Form 6-K PRUDENTIAL PLC For: Mar 31

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of March, 2015

PRUDENTIAL PUBLIC LIMITED COMPANY

(Translation of registrant’s name into English)

LAURENCE POUNTNEY HILL,

LONDON, EC4R 0HH, ENGLAND

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate by check mark whether the registrant is submitting the Form6-K in paper as permitted by Regulation S-T

Rule 101(b)(1): ¨

Indicate by check mark whether the registrant is submitting the Form6-K in paper as permitted by Regulation S-T

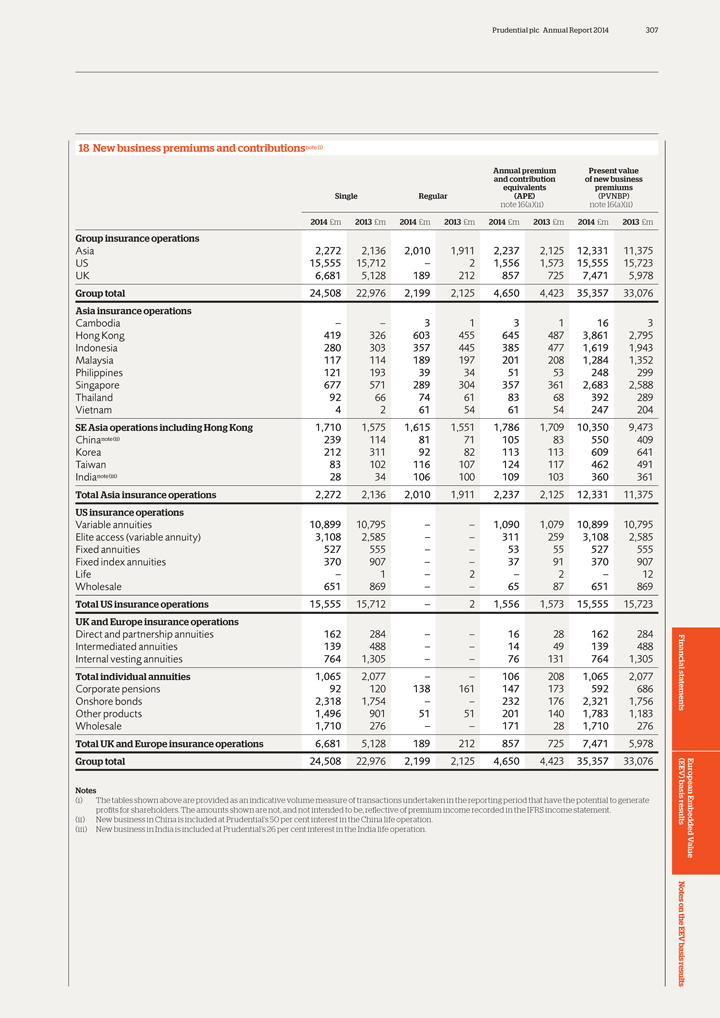

Rule 101(b)(7): ¨

PRUDENTIAL Long-term thinking Prudential plc Annual Report 2014 HK Stock Code: 2378

Contents Group overview 03–13 04 Chairman’s statement 1 06 Group Chief Executive’s report Strategic report 15-70 16 Our world 39 Chief Financial Officer’s 2 18 Our strategy and operating report on our 2014 financial principles performance 19 How our business works 51 Group Chief Risk Officer’s report 20 Measuring our performance on the risks facing our business 22 Our businesses and their and our capital strength performance 61 Corporate responsibility review Governance 71-91 72 Board of Directors 81 Board committee reports 3 76 Chairman’s introduction 89 Additional information 77 Board governance 90 Statutory and regulatory disclosures 80 Group governance 91 Index to principal Directors’ Report disclosures Directors’ remuneration report 93-120 94 Annual statement from the 98 Summary of Directors’ remuneration policy 4 Chairman of the Remuneration 101 Annual report on remuneration Committee 116 Supplementary information 96 Our executive remuneration at a glance Financial statements 5 121-273 European Embedded Value (EEV) basis results 6 275-309 Additional information 311-352 313 Additional unaudited financial information 7 338 Risk factors 344 Glossary 348 Shareholder information 351 How to contact us www.prudential.co.uk

Prudential plc Annual Report 2014 01

Delivering

long-term value

Creating value

Customers

24m

life customers worldwide

Investors

173%

total shareholders’ return1 achieved since 2010

Employees

23,047

employees worldwide

Societies

£19.6m

total community investment spend

Measuring our performance page 20

Prudential delivered a strong, broad-based performance in 2014. Our core strategy of focusing on the three main opportunities available to us in Asia, the US and the UK –

serving the protection and investment needs of the growing middle class in Asia, providing income in retirement to American baby boomers and meeting the fi nancial needs of an ageing British population – is unchanged. It continues to serve us

well.

The execution of this strategy, driven by the operating principles set out in 2009, is central to the Group’s continued success and refl ects the

dedication and quality of our people and their focus on meeting the distinct needs of our customers across the business. This has been one of the key factors enabling us to outperform in the markets in which we compete, delivering value for our

customers and sustainable returns for our shareholders.

The Directors’ Report of Prudential plc for the year ended 31 December 2014 is set out on pages 1 to

14, 71 to 92 and 313 to 352 and includes the sections of the Annual Report referred to in these pages.

Key to report

In focus – fi nd out more about what we do and how we do it Read more on this topic within the report More information online

Note

1 Total shareholders’ return represents the growth in the value of a share plus the

value of dividends paid, assuming that the dividends are reinvested in the Company’s shares on the ex-dividend date.

Directors’ European Embedded Value

Group overview Strategic report Governance remuneration report Financial statements (EEV) basis results Additional information

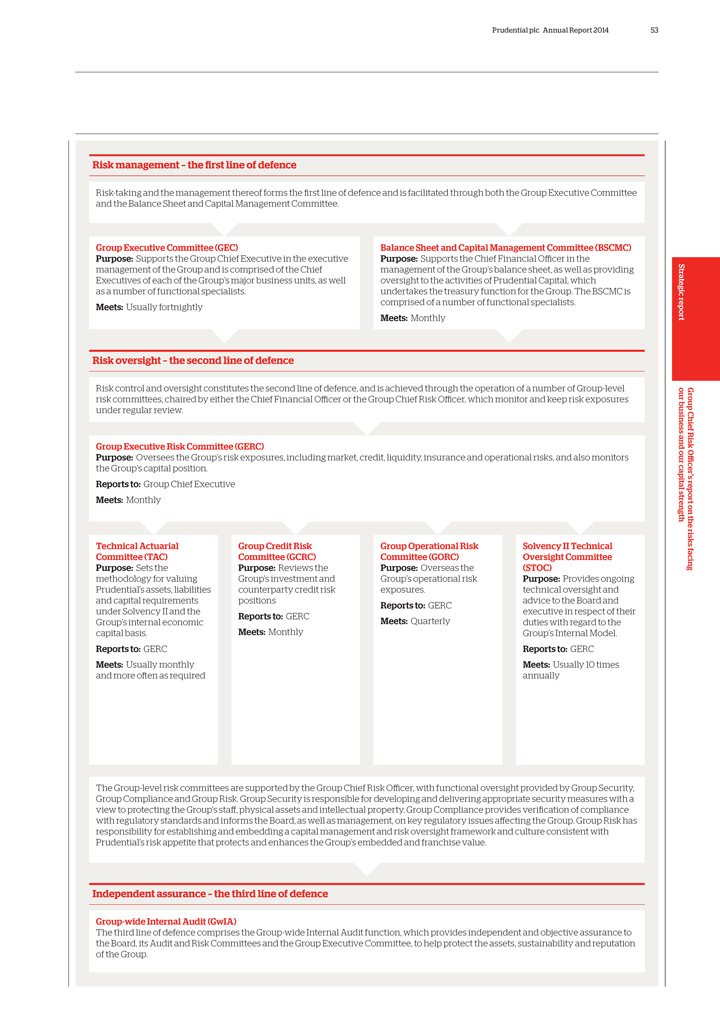

02 Prudential plc Annual Report 2014

Prudential plc Annual Report 2014 03 Section 1 Group overview Group overview 04 Chairman’s statement 06 Group Chief Executive’s report 1

04 Prudential plc Annual Report 2014 Group overview Chairman’s statement Value for our customers and growing returns for our shareholders Prudential was established on the principles of integrity, security and prudence. Those principles are still central to our culture, while we also take the initiative to capture new opportunities. Paul Manduca Chairman I am pleased to introduce Prudential’s 2014 Annual Report. The Group has produced another strong performance, delivering value to our customers, benefits to the communities in which we operate and good returns for our shareholders. This performance has been driven by a consistent focus on the long term and on the needs of our customers. We build sustainable businesses and we know that the service we provide to our customers is central to this goal. As our businesses grow and we continue to develop our high-performing teams in Asia, the US, the UK, Europe, and now in Africa, we ensure that this clear focus is at the core of everything we do. We also make sure that we adhere to our founding values. We were established in London in 1848 on the principles of integrity, security and prudence. More than 166 years later, those principles are still central to our culture, while we also take the initiative to capture new opportunities. Our commitment to creating sustainable value for our customers and our principled approach enable us also to deliver strong returns for our shareholders. I am delighted to report that all four of our major business units have made significant contributions to our profitability in 2014, with Asia remaining our primary focus for growth. Our success is based on a number of key factors. First, we have a clear and disciplined strategy, focused on the long term. Following our success in achieving our previous demanding set of targets, at the end of 2013 our executive team set new objectives to reach by 2017. These are just as testing as their predecessors, and I am pleased to say that we are making solid progress towards them. Our second key advantage is the strength of our leadership. Tidjane Thiam has been an exceptional servant of the Group since 2008, first as Chief Financial Officer and then as Group Chief Executive. As announced, he will be leaving Prudential once his successor is appointed. We will be sorry to see him go but understand his desire to take on a new challenge elsewhere and we wish him every success in his new role at Credit Suisse. We are fortunate to have strength in depth in our management team and the Board has been very focused on succession planning. At the time of writing, I can say that we expect to announce a new Group Chief Executive very shortly. Our third key strength is our robust corporate governance. Good governance is critical to success in financial services. It is one of the factors that has allowed Prudential to flourish for more than a century and a half, by ensuring our purpose and values inform the behaviours and culture of our organisation, and that decisions are taken within proper, effective and transparent reporting structures. Central to good governance is an experienced and skilled Board that is able both to support the executive and provide appropriate challenge, and we have continued to meet our commitment to implement changes that strengthen our Board. In line with that commitment, we have made a number of changes. In April 2014 we announced that our Group Chief Risk Officer, Pierre-Olivier Bouée, was joining the Board. It is important that at a large, complex financial services business such as ours, the Chief Risk Officer is represented, and Pierre-Olivier brings extensive expertise and experience to the Board. At the same time, our former Chief Risk Officer, John Foley, stepped down from the Board, while continuing in his role as Group Investment Director. I would like to thank John for his contribution and I am pleased that he is continuing to fulfil the vital role of Group oversight of financial investments as a member of the Group Executive Committee. In October we also announced that Lord Turnbull, who has been a member of the Board since May 2006, as well as Chairman of the Remuneration Committee since June 2011, would be stepping down at our next Annual General Meeting. I would like to thank Lord Turnbull for his contribution over nine years, which has been of considerable value to the Group. He will be succeeded as Chairman of the Remuneration Committee by Anthony Nightingale CMG, who will also join the Nomination Committee. I am determined to ensure that our Board makes the greatest contribution that it can to Prudential’s success, providing the best possible governance, forming a clear

Prudential plc Annual Report 2014 05 36.93p full-year dividend 10% increase on 2013 £29.2bn EEV shareholders’ funds equivalent to 1,136p per share channel for discussion with shareholders and maintaining good relationships with regulators. The changes we have made in 2014 ensure it is well placed to deal with both the opportunities and the challenges we face. The fourth key factor in our success is that we benefit from a stable and high-quality shareholder base. We respect our shareholders’ views and we take the time and effort to engage with them. Being accessible and transparent towards our shareholders is essential to our success, and we are ensuring that we do everything we can to understand their needs and meet their requirements. The Board has decided to rebase the full-year dividend upwards by 10 per cent, reflecting the 2014 financial performance of the Group. In line with this, the directors recommend a final dividend of 25.74 pence per share (2013: 23.84 pence), which brings the total dividend for the year to 36.93 pence (2013: 33.57 pence). This rebase has been made possible by the continued exceptionally strong performance of the Group. Although the Board has been able to recommend such a rebase in 2014, the Group’s dividend policy remains unchanged. The Board will maintain its focus on delivering a growing dividend from this new higher base, which will continue to be determined after taking into account the Group’s financial flexibility and our assessment of opportunities to generate attractive returns by investing in specific areas of the business. The Board believes that in the medium term a dividend cover of around two times is appropriate. Alongside the benefits provided by our core activities, we also engage in corporate responsibility programmes in the markets in which we operate around the world. In partnership with charitable organisations, we provide long-term funding and deploy the expertise of the many volunteers from our workforce on projects that help to improve the lives of individuals and strengthen communities in many different ways. In 2014, we increased the scale of our corporate responsibility activities, deepening the impact we are having in this area. The projects we support range from encouraging street children in Indonesia to develop life skills and helping with disaster preparedness across South-east Asia, to teaching new skills to financially disadvantaged people in the US and providing apprenticeship opportunities in our businesses here in the UK. We are also beginning equivalent programmes in our new markets in Africa, offering much-needed scholarships in high schools and supporting students of actuarial science. I am particularly proud of the thousands of our employees who take part in these activities. Last year our colleagues contributed more than 62,000 hours of their time to help improve the lives of others. Many of these volunteers take part in the Chairman’s Challenge, our flagship volunteering programme. Last year I took the opportunity to visit our winning 2013 Chairman’s Challenge project in Hong Kong, and it was highly rewarding to see the great work our people are doing there and the tangible benefits they are creating. The 2014 Chairman’s Challenge programme was our most successful yet, with more than 6,000 employees volunteering their time across more than 25 projects. These included a work-readiness and financial literacy programme in Michigan, a life skills programme for children in Thailand, a homebuilding project in India and a series of business and enterprise lessons for primary schoolchildren in Tower Hamlets in London. Our volunteers on these many different projects are achieving great things. I will continue to work with our excellent corporate responsibility teams to increase further our impact in these areas. Finally, I would like to thank all our employees for their contribution to another strong year for Prudential. The skill, commitment and hard work of our people in all our businesses enable us to continue executing our successful strategy and delivering for our customers, our shareholders and the communities in which we operate. I am confident that with that strategy, our strong management and the commitment of our people, we will continue to provide excellent value for our customers and growing returns for our shareholders. Paul Manduca Chairman Our strategy and operating principles page 18 Group overview Chairman’s statement

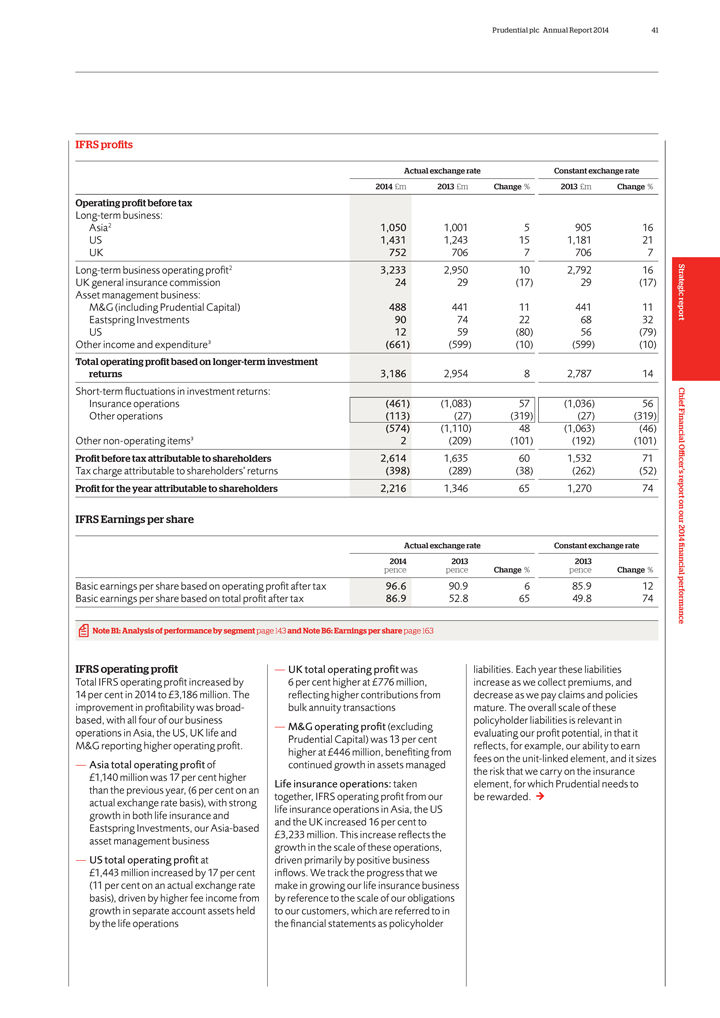

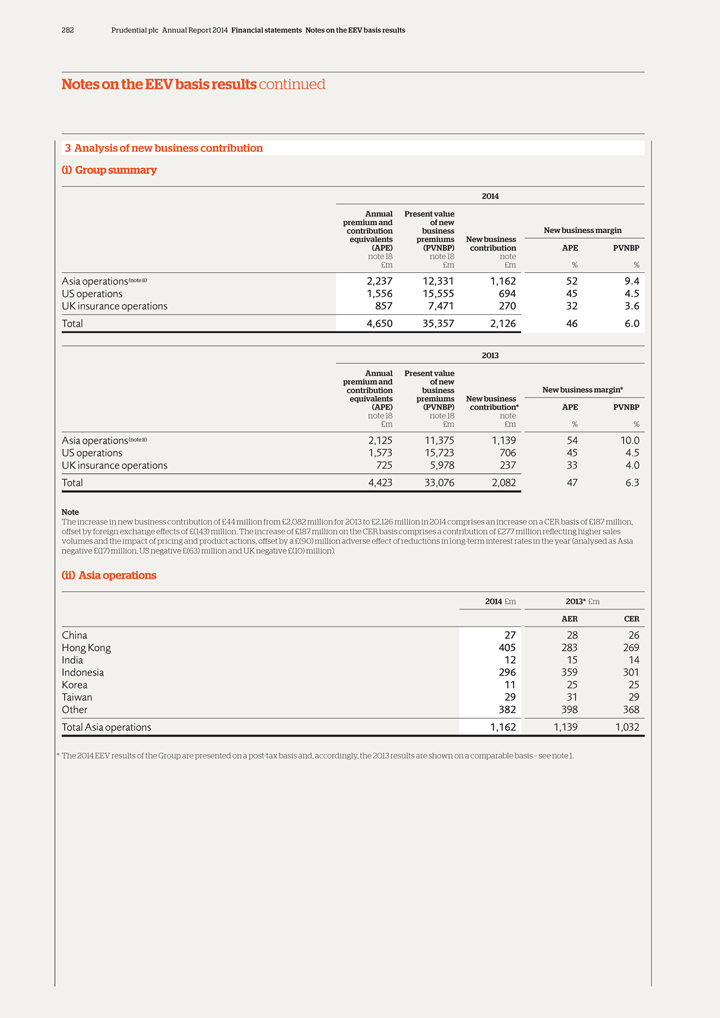

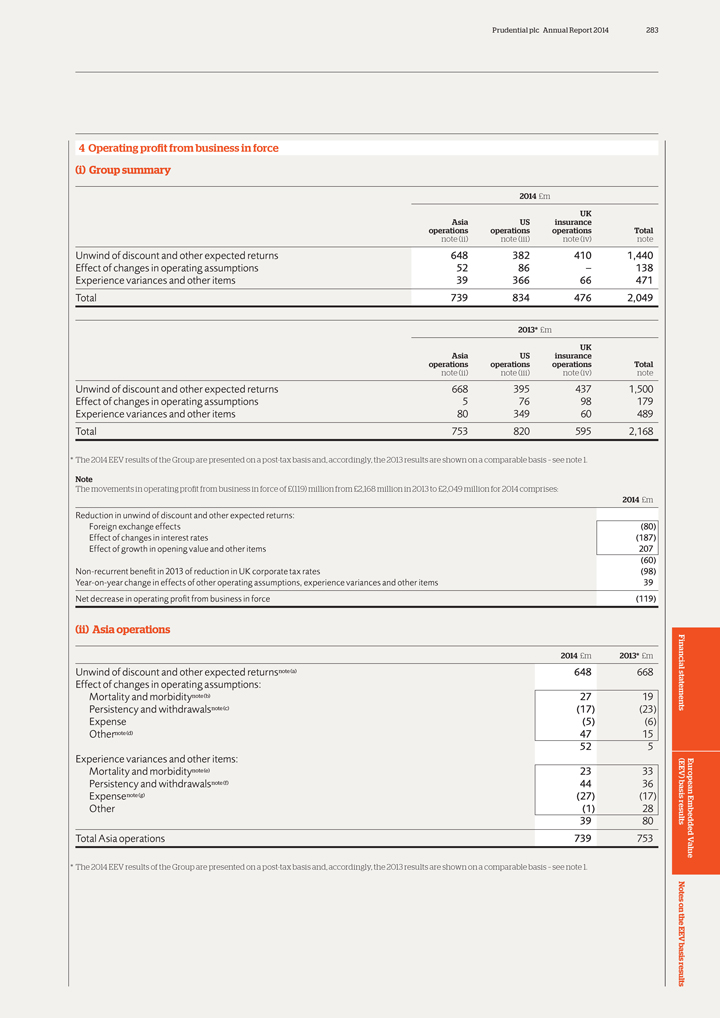

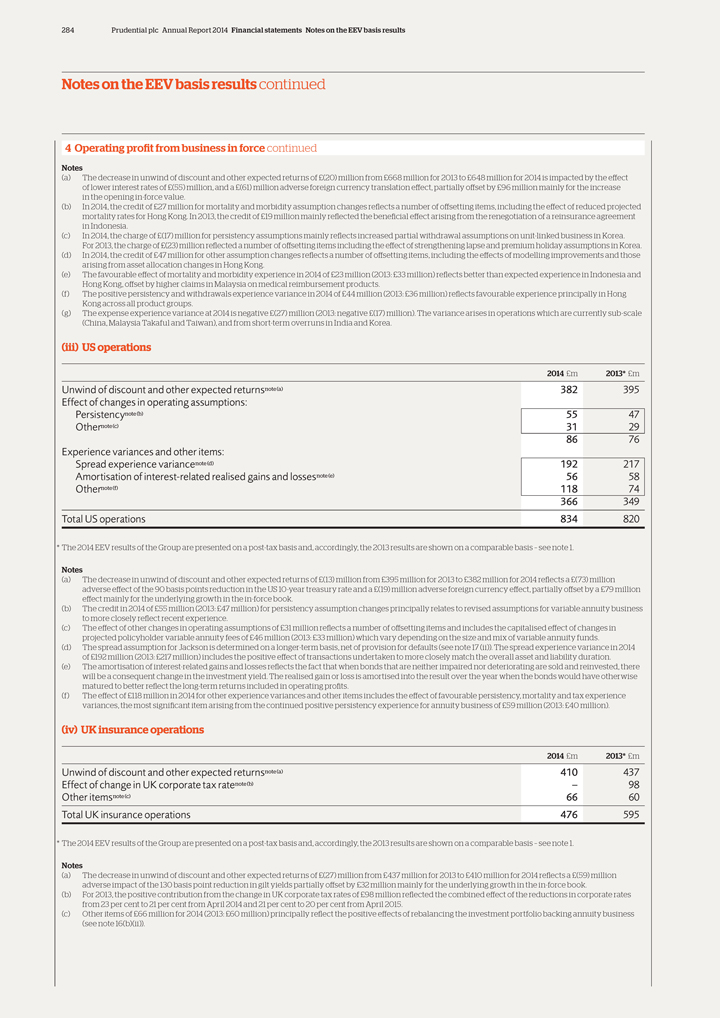

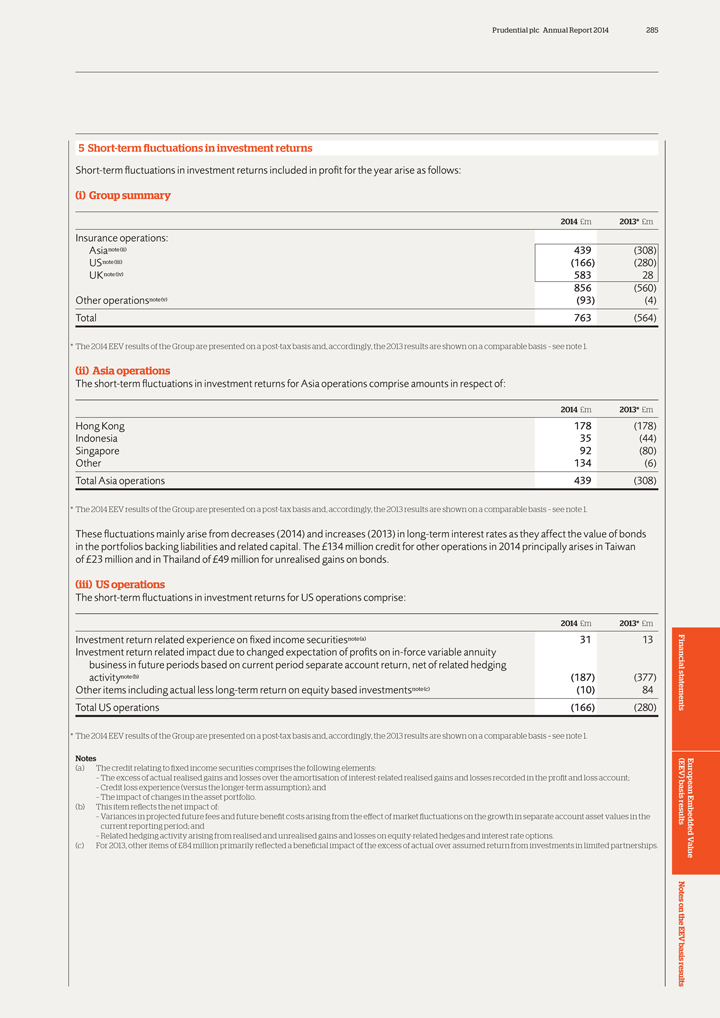

06 Prudential plc Annual Report 2014 Group overview Group Chief Executive’s report Producing profitable growth over the long term The Group delivered double-digit growth across our key metrics of IFRS operating profit, new business profit and cash. Tidjane Thiam Group Chief Executive I am pleased to report that Prudential delivered a strong, broad-based performance in 2014. Our core strategy of focusing on the three main opportunities available to us in Asia, the US and the UK – serving the protection and investment needs of the growing middle class in Asia, providing income in retirement to American baby boomers and meeting the financial needs of an ageing British population – is unchanged. It continues to serve us well. The execution of this strategy, driven by the operating principles set out in 2009, is central to the Group’s continued success and reflects the dedication and quality of our people and their focus on meeting the distinct needs of our customers across the business. This has been one of the key factors enabling Prudential to outperform in the markets in which it competes, delivering value for our customers and sustainable returns for our shareholders. Currency volatility The last two years have seen significant fluctuations in the value of sterling against the local currencies in the US and in some of our key markets in Asia. This has been driven by ongoing speculation about the relative growth trajectories in the world’s major economies, together with often divergent views on the timing, extent and effectiveness of government and central bank intervention. While sterling strengthened significantly in the second half of 2013, driven by expectations that a stronger recovery of the UK economy would lead to an earlier shift in UK monetary policy, the latter part of 2014 has seen a partial reversal of this movement as the relative outlook improved in other areas of the global economy, particularly in the US. However, the negative impact of sterling strength in late 2013 and early 2014 on the financial performance of our overseas businesses is recognised mainly in 2014, as we use average actual exchange rates to report our results in sterling. In that context, it is important to note that the actual flows that we collect from our customers in Asia and the US are received in local currency. We believe that in periods of currency volatility, the most appropriate way to assess the actual performance of these businesses is to look at what they have achieved on a local currency basis, in other words in terms of the actual flows they have collected, rather than the translation of those flows into sterling. Therefore, in this section, every time we comment on the performance of our businesses, we focus on their performance measured in local currency (presented here by reference to percentage growth expressed at constant exchange rates) unless otherwise stated. Group performance1 The Group delivered double-digit growth across our key metrics of IFRS operating profit, new business profit and cash, with all four of our business units delivering good performance in challenging operating conditions. Our Group IFRS operating profit based on longer-term investment returns increased by 14 per cent during the year to £3,186 million. Asia life and asset management operating profit was up 17 per cent to £1,140 million. Our ability to proactively manage our diverse portfolio of businesses at the regional level has enabled us to partially offset the short-term headwinds experienced in a few of our key Asia markets. Strong external net inflows of £5.4 billion and positive market movements have driven operating profit and total funds under management to record levels at Eastspring, our Asia-based asset management business; US life IFRS operating profit increased 21 per cent to £1,431 million. The strong variable annuity inflows we have been able to capture at attractive margins generate higher levels of fee income. This, combined with favourable market movements, increased the value of separate account assets, a key driver of our profits in the US; Note 1 The comparative results referenced above and elsewhere in this report have been prepared using constant exchange rates basis except where otherwise stated. Comparative results on an actual exchange rate basis are also shown in financial tables in the Chief Financial Officer’s report on our 2014 financial performance.

Prudential plc Annual Report 2014 07 Our strategy and operating principles Balanced metrics and disclosures Disciplined capital allocation Proactive risk management Focus on customers and distribution Asia: accelerate United States: build on strength United Kingdom: focus Asset Management: optimise Sustainable value for our stakeholders The Group’s strategy remains unchanged and is focused on capturing three long-term opportunities: — The significant protection gap and investment needs of the Asian middle class; — The transition of US baby boomers into retirement; and — The UK ‘savings gap’ and ageing population in need of returns and income. Our disciplined execution of this strategy has continued to drive profitable growth and higher cash generation, underlining our commitment to delivering both ‘Growth and Cash’. Our strategy and operating principles page 18 £3,186m IFRS operating profit 14% increase1 on 2013 Measuring our performance page 20 — UK life IFRS operating profit grew by 7 per cent to £752 million, benefiting from higher contributions from bulk annuities, which outweighed the impact of significantly lower sales of individual annuities following UK market reforms; and — M&G delivered operating profit of £488 million2, an increase of 11 per cent, reflecting continued strong third-party net inflows combined with favourable market movements in the period, which together have increased M&G’s external funds under management by £11.0 billion to a record £137.0 billion. Net cash remittances from our businesses increased by 11 per cent to £1,482 million, driven by strong organic cash generation and supported by robust local capital positions. Cash remittances of £400 million from Asia were consistent with 2013, the US was up 41 per cent to a record of £415 million, the UK remitted cash of £325 million, as we have been increasing our level of investment in the business in response to the UK market reforms, while M&G (including Prudential Capital) delivered an increase of 17 per cent to a new high of £342 million. Such levels of cash generation are the bedrock of our financial strength. Underlying free surplus generation from our life and asset management businesses, a key indicator of cash production in these businesses, was 9 per cent higher at £2,579 million after reinvestment in new business. We deliberately run the Group to seek to generate organically significant amounts of cash in each of our businesses. The successful implementation of this approach gives us added strategic and financial flexibility, as illustrated by our ability to agree a new deal with Standard Chartered Bank in 2014. The ability of the Group to generate both growth and cash remains a distinctive feature of Prudential in our industry. New business profit3 was up 10 per cent to £2,126 million, driven in 2014 by a combination of higher volumes and pricing and product actions aimed at enhancing profitability. All three of our life businesses made strong contributions, with new business profits from Asia growing by 13 per cent to £1,162 million, the US delivering £694 million, up 4 per cent, and the UK reporting £270 million, up 14 per cent. APE sales4 increased by 12 per cent to £4,650 million. In Asia, APE sales were 15 per cent higher at £2,237 million with APE sales from our ‘sweet spot’ markets5 continuing to be a strong driver of growth. In the US, APE sales were up 4 per cent at £1,556 million as we continued to proactively manage our sales of variable annuities with guarantees. We continue to diversify our product mix with sales of Elite Access, our innovative variable annuity without guarantees, increasing by 26 per cent and contributing to an increase in the proportion of variable annuities sold without living benefit guarantees to 34 per cent of total variable annuity sales. In the UK, APE sales grew by 18 per cent to £857 million, reflecting strong bulk annuity and investment bond volumes which offset the significant contraction of the retail annuity market that followed the Budget reform. M&G delivered net inflows of £7.1 billion (2013: £9.5 billion) as it continued to benefit from high levels of retail sales from Continental Europe, while Eastspring Group overview Group Chief Executive’s report

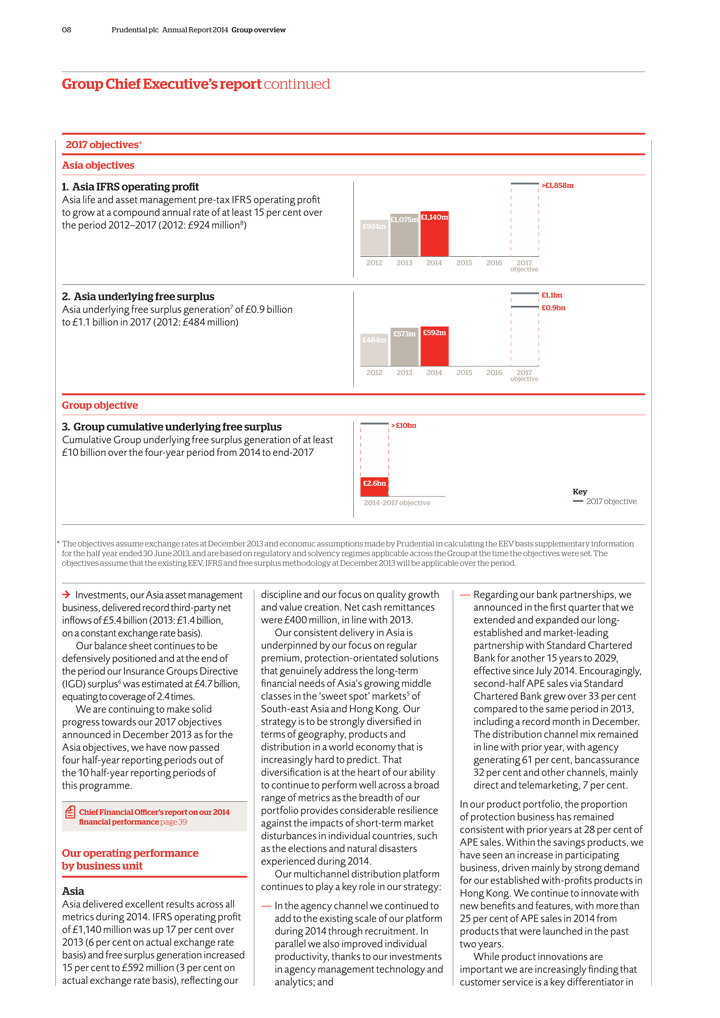

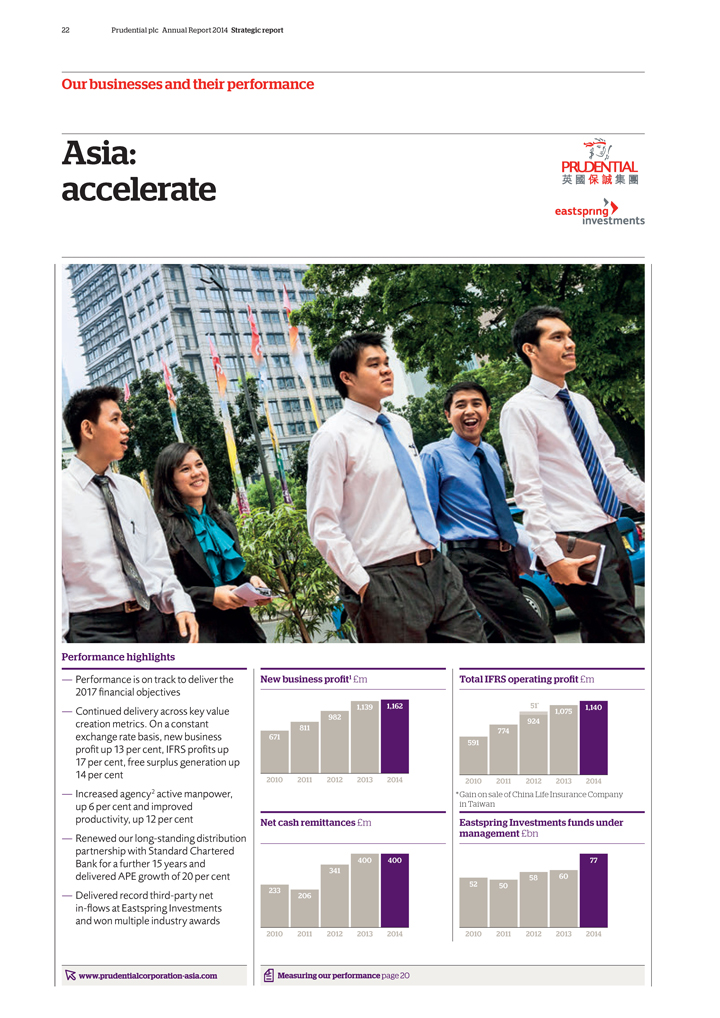

08 Prudential plc Annual Report 2014 Group overview Group Chief Executive’s report continued 2017 objectives* Asia objectives 1. Asia IFRS operating profit Asia life and asset management pre-tax IFRS operating profit to grow at a compound annual rate of at least 15 per cent over the period 2012–2017 (2012: £924 million8) 2. Asia underlying free surplus Asia underlying free surplus generation7 of £0.9 billion to £1.1 billion in 2017 (2012: £484 million) Group objective 3. Group cumulative underlying free surplus Cumulative Group underlying free surplus generation of at least £10 billion over the four-year period from 2014 to end-2017 >£1,858m £924m £1,075m £1,140m 2012 2013 2014 2015 2016 objective 2017 £1.1bn £0.9bn £484m £573m £592m 2012 2013 2014 2015 2016 objective 2017 > £10bn £2.6bn 2014_2017 objective Key 2017 objective * The objectives assume exchange rates at December 2013 and economic assumptions made by Prudential in calculating the EEV basis supplementary information for the half year ended 30 June 2013, and are based on regulatory and solvency regimes applicable across the Group at the time the objectives were set. The objectives assume that the existing EEV, IFRS and free surplus methodology at December 2013 will be applicable over the period. Investments, our Asia asset management business, delivered record third-party net inflows of £5.4 billion (2013: £1.4 billion, on a constant exchange rate basis). Our balance sheet continues to be defensively positioned and at the end of the period our Insurance Groups Directive (IGD) surplus6 was estimated at £4.7 billion, equating to coverage of 2.4 times. We are continuing to make solid progress towards our 2017 objectives announced in December 2013 as for the Asia objectives, we have now passed four half-year reporting periods out of the 10 half-year reporting periods of this programme. Chief Financial Officer’s report on our 2014 financial performance page 39 Our operating performance by business unit Asia Asia delivered excellent results across all metrics during 2014. IFRS operating profit of £1,140 million was up 17 per cent over 2013 (6 per cent on actual exchange rate basis) and free surplus generation increased 15 per cent to £592 million (3 per cent on actual exchange rate basis), reflecting our discipline and our focus on quality growth and value creation. Net cash remittances were £400 million, in line with 2013. Our consistent delivery in Asia is underpinned by our focus on regular premium, protection-orientated solutions that genuinely address the long-term financial needs of Asia’s growing middle classes in the ‘sweet spot’ markets5 of South-east Asia and Hong Kong. Our strategy is to be strongly diversified in terms of geography, products and distribution in a world economy that is increasingly hard to predict. That diversification is at the heart of our ability to continue to perform well across a broad range of metrics as the breadth of our portfolio provides considerable resilience against the impacts of short-term market disturbances in individual countries, such as the elections and natural disasters experienced during 2014. Our multichannel distribution platform continues to play a key role in our strategy: — In the agency channel we continued to add to the existing scale of our platform during 2014 through recruitment. In parallel we also improved individual productivity, thanks to our investments in agency management technology and analytics; and — Regarding our bank partnerships, we announced in the first quarter that we extended and expanded our long-established and market-leading partnership with Standard Chartered Bank for another 15 years to 2029, effective since July 2014. Encouragingly, second-half APE sales via Standard Chartered Bank grew over 33 per cent compared to the same period in 2013, including a record month in December. The distribution channel mix remained in line with prior year, with agency generating 61 per cent, bancassurance 32 per cent and other channels, mainly direct and telemarketing, 7 per cent. In our product portfolio, the proportion of protection business has remained consistent with prior years at 28 per cent of APE sales. Within the savings products, we have seen an increase in participating business, driven mainly by strong demand for our established with-profits products in Hong Kong. We continue to innovate with new benefits and features, with more than 25 per cent of APE sales in 2014 from products that were launched in the past two years. While product innovations are important we are increasingly finding that customer service is a key differentiator in

Prudential plc Annual Report 2014 09 the marketplace, an evolution we welcome given the emphasis we have always placed on service and customer satisfaction. For example, our pioneering PRUhospital Friend concierge service in Indonesia is now four years old and has been extended to 49 hospitals covering 15 cities. It handles over 50 per cent of all protection claims. In Singapore, PRUhealthcare assist is the first-to-market dedicated hotline, staffed by experts who help customers to decide what treatments to pursue and which hospitals to use. Across the region, our success in looking after our customers and anticipating their needs is demonstrated by our ‘repeat sales’ to our existing customers: more than 40 per cent of new business APE sales in 2014 were generated by existing customers and our customer retention rate was over 90 per cent, a very important indicator of quality for us. The incentives of our staff in Asia are well aligned with this philosophy of emphasising quality growth and customer satisfaction. In 2014 we produced £1,162 million of new business profit, 13 per cent higher than 2013, reflecting our continued progress in Asia. In Hong Kong, APE sales grew 39 per cent, driven mainly by increases in agency headcount as well as increases in productivity. Hong Kong also directly benefited from significantly improved second-half sales following the renewal of the Standard Chartered Bank partnership. We have been working for a few years on increasing the proportion of protection sales in Hong Kong and this has paid off in 2014, contributing to a strong sales increase of 50 per cent. The Hong Kong branch of the Prudential Assurance Company was successfully domesticated with effect from 1 January 2014. In Singapore, we continue to lead the market with our popular regular premium and PRUshield products. Agency APE sales grew by 16 per cent as a result of increases in manpower and productivity. Bancassurance sales volumes were impacted by the cessation of the Maybank partnership during 2014, although volumes increased from our successful partnerships with Standard Chartered Bank and United Overseas Bank (‘UOB’). Indonesia had a challenging year, with exceptional flooding disrupting sales in the first quarter, and the transition to a new president impacting sentiment during the year. Although APE sales were down 4 per cent on prior year, the resilience of our business is demonstrated by our significant market outperformance, which has seen our market share increased to 24 per cent9 as other providers were more severely affected by these factors than we were. We remain very optimistic about the outlook for the Indonesian economy and £2,126m EEV new business profit 10% increase1 on 2013 £2,579m underlying free surplus generation 9% increase1 on 2013 we experienced an encouraging rebound in activity during December 2014, with APE sales 36 per cent higher than November, passing the 1 trillion rupiah level for the first time. In Malaysia, our decision to refocus our agency business on health and protection and to grow distribution by Bumiputra agents (‘Bumi’), delivered an encouraging 17 per cent increase in agency activity. The overall increase in APE sales of 6 per cent during 2014 reflects structurally lower average case sizes in the Bumi channel, where we are determined to grow in the next phase of development of our strategy in the country. We deliberately de-emphasised sales of some top-up products that negatively impacted top-line growth – an indicator which for us always comes second to growth in new business profit. Finally, fuel reforms and the prospect of the introduction of a new goods and services tax generated market uncertainty, which weighed on the economy and on our sector. Thailand includes the first full year of operation of our exclusive bancassurance agreement with Thanachart Bank, which together with our other bancassurance partners, UOB and Standard Chartered Bank, has driven a 36 per cent increase in APE sales. The transformation of our business in the Philippines is continuing, with a significant increase in agency activity. Reflecting this, regular premium sales were up 30 per cent on prior year and protection business increased by 36 per cent. Vietnam also had a good year, growing APE sales by 20 per cent on higher levels of agency activity. Our joint venture with CITIC in China continues to perform well, with APE sales increasing by 35 per cent, with progress in both the agency and bank channels. In India our joint venture with ICICI Bank remains the leader in the private sector with a market share of 10 per cent, and post-elections in May we have seen a significant increase in new business. In Taiwan and Korea we remain selective in our participation and as a result we are content to experience fluctuations in new business volumes. Both businesses have generated higher IFRS operating profit in 2014. In addition to running these established businesses, we continue to keep an eye on the future and are setting foundations for growth in new markets. Following the successful launch of our life business in Cambodia in 2013, we are now the market leader. We also opened a representative office in Myanmar during 2014 and recently received a licence for a representative office in Laos. In 2014, Asia EEV life operating profit3 increased by 12 per cent to £1,900 million, largely as a result of the growth in new business profit and a 10 per cent increase in the contribution from the larger in-force book. Eastspring Investments, our Asia asset management business, generated record third-party net inflows of £5.4 billion, 3.8 times higher than in 2013, with success in securing new equity flows, particularly from institutional clients, mitigating lower net inflows in fixed income. Including internal funds, total funds under management as at 31 December 2014 were a record £77.3 billion, up 28 per cent on the prior year as a result of net inflows and positive market movements. IFRS operating profit increased 32 per cent to £90 million, driven by the positive impact on revenue from higher levels of average assets under management. Our businesses and their performance – Asia page 22 US Our US business delivered a strong performance in 2014, with total IFRS operating profit of £1,443 million, up 17 per cent (11 per cent on an actual exchange rate basis). Jackson’s life IFRS operating profit grew 21 per cent (15 per cent on an actual exchange rate basis) to £1,431 million, driven primarily by increased fee income from higher levels of separate account assets. The growth in operating profit underpinned significant levels of capital generation in the period, enabling Jackson to remit a record £415 million of cash to the Group Group overview Group Chief Executive’s report

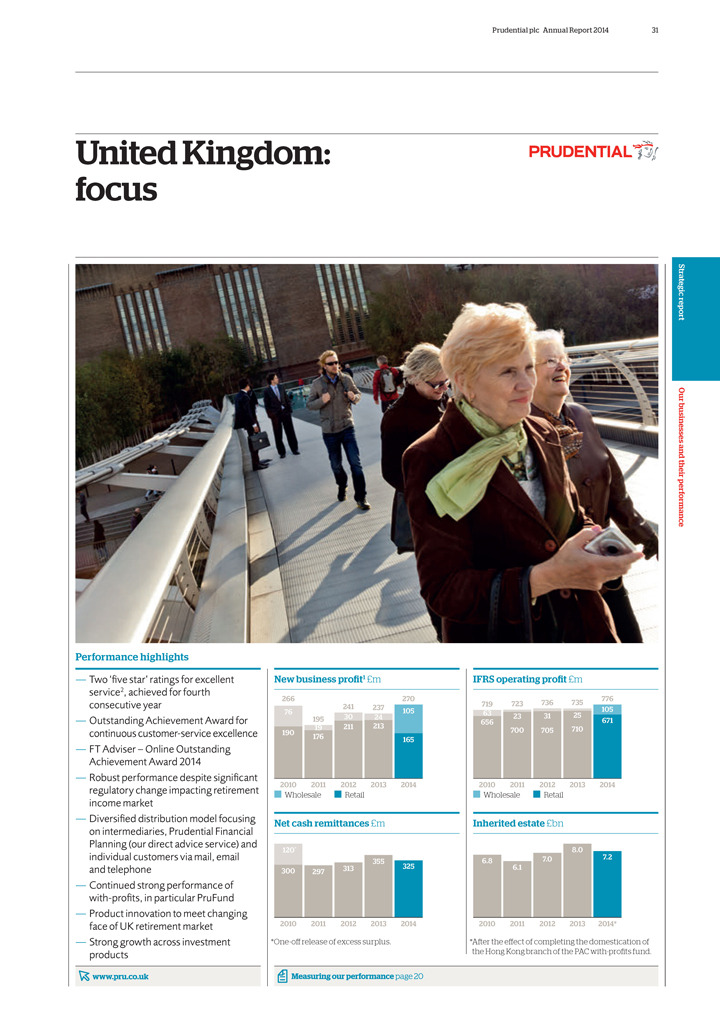

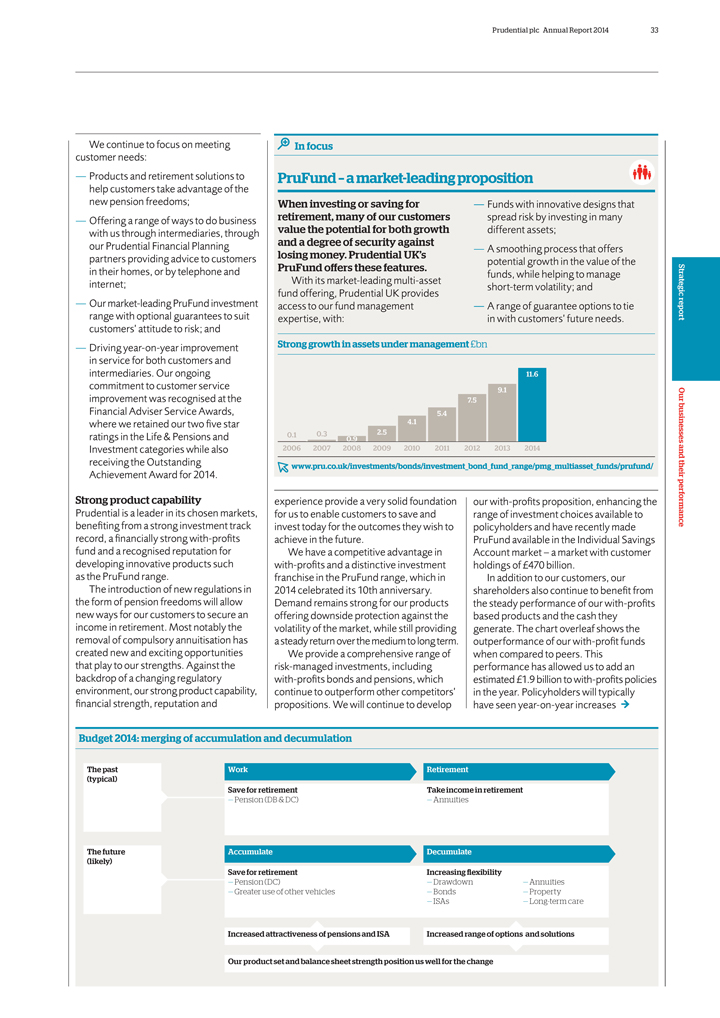

10 Prudential plc Annual Report 2014 Group overview Group Chief Executive’s report continued (2013: £294 million), while maintaining a healthy balance sheet. Jackson’s risk-based capital ratio at the end of 2014 was 456 per cent, compared to 450 per cent at the end of 2013. During 2014, the US continued to see signs of an improving economy, with declining unemployment rates, evidence of recovery in the housing market and stronger GDP growth. The S&P 500 Index rose 11 per cent and the 10-year Treasury rate remained above the 2012 low levels, but declined significantly during the course of the year. Overall, the US competitive landscape has been more stable than in recent periods, as most annuity writers appear to have committed to a particular course of action for the near term. Variable annuity providers continue to modify their product offerings through reductions in fund availability and increased fees. In addition, an increasing number of investment-only variable annuity products have been launched, following the success of Elite Access, our variable annuity without living benefits. Jackson achieved total retail APE sales of £1,491 million in 2014, an increase of 6 per cent compared to 2013. These sales were achieved while continuing to write new business at aggregate internal rates of return in excess of 20 per cent and with a payback period of one year. Including institutional sales, total APE sales increased 4 per cent to £1,556 million, driving new business profit3 growth of 4 per cent to £694 million. Total variable annuity APE sales increased 10 per cent to £1,401 million in 2014. Within this, APE sales of Elite Access rose 26 per cent to £311 million. The economics of our variable annuity business continue to be very attractive. With the success of Elite Access, we continue to improve the diversification of our product mix, contributing to an increase in the share of non-living benefit variable annuity sales to a new high of 34 per cent of total variable annuity APE sales (2013: 31 per cent). Jackson remains focused on proactively managing sales volumes of variable annuities with living benefits to match our annual risk appetite. Jackson’s statutory separate account assets increased by 17 per cent, from £69.8 billion in 2013 to £81.7 billion in 2014 (up 24 per cent on an actual exchange rate basis), reflecting both positive net flows and the growth in the underlying market value of the separate account assets. Fixed annuity APE sales of £53 million remained relatively flat compared to 2013, while fixed index annuity APE sales of £37 million decreased 57 per cent, primarily as a result of product changes implemented in late 2013 to ensure appropriate returns on shareholder capital. EEV life operating profit3 was £1,528 million, up 5 per cent from 2013, reflecting growth in the scale of our in-force book, favourable experience variances, and higher new business profit. We continue to write business at overall new business margins close to post-crisis highs, demonstrating the positive effect of proactive product and pricing actions that have helped to mitigate the adverse impact of the low interest rate environment. IFRS operating profit from non-life operations in the US decreased to £12 million (2013: £56 million), due to a Curian loss of £18 million that included a £38 million charge related primarily to the refund of certain fees by Curian. Jackson’s strategy is unchanged, serving the 77 million baby boomers as they enter retirement, while delivering operating earnings and cash. We continue to price new business on a conservative basis, targeting value over volume. Our hedging remains focused on optimising the economics of our exposures, therefore accepting a degree of volatility in our accounting results where they are not aligned with the underlying economics. Thanks to this approach, Jackson has been able to deliver significant profitable growth across the cycle, while maintaining a strong balance sheet. Since 1 January 2008, Jackson has remitted nearly US$2.6 billion of cash to the Group. Jackson’s approach has successfully translated into value for customers and into profits and cash for shareholders, the metrics through which we ultimately measure the success of our strategy. Our businesses and their performance – United States page 27 £1,482m net cash remittances from business units 11% increase on 2013 UK, Europe and Africa Our UK business continues to focus on its core strengths of investment (with the with-profits offering as a core proposition) and retirement solutions. In 2014, Prudential UK delivered life IFRS operating profit of £752 million, up 7 per cent year-on-year, primarily as a result of higher sales of bulk annuities, partially offset by the impact of the contraction of the individual annuities market following market reforms. Cash remitted to the Group was £325 million, compared to £355 million in 2013, as we increased our investment in new business and upgraded our UK pre- and post-retirement customer proposition. The UK market continues to be heavily influenced by a high level of regulatory and legislative change. The significant reforms of the pensions industry announced by the UK government, including removal of the requirement to purchase a pension annuity from April 2015, have resulted in an increasing proportion of customers deferring the decision to convert their pension savings into retirement income. The increased flexibility afforded by these reforms should ultimately help create an environment where more people are encouraged to save. The changes have also opened up opportunities for us to meet customer needs for alternative retirement solutions, including income drawdown. In December 2014 we launched a flexible drawdown product ahead of the introduction of the April 2015 pension reforms. This product will allow customers to access income drawdown without limits from April 2015, and is suited to customers who want more choice over how they use their retirement savings for income. Retail sales growth across our range of investment products reflected the strength of our distribution capability, particularly our intermediary channel, as we responded to the challenges and opportunities created by the pension reforms. Sales in this segment, which includes onshore and offshore bonds, individual pensions and income drawdown, together delivered APE sales growth of 41 per cent. We will continue to develop our with-profits proposition, enhancing the range of investment choices available to policyholders, and have recently made PruFund available in the Individual Savings Account market. The growth in our investment products was offset by a 49 per cent reduction in APE sales of individual annuities, reflecting the market contraction since the UK budget announcement. Despite this market disruption, overall retail APE sales of £686 million were 2 per cent lower than 2013 and increased by 3 per cent in the second half of the year compared with the

Prudential plc Annual Report 2014 11 same period in 2013. Retail new business profit was 23 per cent lower at £165 million, largely due to the reduced sales of higher-margin individual annuities. Onshore bonds APE sales of £232 million increased by 32 per cent, reflecting the strength of our investment proposition. APE sales from with-profits bonds of £214 million were 34 per cent higher, due to continuing demand for our non-guaranteed bond. We expect significant ongoing demand for our with-profits bond, with customers attracted by the benefit of a smoothed return to help manage market volatility and a strong track record of investment growth. APE sales from other retail products, including individual pensions, income drawdown and offshore bonds, increased by 44 per cent to £201 million. Offshore bond APE sales were 44 per cent higher, reflecting the growing popularity of our with-profits fund. Income drawdown APE sales grew by 133 per cent to £35 million and individual pensions APE sales increased by 44 per cent to £72 million, both driven by the strength of our with-profits PruFund offering, and by customers selecting more flexible retirement income solutions in anticipation of the pension reforms. In total, PruFund assets under management increased 27 per cent to £11.6 billion in 2014. Corporate pensions APE sales of £147 million were 15 per cent lower, mainly due to changes to public sector pension schemes. We remain the largest provider of Additional Voluntary Contribution plans within the public sector, where we provide schemes for 72 of the 99 public sector authorities in the UK (2013: 69 of the 99). Prudential’s continuing focus on the delivery of excellent customer service was recognised at the 2014 Financial Adviser Service Awards where we received an outstanding achievement award for retaining our two ‘Five Star’ ratings in the Life & Pensions and Investment categories for the fourth year running. In the wholesale market we wrote seven new bulk annuity deals in 2014 (2013: three), generating APE sales of £171 million (2013: £28 million) and new business profit3 of £105 million (2013: £24 million). Our approach to bulk transactions in the UK will continue to be one of selective participation, where we can bring both significant value to our customers and meet our shareholder return requirements. Through our longstanding presence in this segment of the life and pensions market, we have developed considerable longevity experience, operational scale and a good investment track record, which together represent expertise and capabilities that are increasingly in demand. The strength and focus of our teams and of our businesses enabled us to deliver good financial and operational progress. Tidjane Thiam Group Chief Executive In Poland, our new life company, Prudential Polska, conducted its second year of business in 2014, growing ahead of plan. Headquartered in Warsaw, the business now has 15 branches across the country and 712 financial planning consultants. Its success is evidence of our ability to build franchises in new territories, leveraging effectively in this case some of our Asian staff and skills. EEV life operating profit3 of £746 million was 10 per cent lower than 2013, reflecting a non-recurring contribution of £98 million in 2013 from the reduction in the rate of UK corporation tax. On 10 November 2014, Prudential Assurance Company Limited announced the sale of its 25 per cent equity stake in the PruHealth and PruProtect businesses to Discovery Group Europe Limited for £155 million in cash, generating an IFRS profit on disposal of £86 million. This transaction enabled Prudential UK to realise its investment at attractive terms and creates strategic flexibility for future participation in the UK protection market. During 2014, we completed the acquisition of Express Life in Ghana and Shield Assurance Company in Kenya, marking the Group’s entry into the nascent African life insurance industry. We are positive about the long-term opportunities in Africa, where we see many of the favourable structural characteristics of our preferred Asia markets, although most sub-Saharan life insurance markets are in the very early stages of development and therefore are not likely to be material in the short term. Our businesses and their performance – United Kingdom page 31 M&G M&G is an investment-led business that has managed money on behalf of individual and institutional investors for more than 80 years. Its focus on producing superior long-term investment returns, coupled with well-established distribution in the UK and across Europe, has underpinned another strong set of financial results, with funds under management and profits both reaching new highs. IFRS operating profit increased 13 per cent to £446 million in 2014, marking the fifth consecutive year of record profits. Over this period operating profit has grown by a compound annual growth rate of 16 per cent. While higher equity markets and buoyant bond markets have both contributed to improving profitability, strong net inflows of client assets since 2009, particularly in the retail market, have been a key driver of the increase in profit achieved by M&G. Reflecting this continued strong operating performance, M&G remitted £285 million of cash to Group in 2014, 21 per cent more than in 2013. During 2014, the combination of continued net fund inflows and generally positive market movements increased M&G’s total funds under management by 8 per cent to £264 billion at the end of the year. Within this, external funds under management grew by 9 per cent to £137 billion and now account for 52 per cent of M&G’s total funds under management, compared with 40 per cent five years ago. Within our retail business, we continue to make strong progress, with expansion of distribution in Continental Europe in recent years transforming the scale of funds under management and helping to diversify the business. Today, international clients account for 43 per cent of retail funds under management, compared with just 16 per cent five years ago, and M&G’s retail funds are now registered in 22 jurisdictions. Net inflows across Continental Europe were at a record level of £8.1 billion in 2014, compared to £7.6 billion in 2013. This more than offset a net outflow of £1.7 billion in the UK (2013: net outflow of £0.7 billion). In the UK, M&G achieved record net inflows into the M&G Property Portfolio Fund, which directly invests across different property sectors such as retail, offices and industrial on behalf of its UK retail client base. The Property Portfolio Fund finished 2014 with external funds under management of £3.0 billion, placing it as the largest retail property fund in the UK market. M&G also continues to pursue business diversification by fund, with seven of its retail funds, representing all the major asset classes, achieving net inflows of at least Group overview Group Chief Executive’s report

12 Prudential plc Annual Report 2014 Group overview

Group Chief Executive’s report continued

£4.7bn

estimated IGD capital surplus covering capital requirements

2.4

times

£250 million during the year. One of these, the M&G Optimal Income Fund,

became the top-selling10 European cross-border fund in 2014, based on annual net flows as of 31 December 2014.

At the end of 2014 retail funds under management

were £74.3 billion, up 11 per cent from 2013 levels, driven by positive net inflows, which totalled £6.7 billion (2013: net inflows of £7.3 billion), including the contribution from our associate entity in South Africa.

A track record of innovation in the institutional market has enabled M&G to be at the forefront of a number of specialist fixed income markets, including leveraged finance and

infrastructure investment. The consistency of institutional investment performance and its reputation for innovation earned M&G the prestigious 2014 Financial News Institutional Asset Management Awards for both fixed income and real estate for

the second consecutive year.

Net institutional inflows were £401 million, compared with £2.1 billion in 2013. As expected, a number of segregated

clients withdrew money from public debt funds as they reallocated scheme assets. There were also further planned redemptions from a large low-margin mandate. In general, outgoing assets have been replaced by flows into higher-margin products,

helping to improve the profitability of the institutional

business. M&G has in place a multi-billion-pound pipeline of institutional commitments at the end of

2014 across a diverse range of investment strategies that has yet to be invested.

External institutional funds under management increased 7 per cent in 2014 to

£62.7 billion.

The recent increase in headcount and investment in operational infrastructure required to preserve service quality as the scale of the

business grows, has been more than matched by revenue growth in 2014. As a result the cost-income ratio11 of 58 per cent in 2014 has improved slightly over the prior year (2013: 59 per cent).

M&G remains focused on producing superior long-term investment returns for clients, while continuing to diversify its business by geography and asset class and providing

capital-efficient profits and cash generation for the Group.

Our businesses and their performance – Asset management page 35

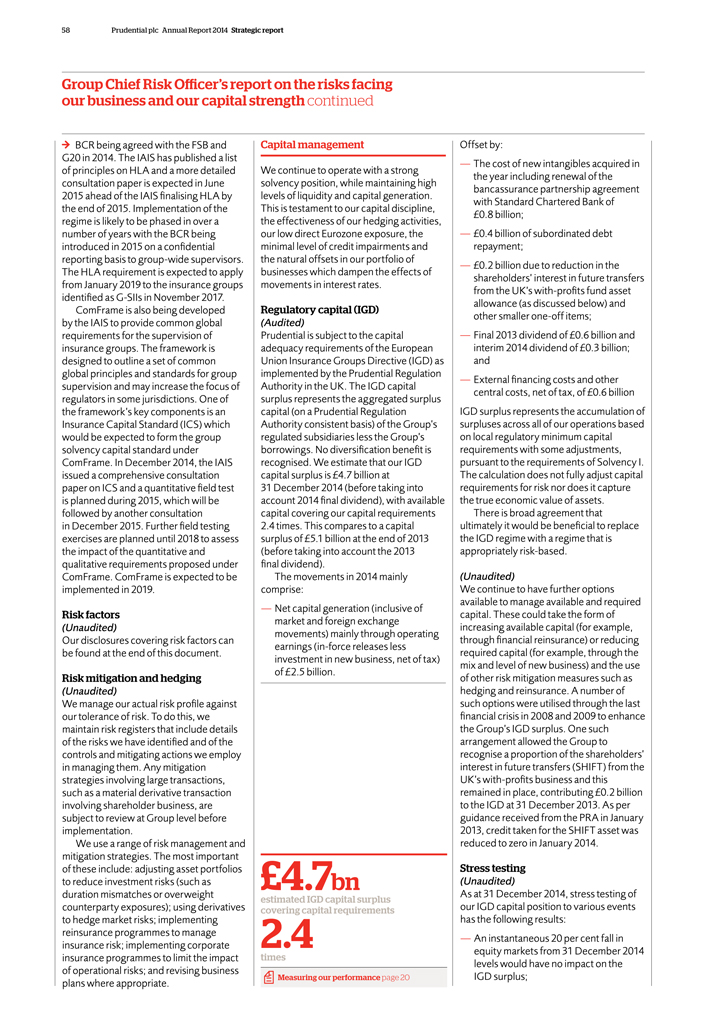

Capital and risk management

We continue to take a disciplined approach to capital management

and have implemented a number of measures over the last few years to enable us to make our capital work both more efficiently and more effectively for the Group. Using the regulatory measures of the IGD, our Group capital surplus position6 at 31

December 2014 was estimated at £4.7 billion (2013: £5.1 billion), after funding the fees payable for the new 15-year exclusive distribution agreement with Standard Chartered Bank. The IGD surplus is stated before allowing for the final

dividend and is equivalent to a cover of 2.4 times.

In July 2013, Prudential plc was listed by the Financial Stability Board as one of nine companies to be

designated as a Global Systemically Important Insurer (GSII). In July 2014 the International Association of Insurance Supervisors released a consultation paper on the Basic Capital Requirement, one of the two types of capital requirement proposed

under the GSII framework. Prudential is monitoring the development and potential impact of the framework of policy measures and engaging closely with the Prudential Regulation Authority on the implication of this designation.

Solvency II is scheduled to come into effect on 1 January 2016 and our preparations are well advanced. While the Omnibus II Directive is now in place, there are still many areas

which require further interpretation. We continue to work with the Prudential Regulation Authority on shaping the outcome to ensure that the

practical details of

Solvency II, including the final implementing measures, are both workable and effective.

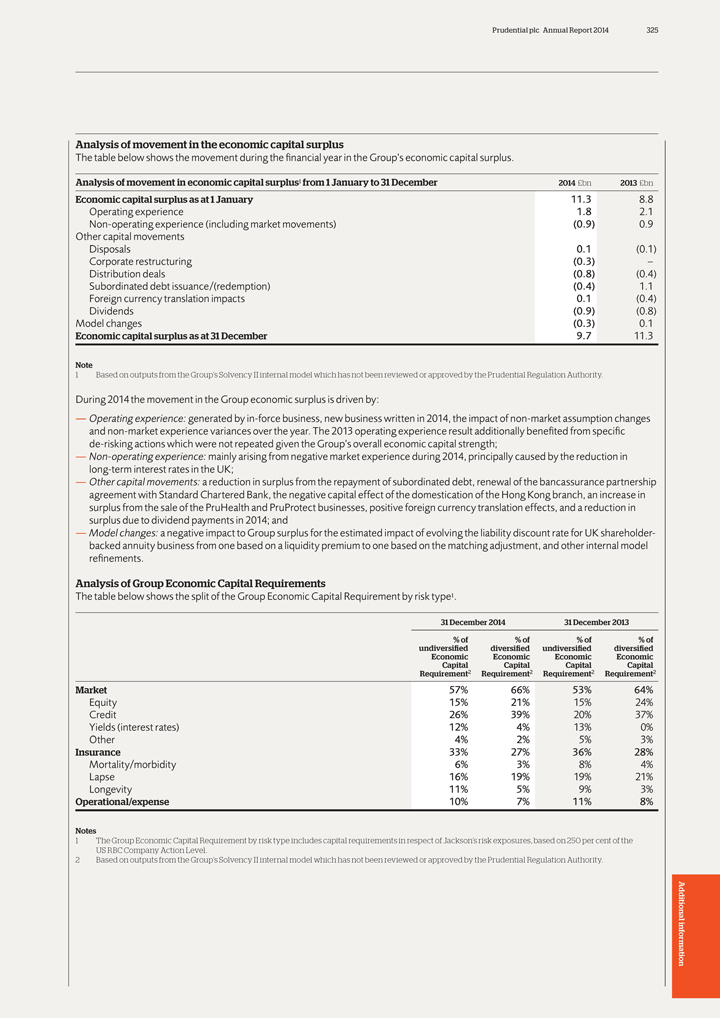

On an economic capital basis12 our surplus at 31 December 2014 of

£9.7 billion (2013: £11.3 billion) is equivalent to an economic capital ratio of 218 per cent (2013: 257 per cent). These results are based on outputs from our Solvency II internal model, which has not yet been approved by the Prudential

Regulation Authority. The results assume US equivalence, place no restrictions on the economic value of overseas surplus, and incorporate a number of other working assumptions. Certain aspects of the methodology and assumptions underpinning these

results will differ from those which are applied in obtaining final Solvency II Pillar I internal model approval. The eventual Solvency II Pillar I ratio, therefore, remains uncertain and is expected to be lower than our economic capital ratio.

Group Chief Risk Officer’s report on the risks facing our business and our capital strength page 51

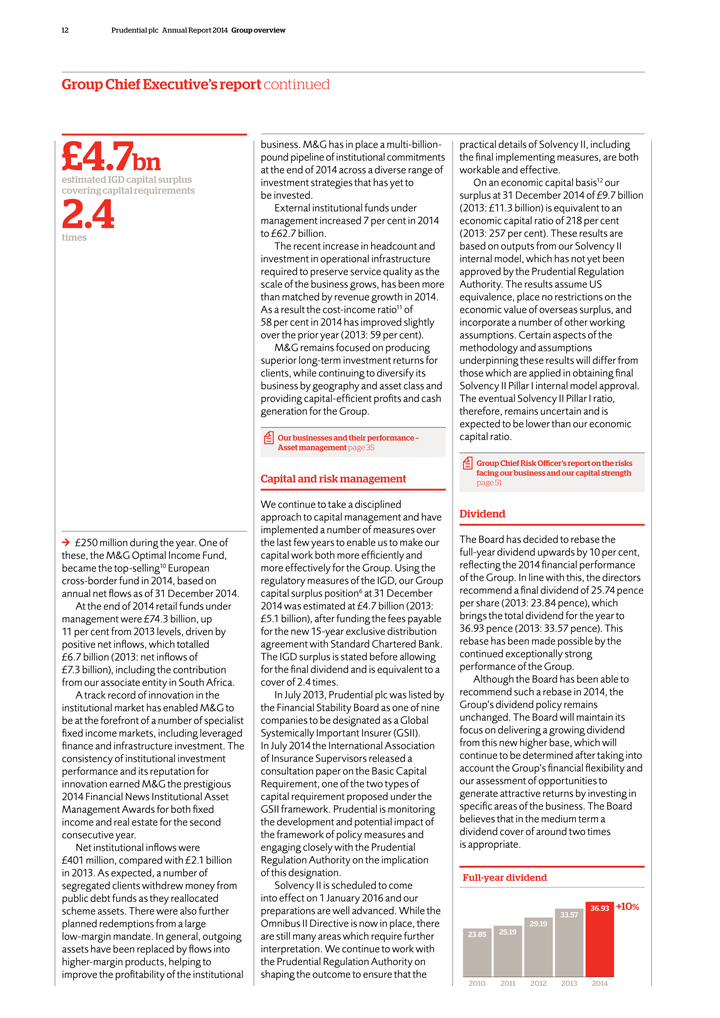

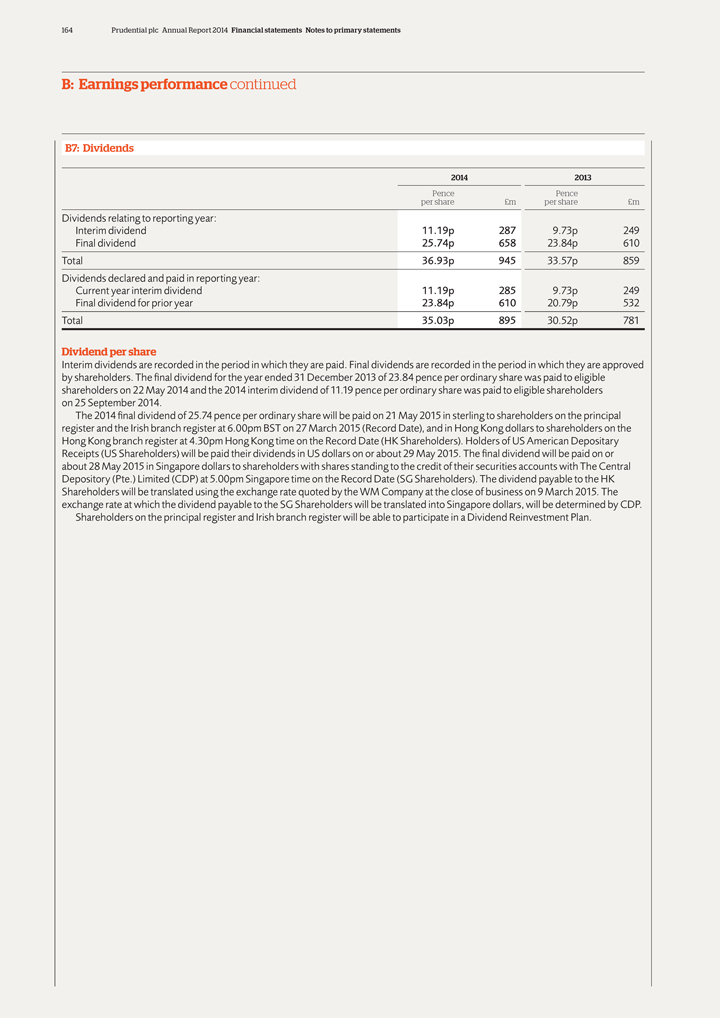

Dividend

The Board has decided to rebase the full-year dividend upwards by 10 per cent,

reflecting the 2014 financial performance of the Group. In line with this, the directors recommend a final dividend of 25.74 pence per share (2013: 23.84 pence), which brings the total dividend for the year to 36.93 pence (2013: 33.57 pence). This

rebase has been made possible by the continued exceptionally strong performance of the Group.

Although the Board has been able to recommend such a rebase in 2014,

the Group’s dividend policy remains unchanged. The Board will maintain its focus on delivering a growing dividend from this new higher base, which will continue to be determined after taking into account the Group’s financial flexibility

and our assessment of opportunities to generate attractive returns by investing in specific areas of the business. The Board believes that in the medium term a dividend cover of around two times is appropriate.

Full-year dividend

33.57 36.93 +10% 29.19 23.85 25.19

2010 2011 2012 2013 2014

Prudential plc Annual Report 2014 13 Outlook 2014 was a successful year for the Group, where the strength and focus of our teams and of our businesses enabled us to deliver good financial and operational progress and maintain a robust capital position, despite a number of challenges both globally and locally. It is clear that we are operating in a period of considerable change. 2015 has already seen a continuation of macroeconomic volatility, political upheaval and unexpected shifts in central bank positioning, with the uncertainty of election outcomes in many countries in Europe, including in the UK, still to come before the end of the year. As a result, investment markets generally remain cautious on the global outlook, reflected in further declines in long-term interest rates in most of the major economies in early 2015. The persistently low level of interest rates is a challenge for insurance companies. However, in recent years we have positioned the Group through proactive actions on product mix, pricing and our balance sheet to mitigate the negative effects of the low interest rate environment and continue to grow our earnings. We have had the same strategy since 2009 and it has served us well. We continue to execute with discipline and purpose and we believe our strategy and operating principles enable us to deliver relative outperformance across the cycle, as evidenced during the financial crisis. Asia, with its strong economic growth, young and growing population with savings and protection needs, and low levels of insurance penetration, continues to represent the most attractive opportunity in our industry today and therefore remains the primary focus o our profitable growth ambitions. Our established, growing multi-distribution platform puts us in a strong position to continue to capture profitably the opportunities available to us in Asia, while the breadth of our franchise, by geography, product and channel, provides us with the resilience that has allowed us to achieve relative outperformance through the cycle, even when individual countries presented short-term challenges. We will continue to invest in enhancing our agency and bancassurance distribution capabilities, to ensure our customers have effective advice-led access to our products. This was most recently evidenced by the renewal in 2014 of our pan-regional relationship with Standard Chartered Bank for another 15 years. The strong underlying fundamentals of economic growth and increasing affluence in Asia, and the quality of our products, people and distribution, remain powerful drivers of our ability to generate profitable growth while delivering value for our customers. In the US and the UK, we continue to utilise our established market position, distribution strength and distinctive products to ensure the delivery of earnings and cash, with strict allocation of capital to segments of the market that offer higher, capital-efficient margins. The UK life insurance market has been subject to significant reform, the ramifications of which are still playing out, but which we believe will ultimately lead to greater customer demand for savings and retirement solutions and create new opportunities for Prudential UK and M&G to leverage their existing expertise. We remain confident in our ability to produce profitable growth over the long term and to continue to create value for our customers and shareholders. It has been a privilege and a pleasure to lead Prudential, one of the iconic companies in UK financial services. We have successfully navigated some challenging times, including the global financial crisis, and have emerged with four profitable and strongly cash-generative businesses. I owe an enormous debt of gratitude to the staff and agents of Prudential around the world who have made these achievements possible and I want to thank them personally for their hard work and dedication. I leave the Group in good shape and look forward to seeing shareholders at my final Annual General Meeting as Group Chief Executive in May. Tidjane Thiam Group Chief Executive Notes 1 The comparative results referenced above and elsewhere in this report have been prepared using constant exchange rates basis except where otherwise stated. Comparative results on an actual exchange rate basis are also shown in financial tables in the Chief Financial Officer’s report on our 2014 financial performance. 2 Including Prudential Capital. 3 The 2014 EEV results of the Group are presented on a post-tax basis and, accordingly, 2013 results are shown on a comparable basis. 4 Annual Premium Equivalent (APE) sales comprise regular premium sales plus one-tenth of single premium insurance sales. 5 ‘Sweet spot’ markets are Indonesia, Singapore, Hong Kong, Malaysia, Philippines, Vietnam and Thailand. 6 Before allowing for final dividend. 7 Underlying free surplus generation comprises underlying free surplus released from long-term business (net of investment in new business) and that generated from asset management operations. The 2012 comparative is based on the retrospective application of new and amended accounting standards and excludes the 2012 one-off gain of £51 million from the sale of the Group’s holding in China Life Insurance Company of Taiwan. 8 Asia 2012 IFRS operating profit of £924 million is based on the retrospective application of new and amended accounting standards as at 31 December 2013, and excludes the 2012 one-off gain of £51 million from the sale of the Group’s holding in China Life Insurance Company of Taiwan. 9 Based on AAJI statistics to 30 September 2014. 10 Source: Lipper FMI, FundFile as of 31 December 2014. 11 Excluding performance fees, carried interest and share of profits from associate entity, PPM South Africa. 12 The methodology and assumptions used in calculating the economic capital results are set out in note II (c) of Additional unaudited financial information. The economic capital ratio is based on outputs from the Group’s Solvency II internal model which will be subject to Prudential Regulation Authority review and approval before its formal adoption in 2016. We remain on track to submit our Solvency II internal model to the Prudential Regulation Authority for approval in 2015 but given the degree of uncertainty remaining these economic capital disclosures should not be interpreted as outputs from an approved internal model. Group overview Group Chief Executive’s report

14 Prudential plc Annual Report 2014

Prudential plc Annual Report 2014 15 Section 2 Strategic report 16 Our world 18 Our strategy and operating principles 19 How our business works 20 Measuring our performance 22 Our businesses and their performance 22 Asia 27 United States 31 United Kingdom 35 Asset management 39 Chief Financial Officer’s report on our 2014 financial performance 51 Group Chief Risk Officer’s report on the risks facing our business and our capital strength 61 Corporate responsibility review Strategic report 2

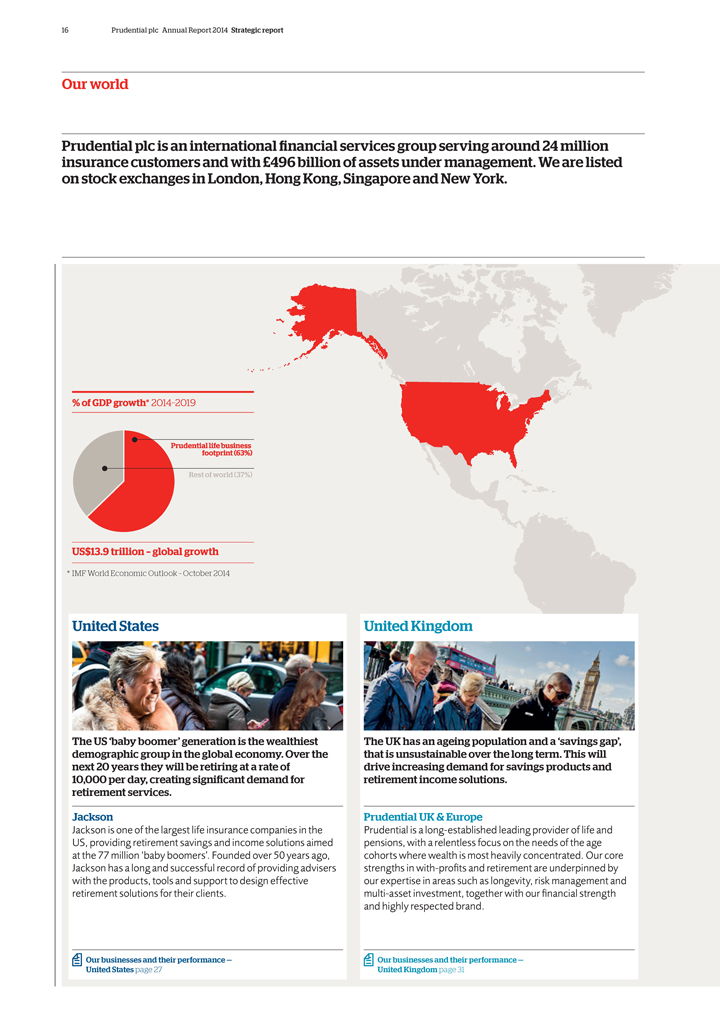

16 Prudential plc Annual Report 2014 Strategic report Our world Prudential plc is an international financial services group serving around 24 million insurance customers and with £496 billion of assets under management. We are listed on stock exchanges in London, Hong Kong, Singapore and New York. % of GDP growth* 2014_2019 Prudential footprint life business (63%) Rest of world (37%) US$13.9 trillion – global growth * IMF World Economic Outlook – October 2014 United States The US ‘baby boomer’ generation is the wealthiest demographic group in the global economy. Over the next 20 years they will be retiring at a rate of 10,000 per day, creating significant demand for retirement services. Jackson Jackson is one of the largest life insurance companies in the US, providing retirement savings and income solutions aimed at the 77 million ‘baby boomers’. Founded over 50 years ago, Jackson has a long and successful record of providing advisers with the products, tools and support to design effective retirement solutions for their clients. Our businesses and their performance — United States page 27 United Kingdom The UK has an ageing population and a ‘savings gap’, that is unsustainable over the long term. This will drive increasing demand for savings products and retirement income solutions. Prudential UK & Europe Prudential is a long-established leading provider of life and pensions, with a relentless focus on the needs of the age cohorts where wealth is most heavily concentrated. Our core strengths in with-profits and retirement are underpinned by our expertise in areas such as longevity, risk management and multi-asset investment, together with our financial strength and highly respected brand. Our businesses and their performance — United Kingdom page 31

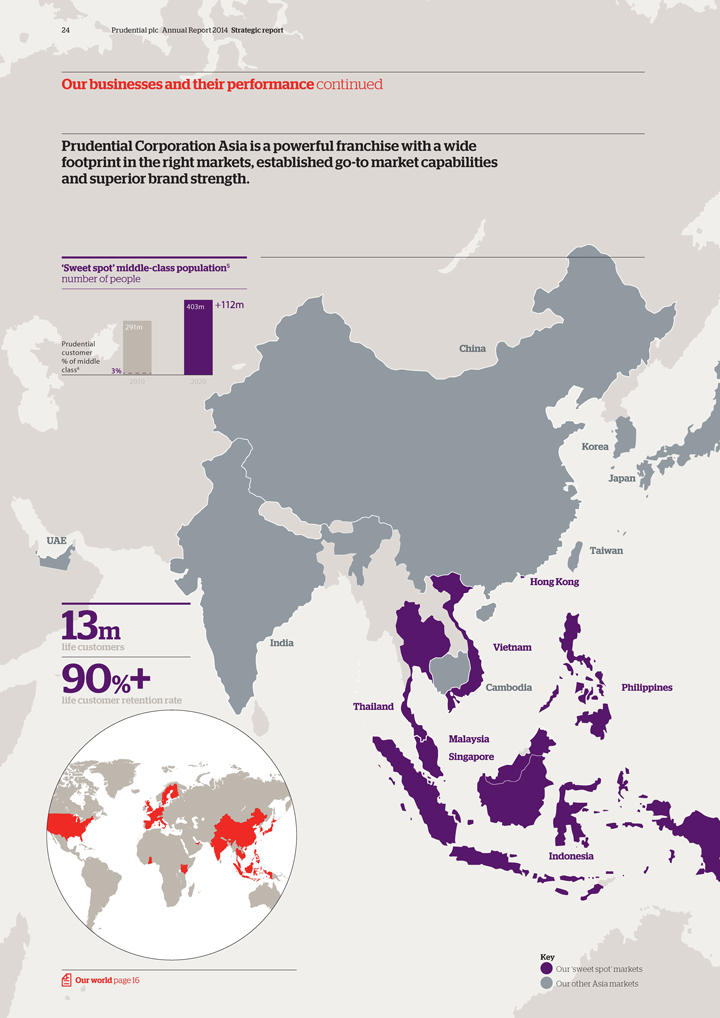

Prudential plc Annual Report 2014 17 24m life customers worldwide £496bn assets under management 4 stock exchange listings 166 years of providing financial security Asset management Europe is home to the second-largest retail asset management industry in the world, with over £6.2 trillion of assets. Asset managers with trusted brands and superior investment performance will see increasing demand for their products. M&G M&G has been investing money for individual and institutional clients for over 80 years. M&G has grown to be one of Europe’s largest retail and institutional fund managers by developing its enduring expertise in active investment. M&G has a conviction-led and long-term approach to investment, developing a deep understanding of the companies and organisations in whose equities, bonds or property M&G invests. Our businesses and their performance — Asset management page 35 Asia The Asian middle class population is forecast to double between 2009 and 2020 and will by then represent over half of the global middle class. This group is getting wealthier and will have significant and growing needs for protection against illness and accident. Prudential Corporation Asia Prudential is a leading international life insurer in Asia with operations in 14 markets and serving the emerging middle class families of the region’s outperforming economies. We have built a high-performing business with effective multichannel distribution, a product portfolio centred on regular savings and protection, award-winning customer services and a well-respected brand. Our businesses and their performance — Asia page 22 Strategic report Our world

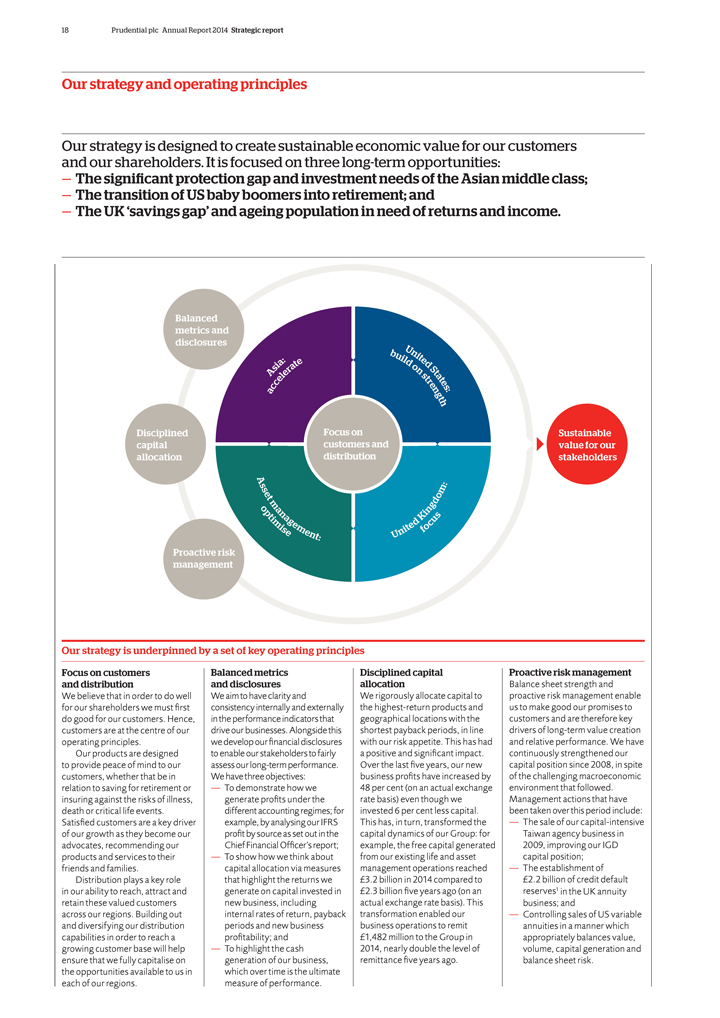

18 Prudential plc Annual Report 2014 Strategic report Our strategy and operating principles Our strategy is designed to create sustainable economic value for our customers and our shareholders. It is focused on three long-term opportunities: — The significant protection gap and investment needs of the Asian middle class; — The transition of US baby boomers into retirement; and — The UK ‘savings gap’ and ageing population in need of returns and income. Balanced metrics and disclosures Disciplined capital allocation Proactive risk management Focus on customers and distribution Asia: accelerate United States: build on strength United Kingdom: focus Asset Management: optimise Sustainable value for our stakeholders Our strategy is underpinned by a set of key operating principles Focus on customers and distribution We believe that in order to do well for our shareholders we must first do good for our customers. Hence, customers are at the centre of our operating principles. Our products are designed to provide peace of mind to our customers, whether that be in relation to saving for retirement or insuring against the risks of illness, death or critical life events. Satisfied customers are a key driver of our growth as they become our advocates, recommending our products and services to their friends and families. Distribution plays a key role in our ability to reach, attract and retain these valued customers across our regions. Building out and diversifying our distribution capabilities in order to reach a growing customer base will help ensure that we fully capitalise on the opportunities available to us in each of our regions. Balanced metrics and disclosures We aim to have clarity and consistency internally and externally in the performance indicators that drive our businesses. Alongside this we develop our financial disclosures to enable our stakeholders to fairly assess our long-term performance. We have three objectives: — To demonstrate how we generate profits under the different accounting regimes; for example, by analysing our IFRS profit by source as set out in the Chief Financial Officer’s report; — To show how we think about capital allocation via measures that highlight the returns we generate on capital invested in new business, including internal rates of return, payback periods and new business profitability; and — To highlight the cash generation of our business, which over time is the ultimate measure of performance. Disciplined capital allocation We rigorously allocate capital to the highest-return products and geographical locations with the shortest payback periods, in line with our risk appetite. This has had a positive and significant impact. Over the last five years, our new business profits have increased by 48 per cent (on an actual exchange rate basis) even though we invested 6 per cent less capital. This has, in turn, transformed the capital dynamics of our Group: for example, the free capital generated from our existing life and asset management operations reached £3.2 billion in 2014 compared to £2.3 billion five years ago (on an actual exchange rate basis). This transformation enabled our business operations to remit £1,482 million to the Group in 2014, nearly double the level of remittance five years ago. Proactive risk management Balance sheet strength and proactive risk management enable us to make good our promises to customers and are therefore key drivers of long-term value creation and relative performance. We have continuously strengthened our capital position since 2008, in spite of the challenging macroeconomic environment that followed. Management actions that have been taken over this period include: — The sale of our capital-intensive Taiwan agency business in 2009, improving our IGD capital position; — The establishment of £2.2 billion of credit default reserves1 in the UK annuity business; and — Controlling sales of US variable annuities in a manner which appropriately balances value, volume, capital generation and balance sheet risk.

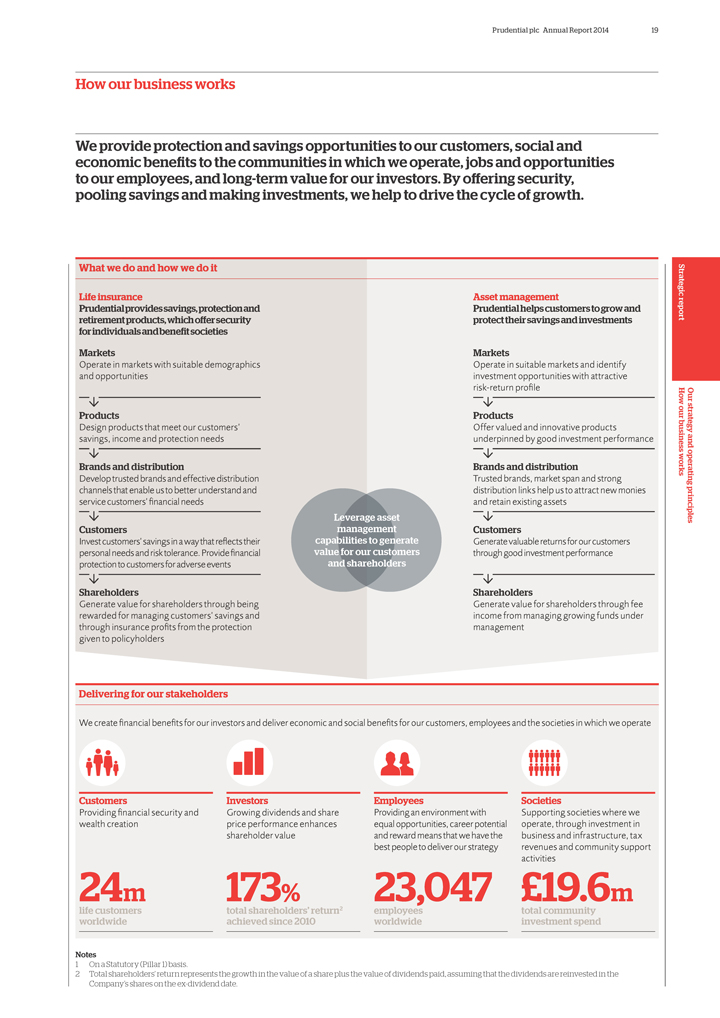

Prudential plc Annual Report 2014 19 How our business works We provide protection and savings opportunities to our customers, social and economic benefits to the communities in which we operate, jobs and opportunities to our employees, and long-term value for our investors. By offering security, pooling savings and making investments, we help to drive the cycle of growth. What we do and how we do it Life insurance Prudential provides savings, protection and retirement products, which offer security for individuals and benefit societies Markets Operate in markets with suitable demographics and opportunities Products Design products that meet our customers’ savings, income and protection needs Brands and distribution Develop trusted brands and effective distribution channels that enable us to better understand and service customers’ financial needs Customers Invest customers’ savings in a way that reflects their personal needs and risk tolerance. Provide financial protection to customers for adverse events Shareholders Generate value for shareholders through being rewarded for managing customers’ savings and through insurance profits from the protection given to policyholders Leverage asset management capabilities to generate value for our customers and shareholders Asset management Prudential helps customers to grow and protect their savings and investments Markets Operate in suitable markets and identify investment opportunities with attractive risk-return profile Products Offer valued and innovative products underpinned by good investment performance Brands and distribution Trusted brands, market span and strong distribution links help us to attract new monies and retain existing assets Customers Generate valuable returns for our customers through good investment performance Shareholders Generate value for shareholders through fee income from managing growing funds under management Delivering for our stakeholders We create financial benefits for our investors and deliver economic and social benefits for our customers, employees and the societies in which we operate Customers Providing financial security and wealth creation 24m life customers worldwide Investors Growing dividends and share price performance enhances shareholder value 173% total shareholders’ return2 achieved since 2010 Employees Providing an environment with equal opportunities, career potential and reward means that we have the best people to deliver our strategy 23,047 employees worldwide Societies Supporting societies where we operate, through investment in business and infrastructure, tax revenues and community support activities £19.6m total community investment spend Notes 1 On a Statutory (Pillar 1) basis. 2 Total shareholders’ return represents the growth in the value of a share plus the value of dividends paid, assuming that the dividends are reinvested in the Company’s shares on the ex-dividend date. Strategic report Our strategy and operating principles How our business works

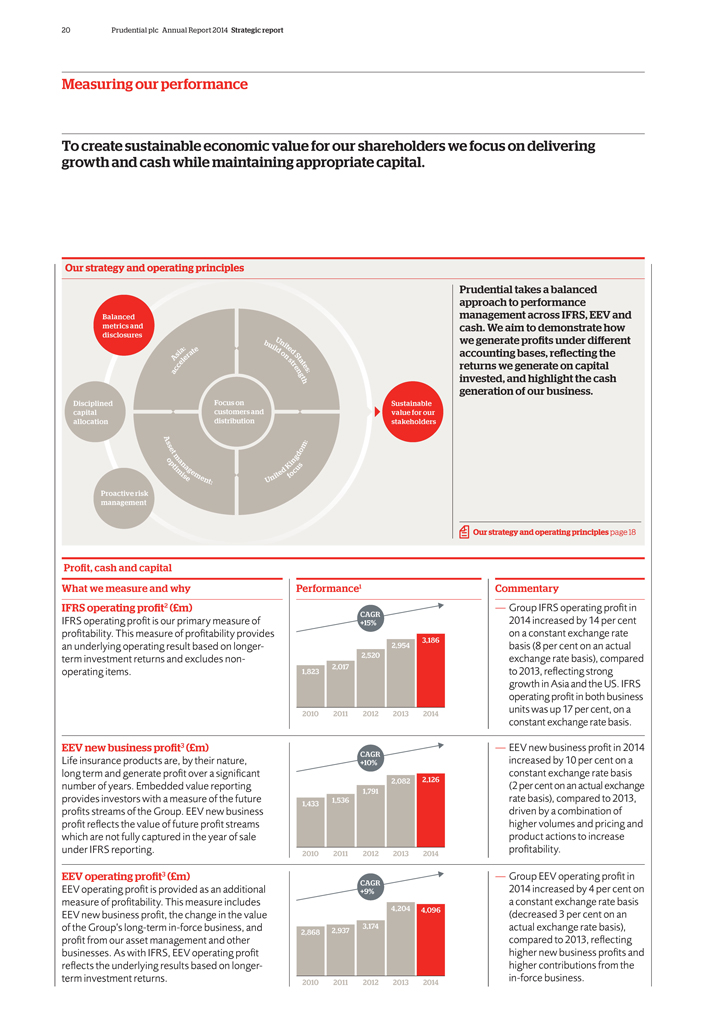

20 Prudential plc Annual Report 2014 Strategic report Measuring our performance To create sustainable economic value for our shareholders we focus on delivering growth and cash while maintaining appropriate capital. Our strategy and operating principles Balanced metrics and disclosures Disciplined capital allocation Proactive risk management Focus on customers and distribution Asia: accelerate United States: build on strength United Kingdom: focus Asset Management: optimize Sustainable value for our stakeholders Prudential takes a balanced approach to performance management across IFRS, EEV and cash. We aim to demonstrate how we generate profits under different accounting bases, reflecting the returns we generate on capital invested, and highlight the cash generation of our business. Our strategy and operating principles page 18 Profit, cash and capital What we measure and why IFRS operating profit2 (£m) IFRS operating profit is our primary measure of profitability. This measure of profitability provides an underlying operating result based on longer-term investment returns and excludes non-operating items. EEV new business profit3 (£m) Life insurance products are, by their nature, long term and generate profit over a significant number of years. Embedded value reporting provides investors with a measure of the future profits streams of the Group. EEV new business profit reflects the value of future profit streams which are not fully captured in the year of sale under IFRS reporting. EEV operating profit3 (£m) EEV operating profit is provided as an additional measure of profitability. This measure includes EEV new business profit, the change in the value of the Group’s long-term in-force business, and profit from our asset management and other businesses. As with IFRS, EEV operating profit reflects the underlying results based on longer-term investment returns. Performance1 CAGR +15% 3,186 2,954 2,520 1,823 2,017 2010 2011 2012 2013 2014 CAGR +10% 1,433 1,536 1,791 2,082 2,126 2010 2011 2012 2013 2014 CAGR +9% 2,868 2,937 3,174 4,204 4,096 2010 2011 2012 2013 2014 Commentary — Group IFRS operating profit in 2014 increased by 14 per cent on a constant exchange rate basis (8 per cent on an actual exchange rate basis), compared to 2013, reflecting strong growth in Asia and the US. IFRS operating profit in both business units was up 17 per cent, on a constant exchange rate basis. — EEV new business profit in 2014 increased by 10 per cent on a constant exchange rate basis (2 per cent on an actual exchange rate basis), compared to 2013, driven by a combination of higher volumes and pricing and product actions to increase profitability. — Group EEV operating profit in 2014 increased by 4 per cent on a constant exchange rate basis (decreased 3 per cent on an actual exchange rate basis), compared to 2013, reflecting higher new business profits and higher contributions from the in-force business.

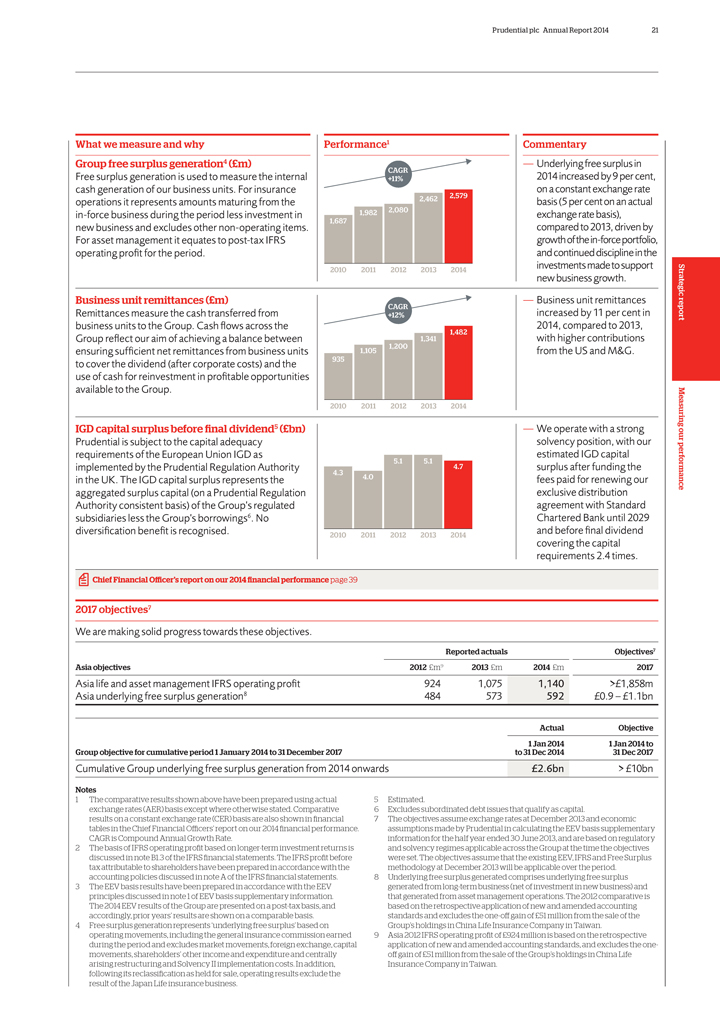

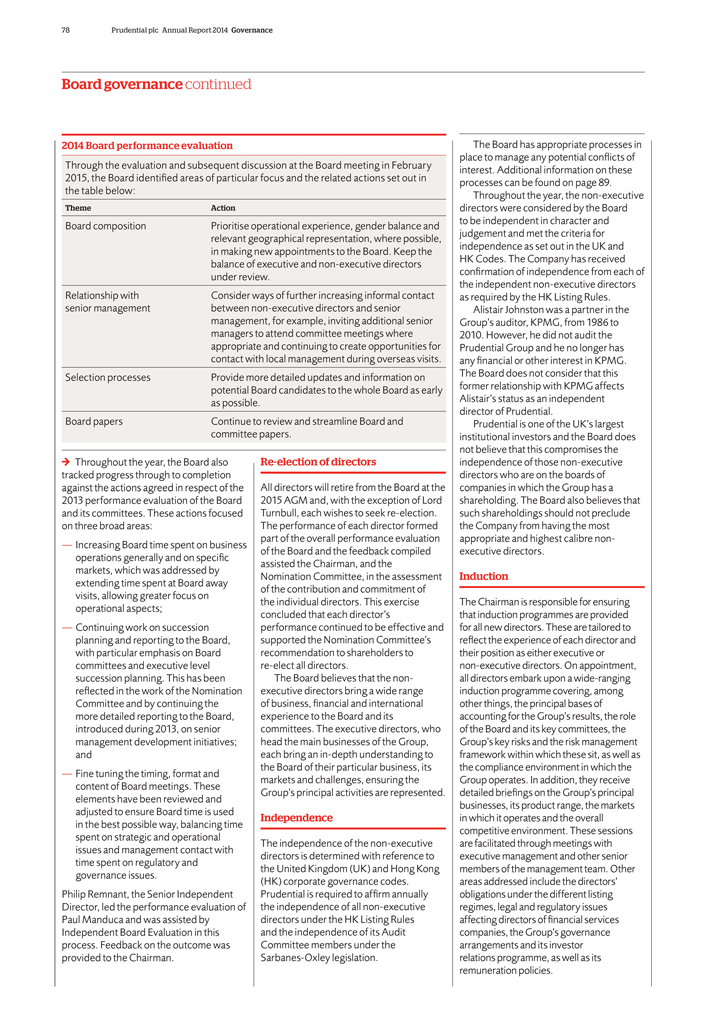

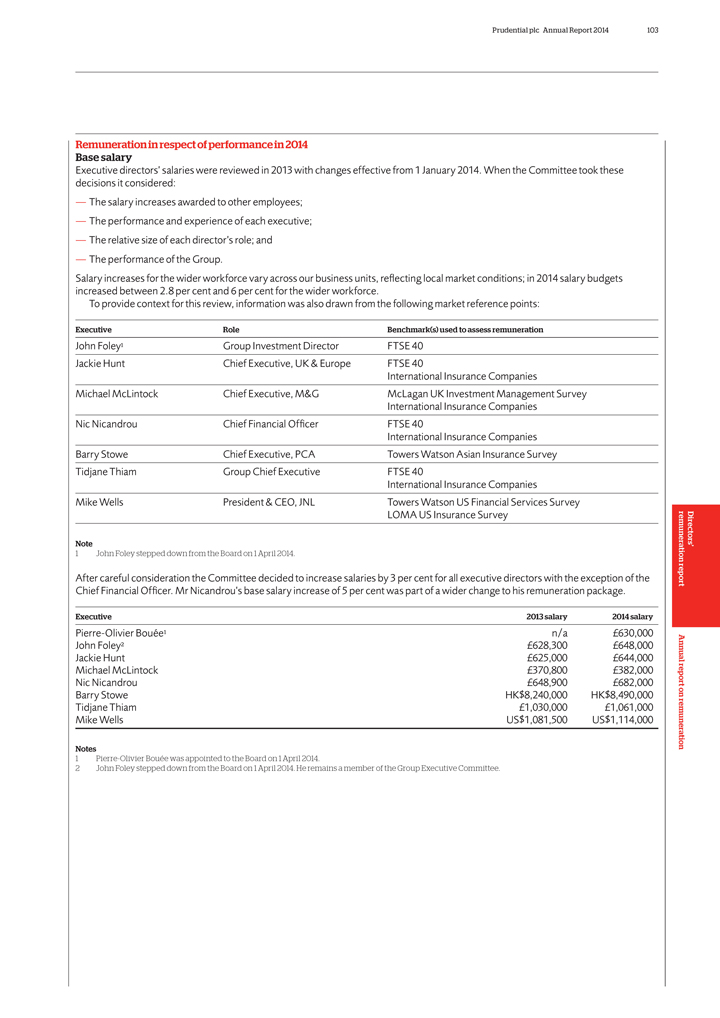

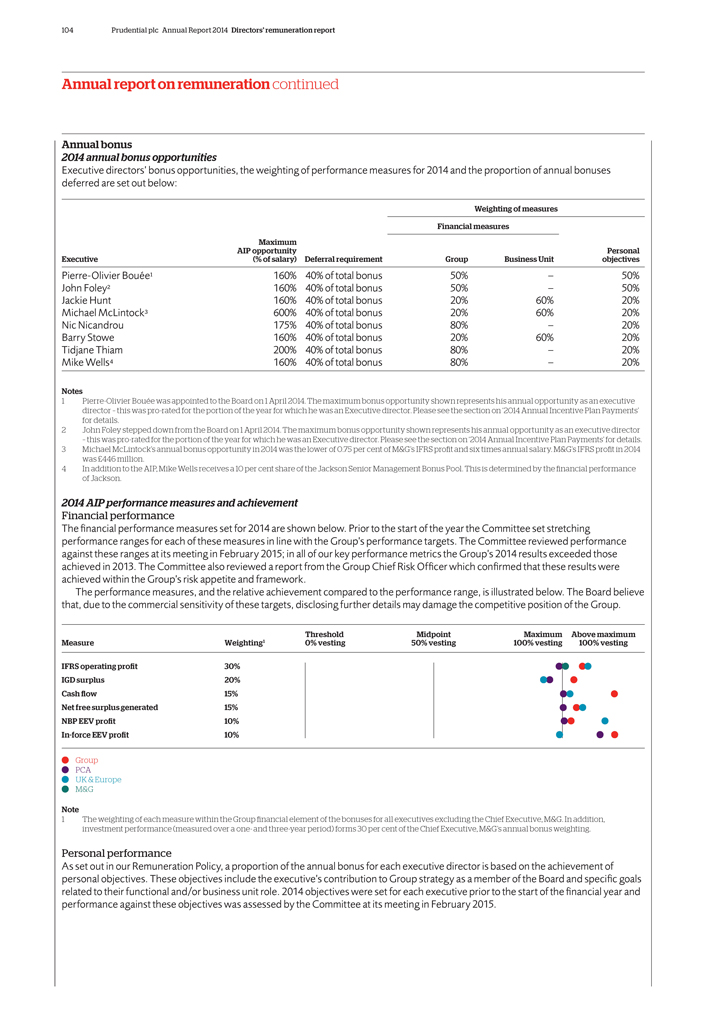

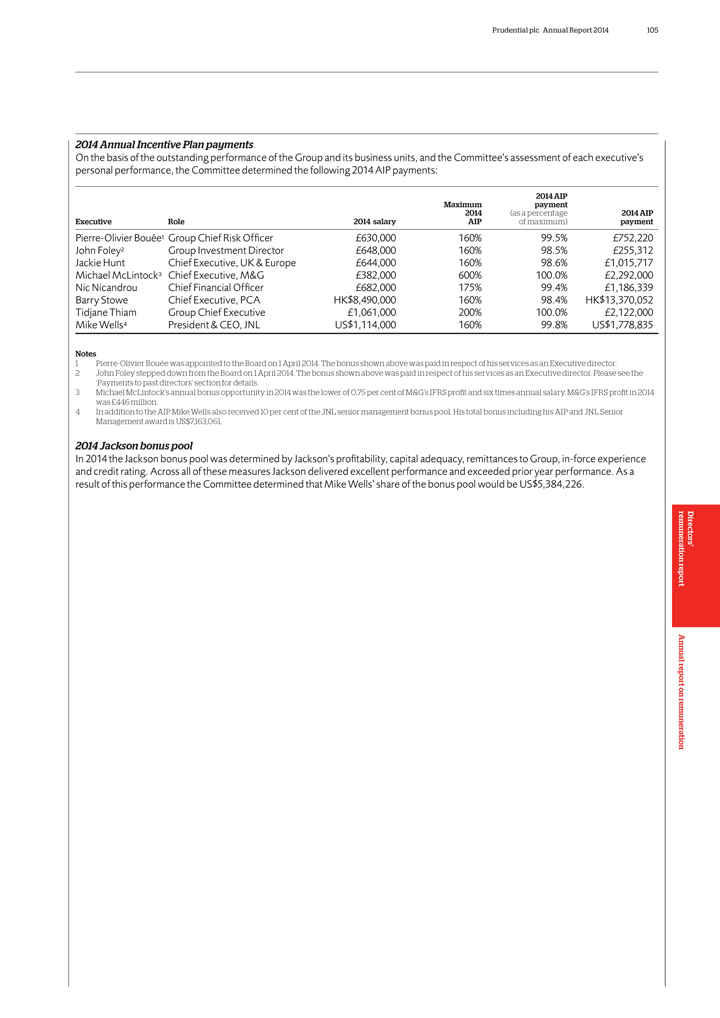

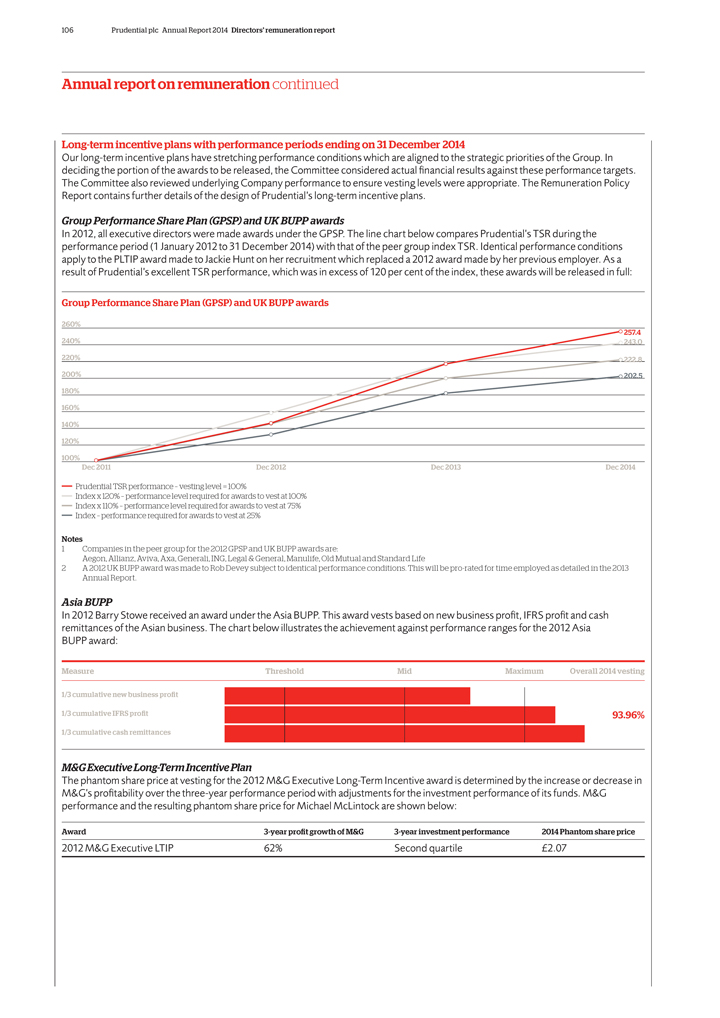

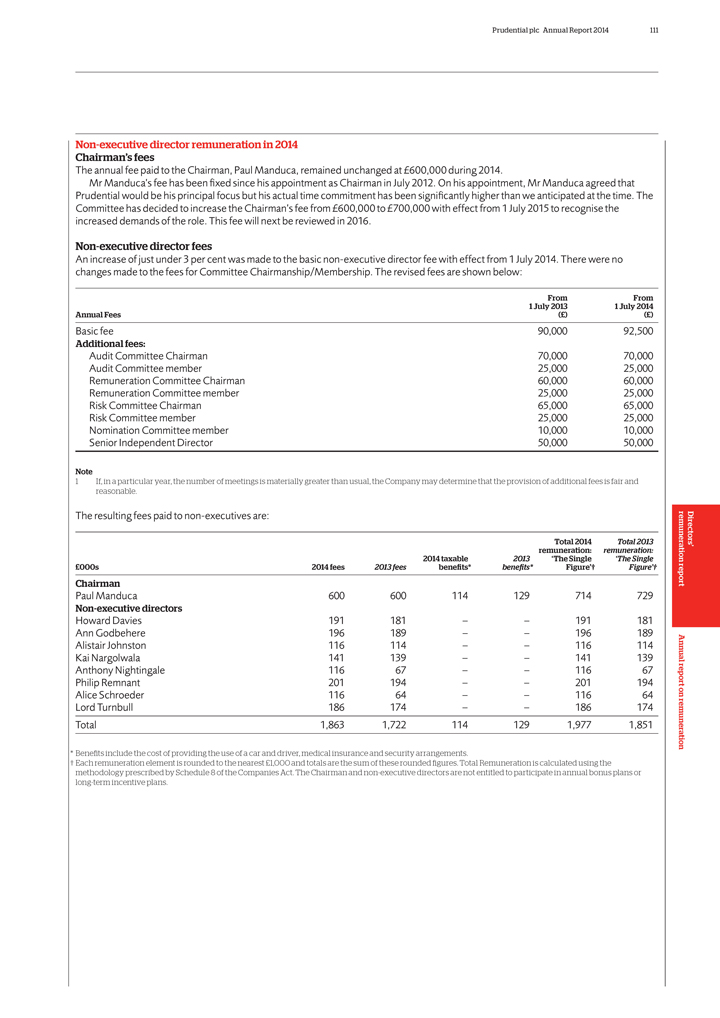

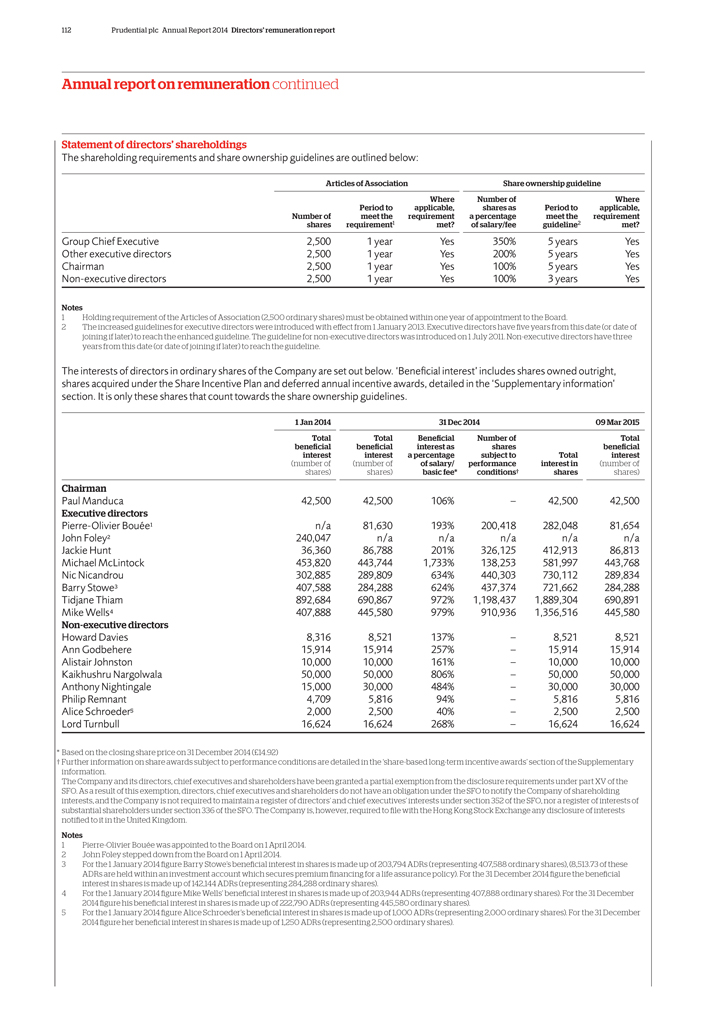

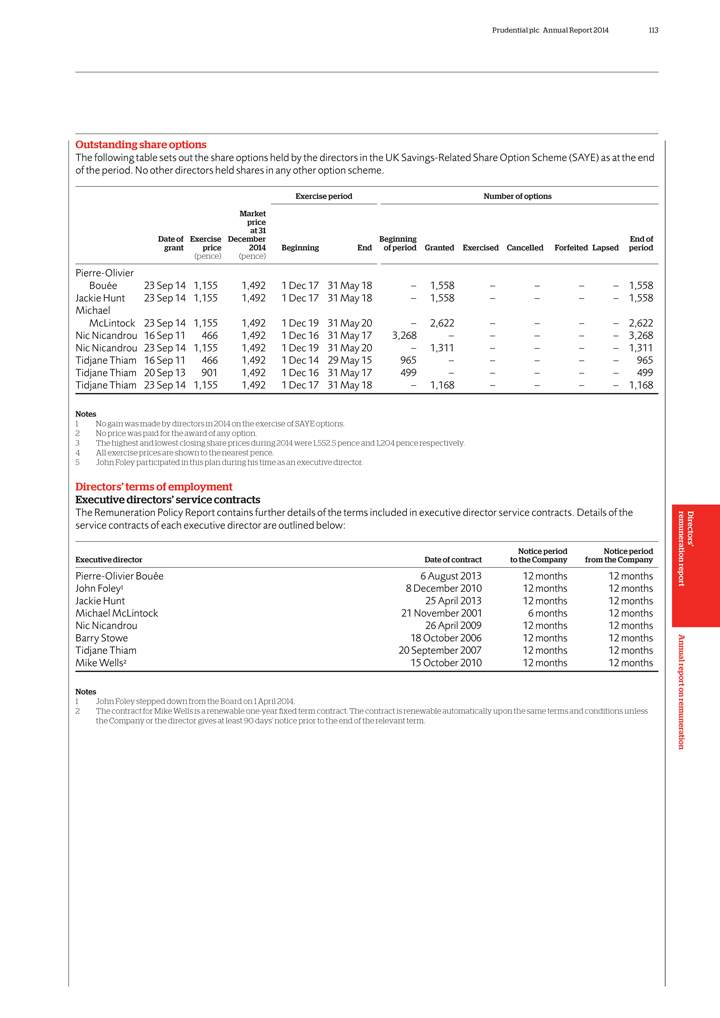

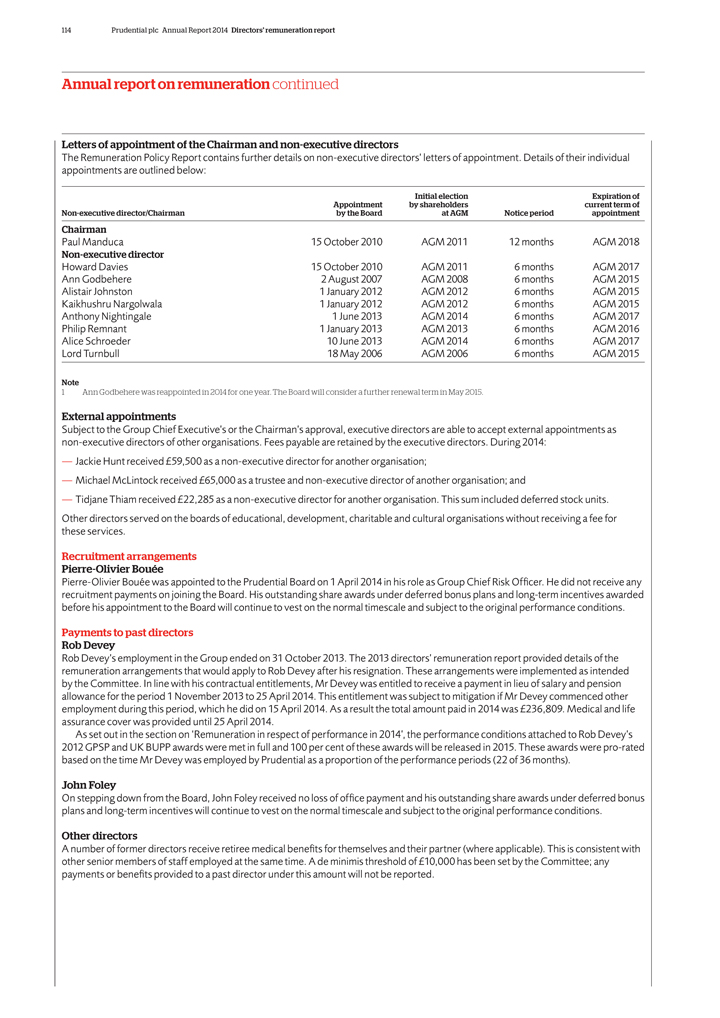

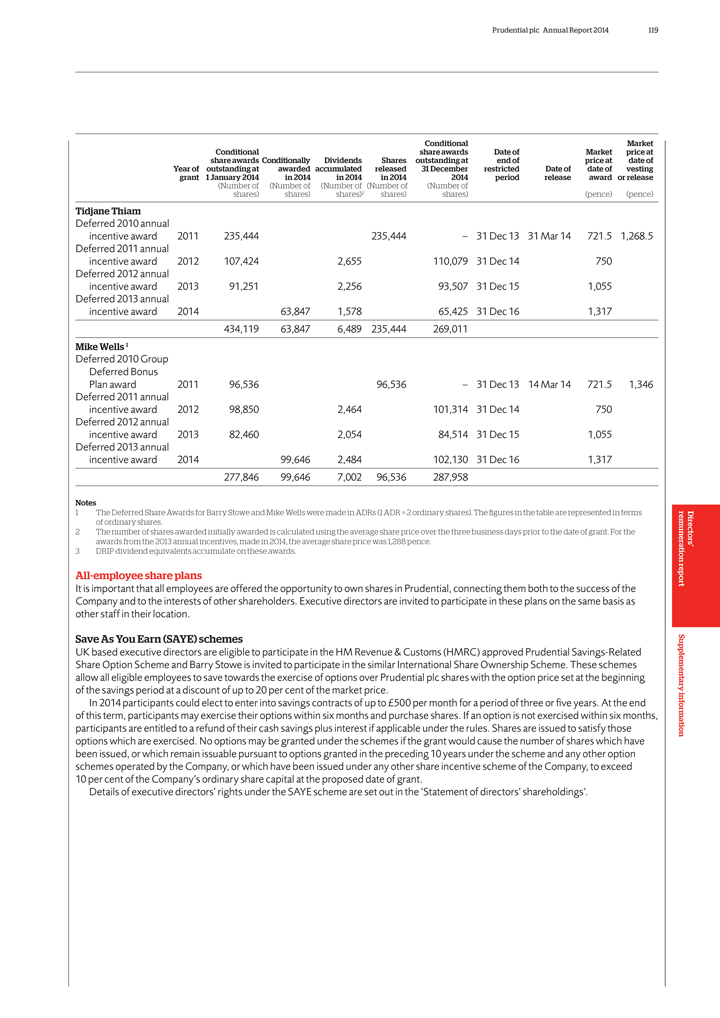

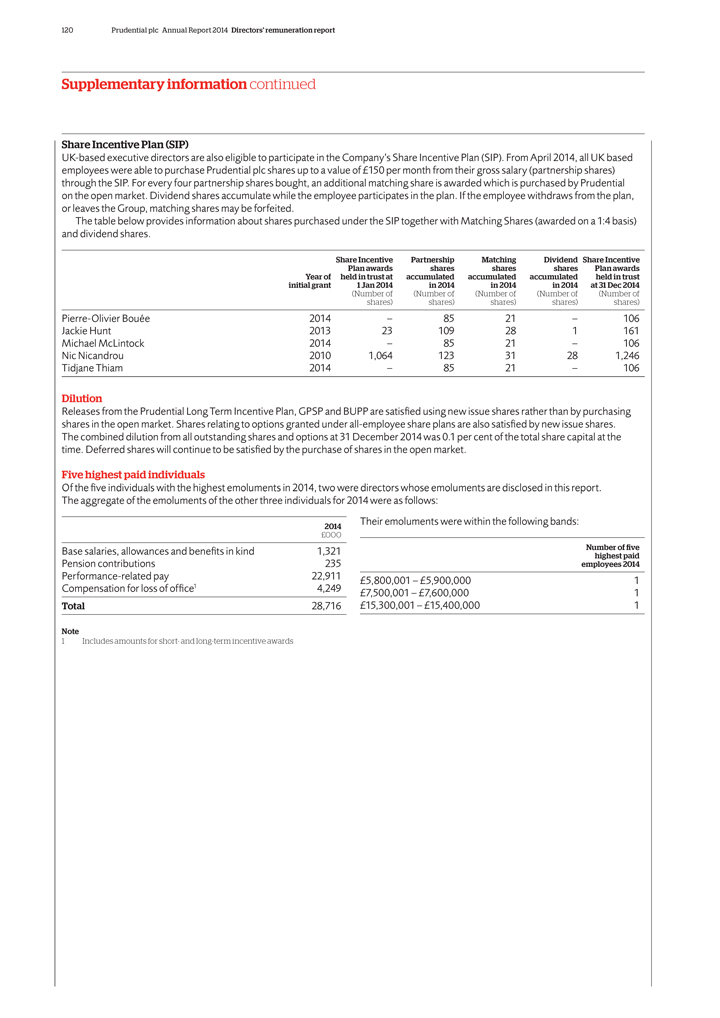

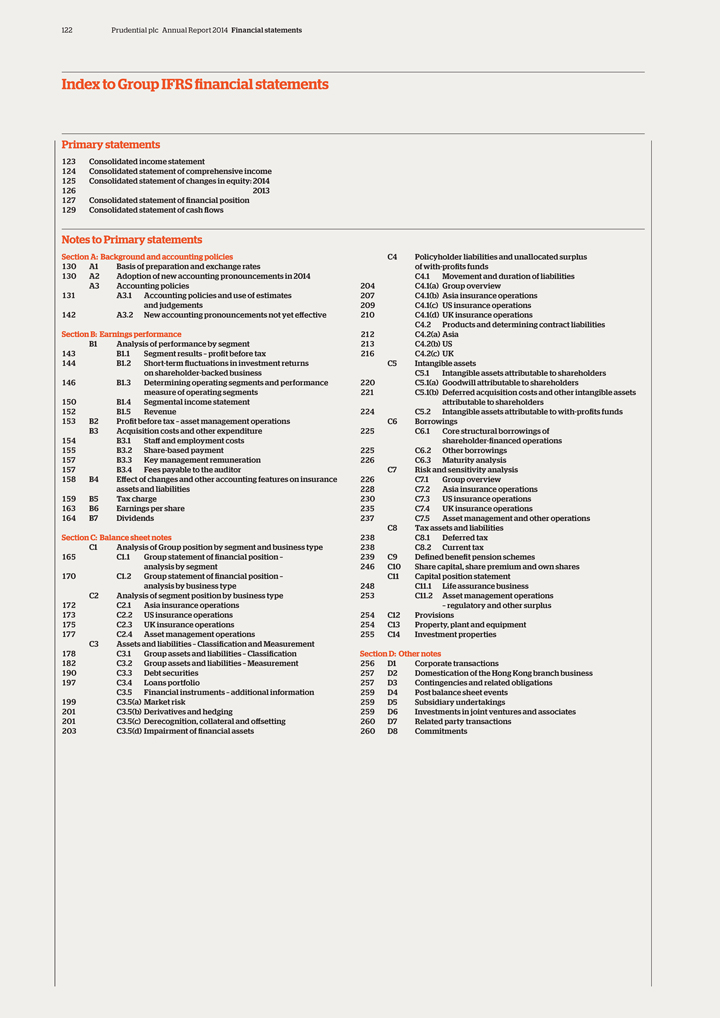

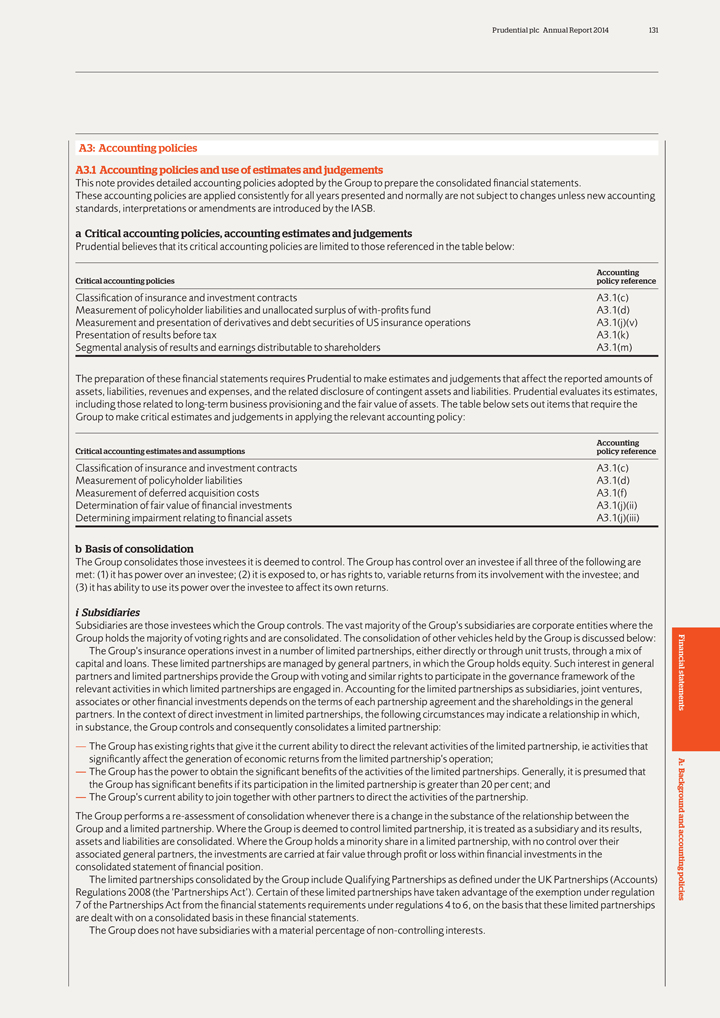

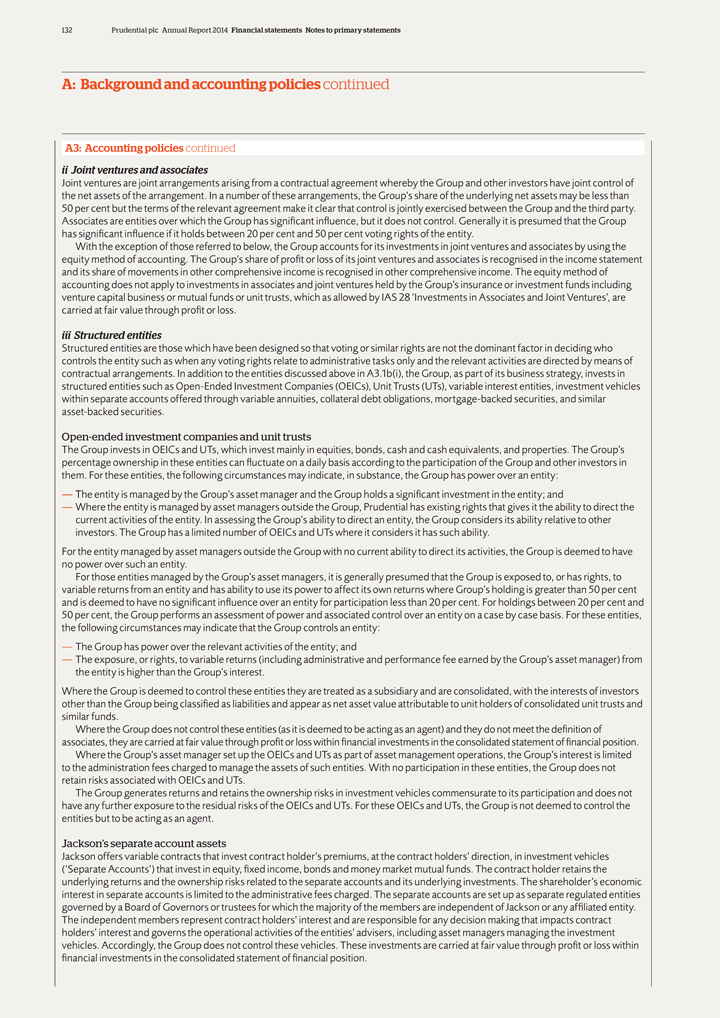

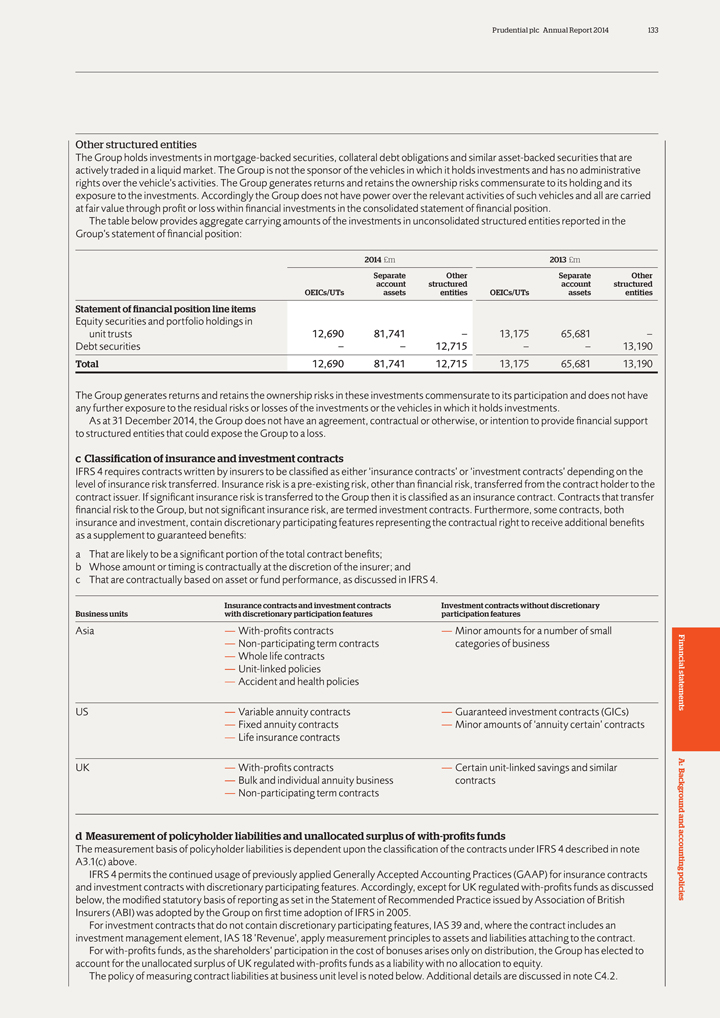

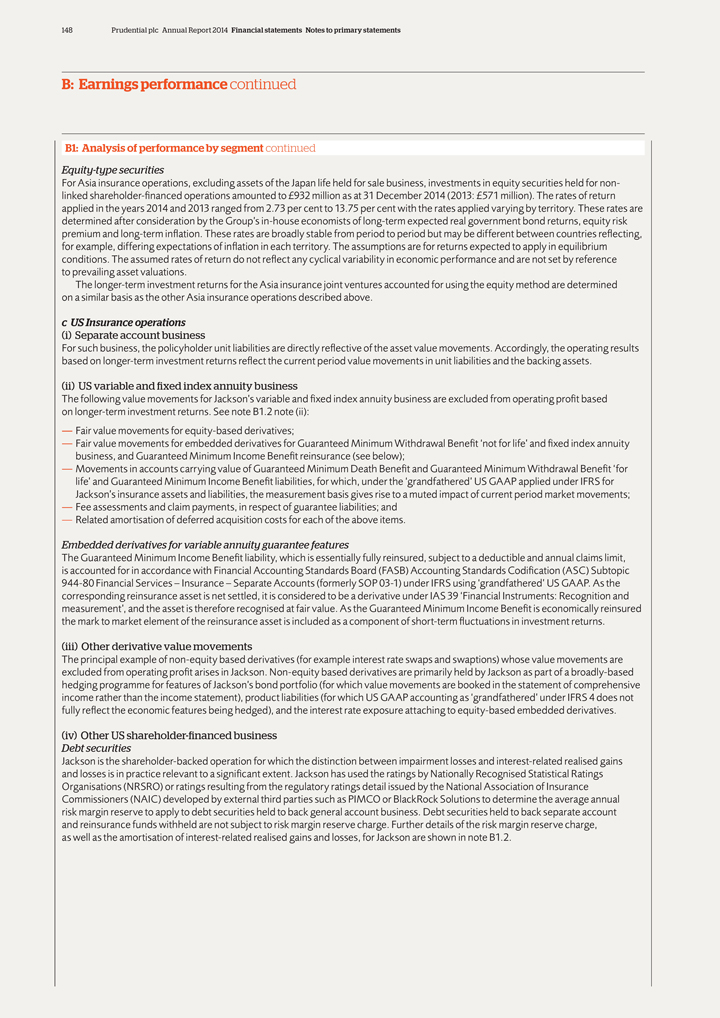

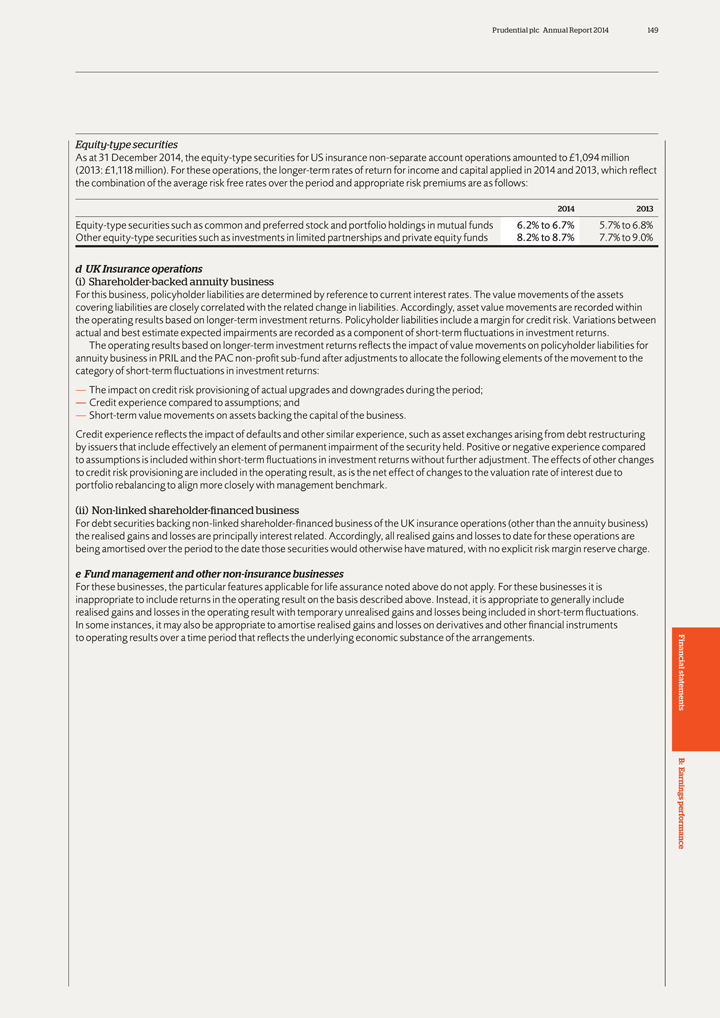

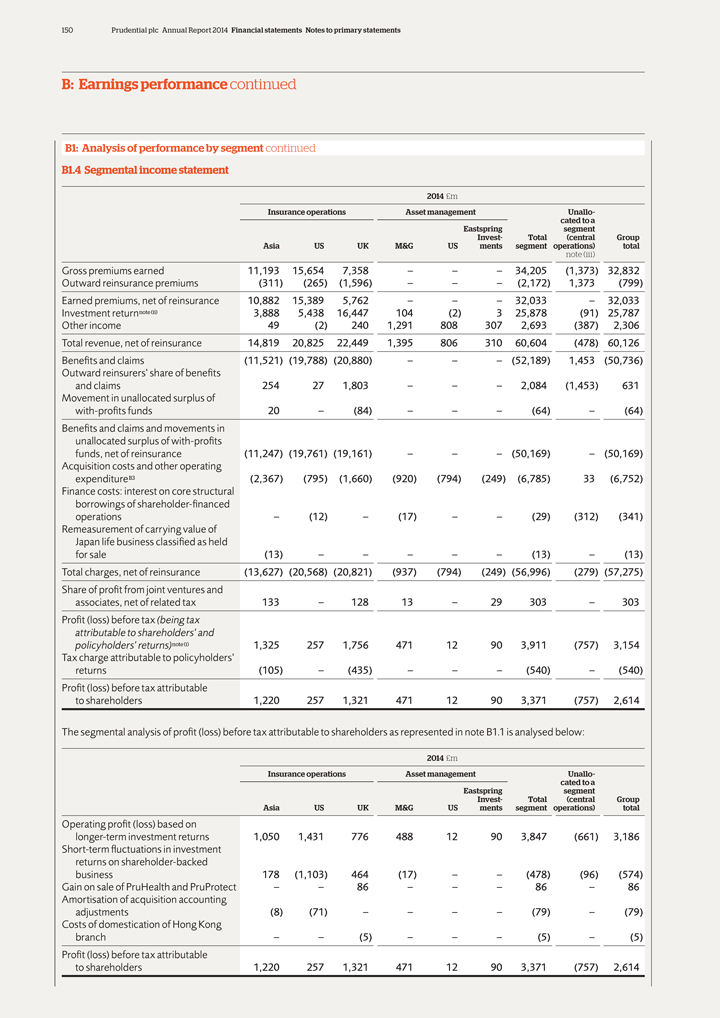

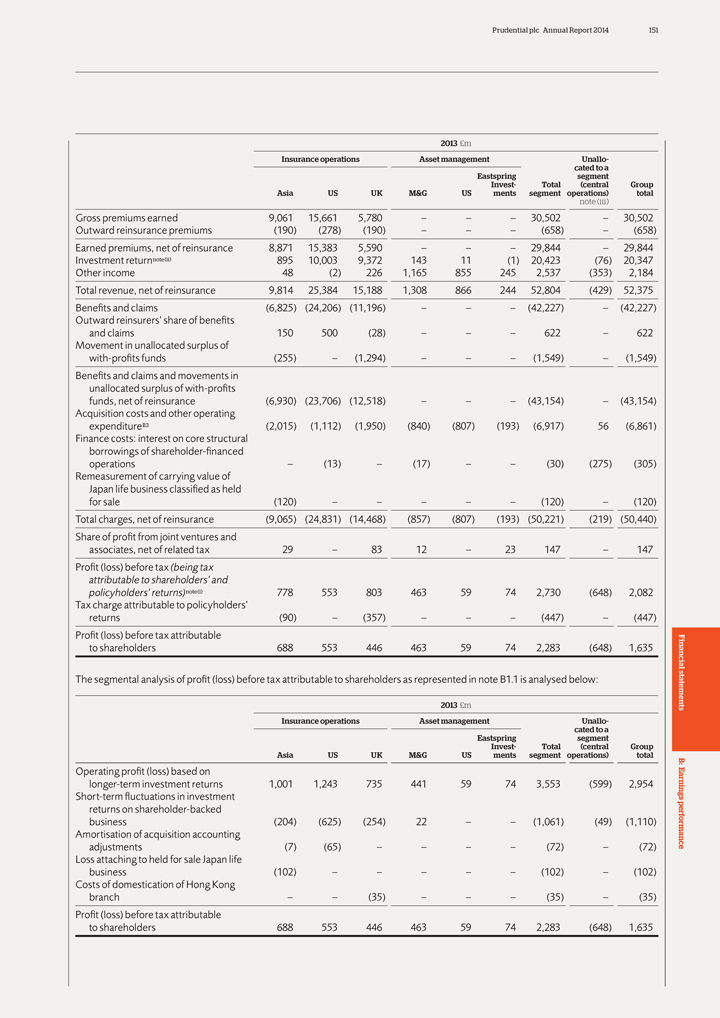

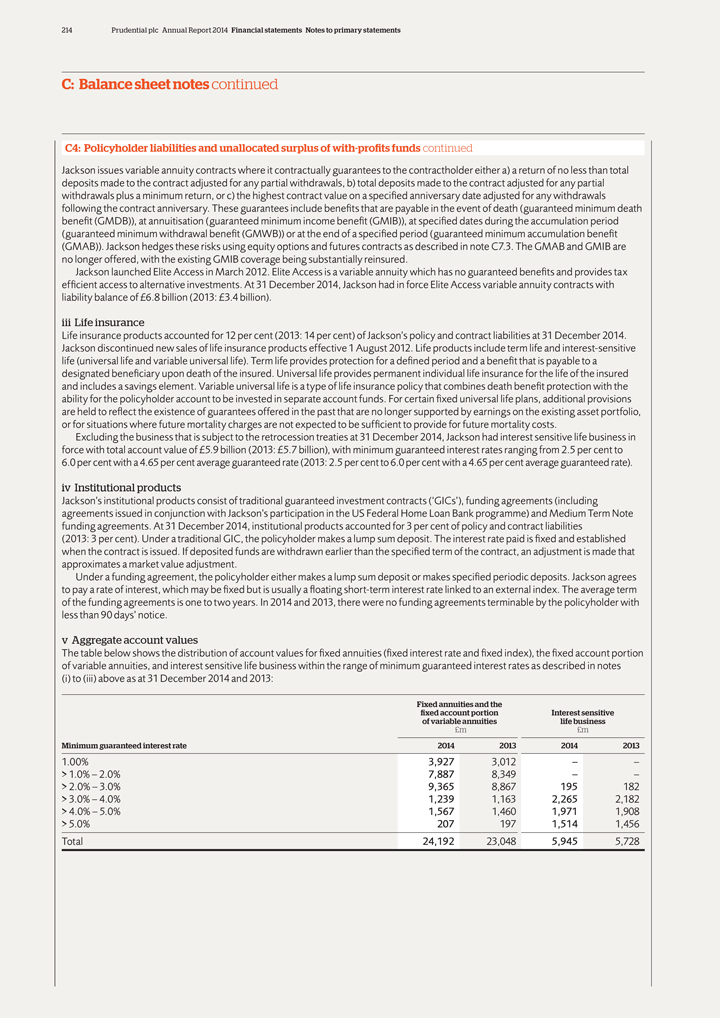

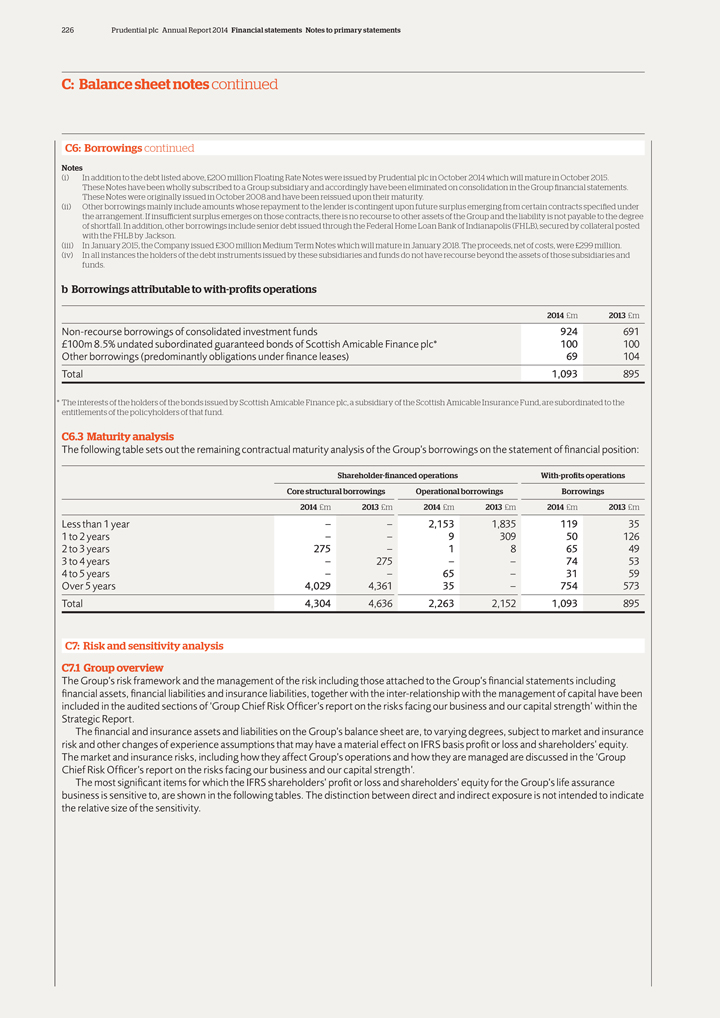

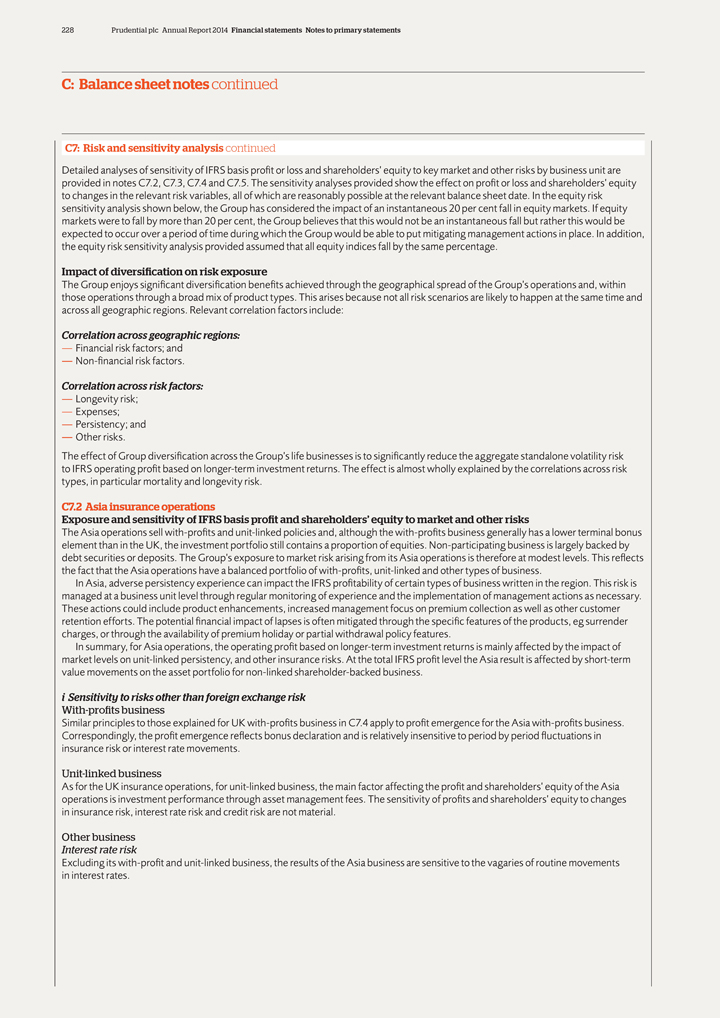

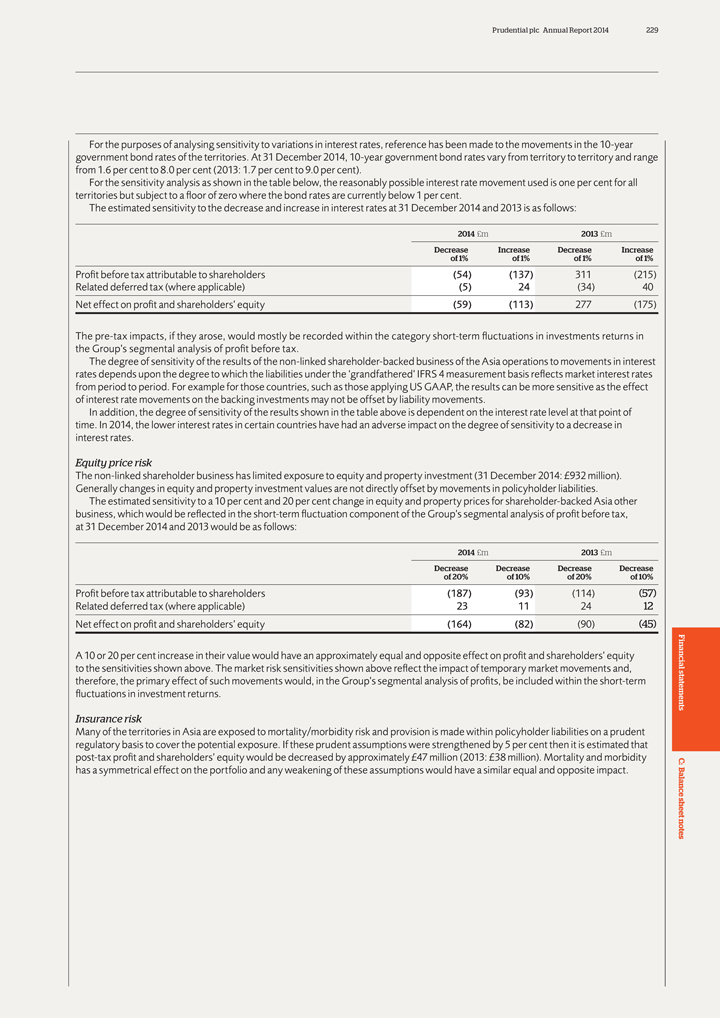

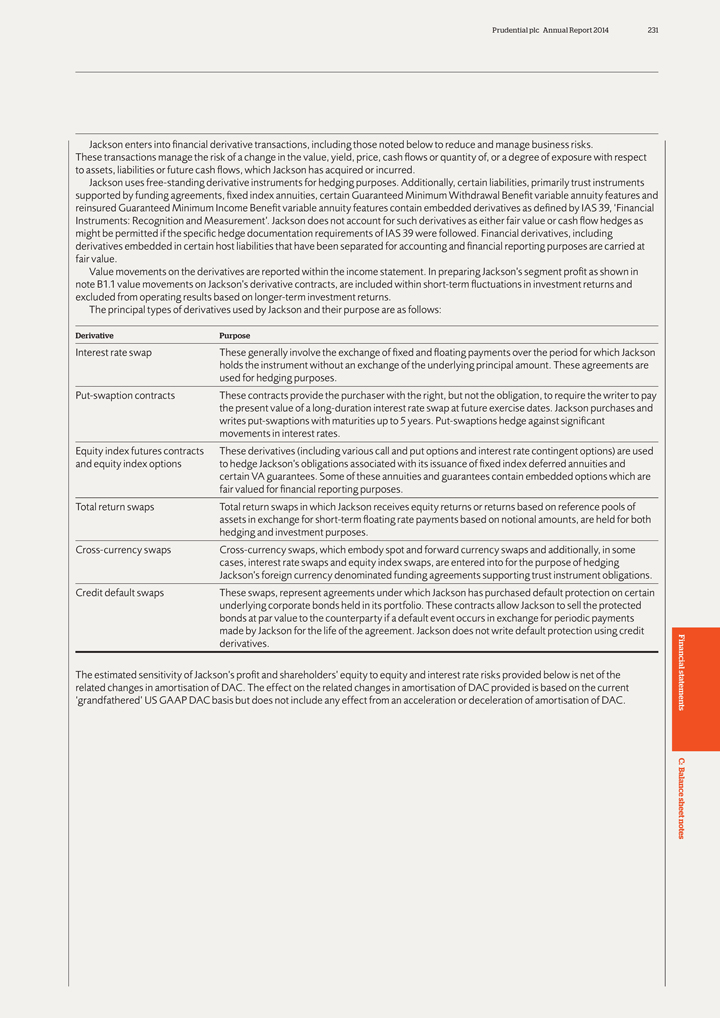

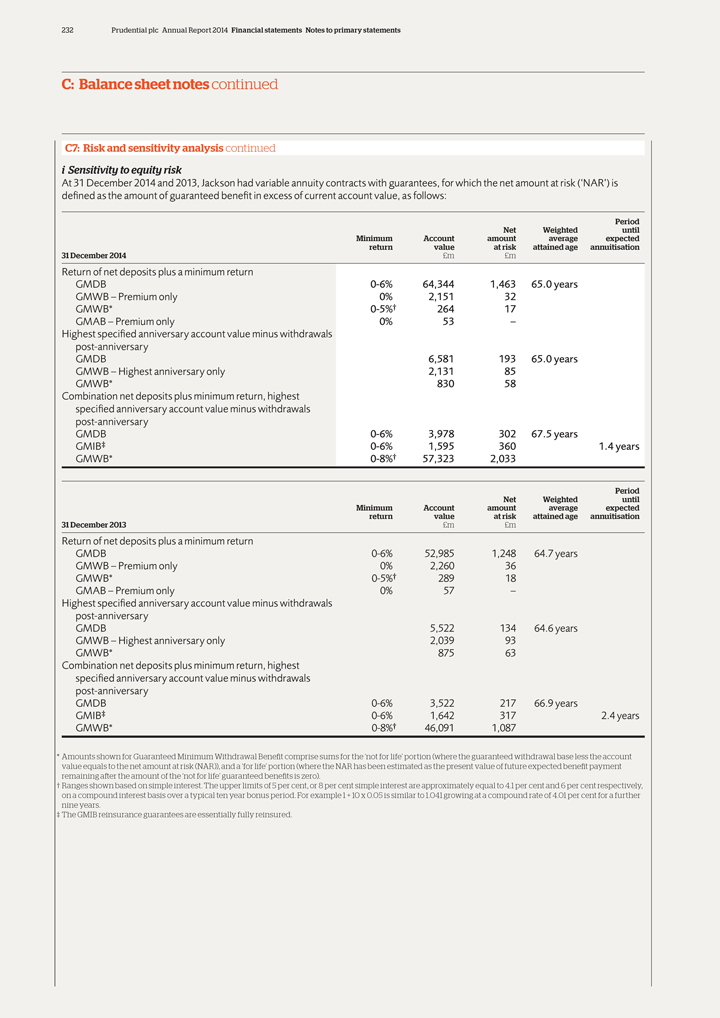

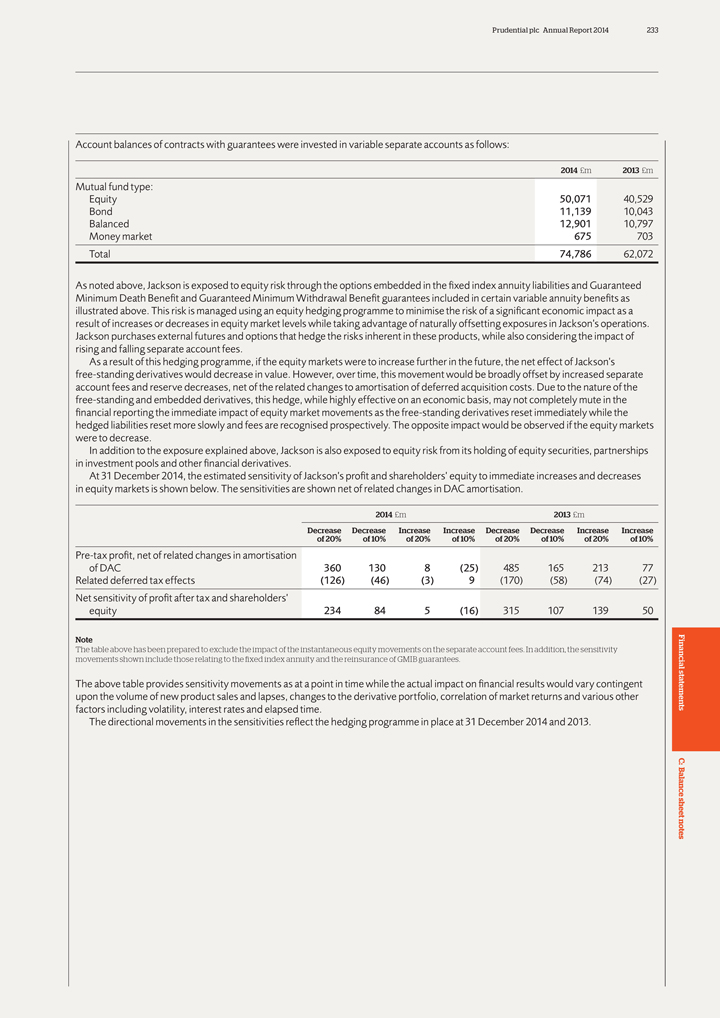

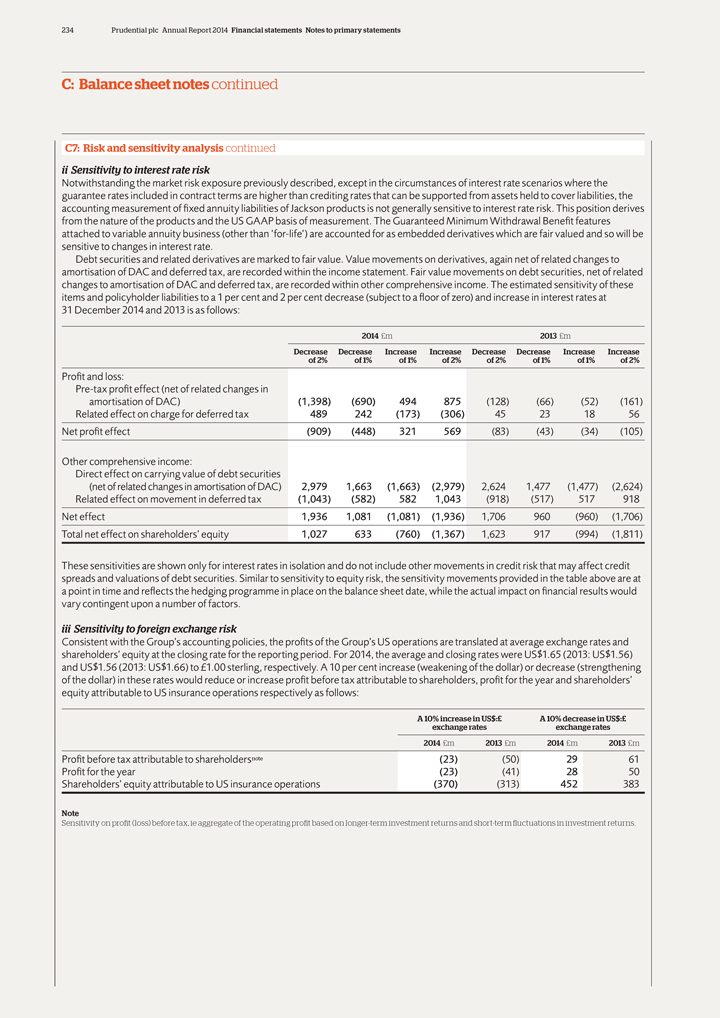

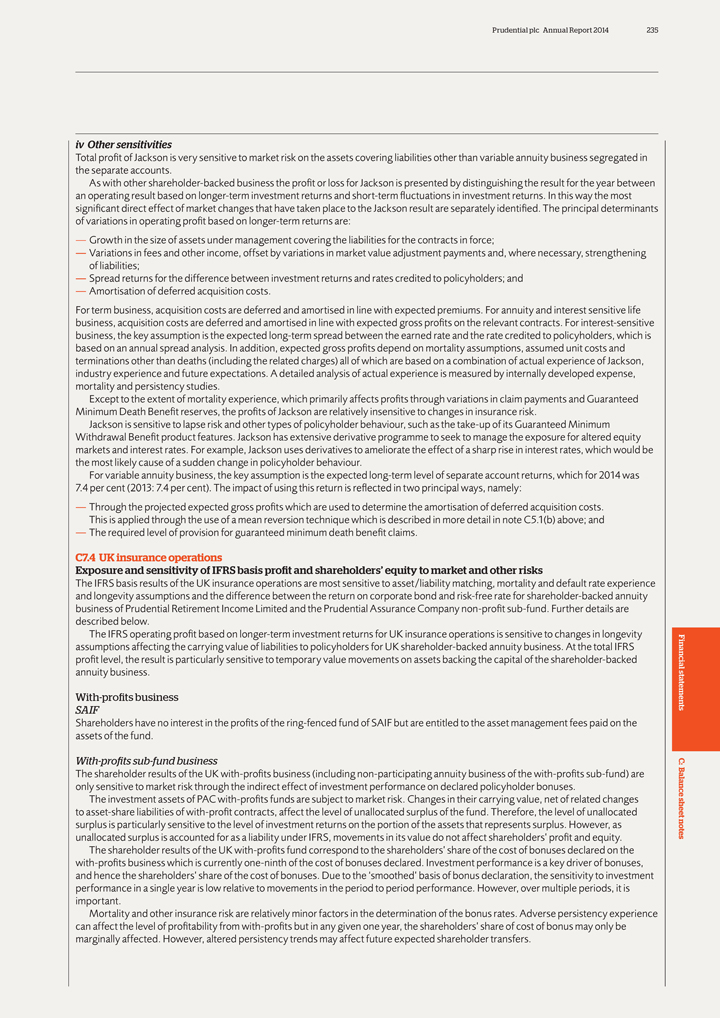

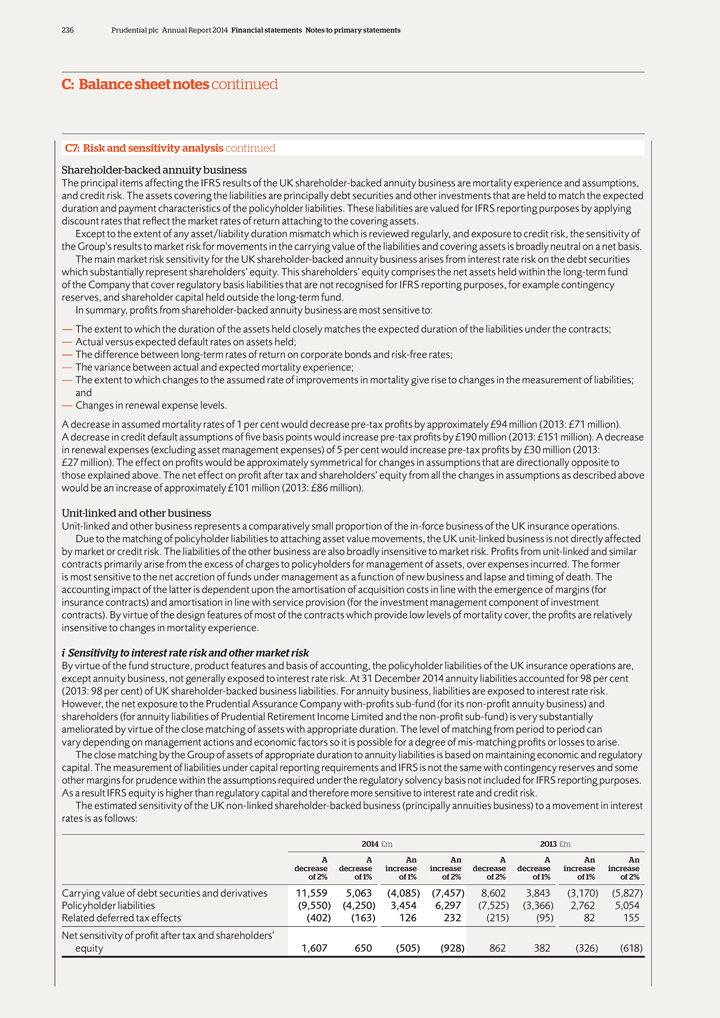

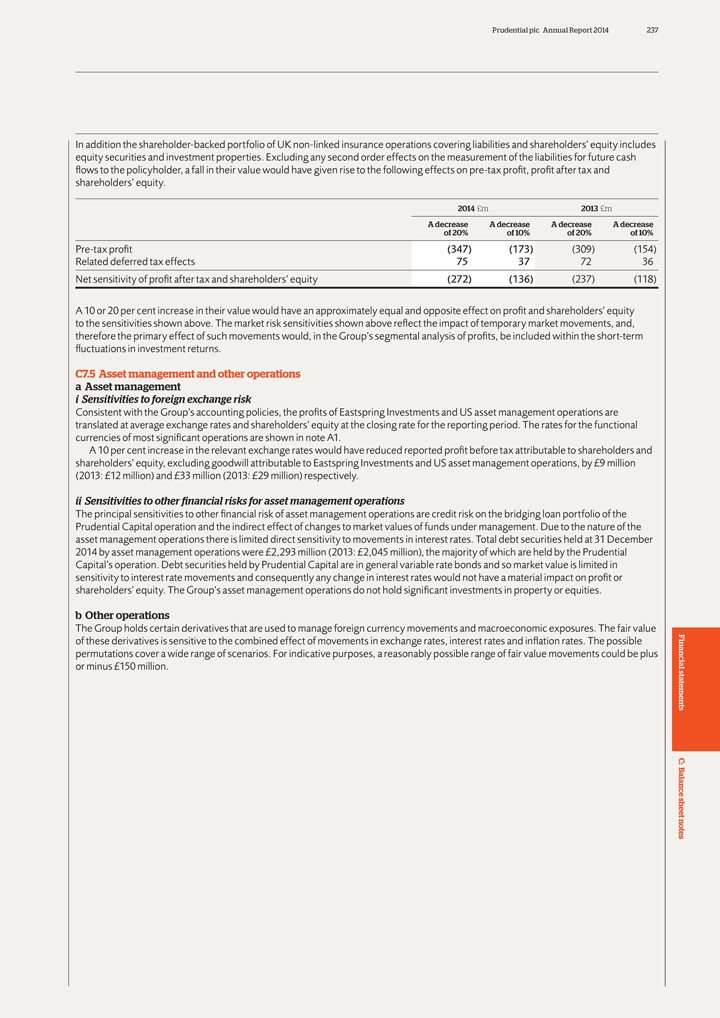

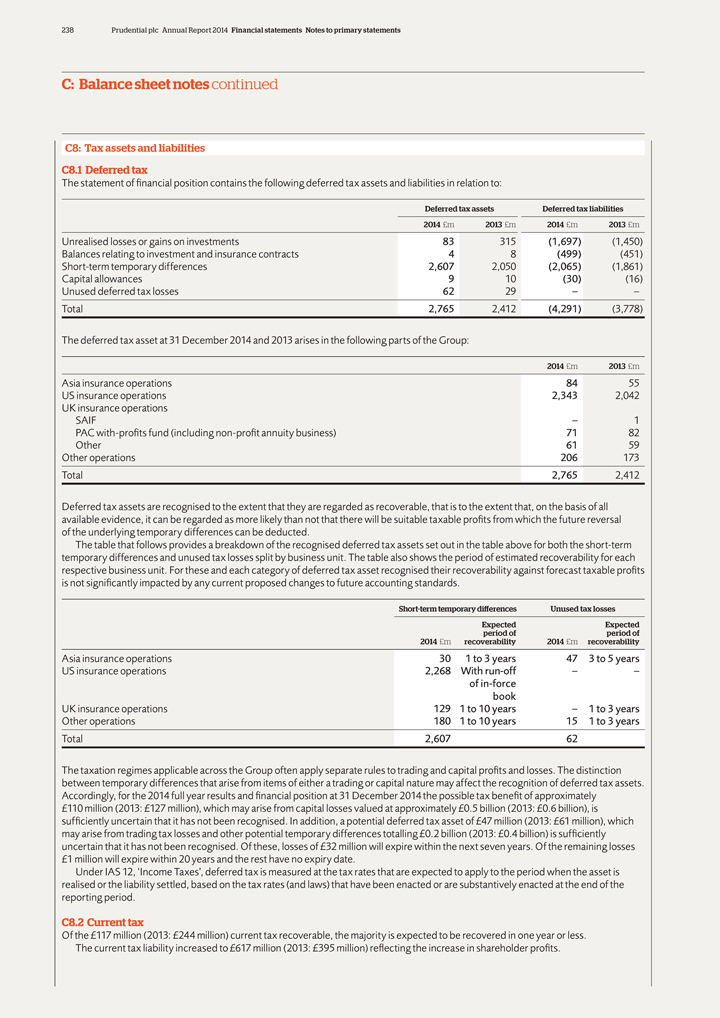

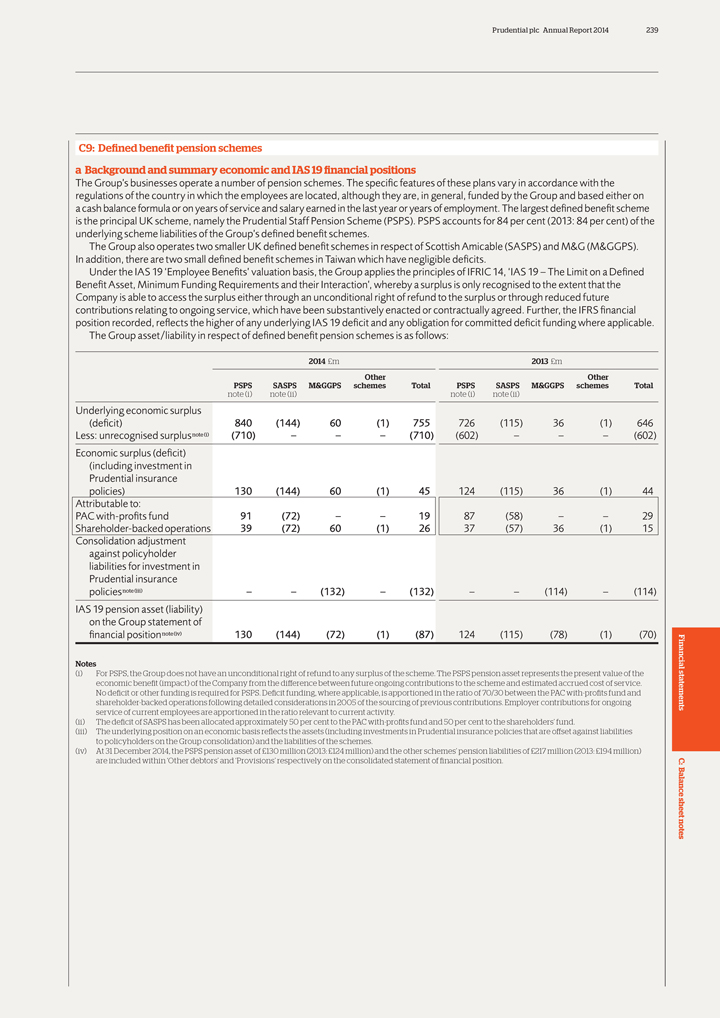

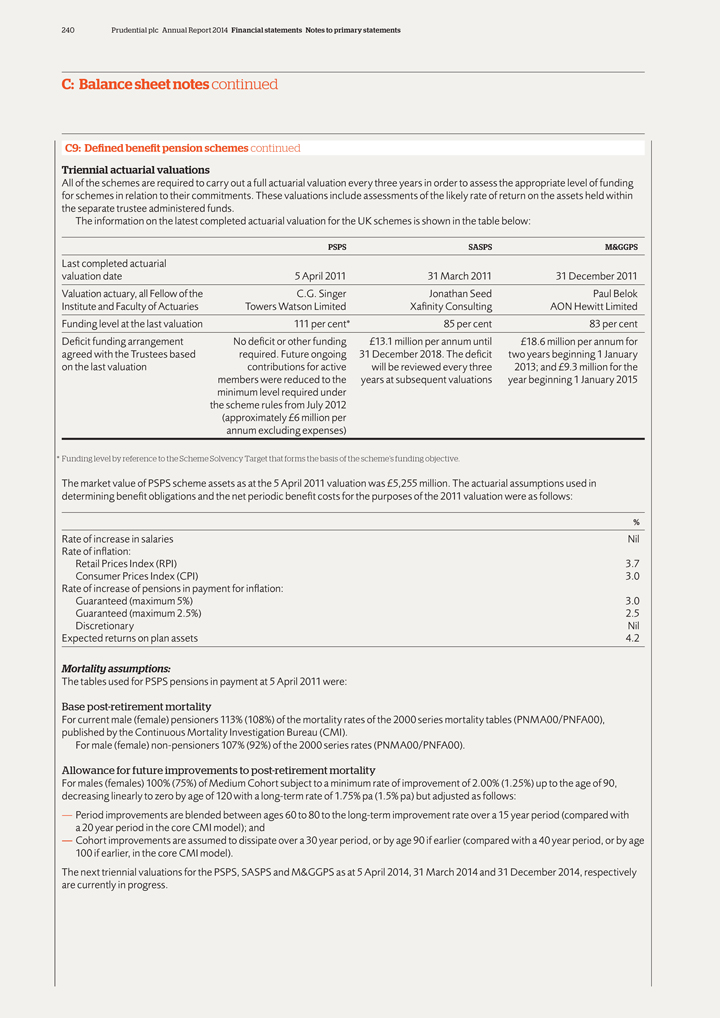

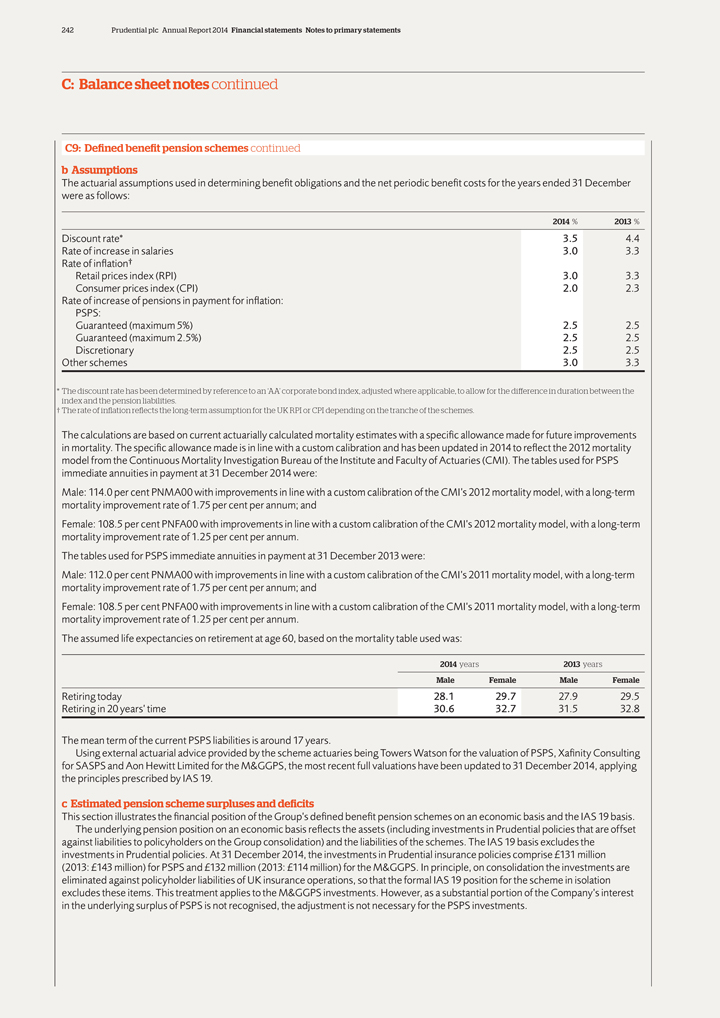

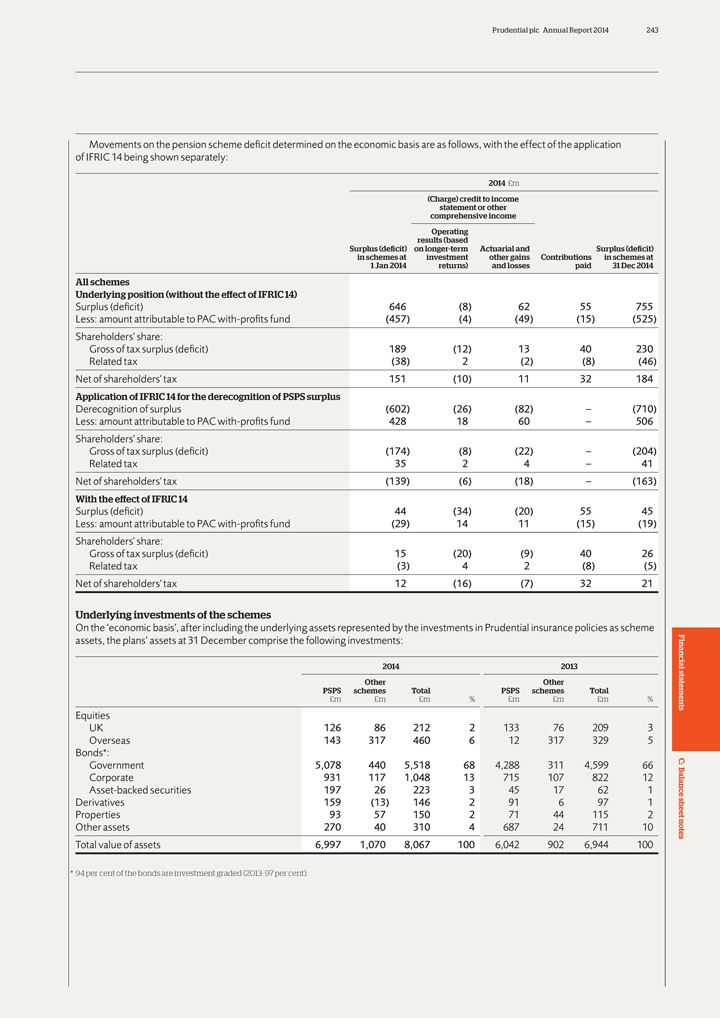

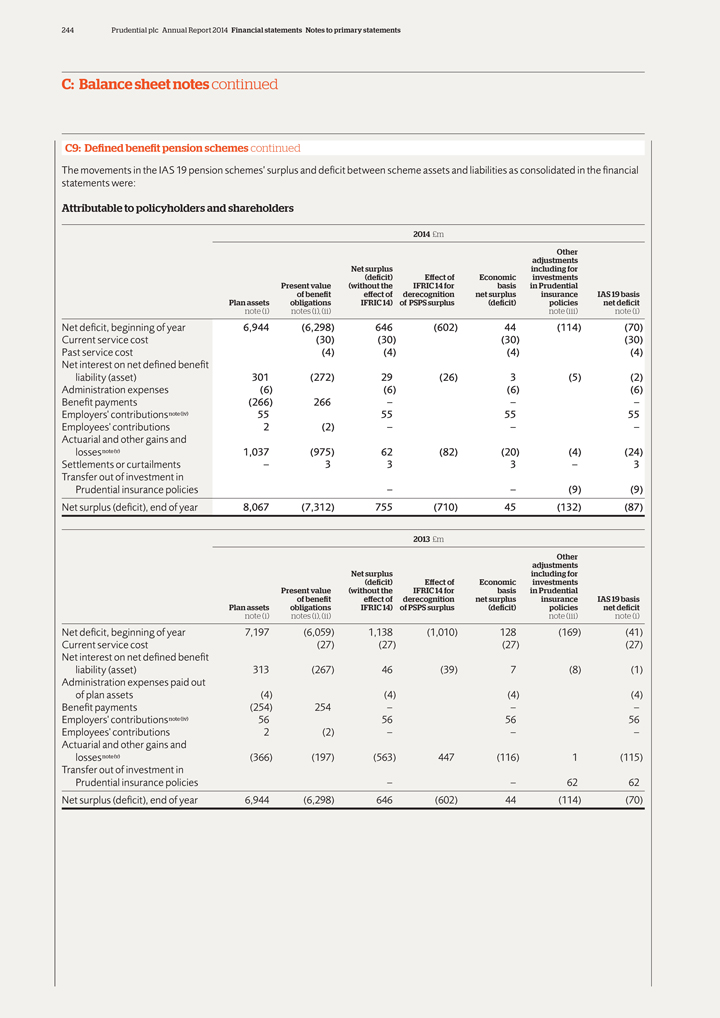

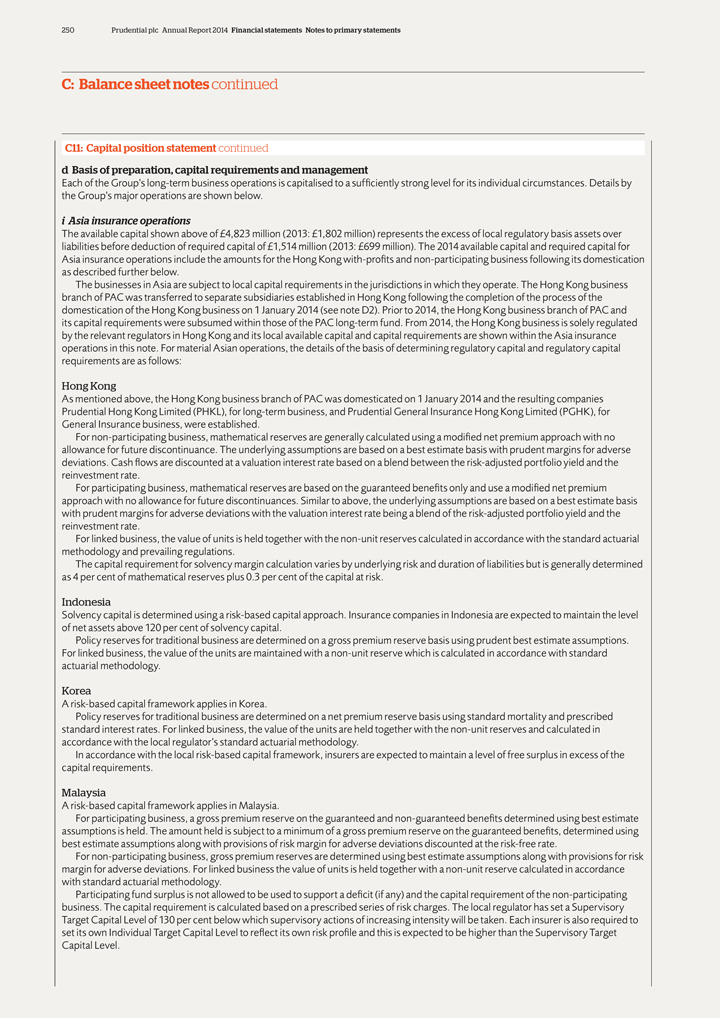

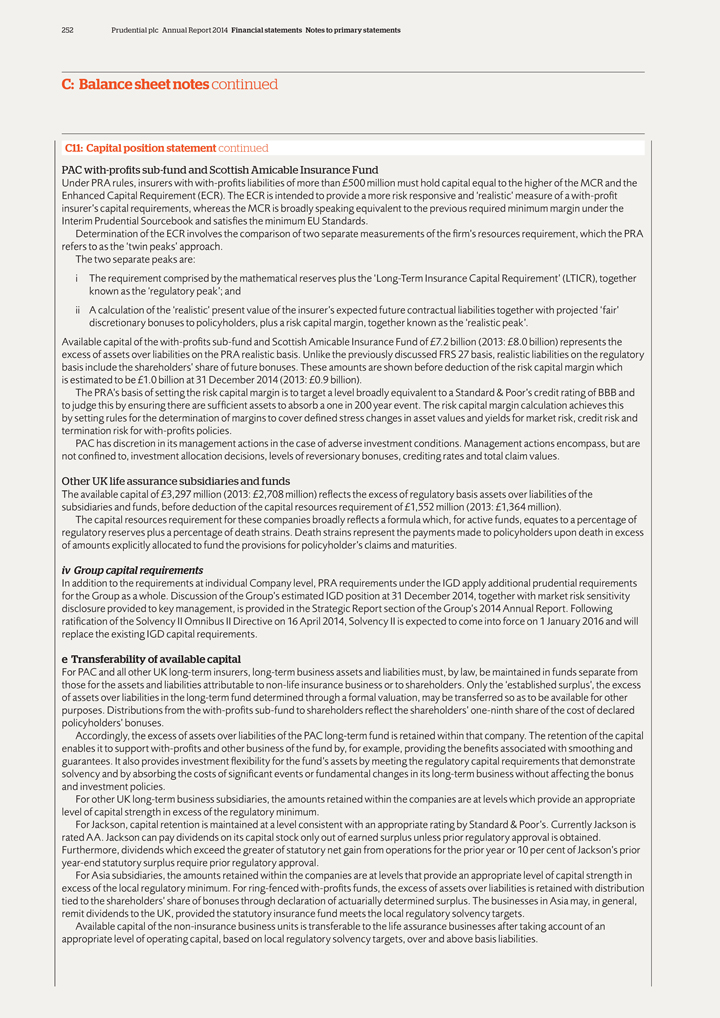

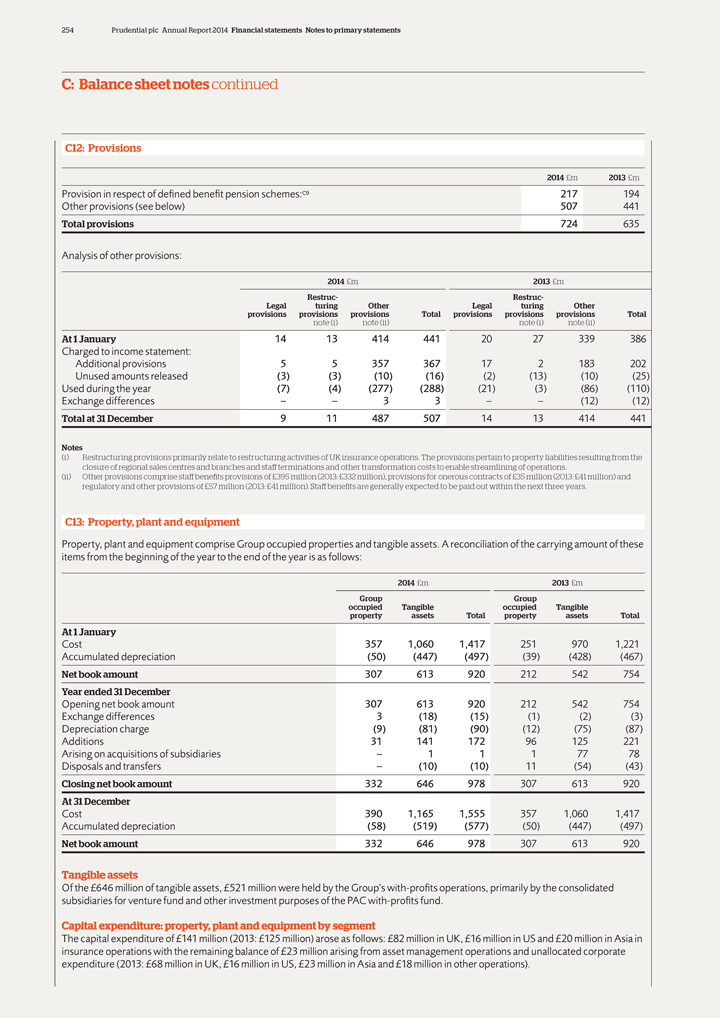

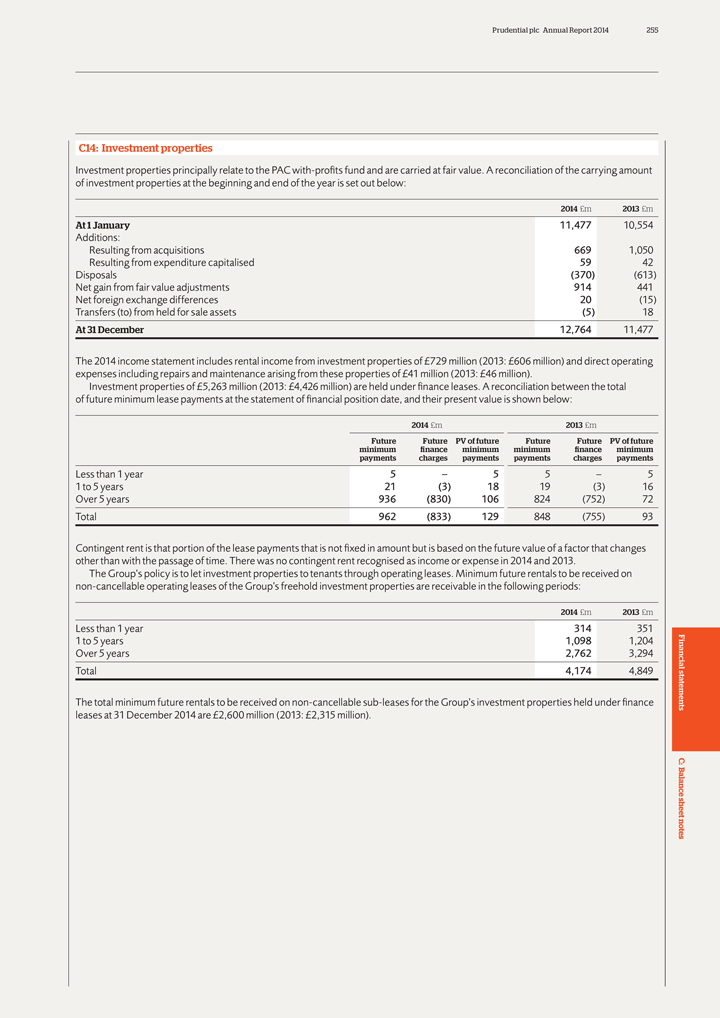

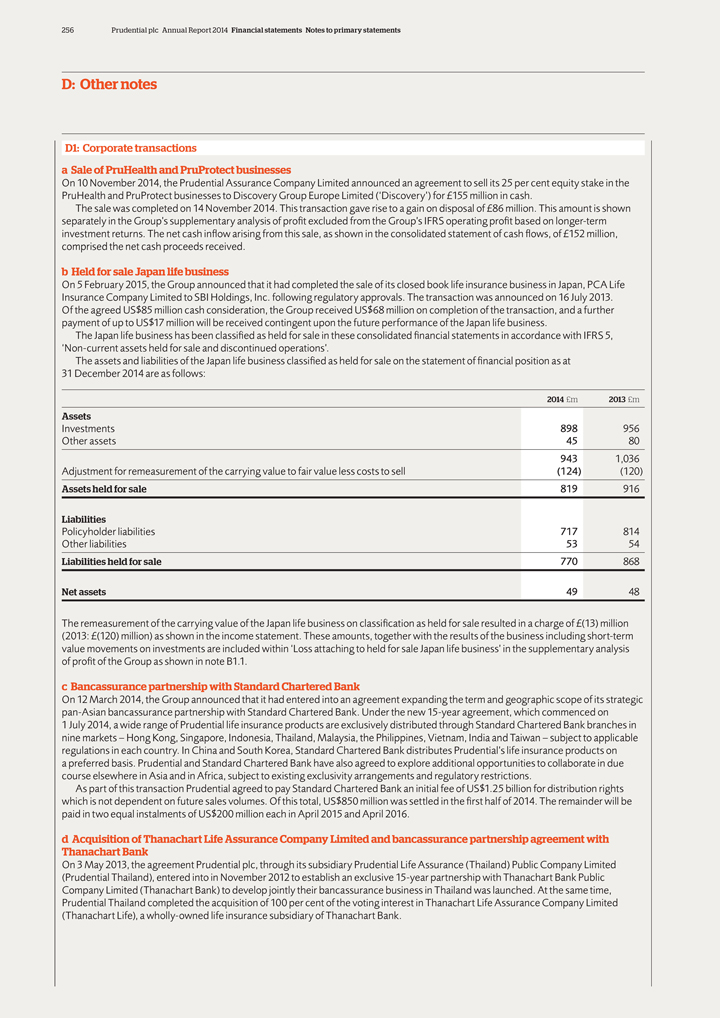

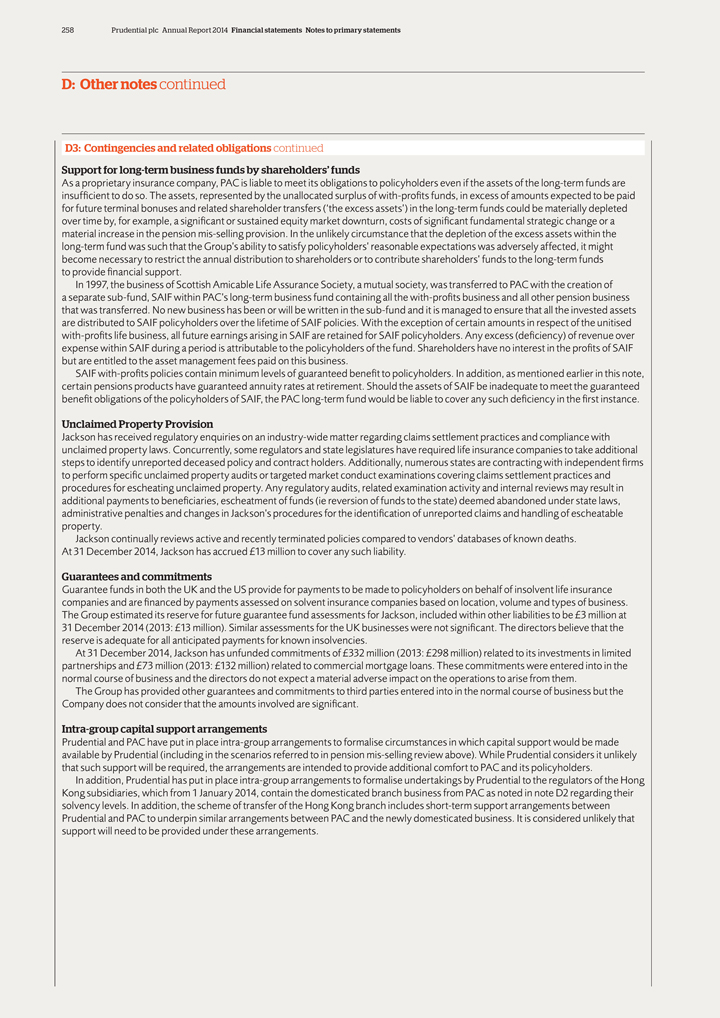

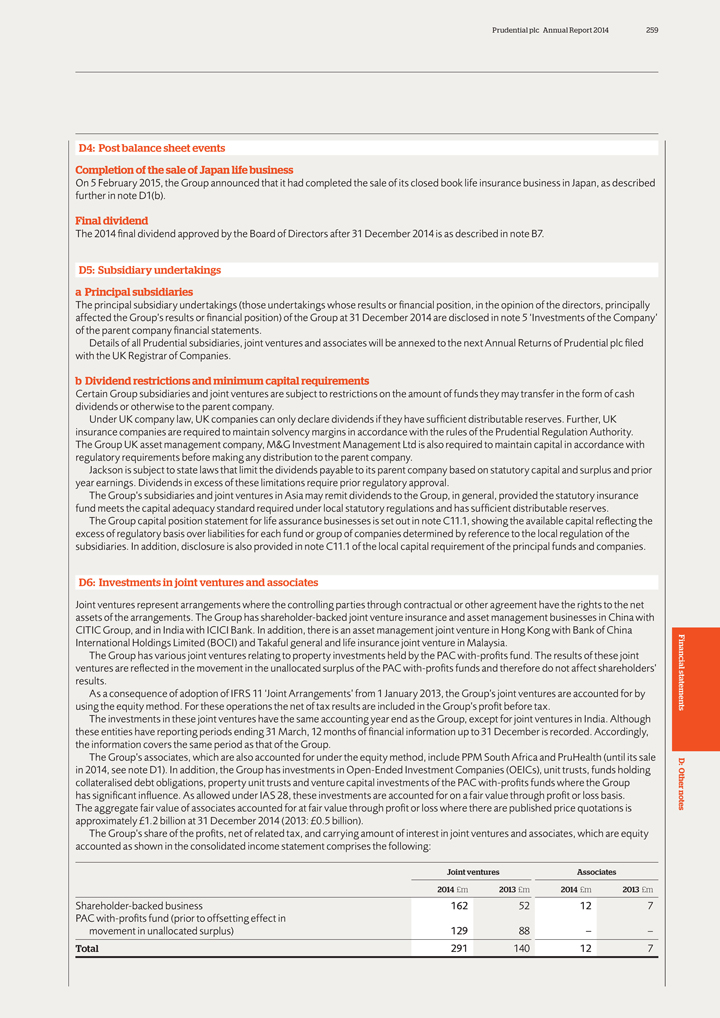

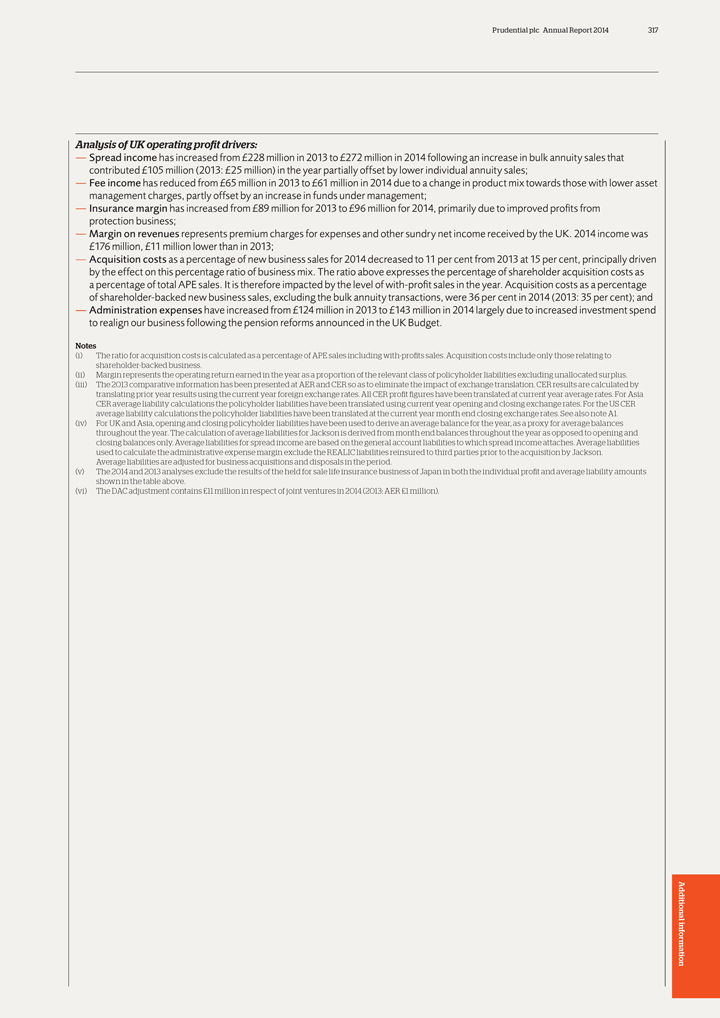

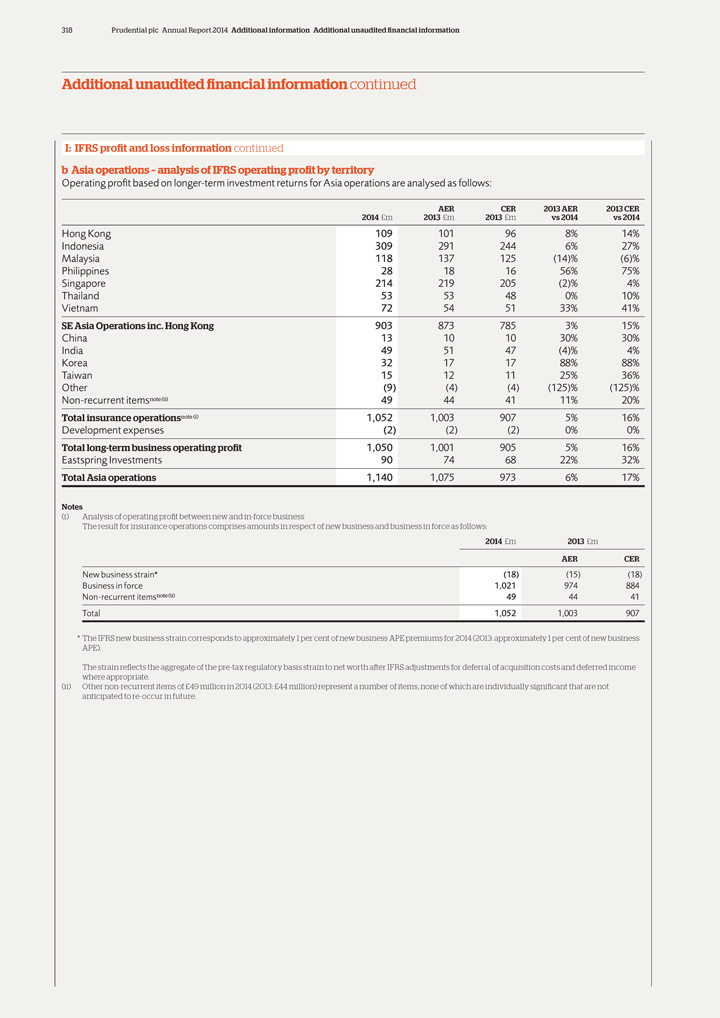

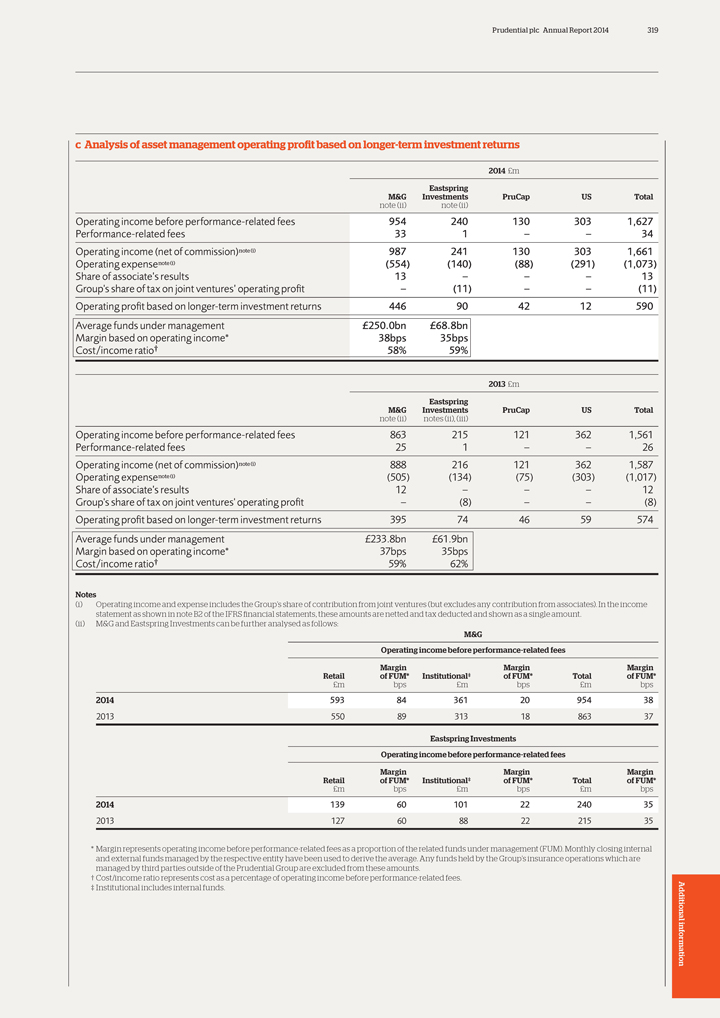

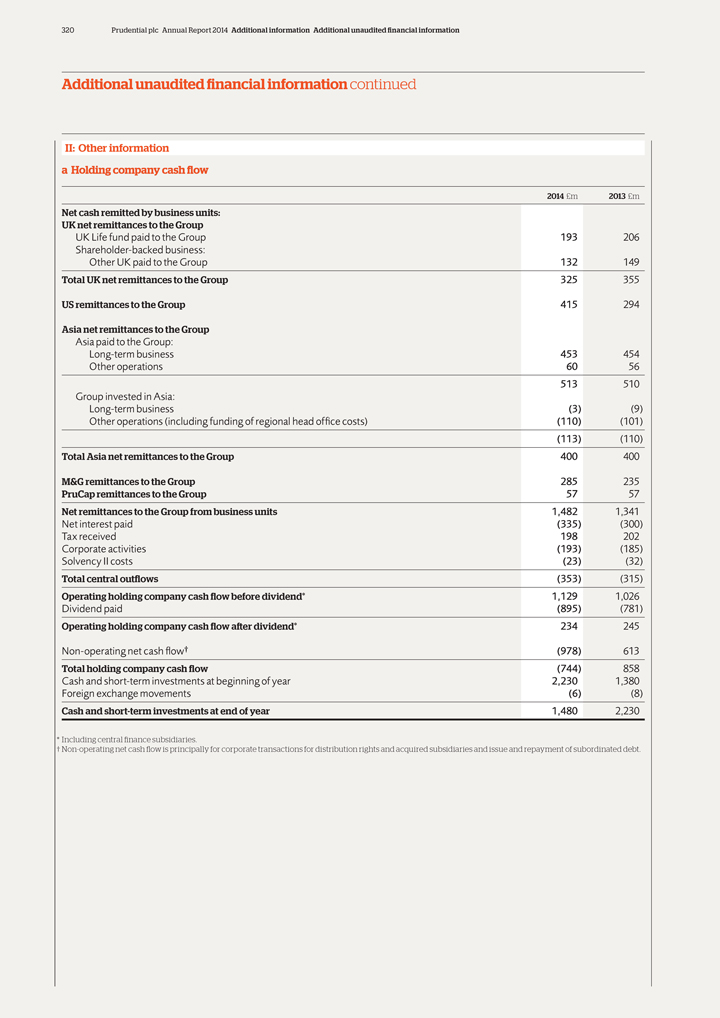

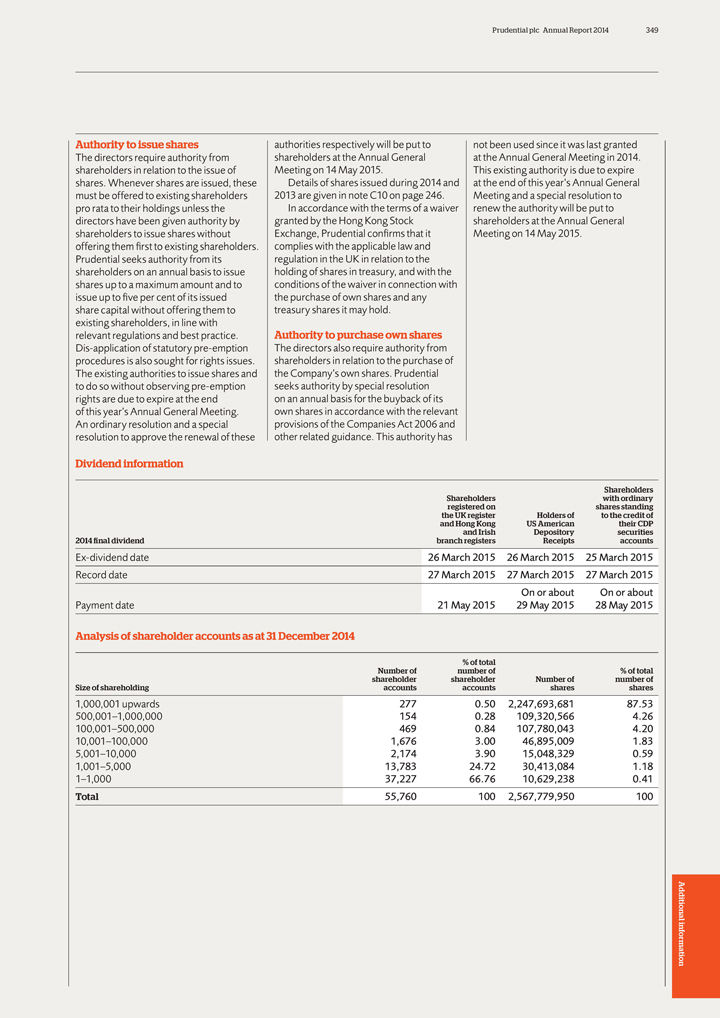

What we measure and why Group free surplus generation4 (£m) Free surplus generation is used to measure the internal cash generation of our business units. For insurance operations it represents amounts maturing from the in-force business during the period less investment in new business and excludes other non-operating items. For asset management it equates to post-tax IFRS operating profit for the period. Business unit remittances (£m) Remittances measure the cash transferred from business units to the Group. Cash flows across the Group reflect our aim of achieving a balance between ensuring sufficient net remittances from business units to cover the dividend (after corporate costs) and the use of cash for reinvestment in profitable opportunities available to the Group. IGD capital surplus before final dividend5 (£bn) Prudential is subject to the capital adequacy requirements of the European Union IGD as implemented by the Prudential Regulation Authority in the UK. The IGD capital surplus represents the aggregated surplus capital (on a Prudential Regulation Authority consistent basis) of the Group’s regulated subsidiaries less the Group’s borrowings6. No diversification benefit is recognised. Performance1 CAGR +11% 2,462 2,579 1,982 2,080 1,687 2010 2011 2012 2013 2014 CAGR +12% 1,341 1,482 1,200 1,105 935 2010 2011 2012 2013 2014 5.1 5.1 4.7 4.3 4.0 2010 2011 2012 2013 2014 Commentary — Underlying free surplus in 2014 increased by 9 per cent, on a constant exchange rate basis (5 per cent on an actual exchange rate basis), compared to 2013, driven by growth of the in-force portfolio, and continued discipline in the investments made to support new business growth. Business unit remittances increased by 11 per cent in 2014, compared to 2013, with higher contributions from the US and M&G. We operate with a strong solvency position, with our estimated IGD capital surplus after funding the fees paid for renewing our exclusive distribution agreement with Standard Chartered Bank until 2029 and before final dividend covering the capital requirements 2.4 times. 2017 objectives7 We are making solid progress towards these objectives. Reported actuals Objectives7 Asia objectives 2012 £m9 2013 £m 2014 £m 2017 Asia life and asset management IFRS operating profit 924 1,075 1,140 >£1,858m Asia underlying free surplus generation8 484 573 592 £0.9 – £1.1bn Actual Objective 1 Jan 2014 1 Jan 2014 to Group objective for cumulative period 1 January 2014 to 31 December 2017 to 31 Dec 2014 31 Dec 2017 Cumulative Group underlying free surplus generation from 2014 onwards £2.6bn > £10bn Chief Financial Officer’s report on our 2014 financial performance page 39 Notes 1 The comparative results shown above have been prepared using actual exchange rates (AER) basis except where otherwise stated. Comparative results on a constant exchange rate (CER) basis are also shown in financial tables in the Chief Financial Officers’ report on our 2014 financial performance. CAGR is Compound Annual Growth Rate. 2 The basis of IFRS operating profit based on longer-term investment returns is discussed in note B1.3 of the IFRS financial statements. The IFRS profit before tax attributable to shareholders have been prepared in accordance with the accounting policies discussed in note A of the IFRS financial statements. 3 The EEV basis results have been prepared in accordance with the EEV principles discussed in note 1 of EEV basis supplementary information. The 2014 EEV results of the Group are presented on a post-tax basis, and accordingly, prior years’ results are shown on a comparable basis. 4 Free surplus generation represents ‘underlying free surplus’ based on operating movements, including the general insurance commission earned during the period and excludes market movements, foreign exchange, capital movements, shareholders’ other income and expenditure and centrally arising restructuring and Solvency II implementation costs. In addition, following its reclassification as held for sale, operating results exclude the result of the Japan Life insurance business. Estimated. Excludes subordinated debt issues that qualify as capital. The objectives assume exchange rates at December 2013 and economic assumptions made by Prudential in calculating the EEV basis supplementary information for the half year ended 30 June 2013, and are based on regulatory and solvency regimes applicable across the Group at the time the objectives were set. The objectives assume that the existing EEV, IFRS and Free Surplus methodology at December 2013 will be applicable over the period. Underlying free surplus generated comprises underlying free surplus generated from long-term business (net of investment in new business) and that generated from asset management operations. The 2012 comparative is based on the retrospective application of new and amended accounting standards and excludes the one-off gain of £51 million from the sale of the Group’s holdings in China Life Insurance Company in Taiwan. Asia 2012 IFRS operating profit of £924 million is based on the retrospective application of new and amended accounting standards, and excludes the one- off gain of £51 million from the sale of the Group’s holdings in China Life Insurance Company in Taiwan.