Form 10-K Meet Group, Inc. For: Dec 31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☑ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended: December 31, 2017

Or

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from: to

The Meet Group, Inc.

(Exact name of registrant as specified in its charter)

Delaware | 001-33105 | 86-0879433 |

(State or Other Jurisdiction of Incorporation or Organization | (Commission File Number) | (I.R.S. Employer Identification No.) |

100 Union Square Drive

New Hope, Pennsylvania 18938

(Address of Principal Executive Office) (Zip Code)

(215) 862-1162

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: | ||

Title of each class | Name of each exchange on which registered | |

Common Stock, $0.001 par value | The NASDAQ Stock Market LLC | |

NASDAQ Capital Market | ||

Securities registered pursuant to Section 12(g) of the Act: None | ||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ Yes ☑ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. ☐ Yes ☑ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☑ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ☑ Yes ☐ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ | Accelerated filer ☒ |

Non-accelerated filer ☐ (Do not check if a smaller reporting company) | Smaller reporting company ☐ |

Emerging growth company ☐ | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for comply with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ☐ Yes ☑ No

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the closing price as of the last business day of the registrant’s most recently completed second fiscal quarter, June 30, 2017, was approximately $356,085,000 based upon the last reported sale price of $5.05 per share on June 30, 2017 on the NASDAQ Capital Market.

The number of shares outstanding of the registrant’s common stock, par value $0.001, as of March 12, 2018, was 72,040,500.

THE MEET GROUP, INC. AND SUBSIDIARIES

TABLE OF CONTENTS

Page | ||||

PART I

ITEM 1. BUSINESS.

COMPANY OVERVIEW

The Meet Group, Inc. (the “Company,” “The Meet Group,” “us,” or “we”) is a portfolio of mobile social entertainment apps designed to meet the universal need for human connection. We leverage a powerful live-streaming video platform, empowering our global community to forge meaningful connections. Our primary apps are MeetMe®, LOVOO®, Skout®, and Tagged®.

We operate location-based social networks for meeting new people, primarily on mobile platforms, including on iPhone, Android, iPad and other tablets, that facilitate interactions among users and encourage users to connect, communicate and engage with each other. In 2017, we laid the foundation for and launched live video, which we believe is the most compelling product we have ever offered. Having historically generated revenue primarily through advertising, live video and other forms of user-pay monetization, including subscriptions and in-app purchases, are becoming an increasingly larger component of total revenue. We believe revenues from video are more sustainable, can grow faster, and are more aligned with the quality of the user experience than revenues from advertising.

We launched live video monetization on two of our apps in 2017 and have seen strong early interest from our users, including increasing engagement and revenue. We also added two additional apps to The Meet Group portfolio. On April 3, 2017, we completed our acquisition of Ifwe Inc. (“if(we)”), a leading global mobile network for meeting new people, and on October 19, 2017, we completed our acquisition of Lovoo GmbH (“Lovoo”), a leading dating app provider in Germany. We believe these acquisitions, in addition to our acquisition of Skout, Inc. (“Skout”) on October 3, 2016, provide significant scale for the future global growth of our social entertainment platform, and we are hard at work today integrating our video technology into both properties.

We also offer online marketing capabilities, which enable marketers to display their advertisements in different formats and in different locations. We offer significant scale to our advertising partners, with hundreds of millions of daily impressions across our active global user base, and sophisticated data science for highly effective hyper-targeting. We work with our advertisers and advertising networks to maximize the effectiveness of their campaigns by optimizing advertisement formats and placements.

Just as Facebook has established itself as the social network of friends and family, and LinkedIn as the social network of colleagues and business professionals, The Meet Group is creating the social entertainment network not of the people you know but of the people you want to know. Nimble and fast-moving, already in more than 100 countries, we are challenging the dominant player in our space, Match Group, and differentiating ourselves with live video, which is not offered by many of our direct competitors. Modeled after the video products offered by Chinese dating app providers, but enhanced in order to appeal to western audiences, our live video product is aimed at the nexus of entertainment and community, where we believe our apps exhibit natural strength.

Our vision extends beyond dating and entertainment. We focus on building quality products to satisfy the universal need for human connection among all people, everywhere--not just paying subscribers. We believe meeting new people is a basic human need, especially for users aged 18-34, when so many long-lasting relationships are made. We use advanced technology to engineer serendipitous connections among people who otherwise might never have met - a sort of digital coffeehouse where everyone belongs. Over the years, The Meet Group’s apps have originated untold numbers of chats, shares, good friendships, dates, romantic relationships - even marriages.

We believe that we have significant growth opportunities enabled through our social entertainment platform. We believe our scale provides unique advantages to grow video monetization, while also establishing a high density of users within the geographic regions we serve. As The Meet Group networks grow and the number of users in a location increases, we believe that users who are seeking to meet new people will incrementally benefit from the quantity of relevant connections.

1

BUSINESS OVERVIEW

How We Create Value for Users

We provide something we feel everyone craves: the magic of human connection. Our innovative apps have advantages the neighborhood pub can’t match. Through our social entertainment platform and pipeline of new products, such as live video streaming, gifting and monetization, we are helping to connect a portion of the over 50 million people aged 18-34 in the U.S. and the more than one billion worldwide. We offer free and subscription-based services to our users, monetizing through advertising, and increasingly, through direct user purchases including video, subscription and in-app purchase revenue. In 2017, we generated approximately 73% of our revenue from advertising.

Monetization of our video product is done through gifting. In our one-to-many livestreaming feature, a single broadcaster can entertain and interact with essentially unlimited viewers on the app. Gifting enables those viewers to use virtual credits purchased through iTunes or Google Play to send the broadcaster a virtual gift as a show of appreciation or interest for that entertainment.

People use The Meet Group apps to make friends, socialize, date, be entertained and chat. In fact, in our internal survey of MeetMe users conducted in November 2017, 84% of those responding said they preferred to start relationships as friends. We believe this comfort level drives higher engagement and retention.

We believe the multi-billion dollar social entertainment industry can meet users’ needs through a range of monetization paths, including both free and paid models. While free models —MeetMe, Skout, Tagged— reduce barriers to entry and accelerate the network effect, our Lovoo app has demonstrated ongoing success with its subscription-based model.

We believe we are well positioned to continue to grow user engagement and generate revenue with our social entertainment platform. We believe our success will depend in large part, as it does every year, on our ability to continue to execute against an aggressive product pipeline.

More than 4 million people use our apps, on average, every day to meet new people in their local communities and throughout the world. In many cases they are logging in multiple times per day in order to interact with people they have met on our apps. They are meeting friends, significant others, and potential spouses every day.

Additionally, more than 20% of our MeetMe, Skout and Tagged mobile users engage with video each day and we are seeing increasing monetization across those apps where video gifting is available.

Our applications offer a variety of ways for users to discover and interact with one another, with an increasing focus on live video as the medium of connection. The most popular feature has traditionally been one-on-one chat, and users spend much of their time with The Meet Group interacting with the connections they've made on our apps. Our primary "magic" is not the chat client itself, but the ease with which our users can find new people with whom to chat. Our chat service is generally provided free to all users. Lovoo limits the number of chats a user can send for free and provides for the ability to unlock additional chats with a paid subscription or in-app purchase.

There are four key types of features we use to facilitate connections between users, “Browse,” “Queue,” “Feed” and “Live”:

The most direct is a “Browse” feature, which allows users to peruse profiles and photos of potential connections nearby or around the world. We use sophisticated, data-backed algorithms to prioritize the most relevant recommendations for each user, optimizing for real connection as measured by each one’s likelihood to reply and engage in a lengthy conversation.

For users interested in a quicker, more gamified experience, each of our apps offers a “Queue” feature, which allows users to, in effect, swipe left and right on potential matches based on their photos and limited profile information. When two users express interest in one another in the queue, we notify each one of the match and encourage them to chat. We believe double-sided match requirement causes these conversations to be significantly more efficient, but somewhat less frequent, than those that come from a Browse feature.

We also enable users, on apps other than Lovoo, to discover and connect with one another around content, including both text and photo posts, within our “Feed” features. In this model, rather than browsing profiles, users are browsing content created by other users, either nearby or around the world. This content offers a compelling jumping-off point for extended conversation, both public (in the form of comments on that content) and private (in the form of one-on-one chats that subsequently develop).

2

In 2017, we began an aggressive push into “Live Video”, adding a new section called “Live”, which we believe to be both an engaging and highly monetizable format for communication and social entertainment on our MeetMe and Skout applications. We expect to add similar functionality to our Tagged and Lovoo applications in 2018. We also plan to add new features within Live and to infuse other areas of the apps with both live and recorded video functionality.

Live enables our users to become performers, gain an audience, cultivate relationships with their top fans, and even earn cash rewards if they produce engaging content and spend enough time on our platforms. The most popular livestreamers interact directly with their live audience on our apps, even allowing audience members to join their streams as guest streamers. Audience members can make in-app purchases to show their appreciation with gifts to livestreamers.

Users can make in-app purchases to access other features within the apps, typically either to unlock content or functionality or to prioritize their profiles or content within the applications. For example, users can spend Credits, Points or Gold for promotion within the Browse and Feed features, which garners them more attention with the goal of allowing them to find more connections more quickly. As another example, users in order to unlock the list of who viewed their profile or who expressed interest.

Finally, each of our apps also offers a subscription service for those users who want to have the very best experience and the most options available to them. Benefits for subscribers vary across the portfolio, but may include: additional advanced filters, suppression of advertisements, permanent access to information or features otherwise locked, and increased or eliminated limits on functionality like daily icebreakers or queue gameplay.

Our Strategy

We are executing on our core mission of meeting the universal need for human connection with a focus on live video products, while diversifying our revenue base towards user-pay revenue such as subscriptions and in-app purchases as we scale our business and strive to grow revenue and adjusted EBITDA.

Our strategy for 2018 and beyond is aimed at growing our audience, building out our video platform, engaging our active user base and delivering new products to drive monetization.

Key elements of our strategy include:

• | Build Great Products to Acquire, Engage, and Thrill Users: Our core focus is to create innovative social experiences using sophisticated data science that help our users meet new people in their local communities and throughout the world. We plan on continuing to invest in improving our core platform as technology advances and in devising new ways of engineering serendipity online. A key area of product focus in 2018 is the delivery, engagement and monetization of our live streaming video. |

• | Offer Innovative and Engaging Ad Products for Marketers: We consider it critical to continue improving our advertising products to create more value for our marketers, attract new customers, and display targeted advertisements that are more relevant for our users. We pursue these goals through a combination of internal innovation and rapid integration of advertising solutions that have been successful in the marketplace. |

• | Integrating our Recent Acquisitions to Drive Growth: Following our acquisitions of if(we) and Lovoo in 2017, we are focused on effectively integrating both companies, realizing synergies, and driving growth across our platform. |

3

Operating Metrics

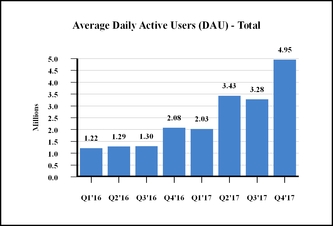

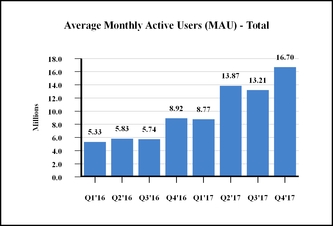

We measure website and application activity in terms of monthly active users (“MAUs”) and daily active users (“DAUs”). We define a MAU as a registered user of one of our platforms who has logged in and visited within the last month of measurement. We define a DAU as a registered user of one of our platforms who has logged in and visited within the day of measurement. For the quarters ended December 31, 2017, 2016 and 2015, total MAUs were approximately 16.70 million, 8.92 million and 4.97 million, respectively, and total DAUs were approximately 4.95 million, 2.08 million and 1.19 million, respectively.

Monthly Average for the Quarter Ended | ||||||||

December 31, | ||||||||

2017 | 2016 | 2015 | ||||||

MAU | 16,695,097 | 8,915,575 | 4,971,638 | |||||

For the Quarter Ended | ||||||||

December 31, | ||||||||

2017 | 2016 | 2015 | ||||||

DAU | 4,953,317 | 2,084,987 | 1,189,290 | |||||

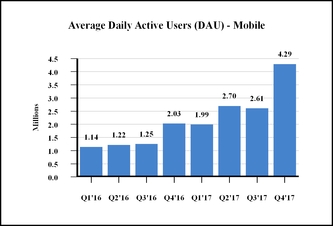

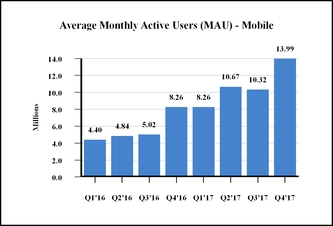

Trends in Our Metrics

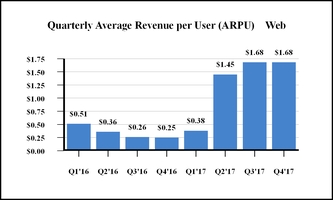

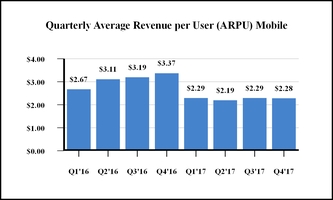

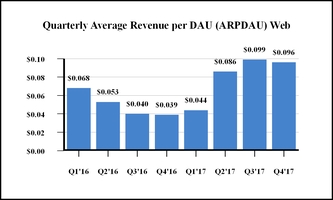

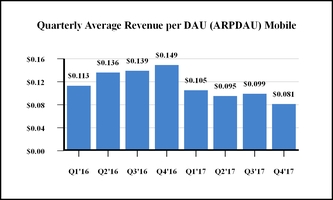

In addition to MAUs and DAUs, we measure activity on the Company’s apps in terms of average revenue per user (“ARPU”) and average daily revenue per daily active user (“ARPDAU”). We define ARPU as the quarterly revenue per average MAU. We define ARPDAU as the average daily revenue per DAU. We define mobile MAU as a user who accessed our sites by one of our mobile applications or by the mobile optimized version of our websites for MeetMe, Skout and Lovoo, whether on a mobile phone or tablet during the month of measurement. We define a mobile DAU as a user who accessed our sites by one of our mobile applications or by the mobile optimized version of our websites for MeetMe, Skout and Lovoo, whether on a mobile phone or tablet during the day of measurement.

In the quarter ended December 31, 2017, the Company averaged 13.99 million mobile MAUs and 16.70 million total MAUs on average, as compared to 8.26 million mobile MAUs and 8.92 million total MAUs on average in the quarter ended December 31, 2016, a net increase of 5.73 million or 69% for mobile MAUs, and a net increase of 7.78 million or 87% for total MAUs. Mobile DAUs were 4.29 million for the quarter ended December 31, 2017, a 112% increase, from 2.03 million in the quarter ended December 31, 2016. For the quarter ended December 31, 2017, the Company averaged 4.95 million total DAUs, as compared to 2.08 million total DAUs on average for the quarter ended December 31, 2016, a net increase of approximately 2.87 million total DAUs, or 138%.

4

(1) | Tables above include active users from Skout, if(we) and Lovoo as of the acquisition dates of October 3, 2016, April 3, 2017 and October 19, 2017. |

In the quarter ended December 31, 2017, the Company earned an average of $1.68 ARPU on the web and $2.28 ARPU on our mobile applications, as compared to $0.25 ARPU on the web and $3.37 in mobile ARPU for the quarter ended December 31, 2016. In the quarter ended December 31, 2017, the Company earned an average of $0.096 ARPDAU on the web and $0.081 on mobile ARPDAU, as compared to $0.039 in web ARPDAU and $0.149 in mobile ARPDAU for the quarter ended December 31, 2016.

(1) | Tables above include active users from Skout, if(we) and Lovoo as of the acquisition dates of October 3, 2016, April 3, 2017 and October 19, 2017. |

As the business continues to evolve and as subscription and in-app purchases contribute to a larger portion of revenue, we may choose to report new or additional metrics that are more closely tied to key business drivers or stop reporting metrics that are no longer relevant.

5

PRODUCT DEVELOPMENT

We are continually developing new products, as well as optimizing our existing platforms and feature sets in order to meet the evolving needs of our user base and advertising partners.

We develop most of our software internally. We will, however, purchase technology and license intellectual property rights where it is strategically important, operationally compatible, or economically advantageous. For instance, we partner with third parties to further our internationalization efforts as we look to bring additional languages into our existing platforms. We are not materially dependent upon licenses and other agreements with third parties relating to product development.

Our technology team of 159 people consists of our product development and engineering team, our database administration team, our quality assurance team and our network system operators. These teams are responsible for feature enhancements and general maintenance across all of our platforms. Our technology team is headquartered in New Hope, Pennsylvania with additional offices in Philadelphia, Pennsylvania, San Francisco, California and Dresden, Germany.

SALES AND MARKETING

We have grown our user base through organic, viral channels as well as through our recent acquisitions. By encouraging members to invite their friends to join our apps and to share their activity across other external platforms, including Facebook and Twitter, and by providing members with easy-to-use tools, we believe we have successfully grown our user base while minimizing marketing costs. We focus primarily on creating a truly differentiated experience and compelling value proposition for new users in our markets and developing the technologies needed to facilitate their word-of-mouth marketing on our behalf in order to attract and retain new members.

Our paid customer acquisition strategy will focus on acquiring users in geographies where we believe we will see payback on our acquisition investment. We spent $15.8 million, $12.1 million and $3.3 million on paid direct user acquisition in 2017, 2016 and 2015, or 12.8%, 15.9% and 5.9% of our total revenue, respectively. The overall Company spend rate in 2018 is expected to be approximately 11% of revenue.

SALES AND OPERATIONS

Our advertising sales and operations team is comprised of 10 full-time employees in the U.S. and Germany and covers major brand agencies, direct response and cost-per-action engagement advertisers, advertising networks, and mobile agencies. Our advertising operations are headquartered in New Hope, Pennsylvania, with additional offices in New York, New York, San Francisco, California and Dresden, Germany.

Our operations and member services team consists of 28 full-time employees, 7 part-time employees, and 140 contractors split between Delhi and Bangalore, India and Cavite, Philippines. This team is responsible for reviewing images and other user-generated content, investigating and responding to member abuse reports, and providing general customer support.

INTELLECTUAL PROPERTY

Our intellectual property includes trademarks related to our brands, products, and services, copyrights in software and creative content, trade secrets, domain names, and other intellectual property rights and licenses of various kinds. We seek to protect our intellectual property through copyright, trade secret, trademark and other laws of the U.S. and other countries, and through contractual provisions.

We consider the MeetMe, Skout, Tagged, Hi5, Lovoo and Social Theater trademarks and our related trademarks to be valuable to the Company, and we have registered these trademarks in the U.S. and other countries throughout the world and aggressively seek to protect them.

6

COMPETITION

We believe we are challenging the dominant player in the dating space, Match Group, but we are not limited to dating. We operate at the forefront of nascent segments (social discovery and social entertainment) of a broader sector that is still being defined (social networking). As such, we face significant competition in every aspect of our business, both from established companies whose products help users meet new people, or are evolving to do so, and from smaller but well-funded startups that can quickly gain attention and compete with us for users. Examples of services that compete with us for users and advertiser interest include, but are not limited to:

• | Mobile applications and websites whose primary focus is to help users meet new people in their geographical area, including Badoo, Twoo and Meetup. |

• | Social networking mobile applications and websites with a focus on dating, which is a subset of the opportunity around meeting new people, such as Zoosk, Match, Happn, PlentyOfFish, OkCupid and Tinder. |

• | Other video platforms that provide one-to-many and one-to-one video services such as live.me, live.ly, musical.ly, Azar, Younow and Periscope. |

• | Broader social networks that currently offer or may evolve to offer services aimed at helping users meet new people in their area, such as Facebook, Twitter and LinkedIn. |

• | Significant competition for Social Theater comes from publishers including TrueX, Unruly Media, SuperSonic Advertising, Jun Group and Genesis Media. |

As we introduce new products, and as other companies introduce new products and services, we expect to become subject to additional competition. Additional information regarding certain risks related to our competition is included in Part I, Item 1A—Risk Factors of this report.

In addition to other online dating and social networking brands, we compete indirectly with offline dating services, such as matchmakers.

EMPLOYEES

As of December 31, 2017, we employed 286 full-time and 12 part-time employees in the U.S. and Germany. Our future success is substantially dependent on the performance of our senior management and key technical personnel, as well as our continuing ability to attract, maintain the caliber of, and retain highly qualified technical and managerial personnel. Additional information regarding certain risks related to our employees is included in Part I, Item 1A—Risk Factors of this report and is incorporated herein by reference.

GOVERNMENT REGULATION

In the U.S., advertising and promotional information presented to visitors on our mobile applications and websites and our other marketing activities are subject to federal and state consumer protection laws that regulate unfair and deceptive practices. There are a variety of state and federal restrictions on the marketing activities conducted by email, or over the Internet, including U.S. federal and state privacy laws and the Telephone Consumer Protection Act of 1991, or the TCPA, the Controlling the Assault of Non-Solicited Pornography and Marketing Act of 2001, or the CAN-SPAM Act. We may also be subject to laws in the various other countries in which we operate, including the General Data Protection Regulation which will come into effect in most of Europe on May 25, 2018. The rules and regulations are complex and may be subject to different interpretations by courts or other governmental authorities. We may unintentionally violate such laws, such laws may be modified, and new laws may be enacted in the future. Any such developments (or developments stemming from enactment or modification of other laws) or the failure to anticipate accurately the application or interpretation of these laws could create liability to us, result in adverse publicity, and negatively affect our businesses. Additional information regarding certain risks related to government regulations is included in Part I, Item 1A—Risk Factors of this report.

CORPORATE HISTORY

The Meet Group was incorporated in Nevada in June 1997, and merged with Insider Guides, Inc., doing business as myYearbook.com, on November 10, 2011. On December 6, 2011, the Company changed its legal domicile to Delaware. Effective June 1, 2012, the Company changed its name from Quepasa Corporation to MeetMe, Inc. and completed the transition of its website to meetme.com in the fourth quarter of 2012. On October 3, 2016 the Company completed its acquisition of Skout, and on April 3, 2017 the Company completed its acquisition of if(we), both of which owned leading global mobile networks for meeting

7

new people, and changed its name to The Meet Group, Inc. On October 19, 2017, the Company completed its acquisition of Lovoo to expand its global footprint, increase its scale and profitability, and diversify our business model by adding expertise in subscription and in-app purchasing. The Company owns and operates the MeetMe, Skout, Tagged, Hi5 and Lovoo mobile applications, and meetme.com, skout.com, tagged.com, hi5.com and lovoo.com.

Our executive offices and principal facilities are located at 100 Union Square Drive, New Hope, Pennsylvania, 18938. Our telephone number is (215) 862-1162. Our corporate website is www.themeetgroup.com. Investors can obtain copies of our SEC filings from our corporate website free of charge, as well as from the SEC website, www.sec.gov. The information contained on our corporate website and the SEC website is not incorporated herein.

AVAILABLE INFORMATION

Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to reports filed or furnished pursuant to Sections 13(a) and 15(d) of the Securities Exchange Act of 1934, are available free of charge on our Investor Relations website at http://ir.themeetgroup.com/docs as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. The SEC maintains a website that contains these filings at www.sec.gov. The information posted on our corporate website and the SEC website is not incorporated herein.

ITEM 1A. RISK FACTORS.

Investing in our common stock involves a high degree of risk. You should consider carefully the risks and uncertainties described below, together with all of the other information in this report, including the consolidated financial statements and the related notes included elsewhere in this report, before deciding whether to invest in shares of our common stock. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties that we are unaware of, or that we currently believe are not material may also become important factors that adversely affect our business. If any of the following risks actually occurs, our business, financial condition, results of operations, and future prospects could be materially and adversely affected. In that event, the market price of our common stock could decline, and you could lose part or all of your investment.

Risks Related to Our Business

If we cannot effectively drive engagement and monetization on our newly-launched Live feature on our mobile applications, our future operating results may suffer.

Our long term strategy includes continued revenue growth from our Live feature that we launched only in 2017. We have not completed launch of Live on all of our apps and we cannot be certain that Live will perform as expected at scale. While we expect to continue to devote substantial resources to the launch and monetization of Live across our apps, we also cannot be certain that our early results on Live are predictive of future results and that Live will continue to grow in the future. Furthermore, Live represents a new and unproven form of revenue, and we do not have a long history of monetizing Live. Live may not monetize as we expect and revenues may be adversely affected. If we do not launch Live across all of our apps as expected, if Live does not grow as expected, or if Live does not perform or monetize as expected, our operating results could be materially and adversely affected.

If we cannot increase our daily and monthly active users and increase their engagement on our mobile applications, our future operating results may decline.

We offer applications that are free to use, with only a small percentage of our users paying for virtual goods. Our financial performance has been and will continue to be significantly determined by our success in adding, retaining, and engaging active users. We must continue to add new members to our user base and retain existing members by offering new and engaging features and products, such as Live, in order to generate revenue from the sale of in-app products and attract advertising investment. The challenges we face include, among other things, our ability to:

• | attract new users and retain existing users at a consistent rate; |

• | increase engagement by existing users; |

• | monetize our user base; |

• | anticipate changes in the social networking and social discovery industry; |

• | launch new products and release enhancements that become popular; |

• | develop and maintain a scalable, high-performance technology infrastructure that can efficiently and reliably handle increased member usage, fast load times and the deployment of new features and applications; |

• | process, store and use data in compliance with governmental regulation and other legal obligations related to privacy; |

8

• | compete with other companies that are currently in, or may in the future enter, the social networking or social discovery industry; |

• | hire, integrate and retain world class talent; and |

• | expand our business internationally and with respect to mobile devices. |

If we fail to retain existing users or add new users, or if our users decrease their level of engagement, our revenue, financial results, and business may be significantly harmed.

The size of our user base and our users’ level of engagement are critical to our success. Our financial performance is significantly affected by our success in adding, retaining, and engaging active users. If people do not perceive our products to be useful, reliable, and trustworthy, we may not be able to attract or retain users or otherwise maintain or increase the frequency and duration of their engagement. A number of other social networking companies that achieved early popularity have since seen their active user bases or levels of engagement decline, in some cases precipitously. There is no guarantee that we will not experience a similar erosion of our active user base or engagement levels. A decrease in user retention, growth, or engagement could render us less attractive to advertisers, which may have a material and adverse impact on our revenue, business, financial condition, and results of operations. Any number of factors could potentially negatively affect user retention, growth, and engagement, including if we fail to:

• | introduce new and improved products that are favorably received; |

• | identify and respond to emerging technological trends in the market; |

• | provide a compelling user experience with the decisions we make with respect to the frequency, prominence, and size of advertising and other commercial content we display; |

• | continue to develop features, such as our Live feature, for mobile devices that users find engaging, that work with a variety of mobile operating systems and networks, and that achieve a high level of market acceptance; |

• | acquire or license leading technologies; |

• | avoid technical or other problems that prevent us from delivering our services in a rapid and reliable manner or otherwise affect the user experience; or |

• | provide adequate customer service to users or advertisers. |

If we are unable to maintain and increase our user base and user engagement, our revenue, financial results, and future growth potential could be adversely affected.

We believe the number of our registered users is higher than the number of actual users.

We believe the number of our registered users is higher than the number of actual users because some members may have multiple registrations, other members may have died or may have become incapacitated, and others may have registered under fictitious names. Members also terminate their memberships and delete their profiles. Given the challenges inherent in identifying these accounts, we do not have a reliable system to accurately identify the number of our active members.

If our users do not interact with each other or our viral marketing strategy fails, our ability to attract new users may suffer and our revenue may decrease.

The majority of our users do not visit our mobile applications frequently and spend a limited amount of time when they do visit. The majority of our screen views are generated by a minority of our users. If we are unable to encourage our users to interact more frequently and to increase the amount of user generated content they provide, our ability to attract new users and our financial results may suffer. In addition, part of our success depends on our users interacting with our products and contributing to our viral advertising platform (Social Theater). If our Social Theater platform is unsuccessful and our users do not participate in Social Theater campaigns, our operating results could suffer.

We generate a significant portion of our revenue from advertising, and in particular, digital advertising. If we incur a loss of advertisers, or a reduction in spending by advertisers, our revenue could substantially decline, resulting in significant operating losses and negatively impacting our cash flows.

We generate a significant portion of our revenue from parties advertising on our platform, and, in particular, those advertisers in the digital advertising market. The digital advertising market has been subject to fluctuations and we have experienced declines in ad rates. In 2017 we experienced significant declines in advertising rates that materially and negatively impacted our operating results. Advertising rates may continue to decline relative to historical levels. Factors such as the lack of standard metrics in the digital advertising market may lead to varying and inconsistent ad rates and potentially demands for rebates.

9

As is common in the industry, our advertisers typically do not have long-term advertising commitments with us. Many of our advertisers spend only a relatively small portion of their overall advertising budget with us. Advertisers may not continue to do business with us, or they may reduce the prices they are willing to pay to advertise with us, if we do not deliver advertising and other commercial content in an effective manner, or if they do not believe that their investment in advertising with us will generate a competitive return relative to other alternatives. Our advertising revenue could be adversely affected by a number of other factors, including:

• | decreases in user engagement, including time spent on our mobile applications; |

• | product changes or inventory management decisions we may make that reduce the size, frequency, or relative prominence of advertising and other commercial content that we display; |

• | our inability to increase the rate at which our users “click through” on the ads we display; |

• | our inability to improve our analytics and measurement solutions that demonstrate the value of our advertising and other commercial content; |

• | loss of advertising market share to our competitors; |

• | adverse legal developments relating to advertising, including legislative and regulatory developments and developments in litigation; |

• | adverse media reports or other negative publicity involving us or other companies in our industry; |

• | objections to the content of our apps and websites; |

• | changes in the way online advertising is priced; |

• | changes in the digital advertising market, including the introduction of standard metrics; |

• | the impact of new technologies that could block or obscure the display of our advertising and other commercial content; and |

• | the impact of macroeconomic conditions and conditions in the advertising industry, and, in particular, the digital advertising industry, in general. |

The occurrence of any of these or other factors could result in a reduction in demand for our advertising and other commercial content, which could reduce the prices we receive for our advertising and other commercial content, or cause advertisers to stop advertising with us altogether. In turn, we could incur a substantial decline in revenue, increased operating losses, and a negative impact on cash flows.

If we fail to maintain and expand our base of advertisers, our revenue and our business could be harmed.

Our ability to grow our business depends in part on our ability to maintain and expand our advertiser base. To do so, we must ensure that existing and prospective advertisers know that our advertising products offer a material benefit and can generate a competitive return relative to other alternatives, including online, mobile and traditional advertising platforms. Advertisers may not continue to do business with us, or they may reduce the prices they are willing to pay to advertise with us, if we do not deliver ads in an effective manner, or if they do not believe that their investment in advertising with us will generate competitive returns. Our ability to do so depends on factors including:

• | Competitiveness of Our Products. We must deliver ads in an effective manner and provide accurate analytics and measurement solutions that demonstrate the value of our advertising products compared to those of our competitors. Similarly, if the pricing of our advertising products does not compare favorably to those of our competitors, advertisers may reduce their advertising with us or choose not to advertise with us at all. |

• | Traffic Quality. The success of our advertising program depends on delivering positive results to our advertising customers. Low-quality or invalid traffic, such as robots, spiders and the mechanical automation of clicking, may be detrimental to our relationships with advertisers and could adversely affect our advertising pricing and revenue. If we fail to detect and prevent click fraud or other invalid clicks on ads, the affected advertisers may experience or perceive a reduced return on their investments, which could lead to dissatisfaction with our products, refusals to pay, refund demands or withdrawal of future business. |

• | Perception of Our Platform. Our ability to compete effectively for advertiser budgets depends on our reputation and perceptions regarding our platform. |

• | Macroeconomic Conditions. Adverse macroeconomic conditions can have a negative impact on the demand for advertising, particularly with respect to online advertising products. Advertisers may have limited advertising budgets and may view online advertising as lower priority than offline advertising. |

As is typical in our industry, our advertisers generally do not have long-term obligations to purchase our products. Their decisions to renew depend on the degree of satisfaction with our products as well as a number of factors that are outside of our control. As a result, we may experience attrition in our advertisers in the ordinary course of business resulting from several factors, including objections to the content or reputation of our apps, losses to competitors or declining advertising budgets. The occurrence of any

10

of these or other factors could result in a reduction in demand for our ads, which may reduce the prices we receive for our ads, either of which would negatively affect our revenue and operating results.

Because we face significant competition from other social networks, video platforms and companies with greater resources, we may not be able to compete effectively.

We face significant competition from other companies that seek to connect members online. As we roll out the Live Video Feature across our applications, we expect to face significant competition from other video platforms that provide one-to-many and one-to-one video services. Our competitors include other companies providing portal and online community and one-to-many and one-to-one video services, such as Match, Facebook, Google, Badoo, PlentyOfFish, OkCupid, live.me, live.ly, musical.ly, Azar, Younow and Periscope. Many of our competitors have greater resources, more established reputations, a broader range of content and products and services, longer operating histories, and more established relationships with their users than we do. They can use their experience and resources against us in a variety of competitive ways, including developing ways to attract and maintain users. These factors may allow our competitors to respond more effectively than us to new or emerging technologies and changes in market requirements. Our competitors may develop products, features, or services that are similar to ours or that achieve greater market acceptance, may undertake more far-reaching and successful efforts at developing new services or marketing campaigns, or may adopt more aggressive pricing policies. Some of our competitors may enjoy better competitive positions in certain geographical regions or within certain user demographics that we currently serve or may serve in the future. These advantages could enable these competitors to offer products that are more appealing to users and potential users than our products or to respond more quickly and/or cost-effectively than us to new or changing opportunities. In addition, within the industry generally, costs for users to switch between products are low, and users have a propensity to try new approaches to connecting with people. As a result, new products, entrants and business models are likely to continue to emerge. It is possible that a new product could gain rapid scale at the expense of existing brands through harnessing a new technology or distribution channel, creating a new approach to connecting people or some other means.

We believe that our ability to compete effectively depends upon many factors both within and beyond our control, including:

• | the usefulness, ease of use, performance, and reliability of our services compared to our competitors; |

• | the size and composition of our user base; |

• | the engagement of our users with our services; |

• | the timing and market acceptance of services, including developments and enhancements to our or our competitors’ services; |

• | our ability to monetize our services; |

• | the frequency, size, and relative prominence of the advertising and other commercial content displayed by us or our competitors; |

• | customer service and support efforts; |

• | marketing and selling efforts; |

• | changes mandated by legislation, regulatory authorities, or litigation, including settlements and consent decrees, some of which may have a disproportionate effect on us; |

• | acquisitions or consolidation within our industry, which may result in more formidable competitors; |

• | our ability to attract, retain, and motivate talented employees, particularly software engineers; |

• | our ability to cost-effectively manage and grow our operations; and |

• | our reputation and brand strength relative to our competitors. |

If we are not able to effectively compete, our user base and level of user engagement may decrease, which could make us less attractive to advertisers and materially and adversely affect our revenue and results of operations.

Because we face competition from traditional media companies, we may not be included in the advertising budgets of large advertisers, which could harm our operating results.

Major brand and network advertising drives a significant portion of our revenue. We rely primarily on cost per thousand (“CPM”) advertising, where the price for advertising is based on the number of users who view it. In addition to mobile application developers and Internet companies, we face competition from companies that offer traditional media advertising opportunities. Most large advertisers have set advertising budgets, a portion of which is allocated to mobile advertising. If we fail to convince these companies to spend a portion of their advertising budgets on social media and specifically with us, however, our operating results could be harmed.

11

We have terminated agreements with our former advertising partner and may not be able to collect amounts due.

On June 2, 2015, we terminated two agreements with Beanstock relating to our advertising inventory on web and mobile: the Web Agreement and the Mobile Agreement. We terminated both agreements for non-payment, and in the third quarter of 2015, we wrote-off the accounts receivable balance under the agreements of $5.7 million as uncollectible. We have filed suit against Beanstock and its guarantor, Adaptive Medias, Inc., and we intend to pursue all available remedies to collect amounts due to us, including liquidated damages under the Mobile Agreement. We cannot guarantee if, when or how much outstanding will be paid to us. We also do not know the amount of time and effort that will be required from management to collect these amounts. On January 20, 2016, the Company received notice from the United States Bankruptcy Court, District of Delaware, that a Chapter 7 bankruptcy case against Beanstock had been filed on October 7, 2015. This action has been stayed by the courts as a result of the bankruptcy filing against Beanstock. For a description of the litigation, see Part I, Item 3-Legal Proceedings.

We rely on the Apple App Store and the Google Play Store to distribute our mobile applications. Our business may suffer if we are unable to maintain a good relationship with Apple and Google, if their terms and conditions or pricing change to our detriment, if we violate, or either company believes that we have violated, its terms and conditions, or if either of these platforms are unavailable for a prolonged period of time.

The Apple App Store and the Google Play Store are our primary distribution, marketing, promotion and payment platforms for our applications. In 2017, we derived 33% of our revenue from Apple and 43% of our revenue from Google. Any deterioration in our relationship with Google or Apple could harm our business and adversely affect the value of our stock.

We are subject to these platforms’ standard terms and conditions for application developers, which govern the promotion, distribution and operation of apps. These platforms have policies governing, for example, use of user data, personal and sensitive information, and advertising IDs, as well as ones relating to advertising (including deceptive, disruptive and inappropriate ads) and interference with app and device functionality. Each platform has broad discretion to change and interpret its terms of service and other policies with respect to us and those changes may be unfavorable to us. A platform provider may also change its fee structure, add fees associated with access to and use of its platform, alter how we are able to advertise on the platform, change how the personal information of its users is made available to application developers on the platform, or limit the use of personal information for advertising purposes. Our business could be harmed if a platform provider modifies its current terms of service or other policies, including fees, in a manner adverse to us.

If we violate, or if a platform provider believes we have violated, these terms and conditions (or if there is any change or deterioration in our relationship with these platform providers), the particular platform provider may discontinue or limit our access to that platform, which could prevent us from making our apps available to or otherwise from serving our mobile customers. Any limit or discontinuation of our access to any platform could adversely affect our business, financial condition or results of operations.

Apple has a policy of reviewing apps prior to making them available in the App Store. In the past, Apple has rejected submissions of specific builds of our apps, and we have had to modify those submissions in order to gain acceptance. On more than one occasion, for example, Apple has rejected our apps because of user generated content and other concerns. In response we devoted additional resources to image review, and changed some of our content allowance policies. Both the review process itself and any necessary resubmissions required in order to gain acceptance can cause delays in the availability of our releases. If this recurs on a prolonged or frequent basis, or other similar issues arise that impact users’ ability to download or use our apps, we may owe some of our customers rebates, which would increase our expenses and lower our gross margins. Delay or failure to gain Apple’s acceptance - and therefore availability in the App Store - could adversely affect our business, financial condition or results of operations.

We also rely on the continued operation and availability of these third-party platforms. In the past, platforms have been unavailable for short periods of time or there have been issues with the in-App purchasing functionality from the storefront. In the event that either the Apple App Store or the Google Play Store is unavailable or if in-App purchasing functionality from the storefront is non-operational for a prolonged period of time, it could have a material adverse effect on our business, financial condition or results of operations.

Furthermore, if Google or Apple loses its market position or otherwise falls out of favor with users, we would need to identify alternative channels for marketing, promoting and distributing our apps, which would consume substantial resources and may not be effective. In addition, Google and Apple have broad discretion to change their terms of service and other policies with respect to us and other developers, and those changes may be unfavorable to us.

12

If the Apple App Store or Google Play changes its search and rating algorithms, it could affect our ability to acquire new mobile members.

Our Apple and Google applications have ranked near the top of the “Free Social” categories and near the top of many key search terms. However, Apple and Google have changed their rating and search algorithms in the past without notice. Future changes to the rating and search algorithms by Apple or Google could impact our rating and search results, leading to a drop in new downloads, which could cause our business and operating results to suffer.

If we are unable to continue to develop or acquire successful applications for mobile platforms and standalone mobile applications, our growth prospects could suffer.

We have offered applications for mobile platforms since May 2010. We expect to continue to devote substantial resources to the development of our mobile applications and new features, such as Live Video, for our mobile applications, but there can be no assurances that we will continue to succeed in developing or acquiring applications and features that appeal to users or advertisers. We may encounter difficulty in attracting leading advertisers to our mobile applications. We may also face challenges working with wireless carriers, mobile platform providers and other mobile communications partners. Finally, we may face challenges converting mobile users into users that pay for in-app products, such as subscriptions and gifts on our Live Video feature. These and other uncertainties make it difficult to know whether we will continue to succeed in developing commercially viable applications for mobile platforms. If we do not succeed in doing so, our growth prospects could suffer.

If our efforts to attract and retain subscribers is not successful, our business could be adversely affected.

Our ability to continue to attract and retain users of our paid subscription services depends in part on our ability to consistently provide our subscribers with a quality experience. Subscribers may cancel their subscription to our service for many reasons, and if our efforts to attract and retain subscribers are not successful, our business, operating results and financial condition may be adversely affected.

If we cannot address technological change in our industry in a timely fashion and develop new services, our future results of operations could be adversely affected.

The Internet and electronic commerce industries are characterized by:

• | rapidly changing technology; |

• | evolving industry standards and practices that could render our platform and proprietary technology obsolete; |

• | changes in consumer tastes and demands; and |

• | frequent introductions of new services or products that embody new technologies. |

Our future performance depends, in part, on our ability to develop, license or acquire leading technologies and program formats, enhance our existing services, and respond to technological advances and consumer tastes and emerging industry standards and practices on a timely and cost-effective basis. Developing mobile and website technology involves significant technical and business risks. We may not be able to successfully use new technologies or adapt our platforms and technology to emerging industry standards. We may not be able to remain competitive or sustain growth if we do not adapt to changing market conditions or customer requirements.

Because we plan to continue expanding our operations abroad where we have limited operating experience, we may be subject to increased business, economic and regulatory risks that could affect our financial results.

We plan to continue the international expansion of our business operations. We may enter new international markets where we have limited or no experience in marketing, selling, and deploying our products. If we fail to deploy or manage our operations in international markets successfully, our business could suffer. In addition, we are subject to a variety of risks inherent in doing business internationally, including:

• | political, social, or economic instability; |

• | risks related to the legal and regulatory environment in foreign jurisdictions, including with respect to privacy, and changes in laws, regulatory requirements, and enforcement; |

• | burdens of complying with a variety of foreign laws; |

• | potential damage to our brands and reputation due to our compliance with local laws, including potential censorship or requirements to provide user information to local authorities, and/or potential penalties for failing to comply with such local laws; |

13

• | lack of familiarity with local customs; |

• | fluctuations in currency exchange rates; |

• | higher levels of credit risk and payment fraud; |

• | reduced protection for intellectual property rights in some countries; and |

• | difficulties in staffing and managing global operations and the increased travel, infrastructure. |

If we are unable to expand internationally and manage the complexity of our global operations successfully, our financial results could be adversely affected.

If we are unable to implement payment gateways to our users, our results of operations could be adversely affected.

We conduct our business in countries outside of the U.S. and depend on payment gateways that are not as well developed as those in the U.S., where most people have credit cards or bank debit cards to use in paying for virtual goods, products, and services. Users in some countries in which we operate do not always have access to credit and debit cards and other payment methods common in the U.S. If we are unable to implement payment gateways that provide our members with the ability to pay for goods, products and services easily, our future results could be adversely affected. Additionally, our inability to collect and receive payments from these other sources could have an adverse effect on our business and results of operations.

Because we rely on Facebook as a distribution, marketing, and promotion platform, if our relationship with Facebook changes or if Facebook loses market share, our business could be adversely affected.

Facebook is an important distribution, marketing and promotion platform for our content and applications. We generate a number of our new users through the Facebook platform and we expect to continue to do so for the foreseeable future. As such, we are subject to Facebook’s standard terms and conditions for Facebook Connect and for application developers, which govern the promotion, distribution and operation of applications on the Facebook platform.

Our ability to acquire new members and provide services to our existing members could be harmed if:

• | Facebook discontinues or limits access to its platform by us and other application developers; |

• | Facebook modifies its terms of service or other policies, including changing how the personal information of its users is made available to application developers on the Facebook platform or shared by users; |

• | Facebook develops its own competitive offerings; or |

• | Facebook disallows our advertising in its platforms. |

We have benefited from Facebook’s strong brand recognition and large user base. If Facebook loses its market position or otherwise falls out of favor with users, we would need to identify alternative channels for marketing, promoting and distributing our content and applications, which could consume substantial resources and may not be effective. In addition, Facebook has broad discretion to change its terms of service and other policies with respect to us and other developers, and any such changes could be unfavorable. Facebook may also change its fee structure or add fees associated with access to and use of the Facebook platform.

Because our business is subject to complex and evolving U.S. and foreign laws and regulations regarding privacy, data protection, and other matters, we could be subject to claims, changes to our business practices, increased cost of operations, or declines in user growth or engagement, or otherwise sustain harm to our business.

We are subject to a variety of laws and regulations in the U.S. and abroad that involve matters central to our business, including user privacy, rights of publicity, data protection, intellectual property, electronic contracts and other communications, competition, protection of minors, consumer protection, taxation, and online payment services. Foreign data protection, privacy, and other laws and regulations are often more restrictive than those in the U.S. federal, state and foreign laws and regulations are constantly evolving and can be subject to significant change. The application and interpretation of these laws and regulations are often uncertain, particularly in the new and rapidly evolving industry in which we operate. In addition, federal, state and foreign legislative or regulatory bodies may enact new or additional laws and regulations concerning data privacy and retention issues which could adversely impact our business. The interpretation and application of privacy, data protection and data retention laws and regulations are currently unsettled in the U.S. and internationally. These laws may be interpreted and applied inconsistently from country to country and inconsistently with our current data protection policies and practices. Complying with these varying state to state or international requirements could cause us to incur substantial costs or require us to change our business practices in a manner adverse to our business.

14

We are also subject to laws and regulations that dictate whether, how, and under what circumstances we can transfer, process and/or receive transnational data that is critical to our operations, including data relating to users, customers, or partners outside the U.S., and those laws and regulations are uncertain and subject to change.

Proposed legislation and regulations could also significantly affect our business. There currently are a number of proposals pending before federal, state, and foreign legislative and regulatory bodies, including the General Data Protection Regulation, a comprehensive privacy and data protection reform, adopted by the European Union in April 2016. It is effective May 2018, and may have impacts on the collection and processing of personal data of European Union individuals which may impact our ability to target ads and otherwise monetize user data, as well as significant penalties for non-compliance. Similarly, there are a number of legislative proposals in the U.S., at both the federal and state level, that could impose new obligations in areas affecting our business.

We use email, push notifications, and text message campaigns to drive user engagement. Disruptions in, restrictions on, and certain legal risks associated with the sending or receipt of emails, push notifications, or text messages or a decrease in user willingness to receive emails, push notifications, and text messages could adversely affect our revenues and business.

We use email, push notifications, and text message campaigns to drive user engagement. We send a large volume of emails, push notifications, and text messages to users notifying them of a variety of activities on our platform, such as new connections. We also rely on the use of email, push notifications, and text messages as a part of our registration and validation processes. Because of the importance of email, push notifications, and text messages to our business, if we are unable to successfully deliver emails, push notifications, or text messages to our users or if users consistently decline to open our emails, push notifications, or text messages, our business could be adversely affected.

We also face a risk that service providers or email applications may block bulk message transmissions or otherwise experience technical difficulties that result in our inability to successfully deliver emails, push notifications, or text messages to our users. Third parties may also block our emails as spam, impose restrictions on our emails, push notifications, or text messages, or start to charge for the delivery of emails through their email systems. In addition, changes in how webmail applications organize and prioritize email may reduce the number of users opening our emails. For example, Google’s Gmail service has a feature that organizes incoming emails into categories (for example, primary, social and promotions). Such categorization or similar inbox organizational features may result in our emails being delivered in a less prominent location in a user’s inbox or viewed as “spam” by our users and could reduce the likelihood of that user opening our emails.

Email communications may subject us to potential risks, such as liabilities or claims resulting from unsolicited email or spamming, lost or misdirected messages, security breaches, illegal or fraudulent use of email or personal information or interruptions or delays in email service. For example, in the U.S., the CAN-SPAM Act establishes certain requirements for the distribution of “commercial” email messages and provides for penalties for transmission of commercial email messages that are intended to deceive the recipient as to source or content. In addition, some countries and states have passed laws regulating commercial email practices that are, in some cases, significantly more punitive and difficult to comply with than the CAN-SPAM Act.

Push notifications and text messages may subject us to potential risks, including liabilities or claims relating to consumer protection laws. For example, the Telephone Consumer Protection Act of 1991, or the TCPA, restricts telemarketing and the use of automatic SMS text messages without proper consent. The Federal Trade Commission, or the FTC, has guidelines that impose responsibilities on companies with respect to communications with consumers, such as text messages, and impose fines and liability for failure to comply with rules with respect to advertising or marketing practices it may deem misleading or deceptive. Furthermore, a number of states and countries have enacted statutes that address telemarketing through SMS text messages. Restrictions on marketing through text messages are enforced in the U.S. by the FTC, the Federal Communications Commission, state agencies and through the availability of statutory damages and class action lawsuits for violations of the TCPA or similar laws. The scope and interpretation of the laws that are or may be applicable to our use of push notifications and text messages are continuously evolving and developing. If we do not comply with these laws or regulations, are named in a lawsuit involving these laws or regulations, or if we become liable under these laws or regulations, we could be harmed, and we could be forced to implement new marketing methods, which could be costly or ineffective.

Without the ability to deliver emails, push notifications, and text messages to our users we may have limited means of maintaining contact and inducing them to use our platform. Due to the importance of email, push notifications, and text messages to our business, any disruptions or restrictions on the distribution or receipt of emails, push notifications, or text messages or increase in the associated costs could have a material adverse effect on our business and operating results.

15

Technologies have been developed that can block the display of our ads, which could adversely affect our financial results.

We generate a significant portion of our revenue from advertising, and technologies have been developed, and will likely continue to be developed, that can block the display of our ads on our website and our mobile applications. These technologies could have had an adverse effect on our financial results and, if such technologies continue to proliferate, in particular with respect to mobile platforms, our future financial results may be harmed.

A failure in or breach of our operational or security systems or infrastructure, or those of third parties with which we do business, including as a result of cyber-attacks, could disrupt our businesses, result in the disclosure or misuse of confidential or proprietary information, damage our reputation, increase our costs and cause losses.

Our ability to attract, retain and serve our users and conduct business may be adversely affected by any significant and widespread disruption to our infrastructure or systems. The incidence of malicious technology-related events, such as cyber-attacks, computer hacking, computer viruses, worms or other destructive or disruptive software, distributed denial of service attacks or other malicious activities (or any combination of these events) are on the rise worldwide and constantly evolving. From time to time, we may become the victim of these types of attacks. Our technologies, systems, networks and our users’ devices have been subject to, and are likely to continue to be the target of, cyber-attacks, computer viruses, malicious code, phishing attacks or information security breaches that could result in the unauthorized release, gathering, monitoring, misuse, loss or destruction of confidential, proprietary and other information of the Company, our employees or sensitive information provided by our users, or otherwise disrupt our or our users’ or other third parties’ business operations.

Disruptions or failures in the physical infrastructure or operating systems that support our businesses and users, or cyber-attacks or security breaches of the networks, systems or devices that our users use to access our products and services could result in the loss of users and business opportunities, significant business disruption to the Company’s operations and business, misappropriation of the Company’s confidential information and/or that of its users, or damage to the Company’s computers or systems and/or those of its users and/or counterparties, and could result in violations of applicable privacy laws and other laws, litigation exposure, regulatory fines, penalties or intervention, loss of confidence in the Company’s security measures, reputational damage, and additional compliance costs. Furthermore, we may become a victim of security breaches, such as the misappropriation, misuse, leakage, falsification or accidental release or loss of user, customer or vendor data maintained in our information technology systems or those of third parties with whom we do business (or upon whom we otherwise rely in connection with our day to day operations). While we continuously develop and maintain systems to detect and prevent events of this nature from impacting our various businesses, these efforts are costly and require ongoing monitoring and updating as technologies change and efforts to overcome preventative security measures become more sophisticated. Furthermore, we may become a victim of security breaches, such as the misappropriation, misuse, leakage, falsification or accidental release or loss of user, customer or vendor data maintained in our information technology systems or those of third parties with whom we do business (or upon whom we otherwise rely in connection with our day to day operations).

If we experience computer malware, viruses, hacking and phishing attacks, and spamming, it could harm our business.

Security breaches, computer malware and computer hacking, and phishing attacks are prevalent in the social media industry, have occurred on our systems in the past and may occur on our systems in the future. Because the techniques used to obtain unauthorized access, disable or degrade service, or sabotage systems change frequently, we may be unable to anticipate these techniques or implement adequate preventative measures. Any security breach caused by hacking, which involves efforts to gain unauthorized access to information or systems, or to cause intentional malfunctions or loss or corruption of data, software, hardware or other computer equipment, or the inadvertent transmission of computer viruses could harm our business, financial condition and operating results. We have experienced and expect to continue to experience hacking attacks. Though it is difficult to determine what harm may directly result from any specific interruption or breach, any failure to maintain performance, reliability, security and availability of our network infrastructure to the satisfaction of our users could harm our reputation and our ability to retain existing users and attract new users. If an actual or perceived breach of our security occurs, the market perception of the effectiveness of our security measures could be harmed, we could lose users, and we could suffer financial exposure due to such events or in connection with remediation efforts, investigation costs, litigation, changed security, and system protection measures.

Increased government regulation could adversely affect our business.

Due to the rapid growth and widespread use of mobile applications and the Internet, national and local governments are enacting and considering various laws and regulations. In February of 2015, for example, the United States Federal Communication Commission announced its “net neutrality” intention of regulating broadband Internet providers as common carriers under Title II of the Communications Act of 1934 and Section 706 of the Telecommunications Act of 1996. We face uncertainty as to the impact of this decision and other government regulation on our business. New laws and regulations designed to protect consumers

16

could adversely affect our business and operations by exposing us to substantial compliance costs and liabilities and impeding growth in use of mobile applications or the Internet. Furthermore, the application of existing domestic laws and regulations remains somewhat unclear, and courts may apply these laws in unintended and unexpected ways. While online dating and social networking websites are not currently required to verify the age or identity of their members or to run criminal background checks on them, for example, any such requirements could increase our cost of operations or discourage use of our services.

As a provider of social networking products with a membership-based element, we are also subject to laws and regulations in certain U.S. states and other countries that apply to our automatically-renewing membership payment models. Certain U.S. states and certain countries in Asia also have laws that specifically govern dating services.

As we continue to expand internationally, both with our acquisition of Lovoo and our increased number of international users, we could also become increasingly subject to foreign laws and regulations which could be inconsistent from country to country. Foreign governments could restrict mobile applications or Internet social networking usage, pass laws that negatively impact our business, or prosecute us for our services. We could incur substantial liabilities for expenses necessary to comply with laws and regulations or penalties for any failure to comply. Additionally, restrictions and compliance costs associated with current and possible future laws and regulations could harm our business and operating results.

If laws that tax usage and sales on the Internet are enacted, increased taxes could adversely affect the commercial use of our marketing services and our financial results.

Due to the global nature of mobile applications and the Internet, it is possible that governments might attempt to tax our activities, including the sale of virtual currency. New or revised tax regulations may subject us to additional sales, use, income, and other taxes. We cannot predict the effect of current attempts to impose sales, income, or other taxes on commerce over the Internet. New or revised taxes and especially sales taxes would likely increase the cost of doing business online, reduce sales, and decrease the attractiveness of advertising on mobile applications or the Internet. Any of these events could have an adverse effect on our business and results of operations.