Rosenblatt Sees Quality China ADR 'Go Private' Deals Closing; Says Still Undervalued to Peers by 5-10x

Get Alerts QIHU Hot Sheet

Rating Summary:

11 Buy, 6 Hold, 0 Sell

Rating Trend: = Flat

Today's Overall Ratings:

Up: 13 | Down: 11 | New: 14

Join SI Premium – FREE

China ADRs have been beaten down as the Chinese local markets correct from bubble territory. This correction has forced the Chinese government to take unprecedented measures to support the market and led many companies to halt their stocks altogether. The situation in China has left many questioning if this will lead Chinese US-traded ADRs involved in "going private" deals to terminate those transactions. However, in a report to clients today Rosenblatt Securities analyst Jun Zhang said he sees a high probability that many of these privatization deals will close and said arbitrage opportunities may exist in some high quality names.

Zhang said while these deals are non-binding, they believe that most privatization deal terms will be unchanged by the short-term volatility of China’s domestic stock market. The analyst noted several key takeaways after meeting with Chinese private equity firms over the past few weeks, some of whom are involved in Chinese ADR privatization deals. His takeaways are as follows:

1) Chinese private equity firms are looking at the long-term valuation gap between China’s domestic market and the U.S. capital markets. They are set on bringing Chinese ADRs back to China’s local markets, despite the shortterm volatility. In regards to the valuation gap, the valuation of its peers in the local markets are still 5-10 times compared to the Chinese companies listed in the U.S. market, even though the Chinese stock markets have been down -50%,

2) More importantly, China’s capital markets are more lenient in comparison to several years ago. The new stock exchange markets, such as the “Innovation board” and the “High-tech board,” would make companies with a VIE structured listings in the China stock market feasible. These new boards don’t require the listing company to be profitable and are flexible regarding the ownership structure.

3) Some Chinese listed companies privatizations are for other purposes, such as reducing the listing costs, providing more incentives for the management team, and the transitioning of the business models to compete with competitors.

Zhang said with big private equity firms involved, such as Sequoia, China Renaissance or Tsinghua Group, it adds more certainty to the deals. They believe note Qihoo 360 Technology (NYSE: QIHU), Momo, Inc. (NASDAQ: MOMO) and 500.com Ltd. (NYSE: WBAI) have big PE’s involved. In addition, he said NQ Mobile (NYSE: NQ) may also get some big PE’s involved in terms of selling their assets.

The analyst we think the stock pull-back would be a great opportunity.

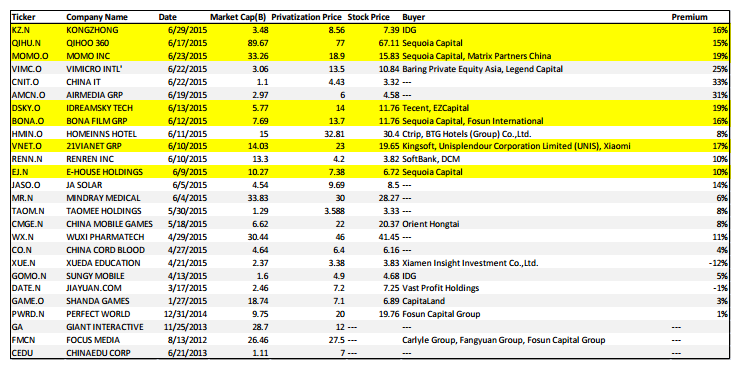

Below is a chart provided highlighting other "go private" deals and the buyers involved:

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Humana (HUM) surges on Q1 beat, reiterated adjusted earnings outlook

- Boeing (BA) Cut To Baa3 From Baa2 By Moody's, Outlook Negative

- Analysts preview Alphabet (GOOGL) EPS

Create E-mail Alert Related Categories

Analyst Comments, Hot Comments, Momentum Movers, Short Sales, Trader TalkSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share