Form DEFA14A WELLS FARGO & COMPANY/MN

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☐ | Definitive Proxy Statement | |

| ☒ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to §240.14a-12 | |

Wells Fargo & Company

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

Wells Fargo Committed to our Vision & Values and Focused on our Goals © 2018 Wells Fargo Bank, N.A. All rights reserved. For public use. March 2018 This presentation deck may be used when meeting and speaking with investors from time to time in connection with the Company’s upcoming annual meeting.

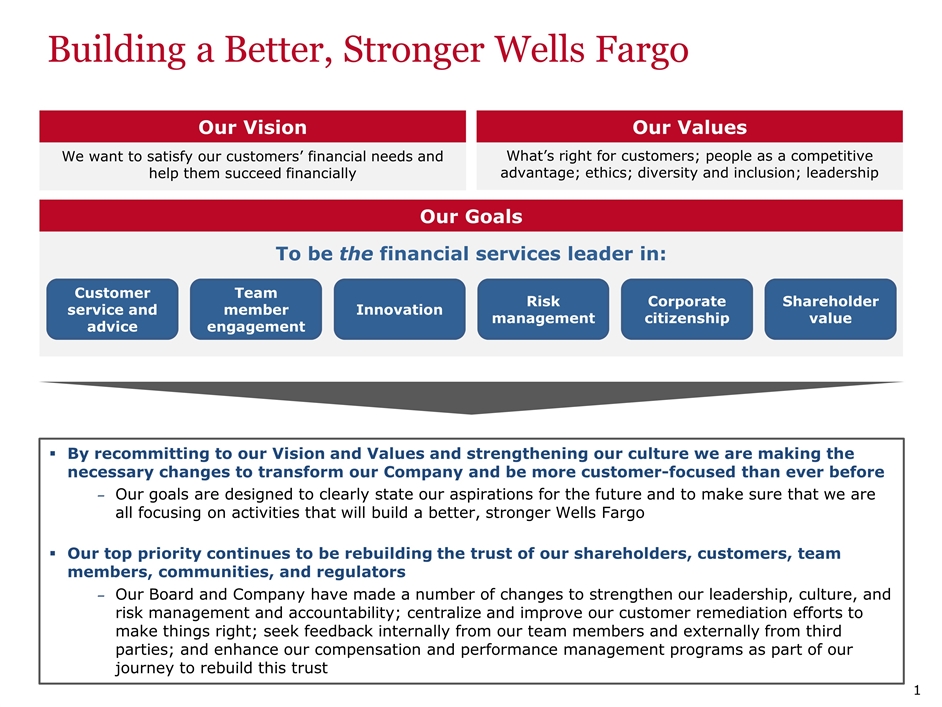

Building a Better, Stronger Wells Fargo We want to satisfy our customers’ financial needs and help them succeed financially Our Vision To be the financial services leader in: Our Goals 1 Customer service and advice Team member engagement Innovation Risk management Corporate citizenship Shareholder value By recommitting to our Vision and Values and strengthening our culture we are making the necessary changes to transform our Company and be more customer-focused than ever before Our goals are designed to clearly state our aspirations for the future and to make sure that we are all focusing on activities that will build a better, stronger Wells Fargo Our top priority continues to be rebuilding the trust of our shareholders, customers, team members, communities, and regulators Our Board and Company have made a number of changes to strengthen our leadership, culture, and risk management and accountability; centralize and improve our customer remediation efforts to make things right; seek feedback internally from our team members and externally from third parties; and enhance our compensation and performance management programs as part of our journey to rebuild this trust What’s right for customers; people as a competitive advantage; ethics; diversity and inclusion; leadership Our Values

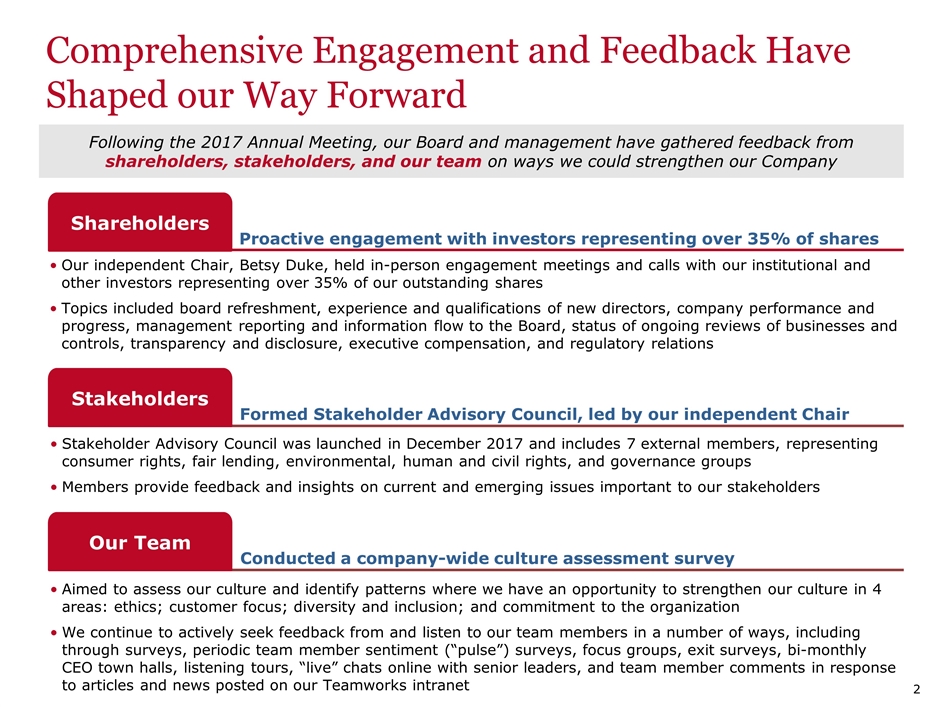

Comprehensive Engagement and Feedback Have Shaped our Way Forward Following the 2017 Annual Meeting, our Board and management have gathered feedback from shareholders, stakeholders, and our team on ways we could strengthen our Company Proactive engagement with investors representing over 35% of shares Shareholders Our independent Chair, Betsy Duke, held in-person engagement meetings and calls with our institutional and other investors representing over 35% of our outstanding shares Topics included board refreshment, experience and qualifications of new directors, company performance and progress, management reporting and information flow to the Board, status of ongoing reviews of businesses and controls, transparency and disclosure, executive compensation, and regulatory relations Formed Stakeholder Advisory Council, led by our independent Chair Stakeholders Stakeholder Advisory Council was launched in December 2017 and includes 7 external members, representing consumer rights, fair lending, environmental, human and civil rights, and governance groups Members provide feedback and insights on current and emerging issues important to our stakeholders Conducted a company-wide culture assessment survey Our Team Aimed to assess our culture and identify patterns where we have an opportunity to strengthen our culture in 4 areas: ethics; customer focus; diversity and inclusion; and commitment to the organization We continue to actively seek feedback from and listen to our team members in a number of ways, including through surveys, periodic team member sentiment (“pulse”) surveys, focus groups, exit surveys, bi-monthly CEO town halls, listening tours, “live” chats online with senior leaders, and team member comments in response to articles and news posted on our Teamworks intranet 2

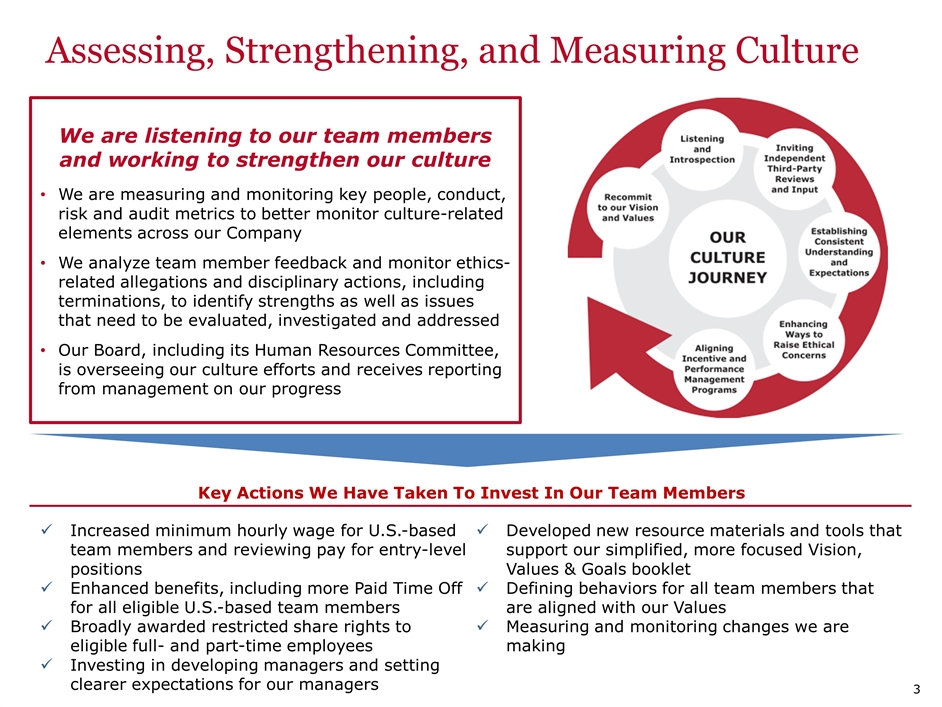

Assessing, Strengthening, and Measuring Culture We are listening to our team members and working to strengthen our culture We are measuring and monitoring key people, conduct, risk and audit metrics to better monitor culture-related elements across our Company We analyze team member feedback and monitor ethics-related allegations and disciplinary actions, including terminations, to identify strengths as well as issues that need to be evaluated, investigated and addressed Our Board, including its Human Resources Committee, is overseeing our culture efforts and receives reporting from management on our progress Increased minimum hourly wage for U.S.-based team members and reviewing pay for entry-level positions Enhanced benefits, including more Paid Time Off for all eligible U.S.-based team members Broadly awarded restricted share rights to eligible full- and part-time employees Investing in developing managers and setting clearer expectations for our managers Developed new resource materials and tools that support our simplified, more focused Vision, Values & Goals booklet Defining behaviors for all team members that are aligned with our Values Measuring and monitoring changes we are making Key Actions We Have Taken To Invest In Our Team Members 3

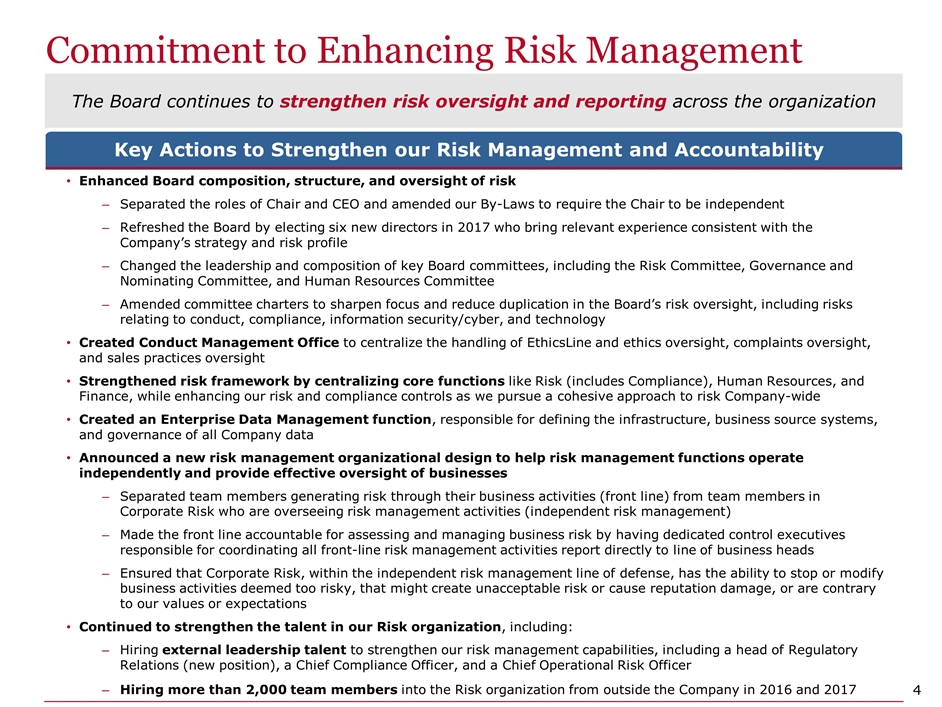

Commitment to Enhancing Risk Management Key Actions to Strengthen our Risk Management and Accountability Enhanced Board composition, structure, and oversight of risk Separated the roles of Chair and CEO and amended our By-Laws to require the Chair to be independent Refreshed the Board by electing six new directors in 2017 who bring relevant experience consistent with the Company’s strategy and risk profile Changed the leadership and composition of key Board committees, including the Risk Committee, Governance and Nominating Committee, and Human Resources Committee Amended committee charters to sharpen focus and reduce duplication in the Board’s risk oversight, including risks relating to conduct, compliance, information security/cyber, and technology Created Conduct Management Office to centralize the handling of EthicsLine and ethics oversight, complaints oversight, and sales practices oversight Strengthened risk framework by centralizing core functions like Risk (includes Compliance), Human Resources, and Finance, while enhancing our risk and compliance controls as we pursue a cohesive approach to risk Company-wide Created an Enterprise Data Management function, responsible for defining the infrastructure, business source systems, and governance of all Company data Announced a new risk management organizational design to help risk management functions operate independently and provide effective oversight of businesses Separated team members generating risk through their business activities (front line) from team members in Corporate Risk who are overseeing risk management activities (independent risk management) Made the front line accountable for assessing and managing business risk by having dedicated control executives responsible for coordinating all front-line risk management activities report directly to line of business heads Ensured that Corporate Risk, within the independent risk management line of defense, has the ability to stop or modify business activities deemed too risky, that might create unacceptable risk or cause reputation damage, or are contrary to our values or expectations Continued to strengthen the talent in our Risk organization, including: Hiring external leadership talent to strengthen our risk management capabilities, including a head of Regulatory Relations (new position), a Chief Compliance Officer, and a Chief Operational Risk Officer Hiring more than 2,000 team members into the Risk organization from outside the Company in 2016 and 2017 4 The Board continues to strengthen risk oversight and reporting across the organization

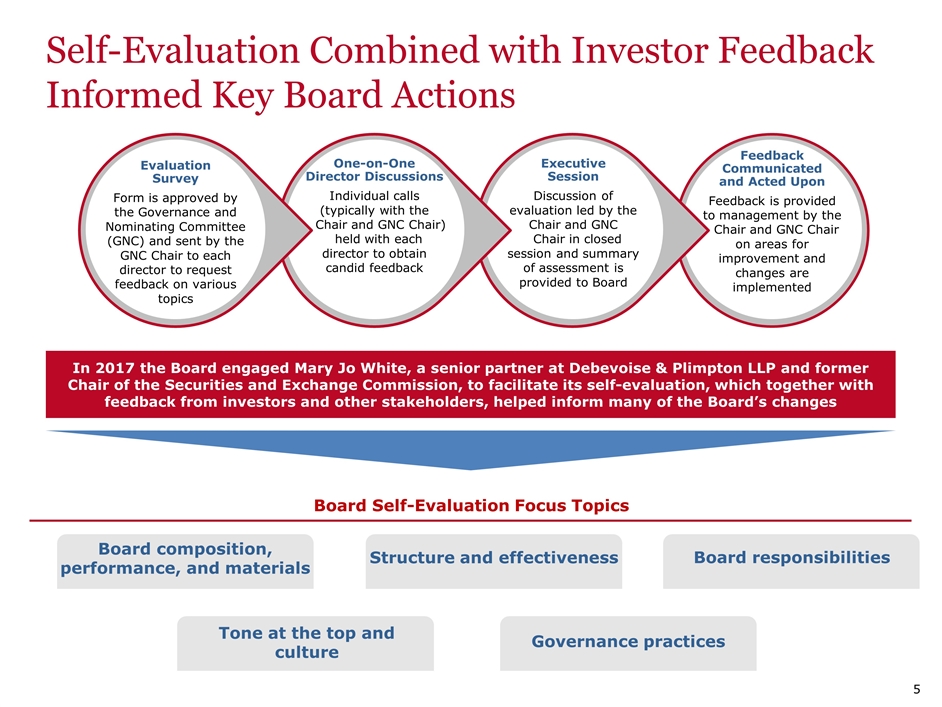

Self-Evaluation Combined with Investor Feedback Informed Key Board Actions Feedback Communicated and Acted Upon Feedback is provided to management by the Chair and GNC Chair on areas for improvement and changes are implemented Executive Session Discussion of evaluation led by the Chair and GNC Chair in closed session and summary of assessment is provided to Board One-on-One Director Discussions Individual calls (typically with the Chair and GNC Chair) held with each director to obtain candid feedback Evaluation Survey Form is approved by the Governance and Nominating Committee (GNC) and sent by the GNC Chair to each director to request feedback on various topics In 2017 the Board engaged Mary Jo White, a senior partner at Debevoise & Plimpton LLP and former Chair of the Securities and Exchange Commission, to facilitate its self-evaluation, which together with feedback from investors and other stakeholders, helped inform many of the Board’s changes Board composition, performance, and materials Structure and effectiveness Tone at the top and culture Governance practices Board responsibilities Board Self-Evaluation Focus Topics 5

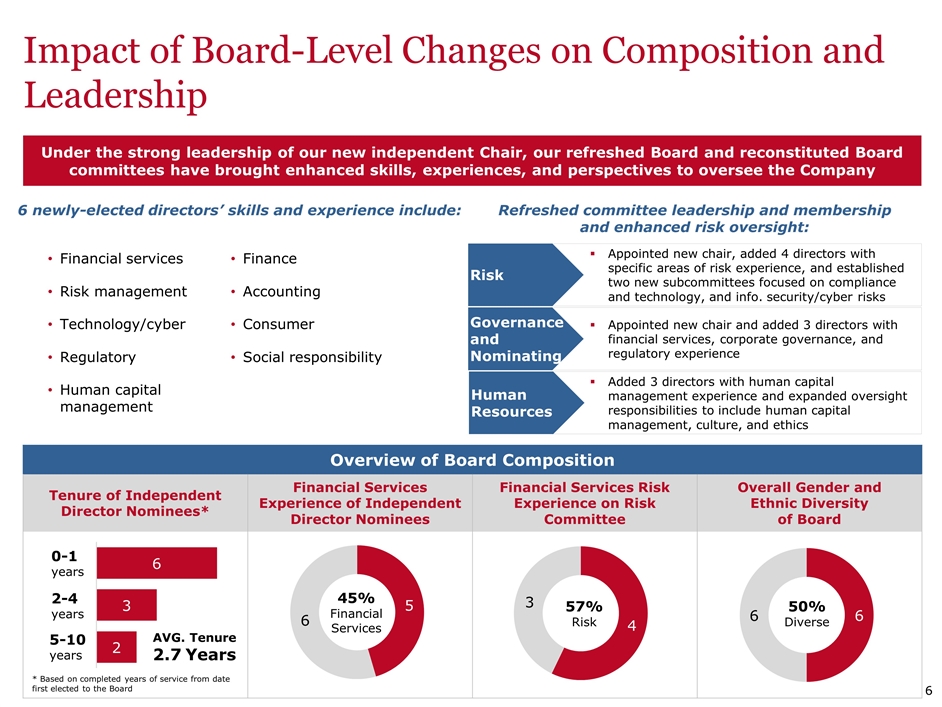

Appointed new chair, added 4 directors with specific areas of risk experience, and established two new subcommittees focused on compliance and technology, and info. security/cyber risks Impact of Board-Level Changes on Composition and Leadership Overview of Board Composition Tenure of Independent Director Nominees* Financial Services Experience of Independent Director Nominees Financial Services Risk Experience on Risk Committee Overall Gender and Ethnic Diversity of Board 0-1 years 2-4 years 5-10 years AVG. Tenure 2.7 Years 45% Financial Services 57% Risk 50% Diverse Risk Appointed new chair and added 3 directors with financial services, corporate governance, and regulatory experience Added 3 directors with human capital management experience and expanded oversight responsibilities to include human capital management, culture, and ethics Governance and Nominating Human Resources 6 newly-elected directors’ skills and experience include: Refreshed committee leadership and membership and enhanced risk oversight: Financial services Risk management Technology/cyber Regulatory Human capital management Finance Accounting Consumer Social responsibility 6 Under the strong leadership of our new independent Chair, our refreshed Board and reconstituted Board committees have brought enhanced skills, experiences, and perspectives to oversee the Company * Based on completed years of service from date first elected to the Board

Diverse and Skilled Board Nominees John D. Baker II Independent Celeste A. Clark Independent Theodore F. Craver, Jr. Independent Elizabeth A. Duke Independent Chair Executive Chairman and CEO, FRP Holdings, Inc. Director Since: Jan. 2009 Committees: AEC, CRC, CC* Other Public Boards: 1 Principal, Abraham Clark Consulting, LLC; retired Sr. VP, Global Public Policy & External Relations, Chief Sustainability Officer, Kellogg Co. Director Since: Jan. 2018 Committees: CRC, CC Other Public Boards: 1 Retired Chairman, President, and CEO, Edison International Director Since: Jan. 2018 Committees: AEC, FC+ Other Public Boards: 1 Former member of the Federal Reserve Board of Governors Director Since: Jan. 2015 Committees: CC, FC, GNC, RC Other Public Boards: 0 Donald M. James Independent Maria R. Morris Independent Karen B. Peetz Independent Juan A. Pujadas Independent Retired Chairman and CEO, Vulcan Materials Company Director Since: Jan. 2009 Committees: FC, GNC*, HRC Other Public Boards: 1 Retired Executive Vice President and head of Global Employee Benefits business, MetLife, Inc. Director Since: Jan. 2018 Committees: HRC, RC Other Public Boards: 1 Retired President, The Bank of New York Mellon Corporation Director Since: Feb. 2017 Committees: FC, HRC, RC* Other Public Boards: 1 Retired Principal, PricewaterhouseCoopers LLP, and former Vice Chairman, Global Advisory Services, PwC Intl. Director Since: Sept. 2017 Committees: CC, FC, RC Other Public Boards: 0 James H. Quigley Independent Ronald L. Sargent Independent Timothy J. Sloan CEO & President Suzanne M. Vautrinot Independent CEO Emeritus and a retired Partner of Deloitte Director Since: Oct. 2013 Committees: AEC*, CC, RC Other Public Boards: 2 Retired Chairman and CEO, Staples, Inc. Director Since: Feb. 2017 Committees: AEC, GNC, HRC+ Other Public Boards: 2 CEO and President, Wells Fargo & Company Director Since: Oct. 2016 Committees: None Other Public Boards: 0 President, Kilovolt Consulting Inc.; Major General (retired), U.S. Air Force Director Since: Feb. 2015 Committees: CRC+, CC, RC Other Public Boards: 2 AEC Audit and Examination Committee FC Finance Committee HRC Human Resources Committee CRC Corporate Responsibility Committee GNC Governance and Nominating Committee RC Risk Committee CC Credit Committee * Committee Chair + Successor as Committee Chair, effective April 24, 2018 7 Ind. Chair since 1/1/2018

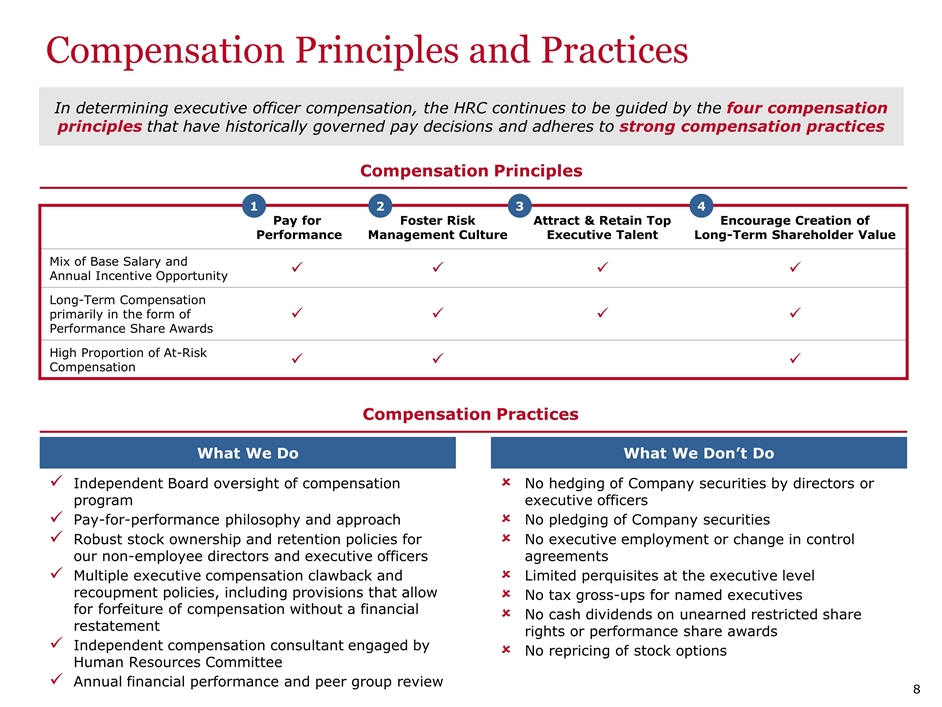

Independent Board oversight of compensation program Pay-for-performance philosophy and approach Robust stock ownership and retention policies for our non-employee directors and executive officers Multiple executive compensation clawback and recoupment policies, including provisions that allow for forfeiture of compensation without a financial restatement Independent compensation consultant engaged by Human Resources Committee Annual financial performance and peer group review No hedging of Company securities by directors or executive officers No pledging of Company securities No executive employment or change in control agreements Limited perquisites at the executive level No tax gross-ups for named executives No cash dividends on unearned restricted share rights or performance share awards No repricing of stock options Compensation Principles and Practices In determining executive officer compensation, the HRC continues to be guided by the four compensation principles that have historically governed pay decisions and adheres to strong compensation practices Pay for Performance Foster Risk Management Culture Attract & Retain Top Executive Talent Encourage Creation of Long-Term Shareholder Value Mix of Base Salary and Annual Incentive Opportunity ü ü ü ü Long-Term Compensation primarily in the form of Performance Share Awards ü ü ü ü High Proportion of At-Risk Compensation ü ü ü 1 Compensation Principles Compensation Practices What We Do What We Don’t Do 2 3 4 8

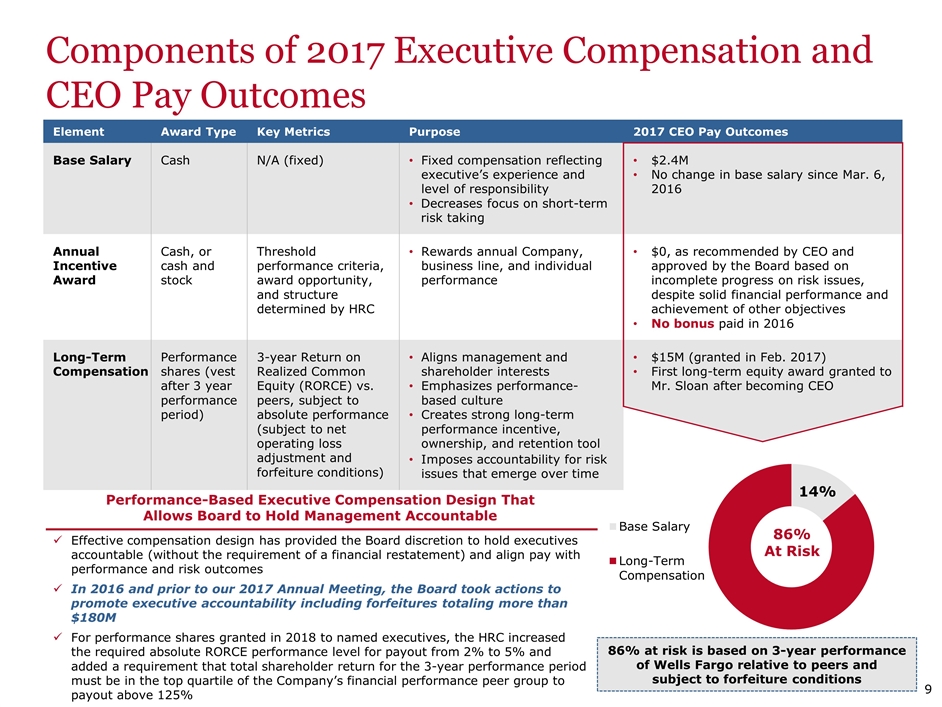

Components of 2017 Executive Compensation and CEO Pay Outcomes Element Award Type Key Metrics Purpose 2017 CEO Pay Outcomes Base Salary Cash N/A (fixed) Fixed compensation reflecting executive’s experience and level of responsibility Decreases focus on short-term risk taking $2.4M No change in base salary since Mar. 6, 2016 Annual Incentive Award Cash, or cash and stock Threshold performance criteria, award opportunity, and structure determined by HRC Rewards annual Company, business line, and individual performance $0, as recommended by CEO and approved by the Board based on incomplete progress on risk issues, despite solid financial performance and achievement of other objectives No bonus paid in 2016 Long-Term Compensation Performance shares (vest after 3 year performance period) 3-year Return on Realized Common Equity (RORCE) vs. peers, subject to absolute performance (subject to net operating loss adjustment and forfeiture conditions) Aligns management and shareholder interests Emphasizes performance-based culture Creates strong long-term performance incentive, ownership, and retention tool Imposes accountability for risk issues that emerge over time $15M (granted in Feb. 2017) First long-term equity award granted to Mr. Sloan after becoming CEO 86% At Risk Performance-Based Executive Compensation Design That Allows Board to Hold Management Accountable Effective compensation design has provided the Board discretion to hold executives accountable (without the requirement of a financial restatement) and align pay with performance and risk outcomes In 2016 and prior to our 2017 Annual Meeting, the Board took actions to promote executive accountability including forfeitures totaling more than $180M For performance shares granted in 2018 to named executives, the HRC increased the required absolute RORCE performance level for payout from 2% to 5% and added a requirement that total shareholder return for the 3-year performance period must be in the top quartile of the Company’s financial performance peer group to payout above 125% 9 86% at risk is based on 3-year performance of Wells Fargo relative to peers and subject to forfeiture conditions

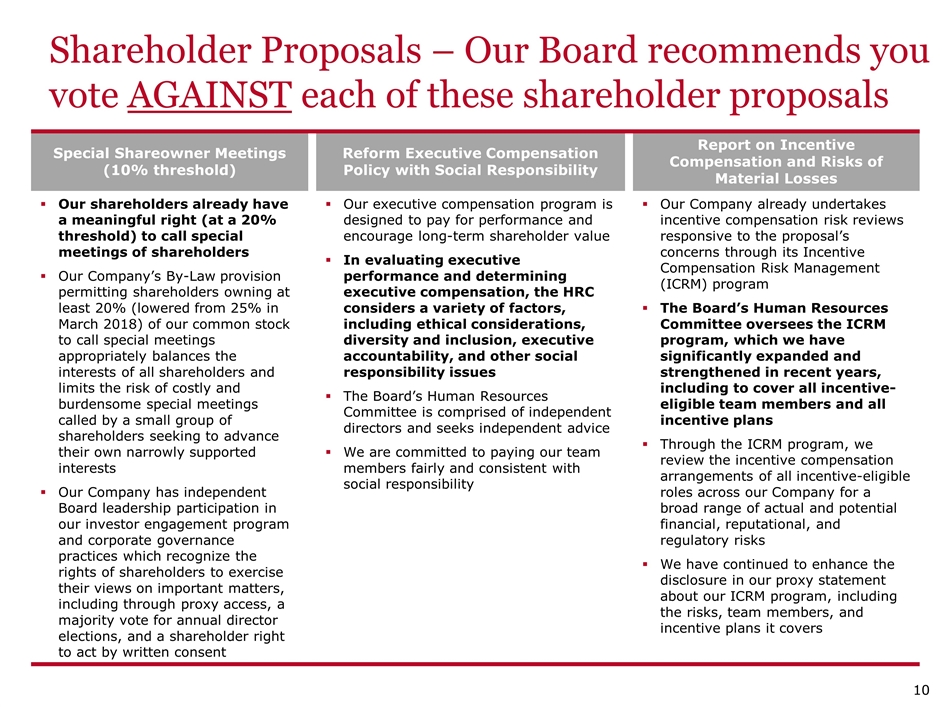

Special Shareowner Meetings (10% threshold) Reform Executive Compensation Policy with Social Responsibility Report on Incentive Compensation and Risks of Material Losses Our shareholders already have a meaningful right (at a 20% threshold) to call special meetings of shareholders Our Company’s By-Law provision permitting shareholders owning at least 20% (lowered from 25% in March 2018) of our common stock to call special meetings appropriately balances the interests of all shareholders and limits the risk of costly and burdensome special meetings called by a small group of shareholders seeking to advance their own narrowly supported interests Our Company has independent Board leadership participation in our investor engagement program and corporate governance practices which recognize the rights of shareholders to exercise their views on important matters, including through proxy access, a majority vote for annual director elections, and a shareholder right to act by written consent Our executive compensation program is designed to pay for performance and encourage long-term shareholder value In evaluating executive performance and determining executive compensation, the HRC considers a variety of factors, including ethical considerations, diversity and inclusion, executive accountability, and other social responsibility issues The Board’s Human Resources Committee is comprised of independent directors and seeks independent advice We are committed to paying our team members fairly and consistent with social responsibility Our Company already undertakes incentive compensation risk reviews responsive to the proposal’s concerns through its Incentive Compensation Risk Management (ICRM) program The Board’s Human Resources Committee oversees the ICRM program, which we have significantly expanded and strengthened in recent years, including to cover all incentive-eligible team members and all incentive plans Through the ICRM program, we review the incentive compensation arrangements of all incentive-eligible roles across our Company for a broad range of actual and potential financial, reputational, and regulatory risks We have continued to enhance the disclosure in our proxy statement about our ICRM program, including the risks, team members, and incentive plans it covers Shareholder Proposals – Our Board recommends you vote AGAINST each of these shareholder proposals 10

Cautionary Statement About Forward-looking Statements Forward looking statement disclaimer This presentation contains forward-looking statements about our future financial performance and business. Because forward-looking statements are based on our current expectations and assumptions regarding the future, they are subject to inherent risks and uncertainties. Do not unduly rely on forward-looking statements as actual results could differ materially from expectations. Forward-looking statements speak only as of the date made, and we do not undertake to update them to reflect changes or events that occur after that date. For information about factors that could cause actual results to differ materially from our expectations, refer to our reports filed with the Securities and Exchange Commission, including the discussion under “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2017, as filed with the Securities and Exchange Commission and available on its website at www.sec.gov. 11

Thank you.