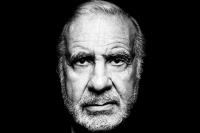

Carl Icahn Expected to More Quietly Call for Aggressive Apple (AAPL) Buyback

Image from Time

Get Alerts AAPL Hot Sheet

Overall Analyst Rating:

NEUTRAL (= Flat)

Dividend Yield: 0.5%

EPS Growth %: -0.7%

Join SI Premium – FREE

With shares of Apple (NASDAQ: AAPL) surging to new all-time highs Wednesday, market chatter suggests that activist investor Carl Icahn will be releasing an updated stock buyback recommendation and new price target shortly. This as the company's annual meeting fast approaches (3/10/15) and the current share repurchase plan winds down.

Apple is currently most of the way through a $90 billion share repurchase plan, which was announced in 2014. As of December 27, 2014, $72.9 billion of the $90 billion had been utilized. At yesterday's Goldman Sachs conference, CEO Tim Cook indicated that a new share repurchase plan will be announced in April. While Mr. Cook didn't indicate the size of a new program he said the company is not a "cash hoarder," despite some views that it is.

Calling out Apple on its share repurchase plan is nothing new for Icahn. In early 2014, Icahn sought a non-binding shareholder proposal, calling for the company to buyback stock more aggressively. Institutional Shareholder Services (ISS) recommended that shareholders vote against the measure, which led to Icahn terminating the so-called precatory proposal.

Icahn will not likely get as aggressive this time around, but it is equally likely that he won't stay quiet either. His guidance on the size of a new share repurchase plan could go a long way in setting investor expectations. Consensus seems to be centering around a $150 billion capital return plan over a 3-year period, but this number also includes dividends.

In addition to Icahn's guidance on share repurchases, markets will be looking for a new price target from the famed hedge fund manager. Currently Icahn and his team have a price target of $203 on Apple. In a recent television interview, Icahn's David Schechter suggested Apple stock is worth roughly ~$215 per share, although that was not a formal target. A model from Icahn on his price target could go a long way to feed the bulls. Although the Street is wildly bullish on the stock (55 buy ratings, versus 13 Neutral or Sell), price targets have lagged. The average price target on Apple is $127.81, according to Ratings Insider, suggesting upside of just 3% from current levels.

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Midday movers: PepsiCo, JetBlue fall; GM, Danaher and UPS rise

- Marriott Vacations Worldwide (VAC) ticks higher on new activist investor

- Apple (AAPL) Announces Special Event For May 7 - Reports

Create E-mail Alert Related Categories

Hedge Funds, Insiders' Blog, Rumors, Stock Buybacks, Trader TalkRelated Entities

Carl Icahn, Goldman Sachs, Dividend, Hedge Funds, Stock BuybackSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share