Form 6-K Loma Negra Compania Indu For: Mar 08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________

FORM 6‑K

_______________

_______________

REPORT OF FOREIGN PRIVATE ISSUER

Pursuant to Rule 13a-16 or 15d-16 under the

Securities Exchange Act of 1934

Securities Exchange Act of 1934

For the month of March, 2018

Commission File Number: 001-38262

_______________

LOMA NEGRA COMPAÑÍA INDUSTRIAL ARGENTINA

SOCIEDAD ANÓNIMA

(Exact Name of Registrant as Specified in its Charter)

SOCIEDAD ANÓNIMA

(Exact Name of Registrant as Specified in its Charter)

LOMA NEGRA CORPORATION

(Translation of Registrant’s name into English)

(Translation of Registrant’s name into English)

_______________

|

Reconquista 1088, 7th Floor

Zip Code C1003ABQ – Ciudad Autónoma de Buenos Aires

Republic of Argentina

|

|

(Address of principal executive offices)

|

_______________

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Loma Negra a member of InterCement Building sustainable partnerships L'amali-Argentina

Disclaimer and Forward Looking Statement This presentation may contain forward-looking statements within the meaning of federal securities law that are subject to risks and uncertainties. These statements are only predictions based upon our current expectations and projections about possible or assumed future results of our business, financial condition, results of operations, liquidity, plans and objectives. In some cases, you can identify forward-looking statements by terminology such as “believe,” “may,” “estimate,” “continue,” “anticipate,” “intend,” “should,” “plan,” “expect,” “predict,” “potential,” “seek,” “forecast,” or the negative of these terms or other similar expressions. The forward-looking statements are based on the information currently available to us. There are important factors that could cause our actual results, level of activity, performance or achievements to differ materially from the results, level of activity, performance or achievements expressed or implied by the forward-looking statements, including, among others things: changes in general economic, political, governmental and business conditions globally and in Argentina, changes in inflation rates, fluctuations in the exchange rate of the peso, the level of construction generally, changes in cement demand and prices, changes in raw material and energy prices, changes in business strategy and various other factors. You should not rely upon forward-looking statements as predictions of future events. Although we believe in good faith that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that future results, levels of activity, performance and events and circumstances reflected in the forward-looking statements will be achieved or will occur. Any or all of Loma Negra’s forward-looking statements in this release may turn out to be wrong. You should consider these forward-looking statements in light of other factors discussed under the heading “Risk Factors” in the prospectus filed with the Securities and Exchange Commission on October 31, 2017 in connection with Loma Negra’s initial public offering. Therefore, readers are cautioned not to place undue reliance on these forward-looking statements.Except as required by law, we undertake no obligation to update publicly any forward-looking statements for any reason after the date of this release to conform these statements to actual results or to changes in our expectations.Note: The Company presented some figures converted from Argentine pesos to U.S. dollars for comparison purposes. The exchange rate used to convert Pesos to U.S. dollars was the reference exchange rate (Communication “A” 3500) reported by the Central Bank for U.S. dollars. The information presented in U.S. dollars is for the convenience of the reader only. Certain figures included in this report have been subject to rounding adjustments. Accordingly, figures shown as totals in certain tables may not be arithmetic aggregations of the figures presented in previous quarters.

4Q17 Highlights: Loma Negra Reports Solid Set of Results Solid market dynamics, with volumes and prices picking up, on positive Argentina market environmentStrong & profitable growth AR$ US$Revenues +57% +38%Adj. EBITDA +57% +38%Net Income a/ Owners +221% +182%Robust operating cash flow, further supported by net IPO proceeds of US$ 106 million (AR$1,867 million) to support capacity expansion strategy

Market leader in Argentina uniquely positioned to capture increasing cement demand… #1 cement player in Argentina and #2 in Paraguay, with 45% and 44% market shares, respectively(1)Operating in a 4-player landscape in Argentina, a fast growing market with low cement per capita consumption and high-growth potentialStrong brand recognition through superior quality and nationwide presence (90-yr track record)Strategically located and vertically-integrated cement, concrete and aggregate facilitiesLimestone reserves support operations for +100 years(2)Manages railway concession to support network Argentina and Paraguay market shares according to AFCP and management estimates, respectively, in 2017.According to 2016 production levels and Company reserves estimates Revenue Breakdown Adjusted EBITDA Breakdown Fiscal Year 2017

driven by economic rebound and immediate reaction in construction activity Source INDEC and Market Expectations Survey as of January 2018Source INDEC Based on AFCP GDP Growth1 (%) Construction Activity2 (YoY Growth, %) Monthly Cement Sales3 (YoY Growth, %) Annual Cement Sales by Type3 (%) 2.30 -2.60 2.40 -2.20 3.00 3.00 0.40 2.90 4.20 2013 2014 2015 2016 2017e 2018e 1Q17 2Q17 3Q17 Dec'16 Jan'17 Feb'17 Mar'17 Apr'17 May'17 Jun'17 Jul'17 Aug'17 Sep'17 Oct'17 Nov'17 Dec'17 0.78 1.8 -0.4 16.0 11.6 9.8 17.1 19.8 7.5 13.0 23.5 16.5 6.8 64% 36% 2013 63% 37% 2014 63% 37% 2015 Bulk Bags 60% 40% 2017 64% 36% 2016

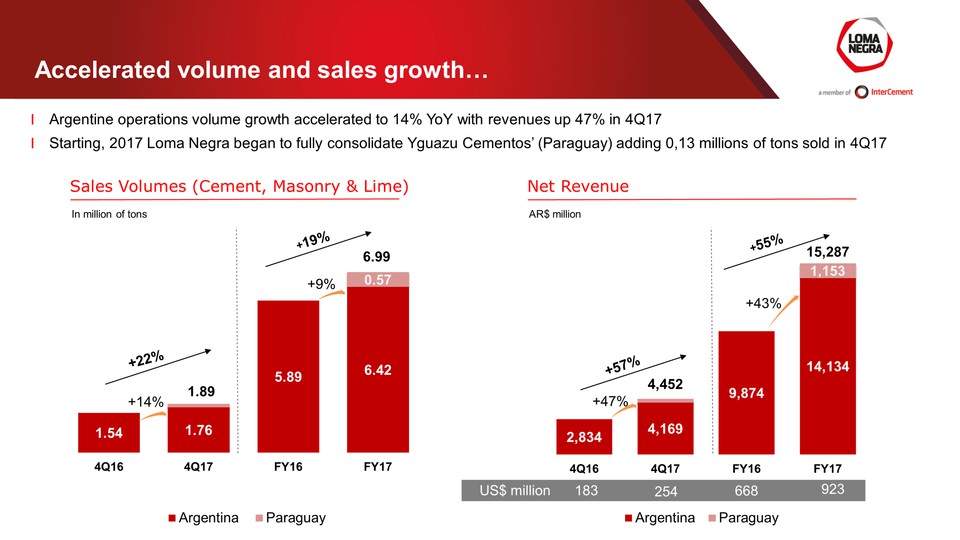

Accelerated volume and sales growth… Sales Volumes (Cement, Masonry & Lime) In million of tons Argentine operations volume growth accelerated to 14% YoY with revenues up 47% in 4Q17Starting, 2017 Loma Negra began to fully consolidate Yguazu Cementos’ (Paraguay) adding 0,13 millions of tons sold in 4Q17 +22% +19% 1.89 6.99 Net Revenue AR$ million +55% +57% +47% +43% 183 254 668 923 US$ million +9% +14% 1.54 17.76 5.89 6.42 0.57 6.99 1.89 4Q16 4Q17 FY16 FY17 2,834 4,169 9,874 14,134 1,153 15,287 4,452 4Q16 4Q17 FY16 FY17

… across all products and markets Robust concrete volumes, up 54% YoY in 4Q17 driven by strong pick-up in public infrastructure in our markets - City of Buenos Aires and Greater Buenos Aires, and Rosario in the province of Santa Fe Railroad volume up 6% YoY driven by solid demand in transportation servicesAggregates volume increased +7% YoY due to capacity constraints despite strong demand Sales Volumes (Cement, Masonry & Lime) 4Q17 4Q16 % Chg. 2017 2016 % Chg. Cement, mansonry % lime Argentina Paraguay MM Tn MM Tn 1.76 0.13 1.54 - 14% n/a 6342 5.89 9% 0.13 - n/a 0.57 - n/a Cement, masonry & lime total 1.89 1.54 22% 6.99 5.89 195 Argentina Concrete Railroad Aggregates MM m3 MM Tn MM Tn 0.24 1.29 0.28 0.16 1.22 0.26 54% 6% 7% 0.82 4.98 1.07 0.60 4.64 0.97 37% 7% 10%

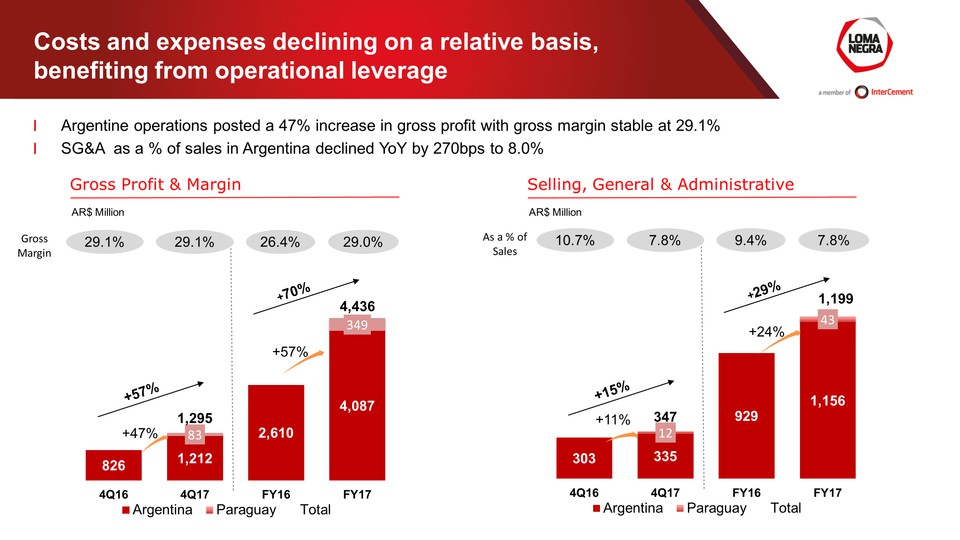

Costs and expenses declining on a relative basis, benefiting from operational leverage Gross Profit & Margin AR$ Million Argentine operations posted a 47% increase in gross profit with gross margin stable at 29.1%SG&A as a % of sales in Argentina declined YoY by 270bps to 8.0% Selling, General & Administrative AR$ Million As a % of Sales 7.8% 9.4% 7.8% 10.7% +15% +29% Gross Margin 29.1% 26.4% 29.0% 29.1% +57% +70% +57% +47% +24% +11% Argentina Paraguay Total 826 1,212 83 2,610 4,087 349 4,436 4Q16 4Q17 FY16 FY17 303 335 12 929 1,156 43 1,199 347

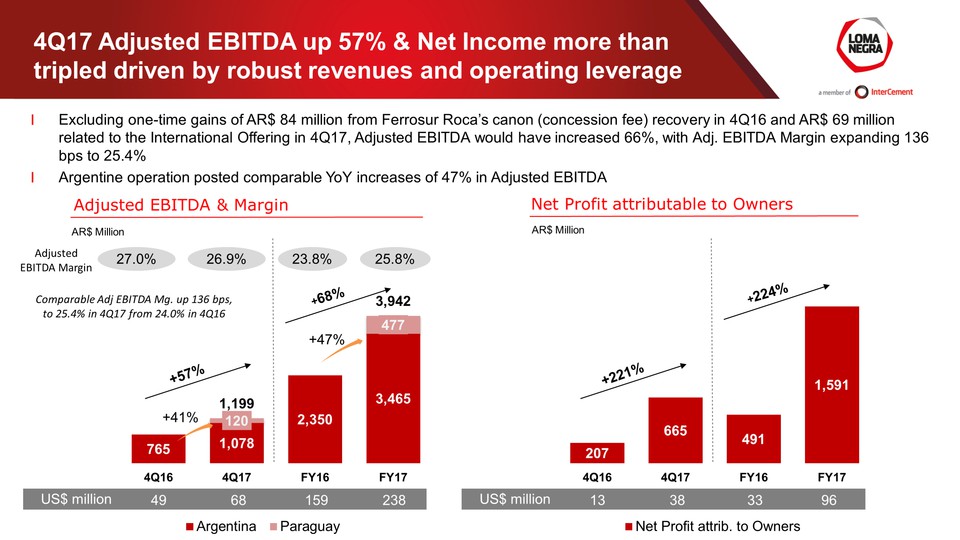

4Q17 Adjusted EBITDA up 57% & Net Income more than tripled driven by robust revenues and operating leverage Adjusted EBITDA & Margin AR$ Million Excluding one-time gains of AR$ 84 million from Ferrosur Roca’s canon (concession fee) recovery in 4Q16 and AR$ 69 million related to the International Offering in 4Q17, Adjusted EBITDA would have increased 66%, with Adj. EBITDA Margin expanding 136 bps to 25.4%Argentine operation posted comparable YoY increases of 47% in Adjusted EBITDA Net Profit attributable to Owners AR$ Million +221% +68% +57% 13 38 33 96 US$ million 49 68 159 238 US$ million 26.9% 23.8% 25.8% 27.0% Adjusted EBITDA Margin Comparable Adj EBITDA Mg. up 136 bps, to 25.4% in 4Q17 from 24.0% in 4Q16 +47% +41% +224% 765 1,078 120 1,199 2,350 3,465 477 3,942 4Q16 4Q17 FY16 FY17 207 665 491 1,591

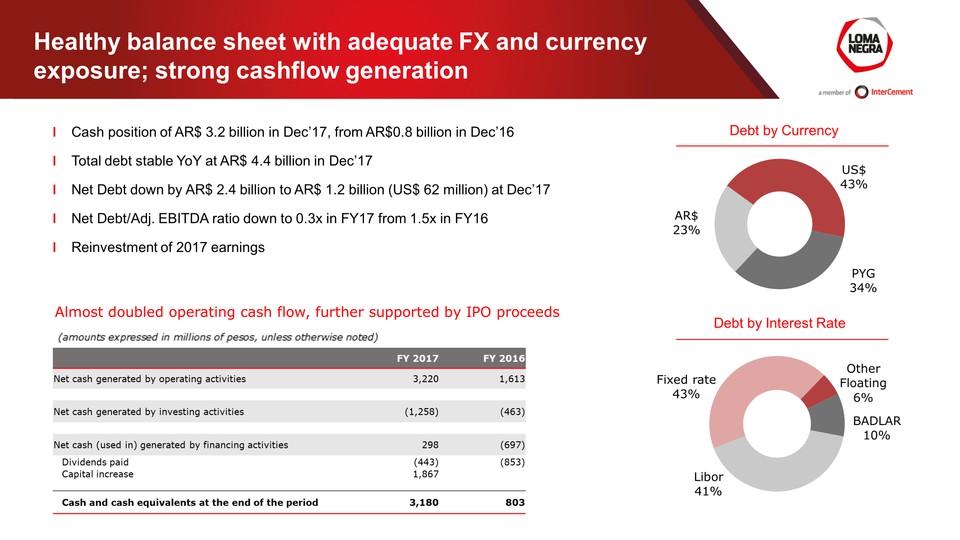

Healthy balance sheet with adequate FX and currency exposure; strong cashflow generation Debt by Currency Debt by Interest Rate Cash position of AR$ 3.2 billion in Dec’17, from AR$0.8 billion in Dec’16Total debt stable YoY at AR$ 4.4 billion in Dec’17Net Debt down by AR$ 2.4 billion to AR$ 1.2 billion (US$ 62 million) at Dec’17Net Debt/Adj. EBITDA ratio down to 0.3x in FY17 from 1.5x in FY16Reinvestment of 2017 earnings Almost doubled operating cash flow, further supported by IPO proceeds FY 2017 FY 2016 Net cash generated by operating activities 3,220 1,613 Net cash generated by investing activities (1,258) (463) Net cash (used in) generated by financing activities 298 (697) Dividends paid (443) (853) Capital increase 1,867 Cash and cash equivalents at the end of the period 3,180 803 AR$ 23% US$ 43% PYG 34% Fixed rate 43% Other Floating 6% BADLAR 10% Libor 41%

Advancing with L’Amalí expansion to maximize attractive growth opportunity in Argentina and further improve margins Expanding plant capacity by 2.7 million tn/year in a region that accounts for ~42% of Argentina’s cement consumptionProduction inputs in-place with capacity to sustain new demand, i.e. electric power and natural gasCost efficiency gains and proximity to limestone reservesUS$350 million capex (US$130/ton), US$ 3 million in FY17Schedule:July ’17: EPC contract with Sinoma (China)4Q17 completed Phase 1, involving basic engineering of new plant and study of soilRelevant permits obtained during the quarterCurrently in Phase 2, including equipment provision and plant construction, anticipated to take 26 monthsStart-up planned for early 2020

Looking ahead Fundamentally healthy market dynamics in Argentina and ParaguayExpect solid cement demand driven by public infrastructure works and private construction, adjusting down from current high recovery levelsLeveraging leading market position with strategically located facilities and nationwide distribution coverage to capture growth in demand Focused on advancing expansion of the L’Amalí plant to maximize growth opportunityMaintain strong cash flow generation and solid balance sheet

Questions & Answers

Exhibit: Summary Financial Statements

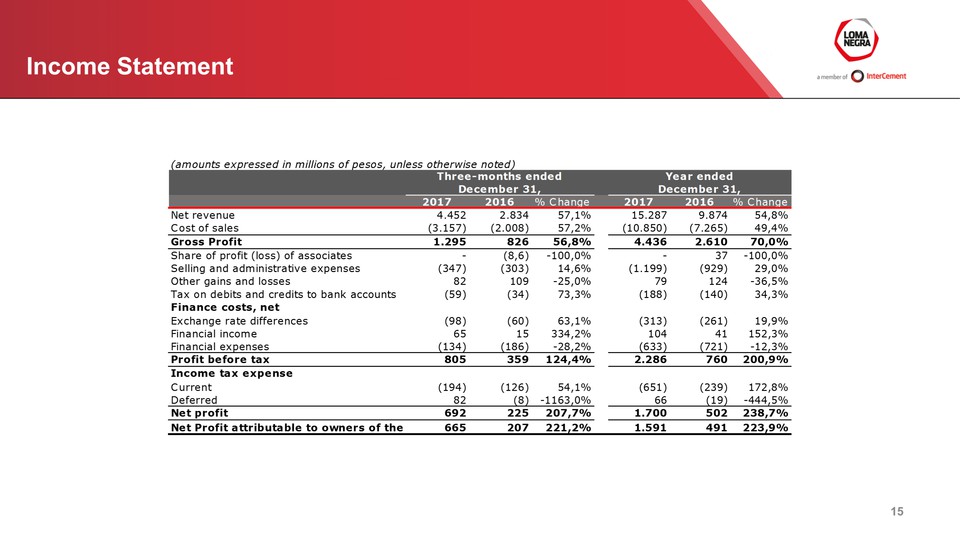

Income Statement 15 (amounts expressed in millions of pesos, unless otherwise noted) Three-months eneded December 31, 2017 2016 % Change Year ended December31, 2017 2016 % Change Net revenue 4.452 2.834 57,1% 15.287 9.874 54,8% Cost of sales (3.157) (2.008) 57,2% (10.850) (7.265) 49,4% Gross Profit 1.295 826 56,8% 4.436 2.610 70,0% Share of profit (loss) of associated - (8,6) -100,0% - 37 -100,0% Selling and adminstrative expenses (347) (303) 14,6% (1.199) (929) 29,0% Other gains and losses Tax on debits and credits to bank accounts Finance costs, net Exchange rate differences Financial income Financial expenses Profit before tax Income tax expense Current Deferred Net profit Net Profit attributable to owners of the 82 (59) (98) 65 (134) 805 (194) 82 692 665 109 934) (60) 15 (186) 359 (126) 98) 225 207 -25,0% 73,3% 63,1% 334,2% -28,2% 124,4% 54,1% -1163,0% 207,7% 221,2% 79 (188) 9313) 104 (633) 2.286 (651) 66 1.700 1.591 124 (140) (261) 41 9721) 760 (239) (19) 502 491 -36,5% 34,3% 19,9% 152,3% -12,3% 200,9% 172,8% -444,5% 238,7% 223,9%

Balance Sheet 16 As of December 31, 2017 2016 Assets Non-Current assets Property, plant and equipment Intangible assets Investments Goodwill Inventories Other receivables Trade accounts receivables Total non-current assets Current assets Inventories Other receivables Trade accounts receivable Investments Cash and banks Total current assets Total Assets Shareholder's Equity Capital stock and other capital related accounts Reserves Retained earnings Accumulated other comprehensive income Equity attributable to the owners of the Company Non-controlling interests Total Shareholder's Equity Liabilities non-current liabilities Borrowings Accounts payable Provisions Tax liabilities Deferred tax liabilities Total non-current liabilities Current liabilities Borrowings Accounts payable Advances from customers Salaries and social security payables Tax liabilities Other liabilities Total current liabilities Total Liabilities Total Shareholder's Equity and Liabilities 5.979 75 0 39 215 145 - 6.454 1.834 242 1.263 2.991 189 6.519 12.972 4.881 57 0 39 176 229 78 5.461 1.717 226 629 694 234 3.501 8.962 1.922 59 1.591 250 3.823 593 4.416 2.604 71 161 0 16 229 3.082 1.760 2.362 206 542 573 32 5.474 8.556 12.972 87 44 460 149 740 390 1.131 1.277 82 121 1 28 293 1.802 3.062 2.226 107 380 225 29 6.030 7.832 8.962

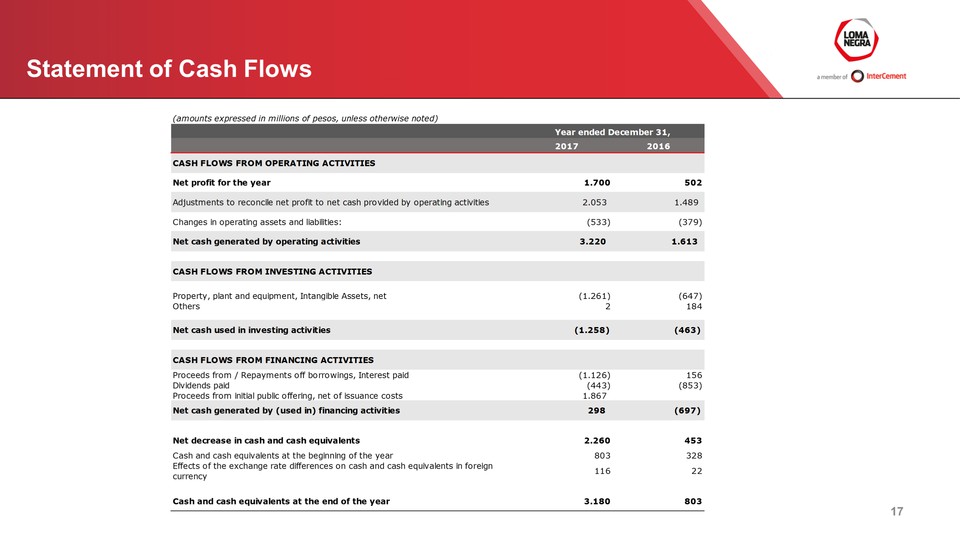

Statement of Cash Flows 17 (amounts expressed in millions of pesos, unless otherwise noted) Year ended December 31, 2017 2016 Cash Flows From Operating Activities Net profit fro the year Adjustments to reconcile net profit to net cash provided by operating activities changes in operating assets and liabilities: Net cash generated by operating activities Cash Flows From Investing Activities Property, plant and equipment, Intangible Assets, net Others Net cash used in investing activities Cash Flows From Financing Activities Proceeds from/Repayments off borrowings, Interest paid Dividends paid Proceeds from initial public offering, net of issuance costs Net cash generated by (used in) financing activities Net decrease in cash and cash equivalents Cash and cash equivalents at the beginning of the year Effects of the exchange rate differences on cash and cash equivalents in foreign currency Cash and cash equivalents at the end of the year 1.700 2.053 (533) 3.220 (1.261) 2 (1.258) (1.126) (443) 1.867 298 2.260 803 116 3.180 502 1.489 (379) 1.613 (647) 184 (463) 156 (853) (697) 453 328 22 803

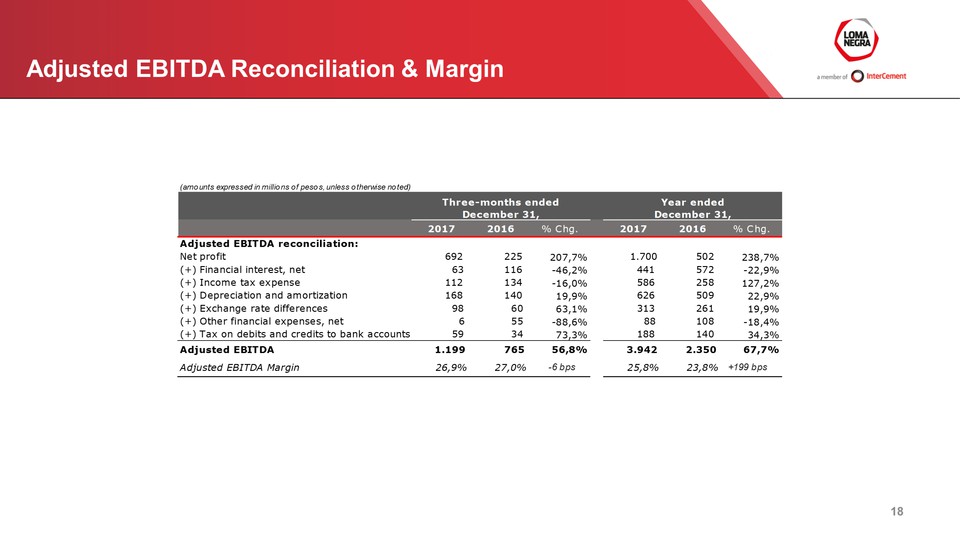

Adjusted EBITDA Reconciliation & Margin 18 (amounts expressed in millions of pesos, unless otherwise noted) Three-months ended December 31, Year Ended December 31, 2017 2016 % Chg. 2017 2016 % Chg. Adjusted EBITDA reconcialition: Net profit (+) Financial interest, net (+) Income tax expense (+) Depreciation and amortization (+) Exchange rate differences (+) Other financial expenses, net (+) Tax on debits and credits to bank accounts Adjusted EBITDA Adjusted EBITDA Margin 692 63 112 168 98 6 59 1.199 26,9% 225 116 134 140 60 55 34 765 27,0% 207,7% -46,2% -16,0% 19,9% 63,1% -88,6% 73,3% 56,8% -6 bps 1.700 441 586 626 313 88 188 3.942 25,8% 502 572 258 509 261 108 140 2.350 23,8% 238,7% -22,9% 127,2% 22,9% 19,9% -18,4% 34,3% 67,7% +199 bps

IR Contact Marcos I. GradinChief Financial Officer and [email protected] Loma Negra a member of InterCement Building sustainable partnerships

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Loma Negra Compañía Industrial Argentina Sociedad Anónima | |||

|

Date: March 8, 2018

|

By:

|

/s/ Marcos I. Gradin | |

| Name: | Marcos I. Gradin | ||

| Title: | Chief Financial Officer | ||