Form 424B4 Audentes Therapeutics,

Table of Contents

Filed Pursuant to Rule 424(b)(4)

Registration No. 333-219797

The information in this preliminary prospectus supplement is not complete and may be changed. This preliminary prospectus supplement and the accompanying prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion

Preliminary Prospectus Supplement dated January 23, 2018

PROSPECTUS SUPPLEMENT

(To prospectus dated August 23, 2017)

$150,000,000

Common Stock

We are offering shares of our common stock.

Our common stock is listed on The Nasdaq Global Market under the symbol “BOLD.” The last reported sale price of our common stock on The Nasdaq Global Market on January 22, 2018 was $37.31 per share. We are an “emerging growth company” as defined under the federal securities laws and, as such, have elected to comply with certain reduced public company reporting requirements.

Investing in the common stock involves risks that are described in the section entitled “Risk Factors” beginning on page S-15 of this prospectus supplement and in the documents incorporated by reference into this prospectus supplement before investing in our securities.

| Per Share |

Total | |||

| Public offering price |

$ | $ | ||

| Underwriting discounts and commissions (1) |

$ | $ | ||

| Proceeds, before expenses, to us |

$ | $ |

| (1) | See the section entitled “Underwriting” for a description of the compensation payable to the underwriters. |

The underwriters may also exercise their option to purchase up to an additional $22,500,000 of shares of our common stock from us, at the public offering price, less the underwriting discounts and commissions, for 30 days after the date of this prospectus supplement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The shares will be ready for delivery on or about , 2018.

Joint Book-Running Managers

| BofA Merrill Lynch | Cowen | Leerink Partners |

Co-Manager

Wedbush PacGrow

The date of this prospectus supplement is , 2018

Table of Contents

Prospectus Supplement

| Page |

||||

| S-1 | ||||

| S-2 | ||||

| S-15 | ||||

| S-18 | ||||

| S-19 | ||||

| S-20 | ||||

| S-21 | ||||

| Material U.S. Federal Income Tax Considerations for Non-U.S. Holders of Common Stock |

S-22 | |||

| S-27 | ||||

| S-34 | ||||

| S-34 | ||||

| S-34 | ||||

| S-34 | ||||

Prospectus

| Page |

||||

| ii | ||||

| 1 | ||||

| 4 | ||||

| 5 | ||||

| 6 | ||||

| 7 | ||||

| 12 | ||||

| 19 | ||||

| 21 | ||||

| 22 | ||||

| 23 | ||||

| 26 | ||||

| 26 | ||||

| 26 | ||||

| 26 | ||||

Neither we nor the underwriters have authorized anyone to provide any information or to make any representations other than those contained in this prospectus supplement, the accompanying prospectus or in any free writing prospectuses we have prepared. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted. The information in this prospectus supplement, the accompanying prospectus, the documents incorporated by reference herein and therein, and in any free writing prospectus that we have authorized for use in connection with this offering is accurate only as of the date of those respective documents. Our business, financial condition, results of operations and prospects may have changed since that date. You should read this prospectus supplement, the accompanying prospectus, the documents incorporated by reference herein and therein, and any free writing prospectus that we have authorized for use in connection with this offering in their entirety before making an

S-i

Table of Contents

investment decision. You should also read and consider the information in the documents to which we have referred you in the sections of this prospectus supplement entitled “Where You Can Find Additional Information” and “Incorporation of Certain Information by Reference.”

For investors outside the United States: Neither we nor the underwriters have done anything that would permit our public offering or possession or distribution of this prospectus supplement or the accompanying prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus supplement or the accompanying prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of our common stock and the distribution of this prospectus supplement or the accompanying prospectus outside of the United States.

S-ii

Table of Contents

ABOUT THIS PROSPECTUS SUPPLEMENT

On August 8, 2017, we filed with the Securities and Exchange Commission, or SEC, a registration statement on Form S-3 (File No. 333-219797) utilizing a shelf registration process relating to the securities described in this prospectus supplement, which registration statement became effective on August 23, 2017. Under this shelf registration process, we may, from time to time, sell common stock and other securities, of which this offering is a part.

This document is in two parts. The first part is the prospectus supplement, including the documents incorporated by reference herein, which describes the specific terms of this offering and also adds to and updates the information contained in the accompanying prospectus and the documents incorporated by reference. The second part, the accompanying prospectus, including the documents incorporated by reference therein, provides more general information, some of which may not apply to this offering. Generally, when we refer to this prospectus, we are referring to both parts of this document combined. Before you invest, you should carefully read this prospectus supplement, the accompanying prospectus and the information incorporated by reference herein and therein, as well as the additional information described in this prospectus supplement under “Where You Can Find Additional Information.” This prospectus supplement may add, update or change information contained in the accompanying prospectus. To the extent that any statement we make in this prospectus supplement is inconsistent with statements made in the accompanying prospectus or any documents incorporated by reference therein, the statements made in this prospectus supplement will be deemed to modify or supersede those made in the accompanying prospectus and such documents incorporated by reference therein.

We are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted. The distribution of this prospectus supplement and the offering of the common stock in certain jurisdictions may be restricted by law. Persons outside the United States who come into possession of this prospectus supplement must inform themselves about, and observe any restrictions relating to, the offering of the common stock and the distribution of this prospectus supplement outside the United States. This prospectus supplement does not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered by this prospectus supplement by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

This prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein include trademarks, service marks and trade names owned by us or other companies. All trademarks, service marks and trade names included or incorporated by reference into this prospectus supplement or the accompanying prospectus are the property of their respective owners.

Unless the context otherwise indicates, references in this prospectus supplement to “Audentes Therapeutics”, “we”, “our”, “us” and “the Company” refer, collectively, to Audentes Therapeutics, Inc., a Delaware corporation.

We have registered the trademarks “Audentes,” “Audentes Therapeutics” and “Courageous Patients. Bold Effort.” in the European Union and we have trademark applications for each of these trademarks pending with the U.S. Patent and Trademark Office. The Audentes logo and all product names are our common law trademarks. All other service marks, trademarks and tradenames appearing in this prospectus are the property of their respective owners. Solely for convenience, the trademarks and trade names referred to in this prospectus appear without the ® and ™ symbols, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights, or the right of the applicable licensor to these trademarks and tradenames.

S-1

Table of Contents

This summary highlights information about us, this offering and information appearing elsewhere in this prospectus supplement, in the accompanying prospectus and in the documents incorporated by reference herein and therein and does not contain all of the information you should consider in making your investment decision. Before deciding to invest in shares of our common stock, you should read this summary together with the more detailed information, including our consolidated financial statements and the accompanying notes, which are incorporated by reference into this prospectus supplement. You should carefully consider, among other things, the matters discussed in the sections entitled “Risk Factors,” “Selected Consolidated Financial Data,” our consolidated financial statements and the accompanying notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” incorporated by reference into this prospectus supplement. Some of the statements in this prospectus supplement and the accompanying prospectus constitute forward-looking statements that involve risks and uncertainties. See “Special Note Regarding Forward-Looking Statements.”

Audentes Therapeutics, Inc.

Overview

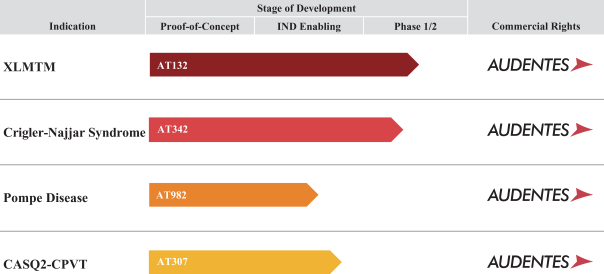

We are a clinical stage biotechnology company focused on developing and commercializing gene therapy products for patients living with serious, life-threatening rare diseases caused by single gene defects. We believe that gene therapy has powerful potential to treat these diseases through delivery of a functional copy of the gene to affected cells, resulting in production of the normal protein. We have built a compelling portfolio of product candidates, including AT132 for the treatment of X-Linked Myotubular Myopathy, or XLMTM, AT342 for the treatment of Crigler-Najjar Syndrome, or Crigler-Najjar, AT982 for the treatment of Pompe disease and AT307 for the treatment of the CASQ2 subtype of Catecholaminergic Polymorphic Ventricular Tachycardia, or CASQ2-CPVT. We have initiated a Phase 1/2 clinical study of AT132 and plan to dose the first patient in a Phase 1/2 clinical study of AT342 in the first quarter of 2018. We are conducting IND-enabling preclinical studies for the systemic administration of AT307 for the treatment of CASQ2-CPVT, for which we plan to file an IND in the first quarter of 2018, and AT982 for the treatment of Pompe disease, for which we plan to file an IND in the second quarter of 2018. We maintain full global rights to all our product candidates.

We have developed a proprietary in-house cGMP manufacturing capability that we believe provides us with a core strategic advantage, enabling superior control over development timelines, costs and intellectual property. Our manufacturing facility is located in South San Francisco in a building that we have improved to support our research, process development and manufacturing capabilities in accordance with current Good Manufacturing Practices, or cGMP, requirements. We have established a comprehensive platform for production of our adeno-associated virus vector, or AAV, product candidates and plan continued investment to further optimize our manufacturing capabilities to cost-effectively produce high-quality AAV vectors at both clinical and commercial scale.

Our vision is to become a fully integrated biotechnology company. In pursuit of this goal, we are executing on our core strategic initiatives, which include the advancement of our current product candidates, the continued development of our proprietary in-house manufacturing capabilities, and the expansion of our pipeline. We have assembled a world-class team with expertise in gene therapy, rare disease drug development and commercialization, and biologics manufacturing.

Our mission is to dramatically and positively transform the lives of patients suffering from serious, life- threatening rare diseases with limited or no treatment options. For example, we are developing AT132 to treat XLMTM, a disease for which there are no approved therapies and from which approximately 50% of affected

S-2

Table of Contents

children die in the first 18 months of life. We believe our product candidates have the potential to provide long-lasting benefits, changing the lives of patients with these devastating diseases. Given the available clinical and regulatory pathways, we believe that the rarity and severity of the diseases we target may provide advantages for drug development, including the potential for expedited development and regulatory review, and market exclusivity.

We focus on the treatment of rare diseases caused by single gene, or monogenic, defects in DNA that we believe can be effectively addressed using gene therapy. Conventional approaches such as protein therapeutics attempt to replace the deficient protein, but they do not correct the underlying genetic defect causing the disease. In addition, protein therapeutics often require frequent administration by injection or infusion and often result in sub-optimal safety and efficacy. We believe gene therapy is an ideal treatment modality for diseases caused by monogenic defects. Our portfolio of product candidates employs the use of AAV, a small, non-pathogenic virus that is genetically engineered to function as a delivery vehicle, or vector, and is administered to a patient to introduce a healthy copy of a mutated gene to the body. AAV gene therapy vectors are modified such that they will not cause an infection like a normal virus, but are capable of delivering therapeutic genes into patients’ cells. Vectors derived from AAV have a well-established safety profile in humans and have been shown to effectively deliver genes to the liver, eye, muscle and brain. Preclinical and clinical data demonstrate that AAV vectors are capable of providing durable efficacy with a favorable adverse event profile due at least in part to AAV’s low immunogenic potential. AAV vectors can be described by the serotype, or strain, of the original virus isolate that was used to form the outer shell, or capsid, of the vector. We selected AAV8 and AAV9 as our in-licensed vector capsid serotypes, based on their biological properties, which we believe will translate into positive clinical effect in our target indications.

Our business model is to develop and commercialize a broad portfolio of gene therapy product candidates to treat rare diseases. We use a focused set of criteria to select product candidates that we believe have the best chance of success. These criteria include:

| • | serious, life-threatening rare diseases; |

| • | monogenic diseases with well-understood biology; |

| • | disease characteristics well-suited for treatment with AAV gene therapy technology; |

| • | high potential for meaningful clinical benefit; |

| • | compelling preclinical data; |

| • | clear measures for evaluation in clinical trials; and |

| • | opportunities for expedited development through established regulatory pathways. |

S-3

Table of Contents

We have built a portfolio of gene therapy product candidates and we intend to further expand our portfolio over time. Set forth below is a table summarizing our development programs.

AT132. XLMTM is characterized by extreme muscle weakness, respiratory failure and early death with an estimated 50% mortality rate in the first 18 months of life. The disease is the result of mutations in the MTM1 gene that affect the production of myotubularin, an enzyme required for normal development and function of skeletal muscle. The incidence of XLMTM is estimated to be one in 50,000 male births. Currently, only supportive treatment options, such as ventilator use or a feeding tube, are available. We are developing AT132, an AAV8 vector containing a functional copy of the MTM1 gene, for the treatment of XLMTM. We believe AT132 may provide patients with significantly improved outcomes based on the ability of AAV8 to treat skeletal muscle. Preclinical study results in both canine and murine models of the disease demonstrated dramatic improvements in all outcomes, including histology, muscle strength, respiratory function and survival. Our goal is to achieve these same benefits in XLMTM patients following a single intravenous administration of AT132.

The clinical development of AT132 was initiated with RECENSUS, a retrospective medical chart review designed to characterize the disease course, natural history and unmet medical need in XLMTM. In December 2017, Audentes announced the publication of initial data from 112 boys in RECENSUS. This analysis confirmed and expanded upon the understanding of the significant disease burden of XLMTM on patients, families and the healthcare system. Audentes is also conducting INCEPTUS, a prospective natural history run-in study. The primary objectives of INCEPTUS are to characterize the clinical condition of children with XLMTM, identify subjects for potential enrollment in ASPIRO (the Phase 1/2 clinical study of AT132 in XLMTM), and serve as a longitudinal baseline and within-patient control for ASPIRO. Preliminary data reported from INCEPTUS confirm the significant neuromuscular and respiratory deficits experienced by XLMTM patients, and provide insight into the relevance and sensitivity of assessments used in ASPIRO.

ASPIRO is a multicenter, multinational, open-label, ascending dose, delayed-treatment control study to evaluate the safety and preliminary efficacy of AT132 in approximately 12 XLMTM patients less than five years of age. We initiated ASPIRO in September 2017 and reported interim data from the first dose cohort of ASPIRO patients in January 2018. The interim data includes safety and efficacy assessments comprised of three AT132-treated patients dosed at 1x1014 vector genomes (vg) per kilogram (kg), and one delayed-treatment control patient. As of December 21, 2017, individual patient follow-up ranged from 4 to 12 weeks.

S-4

Table of Contents

There have been a total of eight adverse events, or AEs, reported in ASPIRO, four of which were determined to be serious adverse events, or SAEs. All SAEs occurred in Patient 3, the first of which was a hospitalization one week post-administration due to pneumonia and was deemed not treatment-related. On January 4, 2018, we reported that Patient 3 was also hospitalized at week seven post-administration due to a gastrointestinal infection and elevated troponin level, the latter of which was deemed a probably treatment-related SAE and was responding to treatment with intravenous steroid administration and supportive care.

Subsequent to the December 21, 2017 data cutoff date, the clinical investigator responsible for managing Patient 3 determined that the adverse events that contributed to the week seven hospitalization should be recategorized as three distinct SAEs, related to each other and deemed to be probably treatment-related. These include myocarditis, elevated troponin levels and mildly elevated creatinine kinase levels, each of which have resolved. Patient 3 was clinically stable throughout the hospital admission and has now been discharged from the hospital.

Of the four non-serious AEs, two have been determined to be probably or possibly treatment-related. Patient 1 experienced a mild, clinically asymptomatic exacerbation of a pre-existing elevated bilirubin level, which was deemed possibly treatment-related and resolved with treatment. Patient 2 experienced a clinically asymptomatic elevation in liver enzyme levels toward the end of the protocol-specified prednisolone weaning period, which was deemed to be probably treatment-related and resolved by extending the duration of steroid coverage.

The key assessment of neuromuscular function in this first data set from the first dose cohort is the CHOP-INTEND scale, in which a maximal score of 64 reflects the level of neuromuscular function that a healthy baby is expected to approach by 3-6 months of age. Additional analyses to be reported based on longer term follow-up include the MFM-20 and Bayley-III™ scales of infant and toddler development (fine and gross motor function). Motor developmental milestones are captured within each of the neuromuscular assessments.

The key assessment of respiratory function in this first data set from the first dose cohort is a measurement of maximal inspiratory pressure, or MIP, for which values ³ 80 cmH20 are considered normal in healthy children less than 5 years of age. Additional analyses to be reported based on longer term follow-up include measurement of maximal expiratory pressure, or MEP, time per day on invasive ventilatory support (tracheostomy) or non-invasive respiratory support (BiPAP), and for those patients who are on 24-hour continuous ventilatory support, an assessment of ability to maintain adequate respiratory function while off a ventilator, termed “respiratory sprinting.”

Patient Interim Data Summaries:

| • | Patient 1: data set includes assessments through week 12 timepoint |

| • | Age 0.8 years (9 months) and on 12 hours of BiPAP per day at baseline |

| • | CHOP-INTEND increased from 29 at baseline to 56 at week 12 |

| • | MIP increased from 33 cmH20 at baseline to 80 cmH20 at week 12 |

| • | No age-appropriate first-year motor milestones were achieved at the baseline assessment; by week 12, Patient 1 had acquired several age appropriate skills, including the ability to control head movements, roll over by himself and sit unassisted for > 5 seconds |

| • | Patient 2: data set includes assessments through week 8 timepoint |

| • | Age 4.1 years and on 17 hours of invasive ventilation per day at baseline |

S-5

Table of Contents

| • | CHOP-INTEND increased from 45 at baseline to 56 at week 8 |

| • | MIP increased from 44 cmH20 at baseline to 77 cmH20 at week 4 |

| • | Patient 3: data set includes assessments through week 4 timepoint |

| • | Age 2.6 years and on continuous (24-hour) invasive ventilation at baseline |

| • | CHOP-INTEND did not change meaningfully from 34 at baseline to 36 at week 4 |

| • | MIP increased from 26 cmH20 at baseline to 44 cmH20 at week 4 |

| • | Patient 4 (delayed-treatment control): data set includes assessments through week 4 timepoint |

| • | Age 4.0 years and on 12 hours of BiPAP per day at baseline |

| • | CHOP-INTEND did not change meaningfully from 49 at baseline to 46 at week 4 |

| • | MIP at baseline was 58 cmH20; MIP was not assessed at week 4 per protocol |

Physicians and caregivers have reported progressive qualitative improvements in disease severity in all treated patients. Ventilator settings (pressure, rate and volume of mechanical ventilation) have been reduced in Patients 1 and 2. All treated patients have demonstrated improvements in airway clearance control, including swallowing and coughing, which is critical to preventing aspiration. By way of example, at baseline Patient 1 required suctioning of the oro-pharyngeal cavity several times per hour, and by week 12 he required no suctioning. In addition, investigators report anecdotally that all treated patients have increased limb and trunk strength, which is an early indicator of gross motor function improvement, and that the velocity and accuracy of their movements have increased. Caregivers also report that patients have increased vocalization, improving their ability to communicate.

AT132 has been granted orphan drug designation in both the United States and European Union, and the FDA has granted Rare Pediatric Disease and Fast Track designations.

AT342. Crigler-Najjar is a rare, congenital autosomal recessive monogenic disease characterized by severely high levels of bilirubin in the blood, which presents a significant risk of irreversible neurological

S-6

Table of Contents

damage and death. The average life expectancy is reported as being 30 years of age with phototherapy. Crigler-Najjar is estimated to affect approximately one in 1,000,000 newborns. Infants with Crigler-Najjar develop severe jaundice shortly after birth resulting in rapid presentation and diagnosis. Crigler-Najjar is caused by mutations in the gene encoding the UGT1A1 (uridine-diphosphate (UDP)-glucuronosyltransferase (UGT) 1A1) enzyme resulting in an inability to convert unconjugated bilirubin to a water-soluble form that can be excreted from the body. Clinical diagnosis is confirmed via genetic testing of the UGT1A1 gene. The current standard of care for Crigler-Najjar is aggressive management of high bilirubin levels with persistent, daily phototherapy, usually for longer than 10 to 12 hours per day using intense fluorescent light focused on the bare skin, while the eyes are shielded. Phototherapy speeds bilirubin decomposition and excretion and lowers serum bilirubin, but wanes in effectiveness as children age due to thickening of the skin and reduction in surface area to body mass ratio. Data from our prospective natural history study LUSTRO demonstrate that persistent phototherapy only reduces bilirubin to levels just below those that are considered to be neurotoxic. In some cases, a liver transplant may be required for survival.

We are developing AT342, an AAV8 vector containing a functional version of the UGT1A1 gene. We have conducted a dose ranging study of AT342 in a Crigler-Najjar knockout mouse model. In this study, a single tail vein injection of AT342 rapidly reduced and normalized bilirubin levels for the duration of the study, an effect that was seen across a range of doses. Previously reported results demonstrate that administration of AAV8-UGT1A1 in newborn Crigler-Najjar mice significantly and durably reduced bilirubin levels, even at UGT1A1 liver expression levels of just five to eight percent of normal. We are advancing AT342 with the goal of administering a single dose that results in a robust, durable reduction in serum bilirubin, a reduction in or elimination of lengthy daily phototherapy, and elimination of the need for a liver transplant. We believe that serum bilirubin levels will be a clinically relevant endpoint and that determination of efficacy of AT342 will be straightforward due to the ease and reliability of measurement.

The IND for AT342 is active, and we have initiated LUSTRO, a prospective natural history-run-in study designed to characterize the disease course, natural history, bilirubin variability and phototherapy usage of patients with Crigler-Najjar. In November 2017, we reported interim data from the LUSTRO study, which confirm the significant risks posed by elevated bilirubin levels in Crigler-Najjar patients and the significant burden on patients and their families that must configure their lives to ensure rigorous adherence to phototherapy of more than 10 to 12 hours per day. We plan to initiate VALENS, the Phase 1/2 clinical study of AT342, in the first quarter of 2018, and to report preliminary clinical data from VALENS in the second quarter of 2018. AT342 has been granted orphan drug designation in both the United States and European Union.

AT982. Pompe disease is a serious, progressive genetic disease characterized by severe muscle weakness, respiratory failure leading to ventilator dependence and, in infants, increased cardiac mass and heart failure. In untreated infants, the disease is often fatal due to cardio-respiratory failure within the first year of life, and in adults the disease is progressive and life-limiting with significant ventilator and wheelchair use. Pompe disease is caused by mutations in the gene encoding the lysosomal enzyme alpha-glucosidase, or GAA, which results in a deficiency of GAA protein and leads to the accumulation of glycogen. The incidence of Pompe disease is approximately one in 40,000 births. The only approved treatment for Pompe disease is enzyme replacement therapy, or ERT, which is a chronic treatment delivered in bi-weekly intravenous infusions. Despite the availability of ERT, significant medical need persists, which is primarily due to the inability of ERT to penetrate key tissues affected by the disease and the immunogenicity of ERT. We believe that gene therapy may address many of these limitations because of the ability of AAV to penetrate relevant tissues in Pompe disease and to produce GAA protein intracellularly, which we expect will result in an improved safety and efficacy profile.

Recently published studies have described new gene therapy approaches to treating Pompe disease with gene therapy vectors that target tissues beyond skeletal and cardiac muscle, which may be of relevance in the

S-7

Table of Contents

disease. While prior work conducted in collaboration with the University of Florida evaluated candidate vectors designed to target only muscle, we have recently independently initiated a comprehensive construct selection study in the Pompe mouse model, wherein we are evaluating both AAV8 and AAV9 capsid serotypes in novel candidate vectors designed to systemically target GAA expression in a range of tissues, including skeletal and cardiac muscle, motor neurons and the liver. We are evaluating these vectors at multiple doses utilizing a broad battery of neuromuscular function and biochemical assays, and anticipate the full results of this study in the first quarter of 2018. We plan to file an IND for the selected candidate construct in the second quarter of 2018 and to initiate a Phase 1/2 clinical study in Pompe patients in the fourth quarter of 2018. We hold exclusive global rights to both AAV8 and AAV9 in Pompe disease from REGENXBIO, and AT982 has been granted orphan drug designation in both the United States and European Union.

AT307. CASQ2-CPVT is a rare monogenic disease that is characterized by life-threatening arrhythmias that may lead to sudden cardiac death. There are currently only limited treatment options with variable efficacy for patients suffering from CPVT, including beta-blockers and a sodium channel blocker, Flecainide. The autosomal recessive form of the disease is caused by mutations in the calsequestrin 2 gene, or CASQ2 gene, and is characterized by stress-induced heartbeat rhythm changes in an otherwise structurally normal heart. It is estimated that CPVT occurs in one in 10,000 people, with approximately 2% to 5% due to mutations in the CASQ2 gene. This equates to an approximate prevalence of 6,000 affected people in North America, Europe and other addressable markets. Despite treatment with anti-arrhythmia therapies, sympathectomy and implantable cardiac defibrillators, a significant portion of the patients remain symptomatic. We are developing AT307, an AAV9 vector containing a functional version of the CASQ2 gene. Preclinical data in murine models of the disease demonstrated an ability to prevent ventricular tachycardia through restoration of CASQ2 protein expression. We are advancing AT307 with the goal of providing a single administration of AT307 that results in a significant reduction in life-threatening arrhythmic events and a major improvement in quality of life.

We are conducting IND-enabling studies of AT307 and plan to file an IND in the first quarter of 2018. We are also conducting ongoing initiatives around CASQ2-CPVT patient identification and disease burden. In the fourth quarter of 2018 we plan to initiate a Phase 1/2 clinical study to evaluate the safety of AT307 in patients with CASQ2-CPVT and to use the efficacy endpoint of an exercise electrocardiogram, which we believe provides a clear means to evaluate therapeutic benefit. AT307 has been granted orphan drug designation in both the United States and European Union.

Although we believe our product candidates have the potential to provide long-term improvement in patient symptoms with a single administration, we continue to conduct preclinical studies and clinical trials to determine the safety and efficacy profiles of our product candidates. The results of on-going and future studies may be different than the results of our earlier studies and trials. We have not received regulatory approval for any of our product candidates, and in order to obtain regulatory approval and commercialize our product candidates, the FDA or foreign regulatory agencies will need to determine that our product candidates are safe and effective. To date, only one gene therapy product has been approved in the United States and two have been approved in Europe.

We have a focused, passionate team with collective expertise in gene therapy, rare disease drug development and commercialization, and biologics manufacturing. Matthew Patterson, our President, Chief Executive Officer and Co-Founder, is a biotechnology leader with over 20 years of experience at Genzyme Corporation, BioMarin Pharmaceutical, Amicus Therapeutics and our company.

Recent Developments

In August 2017, we entered into an “at-the-market” program and sales agreement with Cowen and Company, LLC, under which the Company may, from time to time, offer and sell common stock having an

S-8

Table of Contents

aggregate offering value of up to $75.0 million, referred to as our “at-the-market” offering. During the three months ended September 30, 2017, the Company sold 1,867,920 shares of common stock under the ATM for aggregate net proceeds of $36.4 million. In October 2017, the Company sold 110,441 additional shares of common stock under the ATM for aggregate net proceeds of $2.7 million. On January 14, 2018, we suspended, and during the duration of this offering we are no longer offering, any shares of our common stock pursuant to the prospectus supplement filed with the SEC on August 8, 2017 pursuant to Rule 424(b)(5) relating to the Sales Agreement with Cowen and Company, LLC, dated as of August 8, 2017.

On January 5, 2018, after evaluating the efficacy and safety profile of the first three patients dosed at 1x1014 vector genomes (vg) per kilogram (kg), we recommended to the independent Data Monitoring Committee, or DMC, of ASPIRO, and the DMC agreed, that we proceed with dosing in ASPIRO by expanding the first dose cohort with an additional three patients and extending the steroid regimen with which we treat patients in ASPIRO. We plan to report the next interim data from ASPIRO in the second quarter of 2018.

While we have not finalized our full financial results for the year ended December 31, 2017, we expect to report that we had approximately $133.6 million of cash, cash equivalents and short-term investments as of December 31, 2017. This amount is preliminary, has not been audited and is subject to change. Additional information and disclosures would be required for a more complete understanding of our financial position and results of operations as of December 31, 2017.

Our Strategy

Our strategy is to leverage the expertise of our team and the transformative potential of gene therapy technology to develop treatments that improve outcomes for patients with serious, life-threatening rare diseases. Key elements of our strategy are:

| • | Focus on serving patients. We take pride in our efforts to harness the transformative potential of gene therapy to improve the lives of patients suffering from devastating rare diseases. We intend to continue to engage with patient advocacy groups to better understand the burden of disease and align our efforts with the needs of patients and caregivers. |

| • | Advance our lead product candidates through clinical development. We have initiated ASPIRO, the Phase 1/2 clinical study of AT132 in XLMTM, and plan to initiate VALENS, the Phase 1/2 clinical study of AT342 for the treatment of Crigler-Najjar in the first quarter of 2018. We are conducting IND-enabling preclinical studies of AT307 to treat CASQ2-CPVT, and AT982 to treat Pompe disease, and plan to file INDs for these programs in the first and second quarter of 2018, respectively. Over time, we plan to develop and commercialize a broad portfolio of gene therapy product candidates to treat serious, life-threatening rare diseases with high unmet medical need. |

| • | Continue to expand our pipeline with additional gene therapy product candidates targeting serious, life-threatening rare diseases. We intend to continue leveraging our expertise and focused selection criteria to expand our pipeline of product candidates. Our relationships with leading academic institutions and other rare disease companies are an important component of our strategy for sourcing additional product candidates. |

| • | Continue to build our proprietary manufacturing capabilities and invest in a state-of-the-art cGMP facility. We believe the quality, reliability and scalability of our gene therapy manufacturing approach will be a core competitive advantage crucial to our long-term success. We manufacture all of the clinical supply for our product candidates at our state-of-the-art, multi-product internal manufacturing facility that has been designed to support commercial licensure by both the U.S. Food and Drug Administration and the European Medicines Agency. |

S-9

Table of Contents

Our Strengths

We believe our leadership position is based on our following strengths:

| • | Rare disease expertise. Led by a management team with over 100 years of combined experience in rare diseases, we are building a fully integrated and industry-leading biotechnology company. Leveraging recent developments in gene therapy, we aim to provide durable and meaningful treatment options to patients suffering from rare monogenic diseases. |

| • | Highly focused selection criteria for development programs. We employ a disciplined approach to select and expand our pipeline of product candidates. We believe the application of our selection criteria enables the efficient, cost-effective and successful development of our product candidates. |

| • | Promising product candidate pipeline. We have built a compelling pipeline, and are currently conducting a Phase 1/2 clinical study of our lead product candidate AT132 for the treatment of X-Linked Myotubular Myopathy, or XLMTM. We have three additional product candidates in development, including AT342 for the treatment of Crigler-Najjar Syndrome, AT982 for the treatment of Pompe disease, and AT307 for the treatment of the CASQ2 subtype of Catecholaminergic Polymorphic Ventricular Tachycardia, or CASQ2-CPVT. |

| • | Proprietary know-how and capabilities. Our proprietary manufacturing capabilities provide a major core strategic advantage, including better control over the cost and timelines of developing our product candidates, superior protection of novel inventions and intellectual property, and expanded possibilities for new programs and partnerships. |

| • | Broad network. We believe our strong relationships with key opinion leaders and patient advocacy groups will support our product development efforts and our potential for future commercial success. Leveraging our collaborations with these parties allows us to better understand the diseases we target and optimize our research, clinical development and commercial plans. |

Risks Related to Our Business

Our business is subject to numerous risks and uncertainties, including those highlighted in and incorporated by reference into the section entitled “Risk Factors” immediately following this prospectus supplement summary. These risks include, but are not limited to, the following:

| • | we have a limited operating history and are very early in our development efforts, and we may be unable to develop, obtain regulatory approval for and ultimately commercialize our product candidates; |

| • | we have only just initiated clinical trials in our lead program, and success in early preclinical or clinical studies may not be indicative of results obtained in later preclinical and clinical studies; |

| • | if we do not achieve our projected development goals in the time frames we announce and expect, the commercialization of our products may be delayed and, as a result, our stock price may decline; |

| • | our product candidates are based on a novel AAV gene therapy technology with which there is little clinical experience, which makes it difficult to predict the time and cost of product candidate development and subsequently obtaining regulatory approval; |

S-10

Table of Contents

| • | ethical and legal concerns about gene therapy and genetic testing may result in additional regulations or restrictions on the development and commercialization of our product candidates; |

| • | even if we complete the necessary clinical trials, we cannot predict when, or if, we will obtain regulatory approval to commercialize a product candidate and the approval may be for a more narrow indication than we seek; |

| • | delays or disruptions in our manufacturing operations may delay or disrupt our development and commercialization efforts; |

| • | we may not be successful in our efforts to build a pipeline of additional product candidates; |

| • | if we are unable to obtain and maintain patent protection for our products and technology, or if the scope of the patent protection obtained is not sufficiently broad, our competitors could develop and commercialize products and technology similar or identical to ours, and our ability to successfully commercialize our products and technology may be adversely affected; |

| • | there have been several adverse side effects identified in clinical trials for other gene therapy product candidates in the past, and our product candidates, which are based on gene therapy technology, may cause undesirable and unforeseen side effects or be perceived by the public as unsafe; |

| • | we have a history of operating losses, and we may not achieve or sustain profitability; and |

| • | all of our current product candidates are licensed from or based upon licenses from third parties, and if any of these license or sublicense agreements are terminated or interpreted to narrow our rights, our ability to advance our current product candidates or develop new product candidates based on these technologies will be materially adversely affected. |

Corporate Information

We were incorporated in Delaware in November 2012. Our principal executive offices are located at 600 California Street, 17th Floor, San Francisco, California 94108, and our telephone number is (415) 818-1001. Our website address is www.audentestx.com. The information contained on, or that can be accessed through, our website is not a part of this prospectus. Investors should not rely on any such information in deciding whether to purchase our common stock.

Implications of Being an Emerging Growth Company

As a company with less than $1.07 billion in revenue during our most recently completed fiscal year, we qualify as an “emerging growth company” as defined in Section 2(a) of the Securities Act of 1933, or the Securities Act, as modified by the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. As an emerging growth company, we may take advantage of certain exemptions from various public company reporting requirements, including:

| • | an exemption from compliance with the auditor attestation requirement on the effectiveness of our internal control over financial reporting; |

| • | an exemption from compliance with any requirement that the Public Company Accounting Oversight Board may adopt regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements; |

S-11

Table of Contents

| • | reduced disclosure about our executive compensation arrangements; and |

| • | exemptions from the requirements to obtain a non-binding advisory vote on executive compensation or a stockholder approval of any golden parachute arrangements. |

We may take advantage of these exemptions for up to five years after our initial public offering or such earlier time that we are no longer an emerging growth company. Accordingly, the information contained and incorporated by reference herein may be different than the information you receive from other public companies in which you hold stock. We would cease to be an emerging growth company upon the earliest to occur of: the last day of the fiscal year in which we have more than $1.07 billion in annual revenue; the date we qualify as a “large accelerated filer,” with at least $700 million of equity securities held by non-affiliates; the issuance, in any three- year period, by us of more than $1.0 billion in non-convertible debt securities; and the last day of the fiscal year ending after the fifth anniversary of our initial public offering.

The JOBS Act also permits us, as an emerging growth company, to take advantage of an extended transition period to comply with new or revised accounting standards applicable to public companies and thereby allows us to delay the adoption of those standards until those standards would apply to private companies. We have irrevocably elected not to avail ourselves of this exemption from new or revised accounting standards and, therefore, will be subject to the same new or revised accounting standards as other public companies that are not emerging growth companies.

S-12

Table of Contents

The Offering

| Common stock offered by us |

shares. |

| Common stock to be outstanding immediately after this offering |

shares. |

| Option to purchase additional shares |

We have granted to the underwriters the option, exercisable for 30 days, to purchase up to additional shares of our common stock. |

| Use of proceeds |

We currently intend to use the net proceeds from this offering to advance our full pipeline of product candidates, including: AT132 for the treatment of XLMTM through the interim six-month results from the ongoing ASPIRO trial; AT342 for the treatment of Crigler-Najjar through the interim six-month results from the planned VALENS trial; AT982 for the treatment of Pompe disease through the initiation of a Phase 1/2 clinical trial in the fourth quarter of 2018; AT307 for the treatment of CASQ2-CPVT through the initiation of a Phase 1/2 clinical trial in the fourth quarter of 2018; to improve our internal manufacturing capabilities; and for working capital and other general corporate purposes. See the section entitled “Use of Proceeds.” |

| Risk factors |

You should read the section entitled “Risk Factors” and other information included in this prospectus supplement for a discussion of factors you should consider carefully before deciding to invest in shares of our common stock. |

| Nasdaq symbol |

“BOLD” |

The number of shares of our common stock to be outstanding following this offering is based on 29,733,838 shares of our common stock outstanding as of September 30, 2017 and excludes:

| • | 110,441 shares of our common stock issued pursuant to sales made through our “at-the-market” offering after September 30, 2017; |

| • | 3,689,020 shares of our common stock issuable upon the exercise of outstanding options as of September 30, 2017, with a weighted-average exercise price of approximately $9.92 per share; |

| • | 1,536,311 shares of our common stock issuable upon the exercise of outstanding options granted after September 30, 2017, with a weighted-average exercise price of approximately $27.48 per share; |

| • | 9,914 shares of our common stock issuance upon the exercise of an outstanding warrant, with an exercise price of $15.13 per share; |

| • | 317,437 shares of common stock reserved for future issuance under our stock-based compensation plans as of September 30, 2017, consisting of (i) 107,437 shares of common stock reserved for future issuance under our 2016 Equity Incentive Plan as of September 30, 2017 (consisting of 1,643,748 shares reserved as of September 30, 2017, reduced by 1,536,311 shares underlying stock options granted after September 30, 2017) and (ii) 210,000 shares of common stock reserved for future issuance under our 2016 Employee Stock Purchase Plan; and |

S-13

Table of Contents

| • | 1,495,069 shares of additional common stock reserved for future issuance under our 2016 Equity Incentive Plan pursuant to the automatic annual increase in the number of shares reserved under the plan of 5% of the total shares outstanding that took place January 1, 2018. |

Unless otherwise noted, the information in this prospectus supplement assumes no exercise of outstanding options or warrants and no exercise of the underwriters’ option to purchase additional shares.

S-14

Table of Contents

Investing in our common stock involves a high degree of risk. You should consider carefully the risks and uncertainties described below and in our Quarterly Report on Form 10-Q for the year ended September 30, 2017, which is incorporated by reference into this prospectus supplement, together with all of the other information included in or incorporated by reference into this prospectus supplement or the accompanying prospectus, including the consolidated financial statements, the notes thereto and the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the documents incorporated by reference into this prospectus supplement before deciding whether to invest in shares of our common stock. The risks and uncertainties described below and incorporated by reference into this prospectus supplement are not the only ones we face. Additional risks and uncertainties that we are unaware of or that we deem immaterial may also become important factors that adversely affect our business. If any of the following risks actually occur, our business, financial condition, results of operations and future prospects could be materially and adversely affected. In that event, the market price of our stock could decline, and you could lose part or all of your investment.

Risks Related to Our Financial Position

Comprehensive tax reform bills could increase the tax burden on our orphan drug programs and adversely affect our business and financial condition.

The U.S. government has recently enacted comprehensive tax legislation that includes significant changes to the taxation of business entities. These changes include, among others, (i) a permanent reduction to the corporate income tax rate, (ii) a partial limitation on the deductibility of business interest expense, (iii) a shift of the U.S. taxation of multinational corporations from a tax on worldwide income to a territorial system (along with certain rules designed to prevent erosion of the U.S. income tax base) and (iv) a one-time tax on accumulated offshore earnings held in cash and illiquid assets, with the latter taxed at a lower rate.

Further, the newly enacted comprehensive tax legislation, among other things, reduces the orphan drug credit from 100% to 50% of qualifying expenditures. When and if we become profitable, this reduction in tax credits may result in an increased federal income tax burden on our orphan drug programs as it may cause us to pay federal income taxes earlier under the revised tax law than under the prior law and, despite being partially off-set by a reduction in the corporate tax rate from a top marginal rate of 35% to a flat rate of 21%, may increase our total federal tax liability attributable to such programs.

Notwithstanding the reduction in the corporate income tax rate, the overall impact of this tax reform is uncertain, and our business and financial condition could be adversely affected. In addition, it is uncertain if and to what extent various states will conform to the newly enacted federal tax law. This prospectus supplement does not discuss any such tax legislation or the manner in which it might affect purchasers of our common stock. We urge our stockholders to consult with their legal and tax advisors with respect to any such legislation and the potential tax consequences of investing in our common stock.

Risks Related to Our Business

The insurance coverage and reimbursement status of newly-approved gene therapy products is uncertain. We may not be able to obtain or maintain adequate coverage and reimbursement for our product candidate(s), if approved.

It is difficult to predict what third-party payors will decide with respect to coverage and reimbursement for our product candidates, as gene and cell therapies are novel products that are generally anticipated to establish premium pricing and are initially intended as a one-time single administration. In the United States, Luxturna, a gene therapy product manufactured by Spark Therapeutics, Inc., was approved for marketing by the FDA in

S-15

Table of Contents

December 2017. In October 2017, the FDA approved Yescarta, an additional CAR-T cell therapy product manufactured by Kite Pharma, Inc. Kymriah, a CAR-T cell therapy product manufactured by Novartis AG, was approved for marketing by the FDA in August 2017. While there is no body of established pricing and reimbursement practices for these novel gene and cell therapy products, and no uniform policy of coverage and reimbursement exists among third-party payors, these products may establish a pricing and reimbursement precedent for our product candidates, if approved. The Centers for Medicare and Medicaid Services, or CMS, administers the Medicare and Medicaid programs, which are increasingly used as models for how private payors develop their coverage and reimbursement policies, but coverage and reimbursement for products can differ significantly from payor to payor. It is difficult to predict what the CMS will decide with respect to coverage and reimbursement for a fundamentally novel gene therapy product such as ours, or how the CMS’s decision will affect our ability to obtain coverage and adequate reimbursement from other third-party payors, if any of our product candidates receive FDA approval. Moreover, reimbursement agencies in the European Union may be more conservative than the CMS. For example, several cancer drugs have been approved for reimbursement in the United States but have not been approved for reimbursement in certain European Union Member States.

Investors should not place undue reliance on the results of preclinical experiments or interim results from ASPIRO, our ongoing Phase 1/2 clinical study of AT132 to treat XLMTM, since preliminary data may not be predictive of future results that we plan will form the basis of our global regulatory approval packages, and our product candidates may not receive regulatory approval.

As of the December 21, 2017 data cutoff, the first dose cohort of ASPIRO, an ongoing Phase 1/2 clinical study of AT132 in XLMTM patients, included three patients with XLMTM dosed at 1x1014 vector genomes (vg) per kilogram (kg), and one delayed-treatment control patient. There have been a total of eight AEs reported in ASPIRO, four of which were determined to be SAEs. All SAEs occurred in Patient 3, the first of which was a hospitalization one week post-administration due to pneumonia and was deemed not treatment related.

On January 4, 2018, we reported that Patient 3 was also hospitalized at week seven post-administration due to a gastrointestinal infection and elevated troponin levels, the latter of which was deemed a probably treatment-related SAE and was responding to treatment with intravenous steroid administration and supportive care.

On January 11, 2018, the clinical investigator responsible for managing Patient 3 determined that the adverse events that contributed to the week seven hospitalization should be recategorized as three distinct SAEs, related to each other and deemed to be probably treatment-related. These include myocarditis, elevated troponin levels and mildly elevated creatinine kinase levels, each of which have resolved. Patient 3 was clinically stable throughout the hospital admission and has now been discharged from the hospital.

Of the four non-serious AEs, two have been determined to be probably or possibly treatment-related. Patient 1 experienced a mild, clinically asymptomatic exacerbation of a pre-existing elevated bilirubin level, which was deemed possibly treatment-related and resolved with treatment. Patient 2 experienced a clinically asymptomatic elevation in liver enzyme levels toward the end of the protocol-specified prednisolone weaning period, which was deemed to be probably treatment-related and was controlled by extending the duration of steroid coverage. However, investors should not place undue reliance on the results from completed preclinical studies or interim results from ASPIRO, since they do not ensure that other clinical study data will be comparable, in terms of safety, tolerability, efficacy or other factors the FDA and other regulators will consider in determining whether to approve a BLA for AT132. In addition, data obtained from preclinical and clinical studies are subject to varying interpretations. If the FDA were to interpret data from ASPIRO differently than we do, the clinical development or regulatory approval of our product candidates may be delayed, limited or prevented. While we believe that our ASPIRO Phase 1/2 clinical study is appropriately designed to evaluate the safety, tolerability and preliminary efficacy of AT132 in XLMTM patients, the FDA may disagree with us, require additional information or studies to be conducted, or impose conditions that could delay, restrict or halt our ongoing ASPIRO study or other planned clinical activities.

S-16

Table of Contents

The final dataset, upon which global regulatory decisions will be based, will differ from the datasets previously disclosed. Reasons for these differences may include, but are not limited to:

| • | the December 21, 2017 interim dataset includes a small sample size with an initial cohort of three treated patients and one delayed-treatment control patient, and results from longer term follow-up in this first dose cohort, or results from future cohorts, may be reinterpreted or may not be replicated; |

| • | not all patients may demonstrate improvement; |

| • | patients may discontinue their involvement in ASPIRO for a number of reasons, including disease progression following a response or a lack of clinical benefit, or despite positive outcomes, could become lost to follow up. Any such discontinuations will impact the amount of data we may collect over time; |

| • | additional time and patient accrual provide new opportunities to capture new adverse events and further characterize the safety and efficacy of AT132; and |

| • | the precise composition of the final dataset is subject to additional regulatory feedback, which is expected closer to the time of a BLA, or equivalent, and the advice may vary by regulatory authority. |

As a result, the efficacy and safety profile of AT132 has not been established, and may differ from any interim dataset publicly disclosed. Moreover, regulatory approvals will be based on the final efficacy and safety databases, and as such, we can give no assurance that AT132 or any of our product candidates will receive regulatory approval.

Risks Related to this Offering

Our management will have broad discretion over the use of the proceeds we receive in this offering and might not apply the proceeds in ways that increase the value of your investment.

Our management will have broad discretion to use the net proceeds from this offering, including for any of the purposes described in the section entitled “Use of Proceeds,” and you will be relying on the judgment of our management regarding the application of these proceeds. You will not have the opportunity to influence our decisions on how to use the proceeds, and we may not apply the net proceeds of this offering in ways that increase the value of your investment. Because of the number and variability of factors that will determine our use of the net proceeds from this offering, their ultimate use may vary substantially from their currently intended use. The failure by our management to apply these funds effectively could harm our business. Pending their use, we intend to invest the net proceeds from this offering in marketable securities that may include investment-grade interest-bearing securities, money market accounts, certificates of deposit, commercial paper and guaranteed obligations of the U.S. government. These investments may not yield a favorable return to our stockholders. If we do not invest or apply the net proceeds from this offering in ways that enhance stockholder value, we may fail to achieve expected financial results, which could cause our stock price to decline.

If you purchase our common stock in this offering, you will incur immediate and substantial dilution in the book value of your shares.

You will suffer immediate and substantial dilution in the net tangible book value of our common stock you purchase in this offering. Assuming a public offering price of $ per share, the last reported sale price of our common stock on The Nasdaq Global Market on , purchasers of common stock in this offering will experience immediate dilution of $ per share in net tangible book value of our common stock. In the past, we issued options, warrants and other securities to acquire common stock at prices below the public offering price. To the extent these outstanding securities are ultimately exercised, investors purchasing common stock in this offering will sustain further dilution. See “Dilution” for a more detailed description of the dilution to new investors in the offering.

S-17

Table of Contents

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement and the documents incorporated by reference into this prospectus supplement, including the sections entitled “Prospectus Supplement Summary,” “Risk Factors,” and “Use of Proceeds,” contain forward-looking statements. Forward-looking statements include all statements that are not historical facts and can be identified by the words “believe,” “may,” “will,” “potentially,” “estimate,” “continue.” “anticipate,” “intend,” “could,” “would,” “project,” “plan” “expect,” and similar expressions that convey uncertainty of future events or outcomes.

These forward-looking statements are subject to a number of risks, uncertainties, and assumptions, including those described in and incorporated by reference into “Risk Factors” and elsewhere in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein. Moreover, we operate in a very competitive and rapidly changing environment, and new risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties, and assumptions, the forward-looking events and circumstances discussed in this prospectus supplement may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements.

You should not rely upon forward-looking statements as predictions of future events. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that the future results, levels of activity, performance or events and circumstances reflected in the forward-looking statements will be achieved or occur. We undertake no obligation to update publicly any forward-looking statements for any reason after the date of this prospectus supplement to conform these statements to actual results or to changes in our expectations, except as required by law.

You should read this prospectus supplement, the accompanying prospectus and the documents incorporated by reference into this prospectus supplement and the documents that we reference in this prospectus supplement and have filed with the Securities and Exchange Commission, or SEC, as exhibits to the registration statement of which this prospectus supplement is a part, with the understanding that our actual future results, levels of activity, performance and events and circumstances may be materially different from what we expect.

S-18

Table of Contents

Unless otherwise indicated, information contained in or incorporated by reference into this prospectus supplement and the accompanying prospectus concerning our industry and the markets in which we operate is based on information from various sources, including independent industry publications. In presenting this information, we have also made assumptions based on such data and other similar sources, and on our knowledge of, and our experience to date in, the potential markets for our product candidates. The industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors, including those described in and incorporated by reference into the section entitled “Risk Factors” and in the documents incorporated by reference into this prospectus supplement. These and other factors could cause results to differ materially from those expressed in the estimates made by the independent parties and by us.

S-19

Table of Contents

We estimate that we will receive net proceeds of approximately $140.6 million from the sale of $150.0 million of the shares of our common stock offered in this offering, after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. If the underwriters exercise their option to purchase up to $22.5 million of additional shares in full, we estimate that the net proceeds of the shares we sell in this offering will be approximately $161.7 million.

We currently intend to use the net proceeds from this offering to advance our full pipeline of product candidates, including: AT132 for the treatment of XLMTM through the interim six-month results from the ongoing ASPIRO trial; AT342 for the treatment of Crigler-Najjar through the interim six-month results from the planned VALENS trial; AT982 for the treatment of Pompe disease through the initiation of a Phase 1/2 clinical trial in the fourth quarter of 2018; AT307 for the treatment of CASQ2-CPVT through the initiation of a Phase 1/2 clinical trial in the fourth quarter of 2018; to improve our internal manufacturing capabilities; and for working capital and other general corporate purposes.

We estimate that our current cash, cash equivalents, short-term investments and the net proceeds from this offering will be sufficient for us to fund our operating expenses and capital expenditure requirements through 2019.

The expected use of the net proceeds from this offering represents our intentions based upon our current plans and business conditions. As of the date of this prospectus supplement, we cannot predict with any certainty all of the particular uses for the net proceeds or the amounts that we will actually spend on the uses set forth above. We may use a portion of the net proceeds for the acquisition of, or investment in, technologies, intellectual property or businesses that complement our business, although we have no present commitments or agreements to this effect.

The amounts and timing of our future expenditures and the extent of product candidate development may vary significantly depending on numerous factors, including the status, results and timing of our current preclinical studies and clinical trials we may commence in the future, product approval process with the FDA and other regulatory agencies, our current collaborations and any new collaborations we may enter into with third parties and any unforeseen cash needs. As a result, our management will retain broad discretion over the allocation of the net proceeds from this offering.

The expected net proceeds of this offering will not be sufficient for us to fund any of our product candidates through regulatory approval, and we will need to raise substantial additional capital to complete the development and commercialization of our product candidates.

Pending their use as described above, we intend to invest the net proceeds from this offering in marketable securities that may include investment-grade interest-bearing securities, money market accounts, certificates of deposit, commercial paper and guaranteed obligations of the U.S. government.

S-20

Table of Contents

If you invest in our common stock, your ownership interest will be diluted to the extent of the difference between the public offering price per share of our common stock and the as adjusted net tangible book value per share of our common stock immediately after this offering.

As of September 30, 2017, our net tangible book value was approximately $163.6 million, or $5.50 per share of common stock. Net tangible book value per share represents the amount of our tangible assets less our liabilities divided by the total number of shares of our common stock outstanding as of September 30, 2017.

After giving effect to the sale and issuance of shares of our common stock at an assumed public offering price of $ per share, the last reported sale price of our common stock on The Nasdaq Global Market on , and after deducting estimated underwriting discounts and commissions and estimated offering expenses, our net tangible book value as of September 30, 2017 would have been approximately $ million, or $ per share of our common stock. This represents an immediate increase in net tangible book value of $ per share to our existing stockholders and an immediate dilution of $ per share to investors purchasing shares in this offering, as follows:

| Assumed public offering price per share |

$ | |||||||

| Net tangible book value per share as of September 30, 2017 |

$ | 5.50 | ||||||

| Increase in net tangible book value per share attributable to new investors in this offering |

||||||||

|

|

|

|||||||

| As adjusted net tangible book value per share after this offering |

||||||||

|

|

|

|||||||

| Dilution in net tangible book value per share to investors in this offering |

$ | |||||||

|

|

|

If the underwriters exercise their option to purchase additional shares in full, our as adjusted net tangible book value per share after this offering would be $ per share, and the dilution in net tangible book value per share to new investors in this offering would be $ per share.

The number of shares of our common stock to be outstanding after this offering excludes:

| • | 110,441 shares of our common stock issued pursuant to sales made through our “at-the-market” offering after September 30, 2017; |

| • | 3,689,020 shares of our common stock issuable upon the exercise of outstanding options as of September 30, 2017, with a weighted-average exercise price of approximately $9.92 per share; |

| • | 1,536,311 shares of our common stock issuable upon the exercise of outstanding options granted after September 30, 2017, with a weighted-average exercise price of approximately $27.48 per share; |

| • | 9,914 shares of our common stock issuance upon the exercise of an outstanding warrant, with an exercise price of $15.13 per share; |

| • | 317,437 shares of common stock reserved for future issuance under our stock-based compensation plans as of September 30, 2017, consisting of (i) 107,437 shares of common stock reserved for future issuance under our 2016 Equity Incentive Plan as of September 30, 2017 (consisting of 1,643,748 shares reserved as of September 30, 2017, reduced by 1,536,311 shares underlying stock options granted after September 30, 2017) and (ii) 210,000 shares of common stock reserved for future issuance under our 2016 Employee Stock Purchase Plan; and |

| • | 1,495,069 shares of additional common stock reserved for future issuance under our 2016 Equity Incentive Plan pursuant to the automatic annual increase in the number of shares reserved under the plan of 5% of the total shares outstanding that took place January 1, 2018. |

S-21

Table of Contents

MATERIAL U.S. FEDERAL INCOME TAX CONSIDERATIONS FOR NON-U.S. HOLDERS OF COMMON STOCK

This section summarizes the material U.S. federal income tax considerations relating to the acquisition, ownership and disposition of our common stock by “non-U.S. holders” (as defined below) pursuant to this offering. This summary does not provide a complete analysis of all potential U.S. federal income tax considerations relating thereto. The information provided below is based upon provisions of the Internal Revenue Code of 1986, as amended (the “Code”), Treasury regulations promulgated thereunder, administrative rulings and judicial decisions currently in effect. These authorities may change at any time, possibly retroactively, or the Internal Revenue Service, or IRS, might interpret the existing authorities differently. In either case, the tax considerations of owning or disposing of our common stock could differ from those described below. As a result, we cannot assure you that the tax consequences described in this discussion will not be challenged by the IRS or will be sustained by a court if challenged by the IRS.

This summary does not address the tax considerations arising under the laws of any non-U.S., state or local jurisdiction, or under U.S. federal gift and estate tax laws, except to the limited extent provided below. In addition, this discussion does not address tax considerations applicable to an investor’s particular circumstances or to investors that may be subject to special tax rules, including, without limitation:

| • | banks, insurance companies or other financial institutions; |

| • | partnerships or entities or arrangements treated as partnerships or other pass-through entities for U.S. federal tax purposes (or investors in such entities); |

| • | corporations that accumulate earnings to avoid U.S. federal income tax; |

| • | persons subject to the alternative minimum tax or medicare contribution tax; |

| • | tax-exempt organizations or tax-qualified retirement plans; |

| • | controlled foreign corporations or passive foreign investment companies; |

| • | persons who acquired our common stock as compensation for services; |

| • | dealers in securities or currencies; |

| • | traders in securities that elect to use a mark-to-market method of accounting for their securities holdings; |

| • | persons that own, or are deemed to own, more than 5% of our capital stock (except to the extent specifically set forth below); |

| • | certain former citizens or long-term residents of the United States; |

| • | persons who hold our common stock as a position in a hedging transaction, “straddle,” “conversion transaction” or other risk reduction transaction; |

| • | persons who do not hold our common stock as a capital asset within the meaning of Section 1221 of the Code (generally, for investment purposes); or |

| • | persons deemed to sell our common stock under the constructive sale provisions of the Code. |

S-22

Table of Contents

In addition, if a partnership or entity classified as a partnership for U.S. federal income tax purposes is a beneficial owner of our common stock, the tax treatment of a partner in the partnership or an owner of the entity will depend upon the status of the partner or other owner and the activities of the partnership or other entity. Accordingly, this summary does not address tax considerations applicable to partnerships that hold our common stock, and partners in such partnerships should consult their tax advisors.

INVESTORS CONSIDERING THE PURCHASE OF OUR COMMON STOCK SHOULD CONSULT THEIR OWN TAX ADVISORS REGARDING THE APPLICATION OF THE U.S. FEDERAL INCOME AND ESTATE TAX LAWS TO THEIR PARTICULAR SITUATIONS AND THE CONSEQUENCES OF FOREIGN, STATE OR LOCAL LAWS, AND TAX TREATIES.

Non-U.S. Holder Defined

For purposes of this summary, a “non-U.S. holder” is any holder of our common stock, other than a partnership, that is not:

| • | an individual who is a citizen or resident of the United States; |

| • | a corporation, or other entity taxable as a corporation for U.S. federal income tax purposes, created or organized under the laws of the United States, any state therein or the District of Columbia; |

| • | a trust if it (1) is subject to the primary supervision of a U.S. court and one of more U.S. persons have authority to control all substantial decisions of the trust or (2) has a valid election in effect under applicable U.S. Treasury regulations to be treated as a U.S. person; or |

| • | an estate whose income is subject to U.S. income tax regardless of source. |