Form 10-K SHERWIN WILLIAMS CO For: Dec 31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2014

Commission file number 1-04851

THE SHERWIN-WILLIAMS COMPANY

(Exact name of registrant as specified in its charter)

OHIO | 34-0526850 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

101 West Prospect Avenue, Cleveland, Ohio | 44115-1075 | |

(Address of principal executive offices) | (Zip Code) | |

(216) 566-2000

Registrant’s telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered | |

Common Stock, Par Value $1.00 | New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes o No x

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer x | Accelerated filer o | Non-accelerated filer o | Smaller reporting company o | |||

(Do not check if a smaller reporting company) | ||||||

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

At January 31, 2015, 94,894,689 shares of common stock were outstanding, net of treasury shares. The aggregate market value of common stock held by non-affiliates of the Registrant at June 30, 2014 was $20,077,799,869 (computed by reference to the price at which the common stock was last sold on such date).

DOCUMENTS INCORPORATED BY REFERENCE

Portions of our Annual Report to Shareholders for the fiscal year ended December 31, 2014 (“2014 Annual Report”) are incorporated by reference into Parts I, II and IV of this report.

Portions of our Proxy Statement for the 2015 Annual Meeting of Shareholders (“Proxy Statement”) to be filed with the Securities and Exchange Commission within 120 days of our fiscal year ended December 31, 2014 are incorporated by reference into Part III of this report.

THE SHERWIN-WILLIAMS COMPANY

Table of Contents

Page | ||

Item 1. | ||

Item 1A. | ||

Item 1B. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

Item 5. | ||

Item 6. | ||

Item 7. | ||

Item 7A. | ||

Item 8. | ||

Item 9. | ||

Item 9A. | ||

Item 9B. | ||

Item 10. | ||

Item 11. | ||

Item 12. | ||

Item 13. | ||

Item 14. | ||

Item 15. | ||

PART I

ITEM 1. BUSINESS

Introduction

The Sherwin-Williams Company, founded in 1866 and incorporated in Ohio in 1884, is engaged in the development, manufacture, distribution and sale of paint, coatings and related products to professional, industrial, commercial and retail customers primarily in North and South America with additional operations in the Caribbean region, Europe and Asia. Our principal executive offices are located at 101 West Prospect Avenue, Cleveland, Ohio 44115-1075, telephone (216) 566-2000. As used in this report, the terms “Sherwin-Williams,” “Company,” “we” and “our” mean The Sherwin-Williams Company and its consolidated subsidiaries unless the context indicates otherwise.

Available Information

We make available free of charge on or through our website our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, and amendments to these reports, as soon as reasonably practicable after we electronically file such material with, or furnish such material to, the Securities and Exchange Commission. You may access these documents on the “Investor Relations” page of our website at www.sherwin.com.

We also make available free of charge on our website our Corporate Governance Guidelines, our Director Independence Standards, our Code of Conduct and the charters of our Audit Committee, our Compensation and Management Development Committee and our Nominating and Corporate Governance Committee. You may access these documents in the “Corporate Governance” section on the “Investor Relations” page of our website at www.sherwin.com.

Basis of Reportable Segments

We report our segment information in the same way that management internally organizes our business for assessing performance and making decisions regarding allocation of resources in accordance with the Segment Reporting Topic of the Financial Accounting Standards Board Accounting Standards Codification (ASC). We have four reportable operating segments: Paint Stores Group, Consumer Group, Global Finishes Group and Latin America Coatings Group (individually, a "Reportable Segment" and collectively, the “Reportable Segments”). Factors considered in determining our Reportable Segments include the nature of business activities, the management structure directly accountable to the Company’s chief operating decision maker (CODM) for operating and administrative activities, availability of discrete financial information and information presented to our Board of Directors. We report all other business activities and immaterial operating segments that are not reportable in the Administrative segment. For more information about the Reportable Segments, see pages 6 through 15 of our 2014 Annual Report, which is incorporated herein by reference.

The Company’s CODM has been identified as the Chief Executive Officer because he has final authority over performance assessment and resource allocation decisions. Because of the diverse operations of the Company, the CODM regularly receives discrete financial information about each Reportable Segment as well as a significant amount of additional financial information about certain divisions, business units or subsidiaries of the Company. The CODM uses all such financial information for performance assessment and resource allocation decisions. The CODM evaluates the performance of and allocates resources to the Reportable Segments based on profit or loss before income taxes and cash generated from operations. The accounting policies of the Reportable Segments are the same as those described in Note 1 of the Notes to Consolidated Financial Statements on pages 44 through 47 of our 2014 Annual Report, which is incorporated herein by reference.

Paint Stores Group

The Paint Stores Group consisted of 4,003 company-operated specialty paint stores in the United States, Canada, Puerto Rico, Virgin Islands, Trinidad and Tobago, St. Maarten, Jamaica, Curacao, Aruba and St. Lucia at December 31, 2014. Each store in this segment is engaged in the related business activity of selling paint, coatings and related products to end-use customers. The Paint Stores Group markets and sells Sherwin-Williams® branded architectural paint and coatings, protective and marine products, original equipment manufacturer (“OEM”) product finishes and related items. These products are produced by manufacturing facilities in the Consumer Group. In addition, each store sells selected purchased associated products. The loss of any single customer would not have a material adverse effect on the business of this segment. During 2014, this segment opened 95 net new stores, consisting of 109 new stores opened (95 in the United States, 9 in Canada, 2 in Puerto Rico, 1 in Trinidad and Tobago, 1 in Jamaica and 1 in St. Lucia) and 14 stores closed (11 in the United States and 3 in Canada). During 2013, this segment acquired 306 stores and opened 82 net new stores. During 2012, this segment opened 70 net new stores. A map on the cover flap of our 2014 Annual Report, which is incorporated herein by reference, shows the number of paint stores and their geographic locations. The CODM uses discrete financial information about the Paint Stores Group, supplemented with information by geographic region, product type and customer type, to assess performance of and allocate resources to the Paint Stores Group as a whole. In accordance with ASC 280-10-50-9, the Paint Stores Group as a

1

whole is considered the operating segment, and because it meets the criteria in ASC 280-10-50-10, it is also considered a Reportable Segment.

Consumer Group

The Consumer Group develops, manufactures and distributes a variety of paint, coatings and related products to third party customers primarily in the United States and Canada and the Paint Stores Group. Approximately 66 percent of the total sales of the Consumer Group in 2014 were intersegment transfers of products primarily sold through the Paint Stores Group. Sales and marketing of certain controlled brand and private labeled products are performed by a direct sales staff. The products distributed through third party customers are intended for resale to the ultimate end-user of the product. The Consumer Group had sales to certain customers that, individually, may be a significant portion of the sales of the segment. However, the loss of any single customer would not have a material adverse effect on the overall profitability of the segment. This segment incurred most of the Company’s capital expenditures related to ongoing environmental compliance measures. The CODM uses discrete financial information about the Consumer Group, supplemented with information by product types and customer, to assess performance of and allocate resources to the Consumer Group as a whole. In accordance with ASC 280-10-50-9, the Consumer Group as a whole is considered the operating segment, and because it meets the criteria in ASC 280-10-50-10, it is also considered a Reportable Segment.

Global Finishes Group

The Global Finishes Group develops, licenses, manufactures, distributes and sells a variety of protective and marine products, automotive finishes and refinish products, OEM product finishes and related products in North and South America, Europe and Asia. This segment meets the demands of its customers for a consistent worldwide product development, manufacturing and distribution presence and approach to doing business. This segment licenses certain technology and trade names worldwide. Sherwin-Williams® and other controlled brand products are distributed through the Paint Stores Group and this segment’s 300 company-operated branches and by a direct sales staff and outside sales representatives to retailers, dealers, jobbers, licensees and other third party distributors. During 2014, this segment opened 1 new branch in the United States and closed 1 branch in the United States resulting in no net change. At December 31, 2014, the Global Finishes Group consisted of operations in the United States, subsidiaries in 34 foreign countries and income from licensing agreements in 16 foreign countries. The CODM uses discrete financial information about the Global Finishes Group, supplemented with information about geographic divisions, business units, and subsidiaries, to assess performance of and allocate resources to the Global Finishes Group as a whole. In accordance with ASC 280-10-50-9, the Global Finishes Group as a whole is considered the operating segment, and because it meets the criteria in ASC 280-10-50-10, it is also considered a Reportable Segment. A map on the cover flap of our 2014 Annual Report, which is incorporated herein by reference, shows the number of branches and their geographic locations.

Latin America Coatings Group

The Latin America Coatings Group develops, licenses, manufactures, distributes and sells a variety of architectural paint and coatings, protective and marine products, OEM product finishes and related products in North and South America. This segment meets the demands of its customers for consistent regional product development, manufacturing and distribution presence and approach to doing business. Sherwin-Williams® and other controlled brand products are distributed through this segment’s 276 company-operated stores and by a direct sales staff and outside sales representatives to retailers, dealers, licensees and other third party distributors. During 2014, this segment opened 3 new stores in South America and closed 9 (7 in South America and 2 in Mexico) for a net decrease of 6 stores. At December 31, 2014, the Latin America Coatings Group consisted of operations from subsidiaries in 9 foreign countries, 4 foreign joint ventures and income from licensing agreements in 7 foreign countries. The CODM uses discrete financial information about the Latin America Coatings Group, supplemented with information about geographic divisions, business units, and subsidiaries, to assess performance of and allocate resources to the Latin America Coatings Group as a whole. In accordance with ASC 280-10-50-9, the Latin America Coatings Group as a whole is considered the operating segment, and because it meets the criteria in ASC 280-10-50-10, it is also considered a Reportable Segment. A map on the cover flap of our 2014 Annual Report, which is incorporated herein by reference, shows the number of stores and their geographic locations.

Administrative Segment

The Administrative segment includes the administrative expenses of the Company’s corporate headquarters site. Also included in the Administrative segment was interest expense, interest and investment income, certain expenses related to closed facilities and environmental-related matters, and other expenses which were not directly associated with the Reportable Segments. The Administrative segment did not include any significant foreign operations. Also included in the Administrative segment was a real estate management unit that is responsible for the ownership, management, and leasing of non-retail properties held primarily for use by the Company, including the Company’s headquarters site, and disposal of idle facilities. Sales of this segment represented external leasing revenue of excess headquarters space or leasing of facilities no longer used

2

by the Company in its primary businesses. Gains and losses from the sale of property were not a significant operating factor in determining the performance of the Administrative segment.

Segment Financial Information

For financial information regarding our Reportable Segments, including net external sales, segment profit, identifiable assets and other information by Reportable Segment, see Note 18 of the Notes to Consolidated Financial Statements on pages 71 through 73 of our 2014 Annual Report, which is incorporated herein by reference.

Domestic and Foreign Operations

Financial and other information regarding domestic and foreign operations is set forth in Note 18 of the Notes to Consolidated Financial Statements on page 72 of our 2014 Annual Report, which is incorporated herein by reference.

Additional information regarding risks attendant to foreign operations is set forth on page 30 of our 2014 Annual Report under the caption “Market Risk” of “Management’s Discussion and Analysis of Financial Condition and Results of Operation,” which is incorporated herein by reference.

Business Developments

For additional information regarding our business and business developments, see pages 6 through 15 of our 2014 Annual Report and the “Letter to Shareholders” on pages 2 through 5 of our 2014 Annual Report, which is incorporated herein by reference.

Raw Materials and Products Purchased for Resale

We believe we generally have adequate sources of raw materials and fuel supplies used in our business. There are sufficient suppliers of each product purchased for resale that none of the Reportable Segments anticipate any significant sourcing problems during 2015. See Item 1A Risk Factors for more information regarding cost and sourcing of raw materials.

Seasonality

The majority of the sales for the Reportable Segments traditionally occur during the second and third quarters. There is no significant seasonality in sales for the Administrative segment.

Working Capital

In order to meet increased demand during the second and third quarters, the Company usually builds its inventories during the first quarter. Working capital items (inventories and accounts receivable) are generally financed through short-term borrowings, which include the use of lines of credit and the issuance of commercial paper. For a description of the Company’s liquidity and capital resources, see pages 24 through 30 of our 2014 Annual Report under the caption “Financial Condition, Liquidity and Cash Flow” of “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” which is incorporated herein by reference.

Trademarks and Trade Names

Customer recognition of our trademarks and trade names collectively contribute significantly to our sales. The major trademarks and trade names used by each of the Reportable Segments are set forth below.

• | Paint Stores Group: Sherwin-Williams®, ProMar®, SuperPaint®, A-100®, Duron®, MAB®, PrepRite®, Duration®, Duration Home®, ProGreen®, Harmony®, ProClassic®, Woodscapes®, Deckscapes®, Cashmere®, HGTV Home® by Sherwin-Williams, Emerald®, Duracraft™, Solo®, ProIndustrial™, ProPark®, Frazee®, Parker™ Paints, Kwal®, Color Wheel™ and General Paint™. |

• | Consumer Group: Dutch Boy®, Krylon®, Minwax®, Thompson’s® WaterSeal®, Pratt & Lambert®, Martin Senour®, H&C®, White Lightning®, Dupli-Color®, Rubberset®, Purdy®, Bestt Liebco®, Accurate Dispersions™, Uniflex®, VHT®, Kool Seal®, Snow Roof®, Altax™, Tri-Flow®, Sprayon®, Ronseal™, DuraSeal®, Geocel®, Conco®, Duckback®, Superdeck® and Mason's Select®, HGTV HOME® by Sherwin-Williams. |

• | Global Finishes Group: Sherwin-Williams®, Lazzuril®, Excelo®, Baco®, Planet Color®, AWX Performance Plus™, Ultra™, Ultra-Cure®, Martin Senour®, Kem Aqua®, Sher-Wood®, Powdura®, Polane®, Euronavy®, Inchem®, Sayerlack®, Becker Acroma®, Firetex®, Macropoxy®, Oece™, Arti™, Acrolon®, Sher-Nar®, PermaClad®, Heat-Flex®, Magnalux™, ATX™, Genesis®, Dimension®, Finish 1™, Lanet™, DFL™, Conely™, Envirolastic® and Fastline™. |

• | Latin America Coatings Group: Sherwin-Williams®, Marson®, Metalatex®, Novacor®, Loxon®, Colorgin®, Andina®, Napko™, Martin Senour®, Sumare®, Condor®, Euronavy®, Krylon®, Kem Tone®, Minwax® and Pratt & Lambert®. |

3

Patents

Although patents and licenses are not of material importance to our business as a whole or any segment, the Global Finishes Group and Latin America Coatings Group derive a portion of their income from the licensing of technology, trademarks and trade names to foreign companies.

Backlog and Productive Capacity

Backlog orders are not significant in the business of any Reportable Segment since there is normally a short period of time between the placing of an order and shipment. We believe that sufficient productive capacity currently exists to fulfill our needs for paint, coatings and related products through 2015.

Research and Development

For information regarding our costs of research and development included in technical expenditures, see Note 1 of the Notes to Consolidated Financial Statements on page 47 of our 2014 Annual Report, which is incorporated herein by reference.

Competition

We experience competition from many local, regional, national and international competitors of various sizes in the manufacture, distribution and sale of our paint, coatings and related products. We are a leading manufacturer and retailer of paint, coatings and related products to professional, industrial, commercial and retail customers, however, our competitive position varies for our different products and markets.

In the Paint Stores Group, competitors include other paint and wallpaper stores, mass merchandisers, home centers, independent hardware stores, hardware chains and manufacturer-operated direct outlets. Product quality, product innovation, breadth of product line, technical expertise, service and price determine the competitive advantage for this segment.

In the Consumer Group, domestic and foreign competitors include manufacturers and distributors of branded and private labeled paint and coatings products. Technology, product quality, product innovation, breadth of product line, technical expertise, distribution, service and price are the key competitive factors for this segment.

The Global Finishes Group has numerous competitors in its domestic and foreign markets with broad product offerings and several others with niche products. Key competitive factors for this segment include technology, product quality, product innovation, breadth of product line, technical expertise, distribution, service and price.

In the Latin America Coatings Group, competitors include other paint and wallpaper stores, mass merchandisers, home centers, independent hardware stores, hardware chains and manufacturer-operated direct outlets. Product quality, product innovation, breadth of product line, technical expertise, service and price determine the competitive advantage for this segment.

The Administrative segment has many competitors consisting of other real estate owners, developers and managers in areas in which this segment owns property. The main competitive factors are the availability of property and price.

Employees

We employed 39,674 persons at December 31, 2014.

Environmental Compliance

For additional information regarding environmental-related matters, see page 27 of our 2014 Annual Report under the caption “Environmental-Related Liabilities” of “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Notes 1, 8 and 13 of the Notes to Consolidated Financial Statements on pages 46, 58 and 67, respectively, of our 2014 Annual Report, which is incorporated herein by reference.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

Certain statements contained in “Management's Discussion and Analysis of Financial Condition and Results of Operations,” “Business” and elsewhere in this report constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are based upon management's current expectations, estimates, assumptions and beliefs concerning future events and conditions and may discuss, among other things, anticipated future performance (including sales and earnings), expected growth, future business plans and the costs and potential liability for environmental-related matters and the lead pigment and lead-based paint litigation. Any statement that is not historical in nature is a forward-looking statement and may be identified by the use of words and phrases such as “expects,” “anticipates,” “believes,” “will,” “will likely result,” “will continue,” “plans to” and similar expressions.

Readers are cautioned not to place undue reliance on any forward-looking statements. Forward-looking statements are necessarily subject to risks, uncertainties and other factors, many of which are outside our control, that could cause actual

4

results to differ materially from such statements and from our historical results and experience. These risks, uncertainties and other factors include such things as:

• | general business conditions, strengths of retail and manufacturing economies and the growth in the coatings industry; |

• | competitive factors, including pricing pressures and product innovation and quality; |

• | changes in raw material and energy supplies and pricing; |

• | changes in our relationships with customers and suppliers; |

• | our ability to attain cost savings from productivity initiatives; |

• | our ability to successfully integrate past and future acquisitions into our existing operations, including the recent acquisition of the Comex business in the United States and Canada, as well as the performance of the businesses acquired; |

• | changes in general domestic economic conditions such as inflation rates, interest rates, tax rates, unemployment rates, higher labor and healthcare costs, recessions, and changing government policies, laws and regulations; |

• | risks and uncertainties associated with our expansion into and our operations in Asia, Europe, South America and other foreign markets, including general economic conditions, inflation rates, recessions, foreign currency exchange rates, foreign investment and repatriation restrictions, legal and regulatory constraints, civil unrest and other external economic and political factors; |

• | the achievement of growth in foreign markets, such as Asia, Europe and South America; |

• | increasingly stringent domestic and foreign governmental regulations, including those affecting health, safety and the environment; |

• | inherent uncertainties involved in assessing our potential liability for environmental-related activities; |

• | other changes in governmental policies, laws and regulations, including changes in accounting policies and standards and taxation requirements (such as new tax laws and new or revised tax law interpretations); |

• | the nature, cost, quantity and outcome of pending and future litigation and other claims, including the lead pigment and lead-based paint litigation, and the effect of any legislation and administrative regulations relating thereto; and |

• | unusual weather conditions. |

Readers are cautioned that it is not possible to predict or identify all of the risks, uncertainties and other factors that may affect future results and that the above list should not be considered to be a complete list. Any forward-looking statement speaks only as of the date on which such statement is made, and we undertake no obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

ITEM 1A. RISK FACTORS

The risks described below and in other documents that we file from time to time with the Securities and Exchange Commission could materially and adversely affect our business, results of operations, cash flow, liquidity or financial condition.

Adverse changes in general business and economic conditions in the United States and worldwide may adversely affect our results of operations, cash flow, liquidity or financial condition.

Adverse changes in general business and economic conditions in the United States and worldwide may reduce the demand for some of our products and adversely affect our results of operations, cash flow, liquidity or financial condition. Higher inflation rates, interest rates, tax rates and unemployment rates, higher labor and healthcare costs, recessions, changing governmental policies, laws and regulations, and other economic factors could adversely affect our results of operations, cash flow, liquidity or financial condition.

A weakening or reversal of the general economic recovery in the United States and other countries and regions in which we do business, or the continuation or worsening of the economic downturn in other countries and regions, may adversely affect our results of operations, cash flow, liquidity or financial condition.

Global economic uncertainty continues to exist. A weakening or reversal of the general economic recovery in the United States and other countries and regions in which we do business, or the continuation or worsening of the economic downturn in other countries and regions, may adversely impact our net sales, the collection of accounts receivable, funding for working capital needs, expected cash flow generation from current and acquired businesses, and our investments, which may adversely impact our results of operations, cash flow, liquidity or financial condition.

We finance a portion of our sales through trade credit. Credit markets remain tight, and some customers who require financing for their businesses have not been able to obtain necessary financing. A continuation or worsening of these conditions could limit our ability to collect our accounts receivable, which could adversely affect our results of operations, cash flow, liquidity or financial condition.

We generally fund a portion of our seasonal working capital needs and obtain funding for other general corporate purposes through short-term borrowings backed by our revolving credit facility and other financing facilities. If any of the

5

banks in these credit and financing facilities are unable to perform on their commitments, which could adversely affect our ability to fund seasonal working capital needs and obtain funding for other general corporate purposes, our cash flow, liquidity or financial condition could be adversely impacted.

Although we currently have available credit facilities to fund our current operating needs, we cannot be certain that we will be able to replace our existing credit facilities or refinance our existing or future debt when necessary. Our cost of borrowing and ability to access the capital markets are affected not only by market conditions, but also by our debt and credit ratings assigned by the major credit rating agencies. Downgrades in these ratings will increase our cost of borrowing and could have an adverse effect on our access to the capital markets, including our access to the commercial paper market. An inability to access the capital markets could have a material adverse effect on our results of operations, cash flow, liquidity or financial condition.

We have goodwill and intangible assets recorded on our balance sheet. We periodically evaluate the recoverability of the carrying value of our goodwill and intangible assets whenever events or changes in circumstances indicate that such value may not be recoverable. Impairment assessment involves judgment as to assumptions regarding future sales and cash flows and the impact of market conditions on those assumptions. Future events and changing market conditions may impact our assumptions and may result in changes in our estimates of future sales and cash flows that may result in us incurring substantial impairment charges, which would adversely affect our results of operations or financial condition.

We hold investments in equity and debt securities in some of our defined benefit pension plans. A decrease in the value of plan assets resulting from a general financial downturn may cause a negative pension plan investment performance, which may adversely affect our results of operations, cash flow, liquidity or financial condition.

Protracted duration of economic downturns in cyclical segments of the economy may depress the demand for some of our products and adversely affect our sales, earnings, cash flow or financial condition.

Portions of our business involve the sale of paint, coatings and related products to segments of the economy that are cyclical in nature, particularly segments relating to construction, housing and manufacturing. Our sales to these segments are affected by the levels of discretionary consumer and business spending in these segments. During economic downturns in these segments, the levels of consumer and business discretionary spending may decrease, and the recovery of these segments may lag behind the recovery of the overall economy. This decrease in spending will likely reduce the demand for some of our products and may adversely affect our sales, earnings, cash flow or financial condition.

During the recent recession, the U.S. homebuilding industry experienced a significant and sustained decrease in demand for new homes and an oversupply of new and existing homes available for sale. During this same time period, the U.S. real estate industry also experienced a significant decrease in existing home turnover. The commercial and industrial building and maintenance sectors also experienced a significant decline. The downturn in each of these segments contributed to an unprecedented decline in the demand for some of our products. The recovery in new home starts, existing home sales and new commercial construction has been sluggish and erratic in many markets and remain below their pre-recession highs. Challenging market conditions are expected to continue for the foreseeable future and may worsen. A worsening in these segments will reduce the demand for some of our products and may adversely impact sales, earnings and cash flow.

Increases in the cost of raw materials and energy may adversely affect our earnings or cash flow.

We purchase raw materials (including titanium dioxide and proplylene) and energy for use in the manufacturing, distribution and sale of our products. Factors such as adverse weather conditions, including hurricanes, and other disasters can disrupt raw material and fuel supplies and increase our costs. Although raw materials and energy supplies (including oil and natural gas) are generally available from various sources in sufficient quantities, unexpected shortages and increases in the cost of raw materials and energy, or any deterioration in our relationships with or the financial viability of our suppliers, may have an adverse effect on our earnings or cash flow in the event we are unable to offset higher costs in a timely manner by sufficiently decreasing our operating costs or raising the prices of our products. While we have experienced some easing of the prices of certain raw materials recently, raw material pricing has in the past and likely will in the future experience periods of volatility.

Although we have an extensive customer base, the loss of any of our largest customers could adversely affect our sales, earnings or cash flow.

We have a large and varied customer base due to our extensive distribution network. During 2014, no individual customer accounted for sales totaling more than ten percent of our sales. However, we have some customers that, individually, purchase a large amount of products from us. Although our broad distribution channels help to minimize the impact of the loss of any one customer, the loss of any of these large customers could have an adverse effect on our sales, earnings or cash flow.

Adverse weather conditions may temporarily reduce the demand for some of our products and could have a negative effect on our sales, earnings or cash flow.

6

Our business is seasonal in nature, with the second and third quarters typically generating a higher proportion of sales and earnings than other quarters. From time to time, adverse weather conditions in certain parts of the United States have had an adverse effect on our sales of paint, coatings and related products. For example, unusually cold and rainy weather, especially during the exterior painting season, could have an adverse effect on sales of our exterior paint products. An adverse effect on sales may cause a reduction in our earnings or cash flow.

Increased competition may reduce our sales, earnings or cash flow performance.

We face substantial competition from many international, national, regional and local competitors of various sizes in the manufacture, distribution and sale of our paint, coatings and related products. Some of our competitors are larger than us and have greater financial resources to compete. Other competitors are smaller and may be able to offer more specialized products. Technology, product quality, product innovation, breadth of product line, technical expertise, distribution, service and price are the key competitive factors for our business. Competition in any of these areas may reduce our sales and adversely affect our earnings or cash flow by resulting in decreased sales volumes, reduced prices and increased costs of manufacturing, distributing and selling our products.

To service our debt, we will require a significant amount of cash. Our ability to generate cash depends on many factors beyond our control. We also depend on the business of our subsidiaries to satisfy our cash needs. If we cannot generate the required cash, we may not be able to make the necessary payments required under our indebtedness.

At December 31, 2014, we had total debt of approximately $1.8 billion. We have the ability under our existing credit facilities to incur substantial additional indebtedness in the future. Our ability to make payments on our debt, fund our other liquidity needs, and make planned capital expenditures will depend on our ability to generate cash in the future. Our historical financial results have been, and we anticipate that our future financial results will be, subject to fluctuations. Our ability to generate cash, to a certain extent, is subject to general economic, financial, competitive, legislative, regulatory and other factors that are beyond our control. We cannot assure you that our business will generate sufficient cash flow from our operations or that future borrowings will be available to us in an amount sufficient to enable us to make payments of our debt, fund other liquidity needs and make planned capital expenditures. Additionally, any failure to comply with covenants in the instruments governing our debt could result in an event of default which, if not cured or waived, would have a material adverse effect on us.

A significant portion of our operations are conducted through our subsidiaries. As a result, our ability to generate sufficient cash flow for our needs is dependent to some extent on the earnings of our subsidiaries and the payment of those earnings to us in the form of dividends, loans or advances and through repayment of loans or advances from us. Our subsidiaries are separate and distinct legal entities. Our subsidiaries have no obligation to pay any amounts due on our debt or to provide us with funds to meet our cash flow needs, whether in the form of dividends, distributions, loans or other payments. In addition, any payment of dividends, loans or advances by our subsidiaries could be subject to statutory or contractual restrictions. Payments to us by our subsidiaries will also be contingent upon our subsidiaries' earnings and business considerations. Our right to receive any assets of any of our subsidiaries upon their liquidation or reorganization will be effectively subordinated to the claims of that subsidiary's creditors, including trade creditors. In addition, even if we are a creditor of any of our subsidiaries, our rights as a creditor would be subordinate to any security interest in the assets of our subsidiaries and any indebtedness of our subsidiaries senior to that held by us. Finally, changes in the laws of foreign jurisdictions in which we operate may adversely affect the ability of some of our foreign subsidiaries to repatriate funds to us.

Our results of operations, cash flow or financial condition may be negatively impacted if we do not successfully integrate past and future acquisitions into our existing operations and if the performance of the businesses we acquire do not meet our expectations.

We have historically made strategic acquisitions of businesses in the paint and coatings industry and will likely acquire additional businesses in the future as part of our long-term growth strategy. In 2013, we acquired the Comex business in the United States and Canada. This acquisition involves challenges and risks. In the event that we do not continue to successfully integrate the Comex acquisition into our existing operations so as to realize the expected return on our investment, our results of operations, cash flow or financial condition could be adversely affected.

Risks and uncertainties associated with our expansion into and our operations in Asia, Europe, South America and other foreign markets could adversely affect our results of operations, cash flow, liquidity or financial condition.

Net external sales of our consolidated foreign subsidiaries totaled approximately 19.8%, 20.9% and 21.5% of our total consolidated net sales in 2014, 2013 and 2012, respectively. Sales outside of the United States make up a significant part of our current business and future strategic plans. Our results of operations, cash flow, liquidity or financial condition could be adversely affected by a variety of international factors, including general economic conditions, inflation rates, recessions, foreign currency exchange rates, foreign currency exchange controls, interest rates, foreign investment and repatriation restrictions, legal and regulatory constraints, civil unrest, difficulties in staffing and managing foreign operations and other

7

external economic and political factors. Our inability to successfully manage the risks and uncertainties relating to these factors could adversely affect our results of operations, cash flow, liquidity or financial condition.

In many foreign countries, it is acceptable to engage in certain business practices that we are prohibited from engaging in because of regulations that are applicable to us, such as the Foreign Corrupt Practices Act and the UK Bribery Act. Although we have internal control policies and procedures designed to ensure compliance with these regulations, there can be no assurance that our policies and procedures will prevent a violation of these regulations. Any violation could cause an adverse effect on our results of operations, cash flow or financial condition.

Fluctuations in foreign currency exchange rates could adversely affect our results of operations, cash flow, liquidity or financial condition.

Because of our international operations, we are exposed to risk associated with interest rates and value changes in foreign currencies, which may adversely affect our business. Historically, our reported net sales, earnings, cash flow and financial condition have been subjected to fluctuations in foreign exchange rates. Our primary exchange rate exposure is with the euro, the British pound, the Argentine peso, the Brazilian real, the Chilean peso, the Canadian dollar and the Mexican peso against the U.S. dollar. While we actively manage the exposure of our foreign currency risk as part of our overall financial risk management policy, we believe we may experience losses from foreign currency exchange rate fluctuations, and such losses could adversely affect our sales, earnings, cash flow, liquidity or financial condition.

We are subject to a wide variety of complex domestic and foreign laws and regulations, for which compliance could adversely affect our results of operations, cash flow or financial condition.

We are subject to a wide variety of complex domestic and foreign laws and regulations, and legal compliance risks, including securities laws, tax laws, employment and pension-related laws, competition laws, U.S. and foreign export and trading laws, and laws governing improper business practices. We are affected by new laws and regulations, and changes to existing laws and regulations, including interpretations by courts and regulators. From time to time, our Company, our operations and the industries in which we operate are being reviewed or investigated by regulators, which could lead to enforcement actions or the assertion of private litigation claims and damages.

Although we believe that we have adopted appropriate risk management and compliance programs to mitigate these risks, the global and diverse nature of our operations means that compliance risks will continue to exist. Investigations, examinations and other proceedings, the nature and outcome of which cannot be predicted, will likely arise from time to time. These investigations, examinations and other proceedings could subject us to significant liability and require us to take significant accruals or pay significant settlements, fines and penalties, which could have a material adverse effect on our results of operations, cash flow or financial condition.

We are subject to tax laws and regulations in the United States and multiple foreign jurisdictions. We are affected by changes in tax laws and regulations, as well as changes in related interpretations and other tax guidance. In the ordinary course of our business, we are subject to examinations and investigations by various tax authorities. In addition to existing examinations and investigations, there could be additional examinations and investigations in the future, and existing examinations and investigations could be expanded.

For non-income tax risks, we estimate material loss contingencies and accrue for such loss contingencies as required by U.S. generally accepted accounting principles based on our assessment of contingencies where liability is deemed probable and reasonably estimable in light of the facts and circumstances known to us at a particular point in time. Subsequent developments may affect our assessment and estimates of the loss contingency. In the event the loss contingency is ultimately determined to be significantly higher than currently accrued, the recording of the additional liability may result in a material adverse effect on our results of operations or financial condition for the annual or interim period during which such additional liability is accrued. In those cases where no accrual is recorded because it is not probable that a liability has been incurred and cannot be reasonably estimated, any potential liability ultimately determined to be attributable to us may result in a material adverse effect on our results of operations, cash flow or financial condition for the annual or interim period during which such liability is accrued or paid. For income tax risks, we recognize tax benefits based on our assessment that a tax benefit has a greater than 50% likelihood of being sustained upon ultimate settlement with the applicable taxing authority that has full knowledge of all relevant facts. For those income tax positions where we assess that there is not a greater than 50% likelihood that such tax benefits will be sustained, we do not recognize a tax benefit in our financial statements. Subsequent events may cause us to change our assessment of the likelihood of sustaining a previously-recognized benefit which could result in a material adverse effect on our results of operations, cash flow or financial position for the annual or interim period during which such liability is accrued or paid.

We discuss risks and uncertainties with regard to taxes in more detail in Note 14 of the Notes to Consolidated Financial Statements on pages 68 and 69 of our 2014 Annual Report.

8

Unauthorized disclosure of sensitive or confidential customer, employee, supplier or Company information, whether through a breach of our computer systems, including cyber attacks or otherwise, could severely harm our business.

As part of our business, we collect, process, and retain sensitive and confidential personal information about our customers, employees and suppliers. Despite the security measures we have in place, our facilities and systems, and those of the retailers, dealers, licensees and other third party distributors with which we do business, may be vulnerable to security breaches, cyber attacks, acts of vandalism, computer viruses, misplaced or lost data, programming and/or human errors or other similar events. Any security breach involving the misappropriation, loss or other unauthorized disclosure of confidential customer, employee, supplier or Company information, whether by us or by the retailers, dealers, licensees and other third party distributors with which we do business, could result in losses, severely damage our reputation, expose us to the risks of litigation and liability, disrupt our operations and have a material adverse effect on our business, results of operations and financial condition. The regulatory environment related to information security, data collection and privacy is increasingly rigorous, with new and constantly changing requirements applicable to our business, and compliance with those requirements could result in additional costs.

We are required to comply with numerous complex and increasingly stringent domestic and foreign health, safety and environmental laws and regulations, the cost of which is likely to increase and may adversely affect our results of operations, cash flow or financial condition.

Our operations are subject to various domestic and foreign health, safety and environmental laws and regulations. These laws and regulations not only govern our current operations and products, but also impose potential liability on us for our past operations. We expect health, safety and environmental laws and regulations to impose increasingly stringent requirements upon our industry and us in the future. Our costs to comply with these laws and regulations may increase as these requirements become more stringent in the future, and these increased costs may adversely affect our results of operations, cash flow or financial condition.

We are involved with environmental investigation and remediation activities at some of our currently and formerly owned sites, as well as a number of third-party sites, for which our ultimate liability may exceed the current amount we have accrued.

We are involved with environmental investigation and remediation activities at some of our currently and formerly owned sites and a number of third-party sites. We accrue for estimated costs of investigation and remediation activities at these sites for which commitments or clean-up plans have been developed and when such costs can be reasonably estimated based on industry standards and professional judgment. These estimated costs are based on currently available facts regarding each site. We continuously assess our potential liability for investigation and remediation activities and adjust our environmental-related accruals as information becomes available upon which more accurate costs can be reasonably estimated. Due to the uncertainties surrounding environmental investigation and remediation activities, our liability may result in costs that are significantly higher than currently accrued and may have an adverse effect on our earnings. We discuss these risks and uncertainties in more detail on page 23 of our 2014 Annual Report under the caption “Environmental Matters,” page 27 of our 2014 Annual Report under the caption “Environmental-Related Liabilities” and in Note 8 of the Notes to Consolidated Financial Statements on pages 58 through 60 of our 2014 Annual Report.

9

The nature, cost, quantity and outcome of pending and future litigation, such as litigation arising from the historical manufacture and sale of lead pigments and lead-based paint, could have a material adverse effect on our results of operations, cash flow, liquidity and financial condition.

In the course of our business, we are subject to a variety of claims and lawsuits, including, but not limited to, litigation relating to product liability and warranty, personal injury, environmental, intellectual property, commercial, contractual and antitrust claims that are inherently subject to many uncertainties regarding the possibility of a loss to us. These uncertainties will ultimately be resolved when one or more future events occur or fail to occur confirming the incurrence of a liability or the reduction of a liability. In accordance with the Contingencies Topic of the ASC, we accrue for these contingencies by a charge to income when it is both probable that one or more future events will occur confirming the fact of a loss and the amount of the loss can be reasonably estimated. In the event that a loss contingency is ultimately determined to be significantly higher than currently accrued, the recording of the additional liability may result in a material impact on our results of operations, liquidity or financial condition for the annual or interim period during which such additional liability is accrued. In those cases where no accrual is recorded because it is not probable that a liability has been incurred and the amount of any such loss cannot be reasonably estimated, any potential liability ultimately determined to be attributable to us may result in a material impact on our results of operations, liquidity or financial condition for the annual or interim period during which such liability is accrued. In those cases where no accrual is recorded or exposure to loss exists in excess of the amount accrued, the Contingencies Topic of the ASC requires disclosure of the contingency when there is a reasonable possibility that a loss or additional loss may have been incurred.

Our past operations included the manufacture and sale of lead pigments and lead-based paints. Along with other companies, we are and have been a defendant in a number of legal proceedings, including individual personal injury actions, purported class actions and actions brought by various counties, cities, school districts and other government-related entities, arising from the manufacture and sale of lead pigments and lead-based paints. The plaintiffs' claims have been based upon various legal theories, including negligence, strict liability, breach of warranty, negligent misrepresentations and omissions, fraudulent misrepresentations and omissions, concert of action, civil conspiracy, violations of unfair trade practice and consumer protection laws, enterprise liability, market share liability, public nuisance, unjust enrichment and other theories. The plaintiffs seek various damages and relief, including personal injury and property damage, costs relating to the detection and abatement of lead-based paint from buildings, costs associated with a public education campaign, medical monitoring costs and others. We have also been a defendant in legal proceedings arising from the manufacture and sale of non-lead-based paints that seek recovery based upon various legal theories, including the failure to adequately warn of potential exposure to lead during surface preparation when using non-lead-based paint on surfaces previously painted with lead-based paint. We believe that the litigation brought to date is without merit or subject to meritorious defenses and are vigorously defending such litigation. We have not settled any material lead pigment or lead-based paint litigation. We expect that additional lead pigment and lead-based paint litigation may be filed against us in the future asserting similar or different legal theories and seeking similar or different types of damages and relief.

Notwithstanding our views on the merits, litigation is inherently subject to many uncertainties, and we ultimately may not prevail. Adverse court rulings, such as the court's decision in the Santa Clara County, California proceeding, the jury verdict against us and other defendants in the State of Rhode Island action and the Wisconsin State Supreme Court’s determination that Wisconsin’s risk contribution theory may apply in the lead pigment litigation, or determinations of liability, among other factors, could affect the lead pigment and lead-based paint litigation against us and encourage an increase in the number and nature of future claims and proceedings. In addition, from time to time, various legislation and administrative regulations have been enacted, promulgated or proposed to impose obligations on present and former manufacturers of lead pigments and lead-based paints respecting asserted health concerns associated with such products or to overturn the effect of court decisions in which we and other manufacturers have been successful.

Due to the uncertainties involved, management is unable to predict the outcome of the lead pigment and lead-based paint litigation, the number or nature of possible future claims and proceedings, or the effect that any legislation and/or administrative regulations may have on the litigation or against us. In addition, management cannot reasonably determine the scope or amount of the potential costs and liabilities related to such litigation, or resulting from any such legislation and regulations. We have not accrued any amounts for such litigation. With respect to such litigation, including the public nuisance litigation, the Company does not believe that it is probable that a loss has occurred, and it is not possible to estimate the range of potential losses as there is no prior history of a loss of this nature and there is no substantive information upon which an estimate could be based. In addition, any potential liability that may result from any changes to legislation and regulations cannot reasonably be estimated. In the event any significant liability is determined to be attributable to us relating to such litigation, the recording of the liability may result in a material impact on net income for the annual or interim period during which such liability is accrued. Additionally, due to the uncertainties associated with the amount of any such liability and/or the nature of any other remedy which may be imposed in such litigation, any potential liability determined to be attributable to us arising out of such litigation may have a material adverse effect on our results of operations, cash flow, liquidity or financial

10

condition. An estimate of the potential impact on our results of operations, cash flow, liquidity or financial condition cannot be made due to the aforementioned uncertainties.

A trial commenced in the Santa Clara County, California proceeding on July 15, 2013 and ended on August 22, 2013. The court entered final judgment on January 27, 2014, finding in favor of the plaintiffs and against the Company and two other defendants, and holding the Company jointly and severally liable with the other two defendants to pay $1.15 billion into a fund to abate the public nuisance. The Company has filed a notice of appeal. However, if the appeal process is unsuccessful at reversing the decision or otherwise reducing the amount of the judgment, we and the other defendants will be subject to significant liabilities, costs and expenses to abate the public nuisance in, on and around residences in the plaintiffs' jurisdictions, which could encourage an increase in future public nuisance claims and proceedings. Any adverse court rulings or any determinations of liability against us may result in a material impact on our results of operations, liquidity or financial condition.

We discuss the risks and uncertainties related to litigation, including the lead pigment and lead-based paint litigation, in more detail on page 23 of our 2014 Annual Report under the caption “Litigation and Other Contingent Liabilities,” and pages 29 and 30 of our 2014 Annual Report under the caption “Litigation” of “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and in Note 9 of the Notes to Consolidated Financial Statements on pages 60 through 63 of our 2014 Annual Report.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

11

ITEM 2. PROPERTIES

We own our world headquarters located in Cleveland, Ohio, which includes the world headquarters for the Paint Stores Group, Consumer Group, Global Finishes Group and Latin America Coatings Group. Our principal manufacturing and distribution facilities are located as set forth below. We believe our manufacturing and distribution facilities are well-maintained and are suitable and adequate, and have sufficient productive capacity, to meet our current needs.

CONSUMER GROUP | ||||

Manufacturing Facilities | ||||

Andover, Kansas | Owned | Homewood, Illinois | Owned | |

Arlington, Texas | Owned | Lawrenceville, Georgia | Owned | |

Baltimore, Maryland | Owned | Manchester, Georgia | Owned | |

Bedford Heights, Ohio | Owned | Memphis, Tennessee | Owned | |

Beltsville, Maryland | Owned | Morrow, Georgia | Owned | |

Chicago, Illinois | Owned | Ontario, California | Leased | |

Cincinnati, Ohio | Owned | Orlando, Florida | Owned | |

Columbus, Ohio | Owned | Plymouth, United Kingdom | Leased | |

Crisfield, Maryland | Leased | Portland, Oregon | Leased | |

Elkhart, Indiana | Owned | Rexdale, Ontario, Canada | Owned | |

Ennis, Texas | Owned | Richmond, Kentucky | Owned | |

Fernley, Nevada | Owned | Rockford, Illinois | Leased | |

Flora, Illinois | Owned | San Diego, California | Owned | |

Fort Erie, Ontario, Canada | Owned | Sheffield, United Kingdom | Owned | |

Garland, Texas | Owned | South Holland, Illinois | Owned | |

Greensboro, North Carolina (2) | Owned | Szamotuly, Poland | Owned | |

Grimsby, Ontario, Canada | Owned | Vancouver, British Columbia, Canada | Owned | |

Grove City, Ohio | Owned | Victorville, California | Owned | |

Holland, Michigan | Owned | |||

Distribution Facilities | ||||

Aurora, Colorado | Leased | Richmond, Kentucky | Owned | |

Buford, Georgia | Leased | Shawinigan, Quebec, Canada | Leased | |

Effingham, Illinois | Leased | Sheffield, United Kingdom | Owned | |

Fredericksburg, Pennsylvania | Owned | Swaffham, United Kingdom | Leased | |

Moreno Valley, California | Leased | Szamotuly, Poland | Owned | |

Plymouth, United Kingdom | Leased | Waco, Texas | Leased | |

Reno, Nevada | Leased | Winter Haven, Florida | Owned | |

12

GLOBAL FINISHES GROUP | ||||

Manufacturing Facilities | ||||

Bello, Sweden | Owned | Pianoro, Italy | Owned | |

Binh Duong Province, Vietnam | Owned | Saint Cheron, France | Owned | |

Bolton, United Kingdom | Owned | Sao Paulo, Brazil | Owned | |

Brantford, Ontario, Canada | Owned | Shanghai, China | Leased | |

Cavezzo, Italy | Owned | Texcoco, Mexico | Owned | |

Changzhou, China | Leased | Valencia, Spain | Owned | |

Mariano Comense, Italy | Owned | Wuppertal, Germany | Owned | |

Marsta, Sweden | Owned | Zhao Qing, China | Leased | |

Pasir Gudang, Johor, Malaysia | Owned | |||

Distribution Facilities | ||||

Bolton, United Kingdom | Owned | Nassjo, Sweden | Leased | |

Cavezzo, Italy | Leased | Sao Paulo, Brazil | Owned | |

Changzhou, China | Owned | Shanghai, China | Owned | |

Guadalajara, Mexico | Leased | Texcoco, Mexico | Owned | |

Lima, Peru | Leased | Quito, Ecuador | Owned | |

Mexico City, Mexico | Owned | |||

LATIN AMERICA COATINGS GROUP | ||||

Manufacturing Facilities | ||||

Buenos Aires, Argentina | Owned | Sao Paulo, Brazil (2) | Owned | |

Montevideo City, Uruguay | Owned | Sao Paulo, Brazil | Leased | |

Santiago, Chile | Owned | Quito, Ecuador | Owned | |

Santiago, Chile (2) | Leased | Vallejo, Mexico | Owned | |

Distribution Facilities | ||||

Buenos Aires, Argentina | Owned | Quito, Ecuador | Owned | |

Hermosillo, Mexico | Leased | Santa Catarina, Brazil | Leased | |

Lima, Peru | Leased | Santiago, Chile | Owned | |

Machala, Ecuador | Leased | Sao Paulo, Brazil (2) | Owned | |

Maceio, Brazil | Leased | Vallejo, Mexico | Owned | |

Montevideo City, Uruguay | Owned | |||

The operations of the Paint Stores Group included a manufacturing and distribution facility in Jamaica and 4,003 company-operated specialty paint stores, of which 209 were owned, in the United States, Canada, Puerto Rico, Virgin Islands, Trinidad and Tobago, St. Maarten, Jamaica, Curacao, Aruba and St. Lucia at December 31, 2014. These paint stores are divided into four separate operating divisions that are responsible for the sale of predominantly architectural, protective and marine and related products through the paint stores located within their geographical region. At the end of 2014:

• | the Mid Western Division operated 1,026 paint stores primarily located in the midwestern and upper west coast states; |

• | the Eastern Division operated 803 paint stores along the upper east coast and New England states; |

• | the Canada Division operated 191 paint stores throughout Canada; |

• | the Southeastern Division operated a manufacturing and distribution facility in Jamaica and 1,031 paint stores principally covering the lower east and gulf coast states, Puerto Rico, Jamaica, Trinidad and Tobago, St. Maarten, Virgin Islands, Curacao, Aruba and St. Lucia; and |

• | the South Western Division operated 952 paint stores in the central plains and the lower west coast states. |

13

During 2014, the Paint Stores Group opened 95 net new stores, consisting of 109 new stores opened (95 in the United States, 9 in Canada, 2 in Puerto Rico, 1 in Trinidad and Tobago, 1 in Jamaica and 1 in St. Lucia) and 14 stores closed (11 in the United States and 3 in Canada).

The Global Finishes Group operated 241 branches in the United States, of which 8 were owned, at December 31, 2014. The Global Finishes Group also operated 59 branches internationally, of which 7 were owned, at December 31, 2014, consisting of branches in Canada (24), Europe (16), Chile (14), Mexico (3), Peru (1) and Thailand (1). During 2014, the Global Finishes Group opened 1 new branch in the United States and closed 1 branch in the United States resulting in no net change.

The Latin America Coatings Group operated 276 stores, of which 8 were owned, at December 31, 2014, consisting of stores in Mexico (119), Brazil (87), Chile (42), Ecuador (15), Uruguay (9), Peru (3) and Colombia (1). During 2014, the Latin America Coatings Group opened 3 new stores in South America and closed 9 (7 in South America and 2 in Mexico) for a net decrease of 6 stores.

All real property within the Administrative segment is owned by us. For additional information regarding real property within the Administrative segment, see the information set forth in Item 1 of this report, which is incorporated herein by reference.

For additional information regarding real property leases, see Note 17 of the Notes to Consolidated Financial Statements on page 70 of our 2014 Annual Report, which is incorporated herein by reference.

ITEM 3. LEGAL PROCEEDINGS

For information regarding environmental-related matters and other legal proceedings, see pages 27, and 29 and 30 of our 2014 Annual Report under the captions “Environmental-Related Liabilities” and “Litigation” of “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Notes 1, 8, 9 and 13 of the Notes to Consolidated Financial Statements on pages 46, 58 through 60, 60 through 63 and 67, respectively, of our 2014 Annual Report, which is incorporated herein by reference.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

EXECUTIVE OFFICERS OF THE REGISTRANT

The following is the name, age and present position of each of our executive officers at February 18, 2015, as well as all prior positions held by each during the last five years and the date when each was first elected or appointed as an executive officer. Executive officers are generally elected annually by the Board of Directors and hold office until their successors are elected and qualified or until their earlier death, resignation or removal.

Name | Age | Present Position | Date When First Elected or Appointed |

Christopher M. Connor | 58 | Chairman and Chief Executive Officer, Director | 1994 |

John G. Morikis | 51 | President and Chief Operating Officer | 1999 |

Sean P. Hennessy | 57 | Senior Vice President – Finance and Chief Financial Officer | 2001 |

Thomas E. Hopkins | 57 | Senior Vice President – Human Resources | 1997 |

Catherine M. Kilbane | 51 | Senior Vice President, General Counsel and Secretary | 2013 |

Allen J. Mistysyn | 46 | Senior Vice President – Corporate Controller | 2010 |

Steven J. Oberfeld | 62 | Senior Vice President – Corporate Planning and Development | 2006 |

Robert J. Wells | 57 | Senior Vice President – Corporate Communications and Public Affairs | 2006 |

Robert J. Davisson | 54 | President, The Americas Group | 2010 |

David B. Sewell | 46 | President, Global Finishes Group | 2014 |

Mr. Connor has served as Chairman since April 2000 and Chief Executive Officer since October 1999. Mr. Connor has served as a Director since October 1999 and has been employed with the Company since January 1983.

Mr. Morikis has served as President and Chief Operating Officer since October 2006. Mr. Morikis has been employed with the Company since December 1984.

14

Mr. Hennessy has served as Senior Vice President – Finance and Chief Financial Officer since August 2001. Mr. Hennessy has been employed with the Company since September 1984.

Mr. Hopkins has served as Senior Vice President – Human Resources since February 2002. Mr. Hopkins has been employed with the Company since September 1981.

Ms. Kilbane has served as Senior Vice President, General Counsel and Secretary since January 2013. Prior to joining the Company, Ms. Kilbane was Senior Vice President, General Counsel and Secretary of American Greetings Corporation from October 2003 to December 2012. Ms. Kilbane has been employed with the Company since January 2013.

Mr. Mistysyn has served as Senior Vice President – Corporate Controller since October 2014. Mr. Mistysyn served as Vice President – Corporate Controller from May 2010 to October 2014 and Vice President – Assistant Corporate Controller from August 2009 to May 2010. Mr. Mistysyn has been employed with the Company since June 1990.

Mr. Oberfeld has served as Senior Vice President – Corporate Planning and Development since November 2010. Mr. Oberfeld served as President, Paint Stores Group from October 2006 to November 2010. Mr. Oberfeld has been employed with the Company since October 1984.

Mr. Wells has served as Senior Vice President – Corporate Communications and Public Affairs since February 2009. Mr. Wells has been employed with the Company since May 1998.

Mr. Davisson has served as President, The Americas Group since August 2014. Mr. Davisson served as President, Paint Stores Group from November 2010 to August 2014 and President & General Manager, Southeastern Division, Paint Stores Group from October 1999 to November 2010. Mr. Davisson has been employed with the Company since April 1986.

Mr. Sewell has served as President, Global Finishes Group since August 2014. Mr. Sewell served as President & General Manager, Product Finishes Division, Global Finishes Group from July 2012 to August 2014, Senior Vice President, North American Sales, Automotive Division, Global Finishes Group from September 2011 to July 2012, and Vice President, Sales, Automotive Division, Global Finishes Group from October 2009 to September 2011. Mr. Sewell has been employed with the Company since February 2007.

15

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our common stock is listed on the New York Stock Exchange and traded under the symbol SHW. The number of shareholders of record at January 31, 2015 was 7,224.

Information regarding market prices and dividend information with respect to our common stock is set forth on page 75 of our 2014 Annual Report, which is incorporated herein by reference. The performance graph set forth on page 16 of our 2014 Annual Report is incorporated herein by reference. The information with respect to securities authorized for issuance under the Company’s equity compensation plans is set forth under the caption “Equity Compensation Plan Information” in our Proxy Statement, which is incorporated herein by reference.

Issuer Purchases of Equity Securities

The following table sets forth a summary of the Company’s purchases of common stock during the fourth quarter of 2014.

Period | Total Number of Shares Purchased | Average Price Paid per Share | Total Number of Shares Purchased as Part of a Publicly Announced Plan | Maximum Number of Shares that May Yet Be Purchased Under the Plan | |||||||||

October 1 – October 31 | |||||||||||||

Share repurchase program (a) | 6,825,000 | ||||||||||||

Employee transactions (b) | 70 | $ | 208.49 | NA | |||||||||

November 1 – November 30 | |||||||||||||

Share repurchase program (a) | 6,825,000 | ||||||||||||

December 1 – December 31 | |||||||||||||

Share repurchase program (a) | 1,600,000 | 246.62 | 1,600,000 | 5,225,000 | |||||||||

Employee transactions (b) | 162 | 191.19 | NA | ||||||||||

Total | |||||||||||||

Share repurchase program (a) | 1,600,000 | $246.62 | 1,600,000 | 5,225,000 | |||||||||

Employee transactions (b) | 232 | $196.41 | NA | ||||||||||

(a) | All shares were purchased through the Company’s publicly announced share repurchase program. On October 20, 2011, the Board of Directors of the Company authorized the Company to purchase an additional 20,000,000 shares of its common stock. The Company had remaining authorization at December 31, 2014 to purchase 5,225,000 shares. There is no expiration date specified for the program. The Company intends to repurchase stock under the program in the future. |

(b) | All shares were delivered to satisfy the exercise price and/or tax withholding obligations by employees who exercised stock options. |

16

ITEM 6. SELECTED FINANCIAL DATA

(millions of dollars, except per common share data)

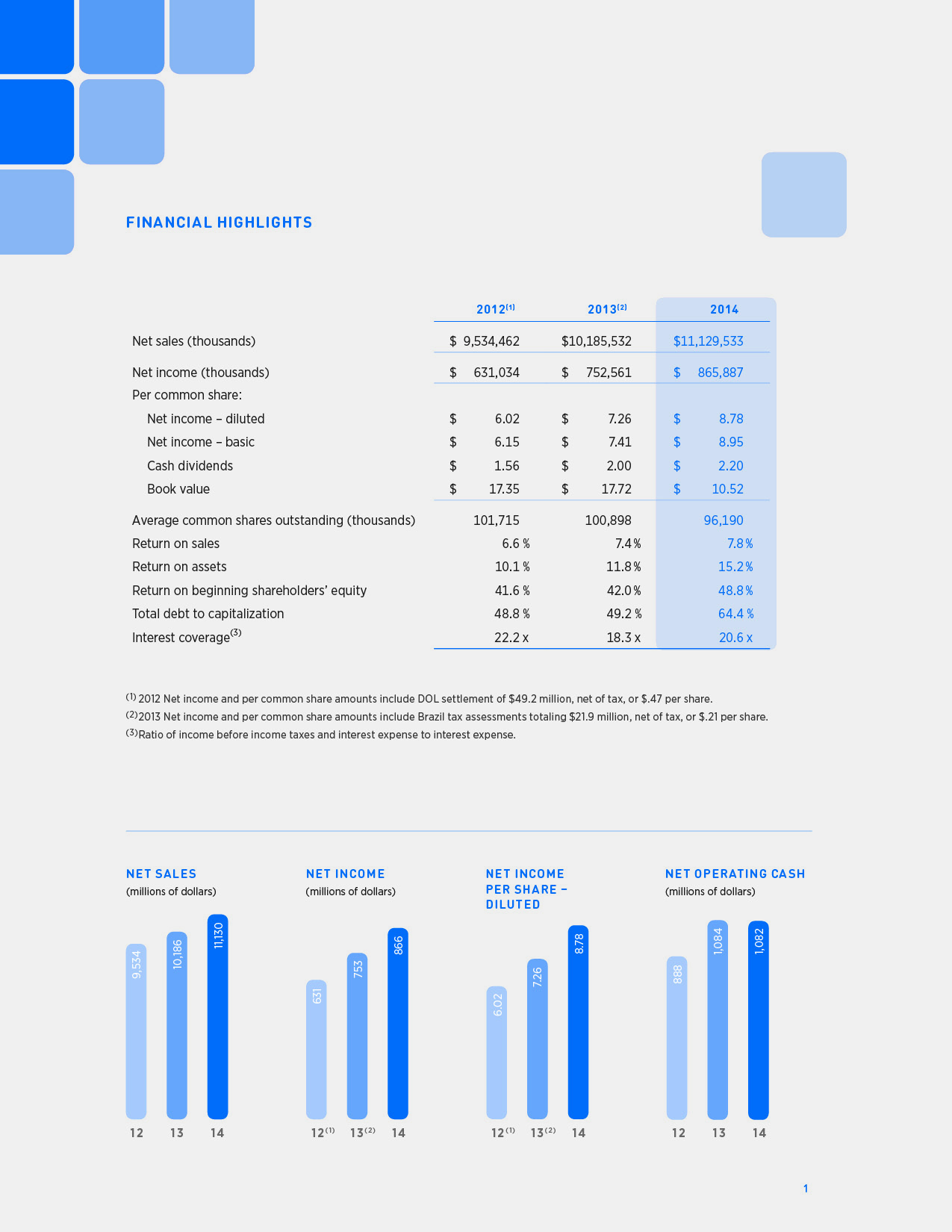

2014 | 2013 | 2012 | 2011 | 2010 | |||||||||||||||||

Operations | |||||||||||||||||||||

Net sales | $ | 11,130 | $ | 10,186 | $ | 9,534 | $ | 8,766 | $ | 7,776 | |||||||||||

Net income | 866 | 753 | 631 | 442 | 462 | ||||||||||||||||

Financial Position | |||||||||||||||||||||

Total assets | $ | 5,706 | $ | 6,383 | $ | 6,235 | $ | 5,229 | $ | 5,169 | |||||||||||

Long-term debt | 1,123 | 1,122 | 1,632 | 639 | 648 | ||||||||||||||||

Ratio of earnings to fixed charges (a) | 7.7x | 7.4x | 7.2x | 6.3x | 5.1x | ||||||||||||||||

Per Common Share Data | |||||||||||||||||||||

Net income — basic | $ | 8.95 | $ | 7.41 | $ | 6.15 | $ | 4.22 | $ | 4.28 | |||||||||||

Net income — diluted | 8.78 | 7.26 | 6.02 | 4.14 | 4.21 | ||||||||||||||||

Cash dividends | 2.20 | 2.00 | 1.56 | 1.46 | 1.44 | ||||||||||||||||

(a) | For purposes of calculating the ratio of earnings to fixed charges, earnings represent income before income taxes plus fixed charges. Fixed charges consist of interest expense, net, including amortization of discount and financing costs and the portion of operating rental expense which management believes is representative of the interest component of rent expense. The following schedule includes the figures used to calculate the ratios: |

2014 | 2013 | 2012 | 2011 | 2010 | |||||||||||||||||

Income before income taxes | $ | 1,258 | $ | 1,086 | $ | 907 | $ | 742 | $ | 678 | |||||||||||

Fixed charges: | |||||||||||||||||||||

Interest expense, net | 64 | 63 | 43 | 42 | 71 | ||||||||||||||||

Interest component of rent expense | 125 | 108 | 103 | 97 | 93 | ||||||||||||||||

Total fixed charges | 189 | 171 | 146 | 139 | 164 | ||||||||||||||||

Earnings | $ | 1,447 | $ | 1,257 | $ | 1,053 | $ | 881 | $ | 842 | |||||||||||

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The information required by this item is set forth on pages 19 through 35 of our 2014 Annual Report under the caption “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” which is incorporated herein by reference.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

We are exposed to market risk associated with interest rates, foreign currency and commodity fluctuations. We occasionally utilize derivative instruments as part of our overall financial risk management policy, but do not use derivative instruments for speculative or trading purposes. The Company entered into foreign currency option and forward currency exchange contracts during 2014 to hedge against value changes in foreign currency. There were no material contracts outstanding at December 31, 2014. Foreign currency option and forward contracts are described in Note 13 of the Notes to Consolidated Financial Statements on page 67 of our 2014 Annual Report. We believe we may experience continuing losses from foreign currency fluctuations. However, we do not expect currency translation, transaction or hedging contract losses to have a material adverse effect on our financial condition, results of operations or cash flows.

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

Information required by this item is set forth on pages 38 through 73 of our 2014 Annual Report under the captions “Report of Management on the Consolidated Financial Statements,” “Report of the Independent Registered Public Accounting Firm on the Consolidated Financial Statements,” “Statements of Consolidated Income and Comprehensive Income,” “Consolidated Balance Sheets,” “Statements of Consolidated Cash Flows,” “Statements of Consolidated Shareholders’ Equity,” and “Notes to Consolidated Financial Statements,” which is incorporated herein by reference. Unaudited quarterly data is set forth in Note 16 of the Notes to Consolidated Financial Statements on page 70 of our 2014 Annual Report, which is incorporated herein by reference.

17

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

None.

ITEM 9A. CONTROLS AND PROCEDURES