Nomura Says China Selloff Poses Only Limited Risk to Economy

With China's stock market continuing to plunge, investors are asking what this means to the real economy in China and thereby U.S. companies with exposure to the country. According to Nomura analyst Yang Zhao the sell-off poses only limited risk.

From the report:

With the Shanghai composite index (SHCOMP) down more than 30% from its top within less than a month, equity market performance has, in our view, become the most uncertain variable in China’s economy through the rest of the year.

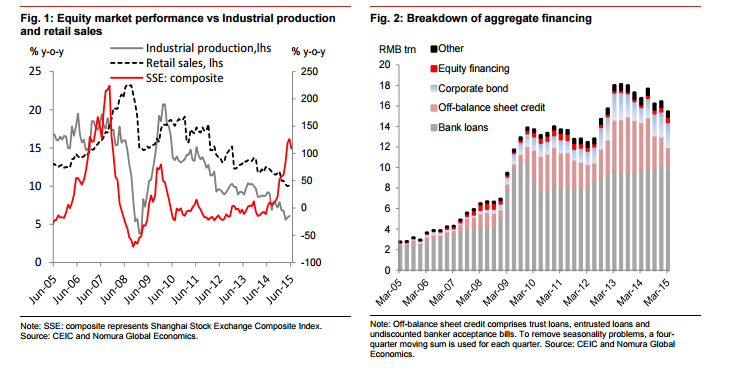

However, the rapid market rally that began last year is widely held to lack grounding in economic fundamentals – a view we share – thus we believe the sharp correction now should in turn have little impact on the real economy. There used to be a correlation between equity market performance and consumption or production, but this has weakened since 2011 and almost faded last year (Figure 1).

The mechanism that channels the paper wealth of the equity market into real household consumption demand is limited in China. First, Chinese households have a much higher savings rate than those in many other economies, which lowers the theoretic wealth effect on consumption. Second, the rapid swings seen in the equity market has resulted in the transference of wealth, rather than the creation and destruction of wealth. While undoubtedly many households have been hurt by the plunge, many others would have sold and profited. Importantly, despite the market coming off, on a net basis the SHCOMP index is still 70% higher now than it was in mid-2014. Third, much of the equity outstanding is held by the government, local governments and state-owned enterprises (SOEs), who now have to shoulder an even larger share of the nominal wealth loss than the private sector.

One effect of the market selloff is that it will make it harder to raise money for fixed asset investment (FAI). However, we believe that again the impact here is likely to be mild given that, in terms of aggregate financing, only about 2% is generated through the equity market (Figure 2). As such, the equity market plays a rather trivial role as a source of funding for the real economy, particularly for FAI. Elsewhere, some bank loans have been extended with shares of listed companies put up as collateral, but we estimate that the total value of these is only around RMB 500bn-600bn, or about 1% of total loans to enterprises.

… and that the risk of financial crisis is limited

While the real economy seems largely immune to equity market movements, we also believe that the risks to the safety of the financial system are limited.

There are several channels through which the current equity correction could lead to some latent financial turmoil. First, brokerages, trust companies and private lenders have extended an estimated RMB3-4trn in margin financing to equity investors, based on some data form the exchange and our estimates. Of this, we believe about RMB1.9trn has been extended through brokerages and we estimate about RMB500bn through trust companies. Margin financing via brokerages has already fallen to RMB1.9trn from its peak of RMB 2.4trn since the correction began. The leverage of margin financing done through brokerages and trust companies is generally under 3x, and the lender’s position is generally well protected as long as the equity market remains liquid enough. Currently, daily trading is still above RMB1trn, suggesting that liquidity is not an issue, although the imposed ±10% daily price band does pose some restriction on the liquidity of some small cap stocks. Overall we believe the risk to financial institutions involved in margin financing is limited.

Second, bank loans to large shareholders of listed companies who use their shares as collateral may face a rising risk of default if the index continues to fall. However, as mentioned above, the value of such loans only accounts a tiny share of banks’ balance sheets, thus the financial risk through this channel is also limited.

But an equity market collapse would handicap structural reform

The sharp rise in equity market volatility may act as a drag on China’s efforts to open up its capital account. Although this needs to be done to accommodate IMF requirements if RMB is going to be considered for inclusion in the SDR basket, we believe China will progress at its own pace to contain any financial systemic risks.

We believe that the recent equity market selloff has taught China’s policymakers an important lesson – that it will be difficult to manage financial markets and that risks may escalate and become problems far faster, and earlier, than the bureaucratic system may be able to deal with them. In a fully open capital market, the difficulties and risks will only be much greater.

SOE reform will also be affected by the equity market turmoil. A prosperous equity market could act as an important channel for state-owned capital to further exit (i.e., privatisation) and allow for the introduction of more responsible private capital and improved governance. However, with the IPO suspension, this channel has been blocked.

The deleveraging process also relies on the expansion of the equity market’s share in the whole financial system. If the equity market fails to function as a valid funding source for companies, they could turn back to bank loans again, with the whole financial system continuing to be dominated by indirect financing.

The impact on policy

Although the overall risk to the economy is limited, in our view, the government has responded to ensure any systemic risk is kept under control.

The People’s Bank of China (PBoC) cut the benchmark interest rate and the banks’ reserve requirement ratio (RRR) simultaneously on 27 June – the first time it has done so since the global financial crisis. Over the past weekend, the China Securities Regulatory Commission (CSRC) set up a market-stabilising fund of at least RMB120bn and ordered a suspension to any IPOs. The CSRC also announced that the Chinese Securities and Finance Corporation (CSFC) will step up, tasked with stabilising the equity market and given the liquidity backup by the PBoC. This morning, the PBoC reiterated the CSRC’s announcement on its website.

Looking ahead, should the fall in the equity market continue, it would increase the risk that monetary policy becomes looser than our current expectations – we expect one more 50bp RRR cut and one 25bp interest rate cut through the rest of the year. Equity market conditions, should they fail to improve, may force the PBoC to cut the RRR or benchmark rate much earlier than we expect.

As the equity market continues to drop, the likelihood of a more aggressive rescue plan being rolled out rises. First, the ministry of finance (MOF) may step in next – we estimate that it could mobilise at least RMB1trn in the short term to support the equity market. Second, the PBoC may extend a large amount of refinancing to the CSFC to stabilise the market.

Equity strategy

Anecdotally, the autos, consumer discretionary and properties sectors look to be most affected.

Nomura’s Auto analyst Ben Lo and team point out that consumers were deferring bigticket purchases to chase the stock market rally in Q2 2015 and may continue to defer such purchases as they are now trapped in the plunge. However, if and when the stock market normalises by late Q3, this could release some pent-up demand.

Nomura’s Consumer Discretionary analyst Katherine Chan and team note that some of the new generation of younger (post-80s) A-share retail investors trapped in the share price plunge are spending more cautiously on dining out, entertainment and travelling. However, it seems that the vast majority have no plans to cut spending on their children or daily necessities.

For Properties, we note that the asking prices of higher-end properties in tier-one cities have retreated since the stock market fall, after spiking notably near the top of the Ashare rally.

Nomura’s Head of China Equity Research, Wendy Liu, believes that the correction is more than half-way through and that Chinese equities may bottom, and subsequently rise, between now and the interim results season (see Take advantage of the panic…, 7 July 2015).

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- PowerSchool Holdings, Inc. (PWSC) Mentioned Cautiously at Spruce Point

- PowerSchool Holdings, Inc. (PWSC) stock tumbles after Spruce Point short report

- HeartCore Enterprises (HTCR) Engages with Onside Content to Develop AI-Based Content Marketing Evaluation and Reporting Index Solution

Create E-mail Alert Related Categories

Analyst Comments, Trader TalkRelated Entities

Nomura, IPOSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share