Form 8-K MITEL NETWORKS CORP For: Jan 16

�

�

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

�

�

FORM 8-K

�

�

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): January�16, 2015

�

�

MITEL NETWORKS CORPORATION

(Exact Name of Registrant as Specified in its Charter)

�

�

�

| Canada | � | 001-34699 | � | 98-0621254 |

| (State or Other Jurisdiction of Incorporation) |

� | (Commission File Number) |

� | (I.R.S. Employer Identification No.) |

350 Legget Drive

Ottawa, Ontario K2K 2W7

(Address of Principal Executive Offices) (Zip Code)

(613) 592-2122

(Registrant�s telephone number, including area code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

�

�

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

�

| � | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

�

| � | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

�

| � | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

�

| � | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

�

�

�

| Item�7.01 | Results of Operations and Financial Condition. |

Mitel Networks Corporation (the �Registrant�) is furnishing under this Item�7.01 a copy of a slide deck presentation (the �Presentation�) made at the 17th Annual Needham Growth Conference on January�14, 2015 in New York City, New York. The Presentation is attached as Exhibit 99.1 hereto.

The information in this Item�7.01, including Exhibit 99.1 attached hereto, is being �furnished� and not �filed� with the Securities and Exchange Commission for purposes of Section�18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities under such section. Furthermore, such information shall not be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, unless specifically identified as being incorporated therein by reference.

�

| Item�9.01 | Financial Statements and Exhibits. |

�

| � | (d) | Exhibits. |

99.1 ����Slide Deck Presentation, dated January�14, 2015

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: January�16, 2015

�

| MITEL NETWORKS CORPORATION | ||

| By: | � | /s/ Greg Hiscock |

| Name: | � | Greg Hiscock |

| Title: | � | General Counsel�& Corporate Secretary |

|

|

�

17th Annual Needham Growth Conference New York � The Palace Hotel

January�14, 2015

|

|

�

Safe Harbor Statement

Forward Looking Statements

Some of the statements in this presentation are forward-looking statements (or forward-looking information) within the meaning of applicable U.S. and Canadian securities laws. These include statements using the words target, outlook, may, will, should, could, estimate, continue, expect, intend, plan, predict, potential, project and anticipate, and similar statements which do not describe the present or provide information about the past. There is no guarantee that the expected events or expected results will actually occur. Such statements reflect the current views of management of Mitel and are subject to a number of risks and uncertainties. These statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, operational and other factors. Any changes in these assumptions or other factors could cause actual results to differ materially from current expectations. All forward-looking statements attributable to Mitel, or persons acting on its behalf, and are expressly qualified in their entirety by the cautionary statements set forth in this paragraph. Undue reliance should not be placed on such statements. In addition, material risks that could cause results of operations to differ include the Mitel�s ability to achieve or sustain profitability in the future since its acquisition of Aastra; fluctuations in the quarterly and annual revenues and operating results; fluctuations in foreign exchange rates; current and ongoing global economic instability political unrest and related sanctions, particularly in connection with the Ukraine and the Middle East; intense competition; reliance on channel partners for a significant component of sales; dependence upon a small number of outside contract manufacturers to manufacture products; the ability to successfully integrate the acquisition of Aastra and realize certain synergies; and, our ability to implement and achieve our business strategies successfully. Additional risks are described under the heading �Risk Factors� in Mitel�s Transition Report on Form 10-K for the eight month period ended December�31, 2013, filed on with the Securities and Exchange Commission on March�31, 2014. Forward-looking statements speak only as of the date they are made. Except as required by law, we do not have any intention or obligation to update or to publicly announce the results of any revisions to any of the forward-looking statements to reflect actual results, future events or developments, changes in assumptions or changes in other factors affecting the forward-looking statements.

Non-GAAP Financial Measurements

This presentation includes references to non-GAAP financial measures including Adjusted EBITDA, non-GAAP income and non-GAAP operating expenses. Non-GAAP financial measures do not have any standardized meaning and are therefore unlikely to be comparable to similar measures presented by other companies. We use these non-GAAP financial measures to assist management and investors in understanding our past financial performance and prospects for the future, including changes in our operating results, trends and marketplace performance, exclusive of unusual events or factors which do not directly affect what we consider to be our core operating performance. Non-GAAP measures are among the primary indicators management uses as a basis for our planning and forecasting of future periods. Investors are cautioned that non-GAAP financial measures should not be relied upon as a substitute for financial measures prepared in accordance with generally accepted accounting principles. Please see the reconciliation of non-GAAP financial measures to the most directly comparable U.S. GAAP measure included in this presentation and, if not contained in this presentation, contained in Mitel�s Reports on Form 8-K which have been filed with the SEC on March�27, 2014,�April�2, 2014,�May�8, 2014,�August�7, 2014 and November�6, 2014.

| 2 |

� |

| �2014 Mitel. Proprietary and Confidential. |

|

|

�

Mitel Today

OPERATING IN 100+ COUNTRIES

2500 CHANNEL PARTNERS

100 MILLION IN CLOUD BUSINESS

60 MILLION END-USER CUSTOMERS

OVER 1,900 PATENTS

OVER $1 BILLION IN REVENUE

#1 GLOBAL LEADERSHIP IN WESTERN EUROPE

OVER 850,000 CLOUD SEATS

BROADEST PORTFOLIO IN THE INDUSTRY

| 3 |

� |

| �2014 Mitel. Proprietary and Confidential. |

|

|

�

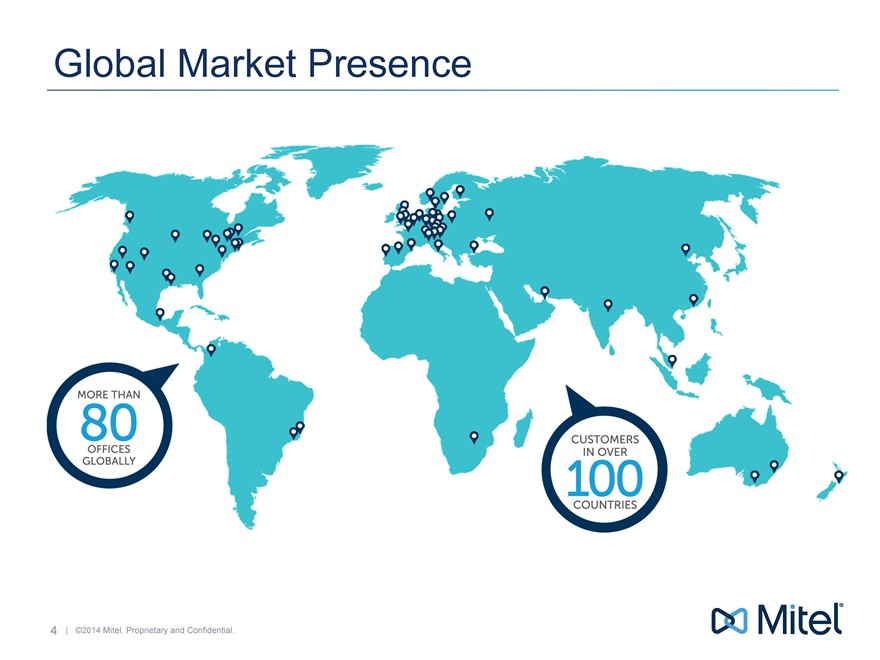

Global Market Presence

MORE THAN 80 OFFICES GLOBALLY

CUSTOMERS IN OVER 100 COUNTRIES

| 4 |

� |

| �2014 Mitel. Proprietary and Confidential. |

|

|

�

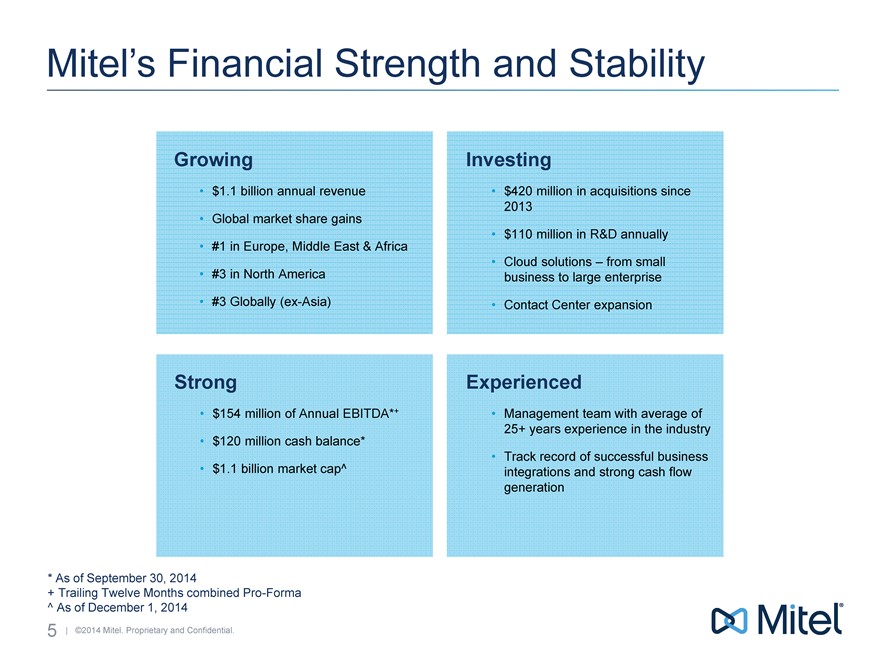

Mitel�s Financial Strength and Stability

Growing

$1.1 billion annual revenue

Global market share gains

#1 in Europe, Middle East�& Africa

#3 in North America

#3 Globally (ex-Asia)

Investing

$420 million in acquisitions since 2013

$110 million in R&D annually

Cloud solutions � from small business to large enterprise

Contact Center expansion

Experienced

Management team with average of 25+ years experience in the industry

Track record of successful business integrations and strong cash flow generation

Strong

$154 million of Annual EBITDA*+

$120 million cash balance*

$1.1 billion market cap^

* As of September�30, 2014

+ Trailing Twelve Months combined Pro-Forma

^ As of December�1, 2014

5 | �2014 Mitel. Proprietary and Confidential.

|

|

�

Broad Customer / Partner Base

Carriers

Education / Government

Financial Services

Health Care

Hospitality

Manufacturing

Professional Services

Media�& Entertainment

Retail

| 6 |

� |

| �2014 Mitel. Proprietary and Confidential. |

|

|

�

Growth Initiatives Delivering

Premise

Solid revenue

Excellent improvement in gross margin

Hardware to software transition

Cloud

Fastest growing

Public and private

Revenues exceeded 10% of total quarterly revenue

Contact Center

Rapid growth with 30% year to date

Results outpacing market growth by 3x

| 7 |

� |

| �2014 Mitel. Proprietary and Confidential. |

|

|

�

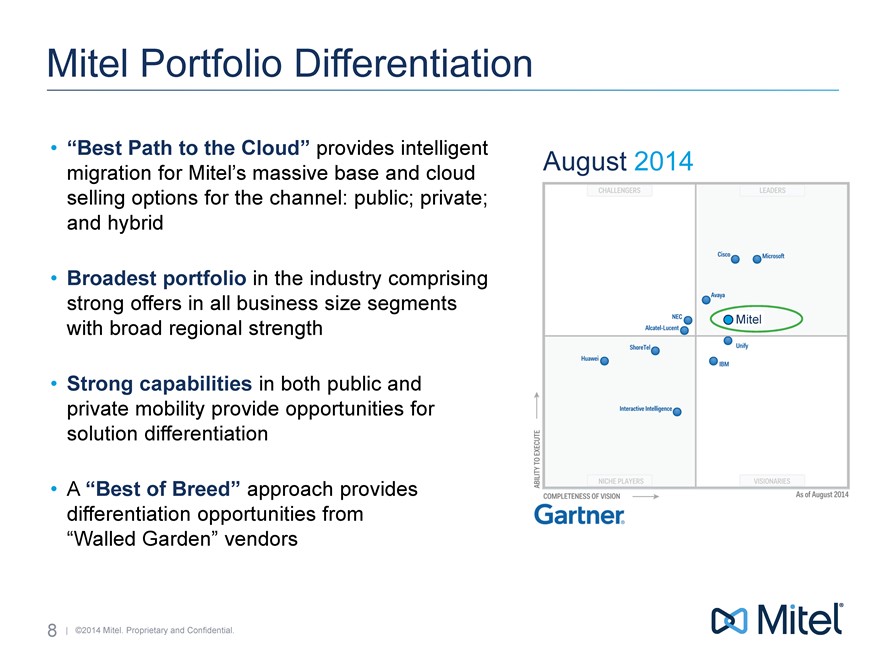

Mitel Portfolio Differentiation

�Best Path to the Cloud� provides intelligent migration for Mitel�s massive base and cloud selling options for the channel: public; private; and hybrid

Broadest portfolio in the industry comprising strong offers in all business size segments with broad regional strength

Strong capabilities in both public and private mobility provide opportunities for solution differentiation

A �Best of Breed� approach provides differentiation opportunities from �Walled Garden� vendors

August 2014

Mitel

8 | �2014 Mitel. Proprietary and Confidential.

|

|

�

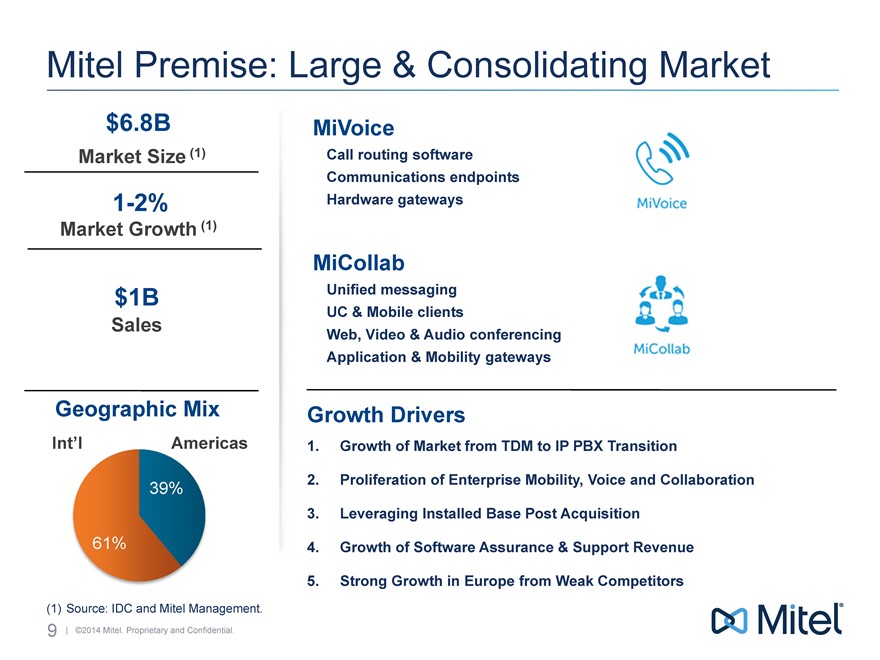

Mitel Premise: Large�& Consolidating Market

$6.8B

Market Size (1)

1-2%

Market Growth (1)

$1B

Sales

Geographic Mix

Int�l Americas

39%

61%

MiVoice

Call routing software

Communications endpoints

Hardware gateways

MiCollab

Unified messaging

UC�& Mobile clients

Web, Video�& Audio conferencing

Application�& Mobility gateways

Growth Drivers

1. Growth of Market from TDM to IP PBX Transition

2. Proliferation of Enterprise Mobility, Voice and Collaboration

3. Leveraging Installed Base Post Acquisition

4. Growth of Software Assurance�& Support Revenue

5. Strong Growth in Europe from Weak Competitors

| (1) |

� |

Source: IDC and Mitel Management. |

9 | �2014 Mitel. Proprietary and Confidential.

|

|

�

Mitel Premise�Why We Are Winning

Installed Base Upgrade

Tremendous 60M user installed base opportunity for upgrades and Software Assurance

Market Share Gains

Gains from weak competitors

Expanded geographic coverage and revenue contribution from growth partners

Additional distribution partners

Growth in recurring revenues

Software Assurance and Support, 27% revenue CAGR

10 | �2014 Mitel. Proprietary and Confidential.

|

|

�

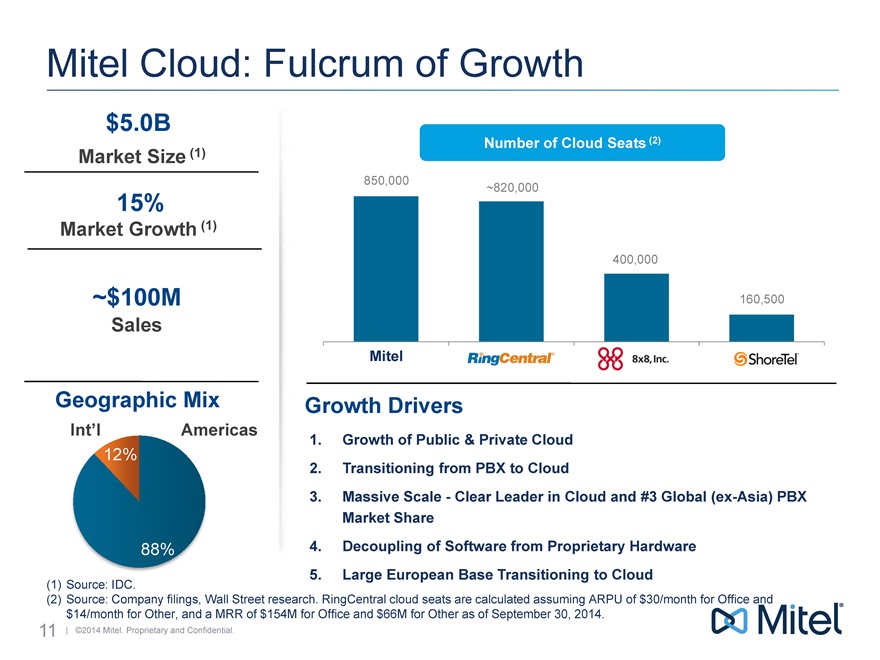

Mitel Cloud: Fulcrum of Growth

$5.0B

Market Size (1)

15%

Market Growth (1)

$100M

Sales

Geographic Mix

Number of Cloud Seats (2)

850,000

820,000

400,000

160,500

Mitel

mitel

Growth Drivers

1. Growth of Public�& Private Cloud

2. Transitioning from PBX to Cloud

3. Massive Scale�Clear Leader in Cloud and #3 Global (ex-Asia) PBX Market Share

4. Decoupling of Software from Proprietary Hardware

5. Large European Base Transitioning to Cloud

Int�l

Americas

12%

88%

| (1) |

� |

Source: IDC. |

(2) Source: Company filings, Wall Street research. RingCentral cloud seats are calculated assuming ARPU of $30/month for Office and $14/month for Other, and a MRR of $154M for Office and $66M for Other as of September�30, 2014.

11 | �2014 Mitel. Proprietary and Confidential.

|

|

�

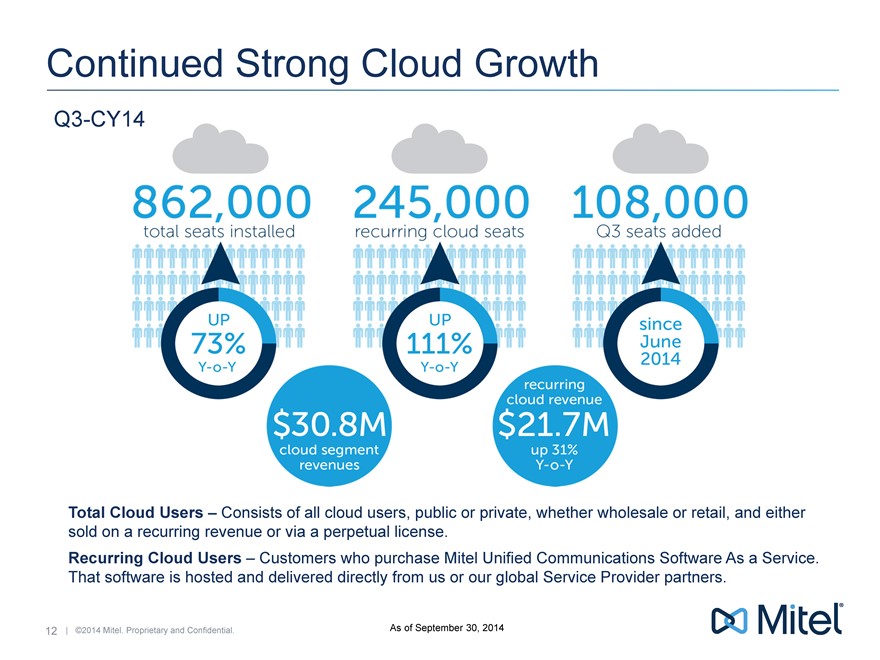

Continued Strong Cloud Growth

Q3-CY14

862,000

total seats installed

UP 73% Y-o-Y

245,000

recurring cloud seats

UP 111% Y-o-Y

108,000

Q3 seats added since June 2014

$30.8M cloud segment revenues

recurring cloud revenue $21.7M up 31% Y-o-Y

Total Cloud Users � Consists of all cloud users, public or private, whether wholesale or retail, and either sold on a recurring revenue or via a perpetual license.

Recurring Cloud Users � Customers who purchase Mitel Unified Communications Software As a Service. That software is hosted and delivered directly from us or our global Service Provider partners.

12 | �2014 Mitel. Proprietary and Confidential.

|

|

�

As of September�30, 2014

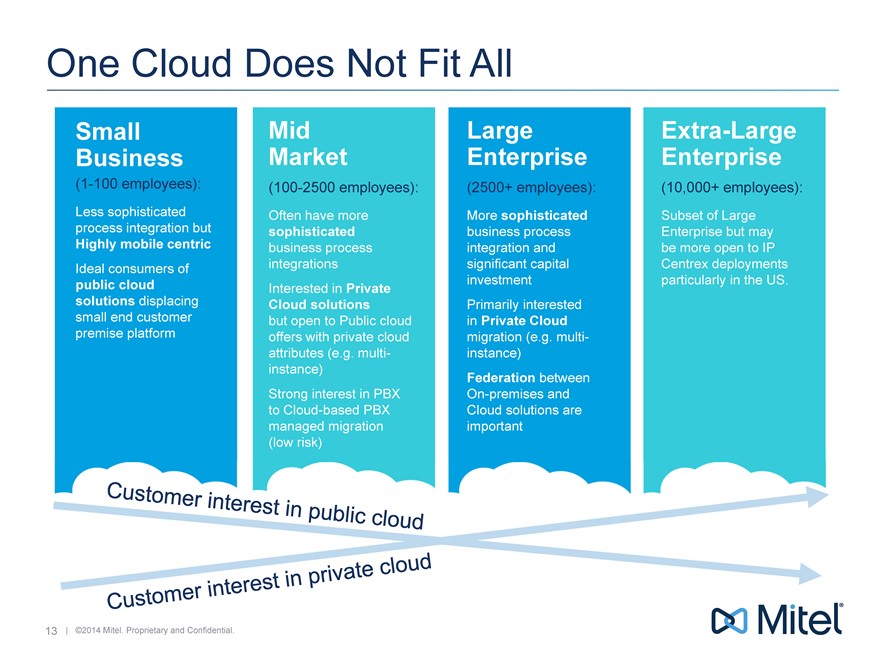

One Cloud Does Not Fit All

Small Business

(1-100 employees):

Less sophisticated process integration but

Highly mobile centric

Ideal consumers of public cloud solutions displacing small end customer premise platform

Mid Market

(100-2500 employees): Often have more sophisticated business process integrations

Interested in Private Cloud solutions but open to Public cloud offers with private cloud attributes (e.g. multi- instance)

Strong interest in PBX to Cloud-based PBX managed migration (low risk)

Large Enterprise

(2500+ employees):

More sophisticated business process integration and significant capital investment

Primarily interested in Private Cloud migration (e.g. multi- instance)

Federation between On-premises and Cloud solutions are important

Extra-Large Enterprise

(10,000+ employees): Subset of Large Enterprise but may be more open to IP Centrex deployments particularly in the US.

Customer interest in public cloud

Customer interest in private cloud

13 | �2014 Mitel. Proprietary and Confidential.

|

|

�

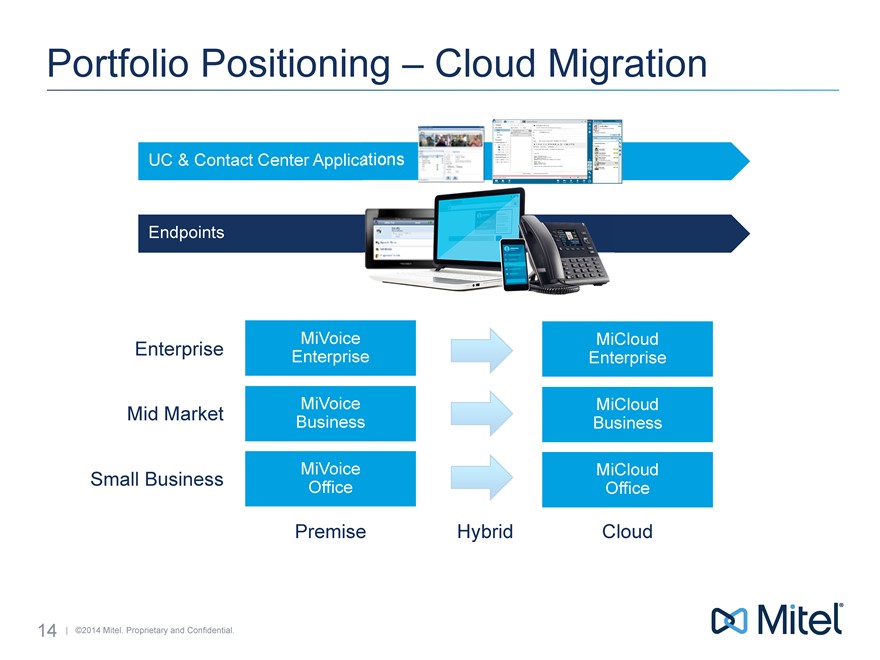

Portfolio Positioning � Cloud Migration

UC�& Contact Center Applications

Endpoints

Enterprise

Mid Market

Small Business

MiVoice Enterprise

MiVoice Business

MiVoice Office

Premise

Hybrid

MiCloud Enterprise

MiCloud Business

MiCloud Office

Cloud

14 | �2014 Mitel. Proprietary and Confidential.

|

|

�

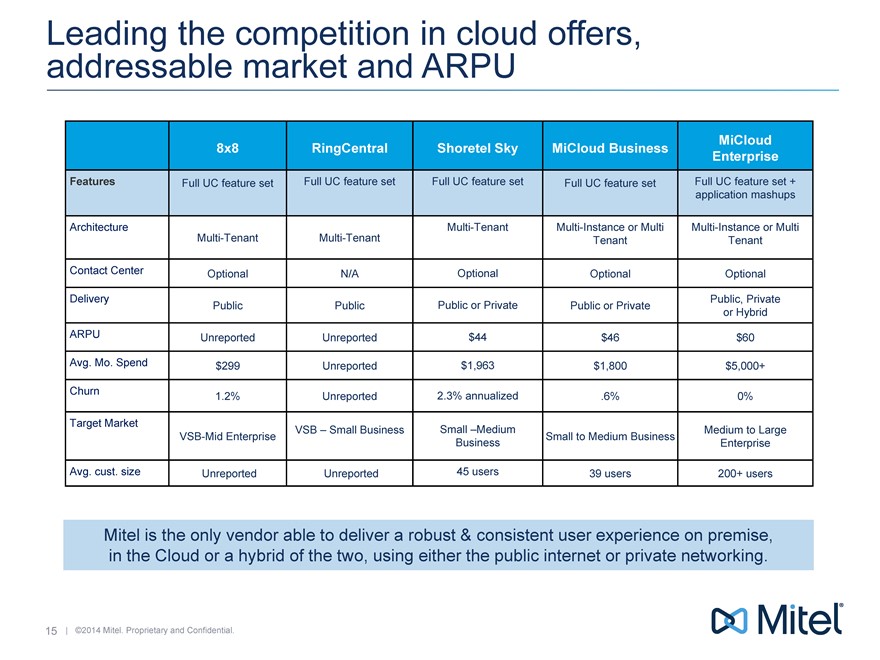

Leading the competition in cloud offers, addressable market and ARPU

Features

Architecture

Contact Center

Delivery

ARPU

Avg. Mo. Spend

Churn

Target Market

Avg. cust. size

8x8

Full UC feature set

Multi-Tenant

Optional

Public

Unreported

$299

1.2%

VSB-Mid Enterprise

Unreported

RingCentral

Full UC feature set

Multi-Tenant

N/A

Public

Unreported

Unreported

Unreported

VSB � Small Business

Unreported

Shoretel Sky

Full UC feature set

Multi-Tenant

Optional

Public or Private

$44

$1,963

2.3% annualized

Small �Medium Business

45 users

MiCloud Business

Full UC feature set

Multi-Instance or Multi Tenant

Optional

Public or Private

$46

$1,800

.6%

Small to Medium Business

39 users

MiCloud Enterprise

Full UC feature set + application mashups

Multi-Instance or Multi Tenant

Optional

Public, Private or Hybrid

$60

$5,000+

0%

Medium to Large Enterprise

200+ users

Mitel is the only vendor able to deliver a robust�& consistent user experience on premise, in the Cloud or a hybrid of the two, using either the public internet or private networking.

15 | �2014 Mitel. Proprietary and Confidential.

|

|

�

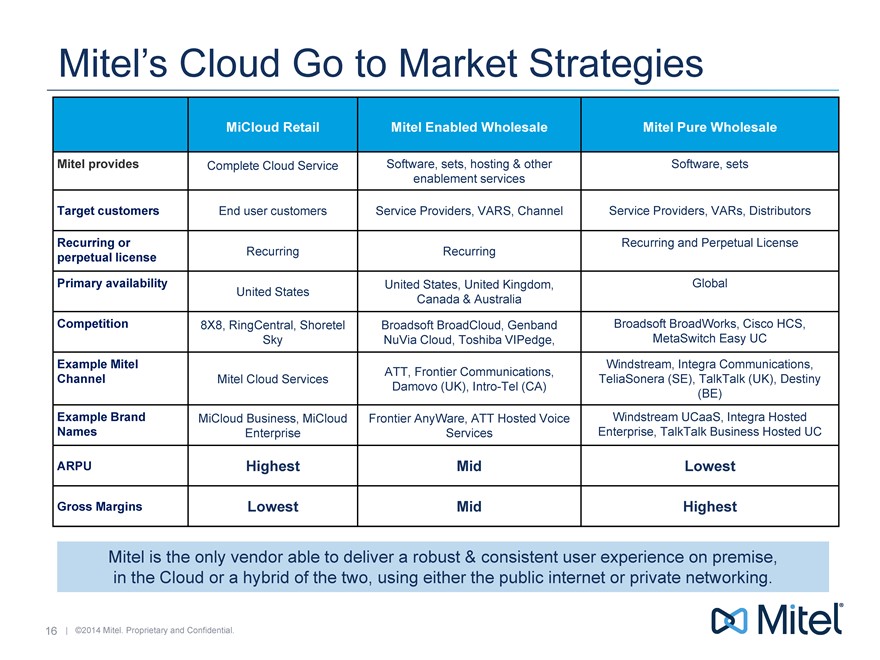

Mitel�s Cloud Go to Market Strategies

Mitel provides

Target customers

Recurring or perpetual license

Primary availability

Competition

Example Mitel

Channel

Example Brand Names

ARPU

Gross Margins

MiCloud Retail

Complete Cloud Service

End user customers

Recurring

United States

8X8, RingCentral, Shoretel Sky

Mitel Cloud Services

MiCloud Business, MiCloud Enterprise

Highest

Lowest

Mitel Enabled Wholesale

Software, sets, hosting�& other enablement services

Service Providers, VARS, Channel

Recurring

United States, United Kingdom, Canada�& Australia

Broadsoft BroadCloud, Genband NuVia Cloud, Toshiba VIPedge,

ATT, Frontier Communications,

Damovo (UK), Intro-Tel (CA)

Frontier AnyWare, ATT Hosted Voice Services

Mid

Mid

Mitel Pure Wholesale

Software, sets

Service Providers, VARs, Distributors

Recurring and Perpetual License

Global

Broadsoft BroadWorks, Cisco HCS, MetaSwitch Easy UC

Windstream, Integra Communications,

TeliaSonera (SE), TalkTalk (UK), Destiny (BE)

Windstream UCaaS, Integra Hosted Enterprise, TalkTalk Business Hosted UC

Lowest

Highest

Mitel is the only vendor able to deliver a robust�& consistent user experience on premise, in the Cloud or a hybrid of the two, using either the public internet or private networking.

16 | �2014 Mitel. Proprietary and Confidential.

|

|

�

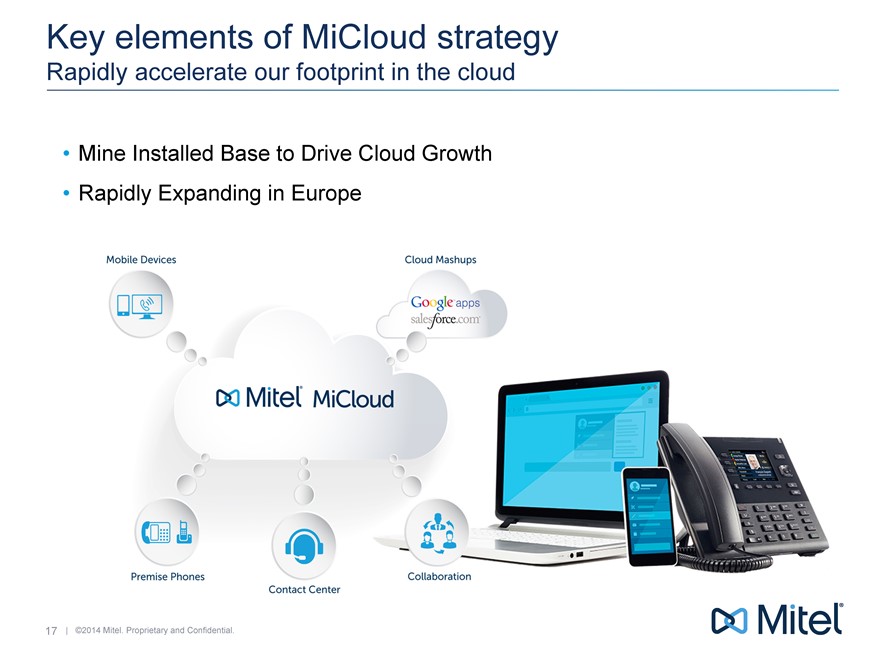

Key elements of MiCloud strategy

Rapidly accelerate our footprint in the cloud

| � |

� |

Mine Installed Base to Drive Cloud Growth |

| � |

� |

Rapidly Expanding in Europe |

17 | �2014 Mitel. Proprietary and Confidential.

|

|

�

Why Mitel wins in the Cloud

Established opportunity

60�million existing Mitel users

Significant New Customer Win Rate

Expert Channel with Flexible Go To Market Strategies

2,500 Channel Partners globally

Flexible commercial models for channel and customers

Solutions Leadership

Flexible solutions enabling Channel to migrate their customers to Cloud, at their pace and leverage customer�s existing Mitel investments

Support today for Hybrid, Private and Public Cloud Deployments

Integration into broader IT frameworks�& application mash ups; solutions tailored to specific customer sizes and market segments

18 | �2014 Mitel. Proprietary and Confidential.

|

|

�

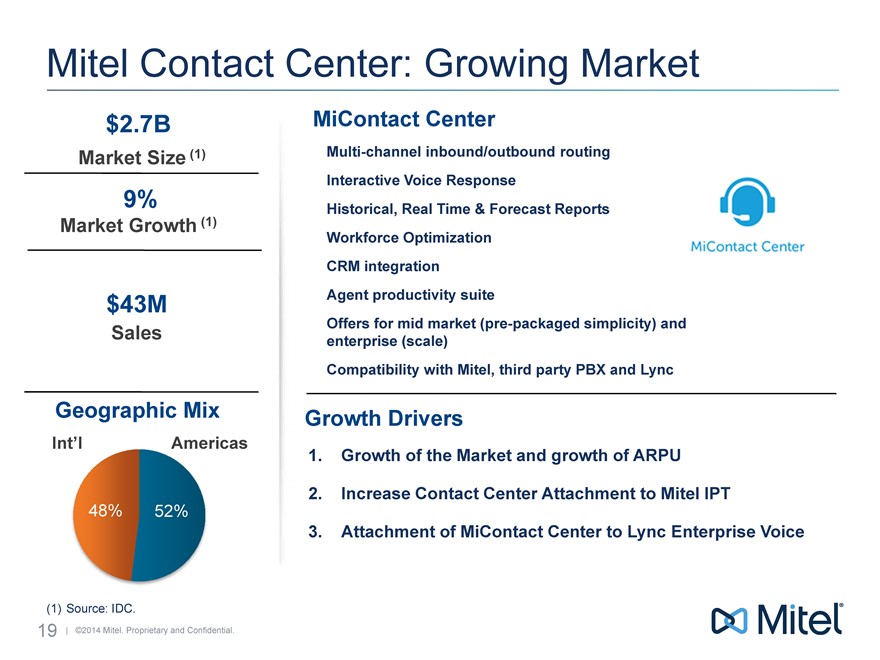

Mitel Contact Center: Growing Market

$2.7B

Market Size (1)

9%

Market Growth (1)

$43M

Sales

Geographic Mix

Int�l

Americas

48%

52%

MiContact Center

Multi-channel inbound/outbound routing Interactive Voice Response Historical, Real Time�& Forecast Reports Workforce Optimization CRM integration Agent productivity suite

Offers for mid market (pre-packaged simplicity) and enterprise (scale) Compatibility with Mitel, third party PBX and Lync

Growth Drivers

1. Growth of the Market and growth of ARPU

2. Increase Contact Center Attachment to Mitel IPT

3. Attachment of MiContact Center to Lync Enterprise Voice

(1) Source: IDC.

19 �2014 Mitel. Proprietary and Confidential.

|

|

�

MiContact Center Track Record of Growth

Revenue growth, 3 Year track record of >20% growth

> 100K agents sold annually

Multi-channel Contact Center revenue up 56% YoY

Average revenue per agent growth in mid market of 50% YoY

20 | �2014 Mitel. Proprietary and Confidential.

|

|

�

Mitel

Powering connections

Financial Overview

|

|

�

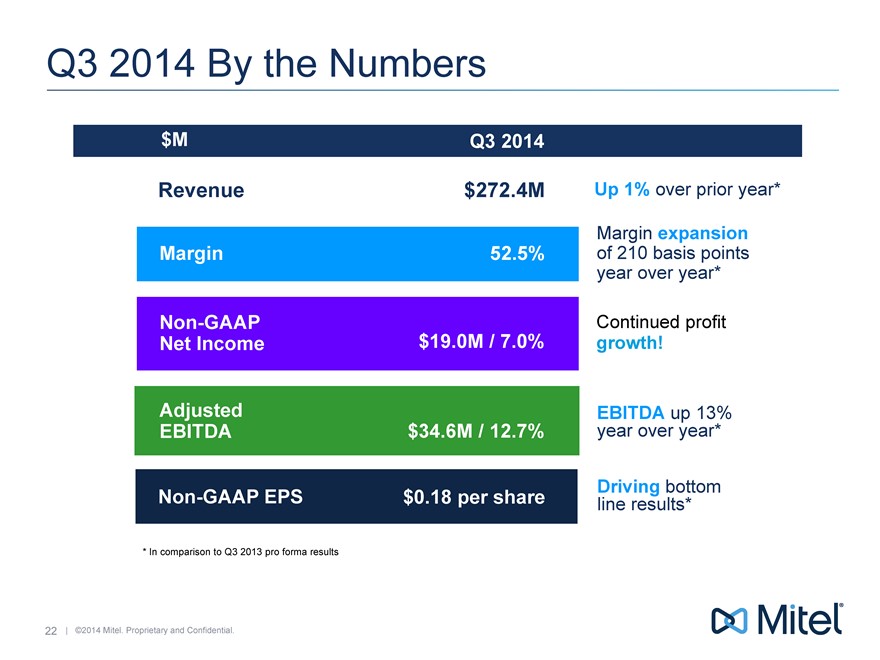

Q3 2014 By the Numbers

$M

Revenue Margin

Non-GAAP Net Income

Adjusted

EBITDA

Non-GAAP EPS

Q3 2014

$272.4M 52.5%

$19.0M / 7.0%

$34.6M / 12.7%

$0.18 per share

Up 1% over prior year* Margin expansion of 210 basis points year over year*

Continued profit growth!

EBITDA up 13%

year over year* Driving bottom

line results*

* In comparison to Q3 2013 pro forma results

22 | �2014 Mitel. Proprietary and Confidential.

|

|

�

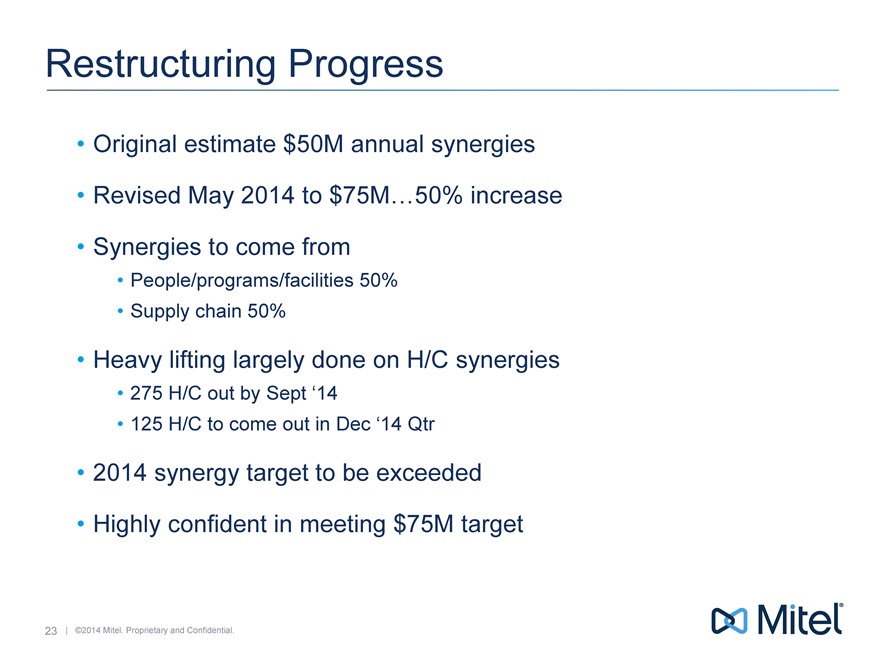

Restructuring Progress

Original estimate $50M annual synergies

Revised May 2014 to $75M�50% increase

Synergies to come from

People/programs/facilities 50%

Supply chain 50%

Heavy lifting largely done on H/C synergies

275 H/C out by Sept �14

125 H/C to come out in Dec �14 Qtr

2014 synergy target to be exceeded

Highly confident in meeting $75M target

23 | �2014 Mitel. Proprietary and Confidential.

|

|

�

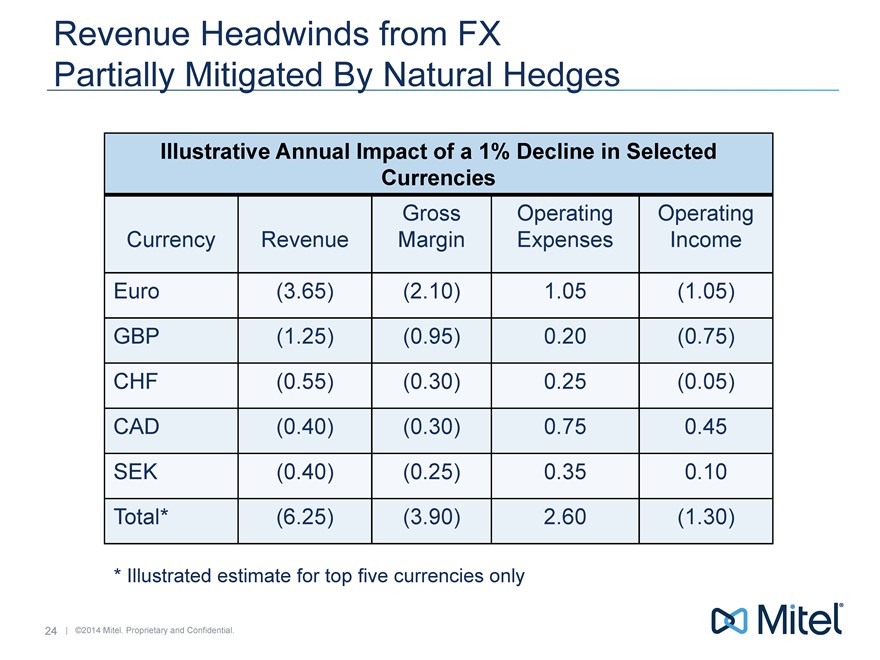

Revenue Headwinds from FX Partially Mitigated By Natural Hedges

Illustrative Annual Impact of a 1% Decline in Selected Currencies

Currency Revenue Gross Margin Operating Expenses Operating Income

Euro(3.65) (2.10) 1.05 (1.05)

GBP (1.25) (0.95) 0.20 (0.75)

CHF (0.55) (0.30) 0.25 (0.05)

CAD (0.40) (0.30) 0.75 0.45

SEK (0.40) (0.25) 0.35 0.10

Total* (6.25) (3.90) 2.60 (1.30)

* Illustrated estimate for top five currencies only

24 | �2014 Mitel. Proprietary and Confidential.

|

|

�

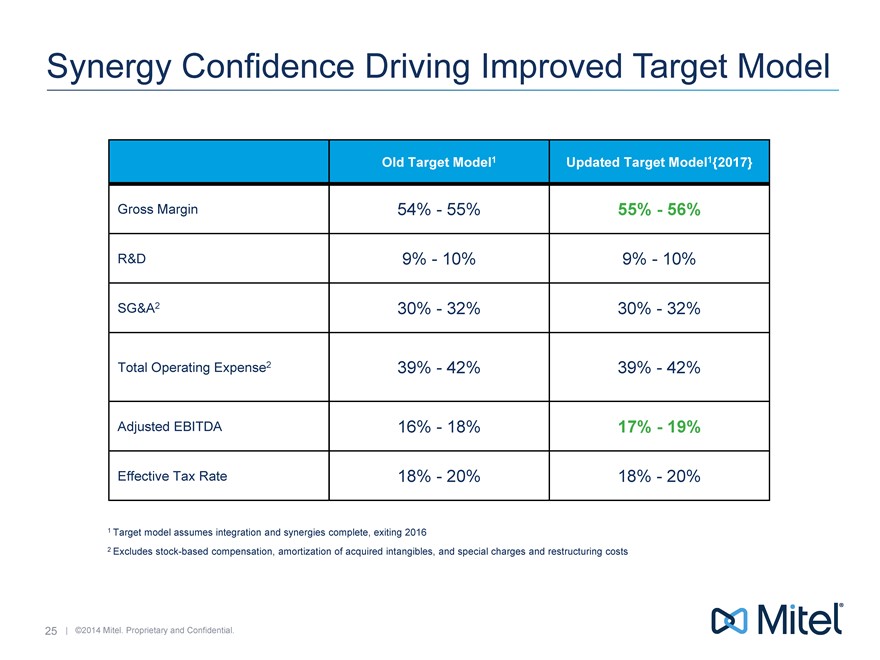

Synergy Confidence Driving Improved Target Model

Old Target Model1 Updated Target Model1{2017}

Gross Margin 54% - 55% 55% - 56%

R&D 9% - 10% 9% - 10%

SG&A2 30% - 32% 30% - 32%

Total Operating Expense2 39% - 42% 39% - 42%

Adjusted EBITDA 16% - 18% 17% - 19%

Effective Tax Rate 18% - 20% 18% - 20%

1 Target model assumes integration and synergies complete, exiting 2016

2 Excludes stock-based compensation, amortization of acquired intangibles, and special charges and restructuring costs

25 | �2014 Mitel. Proprietary and Confidential.

|

|

�

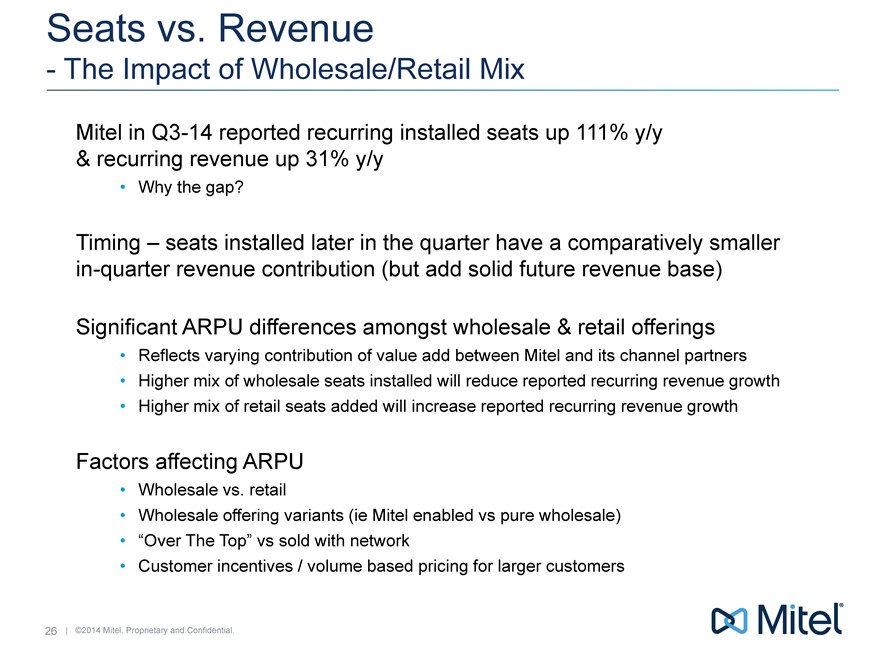

Seats vs. Revenue

- The Impact of Wholesale/Retail Mix

Mitel in Q3-14 reported recurring installed seats up 111% y/y

& recurring revenue up 31% y/y

Why the gap?

Timing � seats installed later in the quarter have a comparatively smaller in-quarter revenue contribution (but add solid future revenue base)

Significant ARPU differences amongst wholesale�& retail offerings

Reflects varying contribution of value add between Mitel and its channel partners

Higher mix of wholesale seats installed will reduce reported recurring revenue growth

Higher mix of retail seats added will increase reported recurring revenue growth

Factors affecting ARPU

Wholesale vs. retail

Wholesale offering variants (ie Mitel enabled vs pure wholesale)

�Over The Top� vs sold with network

Customer incentives / volume based pricing for larger customers

26 | �2014 Mitel. Proprietary and Confidential.

|

|

�

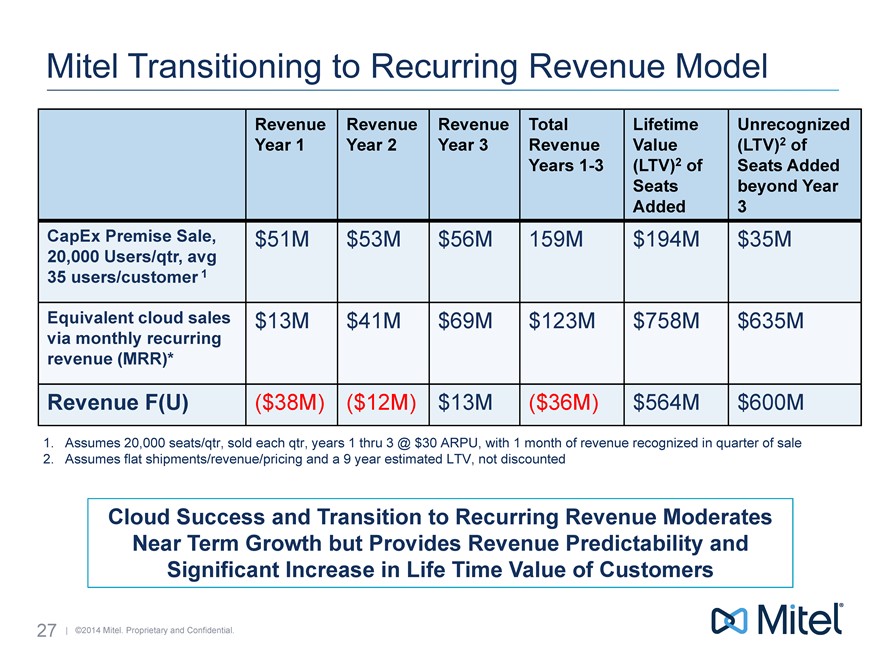

Mitel Transitioning to Recurring Revenue Model

Revenue Year 1 Revenue Year 2 Revenue Year 3 Total Revenue Years 1-3 Lifetime Value (LTV)2 of Seats Added Unrecognized (LTV)2 of Seats Added beyond Year 3

CapEx Premise Sale, 20,000 Users/qtr, avg 35 users/customer 1 $51M $53M $ 56M 159M $ 194M $ 35M

Equivalent cloud sales via monthly recurring revenue (MRR)* $13M $41M $ 69M $123M $ 758M $ 635M

Revenue F(U) ($38M) ($12M) $ 13M ($36M) $ 564M $ 600M

1. Assumes 20,000 seats/qtr, sold each qtr, years 1 thru 3 @ $30 ARPU, with 1 month of revenue recognized in quarter of sale

2. Assumes flat shipments/revenue/pricing and a 9 year estimated LTV, not discounted

Cloud Success and Transition to Recurring Revenue Moderates Near Term Growth but Provides Revenue Predictability and Significant Increase in Life Time Value of Customers

27 | �2014 Mitel. Proprietary and Confidential.

|

|

�

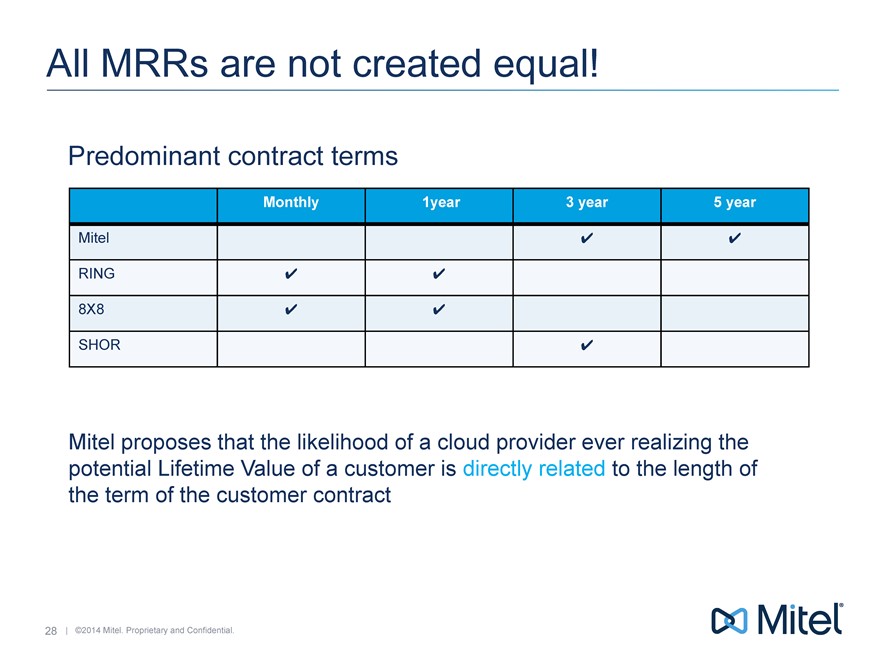

All MRRs are not created equal!

Predominant contract terms

Monthly 1year 3 year 5 year

Mitel

RING

8X8

SHOR

Mitel proposes that the likelihood of a cloud provider ever realizing the potential Lifetime Value of a customer is directly related to the length of the term of the customer contract

28 | �2014 Mitel. Proprietary and Confidential.

|

|

�

Why Mitel

We are business communications experts

We are a market leader

We offer clear customer choice with the best path to the cloud

We are powering connections and consolidating the market

29 | �2014 Mitel. Proprietary and Confidential.

|

|

�

17th Annual Needham Growth Conference New York � The Palace Hotel

January�14, 2015

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- AUTODESK ALERT: Bragar Eagel & Squire, P.C. Announces that a Class Action Lawsuit Has Been Filed Against Autodesk, Inc. and Encourages Investors to Contact the Firm

- Marex Group plc Announces Pricing of Initial Public Offering

- BlackRock® Canada Announces Final April Cash Distributions for the iShares® Premium Money Market ETF

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share