telesites will apply to the Mexican Stock Exchange for the listing of the Telesites Shares, with the objective that these shares be quoted on such exchange. |

| 8. | Distribution of Shares. See “Detailed Information About the Transaction—Share Distribution Date.” |

| 9. | Continuity. Once the Corporate Restructuring becomes effective, América Móvil would continue to be a holding company, and its operations will be centered principally on providing telecommunications services. Telesites will be organized as an independent company, with sufficient capacity to hold its own assets and dispose of them. The membership of Telesites’ board of directors will be established at the Extraordinary Meeting of Shareholders. In addition, América Móvil and Telesites and their respective subsidiaries may execute certain agreements which are customary for this type of transaction to facilitate the separation. See “—Certain Relations Between América Móvil and Telesites.” |

21

Table of Contents

Expenses Related to the Corporate Restructuring

América Móvil will assume the expenses related to the Corporate Restructuring, with the exception of those which, by their inherent nature, should be assumed by Telesites. The expenses include, among others, notary and external legal counsel fees, common in a transaction of this nature. It is expected that total expenses related to the Corporate Restructuring should not exceed $3.5 million Mexican Pesos. Such expenses do not include expenses related to the payment of duties, taxes and registration fees, including those derived from registration with the Public Registry of Commerce, the National Securities Registry and the listing of the Telesites Shares on the Mexican Stock Exchange.

Corporate Restructuring Approval Date

On July 8, 2014, the Board of Directors resolved to implement the necessary and appropriate measures to execute the separation of Telcel’s Site Infrastructure for its independent operation and marketing to third parties. Similarly on November 4, 2014, the Board of Directors, resolved, among other things, to extend the authorization necessary to convene the Extraordinary Meeting of Shareholders that is required for the approval of the AMX Spin-off.

If the Corporate Restructuring is approved, the Spin-off will take full force and effect upon the completion of the following: (i) forty-five (45) calendar days have elapsed following the publication of notice of the Spin-off and registration of the resolutions of the Extraordinary Meeting of Shareholders, as described in “Detailed Information About the Transaction—Approvals and Consents;” (ii) the formation of Telesites has been notarized and registered with the Public Registry of Commerce; and (iii) the conditions set forth in numbered paragraph 6 of “—Detailed Description of the Corporate Restructuring.”

The Share Distribution Date

The distribution of the share certificates representing the share capital of América Móvil and Telesites will be carried out as follows:

| • | Each holder of AMX AA Shares will receive one Telesites AA Share per AMX AA Share held as of the Share Record Date; |

| • | Each holder of AMX L Shares will receive one Telesites L Share per AMX L Share held as of the Share Record Date; |

| • | Each holder of AMX A Shares will receive one Telesites A Share per AMX A Share held as of the Share Record Date; and |

| • | each América Móvil shareholder will continue to be the owner of the same number of AMX Shares and ADSs they held before the Spin-off. |

Only the América Móvil shareholders as of the Share Record Date will receive Telesites Shares as a consequence of the Corporate Restructuring and América Móvil will not receive any Telesites Shares as part of the Corporate Restructuring.

22

Table of Contents

Certain provisions of América Móvil’s corporate bylaws will be modified, as described in “—Relevant Differences Between the América Móvil and Telesites Share Certificates as a Result of the Corporate Restructuring—América Móvil.” As a consequence, once (i) the Spin-off takes full effect; (ii) the Mexican National Banking and Securities Commission has authorized the registration of the Telesites Shares with the National Securities Registry; and (iii) the favorable opinion of the Mexican Stock Exchange is obtained for such shares to be suitable for listing and therefore quoted on the Mexican Stock Exchange, América Móvil will proceed to swap its currently outstanding shares certificates corresponding to the 2011 issuance, for new América Móvil share certificates corresponding to this 2015 issuance, which contain the pertinent clauses, in accordance with the bylaw modifications mentioned.

Prior to the Share Distribution Date, there will be no independent share certificates for the Telesites Shares, the right to receive such shares will be transferred together with the AMX Shares, and no investor may purchase, acquire, sell or transfer Telesites or AMX Shares separately.

With respect to share certificates that are deposited with Indeval, the Share distribution will take place under the terms of the notice to be published by América Móvil for the information of its shareholders, as set forth in the General Rules. Shareholders will be notified of the date on which the Telesites Shares are quoted independently on the Mexican Stock Exchange and the delivery of the share certificates will occur. The distribution of Telesites Shares will not take place until they have been registered with the National Securities Registry.

With respect to share certificates that are not deposited with Indeval, the distribution of Shares will take place in the form and at the time to be set forth in the notice that AMX will publish to inform its shareholders.

Effects of the Spin-off on Holders of América Móvil ADSs

On the Share Distribution Date, the Depositary for AMX’s L Share ADS and A Share ADS programs will receive the pro rata portion of Telesites Shares corresponding to the AMX L Shares and A Shares underlying AMX’s L Share ADSs and A Share ADSs.

Under the terms of the deposit agreements governing AMX’s L Share ADS and A Share ADS programs, whenever the Depositary receives a distribution of securities from América Móvil, other than AMX Shares, the Depositary shall cause those securities to be distributed as promptly as practicable to the AMX ADS holders entitled to receive them, in proportion to the number of AMX ADSs they hold. The distribution may be made in any manner that the Depositary deems equitable and practicable. However, if in the opinion of the Depositary, such distribution cannot be made proportionately among the AMX ADS holders or if, for any other reason, the Depositary deems such distribution not to be feasible, the Depositary may adopt such method as it may deem equitable and practicable for the purpose of effecting such distribution. That method may include the sale of the securities, in which case the net proceeds of such sale shall be distributed by the Depositary to the AMX ADS holders in proportion to the number of AMX ADSs they hold.

América Móvil and the Depositary are currently considering options for effecting the distribution described in the preceding paragraph in an efficient and equitable manner. The Depositary will inform AMX ADS holders how such distribution will be made prior to the Share Distribution Date.

23

Table of Contents

Relevant Differences Between the América Móvil and Telesites Share Certificates as a Result of the Corporate Restructuring

América Móvil

Currently, América Móvil’s share capital is represented by (i) AA Shares, without par value; (ii) A Shares, without par value; and (iii) L Shares, without par value. All of the outstanding Shares of América Móvil are fully paid and non-assessable.

The AA and A Shares have full voting rights. Holders of L Shares may vote only in limited circumstances, such as the transformation of América Móvil from one type of corporation into another; any merger of América Móvil; the extension of its authorized corporate life; its voluntary dissolution; any change in its corporate purpose; any change in its state of incorporation; removal of its shares from listing on the Mexican Stock Exchange or any foreign stock exchange and any other matter that would prejudice the rights of holders of L Shares. In addition, holders of L Shares have the right to appoint two (2) members of the Board of Directors and the corresponding alternate directors.

The AA Shares must always represent at least 51% of the combined AA Shares and A Shares, and may only be owned by holders that qualify as Mexican investors, as provided in América Móvil’s bylaws. Each AA Share or A Share may be exchanged at the option of the holder for one L Share, provided that the AA Shares may never represent less than 20% of América Móvil’s outstanding capital stock or less than 51% of América Móvil’s combined AA Shares and A Shares.

As a consequence of the Corporate Restructuring, it is anticipated that only the accounting value and market value of the AMX Shares will be modified. América Móvil intends to amend its corporate bylaws to adjust the value of the minimum fixed share capital. This proposed bylaw amendment will be available for América Móvil shareholder consultation, in the offices of the Secretary of the Board of Directors, with the advance notice required by the applicable legal and bylaw provisions.

Telesites

As is the case of América Móvil, the share capital of Telesites will be represented by (i) AA Shares, without par value; (ii) A Shares, without par value; and (iii) L Shares, without par value.

The Telesites AA and A Shares will have full voting rights. Holders of L Shares will be able to vote only in limited circumstances, such as the transformation of Telesites from one type of corporation into another; any merger of Telesites; the extension of its authorized corporate life; its voluntary dissolution; any change in its corporate purpose; any change in its state of incorporation; removal of its shares from listing on the Mexican Stock Exchange or any foreign stock exchange and any other matter that would prejudice the rights of holders of L Shares. In addition, holders of L Shares will have the right to appoint two (2) members of the Board of Directors and the corresponding alternate directors.

The AA Shares of Telesites, which will be required to represent at least 51% of the combined AA Shares and A Shares, will only be permitted to be owned by holders that qualify as Mexican investors, as will be provided in Telesites’ bylaws. Each AA Share or A Share will be able to be exchanged at the option of the holder for one L Share, provided that the AA Shares may never represent less than 20% of Telesites’ outstanding capital stock or less than 51% of Telesites’ combined AA Shares and A Shares.

24

Table of Contents

Application will be made to the Mexican National Banking and Securities Commission for the registration of the Telesites Shares with the National Securities Registry. Application will also be made to have Telesites Shares listed on the Mexican Stock Exchange, so that they may be traded on that exchange.

Following the AMX Spin-off, Telesites will be completely independent of América Móvil. In addition, once Telesites is an issuer with shares listed on the National Securities Registry, it will be obligated to comply with all terms of transparency and corporate governance of the applicable stock market regulations in Mexico.

Additionally, after the Share Distribution Date, Telesites shareholders may decide to amend its bylaws to combine all series of capital stock into one series of ordinary shares with the same economic and corporate rights, including voting rights.

Effect of the Corporate Restructuring on AMX Shares

Except for the discussion on the exchange of Shares described in “—The Share Distribution Date,” the Corporate Restructuring described in this Information Statement will not affect the Shares or rights contained in the AMX Shares. As a consequence of the Corporate Restructuring, the amount of minimum fixed share capital of América Móvil will change, without however modifying the total number of Shares that it currently represents. América Móvil intends to amend clause 6 of its corporate bylaws to reflect this change.

Accounting Treatment

The accounting treatment of the Corporate Restructuring for each of the entities involved will be governed by IFRS.

Tax Consequences of the Corporate Restructuring

Tax effects in Mexico

Those holders of Telesites Shares who are non-residents or residents in Mexico for tax purposes will not be subject to personal or corporate income tax (impuesto sobre la renta) or value added tax (impuesto al valor agregado) in Mexico as a result of the Corporate Restructuring.

Once the Corporate Restructuring has been carried out, América Móvil shareholders will receive Telesites Shares in a percentage equivalent to the percentage of AMX Shares the holder owned as of the Share Record Date, as described in this Information Statement. The Telesites Shares received by América Móvil shareholders will not be considered taxable income for Mexican tax purposes.

The Spin-off will not generate tax consequences as a result of the transfer, subject to confirmation by the Mexican Ministry of Finance and assuming that the same shareholders maintain, for at least two years following the Spin-off, at least 51% of the aggregate voting Shares of América Móvil and Telesites. AMX expects that the Slim Family, the Control Trust and Inmobiliaria Carso, S.A. de C.V. (including its subsidiary, Control Empresarial de Capitales, S.A. de C.V.), who are beneficiaries of more than 51% of the subscribed and paid-in A and AA Shares of América Móvil and over 51% of the total outstanding share capital of América Móvil, as of the date of this Information Statement would be able to maintain their shareholder position during the two years following the Spin-off.

25

Table of Contents

Notwithstanding the foregoing, each shareholder should consult with their own tax advisor about the tax consequences of the Corporate Restructuring, including under the applicable laws in Mexico and abroad.

U.S. Federal Income Tax Considerations

The following is a summary of certain U.S. federal income tax consequences of the Spin-off for a U.S. Holder (as defined below) of AMX Shares or ADSs, and of acquiring, owning and disposing of Telesites Shares to U.S. Holders that acquire the Telesites Shares in the Spin-off. This summary is based on the Internal Revenue Code of 1986, as amended (the “Code”), applicable United States Treasury Regulations, judicial authority, administrative rulings effective as of the date hereof, all as currently in effect. These laws and authorities are subject to change, possibly on a retroactive basis. The discussion below does not address any state, local or foreign or estate and gift tax consequences of either the Spin-off or of acquiring, owning or disposing of Telesites Shares received in the Spin-off. The tax treatment of the Spin-off to the holders will vary depending upon their particular situations. Each U.S. Holder should consult its own tax advisor concerning the tax consequences of the Spin-off, including consequences arising under foreign, state, and local laws, and the likelihood that the Spin-off will be taxable to such U.S. Holder.

This discussion does not purport to be a complete analysis of all of the potential tax effects of the Spin-off. This discussion is directed only to U.S. Holders that hold AMX Shares or ADSs, or will hold Telesites Shares, as capital assets and that have the U.S. dollar as their functional currency, and does not address the tax treatment of U.S. Holders that are subject to special tax rules, such as banks, regulated investment companies, real estate investment trusts, pass-through entities (including partnerships and arrangements classified as partnerships for U.S. federal income tax purposes and partners therein), tax-exempt entities, dealers in securities or currencies, traders in securities electing to mark to market, financial institutions, insurance companies, holders of 10% or more of América Móvil Shares or Telesites Shares (whether held directly or through ADSs or both), persons holding ADSs or shares as a position in a “straddle” or conversion transaction, or as part of a “synthetic security” or other integrated financial transaction, certain U.S. expatriates and taxpayers using a taxable year other than the calendar year. The discussion does not address the applicability and effect of the alternative minimum tax or the Medicare tax on net investment income to a U.S. Holder. In addition, the following discussion does not address U.S. federal income tax considerations to a U.S. Holder that chooses to exercise its withdrawal rights in accordance with the Mexican General Corporations Law.

For purposes of this summary, a “U.S. Holder” means a person that is a beneficial owner of AMX Shares or ADSs on the Share Record Date, or of Telesites Shares received in the Spin-off, and who is a citizen or resident of the United States, a U.S. domestic corporation, or otherwise subject to U.S. federal income tax on a net income basis with respect to income from the AMX Shares or Telesites Shares, or the ADSs of América Móvil (as applicable).

In general, this discussion assumes that a U.S. Holder of América Móvil’s ADSs will be treated as the owner of the shares represented by those ADSs for U.S. federal income tax purposes.

Consequences of the Spin-off