Form 8-K VERINT SYSTEMS INC For: Dec 06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 6, 2017

Verint Systems Inc.

(Exact name of registrant as specified in its charter)

001-34807

(Commission File Number)

Delaware | 11-3200514 | |

(State or other jurisdiction of incorporation) | (I.R.S. Employer Identification No.) | |

175 Broadhollow Road, Melville, New York | 11747 | |

(Address of principal executive offices) | (Zip code) | |

(631) 962-9600

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨ | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 7.01 Regulation FD Disclosure.

On December 6, 2017, Verint Systems Inc. disclosed presentation slides that will be used in certain investor relations presentations beginning on and after that date. Copies of the presentation slides are attached as Exhibit 99.1 hereto and incorporated by reference into this Item 7.01 in their entirety.

The presentation slides attached as Exhibit 99.1 hereto are being furnished herewith and shall not be deemed to be "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

Exhibit | ||

Number | Description | |

99.1 | Presentation Slides | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

VERINT SYSTEMS INC. | ||||

Date: | December 6, 2017 | |||

By: | /s/ Douglas E. Robinson | |||

Name: | Douglas E. Robinson | |||

Title: | Chief Financial Officer | |||

EXHIBIT INDEX

Exhibit | ||

Number | Description | |

© 2014 Verint Systems Inc. All Rights Reserved Worldwide.

© 2017 Verint Systems Inc. All Rights Reserved Worldwide.

December 2017

Actionable Intelligence®

© 2017 Verint Systems Inc. All Rights Reserved Worldwide.

Disclaimers

Forward Looking Statements

This presentation contains "forward-looking statements," including statements regarding expectations, predictions, views,

opportunities, plans, strategies, beliefs, and statements of similar effect relating to Verint Systems Inc. These forward-

looking statements are not guarantees of future performance and they are based on management's expectations that

involve a number of known and unknown risks, uncertainties, assumptions, and other important factors, any of which could

cause our actual results to differ materially from those expressed in or implied by the forward-looking statements. The

forward-looking statements contained in this presentation are made as of the date of this presentation and, except as

required by law, Verint assumes no obligation to update or revise them, or to provide reasons why actual results may differ.

For a more detailed discussion of how these and other risks, uncertainties, and assumptions could cause Verint’s actual

results to differ materially from those indicated in its forward-looking statements, see Verint’s prior filings with the

Securities and Exchange Commission.

Non-GAAP Financial Measures

This presentation includes financial measures which are not prepared in accordance with generally accepted accounting

principles (“GAAP”), including certain constant currency measures. For a description of these non-GAAP financial

measures, including the reasons management uses each measure, and reconciliations of these non-GAAP financial

measures to the most directly comparable financial measures prepared in accordance with GAAP, please see the

appendices to this presentation, Verint’s earnings press releases, as well as the GAAP to non-GAAP reconciliation found

under the Investor Relations tab on Verint’s website www.verint.com.

2

© 2017 Verint Systems Inc. All Rights Reserved Worldwide. 3

Crucial insights that enable decision-makers to

anticipate, respond and take action

Actionable

Intelligence

© 2017 Verint Systems Inc. All Rights Reserved Worldwide. 4

Global Market Leader

Over 10,000

Organizations in

More Than 180

Countries

$1 Billion+

Actionable

Intelligence

Company

5,000

Verint

Professionals

Worldwide

Over 80%

of the

Fortune 100

© 2017 Verint Systems Inc. All Rights Reserved Worldwide. 5

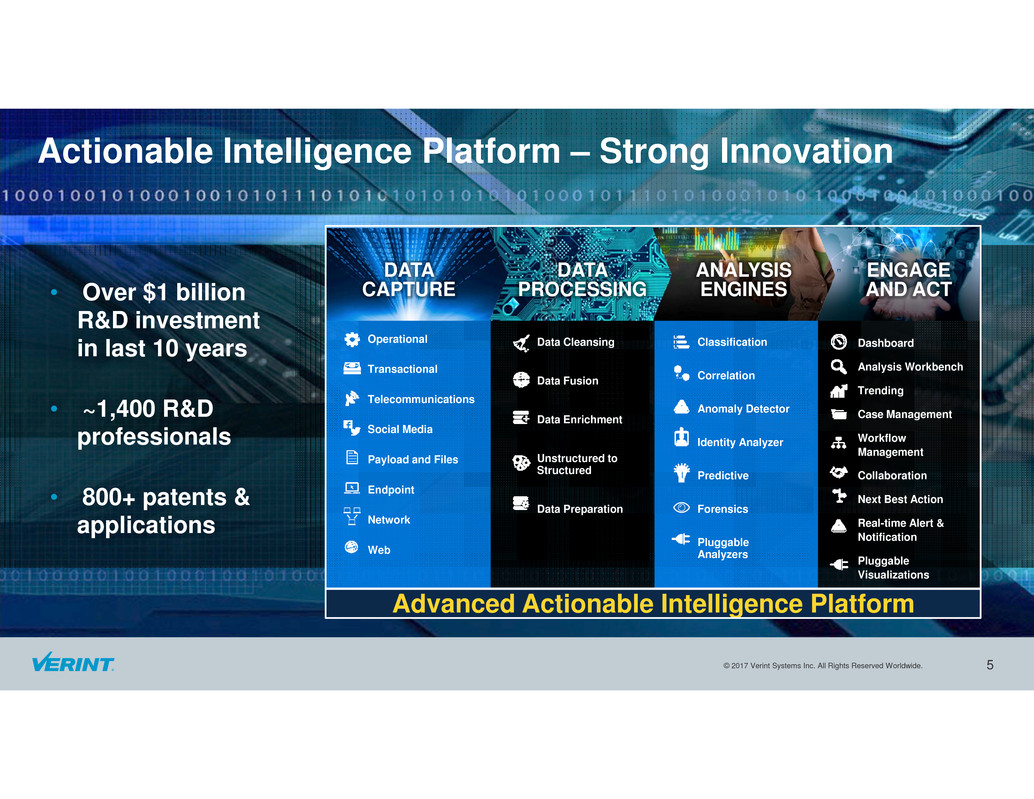

• Over $1 billion

R&D investment

in last 10 years

• ~1,400 R&D

professionals

• 800+ patents &

applications

Actionable Intelligence Platform – Strong Innovation

Classification

Correlation

Anomaly Detector

Identity Analyzer

Predictive

Forensics

Pluggable

Analyzers

Dashboard

Analysis Workbench

Trending

Case Management

Workflow

Management

Collaboration

Next Best Action

Real-time Alert &

Notification

Pluggable

Visualizations

Data Cleansing

Data Fusion

Data Enrichment

Unstructured to

Structured

Data Preparation

Operational

Transactional

Telecommunications

Social Media

Payload and Files

Endpoint

Network

Web

Advanced Actionable Intelligence Platform

ANALYSIS

ENGINES

ENGAGE

AND ACT

DATA

PROCESSING

DATA

CAPTURE

© 2017 Verint Systems Inc. All Rights Reserved Worldwide.

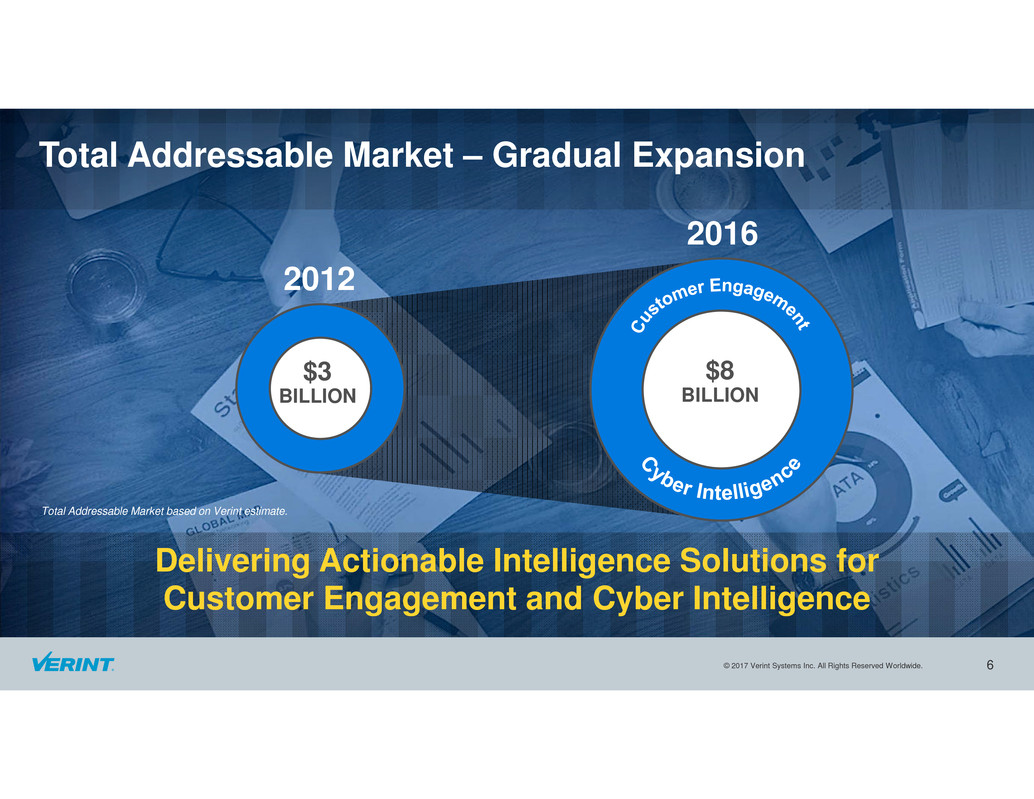

Total Addressable Market – Gradual Expansion

Delivering Actionable Intelligence Solutions for

Customer Engagement and Cyber Intelligence

Total Addressable Market based on Verint estimate.

$3

BILLION

2012

2016

$8

BILLION

6

© 2017 Verint Systems Inc. All Rights Reserved Worldwide.

Customer Engagement

Growth

Trends

• Leading provider of analytical

software that can be deployed on-

premises or in the cloud

• Helps organizations modernize

customer engagement, increase

loyalty and maximize revenue,

while generating operational

efficiencies and mitigating risk

• Deployed by contact centers,

branch and back-office operations,

customer experience and digital

marketing teams

Security

and

compliance

Growing

consumer

expectations

Technology

disruption:

cloud and

automation

Millennial

employees

7

© 2017 Verint Systems Inc. All Rights Reserved Worldwide.

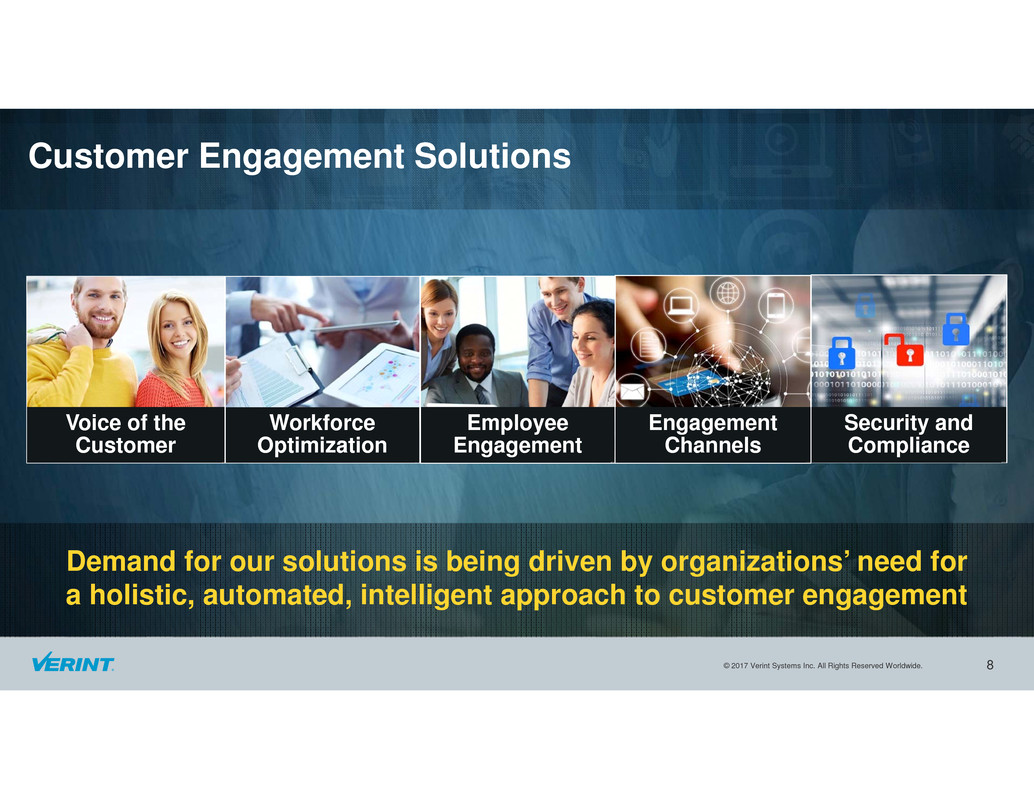

Demand for our solutions is being driven by organizations’ need for

a holistic, automated, intelligent approach to customer engagement

Customer Engagement Solutions

Workforce

Optimization

Security and

Compliance

Engagement

Channels

Employee

Engagement

Voice of the

Customer

8

© 2017 Verint Systems Inc. All Rights Reserved Worldwide.

Verint makes it easy for customer-centric organizations to

modernize their customer engagement operations

Customer Engagement Strategy

Increased

Automation

Extensive

Partner Network

Hybrid Cloud

Deployment Models

Broad, Innovative

Portfolio

9

© 2017 Verint Systems Inc. All Rights Reserved Worldwide.

• Leading provider of security and

intelligence data mining software

• Used for predictive intelligence,

complex investigations, security

threat analysis, and to prevent

crime and terrorism

• Deployed by governments,

critical infrastructure providers

and enterprise customers

Cyber Intelligence

Growth

Trends

Security threats

becoming more

complex

Demand for

data mining

solutions

built with

domain

expertise

Shortage

of qualified

intelligence

analysts

10

© 2017 Verint Systems Inc. All Rights Reserved Worldwide.

Broad portfolio of data mining solutions addresses a wide

range of security and intelligence challenges

Cyber Intelligence Solutions

National Security Law Enforcement Cyber Security

Critical Infrastructure Enterprise Security Border Control

11

© 2017 Verint Systems Inc. All Rights Reserved Worldwide.

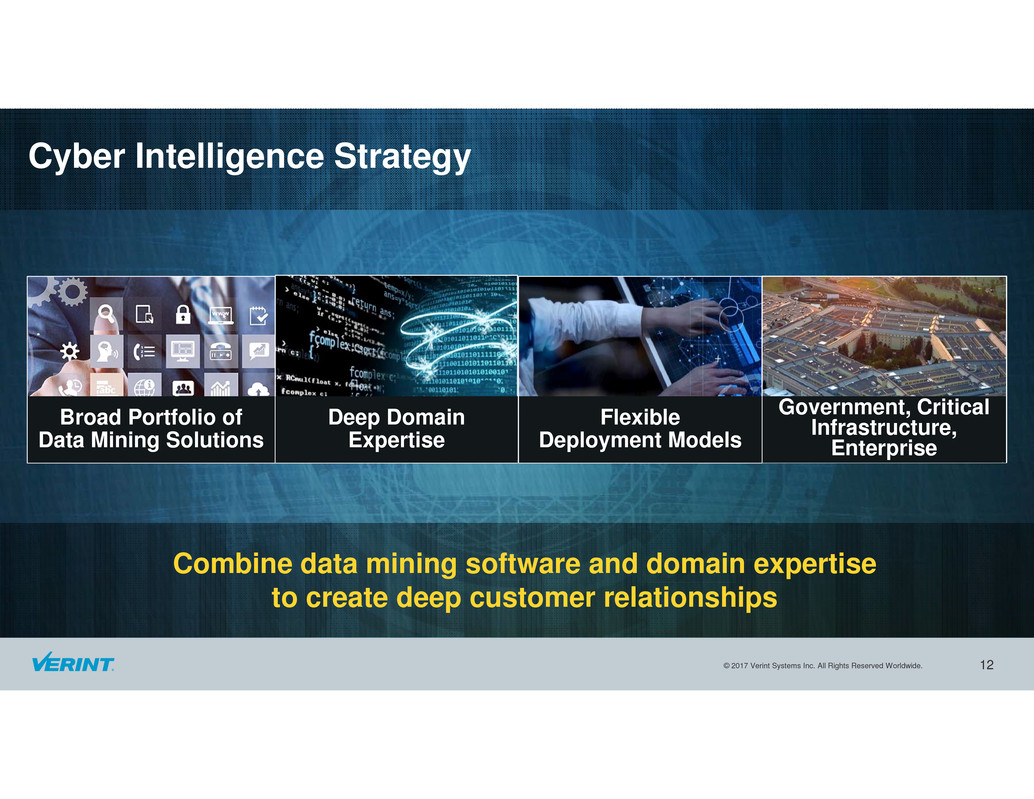

Combine data mining software and domain expertise

to create deep customer relationships

Cyber Intelligence Strategy

Deep Domain

Expertise

Government, Critical

Infrastructure,

Enterprise

Flexible

Deployment Models

Broad Portfolio of

Data Mining Solutions

12

© 2017 Verint Systems Inc. All Rights Reserved Worldwide.

Financial Highlights

13

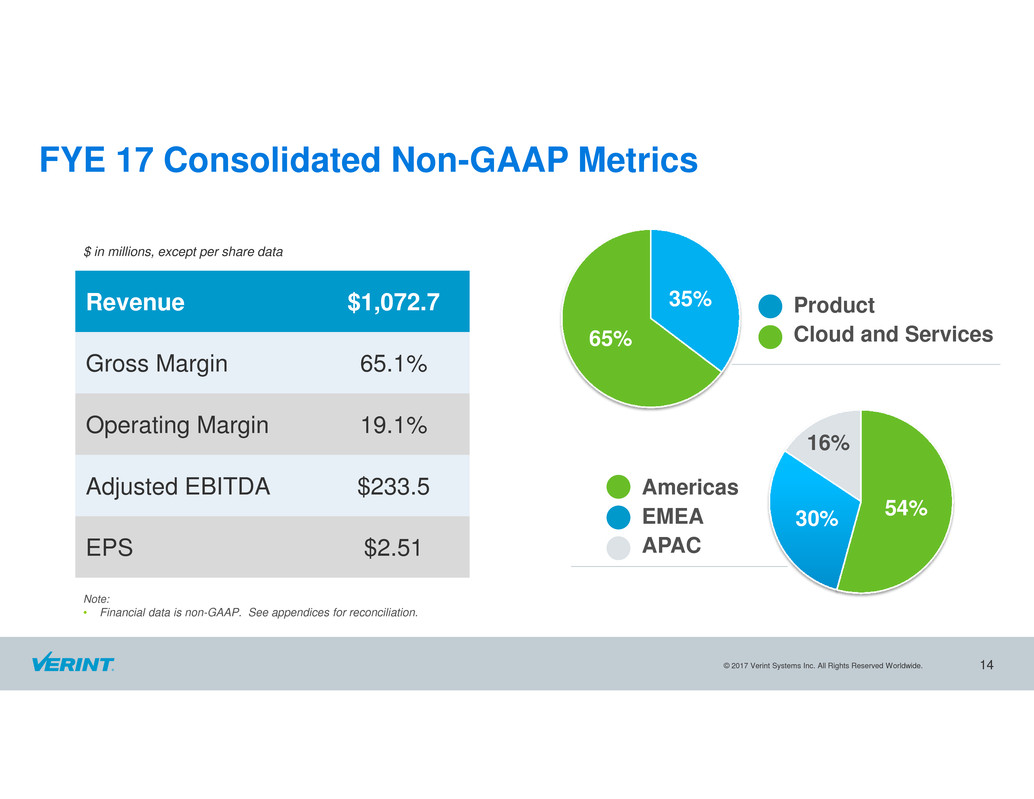

© 2017 Verint Systems Inc. All Rights Reserved Worldwide. 14

Revenue $1,072.7

Gross Margin 65.1%

Operating Margin 19.1%

Adjusted EBITDA $233.5

EPS $2.51

FYE 17 Consolidated Non-GAAP Metrics

35%

65%

54%30%

16%

Americas

EMEA

APAC

Product

Cloud and Services

$ in millions, except per share data

Note:

• Financial data is non-GAAP. See appendices for reconciliation.

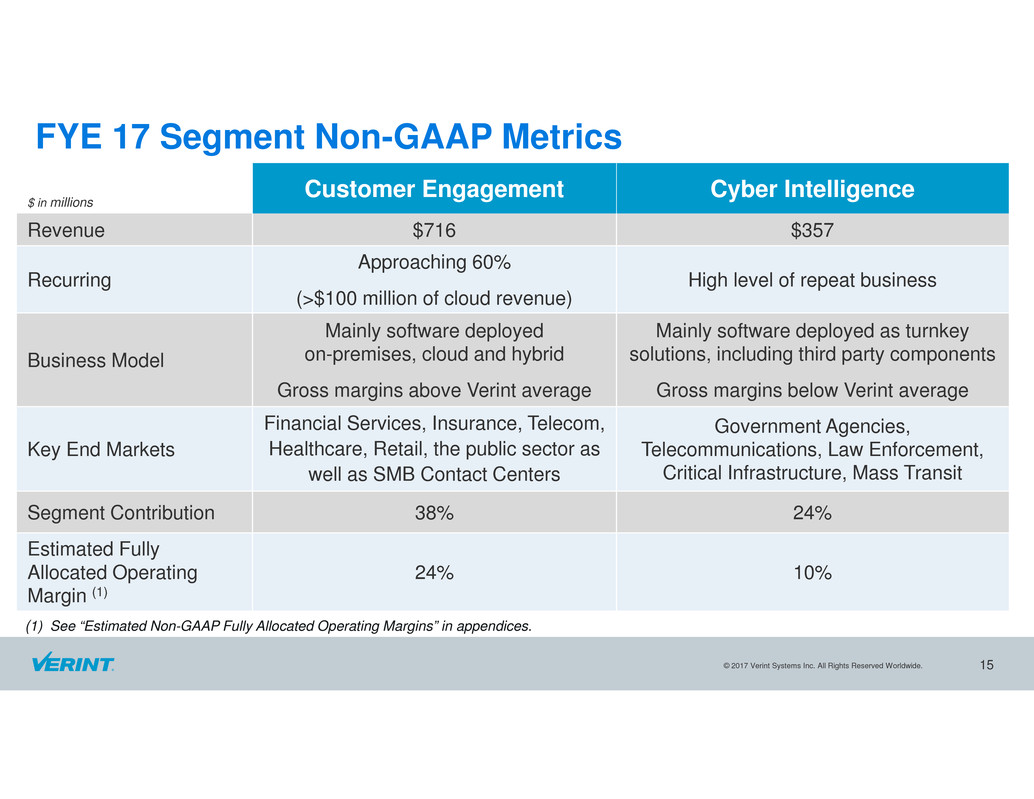

© 2017 Verint Systems Inc. All Rights Reserved Worldwide. 15

FYE 17 Segment Non-GAAP Metrics

$ in millions

Customer Engagement Cyber Intelligence

Revenue $716 $357

Recurring

Approaching 60%

(>$100 million of cloud revenue)

High level of repeat business

Business Model

Mainly software deployed

on-premises, cloud and hybrid

Gross margins above Verint average

Mainly software deployed as turnkey

solutions, including third party components

Gross margins below Verint average

Key End Markets

Financial Services, Insurance, Telecom,

Healthcare, Retail, the public sector as

well as SMB Contact Centers

Government Agencies,

Telecommunications, Law Enforcement,

Critical Infrastructure, Mass Transit

Segment Contribution 38% 24%

Estimated Fully

Allocated Operating

Margin (1)

24% 10%

(1) See “Estimated Non-GAAP Fully Allocated Operating Margins” in appendices.

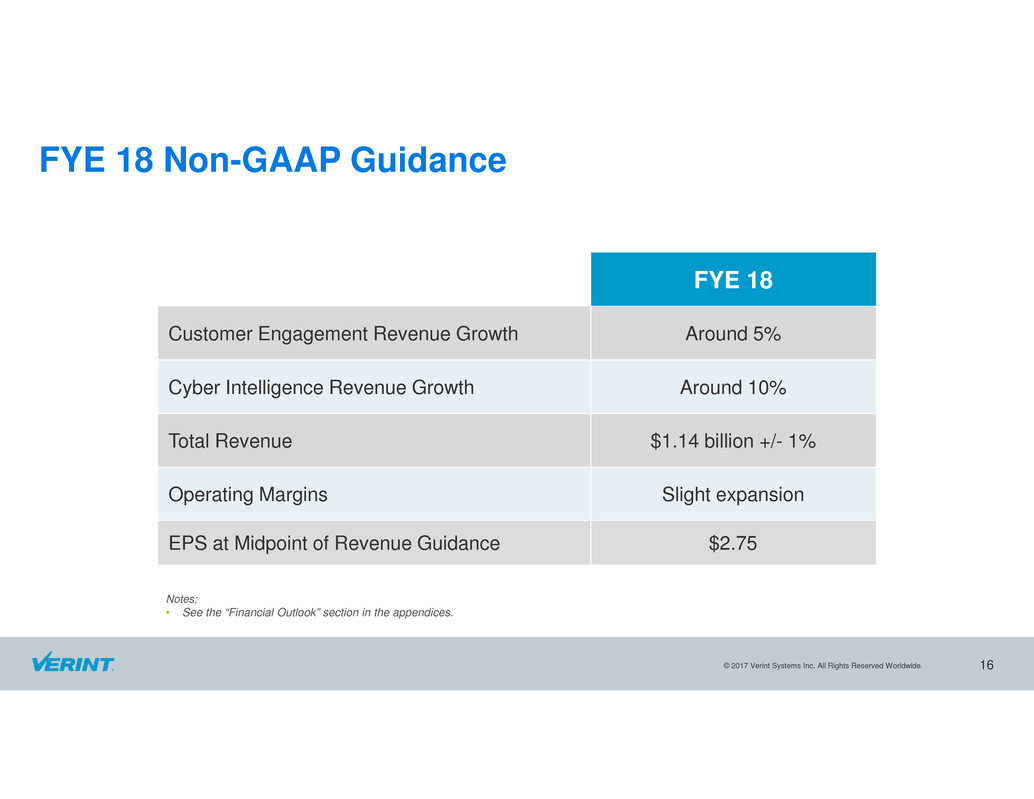

© 2017 Verint Systems Inc. All Rights Reserved Worldwide. 16

FYE 18 Non-GAAP Guidance

FYE 18

Customer Engagement Revenue Growth Around 5%

Cyber Intelligence Revenue Growth Around 10%

Total Revenue $1.14 billion +/- 1%

Operating Margins Slight expansion

EPS at Midpoint of Revenue Guidance $2.75

Notes:

• See the “Financial Outlook” section in the appendices.

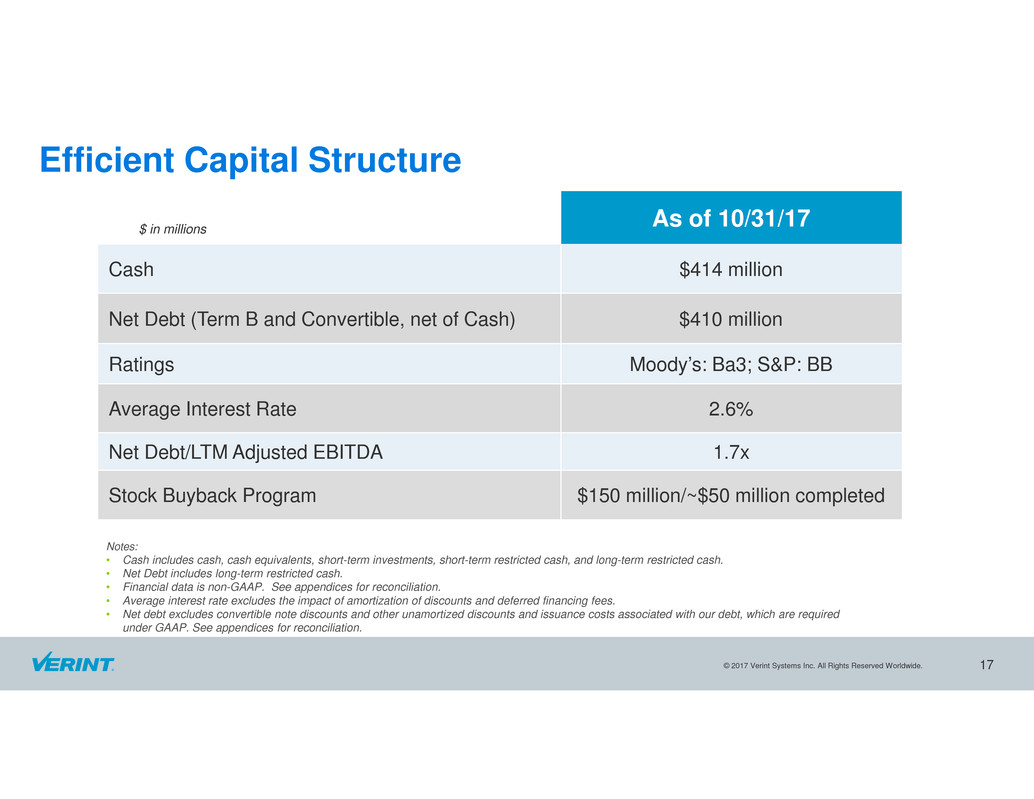

© 2017 Verint Systems Inc. All Rights Reserved Worldwide. 17

Efficient Capital Structure

As of 10/31/17

Cash $414 million

Net Debt (Term B and Convertible, net of Cash) $410 million

Ratings Moody’s: Ba3; S&P: BB

Average Interest Rate 2.6%

Net Debt/LTM Adjusted EBITDA 1.7x

Stock Buyback Program $150 million/~$50 million completed

Notes:

• Cash includes cash, cash equivalents, short-term investments, short-term restricted cash, and long-term restricted cash.

• Net Debt includes long-term restricted cash.

• Financial data is non-GAAP. See appendices for reconciliation.

• Average interest rate excludes the impact of amortization of discounts and deferred financing fees.

• Net debt excludes convertible note discounts and other unamortized discounts and issuance costs associated with our debt, which are required

under GAAP. See appendices for reconciliation.

$ in millions

© 2017 Verint Systems Inc. All Rights Reserved Worldwide.

Long-Term Growth Opportunity

• Leader in Actionable Intelligence Solutions

• Customer Engagement Solutions

• Organizations seeking to simplify and modernize customer engagement operations

• Verint offers the industry’s broadest Customer Engagement portfolio with automation and cloud flexibility

• Cyber Intelligence Solutions

• Security challenges growing, driving the need for innovative data mining and predictive intelligence

• Verint has a global presence and leading portfolio of intelligence powered security solutions

• Long history of growth driven by innovation and domain expertise

18

© 2017 Verint Systems Inc. All Rights Reserved Worldwide.

Appendices

19

© 2017 Verint Systems Inc. All Rights Reserved Worldwide.

About Non-GAAP Financial Measures

The following tables include reconciliations of certain financial measures not prepared in accordance with Generally Accepted Accounting Principles, consisting of non-GAAP

revenue, non-GAAP gross profit and gross margin, non-GAAP operating income and operating margin, non-GAAP other income (expense), net, non-GAAP provision (benefit) for

income taxes and non-GAAP effective income tax rate, non-GAAP net income attributable to Verint Systems Inc., non-GAAP net income per common share attributable to Verint

Systems Inc., adjusted EBITDA, net debt, constant currency measures, and estimated non-GAAP fully allocated operating margins to the most directly comparable financial

measures prepared in accordance with GAAP.

We believe these non-GAAP financial measures, used in conjunction with the corresponding GAAP measures, provide investors with useful supplemental information about the

financial performance of our business by:

• facilitating the comparison of our financial results and business trends between periods, including by excluding certain items that either can vary significantly in

amount and frequency, are based upon subjective assumptions, or in certain cases are unplanned for or difficult to forecast,

• facilitating the comparison of our financial results and business trends with other technology companies who publish similar non-GAAP measures, and

• allowing investors to see and understand key supplementary metrics used by our management to run our business, including for budgeting and forecasting, resource

allocation, and compensation matters.

We also make these non-GAAP financial measures available because a number of our investors have informed us that they find this supplemental information useful.

Non-GAAP financial measures should not be considered in isolation as substitutes for, or superior to, comparable GAAP financial measures. The non-GAAP financial measures we

present have limitations in that they do not reflect all of the amounts associated with our results of operations as determined in accordance with GAAP, and these non-GAAP

financial measures should only be used to evaluate our results of operations in conjunction with the corresponding GAAP financial measures. These non-GAAP financial measures

do not represent discretionary cash available to us to invest in the growth of our business, and we may in the future incur expenses similar to or in addition to

the adjustments made in these non-GAAP financial measures. Other companies may calculate similar non-GAAP financial measures differently than we do, limiting their

usefulness as comparative measures.

20

© 2017 Verint Systems Inc. All Rights Reserved Worldwide.

About Non-GAAP Financial Measures

Our non-GAAP financial measures are calculated by making the following adjustments to our GAAP financial measures:

• Revenue adjustments related to acquisitions. We exclude from our non-GAAP revenue the impact of fair value adjustments required under GAAP relating to acquired customer

support contracts, which would have otherwise been recognized on a stand-alone basis. We believe that it is useful for investors to understand the total amount of revenue that we

and the acquired company would have recognized on a stand-alone basis under GAAP, absent the accounting adjustment associated with the business acquisition. Our non-GAAP

revenue also reflects certain adjustments from aligning an acquired company’s revenue recognition policies to our policies. We believe that our non-GAAP revenue measure helps

management and investors understand our revenue trends and serves as a useful measure of ongoing business performance.

• Amortization of acquired technology and other acquired intangible assets. When we acquire an entity, we are required under GAAP to record the fair values of the intangible assets

of the acquired entity and amortize those assets over their useful lives. We exclude the amortization of acquired intangible assets, including acquired technology, from our non-

GAAP financial measures because they are inconsistent in amount and frequency and are significantly impacted by the timing and size of acquisitions. We also exclude these

amounts to provide easier comparability of pre- and post-acquisition operating results.

• Stock-based compensation expenses. We exclude stock-based compensation expenses related to restricted stock awards, stock bonus programs, bonus share programs, and other

stock-based awards from our non-GAAP financial measures. We evaluate our performance both with and without these measures because stock-based compensation is typically a

non-cash expense and can vary significantly over time based on the timing, size and nature of awards granted, and is influenced in part by certain factors which are generally

beyond our control, such as the volatility of the price of our common stock. In addition, measurement of stock-based compensation is subject to varying valuation methodologies and

subjective assumptions, and therefore we believe that excluding stock-based compensation from our non-GAAP financial measures allows for meaningful comparisons of our

current operating results to our historical operating results and to other companies in our industry.

• Unrealized gains and losses on certain derivatives, net. We exclude from our non-GAAP financial measures unrealized gains and losses on certain foreign currency derivatives

which are not designated as hedges under accounting guidance. We exclude unrealized gains and losses on foreign currency derivatives that serve as economic hedges against

variability in the cash flows of recognized assets or liabilities, or of forecasted transactions. These contracts, if designated as hedges under accounting guidance, would be

considered “cash flow” hedges. These unrealized gains and losses are excluded from our non-GAAP financial measures because they are non-cash transactions which are highly

variable from period to period. Upon settlement of these foreign currency derivatives, any realized gain or loss is included in our non-GAAP financial measures.

21

© 2017 Verint Systems Inc. All Rights Reserved Worldwide.

About Non-GAAP Financial Measures

• Amortization of convertible note discount. Our non-GAAP financial measures exclude the amortization of the imputed discount on our convertible notes. Under GAAP, certain

convertible debt instruments that may be settled in cash upon conversion are required to be bifurcated into separate liability (debt) and equity (conversion option) components in a

manner that reflects the issuer’s assumed non-convertible debt borrowing rate. For GAAP purposes, we are required to recognize imputed interest expense on the difference

between our assumed non-convertible debt borrowing rate and the coupon rate on our $400.0 million of 1.50% convertible notes. This difference is excluded from our non-GAAP

financial measures because we believe that this expense is based upon subjective assumptions and does not reflect the cash cost of our convertible debt.

• Loss on early retirement of debt. We exclude from our non-GAAP financial measures loss on early retirement of debt attributable to refinancing or repaying our debt because we

believe they are not reflective of our ongoing operations.

• Acquisition Expenses, net. In connection with acquisition activity (including with respect to acquisitions that are not consummated), we incur expenses, including legal, accounting,

and other professional fees, integration costs, changes in the fair value of contingent consideration obligations, and other costs. Integration costs may consist of information

technology expenses as systems are integrated across the combined entity, consulting expenses, marketing expenses, and professional fees, as well as non-cash charges to

write-off or impair the value of redundant assets. We exclude these expenses from our non-GAAP financial measures because they are unpredictable, can vary based on the size

and complexity of each transaction, and are unrelated to our continuing operations or to the continuing operations of the acquired businesses.

• Restructuring Expenses. We exclude restructuring expenses from our non-GAAP financial measures, which include employee termination costs, facility exit costs, certain

professional fees, asset impairment charges, and other costs directly associated with resource realignments incurred in reaction to changing strategies or business conditions. All

of these costs can vary significantly in amount and frequency based on the nature of the actions as well as the changing needs of our business and we believe that excluding them

provides easier comparability of pre- and post-restructuring operating results.

• Impairment Charges and Other Adjustments. We exclude from our non-GAAP financial measures asset impairment charges other than those associated with restructuring or

acquisition activity, rent expense for redundant facilities, and gains or losses on sales of property, all of which are unusual in nature and can vary significantly in amount and

frequency.

22

© 2017 Verint Systems Inc. All Rights Reserved Worldwide.

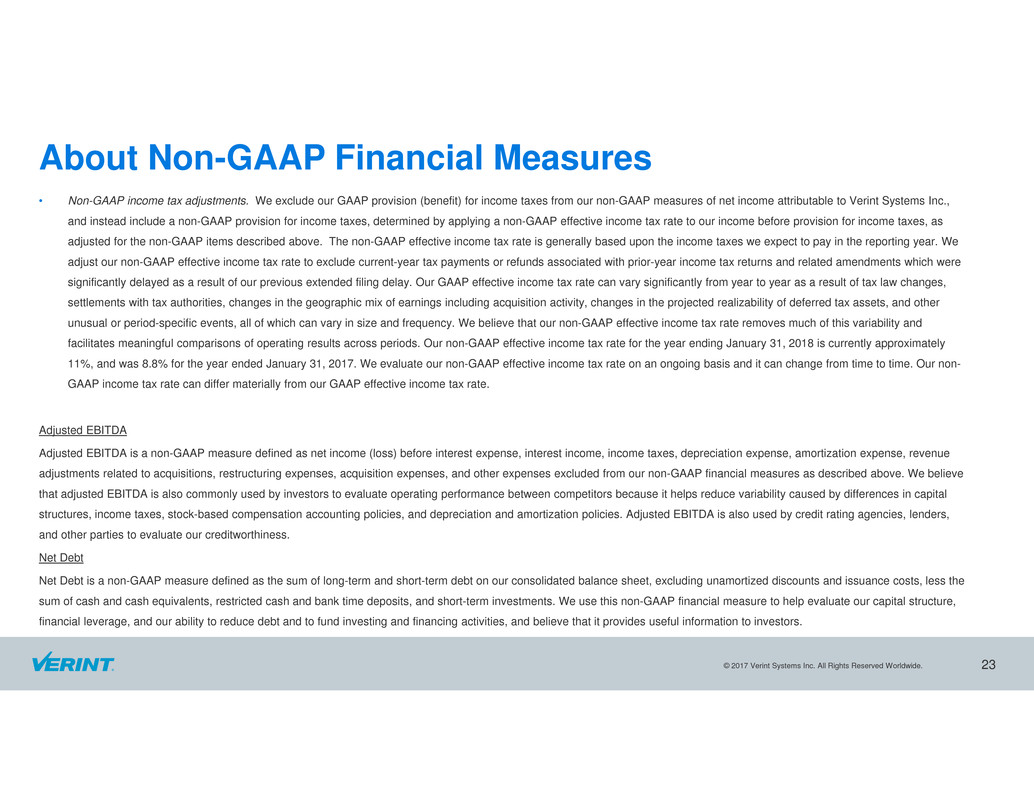

About Non-GAAP Financial Measures

• Non-GAAP income tax adjustments. We exclude our GAAP provision (benefit) for income taxes from our non-GAAP measures of net income attributable to Verint Systems Inc.,

and instead include a non-GAAP provision for income taxes, determined by applying a non-GAAP effective income tax rate to our income before provision for income taxes, as

adjusted for the non-GAAP items described above. The non-GAAP effective income tax rate is generally based upon the income taxes we expect to pay in the reporting year. We

adjust our non-GAAP effective income tax rate to exclude current-year tax payments or refunds associated with prior-year income tax returns and related amendments which were

significantly delayed as a result of our previous extended filing delay. Our GAAP effective income tax rate can vary significantly from year to year as a result of tax law changes,

settlements with tax authorities, changes in the geographic mix of earnings including acquisition activity, changes in the projected realizability of deferred tax assets, and other

unusual or period-specific events, all of which can vary in size and frequency. We believe that our non-GAAP effective income tax rate removes much of this variability and

facilitates meaningful comparisons of operating results across periods. Our non-GAAP effective income tax rate for the year ending January 31, 2018 is currently approximately

11%, and was 8.8% for the year ended January 31, 2017. We evaluate our non-GAAP effective income tax rate on an ongoing basis and it can change from time to time. Our non-

GAAP income tax rate can differ materially from our GAAP effective income tax rate.

Adjusted EBITDA

Adjusted EBITDA is a non-GAAP measure defined as net income (loss) before interest expense, interest income, income taxes, depreciation expense, amortization expense, revenue

adjustments related to acquisitions, restructuring expenses, acquisition expenses, and other expenses excluded from our non-GAAP financial measures as described above. We believe

that adjusted EBITDA is also commonly used by investors to evaluate operating performance between competitors because it helps reduce variability caused by differences in capital

structures, income taxes, stock-based compensation accounting policies, and depreciation and amortization policies. Adjusted EBITDA is also used by credit rating agencies, lenders,

and other parties to evaluate our creditworthiness.

Net Debt

Net Debt is a non-GAAP measure defined as the sum of long-term and short-term debt on our consolidated balance sheet, excluding unamortized discounts and issuance costs, less the

sum of cash and cash equivalents, restricted cash and bank time deposits, and short-term investments. We use this non-GAAP financial measure to help evaluate our capital structure,

financial leverage, and our ability to reduce debt and to fund investing and financing activities, and believe that it provides useful information to investors.

23

© 2017 Verint Systems Inc. All Rights Reserved Worldwide.

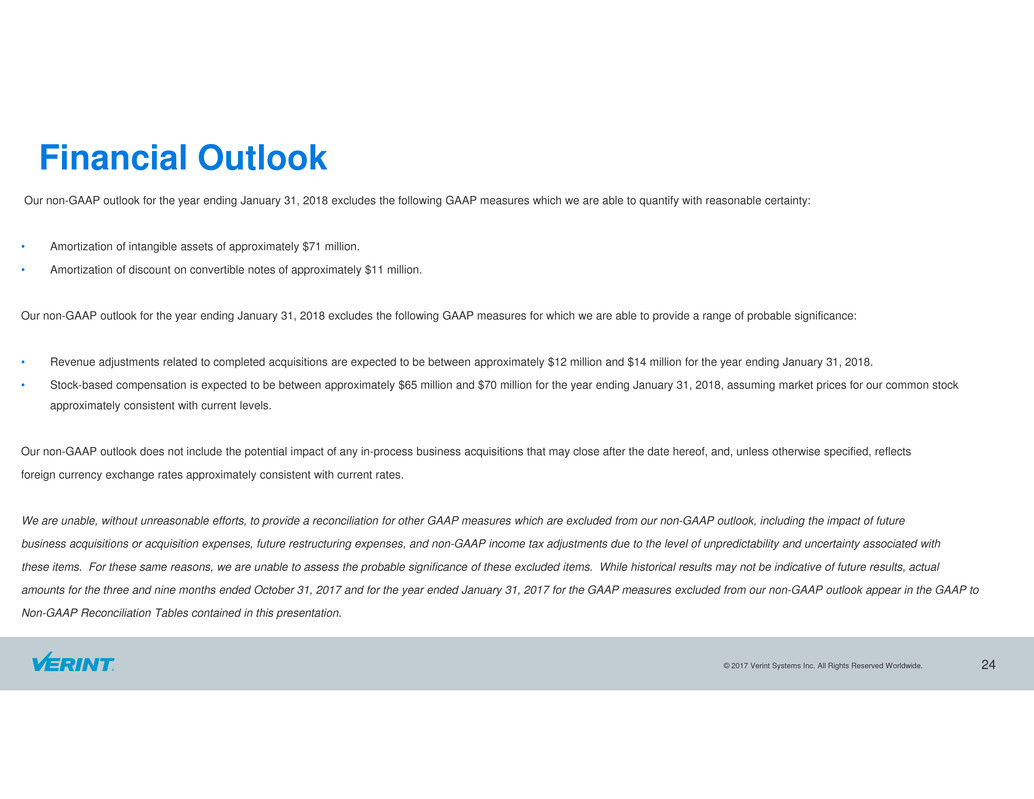

Financial Outlook

Our non-GAAP outlook for the year ending January 31, 2018 excludes the following GAAP measures which we are able to quantify with reasonable certainty:

• Amortization of intangible assets of approximately $71 million.

• Amortization of discount on convertible notes of approximately $11 million.

Our non-GAAP outlook for the year ending January 31, 2018 excludes the following GAAP measures for which we are able to provide a range of probable significance:

• Revenue adjustments related to completed acquisitions are expected to be between approximately $12 million and $14 million for the year ending January 31, 2018.

• Stock-based compensation is expected to be between approximately $65 million and $70 million for the year ending January 31, 2018, assuming market prices for our common stock

approximately consistent with current levels.

Our non-GAAP outlook does not include the potential impact of any in-process business acquisitions that may close after the date hereof, and, unless otherwise specified, reflects

foreign currency exchange rates approximately consistent with current rates.

We are unable, without unreasonable efforts, to provide a reconciliation for other GAAP measures which are excluded from our non-GAAP outlook, including the impact of future

business acquisitions or acquisition expenses, future restructuring expenses, and non-GAAP income tax adjustments due to the level of unpredictability and uncertainty associated with

these items. For these same reasons, we are unable to assess the probable significance of these excluded items. While historical results may not be indicative of future results, actual

amounts for the three and nine months ended October 31, 2017 and for the year ended January 31, 2017 for the GAAP measures excluded from our non-GAAP outlook appear in the GAAP to

Non-GAAP Reconciliation Tables contained in this presentation.

24

© 2017 Verint Systems Inc. All Rights Reserved Worldwide.

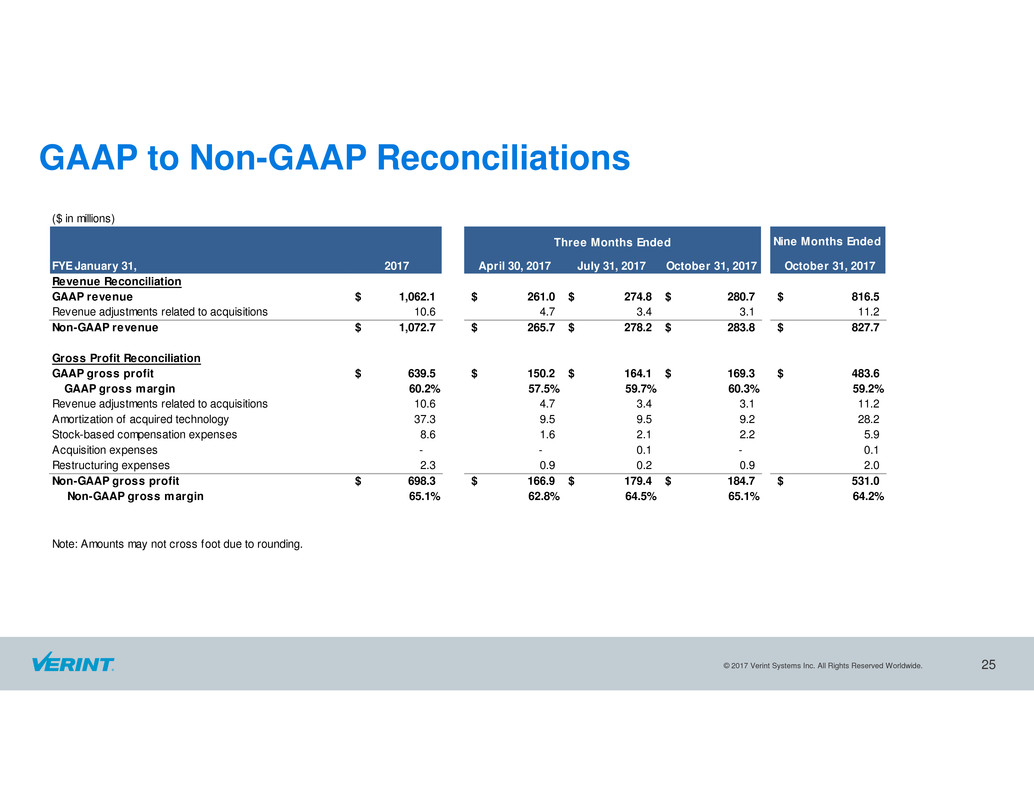

GAAP to Non-GAAP Reconciliations

25

($ in millions)

Nine Months Ended

FYE January 31, 2017 April 30, 2017 July 31, 2017 October 31, 2017 October 31, 2017

Revenue Reconciliation

GAAP revenue 1,062.1$ 261.0$ 274.8$ 280.7$ 816.5$

Revenue adjustments related to acquisitions 10.6 4.7 3.4 3.1 11.2

Non-GAAP revenue 1,072.7$ 265.7$ 278.2$ 283.8$ 827.7$

Gross Profit Reconciliation

GAAP gross profit 639.5$ 150.2$ 164.1$ 169.3$ 483.6$

GAAP gross margin 60.2% 57.5% 59.7% 60.3% 59.2%

Revenue adjustments related to acquisitions 10.6 4.7 3.4 3.1 11.2

Amortization of acquired technology 37.3 9.5 9.5 9.2 28.2

Stock-based compensation expenses 8.6 1.6 2.1 2.2 5.9

Acquisition expenses - - 0.1 - 0.1

Restructuring expenses 2.3 0.9 0.2 0.9 2.0

Non-GAAP gross profit 698.3$ 166.9$ 179.4$ 184.7$ 531.0$

Non-GAAP gross margin 65.1% 62.8% 64.5% 65.1% 64.2%

Note: Amounts may not cross foot due to rounding.

Three Months Ended

© 2017 Verint Systems Inc. All Rights Reserved Worldwide.

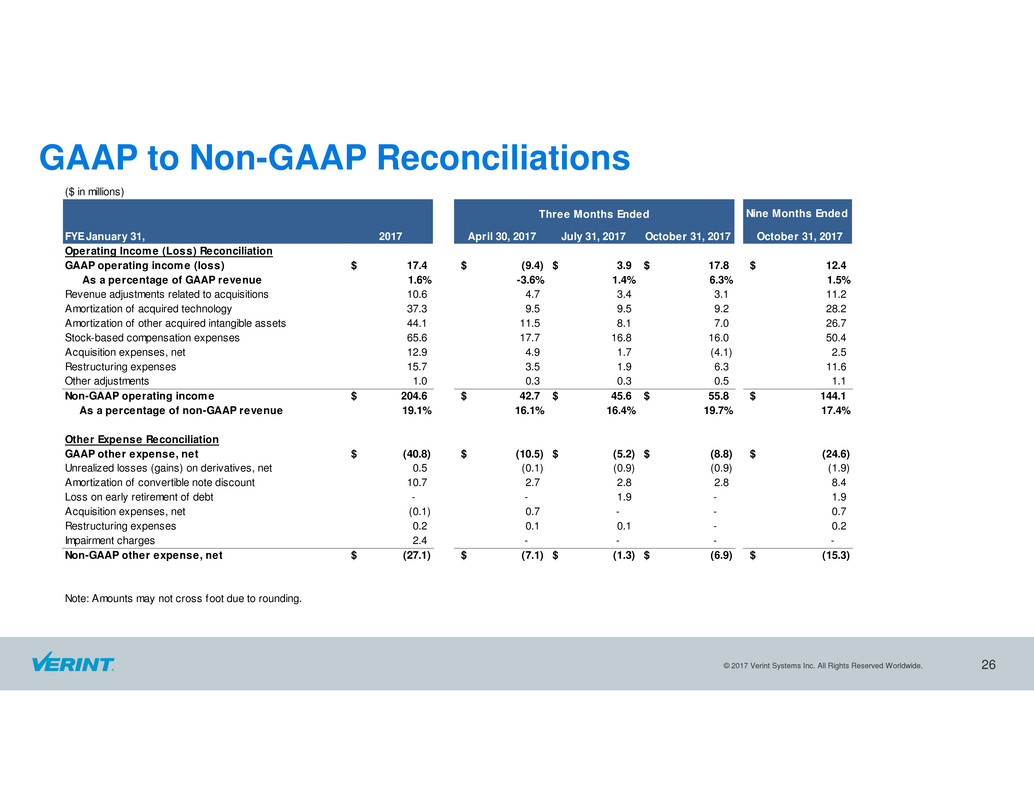

GAAP to Non-GAAP Reconciliations

26

($ in millions)

Nine Months Ended

FYE January 31, 2017 April 30, 2017 July 31, 2017 October 31, 2017 October 31, 2017

Operating Income (Loss) Reconciliation

GAAP operating income (loss) 17.4$ (9.4)$ 3.9$ 17.8$ 12.4$

As a percentage of GAAP revenue 1.6% -3.6% 1.4% 6.3% 1.5%

Revenue adjustments related to acquisitions 10.6 4.7 3.4 3.1 11.2

Amortization of acquired technology 37.3 9.5 9.5 9.2 28.2

Amortization of other acquired intangible assets 44.1 11.5 8.1 7.0 26.7

Stock-based compensation expenses 65.6 17.7 16.8 16.0 50.4

Acquisition expenses, net 12.9 4.9 1.7 (4.1) 2.5

Restructuring expenses 15.7 3.5 1.9 6.3 11.6

Other adjustments 1.0 0.3 0.3 0.5 1.1

Non-GAAP operating income 204.6$ 42.7$ 45.6$ 55.8$ 144.1$

As a percentage of non-GAAP revenue 19.1% 16.1% 16.4% 19.7% 17.4%

Other Expense Reconciliation

GAAP other expense, net (40.8)$ (10.5)$ (5.2)$ (8.8)$ (24.6)$

Unrealized losses (gains) on derivatives, net 0.5 (0.1) (0.9) (0.9) (1.9)

Amortization of convertible note discount 10.7 2.7 2.8 2.8 8.4

Loss on early retirement of debt - - 1.9 - 1.9

Acquisition expenses, net (0.1) 0.7 - - 0.7

Restructuring expenses 0.2 0.1 0.1 - 0.2

Impairment charges 2.4 - - - -

Non-GAAP other expense, net (27.1)$ (7.1)$ (1.3)$ (6.9)$ (15.3)$

Note: Amounts may not cross foot due to rounding.

Three Months Ended

© 2017 Verint Systems Inc. All Rights Reserved Worldwide.

GAAP to Non-GAAP Reconciliations

27

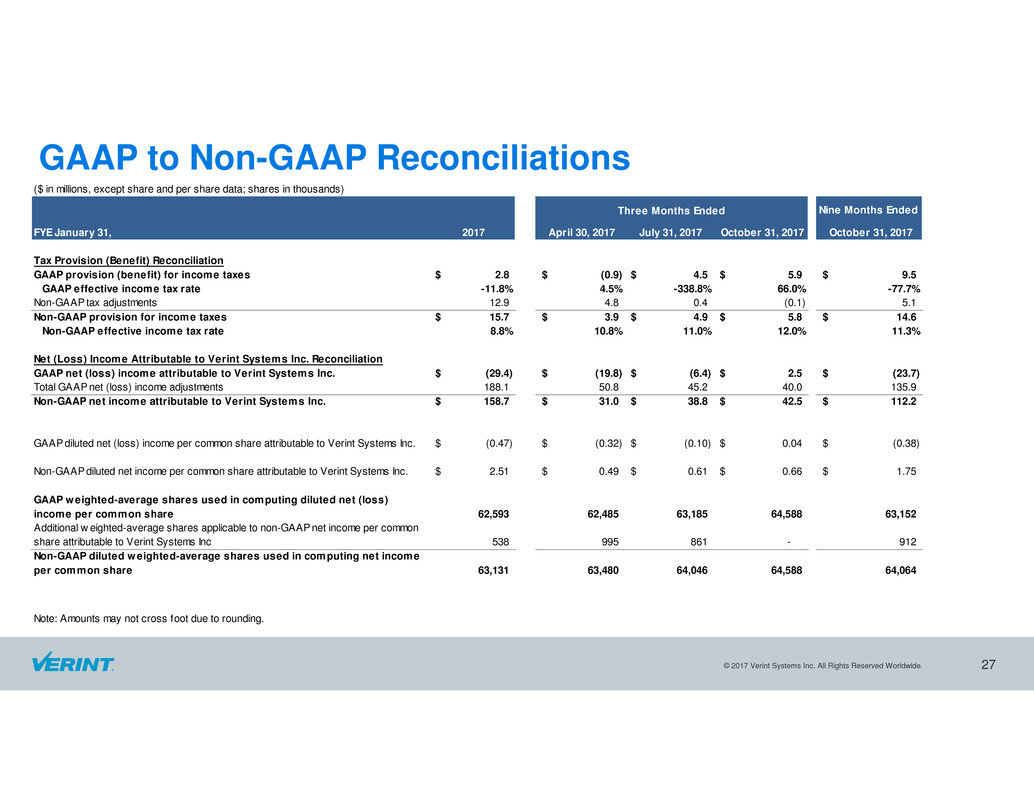

($ in millions, except share and per share data; shares in thousands)

Nine Months Ended

FYE January 31, 2017 April 30, 2017 July 31, 2017 October 31, 2017 October 31, 2017

Tax Provision (Benefit) Reconciliation

GAAP provision (benefit) for income taxes 2.8$ (0.9)$ 4.5$ 5.9$ 9.5$

GAAP effective income tax rate -11.8% 4.5% -338.8% 66.0% -77.7%

Non-GAAP tax adjustments 12.9 4.8 0.4 (0.1) 5.1

Non-GAAP provision for income taxes 15.7$ 3.9$ 4.9$ 5.8$ 14.6$

Non-GAAP effective income tax rate 8.8% 10.8% 11.0% 12.0% 11.3%

Net (Loss) Income Attributable to Verint Systems Inc. Reconciliation

GAAP net (loss) income attributable to Verint Systems Inc. (29.4)$ (19.8)$ (6.4)$ 2.5$ (23.7)$

Total GAAP net (loss) income adjustments 188.1 50.8 45.2 40.0 135.9

Non-GAAP net income attributable to Verint Systems Inc. 158.7$ 31.0$ 38.8$ 42.5$ 112.2$

GAAP diluted net (loss) income per common share attributable to Verint Systems Inc. (0.47)$ (0.32)$ (0.10)$ 0.04$ (0.38)$

Non-GAAP diluted net income per common share attributable to Verint Systems Inc. 2.51$ 0.49$ 0.61$ 0.66$ 1.75$

GAAP weighted-average shares used in computing diluted net (loss)

income per common share 62,593 62,485 63,185 64,588 63,152

Additional w eighted-average shares applicable to non-GAAP net income per common

share attributable to Verint Systems Inc 538 995 861 - 912

Non-GAAP diluted weighted-average shares used in computing net income

per common share 63,131 63,480 64,046 64,588 64,064

Note: Amounts may not cross foot due to rounding.

Three Months Ended

© 2017 Verint Systems Inc. All Rights Reserved Worldwide.

GAAP to Non-GAAP Reconciliations

28

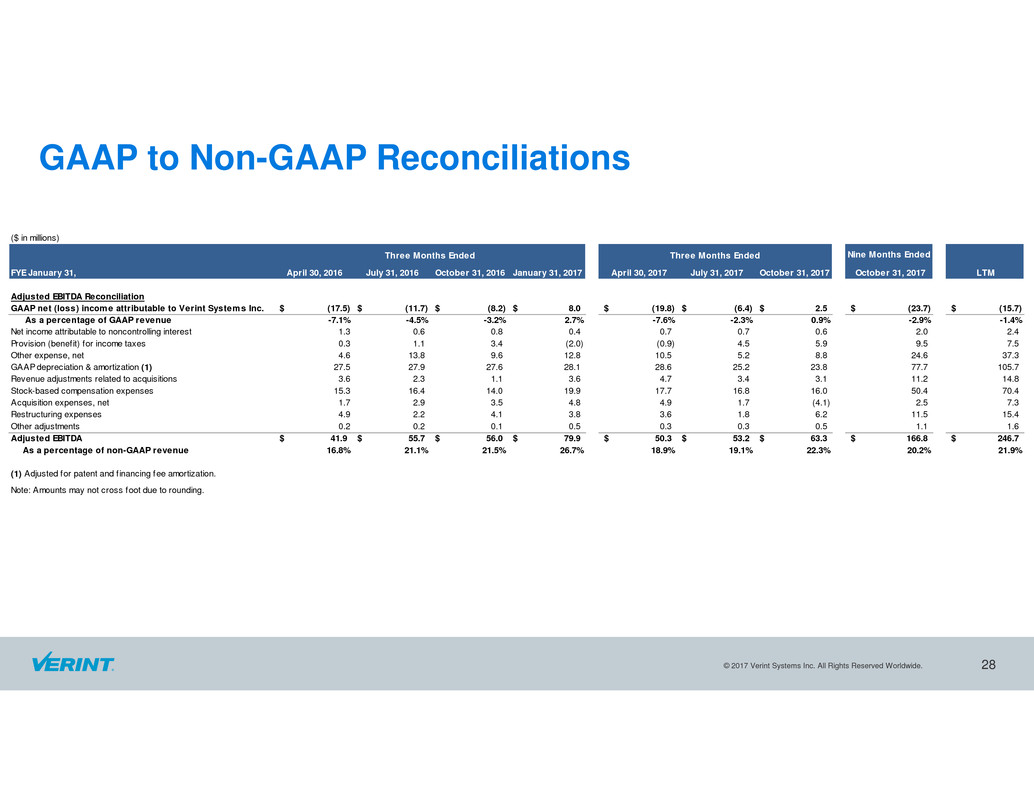

($ in millions)

Nine Months Ended

FYE January 31, April 30, 2016 July 31, 2016 October 31, 2016 January 31, 2017 April 30, 2017 July 31, 2017 October 31, 2017 October 31, 2017 LTM

Adjusted EBITDA Reconciliation

GAAP net (loss) income attributable to Verint Systems Inc. (17.5)$ (11.7)$ (8.2)$ 8.0$ (19.8)$ (6.4)$ 2.5$ (23.7)$ (15.7)$

As a percentage of GAAP revenue -7.1% -4.5% -3.2% 2.7% -7.6% -2.3% 0.9% -2.9% -1.4%

Net income attributable to noncontrolling interest 1.3 0.6 0.8 0.4 0.7 0.7 0.6 2.0 2.4

Provision (benefit) for income taxes 0.3 1.1 3.4 (2.0) (0.9) 4.5 5.9 9.5 7.5

Other expense, net 4.6 13.8 9.6 12.8 10.5 5.2 8.8 24.6 37.3

GAAP depreciation & amortization (1) 27.5 27.9 27.6 28.1 28.6 25.2 23.8 77.7 105.7

Revenue adjustments related to acquisitions 3.6 2.3 1.1 3.6 4.7 3.4 3.1 11.2 14.8

Stock-based compensation expenses 15.3 16.4 14.0 19.9 17.7 16.8 16.0 50.4 70.4

Acquisition expenses, net 1.7 2.9 3.5 4.8 4.9 1.7 (4.1) 2.5 7.3

Restructuring expenses 4.9 2.2 4.1 3.8 3.6 1.8 6.2 11.5 15.4

Other adjustments 0.2 0.2 0.1 0.5 0.3 0.3 0.5 1.1 1.6

Adjusted EBITDA 41.9$ 55.7$ 56.0$ 79.9$ 50.3$ 53.2$ 63.3$ 166.8$ 246.7$

As a percentage of non-GAAP revenue 16.8% 21.1% 21.5% 26.7% 18.9% 19.1% 22.3% 20.2% 21.9%

(1) Adjusted for patent and f inancing fee amortization.

Note: Amounts may not cross foot due to rounding.

Three Months EndedThree Months Ended

© 2017 Verint Systems Inc. All Rights Reserved Worldwide.

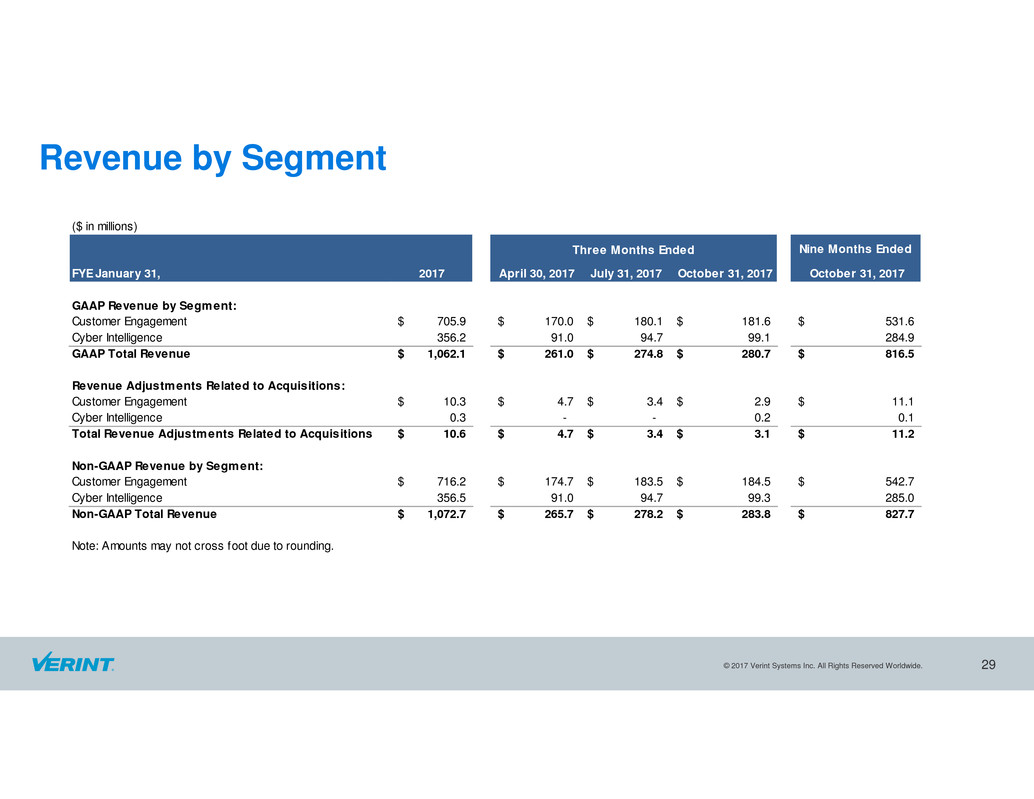

Revenue by Segment

29

($ in millions)

Nine Months Ended

FYE January 31, 2017 April 30, 2017 July 31, 2017 October 31, 2017 October 31, 2017

GAAP Revenue by Segment:

Customer Engagement 705.9$ 170.0$ 180.1$ 181.6$ 531.6$

Cyber Intelligence 356.2 91.0 94.7 99.1 284.9

GAAP Total Revenue 1,062.1$ 261.0$ 274.8$ 280.7$ 816.5$

Revenue Adjustments Related to Acquisitions:

Customer Engagement 10.3$ 4.7$ 3.4$ 2.9$ 11.1$

Cyber Intelligence 0.3 - - 0.2 0.1

Total Revenue Adjustments Related to Acquisitions 10.6$ 4.7$ 3.4$ 3.1$ 11.2$

Non-GAAP Revenue by Segment:

Customer Engagement 716.2$ 174.7$ 183.5$ 184.5$ 542.7$

Cyber Intelligence 356.5 91.0 94.7 99.3 285.0

Non-GAAP Total Revenue 1,072.7$ 265.7$ 278.2$ 283.8$ 827.7$

Note: Amounts may not cross foot due to rounding.

Three Months Ended

© 2017 Verint Systems Inc. All Rights Reserved Worldwide.

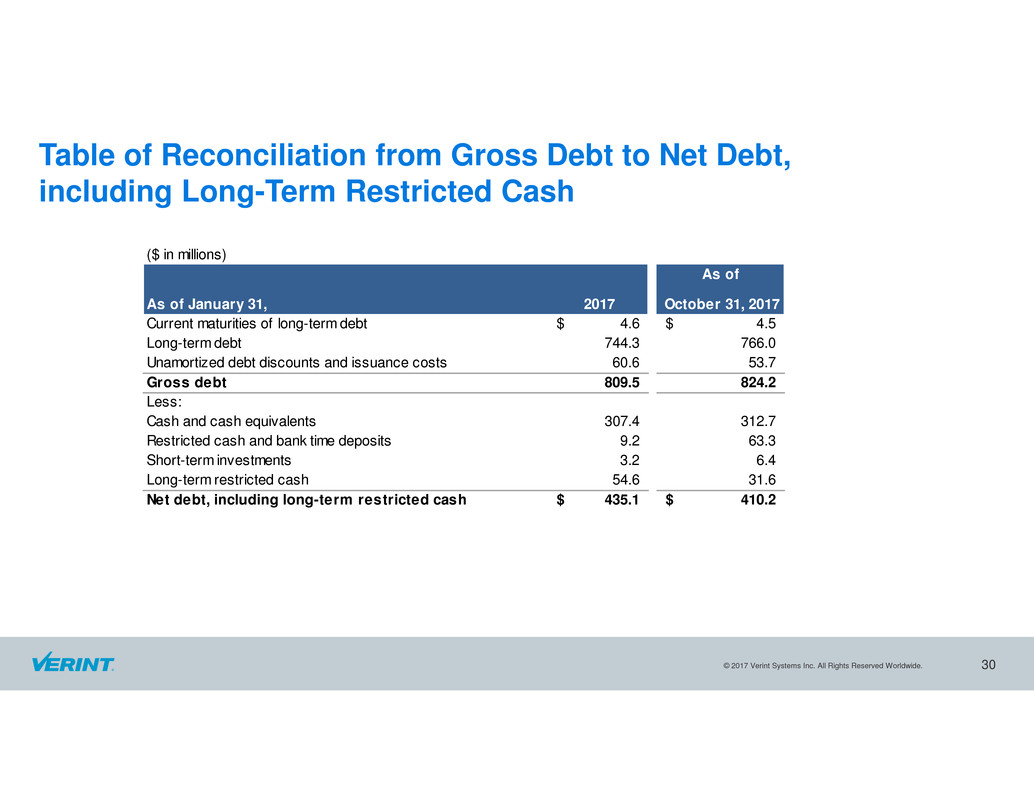

Table of Reconciliation from Gross Debt to Net Debt,

including Long-Term Restricted Cash

30

($ in millions)

As of

As of January 31, 2017 October 31, 2017

Current maturities of long-term debt 4.6$ 4.5$

Long-term debt 744.3 766.0

Unamortized debt discounts and issuance costs 60.6 53.7

Gross debt 809.5 824.2

Less:

Cash and cash equivalents 307.4 312.7

Restricted cash and bank time deposits 9.2 63.3

Short-term investments 3.2 6.4

Long-term restricted cash 54.6 31.6

Net debt, including long-term restricted cash 435.1$ 410.2$

© 2017 Verint Systems Inc. All Rights Reserved Worldwide.

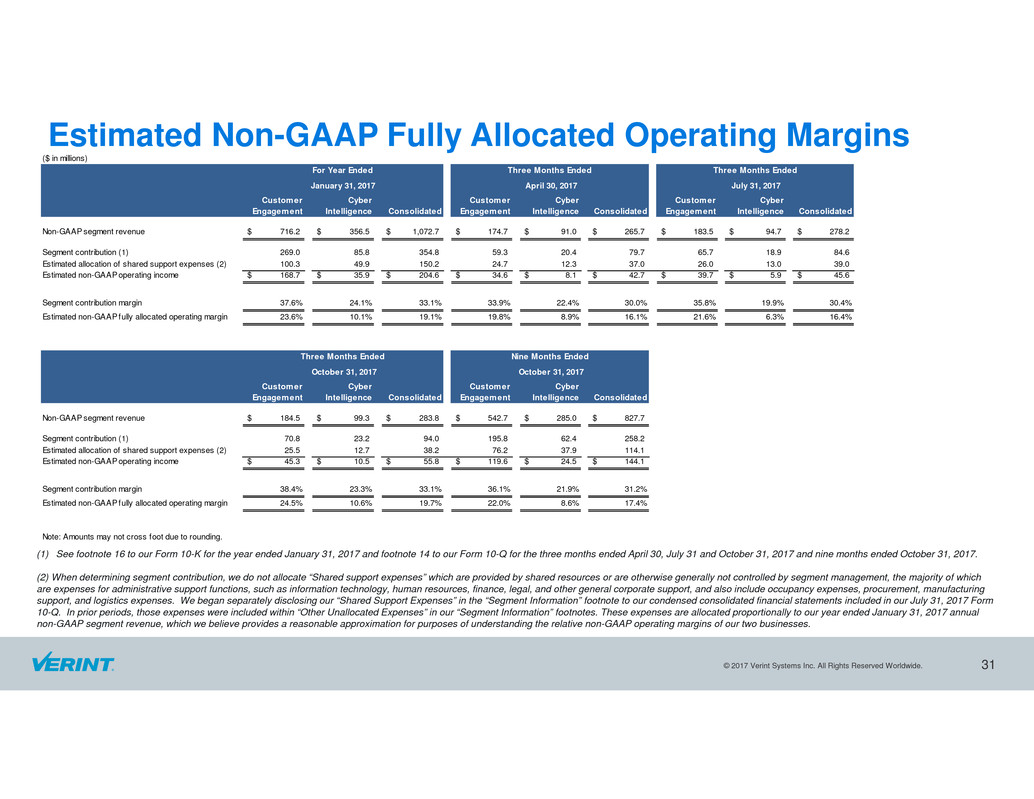

Estimated Non-GAAP Fully Allocated Operating Margins

31

(1) See footnote 16 to our Form 10-K for the year ended January 31, 2017 and footnote 14 to our Form 10-Q for the three months ended April 30, July 31 and October 31, 2017 and nine months ended October 31, 2017.

(2) When determining segment contribution, we do not allocate “Shared support expenses” which are provided by shared resources or are otherwise generally not controlled by segment management, the majority of which

are expenses for administrative support functions, such as information technology, human resources, finance, legal, and other general corporate support, and also include occupancy expenses, procurement, manufacturing

support, and logistics expenses. We began separately disclosing our “Shared Support Expenses” in the “Segment Information” footnote to our condensed consolidated financial statements included in our July 31, 2017 Form

10-Q. In prior periods, those expenses were included within “Other Unallocated Expenses” in our “Segment Information” footnotes. These expenses are allocated proportionally to our year ended January 31, 2017 annual

non-GAAP segment revenue, which we believe provides a reasonable approximation for purposes of understanding the relative non-GAAP operating margins of our two businesses.

($ in millions)

Customer

Engagement

Cyber

Intelligence Consolidated

Customer

Engagement

Cyber

Intelligence Consolidated

Customer

Engagement

Cyber

Intelligence Consolidated

Non-GAAP segment revenue 716.2$ 356.5$ 1,072.7$ 174.7$ 91.0$ 265.7$ 183.5$ 94.7$ 278.2$

Segment contribution (1) 269.0 85.8 354.8 59.3 20.4 79.7 65.7 18.9 84.6

Estimated allocation of shared support expenses (2) 100.3 49.9 150.2 24.7 12.3 37.0 26.0 13.0 39.0

Estimated non-GAAP operating income 168.7$ 35.9$ 204.6$ 34.6$ 8.1$ 42.7$ 39.7$ 5.9$ 45.6$

Segment contribution margin 37.6% 24.1% 33.1% 33.9% 22.4% 30.0% 35.8% 19.9% 30.4%

Estimated non-GAAP fully allocated operating margin 23.6% 10.1% 19.1% 19.8% 8.9% 16.1% 21.6% 6.3% 16.4%

Customer

Engagement

Cyber

Intelligence Consolidated

Customer

Engagement

Cyber

Intelligence Consolidated

Non-GAAP segment revenue 184.5$ 99.3$ 283.8$ 542.7$ 285.0$ 827.7$

Segment contribution (1) 70.8 23.2 94.0 195.8 62.4 258.2

Estimated allocation of shared support expenses (2) 25.5 12.7 38.2 76.2 37.9 114.1

Estimated non-GAAP operating income 45.3$ 10.5$ 55.8$ 119.6$ 24.5$ 144.1$

Segment contribution margin 38.4% 23.3% 33.1% 36.1% 21.9% 31.2%

Estimated non-GAAP fully allocated operating margin 24.5% 10.6% 19.7% 22.0% 8.6% 17.4%

Nine Months Ended

October 31, 2017

July 31, 2017

October 31, 2017

Note: Amounts may not cross foot due to rounding.

For Year Ended Three Months Ended

January 31, 2017 April 30, 2017

Three Months Ended

Three Months Ended

© 2014 Verint Systems Inc. All Rights Reserved Worldwide.

© 2017 Verint Systems Inc. All Rights Reserved Worldwide.

Thank You

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Cafely Releases 2024 Coffee Statistics - Breakdown by Country, Region, and Demographics

- Epazz, Inc.: CryObo, Inc. solar Bitcoin operations will issue tokens

- Ground-Breaking, Drug-Free, and Clinically Tested BackVive Patch Offers Long-Lasting Relief to Chronic Back Pain Sufferers

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share