Form 8-K Internap Corp For: Mar 19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

March 19, 2018

Internap Corporation

(Exact Name of Registrant as Specified in Charter)

|

Delaware

|

001-31989

|

91-2145721

|

|

(State or Other Jurisdiction of Incorporation)

|

(Commission File Number)

|

(IRS Employer Identification Number)

|

|

12120 Sunset Hills Road, Suite 330, Reston, Virginia

|

20190

|

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code: (404) 302-9700

Not applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Securities Act (17 CFR 240.14a-12)

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Securities Act (17 CFR 240.14d-2(b))

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Securities Act (17 CFR 240.13e-2(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01 |

Regulation FD Disclosure.

|

On March 19, 2018, Internap Corporation (the “Company”) is providing potential financing sources with certain information that has not been previously reported by the Company. Such information is contained in Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information contained herein and in the accompanying Exhibit 99.1 shall not be incorporated by reference into any filing of the Company, whether made before or after the date hereof, regardless of any general incorporation language in such filing, unless expressly incorporated by specific reference to this or such filing. The information in this report, including the exhibits hereto, shall be deemed to be “furnished” and therefore shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended.

| ITEM 9.01 |

Financial Statements and Exhibits.

|

| (d) |

Exhibits.

|

The following exhibits are furnished as part of this report:

|

Exhibit

No.

|

Description

|

|

Company Presentation, March 2018

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

INTERNAP CORPORATION

|

||

|

Date: March 19, 2018

|

By:

|

/s/ Richard Diegnan

|

|

Richard Diegnan

|

||

|

SVP and General Counsel

|

||

Exhibit 99.1

Company Presentation March 2018

Forward-Looking Statements © 2017 Internap Corporation (INAP) This presentation contains forward-looking statements. These forward-looking statements include statements related to sales, improved profitability, margin expansion, operations improvement, cost reductions, participation in strategic transactions, our strategy to align into pure-play businesses and our expectations for 2018 revenue, Adjusted EBITDA, Adjusted EBITDA less CapEx and capital expenditures. Our ability to achieve these forward-looking statements is based on certain assumptions, including our ability to execute on our business strategy, leveraging of multiple routes to market, expanded brand awareness for high-performance Internet infrastructure services and customer churn levels. These assumptions may prove inaccurate in the future. Because such forward-looking statements are not guarantees of future performance or results and involve risks and uncertainties, there are important factors that could cause INAP’s actual results to differ materially from those expressed or implied in the forward-looking statements, due to a variety of important factors. Such important factors include, without limitation: our ability to execute on our business strategy into a pure-play business and drive growth while reducing costs; our ability to maintain current customers and obtain new ones, whether in a cost-effective manner or at all; the robustness of the IT infrastructure services market; our ability to achieve or sustain profitability; our ability to expand margins and drive higher returns on investment; our ability to sell into new and existing data center space; the actual performance of our IT infrastructure services and improving operations; our ability to correctly forecast capital needs, demand planning and space utilization; our ability to respond successfully to technological change and the resulting competition; the geographic concentration of the company’s data centers in certain markets and any adverse developments in local economic conditions or the demand for data center space in these markets; ability to identify any suitable strategic transactions; INAP's ability to realize anticipated revenue, growth, synergies and cost savings from the acquisition of SingleHop; INAP's ability to successfully integrate SingleHop’s sales, operations, technology, and products generally; the availability of services from Internet network service providers or network service providers providing network access loops and local loops on favorable terms, or at all; failure of third party suppliers to deliver their products and services on favorable terms, or at all; failures in our network operations centers, data centers, network access points or computer systems; our ability to provide or improve Internet infrastructure services to our customers; our ability to protect our intellectual property; our substantial amount of indebtedness, our possibility to raise additional capital when needed, on attractive terms, or at all, our ability to service existing debt or maintain compliance with financial and other covenants contained in our credit agreement; our compliance with and changes in complex laws and regulations in the U.S. and internationally; our ability to attract and retain qualified management and other personnel; and volatility in the trading price of INAP common stock.These risks and other important factors discussed under the caption “Risk Factors” in our most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission (“SEC”), and our other reports filed with the SEC could cause actual results to differ materially from those indicated by the forward-looking statements made in this presentation. Given these risks and uncertainties, investors should not place undue reliance on forward-looking statements as a prediction of actual results. All forward-looking statements attributable to INAP or persons acting on its behalf are expressly qualified in their entirety by the foregoing forward-looking statements. All such statements speak only as of the date made, and INAP undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

Non-GAAP Measures © 2017 Internap Corporation (INAP) In addition to results presented in accordance with GAAP, this presentation includes non-GAAP financial measures. INAP believes these non-GAAP financial measures provide additional information that is useful to investors in helping to understand our underlying performance and trends.Non-GAAP financial measures have inherent limitations, which are not required to be uniformly applied. Readers should be aware of these limitations and should be cautious with respect to the use of such measures. To compensate for these limitations, we use non-GAAP financial measures as comparative tools, together with GAAP financial measures, to assist in the evaluation of our operating performance or financial condition. Our method of calculating these non-GAAP financial measures may differ from methods used by other companies. These non-GAAP financial measures should not be considered in isolation or as a substitute for those financial measures prepared in accordance with GAAP.Although we believe that our presentation of non-GAAP financial measures provides useful supplemental information to investors regarding our results of operations, our non-GAAP financial measures should only be considered in addition to, and not as a substitute for, or superior to, any measure of financial performance prepared in accordance with GAAP.As required by SEC rules, we have provided in the Appendix to this presentation reconciliations of the non-GAAP financial measures included in this presentation to the most directly comparable GAAP financial measures.

Executive Summary Internap Corporation (“INAP” or the “Company”), founded in 1996 and headquartered in Reston, VA, provides information technology ("IT") infrastructure solutions to businesses in North America, Europe, and Asia-Pacific. INAP is publicly traded on Nasdaq Global Market under the ticker “INAP”For the fiscal year ended December 31, 2017 (“FY 2017”), INAP standalone Revenue, Net Loss and standalone Adjusted EBITDA (non-GAAP)* were $280.7MM, ($45.3)MM and $92.2MM, respectively For FY 2017, the Company generated Pro Forma Revenue (non-GAAP)*, Pro Forma Net Loss (non-GAAP)*, and Pro Forma Adjusted EBITDA (non-GAAP)* of $328.8MM, ($36.9)MM, and $112.1MM, respectivelyThe Company is approaching existing lenders to approve a reduction of the First Lien Term Loan’s pricing from L + 700 bps to L + 550 – 575 bps with no change to the 1.00% LIBOR floor or maturityUpon effectiveness of this repricing amendment, the 101% soft call premium will be reinstated for six months © 2017 Internap Corporation (INAP) * Reconciliation to GAAP on pages 11-17.

Sources & Uses and Pro Forma Capitalization ($ millions) © 2017 Internap Corporation (INAP) Reflects 12/31/17 cash balance of $14.6 million less ~$5.6MM of estimated cash used in connection with the transaction.As of 3/15/2018.Includes INAP FY 2017 CA Adjusted EBITDA (non-GAAP) of $82.5MM (Adjusted EBITDA of $92.2MM less adjustments as defined in INAP’s credit facility), SingleHop FY 2017 Adjusted EBITDA (non-GAAP) of $17.4MM, and $2.5MM of pro forma synergies, representing the midpoint of the projected range of $2-3MM.Revenue recognized by INAP in 2018 will include a purchase accounting adjustment impacting deferred revenue, which may reduce annualized revenue by approximately $2MM. * Reconciliation to GAAP on pages 11-17.

Company Overview INAP COLO INAP CLOUD Data Center services include flexible space and power solutions, as well as physical security 56 Data Centers in 21 metropolitan markets Maintains 97 global POPs offering redundant, remote and local connectivity solutions Single tenant infrastructure environment including servers, storage and network Provides compute and storage services via an integrated platform that includes servers, storage and network Delivered through eleven INAP locations in North America, Europe and Asia-Pacific region Dedicated CPU with the latest Intel Xeon processors, up to 1TB RAM, NVMe storage and increased disk I/O for more consistent networking and control than virtual servers Powered by OpenStack; can be managed through the OpenStack API or portal; can be orchestrated via Heat and Glance COLOCATION MANAGED HOSTING NETWORK CLOUD BARE METAL Higher performance infrastructure and a helping hand, from startup to enterprise level © 2017 Internap Corporation (INAP) INAP COLO75% Revenue Business Unit Contribution (non-GAAP)* Financial Snapshot% of FY 2017 INAP CLOUD25% (1) Data Centers, POPs, and Cloud locations include SingleHop operations. (2017 Segments) (1) * Reconciliation to GAAP on pages 11-17.

Business Update Management Initiatives Achieved in 2017 Update Status Appointed Bob Dennerlein, a veteran with over 25 years of financial leadership experience, as new CFOAppointed Andrew Day and Corey Needles as new General Managers to assume complete responsibility for newly aligned business segmentsAlso appointed Richard Diegnan and Mark Weaver as new General Counsel and Chief Accounting Officer, respectively Rebuild Management Team Complete Reinstituted bonuses and enhanced success-based commissionsBookings beginning to show upward momentum as sales team initiatives ramp upBookings, net of churn, turned positive in December 2016 Investment in Sales Teams In Progress Potential Equity Offering process underway Balance Sheet Recapitalization In Progress Reorganization of Business Complete Internal reorganization into two pure-play business segments complete with new business managers (with P&L responsibility) appointedEvaluating the sale of non-core assets and expect to discontinue unprofitable programs Cost Containment Phase I of III Phase I reduced operating expenses by an annualized run-rate of $6 millionNet headcount reduction of ~60Proceeds partially reinvested in sales teamPhase II to begin in early 2017 © 2017 Internap Corporation (INAP) Continuing to Build Momentum into 2018 Cost Containment Rebuild Management Team Reorganization of Business Investment in Sales Team Balance Sheet Recapitalization Return to Top Line Growth Focus on Tuck-In Acquisitions Investing in Major Data Center Markets Reviewing and Improving Data Center Portfolio Sales Improvements Adjusted EBITDA Margin (non-GAAP)* 530 bps from FY2016 to FY2017 CEO and top 8 executives hired between 2016 and 2017 GM model business units with P&L responsibility Sales force now at target levels, positioning INAP for 2018 productivity New $325MM credit facility entered into in March 2017 following $43MM equity raise in February 2017 Q4 2017 revenue up sequentially to $70MM SingleHop represents a highly strategic transaction Key markets include Dallas, Santa Clara and Phoenix Emphasize emerging identity as a colocation leader with value added services including managed services & hosting, cloud and high performance network services Sales force rebuilt for growthContinue to manage salesforce productivity and channel partners * Reconciliation to GAAP on pages 11-17.

INAP 2017 Recap: Revenue, Profit and FCF Growth Revenue Business Unit Contribution (non-GAAP)* up 6.6% and Business Unit Contribution Margin (non-GAAP)* up 500+ bps since 2016 Adjusted EBITDA (non-GAAP)* up 12.5% and margin expansion of 530bps+ since 2016 $298.3 $280.7 Adjusted EBITDA(non-GAAP)* Business Unit Contribution (non-GAAP)* $113.3 $120.8 Revenue Continues to Stabilize Growing Business Unit Contribution Positive Operating Leverage ($ millions) $82.0 $92.2 Revenue continues to stabilize from 5.9% decline (2016 vs. 2017) to 1.6% sequential QoQ growth (Q3 vs. Q4 2017) © 2017 Internap Corporation (INAP) Improved Free Cash Flow Adjusted EBITDA Less Maintenance Capex (non-GAAP)* $74.7 $84.7 Adjusted EBITDA Less Maintenance Capex (non-GAAP)* up 13.3% and margin expansion of 510bps+ since 2016 * Reconciliation to GAAP on pages 11-17.

INAP 2018 Financial Guidance as of March 8, 2018 © 2017 Internap Corporation (INAP) Building on Adjusted EBITDA less Capex in 2017 $275 - $285 $105 - $115 $40 - 45 INAP Meets And / Or Exceeds Original 2017 Guidance 2018Outlook Revenue Capital Expenditures Adjusted EBITDA (non-GAAP)* ($ millions) Updated Range as of 11/2/2017 and FY2017 Actual Original Range as of 3/9/2017 Adjusted EBITDA (non-GAAP)* Capital Expenditures Adjusted EBITDA Less Capex(non-GAAP)* $84 - $87 Approx. $42 $42 - $45 $277 $282 $281 $320 - $330 $92 $105 - $115 $37 $40 - $45 $65 - $70 $87 $32 $56 $92 $36 2017 Actual Actual Actual Actual $60 $50 * Reconciliation to GAAP on pages 11-17.

Appendix © 2017 Internap Corporation (INAP) Pro Forma Relative Size (2016 Revenue) Reconciliation of Non-GAAP Financial Measures

INAP Reconciliation of Non-GAAP Financial Measures Adjusted EBITDA is a non-GAAP measure and is GAAP net loss plus depreciation and amortization, interest expense, provision (benefit) for income taxes, other expense (income), (gain) loss on disposal of property and equipment, exit activities, restructuring and impairments, stock-based compensation, non-income tax contingency, strategic alternatives and related costs, organizational realignment costs, pre-acquisition costs and claim settlement.Adjusted EBITDA Margin is a non-GAAP measure and is Adjusted EBITDA as a percentage of revenues.Adjusted EBITDA Less Maint. CapEx is a non-GAAP measure and is Adjusted EBITDA less capital expenditures related to maintenance capital only.Represent exit activities and restructuring charges related to sublease income assumptions for certain properties that have taken longer to find sublease tenants. In 2016, primarily non-cash goodwill impairment charges. $78.2MM of non-cash impairment charges incurred in Q3 2016Primarily related to legal and other professional fees incurred in connection with the evaluation of strategic alternatives and related shareholder communications. In 2016, also includes professional fees, employee retention bonus, severance and executive search costs incurred related to Company’s organizational realignment. 1 ($ millions) 2 2 1 11 © 2017 Internap Corporation (INAP) Commentary

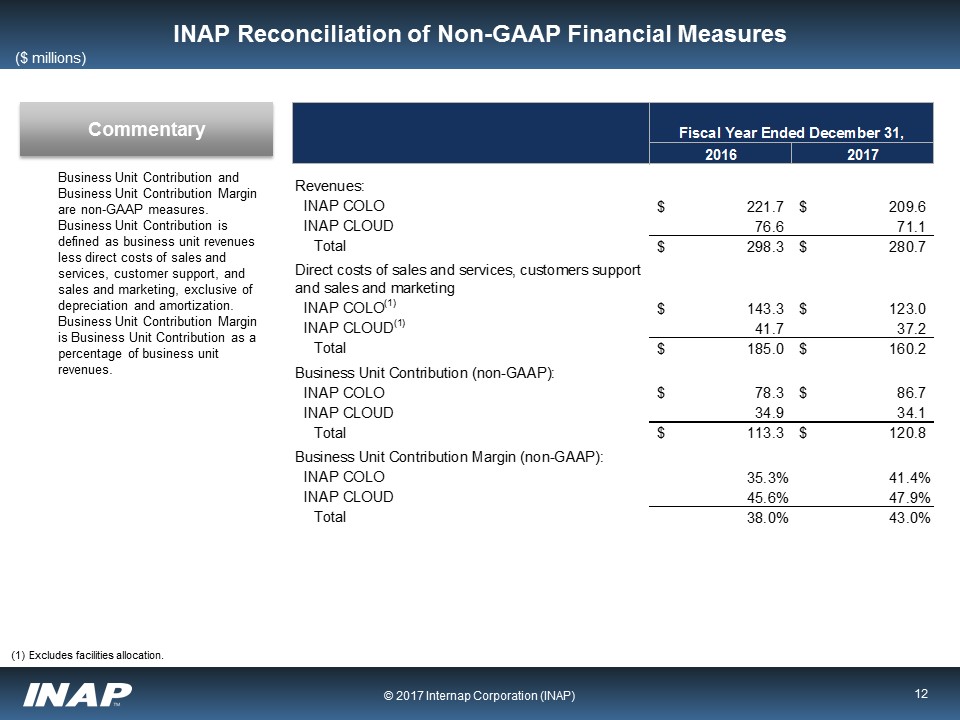

INAP Reconciliation of Non-GAAP Financial Measures ($ millions) 12 © 2017 Internap Corporation (INAP) Business Unit Contribution and Business Unit Contribution Margin are non-GAAP measures. Business Unit Contribution is defined as business unit revenues less direct costs of sales and services, customer support, and sales and marketing, exclusive of depreciation and amortization. Business Unit Contribution Margin is Business Unit Contribution as a percentage of business unit revenues. Commentary Excludes facilities allocation.

INAP Reconciliation of Non-GAAP Financial Measures ($ millions) 13 © 2017 Internap Corporation (INAP)

INAP Reconciliation of Non-GAAP Financial Measures Adjusted EBITDA is a non-GAAP measure and is GAAP net loss plus depreciation and amortization, interest expense, provision (benefit) for income taxes, other expense (income), (gain) loss on disposal of property and equipment, exit activities, restructuring and impairments, stock-based compensation, non-income tax contingency, strategic alternatives and related costs, organizational realignment costs, pre-acquisition costs and claim settlement.Adjusted EBITDA Margin is a non-GAAP measure and is Adjusted EBITDA as a percentage of revenues.Credit Agreement Adjusted EBITDA is a non-GAAP measure and is Adjusted EBITDA less adjustments as defined in INAP’s credit facility.Represent exit activities and restructuring charges related to sublease income assumptions for certain properties that have taken longer to find sublease tenants. In 2016, primarily non-cash goodwill impairment charges. $78.2MM of non-cash impairment charges incurred in Q3 2016Primarily related to legal and other professional fees incurred in connection with the evaluation of strategic alternatives and related shareholder communications. In 2016, also includes professional fees, employee retention bonus, severance and executive search costs incurred related to Company’s organizational realignment. 1 ($ millions) 2 2 1 14 © 2017 Internap Corporation (INAP) Commentary (1) Reconciliation to GAAP on page 17.Revenue recognized by INAP in 2018 will include a purchase accounting adjustment impacting deferred revenue, which may reduce annualized revenue by approximately $2MM. (2)

INAP Reconciliation of Non-GAAP Financial Measures ($ millions) 15 © 2017 Internap Corporation (INAP) Reconciliation to GAAP on page 14.Reconciliation to GAAP on page 17.Revenue recognized by INAP in 2018 will include a purchase accounting adjustment impacting deferred revenue, which may reduce annualized revenue by approximately $2MM.Assumed tax rate of 0% based on INAP’s 2017 Effective Tax Rate. (1) (2) (3) (4) (3)

INAP Reconciliation of Non-GAAP Financial Measures ($ millions) 16 © 2017 Internap Corporation (INAP) Includes INAP FY 2017 CA Adjusted EBITDA (non-GAAP) of $82.5MM (Adjusted EBITDA of $92.2MM less adjustments as defined in INAP’s credit facility), SingleHop FY 2017 Adjusted EBITDA (non-GAAP) of $17.4MM, and $2.5MM of pro forma synergies, representing the midpoint of the projected range of $2-3MM.Revenue recognized by INAP in 2018 will include a purchase accounting adjustment impacting deferred revenue, which may reduce annualized revenue by approximately $2MM.Reconciliation to GAAP on page 14.

SingleHop Reconciliation of Non-GAAP Financial Measures Pro Forma Adjusted EBITDA is a non-GAAP measure and is Adjusted EBITDA plus Pro Forma adjustments related to finding long-term leases for certain locations, contract negotiations with vendors, software and fiber, systems integration and sales department consolidation.Pro Forma Adjusted EBITDA Less CapEx is a non-GAAP measure and is Pro Forma Adjusted EBITDA less capital expenditures.Revenue recognized by INAP in 2018 will include a purchase accounting adjustment impacting deferred revenue, which may reduce annualized revenue by approximately $2MM.Primarily related to finding long-term leases for certain locations and contract negotiations with vendors 1 ($ millions) 1 17 © 2017 Internap Corporation (INAP) Commentary