Form 10-K AUTOLIV INC For: Dec 31

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2014

Commission file number: 001-12933

AUTOLIV, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 51-0378542 | |

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification No.) |

Vasagatan 11, 7th Floor, SE-111 20

Box 70381, SE-107 24

Stockholm, Sweden

(Address of principal executive offices)

+46 8 587 20 600

(Registrant’s telephone number,

including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class: |

Name of each exchange on which registered: | |

| Common Stock, par value $1.00 per share | New York Stock Exchange |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days. Yes: x No: ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes: x No: ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer: | x | Accelerated filer: | ¨ | |||

| Non-accelerated filer | ¨ | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes: ¨ No: x

The aggregate market value of the voting and non-voting common equity of Autoliv, Inc. held by non-affiliates as of the last business day of the second fiscal quarter of 2014 amounted to $9,894 million.

Number of shares of Common Stock outstanding as of February 16, 2015: 88,701,893.

DOCUMENTS INCORPORATED BY REFERENCE

1. Portions of the Annual Report to Stockholders for the fiscal year ended December 31, 2014 (the “Annual Report”) are incorporated by reference into Parts I and II.

2. Portions of the definitive Proxy Statement for the annual stockholders’ meeting to be held May 5, 2015, to be dated on or around March 23, 2015 (the “2015 Proxy Statement”), are incorporated by reference into Part III.

Table of Contents

Index

1

Table of Contents

General

Autoliv, Inc. (“Autoliv”, the “Company” or “we”) is a Delaware corporation with its principal executive offices in Stockholm, Sweden. It was created from the merger of Autoliv AB and the automotive safety products business of Morton International, Inc., in 1997. The Company functions as a holding corporation and owns two principal subsidiaries, AAB and Autoliv ASP, Inc.

Autoliv is a leading developer, manufacturer and supplier to the automotive industry of automotive safety systems with a broad range of product offerings, including passive safety systems and active safety systems. Passive safety systems include modules and components for passenger and driver-side airbags, side-impact airbag protection systems, seatbelts, steering wheels, passive safety electronics, whiplash protection systems and child seats, including components for such systems. Active safety systems include automotive radars, night driving assist, camera-based vision systems, brake controls and other active safety systems.

Autoliv’s filings with the United States Securities and Exchange Commission (the “SEC”), which include this Annual Report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, insider transaction reports on Forms 3 and 4 and all related amendments, are made available free of charge on our corporate website at www.autoliv.com and are available as soon as reasonably practicable after they are electronically filed with the SEC.

Shares of Autoliv common stock are traded on the New York Stock Exchange under the symbol “ALV”. Swedish Depository Receipts representing shares of Autoliv common stock (“SDRs”) trade on NASDAQ OMX Stockholm under the symbol “ALIV SDB”, and options in SDRs trade on the same exchange under the name “Autoliv SDB”. Options in Autoliv shares are traded on NASDAQ OMX Philadelphia and NYSE Amex Options under the symbol “ALV”. Our fiscal year ends on December 31.

* Safe Harbor Statement

This Form 10-K contains statements that are not historical facts but rather forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements include those that address activities, events or developments that Autoliv or its management believes or anticipates may occur in the future. For example, forward-looking statements include, without limitation, statements relating to industry trends (including light vehicle production), business opportunities, sales contracts, sales backlog, and on-going commercial arrangements and discussions, as well as any statements about estimated sales, estimated operating margin, effective tax rate or other future operating performance or financial results.

In some cases, you can identify these statements by forward-looking words such as “estimates,” “expects,” “anticipates,” “projects,” “plans,” “intends,” “believes,” “may,” “likely,” “might,” “will,” “should,” “could,” or the negative of these terms and other comparable terminology, although not all forward-looking statements contain such words.

All forward-looking statements, including without limitation, management’s examination of historical operating trends and data, are based upon our current expectations, various assumptions and data available from third parties. Our expectations and assumptions are

2

Table of Contents

expressed in good faith and we believe there is a reasonable basis for them. However, there can be no assurance that such forward-looking statements will materialize or prove to be correct as forward-looking statements are inherently subject to known and unknown risks, uncertainties and other factors which may cause actual future results, performance or achievements to differ materially from the future results, performance or achievements expressed in or implied by such forward-looking statements.

Because these forward-looking statements involve risks and uncertainties, the outcome could differ materially from those set out in the forward-looking statements for a variety of reasons, including without limitation, changes in light vehicle production, fluctuation in vehicle production schedules for which the Company is a supplier; market acceptance of our new products; changes in general industry market conditions or regional growth or declines; changes in and the successful execution of our capacity alignment, restructuring and cost reduction initiatives discussed herein and the market reaction thereto; loss of business from increased competition; higher raw material, fuel and energy costs; changes in consumer and customer preferences for end products; customer losses; changes in regulatory conditions; customer bankruptcies; consolidations or restructuring; divestiture of customer brands; unfavorable fluctuations in currencies or interest rates among the various jurisdictions in which we operate; component shortages; costs or difficulties related to the integration of any new or acquired businesses and technologies; continued uncertainty in program awards and performance; the financial results of companies in which Autoliv has made technology investments or joint-venture arrangements; pricing negotiations with customers; our ability to be awarded new business; product liability, warranty and recall claims and investigations and other litigation and customer reactions thereto; higher expenses for our pension and other postretirement benefits including higher funding requirements of our pension plans; work stoppages or other labor issues at our facilities or at the facilities of our customers or suppliers; possible adverse results of pending or future litigation or infringement claims; negative impacts of antitrust investigations or other governmental investigations and associated litigation relating to the conduct of our business; tax assessments by governmental authorities and changes in our effective tax rate, dependence on key personnel; legislative or regulatory changes limiting our business; political conditions; dependence on and relationships with customers and suppliers; and other risks and uncertainties identified in Item 1A “Risk Factors” and Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this Form 10-K for the year ended December 31, 2014. The Company undertakes no obligation to update publicly or revise any forward-looking statements in light of new information or future events.

For any forward-looking statements contained in this or any other document, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995, and we assume no obligation to update any such statement.

Business

Autoliv is the world’s leading supplier of automotive safety systems, with a broad range of product offerings, including passive safety systems and active safety systems. Passive safety systems are primarily meant to improve vehicle safety, and include modules and components for passenger and driver-side airbags, side-impact airbag protection systems, seatbelts, steering wheels, passive safety electronics, whiplash protection systems and child seats, and components for such systems. Active safety systems are designed to make driving easier and more comfortable and to intervene before a collision in order to make accidents avoidable or reduce the impact. Active safety products include automotive radars, night driving assist, camera-based vision systems, brake controls and other active safety systems.

3

Table of Contents

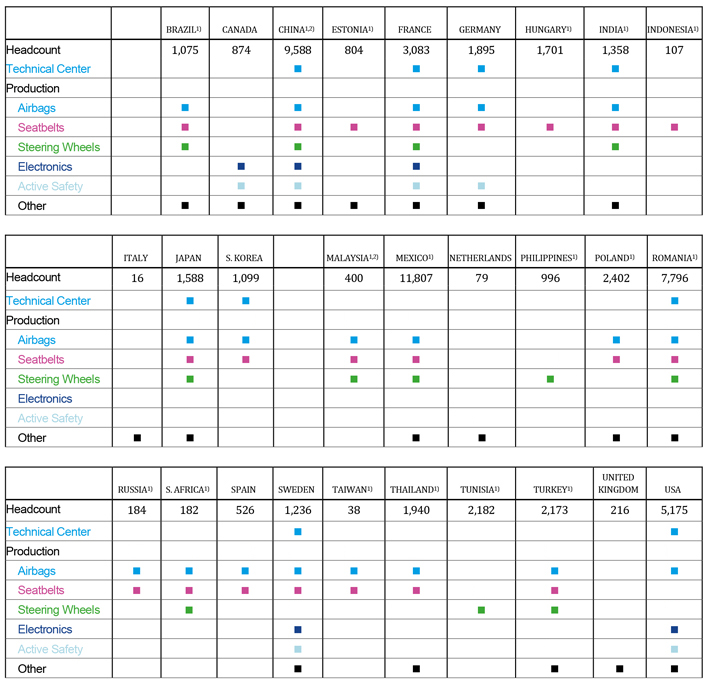

Including joint venture operations, Autoliv has approximately 80 production facilities in 27 countries and our customers include the world’s largest car manufacturers. Autoliv’s sales in 2014 were $9.2 billion, approximately 65% of which consisted of airbags and associated products, approximately 30% of which consisted of seatbelts and associated products, and approximately 5% of which consisted of active safety and associated products. Our geographical regions are Europe, the Americas, China, Japan and the Rest of Asia (ROA).

Autoliv’s head office is located in Stockholm, Sweden, where we currently employ 54 people. Autoliv had approximately 50,800 employees worldwide at December 31, 2014, and a total headcount, including temporary personnel, of approximately 60,000.

The information required by Item 1 regarding developments in the Company’s business during 2014 is contained in the Annual Report on pages 28-31 and 39-43 and is incorporated herein by reference. The Annual Report is available on Autoliv’s website, www.autoliv.com and is filed as Exhibit 13 to this Form 10-K.

Financial Information on Segments

Autoliv considers its products to be components of integrated automotive safety systems, which fall within a single industry segment. Autoliv had two main operating segments throughout 2014: (i) Passive Safety products (airbags, seatbelts, steering wheels, restraint electronics, crash sensors) and (ii) Active Safety products (camera-based vision systems, night driving assist, automotive radars, brake controls and other active safety systems). For financial reporting purposes these two operating segments have been combined into a single reportable segment in accordance with the provisions of Accounting Standards Codification (ASC) 280 Segment Reporting. The financial data relating to Autoliv’s business in this segment over the last three fiscal years is contained in the Consolidated Financial Statements on pages 56 through 59 of the Annual Report and is incorporated herein by reference. A statement of net sales by product group and region for the last three years is contained in Note 19 of the Notes to the Consolidated Financial Statements on page 80 of the Annual Report and is incorporated herein by reference.

Products, Market and Competition

Information concerning products, markets and competition is included in the sections “Active Safety for Prevention and Assistance”, “Passive Safety for Protection” and “Innovations to Save Lives” on pages 14-21 and “Our Market and Competitors” on pages 28 and 29, and in the Management Discussion and Analysis sections “Dependence on Customers”, “New Competition” and “Patents and Proprietary Technology” on pages 52 and 53 of the Annual Report and is incorporated herein by reference.

Manufacturing and Production

Including joint venture operations, Autoliv has approximately 80 production facilities located in 27 countries, consisting of both component factories and assembly factories. See “Item 2. Properties” for a description of Autoliv’s principal properties. The component factories manufacture inflators, gas generants, initiators, textile cushions, webbing materials, electronics, pressed steel parts, springs and overmoulded steel parts used in seatbelt and airbag assembly, steering wheels and our active safety, vision and night vision systems and our other safety electronic systems. The assembly factories source components from a number of parties, including Autoliv’s own component factories, and assemble complete restraint systems for “just-in-time” delivery to customers. These factories also assemble our active safety, vision and night vision systems. The products manufactured by Autoliv’s consolidated subsidiaries in 2014 consisted of approximately 143 million complete seatbelt systems (of which approximately 62 million were fitted with pretensioners), approximately 84 million side-impact airbags (including curtain airbags), approximately 46 million frontal airbag modules, approximately 16 million steering wheels, approximately 17 million electronic units (airbag control), and approximately 5 million active safety units.

4

Table of Contents

Autoliv’s “just-in-time” delivery systems have been designed to accommodate the specific requirements of each customer for low levels of inventory and rapid stock delivery service. “just-in-time” deliveries require final assembly, or at least, distribution centers in geographic areas close to customers to facilitate rapid delivery. The fact that the major automobile manufacturers are continually expanding production activities into more countries and require the same or similar safety systems as those produced in Europe, Japan or the U.S. increases the importance to suppliers of having assembly capacity in several countries. Consolidation among our customers also supports this trend.

If the supply of raw materials and components is not disrupted, Autoliv’s assembly operations generally are not constrained by capacity considerations. When dramatic shifts in light vehicle production occur, Autoliv can generally adjust capacity in response to changes in demand within a few weeks by adding or removing work shifts and within a few months by adding or removing standardized production and assembly lines. Most of Autoliv’s assembly factories can make sufficient space available to accommodate additional production lines to satisfy foreseeable increases in capacity. As a result, Autoliv can usually adjust its manufacturing capacity faster than its customers can adjust their capacity to fluctuations in the general demand for vehicles or in the demand for a specific vehicle model, provided that customers notify Autoliv when they become aware of such changes in demand.

When dramatic shifts in light vehicle production occur or when there is a shift in the regional light vehicle production, the capacity adjustments can take more time and be more costly. Additionally, when there is a significant demand for a given product due to a major recall of a competitor’s product, such as our customers are experiencing now, capacity adjustments may take time.

We could experience disruption in our supply or delivery chain, which could cause one or more of our customers to halt or delay production. For more information, see Item 1A – Risk Factors.

Quality Management

Autoliv believes that superior quality is a prerequisite to it being considered a leading global supplier of automotive safety systems and is key to its financial performance, because quality excellence is critical for winning new orders, preventing recalls and maintaining low scrap rates. Autoliv has for many years emphasized a “zero-defect” proactive quality policy and continues to strive to improve its working methods. This means both that Autoliv’s products must always meet performance expectations, and that Autoliv’s products must be delivered to its customers at the right times and in the right amounts. Furthermore, our continued quality improvements further enhance our image among customers, employees and authorities.

Although quality has always been paramount in the automotive industry, especially for safety products, vehicle manufacturers have become increasingly quality focused with even less tolerance for any deviations. This intensified quality focus is partially due to an increase in the number of vehicle recalls for a variety of reasons (not just safety), including a few high-profile vehicle recalls. This trend is likely to continue as vehicle manufacturers introduce even stricter quality requirements. We have not been immune to the recalls that have been impacting the entire automobile industry.

In response to this trend and to improve our own quality, we launched in the summer of 2010 the next step in our strategy of shaping a proactive quality culture of zero defects. It is called “Q5” because it addresses quality in five dimensions: products, customers, growth, behavior and suppliers. The goal of Q5 is to firmly tie together quality with value within all of our processes and for all of our employees, thereby leading to the best value for our customers. Since 2010, we have continually expanded this quality initiative to provide additional skills training to more employees and suppliers. These activities have made a significant contribution to the improvement in non-conforming events.

5

Table of Contents

In our pursuit of excellence, we have developed a chain of four “defense lines” against quality issues. These defense lines consist of: 1) robust product designs, 2) flawless components from suppliers and our own in-house component companies, 3) manufacturing flawless products with a system for verifying that our products conform with specifications and 4) an advanced traceability system in the event of a recall.

Our pursuit of excellence extends from the earliest phases of product development to the proper disposal of a product following many years of use in a vehicle. Autoliv’s comprehensive Autoliv Product Development System (“APDS”) process includes several key check points during the development of new products that are designed to ensure that new products are well-built and have no hidden defects. Through this process, we work closely with our suppliers to set clear standards that help to ensure robust component design and lowest cost for function in order to proactively prevent problems and ensure we deliver only the best designs to the market.

The Autoliv Production System (“APS”), based on the goals of improving quality and efficiency, is at the core of Autoliv’s manufacturing philosophy. APS integrates essential quality elements, such as mistake proofing, statistical process control and operator involvement, into the manufacturing processes so all Autoliv associates are aware of and understand the critical connection between themselves and our lifesaving products. This “zero-defect” principle extends beyond Autoliv to the entire supplier base. All of our suppliers must accept the strict quality standards in the global Autoliv Supplier Manual, which defines our quality requirements and focuses on preventing bad parts from being produced by our suppliers and helps eliminate bad intermediate products in our assembly lines as early as possible. In addition, Autoliv’s One Product One Process (“1P1P”) initiative is its strategy for developing and managing standardization of both core products and customer-specific features, leading not only to improved quality, but also greater cost efficiency and more efficient management of the supply chain.

Autoliv continues to execute its plan to have all subsidiaries certified to ISO/TS 16949, a global automotive quality management standard.

Additional information on quality management is included in the section “Quality” on pages 10 and 11 of the Annual Report and is incorporated herein by reference.

Environmental and Safety Regulations

For information on how environmental and safety regulations impact our business, see “Risk Factors – Our business may be adversely affected by environmental and safety regulations or concerns” in Item 1A and “Environmental” and “Regulations” under the section “Risks and Risk Management” on page 52 of the Annual Report, which is incorporated herein by reference.

Raw materials

For information on the sources and availability of raw materials, see “Risk Factors - Changes in the source, cost, availability of and regulations pertaining to raw materials and components may adversely affect our profit margins” in Item 1A.

Intellectual Property

For information on our use of intellectual property and its importance to us, see “Risk Factors - If our patents are declared invalid or our technology infringes on the proprietary rights of others, our ability to compete may be impaired” in Item 1A.

6

Table of Contents

Seasonality and Backlog

Autoliv’s business is not subject to significant seasonal fluctuations. Autoliv has frame contracts with car manufacturers and such contracts are typically entered into up to three years before the start of production of the relevant car model or platform and provide for a term covering the life of said car model or platform. However, typically these contracts do not provide minimum quantities, firm prices or exclusivity but instead permit the manufacturer to resource the relevant products at given intervals (or at any time) from other suppliers.

Dependence on Customers

For information on our dependence on customers, see “Risk Factors - Our business could be materially and adversely affected if we lost any of our largest customers or if they were unable to pay their invoices” in Item 1A and “Dependence on Customers” under the section “Risks and Risk Management” on page 52 of the Annual Report which is incorporated herein by reference.

Research, Development and Engineering

Expenses incurred for research, development and engineering activities, net were $536 million, $489 million and $455 million for the years ended December 31, 2014, 2013 and 2012, respectively. Additional information on research, development and engineering is included in the sections titled “Innovations to Save Lives” on page 14, and “Patents and Proprietary Technology” on page 53 of the Annual Report and is incorporated herein by reference.

Regulatory Costs

The fitting of seatbelts in most types of motor vehicles is mandatory in almost all countries and many countries have strict laws regarding the use of seatbelts while in vehicles. In addition, most developed countries require that seats in intercity buses and commercial vehicles be fitted with seatbelts. In the U.S., federal legislation requires frontal airbags, both on the driver-side and the passenger-side, in all new passenger cars and in all new light vehicles, which are defined as unloaded vehicle weight of 5,500 pounds or less.

For information concerning the material effects on our business relating to our compliance with government safety regulations, see “Risk Factors - Our business may be adversely affected by environmental, occupational health and safety or other governmental regulations” in Item 1A and “Regulations” under the section “Risks and Risk Management” on page 52 of the Annual Report, which is incorporated herein by reference.

Autoliv Personnel

As of December 31, 2014, Autoliv and its subsidiaries had approximately 50,800 employees and approximately 9,200 temporary personnel. Autoliv considers its relationship with its personnel to be good and while there have been a small number of minor labor disputes there has been no significant or lasting impact to the employee relationship, customer perception or business results.

Important unions to which some of Autoliv’s employees belong in Europe include: IG Metall in Germany; Unite the union in the United Kingdom; Confédération Générale des Travailleurs, Confédération Française Démocratique du Travail, Confédération Française de l’Encadrement et des cadres, Force Ouvrière and Confédération Française des travailleurs Chrétiens in France; Federacion Minerometalurgica, Union General de Trabajadores, Union Sindical Obrera, Comisiones Obereras and Confederacion General de Trabajadores in Spain; and Swedish Metal Workers Union and the Swedish Association of Graduated Engineers in Sweden.

In addition, Autoliv’s employees in other regions are represented by the following unions: Unifor and the International Association of Machinists and Aerospace Workers (IAM) in Canada; Sindicato Nacional de Trabajadores de la Industria Metalurgica y Similares,

7

Table of Contents

Sindicato de Trabajadores de la Pequena y Mediana Industria and Sindicato de Jornaleros y Obreros Industiales de la Industria Maquiladora in Mexico; Sindicato dos Trabalhadores nas industrias Metalurgicas, Mecanicas e de Material eletrico e Eletronico, Siderurgicas, Automobilsticas e de Autopecas de Taubate in Brazil; and the Korean Metal Workers Union in Korea.

In many European countries, Canada, Mexico, Brazil and Korea wages, salaries and general working conditions are negotiated with local unions and/or are subject to centrally negotiated collective bargaining agreements. The terms of our various agreements with unions typically range between 1-3 years. Some subsidiaries in Europe, Canada, Brazil and Korea must negotiate with the applicable local unions important changes in operations, working and employment conditions. Twice a year, the Company’s management conducts a meeting with the European Work Council (EWC) to provide employee representatives with important information about the Company and a forum for the exchange of ideas and opinions.

In many Asia Pacific countries, the central or regional governments provide guidance each year for salary adjustments or statutory minimum wage for workers.

Autoliv’s employees may join associations in accordance with local legislation and rules, although the level of unionization varies significantly throughout our operations.

For more information concerning Autoliv’s personnel and restructuring initiatives, see “Price Erosion and Cost Challenges” and “Operational Initiatives” on page 40 and “Personnel” on pages 47 and 48 in the Management Discussion and Analysis of the Annual Report, which is incorporated herein by reference.

Financial Information on Geographic Areas

Financial information concerning Autoliv’s geographic areas is included in the sections “Superior Global Presence” and “Our Market and Competitors” on pages 26-29, “One Product One Process” on pages 12 and 13 and in Note 19 of the Notes to Consolidated Financial Statements on page 80 of the Annual Report, which is incorporated herein by reference. See also “Risk Factors – Our business is exposed to risks inherent in global operations” in Item 1A.

Joint Ventures

An important element of Autoliv’s strategy has been to establish joint ventures to promote its geographical expansion and technological development and to gain assistance in marketing Autoliv’s full product line to local automobile manufacturers. Autoliv is not currently involved in any joint ventures that have been formed for the purpose of developing technology, but it is possible that strategic alliances combining Autoliv’s technologies and expertise with that of others may expand business opportunities in the future.

Autoliv typically contributes design and production knowledge to joint ventures, with the local partner providing sales support and manufacturing facilities. Some of these local partners manufacture and sell standardized seatbelt systems, and will, through the joint venture with Autoliv, be able to upgrade their technology to meet specific customer demands and/or expand their product offerings.

For information on how these joint ventures are accounted for, including the name and Autoliv’s percentage of ownership, see Note 7 of the Notes to Consolidated Financial Statements on page 68 of the Annual Report, which is incorporated herein by reference.

Available information

The public may read and copy any materials Autoliv files with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-732-0330. Additional information regarding the Company’s filings with the SEC is included in the sections “Readers Guide” and “Financial Information” on page 2 of the Annual Report and is incorporated herein by reference.

8

Table of Contents

Our business, financial condition, operating results and cash flows may be impacted by a number of factors. A discussion of the risks associated with these factors is included below.

RISKS RELATED TO OUR INDUSTRY

The cyclical nature of automotive sales and production can adversely affect our business

Our business is directly related to light vehicle production (“LVP”) in the global market and by our customers and LVP is the most important driver for our sales. LVP is highly cyclical and depends on general economic conditions as well as other factors, including consumer spending and preferences and changes in interest rate levels and credit availability, consumer confidence, fuel costs, fuel availability, environmental impact, governmental incentives, and political volatility, especially in energy producing countries and growth markets. In addition, light vehicle sales and production can be affected by our customers’ ability to continue operating in response to challenging economic conditions and in response to changing labor relations issues, regulatory requirements, trade agreements and other factors. Any significant (adverse) change in any of these factors, including, but not limited to, general economic conditions and the resulting bankruptcy of a customer or the closure of a customer manufacturing facility, may result in a reduction in automotive sales and production by our customers, and thus have a material adverse effect on our business, results of operations and financial condition.

Our sales are also affected by inventory levels of our customers. We cannot predict when our customers will decide to either increase or reduce inventory levels or whether new inventory levels will approximate historical inventory levels. This may exacerbate variability in our sales and financial condition. Uncertainty regarding inventory levels may be exacerbated by consumer financing programs initiated or terminated by our customers or governments as such changes may affect the timing of their sales.

Changes in LVP and/or customers’ inventory levels will have an impact on our earnings guidance and estimates and any significant reduction in automotive sales and/or light vehicle production by our customers, whether due to general economic conditions or any other fact(s) relevant to LVP, will likely have a material adverse effect on our business, results of operations and financial condition.

Change in consumer trends, political decisions affecting vehicle sales and growth in different markets could adversely affect our results in the future

The average global content of safety systems per light vehicle (airbags, seatbelts, steering wheels and related electronics, radar, night vision systems and cameras) remained relatively flat at around $300 during the period 2012-2014. However, vehicles produced in different markets may have various safety content values. For example, in Western Europe

9

Table of Contents

and North America many of the cars in the large-size segment have safety content values of more than $500 per vehicle while the average safety content of light vehicles in China and India was only approximately $220 and $60, respectively. Due to the fact that growth in global LVP is highly concentrated in markets such as China and India our operating results may suffer if the safety content per vehicle remains low in our growth markets. As safety content per vehicle is also an indicator of our sales development, should the current trends continue, the average value of safety systems per vehicle could decline.

We operate in highly competitive markets

The markets in which we operate are highly competitive. The market for occupant restraint systems continues to consolidate while the market for active safety has not yet consolidated. We compete with a number of other manufacturers that produce and sell similar products. Among other factors, our products compete on the basis of price, product quality, manufacturing and distribution capability, product design, product delivery and product service. Some of our competitors are subsidiaries (or divisions, units or similar) of companies that are larger and have greater financial and other resources than us. Some of our competitors may also have a “preferred status” as a result of special relationships with certain customers. Our active safety products may require significant resources to develop both hardware and software solutions. Our products may not be able to compete successfully with the products of our competitors. In addition, our competitors may predict the course of market development more accurately than we do, develop products that are superior to our products, have the ability to produce similar products at a lower cost than we can, or adapt more quickly than we do to new technologies or evolving regulatory, industry or customer requirements. We may also encounter increased competition in the future from existing or new competitors. As a result, our products may not be able to compete successfully with their products. Should this happen, we will suffer material adverse effects on our business, results of operations and financial condition.

The competitive factors noted above are especially present in the field of active safety. This is a new and developing segment in the automotive industry and inherently includes a higher level of uncertainty than more mature markets. The number of competitors shows risk of increasing as mega-suppliers from outside the automotive industry, such as Microsoft and Google, consider the business opportunities presented by automated driving. The high development cost in active safety limits the number of technical solutions that can be pursued by most Tier 1 suppliers, leading to risk of exposure to a disruptive technology different than those being developed by the Company.

The discontinuation, lack of commercial success, or loss of business with respect to a particular vehicle model for which we are a significant supplier could reduce our sales and harm our profitability

Although we have frame contracts with many of our customers, these frame contracts generally provide for the supply of a customer’s annual requirements for a particular model and assembly plant, rather than for the purchase of a specific quantity of products. Furthermore, these frame contracts are often subject to renewal/re-quotation at the customer’s option at periodic intervals, sometimes as frequent as on a year-to-year basis. Therefore, the discontinuation of, the loss of business with respect to, or a lack of commercial success of a particular vehicle model or a particular vehicle brand for which we are a significant supplier could reduce our sales and harm our profitability. Although our sales are split over several hundred contracts covering approximately 1,400 vehicle platforms or vehicle models, a significant decline in overall demand for such vehicles, or a dramatic change in vehicle preferences, could have a material adverse effect on our sales.

10

Table of Contents

RISKS RELATED TO OUR BUSINESS

Escalating pricing pressures from our customers may adversely affect our business

The automotive industry has been characterized by increasingly aggressive pricing pressure from customers for many years. This trend is partly attributable to the major automobile manufacturers’ strong purchasing power. As with other automotive component manufacturers, we are often expected to quote fixed prices or are forced to accept prices with annual price reduction commitments for long-term sales arrangements or discounted reimbursements for engineering work. Our future profitability will depend upon, among other things, our ability to continuously reduce our cost per unit and maintain our cost structure, enabling us to remain cost-competitive.

Our profitability is also influenced by our success in designing and marketing technological improvements in automotive safety systems which help us offset price reductions by the Original Equipment Manufacturers (“OEMs”). If we are unable to offset continued price reductions through improved operating efficiencies and reduced expenditures, these price reductions may have a material adverse effect on our business, results of operations and financial condition.

We could experience disruption in our supply or delivery chain, which could cause one or more of our customers to halt or delay production

We, as with other component manufactures in the automotive industry, ship products to vehicle assembly plants throughout the world so they are delivered on a “just-in-time” basis in order to maintain low inventory levels. Our suppliers (external suppliers as well as our own production sites) also use a similar method. However, this “just-in-time” method makes the logistics supply chain in our industry very complex and very vulnerable to disruptions.

The potential loss of, or loss of access to, one of our suppliers or our own production sites could be caused by a myriad of potential problems, such as closures of one of our own or one of our suppliers’ plants or critical manufacturing lines due to strikes, mechanical failures, electrical outages, fires, explosions, critical pollution levels, political upheaval, as well as logistical complications due to weather, volcanic eruptions, earthquakes, flooding or other natural disasters, acts of terrorism, mechanical failures, delayed customs processing and more. Additionally, as we expand in growth markets, the risk for such disruptions is heightened. The lack of even a small single subcomponent necessary to manufacture one of our products, for whatever reason, could force us to cease production, possibly for a prolonged period. Similarly, a potential quality issue could force us to halt deliveries while we validate the products. Even where products are ready to be shipped or have been shipped, delays may arise before they reach our customer. Our customers may halt or delay their production for the same reason if one of their other suppliers fails to deliver necessary components. This may cause our customers to suspend their orders or instruct us to suspend delivery of our products, which may adversely affect our financial performance.

When we cease timely deliveries, we have to absorb our own costs for identifying and resolving the ultimate problem as well as expeditiously producing replacement components or products. Generally, we must also carry the costs associated with “catching up,” such as overtime and premium freight.

Additionally, if we are the cause of a customer being forced to halt production the customer may seek to recoup all of its losses and expenses from us. These losses and expenses could be very significant and may include consequential losses such as lost profits. Thus, any supply-chain disruption, however small, could potentially cause the complete shutdown

11

Table of Contents

of an assembly line of one of our customers, and any such shutdown could expose us to material claims of compensation. Where a customer halts production because of another supplier failing to deliver on time, we may not be fully compensated, if at all.

Disruptions in our supply chain, whether caused by a volcano, earthquake, flooding, other natural disaster, or act of terrorism, could cause significant delays and complications to our ability to ship our products to customers, as well as receive shipments from our suppliers. Also, similar difficulties for other suppliers may force our customers to halt production, which may in turn impact our sales shipments to such customers. It is impossible for us to predict if and when disruptions of air, ground and sea transport will occur again and, if so, what impact such disruptions will have. Any such disruptions could severely impact our operations and/or those of our customers and force us to halt production for prolonged periods of time and/or to absorb very significant costs to avoid disruption of our customers’ operations.

Changes in the source, cost, availability of and regulations pertaining to raw materials and components may adversely affect our profit margins

Our business uses a broad range of raw materials and components in the manufacture of our products, nearly all of which are generally available from a number of qualified suppliers. Strong worldwide demand for certain raw materials has had a significant impact on raw material prices and short-term availability in recent years. Increases in the price of the raw materials and components in our products could materially increase our operating costs and materially and adversely affect our profit margin, as direct material costs amounted to approximately 54% of our net sales in 2014, of which approximately half is the raw material cost portion.

Commercial negotiations with our customers and suppliers may not always offset all of the adverse impact of higher raw material, energy and commodity costs. In addition, no assurances can be given that the magnitude and duration of such cost increases or any future cost increases could not have a larger adverse impact on our profitability and consolidated financial position than currently anticipated.

Additionally, there will be costs associated with complying with the SEC disclosure requirements regarding conflict minerals, including for diligence to determine the sources of conflict minerals used in our products and other potential changes to products, processes or sources of supply as a consequence of such verification activities. These rules could adversely affect the sourcing, supply and pricing of materials used in our products. As there may be only a limited number of suppliers offering “conflict free” conflict minerals, we cannot be sure that we will be able to obtain necessary conflict minerals from such suppliers in sufficient quantities or at competitive prices. Also, we may face reputational challenges if we determine that certain of our products contain minerals not determined to be conflict free or if we are unable to sufficiently verify the origins for all conflict minerals used in our products through the procedures we may implement.

Adverse developments affecting one or more of our major suppliers could harm our profitability

Any significant disruption in our supplier relationships, particularly relationships with single-source suppliers, could harm our profitability. Furthermore, some of our suppliers may not be able to sufficiently manage the currency commodity cost volatility and/or sharply changing volumes while still performing as we expect. For example, large recall or field actions from OEMs can stress the capacity of our supply chain and may inhibit our ability to timely deliver order volumes. Over time, more of our suppliers are located in growth markets. As such, there is a risk for delivery delays, production delays, production issues or delivery of non-conforming products by our suppliers. Even where these risks do not materialize, we may incur costs as we try to make contingency plans for such risks.

12

Table of Contents

Our business could be materially and adversely affected if we lost any of our largest customers or if they were unable to pay their invoices

We are dependent on a relatively few number of automobile manufacturers with strong purchasing power, as a result of high market concentration that has developed due to customer consolidation during the last few decades. Our five largest customers represented 52% of our consolidated sales for 2014. Our largest contract accounted for approximately 3.7% of our total fiscal 2014 sales and expires in 2019. Although business with any given customer is typically split into several contracts (either on the basis of one contract per vehicle model or on a broader platform basis), the loss of all of the business from any of our primary customers (whether by cancellation of existing contracts or the failure to award us new business) could have a material adverse effect on our business, results of operations and financial position. Customers may put us on a “new business hold” which would limit our ability to quote or be awarded all or part of their future vehicle contracts if quality or other issues arise in the vehicles for which we were a supplier. Such new business holds range in length and scope and are generally accompanied by a certain set of remedial conditions that are required to be met prior to being eligible to bid for new business. Meeting any such conditions within the prescribed timeframe may require additional Company resources. A failure to satisfy such remedial conditions may have a materially adverse impact on our financial results in the long term.

There is a risk that one or more of our major customers could be unable to pay our invoices as they become due or that a customer will simply refuse to make such payments given its financial difficulties. If a major customer would enter into bankruptcy proceedings or similar proceedings whereby contractual commitments are subject to stay of execution and the possibility of legal or other modification, or if a major customer otherwise successfully procures protection against us legally enforcing its obligations, it is likely that we will be forced to record a substantial loss.

Information concerning our major customers is included in the Annual Report in a graph and in the section headed “Our Customers” on page 30 and in Note 19 of the Consolidated Financial Statements on page 80 of the Annual Report.

We are involved from time to time in legal proceedings and our business may suffer as a result of adverse outcomes of current or future legal proceedings

We are, from time to time, involved in litigation, regulatory proceedings and commercial or contractual disputes that may be significant. These matters may include, without limitation, disputes with our suppliers and customers, intellectual property claims, shareholder litigation, government investigations, class action lawsuits, personal injury claims, and environmental issues, antitrust, customs and VAT disputes, employment and tax issues. In such matters, government agencies or private parties may seek to recover from us very large, indeterminate amounts in penalties or monetary damages (including, in some cases, treble or punitive damages) or seek to limit our operations in some way. The possibility exists that claims may be asserted against us and their magnitude may remain unknown for long periods of time. A substantial legal liability or adverse regulatory outcome and the substantial cost to defend the litigation or regulatory proceedings may have an adverse effect on our business, operating results, financial condition, cash flows and reputation. No assurances can be given that such proceedings and claims will not have a material adverse impact on our profitability and consolidated financial position or that reserves or insurance will mitigate such impact.

See Note 16 of the Consolidated Financial Statements on page 74 of the Annual Report.

13

Table of Contents

We are currently undergoing an antitrust investigation by the European Commission and it is probable that the Company’s operating results and cash flows will be materially adversely impacted

The European Commission (“EC”) is engaged in a long-running investigation into possible anti-competitive behavior among certain suppliers to the automotive vehicle industry, including Autoliv. From June 7 to June 9, 2011, representatives of the EC visited two facilities of Autoliv BV & Co KG, a Company subsidiary in Germany, to gather information for such inquiry. The EC’s investigation is still ongoing. It is the Company’s policy to cooperate with governmental investigations. Although the duration or ultimate outcome of the EC investigation cannot be predicted or estimated, it is probable that the Company’s operating results and cash flows will be materially adversely impacted for the reporting periods in which the EC investigation is resolved or becomes estimable. The Company remains unable to estimate the impact the EC investigation will have or predict the reporting periods in which such impact may be recorded. However, the EC investigation may still require significant management time and attention and could result in significant expenses as well as unfavorable outcomes that could have a material adverse impact on our customer relationships, business prospects, reputation, operating results, cash-flows or financial results, and our insurance may not mitigate such impact.

We may be subject to litigation in the U.S. or elsewhere that could negatively impact our business

The Company may be subject to litigation in the future, including claims relating to antitrust or other issues. These types of lawsuits could require significant management time and attention and could result in significant expenses as well as unfavorable outcomes that could have a material adverse impact on our customer relationships, business prospects, reputation, operating results, cash-flows or financial results, and our insurance may not mitigate such impact.

We are subject to civil antitrust litigation in the U.S. and Canada following the DOJ settlement and may be subject to additional civil antitrust litigation in the U.S. or elsewhere that could negatively impact our business

Following the Company’s guilty plea as part of the DOJ settlement, the Company and its competitors were sued in multiple purported class action lawsuits in the U.S. and Canada alleging violations of antitrust and related laws and seeking to recover treble damages for the alleged classes of direct purchasers, auto dealers and vehicle purchasers/lessees. The Company, without admitting any liability, entered into separate settlement agreements with representatives of each of the three classes of plaintiffs. The direct purchaser settlement has been approved by the court while the other settlement agreements await court approval. The Company is in discussions with certain OEMs regarding the possible resolution of potential claims for purchases not covered by the U.S. direct purchaser settlement. The outcome of these discussions is uncertain and any potential loss contingencies resulting from these discussions with these OEMs, individually or in the aggregate are not at this time reasonably estimable but could negatively impact the Company’s results in the period in which they are resolved or become estimable. The Company may also be subject to additional civil antitrust lawsuits in the future in the U.S., Canada or in other countries that permit such civil claims, including lawsuits or other actions by our customers. These types of lawsuits require significant management time and attention and could result in significant expenses as well as unfavorable outcomes that could have a material adverse impact on our customer relationships, business prospects, reputation, operating results, cash-flows or financial results, and our insurance may not mitigate such impact.

14

Table of Contents

We are, and have been, subject to investigations by other competition authorities and may be subject to investigations by additional competition authorities that could negatively impact our business

Competition authorities in Canada, South Korea and South Africa have previously initiated investigations of certain suppliers to the automotive vehicle industry, including Autoliv. Competition authorities in additional countries, including Japan, may initiate similar investigations. These types of investigations require significant management time and attention, as the EC and DOJ investigations already have. These investigations could also result in significant expenses as well as unfavorable outcomes that could have a material adverse impact on our customer relationships, business prospects, reputation, operating results, cash flows or financial results, and our insurance may not mitigate such impact.

We may incur material losses and costs as a result of product liability and warranty and recall claims that may be brought against us or our customers

We face an inherent business risk of exposure to product liability and warranty claims in the event that our products actually or allegedly fail to perform as expected or the use of our products results, or is alleged to result, in bodily injury and/or property damage. Increasing regulation and reporting requirements regarding potentially defective products, particularly in the United States, may increase the possibility that we become involved in product liability or recall investigations or claims. Although we carry product liability and product recall insurance at levels that management believes to be sufficient to cover our risk, such insurance may not always be available in appropriate amounts or in all markets. Accordingly, we could experience material warranty or product liability losses in the future and incur significant costs to process and defend these claims.

Product recalls in our industry, even if they do not involve our products, can harm the reputations of our customers, competitors, and us, particularly if those recalls cause consumers to question the safety or reliability of products similar to those we produce.

In addition, if any of our products are, or are alleged to be, defective, we may be required to participate in a recall involving such products. Every vehicle manufacturer has its own practices regarding product recalls and other product liability actions relating to its suppliers, and the performance and remedial requirements vary between jurisdictions. Due to recent recall activity in the automotive industry, some vehicle manufactures have become even more sensitive to product recall risks. As suppliers become more integrally involved in the vehicle design process and assume more of the vehicle assembly functions, vehicle manufacturers are increasingly looking to their suppliers for contribution when faced with recalls and product-liability claims. In addition, with global platforms and procedures, vehicle manufacturers are increasingly evaluating our quality performance on a global basis; any one or more quality, warranty or other recall issue(s) (including issues affecting few units and/or having a small financial impact) may cause a vehicle manufacturer to implement measures which may have a severe impact on our operations, such as a global temporary or prolonged suspension of new orders. In addition, as our products more frequently use global designs and are based on or utilize the same or similar parts, components or solutions, there is a risk that the number of vehicles affected globally by a failure or defect will increase significantly and hence also our costs. A warranty, recall or product-liability claim brought against us in excess of our available insurance may have a material adverse effect on our business. Vehicle manufacturers are also increasingly requiring their outside suppliers to guarantee or warrant their products and bear the costs of repair and replacement of such products under new vehicle warranties. A vehicle manufacturer may attempt to hold us responsible for some or the entire repair or replacement costs of defective products under new vehicle warranties, when the product supplied did not perform as represented. Accordingly, the future costs of warranty claims by our customers may be material. However, the final amounts determined to be due related to these matters could differ materially from our recorded warranty estimates and our financial results may be materially impacted as a result.

15

Table of Contents

Work stoppages or other labor issues at our customers’ facilities or at our facilities could adversely affect our operations

The economically challenging conditions in the automotive industry and actions taken by our customers and other suppliers to address negative industry trends may have the side effect of causing labor relations problems at those companies. If any of our customers experience a material work stoppage, that customer may halt or limit the purchase of our products. Similarly, a work stoppage at another supplier could interrupt production at one of our customers’ plants which would have the same effect. This could cause us to shut down production facilities supplying these products, which could have a material adverse effect on our business, results of operations and financial condition. While labor contract negotiations at our locations historically have rarely resulted in work stoppages, we cannot assure that we will be able to negotiate acceptable contracts with these unions or that our failure to do so will not result in work stoppages. A work stoppage at one or more of our plants or our customers’ facilities could have a material adverse effect on our business.

Our ability to operate our company effectively could be impaired if we fail to attract and retain key personnel

Our ability to operate our business and implement our strategies effectively depends, in part, on the efforts of our executive officers and other key employees. In addition, our future success will depend on, among other factors, our ability to attract and retain other qualified personnel, particularly engineers and other employees with electronics and software expertise, which may be difficult if the workforce loses interest in the automotive industry in favor of other technological fields. The loss of the services of any of our key employees or the failure to attract or retain other qualified personnel could have a material adverse effect on our business.

Similarly, we are committed to safeguarding our employees as well as our production facilities by employing several policies, standards and procedures related to site risk management. We cannot be certain that our efforts to protect against potential natural hazards and political events throughout the areas and countries where Autoliv is active will be successful in protecting our employees. If we fail to adequately protect against these hazards, it could have a material adverse effect on our business.

Restructuring initiatives and capacity alignments are complex and difficult and at any time additional restructuring steps may be necessary, possibly on short notice and at significant cost

Our restructuring initiatives and capacity alignments include efforts to adjust our manufacturing capacity, including plant closures, transfer of sourcing to low-cost countries, consolidation of our supplier base and standardization of products, to reduce our overhead costs and consolidate our tech centers. The successful implementation of our restructuring activities and capacity alignments will require us to involve sourcing, logistics, technology and employment arrangements. The complex nature of our various restructuring initiatives could cause difficulties or delays in the implementation of any such initiative or it may not be immediately effective, resulting in an adverse material impact on our performance. In addition, there is a risk that inflation, high-turnover rates and increased competition may reduce the efficiencies now available in low-cost countries to levels that no longer allow for cost-beneficial restructuring opportunities.

16

Table of Contents

A prolonged recession and/or another downturn in our industry could result in us having insufficient funds to continue our operations without additional financing activities

Our ability to generate cash from our operations is highly dependent on sales and therefore on light vehicle production, the global economy and especially the economies of our important markets. If light vehicle production were to remain on low levels for an extended period of time, this would result in a significantly negative cash flow. Similarly, if cash losses for customer defaults rise sharply, this would also result in a negative cash flow. Such negative cash flow could result in our having insufficient funds to continue our operations unless we can procure external financing, which may not be possible.

A prolonged recession and/or another downturn in our industry could result in external financing not being available to us or available only on materially different terms than what has historically been available

Our current credit rating could be lowered as a result of us experiencing significant negative cash flows or a dire financial outlook. This may affect our ability to procure financing. We may also for the same, or other reasons, find it difficult to secure new long-term credit facilities, at reasonable terms, when our principal credit facility expires in 2018. These risks are exacerbated by the current instability in the global credit markets and global economic pressure. Further, even our existing unutilized credit facilities may not be available to us as agreed, or only at additional cost, if participating banks are unable to raise the necessary funds, where, for instance, financial markets are not functioning as expected or one or more banks in our Revolving Credit Facility syndicate were to default. If external financing is unavailable to us when necessary, we may have insufficient funds to continue our operations.

Information concerning our credit facilities and other financings are included in the Annual Report on page 48 in the section headed “Treasury Activities” and in Note 12 to the Consolidated Financial Statements on pages 70 and 71 of the Annual Report.

Our indebtedness may harm our financial condition and results of operations

As of December 31, 2014, we have outstanding debt of $1.60 billion, including $165 million in privately placed debt issued in 2007 and $1.25 billion in privately placed debt issued in April 2014. We may incur additional debt for a variety of reasons. Although our significant credit facilities and debt agreements do not have any financial covenants, our level of indebtedness will have several important effects on our future operations, including, without limitation:

| • | a portion of our cash flows from operations will be dedicated to the payment of any interest or could be used for amortization required with respect to outstanding indebtedness; |

| • | increases in our outstanding indebtedness and leverage will increase our vulnerability to adverse changes in general economic and industry conditions, as well as to competitive pressure; |

| • | depending on the levels of our outstanding debt, our ability to obtain additional financing for working capital, acquisitions, capital expenditures, general corporate and other purposes may be limited; and |

| • | potential future tightening of the availability of capital both from financial institutions and the debt markets may have an adverse effect on our ability to access additional capital. |

17

Table of Contents

Governmental restrictions may impact our business adversely

Some of our customers are owned by a governmental entity, receive various forms of governmental aid or support or are subject to governmental influence in other forms. As a result, they may be required to procure components from local suppliers to achieve a specific local content or be subject to other restrictions regarding localized content. The nature and form of any such restrictions or protections, whatever their basis, is very difficult to predict as is their potential impact. However, they are likely to be based on political rather than economical or operational considerations and may materially impact our business.

We periodically review the carrying value of our assets for possible impairment; the value of one or more of our assets may not be realized if one or more of our customers cease production or decrease their production volumes and we could be required to write down amounts of certain assets and record impairment charges

If one or more of our customers’ plants cease production or decrease their production volumes, the assets we carry related to our plants serving such customers may decrease in value because we may no longer be able to utilize or realize them as intended. Where such decreases are significant, such impairments may have a materially adverse impact on our financial results.

We periodically review the carrying value of our goodwill and other intangible assets for possible impairment; if future circumstances indicate that goodwill or other intangible assets are impaired, we could be required to write down amounts of goodwill or other intangible assets and record impairment charges

We monitor the various factors that impact the valuation of our goodwill and other intangible assets, including expected future cash flow levels, global economic conditions, market price for our stock, and trends with our customers. Impairment of goodwill and other identifiable intangible assets may result from, among other things, deterioration in our performance and especially the cash-flow performance of these goodwill assets, adverse market conditions and adverse changes in applicable laws or regulations. If there are changes in these circumstances or the other variables associated with the estimates, judgments and assumptions relating to the valuation of goodwill, when assessing the valuation of our goodwill items, we may determine that it is appropriate to write down a portion of our goodwill or intangible assets and record related non-cash impairment charges. In the event that we determine that we are required to write-down a portion of our goodwill items and other intangible assets and thereby record related non-cash impairment charges, our financial position and results of operations would be adversely affected.

We face risks related to our defined benefit pension plans or employee benefit plans, including the need for additional funding as well as higher costs and liabilities

Our defined benefit pension plans or employee benefit plans may require additional funding or give rise to higher related costs and liabilities which, in some circumstances, could reach material amounts and negatively affect our results of operations. We are required to make certain year-end assumptions regarding our pension plans. Our pension obligations are dependent on several factors, including factors outside our control such as changes in interest rates, the market performance of the diversified investments underlying the pension plans, actuarial data and adjustments and an increase in the minimum funding requirements or other regulatory changes governing the plans. Adverse equity market conditions and volatility in the credit market may have an unfavorable impact on the value of our pension assets and our future estimated pension liabilities. Internal factors such as an adjustment to the level of benefits provided under the plans may also lead to an increase in our pension liability. If these or other internal and external risks were to occur,

18

Table of Contents

alone or in combination, our required contributions to the plans and the costs and net liabilities associated with the plans could increase substantially and have a material effect on our business.

Information concerning our defined benefit and postretirement plans is included in Note 18 of the Consolidated Financial Statements on pages 76 through 79 of the Annual Report.

You should not anticipate or expect the payment of cash dividends on our common stock

Our dividend policy is subject to the discretion of our Board of Directors and depends upon a number of factors, including our earnings, financial condition, cash and capital needs and general economic or business conditions. Although we currently use dividends as a way to return value to our stockholders, in the past our Board of Directors suspended our quarterly dividend after determining that a suspension was necessary in light of the decline in global light vehicle production, the uncertainty surrounding the recession at the time and the inherent risk of customer defaults. While we have resumed the payment of dividends on our common stock, in the future, there can be no assurance that the Board of Directors will continue to declare dividends.

Increases in IT security threats, the sophistication of computer crime and our reliance on global data centers could expose our systems, networks, solutions and services to risks

As the world’s largest automotive safety system supplier with worldwide facilities, we rely extensively on information technology (“IT”) systems and the use of our global data centers. These IT systems and data centers are vulnerable to disruptions, including those resulting from natural disasters, cyber-attacks or failures in third-party-provided services. Disruptions and attacks on our IT systems pose a risk to the security of our systems and our ability to protect our networks and the confidentiality, availability and integrity of our and our customers’ data. As a result, such attacks or disruptions could potentially lead to the leakage of our or our customers’ confidential information, including our financial data and intellectual property, improper use of our systems and networks, manipulation and destruction of data, production downtimes and both internal and external supply shortages, which could have an adverse effect on our results of operations.

RISKS RELATED TO INTERNATIONAL OPERATIONS

Our business is exposed to risks inherent in global operations

Due to our global operations, we are subject to many laws governing international relations (including but not limited to the Foreign Corrupt Practices Act and the U.S. Export Administration Act), which prohibit improper payments to government officials and restrict where and how we can do business, what information or products we can supply to certain countries and what information we can provide to authorities in governmental organizations.

Although we have procedures and policies in place that should mitigate the risk of violations of these laws, there is no guarantee that they will be sufficiently effective. If and when we acquire new businesses, we may not be able to ensure that the pre-existing controls and procedures meant to prevent violations of the rules and laws were effective, and violations may occur if we are unable to timely implement corrective and effective controls and procedures when integrating newly acquired businesses.

19

Table of Contents

We also have manufacturing and distribution facilities in many countries. Some of these countries are growth markets. International operations, especially in growth markets, are subject to certain risks inherent in doing business abroad, including:

| • | exposure to local economic conditions; |

| • | inability to collect, or delays in collecting, VAT and/or other receivables associated with remittances and other payments by subsidiaries; |

| • | exposure to local political turmoil; |

| • | expropriation and nationalization; |

| • | enforcing legal agreements or collecting receivables through foreign legal systems; |

| • | currency controls, including lack of liquidity in foreign currency due to governmental restrictions, trade protection policies and currency controls, which may create difficulty in repatriating profits or making other remittances; |

| • | investment restrictions or requirements; and |

| • | export and import restrictions. |

Increasing our manufacturing footprint in the growth markets and our business relationships with automotive manufacturers in these markets are particularly important elements of our strategy. As a result, our exposure to the risks described above may be greater in the future, and our exposure to risks associated with developing countries, such as the risk of political upheaval and reliability of local infrastructure, may increase. The likelihood of such occurrences and their potential impact on us vary from country to country and are unpredictable. In particular, the current situation in Russia, including ongoing sanctions and regional military and political instability may adversely impact our business and operations in that country. Economic sanctions imposed by the United States and some members of the European Union have targeted Russian companies and restricted trade and access to capital markets. In response, Russia announced its own trading sanctions against nations that implemented such sanctions. Due to these restrictions, it may become more difficult for some of our customers in the region to obtain financing or access U.S. currency and our customers’ ability to pay could be impacted, which could have a material adverse impact on our business and results. Moreover, the prevailing economic and political situation in Russia has led to significant devaluation of the Ruble.

We operate in the highly competitive automotive supply market in China and face competition from both international and smaller domestic manufacturers. As the size of the Chinese market increases, we anticipate that additional competitors, both international and domestic, may seek to enter the Chinese market resulting in increased competition. In addition, our business is sensitive to economic and market conditions that drive sales volume in China. If we are unable to maintain our position in the Chinese market or if vehicle sales in China decrease or do not continue to increase, our business, results of operations and financial condition could be materially adversely affected.

Additionally, growth markets, like China, have a tendency to demonstrate greater uncertainty and volatility as customer demand may be unpredictable and OEMs may not have sufficient experience in predicting customer demand, which can result in erratic production schedules which in turn may have a negative impact on our operating results.

Global integration may result in additional risks

Because of our efforts to integrate our operations globally to manage cost, we face the additional risk that, should any of the other risks discussed herein materialize, the negative effects could be more pronounced. For example, while supply delays of a component have

20

Table of Contents

typically only affected a few customer models, such a delay could now affect several models of several customers in several geographic areas. Similarly, should we face a recall or warranty issue due to a defective product, such a recall or warranty issue is now more likely to involve a larger number of units in several geographic areas.

Exchange rate risks

In addition, as a result of our global presence, a significant portion of our revenues and expenses are denominated in currencies other than the U.S. dollar. We are therefore subject to foreign currency risks and foreign exchange exposure. Such risks and exposures include:

| • | transaction exposure, which arises because the cost of a product originates in one currency and the product is sold in another currency; |

| • | revaluation effects, which arises from valuation of assets denominated in other currencies than the reporting currency of each unit; |

| • | translation exposure in the income statement, which arises when the income statements of non-U.S. subsidiaries are translated into U.S. dollars; |

| • | translation exposure in the balance sheet, which arises when the balance sheets of non-U.S. subsidiaries are translated into U.S. dollars; and |

| • | changes in the reported U.S. dollar amounts of cash flows. |