Form 8-K VALERO ENERGY PARTNERS For: Mar 03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 3, 2015

VALERO ENERGY PARTNERS LP

(Exact name of registrant as specified in its charter)

| Delaware | 1-36232 | 90-1006559 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

| One Valero Way |

||

| San Antonio, Texas | 78249 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (210) 345-2000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 7.01 | Regulation FD Disclosure. |

Senior management of Valero Energy Partners LP (the “Partnership”) will make certain investor presentations beginning as early as March 3, 2015. The slides attached to this report were prepared for management’s presentations. The slides are included in Exhibit 99.01 to this report and are incorporated herein by reference. The slides will be available on the Partnership’s website at www.valeroenergypartners.com.

The information in this report is being furnished, not filed, pursuant to Regulation FD. Accordingly, the information in Items 7.01 and 9.01 of this report will not be incorporated by reference into any registration statement filed by the Partnership under the Securities Act of 1933, as amended, unless specifically identified therein as being incorporated therein by reference. The furnishing of the information in this report is not intended to, and does not, constitute a determination or admission by the Partnership that the information in this report is material or complete, or that investors should consider this information before making an investment decision with respect to any security of the Partnership or any of its affiliates.

Safe Harbor Statement

Statements contained in the exhibit to this report that state the Partnership’s or its management’s expectations or predictions of the future are forward-looking statements intended to be covered by the safe harbor provisions of the Securities Act of 1933, as amended, and the Securities Exchange Act of 1934, as amended. It is important to note that the Partnership’s actual results could differ materially from those projected in such forward-looking statements. Factors that could affect those results include those mentioned in the documents that the Partnership has filed with the Securities and Exchange Commission.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

99.01 Slides from management presentation.

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Partnership has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| VALERO ENERGY PARTNERS LP | ||||||

| by: | Valero Energy Partners GP LLC, its general partner | |||||

| Date: March 3, 2015 | by: | /s/ Jay D. Browning | ||||

| Jay D. Browning | ||||||

| Senior Vice President and General Counsel | ||||||

Barclays MLP

Corporate Access Day March 2015

Exhibit 99.01 |

Safe Harbor

Statement 2

This presentation contains forward-looking statements within the meaning of federal

securities laws. These statements discuss future expectations, contain projections of

results of operations or of financial condition or state other forward-looking

information. You can identify forward-looking statements by words such as

“anticipate,” “believe,” “estimate,” “expect,”

“forecast,” “project,” “could,” “may,” “should,” “would,” “will” or

other similar expressions that convey the uncertainty of future events or outcomes. These

forward-looking statements are not guarantees of future performance and are subject

to risks, uncertainties and other factors, some of which are beyond the Partnership's

control and are difficult to predict. These statements are often based upon various

assumptions, many of which are based, in turn, upon further assumptions, including examination of

historical operating trends made by the management of the Partnership. Although the

Partnership believes that these assumptions were reasonable when made, because

assumptions are inherently subject to significant uncertainties and contingencies,

which are difficult or impossible to predict and are beyond its control, the

Partnership cannot give assurance that it will achieve or accomplish these expectations,

beliefs or intentions. When considering these forward-looking statements, you

should keep in mind the risk factors and other cautionary statements contained in the

Partnership’s filings with the U.S. Securities and Exchange Commission, including

the Form S-1 and prospectus relating to the initial public offering of the Partnership’s common units,

and the Partnership’s annual reports on Form 10-K and quarterly reports on Form

10-Q, available on the Partnership’s website at

www.valeroenergypartners.com. These risks could cause the Partnership’s actual

results to differ materially from those contained in any forward-looking statement.

|

3

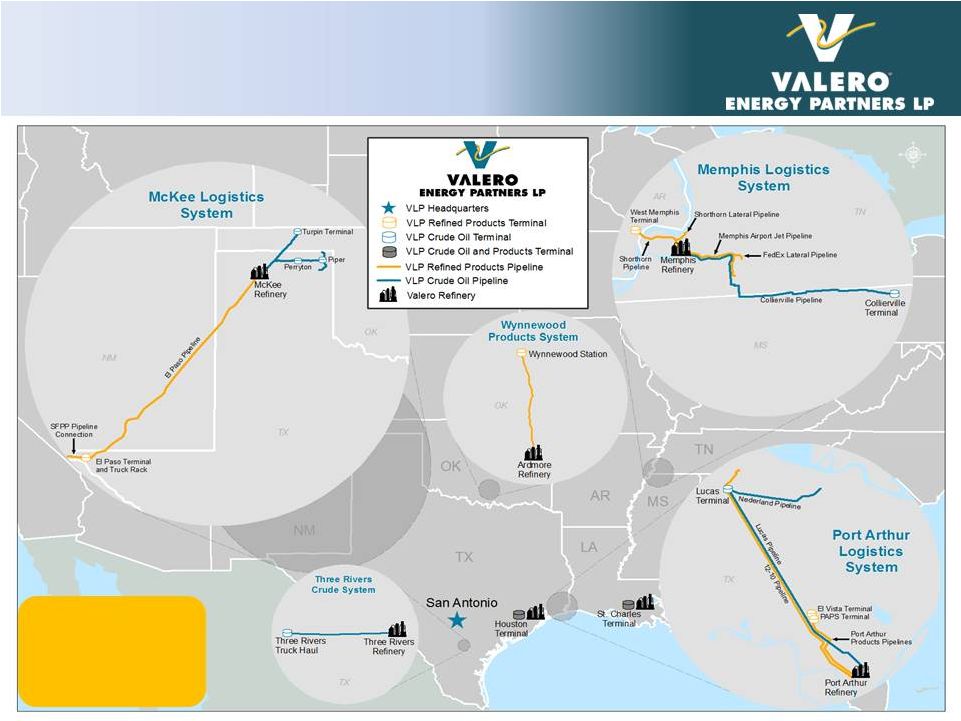

A Growth-Oriented Logistics MLP

with 100% Fee-Based Revenues

VLP

is

sponsored

by

Valero

Energy

Corp.

(NYSE: VLO),

the world’s largest

independent refiner |

Our

Strategy •

Maintain safe and reliable operations in our high-quality asset base

•

Avoid direct commodity price risk

•

Target LP unit distribution compound annual growth rate (CAGR) in the range of 20% to

25% •

Executing on our plan to complete $1 billion of acquisition transactions from VLO in

2015 $671 million acquisition closed on March 1, 2015

•

Significant inventory of acquisition targets at VLO, which is focused on midstream

growth •

Opportunities to diversify business and develop third-party volumes as VLP matures

•

Target investment grade credit rating

4

Generate Stable, Predictable Cash Flows

Maintain Top-Tier Growth Profile

Demonstrate Financial Discipline |

5

Long-Term Agreements Provide

Stable and Predictable Cash Flows

Terminals

•

All transportation and terminal

services agreements have 10

year initial terms and 5 year

renewal terms

Memphis refinery truck rack is

exception, without renewal term

•

Approximately 85% of revenues

contractually obligated by

minimum volume commitments

(MVCs)

•

No direct commodity price

exposure

•

2014 revenues were balanced

between pipelines and terminals

2014 Revenue

Pipelines

44%

56% |

6

Delivering Growth

VLP is on target to acquire $1 billion of assets from VLO in 2015

•

1

st

acquisition –

Texas Crude

Systems Business in July 2014

for $154 million

•

2

nd

acquisition –

Houston and

St. Charles Terminal Services

Business in March 2015 for

$671 million

•

Plan to grow VLP’s 4Q15

annualized EBITDA to

approximately $200 million

•

Targeting nearly 25% CAGR

for LP distributions through

2017

See Appendix for reconciliation of estimated 2015 EBITDA to net income.

$95

$200

4Q14

Annualized

4Q15E

Annualized

Adjusted EBITDA Attributable to VLP

(millions) |

7

Acquisition of Houston and St. Charles

Terminal Services Business from VLO

Operations

•

Crude oil, intermediates, and refined

petroleum product terminaling

services in Houston, Texas and Norco,

Louisiana

3.6 million barrels of storage capacity on the

Houston ship channel

10 million barrels of storage on the Mississippi

River

•

10-year terminaling agreements with

VLO subsidiaries

•

Over 85% of revenues contractually

obligated by MVCs

Transaction expected to be immediately accretive to VLP

Financing

•

$671 million transaction closed on

March 1, 2015

•

$411 million in cash to VLO

$211 million of cash from balance sheet

$200 million under revolving credit facility

•

$160 million 5-year subordinated loan

agreement with VLO

•

$100 million issuance of VLP units to

VLO

1,908,100 million common units

38,941 general partner units

Common and general partner units allocated

in proportion to allow general partner to

maintain its 2 percent interest

•

Expected to contribute $75 million of

EBITDA annually |

Significant

Inventory of Logistics Assets at VLO to Fuel VLP’s Growth

(1)

Includes assets that have other joint venture or minority interests.

(2)

Includes approximately 4 million barrels of underground storage capacity.

Pipelines

(1)

Racks,

Terminals,

and

Storage

(1)

Rail

Marine

(1)

Fuels Distribution

8

•

VLO

is

evaluating

qualifying

volumes

and

commercial

structure

as

potential

drop-

down candidate

•

51 docks

•

Two Panamax class vessels

•

Three crude unloading facilities with estimated total capacity of 150 MBPD

•

Purchased CPC-1232 railcars expected to serve VLO’s long-term needs in ethanol

and asphalt

•

Approximately 100 million barrels

(2)

of active shell capacity for crude and products

•

139 truck rack bays

•

Over 1,200 miles of active pipelines

•

Expect start-up of 440-mile Diamond Pipeline from Cushing to Memphis refinery in

1H17 |

9

Significant Inventory of Estimated MLP

Eligible EBITDA at VLO

Fuels distribution would provide incremental EBITDA if selected

$800

($15)

($75)

$24

$34

$46

$814

Dec 2013

Guidance (with

base + 2014-2015

projects)

July 2014 Drop

Down

March 2015 Drop

Down

2014 -

2015

Additional

Logisitics Projects

2016 -

2017

Logistics Projects

Diamond Pipeline Current Guidance

Option

millions |

10

VLO’s Estimated Logistics Capital Spending

VLO’s logistics investments are expected to increase feedstock flexibility and

refined product export capability

Source: VLO management presentations

$510

$175

$45

$220

$180

$665

$185

$45

$5

$915

$400

$715

2014

2015E

2016E

(millions)

Marine, Docks, and Other

Logistics

Pipelines and Tanks

Railcars and Unloading |

11

Strong Growth Driving VLP

Unit Performance

Source: Bloomberg prices through Feb 26, 2015

$0.2125

$0.2125

$0.2225

$0.2400

$0.2660

4Q13*

1Q14

2Q14

3Q14

4Q14

Distribution per LP Unit

$2.6

$13.6

$15.7

$21.1

$22.6

4Q13

1Q14

2Q14

3Q14

4Q14

Distributable Cash Flow

(millions)

130%

1%

10%

30%

50%

70%

90%

110%

130%

150%

VLP Unit Performance Since IPO

VLP Price

AMZ Index

-10%

*

Prorated minimum quarterly distribution (MQD) for period of Dec 16 – 31 |

•

Strategic relationship with VLO, an investment-grade

sponsor

•

High-quality, well-maintained assets integrated with VLO’s

refineries and located in advantaged regions

•

Stable and predictable cash flows from long-term, fee-based

contracts

•

Executing on accelerated growth strategy with recent $671

million acquisition

•

Significant inventory of acquisition opportunities at VLO

•

Targeting LP unit distribution CAGR in the 20% to 25% range

over the next few years

12

VLP’s Competitive Strengths |

Appendix

Topic

Page

VLP Alignment with VLO

14

Long Term Macro Market Expectations

15

VLO Asset Overview

16

Non-GAAP Reconciliations

17

IR Contact Information

18

13 |

14

VLP Aligned with VLO

•

VLO remains invested in VLP

–

71% of LP ownership

comprised of common units

and subordinated units

–

100% GP ownership and all

associated IDRs

•

VLO continues to grow its

midstream business and

intends to use VLP as the

primary vehicle to facilitate

this growth

Certain wholly owned subsidiary of

Valero Energy Corporation

Common Units

Subordinated Units

Valero Energy

Corporation

(NYSE: VLO)

Public

Unitholders

Common Units

Valero Energy Partners GP LLC

(our General Partner)

General Partner Units

Incentive Distribution Rights

100.0% ownership interest

100.0% ownership interest

28.4% limited partner

interest

2.0% general partner interest

Valero Energy Partners LP

(NYSE: VLP)

(the Partnership)

100.0% ownership interest

Valero Partners Operating Co. LLC

Operating Subsidiaries

100.0% ownership interest

69.6% limited

partner interest |

15

Our Long-Term Macro Market

Expectations

Global Outlook

U.S. Economy and

Petroleum Demand

North American

Resource

Advantage

International Export

Markets

•

Economic activity and total petroleum demand increases

•

Transportation fuels demand grows

•

Refining capacity growth slows after 2015; utilization stabilizes then

expected to increase

•

Refinery rationalization pressure continues in Europe, Japan, and Australia

•

Economic growth strengthens over next five years, which stimulates refined

product demand

•

Diesel and jet fuel demand continues to strengthen

•

Gasoline demand continues to recover moderately

•

Natural gas production growth still attractive and development continues

•

Crude production is economic; growth continues, but tempered with lower

prices

•

North American refiners maintain competitive advantage

•

Broad lifting of crude export ban not expected for several years, if ever

•

U.S. continues to be an advantaged net exporter of products

•

Atlantic Basin market continues to grow, with increasing demand from

Latin America and Africa

•

U.S. Gulf Coast is strategically positioned with globally competitive assets

|

16

VLO’s Assets Concentrated in

Advantaged Locations

Refinery

Capacities (MBPD)

Nelson

Index

Throughput

Crude Oil

Corpus Christi

325

205

19.9

Houston

175

90

15.4

Meraux

135

125

9.7

Port Arthur

375

335

12.4

St. Charles

290

215

16.0

Texas City

260

225

11.1

Three Rivers

100

89

13.2

Gulf Coast

1,660

1,284

14.0

Ardmore

90

86

12.1

McKee

180

168

9.5

Memphis

195

180

7.9

Mid-Con

465

434

9.3

Pembroke

270

210

10.1

Quebec City

235

230

7.7

North Atlantic

505

440

8.9

Benicia

170

145

16.1

Wilmington

135

85

15.9

West Coast

305

230

16.0

Total or Avg.

2,935

2,388

12.4 |

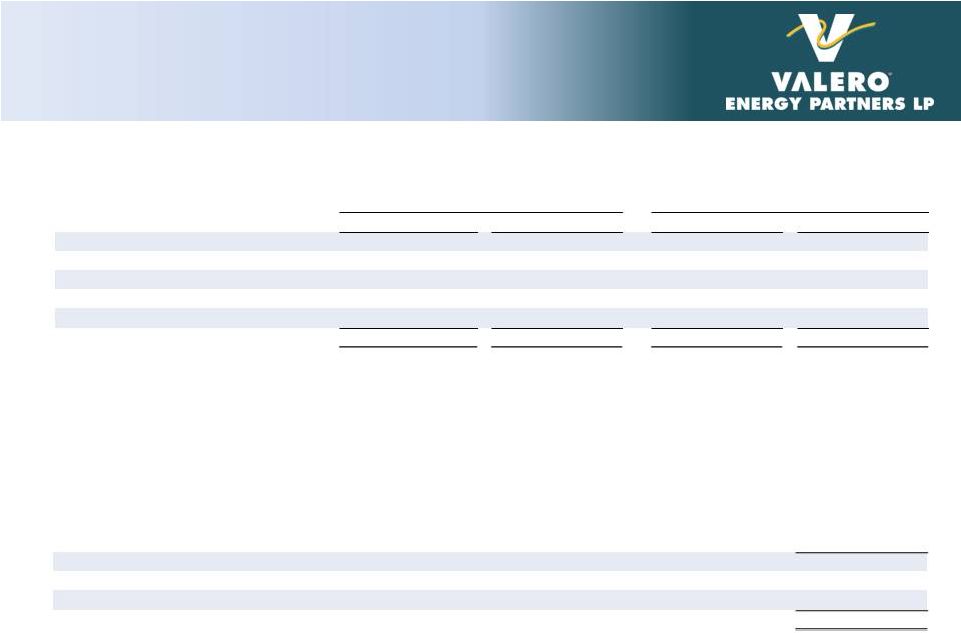

17

Non-GAAP Reconciliations

RECONCILIATION OF NET INCOME UNDER GAAP TO EBITDA

(in millions)

RECONCILIATION OF FORECASTED NET INCOME UNDER GAAP TO EBITDA

(in millions)

Full Year Beginning

March 1, 2015

Valero Partners

Houston and Louisiana

Forecasted net income

$

37

Add: Forecasted depreciation expense

20

Add: Forecasted interest expense

18

Forecasted EBITDA

$

75

(1)

Interest expense and cash interest paid both include commitment fees to be paid on our

revolving credit facility. Interest expense also includes the amortization of estimated deferred issuance

costs to be incurred in connection with establishing our revolving credit facility. Three Months Ended

Three Months Ended

December 31, 2014

December 31, 2015

As Reported

Annualized (x4)

Forecasted

Annualized (x4)

Net income

$

19

$

76

$

32

$

128

Plus:

Depreciation expense

5

18

11

44

Interest expense

(1)

-

1

7

28

Income tax expense

-

-

-

-

EBITDA

$

24

$

95

$

50

$

200 |

18

Investor Relations Contacts

For more information, please contact:

John Locke

Executive Director, Investor Relations

210-345-3077

john.locke@valero.com

Karen Ngo

Manager, Investor Relations

210-345-4574

karen.ngo@valero.com |

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Valero Energy (VLO) PT Raised to $192 at Citi

- Share buybacks in Spar Nord Bank – transactions in week 16

- Danske Bank A/S, transactions by persons discharging managerial responsibilities

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share