Form 8-K Broadcom Ltd For: Nov 06 Filed by: Broadcom Cayman L.P.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 6, 2017

Broadcom Limited

Broadcom Cayman L.P.

(Exact name of registrants as specified in its charter)

| Singapore Cayman Islands |

001-37690 333-205938-01 |

98-1254807 98-1254815 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) | ||

| Broadcom Limited 1 Yishun Avenue 7 Singapore 768923 Broadcom Cayman L.P. c/o Broadcom Limited 1 Yishun Avenue 7 Singapore 768923 |

N/A | |||

| (Address of principal executive offices) | (Zip Code) | |||

Registrants’ telephone number, including area code (65) 6755-7888

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☒ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2).

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 8.01. | Other Events. |

On November 6, 2017, Broadcom Limited (“Broadcom”) issued a press release (the “Press Release”) announcing its proposal (the “Proposal”) to acquire all of the outstanding shares of common stock of Qualcomm Incorporated (“Qualcomm”). Broadcom also made available a related investor presentation (the “Investor Presentation”).

The foregoing description of the Proposal is qualified in its entirety by reference to the Press Release and the Investor Presentation, copies of which are attached hereto as Exhibit 99.1 and Exhibit 99.2, respectively.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits.

| Exhibit Number |

Description | |

| 99.1 | Press Release, dated November 6, 2017. | |

| 99.2 | Investor Presentation, dated November 6, 2017 | |

Cautionary Note Regarding Forward-Looking Statements

This report contains forward-looking statements (including within the meaning of Section 21E of the United States Securities Exchange Act of 1934, as amended, and Section 27A of the United States Securities Act of 1933, as amended) concerning Broadcom. These statements include, but are not limited to, statements that address our expected future business and financial performance and statements about (i) proposed transaction involving Broadcom and Qualcomm and the expected benefits of the proposed transaction, (ii) the expected benefits of other acquisitions, (iii) our plans, objectives and intentions with respect to future operations and products, (iv) our competitive position and opportunities, (v) the impact of acquisitions on the market for our products, and (vi) other statements identified by words such as “will”, “expect”, “believe”, “anticipate”, “estimate”, “should”, “intend”, “plan”, “potential”, “predict”, “project”, “aim”, and similar words, phrases or expressions. These forward-looking statements are based on current expectations and beliefs of the management of Broadcom, as well as assumptions made by, and information currently available to, such management, current market trends and market conditions and involve risks and uncertainties, many of which are outside Broadcom’s and management’s control, and which may cause actual results to differ materially from those contained in forward-looking statements. Accordingly, you should not place undue reliance on such statements.

Such risks, uncertainties and assumptions include: the ultimate outcome of any possible transaction between Broadcom and Qualcomm, including the possibility that Qualcomm will reject the proposed transaction with Broadcom; uncertainties as to whether Qualcomm will cooperate with Broadcom regarding the proposed transaction; the effect of the announcement of the proposed transaction on the ability of Broadcom and Qualcomm to retain customers, to retain and hire key personnel and to maintain favorable relationships with suppliers or customers; the timing of the proposed transaction; the ability to obtain regulatory approvals and satisfy other closing conditions to the completion of the proposed transaction (including shareholder approvals); and other risks related to the completion of the proposed transaction and actions related thereto. Other risks, uncertainties and assumptions that could materially affect future results include: any risks associated with loss of our significant customers and fluctuations in the timing and volume of significant customer demand; our dependence on contract manufacturers and outsourced supply chain; any acquisitions we may make, as well as delays, challenges and expenses associated with receiving governmental and regulatory approvals and satisfying other closing conditions, and with integrating acquired companies with our existing businesses and our ability to achieve the benefits, growth prospects and synergies expected from such acquisitions, including our pending acquisition of Brocade Communications Systems, Inc. and our proposed acquisition of Qualcomm; the ability of Broadcom to integrate Qualcomm’s business and make changes to its business model, and to resolve legal proceedings, governmental investigations and customer disputes relating to Qualcomm’s licensing practices; our ability to accurately estimate customers’ demand and adjust our manufacturing and supply chain accordingly; our significant indebtedness, including the substantial indebtedness we expect to incur in connection with our proposed acquisition of Qualcomm, and the need to generate sufficient cash flows to service and repay such debt; dependence on and risks associated with distributors of our products; our ability to improve our manufacturing efficiency and quality; increased dependence on a small number of markets; quarterly and annual fluctuations in operating results; cyclicality in the semiconductor industry or in our target markets; global economic conditions and concerns; our competitive performance and ability to continue achieving design wins with our customers, as well as the timing of those design wins; rates of growth in our target markets; prolonged disruptions of our or our contract manufacturers’ manufacturing facilities or other significant operations; our dependence on outsourced service providers for certain key business services and their ability to execute to our requirements; our ability to maintain or improve gross margin; our ability to maintain tax concessions in certain jurisdictions;

our ability to protect our intellectual property and the unpredictability of any associated litigation expenses; any expenses or reputational damage associated with resolving customer product and warranty and indemnification claims; our ability to sell to new types of customers and to keep pace with technological advances; market acceptance of the end products into which our products are designed; and other events and trends on a national, regional and global scale, including those of a political, economic, business, competitive and regulatory nature.

Our filings with the Securities and Exchange Commission (“SEC”), which you may obtain for free at the SEC’s website at http://www.sec.gov, discuss some of the important risk factors that may affect our business, results of operations and financial condition. We undertake no intent or obligation to publicly update or revise any of these forward looking statements, whether as a result of new information, future events or otherwise, except as required by law.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Broadcom Limited | ||||||

| Date: November 6, 2017 | By: | /s/ Thomas H. Krause, Jr. | ||||

| Thomas H. Krause, Jr. | ||||||

| Chief Financial Officer | ||||||

| Broadcom Cayman L.P., by its general partner Broadcom Limited | ||||||

| By: | /s/ Thomas H. Krause, Jr. | |||||

| Thomas H. Krause, Jr. | ||||||

| Chief Financial Officer | ||||||

Exhibit 99.1

Broadcom Proposes to Acquire Qualcomm for $70.00 per Share in Cash and Stock in Transaction Valued at $130 Billion

Broadcom Proposal Stands Whether Qualcomm’s Pending Acquisition of NXP is Consummated on the Currently Disclosed Terms of $110 per Share or the NXP Transaction is Terminated

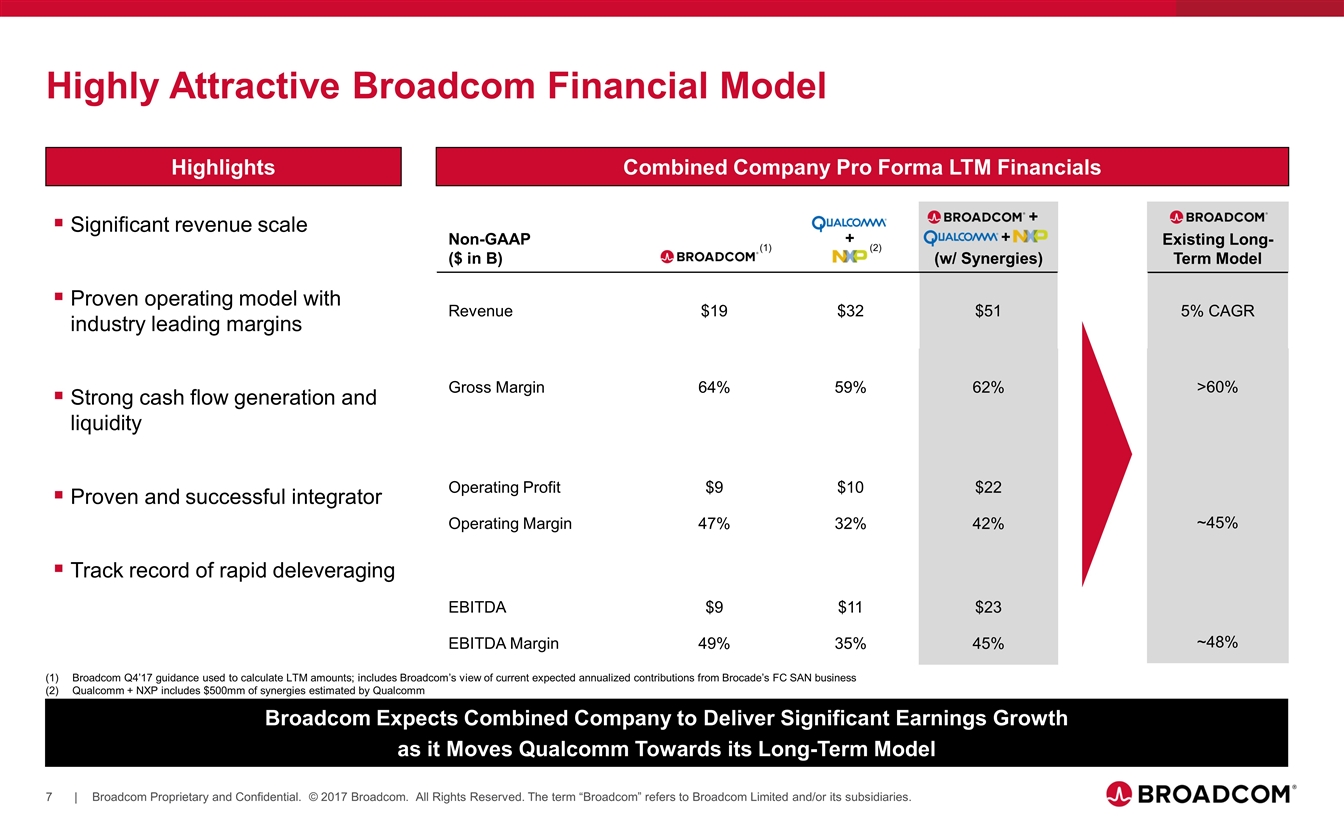

Broadcom and Qualcomm, Including NXP, Will Have Pro Forma Fiscal 2017 Revenues of Approximately $51 Billion and EBITDA of Approximately $23 Billion, Including Synergies

Delivers Immediate, Substantial and Compelling Premium for Qualcomm Stockholders

Silver Lake Partners Provides $5 Billion Convertible Debt Financing Commitment Letter to Support Transaction

SAN JOSE, Calif. – Nov. 6, 2017 – Broadcom Limited (NASDAQ: AVGO) (“Broadcom”), a leading semiconductor device supplier to the wired, wireless, enterprise storage, and industrial end markets, today announced a proposal to acquire all of the outstanding shares of Qualcomm Incorporated (NASDAQ: QCOM) (“Qualcomm”) for per share consideration of $70.00 in cash and stock.

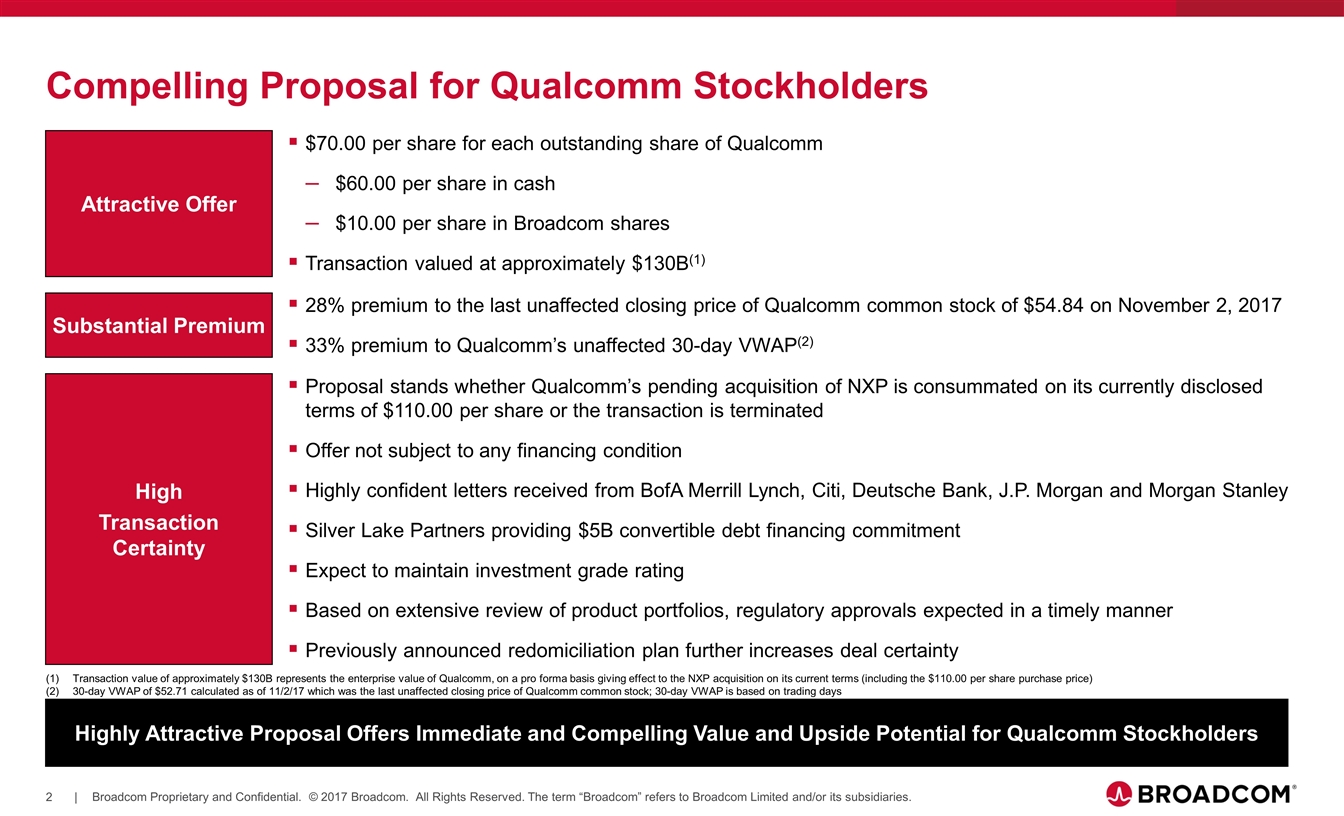

Under Broadcom’s proposal, the $70.00 per share to be received by Qualcomm stockholders would consist of $60.00 in cash and $10.00 per share in Broadcom shares. Broadcom’s proposal represents a 28% premium over the closing price of Qualcomm common stock on November 2, 2017, the last unaffected trading day prior to media speculation regarding a potential transaction, and a premium of 33% to Qualcomm’s unaffected 30-day volume-weighted average price. The Broadcom proposal stands whether Qualcomm’s pending acquisition of NXP Semiconductors N.V. (“NXP”) is consummated on the currently disclosed terms of $110 per NXP share or the transaction is terminated. The proposed transaction is valued at approximately $130 billion on a pro forma basis, including $25 billion of net debt, giving effect to Qualcomm’s pending acquisition of NXP on its currently disclosed terms.

“Broadcom’s proposal is compelling for stockholders and stakeholders in both companies. Our proposal provides Qualcomm stockholders with a substantial and immediate premium in cash for their shares, as well as the opportunity to participate in the upside potential of the combined company,” said Hock Tan, President and Chief Executive Officer of Broadcom. “This complementary transaction will position the combined company as a global communications leader with an impressive portfolio of technologies and products. We would not make this offer if we were not confident that our common global customers would embrace the proposed combination. With greater scale and broader product diversification, the combined company will be positioned to deliver more advanced semiconductor solutions for our global customers and drive enhanced stockholder value.”

Tan continued, “We have great respect for the company founded 32 years ago by Irwin Jacobs, Andrew Viterbi and their colleagues, and the revolutionary technologies they developed. Following the combination, Qualcomm will be best positioned to build on its legacy of innovation and invention. Given the common strengths of our businesses and our shared heritage of, and continued focus on, technology innovation, we are confident we can quickly realize the benefits of this compelling transaction for all stakeholders. Importantly, we believe that Qualcomm and Broadcom employees will benefit from substantial opportunities for growth and development as part of a larger company.”

Thomas Krause, Broadcom Chief Financial Officer, added, “The Broadcom business continues to perform very well. Broadcom has completed five major acquisitions since 2013, and has a proven track record of rapidly deleveraging and successfully integrating companies to create value for our stockholders, employees and customers. Given the complementary nature of our products, we are confident that any regulatory requirements necessary to complete a combination with Qualcomm will be met in a timely manner. We look forward to engaging immediately in discussions with Qualcomm so that we can sign a definitive agreement and complete this transaction expeditiously.”

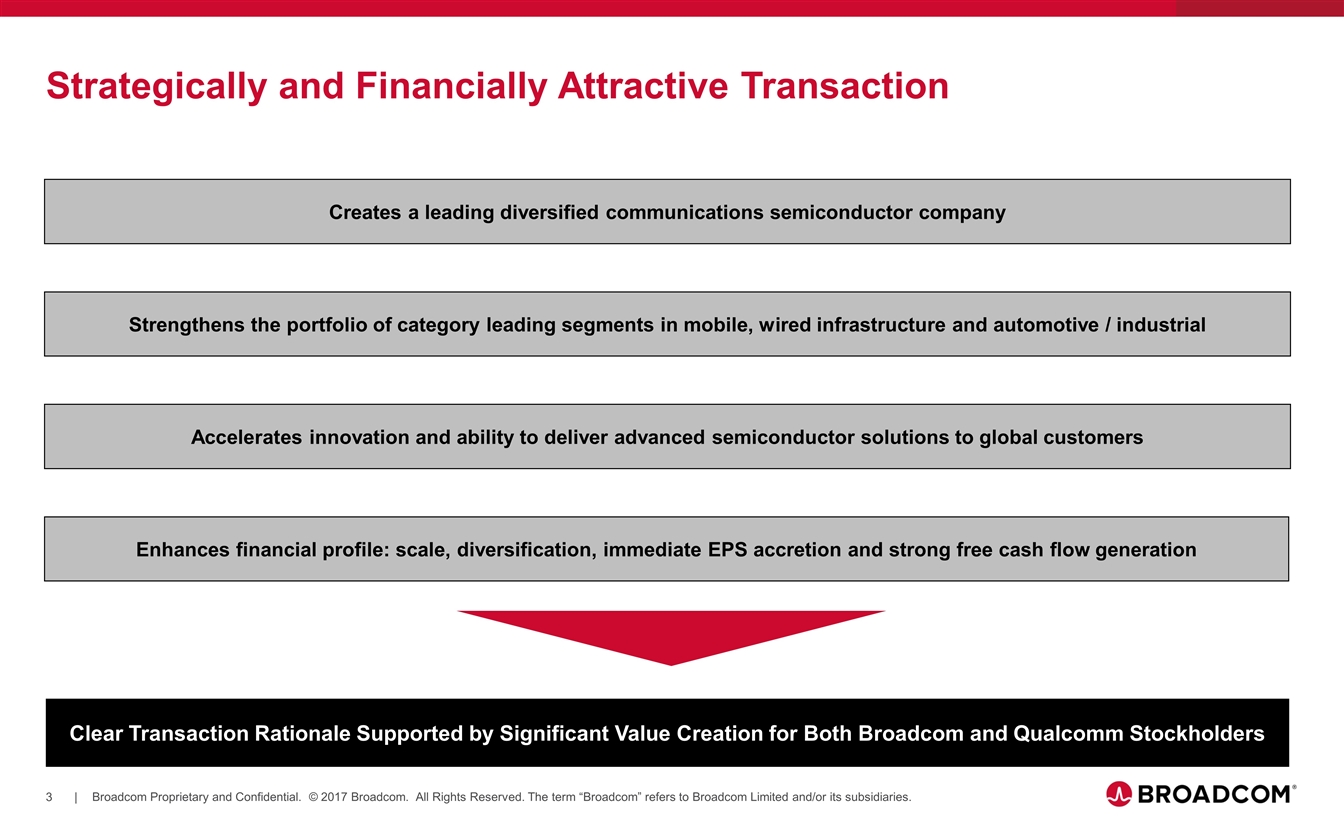

Strategic and Financial Benefits

| • | Creates a Leading Diversified Communications Semiconductor Company: Qualcomm’s cellular business is highly complementary to Broadcom’s portfolio, and the combination will create a strong, global company with an impressive portfolio of technologies and products. |

| • | Accelerates Innovation to Deliver More Advanced Semiconductor Solutions to Global Customers: As a result of enhanced scale, reach and financial flexibility, the combined company will benefit from the ability to accelerate innovation and deliver more advanced semiconductor solutions to its broad global customer base. |

| • | Compelling Financial Benefits: The combined company will have an enhanced financial profile, benefiting from Broadcom’s proven operating model with industry-leading margins. The combined Broadcom and Qualcomm, including NXP, will have pro forma fiscal 2017 revenues of approximately $51 billion and pro forma 2017 EBITDA of approximately $23 billion, including synergies. The transaction is expected to be accretive to Broadcom’s Non-GAAP EPS in the first full year after close. |

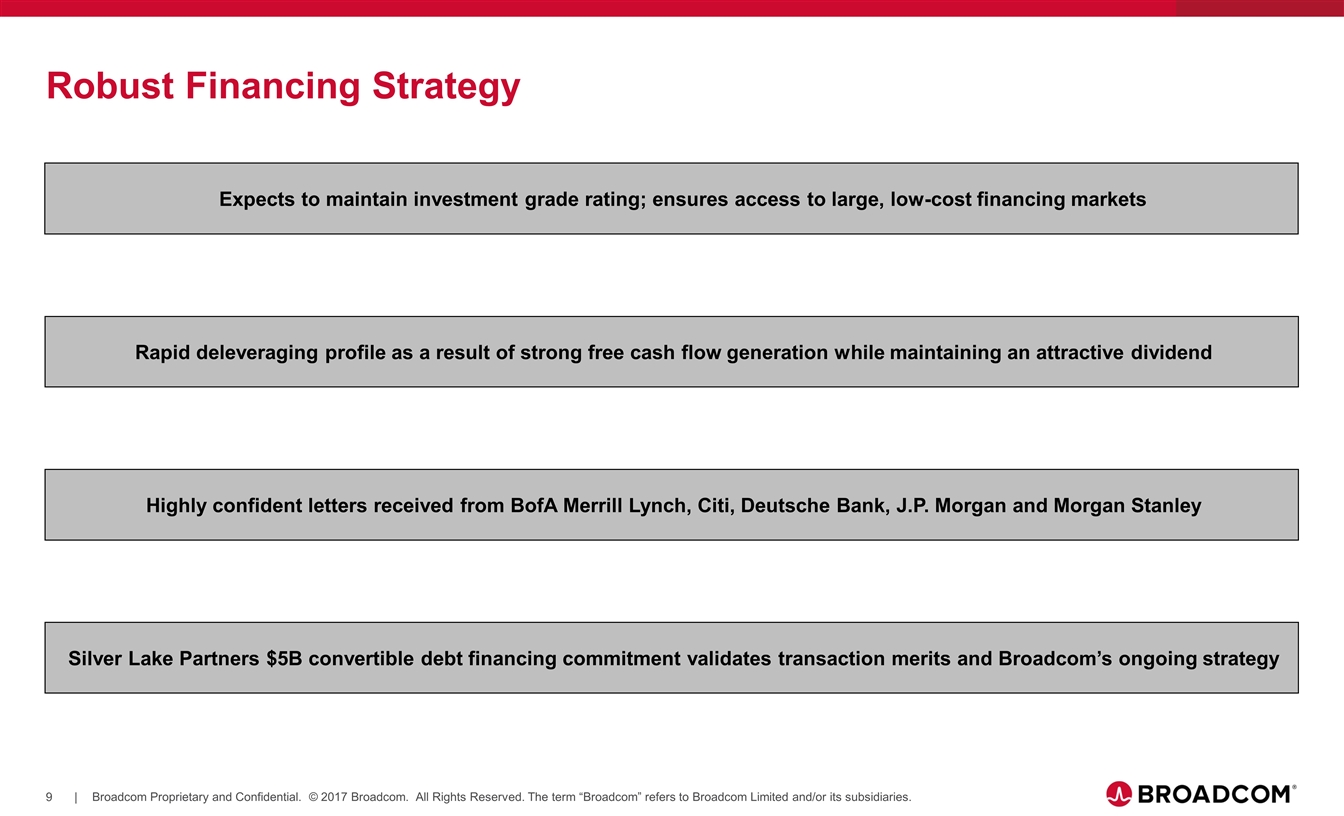

The combined company is expected to have an investment grade credit rating and strong cash flow generation to facilitate rapid deleveraging.

Approvals and Financing

Broadcom’s proposal was unanimously approved by the Board of Directors of Broadcom. Broadcom is prepared to engage immediately in discussions with Qualcomm to work toward a mutually acceptable definitive agreement and is ready to devote all necessary resources to finalize the necessary documentation on an expeditious basis.

The proposed transaction will not be subject to any financing condition. BofA Merrill Lynch, Citi, Deutsche Bank, J.P. Morgan and Morgan Stanley have advised Broadcom in writing that they are highly confident that they will be able to arrange the necessary debt financing for the proposed transaction. Silver Lake Partners, which has served as a strategic partner to Broadcom in prior transactions, has provided Broadcom with a commitment letter for a $5 billion convertible debt financing in connection with the transaction.

Broadcom expects that the proposed transaction would be completed within approximately 12 months following the signing of a definitive agreement.

Redomicile Announcement

As previously announced on November 2, 2017, Broadcom intends to redomicile to change the parent company of the Broadcom corporate group from a Singapore company to a U.S. corporation.

Letter to Qualcomm

The full text of a letter sent to Qualcomm is below.

November 6, 2017

Board of Directors

Qualcomm Incorporated

5775 Morehouse Drive

San Diego, CA 92121

Dear Members of the Board of Directors:

On behalf of Broadcom, I am pleased to submit this proposal to acquire Qualcomm in a transaction that will provide Qualcomm stockholders with an immediate, substantial and compelling premium to the value that would be achievable by Qualcomm on a standalone basis, as well as the opportunity to participate in the upside potential of the combined company.

As you know from prior discussions between our two companies, Broadcom has been interested for some time in combining Qualcomm’s mobile business with the Broadcom platform. We continue to believe that such a combination will deliver substantial benefits to our respective stockholders, employees, customers and other stakeholders. We are hopeful that you will agree that the proposal we outline in this letter presents a compelling opportunity for Qualcomm stockholders to realize both present and future value for their Qualcomm shares.

Strategic Rationale

We have great respect for the legacy Qualcomm has built since its founding more than 30 years ago by Irwin Jacobs, Andrew Viterbi and their colleagues. Based on our knowledge of the semiconductor industry, we believe that there is a significant strategic, financial and operational rationale for the proposed transaction. A combination of Qualcomm and Broadcom will create a strong, global company with an impressive portfolio of industry-leading technologies and products. Given the highly complementary nature of our businesses, we are confident that our global customers will embrace the proposed combination as we work strategically with them to deliver more advanced value-added semiconductor solutions.

Since I discussed a combination with Steve in August of last year, Broadcom has successfully completed the integration of the Broadcom-Avago combination, de-levered its balance sheet and meaningfully increased revenues and profitability. As a result, Broadcom stockholders have been rewarded with a 55% appreciation in Broadcom’s stock price since that time, ranking in the top 10% among the S&P 500 over that period. We believe these factors, coupled with our history of successful acquisitions and

integrations, clearly demonstrate our commitment and ability to implement value-enhancing transactions and deliver robust results for stockholders, employees, customers and other stakeholders.

Proposed Terms

We are offering Qualcomm stockholders $70.00 per share, consisting of $60.00 per share in cash and $10.00 per share in Broadcom shares. This represents a significant premium of 28% to the closing price of Qualcomm common stock on November 2, 2017, the last unaffected trading day prior to media speculation regarding a potential transaction, and a premium of 33% to Qualcomm’s unaffected 30-day volume-weighted average price. Our proposal stands whether your pending acquisition of NXP is consummated on the currently disclosed terms of $110 per share or that transaction is terminated.

Our proposal will enable Qualcomm stockholders to achieve both immediate cash value and the ability to participate in the future success of the combined enterprise, which will benefit from greater scale and broader product diversification. The combination of our two companies and associated synergies will be accretive to Broadcom’s earnings, which will directly benefit Qualcomm stockholders through their equity ownership in the combined company. We have significant experience with acquiring and integrating companies and an established track record of delivering financial results for our stockholders. I am confident that we can deliver similar results for our combined stockholders should we consummate this transaction.

Financing

The proposed transaction will not be subject to any financing condition. BofA Merrill Lynch, Citi, Deutsche Bank, J.P. Morgan and Morgan Stanley have advised us in writing that they are highly confident that they will be able to arrange the necessary debt financing for the proposed transaction. Silver Lake Partners, which has served as a strategic partner to Broadcom in prior transactions, has provided Broadcom with a commitment letter for a $5 billion convertible debt financing in connection with the transaction. We also expect to maintain our investment grade credit rating following the proposed transaction. We and our advisors are available to review our financing plans with you at your convenience.

Regulatory Approvals

We and our advisors have conducted extensive analysis of the regulatory approvals that will be required in connection with the proposed transaction, and we are confident that the transaction will receive all necessary approvals in a timely manner. We would not make this offer if we were not confident that our common global customers would embrace the proposed combination, and we do not anticipate any material antitrust or other regulatory issues that would extend the normal timetable for closing a transaction of this nature.

Employees

We have a long history of providing outstanding opportunities for leadership and growth to employees, including business unit leaders, of companies we acquire. Employees

who have joined our company as a result of acquisitions have become an integral part of our business, and we look forward to the opportunity to welcome Qualcomm’s employees to Broadcom.

Conclusion

We believe that our proposal represents the most attractive, value-enhancing alternative available to Qualcomm stockholders, and that it is in the best interests of both parties to proceed as soon as possible to reach agreement on a transaction structure and terms. We are ready to devote all necessary resources to finalize all documentation on an expeditious basis. We and our advisors are prepared to engage in discussions immediately to work toward a mutually beneficial transaction.

We look forward to working with you to complete this transaction successfully and suggest that our respective financial and legal advisors and senior management team meet at your earliest convenience to work toward this goal.

This letter does not constitute a binding obligation or commitment of either company to proceed with any transaction. No such obligations will in any event be imposed on either party unless and until a mutually acceptable definitive agreement is formally entered into by both parties.

Sincerely,

/s/ Hock Tan

Hock Tan

President and Chief Executive Officer

Advisors

Moelis & Company LLC, Citi, Deutsche Bank, J.P. Morgan, BofA Merrill Lynch and Morgan Stanley are acting as financial advisors to Broadcom. Wachtell, Lipton, Rosen & Katz and Latham & Watkins LLP are acting as legal counsel.

Additional Materials

An investor presentation and infographic regarding Broadcom’s proposal will be filed with the Securities and Exchange Commission and is available on the Investor Relations page of Broadcom’s website.

About Broadcom Limited

Broadcom Limited (NASDAQ: AVGO) is a leading designer, developer and global supplier of a broad range of digital and analog semiconductor connectivity solutions. Broadcom Limited’s extensive product portfolio serves four primary end markets: wired infrastructure, wireless communications, enterprise storage and industrial & other. Applications for our products in these end markets include: data center networking, home connectivity, set-top box, broadband access, telecommunications equipment, smartphones and base stations, data center servers and storage, factory automation, power generation and alternative energy systems, and electronic displays.

Forward-Looking Statements

This communication contains forward-looking statements (including within the meaning of Section 21E of the United States Securities Exchange Act of 1934, as amended, and Section 27A of the United States Securities Act of 1933, as amended) concerning Broadcom and Qualcomm. These statements include, but are not limited to, statements that address Broadcom’s expected future business and financial performance and statements about (i) proposed transaction involving Broadcom and Qualcomm and the expected benefits of the proposed transaction, (ii) the expected benefits of other acquisitions, (iii) Broadcom’s plans, objectives and intentions with respect to future operations and products, (iv) Broadcom’s competitive position and opportunities, (v) the impact of acquisitions on the market for Broadcom’s products, and (vi) other statements identified by words such as “will”, “expect”, “believe”, “anticipate”, “estimate”, “should”, “intend”, “plan”, “potential”, “predict”, “project”, “aim”, and similar words, phrases or expressions. These forward-looking statements are based on current expectations and beliefs of the management of Broadcom, as well as assumptions made by, and information currently available to, such management, current market trends and market conditions and involve risks and uncertainties, many of which are outside Broadcom’s and management’s control, and which may cause actual results to differ materially from those contained in forward-looking statements. Accordingly, you should not place undue reliance on such statements.

Such risks, uncertainties and assumptions include: the ultimate outcome of any possible transaction between Broadcom and Qualcomm, including the possibility that Qualcomm will reject the proposed transaction with Broadcom; uncertainties as to whether Qualcomm will cooperate with Broadcom regarding the proposed transaction; the effect of the announcement of the proposed transaction on the ability of Broadcom and Qualcomm to retain customers, to retain and hire key personnel and to maintain favorable relationships with suppliers or customers; the timing of the proposed transaction; the ability to obtain regulatory approvals and satisfy other closing conditions to the completion of the proposed transaction (including shareholder approvals); and other risks related to the completion of the proposed transaction and actions related thereto. Other risks, uncertainties and assumptions that could materially affect future results include: any risks associated with loss of Broadcom’s significant customers and fluctuations in the timing and volume of significant customer demand; Broadcom’s dependence on contract manufacturers and outsourced supply chain; any acquisitions Broadcom may make, as well as delays, challenges and expenses associated with receiving governmental and regulatory approvals and satisfying other closing conditions, and with integrating acquired companies with Broadcom’s existing businesses and Broadcom’s ability to achieve the benefits, growth prospects and synergies expected from such acquisitions, including Broadcom’s pending acquisition of Brocade Communications Systems, Inc. and Broadcom’s proposed acquisition of Qualcomm; the ability of Broadcom to integrate Qualcomm’s business and make changes to its business model, and to resolve legal proceedings, governmental investigations and customer disputes relating to Qualcomm’s licensing practices; Broadcom’s ability to accurately estimate customers’ demand and adjust Broadcom’s manufacturing and supply chain accordingly; Broadcom’s significant indebtedness, including the substantial indebtedness Broadcom expects to incur in connection with Broadcom’s proposed acquisition of Qualcomm, and the need to generate sufficient cash flows to service and repay such debt; dependence on and risks associated with distributors of Broadcom’s products; Broadcom’s ability to improve its manufacturing efficiency and quality; increased dependence on a small number of markets; quarterly and annual fluctuations in operating results; cyclicality in the semiconductor industry or in Broadcom’s target markets;

global economic conditions and concerns; Broadcom’s competitive performance and ability to continue achieving design wins with its customers, as well as the timing of those design wins; rates of growth in Broadcom’s target markets; prolonged disruptions of Broadcom’s or its contract manufacturers’ manufacturing facilities or other significant operations; Broadcom’s dependence on outsourced service providers for certain key business services and their ability to execute to its requirements; Broadcom’s ability to maintain or improve gross margin; Broadcom’s ability to maintain tax concessions in certain jurisdictions; Broadcom’s ability to protect its intellectual property and the unpredictability of any associated litigation expenses; any expenses or reputational damage associated with resolving customer product and warranty and indemnification claims; Broadcom’s ability to sell to new types of customers and to keep pace with technological advances; market acceptance of the end products into which Broadcom’s products are designed; and other events and trends on a national, regional and global scale, including those of a political, economic, business, competitive and regulatory nature.

Broadcom’s filings with the Securities and Exchange Commission (“SEC”), which you may obtain for free at the SEC’s website at http://www.sec.gov, discuss some of the important risk factors that may affect Broadcom’s business, results of operations and financial condition. Broadcom undertakes no intent or obligation to publicly update or revise any of these forward looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Additional Information

This communication does not constitute an offer to buy or solicitation of an offer to sell any securities. This communication relates to a proposal which Broadcom has made for an acquisition of Qualcomm. In furtherance of this proposal and subject to future developments, Broadcom (and, if a negotiated transaction is agreed, Qualcomm) may file one or more registration statements, proxy statements, tender offer statements or other documents with the SEC. This communication is not a substitute for any proxy statement, registration statement, tender offer statement, prospectus or other document Broadcom and/or Qualcomm may file with the SEC in connection with the proposed transaction.

Investors and security holders of Broadcom and Qualcomm are urged to read the proxy statement(s), registration statement, tender offer statement, prospectus and/or other documents filed with the SEC carefully in their entirety if and when they become available as they will contain important information about the proposed transaction. Any definitive proxy statement(s) or prospectus(es) (if and when available) will be mailed to stockholders of Broadcom and/or Qualcomm, as applicable. Investors and security holders will be able to obtain free copies of these documents (if and when available) and other documents filed with the SEC by Broadcom through the web site maintained by the SEC at http://www.sec.gov.

This document shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended.

This communication is neither a solicitation of a proxy nor a substitute for any proxy statement or other filings that may be made with the SEC. Nonetheless, Broadcom and its directors and

executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed transactions. You can find information about Broadcom’s executive officers and directors in Broadcom’s definitive proxy statement filed with the SEC on February 17, 2017. Additional information regarding the interests of such potential participants will be included in one or more registration statements, proxy statements, tender offer statements or other documents filed with the SEC if and when they become available. These documents (if and when available) may be obtained free of charge from the SEC’s website http://www.sec.gov.

Investors:

Ashish Saran

Broadcom Limited

Investor Relations

408-433-8000

Or

Tom Germinario / Rick Grubaugh

D.F. King & Co., Inc.

212-269-5550

Media:

Joele Frank / Steve Frankel / Andi Rose

Joele Frank, Wilkinson Brimmer Katcher

212-355-4449

Broadcom Proposal to Acquire Qualcomm Creating a leading diversified communications semiconductor company Investor Presentation November 6, 2017 Exhibit 99.2

Cautions Regarding Forward-Looking Statements This communication contains forward-looking statements (including within the meaning of Section 21E of the United States Securities Exchange Act of 1934, as amended, and Section 27A of the United States Securities Act of 1933, as amended) concerning Broadcom and Qualcomm. These statements include, but are not limited to, statements that address Broadcom’s expected future business and financial performance and statements about (i) proposed transaction involving Broadcom and Qualcomm and the expected benefits of the proposed transaction, (ii) the expected benefits of other acquisitions, (iii) Broadcom’s plans, objectives and intentions with respect to future operations and products, (iv) Broadcom’s competitive position and opportunities, (v) the impact of acquisitions on the market for Broadcom’s products, and (vi) other statements identified by words such as “will”, “expect”, “believe”, “anticipate”, “estimate”, “should”, “intend”, “plan”, “potential”, “predict”, “project”, “aim”, and similar words, phrases or expressions. These forward-looking statements are based on current expectations and beliefs of the management of Broadcom, as well as assumptions made by, and information currently available to, such management, current market trends and market conditions and involve risks and uncertainties, many of which are outside Broadcom’s and management’s control, and which may cause actual results to differ materially from those contained in forward-looking statements. Accordingly, you should not place undue reliance on such statements. Such risks, uncertainties and assumptions include: the ultimate outcome of any possible transaction between Broadcom and Qualcomm, including the possibility that Qualcomm will reject the proposed transaction with Broadcom; uncertainties as to whether Qualcomm will cooperate with Broadcom regarding the proposed transaction; the effect of the announcement of the proposed transaction on the ability of Broadcom and Qualcomm to retain customers, to retain and hire key personnel and to maintain favorable relationships with suppliers or customers; the timing of the proposed transaction; the ability to obtain regulatory approvals and satisfy other closing conditions to the completion of the proposed transaction (including shareholder approvals); and other risks related to the completion of the proposed transaction and actions related thereto. Other risks, uncertainties and assumptions that could materially affect future results include: any risks associated with loss of Broadcom’s significant customers and fluctuations in the timing and volume of significant customer demand; Broadcom’s dependence on contract manufacturers and outsourced supply chain; any acquisitions Broadcom may make, as well as delays, challenges and expenses associated with receiving governmental and regulatory approvals and satisfying other closing conditions, and with integrating acquired companies with Broadcom’s existing businesses and Broadcom’s ability to achieve the benefits, growth prospects and synergies expected from such acquisitions, including Broadcom’s pending acquisition of Brocade Communications Systems, Inc. and Broadcom’s proposed acquisition of Qualcomm; the ability of Broadcom to integrate Qualcomm’s business and make changes to its business model, and to resolve legal proceedings, governmental investigations and customer disputes relating to Qualcomm’s licensing practices; Broadcom’s ability to accurately estimate customers’ demand and adjust Broadcom’s manufacturing and supply chain accordingly; Broadcom’s significant indebtedness, including the substantial indebtedness Broadcom expects to incur in connection with Broadcom’s proposed acquisition of Qualcomm, and the need to generate sufficient cash flows to service and repay such debt; dependence on and risks associated with distributors of Broadcom’s products; Broadcom’s ability to improve its manufacturing efficiency and quality; increased dependence on a small number of markets; quarterly and annual fluctuations in operating results; cyclicality in the semiconductor industry or in Broadcom’s target markets; global economic conditions and concerns; Broadcom’s competitive performance and ability to continue achieving design wins with its customers, as well as the timing of those design wins; rates of growth in Broadcom’s target markets; prolonged disruptions of Broadcom’s or its contract manufacturers’ manufacturing facilities or other significant operations; Broadcom’s dependence on outsourced service providers for certain key business services and their ability to execute to its requirements; Broadcom’s ability to maintain or improve gross margin; Broadcom’s ability to maintain tax concessions in certain jurisdictions; Broadcom’s ability to protect its intellectual property and the unpredictability of any associated litigation expenses; any expenses or reputational damage associated with resolving customer product and warranty and indemnification claims; Broadcom’s ability to sell to new types of customers and to keep pace with technological advances; market acceptance of the end products into which Broadcom’s products are designed; and other events and trends on a national, regional and global scale, including those of a political, economic, business, competitive and regulatory nature. Broadcom’s filings with the Securities and Exchange Commission (“SEC”), which you may obtain for free at the SEC’s website at http://www.sec.gov, discuss some of the important risk factors that may affect Broadcom’s business, results of operations and financial condition. Broadcom undertakes no intent or obligation to publicly update or revise any of these forward looking statements, whether as a result of new information, future events or otherwise, except as required by law. Additional Information This communication does not constitute an offer to buy or solicitation of an offer to sell any securities. This communication relates to a proposal which Broadcom has made for an acquisition of Qualcomm. In furtherance of this proposal and subject to future developments, Broadcom (and, if a negotiated transaction is agreed, Qualcomm) may file one or more registration statements, proxy statements, tender offer statements or other documents with the SEC. This communication is not a substitute for any proxy statement, registration statement, tender offer statement, prospectus or other document Broadcom and/or Qualcomm may file with the SEC in connection with the proposed transaction. Investors and security holders of Broadcom and Qualcomm are urged to read the proxy statement(s), registration statement, tender offer statement, prospectus and/or other documents filed with the SEC carefully in their entirety if and when they become available as they will contain important information about the proposed transaction. Any definitive proxy statement(s) or prospectus(es) (if and when available) will be mailed to stockholders of Broadcom and/or Qualcomm, as applicable. Investors and security holders will be able to obtain free copies of these documents (if and when available) and other documents filed with the SEC by Broadcom through the web site maintained by the SEC at http://www.sec.gov. This document shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended. This communication is neither a solicitation of a proxy nor a substitute for any proxy statement or other filings that may be made with the SEC. Nonetheless, Broadcom and its directors and executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed transactions. You can find information about Broadcom’s executive officers and directors in Broadcom’s definitive proxy statement filed with the SEC on February 17, 2017. Additional information regarding the interests of such potential participants will be included in one or more registration statements, proxy statements, tender offer statements or other documents filed with the SEC if and when they become available. These documents (if and when available) may be obtained free of charge from the SEC’s website http://www.sec.gov. This communication does not constitute an offer to buy or solicitation of an offer to sell any securities. This communication relates to a proposal which Broadcom has made for an acquisition of Qualcomm. In furtherance of this proposal and subject to future developments, Broadcom (and, if a negotiated transaction is agreed, Qualcomm) may file one or more registration statements, proxy statements, tender offer statements or other documents with the SEC. This communication is not a substitute for any proxy statement, registration statement, tender offer statement, prospectus or other document Broadcom and/or Qualcomm may file with the SEC in connection with the proposed transaction. Investors and security holders of Broadcom and Qualcomm are urged to read the proxy statement(s), registration statement, tender offer statement, prospectus and/or other documents filed with the SEC carefully in their entirety if and when they become available as they will contain important information about the proposed transaction. Any definitive proxy statement(s) or prospectus(es) (if and when available) will be mailed to stockholders of Broadcom and/or Qualcomm, as applicable. Investors and security holders will be able to obtain free copies of these documents (if and when available) and other documents filed with the SEC by Broadcom through the web site maintained by the SEC at http://www.sec.gov. This document shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended. This communication is neither a solicitation of a proxy nor a substitute for any proxy statement or other filings that may be made with the SEC. Nonetheless, Broadcom and its directors and executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed transactions. You can find information about Broadcom’s executive officers and directors in Broadcom’s definitive proxy statement filed with the SEC on February 17, 2017. Additional information regarding the interests of such potential participants will be included in one or more registration statements, proxy statements, tender offer statements or other documents filed with the SEC if and when they become available. These documents (if and when available) may be obtained free of charge from the SEC’s website http://www.sec.gov. Forward-Looking Statements

Attractive Offer Substantial Premium High Transaction Certainty Highly Attractive Proposal Offers Immediate and Compelling Value and Upside Potential for Qualcomm Stockholders $70.00 per share for each outstanding share of Qualcomm $60.00 per share in cash $10.00 per share in Broadcom shares Transaction valued at approximately $130B(1) 28% premium to the last unaffected closing price of Qualcomm common stock of $54.84 on November 2, 2017 33% premium to Qualcomm’s unaffected 30-day VWAP(2) Proposal stands whether Qualcomm’s pending acquisition of NXP is consummated on its currently disclosed terms of $110.00 per share or the transaction is terminated Offer not subject to any financing condition Highly confident letters received from BofA Merrill Lynch, Citi, Deutsche Bank, J.P. Morgan and Morgan Stanley Silver Lake Partners providing $5B convertible debt financing commitment Expect to maintain investment grade rating Based on extensive review of product portfolios, regulatory approvals expected in a timely manner Previously announced redomiciliation plan further increases deal certainty Compelling Proposal for Qualcomm Stockholders Transaction value of approximately $130B represents the enterprise value of Qualcomm, on a pro forma basis giving effect to the NXP acquisition on its current terms (including the $110.00 per share purchase price) 30-day VWAP of $52.71 calculated as of 11/2/17 which was the last unaffected closing price of Qualcomm common stock; 30-day VWAP is based on trading days

Strategically and Financially Attractive Transaction Creates a leading diversified communications semiconductor company Strengthens the portfolio of category leading segments in mobile, wired infrastructure and automotive / industrial Accelerates innovation and ability to deliver advanced semiconductor solutions to global customers Enhances financial profile: scale, diversification, immediate EPS accretion and strong free cash flow generation Clear Transaction Rationale Supported by Significant Value Creation for Both Broadcom and Qualcomm Stockholders

Global Semiconductor Industry Leadership Financials adjusted for closed acquisitions and divestitures where financial information was publicly disclosed. LTM Revenue of international companies is based on an FX spot rate as of 11/2/2017; using an average rate over the time revenue was generated would give slightly different numbers Device Solutions semiconductor revenue Broadcom Q4’17 guidance used to calculate LTM amounts; includes Broadcom’s view of current expected annualized contributions from Brocade’s FC SAN business Combined Company to Have Greater Scale, Diversity and Broadcom’s Industry-Leading Operating Model (3) + + + (3) (3) LTM Revenue ($B)(1) (2)

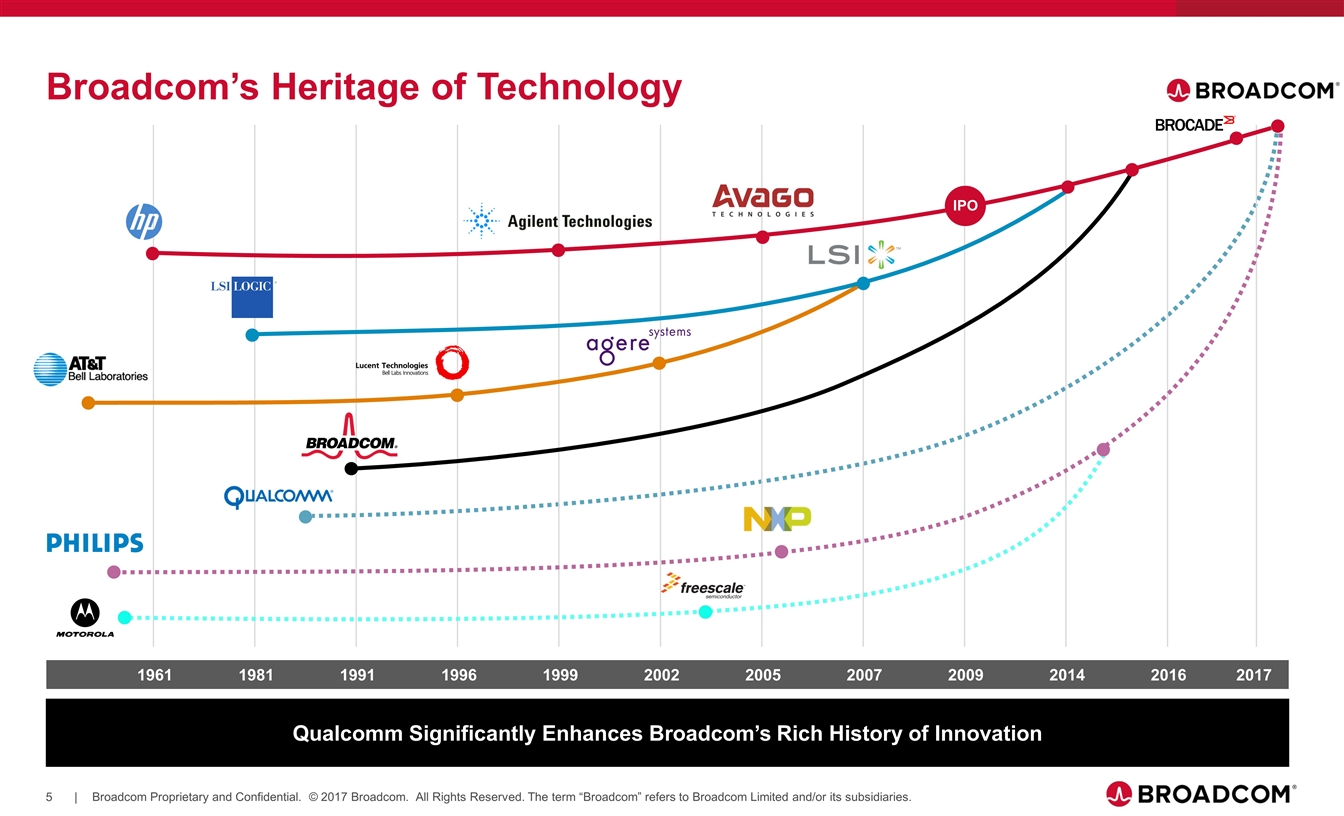

Qualcomm Significantly Enhances Broadcom’s Rich History of Innovation Broadcom’s Heritage of Technology IPO 1961 1981 1991 1996 1999 2002 2005 2007 2009 2014 2016 2017

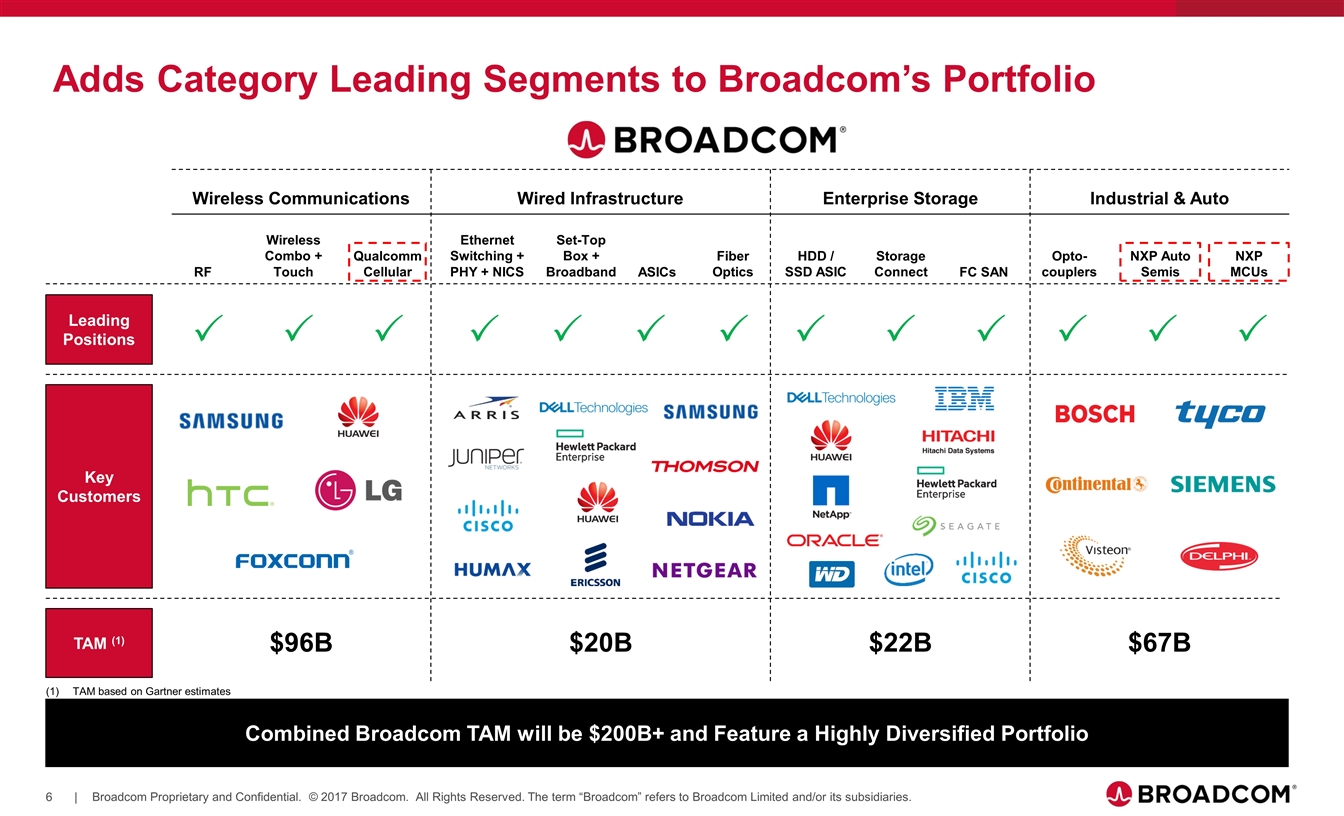

NXP Auto Semis NXP MCUs Leading Positions Key Customers TAM (1) RF Wireless Combo + Touch Set-Top Box + Broadband Ethernet Switching + PHY + NICS ASICs Fiber Optics HDD / SSD ASIC Storage Connect FC SAN P P P P P P P P P P P P Opto-couplers P Wireless Communications Wired Infrastructure Enterprise Storage Industrial & Auto $96B $20B $22B $67B Qualcomm Cellular Combined Broadcom TAM will be $200B+ and Feature a Highly Diversified Portfolio TAM based on Gartner estimates Adds Category Leading Segments to Broadcom’s Portfolio

Existing Long-Term Model 5% CAGR >60% ~45% ~48% Highly Attractive Broadcom Financial Model Significant revenue scale Proven operating model with industry leading margins Strong cash flow generation and liquidity Proven and successful integrator Track record of rapid deleveraging Highlights Broadcom Q4’17 guidance used to calculate LTM amounts; includes Broadcom’s view of current expected annualized contributions from Brocade’s FC SAN business Qualcomm + NXP includes $500mm of synergies estimated by Qualcomm Combined Company Pro Forma LTM Financials Non-GAAP ($ in B) (w/ Synergies) Revenue $19 $32 $51 Gross Margin 64% 59% 62% Operating Profit $9 $10 $22 Operating Margin 47% 32% 42% EBITDA $9 $11 $23 EBITDA Margin 49% 35% 45% Broadcom Expects Combined Company to Deliver Significant Earnings Growth as it Moves Qualcomm Towards its Long-Term Model (1) + + + (2)

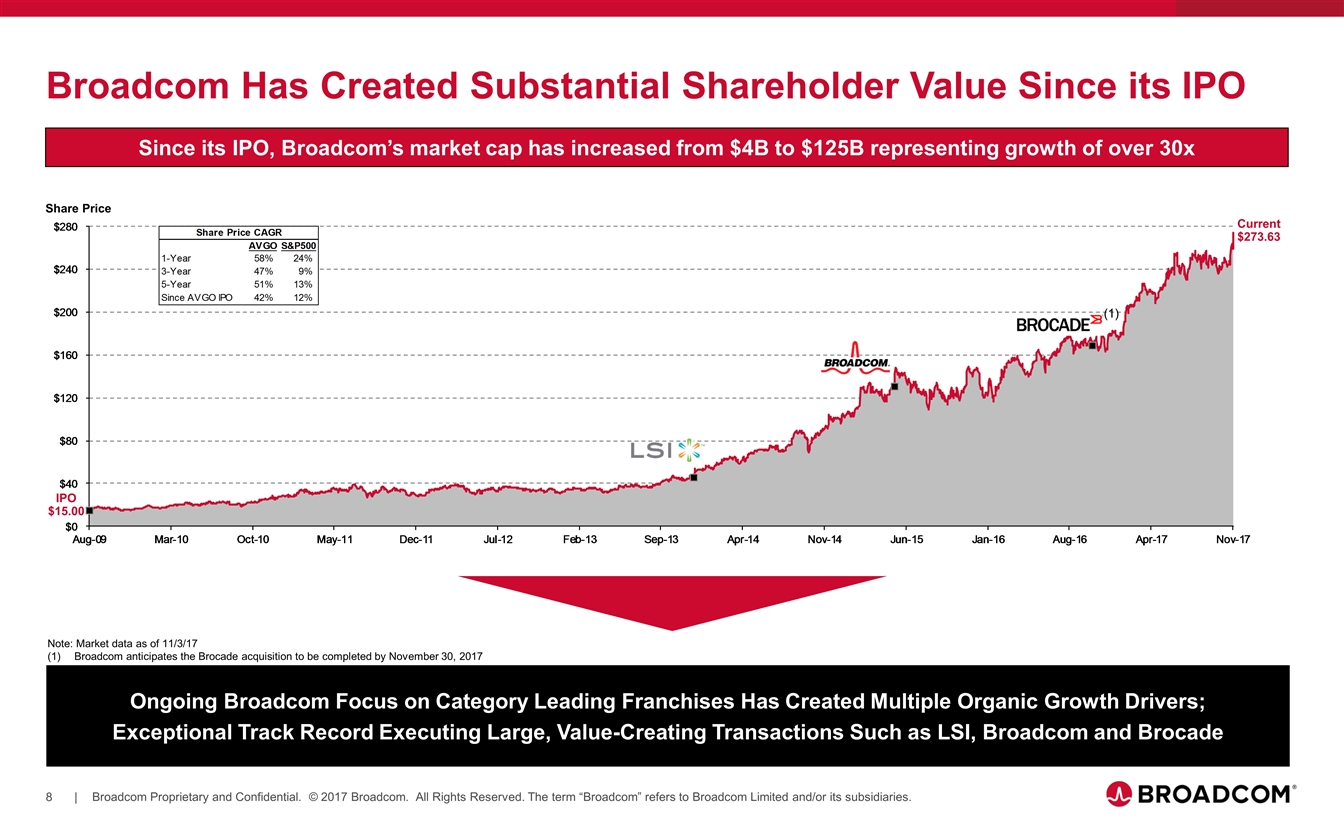

Broadcom Has Created Substantial Shareholder Value Since its IPO Ongoing Broadcom Focus on Category Leading Franchises Has Created Multiple Organic Growth Drivers; Exceptional Track Record Executing Large, Value-Creating Transactions Such as LSI, Broadcom and Brocade Share Price IPO $15.00 Current $273.63 Since its IPO, Broadcom’s market cap has increased from $4B to $125B representing growth of over 30x (1) Note: Market data as of 11/3/17 Broadcom anticipates the Brocade acquisition to be completed by November 30, 2017

Expects to maintain investment grade rating; ensures access to large, low-cost financing markets Robust Financing Strategy Rapid deleveraging profile as a result of strong free cash flow generation while maintaining an attractive dividend Highly confident letters received from BofA Merrill Lynch, Citi, Deutsche Bank, J.P. Morgan and Morgan Stanley Silver Lake Partners $5B convertible debt financing commitment validates transaction merits and Broadcom’s ongoing strategy

Clear Roadmap to Completion Regulatory Approvals Expected in Timely Manner Transaction subject to: HSR in U.S. and regulatory approvals in relevant jurisdictions globally Redomiciling plan further increases deal certainty Broadcom expects transaction would close within approximately 12 months of definitive agreement Committed to Transaction Broadcom has devoted substantial time and effort to understanding merits of transaction and has made good faith efforts to discuss a business combination with Qualcomm Unanimous Broadcom Board approval No financing condition Proposal stands whether Qualcomm’s pending acquisition of NXP is consummated on its currently disclosed terms of $110.00 per share or the transaction is terminated Broadcom and its advisors are prepared to engage immediately to work towards definitive agreement Broadcom Believes the Transaction will Significantly Benefit Both Qualcomm and Broadcom Stakeholders

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Broadcom's critics reject its cloud licensing changes

- Jesper and Jesse Will Work Together Again at rabbit!

- ROSEN, RECOGNIZED INVESTOR COUNSEL, Encourages Compass Minerals International, Inc. Investors to Inquire About Securities Class Action Investigation – CMP

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share