Form 8-K MITEL NETWORKS CORP For: Mar 31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): March 31, 2015

MITEL NETWORKS CORPORATION

(Exact Name of Registrant as Specified in its Charter)

| Canada | 001-34699 | 98-0621254 | ||

| (State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

350 Legget Drive

Ottawa, Ontario K2K 2W7

(Address of Principal Executive Offices) (Zip Code)

(613) 592-2122

(Registrant’s telephone number, including area code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| x | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 8.01 | Other Events |

Mitel is filing under this Item 8.01 a copy of a lender presentation, which presentation is incorporated by reference herein.

| Item 9.01 | Financial Statements and Exhibits. |

| (d) | Exhibits. |

| 99.1 | Lender Presentation dated March 31, 2015 |

Forward Looking Statements

Some of the statements in this Current Report on Form 8-K are forward-looking statements (or forward-looking information) within the meaning of applicable U.S. and Canadian securities laws. These include statements using the words believe, target, outlook, may, will, should, could, estimate, continue, expect, intend, plan, predict, potential, project and anticipate, and similar statements which do not describe the present or provide information about the past. There is no guarantee that the expected events or expected results will actually occur. Such statements reflect the current views of management of Mitel and are subject to a number of risks and uncertainties. These statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, operational and other factors. Any changes in these assumptions or other factors could cause actual results to differ materially from current expectations. All forward-looking statements attributable to Mitel, or persons acting on its behalf, and are expressly qualified in their entirety by the cautionary statements set forth in this paragraph. Undue reliance should not be placed on such statements. In addition, material risks that could cause actual results to differ from forward-looking statements include: the inherent uncertainty associated with financial or other projections; the integration of Mavenir and the ability to recognize the anticipated benefits from the acquisition of Mavenir; the ability to obtain required regulatory approvals for the exchange offer and merger, the timing of obtaining such approvals and the risk that such approvals may result in the imposition of conditions that could adversely affect the expected benefits of the acquisition of Mavenir; the risk that the conditions to the exchange offer or merger are not satisfied on a timely basis or at all and the failure of the exchange offer or merger to close for any other reason; risks relating to the value of the Mitel common shares to be issued in connection with the exchange offer and merger; the anticipated size of the markets and continued demand for Mitel and Mavenir products and the impact of competitive products and pricing that could result from the announcement of the acquisition of Mavenir; access to available financing on a timely basis and on reasonable terms, including the refinancing of Mitel’s debt to fund the cash portion of the consideration in connection with the exchange offer and merger; Mitel’s ability to achieve or sustain profitability in the future since its acquisition of Aastra; fluctuations in quarterly and annual revenues and operating results; fluctuations in foreign exchange rates; current and ongoing global economic instability, political unrest and related sanctions; intense competition; reliance on channel partners for a significant component of sales; dependence upon a small number of outside contract manufacturers to manufacture products; and, Mitel’s ability to implement and achieve its business strategies successfully. Additional risks are described under the heading “Risk Factors” in Mitel’s Annual Report on Form 10-K for the year ended December 31, 2014, filed with the SEC on February 26, 2015, and in Mavenir’s Annual Report on Form 10-K for the year ended December 31, 2014, filed with the SEC on March 3, 2015. Forward-looking statements speak only as of the date they are made. Except as required by law, Mitel does not have any intention or obligation to update or to publicly announce the results of any revisions to any of the forward-looking statements to reflect actual results, future events or developments, changes in assumptions or changes in other factors affecting the forward-looking statements.

Important Information For Investors

The exchange offer for the outstanding shares of Mavenir common stock referenced in this presentation has not yet commenced. This announcement is for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell shares of Mavenir common stock, nor is it a substitute for the registration statement and exchange offer materials that Mitel and its acquisition subsidiary will file with the U.S. Securities and Exchange Commission (the “SEC”) upon commencement of the exchange offer. At the time the offer is commenced, Mitel and its acquisition subsidiary will file exchange offer materials on Schedule TO and a registration statement with the SEC, and Mavenir will file a Solicitation/Recommendation Statement on Schedule 14D-9 with the SEC with respect to the exchange offer. The exchange offer materials (including a Prospectus/Offer to Exchange, a related Letter of Transmittal and certain other offer documents) and the Solicitation/Recommendation Statement will contain important information. Holders of shares of Mavenir common stock are urged to read these documents when they become available because they will contain important information that holders of Mavenir common stock should consider before making any decision regarding tendering their shares. The Prospectus/Offer to Exchange, the related Letter of Transmittal and certain other offer documents, as well as the Solicitation/Recommendation Statement, will be made available to all holders of shares of Mavenir common stock at no expense to them. The exchange offer materials and the Solicitation/Recommendation Statement will be made available for free at the SEC’s web site at www.sec.gov. Copies of these documents will also be made available free of charge on Mitel’s website at investor.Mitel.com or by contacting Mitel’s Investor Relations Department at 469-574-8134. Copies of the documents filed with the SEC by Mavenir will be available free of charge on Mavenir’s website at www.investor.Mavenir.com or by contacting Mavenir’s Investor Relations Department at 469-916-4393x5080.

In addition to the Prospectus/Offer to Exchange, the related Letter of Transmittal and certain other offer documents, as well as the Solicitation/Recommendation Statement, Mitel and Mavenir file annual, quarterly and special reports and other information with the SEC. You may read and copy any reports or other information filed by Mitel or Mavenir at the SEC public reference room at 100 F Street, N.E., Washington, D.C. 20549. Please call the Commission at 1-800-SEC-0330 for further information on the public reference room. Mitel’s and Mavenir’s filings with the SEC are also available to the public from commercial document-retrieval services and at the website maintained by the SEC at www.sec.gov.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: March 31, 2015

| MITEL NETWORKS CORPORATION | ||

| By: | /s/ Greg Hiscock | |

| Name: | Greg Hiscock | |

| Title: | General Counsel & Corporate Secretary | |

Lender Presentation

Mitel Networks

March 31, 2015

Exhibit 99.1 |

| ©2015 Mitel. Proprietary and Confidential.

SAFE HARBOR STATEMENT

Forward Looking Statements

2

This presentation includes references to non-GAAP financial measures including adjusted EBITDA,

non-GAAP net income and non-GAAP operating expenses. Non-GAAP financial

measures do not have any standardized meaning and are therefore unlikely to be comparable to similar measures presented by other

companies. We use these non-GAAP financial measures to assist management and investors in

understanding our past financial performance and prospects for the future, including changes in

our operating results, trends and marketplace performance, exclusive of unusual events or factors which do not directly affect

what we consider to be our core operating performance. Non-GAAP measures are among the primary

indicators management uses as a basis for our planning and forecasting of future periods.

Investors are cautioned that non-GAAP financial measures should not be relied upon as a substitute for financial measures prepared

in accordance with generally accepted accounting principles. Some of the statements

in this presentation are forward-looking statements (or forward-looking information) within the meaning of applicable U.S. and Canadian

securities laws. These include statements using the words believe, target, outlook, may, will, should,

could, estimate, continue, expect, intend, plan, predict, potential, project and anticipate, and

similar statements which do not describe the present or provide information about the past. There is no guarantee that the

expected events or expected results will actually occur. Such statements reflect the current views of

management of Mitel and are subject to a number of risks and uncertainties. These statements are

based on many assumptions and factors, including general economic and market conditions, industry conditions,

operational and other factors. Any changes in these assumptions or other factors could cause actual

results to differ materially from current expectations. All forward-looking statements

attributable to Mitel, or persons acting on its behalf, and are expressly qualified in their entirety by the cautionary statements set forth

in this paragraph. Undue reliance should not be placed on such statements. In addition, material risks

that could cause actual results to differ from forward- looking statements include: the

inherent uncertainty associated with financial or other projections; the integration of Mavenir and the ability to recognize the

anticipated benefits from the acquisition of Mavenir; the ability to obtain required regulatory

approvals for the exchange offer and merger, the timing of obtaining such approvals and the risk

that such approvals may result in the imposition of conditions that could adversely affect the expected benefits of the acquisition of

Mavenir; the risk that the conditions to the exchange offer or merger are not satisfied on a timely

basis or at all and the failure of the exchange offer or merger to close for any other reason;

risks relating to the value of the Mitel common shares to be issued in connection with the exchange offer and merger; the anticipated

size of the markets and continued demand for Mitel and Mavenir products and the impact of competitive

products and pricing that could result from the announcement of the acquisition of Mavenir;

access to available financing on a timely basis and on reasonable terms, including the refinancing of Mitel’s debt to

fund the cash portion of the consideration in connection with the exchange offer and merger; Mitel's

ability to achieve or sustain profitability in the future since its acquisition of Aastra;

fluctuations in quarterly and annual revenues and operating results; fluctuations in foreign exchange rates; current and ongoing global

economic instability, political unrest and related sanctions, particularly in connection with the

Ukraine and the Middle East; intense competition; reliance on channel partners for a significant

component of sales; dependence upon a small number of outside contract manufacturers to manufacture products; and, Mitel’s

ability to implement and achieve its business strategies successfully. Additional risks are described

under the heading "Risk Factors" in Mitel's Annual Report on Form 10-K for the year

ended December 31, 2014, filed with the SEC on February 26, 2015, and in Mavenir’s Annual Report on Form 10-K for the year ended

December 31, 2014, filed with the SEC on March 3, 2015. Forward-looking statements speak only as of

the date they are made. Except as required by law, Mitel does not have any intention or

obligation to update or to publicly announce the results of any revisions to any of the forward-looking statements to reflect actual

results, future events or developments, changes in assumptions or changes in other factors affecting the

forward-looking statements. Non-GAAP Financial

Measurements |

| ©2015 Mitel. Proprietary and Confidential.

Presenters

Mitel

Steve Spooner

Chief Financial Officer

Richard McBee

President, Chief Executive Officer and

Member of the Board of Directors

Mavenir

Pardeep Kohli

President, Chief Executive Officer and

Member of the Board of Directors

Terry Hungle

Chief Financial Officer

3 |

| ©2015 Mitel. Proprietary and Confidential.

Agenda

•

Transaction Overview

•

Mitel Business Overview

•

Mavenir Business Overview

•

Transaction Rationale

•

Financial Overview

•

Key Credit Highlights

•

Syndication Overview

4 |

| ©2015 Mitel. Proprietary and Confidential.

Transaction Overview

5 |

| ©2015 Mitel. Proprietary and Confidential.

Transaction Overview

•

On

March

2

nd

,

2015,

Mitel

Networks

Corporation

(the

“Company”

or

“Mitel”),

announced

it

had

entered

into a definitive merger agreement to acquire the outstanding shares of Mavenir

Systems, Inc. (the “Target”

or “Mavenir”)

•

Acquisition valued at $559mm, or 4.3x FY 12/31/14 Mavenir sales of $130mm

•

Purchase consideration is a mix of $350mm in cash and $208mm in equity

•

Pro Forma shareholder ownership of 84% Mitel and 16% Mavenir

•

Combined company Pro Forma Adjusted EBITDA of $184mm

•

Combination creates a global leader in converged IP communications for enterprises,

service providers and mobile operators

•

Upon closing, Mavenir will become the mobile business of Mitel, operating under the

brand Mavenir

•

As part of this transaction, the Company will refinance Mitel’s existing

Credit Facilities with the following Senior Secured Credit Facilities:

•

$50mm Senior Secured Revolving Credit Facility

•

$650mm Senior Secured Term Loan B

•

Expected net leverage at close of 3.2x

6

•

The transaction is expected to close in late April |

| ©2015 Mitel. Proprietary and Confidential.

Sources & Uses and Pro Forma Capitalization

Pro Forma Capitalization

Sources and Uses

7

($ in millions)

Sources of Funds

Amount

Uses of Funds

Amount

New Revolver ($50 mm)

$0.0

Mavenir Purchase Price

$558.7

New First Lien Term Loan B

650.0

Repayment of Mavenir Debt

26.8

Cash From Balance Sheet

48.7

Refinance Existing Mitel Debt

279.1

Equity Issuance

208.4

Fees, Expenses & OID

42.4

Total Sources

$907.0

Total Uses

$907.0

Note: Mavenir purchase price calculation assumes Mitel stock price of $10.19 per

share as of close on March 27, 2015. Pro Forma

($ in millions)

Rating

Maturity

12/31/2014

Cash

CFR: B2 / B+

$71.7

Revolver ($50 mm)

5 years

$0.0

New First Lien Term Loan B

Ba3 / B+ (RR 3)

7 years

650.0

Total First Lien Debt

$650.0

Capital Leases

--

--

13.1

Total Debt

$663.1

PF Adj. EBITDA

$184.0

Credit Statistics

Total Debt / PF Adj. EBITDA

3.6x

Net Debt / PF Adj. EBITDA

3.2x |

| ©2015 Mitel. Proprietary and Confidential.

Pro Forma Corporate Structure

(1)

Mavenir U.S.

Subsidiaries

Mitel U.S. Subsidiaries

Borrower

Guarantor, subject to

customary exclusions for

immaterial subsidiaries, and

customary “guaranty and

security principles.”

Guarantor, subject to

customary exclusions for

immaterial subsidiaries.

(1)

Simplified

for

illustrative

purposes,

and

after

giving

effect

to

(i)

the

acquisition

of

Mavenir,

(ii)

the

post-closing

reorganization

of

certain

Mavenir

subsidiaries

and

(iii) post-closing delivery of certain non US and Canadian guarantees and

collateral. 8

New $50M Revolving

Credit Facility

Mitel Networks

Corporation

(Canada)

New $650M Senior

Secured Term B Loan

Mitel U.S. Holdings Inc.

(USA)

Mitel / Mavenir

Non–U.S. Subsidiaries

Mavenir Systems Inc.

(USA) |

| ©2015 Mitel. Proprietary and Confidential.

Mitel Business Overview

9 |

| ©2015 Mitel. Proprietary and Confidential.

Mitel Today

10 |

| ©2015 Mitel. Proprietary and Confidential.

Mitel Overview

Source: Mitel management.

(1)

Pro forma for Aastra acquisition.

(2)

Pro forma adjusted EBITDA for Mitel includes the results of Aastra from the date of

acquisition of January 31, 2014 (11 months) and does not include Aastra's January 2014 results.

Mitel Premise

CY14 Revenue

(mm): $1,024

% of Total Revenue:

90%

Mitel Overall

CY14 Revenue (mm):

CY14 Revenue Growth:

CY14 Gross

Margin:

CY14 Adjusted EBITDA (mm):

Mitel Cloud

CY14 Revenue (mm): $116

% of Total Revenue:

10% •

MiVoice unified communications platforms

addresses both small business and large

enterprise needs, providing extensive

communication features, robust call

control, and support for a wide range of

innovative desktop devices and

applications

•

MiCollab offers an in-office experience

regardless of location / device with tools

such as presence, visual voice mail,

conferencing, and more

•

MiContact Center offers solutions that

improve employee productivity and

control operational costs within

businesses of all sizes

•

Compatibility with Mitel, third party PBX

and Lync

•

Contact center annual revenue of $48

million (included in Premise)

•

MiCloud offers a pay-as-you-grow,

cloud-based platform for all business

communication needs

•

Cut hardware and IT costs, free up

resources and gain new efficiencies

•

Leverage flexible deployment and

migration

11

(2)

(1)

$1,140

(1%)

53%

$167 |

| ©2015 Mitel. Proprietary and Confidential.

(1)

As of December 31, 2014

(2)

As of March 18, 2015

Mitel’s Financial Strength and Stability

12

Growing

•

$1.1 billion annual revenue

•

Global market share gains

•

#1 in Europe, Middle East & Africa

•

#3 in North America

•

#3 Globally (ex-Asia)

Investing

•

$420 million in acquisitions since 2013

•

$118 million in R&D annually

•

Cloud solutions –

from small business

to large enterprise

•

Contact Center expansion

Strong

•

$167 million of Annual EBITDA

(1)

•

$111 million cash balance

(1)

•

$1,023 million market cap

(2)

Experienced

•

Management team with average of

25+ years experience in the industry

including mobile sector

•

Track record of successful business

integrations and strong cash flow

generation |

| ©2015 Mitel. Proprietary and Confidential.

Broad Customer / Partner Base

Retail

Professional Services

Manufacturing

Carriers

Financial Services

Education / Government

13

Health Care

Hospitality

Media & Entertainment |

| ©2015 Mitel. Proprietary and Confidential.

Mitel Premise: Large & Consolidating Market

$6.8bn

Market Size

(1)

~2%

Market Growth

(1)

~$1bn

Sales

MiVoice

Call routing software

Communications endpoints

Hardware gateways

MiCollab

Unified messaging

UC & Mobile clients

Web, Video & Audio conferencing

Application & Mobility gateways

Growth Drivers

Int’l

Americas

Geographic Mix

(1)

Source: IDC and Mitel Management.

14

39%

61%

1.

Growth of Market from TDM to IP PBX Transition 2.

Proliferation of Enterprise Mobility, Voice and Collaboration 3.

Leveraging Installed Base Post Acquisition 4.

Growth of Software Assurance & Support Revenue 5.

Strong Growth in Europe from Weak Competitors |

| ©2015 Mitel. Proprietary and Confidential.

Mitel Cloud: Fulcrum of Growth

$5.0bn

Market Size

(1)

Market Growth

(1)

~$100mm

Sales

Growth Drivers

Geographic Mix

1.

Growth of Public & Private Cloud

2.

Transitioning from PBX to Cloud

3.

Massive Scale -

A leader in Cloud

4.

Decoupling of Software from Proprietary Hardware

5.

Large European Base Transitioning to Cloud

Number of Cloud Seats

(2)

(1)

Source: IDC.

(2)

Source: Synergy Research Group as of September 2014.

861

465

357

238

(in thousands)

12%

88%

Int’l

Americas

~15%

15 |

|

©2015 Mitel. Proprietary and Confidential. Mitel Contact Center: Growing Market

$2.7bn

Market Size

(1)

~9%

Market Growth

(1)

$42mm

Sales

Growth Drivers

Geographic Mix

1.

2.

3.

Multi-channel inbound/outbound routing

Interactive Voice Response

Historical, Real Time & Forecast Reports

Workforce Optimization

CRM integration

Agent productivity suite

Compatibility with Mitel, third party PBX and Lync

Int’l

Americas

(1)

Source: IDC.

48%

52%

Offers for mid market (pre-packaged simplicity) and

enterprise (scale)

MiContact Center

Growth of the Market and growth of ARPU

Increase Contact Center Attachment to Mitel IPT

Attachment of MiContact Center to Lync Enterprise Voice

16 |

| ©2015 Mitel. Proprietary and Confidential.

Mitel Portfolio Differentiation

•

“Best Path to the Cloud”

provides intelligent

migration for Mitel’s massive base and cloud

selling options for the channel: public; private;

and hybrid

•

Broadest

portfolio

in

the

industry

comprising

strong offers in all business size segments

with broad regional strength

•

Strong

capabilities

in

both

public

and

private mobility provide opportunities for

solution differentiation

•

A

“Best

of

Breed”

approach

provides

differentiation opportunities from

“Walled Garden”

vendors

August

2014

Mitel

17 |

|

©2015 Mitel. Proprietary and Confidential. Continued Strong Cloud Growth

18

Total

Cloud

Users

–

Consists

of

all

cloud

users,

public

or

private,

whether

wholesale

or

retail, and either sold

on a recurring revenue or via a perpetual license

Recurring

Cloud

Users

–

Customers

who

purchase

Mitel

Unified

Communications

Software

As

a

Service.

That software is hosted and delivered directly from us or our global Service Provider partners

CY14

$116mm

Total Cloud Segment

Revenues

Recurring

Cloud Revenue

$85mm

269,000

1,000,000+

Total Seats Installed

~177,400

Q4 Seats Added

Note: Pro forma for Aastra acquisition.

UP

83%

Y-o-Y

UP

122%

Y-o-Y

As of

December

2014

Recurring Cloud Seats |

| ©2015 Mitel. Proprietary and Confidential.

Mavenir Business Overview

19 |

| ©2015 Mitel. Proprietary and Confidential.

Mavenir Overview

•

Wireless pure-play networking solutions provider

•

A leading provider of mobile voice, messaging and video solutions

•

Capitalizing on two key network trends

•

4G All-IP

•

Virtualized, scalable software

•

Customer relationships with 15 of the top 20 mobile global operators

•

3 of the top 4 in the US

•

3 of the top 4 in Europe

•

Positioned well to drive growth from transition to 4G/VoLTE

•

Strong financial profile

•

CY 2014 Revenue: $129.8 million, up 28.1% vs. CY13

•

~1,100 employees

•

Growing number of carrier footprint wins

20 |

| ©2015 Mitel. Proprietary and Confidential.

Mavenir

–

A

Leader

in

Mobility

Point S/W-based

Solutions

Complete S/W Portfolio

21

End to End (proprietary

H/W) |

| ©2015 Mitel. Proprietary and Confidential.

Customer Highlights

VoLTE/WiFi

17

RCS

17

CORE

23

Growing Roster of Blue Chip 4G Customers

•

3 of top 4 operators in the US; 3 of top 4 operators in Europe

Diversified 4G Customer Base

•

Geographically diverse, as well across product lines

Strong 2G/3G Customer Base

•

15 of top 20 operators globally

2G/3G/4G

130+

Based on Mavenir 2Q2014 data

22 |

| ©2015 Mitel. Proprietary and Confidential.

Strong/Diverse Customer Base

130+ Customers Globally with over 1bn Subscribers

Growing Roster of Tier One Customers for Next Generation 4G Solutions

23 |

| ©2015 Mitel. Proprietary and Confidential.

Mavenir’s 4G Solutions Addressing the Opportunity

OSS/BSS

Billing

NMS

SLA

CRM

Voice & Video

Telephony

Server

Enhanced Messaging

IMS-PBX

IMS Core Network

Evolved Packet Core Network

Access Network

Rich Message

Server

Presence

Server

Session

Control

Session

Border

Control

IMS

Centralized

Services GW

Mobility

Management

Entity

SAE

Gateways

Evolved

Packet Date

Gateway

LTE

Wi-Fi

Fixed

Cable

1

Best-in-Breed Wireless

Applications & Services

2

Fully Virtualized Software

Product Portfolio

3

High Performance Media

Handling Architecture

4

Optimized E2E LTE

Architecture for Voice (R4)

24 |

| ©2015 Mitel. Proprietary and Confidential.

Speed

up to

15x

faster

Services

more

revenue

Savings

less

cost

Spectrum

up to

10x

better

Why 4G LTE is a Necessity

25 |

| ©2015 Mitel. Proprietary and Confidential.

4G LTE Progress

Operators globally

1000+

801

invested in LTE

<5%

445

launched

Connections on

LTE

Source: GSMA, February 2015

2014 –

59.6 million VoLTE subscriptions

2019 –

1.2 billion VoLTE subscriptions

Source: ABI June 2014

26 |

| ©2015 Mitel. Proprietary and Confidential.

Reason Why Mavenir’s Business is Sticky

Mobile operators typically don't change suppliers over the life of a

single generation of technology

Higher "stickiness" factor as supplier of application & services

due to

greater customization and integration with back office infrastructure

Very long commercial tender and vendor selection processes

(typically 12-18 months) make repeating the process cost prohibitive

Mobile operators lack the resources to repeat very long lab

validation and network integration cycles (typically up to 24 months)

Mobile operator reluctance to admit making a mistake in a major

decision such as choosing their 4G supplier

27 |

Transaction Rationale

28

| ©2015 Mitel. Proprietary and Confidential.

|

| ©2015 Mitel. Proprietary and Confidential.

Market Dynamics Driving Change

29

Commoditization

Price Pressure

Segmentation

New Service Providers Challenging Traditional

Operators’

Business & Operating Model

Rich services driving usage

Expansion into enterprise

Mobile apps supporting BYOD

Pricing driving residential share

Service ubiquity constraints

Economy of scale challenges

OTT

Operators

Cloud Telephony |

| ©2015 Mitel. Proprietary and Confidential.

Capitalizing on Two Major Trends

30

Operators are Transforming

Cloud

Convergence

CONVERGENCE

Operators

Wireline

Wireless

Business

Org Realignment

Wireless and Business

Units Consolidation

New Business

Models

Network

Consolidation

Service

Ubiquity

Adjacency

Expansion, Mergers,

Technology Rationalization

Cloud

Virtualization, NFV, SDN,

Telco Cloud |

| ©2015 Mitel. Proprietary and Confidential.

Convergence Creating Market Opportunity

31

Business

Operator

Enterprise

#1 EMEA/#3 N.A.

PBX/IP PBX

#1 Business Cloud

Communications

GREATER THAN SUM OF ALL PARTS

RELATIONSHIP

VALUE

TECHNOLOGY

Valuable Business Features

Enterprise Relationships

Converged IP Network

Incumbent at Operators

Mass Market Scale

Cloud Infrastructure

Consumer

#2 VoLTE/RCS

Mobile

Infrastructure

Hosted

Business Services

Mobility

UC

Cloud

Seats

Premise

Equipment |

| ©2015 Mitel. Proprietary and Confidential.

Mobilization of Unified Communications

Collaboration

Cloud/Hosted

Contact Center

Voice/Video

SERVICES

DELIVERY

Mobile

32

Mobilization of Unified Communications Across

Industry Verticals and Access Technologies |

| ©2015 Mitel. Proprietary and Confidential.

Mitel

•

Growth

Creates three growth pillars with

combined $300mm revenue growing

at >20% YoY

Cloud + Contact Center + Mobility

Supply Operators directly in addition

to Enterprises

•

TAM

$14bn increase by 2018

•

Portfolio

Accelerates Mobile UC evolution

Introduces highly scalable mobile

platform

Mavenir

•

Scale

Grows and diversifies revenue

sources ($1bn+)

Growth in Sales and Operations to

support increased business

Expands global presence via Mitel

channel partners

•

Portfolio

Introduces feature rich business

services

Accelerates in-flight Mobile UC and

differentiated end-to-end SIP

Trunking offer

Gains access to robust vertically

integrated Enterprise solutions

Transaction Benefits

33 |

|

©2015 Mitel. Proprietary and Confidential. Source: Company filings and Wall Street

research. (1)

TAM growth includes new Business Services in 2015, which grows from $1.1bn in 2015 to $3.1bn in 2018 at

a CAGR of 42%. Voice

Expertise

Operational

Expertise

•

Differentiated and broadest business

IP-voice portfolio in the industry for all

business size segments with broad

regional strength

•

Continually expanding margins and increasing

profitability; history of successful synergies

attainment

•

Management successfully integrated and realized

synergies from multiple acquisitions

Execution

on Growing

Market

Mitel Skill Set

Premise

Cloud

•

Stable and profitable business

•

Provides strong cash flow to support high growth

Cloud and Carrier Mobility growth

•

Hardware to software transition

•

$6.8bn TAM in 2014 growing at ~2% CAGR to

$7.6bn in 2018

•

Revenues growing at 24% and exceed 10% of

quarterly revenue

•

Positioned to benefit from fast growing market

•

Public and private cloud

•

$5.0bn TAM in 2014 growing at ~15% CAGR to

$8.7bn in 2018

Mobile

Opportunities

•

Mavenir provides key strategic carrier relationships

•

Key personnel with expertise in mobile infrastructure

•

Strong technology and patents

•

Large and rapidly growing market: $2.6bn TAM in

2014 growing at ~52% CAGR to $14.0bn 2018

(1)

•

Mitel undergoing successful business transition to

Cloud and Contact Center, two rapidly growing

markets

•

Cloud and Contact Center to make up 16% of Mitel

revenue in 2015; Contact Center outpacing market

growth by 3x

•

Proven ability to grow faster than market

Leveraging Mitel’s Core Skill Sets

34 |

| ©2015 Mitel. Proprietary and Confidential.

Expanding the Market through Combination

Source: Dell’Oro, Infonetics, MarketsandMarkets.

35

Additional

TAM from

Mavenir

Mitel

Existing

TAM

($bn)

TAM Expansion

Mobility

Contact Center Applications

Hosted/Cloud Voice and UC

Premise Based IP PBX

19% Pro Forma

‘14 –

’18 CAGR

6.8

7.6

5.0

8.7

2.7

3.9

2.6

14.0

$17.1

$34.2

2014

2018 |

| ©2015 Mitel. Proprietary and Confidential.

Source: Mitel and Mavenir management estimates.

Mitel’s Three Strategic Growth Pillars

Mobile/Cloud/Contact Center Represent ~30% Rev Mix

36

2015 Before

2015 After

Premise Growth Rate: (4%)

Cloud + Contact Center

Growth Rate

>20%

Premise Growth Rate: (4%)

Cloud + Contact Center + Mobility

Growth Rate

>20%

Contact Center

5%

Premise

85%

Represent

16%

of

Revenue in

2015

Represent

28%

of

Revenue in

2015

Contact

Center

4%

Premise

72%

Cloud

10%

Mobility

14%

Cloud

10% |

| ©2015 Mitel. Proprietary and Confidential.

Mitel / Mavenir Portfolios

Mobile

2G / 3G / 4G / Wi-Fi

MMTEL & 3GPP Services

Converged IP Core

Mavenir

Mitel

•

Highly Scalable Mobile Platform

•

Converged IP Core Network

•

Wireless & Fixed Network Services

•

Feature Rich Business Services

•

Leading Cloud Telephony Services

•

Broad Industry Vertical Solutions

37 |

| ©2015 Mitel. Proprietary and Confidential.

Mitel + Mavenir Portfolio Addresses Convergence

Mobile / Cloud / Fixed

2G / 3G / 4G / Wi-Fi

MMTEL & 3GPP Services

Converged IP Core

Mitel

•

Highly Scalable Converged Mobile & Fixed Platform

•

Broad Range of Fixed/Cloud Mobile Business Services

•

Suite of Converged IP Core Networking Solutions

•

Broad Industry Vertical Solutions

38 |

| ©2015 Mitel. Proprietary and Confidential.

Financial Overview

39 |

| ©2015 Mitel. Proprietary and Confidential.

Note:

On

3/31/2014,

Mitel

announced

the

changing

of

FYE

from

April

30

to

December

31

.

Numbers

may

not

sum

due

to

rounding.

(1)

CY 13 and CY 14 results are pro forma for Aastra acquisition.

(2)

Pro Forma adjusted EBITDA for Mitel includes the results of Aastra from the date of

acquisition of January 31, 2014 (11 months) and does not include Aastra's January 2014 results.

Mitel Historical Financial Overview

$1,156

$1,140

$612

$577

$1,140

$612

($ in millions)

($ in millions)

($ in millions)

($ in millions)

$577

$1,156

(1)

(1)

(1)

(1)

(1)

(1)

40

FY 12

FY 13

CY 13

CY 14

Americas

EMEA

APAC

$429

$412

$498

$489

$163

$149

$621

$614

$20

$16

$36

$37

Revenue by Geography

(1)

(1)

(2)

$88

$84

$141

$167

FY 12

FY 13

CY 13

CY 14

Historical Adjusted EBITDA

Revenue by Segment

EBITDA Less Cash Capital Expenditures

FY 12

FY 13

CY 13

CY 14

Premise

Cloud

$579

$524

$1,063

$1,024

$33

$53

$93

$116

$74

$72

$130

$153

FY 12

FY 13

CY 13

CY 14

th

st |

| ©2015 Mitel. Proprietary and Confidential.

Mavenir Historical Financial Overview

$74

$101

$130

$74

$101

$130

($ in millions)

($ in millions)

($ in millions)

($ in millions)

Note:

Mavenir

fiscal

year

ends

December

31

st

.

Numbers

may

not

sum

due

to

rounding.

41

FY 2012

FY 2013

FY 2014

Americas

EMEA

APAC

$37

$48

$71

$21

$38

$41

$16

$15

$18

FY 2012

FY 2013

FY 2014

($10)

($2)

($6)

Revenue by Geography

Historical Adjusted EBITDA

Revenue by Segment

EBITDA Less Cash Capital Expenditures

Software

Maintenance

$52

$79

$104

$21

$22

$26

FY 2012

FY 2013

FY 2014

($15)

($5)

($11)

FY 2012

FY 2013

FY 2014 |

| ©2015 Mitel. Proprietary and Confidential.

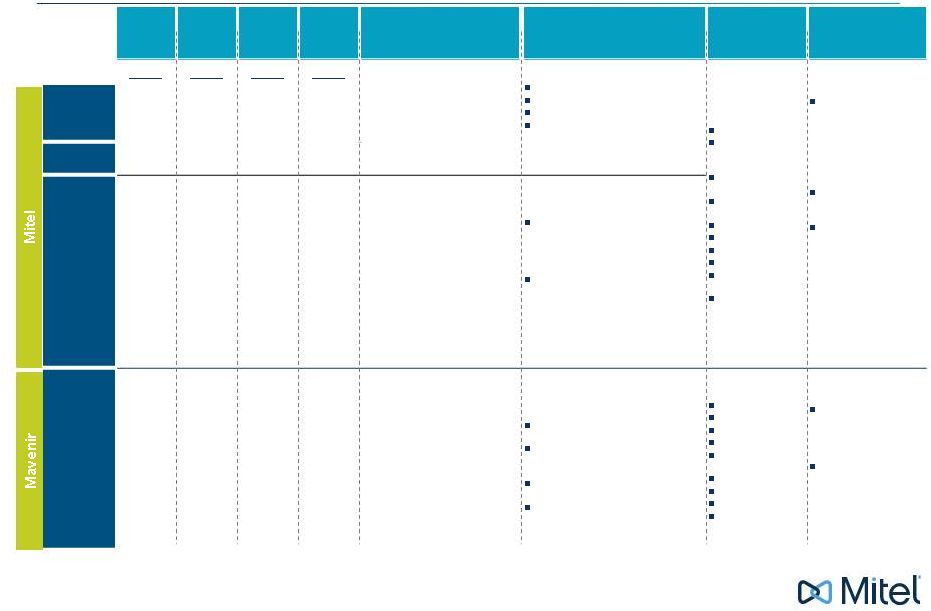

Revenue

($mm)

% of

Revenues

Gross

Margin

% of

Gross

Margin

Outlook

Description

Customers

Competitors

CY 14

CY 14

CY 14

CY 14

Premise Based IP PBX

2014 TAM: $6.8B

’14-’18 CAGR: ~2%

Contact Center Applications

2014 TAM: $2.7B

14-’18 CAGR: ~9%

Premise-based IP platforms

TDM telephony platforms

Desktop devices

Unified communications and

collaboration and contact center

applications

Allstate

Department of

Foreign Affairs,

Canada

NYC Department of

Education

Iowa State

University

Marks & Spencer

Operation Smile

Rimini Street

Team Sport

United States Postal

Service

United Way

Traditional IP

Communications

Vendors:

Avaya,

Cisco

Systems, Alcatel-Lucent,

NEC, Panasonic,

ShoreTel, Unify

(Siemens Enterprise

Networks), Toshiba

Software Vendors (UCC

Market):

Microsoft,

Google

Cloud

Vendors:

AT&T,

Avaya, Broadsoft,

CBeyond, Cisco

Systems, 8X8, J2 Global,

Ring Central, Sprint

Nextel, ShoreTel, Unify,

U.S. Telepacific, Verizon,

Vonage, West IP

Communications, XO

Holding

Premise

Based IP

PBX

$1023.8

80.6%

53.3%

80.7%

Contact

Center

Hosted

/Cloud

Voice and

UC

$116.1

9.1%

50.3%

8.6%

Hosted /Cloud Voice and UC

2014 TAM: $5.0B

’14-’18 CAGR: ~15%

MiCloud –

Retail Cloud Offering:

Hosted cloud & related services, UCC

applications, voice & data

telecommunications and desktop

devices

Powered

by

Mitel

–

Wholesale

Offering:

PBX, voice & video calling,

SIP Trunking, voicemail, call center,

audio conferencing and video & web

collaboration services

Mobility

$129.8

10.2%

55.7%

10.7%

Mobility

2014 TAM: $2.6B

’14-’18 CAGR: ~52%

Rich communications and cloud-based

services:

Carrier-grade, integrated

communication services

IP-based voice, video, rich

communications and enhanced

messaging services

Single identity across multiple devices

and services

Interworking with legacy SMS

AT&T

Deutsche Telekom

H3

MTS

MetroPCS / T-

Mobile

Orange

Tele2

Telestra

Vodafone

Network Infrastructure

Providers:

Alcatel-

Lucent, Ericsson, Nokia

Siemens Networks,

Huawei

Specialty Solution

Providers:

Acme

Packet, Broadsoft, Sonus

Networks, Metaswitch,

Comverse, Acision

42

Combined Company Overview

(1)

CY 14 is pro forma for Aastra acquisition.

(2)

Source: IDC.

(2)

(2)

(2)

(1)

(1)

(1)

(1) |

| ©2015 Mitel. Proprietary and Confidential.

(1)

FY

13

and

FY

14

Mitel

results

are

for

the

12

months

ended

April

30

th

and

Mavenir

results

are

for

the

12

months

ended

December

31

st

.

(2)

CY 13 and CY 14 Mitel results are pro forma for Aastra acquisition.

(3)

Pro forma adjusted EBITDA for Mitel includes the results of Aastra from the date of

acquisition of January 31, 2014 (11 months) and does not include Aastra's January 2014 results.

(4)

Pro forma for purchase price accounting adjustment related to the fair value of

deferred revenue. Pro Forma Historical Financial Overview

Historical Adjusted EBITDA

Revenue by Geography

Revenue by Company

EBITDA Less Cash Capital Expenditures

$1,257

$1,266

$686

$678

$1,266

$686

($ in millions)

($ in millions)

($ in millions)

($ in millions)

$678

$1,257

$78

$82

$139

$184

(2)

(2)

(2)

(2)

(2)

(2)

(2)

(2)

(1)

(1)

(1)

(1)

(1)

(1)

(1)

(1)

(4)

(4)

(3)

43

$88

$84

$141

$167

$(10)

$(2)

$(2)

$(6)

$23

FY 12

FY 13

CY 13

CY 14

Mitel

Mavenir

Synergies Adjustment

$ 59

$ 67

$ 125

$ 165

FY 12

FY 13

CY 13

CY 14

$466

$460

$547

$556

$184

$187

$660

$655

$36

$31

$51

$54

FY 12

FY 13

CY 13

CY 14

Americas

EMEA

APAC

$612

$577

$1,156

$1,140

$74

$101

$101

$126

FY 12

FY 13

CY 13

CY 14

Mitel

Mavenir

Note:

On

3/31/2014,

Mitel

announced

the

changing

of

FYE

from

April

30

th

to

December

31

st

.

Mavenir

fiscal

year

ends

December

31

st

.

Numbers

may

not

sum

due

to

rounding. |

| ©2015 Mitel. Proprietary and Confidential.

Synergy Realization from Mavenir

44

($ in millions)

($ in millions)

($ in millions)

Synergy

P&L Item

2015

2016

2017

2018

Replace Sonus SBC used in Mitel Cloud data centers with Mavenir

COGS

$ 0.1

$ 0.3

$ 0.3

$ 0.3

3rd party product cost avoidance

COGS

-

2.0

3.0

5.0

G&A overlap

G&A

-

1.8

3.5

3.5

Eliminate duplicate public company costs

G&A

0.2

0.4

0.4

0.4

Insource Mitel HCL and Wipro R&D in India

R&D

0.5

3.3

3.3

3.3

Leverage low cost R&D capabilities in India

R&D

2.5

4.8

4.8

4.8

Eliminate duplicate facility spend

R&D

0.5

1.0

1.0

1.0

R&D cost avoidance re: mobile PBX (leverage Mitel's Telepo solution)

R&D

2.0

5.0

5.0

5.0

Estimated Synergies

$5.8

$18.7

$21.4

$23.4

Estimated Synergies

Estimated Cost to Execute Synergies

($14.5)

($11.8)

2015

2016

$5.8

$18.7

$21.4

$23.4

2015

2016

2017

2018 |

| ©2015 Mitel. Proprietary and Confidential.

Aastra Synergy Update

•

Continually expanding margins and increasing

profitability; history of successful synergy attainment

•

Management has successfully integrated and realized

synergies from multiple acquisitions, including the

January 2014 acquisition of Aastra

•

Disciplined approach to integration:

•

Integration Management Office (IMO) steering

committee removes roadblocks, sets tone, ensures

cultural mesh, and monitors for success

•

Weekly status calls including VP IMO and

integration team leads ensures commitment

timelines and synergy targets

•

Utilizes Bain toolset and best practices

Synergy Realization for Aastra Acquisition

•

Initial estimate at time of acquisition in January 2014 was for $50M

in synergies to be realized by 2016

•

In May 2014 the initial synergy estimate was increased 50% to $75M

•

As of 12/31/14, Mitel had already actioned annualized synergies of

$73mm

Mitel Operational Excellence

Total: $73mm

Deleveraging Post Aastra Acquisition

•

As a result of the better than expected synergies and

strong free cash flow, Mitel has repaid ~$75mm of the

$355mm TLB raised in 2014

45

Note: Represents executed synergies and related costs for 2014 only.

Synergies Breakdown

by Department ($mm)

Synergies Breakdown

by Category ($mm)

G&A

$ 10

14%

COGS

$ 31

43%

S&M

$ 21

28%

R&D

$ 11

15%

Cost to Execute

Synergies: $62mm

Non-

Headcount

$26

36%

Headcount

(HC)

$47

64%

Facility

restructuring

$ 4

7%

Integration

costs

$ 23

37%

Severance

$ 35

56% |

| ©2015 Mitel. Proprietary and Confidential.

Key Credit Highlights

46 |

| ©2015 Mitel. Proprietary and Confidential.

Credit Highlights

47

Enhanced Scale

Strong

Technology

Leadership

Well Positioned

to Address

Convergence

•

Combined

Company

becomes

a

leader

in

next

generation

enterprise,

mobile

and

cloud

communications

•

Mitel

–

1mm+

cloud

seats,

2,500

channel

partners,

$1.1bn

revenue,

60mm+

end-user

customers

•

Mavenir –

Partners with 3 of the top 4 operators in the US, 3 of the top 4 in Europe, and 15

of the top 20 globally, $130mm revenue growing at 30%, 130+ customers and

over 1bn 4G subscribers under contract

•

Mitel's voice expertise

•

Differentiated and broadest enterprise IP-voice portfolio in the industry for

all business size segments with broad regional strength; 1,600+

patents •

Mavenir's mobile expertise

•

Best-in-breed wireless applications & services

•

Fully virtualized software product portfolio

•

High performance media handling architecture for SBC, EPC

•

Optimized E2E LTE architecture for VoLTE

•

Positioned to capitalize on the evolution in the service provider landscape

through the convergence of enterprise and mobile communications and the

evolution of software based networks

•

Mitel is #1 in Business Cloud Communications and #1 EMEA/#3 N.A./#3 Globally

(ex-Asia) in PBX/IP PBX

•

Mavenir is a global leader in VoLTE/RCS |

Credit Highlights (cont’d)

Mitel Execution in

Growing Markets

•

Mitel undergoing successful expansion into Cloud and Contact Center, two rapidly

growing markets

•

Cloud and Contact Center expected to make up 16% of Mitel revenue in 2015; Contact

Center outpacing market growth by 3x

•

Proven ability to grow faster than market

Mitel / Mavenir

Attractive End

Markets

•

Premise: $6.8bn market in 2014 growing at ~2% CAGR to $7.6bn in 2018

•

Cloud: $5.0bn market in 2014 growing at ~15% CAGR to $8.7bn in 2018

•

Mobile:

$2.6bn

market

in

2014

growing

at

~52%

CAGR

to

$14.0bn

in

2018

(2)

•

Contact

Center:

$2.7bn

TAM

in

2014

growing

at

~9%

CAGR

to

$3.9bn

in

2018

Mitel Operational

Excellence

•

Strong track record of expanding margins and increasing profitability

•

Management successfully integrated and realized synergies from multiple

acquisitions (e.g., Aastra)

•

Significant scale increase from LTM revenue of $580mm before Aastra acquisition to

$1.1bn currently

•

Well

received

deleveraging

through

debt

paydown:

2.6x

at

Aastra

acquisition

to

current

1.5x

(1)

Source: IDC, Management Presentation, Company filings.

(1)

Indicates Debt/LTM EBITDA per 12/31/14 compliance certificate.

(2)

TAM growth includes new Business Services in 2015, which grows from $1.1bn in 2015

to $3.1bn in 2018 at a CAGR of 42%. 48

| ©2015 Mitel. Proprietary and Confidential.

|

| ©2015 Mitel. Proprietary and Confidential.

Appendix

49 |

| ©2015 Mitel. Proprietary and Confidential.

Adjusted EBITDA Reconciliation

(1)

Pro forma adjusted EBITDA for Mitel includes the results of Aastra from the date of

acquisition of January 31, 2014 (11 months) and does not include Aastra's January 2014 results.

50

($ in millions)

Fiscal Year Ended

December 31, 2014

Mitel

Mitel Net Income (Loss)

$ (7.3)

Interest expense

21.0

Income tax expense (recovery)

(22.9)

Foreign exchange loss (gain)

(3.9)

Debt and warrant retirement costs

16.2

Amortization and depreciation

75.9

EBITDA

79.0

Special charges and restructuring costs

72.7

Stock-based compensation

6.1

Acquisition accounting for deferred revenue

9.1

Mitel Adjusted EBITDA

(1)

$ 166.9

Mavenir

Mavenir Net Income (Loss)

$ (26.0)

Interest expense

2.0

Income tax expense (recovery)

0.5

Amortization and depreciation

5.4

EBITDA

(18.1)

Loss on early extinguishment of debt

1.8

Foreign exchange loss (gain)

4.7

Stock-based compensation

4.6

Acquisition related transaction and restructuring costs

0.8

Mavenir Adjusted EBITDA

$ (6.3)

Pro Forma Combined Company

Adjusted EBITDA before Synergies

$ 160.6

Mavenir synergies adjustment

23.4

Adjusted EBITDA post Synergies

$ 184.0

|

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Shake Shack (SHAK) Announces Resignation of Jonathan Sokoloff from Board, Cuts Board Size to 10 from 11

- Churchwell Insurance Agency's Executive Liability Team Recognized as Industry Leaders at Water Tower Research AI and Technology Hybrid Conference

- Titan Logix Corp. Reports its Fiscal 2024 Second Quarter Financial Results

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share