Form 6-K IAMGOLD CORP For: Mar 30

FORM 6-K

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

Date: March 30, 2015

Commission File Number 001-31528

IAMGOLD Corporation

(Translation of registrant’s name into English)

401 Bay Street Suite 3200, PO Box 153

Toronto, Ontario, Canada M5H 2Y4

Tel: (416) 360-4710

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

| Form 20-F | ¨ | Form 40-F | x |

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Description of Exhibit

| Exhibit | Description of Exhibit | |

| 99.1 | Annual Report 2014 |

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| IAMGOLD CORPORATION | ||||||

| Date: March 30, 2015 | By: | /s/ Tim Bradburn | ||||

| Vice President, Legal and Corporate Secretary | ||||||

Exhibit 99.1

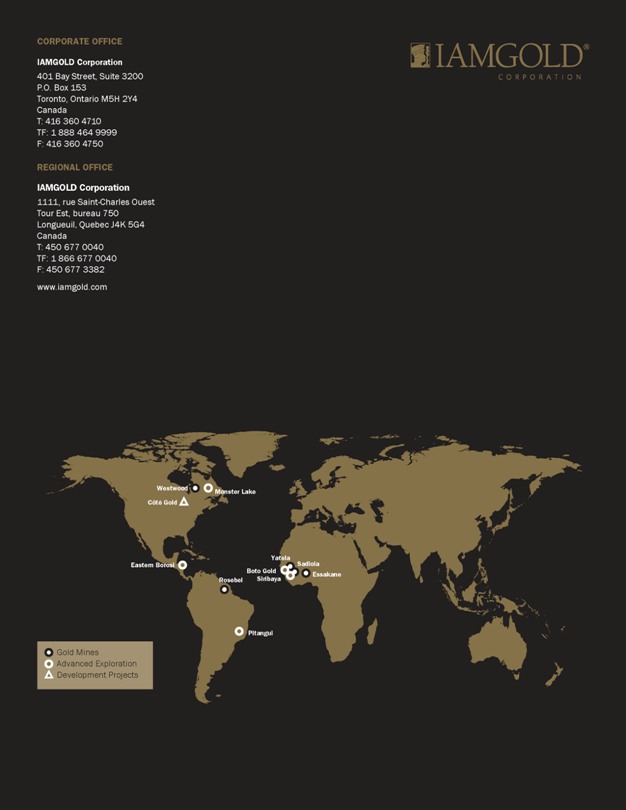

IAMGOLD (www.iamgold.com) is a mid-tier mining company with four operating gold mines (including current joint ventures) on three continents. A solid base of strategic assets in Canada, South America and Africa is complemented by development and exploration projects and continued assessment of accretive acquisition opportunities. IAMGOLD is in a strong financial position with extensive management and operational expertise.

O P E R A T I N G A N D F I N A N C I A L H I G H L I G H T S

| 2013 | 2014 | |||||||

| Gold production – attributable1 (oz.) |

835,000 | 844,000 | ||||||

| Average realized gold price2 ($/oz.) |

1,399 | 1,259 | ||||||

| Total cash cost2,3,4 – gold mines5 ($/oz.) |

801 | 848 | ||||||

| All-in sustaining costs2,4 – gold mines5 ($/oz.) |

1,222 | 1,101 | ||||||

| Financial |

||||||||

| Cash, cash equivalents and bullion (at market) ($ millions) |

384.6 | 321.0 | ||||||

| Net losses ($ millions) |

(832.5 | ) | (206.8 | ) | ||||

| Adjusted net earnings including discontinued operations attributable to IAMGOLD equity holders2 ($ millions) |

137.3 | 32.8 | ||||||

| Adjusted net earnings including discontinued operations per share2 ($/share)

|

|

0.36

|

|

|

0.09

|

| ||

| 1 | Attributable gold production includes Westwood pre-commercial production for the year ended December 31, 2014 and December 31, 2013 of 10,000 ounces of 73,000 ounces, respectively. |

| 2 | This is a non-GAAP measure; refer to the non-GAAP performance measures section of the MD&A. |

| 3 | The total cash costs computation does not include Westwood pre-commercial production for the year ended December 31, 2014 and December 31, 2013 of 10,000 ounces and 73,000 ounces, respectively. |

| 4 | By-product credits are included in the calculation of this measure; refer to the non-GAAP performance measures section of the MD&A for the reconciliation to GAAP. |

| 5 | Gold mines, as used with total cash costs and all-in sustaining costs, consist of Rosebel, Essakane, Westwood (commercial production), Mouska, Sadiola and Yatela on an attributable basis. |

K E Y O P E R AT I O N S AT A G L A N C E

| Mine

|

Location

|

Operator

|

IAMGOLD

|

2014 Production1 (000s oz.)

|

2015 Production1 (000s oz.)

| |||||||

| Rosebel |

Suriname | IAMGOLD | 95% | 325 | 290–300 | |||||||

| Essakane |

Burkina Faso | IAMGOLD | 90% | 332 | 360–370 | |||||||

| Westwood2

|

Canada

|

IAMGOLD

|

|

100%

|

|

92

|

110–130

| |||||

| Total Owner/Operated

|

749

|

760–800

| ||||||||||

| Joint ventures |

Mali | AngloGold Ashanti | Sadiola 41% | 95 | 60 | |||||||

| AngloGold Ashanti |

Yatela 40% | |||||||||||

| Total production

|

844

|

820–860

| ||||||||||

| 1 | All production numbers are on an attributable basis. |

| 2 | Westwood 2014 production includes production from the Doyon division. |

R E S E R V E S A N D R E S O U R C E S S U M M A R Y

| Gold Operations

|

Attributable Contained Ounces of Gold (000s)

| |||

| Dec. 31,2013 | Dec. 31, 2014 | |||||||

| Total proven and probable reserves |

10,127 | 8,608 | ||||||

| Total measured and indicated resources (includes mineral reserves)1,2 |

23,408 | 21,412 | ||||||

| Total inferred resources |

6,299 | 7,018 | ||||||

| 1 | Measured and indicated gold resources are inclusive of proven and probable reserves. |

| 2 | In mining operations, measured and indicated resources that are not mineral reserves are considered uneconomic at the price used for reserves estimations, but are deemed to have a reasonable prospect of economic extraction. |

All figures are in USD

C H A I R M A N ’ S M E S S A G E

Last year marked another challenging year for the gold sector. With a second year of compressed gold prices, many companies had no choice but to adapt to the new landscape.

I am a firm believer that it is during these challenging times that companies can make some of the most effective changes, and in doing so, come out stronger. It is for this reason that I commend IAMGOLD management for making the tough decisions that have allowed IAMGOLD to start 2015 on such a strong footing, setting the stage for an exciting year ahead.

For a second year in a row, cost reduction, cash preservation and capital discipline were entrenched in our business every day; they were the foundation upon which every decision was made. Our commitment to these three priorities resulted in a reduction in all-in sustaining costs year-over-year finishing at $1,021/oz. in the fourth quarter, a balance sheet with over $800 million in cash and bullion, and informed and strategic capital allocation decisions.

The Westwood mine commenced commercial production on July 1, 2014 and produced 70,000 ounces of gold in the first six months. I applaud the hard work that was necessary from everyone at the mine to achieve this result. I look forward to the mine’s first full year of commercial production as it ramps up to full production levels over the next 4 to 5 years.

With the three strategic priorities in mind, IAMGOLD underwent a restructuring which resulted in a leaner, more resilient company. Although not easy, this was necessary in order to better position the Company for success in the current environment in which we operate. As we enter the new year, IAMGOLD does so with reduced overall corporate general and administrative expenses, while at the same time having the flexibility and agility to act opportunistically should we find a compelling opportunity.

The sale of Niobec in 2014 was a significant milestone, a key factor that sets the stage for a transformational year ahead for IAMGOLD. This transaction has afforded the Company financial strength and capacity that separates IAMGOLD from its peers. It provides IAMGOLD with the ability to invest in its own gold portfolio and also to make an acquisition with attractive grades, which can lower the overall cost structure.

With commercial production ramping up at Westwood, a focus on optimizing performance at Rosebel and Essakane, the exploration team’s efforts to increase reserves and resources, and a balance sheet that facilitates the Company’s mergers and acquisitions (“M&A”) strategy, IAMGOLD is in a position to effect change. I am confident that the changes made under the direction of the Company’s management team in 2014 will serve us well into the years to come.

William D. Pugliese

Chairman

IAMGOLD Corporation

2 | IAMGOLD | Annual Report 2014

S T R A I G H T T A L K W I T H M A N A G E M E N T

I am proud of how the IAMGOLD team performed in 2014.

We continued reducing costs, enhancing returns from our existing assets and ensuring that capital projects met our internal rates of return. We beat our cost guidance by 10%, with four consecutive quarters of decreasing all-in sustaining costs to finish the fourth quarter at $1,021/oz., $209/oz. lower year-over-year. Westwood’s first six months of commercial production, improving grades at Rosebel, and benefits from Essakane’s expansion and its higher grades, all contributed to driving production for the year to 844,000 ounces. With safety a primary focus every day, I am pleased to report that the frequency of all types of serious injuries improved 35% year-over-year.

Essakane and Rosebel finished the year with positive free cash flow and I’m confident that we can achieve this at a consolidated level this year. With increasingly encouraging results from our advanced exploration projects and a cash and bullion position over $800 million, we start 2015 on solid ground. Building on our accomplishments in 2014, we will continue driving forward with our three strategic priorities at the root of every decision.

The sale of Niobec was completed on January 22, 2015. The $500 million received in cash for the niobium business strengthened our financial capacity for both investing in our existing assets and pursuing M&A and joint venture opportunities that can contribute to positive cash flow. With our long-term debt not due for another five years, we are positioned to dramatically change IAMGOLD’s profile this coming year. Although we have the ability to make an acquisition immediately, we will be disciplined, moving only if our investment criteria can be met.

In late 2014, we also changed the corporate structure as part of our continuing efforts to maximize economic returns. With the primary objective to create a more efficient and effective corporate structure with embedded agility and scalability, we reduced our top leadership team by 40% and decided to outsource future project development work. We are now much leaner, which allows us to better adapt to the market conditions at hand and provides us with the flexibility to act opportunistically when things change.

I believe in the long-term value of gold. The year has begun on a positive note for the industry with gold up, the price of oil and exchange rates moving in our favour and an increasing appetite for mergers and acquisitions. Our ability to optimize performance while having the financial means to add to our portfolio in a meaningful way, sets the stage for IAMGOLD to deliver value to our shareholders and to Change the Game.

Stephen J.J. Letwin

President and Chief Executive Officer

IAMGOLD Corporation

IAMGOLD | Annual Report 2014 | 3

C H A N G I N G T H E G A M E : D I S C I P L I N E D A C Q U I S I T I O N S A N D D I V E S T I T U R E S

Sale of Niobec

On January 22, 2015, we announced the closing of the sale of Niobec for a total consideration of $530 million. The sale of Niobec comprised an underground niobium mine, the associated processing facilities located in Saint-Honoré-de-Chicoutimi in the Saguenay-Lac-Saint-Jean region, Quebec, and an adjacent rare earth element (“REE”) deposit. The sale of Niobec, for a price that was 10 times EBITDA, strengthened our financial capacity which allows us to optimize the returns from our existing asset portfolio and provides us the optionality to pursue profitable M&A growth opportunities. We could achieve this by deploying the partial or full proceeds from the sale to an acquisition that would generate positive near-term cash flow and improve our grade and cost profile, or explore JVs and partnerships. Although we have the financial means to act quickly, we will be disciplined in our approach. It is imperative that the below criteria be met in order for us to take the opportunity into consideration.

Acquisition Criteria

Under the leadership of Jeff Snow, our General Counsel and Senior Vice President of Business Development, we continue evaluating opportunities to acquire gold assets. With over $800 million in cash and bullion subsequent to the sale of Niobec, we have the financial capacity to acquire a producing or near-term producing mine that could increase our near-term cash flow, improve grades and reduce our cost structure. An acquisition could take the shape of another mining company, a stand-alone asset, or a bolt-on to one of our existing operations. Whether we make an acquisition or not will depend on it meeting the following criteria:

| • The mine is in production or nearing production and thus capable of generating positive free cash flow.

• It is producing or will produce at least 100,000 ounces annually.

• It has a lower cost structure and attractive grade profile.

• It is predominantly gold.

• It has reserves of at least 1 million ounces.

• It is located in a positive mining jurisdiction. |

|

Our priority for the use of proceeds is to reinvest in our business. We have the financial capacity to both optimize the returns from our existing assets and seek profitable M&A opportunities to acquire an asset that, if not already generating positive cash flow, is very close to doing so. By making an acquisition, our consolidated production and cost profile will improve, thus allowing us the opportunity to Change the Game.

8 | IAMGOLD | Annual Report 2014

C H A N G I N G T H E G A M E : M A N A G I N G A S T R O N G P I P E L I N E

Greenfield – Boto Gold Project, Senegal

Our wholly-owned Boto Gold Project comprises 236 square kilometres, and has an indicated resource of 1.23 million ounces, with an average grade of 1.68 grams of gold per tonne, and a further 635,000 ounces in inferred resources grading 1.80 grams of gold per tonne (resources as at December 31, 2014). Final assay results from the 2014 drilling program continued to demonstrate wide intervals of high-grade mineralization from the core of the Malikoundi deposit, the largest deposit discovered to date on the property. Further results from infill diamond drill holes reported in February 2015 included 9 metres grading 10.5 g/t Au (including 5 metres grading 17.55 g/t Au), 44 metres grading 4.46 g/t Au (including 6 metres grading 14.46 g/t Au) and 40 metres grading 3.24 g/t Au (including 11 metres grading 8.15 g/t Au). In 2015, we plan to complete our ongoing 50 metre by 50 metre infill delineation campaign started in 2014 for the purpose of upgrading resources at the Malikoundi deposit. Results will be incorporated in a further resource estimate to support ongoing technical studies.

Greenfield – Pitangui Project, Brazil

The Pitangui Project, 100%-owned, is located on an 180-square-kilometre land package in Brazil’s Iron Quadrangle, the second largest gold producing region in the country. Our focus is on the newly discovered São Sebastião deposit with an estimated resource of 638,000 inferred ounces averaging 4.88 grams of gold per tonne hosted in iron formations for which the region is well known (resources as at January 9, 2013). Subsequent drilling results confirmed the continuity of mineralization and revealed new high-grade intervals in a second zone, not surprising given that deposits of this nature typically comprise multiple mineralized shoots. Although drilling continues, highlights of results released during 2014 included 7.5 metres grading 9.73 g/t Au and 4.9 metres grading 10.16 g/t Au. With an objective to both expand and improve the confidence in the delineated resources, these results are expected to provide a positive impact and will be incorporated in an updated resource model once all results from the current program are received and validated.

C H A N G I N G T H E G A M E : J O I N T V E N T U R E S

MONSTER LAKE, QUEBEC

Partner: Option agreement with TomaGold Corporation. Why it is exciting: Encouraging results from our first exploration program have not only confirmed an extension of the high-grade 325-Megane zone at depth where it remains open, but also have identified several new gold-bearing structures for further exploration. Recent highlights reported from the drilling program (see news release dated February 5, 2015) include:

• 9.18 metres grading 46.33 g/t Au (including 2.2 metres grading 182.8 g/t Au), • 3.42 metres grading 18.68 g/t Au, and

• 7.1 metres grading 6.74 g/t Au.

EASTERN BOROSI, NICARAGUA

Partner: Option agreement with Calibre Mining. Why it is exciting: In 2014 diamond drilling tested five gold-silver vein systems over a strike length of 3 kilometres. Calibre Mining announced final 2014 assay results (news release dated January 21, 2015) including highlights of:

• 5.1 metres grading 13.44 g/t Au and 14.49 g/t Ag, and • 2.8 metres grading 26.48 g/t Au and 24.2 g/t Ag.

A Phase II drilling program planned for 2015 will focus on testing remaining priority targets and delineating extensions to the mineralized shoots discovered in 2014.

DIAKHA – SIRIBAYA, MALI

Partner: 50:50 joint venture with Merrex Gold Inc. Why it is exciting: The drill program in 2014 confirmed a new discovery at Diakha with the intersection of multiple zones of gold mineralization with significant widths and grades. In 2014, reported highlights from assay results (Merrex news release dated August 28, 2014) included:

• 34 metres grading 4.85 g/t Au, • 19 metres grading 7.3 g/t Au, and • 12 metres grading 10.99 g/t Au.

The primary focus for 2015 will be to complete an infill delineation drilling program to enable the estimation of an initial

NI-43-101-compliant resource estimate as results warrant.

IAMGOLD | Annual Report 2014 | 9

2 0 1 4 M I N E R A L R E S E R V E S A N D R E S O U R C E S

Mineral resources (“resources”) and mineral reserves (“reserves”) have been estimated as at December 31, 2014 pursuant to Canadian securities regulatory requirements, specifically the requirements of National Instrument 43-101 and the definitions of resources and reserves incorporated therein. Consistent with National Instrument 43-101, resources are divided into “inferred,” “indicated” and “measured” based on the level of geological confidence in the mineralization, and reserves, into “probable” and “proven” upon at least a pre-feasibility study having been undertaken on the indicated and measured resources. Measured and indicated resources are inclusive of proven and probable reserves. Mineral resources that are not mineral reserves do not have demonstrated economic viability and are not guaranteed to have economic viability. Inferred resources are too speculative geologically to have any economic considerations applied to them that would allow a translation into reserves.

Cautionary Notes to U.S. Investors

The United States Securities and Exchange Commission (“SEC”) limits disclosure for U.S. reporting purposes to mineral deposits that a company can economically and legally extract or produce. IAMGOLD uses certain terms in the Annual Report, such as “measured,” “indicated,” or “inferred,” which may not be consistent with the reserve definitions established by the SEC. U.S. investors are urged to consider closely the disclosure in the IAMGOLD Annual Reports on Forms 40-F filed with the SEC.

G O L D M I N E R A L R E S E R V E S

| 100% Basis Reserves | PROVEN | PROBABLE | ||||||||||||||||||||||

| As at December 31, 2014 | Tonnes (000s) |

Grade (g/t) |

Contained Ounces (000s) |

Tonnes (000s) |

Grade (g/t) |

Contained Ounces (000s) |

||||||||||||||||||

| Rosebel1 (95%) |

76,371 | 1.1 | 2,603 | 17,269 | 1.0 | 552 | ||||||||||||||||||

| Essakane1 (90%) |

— | — | — | 108,821 | 1.1 | 3,886 | ||||||||||||||||||

| Westwood2 (100%) |

301 | 7.3 | 71 | 2,070 | 7.0 | 468 | ||||||||||||||||||

| Sadiola3 (41%) |

— | — | — | 57,428 | 2.1 | 3,841 | ||||||||||||||||||

| Côté Gold (92.5%) |

— | — | — | — | — | — | ||||||||||||||||||

| Boto (100%) |

— | — | — | — | — | — | ||||||||||||||||||

| Pitangui (100%) |

— | — | — | — | — | — | ||||||||||||||||||

| Total proven reserves |

76,672 | 1.1 | 2,674 | |||||||||||||||||||||

| Total probable reserves |

185,588 | 1.5 | 8,747 | |||||||||||||||||||||

| Total proven and probable reserves |

262,260 | 1.4 | 11,421 | |||||||||||||||||||||

| Attributable Reserves | PROVEN | PROBABLE | ||||||||||||||||||||||

| As at December 31, 2014 | Tonnes (000s) |

Grade (g/t) |

Contained Ounces (000s) |

Tonnes (000s) |

Grade (g/t) |

Contained Ounces (000s) |

||||||||||||||||||

| Rosebel1 (95%) |

72,552 | 1.1 | 2,473 | 16,406 | 1.0 | 524 | ||||||||||||||||||

| Essakane1 (90%) |

— | — | — | 97,939 | 1.1 | 3,497 | ||||||||||||||||||

| Westwood2 (100%) |

301 | 7.3 | 71 | 2,070 | 7.0 | 468 | ||||||||||||||||||

| Sadiola3 (41%) |

— | — | — | 23,545 | 2.1 | 1,575 | ||||||||||||||||||

| Côté Gold (92.5%) |

— | — | — | — | — | — | ||||||||||||||||||

| Boto (100%) |

— | — | — | — | — | — | ||||||||||||||||||

| Pitangui (100%) |

— | — | — | — | — | — | ||||||||||||||||||

| Total proven reserves |

72,853 | 1.1 | 2,544 | |||||||||||||||||||||

| Total probable reserves |

139,960 | 1.3 | 6,065 | |||||||||||||||||||||

| Total proven and probable reserves |

212,814 | 1.3 | 8,608 | |||||||||||||||||||||

IAMGOLD | Annual Report 2014 | 11

2 0 1 4 M I N E R A L R E S E R V E S A N D R E S O U R C E S ( C O N T I N U E D )

G O L D M I N E R A L R E S O U R C E S

(inclusive of mineral reserves)

| 100% Basis Resources | MEASURED | INDICATED | INFERRED | |||||||||||||||||||||||||||||||||

| As at December 31, 2014 | Tonnes (000s) |

Grade (g/t) |

Contained Ounces (000s) |

Tonnes (000s) |

Grade (g/t) |

Contained Ounces (000s) |

Tonnes (000s) |

Grade (g/t) |

Contained Ounces (000s) |

|||||||||||||||||||||||||||

| Rosebel1 (95%) |

126,712 | 1.0 | 4,124 | 50,993 | 1.0 | 1,678 | 19,014 | 0.9 | 542 | |||||||||||||||||||||||||||

| Essakane1 (90%) |

– | – | – | 124,432 | 1.2 | 4,702 | 14,830 | 1.3 | 628 | |||||||||||||||||||||||||||

| Westwood2 (100%) |

199 | 11.7 | 75 | 1,455 | 11.1 | 520 | 9,729 | 10.9 | 3,397 | |||||||||||||||||||||||||||

| Sadiola3 (41%) |

12,971 | 0.8 | 320 | 102,146 | 1.9 | 6,275 | 5,523 | 1.6 | 291 | |||||||||||||||||||||||||||

| Côté Gold4 (92.5%) |

– | – | – | 278,600 | 0.9 | 7,716 | 52,300 | 0.7 | 1,241 | |||||||||||||||||||||||||||

| Boto4(100%) |

– | – | – | 22,796 | 1.7 | 1,232 | 10,957 | 1.8 | 635 | |||||||||||||||||||||||||||

| Pitangui4(100%) |

– | – | – | – | – | – | 4,070 | 4.9 | 638 | |||||||||||||||||||||||||||

| Total measured resources |

139,882 | 1.0 | 4,519 | |||||||||||||||||||||||||||||||||

| Total indicated resources |

580,422 | 1.2 | 22,123 | |||||||||||||||||||||||||||||||||

| Total measured and indicated resources5,6 |

720,304 | 1.2 | 26,642 | |||||||||||||||||||||||||||||||||

| Total inferred resources |

116,423 | 2.0 | 7,373 | |||||||||||||||||||||||||||||||||

| Attributable Resources | MEASURED | INDICATED | INFERRED | |||||||||||||||||||||||||||||||||

| As at December 31, 2014 | Tonnes (000s) |

Grade (g/t) |

Contained Ounces (000s) |

Tonnes (000s) |

Grade (g/t) |

Contained Ounces (000s) |

Tonnes (000s) |

Grade (g/t) |

Contained Ounces (000s) |

|||||||||||||||||||||||||||

| Rosebel1 (95%) |

120,376 | 1.0 | 3,918 | 48,443 | 1.0 | 1,594 | 18,063 | 0.9 | 515 | |||||||||||||||||||||||||||

| Essakane1 (90%) |

– | – | – | 111,989 | 1.2 | 4,232 | 13,347 | 1.3 | 565 | |||||||||||||||||||||||||||

| Westwood2 (100%) |

199 | 11.7 | 75 | 1,455 | 11.1 | 520 | 9,729 | 10.9 | 3,397 | |||||||||||||||||||||||||||

| Sadiola3 (41%) |

5,318 | 0.8 | 131 | 41,880 | 1.9 | 2,573 | 2,264 | 1.6 | 119 | |||||||||||||||||||||||||||

| Côté Gold4 (92.5%) |

– | – | – | 257,705 | 0.9 | 7,137 | 48,378 | 0.7 | 1,148 | |||||||||||||||||||||||||||

| Boto4(100%) |

– | – | – | 22,796 | 1.7 | 1,232 | 10,957 | 1.8 | 635 | |||||||||||||||||||||||||||

| Pitangui4(100%) |

– | – | – | – | – | – | 4,070 | 4.9 | 638 | |||||||||||||||||||||||||||

| Total measured resources |

125,894 | 1.0 | 4,124 | |||||||||||||||||||||||||||||||||

| Total indicated resources |

484,268 | 1.1 | 17,287 | |||||||||||||||||||||||||||||||||

| Total measured and indicated resources5,6 |

610,161 | 1.1 | 21,412 | |||||||||||||||||||||||||||||||||

| Total inferred resources |

106,809 | 2.0 | 7,018 | |||||||||||||||||||||||||||||||||

| 1 | Rosebel and Essakane mineral reserves have been estimated as of December 31, 2014 using a $1,300/oz. gold price and mineral resources have been estimated as of December 31, 2014 using a $1,500/oz. gold price and have been estimated in accordance with NI 43-101. |

| 2 | Westwood mineral reserves have been estimated as of December 31, 2014 using a $1,300/oz. gold price and mineral resources have been estimated as of December 31, 2014 using a 6.0 g/t Au cut-off over a minimum width of 2 metres and have been estimated in accordance with NI 43-101. |

| 3 | Mineral reserves at Sadiola have been estimated as of December 31, 2014 using an average $1,100/oz. gold price and mineral resources have been estimated as of December 31, 2014 using a $1,600/oz. gold price and have been estimated in accordance with JORC code. |

| 4 | Côté Gold and Boto Gold mineral resources have been estimated as of December 31, 2014 using a $1,500/oz. gold price. Pitangui mineral resources have been estimated as of January 9, 2014 using a $1,500/oz. gold price. All three resources have been estimated in accordance with NI 43-101. |

| 5 | In mining operations, measured and indicated resources that are not mineral reserves are considered uneconomic at the price used for reserve estimations but are deemed to have a reasonable prospect of economic extraction. |

| 6 | Measured and indicated gold resources are inclusive of proven and probable reserves. |

D e s i g n e d b y b m i r B r y a n M i l l s I r a d e s s o w w w . b m i r . c o m

12 | IAMGOLD | Annual Report 2014

2014 FINANCIAL REVIEW

| Management’s Discussion and Analysis |

1 | |||||

| Management’s Responsibility for Financial Reporting |

38 | |||||

| Report of Independent Registered Public Accounting Firm |

40 | |||||

| Consolidated Financial Statements |

42 | |||||

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL POSITION AND RESULTS OF OPERATIONS

YEAR ENDED DECEMBER 31, 2014

The following Management’s Discussion and Analysis (“MD&A”) of IAMGOLD Corporation (“IAMGOLD” or the “Company”), dated February 18, 2015, should be read in conjunction with IAMGOLD’s audited consolidated financial statements and related notes for December 31, 2014 thereto which appear elsewhere in this report. All figures in this MD&A are in U.S. dollars, unless stated otherwise. Additional information on IAMGOLD Corporation can be found at www.sedar.com or www.sec.gov.

CAUTIONARY STATEMENT ON FORWARD-LOOKING INFORMATION

All information included in this MD&A, including any information as to the Company’s future financial or operating performance, and other statements that express management’s expectations or estimates of future performance, other than statements of historical fact, constitute forward-looking information or forward-looking statements and are based on expectations, estimates and projections as of the date of this MD&A. For example, forward-looking statements contained in this MD&A are found under, but are not limited to being included under, the headings “2014 Summary”, “Outlook” and “Annual Updates”, and include, without limitation, statements with respect to: the Company’s guidance for production, total cash costs, all-in sustaining costs, depreciation expense, effective tax rate, capital expenditures, operations outlook, development and expansion projects, exploration, the future price of gold, the estimation of mineral reserves and mineral resources, the realization of mineral reserve and mineral resource estimates, the timing and amount of estimated future production, costs of production, permitting timelines, currency fluctuations, requirements for additional capital, government regulation of mining operations, environmental risks, unanticipated reclamation expenses, title disputes or claims and limitations on insurance coverage. Forward-looking statements are provided for the purpose of providing information about management’s current expectations and plans relating to the future. Forward-looking statements are generally identifiable by, but are not limited to, the use of the words “may”, “will”, “should”, “continue”, “expect”, “anticipate”, “estimate”, “believe”, “intend”, “plan”, “suggest”, “guidance”, “outlook”, “potential”, “prospects”, “seek”, “targets”, “strategy” or “project” or the negative of these words or other variations on these words or comparable terminology. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable by management, are inherently subject to significant business, economic and competitive uncertainties and contingencies. The Company cautions the reader that reliance on such forward-looking statements involve risks, uncertainties and other factors that may cause the actual financial results, performance or achievements of IAMGOLD to be materially different from the Company’s estimated future results, performance or achievements expressed or implied by those forward-looking statements, and the forward-looking statements are not guarantees of future performance. These risks, uncertainties and other factors include, but are not limited to, changes in the global prices for gold, copper, silver or certain other commodities (such as diesel and electricity); changes in U.S. dollar and other currency exchange rates, interest rates or gold lease rates; risks arising from holding derivative instruments; the level of liquidity and capital resources; access to capital markets, and financing; mining tax regimes; ability to successfully integrate acquired assets; legislative, political or economic developments in the jurisdictions in which the Company carries on business; operating or technical difficulties in connection with mining or development activities; laws and regulations governing the protection of the environment; employee relations; availability and increasing costs associated with mining inputs and labour; the speculative nature of exploration and development, including the risks of diminishing quantities or grades of reserves; adverse changes in the Company’s credit rating; contests over title to properties, particularly title to undeveloped properties; and the risks involved in the exploration, development and mining business. With respect to development projects, IAMGOLD’s ability to sustain or increase its present levels of gold production is dependent in part on the success of its projects. Risks and unknowns inherent in all projects include the inaccuracy of estimated reserves and resources, metallurgical recoveries, capital and operating costs of such projects, and the future prices for the relevant minerals. Development projects have no operating history upon which to base estimates of future cash flows. The capital expenditures and time required to develop new mines or other projects are considerable, and changes in costs or construction schedules can affect project economics. Actual costs and economic returns may differ materially from IAMGOLD’s estimates or IAMGOLD could fail to obtain the governmental approvals necessary for the operation of a project; in either case, the project may not proceed, either on its original timing or at all.

For a more comprehensive discussion of the risks faced by the Company, and which may cause the actual financial results, performance or achievements of IAMGOLD to be materially different from the Company’s estimated future results, performance or achievements expressed or implied by forward-looking information or forward-looking statements, please refer to the Company’s latest Annual Information Form (“AIF”), filed with the Canadian securities regulatory authorities at www.sedar.com, and filed under Form 40-F with the United States Securities Exchange Commission at www.sec.gov/edgar.html. The risks described in the AIF (filed and viewable on www.sedar.com and www.sec.gov/edgar.html, and is available upon request from the Company) are hereby incorporated by reference into this MD&A.

The Company disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise except as required by applicable law.

IAMGOLD CORPORATION

ANNUAL MANAGEMENT’S DISCUSSION AND ANALYSIS – DECEMBER 31, 2014

PAGE 1

| 2 | ||||

| 2 | ||||

| 3 | ||||

| 6 | ||||

| 7 | ||||

| 8 | ||||

| 10 | ||||

| 16 | ||||

| 17 | ||||

| 20 | ||||

| 20 | ||||

| 22 | ||||

| 23 | ||||

| 23 | ||||

| 23 | ||||

| Disclosure Controls and Procedures and Internal Control over Financial Reporting |

23 | |||

| 24 | ||||

| 24 | ||||

| 26 | ||||

| 26 | ||||

| 30 |

IAMGOLD is a mid-tier mining company with four operating gold mines on three continents. A solid base of strategic assets in Canada, South America and Africa is complemented by development and exploration projects, and continued assessment of accretive acquisition opportunities. IAMGOLD is in a strong financial position with extensive management and operational expertise. IAMGOLD (www.iamgold.com) is listed on the Toronto Stock Exchange (trading symbol “IMG”) and the New York Stock Exchange (trading symbol “IAG”).

IAMGOLD’s commitment is to Zero Harm, in every aspect of its business. IAMGOLD is one of the companies on the JSI index1.

| • | Attributable gold production, inclusive of joint venture operations, was 844,000 ounces, up by 9,000 ounces from 2013 and within guidance. |

| • | Strong performance by Westwood in its first two quarters of commercial production, producing 70,000 ounces with all-in sustaining costs2 of $1,031 per ounce sold. |

| • | Gold production at Essakane continues to increase, up 33% from 2013. |

| • | Below guidance, all-in sustaining costs2,3 - gold mines5 was $1,101 per ounce sold, 10% lower than 2013. |

| • | Capital expenditures of $325 million were below guidance and 51% lower than 2013. |

| • | Total cash costs2,4 - gold mines were $848 per ounce produced and within guidance. |

| • | The Company’s initiative to convert a portion of its non-cash working capital contributed over $50 million in cash in 2014. |

| • | On January 22, 2015, the Company completed the sale of Niobec and received cash after tax of $500 million, increasing cash, cash equivalents and gold bullion (at market value) to approximately $800 million. |

| • | Continued positive assay results from the 2014 drill program at the 100% owned Boto Gold Project in eastern Senegal, West Africa. Highlights from further drilling include 9 metres grading 10.5 g/t Au, 44 metres grading 4.46 g/t Au and 40 metres grading 3.24 g/Au (refer to the news release dated February 3, 2015). |

| • | In February 2015, the Company issued flow-through shares for proceeds of Cd$50 million. |

| 1 | Jantzi Social Index (“JSI”). The JSI is a socially screened market capitalization-weighted common stock index modeled on the S&P/TSX 60. It consists of companies that pass a set of broadly based environmental, social and governance rating criteria. |

| 2 | This is a non-GAAP measure. Refer to the non-GAAP performance measures section of the MD&A. |

| 3 | The Company, in the third quarter 2014, began including the income from its Diavik royalty as an offset to operating costs in the calculation of this measure. Previous periods were revised for comparability. |

| 4 | The total cash costs computation does not include Westwood pre-commercial production for the year ended 2014 of 10,000 ounces. |

| 5 | Gold mines, as used with total cash costs and all-in sustaining costs, consist of Rosebel, Essakane, Westwood (commercial production), Mouska, Sadiola and Yatela on an attributable basis. |

IAMGOLD CORPORATION

ANNUAL MANAGEMENT’S DISCUSSION AND ANALYSIS – DECEMBER 31, 2014

PAGE 2

FINANCIAL

| • | Net cash from operating activities including discontinued operations for 2014 was $312.2 million, up $65.9 million or 27% from the prior year. The increase was mainly due to a reduction in inventory ($51.3 million), lower income taxes paid ($95.4 million) and managing vendor payment terms ($15.3 million), partially offset by lower earnings from operations. |

| • | Net cash from operating activities before changes in working capital1 including discontinued operations for 2014 was $317.3 million ($0.84 per share1), up $11.7 million ($0.03 per share) or 4% from the prior year. |

| • | Over the past 12 months, the initiative to convert non-cash working capital accounts to cash has contributed over $50 million to the Company’s cash position. In 2015, the Company will continue to manage working capital, effectively balancing its liquidity position, while maintaining appropriate inventory levels to support operations. |

| • | Cash, cash equivalents and gold bullion (at market value) from continuing operations was $321.0 million at December 31, 2014, down $63.6 million since December 31, 2013. The Company received cash from operating activities ($312.2 million), proceeds on sale and leaseback arrangements ($31.5 million) and net repayments from related parties ($14.7 million). The Company used cash for capital expenditures on property, plant and equipment and exploration and evaluation assets ($376.7 million), dividends to non-controlling interests and interest paid ($26.8 million). Cash held by the discontinued operations was $12.0 million. |

| • | Revenues from continuing operations for 2014 were $1,007.9 million, up $60.4 million or 6% from the prior year. The increase was a result of higher gold sales of 122,000 ounces ($163.3 million) primarily attributable to the completion of the expansion at Essakane and achievement of commercial production at Westwood, partially offset by lower sales from Mouska, as operations ceased in the third quarter 2014. This increase was partially offset by lower realized gold prices ($103.7 million). Revenues from continuing operations for the fourth quarter 2014 were $272.5 million, up $77.4 million or 40% from the same prior year period mainly due to higher gold ounces sold, partially offset by lower realized gold prices. |

| • | Cost of sales from continuing operations for 2014 were $892.9 million, up $224.4 million or 34% from the prior year as a result of increased production at Essakane ($102.5 million), the commencement of commercial production at Westwood ($50.9 million), higher operating costs for harder rock and lower capitalized stripping at Rosebel ($56.6 million) and higher depreciation expenses ($61.2 million). The increase was partially offset by the closure of Mouska ($40.6 million) and lower royalties driven by lower realized gold prices ($3.3 million). Cost of sales for the fourth quarter 2014 was up $77.7 million or 48% from the same prior year period mainly due to higher production volumes and depreciation. |

| • | The depreciation expense in 2014 was $205.0 million, up 43% from the prior year. This is primarily a result of the commencement of commercial production at Westwood in the third quarter 2014, Essakane’s commissioning of the expanded milling facilities and higher amortization of capitalized stripping at Essakane and Rosebel. |

| • | Income tax expense for the year was $117.9 million, of which $113.7 million was deferred. With losses from continuing operations prior to income taxes for the year, it would be reasonable to expect an income tax benefit rather than an income tax expense. However, the Company had significant loss carry forwards valued at $76.0 million that were recorded as a deferred tax asset, and with the sale of Niobec the Company no longer had the benefit of the projected future taxable income that would have offset taxable losses in Canada. Accordingly, the Company wrote off the entire asset in the third quarter in accordance with IFRS. This resulted in a non-cash deferred tax expense. In addition, the strengthening U.S. dollar reduced the tax base of mining assets in foreign jurisdictions that had the effect of lowering future tax deductions when translated into U.S. dollars, and higher mining duty tax rates and other tax related adjustments also contributed to the deferred tax expense totaling $113.7 million. These are non-cash items and the write off of the asset is not indicative of the economic value of the underlying tax pools that may be used to reduce cash income taxes in the future. |

| • | Net losses from continuing operations attributable to equity holders for 2014 were $269.5 million, or $0.72 per share, an improvement of $593.1 million, or $1.57 per share, from the prior year. This improvement mainly related to the non-recurrence of the prior year impairment charges on goodwill and mining assets ($888.1 million) and marketable securities and associates ($72.5 million), higher revenues ($60.4 million), lower write-down of receivables ($54.6 million), lower share of net losses from investments in associates and joint ventures ($41.2 million), and lower exploration expense ($26.5 million). This is partially offset by the increased cost in estimates of asset retirement obligations at closed sites ($57.5 million), net derivative losses ($48.5 million), and higher cost of sales and income tax expense as noted above. Net losses from continuing operations attributable to equity holders for the fourth quarter 2014 were $148.7 million, compared to net losses of $843.8 million for the same prior year period. This improvement mainly related to the drivers discussed above. |

| • | Adjusted net earnings including discontinued operations attributable to equity holders1 for 2014 were $32.8 million ($0.09 per share), down $104.5 million ($0.27 per share) from the prior year. Adjusted net earnings including discontinued operations attributable to equity holders for the fourth quarter 2014 were $10.2 million ($0.03 per share), down $9.5 million ($0.02 per share) from the same prior year period. |

| 1 | This is a non-GAAP measure. Refer to the non-GAAP performance measures section of the MD&A. |

IAMGOLD CORPORATION

ANNUAL MANAGEMENT’S DISCUSSION AND ANALYSIS – DECEMBER 31, 2014

PAGE 3

| • | Net earnings for Niobec were presented separately as net earnings from discontinued operations, net of tax in the consolidated statements of earnings. Comparative periods have been adjusted accordingly. Net earnings from discontinued operations for 2014 were $62.7 million, up $32.6 million or 108% from the prior year. The increase was a result of higher sales, improved grades, lower costs due to improved operational efficiencies and the favourable impact of a stronger U.S. dollar relative to the Canadian dollar at Niobec. |

OPERATIONS

| • | Regarding health and safety, the frequency of all types of serious injuries (measured as DART rate6) for 2014 was 0.66 compared to 1.01 for the prior year, representing a 35% improvement. The Company deeply regretted to report the death of an employee at the Rosebel operations during the second quarter 2014. |

GOLD

| • | In 2014, attributable gold production, inclusive of joint venture operations, was 844,000 ounces, up 9,000 ounces from the prior year. Gold production was higher mainly due to increased throughput of higher grade ore at Essakane as a result of the expanded plant (82,000 ounces) and the ramp-up of production at Westwood (7,000 ounces). This was partially offset by the closure of Mouska (51,000 ounces), winding down of operations at Yatela (16,000 ounces), lower grades at Rosebel (11,000 ounces), and lower grades at Sadiola (2,000 ounces). Attributable gold production, inclusive of joint venture operations, for the fourth quarter 2014, was up 46,000 ounces or 24% from the same prior year period mainly due to higher grades at Essakane and Rosebel. |

| • | Attributable gold sales, inclusive of joint venture operations, for 2014 was 835,000 ounces, compared to attributable gold commercial production of 834,000 ounces. The variance of 1,000 ounces is due to a decrease in the gold inventory at Rosebel (7,000 ounces), the depletion of remaining gold doré at Mouska (4,000 ounces) and timing of sales at Sadiola (1,000 ounces), partially offset by the timing of sales at Essakane (6,000 ounces) and Westwood (5,000 ounces). Attributable gold sales, inclusive of joint venture operations, for the fourth quarter 2014, was up 61,000 ounces or 35% from the same prior year period mainly due to the recognition of Westwood sales, increased production at Essakane and Rosebel, partially offset by the closure of Mouska in 2014 and the winding down of production from the joint venture operations. |

| • | Total cash costs1,2 - gold mines4 for 2014 were $848 per ounce produced, up 6% from the prior year. The increase was mainly due to the increased proportions of hard rock processed at Rosebel and Essakane. This was partially offset by the sustained benefits from the Company’s cost reduction program. Total cash costs - gold mines for the fourth quarter 2014 was $788 per ounce produced, down $40 or 5% from the same prior year period, mainly due to a higher proportion of production from the lower cost owner-operator sites. |

| • | All-in sustaining costs1,3 - gold mines for 2014 were $1,101 per ounce sold, down 10% from the prior year. The decrease was mainly a result of lower sustaining capital. All-in sustaining costs - gold mines for the fourth quarter 2014 were $1,021 per ounce sold, down 17% from the same prior year period. The decrease was mainly a result of lower sustaining capital. |

| • | All-in sustaining costs - total5 for 2014 were $992 per ounce sold, down 13% from the prior year. This measure includes the impact of the Niobec operating margin1 and its sustaining capital expenditures. |

NIOBIUM

| • | Niobium (disclosed as discontinued operations) production for 2014 was 5.6 million kilograms, up 6% from the prior year. The operating margin per kilogram of niobium1 for 2014 increased by 11% compared to the prior year to $20 per kilogram, as the operating costs benefited from increased production levels and the continued benefits of the cost reduction program and the favourable impact of a stronger U.S. dollar relative to the Canadian dollar. For the fourth quarter 2014, niobium production from discontinued operations was 6% lower than the same prior year period and there was no change in the operating margin. |

SUMMARY OF FINANCIAL AND OPERATING RESULTS

| Financial Position from continuing operations ($ millions) |

December 31, 2014 | December 31, 2013 | ||||||

| Cash, cash equivalents, and gold bullion |

||||||||

| at market value |

$ | 321.0 | $ | 384.6 | ||||

| at cost |

$ | 255.4 | $ | 319.2 | ||||

| Total assets |

$ | 4,222.8 | $ | 4,190.4 | ||||

| Long-term debt |

$ | 641.7 | $ | 640.3 | ||||

| Available credit facilities |

$ | 500.0 | $ | 750.0 | ||||

| 1 | This is a non-GAAP measure. Refer to the non-GAAP performance measures section of the MD&A. |

| 2 | The total cash costs computation does not include Westwood pre-commercial production for the year ended December 31, 2014 of 10,000 ounces, and for the three months and year ended December 31, 2013 of 20,000 and 73,000 ounces, respectively. |

| 3 | The Company, in the third quarter 2014, began including the income from its Diavik royalty as an offset to operating costs in the calculation of this measure. Previous periods were revised for comparability. |

| 4 | Gold mines, as used with total cash costs and all-in sustaining costs, consist of Rosebel, Essakane, Westwood (commercial production), Mouska, Sadiola and Yatela on an attributable basis. |

| 5 | Total, as used with all-in sustaining costs, includes the impact of niobium contribution, which is classified as discontinued operations, defined as the Niobec operating margin and its sustaining capital, on a per gold ounce sold basis. Refer to the all-in sustaining costs table in the non-GAAP performance measures section of the MD&A. |

| 6 | The DART rate refers to the number of days away, restricted duty or job transfer incidents that occur per 100 employees. |

IAMGOLD CORPORATION

ANNUAL MANAGEMENT’S DISCUSSION AND ANALYSIS – DECEMBER 31, 2014

PAGE 4

| Three months ended December 31, |

Years ended December 31, |

|||||||||||||||

| Financial Results ($ millions, except where noted) |

2014 | 2013 | 2014 | 2013 | ||||||||||||

| Continuing Operations |

||||||||||||||||

| Revenues |

$ | 272.5 | $ | 195.1 | $ | 1,007.9 | $ | 947.5 | ||||||||

| Cost of sales |

$ | 239.5 | $ | 161.8 | $ | 892.9 | $ | 668.5 | ||||||||

| Earnings from continuing mining operations1 |

$ | 33.0 | $ | 33.3 | $ | 115.0 | $ | 279.0 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net losses including discontinued operations attributable to equity holders of IAMGOLD |

$ | (122.0 | ) | $ | (840.3 | ) | $ | (206.8 | ) | $ | (832.5 | ) | ||||

| Net losses including discontinued operations attributable to equity holders of IAMGOLD per share ($/share) |

$ | (0.32 | ) | $ | (2.23 | ) | $ | (0.55 | ) | $ | (2.21 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Adjusted net earnings including discontinued operations attributable to equity holders of IAMGOLD1 |

$ | 10.2 | $ | 19.7 | $ | 32.8 | $ | 137.3 | ||||||||

| Adjusted net earnings including discontinued operations per share ($/share)1 |

$ | 0.03 | $ | 0.05 | $ | 0.09 | $ | 0.36 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net cash from operating activities including discontinued operations |

$ | 72.0 | $ | 44.0 | $ | 312.2 | $ | 246.3 | ||||||||

| Net cash from operating activities before changes in working capital including discontinued operations1 |

$ | 93.7 | $ | 54.7 | $ | 317.3 | $ | 305.6 | ||||||||

| Net cash from operating activities before changes in working capital including discontinued operations ($/share)1 |

$ | 0.25 | $ | 0.15 | $ | 0.84 | $ | 0.81 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net earnings from discontinued operations attributable to equity holders of IAMGOLD |

$ | 26.7 | $ | 3.5 | $ | 62.7 | $ | 30.1 | ||||||||

| Net earnings from discontinued operations attributable to equity holders of IAMGOLD ($/share) |

$ | 0.07 | $ | 0.01 | $ | 0.17 | $ | 0.08 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Key Operating Statistics |

||||||||||||||||

| Gold sales - attributable (000s oz) |

234 | 173 | 835 | 740 | ||||||||||||

| Gold commercial production - attributable (000s oz) |

241 | 175 | 834 | 762 | ||||||||||||

| Gold production - attributable2 (000s oz) |

241 | 195 | 844 | 835 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Average realized gold price1 ($/oz) |

$ | 1,201 | $ | 1,273 | $ | 1,259 | $ | 1,399 | ||||||||

| Total cash costs1,3,4 - gold mines5 ($/oz) |

$ | 788 | $ | 828 | $ | 848 | $ | 801 | ||||||||

| Gold margin1 ($/oz) |

$ | 413 | $ | 445 | $ | 411 | $ | 598 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| All-in sustaining costs1,4,6 - gold mines ($/oz) |

$ | 1,021 | $ | 1,230 | $ | 1,101 | $ | 1,222 | ||||||||

| All-in sustaining costs - total7 ($/oz) |

$ | 938 | $ | 1,113 | $ | 992 | $ | 1,143 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Discontinued operations |

||||||||||||||||

| Niobium production (millions of kg Nb) |

1.5 | 1.6 | 5.6 | 5.3 | ||||||||||||

| Niobium sales (millions of kg Nb) |

1.5 | 1.3 | 5.8 | 4.9 | ||||||||||||

| Operating margin1 ($/kg Nb) |

$ | 20 | $ | 20 | $ | 20 | $ | 18 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| 1 | This is a non-GAAP measure. Refer to the non-GAAP performance measures section of the MD&A. |

| 2 | Attributable gold production includes Westwood pre-commercial production for the year ended December 31, 2014 of 10,000 ounces, and for the three months and year ended December 31, 2013 of 20,000 ounces and 73,000 ounces, respectively. |

| 3 | The total cash costs computation does not include Westwood pre-commercial production for the year ended December 31, 2014 of 10,000 ounces, and for the three months and year ended December 31, 2013 of 20,000 and 73,000 ounces, respectively. |

| 4 | By-product credits are included in the calculation of this measure; refer to the non-GAAP performance measures section of the MD&A for the reconciliation to GAAP. |

| 5 | Gold mines, as used with total cash costs and all-in sustaining costs, consist of Rosebel, Essakane, Westwood (commercial production), Mouska, Sadiola and Yatela on an attributable basis. |

| 6 | The Company, in the third quarter 2014, began including the income from its Diavik royalty as an offset to operating costs in the calculation of this measure. Previous periods were revised for comparability. |

| 7 | Total, as used with all-in sustaining costs, includes the impact of niobium contribution, which is classified as discontinued operations, defined as the Niobec operating margin and sustaining capital, on a per gold ounce sold basis. Refer to the all-in sustaining costs table in the non-GAAP performance measures section of the MD&A. |

IAMGOLD CORPORATION

ANNUAL MANAGEMENT’S DISCUSSION AND ANALYSIS – DECEMBER 31, 2014

PAGE 5

Effective at December 31, 2014, the Company reduced its gold price per ounce assumption for estimating mineral reserves by $100, as compared to 2013, to $1,300 in line with current industry trends and prudent business practices. This, along with other factors in the estimation process, has contributed to a decrease in total proven and probable mineral reserves.

| IAMGOLD’s Share1 |

2014 | 2013 | ||||||

| Gold (000s attributable oz contained) |

||||||||

| Total proven and probable mineral reserves |

8,608 | 10,127 | ||||||

| Total measured and indicated mineral resources2,3 |

21,412 | 23,408 | ||||||

| Total inferred resources |

7,018 | 6,299 | ||||||

|

|

|

|

|

|||||

| 1 | On January 22, 2015, the Company announced that it had closed the sale of Niobec, which included the total rare earth oxides (“TREO”). As such, the Company will no longer report niobium reserves or resources or TREO for Niobec. |

| 2 | Measured and indicated gold resources are inclusive of proven and probable reserves. |

| 3 | In mining operations, measured and indicated resources that are not mineral reserves are considered uneconomic at the price used for reserves estimations, but are deemed to have a reasonable prospect of economic extraction. |

Assumptions used to determine reserves and resources are as follows:

| 2014 | 2013 | |||||||

| Weighted average gold price used for: |

||||||||

| Gold reserves ($/oz) |

1,263 | 1 | 1,357 | 3 | ||||

| Gold resources ($/oz) |

1,510 | 2 | 1,540 | 4 | ||||

|

|

|

|

|

|||||

| Foreign exchange rate (C$/US$) |

1.10 | 1.10 | ||||||

|

|

|

|

|

|||||

| 1 | Mineral reserves have been estimated at December 31, 2014 using a gold price of $1,300 per ounce for Rosebel, Westwood and Essakane and $1,100 per ounce for Sadiola. |

| 2 | Mineral resources have been estimated at December 31, 2014, using a gold price of $1,500 per ounce for Côté Gold project, Boto project, Pitangui project, Essakane, Rosebel and Westwood, and $1,600 per ounce for Sadiola. A cut-off of 6.0 g/t Au over a minimum thickness of 2 meters was used for Westwood. |

| 3 | Mineral reserves have been estimated at December 31, 2013, using a gold price of $1,400 per ounce for Westwood, Rosebel and Essakane, $1,100 per ounce for Sadiola and $1,300 per ounce for Mouska. |

| 4 | Mineral resources have been estimated at December 31, 2013, using a gold price of $1,300 per ounce for Mouska with a foreign exchange rate of 1.10C$/U.S.$, $1,600 per ounce for Sadiola, Yatela and Doyon and $1,500 per ounce for Rosebel and Essakane. A cut-off of 6.0 g/t Au over a minimum thickness of 2 metres was used for Westwood. |

During 2014, reserves and resources changed as follows:

| • | Total attributable proven and probable gold reserves decreased by 15% or 1.5 million ounces (net of depletion) to 8.6 million ounces of gold at the end of 2014, mainly due to general mine depletion not compensated by the addition of new reserves at Rosebel, Essakane and Westwood (0.8 million ounces), economic and geotechnical parameters at Rosebel (0.7 million ounces), and the use of a lower gold price per ounce assumption to estimate reserves at owner-operated sites (0.4 million ounces). This was partially offset by positive economic parameters at Sadiola (0.3 million ounces) and a transfer of resources at Westwood (0.1 million ounces). The weighted average gold price assumption used to determine mineral reserves as at December 31, 2014 was $1,263 per ounce compared to $1,357 per ounce as at December 31, 2013. |

| • | Total attributable measured and indicated gold resources (inclusive of reserves) decreased by 9% or 2.0 million ounces to 21.4 million ounces of gold at the end of 2014, mainly due to the influence of economic parameters and depletion at Rosebel (1.6 million ounces) and Essakane (0.5 million ounces), partially offset by the addition of resources from the Boto project (0.1 million ounces) and Côté Gold project (0.1 million ounces). |

IAMGOLD CORPORATION

ANNUAL MANAGEMENT’S DISCUSSION AND ANALYSIS – DECEMBER 31, 2014

PAGE 6

| IAMGOLD Full Year Guidance3 |

2015 | |

| Rosebel (000s oz) |

290 - 300 | |

| Essakane (000s oz) |

360 - 370 | |

| Westwood (000s oz) |

110 - 130 | |

|

| ||

| Total owner-operated production (000s oz) |

760 - 800 | |

| Joint ventures (000s oz) |

60 | |

|

| ||

| Total attributable production (000s oz) |

820 - 860 | |

|

| ||

| Total cash costs1 - owner-operator ($/oz) |

$825 - $865 | |

| Total cash costs - gold mines2 ($/oz) |

$850 - $900 | |

|

| ||

| All-in sustaining costs1 - owner-operator ($/oz) |

$1,050 - $1,150 | |

| All-in sustaining costs - gold mines ($/oz) |

$1,075 - $1,175 | |

|

| ||

| 1 | This is a non-GAAP measure. Refer to the non-GAAP performance measures section of the MD&A. |

| 2 | Gold mines, as used with total cash costs and all-in sustaining costs, consist of Rosebel, Essakane, Westwood, Sadiola and Yatela on an attributable basis. |

| 3 | The outlook is based on 2015 full year assumptions with an average realized gold price of $1,250 per ounce, Canadian $/U.S.$ exchange rate of 1.15, U.S.$/€ exchange rate of 1.20 and average crude oil price of $73 per barrel. This considers consensus forecasted price and the Company’s hedging programs. |

GOLD PRODUCTION AND CASH COSTS

The Company expects 2015 attributable gold production to be in the range of 820,000 to 860,000 ounces. This reflects the ramp-up of production at Westwood and higher grades from hard rock ore processed at the expanded plant at Essakane, lower production at Rosebel due to a higher proportion of hard rock, and lower production at the joint ventures. Production is expected to be slightly lower in the first quarter and the fourth quarter compared to the second quarter and third quarter due to mine sequencing at Westwood. Total cash costs1 - gold mines for 2015 are expected to be within the range of $850 and $900 per ounce and total all-in sustaining costs1 - gold mines are expected to be in the range of $1,075 and $1,175 per ounce. This considers the positive impact from the reduction in the oil price and a stronger U.S. dollar. However, the growing proportion of harder ore at Rosebel and Essakane is expected to exert greater demand on crushing and grinding capacity, which in turn increases energy consumption and use of reagents.

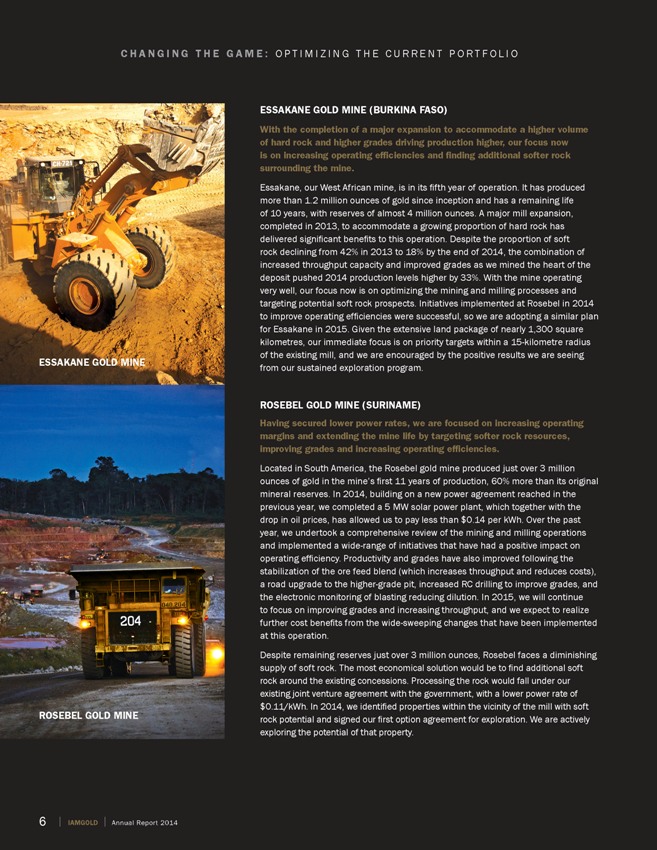

ROSEBEL

The Company expects mining activity in 2015 to be comparable to 2014 with approximately 70% of the mining expected from the longer haul southern pits. Rosebel will continue to benefit from the use of engineered stockpiles which has provided significant improvements to the circuit stability and is resulting in reduced grinding media and reagent consumption, and stable power draw. Furthermore, the commissioning of the solar farm in 2014 will continue to yield power credits for Rosebel in 2015. Operational enhancements will continue and the Company will explore further opportunities to improve performance, manage grades and reduce unit production costs including initiatives in dilution reduction, mine-to-mill throughput enhancement, fuel and tire management through better road maintenance practices, and alternative processing such as heap leaching. Attributable production in 2015 is expected to be in the range of 290,000 to 300,000 ounces.

ESSAKANE

The Company expects production at Essakane to ramp up by approximately 10% in 2015 to achieve the designed capacity. The mining activity is expected to be higher with the mining of the Falagountou deposit to commence in 2015. In order to improve grades and maintain optimal throughput levels, Essakane will use one of its two processing lines to process 100% of the hard rock and the other for processing blended ore. The Company continues to implement operational enhancements to lower unit costs. Attributable production in 2015 is expected to be in the range of 360,000 and 370,000 ounces.

WESTWOOD

Production at Westwood will continue to ramp-up as the focus in 2015 continues to be on development activities and stope preparation. The Company plans to undertake approximately 18 km of lateral development and 5 km of vertical development in 2015. Although the mill is scheduled for continuous operation in 2015, production will be slightly lower in the first quarter and the fourth quarter compared to the second quarter and the third quarter due to mine development sequencing, which will offer flexibility to the mine over the ramp-up period. Total production in 2015 is expected to be in the range of 110,000 to 130,000 ounces.

DEPRECIATION EXPENSE

Depreciation expense, excluding Niobec, is expected to increase by about 40% in 2015 compared to 2014 as a result of a full year of commercial production at Westwood, higher amortization of capitalized stripping costs at Rosebel, lower reserves at Essakane and Rosebel, and expected timing of capital additions. Depreciation expense is expected to be in the range of $285 to $295 million.

| 1 | This is a non-GAAP measure. Refer to the non-GAAP performance measures section of the MD&A. |

IAMGOLD CORPORATION

ANNUAL MANAGEMENT’S DISCUSSION AND ANALYSIS – DECEMBER 31, 2014

PAGE 7

INCOME TAXES

The Company expects to pay cash taxes in the range of $17.0 million to $22.0 million for the twelve months ending December 31, 2015. In addition, adjustments to deferred tax assets and or liabilities may also be recorded during this period.

CAPITAL EXPENDITURES OUTLOOK1

The Company is budgeting capital expenditures of $230 million ± 10% in 2015. This represents an approximate 30% reduction from 2014.

| ($ millions) |

Sustaining | Development/ Expansion (Non-sustaining) |

Total | |||||||||

| Owner-operator |

||||||||||||

| Rosebel |

$ | 70 | $ | 10 | $ | 80 | ||||||

| Essakane |

55 | 5 | 60 | |||||||||

| Westwood |

30 | 50 | 80 | |||||||||

|

|

|

|

|

|

|

|||||||

| 155 | 65 | 220 | ||||||||||

| Côté Gold |

— | 5 | 5 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total owner-operator |

155 | 70 | 225 | |||||||||

| Joint venture - Sadiola |

5 | — | 5 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total (±10%) |

$ | 160 | $ | 70 | $ | 230 | ||||||

|

|

|

|

|

|

|

|||||||

| 1 | Capitalized borrowing costs are not included. |

GLOBAL FINANCIAL MARKET CONDITIONS

Macro divergences in the global economy created financial market instability in the global currency market in 2014. In the U.S., the Federal Reserve ended its $5 trillion in asset purchases in the fourth quarter 2014, as expected. However subsequently, there have been significant and surprising moves by other Central Banks. In January 2015, the Swiss National Bank reversed its policy to keep the Swiss Franc pegged at 1.20 to the Euro; the European Central Bank announced a greater than expected Euro 1.1 Trillion Quantitative Easing program beginning March 2015; and the Bank of Canada unexpectedly cut rates. Many of these moves were in response to falling commodity prices, led by the collapse of oil in late 2014 and the deflationary pressures this may cause. As a result, many key currencies including the Canadian dollar and the Euro fell drastically against the U.S. dollar.

Events and conditions in the global financial markets impact gold prices, commodity prices, interest rates and currency rates. These conditions and market volatilities may have a positive or negative impact on the Company’s revenues, operating costs, project development expenditures and project planning.

NIOBIUM MARKET

Demand for niobium has risen 12% year over year, mainly due to stronger steel production in developed countries. World steel production for 2014 was 1.2% higher than in 2013 due to rising production in North America, the European Union, the Middle East, China and Asia. The average realized sales price of $40.31/kg was stable in 2014 when compared to 2013.

GOLD MARKET

The consensus outlook on the price of gold for 2015 seems to have stabilized above $1,200 per ounce. During 2014, the price of gold traded within a $200 range through 2014, yet ended the year essentially unchanged from the end of 2013. The dominant view is that gold may react negatively to expected interest rates increases should the U.S. Federal Reserve begin to tighten monetary policy in 2015. However, the recent loosening of monetary policy by several Central Banks is countering this and lending support to a more constructive trend for the price of gold. Adding to this is the risk of geo-political events and the market response toward safe-haven assets like gold.

Another influencing factor on the price of gold is the cost of mining and producing gold. All-in sustaining costs (as defined by the World Gold Council) has averaged between $1,050 and $1,150 per ounce sold. It is becoming more expensive to mine gold and the price of gold is getting closer to the production cost for many companies. Eventually the supply demand dynamics will make it uneconomical to continue mining below this cost. As this happen, prices should recalibrate to reflect all-in sustaining costs for producers.

The market price of gold is a significant driver of the Company’s financial performance. Through 2014, the Company sold gold at an average price of $1,259 per ounce, just below the average market price of $1,266 per ounce.

IAMGOLD CORPORATION

ANNUAL MANAGEMENT’S DISCUSSION AND ANALYSIS – DECEMBER 31, 2014

PAGE 8

| Years ended December 31, | ||||||||

| 2014 | 2013 | |||||||

| Average market gold price ($/oz) |

$ | 1,266 | $ | 1,411 | ||||

| Average realized gold price1 ($/oz) |

$ | 1,259 | $ | 1,399 | ||||

| Closing market gold price ($/oz) |

$ | 1,206 | $ | 1,205 | ||||

| 1 | This is a non-GAAP measure. Refer to the non-GAAP performance measures section of the MD&A. |

CURRENCY AND OIL PRICE

The currency markets were relatively stable for most of 2014 until late in the year when currencies depreciated materially relative to the U.S. dollar. Some currencies like the Canadian dollar were vulnerable to the collapse in commodity prices - specifically oil - while others like the Euro were driven by more fundamental macro-economic conditions. The relative strength of the U.S. dollar accelerated in the early part of 2015 as several Central Banks eased domestic monetary policy.

The Company’s functional currency is the U.S. dollar. Substantially all of its revenue is in U.S. dollars as gold is priced in U.S. dollars. The Company’s main exposure is movements in the Canadian dollar and Euro against the U.S dollar, which have a direct impact on the Company’s Canadian mining activities and international operations. The Company anticipates $240 million of Canadian dollar exposure for 2015 related to its Canadian mining operation and corporate expenses. The Company forecasts an exposure of Euro 238 million for 2015 related to its mining operations in West Africa. The Company’s currency hedging strategy is designed to mitigate the exchange rate volatility of these currencies. Refer to financial condition - market risks section for more information.

The market price of oil fell dramatically in 2014. The average market price for West Texas Intermediate (WTI) crude oil was $93 per barrel in 2014, but closed the year at a price of $53 per barrel. In the fourth quarter 2014, prices fell as key producers like OPEC decided to not cut back on production while U.S. shale production contributed to the growing supply surplus. The increase in demand within the US market, due to an improving economic outlook, was not enough to off-set the supply surplus.

Oil is a key component of the Company’s cost structure. In 2014, the Company consumed an estimated 1.48 million barrels of oil and is expecting to consume approximately 1.48 million barrels of oil through 2015. The Company hedges the price volatility of its fuel costs by hedging the price of oil. Refer to financial condition - market risks section for more information.

| Years ended December 31, | ||||||||

| 2014 | 2013 | |||||||

| Average rates |

||||||||

| Canadian$ / U.S.$ |

1.1044 | 1.0299 | ||||||

| U.S.$ / € |

1.3284 | 1.3285 | ||||||

|

|

|

|

|

|||||

| Closing rates |

||||||||

| Canadian$ / U.S.$ |

1.1601 | 1.0636 | ||||||

| U.S.$ / € |

1.2101 | 1.3779 | ||||||

|

|

|

|

|

|||||

| Average market oil price ($/barrel) |

$ | 93 | $ | 98 | ||||

| Closing market oil price ($/barrel) |

$ | 53 | $ | 98 | ||||

|

|

|

|

|

|||||

SENSITIVITY IMPACT

The following table provides estimated sensitivities around certain inputs, excluding the impact of the Company’s hedging program that can affect the Company’s operating results, assuming expected 2015 production levels.

| Change of | Annualized impact on Total Cash Costs1 - Gold Mines3 by $/oz |

Annualized impact on All-in Sustaining Costs1 - Gold Mines3 by $/oz |

||||||||||

| Gold price2 |

$ | 100/oz | $ | 4/oz | $ | 4/oz | ||||||

| Oil price |

$ | 10/barrel | $ | 13/oz | $ | 14/oz | ||||||

| Canadian$ / U.S.$ |

$ | 0.10 | $ | 12/oz | $ | 19/oz | ||||||

| U.S.$ / € |

$ | 0.10 | $ | 12/oz | $ | 16/oz | ||||||

| 1 | This is a non-GAAP measure. Refer to the non-GAAP performance measures section of the MD&A. |

| 2 | Gold price sensitivities relate to royalty cost arrangements, which are included in total cash costs and all-in sustaining costs. |

| 3 | Gold mines, as used with total cash costs and all-in sustaining costs, consist of Rosebel, Essakane, Westwood (commercial production), Mouska, Sadiola and Yatela on an attributable basis. |

IAMGOLD CORPORATION

ANNUAL MANAGEMENT’S DISCUSSION AND ANALYSIS – DECEMBER 31, 2014

PAGE 9

| Attributable Gold Sales2 (000s oz) |

Average Realized Gold Price1 ($/oz) |

|||||||||||||||

| Years ended December 31, | Years ended December 31, | |||||||||||||||

| 2014 | 2013 | 2014 | 2013 | |||||||||||||

| Owner-operator |

739 | 627 | $ | 1,258 | $ | 1,397 | ||||||||||

| Joint ventures |

96 | 113 | $ | 1,263 | $ | 1,413 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| 835 | 740 | $ | 1,259 | $ | 1,399 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| 1 | This is a non-GAAP measure. Refer to the non-GAAP performance measures section of the MD&A. |

| 2 | Includes Rosebel and Essakane at 95% and 90%, respectively. |

The table below presents the gold production attributable to the Company along with the weighted average total cash costs per gold ounce produced and all-in sustaining costs per gold ounce sold.

| Gold Production (000s oz) |

Total Cash Costs1,2 ($ per gold ounce produced) |

All-in Sustaining Costs1 ($ per gold ounce sold) |

||||||||||||||||||||||

| Years ended December 31 |

2014 | 2013 | 2014 | 2013 | 2014 | 2013 | ||||||||||||||||||

| Continuing operations |

||||||||||||||||||||||||

| Owner-operator |

||||||||||||||||||||||||

| Rosebel (95%) |

325 | 336 | $ | 804 | $ | 718 | $ | 1,045 | $ | 1,063 | ||||||||||||||

| Essakane (90%) |

332 | 250 | 852 | 753 | 1,060 | 1,177 | ||||||||||||||||||

| Doyon division (100%) |

82 | 63 | 768 | 832 | 955 | 889 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| 739 | 649 | 822 | 743 | 1,090 | 1,162 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Joint ventures |

||||||||||||||||||||||||

| Sadiola (41%) |

84 | 86 | 985 | 1,101 | 1,083 | 1,476 | ||||||||||||||||||

| Yatela (40%) |

11 | 27 | 1,590 | 1,243 | 1,929 | 1,789 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| 95 | 113 | 1,055 | 1,136 | 1,182 | 1,551 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total commercial operations |

834 | 762 | 848 | 801 | 1,101 | 1,222 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Doyon division (100%) |

10 | 73 | — | — | — | — | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| 844 | 835 | 848 | 801 | 1,101 | 1,222 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Cash costs, excluding royalties |

790 | 729 | ||||||||||||||||||||||

| Royalties |

58 | 72 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total cash costs3 |

$ | 848 | $ | 801 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| All-in sustaining costs3,4 - gold mines5 |

1,101 | 1,222 | ||||||||||||||||||||||

| Including discontinued operations |

||||||||||||||||||||||||

| Niobium contribution6 |

(109 | ) | (79 | ) | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| All-in sustaining costs - total7 |